Abstract

We formulated a problem faced by a power producer who owns a combined-cycle gas turbine (CCGT) and desires to maximize its expected profit in a medium-term planning horizon. We assumed that this producer can participate in the spot and over-the-counter markets to buy and sell natural gas and electricity. We also considered that the power producer has gas storage available that can be used for handling the availability of gas and the uncertainty of gas prices. A stochastic programming model was used to formulate this problem, where the electricity and gas prices were characterized as stochastic processes using a set of scenarios. The proposed model includes the technical constraints resulting from the operation of the combined cycle power plant and the gas storage and a detailed description of the different markets in which the power producer can participate. Finally, the performance of the proposed model is tested in a realistic case study. The numerical results show that the usage of the gas storage unit allows the power producer to increase its expected profit. Additionally, it is observed that bilateral contracting decisions are not influenced by the presence of the gas storage unit.

1. Introduction

To reduce anthropogenic greenhouse gas emissions according to the international agreement of Paris 2015, the European Commission has defined a long-term strategy aiming to achieve net-zero greenhouse gas emissions by 2050 [1]. In this transformation process, the electricity production coming from combined-cycles gas turbines (CCGTs) is intended to play a principal role in providing a dispatchable and reliable supply of electricity as participation of renewable technologies is increasing [2]. CCGTs have been installed widely in power systems around the world because these units present high energy efficiency, low installation costs, and short construction times. Additionally, CCGTs allow fast startups and shutdowns and they can change their production very quickly. For these reasons, CCGTs will be a key factor in the transformation of current power systems to renewable-dominated ones. As a result, the share of total power generation in the world met by natural gas is forecasted to increase from 5.5 PWh in 2017 to over 8.7 PWh by 2040 [3].

In this context, the objective of a power producer owning a CCGT unit consists of maximizing its expected profit. To do that, the producer must decide its participation in electricity and natural gas markets. It is observed that the profit of a power producer mainly depends on the spark price, which is the margin between electricity and natural gas prices. Natural gas and electricity have different physical features, which explain the existence of different set-ups and products in the markets associated with both assets. The main difference between both commodities is that natural gas can be stored, like gas (NG) or liquefied (LNG), in an easy and affordable manner. In fact, the possibility of using a physical storage of natural gas could be an advantage for producers owning CCGT. On the contrary, electricity is difficult and expensive to store in large quantities. However, it is expected that the future evolution of electrochemical batteries will allow the utility-scale storage of electricity at an affordable cost. In this context, a power producer must determine appropriate strategies for purchasing gas and for selling electricity using available market instruments in order to maximize its expected profit.

The optimal management of CCGTs in a medium-term planning horizon has been studied in the technical literature during the last years. From the energy producer’s perspective, Kaye and others have illustrated in their pioneering work [4] the use of medium- and long-term future contracts for coverage against the risk of profit volatility. References [5,6] have analyzed the economic clearance of thermal power plants, with special interest in the study of the cost function. Furthermore, several works have characterized the uncertainty associated with this decision-making problem using stochastic programming models. A stochastic optimization model for daily operation of a natural gas-fired generation company was proposed in [7]. This model considers a short-term planning horizon and uncertainties in the spot prices of both gas and electricity. A model for optimal short-term natural gas nomination decision in generation portfolio management analyzing the impacts of variable load, price volatilities, and long-term fuel contract/storage was proposed in [8]. The authors of [9] proposed a procedure to optimize the short-term natural gas supply portfolio for a power producer. In [10], the long-term decision-making problem faced by a CCGT owner considering the possibility of congestions in the natural gas system was formulated. The scheduling of a shale-gas reservoir used by power producers was formulated as a large-scale mixed-integer linear programming problem in [11]. The authors of [12] provided a medium-term decision-making procedure for a generation company owning a generation portfolio comprised by a gas unit, a wind farm, and energy storage systems. In addition, a few works have addressed the operation of underground storage facilities. For instance, Ref. [13] described a basic modeling of a gas warehouse, whereas [14,15] presented different models for the operation of underground storage facilities.

Note that several works cited above, Ref. [7,8,9,10,11,12], have characterized the uncertainty associated with the decision-making problem faced by CCGT owners using stochastic programming models. Stochastic programming is a well-known methodology that has been applied in numerous fields. A detailed description of the basics of stochastic programming can be found in [16,17]. In this sense, Ref. [18,19] presented an extensive collection of applications of stochastic programming.

In this paper, we formulate the problem of a power producer managing a CCGT that seeks to maximize its expected profit in a medium-term planning horizon. The producer can participate in the spot and over-the-counter markets for purchases and sales of natural gas and sales of electricity. We evaluate a real-sized natural gas combined cycle power plant that has gas storage available, which can be used for handling the uncertainty of gas prices and availability. Another novelty implemented in the proposed formulation is to consider the costs of acquiring access services in the gas transmission systems under third party access (TPA) practice. The TPA introduces rules with the objectives of providing market access and enabling fair and nondiscriminatory competition. In this way, the infrastructure operators must offer the same service to users under the same contractual conditions. The basic open access service consists of infrastructure capacity to carry out activities of regasification, storage, and transportation. These capacity services are offered in standard products under a firm or interruptible basis, with a defined duration and gas flow direction. In this way, the most common capacity allocation mechanisms are auctions, first-come-first-served, and open subscription windows, all with regulated tariff and, in auction case, an additional charge called premium. The power producer participates by acquiring firm exit gas capacity to withdraw from the main gas pipeline through a direct line connected to the CCGT. Finally, we assume that the considered producer is a price-taker participant in gas and electricity markets without any market power.

The rest of the paper is structured as follows. Section 2 provides a description of the electricity and gas markets contemplated in this paper, the gas storage unit schema, the decision-making process, and the uncertainty characterization. In Section 3, the mathematical formulation of the proposed model is explained. Section 4 specifies the input data used to carry out the numerical analyses, while Section 5 explains the results obtained from different case studies. Section 6 highlights the main conclusions of this study. Finally, the notation used in this paper is included in the Appendix A.

2. Model Description

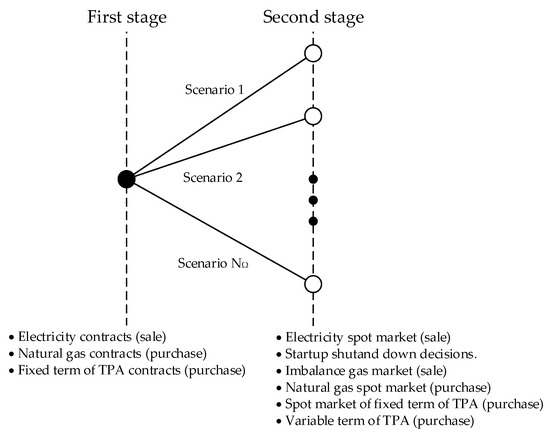

The considered decision-making process comprises two stages. Decisions about signing gas and electricity bilateral contracts in over-the-counter markets are made in the first stage at the beginning of the medium-term planning horizon. These decisions are made before knowing the actual realization of gas and electricity prices in the spot markets. The decisions concerning the sale and purchase of electricity and gas in the spot markets, the purchase of gas capacity via TPA contracts, and the operation of the CCGT and the gas storage are defined as short-term decisions and they are made in the second stage.

2.1. Electricity and Gas Markets

The description of the different trading floors considered in this paper is provided in this subsection. The considered power producer can participate in the electricity and gas markets described below:

- (a)

- Electricity markets: It is assumed that the power producer can participate in two different markets:

- Spot market: This is an organized market where the power producer submits sale hourly bids for the day-ahead energy market. The bids are made for each hour of the next day, and hourly prices result from clearing the market.

- Bilateral contracting in over-the-counter market (OTC). The terms of these contracts are nonprefixed and they are agreed between the signing parties. These contracts are usually middle-term contracts, where the power producer sells hourly quantities of electricity at known prices. Observe that the decisions on bilateral contracting are made before knowing the spot market prices.

- (b)

- Gas markets: the different markets where a producer owning a CCGT must participate in order to obtain gas supply are the following ones:

- Spot market: This is an organized market with auctions and continuous sessions. The power producer may purchase natural gas in products with daily quantities and prices. The daily quantities are usually known and fixed, whereas prices are unknown.

- Bilateral contracting in OTC: Like in the case of electricity bilateral contracts, the terms of these contracts are agreed between the signing parties. We consider middle-term contracts where the power producer purchases natural gas with daily quantities and prices, being that information is known when the contract is signed.

- TPA market: This is an organized market where the power producer acquires firm capacity to withdraw natural gas from the virtual balancing point (VBP) to the CCGT. The VBP is a nonphysical hub that is defined for trading gas in the different markets. The capacity is bought in the TPA market through standard products with regulated daily prices. The capacity tariff is composed of fixed and variable terms known for the power producer.

- Imbalance settlement in the VBP market: This is an organized market where the power producer pays for daily pipeline balancing actions because of differences between initial inventory, injections, trading transactions, and withdrawals. The tariff is composed of a variable term that is known for the power producer.

Observe that the settlement of the electricity markets is performed on an hourly basis, whereas gas markets are daily settled.

2.2. Gas Storage Unit

It is assumed that the CCGT owner can use a gas storage unit to procure part of its gas demand. The gas storage unit provides the possibility of same-day injection and withdrawal cycles. In this manner, a gas storage unit provides additional flexibility to the operation of the CCGT since it can be used for injecting the contracted gas not used and for extracting gas when the contracted gas quantity is less than the demanded quantity. Additionally, the gas storage unit can be used to perform an economic arbitrage among the different gas markets.

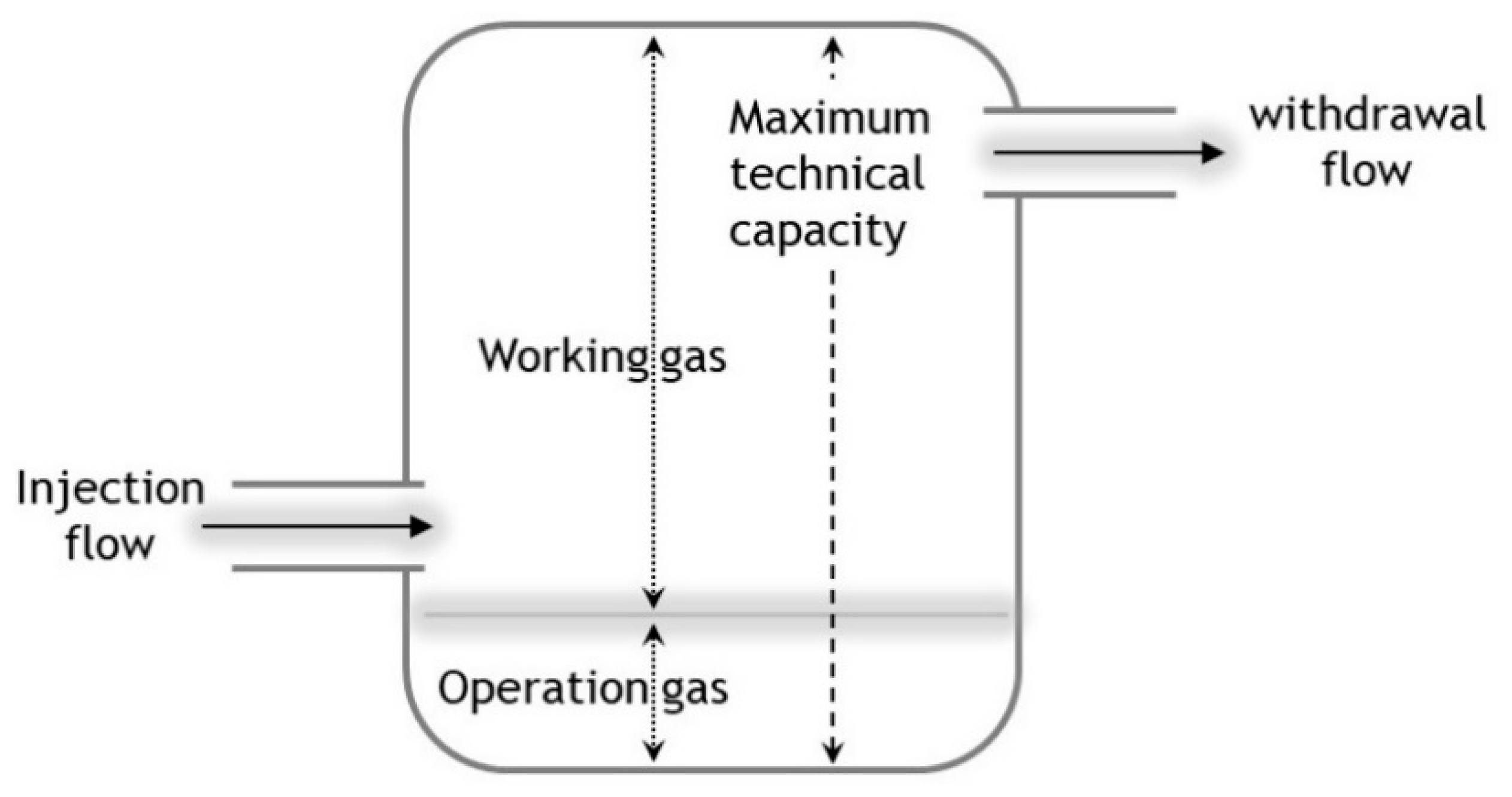

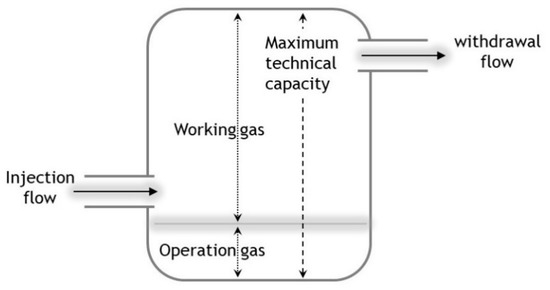

A basic scheme of the gas storage unit is shown in Figure 1. A gas storage unit is characterized by the maximum technical capacity of the storage and the minimum operation gas, which is defined as the minimum quantity of gas that must remain in the storage at any time. The working gas is defined as the difference between the maximum technical capacity of the storage and the minimum operation gas.

Figure 1.

Gas storage unit schema.

2.3. Decision Making and Uncertainty Characterization

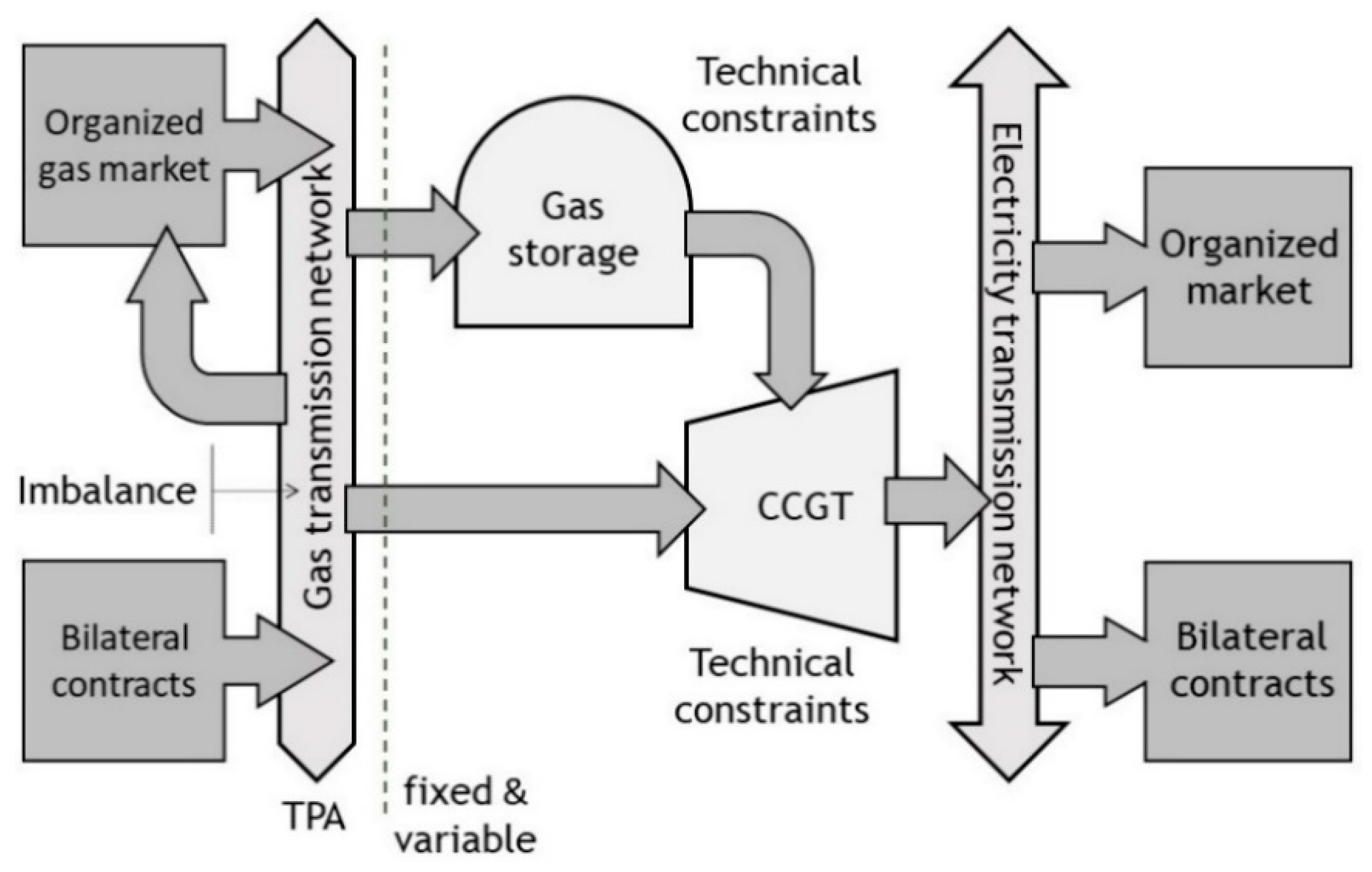

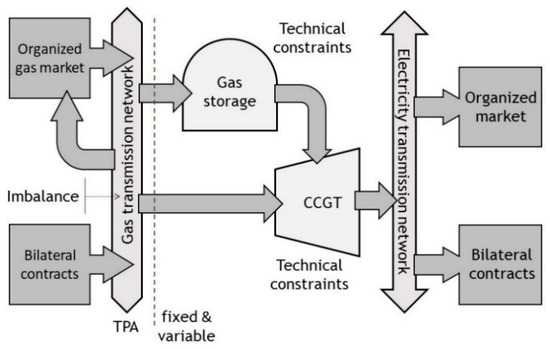

Figure 2 describes graphically the decision-framework process faced by the power producer. Observe that, additionally to the decisions on purchases and sales in the electricity and gas markets, the CCGT owner has to make all the decisions related to the operation of the CCGT and the gas storage.

Figure 2.

Decision-framework structure.

There exist different levels of information available to the power producer when it has to decide the purchases and sales in the electricity and gas markets. The most important uncertainty sources in this problem are the electricity and gas spot prices. These uncertain parameters are characterized as random variables and they are represented using a set of plausible realizations or scenarios. In this manner, a scenario can be defined as a possible realization of the random variables, and it has an associated occurrence probability. Time series models, such as ARIMA models, can be easily used to produce scenarios through generating multiple realizations of the uncertain parameters.

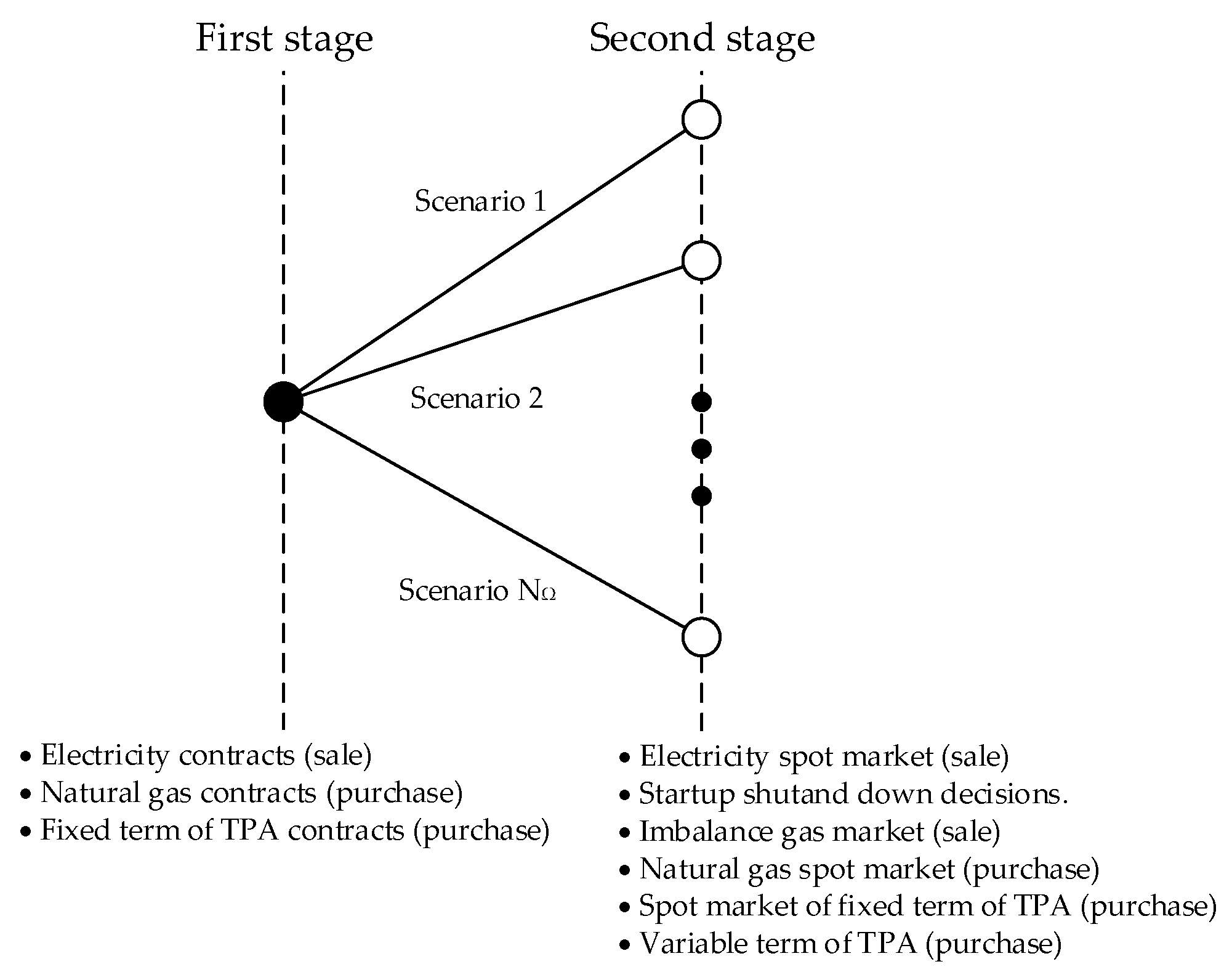

Considering the above, we can distinguish between here-and-now and wait-and-see decisions in the decision-making process of the power producer. Decisions on bilateral contracts in electricity and gas markets are made under uncertainty of electricity and gas spot prices, i.e., before knowing the realization of these uncertain parameters. Because these decisions are made with imperfect information about electricity and gas spot prices, they are denoted as here-and-now or first-stage decisions and they are not dependent on the scenario index. In contrast, decisions related to the operation of the CCGT and the gas storage as well as to the participation in spot electricity and gas markets are deferred in time with respect to the bilateral contracting decisions, and we can consider that they are made with perfect information with respect to the uncertain parameters. These decisions are referred to as wait-and-see or second-stage decisions and they explicitly depend on the scenario index. In summary, the decisions made by the power producer are the following ones:

- First-stage decisions:

- Electricity sales in a portfolio of physical bilateral contracts.

- Natural gas purchases in a portfolio of physical bilateral contracts.

- Purchases of the fixed term of TPA for gas capacity through bilateral contracts. The gas capacity purchased from bilateral contracts do not include a premium.

- Second-stage decisions:

- Electricity sales in the spot market.

- Startup and shutdown decisions.

- Sales of the imbalance gas resulting from the day before.

- Natural gas purchases in the spot market.

- Purchases of the fixed term of TPA for gas capacity in the spot market. In this case, the capacity is acquired in auctions of short-term products and these include the premium per product.

- Purchases of the variable term of TPA for gas capacity. This term includes: (i) the gas injected into the storage, (ii) the gas purchased through bilateral contracts, (iii) the gas purchased in the spot market, and (iv) the gas from imbalances and used in the CCGT.

Figure 3 depicts the decision framework described above.

Figure 3.

Decision-making framework.

3. Mathematical Formulation

This section includes the description of the formulation of the proposed model. Note that the notation used thorughout the paper is provided in the Appendix A.

The complete formulation of the proposed model follows.

Subject to:

(CCGT technical constraints)

(Storage technical constraints)

(Natural gas market constraints)

(Startup and shutdown costs of the CCGT)

(Balance constraints)

(TPA constraints)

where Ψ is the set of all optimization variables in (1).

- -

- The objective Equation (1) is equal to the expected profit of the power producer and comprises the following terms:

- -

- The revenue obtained from selling electricity in the bilateral contracting market.

- -

- The expected revenue obtained from selling electricity in the electricity spot market.

- -

- The expected costs derived from startups and shutdowns of the CCGT.

- -

- The cost derived from purchasing gas in the bilateral contracting market.

- -

- The expected revenue obtained from selling gas in the spot market.

- -

- The expected cost derived from purchasing gas in the spot market.

- -

- The expected cost derived from the fixed term of the capacity bought in the TPA market.

- -

- The expected cost derived from the variable term of the capacity bought in the TPA market.

- -

- The expected cost derived from the imbalances of gas in the VBP.

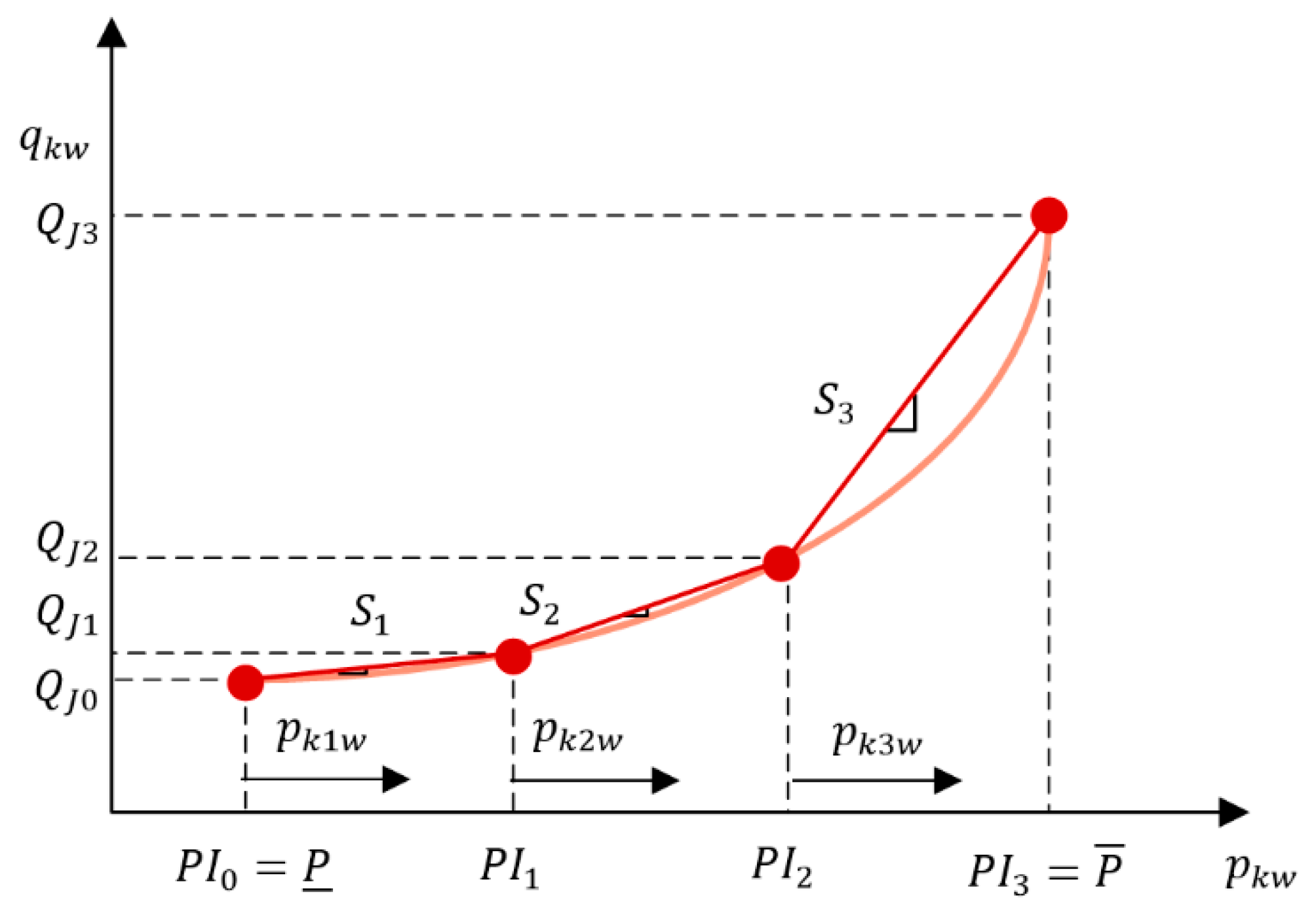

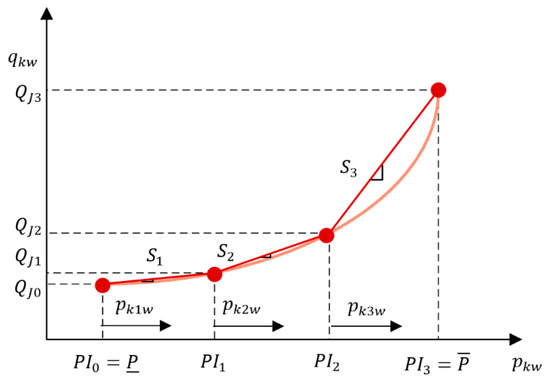

Constraints (2)–(12) enforce the technical constraints of the CCGT. Constraints (2) establish the maximum and minimum power outputs of the CCGT. Startup and ramp-up limits constraints are defined in (3)–(6). The total natural gas consumption by the CCGT is computed through the heat rate of the unit. In this manner, the heat rate represents the natural gas consumed in each period k and scenario ω, , per power output, . Because the heat rate is a non-linear function, a convex and piecewise linear approximation has been formulated through constraints (7)–(12). Observe that is the power generated in period k, scenario ω, and block b of the linear approximation. As an example, Figure 4 shows a three-block piecewise linear approximation of the heat rate curve. Observe that the linearization of the curve can be easily done by computing pairs , where is the number of blocks in the linear approximation. The slope of each block, , can be computed as .

Figure 4.

Example of three-block piecewise linear approximation of the heat rate curve.

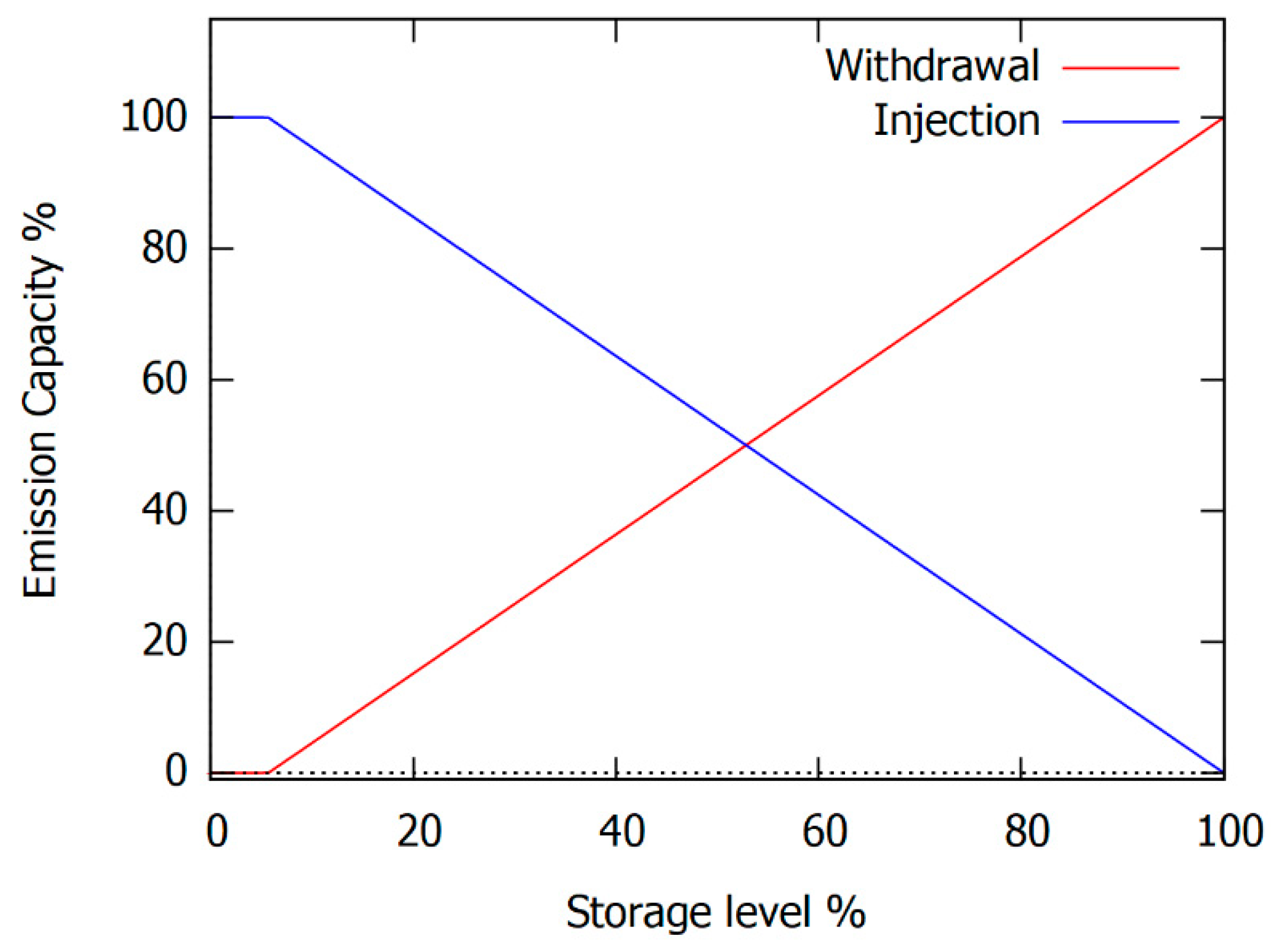

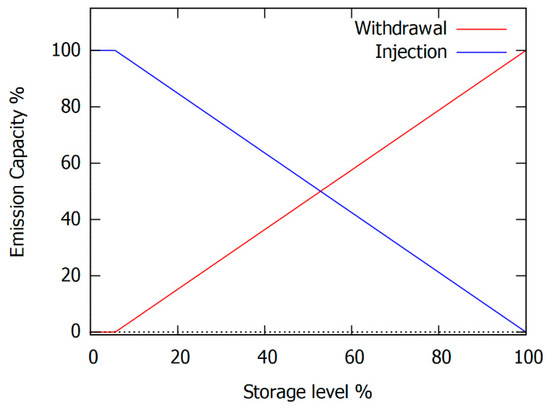

The operation of the gas storage is formulated by constraints (13)–(21). The maximum and minimum limits of the amount of gas that can be stored are defined in constraints (13). In the same manner, the injection and withdrawal limits are modeled by (14) and (15). Observe that a minimum quantity of stored gas (operation gas) is required to withdraw gas from the storage. For modeling this condition, constraints (16)–(19) model the injection and withdrawal processes using binary variable , which is equal to 1 if gas stored is greater than the operation gas in period d and scenario ω, being 0 otherwise. The gas balance in the storage is established by constraints (20) and (21).

The decisions on the gas market are formulated by constraints (22)–(26). The non-negativity of gas quantity sold in continuous session, and the gas purchased through bilateral contracts is ensured by constraints (22) and (23), respectively. The total gas quantity bought on the gas spot market is formulated by constraint (24). The imbalances of gas resulting by an excess in the purchases of gas is formulated by constraints (25) and (27). The imbalance of gas in a given day is equal to the sum of the imbalance of gas in the day before and the quantities of gas overbought in the spot market and through bilateral contracts. Note that the resulting imbalances of gas in a given day can be sold during the next day in the continuous session of the spot market.

The startup and shutdown costs of the CCGT are formulated by constraints (28)–(33). Note that the startups and shutdowns of the CCGT are computed using the binary variable which models the commitment of the CCGT. Constraints (34) establish that the power output of the CCGT can be sold in the spot market and through bilateral contracts. Constraints (35) and (36) state that the amount of gas consumed by the CCGT can be obtained from the gas spot market, bilateral contracts, the gas storage or previous imbalances. In the same manner, constraints (37) and (38) establish that the gas injected into the storage can come from purchases in the spot market, bilateral contracts or imbalances. Constraints (7) and (40) formulate that the gas purchased through the gas spot market and through bilateral contracts can be used for (i) generating electricity, (ii) injecting it into the storage, and (iii) for generating an excess imbalance of gas.

Finally, constraints (41) and (42) are used to bound the quantity of gas purchased in the spot market to the capacity purchased in the TPA market. Binary variable is used in these constraints and is equal to 1 if TPA product t is bought in daily period d and scenario ω, being equal to 0 otherwise.

The proposed model is a two-stage stochastic programming problem whose deterministic equivalent problem is a mixed-integer lineal programming that can be solved using commercial software.

4. Case Study

In order to test the proposed model and analyse the impact of the operation of a gas storage unit on the profit of the power producer, two cases are solved either considering the availability or not of a gas storage unit that can be used by the power producer. Additionally, two sensitivity analyses and an out-of-sample study have been developed to test the performance of the proposed model.

4.1. Input Data

We consider a power producer managing a combined cycle power plant that desires to maximize its expected profit in a medium-term planning horizon comprising seven days. It is assumed that the considered power producer is a price taker in gas and electricity markets, i.e., the transactions of the power producer in both markets do not influence market prices. The uncertainty of the spot electricity and natural gas prices are characterized by using a set of scenarios that are generated using time series models.

4.1.1. Combined Cycle Gas Turbine

We consider a typical CCGT composed of one gas turbine, a heat recovery steam generator, and a steam turbine. The capacity and minimum power output of the CCGT are 400 and 120 MW, respectively. Table 1 provides the three-block piecewise linear approximation used to characterize the gas consumption of the unit as a function of the power output. The startup and shutdown power ramps are equal to 120 and 130 MW/h, respectively, whereas the up and down power ramps are equal to 100 and 150 MW/h, respectively. The startup cost is 2000 € and the shutdown cost is 800 €.

Table 1.

Characteristics of the heat-rate blocks.

4.1.2. Natural Gas Storage

The storage capacity is 35,000 MWh, and the minimum gas level, or the operation gas, is fixed to 2000 MWh. In this way, the storage can supply gas such that the CCGT works at full capacity for two days. The initial status of the gas storage unit is at operation level, i.e., it contains 2000 MWh. The gas storage unit allows for the possibility of same-day injection and withdrawal cycles. Thus, the maximum injection and withdrawal capacity of the storage is set at 16,000 MWh/day. Figure 5 represents the injection and withdrawal curves. The injection is possible until the storage unit is full, whereas the withdrawal is possible until the operation gas level is reached.

Figure 5.

Injection and withdrawal curves of the gas storage unit.

4.1.3. Electricity Contracts and Spot Prices

As explained in Section 2, it is considered that the producer can participate in several electricity and gas markets. We assume that the power producer can choose among four bilateral contracts to sell electricity in the considered planning horizon. Each contract has a fixed price and a duration of 168 h. Table 2 provides the characteristics of each contract. The bilateral contract prices are the minimum, average, and maximum marginal prices of the Spanish daily market for 23 June 2019, and the maximum of June 2019. All these values are published by OMI-Polo Español S.A. (OMIE) [20].

Table 2.

Electricity bilateral contracts—energy and prices.

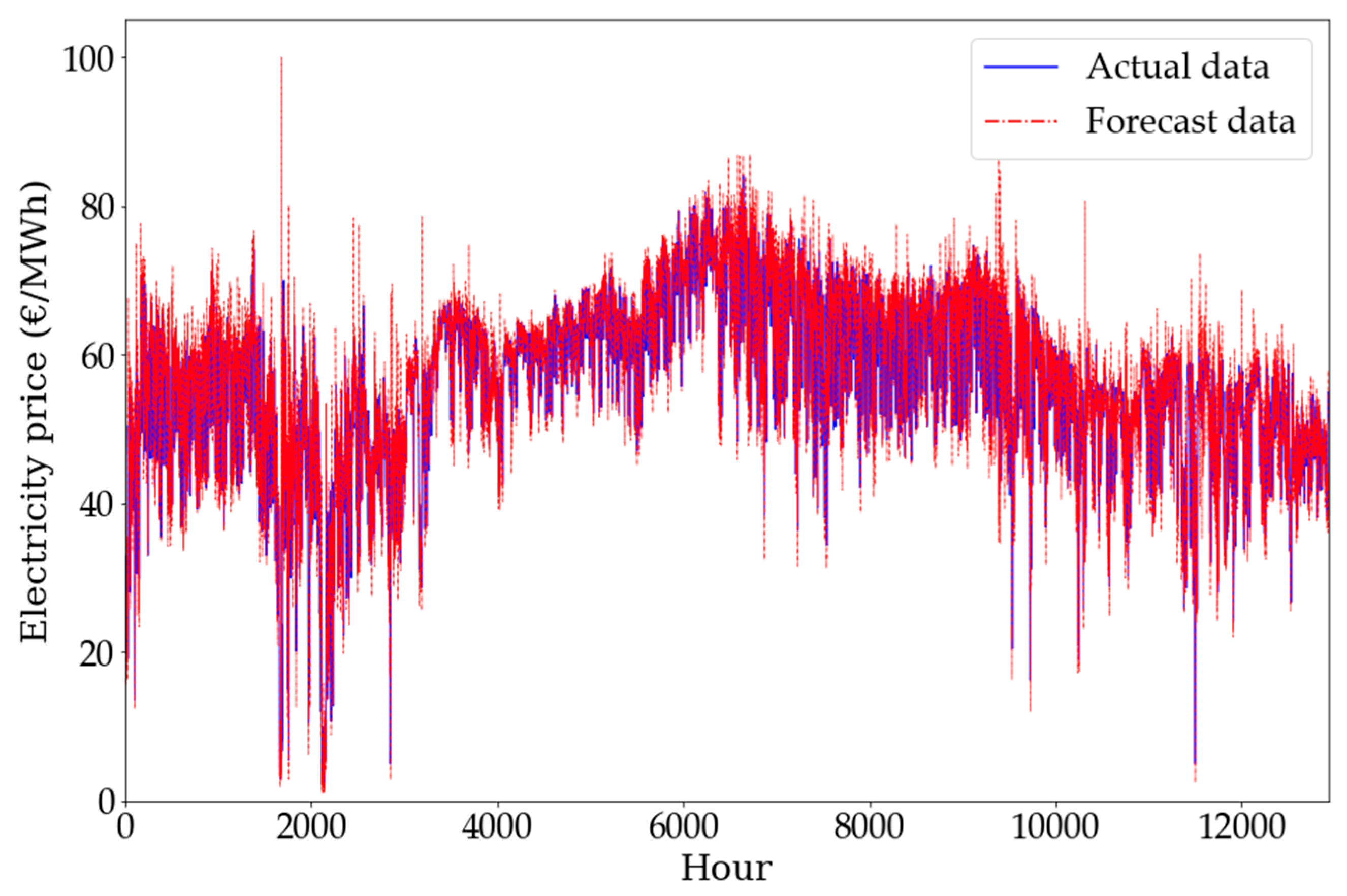

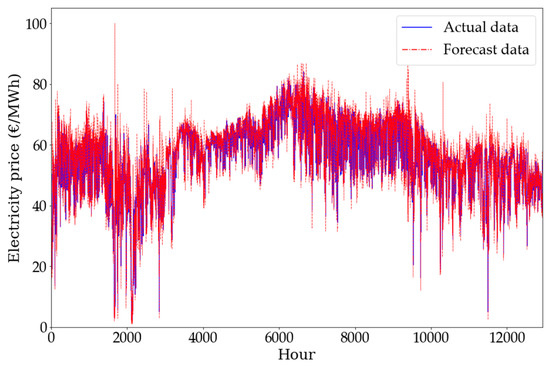

We used a time series model to generate randomly a number of scenarios used for modeling the uncertain electricity spot prices. Then, we applied the scenario-reduction technique based on the fast-forward algorithm described in [21] to select a reduced number of representative scenarios. This algorithm reduces a set of scenarios minimizing a prespecified probability distance between scenarios. As in the case of bilateral contract prices, the considered time series of the electricity prices corresponds to the marginal prices of the Spanish daily market [20]. The time series comprises hourly data and the period used is from 1 January 2018 to 30 June 2019.

A Seasonal Autoregressive Integrated Moving Average model (SARIMA) (100)(410)24 of the natural logarithm of the electricity price series, , defined through (43) was used. Symbol represents the backshift operator that if applied to renders . Parameter is the autoregressive parameter associated with delay , and is the error term that is distributed as a white noise process. Finally, parameter is a constant. The interested reader is referred to [22] for additional information about SARIMA models.

The parameters of the model were estimated using the Matlab software [23]. Table 3 provides the coefficients describing the models.

Table 3.

Seasonal Autoregressive Integrated Moving Average model (SARIMA) coefficients. Electricity price.

The historical values pertaining to the period 1 January 2018 to 23 June 2019 are employed as calibration data to define the prediction models, which are later used to forecast the following 168 hourly values, that is from 24 June 2019 to 30 June 2019.

Figure 6 shows how the fit looks reasonable throughout the entire historical data set.

Figure 6.

Fit of the entire historical data set of electricity price with a relative error equal to 3.71%.

To analyse the accuracy of the models, the relative error expressed by (44) is used.

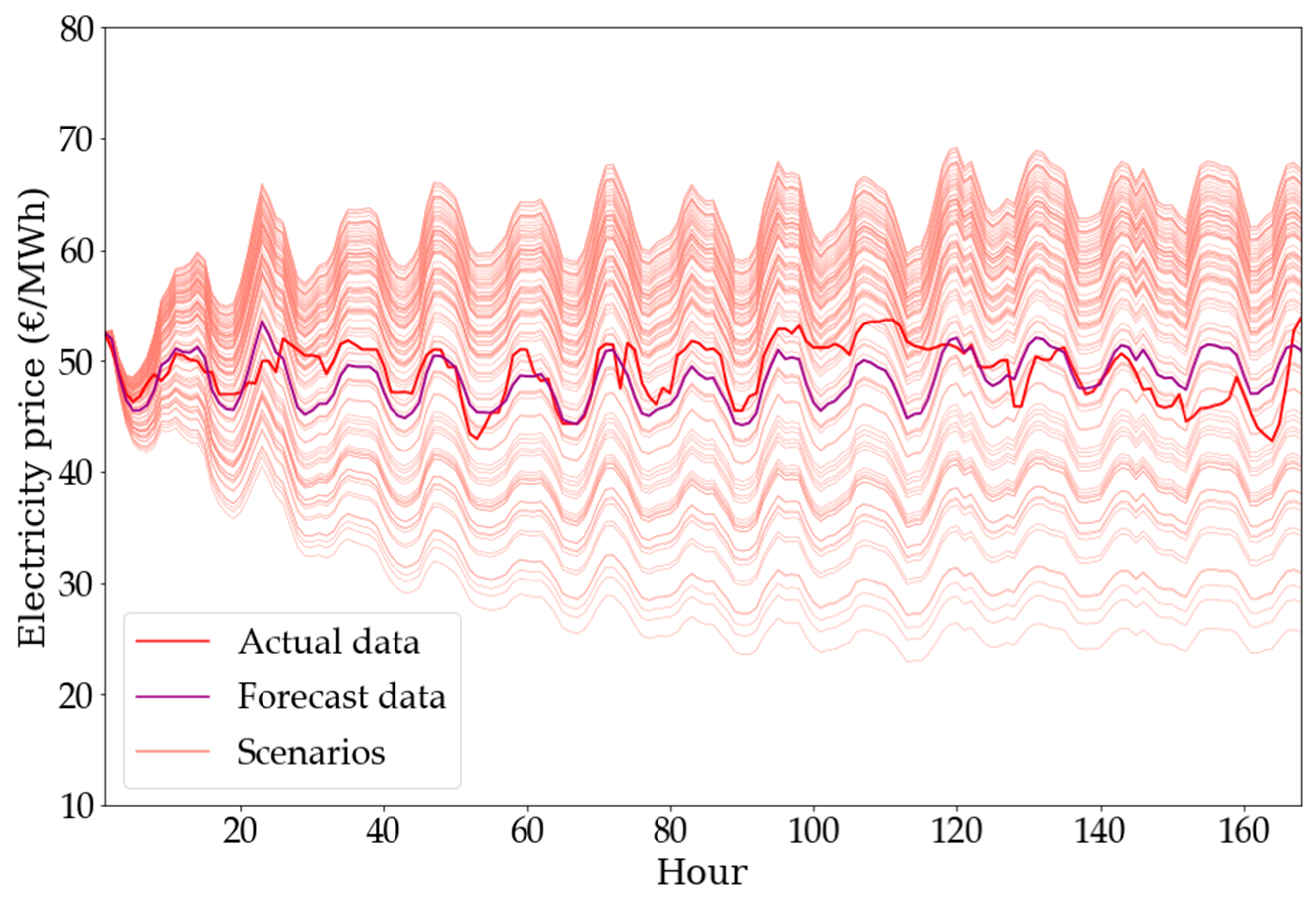

In this way, the average relative error obtained for these 168 h is equal to 5.17%, which represents an acceptable performance for this study whose objective is to generate plausible scenarios instead of forecasting spot prices.

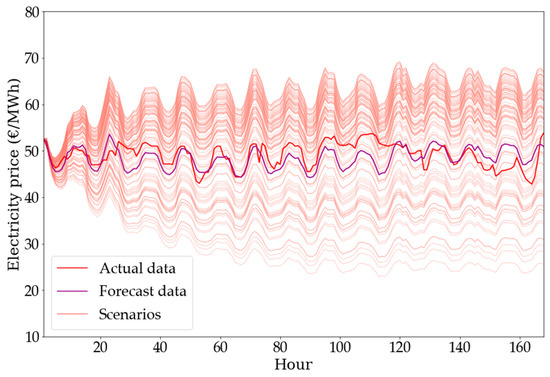

In this manner, 100 price spot price scenarios were generated using the procedure described above. Previous numerical experiments with different numbers of scenarios suggest that at least 100 scenarios are necessary to represent adequately electricity and gas spot price distributions. Figure 7 shows the actual hourly electricity price series between 24 June 2019 and 30 June 2019, the forecast data using the proposed SARIMA model, and the 100 scenarios generated using a Gaussian white noise process as the error term of the SARIMA model.

Figure 7.

Electricity actual price time series, forecasts, and one hundred scenarios.

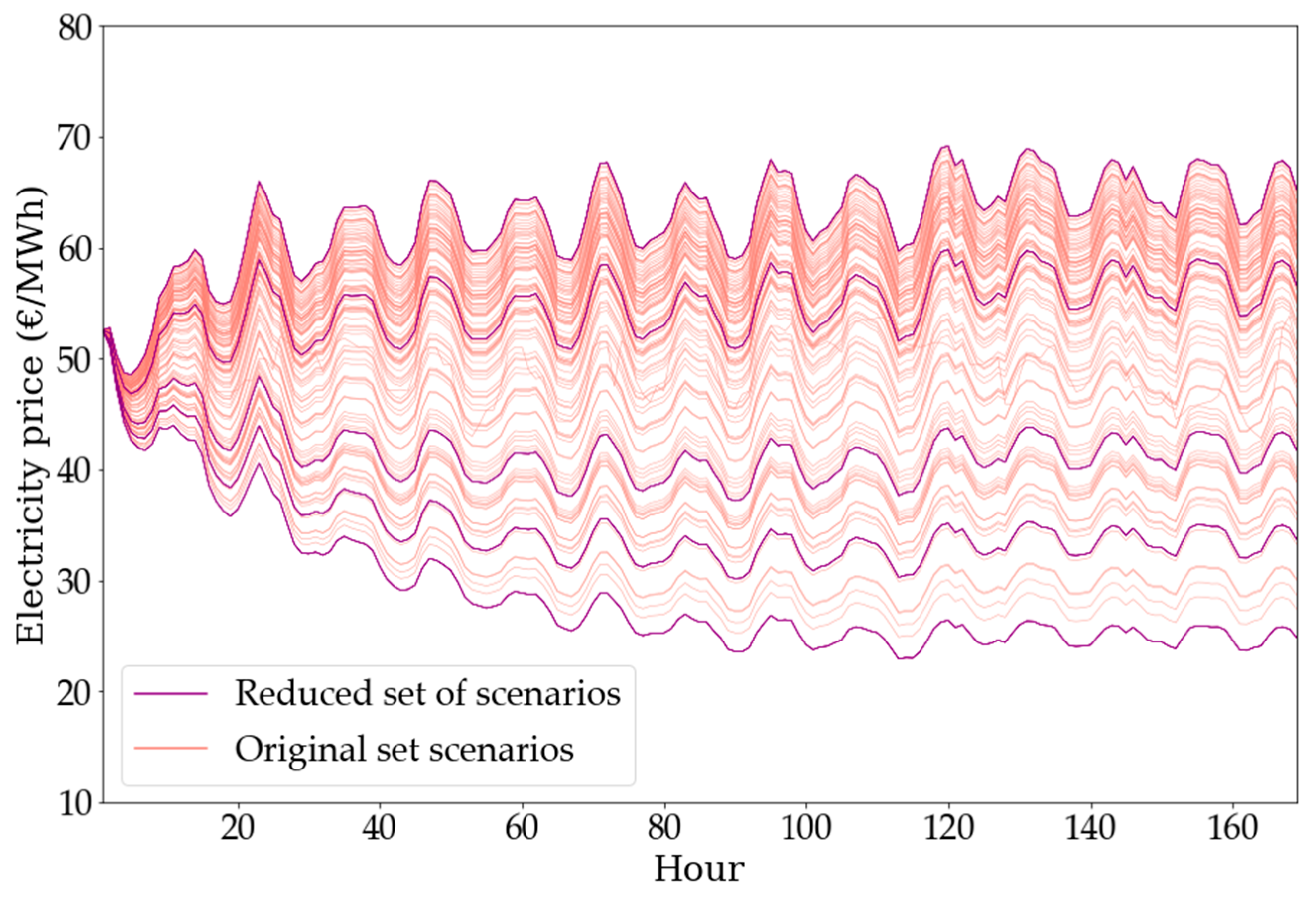

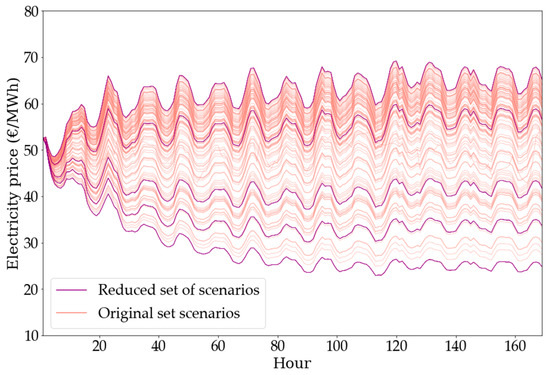

The next step consists of selecting the most representative scenarios using the scenario reduction technique mentioned above. Table 4 shows the average 10, 50, and 90 percentiles of the probability distribution of the electricity spot price for different cardinalities of the reduced set of scenarios. This table reveals the good performance of the scenario reduction algorithm proposed in [21]. The median of both series is accurately represented even if a very small number of scenarios is considered. However, the 10 and 90 percentiles are not well represented when only one or three scenarios are considered. Based on the values provided by Table 4, it is considered that the reduction of the original set of 100 scenarios to 5 yields an adequate trade-off between tractability and accuracy.

Table 4.

Average 10, 50, and 90 percentiles of the probability distribution of electricity spot price for different reduced sets of scenarios.

Figure 8 shows both the original and the reduced set of scenarios, while Table 5 provides the probability and the average price in each scenario.

Figure 8.

Initial set of electricity price scenarios and the five most representative scenarios.

Table 5.

Probabilities and average price of the five electricity price scenarios.

4.1.4. Gas Contracts and Spot Prices

In this case, four bilateral contracts can be negotiated at the beginning of the planning horizon. The contracts have constant prices and a duration of seven days. Table 6 provides the characteristics of each bilateral contract. The bilateral contract prices are the value for 2 June 2019 and the minimum, maximum, and average of the daily product in the Spanish zone of the Spanish organized gas market, all published by MIBGAS [24].

Table 6.

Natural gas bilateral contracts—quantity and prices.

We consider that the natural gas spot market has eight products available, which are characterized by the quantity given in Table 7 that must be constantly supplied during the seven-day planning horizon. Therefore, the power producer must negotiate in the market the purchase of one or the combination of several products according to its natural gas needs.

Table 7.

Natural gas spot market—quantity by daily products.

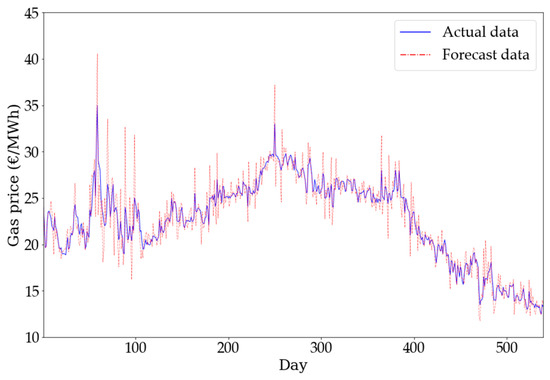

As with electricity prices, the time series of the prices of natural gas used is that published by MIBGAS [24] as “GDAES_D+1” product for the daily product in the Spanish zone. The time series is daily, and the time interval for the study is between 1 January 2018 and 30 June 2019. The series consists of 546 values.

The procedure followed to generate the gas price scenarios is equivalent to that used for the electricity prices. In this case, a SARIMA (210)(210)7 of the natural logarithm of the natural gas prices, (45) is used. The parameters of the model were created using the Matlab software [23] and are provided in Table 8.

Table 8.

SARIMA coefficients. Gas price.

The values pertaining to the period 1 January 2018 to 23 June 2019 are employed as calibration data and to forecast the next seven values, that is from 24 June 2019 to 30 June 2019.

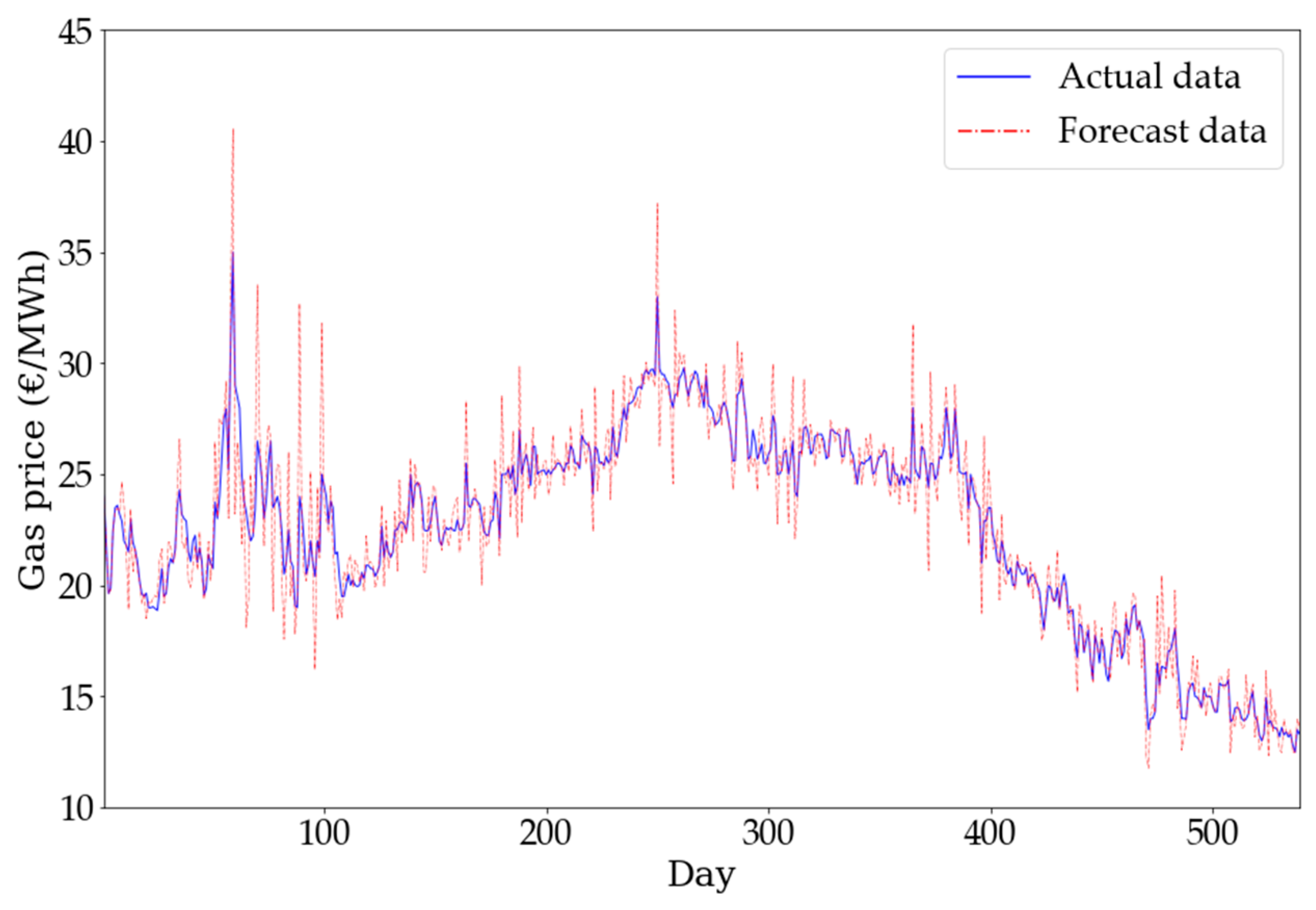

Figure 9 shows how the forecast looks throughout the entire historical data set.

Figure 9.

Fit the entire historical data set of gas price with a relative error equal to 3.93%.

Following Equation (45), the average relative error for these seven days, of the proposed model is 0.99%. Observe that gas spot prices are much more stable than electricity spot prices and are, therefore, easier to characterize.

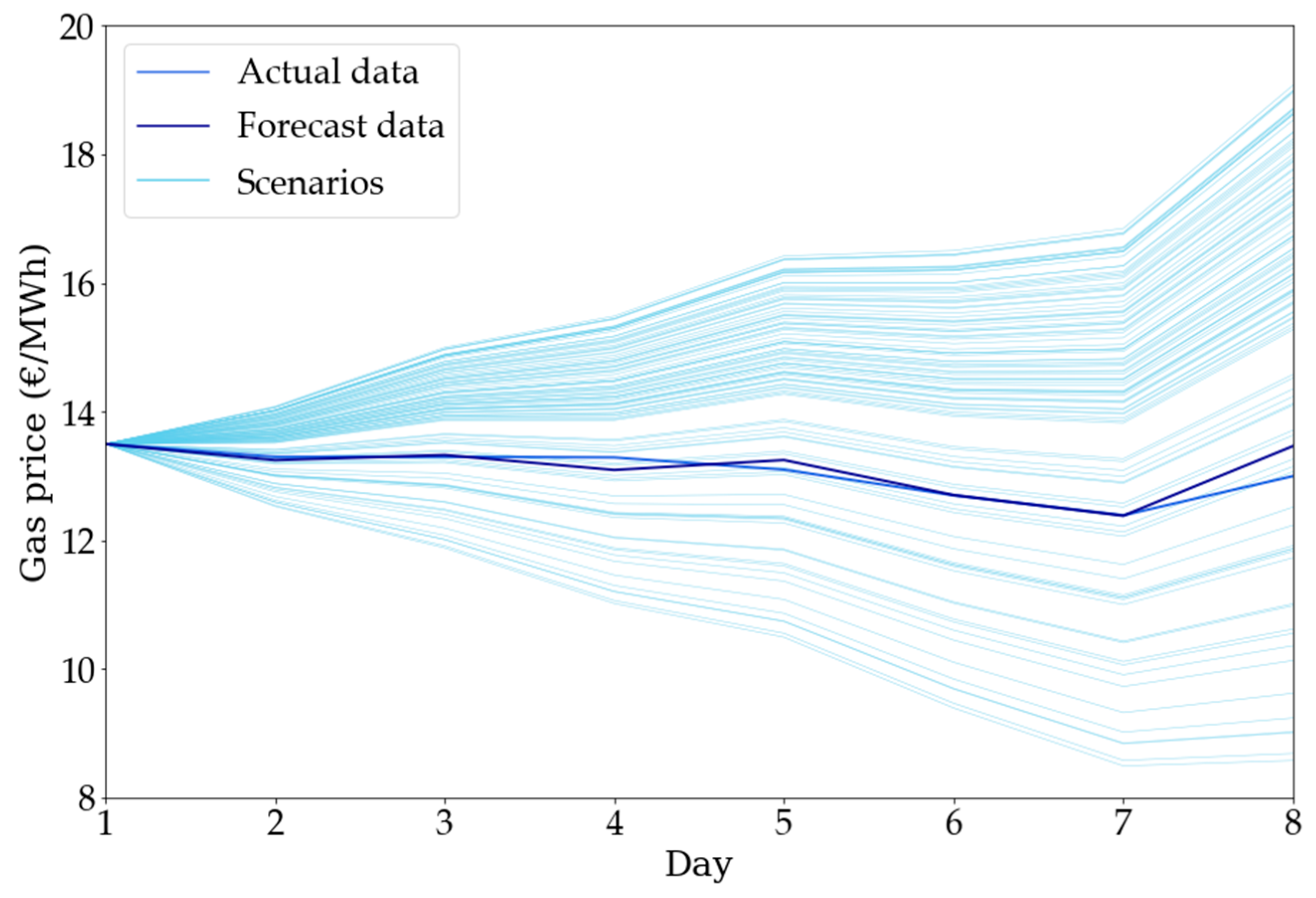

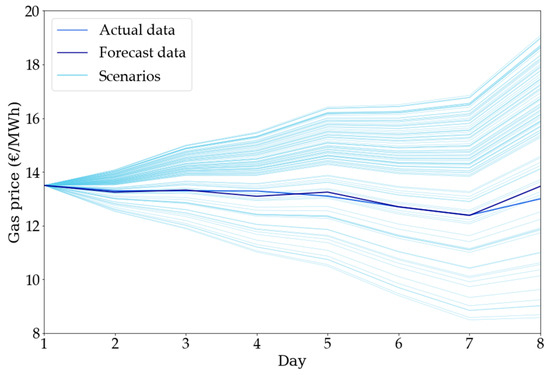

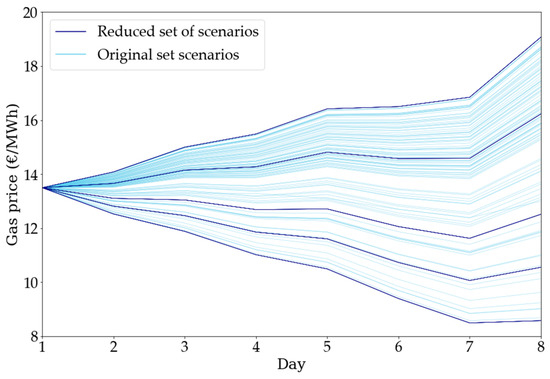

Then, the model is used to generate 100 gas price scenarios for the forecast interval. Figure 10 shows the real daily gas price series between 24 June 2019 and 30 June 2019, a forecast and the 100 scenarios generated using a Gaussian white noise process.

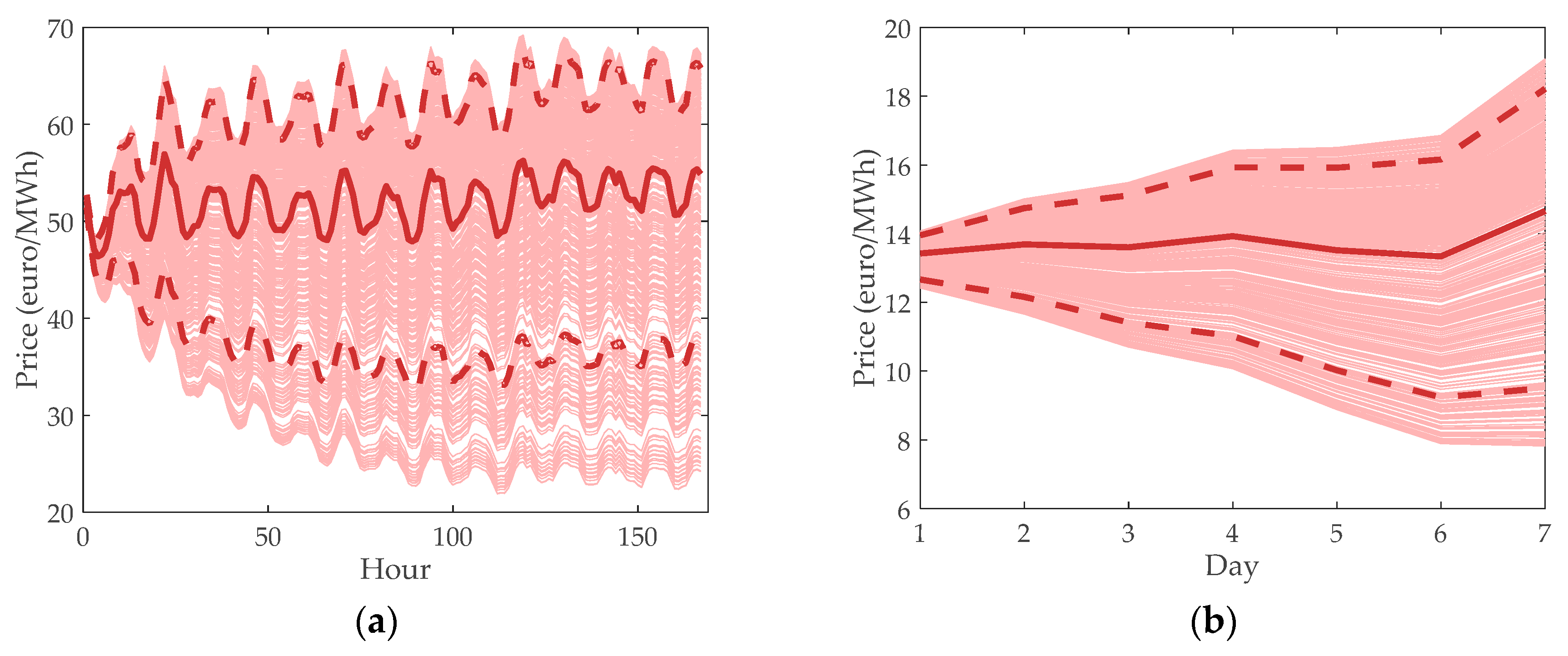

Figure 10.

Gas price time series forecast and 100 scenarios.

As in the case of electricity spot prices, the original number of 100 scenarios has been reduced to five using the fast-forward scenario reduction algorithm. Table 9 represents the average 10, 50, and 90 percentiles of the probability distributions of gas spot prices for different sizes of the reduced set of scenarios. Based on the values presented in this table, five scenarios are considered to be enough to represent adequately the initial set of 100 scenarios.

Table 9.

Average 10, 50, and 90 percentiles of the probability distribution of gas spot price for different reduced sets of scenarios.

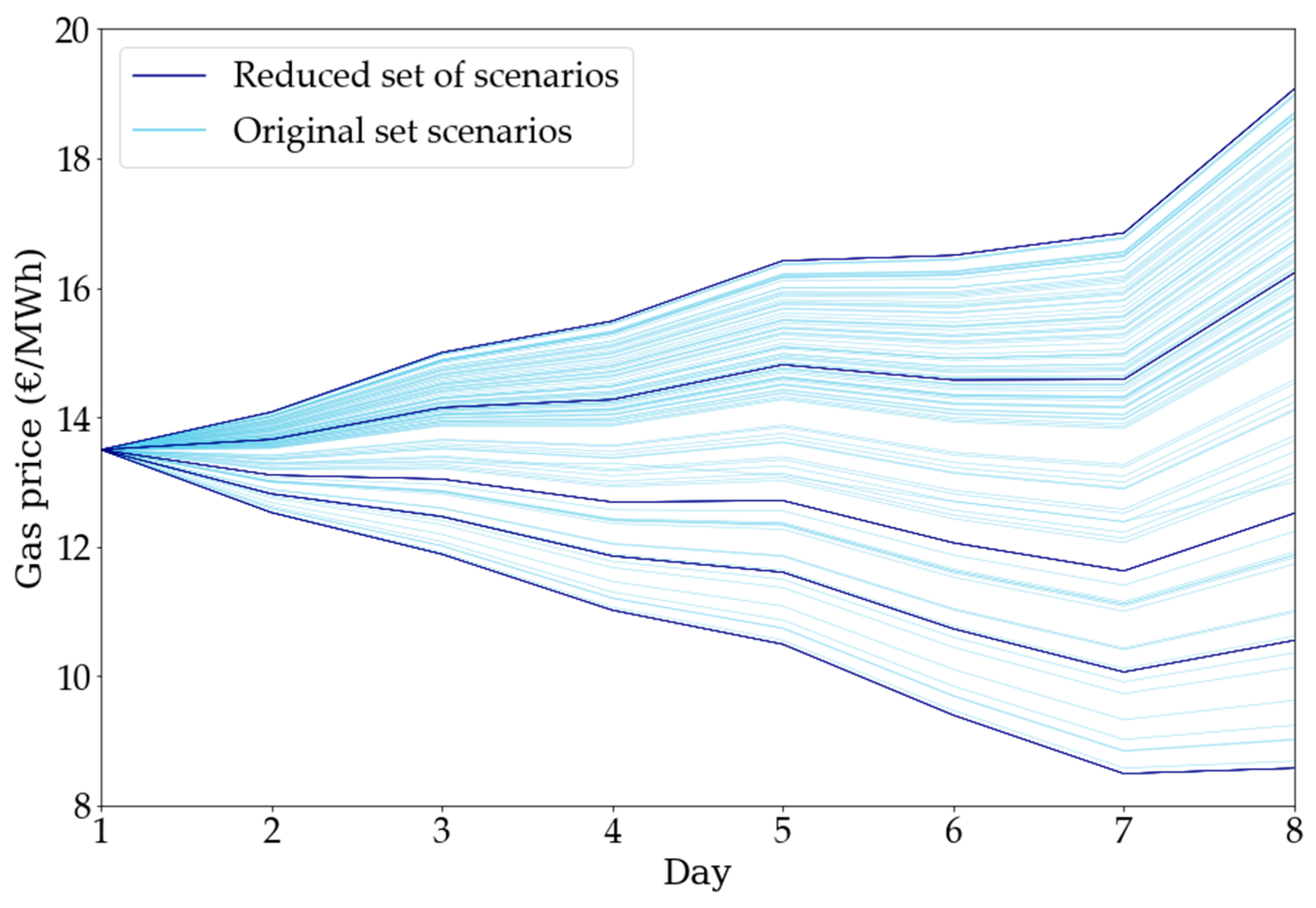

Figure 11 represents graphically the original and reduced sets of scenarios. Table 10 provides the probability and the average price in each of the five scenarios.

Figure 11.

One hundred gas price scenarios and the most significant five scenarios.

Table 10.

Probabilities of the most significant five gas price scenarios.

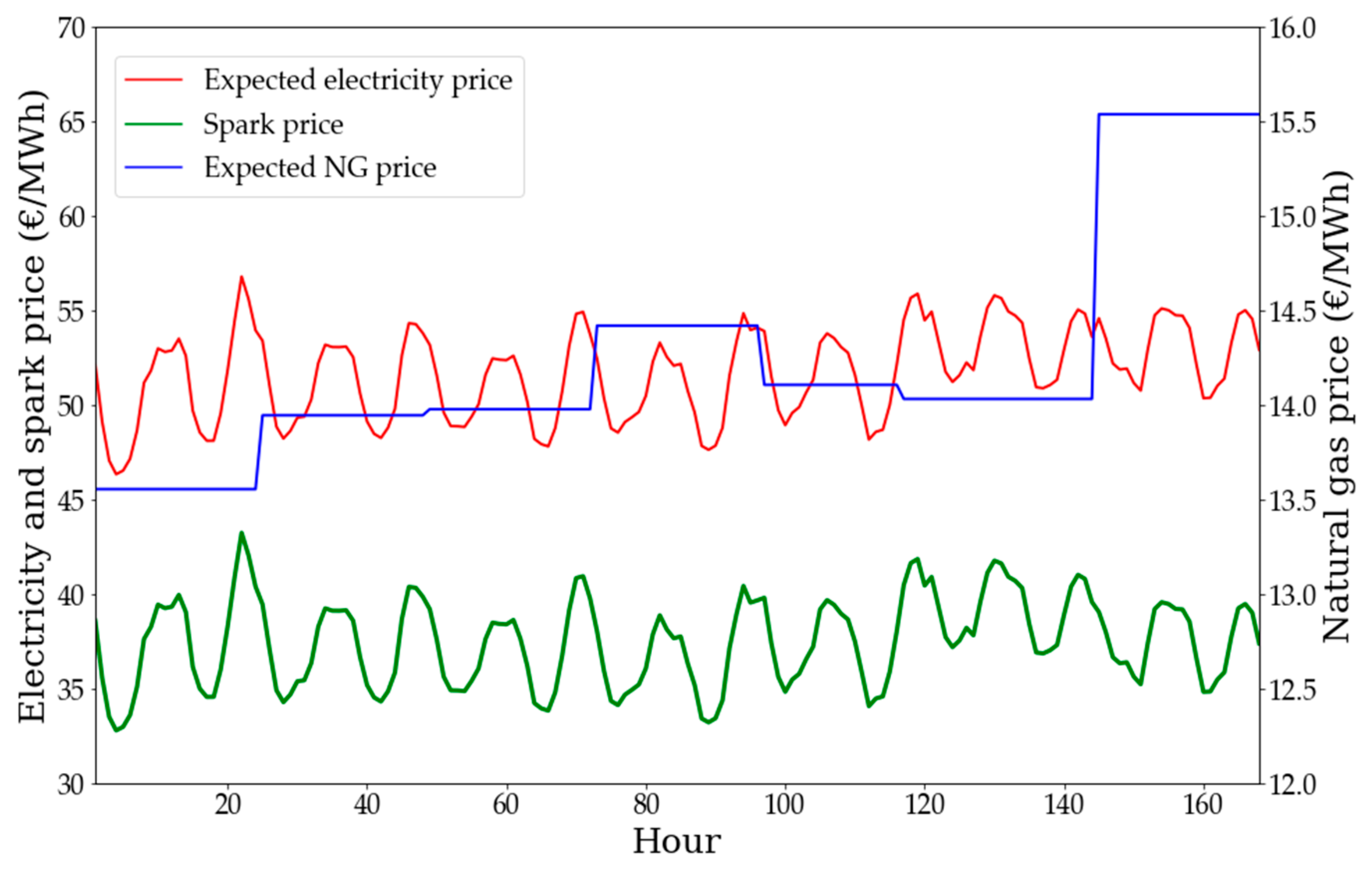

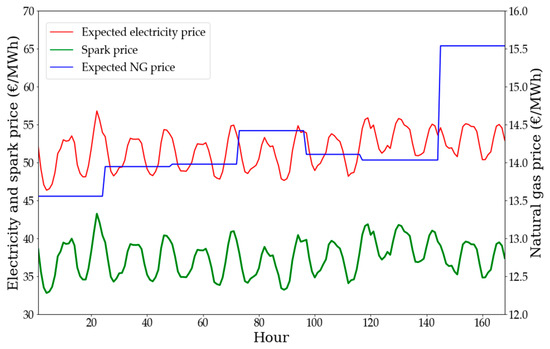

According to the spot prices considered in the electricity and natural gas markets, the expected spark price is represented with a green line in Figure 12, whereas the expected electricity price is drawn with a red line, both referenced to the left axis. The spark price is the difference between the electricity and gas spot prices. As the price of natural gas is smaller than the electricity price, it is represented on the right axis. This figure shows that the resulting expected spark price slightly decreases over time.

Figure 12.

Expected spark price and expected prices of electricity and natural gas.

On the other hand, the purchases of TPA capacity can be made through eight daily products that are available during the seven-day planning horizon. The quantities of the products are shown in Table 11. The TPA price fixed term is 28.657 €/MWh and the variable term is 0.615 €/MWh both defined as Toll 1.3 in Order IET/2446/27 December 2013 [24]. The fixed term is affected by a coefficient defined by product type and season, values specified in Order ETU/1977/23 December 2016 [25]. The coefficients used to resolve the proposed cases are defined in Table 11.

Table 11.

Open access capacity market—fixed term coefficients by duration type and day.

For bilateral contracts the coefficients used are shown in Table 12.

Table 12.

Bilateral contracts—fixed term coefficients by duration type and day.

The premium per product shown in Table 13.

Table 13.

Open access capacity market—quantity by products, and auction premium.

The imbalance tariff is set to 14.16 €/MWh, that is the marginal purchase price for 28 June 2019 used as reference prices for imbalances rates (MIBGAS) [23] and applies to the total imbalance occurred during the day. The initial imbalance is assumed to be null. The imbalance gas of the day before could be sold in the continuous sessions of the spot market. In this case, the additional cost of selling gas in this session is 0.95% of the natural gas prices in the spot market in that day.

Finally, combining the five price scenarios of the electricity spot market and the five price scenarios of the natural gas spot market, a total of 25 scenarios is considered.

5. Results

The case studies are solved using CPLEX 12.7.1.0 [26] under General Algebraic Modelling System (GAMS) 24.9.1 [27] on a Linux-based server with ten 2.9 GHz processors and 250 GB of RAM. The optimality gap is set to 0.1%. Table 14 provides the computational size of the problem and the computing times. Note that the computing time is acceptable considering that the problem is for a medium-term horizon.

Table 14.

Computational issues.

5.1. Expected Profit

Table 15 includes the expected profit obtained by the producer with and without a natural gas storage unit. Observe that the use of the storage increases the expected profit by 2.0%.

Table 15.

Expected profit.

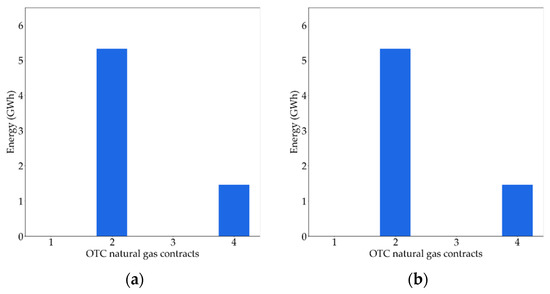

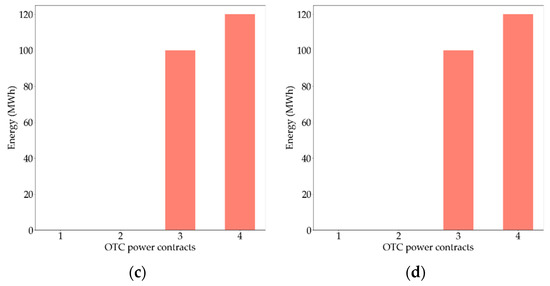

5.2. Bilateral Contracts

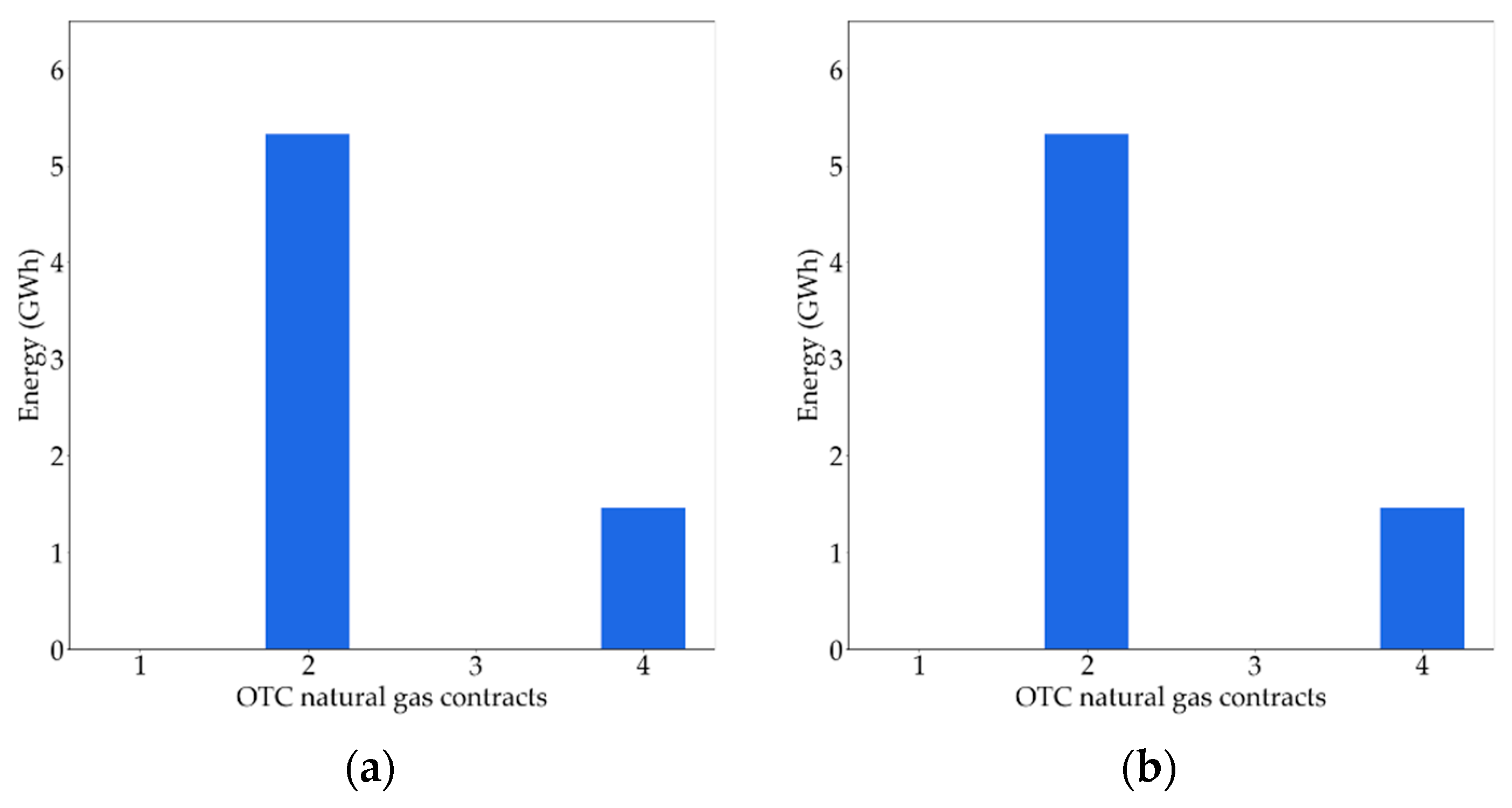

Figure 13 shows the results corresponding to the signed electricity and natural gas bilateral contracts. Note that natural gas contracts with lower prices are selected, while the sum of their quantities, 6781.50 MWh per day, only allows production around the maximum power output for 10 h per day. Observe that the bilateral contracts that are signed are the same in both cases.

Figure 13.

Bilateral contracts selected. (a) Natural gas purchases per day and per bilateral contract with storage; (b) natural gas purchases per day and per bilateral contract without storage; (c) electricity sold per hour and per bilateral contract with gas storage; (d) electricity sold per hour and per bilateral contract without gas storage.

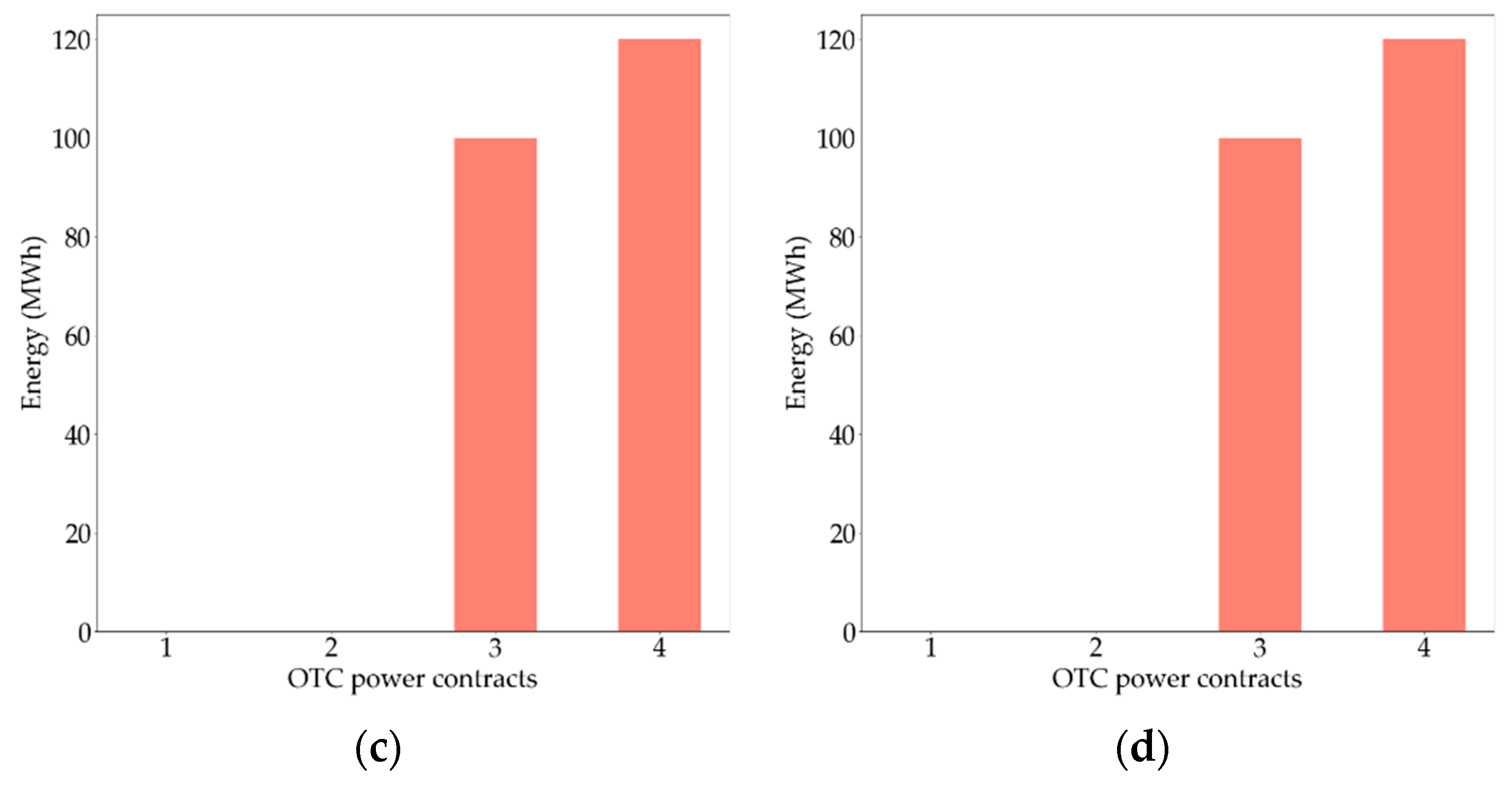

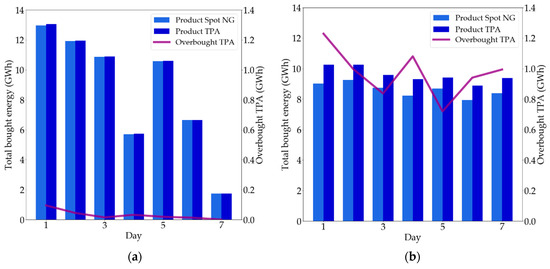

5.3. TPA Contracts

Figure 14 represents the capacity contracted in the TPA market. For the sake of clarity, the total quantity of natural gas products purchased in the spot market is compared with the access capacity purchased in the TPA market. It is observed that the capacity contracted in the TPA market is highly dependent on the presence of the gas storage. The purple line represents the excess of TPA that is contracted but is not used. Observe that this value is much smaller in the case in which the gas storage is considered.

Figure 14.

Relationship among spot natural gas product and access capacity (a) with a gas storage and (b) without gas storage.

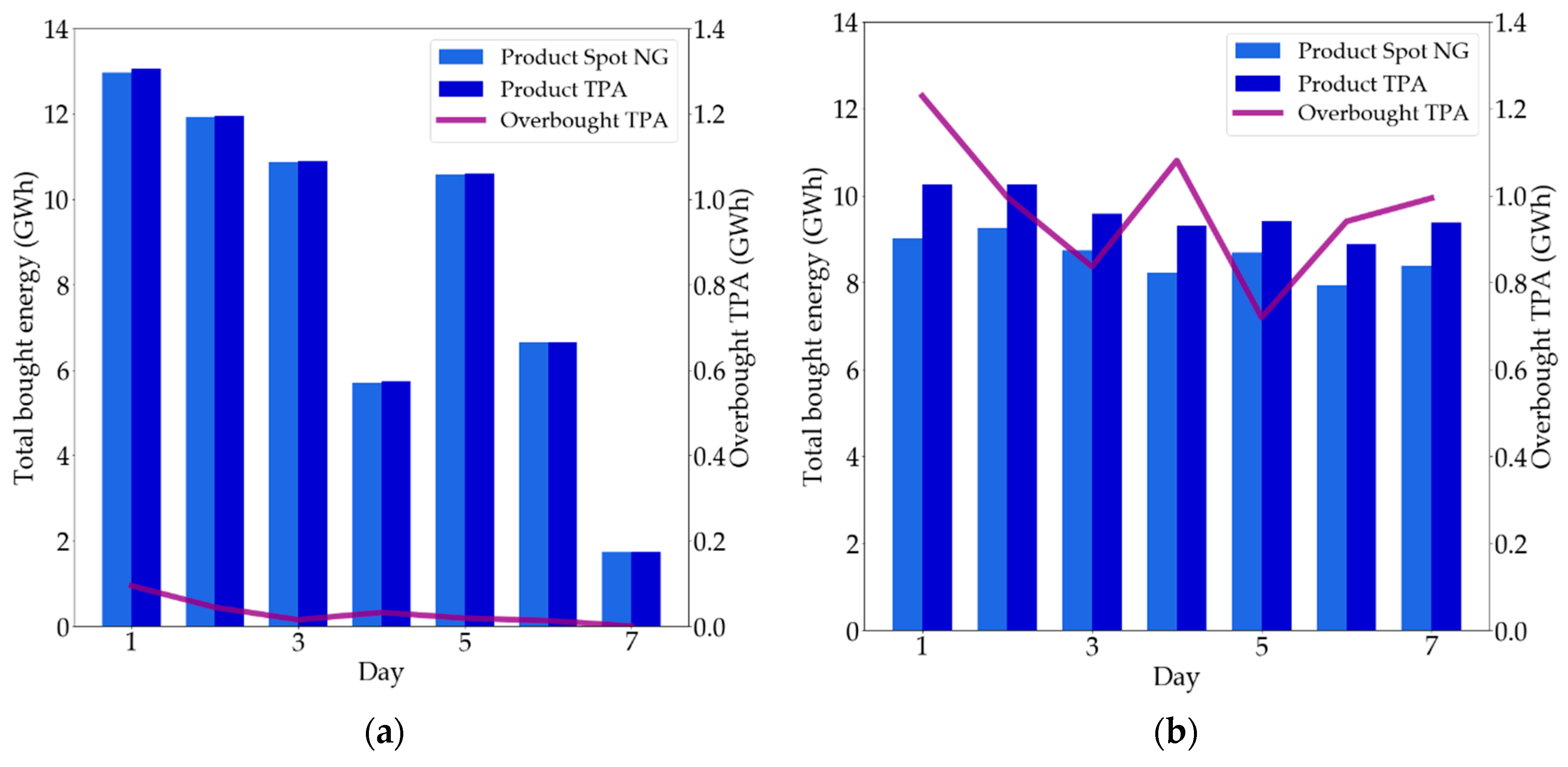

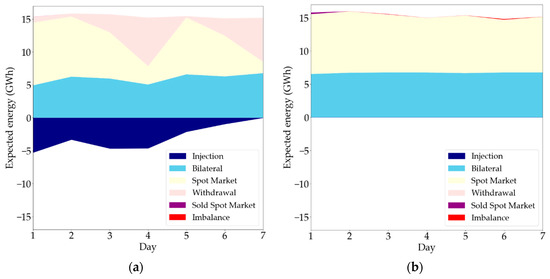

5.4. Expected Gas Procurement

Figure 15a shows the schedule of the gas procurement of the CCGT during the planning horizon considering the natural gas storage. The gas purchased in bilateral contracts is partially used in each day. Additionally, natural gas is withdrawn from the storage unit as well as purchased from the spot market to produce electricity. The natural gas injected into the storage is represented in the negative axis and comes from the gas purchased in the bilateral contract and spot market. Note that when gas prices are low, more gas is injected into the storage regarding the technical constraints. The stored gas is then used to feed the CCGT when the gas prices in the spot market are comparatively higher. A small quantity of gas is sold at the beginning and no imbalances is used. Figure 15b shows the gas procurement of the CCGT in the case in which gas storage is not considered. In this case, a small quantity of gas is sold in spot market in most of the days and a small quantity of imbalances is used. As it can be seen, the largest quantity of gas needed to feed the CCGT is purchased in the spot market.

Figure 15.

The expected gas procurement. (a) Natural used per day to feed the combined-cycle gas turbine (CCGT) using the gas storage; (b) natural used per day to feed the CCGT without gas storage.

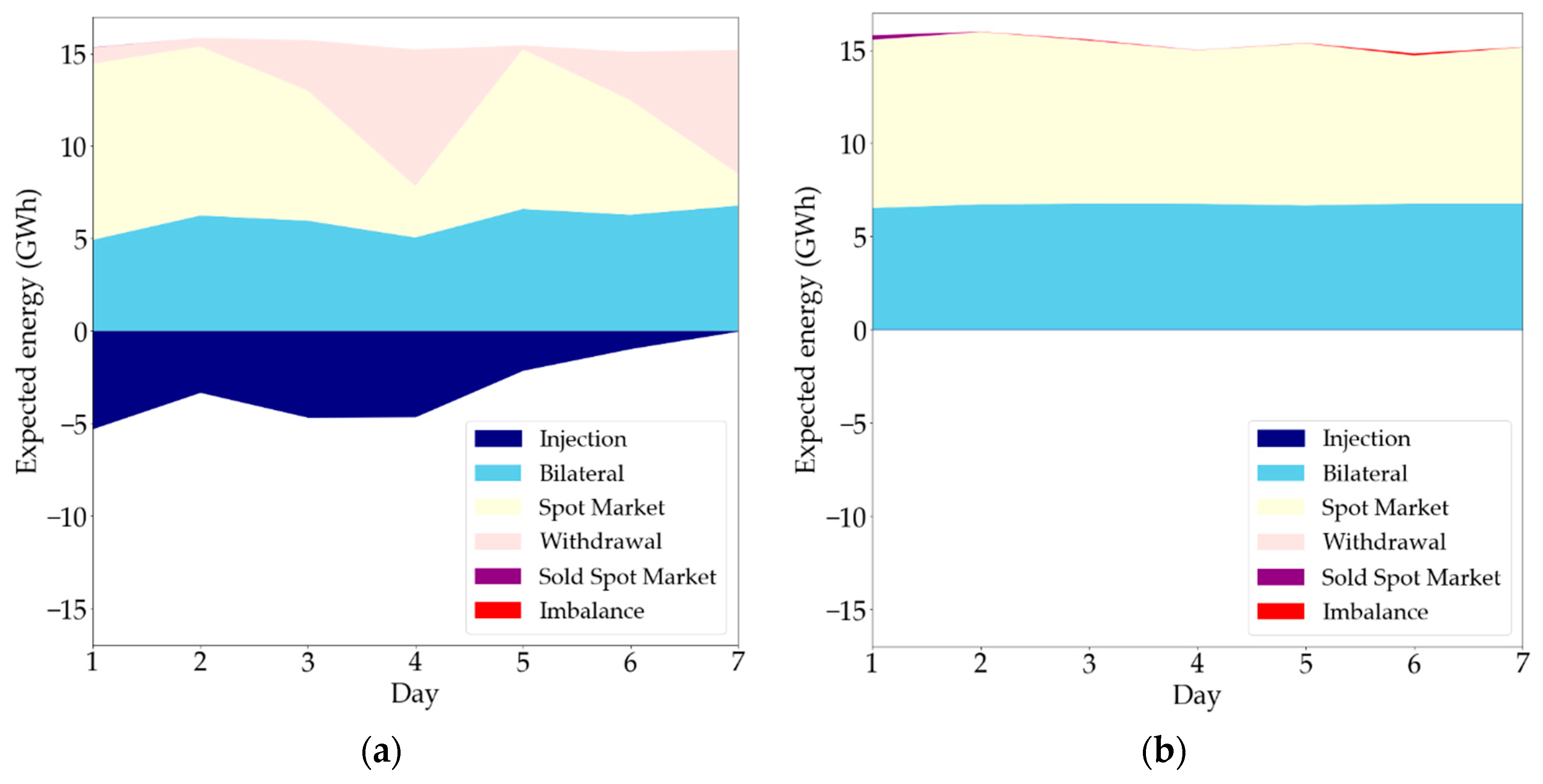

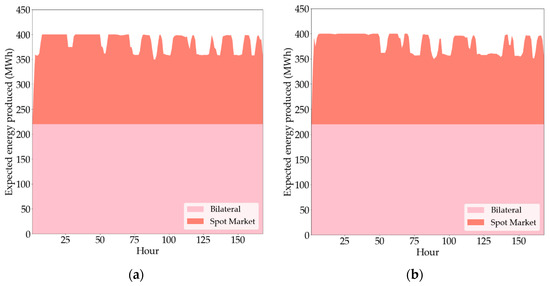

5.5. Expected Electricity Sales

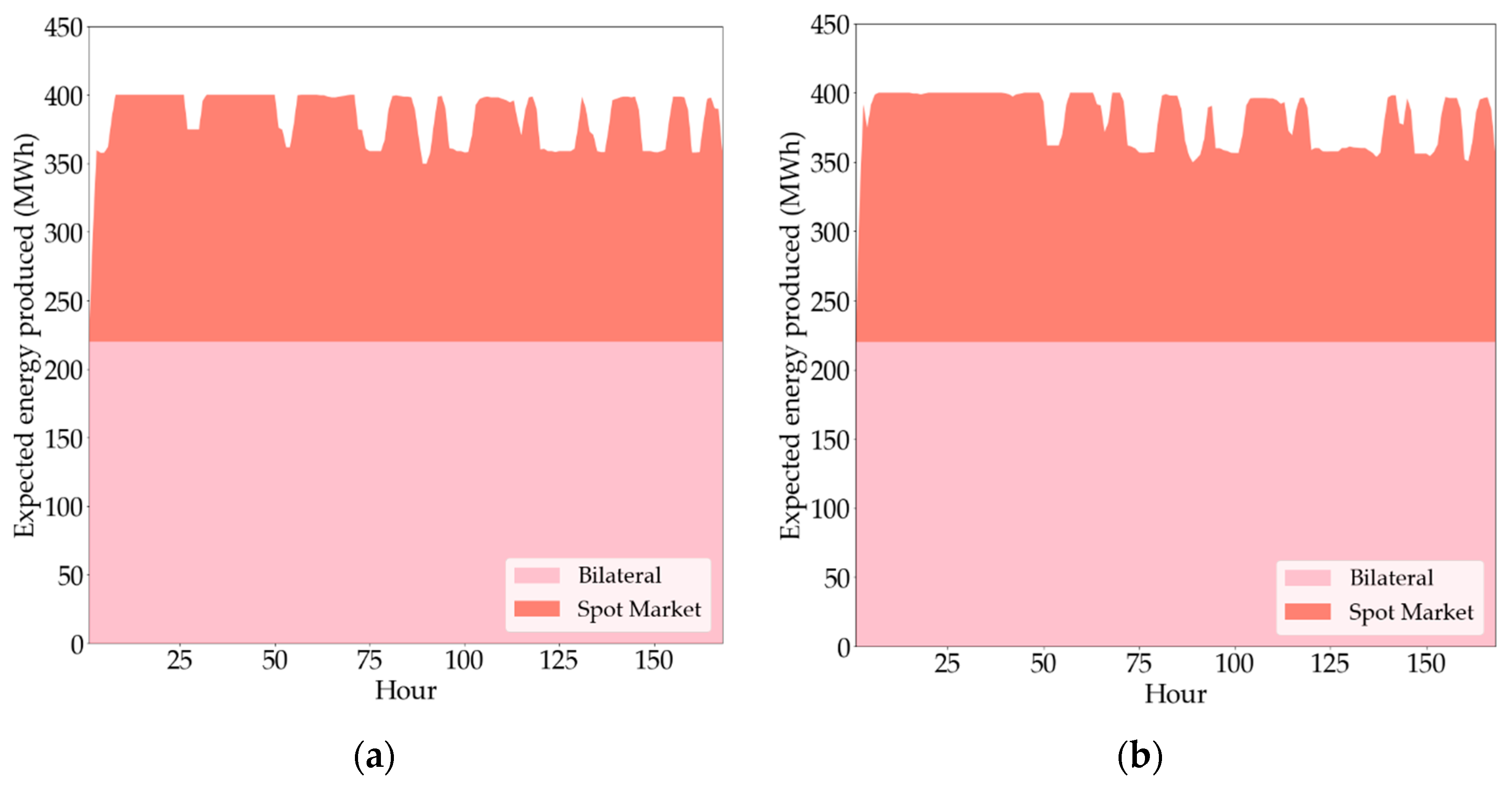

Figure 16 provides the sale of electricity in both cases, with and without gas storage. As stated above, the quantity of electricity sold through bilateral contracts is the same in both cases. However, the quantities traded in the spot market are different. In the case with a gas storage, the sales in the spot market are around 1.1% higher. The total expected electricity sold in the spot market by the CCGT owner with a storage unit is 27.40 GWh, whereas that amount is equal to 27.11 GWh in the case without gas storage.

Figure 16.

The expected energy produced, (a) with gas storage, and (b) without gas storage.

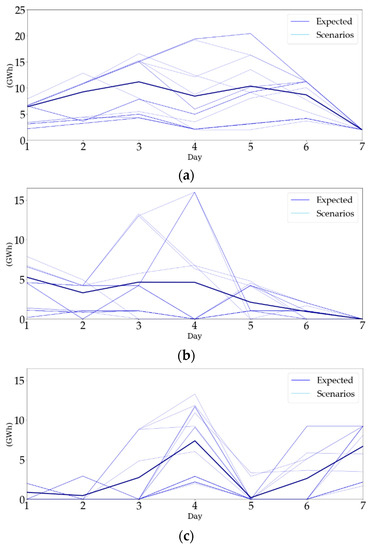

5.6. Storage Operation Per Scenario

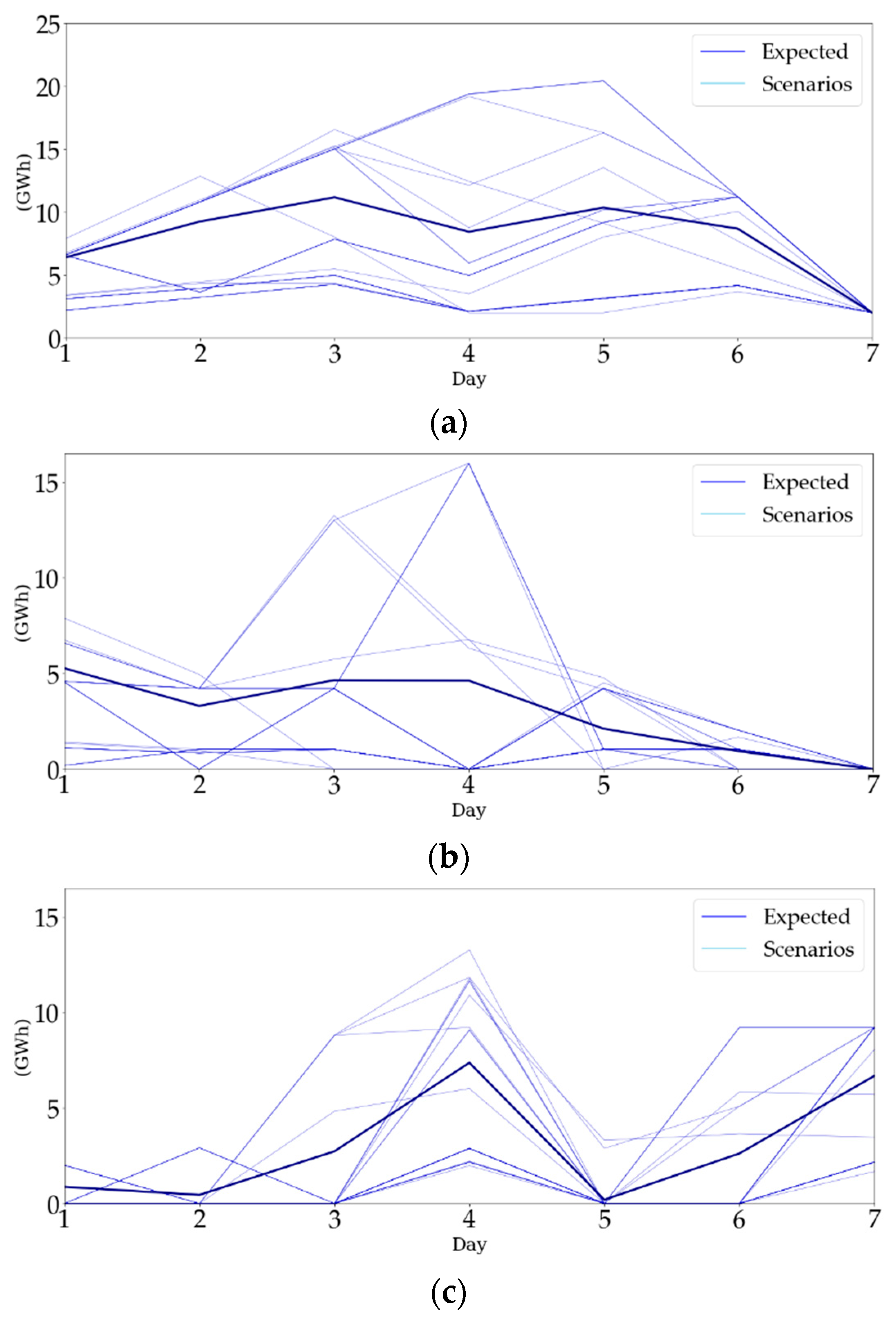

Figure 17 represents the operation of the gas storage for each of the 25 considered scenarios. Dark blue lines represent expected values, whereas single scenarios are represented using light blue lines. It is observed that the energy stored increases during the first three days and continuously decreases during the last three of the planning horizon (see Figure 17a). The reason for this is the largest quantity of gas injection occurs between days one and three, as shown in Figure 17b. On the contrary, the withdrawal grows until all available working gas is used (see Figure 17c). On the fourth day, the largest amount of stored gas is withdrawn and then on the fifth day the withdrawal is significantly reduced.

Figure 17.

Storage operation per scenario. (a) Energy stored; (b) energy injected, and (c) energy withdrawn.

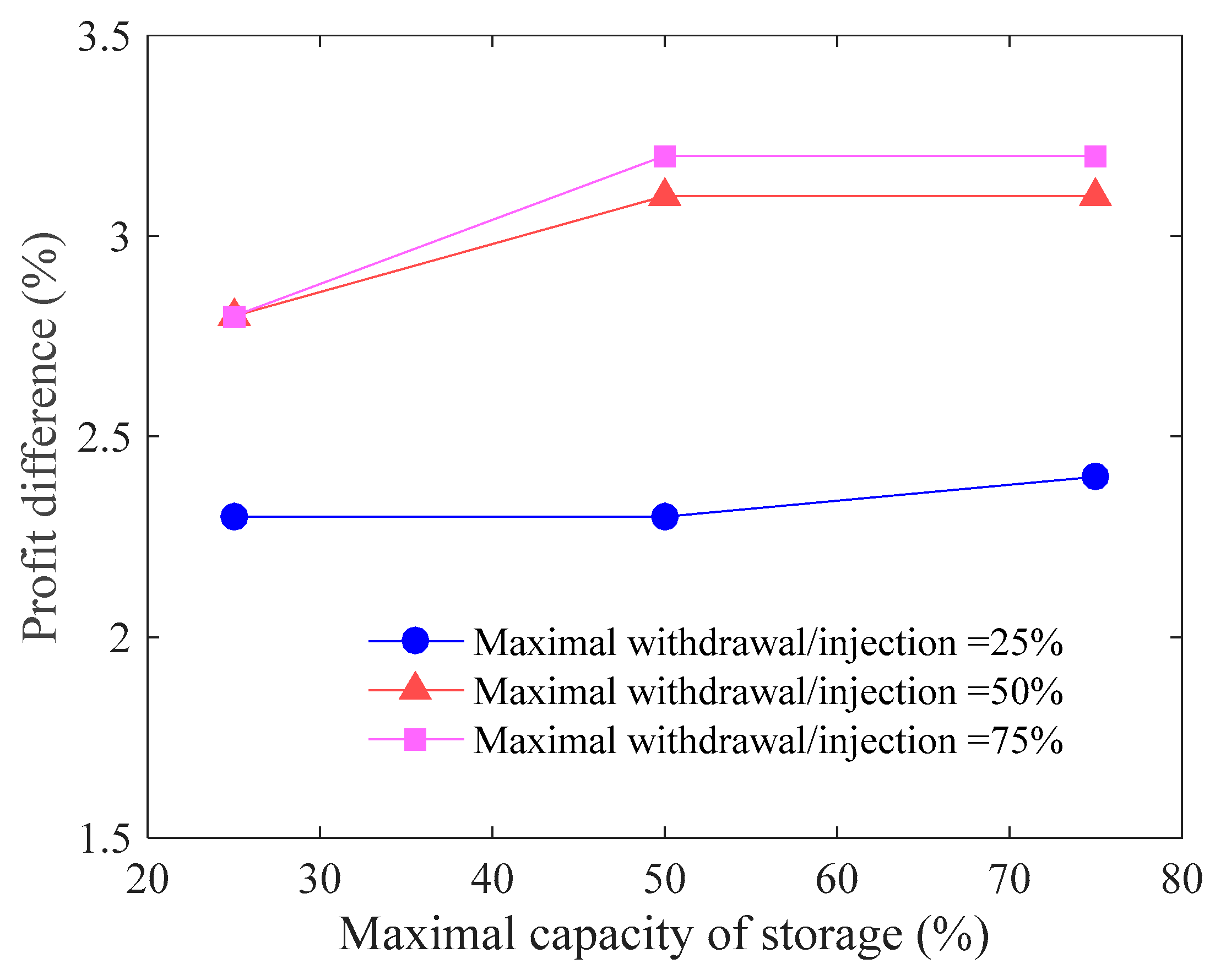

5.7. Sensitivity Analysis: Gas Storage Unit

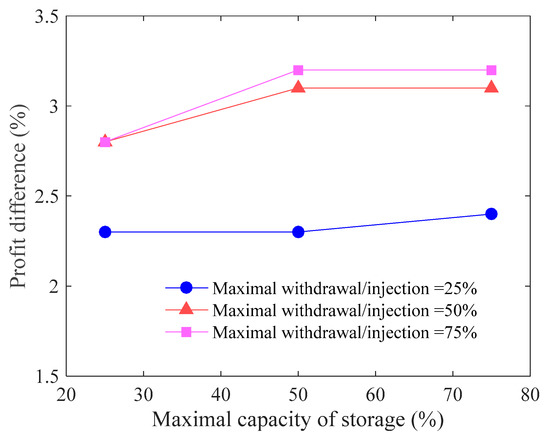

In this section, we provide the results obtained from performing a sensitivity analysis based on the size of the gas storage unit. The sensitivity analysis is carried out by modifying the value of two parameters, namely the maximal technical capacity of the storage unit and the withdrawal/injection flow capacity. Therefore, we solve the proposed model for different values of those parameters and evaluate their influence on the outcomes. Specifically, we solve the model considering three additional sizes of the maximal technical capacity, i.e., sizes corresponding to 25%, 50%, and 75% of the highest value considered (35,000 MWh). In addition, we combine the previous cases with three different values of the withdrawal/injection flow capacity, which are defined following the same criterion, i.e., the flow capacity takes values corresponding to 25%, 50%, and 75% of the highest value considered (16,000 MWh/day). For the sake of conciseness, we compare the outcomes of each case in terms of the increase on expected profit compared to the case without a natural gas storage unit. Figure 18 provides the expect profit increase obtained when storage is used. From this figure, we observe that when the maximal withdrawal/infection capacity decreases from 75% to 50% of the initial capacity, the profit difference remains rather stable. However, the reduction from 50% to 25% of the withdrawal/infection capacity leads to a high decrease in the profit difference of both cases. From this figure, we can also conclude that, in terms of profit, the reduction of the maximal withdrawal infection is more relevant than the reduction of the maximal capacity of storage.

Figure 18.

Sensitivity analysis: gas storage size.

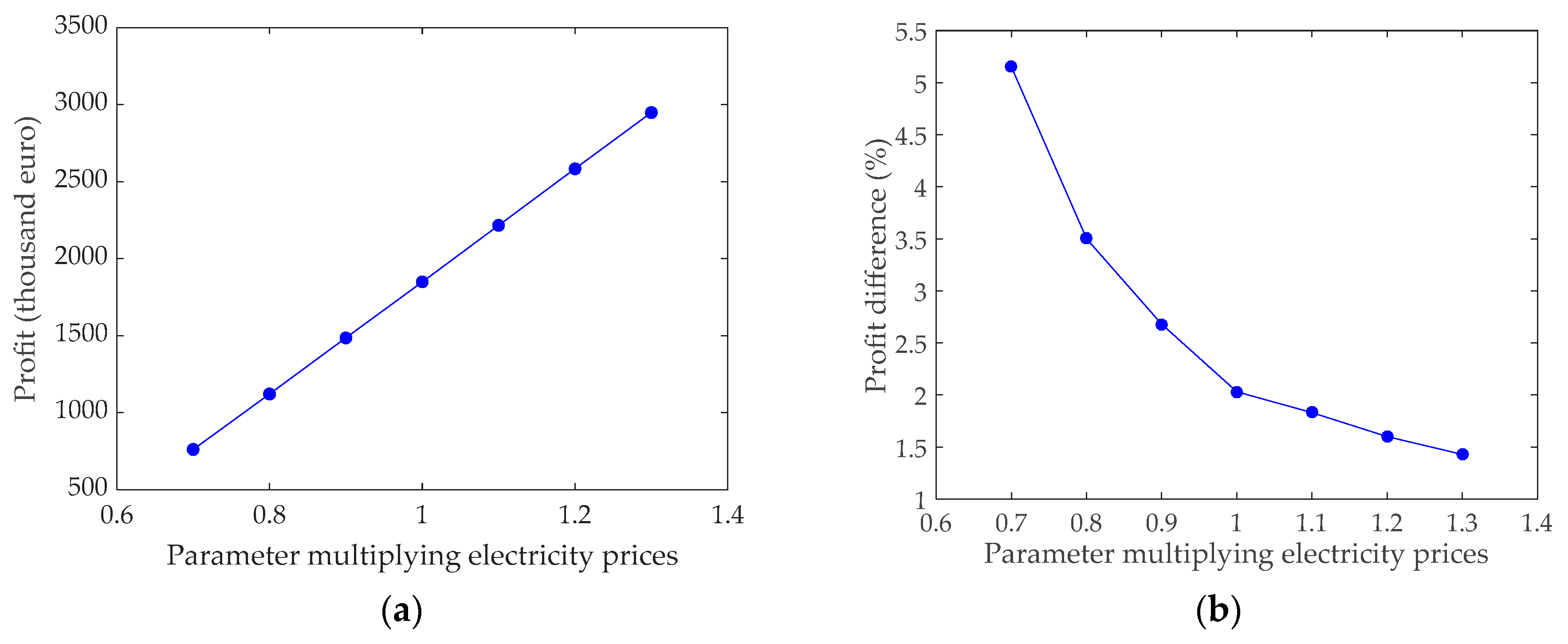

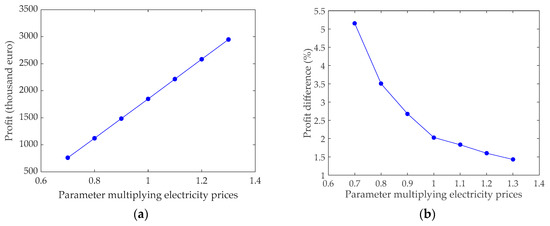

5.8. Sensitivity Analysis: Spark Price

The objective of this section is to analyze qualitatively and quantitatively the influence of the spark price between electricity and gas spot markets on the expected profit obtained by the power producer in the cases with and without gas storage. For doing that, the electricity prices in the spot and OTC markets are multiplyed by a factor ranging between 1.3 and 0.7. The obtained results are represented in Figure 19. Figure 19a depicts the expected profit in the case in which storage is considered. As expected, this figure shows that the expected profit obtained by the power producer increases as the electricity price and the spark price grow. Figure 19b provides the difference between the solutions with and without gas storage expressed in terms of expected profit. This figure shows that this differece decreases as the spark prices increases. In particular, the expected profit in the case in which gas storage is considered grows from 2.03% in the base case to 5.15% if the electricity prices are multiplyed by a factor equal to 0.7. This result indicates that the usage of gas storage is of interest in the case of experiencing low spark prices.

Figure 19.

Sensitivity analysis: spark price. (a) Expected profit considering storage, (b) difference between the profits of cases with and without storage.

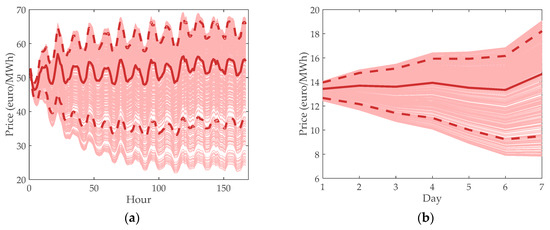

5.9. Out-of-Sample Analysis

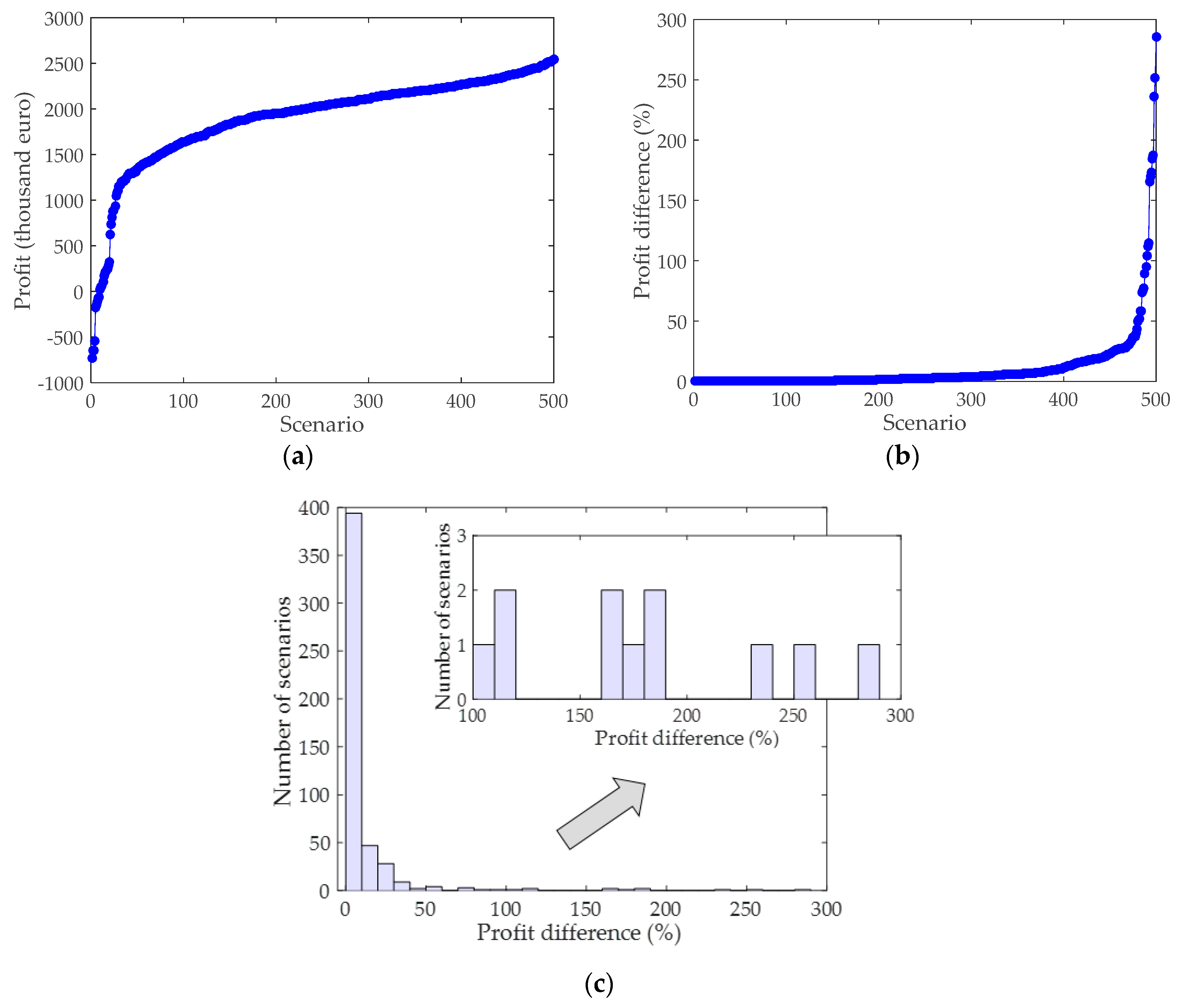

To conclude this case study, we add the results corresponding to an out-of-sample analysis whose objective is to analyze the impact of experiencing different electricity and gas prices to those considered in the reduced set of scenarios. The procedure followed to carry out the out-of-sample analysis consists of the following steps: (i) we solve the proposed scheduling model considering as initial set of scenarios those provided in Section 4.1.3 and Section 4.1.4; (ii) we take the values of the first-stage decisions, i.e., electricity contracts (sale), natural gas contracts (purchase), and fixed term of TPA contracts (purchase); (iii) we solve again the scheduling model but this time fixing the values of the first-stage decisions to those indicated in (ii) and considering a larger set of electricity and gas price scenarios; and (iv) we analyze the values of the second-stage decision variables. In order to perform this analysis a new set of 500 electricity and gas price scenarios has been generated using the procedure described in Section 4.1.3 and Section 4.1.4. The resulting sets of scenarios are provided in Figure 20a,b. In these figures, solid and thick lines represent mean values, whereas dashed lines are used to depict the 10 and 90 percentiles of both price distributions.

Figure 20.

Out-of-sample scenarios. (a) Electricity price scenarios; (b) gas price scenarios.

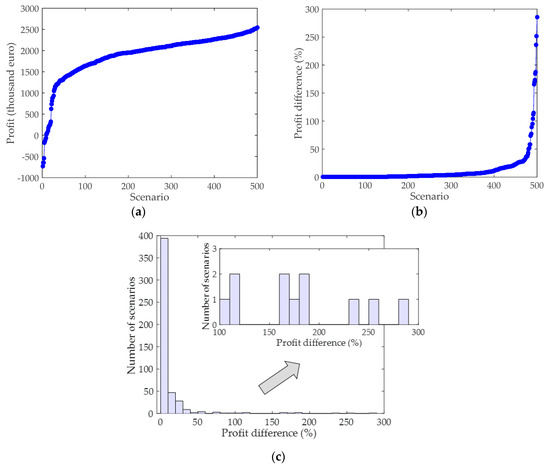

The main results of this analysis are depicted in Figure 21. The profit per scenario in the case with gas storage is represented in Figure 21a, whereas the difference between the profits attained in cases in which gas storage is either considered or not is shown in Figure 21b. For the sake of clarity, values are increasingly ordered in both figures. Finally, in order to improve the readability of the results, Figure 21c represents the histogram of the values represented in Figure 21b. Considering the above, Figure 21a shows that negative profits occur in 9 scenarios, which represents only 1.8% of the total number of scenarios. Figure 21b,c shows that the profit obtained in the case that considers storage is always greater than that resulting when storage is not considered. The difference between these two cases is higher than 100% in 11 scenarios. This result indicates that the gas storage is useful to handle unexpected variations of electricity and gas prices. In this sense, it is important to note that 20 scenarios have a negative profit associated if the storage is not considered. Observe that this value doubles the number of scenarios with negative profits in the case in which storage is considered.

Figure 21.

Out-of-sample results. (a) Profit per scenario considering storage; (b) difference between the profits of cases with and without storage, (c) histogram of the difference between profits of cases with and without storage.

6. Conclusions

In this paper, a two-stage stochastic problem is proposed to investigate the problem of a power producer managing a combined-cycle gas turbine that seeks to maximize its expected profit over a medium-term planning horizon considering the uncertainty in the electricity and gas spot market prices. The proposed model takes into account the different physical features between natural gas and electricity and introduces as a novelty the technical and economic management of a gas storage. In addition, we consider that the producer can participate in different markets, such as spot, bilateral, imbalances, and third-party access markets.

The analysis of the numerical results indicates the decisions on the bilateral contracts do not depend on the presence of the gas storage unit. With respect to the participation in the daily markets, the gas storage avoids gas imbalances and reduces overbuying in the TPA market, which results in comparatively higher expected profits. In addition, the availability of gas storage reduces fluctuations in CCGT production. The out-of-sample analysis shows that the gas storage is useful to mitigate the effect of experiencing electricity and gas prices different from those considered in the scheduling model.

Research is currently underway to account for the participation of CCGTs in adjustment and ancillary services in the medium-term decision-making problem described in this paper. Another interesting avenue of research is to develop an investment model to determine the optimal storage and maximum injection and withdrawal capacities of gas storages for CCGT units.

Author Contributions

Conceptualization, H.G.-V. and M.C.; validation, M.C.; investigation, H.G.-V.; writing—original draft preparation, H.G.-V.; writing—review and editing, M.C., R.D. and H.G.-V. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Ministry of Economy and Competitiveness of Spain grant number DPI2015-71280-R MINECO/FEDER, UE.

Acknowledgments

The authors acknowledge the supervision of Antonio J. Conejo during the first steps of this work.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

The notation used throughout this paper is provided below:

Acronyms:

| ARIMA | Autoregressive integrated moving average model |

| CCGT | Combined-cycle gas turbine |

| LHV | Lower heating value |

| LMP | Locational marginal prices |

| LNG | Liquified natural gas |

| NG | Natural gas |

| OTC | Over the counter |

| PGE2 | PG&E Citygate hub prices used in CAISO market systems |

| SARIMA | Seasonal autoregressive integrated moving average model |

| TPA | Third-party access |

| VBP | Virtual balancing point |

Indices

| Index of breakpoints used to model the piecewise linear approximation of the gas consumption of the CCGT | |

| Index of time periods [daily] | |

| Index of natural gas products | |

| Index of time periods [hourly] | |

| Index of TPA products | |

| Index of natural gas bilateral contracts | |

| Index of electricity bilateral contracts | |

| Index of scenarios |

Sets

| Set of breakpoints “Heat rate blocks” | |

| Set of electricity bilateral contracts | |

| Set of daily time periods | |

| Set of natural gas products | |

| Set of hourly time periods | |

| Set establishing relation between daily and hourly periods | |

| Set of TPA products | |

| Set of natural gas bilateral contracts | |

| Set of natural gas bilateral contracts defined in day d | |

| Set of natural electricity bilateral contracts | |

| Set of natural electricity bilateral contracts in hourly period k | |

| Set of scenarios |

Variables

| Binary variable that is equal to 1 if electricity bilateral contract z is signed, being 0 otherwise | |

| Binary variable that is equal to 1 if gas bilateral contract y is signed, being 0 otherwise | |

| Shutdown cost in hourly period k and scenario ω | |

| Startup cost in hourly period k and scenario ω | |

| Binary variable that is equal to 1 if gas product h is bought in daily period d and scenario ω, being 0 otherwise | |

| Binary variable that is equal to 1 if TPA product t is bought in daily period d and scenario ω, being 0 otherwise | |

| Power generated in hourly period k and scenario ω | |

| Power sold in spot market in hourly period k and scenario ω | |

| Power produced in hourly period k in breakpoint b and scenario ω | |

| Gas quantity consumed in hourly period k and scenario ω | |

| Gas quantity stored at the end of the daily period d in the storage in scenario ω | |

| Imbalance gas quantity in PVB at the end of the daily period d and scenario ω | |

| Gas quantity injected in daily period d in the storage in scenario ω | |

| Gas quantity bought in spot market in daily period d in product h and scenario ω | |

| TPA capacity bought in daily period d in product t and scenario ω | |

| Gas quantity withdrawn in daily period d from the storage in scenario ω | |

| Bilateral contracts gas quantity consumed in daily period d and scenario ω | |

| Imbalance gas quantity consumed in daily period d and scenario ω | |

| Gas quantity bought in spot market and consumed in daily period d and scenario ω | |

| Imbalance quantity by gas overbought in bilateral contracts in daily period d and scenario ω | |

| Imbalance gas quantity from the day before and not completely consumed in daily period d and scenario ω | |

| Imbalance quantity by gas overbought in spot market in daily period d and scenario ω | |

| Bilateral contracts gas quantity stored in daily period d in the storage in scenario ω | |

| Imbalance gas quantity injected in daily period d in the storage in scenario ω | |

| Gas quantity bought in spot market in daily period d injected in the storage in scenario ω | |

| Gas quantity sold in continuous session in daily period d and scenario ω | |

| Binary variable that is equal to 1 if the status of the CCGT unit is online in hourly period k and scenario ω, being 0 otherwise | |

| Binary variable that is equal to 1 if the level of gas in the storage is higher than the operation gas in daily period d and scenario ω, being 0 otherwise |

Parameters

| Shutdown cost of CCGT unit | |

| Startup cost of CCGT unit | |

| Number of breakpoints “Heat rate blocks” | |

| Number of electricity bilateral contracts | |

| Number of daily time periods | |

| Number of gas products | |

| Number of hourly time periods | |

| Number of TPA products | |

| Number of gas bilateral contracts | |

| Number of scenarios | |

| Initial status of the gas quantity in the storage, being equal to 1 if gas stored is larger than the operation gas | |

| Power sold in bilateral contract z | |

| Maximum nominal power output of CCGT unit | |

| Minimum power output of CCGT unit | |

| Initial power output of CCGT unit | |

| Power output of CCGT unit in breakpoint b | |

| Gas quantity bought in period d in bilateral contract y | |

| Minimum quantity of operation gas in the storage | |

| Maximum technical capacity of the storage | |

| Initial gas quantity stored in the storage | |

| Maximum injection capacity of the storage | |

| Maximum withdrawal capacity of the storage | |

| Gas quantity consumed by CCGT unit working on minimum power output | |

| Initial imbalance in PVB | |

| Gas quantity bid in auctions in daily period d of natural gas product h | |

| TPA Capacity bid in auctions in daily period d of firm exit gas capacity product h | |

| Ramp-down limit of CCGT unit | |

| Ramp-up limit of CCGT unit | |

| Heat rate slope of CCGT unit in breakpoint of consumption b | |

| Shutdown ramp limit of CCGT unit | |

| Startup ramp limit of CCGT unit | |

| Initial status of CCGT unit, that is equal to 1 if the unit is online | |

| Fixed term coefficient of TPA capacity in auctions in period d of firm exit gas capacity product t | |

| Fixed term coefficient of TPA capacity in period d of firm exit gas in bilateral contract y | |

| Coefficient that represents an additional cost to sale gas in continuous sessions | |

| Fixed term premium of TPA capacity in auctions in period d of firm exit gas capacity product t | |

| Electricity price in bilateral contract z | |

| Gas price in bilateral contract y | |

| Electricity spot price in hourly period k and scenario ω | |

| Gas price in continuous sessions in daily period d and scenario ω | |

| Gas spot price in auctions in period d of product h and scenario ω | |

| TPA fixed term of the tariff for exit firm capacity in daily period d | |

| TPA variable term of the tariff for exit firm capacity in daily period d | |

| PVB imbalance tariff in daily period d | |

| Scenario probability |

References

- COM 773 Final at EUR-Lex. 2018. Available online: https://eur-lex.europa.eu/homepage.html (accessed on 22 August 2019).

- IEA (International Energy Agency). World Energy Outlook. Available online: https://www.iea.org/reports/world-energy-outlook-2018 (accessed on 1 September 2019).

- Gas for Climate. The Optimal Role for Gas in a Net-Zero Emissions Energy System at Navigant. Available online: https://www.navigant.com/ (accessed on 22 August 2019).

- Kaye, R.J.; Outhred, H.R.; Bannister, C.H. Forward contracts for the operation of an electricity industry under spot pricing. IEEE Trans. Power Syst. 1990, 5, 46–52. [Google Scholar] [CrossRef]

- Gómez-Expósito, A.; Conejo, A.J.; Canizares, C. Electric Energy Systems: Analysis and Operation; CRC Press: Boca Raton, FL, USA, 2008. [Google Scholar]

- Shahidehpour, M.; Yamin, H.; Li, Z. Market Overview in Electric Power Systems; John Wiley & Sons, Inc: New York, NY, USA, 2002. [Google Scholar]

- Jirutitijaroen, P.; Kim, S.; Kittithreerapronchai, O.; Prina, J. An optimization model for natural gas supply portfolios of a power generation company. Appl. Energy 2013, 107, 1–9. [Google Scholar] [CrossRef]

- Zhuang, D.X.; Jiang, J.N.; Gan, D. Optimal short-term natural gas nomination decision in generation portfolio management. Eur. Trans. Electr. Power 2011, 21, 1–10. [Google Scholar] [CrossRef]

- Chen, H.; Baldick, R. Optimizing short-term natural gas supply portfolio for electric utility companies. IEEE Trans. Power Syst. 2007, 22, 232–239. [Google Scholar] [CrossRef]

- Dueñas, P.; Barquín, J.; Reneses, J. Strategic management of multi-year natural gas contracts in electricity markets. IEEE Trans. Power Syst. 2012, 27, 771–779. [Google Scholar] [CrossRef]

- Knudsen, B.R.; Whitson, C.H.; Foss, B. Shale-gas scheduling for natural-gas supply in electric power production. Energy 2014, 78, 165–182. [Google Scholar] [CrossRef]

- Ansary, M.; Latify, M.A.; Yousefy, G.R. GenCo’s mid-term optimal operation analysis: Interaction of wind farm, gas turbine, and energy storage systems in electricity and natural gas markets. IET Gener. Transm. Distrib. 2019, 13, 2328–2338. [Google Scholar] [CrossRef]

- Midthun, K.T. Optimization Models for Liberalized Natural Gas Markets. Fakultet for Samfunnsvitenskap og Teknologiledelse. Ph.D. Dissertation. 2007. Available online: https://ntnuopen.ntnu.no/ntnu-xmlui/handle/11250/265615 (accessed on 1 September 2019).

- Gabriel, S.A.; Kiet, S.; Zhuang, J. A mixed complementarity-based equilibrium model of natural gas markets. Oper. Res. 2005, 53, 799–818. [Google Scholar] [CrossRef]

- Holland, A. Injection/withdrawal scheduling for natural gas storage facilities. In Proceedings of the 2007 ACM Symposium on Applied Computing, Seoul, Korea, 11–15 March 2007; pp. 332–333. Available online: https://www.academia.edu/2811831/Injection_withdrawal_scheduling_for_natural_gas_storage_facilities (accessed on 1 September 2019).

- Birge, J.R.; Louveaux, F. Introduction to Stochastic Programming, Second Edition; Springer: New York, NY, USA, 2011. [Google Scholar]

- Kall, P.; Wallace, S.W.; Kall, P. Stochastic Programming; Wiley: Chichester, UK, 1994. [Google Scholar]

- Wallace, S.W.; Ziemba, W.T. (Eds.) Applications of Stochastic Programming; SIAM-MPS: Philadelphia, PA, USA, 2005. [Google Scholar]

- Conejo, A.J.; Carrión, M.; Morales, J.M. Decision Making under Uncertainty in Electricity Markets; Springer: New York, NY, USA, 2010. [Google Scholar]

- OMIE. Available online: http://www.omie.es/files/flash/ResultadosMercado.html# (accessed on 20 November 2019).

- Dupačová, J.; Gröwe-Kuska, N.; Römisch, W. Scenario reduction in stochastic programming. Math. Progr. 2003, 95, 493–511. [Google Scholar] [CrossRef]

- Box, G.E.P.; Jenkins, G.M.; Reinsel, G.C. Time Series Analysis: Forecasting and Control, 5th ed.; Wiley: Upper Saddle River, NJ, USA, 2015. [Google Scholar]

- Matlab. Available online: https://www.mathworks.com/products/matlab.html (accessed on 20 November 2019).

- MIBGAS. Available online: http://www.mibgas.es/en/gas-markets (accessed on 22 August 2019).

- BOE. Available online: https://www.boe.es/buscar/index.php?lang=en (accessed on 21 November 2019).

- CPLEX 12 at GAMS. Available online: https://www.gams.com/latest/docs/S_CPLEX.html (accessed on 22 August 2019).

- GAMS. Available online: https://www.gams.com (accessed on 22 August 2019).

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).