Analyzing Carbon Emissions Embodied in Construction Services: A Dynamic Hybrid Input–Output Model with Structural Decomposition Analysis

Abstract

1. Introduction

2. Literature Review

3. Methodology and Data Preparation

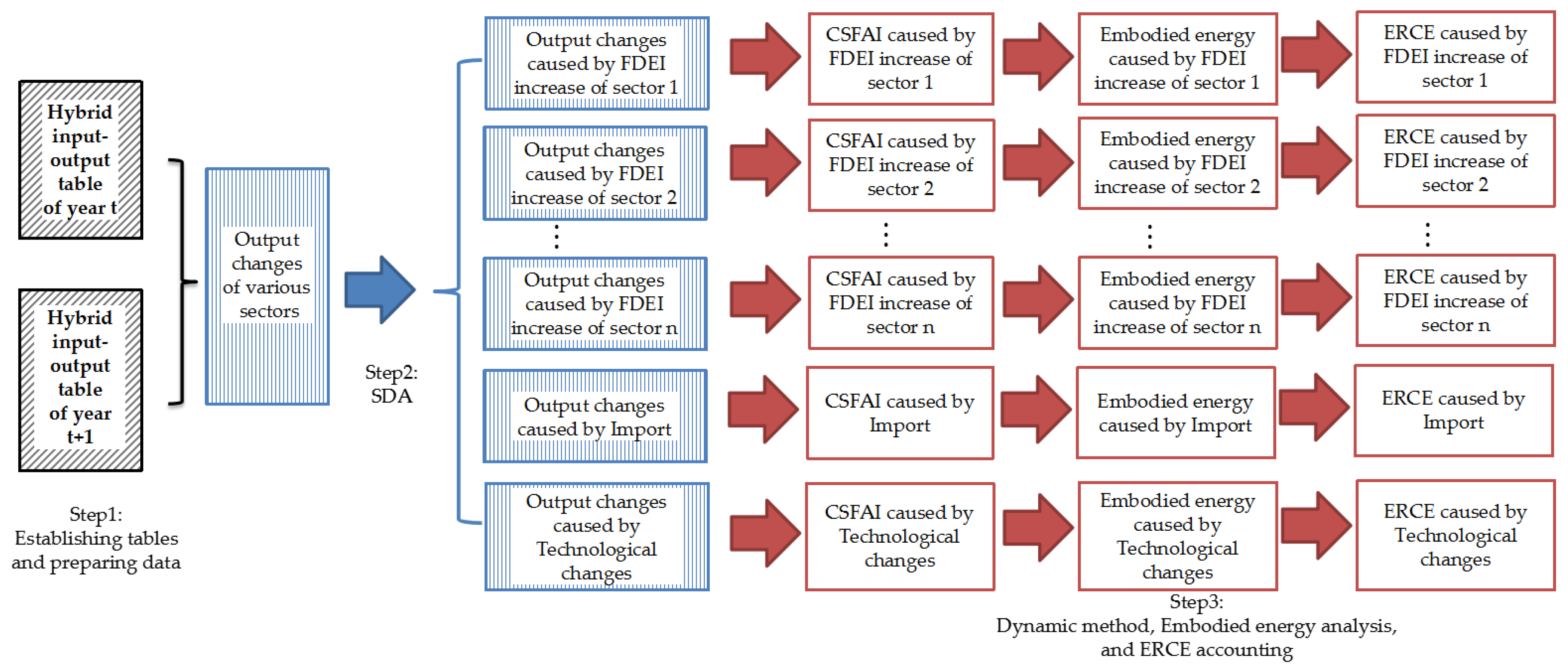

3.1. DHI/O-SDA Model

3.1.1. Establishment of Energy-Economic Hybrid Tables

3.1.2. SDA

3.1.3. CSFAI Estimation, Embodied Energy Analysis and ERCE Calculation

3.2. Data Preparation

4. Results, Uncertainties and Discussions

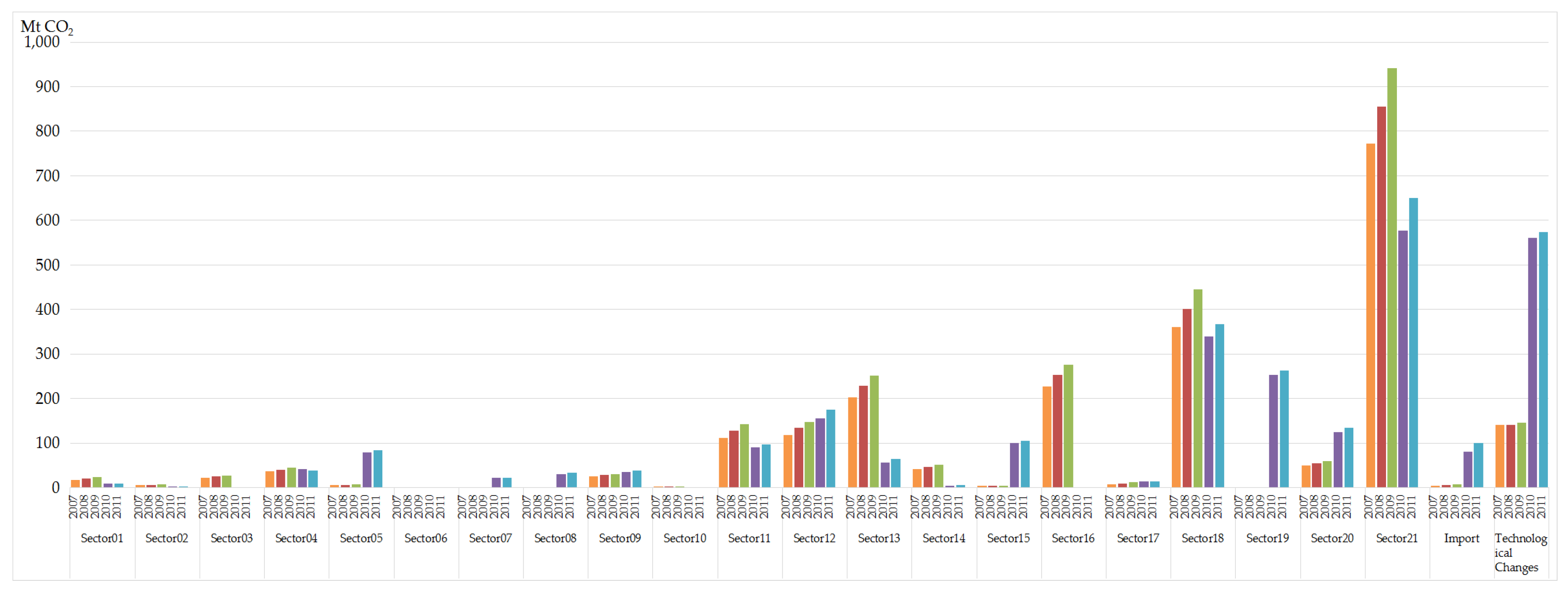

4.1. ERCE Embodied in CSFAI Caused by Each Sector

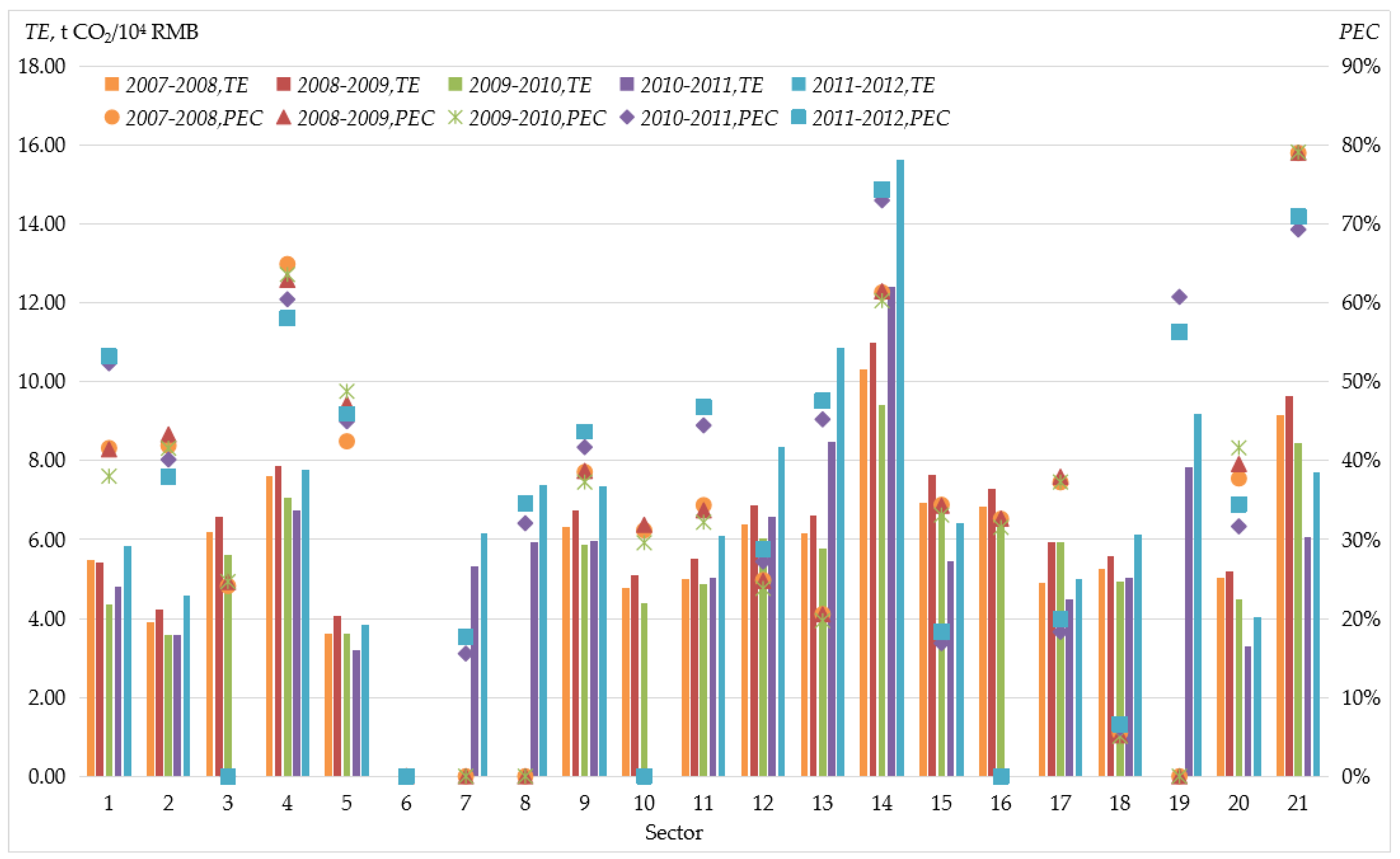

4.2. ERCE Embodied in CSFAI Caused by Sectoral a Unit of FDEI Increase

4.2.1. Analysis in the Horizontal Direction

ER

TE

PEC

4.2.2. Analysis in the Vertical Direction

4.3. Uncertainties and Discussions

4.3.1. Verification of the Model Result

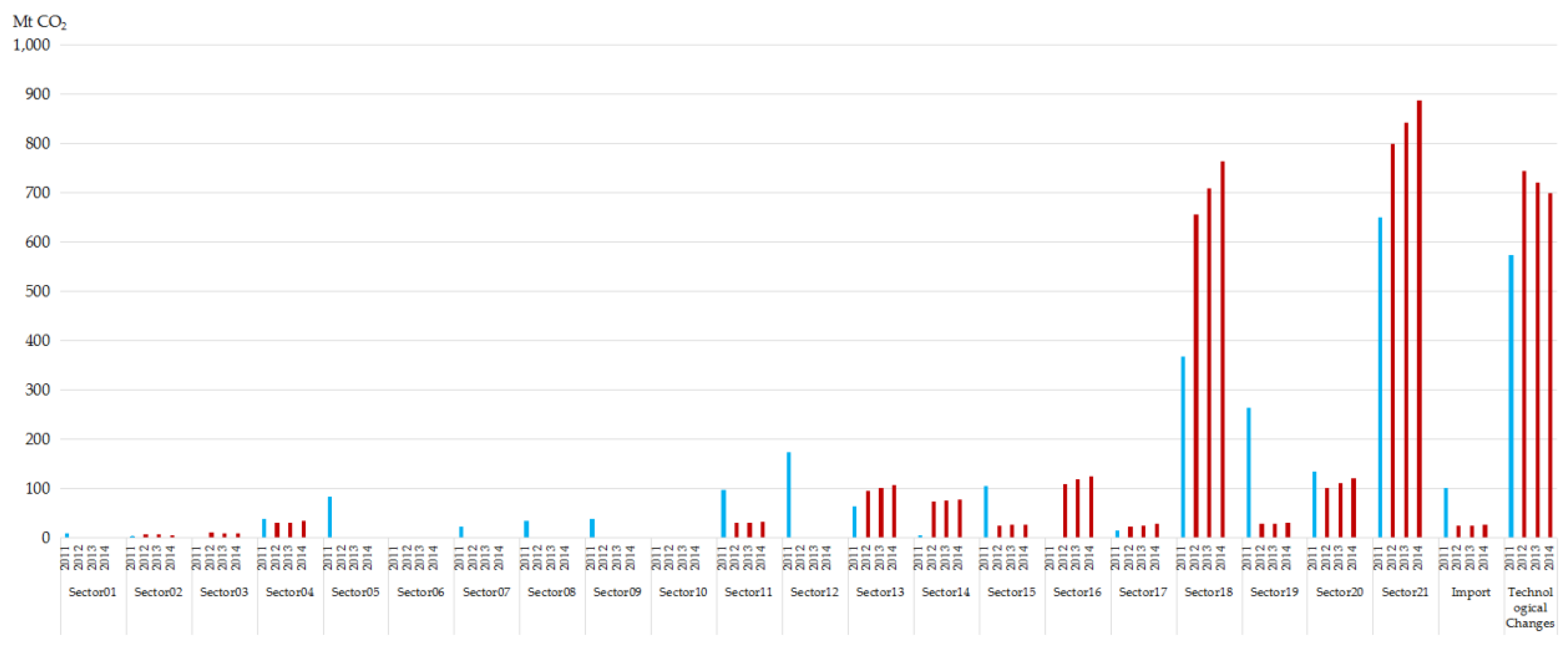

4.3.2. Comparisons with the Results from 2012 to 2015

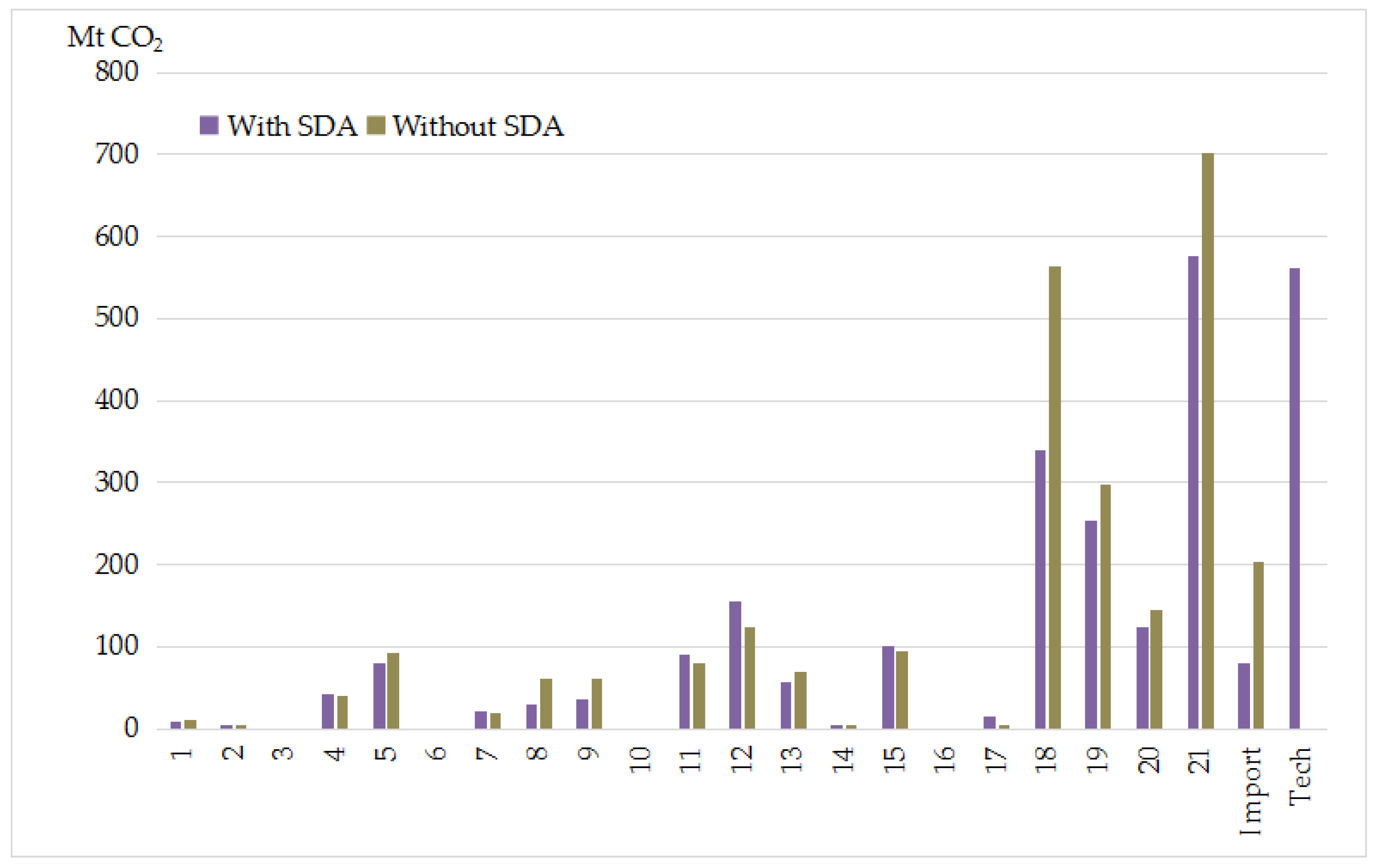

4.3.3. Comparison of DHI/O and DHI/O-SDA Models

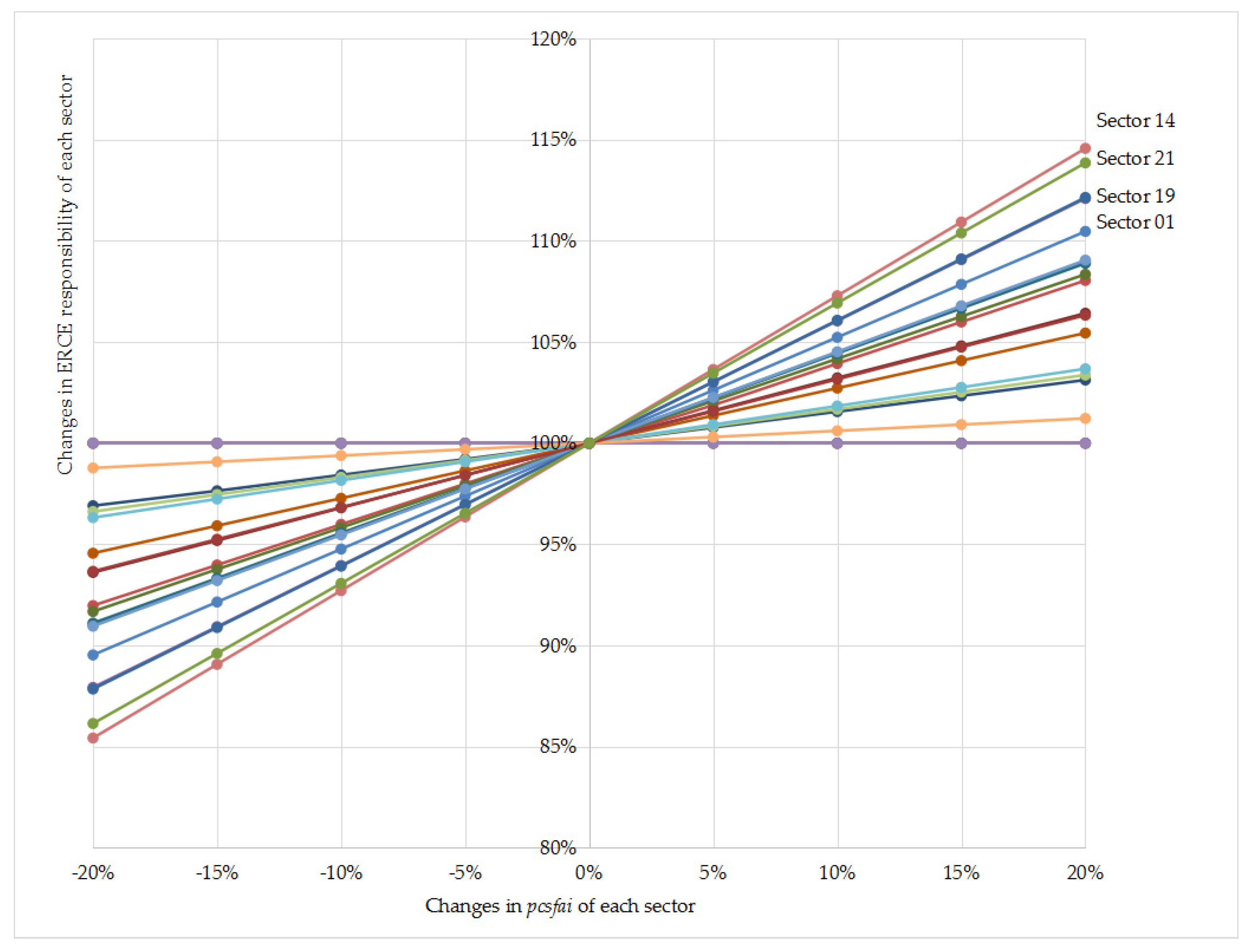

4.3.4. Sensitivity Analysis of pcsfait

4.3.5. Statistical Error Analysis

4.3.6. Limitations of the DHI/O-SDA Model

5. Conclusions and Policy Implications

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Abbreviations

| CO2 | Carbon dioxide |

| CSFAI | Constructive Services-related Fixed Assets Investment |

| DHI/O | Dynamic Hybrid Input–output |

| DHI/O-SDA model | Dynamic Hybrid Input–output model combined with Structural Decomposition Analysis |

| ER | ERCE embodied in CSFAI consumed by each sector caused by a unit of final demand increase in any specific sector |

| ERCE | Energy-related Carbon Emission |

| FDEI | Final Demand Excluding Import |

| IPCC | Intergovernmental Panel on Climate Change |

| NBS | National Bureau of Statistics |

| pcsfai | Ratio of CSFAI to the total fixed assets investment |

| PEC | Proportion of ER in the TE caused by a unit of final demand increase of any specific sector |

| SDA | Structural Decomposition Analysis |

| TE | Sum of ER in each sector caused by a unit of final demand increase of any specific sector |

Appendix A

| Sector (Full Name) | Sector (Abbreviation) | Code in This Paper | Code in I/O Table, 2007 | Code in I/O Table, 2010 | Code in I/O Table, 2012 |

|---|---|---|---|---|---|

| Mining and Washing of Coal | Coal | 01 | 006 | 02 | 06006 |

| Extraction of Petroleum and Natural Gas | Petroleum and Natural Gas | 02 | 007 | 03 | 07007 |

| Processing of Petroleum, Coking, and Processing of Nuclear Fuel | Petroleum Processing | 03 | 037 | 11 | 25039 |

| 038 | 25040 | ||||

| Production and Supply of Electric Power, Heat Power, and Gas | Electric Power | 04 | 092 | 23 | 44096 |

| 093 | 24 | 45097 | |||

| Agriculture, Forestry, Animal Husbandry, and Fishing | Agriculture | 05 | 001 | 01 | 01001 |

| 002 | 02002 | ||||

| 003 | 03003 | ||||

| 004 | 04004 | ||||

| Smelting and Pressing of Ferrous Metals | Ferrous Metals | 06 | 057 | 14 | 31059 31060 31061 |

| 058 | |||||

| 059 | |||||

| 060 | |||||

| 062 | 32063 | ||||

| Manufacture of Raw Chemical Materials and Chemical Products | Chemical | 09 | 039 | 12 | 26041 |

| 040 | 26042 | ||||

| 041 | 26043 | ||||

| 042 | 26044 | ||||

| 043 | 26045 | ||||

| 044 | 26046 | ||||

| 045 | 26047 | ||||

| 046 | 27048 | ||||

| 047 | 28049 | ||||

| 048 | 29050 | ||||

| 049 | 29051 | ||||

| Non-Energy Mining | Mining of Non-energy | 10 | 008 | 04 05 | 08008 |

| 009 | 09009 | ||||

| 010 | 10010 | ||||

| Manufacture of Foods, Drinks, and Tobacco | Foods | 11 | 011 | 06 | 13012 |

| 012 | 13013 | ||||

| 013 | 13014 | ||||

| 014 | 13015 | ||||

| 015 | 13016 | ||||

| 016 | 13017 | ||||

| 017 | 13018 | ||||

| 018 | 14019 | ||||

| 019 | 14020 | ||||

| Manufacture of Machinery | Machinery | 12 | 064 065 066 067 068 069 070 071 072 | 16 | 34065 34066 34067 34068 34069 34070 35071 35072 35073 35074 |

| Manufacture of Automobiles, Railway, Ship, Aerospace, and Other Equipment | Automobiles | 13 | 073 074 075 076 | 17 | 36075 36076 37077 37078 37079 |

| Manufacture of Textile, Apparel, Accessories, Leather, Fur, Feather, and Related Products, and Footwear | Textile | 14 | 025 026 027 028 029 030 031 | 07 08 | 17026 17027 17028 17029 17030 18031 19032 19033 |

| Manufacture of Paper; Paper Products; Articles for Culture, Education, and Arts and Crafts; and Printing and Reproduction of Recording Media | Paper | 15 | 034 | 10 | 22036 |

| 035 | 23037 | ||||

| 036 | 24038 | ||||

| Wholesale, Retail Trade, and Hotel, Restaurants | Wholesale | 20 | 108 | 30 31 | 51103 |

| 109 | 61112 | ||||

| 110 | 62113 | ||||

| 122 | 77126 | ||||

| 123 | 78127 | ||||

| 124 | 79128 | ||||

| 125 | 80129 | ||||

| 126 | 82130 | ||||

| 127 | 83131 | ||||

| 128 | 84132 | ||||

| 129 | 85133 | ||||

| 130 | 86134 | ||||

| 131 | 87135 | ||||

| 132 | 88136 | ||||

| 133 | 89137 | ||||

| 134 | 93138 | ||||

| 135 | 90139 |

Appendix B

| 2007–2008 | |||||||||||||||||||||

| Sector | 01 | 02 | 03 | 04 | 05 | 06 | 07 | 08 | 09 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| Caused by sector 01 | 2.28 | 0.07 | 0.07 | 0.47 | 0.05 | 0.17 | 0.06 | 0.03 | 0.16 | 0.05 | 0.03 | 0.14 | 0.03 | 0.09 | 0.03 | 0.23 | 0.05 | 0.00 | 0.52 | 0.11 | 0.85 |

| Caused by sector 02 | 0.05 | 1.64 | 0.07 | 0.34 | 0.03 | 0.15 | 0.04 | 0.02 | 0.14 | 0.04 | 0.02 | 0.12 | 0.03 | 0.08 | 0.03 | 0.16 | 0.03 | 0.00 | 0.27 | 0.08 | 0.57 |

| Caused by sector 03 | 0.31 | 1.24 | 1.49 | 0.60 | 0.04 | 0.15 | 0.05 | 0.03 | 0.21 | 0.04 | 0.04 | 0.15 | 0.03 | 0.09 | 0.04 | 0.20 | 0.04 | 0.00 | 0.48 | 0.13 | 0.83 |

| Caused by sector 04 | 0.44 | 0.09 | 0.07 | 4.94 | 0.03 | 0.08 | 0.05 | 0.02 | 0.11 | 0.03 | 0.03 | 0.07 | 0.03 | 0.08 | 0.03 | 0.26 | 0.03 | 0.00 | 0.28 | 0.08 | 0.87 |

| Caused by sector 05 | 0.04 | 0.05 | 0.05 | 0.24 | 1.54 | 0.03 | 0.02 | 0.01 | 0.28 | 0.02 | 0.21 | 0.04 | 0.02 | 0.04 | 0.03 | 0.07 | 0.02 | 0.00 | 0.25 | 0.08 | 0.60 |

| Caused by sector 06 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Caused by sector 07 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Caused by sector 08 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Caused by sector 09 | 0.12 | 0.14 | 0.11 | 0.81 | 0.13 | 0.08 | 0.06 | 0.03 | 2.43 | 0.08 | 0.08 | 0.09 | 0.03 | 0.17 | 0.09 | 0.19 | 0.05 | 0.00 | 0.49 | 0.14 | 0.99 |

| Caused by sector 10 | 0.07 | 0.07 | 0.07 | 0.51 | 0.04 | 0.09 | 0.06 | 0.04 | 0.28 | 1.48 | 0.03 | 0.16 | 0.04 | 0.10 | 0.04 | 0.22 | 0.04 | 0.00 | 0.55 | 0.11 | 0.76 |

| Caused by sector 11 | 0.05 | 0.05 | 0.05 | 0.32 | 0.76 | 0.04 | 0.02 | 0.02 | 0.27 | 0.02 | 1.72 | 0.04 | 0.02 | 0.07 | 0.09 | 0.10 | 0.03 | 0.00 | 0.41 | 0.13 | 0.79 |

| Caused by sector 12 | 0.09 | 0.13 | 0.15 | 0.57 | 0.06 | 0.47 | 0.20 | 0.04 | 0.31 | 0.14 | 0.05 | 1.59 | 0.05 | 0.13 | 0.06 | 0.53 | 0.09 | 0.00 | 0.53 | 0.18 | 1.01 |

| Caused by sector 13 | 0.08 | 0.12 | 0.12 | 0.54 | 0.07 | 0.37 | 0.16 | 0.04 | 0.38 | 0.11 | 0.06 | 0.28 | 1.26 | 0.21 | 0.06 | 0.43 | 0.09 | 0.00 | 0.50 | 0.20 | 1.08 |

| Caused by sector 14 | 0.08 | 0.06 | 0.06 | 0.58 | 0.33 | 0.05 | 0.03 | 0.02 | 0.53 | 0.03 | 0.14 | 0.07 | 0.02 | 6.32 | 0.09 | 0.15 | 0.04 | 0.00 | 0.45 | 0.14 | 1.12 |

| Caused by sector 15 | 0.09 | 0.08 | 0.07 | 0.67 | 0.17 | 0.09 | 0.07 | 0.02 | 0.62 | 0.05 | 0.07 | 0.09 | 0.04 | 0.33 | 2.39 | 0.27 | 0.20 | 0.00 | 0.48 | 0.16 | 0.99 |

| Caused by sector 16 | 0.09 | 0.10 | 0.11 | 0.61 | 0.08 | 0.28 | 0.32 | 0.05 | 0.42 | 0.13 | 0.06 | 0.15 | 0.04 | 0.19 | 0.08 | 2.23 | 0.09 | 0.00 | 0.50 | 0.18 | 1.14 |

| Caused by sector 17 | 0.05 | 0.05 | 0.05 | 0.37 | 0.21 | 0.09 | 0.04 | 0.02 | 0.34 | 0.03 | 0.06 | 0.06 | 0.02 | 0.23 | 0.06 | 0.16 | 1.83 | 0.00 | 0.38 | 0.11 | 0.74 |

| Caused by sector 18 | 0.09 | 0.13 | 0.14 | 0.49 | 0.06 | 0.36 | 0.10 | 0.29 | 0.30 | 0.14 | 0.05 | 0.14 | 0.04 | 0.13 | 0.06 | 0.35 | 0.09 | 0.29 | 0.84 | 0.17 | 1.02 |

| Caused by sector 19 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Caused by sector 20 | 0.04 | 0.05 | 0.05 | 0.24 | 0.17 | 0.03 | 0.02 | 0.01 | 0.14 | 0.02 | 0.22 | 0.04 | 0.03 | 0.12 | 0.06 | 0.11 | 0.03 | 0.00 | 0.53 | 1.90 | 1.23 |

| Caused by sector 21 | 0.04 | 0.04 | 0.05 | 0.25 | 0.06 | 0.05 | 0.04 | 0.02 | 0.24 | 0.02 | 0.05 | 0.05 | 0.03 | 0.14 | 0.11 | 0.20 | 0.04 | 0.00 | 0.33 | 0.15 | 7.23 |

| 2008–2009 | |||||||||||||||||||||

| ERCE of Sector | 01 | 02 | 03 | 04 | 05 | 06 | 07 | 08 | 09 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| Caused by sector 01 | 2.24 | 0.07 | 0.07 | 0.41 | 0.06 | 0.17 | 0.06 | 0.03 | 0.17 | 0.05 | 0.03 | 0.15 | 0.03 | 0.09 | 0.03 | 0.23 | 0.05 | 0.00 | 0.51 | 0.11 | 0.84 |

| Caused by sector 02 | 0.05 | 1.83 | 0.07 | 0.34 | 0.03 | 0.16 | 0.04 | 0.02 | 0.16 | 0.05 | 0.03 | 0.14 | 0.03 | 0.08 | 0.03 | 0.17 | 0.03 | 0.00 | 0.28 | 0.09 | 0.59 |

| Caused by sector 03 | 0.34 | 1.38 | 1.62 | 0.58 | 0.05 | 0.16 | 0.05 | 0.03 | 0.22 | 0.05 | 0.05 | 0.16 | 0.04 | 0.10 | 0.04 | 0.21 | 0.04 | 0.00 | 0.47 | 0.13 | 0.86 |

| Caused by sector 04 | 0.49 | 0.11 | 0.08 | 4.96 | 0.04 | 0.09 | 0.05 | 0.02 | 0.13 | 0.03 | 0.03 | 0.08 | 0.03 | 0.08 | 0.03 | 0.28 | 0.03 | 0.00 | 0.29 | 0.09 | 0.94 |

| Caused by sector 05 | 0.04 | 0.05 | 0.05 | 0.23 | 1.92 | 0.03 | 0.02 | 0.01 | 0.30 | 0.02 | 0.23 | 0.04 | 0.02 | 0.05 | 0.03 | 0.07 | 0.02 | 0.00 | 0.27 | 0.09 | 0.60 |

| Caused by sector 06 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Caused by sector 07 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Caused by sector 08 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Caused by sector 09 | 0.12 | 0.15 | 0.12 | 0.77 | 0.17 | 0.08 | 0.06 | 0.03 | 2.61 | 0.09 | 0.09 | 0.10 | 0.03 | 0.18 | 0.09 | 0.21 | 0.05 | 0.00 | 0.52 | 0.16 | 1.08 |

| Caused by sector 10 | 0.07 | 0.07 | 0.08 | 0.49 | 0.05 | 0.11 | 0.06 | 0.04 | 0.30 | 1.62 | 0.04 | 0.19 | 0.04 | 0.10 | 0.04 | 0.24 | 0.04 | 0.00 | 0.56 | 0.13 | 0.81 |

| Caused by sector 11 | 0.05 | 0.05 | 0.05 | 0.31 | 0.97 | 0.04 | 0.03 | 0.02 | 0.29 | 0.02 | 1.86 | 0.05 | 0.02 | 0.08 | 0.10 | 0.11 | 0.03 | 0.00 | 0.44 | 0.15 | 0.85 |

| Caused by sector 12 | 0.10 | 0.15 | 0.16 | 0.57 | 0.08 | 0.52 | 0.22 | 0.05 | 0.33 | 0.16 | 0.06 | 1.70 | 0.06 | 0.14 | 0.06 | 0.58 | 0.08 | 0.00 | 0.56 | 0.20 | 1.11 |

| Caused by sector 13 | 0.09 | 0.13 | 0.13 | 0.53 | 0.09 | 0.40 | 0.18 | 0.04 | 0.41 | 0.13 | 0.06 | 0.30 | 1.35 | 0.22 | 0.06 | 0.46 | 0.08 | 0.00 | 0.53 | 0.22 | 1.17 |

| Caused by sector 14 | 0.08 | 0.07 | 0.06 | 0.56 | 0.44 | 0.06 | 0.04 | 0.02 | 0.56 | 0.03 | 0.16 | 0.08 | 0.03 | 6.76 | 0.10 | 0.16 | 0.04 | 0.00 | 0.47 | 0.15 | 1.14 |

| Caused by sector 15 | 0.11 | 0.09 | 0.08 | 0.67 | 0.22 | 0.11 | 0.08 | 0.03 | 0.67 | 0.06 | 0.08 | 0.10 | 0.04 | 0.36 | 2.62 | 0.35 | 0.19 | 0.00 | 0.52 | 0.18 | 1.10 |

| Caused by sector 16 | 0.09 | 0.11 | 0.11 | 0.60 | 0.11 | 0.30 | 0.34 | 0.06 | 0.44 | 0.15 | 0.07 | 0.16 | 0.04 | 0.20 | 0.09 | 2.38 | 0.08 | 0.00 | 0.52 | 0.20 | 1.23 |

| Caused by sector 17 | 0.06 | 0.06 | 0.06 | 0.41 | 0.30 | 0.10 | 0.05 | 0.03 | 0.40 | 0.04 | 0.07 | 0.07 | 0.03 | 0.27 | 0.08 | 0.19 | 2.26 | 0.00 | 0.44 | 0.13 | 0.88 |

| Caused by sector 18 | 0.10 | 0.14 | 0.15 | 0.47 | 0.08 | 0.37 | 0.10 | 0.32 | 0.32 | 0.15 | 0.06 | 0.15 | 0.04 | 0.14 | 0.06 | 0.37 | 0.09 | 0.29 | 0.89 | 0.19 | 1.09 |

| Caused by sector 19 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Caused by sector 20 | 0.04 | 0.05 | 0.05 | 0.23 | 0.22 | 0.03 | 0.02 | 0.01 | 0.14 | 0.02 | 0.24 | 0.04 | 0.03 | 0.12 | 0.06 | 0.10 | 0.03 | 0.00 | 0.51 | 2.06 | 1.20 |

| Caused by sector 21 | 0.04 | 0.05 | 0.05 | 0.24 | 0.07 | 0.05 | 0.04 | 0.02 | 0.26 | 0.03 | 0.05 | 0.06 | 0.03 | 0.15 | 0.11 | 0.21 | 0.04 | 0.00 | 0.35 | 0.16 | 7.62 |

| 2009–2010 | |||||||||||||||||||||

| Sector | 01 | 02 | 03 | 04 | 05 | 06 | 07 | 08 | 09 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| Caused by sector 01 | 1.66 | 0.06 | 0.06 | 0.34 | 0.05 | 0.14 | 0.05 | 0.02 | 0.14 | 0.04 | 0.03 | 0.12 | 0.03 | 0.07 | 0.03 | 0.19 | 0.04 | 0.00 | 0.50 | 0.10 | 0.71 |

| Caused by sector 02 | 0.04 | 1.49 | 0.06 | 0.30 | 0.03 | 0.13 | 0.04 | 0.02 | 0.14 | 0.04 | 0.02 | 0.12 | 0.02 | 0.07 | 0.02 | 0.14 | 0.02 | 0.00 | 0.28 | 0.08 | 0.52 |

| Caused by sector 03 | 0.27 | 1.12 | 1.38 | 0.51 | 0.05 | 0.13 | 0.04 | 0.03 | 0.19 | 0.04 | 0.04 | 0.14 | 0.03 | 0.08 | 0.03 | 0.17 | 0.03 | 0.00 | 0.46 | 0.12 | 0.74 |

| Caused by sector 04 | 0.39 | 0.09 | 0.07 | 4.50 | 0.04 | 0.07 | 0.04 | 0.02 | 0.11 | 0.03 | 0.03 | 0.07 | 0.03 | 0.07 | 0.03 | 0.23 | 0.02 | 0.00 | 0.30 | 0.08 | 0.85 |

| Caused by sector 05 | 0.03 | 0.04 | 0.04 | 0.19 | 1.77 | 0.02 | 0.01 | 0.01 | 0.25 | 0.01 | 0.20 | 0.03 | 0.01 | 0.04 | 0.03 | 0.06 | 0.01 | 0.00 | 0.27 | 0.08 | 0.50 |

| Caused by sector 06 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Caused by sector 07 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Caused by sector 08 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Caused by sector 09 | 0.10 | 0.11 | 0.10 | 0.67 | 0.17 | 0.07 | 0.06 | 0.03 | 2.19 | 0.07 | 0.08 | 0.09 | 0.03 | 0.15 | 0.08 | 0.18 | 0.03 | 0.00 | 0.53 | 0.15 | 0.98 |

| Caused by sector 10 | 0.06 | 0.06 | 0.06 | 0.42 | 0.05 | 0.10 | 0.06 | 0.04 | 0.25 | 1.30 | 0.03 | 0.17 | 0.04 | 0.09 | 0.03 | 0.21 | 0.03 | 0.00 | 0.56 | 0.12 | 0.71 |

| Caused by sector 11 | 0.04 | 0.04 | 0.04 | 0.27 | 0.91 | 0.03 | 0.02 | 0.02 | 0.25 | 0.02 | 1.57 | 0.04 | 0.02 | 0.06 | 0.08 | 0.10 | 0.02 | 0.00 | 0.45 | 0.14 | 0.75 |

| Caused by sector 12 | 0.08 | 0.12 | 0.13 | 0.51 | 0.07 | 0.45 | 0.19 | 0.04 | 0.28 | 0.14 | 0.05 | 1.43 | 0.05 | 0.12 | 0.05 | 0.49 | 0.05 | 0.00 | 0.58 | 0.19 | 1.00 |

| Caused by sector 13 | 0.07 | 0.10 | 0.11 | 0.48 | 0.08 | 0.34 | 0.15 | 0.04 | 0.34 | 0.11 | 0.05 | 0.25 | 1.14 | 0.19 | 0.05 | 0.39 | 0.06 | 0.00 | 0.54 | 0.21 | 1.06 |

| Caused by sector 14 | 0.06 | 0.05 | 0.05 | 0.49 | 0.43 | 0.05 | 0.03 | 0.02 | 0.46 | 0.03 | 0.14 | 0.06 | 0.02 | 5.67 | 0.08 | 0.14 | 0.03 | 0.00 | 0.48 | 0.14 | 0.97 |

| Caused by sector 15 | 0.09 | 0.07 | 0.07 | 0.60 | 0.21 | 0.10 | 0.08 | 0.02 | 0.56 | 0.05 | 0.07 | 0.09 | 0.04 | 0.30 | 2.25 | 0.35 | 0.12 | 0.00 | 0.55 | 0.17 | 1.01 |

| Caused by sector 16 | 0.07 | 0.09 | 0.09 | 0.53 | 0.10 | 0.25 | 0.28 | 0.05 | 0.37 | 0.13 | 0.06 | 0.14 | 0.03 | 0.17 | 0.07 | 1.99 | 0.05 | 0.00 | 0.53 | 0.19 | 1.11 |

| Caused by sector 17 | 0.06 | 0.06 | 0.06 | 0.41 | 0.31 | 0.10 | 0.04 | 0.03 | 0.38 | 0.04 | 0.07 | 0.07 | 0.03 | 0.26 | 0.08 | 0.19 | 2.21 | 0.00 | 0.51 | 0.14 | 0.89 |

| Caused by sector 18 | 0.08 | 0.12 | 0.13 | 0.41 | 0.08 | 0.30 | 0.09 | 0.27 | 0.26 | 0.12 | 0.05 | 0.12 | 0.03 | 0.11 | 0.05 | 0.31 | 0.07 | 0.25 | 0.92 | 0.17 | 0.97 |

| Caused by sector 19 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Caused by sector 20 | 0.03 | 0.04 | 0.04 | 0.20 | 0.20 | 0.03 | 0.02 | 0.01 | 0.11 | 0.01 | 0.21 | 0.03 | 0.02 | 0.09 | 0.05 | 0.08 | 0.02 | 0.00 | 0.47 | 1.87 | 0.98 |

| Caused by sector 21 | 0.03 | 0.04 | 0.04 | 0.21 | 0.06 | 0.04 | 0.03 | 0.01 | 0.22 | 0.02 | 0.04 | 0.04 | 0.03 | 0.12 | 0.09 | 0.17 | 0.03 | 0.00 | 0.36 | 0.15 | 6.68 |

| 2010–2011 | |||||||||||||||||||||

| ERCE of Sector | 01 | 02 | 03 | 04 | 05 | 06 | 07 | 08 | 09 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| Caused by sector 01 | 2.52 | 0.05 | 0.06 | 0.27 | 0.04 | 0.15 | 0.02 | 0.03 | 0.14 | 0.06 | 0.04 | 0.13 | 0.07 | 0.10 | 0.01 | 0.30 | 0.01 | 0.00 | 0.32 | 0.05 | 0.45 |

| Caused by sector 02 | 0.12 | 1.44 | 0.07 | 0.27 | 0.03 | 0.14 | 0.02 | 0.03 | 0.15 | 0.06 | 0.03 | 0.14 | 0.06 | 0.10 | 0.01 | 0.24 | 0.01 | 0.00 | 0.20 | 0.04 | 0.43 |

| Caused by sector 03 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Caused by sector 04 | 0.65 | 0.09 | 0.09 | 4.07 | 0.03 | 0.08 | 0.02 | 0.02 | 0.11 | 0.04 | 0.04 | 0.07 | 0.07 | 0.10 | 0.01 | 0.41 | 0.01 | 0.00 | 0.22 | 0.05 | 0.54 |

| Caused by sector 05 | 0.05 | 0.03 | 0.05 | 0.17 | 1.44 | 0.03 | 0.01 | 0.01 | 0.29 | 0.02 | 0.29 | 0.04 | 0.04 | 0.06 | 0.01 | 0.10 | 0.00 | 0.00 | 0.20 | 0.05 | 0.31 |

| Caused by sector 06 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Caused by sector 07 | 0.18 | 0.08 | 0.10 | 0.88 | 0.05 | 0.12 | 0.83 | 0.07 | 0.28 | 0.66 | 0.06 | 0.14 | 0.09 | 0.15 | 0.02 | 0.45 | 0.03 | 0.00 | 0.38 | 0.08 | 0.66 |

| Caused by sector 08 | 0.23 | 0.10 | 0.13 | 0.53 | 0.06 | 0.14 | 0.03 | 1.90 | 0.38 | 0.25 | 0.07 | 0.14 | 0.10 | 0.19 | 0.04 | 0.45 | 0.02 | 0.00 | 0.48 | 0.09 | 0.62 |

| Caused by sector 09 | 0.16 | 0.11 | 0.12 | 0.60 | 0.14 | 0.08 | 0.03 | 0.05 | 2.48 | 0.11 | 0.13 | 0.10 | 0.08 | 0.26 | 0.03 | 0.31 | 0.01 | 0.00 | 0.41 | 0.09 | 0.65 |

| Caused by sector 10 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Caused by sector 11 | 0.07 | 0.04 | 0.05 | 0.23 | 0.73 | 0.04 | 0.01 | 0.03 | 0.27 | 0.03 | 2.24 | 0.04 | 0.05 | 0.10 | 0.03 | 0.16 | 0.01 | 0.00 | 0.35 | 0.09 | 0.48 |

| Caused by sector 12 | 0.13 | 0.11 | 0.16 | 0.46 | 0.06 | 0.52 | 0.10 | 0.07 | 0.32 | 0.23 | 0.07 | 1.79 | 0.15 | 0.18 | 0.02 | 0.92 | 0.02 | 0.00 | 0.45 | 0.11 | 0.70 |

| Caused by sector 13 | 0.12 | 0.10 | 0.13 | 0.43 | 0.07 | 0.38 | 0.08 | 0.07 | 0.38 | 0.18 | 0.08 | 0.28 | 3.83 | 0.30 | 0.02 | 0.72 | 0.02 | 0.00 | 0.43 | 0.12 | 0.73 |

| Caused by sector 14 | 0.10 | 0.05 | 0.06 | 0.44 | 0.34 | 0.05 | 0.01 | 0.03 | 0.51 | 0.04 | 0.20 | 0.07 | 0.06 | 9.07 | 0.03 | 0.23 | 0.01 | 0.00 | 0.37 | 0.10 | 0.63 |

| Caused by sector 15 | 0.14 | 0.07 | 0.08 | 0.53 | 0.17 | 0.10 | 0.05 | 0.04 | 0.62 | 0.09 | 0.10 | 0.10 | 0.10 | 0.54 | 0.92 | 0.57 | 0.04 | 0.00 | 0.42 | 0.10 | 0.67 |

| Caused by sector 16 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Caused by sector 17 | 0.09 | 0.06 | 0.07 | 0.38 | 0.25 | 0.11 | 0.02 | 0.04 | 0.43 | 0.06 | 0.11 | 0.08 | 0.08 | 0.41 | 0.03 | 0.36 | 0.82 | 0.00 | 0.40 | 0.08 | 0.59 |

| Caused by sector 18 | 0.13 | 0.11 | 0.15 | 0.37 | 0.06 | 0.37 | 0.04 | 0.45 | 0.30 | 0.20 | 0.07 | 0.14 | 0.10 | 0.18 | 0.02 | 0.57 | 0.03 | 0.31 | 0.64 | 0.09 | 0.69 |

| Caused by sector 19 | 0.11 | 0.20 | 0.28 | 0.24 | 0.07 | 0.09 | 0.02 | 0.03 | 0.18 | 0.05 | 0.07 | 0.10 | 0.34 | 0.17 | 0.02 | 0.25 | 0.01 | 0.00 | 4.76 | 0.08 | 0.77 |

| Caused by sector 20 | 0.05 | 0.03 | 0.04 | 0.17 | 0.15 | 0.03 | 0.01 | 0.01 | 0.12 | 0.02 | 0.27 | 0.03 | 0.06 | 0.13 | 0.02 | 0.14 | 0.01 | 0.00 | 0.32 | 1.04 | 0.66 |

| Caused by sector 21 | 0.05 | 0.04 | 0.05 | 0.19 | 0.05 | 0.05 | 0.02 | 0.02 | 0.24 | 0.04 | 0.07 | 0.05 | 0.09 | 0.19 | 0.04 | 0.32 | 0.01 | 0.00 | 0.28 | 0.08 | 4.21 |

| 2011–2012 | |||||||||||||||||||||

| ERCE of Sector | 01 | 02 | 03 | 04 | 05 | 06 | 07 | 08 | 09 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| Caused by sector 01 | 3.11 | 0.05 | 0.08 | 0.29 | 0.04 | 0.18 | 0.02 | 0.04 | 0.17 | 0.07 | 0.05 | 0.14 | 0.06 | 0.12 | 0.01 | 0.34 | 0.02 | 0.00 | 0.27 | 0.06 | 0.70 |

| Caused by sector 02 | 0.26 | 1.73 | 0.07 | 0.28 | 0.03 | 0.16 | 0.02 | 0.03 | 0.18 | 0.06 | 0.05 | 0.14 | 0.06 | 0.11 | 0.01 | 0.28 | 0.01 | 0.00 | 0.20 | 0.06 | 0.84 |

| Caused by sector 03 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Caused by sector 04 | 0.81 | 0.11 | 0.11 | 4.52 | 0.03 | 0.10 | 0.02 | 0.03 | 0.14 | 0.05 | 0.05 | 0.08 | 0.06 | 0.10 | 0.01 | 0.53 | 0.01 | 0.00 | 0.22 | 0.06 | 0.75 |

| Caused by sector 05 | 0.06 | 0.04 | 0.06 | 0.17 | 1.77 | 0.03 | 0.01 | 0.01 | 0.38 | 0.02 | 0.38 | 0.04 | 0.04 | 0.07 | 0.01 | 0.10 | 0.00 | 0.00 | 0.19 | 0.06 | 0.42 |

| Caused by sector 06 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Caused by sector 07 | 0.22 | 0.09 | 0.12 | 0.92 | 0.07 | 0.13 | 1.09 | 0.09 | 0.36 | 0.71 | 0.08 | 0.12 | 0.08 | 0.19 | 0.02 | 0.41 | 0.08 | 0.00 | 0.37 | 0.09 | 0.92 |

| Caused by sector 08 | 0.27 | 0.12 | 0.16 | 0.56 | 0.07 | 0.16 | 0.04 | 2.55 | 0.48 | 0.32 | 0.09 | 0.16 | 0.11 | 0.26 | 0.04 | 0.49 | 0.02 | 0.00 | 0.48 | 0.11 | 0.88 |

| Caused by sector 09 | 0.20 | 0.13 | 0.16 | 0.62 | 0.19 | 0.08 | 0.03 | 0.05 | 3.21 | 0.11 | 0.19 | 0.10 | 0.07 | 0.37 | 0.03 | 0.32 | 0.01 | 0.00 | 0.43 | 0.13 | 0.91 |

| Caused by sector 10 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Caused by sector 11 | 0.07 | 0.05 | 0.06 | 0.23 | 0.87 | 0.04 | 0.01 | 0.03 | 0.32 | 0.03 | 2.86 | 0.05 | 0.05 | 0.12 | 0.03 | 0.16 | 0.01 | 0.00 | 0.36 | 0.13 | 0.62 |

| Caused by sector 12 | 0.15 | 0.13 | 0.19 | 0.47 | 0.07 | 0.61 | 0.13 | 0.08 | 0.41 | 0.26 | 0.10 | 2.40 | 0.19 | 0.23 | 0.03 | 1.19 | 0.03 | 0.00 | 0.47 | 0.15 | 1.05 |

| Caused by sector 13 | 0.14 | 0.11 | 0.16 | 0.44 | 0.08 | 0.45 | 0.12 | 0.09 | 0.47 | 0.21 | 0.10 | 0.30 | 5.17 | 0.37 | 0.02 | 0.89 | 0.03 | 0.00 | 0.48 | 0.17 | 1.06 |

| Caused by sector 14 | 0.12 | 0.06 | 0.08 | 0.46 | 0.39 | 0.05 | 0.02 | 0.03 | 0.64 | 0.04 | 0.24 | 0.07 | 0.06 | 11.62 | 0.03 | 0.24 | 0.01 | 0.00 | 0.38 | 0.18 | 0.90 |

| Caused by sector 15 | 0.15 | 0.07 | 0.10 | 0.53 | 0.21 | 0.10 | 0.10 | 0.04 | 0.74 | 0.11 | 0.13 | 0.09 | 0.08 | 0.80 | 1.18 | 0.45 | 0.07 | 0.00 | 0.43 | 0.14 | 0.92 |

| Caused by sector 16 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Caused by sector 17 | 0.10 | 0.06 | 0.08 | 0.35 | 0.28 | 0.10 | 0.03 | 0.05 | 0.49 | 0.06 | 0.13 | 0.09 | 0.07 | 0.48 | 0.03 | 0.41 | 1.00 | 0.00 | 0.38 | 0.11 | 0.74 |

| Caused by sector 18 | 0.16 | 0.12 | 0.19 | 0.39 | 0.08 | 0.50 | 0.06 | 0.56 | 0.40 | 0.24 | 0.09 | 0.14 | 0.10 | 0.23 | 0.03 | 0.71 | 0.04 | 0.41 | 0.52 | 0.12 | 1.06 |

| Caused by sector 19 | 0.14 | 0.24 | 0.38 | 0.26 | 0.08 | 0.11 | 0.02 | 0.03 | 0.22 | 0.05 | 0.10 | 0.11 | 0.46 | 0.18 | 0.02 | 0.30 | 0.01 | 0.01 | 5.18 | 0.11 | 1.18 |

| Caused by sector 20 | 0.05 | 0.03 | 0.04 | 0.16 | 0.15 | 0.03 | 0.01 | 0.01 | 0.13 | 0.02 | 0.29 | 0.03 | 0.06 | 0.13 | 0.02 | 0.18 | 0.01 | 0.00 | 0.29 | 1.38 | 0.99 |

| Caused by sector 21 | 0.06 | 0.04 | 0.06 | 0.19 | 0.07 | 0.06 | 0.02 | 0.03 | 0.28 | 0.04 | 0.09 | 0.05 | 0.11 | 0.24 | 0.05 | 0.42 | 0.01 | 0.01 | 0.29 | 0.11 | 5.47 |

References

- Intergovernmental Panel on Climate Change. Climate Change 2018: Global Warming of 1.5 °C. Available online: https://www.ipcc.ch/sr15/ (accessed on 28 March 2019).

- Intergovernmental Panel on Climate Change. Climate Change 2014: Mitigation of Climate Change. Available online: https://www.ipcc.ch/report/ar5/wg3/ (accessed on 29 December 2018).

- Ma, L.; Liu, P.; Fu, F.; Li, Z.; Ni, W. Integrated energy strategy for the sustainable development of China. Energy 2010, 36, 1143–1154. [Google Scholar] [CrossRef]

- Fu, F.; Pan, L.Y.; Ma, L.W.; Li, Z. A simplified method to estimate the energy–saving potentials of frequent construction and demolition process in China. Energy 2013, 49, 316–322. [Google Scholar] [CrossRef]

- Fu, F.; Ma, L.; Li, Z.; Polenske, K.R. The implications of China’s investment–driven economy on its energy consumption and carbon emissions. Energy Convers. Manag. 2014, 85, 573–580. [Google Scholar] [CrossRef]

- Acquaye, A.A.; Duffy, A.P. Input–output analysis of Irish construction sector greenhouse gas emissions. Build. Environ. 2010, 45, 784–791. [Google Scholar] [CrossRef]

- Liu, Z.; Geng, Y.; Lindner, S.; Zhao, H.; Fujita, T.; Guan, D. Embodied energy use in China’s industrial sectors. Energy Policy 2012, 49, 751–758. [Google Scholar] [CrossRef]

- Huang, L.; Krigsvoll, G.; Johansen, F.; Liu, Y.; Zhang, X. Carbon emission of global construction sector. Renew. Sustain. Energy Rev. 2018, 81, 1906–1916. [Google Scholar] [CrossRef]

- Holz, C.A. New capital estimates for China. China Econ. Rev. 2006, 17, 142–185. [Google Scholar] [CrossRef]

- Bullard, C.W.I.; Herendeen, R.A. Energy Impact of Consumption Decisions. Proc. IEEE 1975, 63, 484–493. [Google Scholar] [CrossRef]

- Leontief, W. The Dynamic Inverse. In Contributions to Input-Output Analysis; Carter, A.P., Brody, A., Eds.; North Holland: Amsterdam, The Netherlands, 1970. [Google Scholar]

- Miller, R.E.; Blair, P.D. Input-Output Analysis: Foundations and Extensions; Cambridge University Press: New York, NY, USA, 2009. [Google Scholar]

- Pauliuk, S.; Wood, R.; Hertwich, E.G. Dynamic Models of Fixed Capital Stocks and Their Application in Industrial Ecology. J. Ind. Ecol. 2015, 19, 104–116. [Google Scholar] [CrossRef]

- Rhoten, R.P. Dynamic input-output analysis of the economics of energy. In Proceedings of the Energy ’78 IEEE 1978 Region V Annual Conference, Tulsa, OK, USA, 16–18 April 1978. [Google Scholar]

- Tamura, H.; Ito, K. Application of dynamic input–output analysis to evaluating trade–offs between environmental pollution and energy consumption. Syst. Control 1984, 28, 529–535. [Google Scholar]

- Song, J.; Yang, W.; Higano, Y.; Wang, X.E. Dynamic integrated assessment of bioenergy technologies for energy production utilizing agricultural residues: An input–output approach. Appl. Energy 2015, 158, 178–189. [Google Scholar] [CrossRef]

- Yu, S.; Zheng, S.; Ba, G.; Wei, Y.M. Can China realise its energy-savings goal by adjusting its industrial structure? Econ. Syst. Res. 2016, 28, 273–293. [Google Scholar] [CrossRef]

- Pan, L.; Liu, P.; Li, Z.; Wang, Y. A dynamic input–output method for energy system modeling and analysis. Chem. Eng. Res. Des. 2018, 131, 183–192. [Google Scholar] [CrossRef]

- Dobos, I.; Tallos, P. A dynamic input-output model with renewable resources. Cent. Eur. J. Oper. Res. 2013, 21, 295–305. [Google Scholar] [CrossRef]

- Cruz, J.B., Jr.; Tan, R.R.; Culaba, A.B.; Ballacillo, J.A. A dynamic input-output model for nascent bioenergy supply chains. Appl. Energy 2009, 861, S86–S94. [Google Scholar] [CrossRef]

- Nie, H.; Kemp, R.; Vivanco, D.F. Véronique Vasseur. Structural decomposition analysis of energy–related CO2 emissions in China from 1997 to 2010. Energy Effic. 2016, 9, 1351–1367. [Google Scholar] [CrossRef]

- Wang, C.; Wang, F.; Zhang, X.; Zhang, H. Influencing mechanism of energy–related carbon emissions in Xinjiang based on the input–output and structural decomposition analysis. J. Geogr. Sci. 2017, 27, 365–384. [Google Scholar] [CrossRef]

- Wood, R. Structural decomposition analysis of Australia’s greenhouse gas emissions. Energy Policy 2009, 37, 4943–4948. [Google Scholar] [CrossRef]

- Chenery, H.; Shishido, S.; Watanabe, T. The pattern of Japanese Growth, 1914–1954. Ecomometrica 1962, 30, 98–139. [Google Scholar] [CrossRef]

- Gould, B.; Kulshreshtha, S. An interindustry analysis of structural change and energy use linkage in the Saskatchewan economy. Energy Econ. 1986, 8, 186–196. [Google Scholar] [CrossRef]

- Rose, A.; Chen, C.Y. Sources of change in energy use in the US economy, 1972–1982. Resour. Energy 1991, 13, 1–21. [Google Scholar] [CrossRef]

- Lee, C.F.; Lin, S.J. Structural decomposition of CO2 emissions from Taiwan’s petrochemical industries. Energy Policy 2001, 29, 237–244. [Google Scholar] [CrossRef]

- Zhang, Y. Structural decomposition analysis of sources of decarbonizing economic development in China; 1992–2006. Ecol. Econ. 2009, 68, 2399–2405. [Google Scholar] [CrossRef]

- Butnar, I.; Llop, M. Structural decomposition analysis and input–output subsystems: Changes in CO2 emissions of Spanish service sectors (2000–2005). Ecol. Econ. 2011, 70, 2012–2019. [Google Scholar] [CrossRef]

- Yamakawa, A.; Peters, G.P. Structural Decomposition Analysis of Greenhouse Gas Emissions in Norway 1990–2002. Econ. Syst. Res. 2011, 23, 303–318. [Google Scholar] [CrossRef]

- Tian, X.; Chang, M.; Tanikawa, H.; Shi, F.; Imura, H. Structural decomposition analysis of the carbonization process in Beijing: A regional explanation of rapid increasing carbon dioxide emission in China. Energy Policy 2013, 53, 279–286. [Google Scholar] [CrossRef]

- Intergovernmental Panel on Climate Change. 2006 IPCC Guidelines for National Greenhouse Gas Inventories; IGES: Prefecture, Japan, 2006. [Google Scholar]

- State Council of People’s Republic of China. Measures for Expanding Domestic Demand and Promoting Economic Growth Deployed at the Standing Meeting of the State Council. 9 November 2008. Available online: http://www.gov.cn/ldhd/2008-11/09/content_1143689.htm (accessed on 28 February 2019).

- National Bureau of Statistics. The Input-Output Table of CHINA 2007. Available online: http://data.stats.gov.cn/ifnormal.htm?u=/files/html/quickSearch/trcc/trcc01.html&h=740 (accessed on 28 February 2019).

- National Bureau of Statistics. The Input-Output Table of CHINA 2010. Available online: http://data.stats.gov.cn/ifnormal.htm?u=/files/html/quickSearch/trcc/trcc01.html&h=740 (accessed on 28 February 2019).

- National Bureau of Statistics. The Input-Output Table of CHINA 2012. Available online: http://data.stats.gov.cn/ifnormal.htm?u=/files/html/quickSearch/trcc/trcc01.html&h=740 (accessed on 28 February 2019).

- National Bureau of Statistics. China Energy Statistical Yearbook 2013; China Statistics Press: Beijing, China, 2014.

- National Bureau of Statistics. China Statistical Yearbook 2016; China Statistics Press: Beijing, China, 2017.

- Zhang, X.; Li, Z.; Ma, L.; Chong, C.; Ni, W. Forecasting the Energy Embodied in Construction Services Based on a Combination of Static and Dynamic Hybrid Input-Output Models. Energies 2019, 12, 300. [Google Scholar] [CrossRef]

- Hu, J. Hu Jintao’s Report at the Eighteenth National Congress of the Communist Party of China. People’s Daily. 18 November 2012. Available online: http://politics.people.com.cn/n/2012/1118/c1001-19612670.html (accessed on 28 February 2019).

- State Council of People’s Republic of China. About the Steel Industry to Resolve Excess Production Capacity. 4 February 2016. Available online: http://www.gov.cn/zhengce/content/2016-02/04/content_5039353.htm (accessed on 28 February 2019).

- State Council of People’s Republic of China. Opinions on Enhancing the Protection of Ecological Environment in an All-Round Way and Fighting the Strong Battle of Pollution Prevention and Control. 24 June 2018. Available online: http://www.gov.cn/zhengce/2018-06/24/content_5300953.htm (accessed on 28 February 2019).

| Primary Fossil Fuel | Low Heat Value (TJ/t) | CO2 Emission Factor (kg/TJ) |

|---|---|---|

| Coal | 0.0293 | 98,300 |

| Crude oil | 0.0423 | 73,300 |

| Natural gas | 0.048 | 56,100 |

| The Cause of ERCE Embodied in CSFAI | ERCE Embodied in CSFAI Consumed by Sector 1 | … | ERCE Embodied in CSFAI Consumed by Sector j | … | ERCE Embodied in CSFAI Consumed by Sector n |

|---|---|---|---|---|---|

| Unit FDEI increase of sector 1 | ER11 | … | ER1j | … | ER1n |

| ︙ | ︙ | ︙ | ︙ | ︙ | ︙ |

| Unit FDEI increase of sector i | ERi1 | … | ERij | … | ERin |

| ︙ | ︙ | ︙ | ︙ | ︙ | ︙ |

| Unit FDEI increase of sector n | ERn1 | … | ERnj | … | ERnn |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, X.; Li, Z.; Ma, L.; Chong, C.; Ni, W. Analyzing Carbon Emissions Embodied in Construction Services: A Dynamic Hybrid Input–Output Model with Structural Decomposition Analysis. Energies 2019, 12, 1456. https://doi.org/10.3390/en12081456

Zhang X, Li Z, Ma L, Chong C, Ni W. Analyzing Carbon Emissions Embodied in Construction Services: A Dynamic Hybrid Input–Output Model with Structural Decomposition Analysis. Energies. 2019; 12(8):1456. https://doi.org/10.3390/en12081456

Chicago/Turabian StyleZhang, Xi, Zheng Li, Linwei Ma, Chinhao Chong, and Weidou Ni. 2019. "Analyzing Carbon Emissions Embodied in Construction Services: A Dynamic Hybrid Input–Output Model with Structural Decomposition Analysis" Energies 12, no. 8: 1456. https://doi.org/10.3390/en12081456

APA StyleZhang, X., Li, Z., Ma, L., Chong, C., & Ni, W. (2019). Analyzing Carbon Emissions Embodied in Construction Services: A Dynamic Hybrid Input–Output Model with Structural Decomposition Analysis. Energies, 12(8), 1456. https://doi.org/10.3390/en12081456