1. Introduction

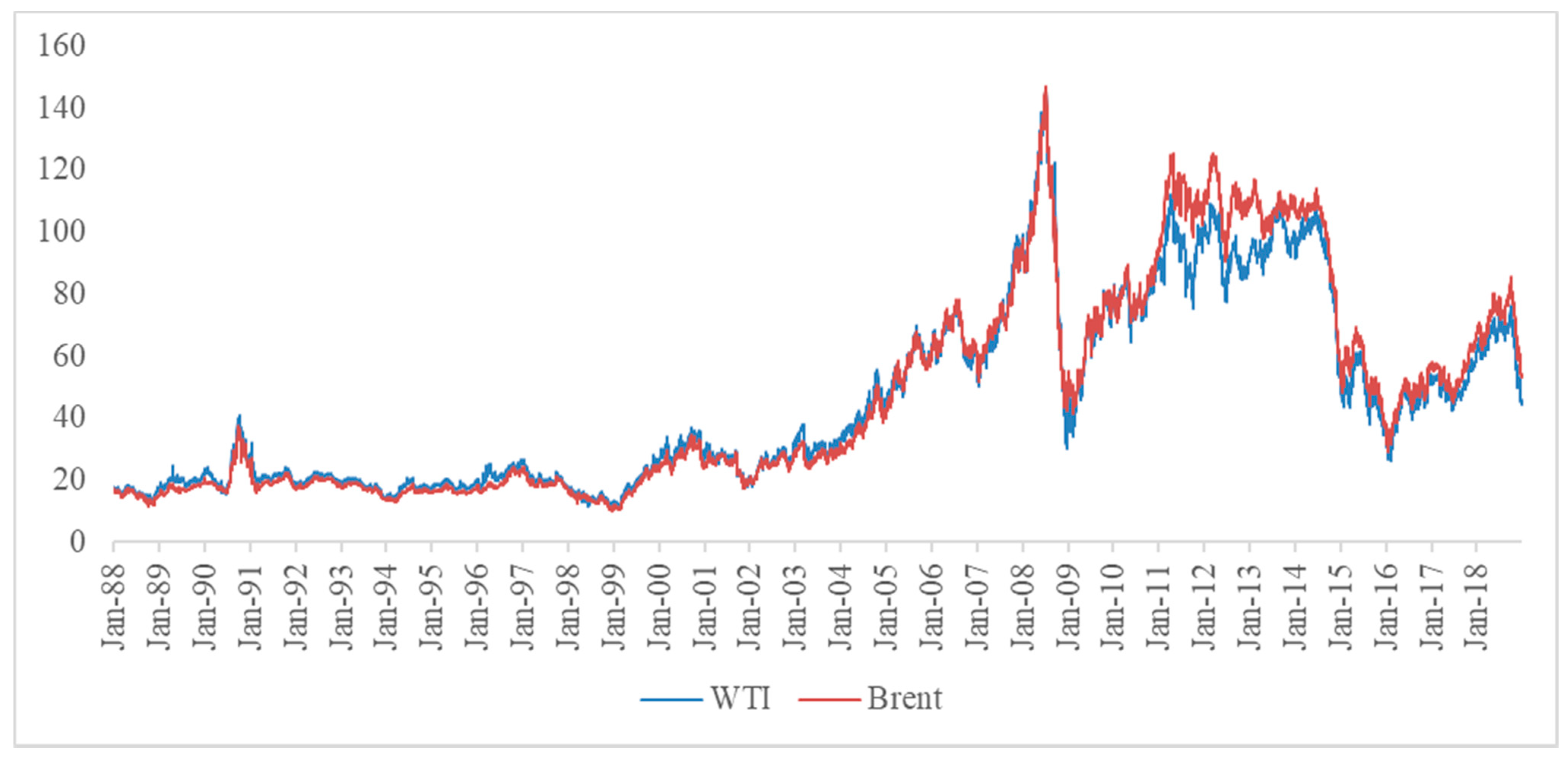

Crude oil is one of the most volatile financial assets and important industrial inputs in the global economy. As such, the crude oil risk has been well researched. From an economic perspective, a highly volatile crude oil price can cause great economic uncertainty, as was the case during the great recession due to the sharp increase in crude oil prices. Then, during the 2008 global financial crisis, the sharp decline in crude oil spot prices caused great uncertainty in the financial market. For example, the average annualized standard deviation of the West Texas Intermediate (WTI) crude oil price in our sample period is 39.186, whereas that of the S&P 500 market index is 12.873. (This ratio is based on the authors’ own calculations using the sample period of the present study.) In other words, the volatility of crude oil is three times that of the U.S. stock market.

Given this high volatility, managing and forecasting the risk associated with the crude oil market has become increasingly important. For investors, the high level of risk causes extreme price movements, which can damage their portfolios [

1]. For policymakers, the highly volatile crude oil market makes the future state of the economy less certain, thus making it more difficult to formulate appropriate policies. Therefore, the main goal of this study was to develop an alternative approach to forecast the crude oil risk, especially in cases of extreme risk over time, thus helping investors and policymakers to quantify such risk.

Furthermore, the value-at-risk (VaR) measure is widely used by financial intermediaries and banks to quantify the market risk [

2]. However, this measure fails to capture extreme tail events, which occur frequently in the crude oil market. Therefore, we employed the expected shortfall (ES) measure to assess extreme risk in this market. Since the Basel III requirements are implemented worldwide, risk managers, banking supervisors, and regulators tend to pay greater attention to ES measures. Therefore, it is important that we measure extreme risk in the crude oil market by considering both the VaR and the ES.

In prior studies, the accuracy of VaR and ES forecasts depended heavily on having relevant volatility estimation and conditional distribution specifications [

3,

4,

5,

6,

7,

8,

9,

10,

11]. On one hand, volatility estimation depends on an investor’s time horizon, where losses are potentially greater in the short run than they are in the long run. For example, by incorporating a wavelet analysis into the capital asset pricing model (CAPM), Fernandez [

7] showed that volatility increases with the data frequency. Similarly, Cifter [

5] showed improved financial risk forecasting by using the wavelet-based extreme value theory. Specifically, since investors are sensitive to the investment horizon, incorporating wavelet analysis will provide investors with a good indicator to evaluate their portfolio risk across the investment horizon. Meanwhile, policymakers focus more on the long-term effect of crude oil risk on the economy, which can be examined using the empirical results from wavelet analysis.

On the other hand, focusing on model selection may mean that assumptions are made and that a distribution needs to be selected. For example, Lyu et al. [

10] examined three distributions (i.e., skewed general error, generalized asymmetric Student’s

t, and generalized hyperbolic skewed Student’s

t) and showed that a more accurate VaR measurement could be estimated. Instead of choosing an optimal distribution, Zhao et al. [

11] employed fractional generalized autoregressive conditional heteroskedasticity (GARCH) models to perform a VaR forecast, in which they considered long memory, volatility clustering, asymmetry, and thick tails. In their results, the fractionally integrated, asymmetric power, autoregressive, conditional heteroscedasticity in mean with extreme value theory (FIAPARCH-M-EVT) model performed the most effectively. In other words, the parameters estimated using a nonparametric model change with the distribution and assumptions, implying that the distribution with the best fit is unstable across sample periods (e.g., [

8]).

However, as a coherent risk measure, the ES has no loss function to minimize the expected loss, which also means that we cannot compare the results [

12]. To resolve this problem, we employed the semiparametric approach of Fissler and Ziegel (FZ) [

13] and added a wavelet approach to the ES and VaR (wavelet-based semiparametric approaches also exist; see Boubaker and Sghaier [

14] and Zhou and Lin [

15]). Specifically, we based our VaR and ES semiparametric models on the generalized autoregressive score (GAS) model [

16], which is quite different from the wavelet decomposed nonlinear ensemble VaR model [

17]. In other words, our proposed models can be elicited from the loss function and are irrelevant to the conditional distribution under different time scales.

Therefore, the contributions of this study are as follows: firstly, we enrich the current literature by considering an ES measure to model extreme risk in the crude oil market using different time scales. We chose the ES measure because the crude oil market exhibits extreme price movements in our sample compared to those of the VaR measure, which does not adequately account for the extreme tail risk. Moreover, by combining the wavelet and semiparametric approaches, we examined the dynamics of forecasts based on both the ES and the VaR measures over time (particularly in the long term). Additionally, we considered potential performance gains across time scales by introducing a wavelet analysis into the risk modeling process.

Secondly, we addressed the problem of elicitability in the ES measure and removed doubts about its backtestability [

18,

19]. Unlike the conditional autoregressive VaR (CAViaR) dynamics [

20,

21,

22], our proposed models are free of backtestability, which means that we cannot compare different risk estimation procedures. Specifically, we employed the FZ loss function to compare the VaR and ES measures based on a parametric or semiparametric model. In addition, we compared the forecast accuracy between the semiparametric GAS model and the nonparametric GARCH model using tests developed by Diebold and Mariano [

23]. We also employed goodness-of-fit procedures to justify the model.

Thirdly, we propose a semiparametric GAS model to jointly measure the VaR and ES in the crude oil market. By doing so, we remove the need to make assumptions or select distributions. Unlike the direct approach of FZ [

13], Taylor [

24] estimated the dynamic VaR and ES measures jointly using an alternative distribution, such as the asymmetric Laplace distribution, and this has been proven to be effective under loss functions [

13]. In contrast to other studies that rely heavily on distribution and model selection (e.g., [

8,

10]), our results show that the semiparametric model provides better forecasting results and robustness. In summary, our results provide new insights into market risk predictions for the crude oil market over different time scales.

The remainder of this paper proceeds as follows: in

Section 2, we present the wavelet, rolling-window, nonparametric-based, and semiparametric models, which we used to forecast the VaR and ES, along with their estimation methodologies. In

Section 3, we present the data and the descriptive statistics. In

Section 4, we summarize the in-sample estimates and the out-of-sample forecasts and compare the measurements and robustness of each. We conclude the paper in

Section 5.

4. Empirical Results

4.1. VaR and ES for the Raw Data

We present the estimated parameter (January 1988 to December 1999) for the distribution-based model in Panel A of

Table 2, which was determined using stepwise estimation methodology. First, we estimated the mean equation based on the ARMA process. Then, we estimated the GARCH process. Finally, we estimated the parameters using the standardized residuals. The empirical results are reported in a similar manner. In the first panel of

Table 2, the estimations for the ARMA (

p·

q) model are provided. We selected the optimal choices of

p and

q using the BIC, yielding zero for

p and three for

q for both crude oil returns. Moreover, the optimal ARMA model included a constant value that was considered as the unpredictability of the crude oil returns. After obtaining the innovations from the ARMA model, we determined the estimation results of the GARCH(1, 1) model, and these are provided in the second panel. We observed high persistence in the GARCH processes. The estimated

parameters were equal to 0.878 and 0.883, which are quite similar to those presented in the majority of previous studies [

9,

10]. The last row contains the parameters for the skew-

t distribution with significant skewness, consistent with the work of Lyu et al. [

10].

Similarly, we report the empirical results of the three ES and VaR measures based on the one-factor models in Panel B of

Table 2. The empirical results for the one-factor GAS model are provided in the first column. The second and third columns show the GARCH model estimated using FZ0 loss minimization and the hybrid model. Specifically, we constructed the hybrid model by incorporating a GARCH-type forcing variable (

) into an augmented one-factor GAS model. In the last row, we provide the in-sample average loss for each specified model. The GARCH forcing variable in the hybrid model was significantly different from zero, which indicates that the GARCH process is important for modeling the crude oil VaR and ES values. Moreover, the persistence parameter

was found to be significant, with a value close to one, implying similar persistence processes to the GARCH model.

To save space, we report a summarized version of the descriptive statistics for the in-sample VaR and ES when

= 0.05. We provide all data for the VaR and ES after identifying the model with the best fit. We present the empirical results for the nonparametric model in Panel A of

Table 3, which shows a slight difference between the means and standard deviations for VaR and ES. However, the skewness and kurtosis values are shown to be the same. Moreover, a higher risk is presented for the WTI crude oil than for the Brent crude oil, as indicated for both the VaR and the ES.

Panel B provides the descriptive statistics for the in-sample VaR and ES when = 0.05, based on the semiparametric models. All the descriptive statistics were found to differ across the models and were quite different from those in Panel A. Moreover, for both the WTI and Brent crude oil returns, the values of the descriptive statistics for the parameter-driven (non-distribution-based) model were slightly lower than those of the non-parameter-driven (distribution-based) model.

In this section, we describe the employment of out-of-sample forecasting to validate the fitness between distribution- and non-distribution-based models. For simplicity, we only discuss the results when = 0.05. We used three types of models to forecast the VaR and ES: the rolling-window, distribution-based, and semiparametric dynamic models. We considered the rolling-window method (125, 250, and 500 days) as the benchmark case. We employed the ARMA−GARCH model as the distribution-based model. To forecast the VaR and ES nonparametrically, we used the normal distribution, the skew Student’s-t distribution, and an empirical distribution based on the estimated standardized residuals. The semiparametric dynamic ES and VaR measures used were the one-factor GAS model, the GARCH model estimated using FZ0 loss minimization, and the hybrid GAS/GARCH model. As shown in the previous section, we estimated the parameters of these models to forecast the VaR and ES based on a 12-year sample period.

In

Table 4, we show the average loss of the model forecasts based on the FZ0 loss function. The bold text highlights the lowest values and the italics denote the second lowest value in each column. For the VaR and ES, GARCH-FZ was found to perform best for both the WTI and the Brent crude oils. Moreover, GARCH-SKT and GAS-1F performed second-best for the WTI and Brent crude oil prices, respectively. The worst-performing model was the rolling-window model (500 days). In addition, the

p-values from the goodness-of-fit test presented in the second and third columns of

Table 4 were used to evaluate the VaR and ES forecasts. Here, entries greater than 0.1 are shown in bold, and those between 0.05 and 0.1 are shown in italics. For the WTI crude oil, four models passed the test for the VaR, whereas three models passed the test for the ES. In contrast, only one dynamic model passed the test for the VaR and ES for the Brent crude oil. Unfortunately, the three rolling-window models and the hybrid models failed in all cases. The GARCH-FZ model performed the best, as usual, in the goodness-of-fit test.

To further confirm our results, we determined the Diebold−Mariano (DM)

t-statistics for the VaR and ES of the WTI crude oil on the loss difference, using the “row model minus column model” calculation, and these are shown in

Table 5. A positive result indicates that the row model underperformed compared to the column model. As

Table 5 shows, the GARCH-FZ model outperformed all competing models, with all positive entries having significant values, in contrast to the three rolling-window, GARCH-N, and hybrid models. The exceptions were the GARCH-SKT, GARCH-EDF, and GAS-1F models, with DM

t-statistics of 1.382, 1.637, and 0.678, respectively. The DM

t-statistics for the Brent crude oil VaR and ES values were similar.

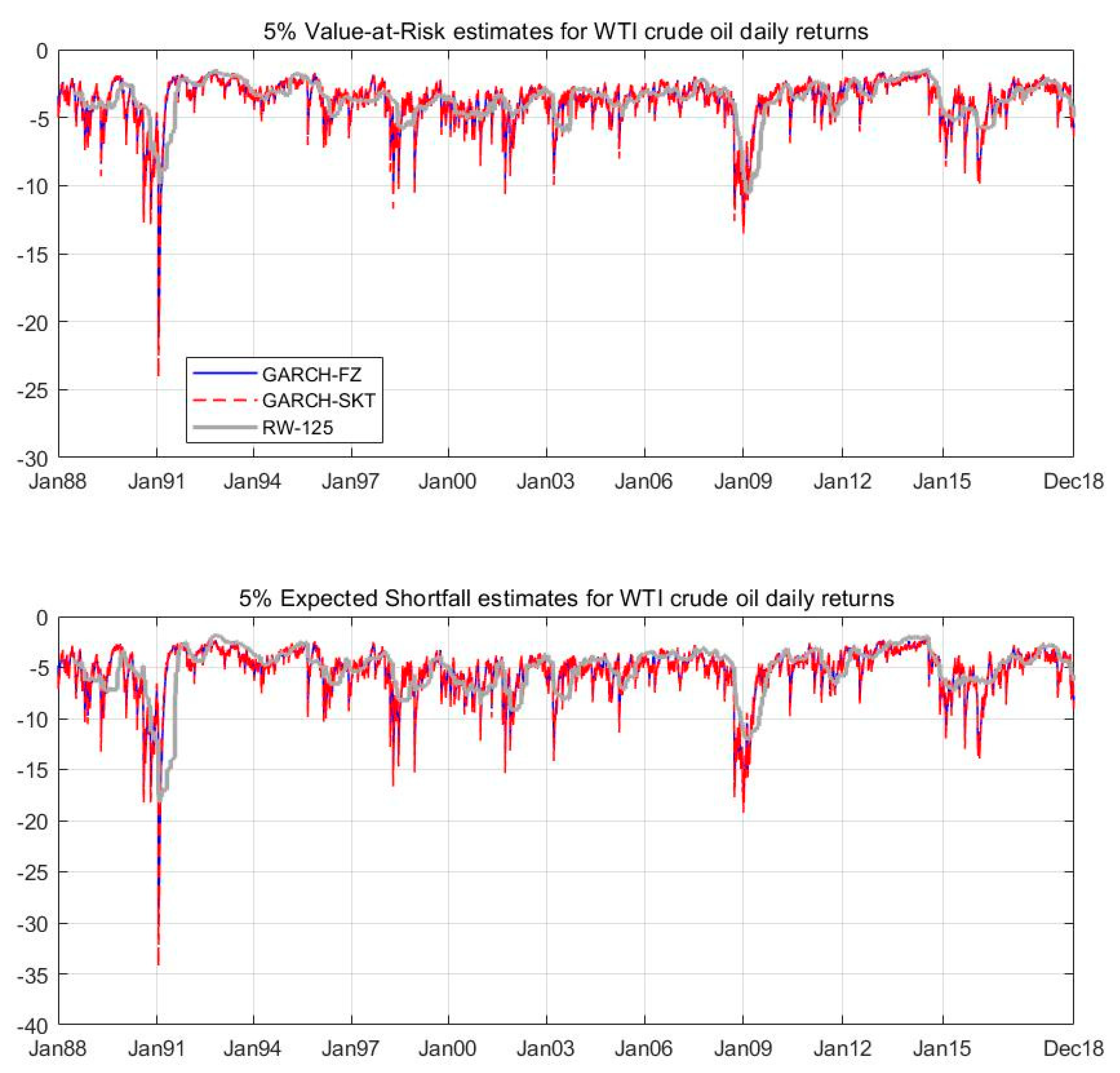

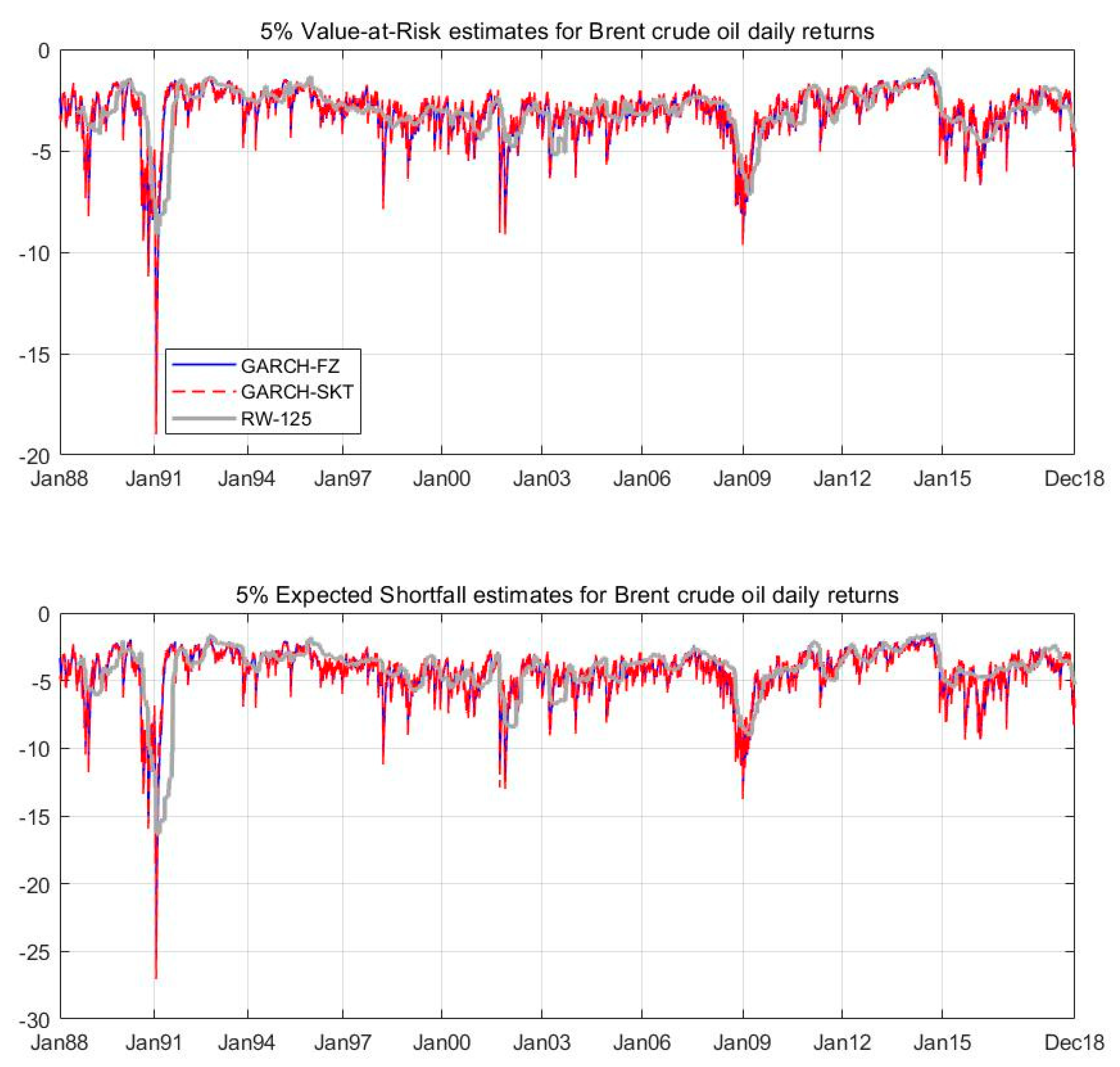

Finally, we provide the fitted 5% ES and VaR values for the three types of models by selecting the best-performing model in the subgroup—that is, the rolling-window model (125 days), the GARCH-SKT model, and the GARCH-FZ model. As

Figure 2 and

Figure 3 show, the WTI crude oil VaR and ES values were found to be more volatile than those of the Brent crude oil. The most extreme ES values were observed during the Gulf War, with an estimated 35% decrease for the WTI crude oil and a 30% decrease for the Brent crude oil. The second most extreme ES values occurred during the 2008 global financial crisis, with a decrease of approximately 15% for the WTI crude oil and a 10% decrease for the Brent crude oil, which are similar to the findings of Do and Bhatti [

37], Wu et al. [

38] and Parker and Bhatti [

39].

4.2. VaR and ES for the Wavelet

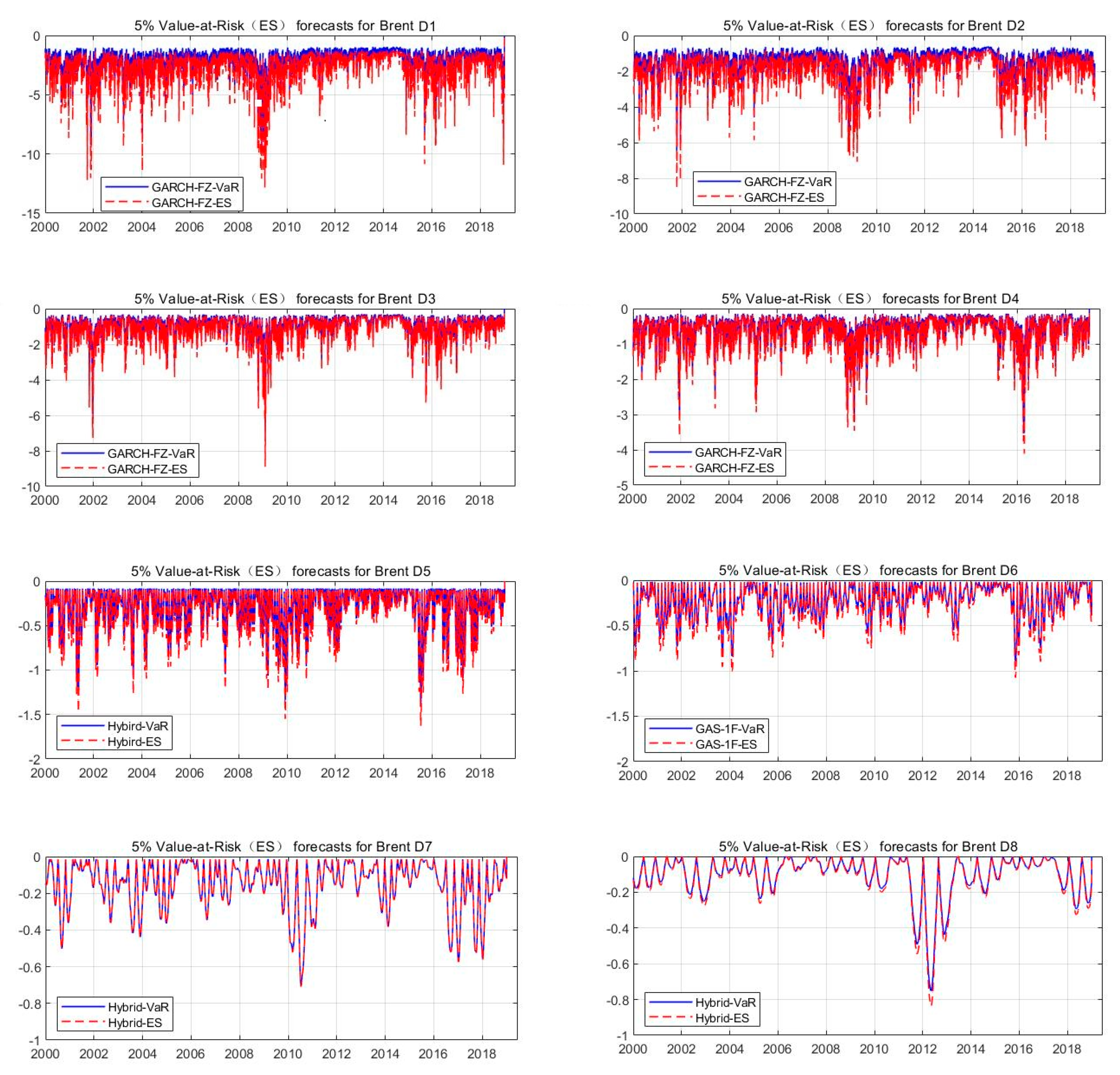

By following the same procedures for the VaR and ES as those of the original crude oil return, we considered the VaR and ES for the wavelet. Specifically, we decomposed the original crude oil return into eight wavelet details (i.e., D1 to D8). We considered the time scales from D1 to D4 as the short-term scale, from D5 to D6 as the mid-term scale, and from D7 to D8 as the long-term scale. (Specifically, D1 denotes a 2 day scale, D2 denotes a 4 day scale, D3 denotes an 8 day scale, D4 denotes a 16 day scale, D5 denotes a 32 day scale, D6 denotes a 64 day scale, D7 denotes a 128 day scale, and D8 denotes a 256 day scale.)

For simplicity, we report the average loss of the model forecasts based on the FZ0 loss function for these wavelet details in

Table 6. Panel A summarizes the average loss for the WTI crude oil, and Panel B summarizes the average loss for the Brent crude oil. The lowest values in each column are denoted in bold. Panel A shows that the GARCH-FZ model is the best choice for D1 and D2; the GARCH-EDF model is the best choice for D3; the GAS-1F model is the best choice for D5, D6, and D7; the hybrid model is the best choice for D4 and D8. Panel B shows that the GARCH-FZ model is the best choice for D1 to D4; the hybrid model is the best choice for D5, D7, and D8; the GAS-1F model is the best choice for D6. Overall, regardless of whether we examined the WTI or the Brent crude oil, the semiparametric models significantly outperformed the nonparametric models.

Similarly, the DM

t-statistics for the VaR and ES of the WTI and Brent crude oils are presented in

Table 7 and

Table 8. The DM

t-statistics were found to be positive for the models with the best fit, as discussed above. For example, the GARCH-FZ model contains all positive entries for D1 and D2, implying that it outperformed all the competing models. This is significant when comparing the three parametric GARCH-N models. The GARCH-EDF model contains all positive entries for D3, with the only exception being the hybrid model, with a DM

t-statistic of 0.508. We obtained the same results for the DM

t-statistics of the Brent crude oil VaR and ES. Overall, we confirmed that the semiparametric model performs better than the nonparametric models.

Furthermore, the fitted 5% ES and VaR for the best-performing model for each time scale according to the lowest average loss are summarized in

Table 6.

Figure 4 plots the forecasts of ES and VaR for the WTI crude oil, and

Figure 5 plots the forecasts for the Brent crude oil. The wavelet details for the WTI crude oil VaR and ES were found to be more volatile than those for the Brent crude oil. Moreover, the volatility of the VaR and ES decreased as the time scale increased. The results are similar to those of Fernandez [

7]—that is, the variance in the VaR and ES stems mainly from the short-term wavelet components. Moreover, the GARCH-FZ model was found to be driven only by information when the VaR was violated, which indicates a deterministic reversion to the long-run mean on the following day. Thus, the behaviors of the VaR and ES for the GARCH-FZ model are smoother than those of the other models.

4.3. Further Robustness Tests

To ensure the robustness of our results, we considered the average loss across four different tails:

values of 0.10, 0.05, 0.025, and 0.01. We used this procedure to investigate the performance of the models in their response to changes based on the depths of the tails (see

Table 9). For the original WTI crude oil series, the best-performing model was the GARCH-FZ model, followed by the GARCH-SKT model, across different values of

. In other words, the GARCH estimated by the FZ0 loss minimization parametrically outperformed the GARCH estimated by the nonparametric residuals. However, for the Brent crude oil, the best-performing model was the GARCH-FZ, followed by GAS-1F, when

was equal to 0.05, 0.025, and 0.01. For

= 0.10, the GAS-FZ model outperformed the GARCH-FZ model, which occurred because the GAS model depends on the observed VaR violation.

When the values of were very small, these violations rarely occurred. In contrast, the squared residual from the GARCH model provided information flows to move the risk measures, regardless of the VaR violation. If the values of were not too small, then the GAS model with the FZ0 loss function began to perform well. This is likely because the Brent crude oil price data are less volatile than that of the WTI crude oil price data. Overall, we took the average of the rank in the final column. Clearly, the distribution-based GARCH model is always the second or lower choice.

Since the out-of-sample period was from January 2000 to December 2018, it included the 2008 global financial crisis, which presented a significant structural change in VaR and ES forecasting. To address this structural break, we further determined the results of the performance of the models in terms of their responses to changes, based on the depth of the tails before and after the 2008 global financial crisis (see

Table 10). For simplicity, we only looked at the forecast results based on the WTI price. As shown in

Table 10, although there were slight changes in rankings for the performance of the individual models, the average rankings remained the same. In this sense, our model provided a consistent forecast.

To further explore the performance differences as the time scale changed, we also determined the performance rankings for both the nonparametric models and the semiparametric models. Once again, the semiparametric models always outperformed the nonparametric models. The distribution-based GARCH model was always the second or lower choice for the short-term scales. Specifically, the GARCH-FZ model performed the best for the short-term scales, whereas the hybrid model performed the best for the long-term scales.

Moreover, as the time scale increased, the semiparametric model estimated using FZ0 loss minimization parametrically outperformed the GARCH model estimated using nonparametric residuals, regardless of the type of model. Since the short-term wavelet components are more volatile than the long-term wavelet components, the hybrid model began to perform well for the mid- and long-term scales. In addition, we also identified a similar forecast performance by considering two market regimes across the time scales, as shown in

Table 10. Only the short-term scale exhibited variations in the rankings of performance for the individual model without changing the average rankings. For example, for the D6 component of the WTI crude oil, the hybrid model was ranked first, followed by the GAS-1F and GARCH-FZ models. Moreover, as the time scale increased, violations of rank across the values of

rarely occurred for these models, especially for the semiparametric models. At the same time, the wavelet components for the Brent crude oil exhibited similar patterns to those for the WTI crude oil. The results also indicate that the semiparametric models are the best choice when estimating the VaR and ES, regardless of the time scale.

5. Conclusions

Understanding the risk of the crude oil market across time scales is essential for risk management and asset pricing. Conventional analyses of market risk rely on the assumption of the conditional distribution of returns. However, the accuracy of this approach relies on making correct choices for distribution and assumptions. To overcome the problem of distribution-dependent forecasts of the VaR and ES, we developed a wavelet-based approach based on the semiparametric methodology that is independent of assumptions on the distribution. Moreover, we investigated the statistical decision theory to jointly model the dynamic ES and VaR values in order to address the problem of elicitability for ES. We proposed three types of dynamic VaR and ES based on parametric structures and compared their performance with that of the nonparametric forecast models. Our study relaxed the strict assumption about the nonparametric distribution-based model with a more robust result that will help financial practitioners, energy policymakers, and energy economists to improve their forecasting ability for VaR and ES in the crude oil market.

In the empirical analysis, we employed a full sample of the daily WTI and Brent crude oil prices from January 1988 to December 2018 to investigate whether the semiparametric models outperform the nonparametric models in terms of forecasting the VaR and ES in the crude oil market for different time horizons. We used the first 12 years (before 2000) to estimate the parameters and the last 19 years (after 2000) to forecast the VaR and ES under different confidence levels of for different time scales. The empirical results show that the VaR and ES forecasts based on the GARCH-FZ model outperform those based on the other models for the original crude oil return series. For the wavelet-based VaR and ES forecasts, we found that the GARCH-FZ model performs best in the short term, whereas the hybrid model performs best in the mid and long term. Moreover, as the time scale increases, the semi-parameter models outperform the nonparametric distribution-based model with a decreasing market risk in the crude oil market. Overall, we found that our proposed semiparametric model outperforms the nonparametric model, regardless of the time scale.

Our findings have several implications. Firstly, investors should choose their distributions or investment horizons carefully when building their risk forecast models. A semiparametric model provides more robust results in the crude oil market than a parametric model, regardless of the time scale. It also improves the accuracy of risk and portfolio management for different time horizons. Secondly, by introducing a wavelet analysis into the semiparametric VaR and ES measures, our proposed models allow risk managers to evaluate the extreme crude oil risk under different investment horizons in highly volatile environments, by considering the GARCH-FZ model in the short term and by considering the hybrid model in the long term. The ES measure is especially effective for measuring extreme risk for the crude oil market. Thirdly, with fewer assumptions of the conditional distribution in the VaR and ES model, policymakers can create appropriate crude oil policies, because they can easily model the influence of crude oil risk on the real economy. Specifically, by using the appropriate energy policy to stabilize the oil price fluctuations, the negative outcome to the economy from oil shock will be alleviated.