Revisiting Electricity Network Tariffs in a Context of Decarbonization, Digitalization, and Decentralization

Abstract

1. Introduction

2. Principles for Tariff Design

- Cost reflectivity: electricity tariffs reflect the costs of delivering the service, recognizing that electricity costs may vary by time, location, and supplied quality [15]. Additional objectives related to economic efficiency and, in some sense, ingredients for cost reflectivity are the following:

- ○

- Cost additivity: tariffs are formed by aggregating different cost categories or items up to reflect the total system costs.

- ○

- Symmetry: costs that depend on consumption and injection of energy or power are charged/rewarded following the same methodology within the chosen locational and time granularity.

- ○

- Robustness against consumer aggregation: costs that do not change depending on whether consumption is aggregated or individualized per consumer should not be charged differently to the aggregation of consumers than to individual consumers.

- Predictability: in the short term, how precisely consumers can estimate ex-ante the amount they will be charged. In the long term, predictability of tariffs and their methods of calculation provides regulatory certainty to users.

- Technology neutral: tariffs should be agnostic to the particular activities for which electricity is used by network users or to the technology used to withdraw or inject energy into the grid [1].

- Minimization of cross-subsidies: one consumer’s actions should not negatively impact other consumers’ charges.

- Although allocative equity is a consideration of the equity principle, its implications are completely aligned with the economic efficiency principle. For example, as explained in [13], one of the main implications of allocative equity is that marginal consumption/production should be charged/paid according to the marginal cost/value it creates. This can be assumed as cost reflectivity and, therefore, would conduce to a more efficient system.

- Distributional equity: charges should be proportional to the economic capability of each user. This is critical when allocating residual costs to vulnerable consumers [13,16]. Residual costs are those costs that have no cost driver, and cannot be recovered following economically efficient signals, as further defined in Section 3. This implication directly grapples with economic efficiency principles.

- Transitional equity: a transition from an old to a new tariff scheme should be gradually implemented.

2.1. Revisiting Principles of Tariff Design under the 3 Ds

2.1.1. Digitalization

2.1.2. Decarbonization

2.1.3. Decentralization

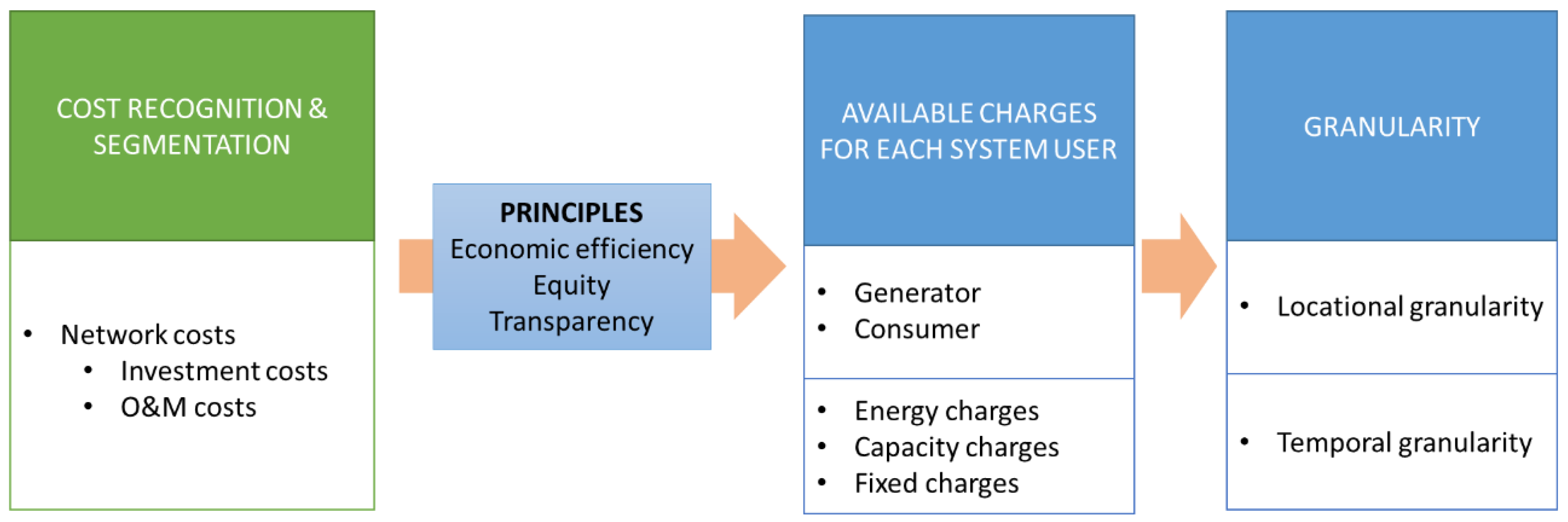

3. Methodology

3.1. Introduction

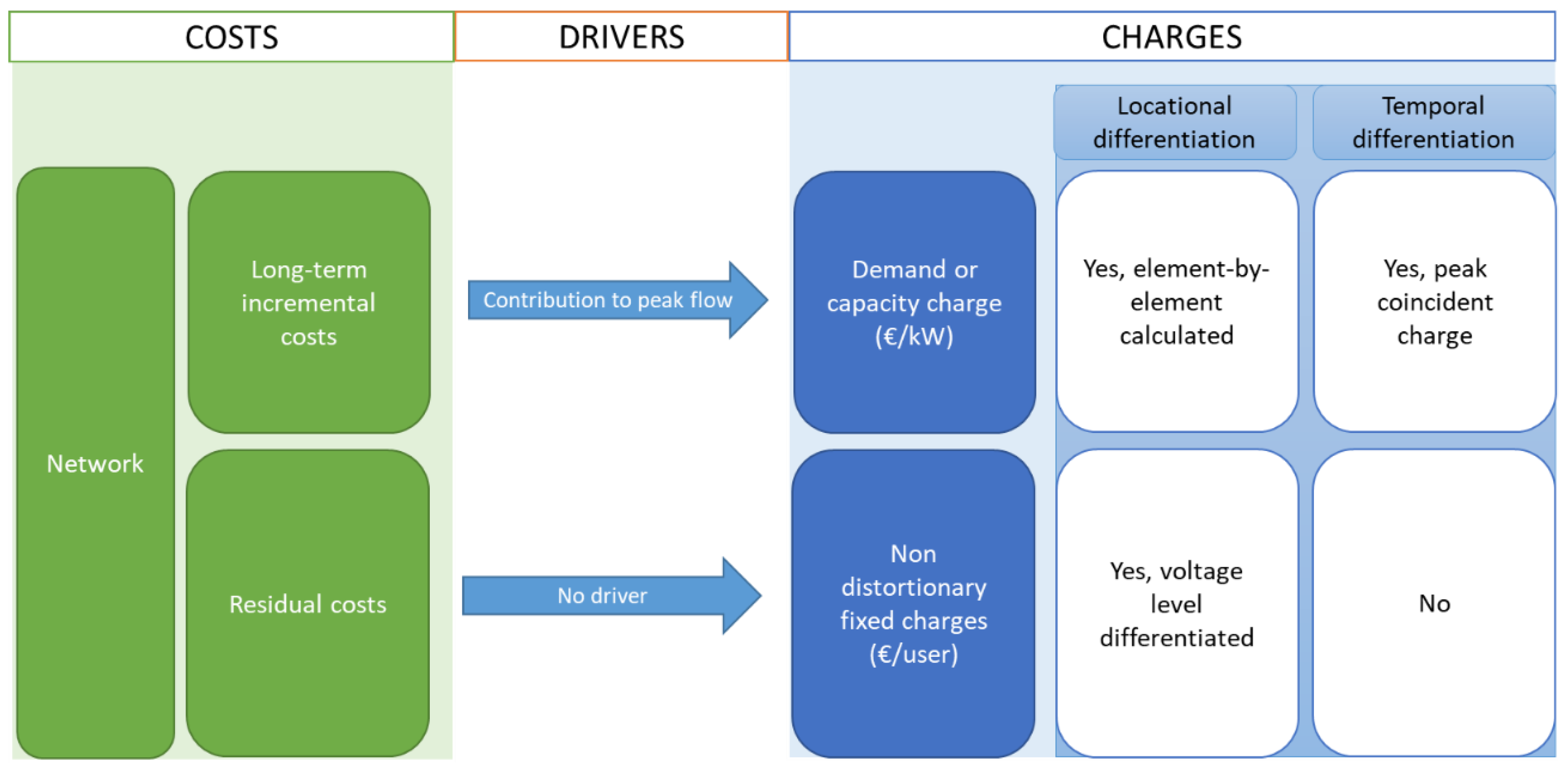

3.1.1. Cost Segmentation and Cost Drivers

3.1.2. Network Users and Type of Charges

3.1.3. Granularity

3.2. Methodology for Allocation of Network Costs

3.2.1. Cost Recognition and Segmentation

3.2.2. Network Users and Types of Charges

3.2.3. Granularity

3.2.4. Proposed Network Charges: Summary

4. Case Study

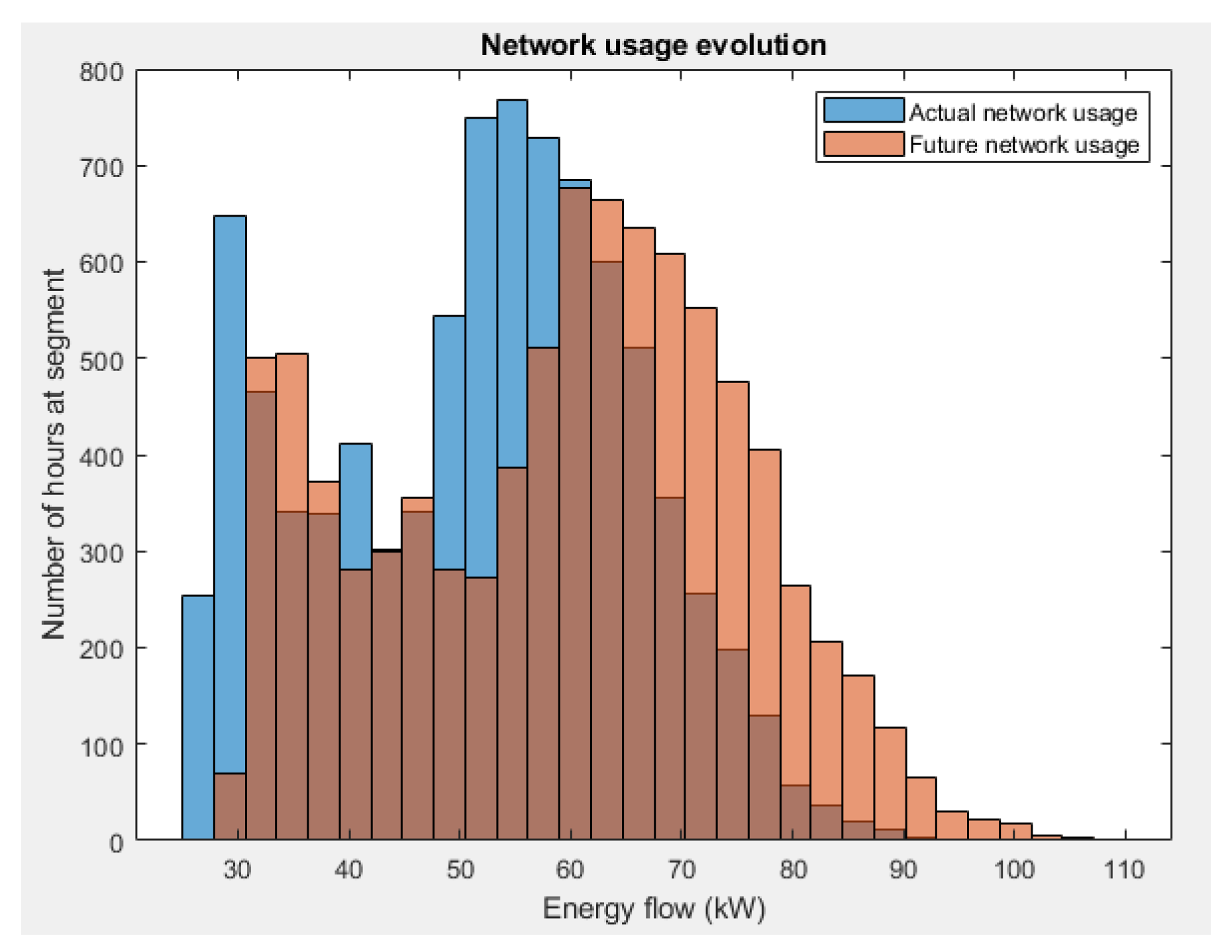

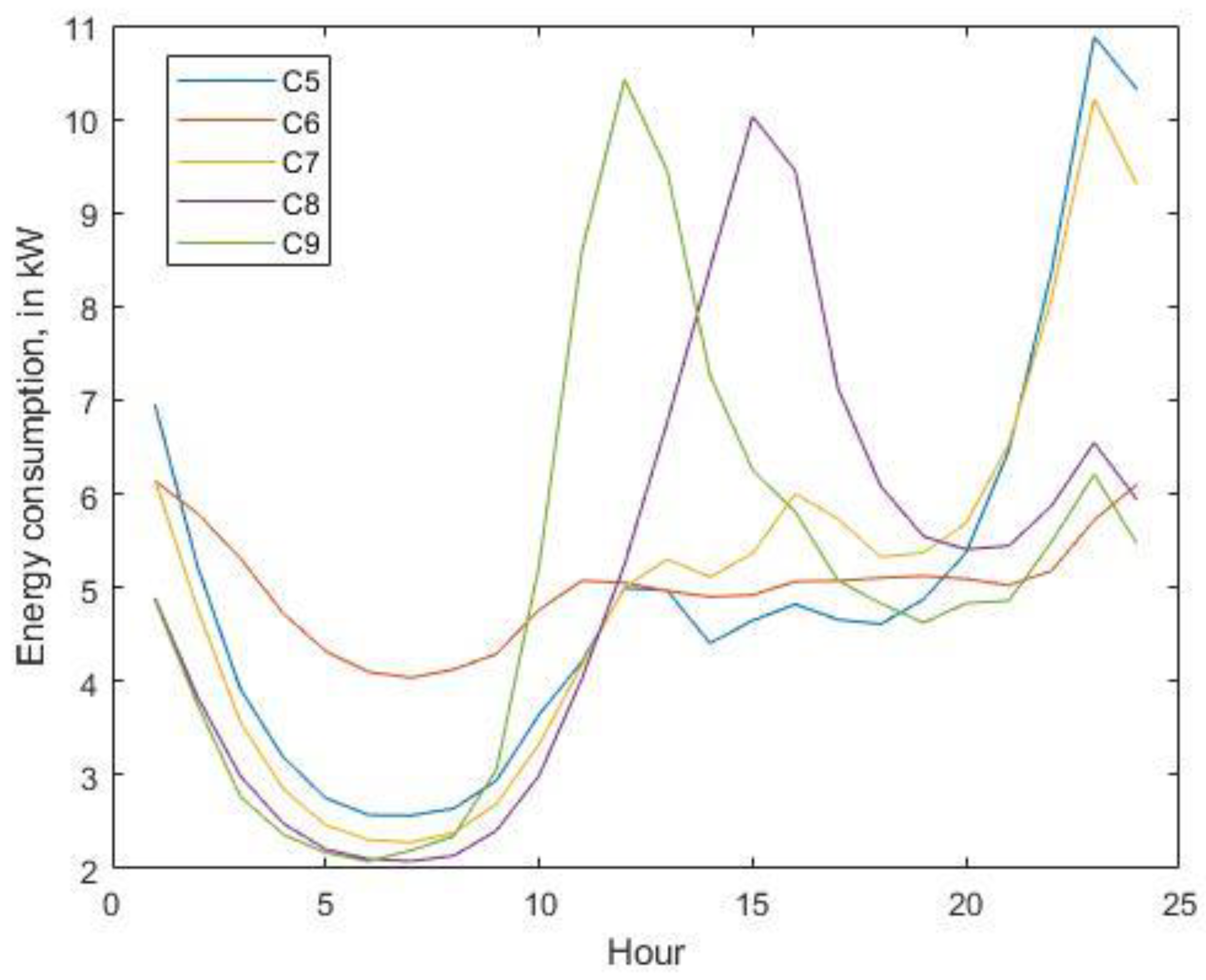

4.1. Network Model Description

4.2. Network Tariff Description

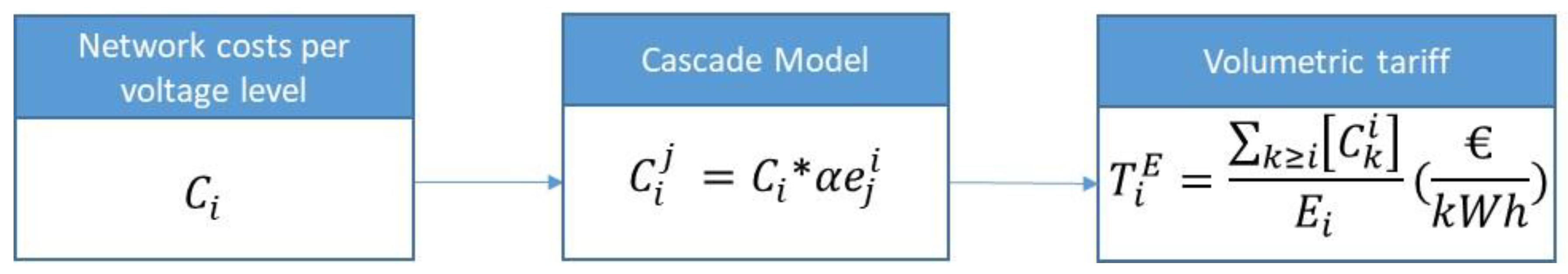

4.2.1. Volumetric Tariff

- = voltage levels 1 (low voltage), 2 (medium voltage) and 3 (high voltage);

- = network costs per voltage level i;

- = costs of voltage level i that will be allocated to users of voltage level j;

- = cost sharing factor based on the electricity flow from voltage level i to voltage level j;

- = volumetric network tariff (€/kWh) for consumers connected at voltage level i;

- = aggregated consumption (kWh) at voltage level i.

4.2.2. Spanish Tariff

- The acknowledged regulated costs for each network voltage level are determined. Costs are allocated to two types of charges so that the capacity charge is responsible for recovering 100% of the high-voltage (HV) network costs and 75% of the medium-voltage (MV) and low-voltage (LV) costs, while the energy charge is collecting 25% of MV and 25% of LV costs.

- The costs from a voltage level are allocated to the different periods according to the proportion of peak hours found at each period. For example, if period 1 contains 50% of the total peak hours, 50% of costs will be allocated to that period. In this case study, it has been considered that the peak hours are the 8 h of highest consumption at each voltage level.

- The cascading model is applied, following the assumption that those responsible for the costs of a voltage level are the users connected at that voltage level and the users connected at lower voltage levels [46]. For computing the capacity charge, the peak demand power balance is used to calculate how the cost of a voltage level and period is divided among responsible users at the same and other voltage levels. The power flow between voltage levels is the flow in the transformers at the previously determined peak hours. Knowing these flows, the costs of a voltage level are allocated among the different voltage levels proportionally to the maximum flow of each period. This calculation is made for each voltage level, for each hourly period and for each type of charge (volumetric or capacity). In the case of computing volumetric charges, the aggregated energy consumed in each period and each voltage level is used instead of the peak demand.

- p = time periods from 1 (peak period) to 3 (off-peak period);

- = voltage levels 1 (low voltage), 2 (medium voltage) and 3 (high voltage);

- = network costs of voltage level i to be recovered by capacity charges;

- = part of network costs of voltage level i allocated to time period p, to be recovered by capacity charges;

- = number of hours with maximum energy flows;

- = number of hours of time period p included in the H for voltage level i;

- = costs of voltage level i that will be allocated to users of voltage level j, at time period p, to be recovered by capacity charges;

- = cost sharing factor based on the electricity flow from voltage level i to voltage level j, for the time period p, applied to costs recovered by capacity charges;

- = network capacity charge (€/kW) for consumers connected to voltage level i, for time period p;

- = aggregated maximum capacity (kW) at voltage level i and time period p;

- = network costs per voltage level i to be recovered by energy charges;

- = part of network costs of voltage level i allocated to time period p, to be recovered by energy charges;

- = costs of voltage level i that will be allocated to users of voltage level j, at time period p, to be recovered by energy charges;

- = cost sharing factor based on the electricity flow from voltage level i to voltage level j, for the time period p, applied to costs recovered by energy charges;

- = network energy charge (€/kW) for consumers connected to voltage level i, for time period p;

- = aggregated consumption (kWh) at voltage level i and time period p.

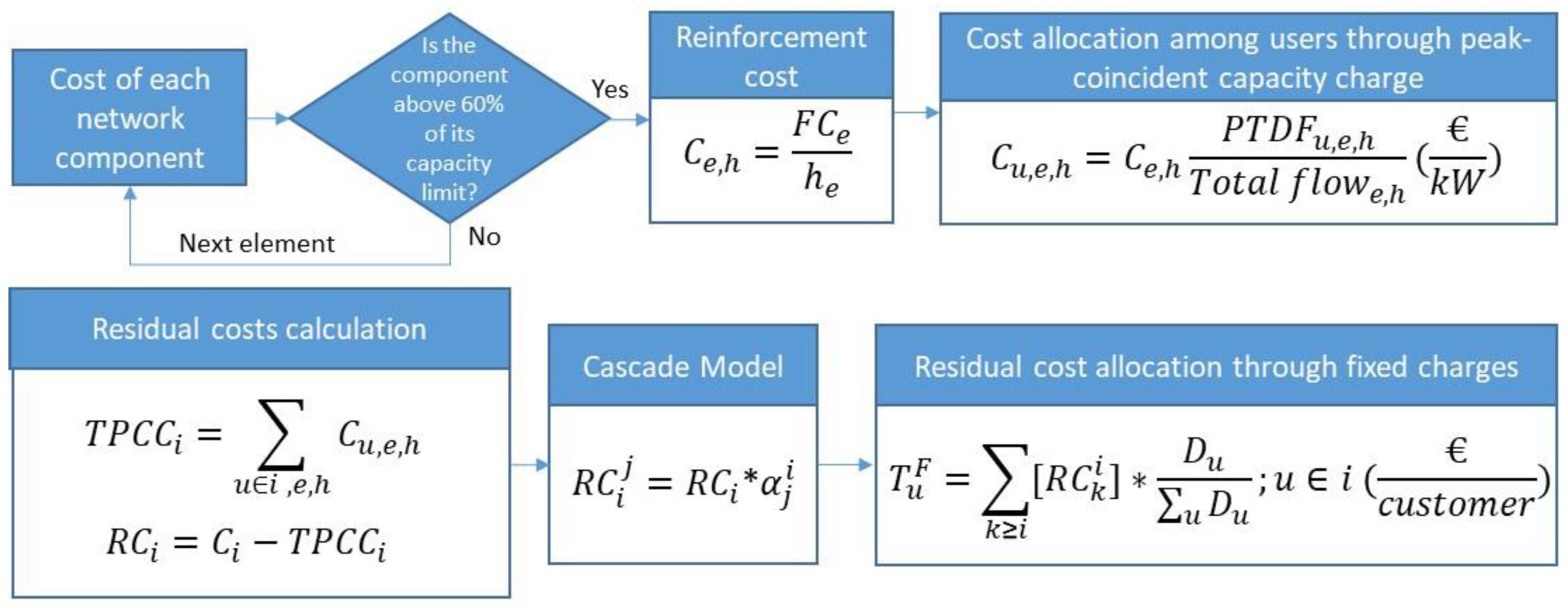

4.2.3. Efficient Tariff

- = voltage levels 1 (low voltage), 2 (medium voltage) and 3 (high voltage);

- e = network component (line, transformer);

- u = network user (consumer or generator);

- = cost of element e allocated to hour h;

- = annualized future reinforcement cost of element e;

- = number of hours in which component e is above 60% of its capacity limit;

- = cost of element e allocated to user u at hour h;

- = network flow of component e caused by user u at hour h;

- = flow along component e at hour h;

- = total peak-coincident charges at voltage level i;

- = total network costs of voltage level i;

- = residual network costs of voltage level i;

- = residual costs of voltage level i that will be allocated to users of voltage level j;

- = cost sharing factor based on the electricity flow from voltage level i to voltage level j;

- = fixed charge for consumer u (€/consumer);

- = maximum demand at peak or shoulder periods of consumer u.

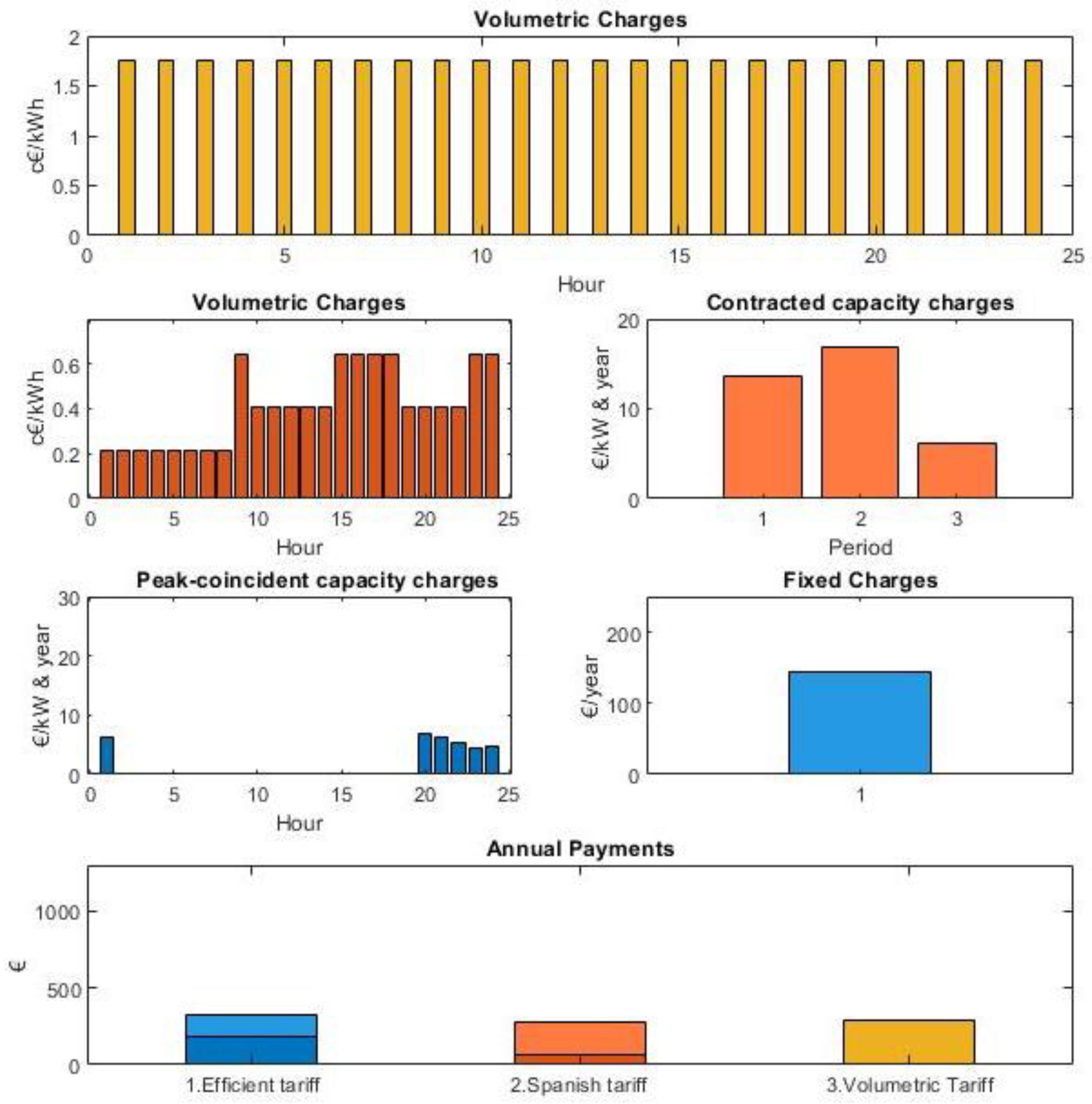

4.2.4. First Case

4.2.5. Second Case

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Pérez-Arriaga, I.J. Chapter 8. Electricity tariffs. In Regulation of the Power Sector; Power Systems; Springer: London, UK, 2013; ISBN 978-1-4471-5033-6. [Google Scholar]

- Schittekatte, T.; Meeus, L. Limits of Traditional Distribution Network Tariff Design and Options to Move Beyond; Robert Schuman Centre for Advanced Studies Policy Briefs; Florence School of Regulation: Florence, Italy, 2018; ISBN 978-92-9084-613-0. [Google Scholar]

- Siano, P. Demand response and smart grids—A survey. Renew. Sustain. Energy Rev. 2014, 30, 461–478. [Google Scholar] [CrossRef]

- Pérez-Arriaga, I.J. Utility of the Future. An MIT Energy Initiative Response to an Industry in Transition. Available online: http://energy.mit.edu/wp-content/uploads/2016/12/Utility-of-the-Future-Full-Report.pdf (accessed on 7 March 2019).

- Brown, D.P.; Sappington, D.E.M. On the role of maximum demand charges in the presence of distributed generation resources. Energy Econ. 2018, 69, 237–249. [Google Scholar] [CrossRef]

- Glachant, J.-M.; Rossetto, N. The Digital World Knocks at Electricity’s Door: Six Building Blocks to Understand Why. Available online: http://cadmus.eui.eu//handle/1814/59044 (accessed on 29 September 2019).

- Distribution System Operators Observatory. Overview of the Electricity Distribution System in Europe; Joint Research Centre: Brussels, Belgium, 2018; Available online: http://publications.jrc.ec.europa.eu/repository/bitstream/JRC113926/jrc113926_kjna29615enn_newer.pdf (accessed on 9 July 2019).

- United Nations. Paris Agreement. Available online: https://unfccc.int/sites/default/files/english_paris_agreement.pdf (accessed on 24 June 2019).

- Directive (EU) 2018/2001 of the European Parliament and of the Council of 11 December 2018 on the Promotion of the Use of Energy from Renewable Sources. Available online: http://data.europa.eu/eli/dir/2018/2001/oj/eng (accessed on 24 June 2019).

- ACER Market Monitoring Report 2017—Electricity and Gas Retail Markets Volume. Available online: https://www.acer.europa.eu/Official_documents/Acts_of_the_Agency/Publication/ACER%20Market%20Monitoring%20Report%202017%20-%20Electricity%20and%20Gas%20Retail%20Markets%20Volume.pdf (accessed on 24 June 2019).

- Regulatory Policy and Governance: Supporting Economic Growth and Serving the Public Interest; OECD: Paris, France, 2011; ISBN 978-92-64-11656-6.

- Rodríguez Ortega, M.P.; Pérez-Arriaga, J.I.; Abbad, J.R.; González, J.P. Distribution network tariffs: A closed question? Energy Policy 2008, 36, 1712–1725. [Google Scholar] [CrossRef]

- Burger, S.; Schneider, I.; Botterud, A.; Pérez-Arriaga, I. Chapter 8—Fair, Equitable, and Efficient Tariffs in the Presence of Distributed Energy Resources. In Consumer, Prosumer, Prosumager; Sioshansi, F., Ed.; Academic Press: Cambridge, MA, USA, 2019; pp. 155–188. ISBN 978-0-12-816835-6. [Google Scholar]

- Batlle, C. A method for allocating renewable energy source subsidies among final energy consumers. Energy Policy 2011, 39, 2586–2595. [Google Scholar] [CrossRef]

- Pollitt, M.G. Electricity Network Charging in the Presence of Distributed Energy Resources: Principles, Problems and Solutions. EEEP 2018, 7. [Google Scholar] [CrossRef]

- Strielkowski, W.; Štreimikienė, D.; Bilan, Y. Network charging and residential tariffs: A case of household photovoltaics in the United Kingdom. Renew. Sustain. Energy Rev. 2017, 77, 461–473. [Google Scholar] [CrossRef]

- Nijhuis, M.; Gibescu, M.; Cobben, J.F.G. Analysis of reflectivity & predictability of electricity network tariff structures for household consumers. Energy Policy 2017, 109, 631–641. [Google Scholar] [CrossRef]

- Schittekatte, T.; Meeus, L. How Future-Proof Is Your Distribution Grid Tariff Design? Policy Briefs 2017/03; Florence School of Regulation: Florence, Italy, 2017. [Google Scholar] [CrossRef]

- Gerres, T.; Chaves, J.P.; Martín, F.; Rivier, M.; Gómez, T. The role of nuclear power plants in electricity systems with high RES share. In Proceedings of the IEEE Milan PowerTech, Milan, Italy, 23–27 June 2019. [Google Scholar] [CrossRef]

- Mastropietro, P. Who should pay to support renewable electricity? Exploring regressive impacts, energy poverty and tariff equity. Energy Res. Soc. Sci. 2019, 56, 101222. [Google Scholar] [CrossRef]

- Barrera, F. Peajes Eléctricos: Una Barrera para la Transición Energética; Frontier Economics: Berlin, Germany, 2019; Available online: https://www.frontier-economics.com/media/3346/frontier-peajes-el%C3%A9ctricos-junio-2019.pdf (accessed on 1 July 2019).

- Abdelmotteleb, I.; Gómez, T.; Chaves Ávila, J.P.; Reneses, J. Designing efficient distribution network charges in the context of active customers. Appl. Energy 2018, 210, 815–826. [Google Scholar] [CrossRef]

- Bergaentzlé, C.; Jensen, I.G.; Skytte, K.; Olsen, O.J. Electricity grid tariffs as a tool for flexible energy systems: A Danish case study. Energy Policy 2019, 126, 12–21. [Google Scholar] [CrossRef]

- Haapaniemi, J.; Haakana, J.; Räisänen, O.; Lassila, J.; Partanen, J. DSO tariff driven customer grid defections—Techno-economical risks for DSO? In Proceedings of the 25th International Conference on Electricity Distribution (CIRED 2019), Madrid, Spain, 3–6 June 2019. [Google Scholar] [CrossRef]

- EDP. Tabla Peajes Eléctricos 01–19. Available online: https://www.edpenergia.es/recursos/doc/portal-clientes/20130827/precios/tarifas-electricas-para-empresas.pdf? (accessed on 26 August 2019).

- Regulation (EU) 2019/943. Volume 158. Available online: http://data.europa.eu/eli/reg/2019/943/oj/eng (accessed on 15 July 2019).

- Directive (EU) 2019/944. Volume 158. Available online: https://eur-lex.europa.eu/eli/dir/2019/944/oj (accessed on 15 July 2019).

- Bonbright, J.C. Principles of Public Utility Rates. Available online: http://media.terry.uga.edu/documents/exec_ed/bonbright/principles_of_public_utility_rates.pdf (accessed on 3 July 2019).

- Ofgem Introduction on Access and Forward-Looking Charges Significant Code Review. Available online: https://www.ofgem.gov.uk/system/files/docs/2019/09/111_-_working_paper_-_summer_2019_-_intro_note_final.pdf (accessed on 12 December 2019).

- Simshauser, P. Distribution network prices and solar PV: Resolving rate instability and wealth transfers through demand tariffs. Energy Econ. 2016, 54, 108–122. [Google Scholar] [CrossRef]

- Hoarau, Q.; Perez, Y. Network tariff design with prosumers and electromobility: Who wins, who loses? Energy Econ. 2019. [Google Scholar] [CrossRef]

- Borenstein, S. Private Net Benefits of Residential Solar PV: The Role of Electricity Tariffs, Tax Incentives, and Rebates. J. Assoc. Environ. Resour. Econ. 2017, 4, S85–S122. [Google Scholar] [CrossRef]

- Trabish, H.K. How Storage Can Help Solve the Distributed Energy ‘Death Spiral’: A New Navigant Paper Lays out Three Examples of How Storage Can Facilitate the Transition to a More Distributed Grid. Available online: https://www.utilitydive.com/news/how-storage-can-help-solve-the-distributed-energy-death-spiral/421160/ (accessed on 9 July 2019).

- González, A. (Spanish): Implicaciones de la Continuidad de Suministro en el Diseño de la Tarifa de Red de Distribución. Ph.D. Thesis, Universidad Pontificia de Comillas, Madrid, Spain, November 2014. [Google Scholar]

- Van Langen, V. Network Tariffs in Electricity and Gas. Available online: https://www.energy-community.org/dam/jcr:57a0a8a5-e7e8-4a6f-95f4-0c970f04250f/REG102019_ACM.pdf (accessed on 29 March 2019).

- Eero, V. Battery Storage Costs and Impact on PV Competitiveness. Available online: http://www.iea-pvps.org/fileadmin/dam/intranet/ExCo/51st_Malaysia/Vartiainen_Battery_Storage_Costs_and_Impact_on_PV_Competitiveness_20180924.pdf (accessed on 9 July 2019).

- Ioannis, T.; Tarvydas, D.; Lebedeva, N. Li-ion Batteries for Mobility and Stationary Storage Applications. Available online: https://publications.jrc.ec.europa.eu/repository/bitstream/JRC113360/kjna29440enn.pdf (accessed on 9 July 2019).

- BP Energy Outlook 2019. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/energy-outlook/bp-energy-outlook-2019.pdf (accessed on 9 July 2019).

- Hayward, J.A.; Graham, P.W. Electricity Generation Technology Cost Projections: 2017–2050. Available online: https://publications.csiro.au/rpr/download?pid=csiro:EP178771&dsid=DS2 (accessed on 9 July 2019).

- Ofgem Targeted Charging Review: Decision and Impact Assessment. Available online: https://www.ofgem.gov.uk/system/files/docs/2019/12/full_decision_doc_formatted_updated9.pdf (accessed on 26 November 2019).

- Batlle, C.; Mastropietro, P.; Rodilla, P. Redesigning residual cost allocation in electricity tariffs: A proposal to balance efficiency, equity and cost recovery. Renew. Energy 2020, 155, 257–266. [Google Scholar] [CrossRef]

- Borenstein, S. The economics of fixed cost recovery by utilities. Electr. J. 2016, 29, 5–12. [Google Scholar] [CrossRef]

- Passey, R.; Haghdadi, N.; Bruce, A.; MacGill, I. Designing more cost reflective electricity network tariffs with demand charges. Energy Policy 2017, 109, 642–649. [Google Scholar] [CrossRef]

- Schittekatte, T.; Meeus, L. Introduction to Network Tariffs and Network Codes for Consumers, Prosumers, and Energy Communities; Florence School of Regulation: Florence, Italy, 2018. [Google Scholar] [CrossRef]

- CNMC. Propuesta por la que se Establece la Metodología para el Cálculo de los Peajes de Transporte y Distribución de Electricidad. Available online: https://www.cnmc.es/sites/default/files/editor_contenidos/Energia/Consulta%20Publica/01%20Propuesta%20_CIR_DE_002_19_peajes_el%C3%A9ctricos.pdf (accessed on 27 August 2019).

- Reneses, J.; Gómez, T.; Rivier, J.; Angarita, J.L. Electricity tariff design for transition economies: Application to the Libyan power system. Energy Econ. 2011, 33, 33–43. [Google Scholar] [CrossRef]

- Sauer, P.W. On the Formulation of Power Distribution Factors for Linear Load Flow Methods. IEEE Trans. Power Appar. Syst. 1981, 100, 764–770. [Google Scholar] [CrossRef]

| Tariff | Period 1 | Period 2 | Period 3 | |

|---|---|---|---|---|

| 2.0A | CT (€/kW year) | 38.043426 | - | - |

| ET (€/kWh) | 0.044027 | - | - | |

| 2.0DHA | CT (€/kW year) | 38.043426 | - | - |

| ET (€/kWh) | 0.062012 | 0.002215 | - | |

| 2.0DHS | CT (€/kW year) | 38.043426 | - | - |

| ET (€/kWh) | 0.062012 | 0.002879 | 0.000886 | |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Morell Dameto, N.; Chaves-Ávila, J.P.; Gómez San Román, T. Revisiting Electricity Network Tariffs in a Context of Decarbonization, Digitalization, and Decentralization. Energies 2020, 13, 3111. https://doi.org/10.3390/en13123111

Morell Dameto N, Chaves-Ávila JP, Gómez San Román T. Revisiting Electricity Network Tariffs in a Context of Decarbonization, Digitalization, and Decentralization. Energies. 2020; 13(12):3111. https://doi.org/10.3390/en13123111

Chicago/Turabian StyleMorell Dameto, Nicolás, José Pablo Chaves-Ávila, and Tomás Gómez San Román. 2020. "Revisiting Electricity Network Tariffs in a Context of Decarbonization, Digitalization, and Decentralization" Energies 13, no. 12: 3111. https://doi.org/10.3390/en13123111

APA StyleMorell Dameto, N., Chaves-Ávila, J. P., & Gómez San Román, T. (2020). Revisiting Electricity Network Tariffs in a Context of Decarbonization, Digitalization, and Decentralization. Energies, 13(12), 3111. https://doi.org/10.3390/en13123111