Towards Flexibility Trading at TSO-DSO-Customer Levels: A Review

Abstract

1. Introduction

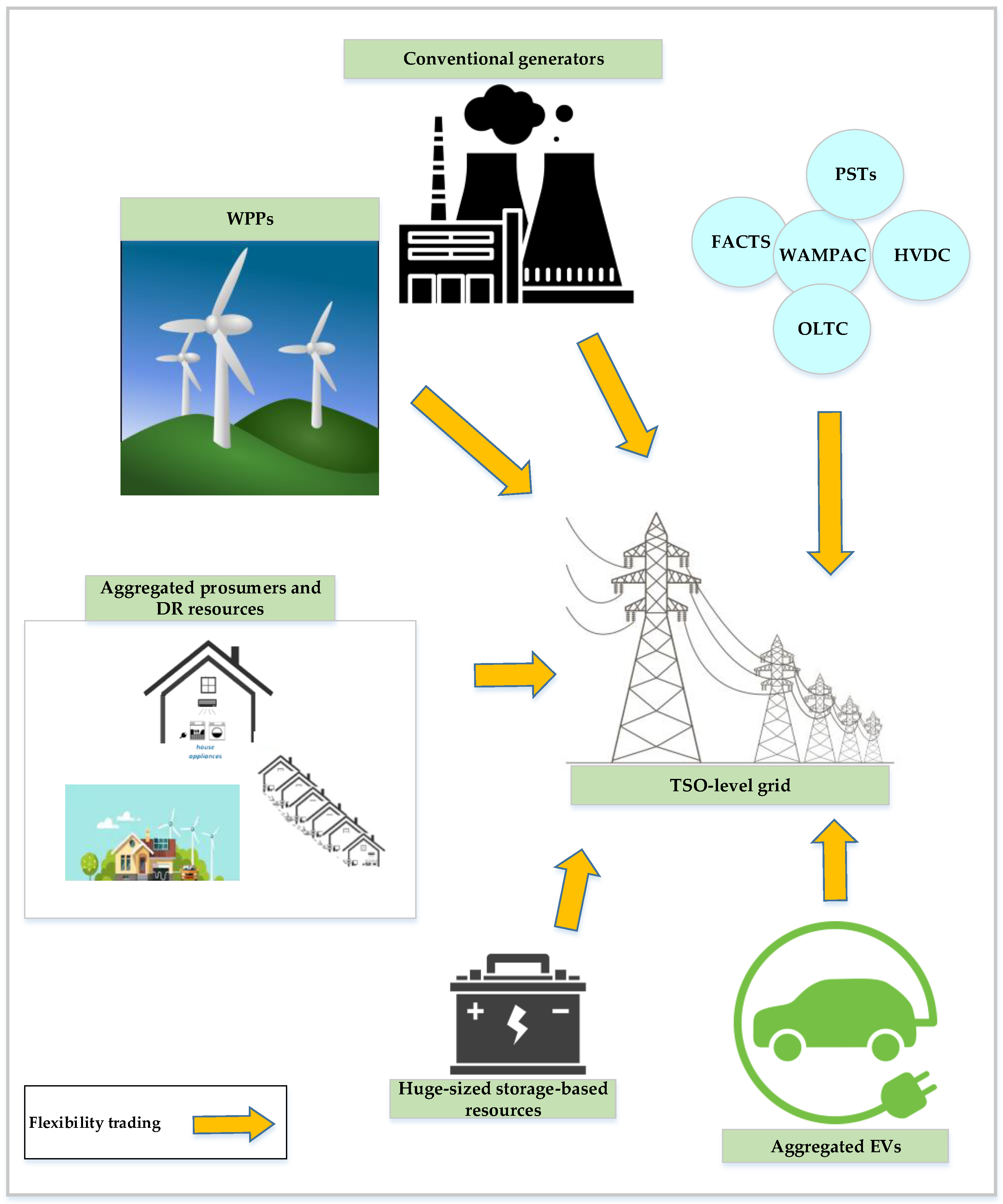

- Conducting a comprehensive review of conventional as well as new potential flexible resources located at different levels of power systems including transmission-level, distribution-level (DSO) and customer-level. At each level, the system operator has different responsibilities which make them deploy different kinds of flexible resources in order to enhance the flexibility of the power system.

- Seeking the existing flexibility trading structures of different-level systems proposed by the recent research. The trading structures aim to facilitate injecting flexibility to the DSO-, TSO-, and customer-level networks.

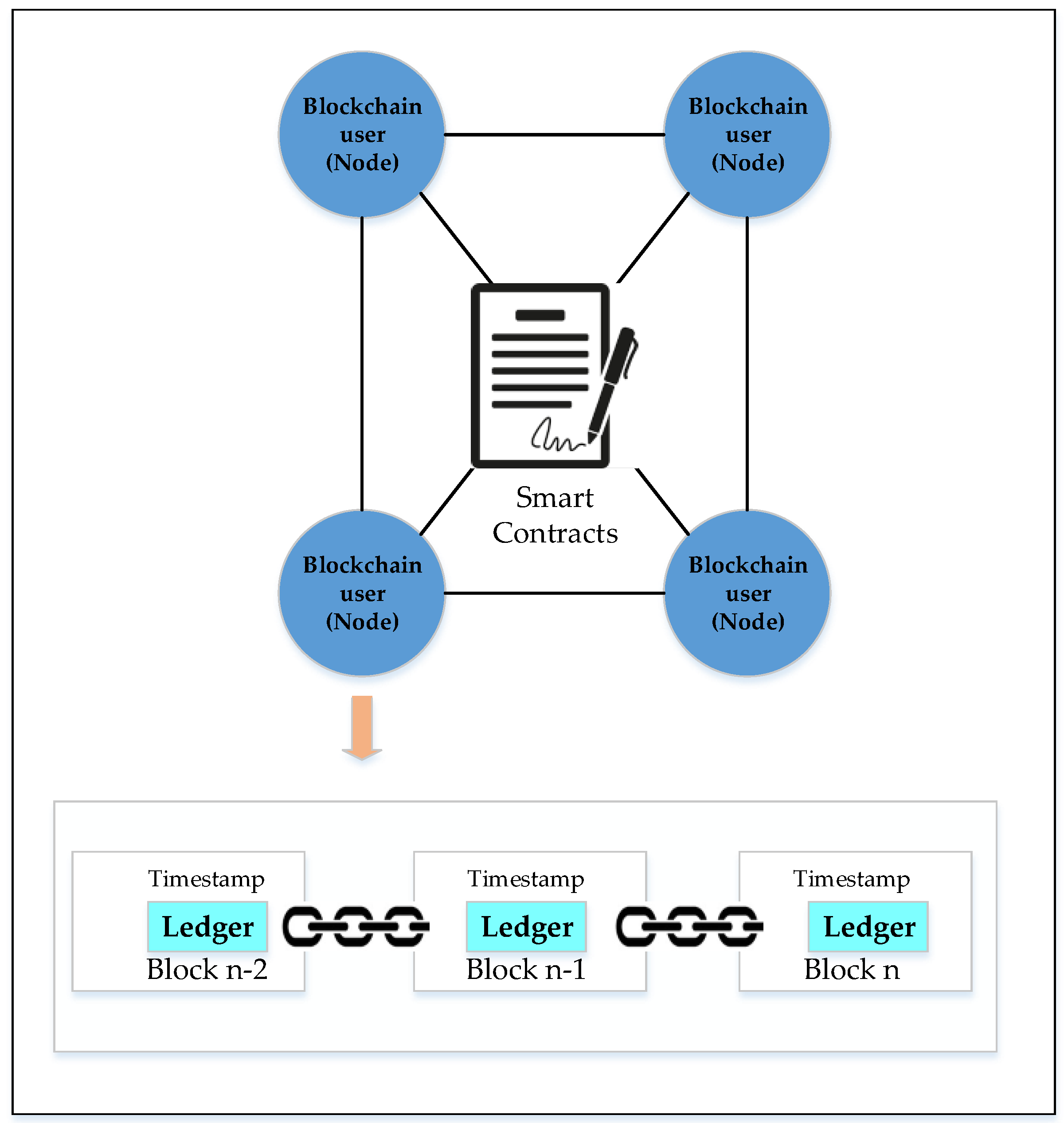

- A newly emerged ICT technology, blockchain technology, is analyzed in this paper and its merits and applications in the flexibility trading are discussed as well.

2. Flexibility at TSO Level

2.1. Flexible Resources at TSO Level

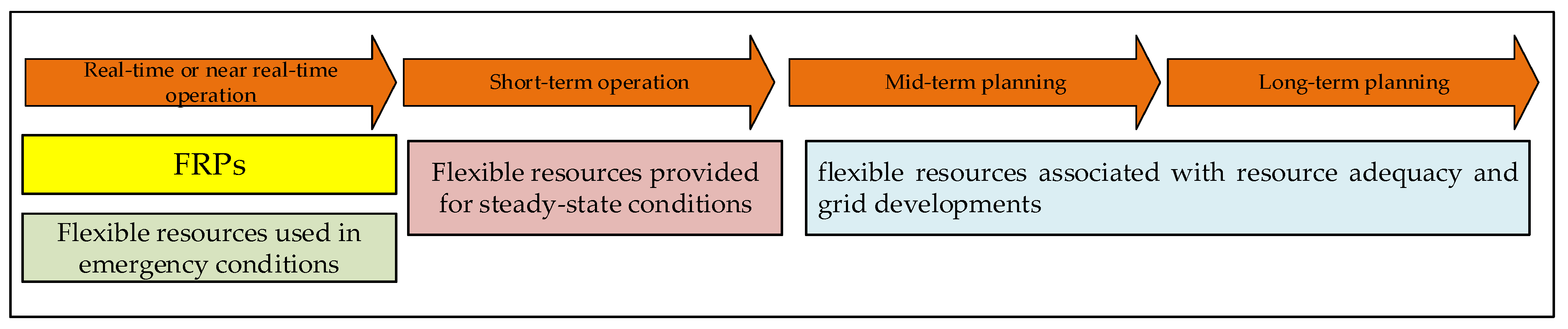

2.2. Flexibilities Related Trading at TSO Level

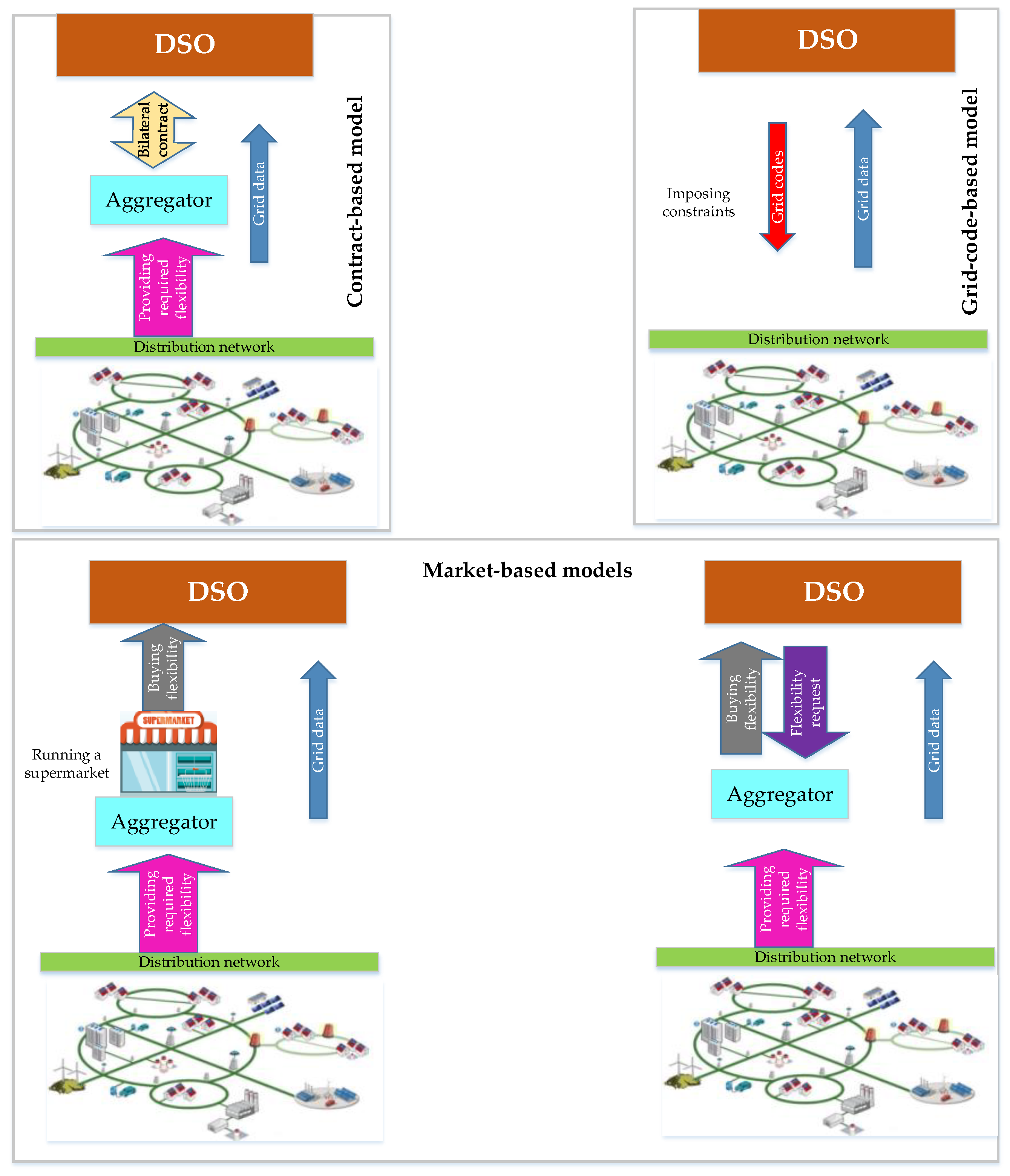

3. Flexibility at DSO Level

3.1. Flexible Resources at DSO Level

3.2. Flexibilities Related Trading at DSO Level

4. Flexibility at Customer Level

4.1. Flexible Resources at Customer Level

4.2. Flexibilities Related Trading at Customer Level

5. Application of Blockchain Technology in Flexibility Trading

- (1)

- All DR products can be integrated through a single venue, enhancing the liquidity as well as providing a combination of different DR products.

- (2)

- It has the ability to allocate the value of flexibility in a fair manner.

- (3)

- It promotes competitive operation and reduces costs by eliminating centralized entities.

- (4)

- A blockchain-based platform may incentivize users to innovate and extend functionality as needed.

- (5)

- Users can manage their own personal data as there is no need for a centralized entity to take control of their private data.

6. Discussion and Conclusions

Author Contributions

Funding

Conflicts of Interest

Nomenclature

| AHS | Automatic Home System | FACTS | Flexible AC Transmission System |

| AMI | Advanced Metering Infrastructure | FLECH | Flexibility Clearing House |

| ANM | Active Network Management | FRP | Flexible Ramping Product |

| BES | Battery Energy System | HEM | Home Energy Management |

| DER | Distributed Energy Resources | HV | High Voltage |

| DLR | Dynamic Line Rating | HVDC | High Voltage DC |

| DR | Demand Response | ICT | Information and Communication Technology |

| DSO | Distribution System Operator | LV | Low Voltage |

| EV | Electric Vehicle | MG | Microgrid |

| MV | Medium Voltage | SCUC | Security-Constrained Unit Commitment |

| OLTC | On-Load Tap Changing | SCED | Security-Constrained Economic Dispatch |

| PST | Phase Shifting Transformer | TSO | Transmission System Operator |

| PV | Photovoltaic | WPP | Wind Power Producer |

| RES | Renewable Energy Source | WAMPAC | Wide-Area Monitoring Protection and Control |

References

- Change, I.C. Mitigation of climate change. In Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change; IPCC Climate: Geneva, Switzerland, 2014; Volume 1454, pp. 559–560. [Google Scholar]

- Stocker, T.F.; Qin, D.; Plattner, G.K.; Alexander, L.V.; Allen, S.K.; Bindoff, N.L.; Breon, F.M.; Church, J.A.; Cubasch, U.; Emori, S. Technical Summary—Climate Change 2013: The Physical Science Basis. In Contribution of Working Group I to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change; IPCC Climate: Geneva, Switzerland, 2013; pp. 33–115. [Google Scholar] [CrossRef]

- Ssekulima, E.B.; Anwar, M.B.; Al Hinai, A.; El Moursi, M.S. Wind speed and solar irradiance forecasting techniques for enhanced renewable energy integration with the grid: A review. IET Renew. Power Gener. 2016, 10, 885–989. [Google Scholar] [CrossRef]

- Heydarian-Forushani, E.; Moghaddam, M.P.; Sheikh-El-Eslami, M.K.; Shafie-Khah, M.; Catalão, J.P.S. A stochastic framework for the grid integration of wind power using flexible load approach. Energy Convers. Manag. 2014, 88, 985–998. [Google Scholar] [CrossRef]

- Anwar, M.B.; El Moursi, M.S.; Xiao, W. Dispatching and frequency control strategies for marine current turbines based on doubly fed induction generator. IEEE Trans. Sustain. Energy 2015, 7, 262–270. [Google Scholar] [CrossRef]

- Wang, Y.; Silva, V.; Lopez-Botet-Zulueta, M. Impact of high penetration of variable renewable generation on frequency dynamics in the continental Europe interconnected system. IET Renew. Power Gener. 2016, 10, 10–16. [Google Scholar] [CrossRef]

- Lovins, A.B. Reliably integrating variable renewables: Moving grid flexibility resources from models to results. Electr. J. 2017, 30, 58–63. [Google Scholar] [CrossRef]

- Ela, E.; Milligan, M.; Bloom, A.; Botterud, A.; Townsend, A.; Levin, T. Evolution of Wholesale Electricity Market Design with Increasing Levels of Renewable Generation; National Renewable Energy Laboratory (NREL): Golden, CO, USA, 2014.

- Dalhues, S.; Zhou, Y.; Pohl, O.; Rewald, F.; Erlemeyer, F.; Schmid, D.; Zwartscholten, J.; Hagemann, Z.; Wagner, C.; Gonzalez, D.M. Research and practice of flexibility in distribution systems: A review. CSEE J. Power Energy Syst. 2019, 5, 285–294. [Google Scholar]

- Lannoye, E.; Flynn, D.; O’Malley, M. Evaluation of power system flexibility. IEEE Trans. Power Syst. 2012, 27, 922–931. [Google Scholar] [CrossRef]

- Aghaei, J.; Alizadeh, M.-I. Demand response in smart electricity grids equipped with renewable energy sources: A review. Renew. Sustain. Energy Rev. 2013, 18, 64–72. [Google Scholar] [CrossRef]

- Siano, P. Demand response and smart grids—A survey. Renew. Sustain. Energy Rev. 2014, 30, 461–478. [Google Scholar] [CrossRef]

- Pinson, P.; Madsen, H. Benefits and challenges of electrical demand response: A critical review. Renew. Sustain. Energy Rev. 2014, 39, 686–699. [Google Scholar]

- Haider, H.T.; See, O.H.; Elmenreich, W. A review of residential demand response of smart grid. Renew. Sustain. Energy Rev. 2016, 59, 166–178. [Google Scholar] [CrossRef]

- Mohandes, B.; El Moursi, M.S.; Hatziargyriou, N.D.; El Khatib, S. A review of power system flexibility with high penetration of renewables. IEEE Trans. Power Syst. 2019. [Google Scholar] [CrossRef]

- Villar, J.; Bessa, R.; Matos, M. Flexibility products and markets: Literature review. Electr. Power Syst. Res. 2018, 154, 329–340. [Google Scholar] [CrossRef]

- Wang, Q.; Hodge, B.-M. Enhancing power system operational flexibility with flexible ramping products: A review. IEEE Trans. Ind. Inform. 2016, 13, 1652–1664. [Google Scholar] [CrossRef]

- ISGAN—Smarter & Stronger Power Transmission: Review of feasible technologies for enhanced capacity and flexibility. Available online: https://www.iea-isgan.org/smarter-stronger-power-transmission-review-of-feasible-technologies-for-enhanced-capacity-and-flexibility/ (accessed on 20 November 2019).

- Tchoubraev, D.; Wiczynski, D. Swiss TSO integrated operational planning, optimization and ancillary services system. In Proceedings of the 2015 IEEE Eindhoven PowerTech, Eindhoven, The Netherlands, 29 June–2 July 2015; IEEE: Piscataway, NJ, USA, 2015; pp. 1–6. [Google Scholar]

- Hu, J.; Sarker, M.R.; Wang, J.; Wen, F.; Liu, W. Provision of flexible ramping product by battery energy storage in day-ahead energy and reserve markets. IET Gener. Transm. Distrib. 2018, 12, 2256–2264. [Google Scholar] [CrossRef]

- Cedec, E.; ENTSOe, E. Geode, «TSO-DSO Report-An Integrated Approach to Active System Management». 2019. Available online: https://docstore.entsoe.eu/Documents/Publications/Position%20papers%20and%20reports/TSO-DSO_ASM_2019_190416.pdf (accessed on 30 December 2019).

- Thakurta, P.G.; Maeght, J.; Belmans, R.; Van Hertem, D. Increasing transmission grid flexibility by TSO coordination to integrate more wind energy sources while maintaining system security. IEEE Trans. Sustain. Energy 2014, 6, 1122–1130. [Google Scholar] [CrossRef]

- Verseille, J.; Staschus, K. The Mesh-Up: ENTSO-E and European TSO Cooperation in Operations, Planning, and R&D. IEEE Power Energy Mag. 2014, 13, 20–29. [Google Scholar]

- Widergren, S.; Subbarao, K.; Chassin, D.; Fuller, J.; Pratt, R. Residential real-time price response simulation. In Proceedings of the 2011 IEEE Power and Energy Society General Meeting, Detroit, MI, USA, 24–28 July 2011; IEEE: Piscataway, NJ, USA, 2011; pp. 1–5. [Google Scholar]

- De Zotti, G.; Pourmousavi, S.A.; Morales, J.M.; Madsen, H.; Poulsen, N.K. Consumers’ Flexibility Estimation at the TSO Level for Balancing Services. IEEE Trans. Power Syst. 2018, 34, 1918–1930. [Google Scholar] [CrossRef]

- Zhang, B.; Kezunovic, M. Impact on power system flexibility by electric vehicle participation in ramp market. IEEE Trans. Smart Grid 2015, 7, 1285–1294. [Google Scholar] [CrossRef]

- Chen, K.; Han, D.; Sun, W. Modeling for operational strategy of flexible ramping capacity in deregulated power system considering EV aggregators participation. In Proceedings of the 2018 International Conference on Power System Technology (POWERCON), Guangzhou, China, 6–8 November 2018; IEEE: Piscataway, NJ, USA, 2018; pp. 4175–4180. [Google Scholar]

- Khoshjahan, M.; Moeini-Aghtaie, M.; Fotuhi-Firuzabad, M. Developing new participation model of thermal generating units in flexible ramping market. IET Gener. Transm. Distrib. 2019. [Google Scholar] [CrossRef]

- Ye, H.; Li, Z. Deliverable robust ramping products in real-time markets. IEEE Trans. Power Syst. 2017, 33, 5–18. [Google Scholar] [CrossRef]

- Chen, R.; Wang, J.; Botterud, A.; Sun, H. Wind power providing flexible ramp product. IEEE Trans. Power Syst. 2016, 32, 2049–2061. [Google Scholar] [CrossRef]

- Wang, Z.; Shen, C.; Liu, F.; Wang, J.; Wu, X. An Adjustable Chance-Constrained Approach for Flexible Ramping Capacity Allocation. IEEE Trans. Sustain. Energy 2018, 9, 1798–1811. [Google Scholar] [CrossRef]

- Cui, M.; Zhang, J.; Wu, H.; Hodge, B.-M. Wind-friendly flexible ramping product design in multi-timescale power system operations. IEEE Trans. Sustain. Energy 2017, 8, 1064–1075. [Google Scholar] [CrossRef]

- Heydarian-Forushani, E.; Golshan, M.E.H.; Shafie-khah, M.; Siano, P. Optimal operation of emerging flexible resources considering sub-hourly flexible ramp product. IEEE Trans. Sustain. Energy 2017, 9, 916–929. [Google Scholar] [CrossRef]

- Zach, K.A.; Auer, H. Bulk energy storage versus transmission grid investments: Bringing flexibility into future electricity systems with high penetration of variable RES-electricity. In Proceedings of the 2012 9th International Conference on the European Energy Market, Florence, Italy, 10–12 May 2012; IEEE: Piscataway, NJ, USA, 2012; pp. 1–5. [Google Scholar]

- Wang, F.; Xu, H.; Xu, T.; Li, K.; Shafie-Khah, M.; Catalão, J.P.S. The values of market-based demand response on improving power system reliability under extreme circumstances. Appl. Energy 2017, 193, 220–231. [Google Scholar] [CrossRef]

- Zhou, S.; Shu, Z.; Gao, Y.; Gooi, H.B.; Chen, S.; Tan, K. Demand response program in Singapore’s wholesale electricity market. Electr. Power Syst. Res. 2017, 142, 279–289. [Google Scholar] [CrossRef]

- Khajeh, H.; Foroud, A.A.; Firoozi, H. Robust bidding strategies and scheduling of a price-maker microgrid aggregator participating in a pool-based electricity market. IET Gener. Transm. Distrib. 2018, 13, 468–477. [Google Scholar] [CrossRef]

- Nikoobakht, A.; Aghaei, J.; Khatami, R.; Mahboubi-Moghaddam, E.; Parvania, M. Stochastic flexible transmission operation for coordinated integration of plug-in electric vehicles and renewable energy sources. Appl. Energy 2019, 238, 225–238. [Google Scholar] [CrossRef]

- Cornelius, A. Assessing the Impact of Flexible Ramp Capability Products in the Midcontinent ISO. Master’s Thesis, Duke University, Durham, NC, USA, 2014. [Google Scholar]

- Navid, N.; Rosenwald, G. Market solutions for managing ramp flexibility with high penetration of renewable resource. IEEE Trans. Sustain. Energy 2012, 3, 784–790. [Google Scholar] [CrossRef]

- Osório, G.J.; Shafie-Khah, M.; Soares, N.G.S.; Catalão, J.P.S. Optimal Dynamic Tariffs for Flexible Ramp Market in the Presence of Wind Power Generation and Demand Response. In Proceedings of the 2018 IEEE International Conference on Environment and Electrical Engineering and 2018 IEEE Industrial and Commercial Power Systems Europe (EEEIC/I&CPS Europe), Palermo, Italy, 12–15 June 2018; IEEE: Piscataway, NJ, USA, 2018; pp. 1–5. [Google Scholar]

- Wang, B.; Hobbs, B.F. Real-time markets for flexiramp: A stochastic unit commitment-based analysis. IEEE Trans. Power Syst. 2015, 31, 846–860. [Google Scholar] [CrossRef]

- MISO, M. Energy and Operating Reserve Markets. Bus. Pract. Man. BPM-002-r11. 2018. Available online: https://www.misoenergy.org/legal/business-practice-manuals/ (accessed on 30 December 2019).

- Thomas, D.; Iain, M.; Dale, G. Virtual power plants leveraging energy flexibility in regional markets. CIRED-Open Access Proc. J. 2017, 2017, 2939–2943. [Google Scholar] [CrossRef]

- Zhang, C.; Yi, D.; Nordentoft, N.C.; Pinson, P.; Østergaard, J. FLECH: A Danish market solution for DSO congestion management through DER flexibility services. J. Mod. Power Syst. Clean Energy 2014, 2, 126–133. [Google Scholar] [CrossRef]

- Alkandari, A.; Sami, A.A.; Sami, A. Proposed DSO ancillary service processes considering smart grid requirements. CIRED-Open Access Proc. J. 2017, 2017, 2846–2847. [Google Scholar] [CrossRef]

- Short, T.A. Electric Power Distribution Handbook; CRC Press: Boca Raton, FL, USA, 2018; ISBN 1315215551. [Google Scholar]

- Ding, Y.; Hansen, L.H.; Cajar, P.D.; Brath, P.; Bindner, H.W.; Zhang, C.; Nordentoft, N.C. Development of a DSO-market on Flexibility Services. 2013. Available online: https://backend.orbit.dtu.dk/ws/portalfiles/portal/176493622/WP_3_8_report.pdf (accessed on 30 December 2019).

- Huang, S.; Wu, Q.; Cheng, L.; Liu, Z. Optimal reconfiguration-based dynamic tariff for congestion management and line loss reduction in distribution networks. IEEE Trans. Smart Grid 2015, 7, 1295–1303. [Google Scholar] [CrossRef]

- Kulmala, A.; Alonso, M.; Repo, S.; Amaris, H.; Moreno, A.; Mehmedalic, J.; Al-Jassim, Z. Hierarchical and distributed control concept for distribution network congestion management. IET Gener. Transm. Distrib. 2017, 11, 665–675. [Google Scholar] [CrossRef]

- Shen, F.; Huang, S.; Wu, Q.; Repo, S.; Xu, Y.; Østergaard, J. Comprehensive Congestion Management for Distribution Networks based on Dynamic Tariff, Reconfiguration and Re-profiling Product. IEEE Trans. Smart Grid 2018. [Google Scholar] [CrossRef]

- Brochure, C. Guidelines for increased utilization of existing overhead trasnsmission lines. WG B2 2008, 13, 26–31. [Google Scholar]

- Heussen, K.; Bondy, D.E.M.; Hu, J.; Gehrke, O.; Hansen, L.H. A clearinghouse concept for distribution-level flexibility services. In Proceedings of the IEEE PES ISGT Europe 2013, Lyngby, Denmark, 6–9 October 2013; IEEE: Piscataway, NJ, USA, 2013; pp. 1–5. [Google Scholar]

- Heydarian-Forushani, E.; Moghaddam, M.P.; Sheikh-El-Eslami, M.K.; Shafie-khah, M.; Catalão, J.P.S. Risk-constrained offering strategy of wind power producers considering intraday demand response exchange. IEEE Trans. Sustain. Energy 2014, 5, 1036–1047. [Google Scholar] [CrossRef]

- Panwar, L.K.; Reddy, S.; Verma, A.; Panigrahi, B.K. Dynamic incentive framework for demand response in distribution system using moving time horizon control. IET Gener. Transm. Distrib. 2017, 11, 4338–4347. [Google Scholar] [CrossRef]

- Majzoobi, A.; Khodaei, A. Application of microgrids in supporting distribution grid flexibility. IEEE Trans. Power Syst. 2016, 32, 3660–3669. [Google Scholar] [CrossRef]

- Morstyn, T.; Teytelboym, A.; McCulloch, M.D. Designing Decentralized Markets for Distribution System Flexibility. IEEE Trans. Power Syst. 2018, 34, 2128–2139. [Google Scholar] [CrossRef]

- Iria, J.P.; Soares, F.J.; Matos, M.A. Trading small prosumers flexibility in the energy and tertiary reserve markets. IEEE Trans. Smart Grid 2018, 10, 2371–2382. [Google Scholar] [CrossRef]

- Zhu, X.; Han, H.; Gao, S.; Shi, Q.; Cui, H.; Zu, G. A multi-stage optimization approach for active distribution network scheduling considering coordinated electrical vehicle charging strategy. IEEE Access 2018, 6, 50117–50130. [Google Scholar] [CrossRef]

- Knezović, K.; Marinelli, M.; Codani, P.; Perez, Y. Distribution grid services and flexibility provision by electric vehicles: A review of options. In Proceedings of the 2015 50th International Universities Power Engineering Conference (UPEC), Stoke on Trent, UK, 1–4 September 2015; IEEE: Piscataway, NJ, USA, 2015; pp. 1–6. [Google Scholar]

- Huang, S.; Wu, Q. Real-time congestion management in distribution networks by flexible demand swap. IEEE Trans. Smart Grid 2017, 9, 4346–4355. [Google Scholar] [CrossRef]

- Stadler, I. Electrical Energy Storage. In Handbook of Energy Storage; Springer: Berlin/Heidelberg, Germany, 2019; pp. 191–225. [Google Scholar]

- Parthasarathy, C.; Hafezi, H.; Laaksonen, H.; Kauhaniemi, K. Modelling and Simulation of Hybrid PV & BES Systems as Flexible Resources in Smartgrids–Sundom Smart Grid Case. In Proceedings of the 2019 IEEE Milan PowerTech, Milan, Italy, 23–27 June 2019; IEEE: Piscataway, NJ, USA, 2019; pp. 1–6. [Google Scholar]

- Ghazvini, M.A.F.; Lipari, G.; Pau, M.; Ponci, F.; Monti, A.; Soares, J.; Castro, R.; Vale, Z. Congestion management in active distribution networks through demand response implementation. Sustain. Energy Grids Netw. 2019, 17, 100185. [Google Scholar] [CrossRef]

- Zhao, J.; Wang, Y.; Song, G.; Li, P.; Wang, C.; Wu, J. Congestion Management Method of Low-Voltage Active Distribution Networks Based on Distribution Locational Marginal Price. IEEE Access 2019, 7, 32240–32255. [Google Scholar] [CrossRef]

- Ziras, C.; Kazempour, J.; Kara, E.C.; Bindner, H.W.; Pinson, P.; Kiliccote, S. A Mid-Term DSO Market for Capacity Limits: How to Estimate Opportunity Costs of Aggregators? IEEE Trans. Smart Grid 2019. [Google Scholar] [CrossRef]

- Vo, T.H.; Haque, A.; Nguyen, P.H.; Kamphuis, I.G.; Eijgelaar, M.; Bouwman, I. A study of congestion management in smart distribution networks based on demand flexibility. In Proceedings of the 2017 IEEE Manchester PowerTech, Manchester, UK, 18–22 June 2017; IEEE: Piscataway, NJ, USA, 2017; pp. 1–6. [Google Scholar]

- Crăciun, B.-I.; Kerekes, T.; Séra, D.; Teodorescu, R. Overview of recent grid codes for PV power integration. In Proceedings of the 2012 13th International Conference on Optimization of Electrical and Electronic Equipment (OPTIM), Brasov, Romania, 24–26 May 2012; IEEE: Piscataway, NJ, USA, 2012; pp. 959–965. [Google Scholar]

- Olivella-Rosell, P.; Lloret-Gallego, P.; Munné-Collado, Í.; Villafafila-Robles, R.; Sumper, A.; Ottessen, S.; Rajasekharan, J.; Bremdal, B. Local flexibility market design for aggregators providing multiple flexibility services at distribution network level. Energies 2018, 11, 822. [Google Scholar] [CrossRef]

- Olivella-Rosell, P.; Bullich-Massagué, E.; Aragüés-Peñalba, M.; Sumper, A.; Ottesen, S.Ø.; Vidal-Clos, J.-A.; Villafáfila-Robles, R. Optimization problem for meeting distribution system operator requests in local flexibility markets with distributed energy resources. Appl. Energy 2018, 210, 881–895. [Google Scholar] [CrossRef]

- Zoeller, H.; Reischboeck, M.; Henselmeyer, S. Managing Volatility in Distribution Networks with Active Network Management; IET: London, UK, 2016. [Google Scholar]

- Damisa, U.; Nwulu, N.I.; Sun, Y. Microgrid energy and reserve management incorporating prosumer behind-the-meter resources. IET Renew. Power Gener. 2018, 12, 910–919. [Google Scholar] [CrossRef]

- Pau, G.; Collotta, M.; Ruano, A.; Qin, J. Smart home energy management 2017. Energies 2017, 10, 382. [Google Scholar] [CrossRef]

- Ikpehai, A.; Adebisi, B.; Rabie, K. Broadband PLC for clustered advanced metering infrastructure (AMI) architecture. Energies 2016, 9, 569. [Google Scholar] [CrossRef]

- Ahmed, M.; Kang, Y.; Kim, Y.-C. Communication network architectures for smart-house with renewable energy resources. Energies 2015, 8, 8716–8735. [Google Scholar] [CrossRef]

- Bradac, Z.; Kaczmarczyk, V.; Fiedler, P. Optimal scheduling of domestic appliances via MILP. Energies 2015, 8, 217–232. [Google Scholar] [CrossRef]

- Pascual, J.; Sanchis, P.; Marroyo, L. Implementation and control of a residential electrothermal microgrid based on renewable energies, a hybrid storage system and demand side management. Energies 2014, 7, 210–237. [Google Scholar] [CrossRef]

- Collotta, M.; Pau, G. A solution based on bluetooth low energy for smart home energy management. Energies 2015, 8, 11916–11938. [Google Scholar] [CrossRef]

- Paudel, A.; Chaudhari, K.; Long, C.; Gooi, H.B. Peer-to-Peer Energy Trading in a Prosumer-Based Community Microgrid: A Game-Theoretic Model. IEEE Trans. Ind. Electron. 2018, 66, 6087–6097. [Google Scholar] [CrossRef]

- Liu, Y.; Xiao, L.; Yao, G.; Bu, S. Pricing-based demand response for a smart home with various types of household appliances considering customer satisfaction. IEEE Access 2019, 7, 86463–86472. [Google Scholar] [CrossRef]

- Khorasany, M.; Mishra, Y.; Ledwich, G. A decentralised bilateral energy trading system for peer-to-peer electricity markets. IEEE Trans. Ind. Electron. 2019. [Google Scholar] [CrossRef]

- Olivella-Rosell, P.; Rullan, F.; Lloret-Gallego, P.; Prieto-Araujo, E.; Ferrer-San-José, R.; Barja-Martinez, S.; Bjarghov, S.; Lakshmanan, V.; Hentunen, A.; Forsström, J. Centralised and Distributed Optimization for Aggregated Flexibility Services Provision. arXiv 2019, arXiv:1907.08125. [Google Scholar]

- Gazafroudi, A.S.; Corchado, J.M.; Keane, A.; Soroudi, A. Decentralised flexibility management for EVs. IET Renew. Power Gener. 2019, 13, 952–960. [Google Scholar] [CrossRef]

- Prieto-Castrillo, F.; Shokri Gazafroudi, A.; Prieto, J.; Corchado, J.M. An ising spin-based model to explore efficient flexibility in distributed power systems. Complexity 2018, 2018. [Google Scholar] [CrossRef]

- Gazafroudi, A.S.; Prieto-Castrillo, F.; Pinto, T.; Corchado, J.M. Energy flexibility management in power distribution systems: Decentralized approach. In Proceedings of the 2018 International Conference on Smart Energy Systems and Technologies (SEST), Sevilla, Spain, 10–12 September 2018; IEEE: Piscataway, NJ, USA, 2018; pp. 1–6. [Google Scholar]

- Shokri Gazafroudi, A.; Prieto, J.; Corchado, J.M. Virtual Organization Structure for Agent-Based Local Electricity Trading. Energies 2019, 12, 1521. [Google Scholar] [CrossRef]

- Gazafroudi, A.S.; Corchado, J.M.; Shafie-khah, M.; Lotfi, M.; Joao Catalao, P.S. Iterative Algorithm For Local Electricity Trading. In Proceedings of the 2019 IEEE Milan PowerTech, Milan, Italy, 23–27 June 2019; IEEE: Piscataway, NJ, USA, 2019; pp. 1–6. [Google Scholar]

- Gazafroudi, A.S.; Shafie-khah, M.; Prieto-Castrillo, F.; Corchado, J.M.; Catalao, J.P.S. Monopolistic and Game-based Approaches to Transact Energy Flexibility. IEEE Trans. Power Syst. 2019, 1. [Google Scholar] [CrossRef]

- Ramos, A.; De Jonghe, C.; Gómez, V.; Belmans, R. Realizing the smart grid’s potential: Defining local markets for flexibility. Util. Policy 2016, 40, 26–35. [Google Scholar] [CrossRef]

- Bremdal, B.A.; Olivella-Rosell, P.; Rajasekharan, J.; Ilieva, I. Creating a local energy market. CIRED-Open Access Proc. J. 2017, 2017, 2649–2652. [Google Scholar] [CrossRef]

- Pinto, T.; Faia, R.; Ghazvini, M.A.F.; Soares, J.; Corchado, J.M.; do Vale, Z.M.A. Decision support for small players negotiations under a transactive energy framework. IEEE Trans. Power Syst. 2018. [Google Scholar] [CrossRef]

- Praça, I.; Ramos, C.; Vale, Z.; Cordeiro, M. MASCEM: A multiagent system that simulates competitive electricity markets. IEEE Intell. Syst. 2003, 18, 54–60. [Google Scholar] [CrossRef]

- Kok, C.; Kazempour, J.; Pinson, P. A DSO-level contract market for conditional demand response. In Proceedings of the 13th IEEE PES PowerTech Conference, Milan, Italy, 23–27 June 2019; IEEE: Piscataway, NJ, USA, 2019. [Google Scholar]

- Mengelkamp, E.; Notheisen, B.; Beer, C.; Dauer, D.; Weinhardt, C. A blockchain-based smart grid: Towards sustainable local energy markets. Comput. Sci. Dev. 2018, 33, 207–214. [Google Scholar] [CrossRef]

- Debus, J. Consensus Methods in Blockchain Systems; Technical Report; Frankfurt School of Finance & Management, Blockchain Center: Frankfurt am Main, Germany, 2017; pp. 1–58. [Google Scholar]

- Gao, C.; Ji, Y.; Wang, J.; Sai, X. Application of blockchain technology in peer-to-peer transaction of photovoltaic power generation. In Proceedings of the 2018 2nd IEEE Advanced Information Management, Communicates, Electronic and Automation Control Conference (IMCEC), Xi’an, China, 25–27 May 2018; IEEE: Piscataway, NJ, USA, 2018; pp. 2289–2293. [Google Scholar]

- Ellis, P.; Hubbard, J. Flexibility Trading Platform—Using Blockchain to Create the Most Efficient Demand-side Response Trading Market. In Transforming Climate Finance and Green Investment with Blockchains; Elsevier: Amsterdam, The Netherlands, 2018; pp. 99–109. [Google Scholar]

- Di Silvestre, M.L.; Gallo, P.; Ippolito, M.G.; Musca, R.; Sanseverino, E.R.; Tran, Q.T.T.; Zizzo, G. Ancillary Services in the Energy Blockchain for Microgrids. IEEE Trans. Ind. Appl. 2019. [Google Scholar] [CrossRef]

- Pop, C.; Cioara, T.; Antal, M.; Anghel, I.; Salomie, I.; Bertoncini, M. Blockchain based decentralized management of demand response programs in smart energy grids. Sensors 2018, 18, 162. [Google Scholar] [CrossRef] [PubMed]

| References | Reconfiguration and Reinforcing Method | DERs | Aggregators and MGs | Storage-Based and EVs | DR | Market-Based | Others |

|---|---|---|---|---|---|---|---|

| [47] | ✓ | ✓ | |||||

| [48] | ✓ | ||||||

| [49] | ✓ | ||||||

| [50] | ✓ | ||||||

| [51] | ✓ | ||||||

| [52] | ✓ | ||||||

| [66] | ✓ | ||||||

| [9] | ✓ | ||||||

| [54] | ✓ | ||||||

| [55] | ✓ | ||||||

| [56] | ✓ | ||||||

| [57] | ✓ | ||||||

| [58] | ✓ | ||||||

| [59] | ✓ | ||||||

| [60] | ✓ | ||||||

| [61] | ✓ | ||||||

| [62] | ✓ | ||||||

| [63] | ✓ | ||||||

| [64] | ✓ | ||||||

| [65] | ✓ | ||||||

| [67] | ✓ | ✓ |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Khajeh, H.; Laaksonen, H.; Gazafroudi, A.S.; Shafie-khah, M. Towards Flexibility Trading at TSO-DSO-Customer Levels: A Review. Energies 2020, 13, 165. https://doi.org/10.3390/en13010165

Khajeh H, Laaksonen H, Gazafroudi AS, Shafie-khah M. Towards Flexibility Trading at TSO-DSO-Customer Levels: A Review. Energies. 2020; 13(1):165. https://doi.org/10.3390/en13010165

Chicago/Turabian StyleKhajeh, Hosna, Hannu Laaksonen, Amin Shokri Gazafroudi, and Miadreza Shafie-khah. 2020. "Towards Flexibility Trading at TSO-DSO-Customer Levels: A Review" Energies 13, no. 1: 165. https://doi.org/10.3390/en13010165

APA StyleKhajeh, H., Laaksonen, H., Gazafroudi, A. S., & Shafie-khah, M. (2020). Towards Flexibility Trading at TSO-DSO-Customer Levels: A Review. Energies, 13(1), 165. https://doi.org/10.3390/en13010165