1. Introduction

In Germany, as in many other countries, market penetration of volatile renewable electricity producers has reached a significant level. In accordance to federal government and European Union goals, the German power sector is set to increase its share of electricity produced by renewable energy sources (RES) to at least 35% by the end of 2020, at least 65% in 2030, and at least 80% in 2050 [

1]. RES in this context are wind, solar, biomass, hydro and niche producers (e.g., geothermal). The share of RES in the gross electricity consumption reached 31.6% in 2016, double the share compared to 2008 [

2]. This puts it on track to reach the stated goal. Because of the volatile nature of renewable production, the doubling of produced electricity was accompanied with a bigger increase in production capacity of 287%, corresponding to a share of the total production capacity of 52% [

3].

The increase in renewable energy generation is primarily driven by expansion of wind and solar power. This expansion of volatile electricity production has measurable effects on price volatility and dependencies between renewable infeed and prices [

4,

5]. A principle component analysis (PCA) of price variation shows that seasonal factors, which affect renewable generation, are a major component [

6]. A similar approach has been used to assess the role of prices spikes in electricity markets [

7]. The volatility caused by RES expansion poses numerous challenges for actors in the energy system. Potential investors in new power plants need their assets to generate enough revenue to cover fixed costs; policy makers have to ensure that energy demand can (almost) always be satisfied. These challenges can be tackled in numerous ways. New market designs can help to ensure matching of supply and demand [

8,

9], and advanced algorithmic techniques can be used to automate trading in energy markets [

10,

11]. Our work falls in the realm of statistical modelling that allows for advanced forecasting in the highly stochastic energy system.

There is a large body of work in statistical modelling of energy systems and markets, respectively. Using a GARCH (Generalized Autoregressive Conditional Heteroskedasticity) model, [

4] shows that wind power decreases the average price level, but increases volatility. The same relationship is shown by [

12]. This effect is not only present in the German energy system, but has also been demonstrated for the Texan electricity market [

13]. Electricity prices further inhibit statistically significant calendar effects [

14]. While most renewable energy producers are currently shielded from these market effects by guaranteed infeed tariffs, this system is being phased out gradually in Germany. New plants do not get guaranteed remuneration for their infeed and old plants are dropping out of the compensation scheme. As a consequence of the shift from guaranteed infeed tariffs to market-based remuneration, there is a trend to market-based financing mechanisms for new installations and plants without fixed compensation. One of these are power purchase agreements (PPAs). Here, the production of a specific electricity producer is sold to an energy trading company or directly to a consumer. While there is a large potential for increasing use of PPAs, risk averse energy trading companies have to manage the acquired risk exposure. The underlying drivers to motivate risk aversion are diverse among different actors. Asset owners are typically risk averse because they carry the capital costs for new installations. To securely refinance their investment, they need to hedge against risks from regulation and technical failure [

15]. In liberalized energy markets they also have to hedge against market risks. A common aspect of this risk for different actors along the energy value chain is the aforementioned problem of joint price and quantity risk. The seminal paper of [

16] describes this problem for farmers wishing to protect themselves from output uncertainty and unknown market prices. Not only is the future production of a volatile (e.g., wind) portfolio unknown, the revenue from this production is also unclear. The adverse relationship of production and prices, i.e., lower prices in situations with high production and vice versa, exposes market actors to a higher risk than the two individual risk factors [

17,

18]. This also makes it risky to perform a simple volume hedge, where the hedged quantity is the expected production volume. Due to the dependence structure, this strategy would leave the market actor exposed to disregarded risk aspects.

Owners of RES regularly conclude agreements with market access providers, who offer them so PPAs in the form of “fixed-for-fluctuating-agreements”, where the owner receives a fixed price for the future production and thus remains solely with the volumetric risk [

19]. As the production volume is driven by weather phenomena, it can be assessed by project developers without in-depth knowledge of energy markets. Companies offering “fixed-for-fluctuating-agreements” or power purchase agreements (PPAs) are paying the producer fixed rates, while facing both unknown production volumes and market prices in the future. They are therefore motivated to hedge against both price and volumetric risks using different instruments. As prices and generation are both stochastic and cross-correlated, this is a complex task. A hedging decision which does not take the stochastic relationship of quantities and price into account risks undervaluing the situations with the highest negative impact on revenue.

Financial risks (not only in energy markets) are often quantified by the Value-at-Risk (VaR) metric. It describes the highest possible loss of a return distribution with a

confidence, where

p is the exogenously defined risk level [

20]. Typical VaR levels are 5% (e.g., [

21]) or 1% (e.g., [

22]). An extension is Conditional Value-at-Risk (CVaR), which conditions VaR on information before a specific point in time [

23]. A second measure common to risk management is Expected Shortfall (ES). It is the expected value of the Value-at-Risk at the

confidence level. Expected Shortfall is better suited to conceptualize the risk for fat-tailed return distributions, because it reflects the resulting higher likelihood of extreme values in its value [

24].

To optimize its market position, an energy trader has to model the dependence structure of production and prices accounting for its complexity, especially with regard to the joint distribution’s tails. This work focuses on modeling this aspect with regard to the wholesale electricity market, as participation of volatile renewable energy sources in other markets (e.g., regulation) is uncommon in Germany. A mathematical tool to do so are copulas (see, e.g., [

24]). Copulas disentangle the dependence structure of multiple variables from their marginal distributions. They are regularly used in applications of mathematical finance and economics, but gained interest in energy research in the past years [

25,

26]. With the combination of fitted marginal models and copulas, market prices and infeed volumes under a joint distribution can be simulated. The resulting values can be used to optimize the hedging decision using different hedging instruments and to reduce the risk an energy trading company faces. The process of the market position optimization is similar to the work of [

19], who used the approach in an analysis of the Danish energy market. Using German data, we develop a better understanding of the relationship of wind power infeed and prices in this market. The final risk model assumes futures prices that equal the expected wholesale price, i.e., it assumes efficient (financial) markets. Doing so is common practice (see, e.g., [

18,

19,

21]). This approach enables a focus on the variance effects of different hedging instruments, rather than expected revenue, for dealing with the price risk.

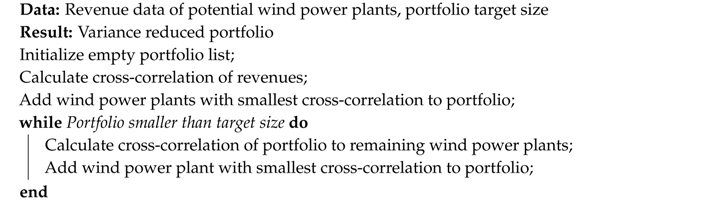

The remainder of this paper is structured as follows. First, data and the distribution function estimation process are presented. Then, the estimated distribution functions are used to bootstrap a simulation of joint infeed and price realizations. Using this simulation, different portfolios are optimized with regard to the remaining variance in revenues. The estimation and simulation procedure can be summarized by the following steps:

Apply outlier model to price data;

Apply logit-transform to infeed data;

Estimate seasonal models;

Estimate autoregressive and moving average components and variance terms;

Estimate suitable distributions for the standardized residuals;

Estimate suitable copula.

With the fitted model, Monte Carlo simulations can be performed:

Draw random samples from copula;

Re-transform these to price and infeed values for a chosen time-period;

Estimate values of hedging instruments for different portfolios;

Minimize variance of revenue distribution over different quantities of hedging contracts for different portfolios.

Using this approach, we show that a copula based variance minimizing hedge can reduce Conditional Value-at-Risk (CVaR) of a wind power portfolio significantly and improve with regard to expected shortfall (ES) compared to a simpler volume hedge (based on the expected production). Further, we build a variance reduced portfolio and show that needed hedging volumes are lower for both volume hedge und variance minimizing hedge. Our contribution is thus two-fold. First, we provide a statistical analysis of the complex joint relationship of wind power infeed and electricity prices in the German market. Second, we develop an initial set of tools for risk management of volatile portfolios in electricity markets with high RES penetration.

2. Data

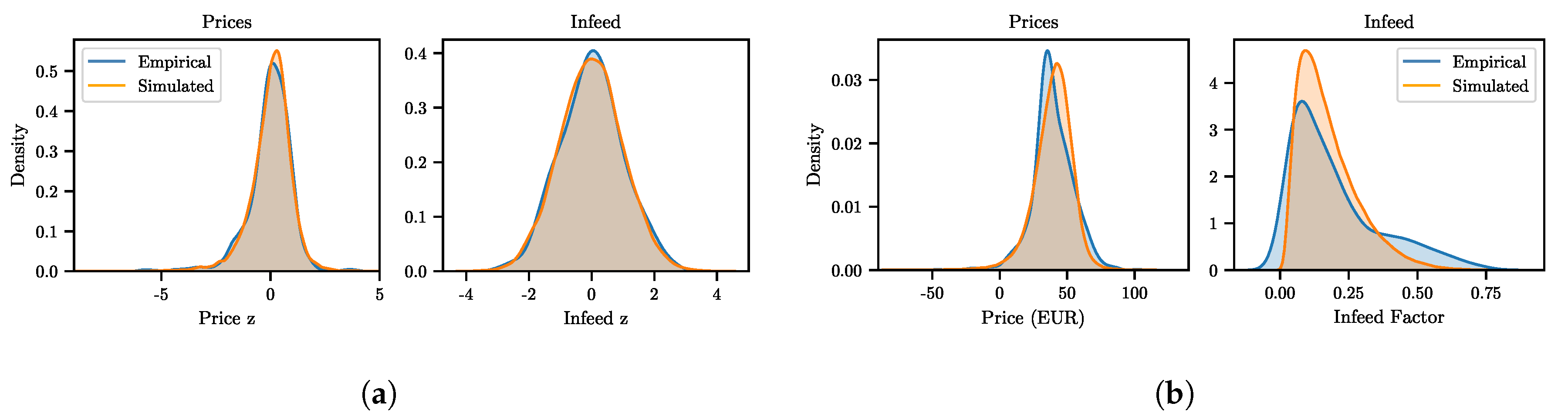

The historical price data and wind infeed (min-max normalized) can be seen in

Figure 1. Price data is based on German day-ahead clearing prices of EPEX SPOT (

https://www.epexspot.com/en). While there are other marketplaces for electricity, and a large volume of over-the-counter (OTC) trading outside energy exchanges, the day-ahead auction is the exchange-based marketplace with highest liquidity in Germany. The original resolution of our data is EUR/MWh. While seemingly counter-intuitive for the analysis of volatility, it is common practice to aggregate the data to daily values. The main reason is that the day-ahead auction clears for all hourly slots of the next day simultaneously. Because of this, the prices of the day-ahead auction do not constitute a sequential series [

27,

28,

29].

Part of the wind portfolio of Next Kraftwerke (

https://www.next-kraftwerke.com/) constitutes the data source for wind power infeed. The portfolio is preprocessed such that data of 46 wind power plants for a time span of 820 days between January 2017 and March 2019 is available. It has a linear correlation coefficient of

with the total German wind power infeed, meaning it is highly representative for the German geographic properties. The infeed is processed using two transformations. As it has an upward trend due to increasing installed capacity, it is standardized as a factor of the total installed capacity. Then, a logistic transformation is applied to the standardized time series. This is due to the fact that boundaries are problematic when modeling the mean and variance models [

19]. Before fitting the models, the mean value is subtracted from the time series of wind and prices, i.e., they are centered.

Figure 2 shows the joint distribution of the infeed factor (as average across the portfolio) and the spot prices as well as the joint distribution of the transformed time series. A clear dependency is visible. The descriptive statistics in

Table 1 confirm the visual analysis.

Outliers and Seasonality

There are extreme spikes in electricity prices with a variety of methods to correct or replace these values [

7,

27,

30]. Although extreme prices are correct data points, reflecting actual (if rare) economic regimes (cf. [

31]), it is reasonable and common practice to treat the data when estimating stochastic models on it. This is because they disproportionately skew the time series [

27,

30]. This is especially true for hourly data that is more volatile than daily data, and also holds for the aggregated time series.

A simple method to treat extreme values is the fixed price threshold, where the time series is truncated subject to an upper and a lower bound. This method, amongst other similar ones, risks capturing either too few or too many outliers when dealing with data over a long time span. This due to the fact that electricity prices show strong mean variations of several years. An approach to tackle this issue is to remove the trend from the price data using a moving average before applying a filter to the residuals. Because the data not only varies in its mean but also in its variance, a variable price threshold of at least three standard deviations can be used. With some model extensions, this filter can be run iteratively until no more outliers are detected [

30]. As the infeed is standardized on a

-interval, no extreme values are present in the data. The preprocessing and choice of infeed data ensures that sufficiently long time spans with complete infeed data are available for all regarded power plants and no methods for interpolation of results are necessary.

An idiosyncratic aspect of electricity prices is their strong seasonal variation. To account for seasonality, we decompose the electricity price into three distinct components, a short-term and a long-term seasonal component (STSC and LTSC), and a stochastic component

. Thus, the random variable

representing the day-ahead price can be described as follows.

The LTSC

is defined as a sinusoidal with a yearly period.

Parameters and determine phase and amplitude of the sinusoidal, whereas determines mean. The denominator is due to the fact that daily data is used.

The STSC

, representing daily patterns, is not modeled as a sinusoidal with higher frequency, but using a least squares dummy variable approach. This is due to the fact that daily electricity consumption (and hence, price) patterns do not follow a smooth trend, but are subject to distinct difference between days, e.g., Sunday and Monday. Hence, daily dummy variables are assigned to each day of the week.

The days of the week are defined by , with the being Monday. denotes the length of one week in days, i.e., . denotes the parameter for day i. For instance, means that the short-term seasonal component for Mondays equals 1. Note that the random infeed quantity at time t can be modeled similarly to , however, there is no STSC as wind power does not follow a weekly pattern.

3. Estimation Procedure

The preprocessed data is used to estimate both marginal and joint distribution models. The widely used choice for the estimation of the marginal distribution are ARMA-GARCH models, which model the conditional mean and variance of the variables [

4,

6,

19,

24]. ARMA models describe stationary stochastic processes through autoregressive and moving-average terms. The autoregressive term uses

p lags of the dependent variable and the moving-average term

q lags of the error term. The errors

are assumed to be independent and identically distributed (iid) and

, where

is usually the Normal distribution. The ARMA process for a random variable

is

where

and

are the coefficients of the respective lag orders

i and

j. The GARCH extension replaces the error term with another autoregressive function to account for heteroskedasticity in the errors. It is also defined with a lag order of

p and

q and can be written as

where

and

are the coefficients of the respective lag orders

i and

j. The parameters are restricted to ensure stationarity, with

,

,

, and

[

32]. Usually,

. The normality condition can be relaxed, so that

[

21]. This not only permits more general parametric distributions for the error term, its distribution is also conditioned on its past. The conditioning on

includes past information not only from the variable in question but from all variables. In many cases, when there is no cross-dependency, this can be restricted to the respective variable while still ensuring that all models are conditioned using the same information [

24]. While the mean and variance models are coupled through the error term, they can be estimated separately, with the residuals of the ARMA model serving as input for the GARCH model [

27]. This adds modeling flexibility and eases convergence. The lag order of the ARMA and GARCH models can be identified by comparing the Bayesian Information Criteria (BIC) or Akaike Information Criteria (AIC). The more widely used (e.g., [

21,

24]) BIC is defined as

where

denotes the likelihood function. BIC penalizes model complextiy depending on model size (number of lag parameters)

d and sample size

n to avoid overfitting [

27]. The model with the lowest BIC is considered best. After successfully estimating a model for both mean and variance, standardized residuals can be obtained. These are then used to estimate the copula. Also, a suitable distribution is fitted on the residuals to re-transform the samples obtained from the copula [

24].

3.1. Goodness of Fit

The goodness of fit (GoF) of ARMA and GARCH models can be evaluated by plotting the (partial) autocorrelation functions ((P)ACF) of the model’s residuals. If the model is fitted well, no significant autocorrelation should remain. This can be tested using the Ljung-Box Q-test of serial independence. The test statistic is given by

Here,

n is the sample size,

the sample autocorrelation at lag

k, and

h the maximum length for which the test is being performed [

33]. Under

, the data is independently distributed. Thus, the test should not reject for the mean and variance model. Two widely used tests exist to evaluate the goodness of fit for the distributions which were estimated from the residuals. These are the Kolmogorov-Smirnov (KS) and Cramer-von-Mises (CvM) tests. Both are performed on the values of the residuals’ empirical CDF and test the similarity with a known (specified) distribution, where both are the same under

:

is obtained using the empirical CDF and

using the fitted parametric distribution. As KS and CvM tests are also available to evaluate the GoF of the copula model, subscript

i denotes the applicability to the individual models.

3.2. Copula Model

Copulas are used to model the dependence structure of random variables [

34]. Whereas, e.g., multivariate normal distributions require all variables and their dependency to have a normal distribution, copulas allow modeling separate marginal distributions of multiple random variables and their dependence. This allows for high flexibility in choosing a suitable distribution and simplifies the estimation procedure, as it can be done in stages [

24]. Copulas are common in risk management and econometric applications [

35,

36,

37,

38]. A

d-dimensional copula is a cumulative distribution function on

d uniform marginals [

39].

Then, with

, three properties define a copula: 1)

is non-decreasing in every component

. 2) The marginal in component

i can be obtained with

for all

because of its uniform distribution

3) When

,

is always non-negative. Assuming differentiability of the marginal distributions, the copula can be written as (see, e.g., [

24])

Extensions of copula theory with regard to conditional distributions exist [

40] and have been applied to energy modelling [

21]. Consider for the bivariate case two random variables

with a joint conditional distribution function

and respective conditional marginal distribution functions

. Then, a conditional copula

with two dimensions exists, such that

Note that both the marginal models and the copula are conditioned on the past. If the marginals are continuous, the copula

C is unique.

with

. Each

has the probability integral transform variable

The two main families of copulas are called Elliptical and Archimedean. Elliptical copulas are based on elliptical distributions, the two best-known of which are the Gaussian (normal) and Student’s t distribution. They are distinct in that the linear correlation fully describes their dependence structure (in contrast to other copula families, where this is false) [

39]. In contrast to Elliptical copulas, Archimedean copulas are explicitly defined with so-called generator functions

. They interpolate between dependence structures like independence and comonotonicity, typically using a free parameter

. The general generator function is continuous and strictly decreasing:

, with

. In the bivariate case, the copula then has the form

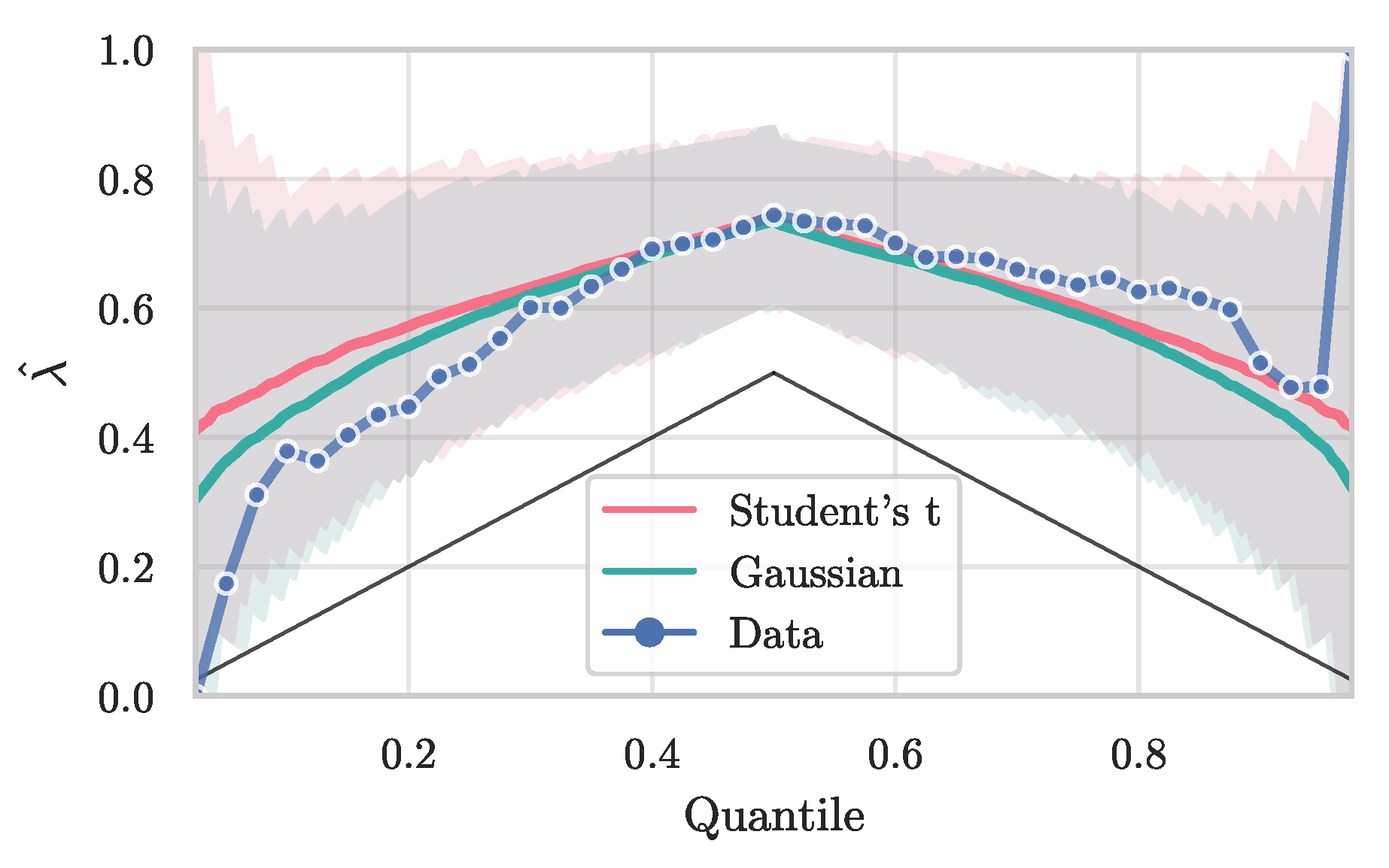

Five different copula types have been fitted for the residuals. See

Table 2 for their respective formulations. Which copula type is suitable for modeling can be evaluated using measures of dependence and goodness of fit tests.

Goodness of Fit

Model specification and goodness of fit (GoF) tests can be seen as complementary. GoF tests can be limited in their explanatory power and be too weak or too strict to conclude a models suitability. Model specification tests are a good way to compare different models but do not always help in deciding the validity of a chosen model [

24]. For fully parametric models, both the distributions resulting from the marginal models and the copula model are parametric. While this allows to fully specify a log-likelihood for estimation, the commonly used approach is to estimate a model in stages. In that case, the marginal models should not exhibit cross-equation restrictions. For nested models (e.g., comparing a Gaussian copula with a Student’s t copula) a likelihood ratio test can be used. An even simpler but very crude method is to rank the model likelihoods (see, e.g., [

24]).

The KS and CvM test are two widely used GoF measures to compare an estimated copula with the empirical results. Their statistics adapted to the copula case are

and use the empirical copula

which is defined as

As these tests are based on the empirical copula, they only work for constant, i.e., not time-dependent, copula models [

24].

5. Discussion

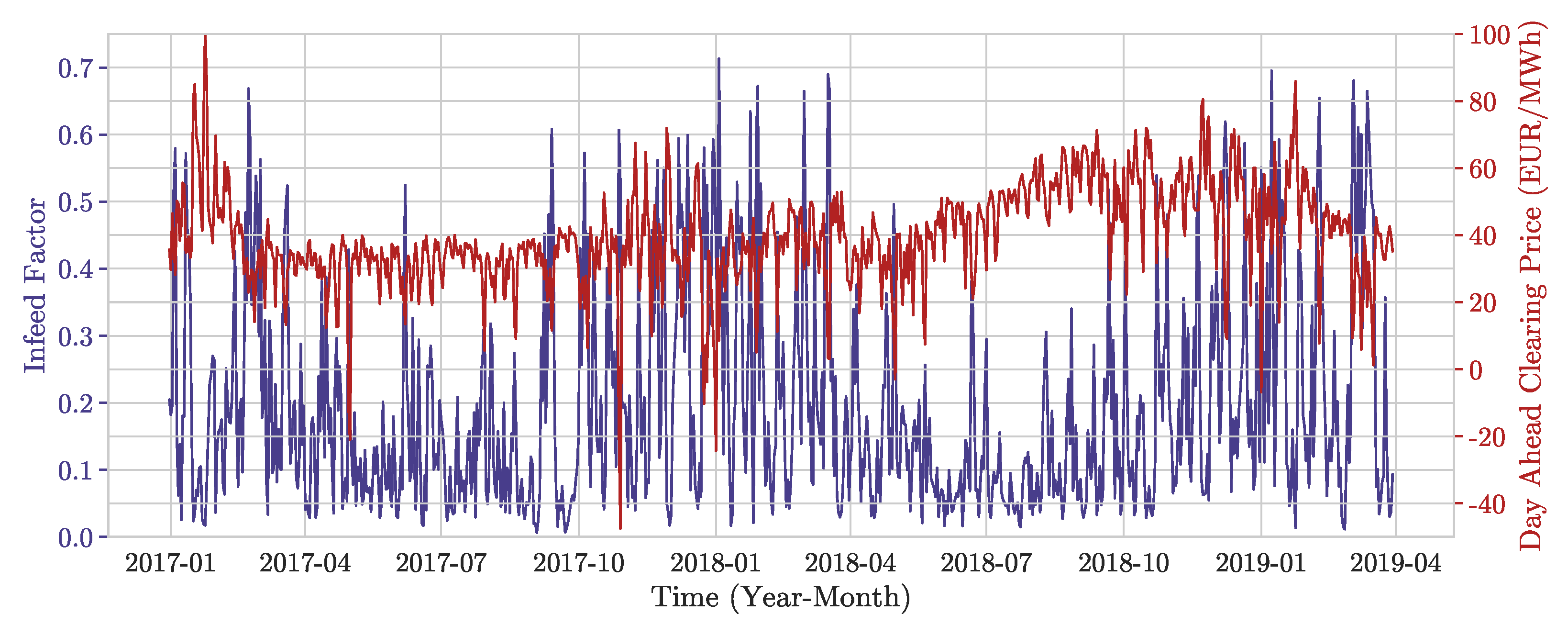

The key contribution of this paper is the modeling the dependence structure of an actual wind portfolio infeed and German electricity prices with the help of copulas. To enable the estimation, models for cleaning the data of outliers, estimating deterministic seasonal components, and autoregressive models for the mean and variance components of the data are specified. With the standardized residuals of these marginal models, marginal distributions and a suitable copula model are estimated. Following the estimation of marginal models, distributions, and the dependence structure, price-infeed pairs could be simulated. On these values, a model was defined to estimate and optimize the risk arising from the modeled relationship of the variables. This could then be used to minimize the revenue variance by varying the quantity of different hedging products.

In an empirical example, all modeling steps were applied to infeed data from a large German virtual power plant operator and price data from the German market. A yearly seasonal model and an ARMA process was applied to the infeed data, with the residuals conforming to a Normal distribution. The price data was treated using an outlier model, a yearly and a weekly seasonal model and an ARMA-GARCH process.

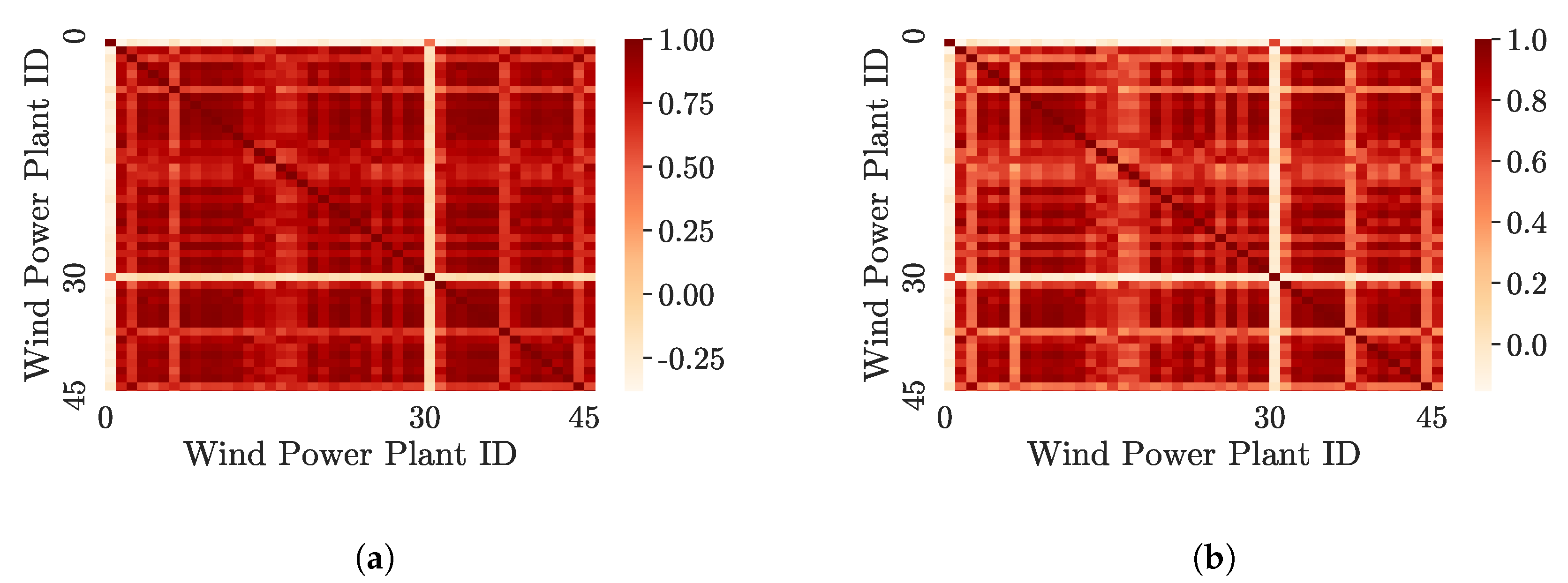

We show that the revenue variance minimizing hedge using monthly futures contracts strongly reduces the Conditional Value-at-Risk and Expected Shortfall for a market actor facing joint price and volumetric risk. In this respect, the findings are similar to the study by [

19] regarding the Danish market. Additionally, the hedge performs better than a simple volume hedge using the same instrument with regard to expected shortfall. Hence, we conclude that using the minimal revenue variance hedge with monthly futures can significantly reduce the price risk for a volatile electricity producer. Further, we show that a diversified portfolio with low cross-correlation in revenue streams from individual power plants improves risk aspects of the portfolio. Hedging volume can be reduced both with regard to a volume hedge and with regard to the minimum variance hedge. It can be therefore seen that value of an individual power plant does not only depend on the windiness of its location, but also its relationship to the remainder of the portfolio. This is especially true for risk averse decision-makers.

Some limitations remain. The risk model rests on strong assumptions, e.g., enforcing revenue neutrality, not all of which are realistic. Comparing the simulated distributions of both infeed and prices to the empirical ones, there remain differences for the price values. This suggests that there are further price drivers that are unaccounted for in the marginal model (see

Appendix A). The empirical example limited itself to only one type of hedging instrument, primarily because illiquid markets preclude an application. Still, accounting for a broader set of derivates, e.g., weather derivates, would enhance the work. An interesting extension of our work is to include (stochastic) risk premiums together with an explicit modeling of the decision-makers risk aversion, in order to develop a decision support system for energy traders seeking to optimize their position.

Despite the limitations, we showed that volatile RES infeed and electricity prices show a complex relationship that is not fully captured by a simple Gaussian model only specifying correlation. Providing an initial method to manage risk subject to this relationship, we are motivating more research on complex risk management in electricity markets with high degree of RES penetration.