3.2. Monthly Robust Stochastic Optimization

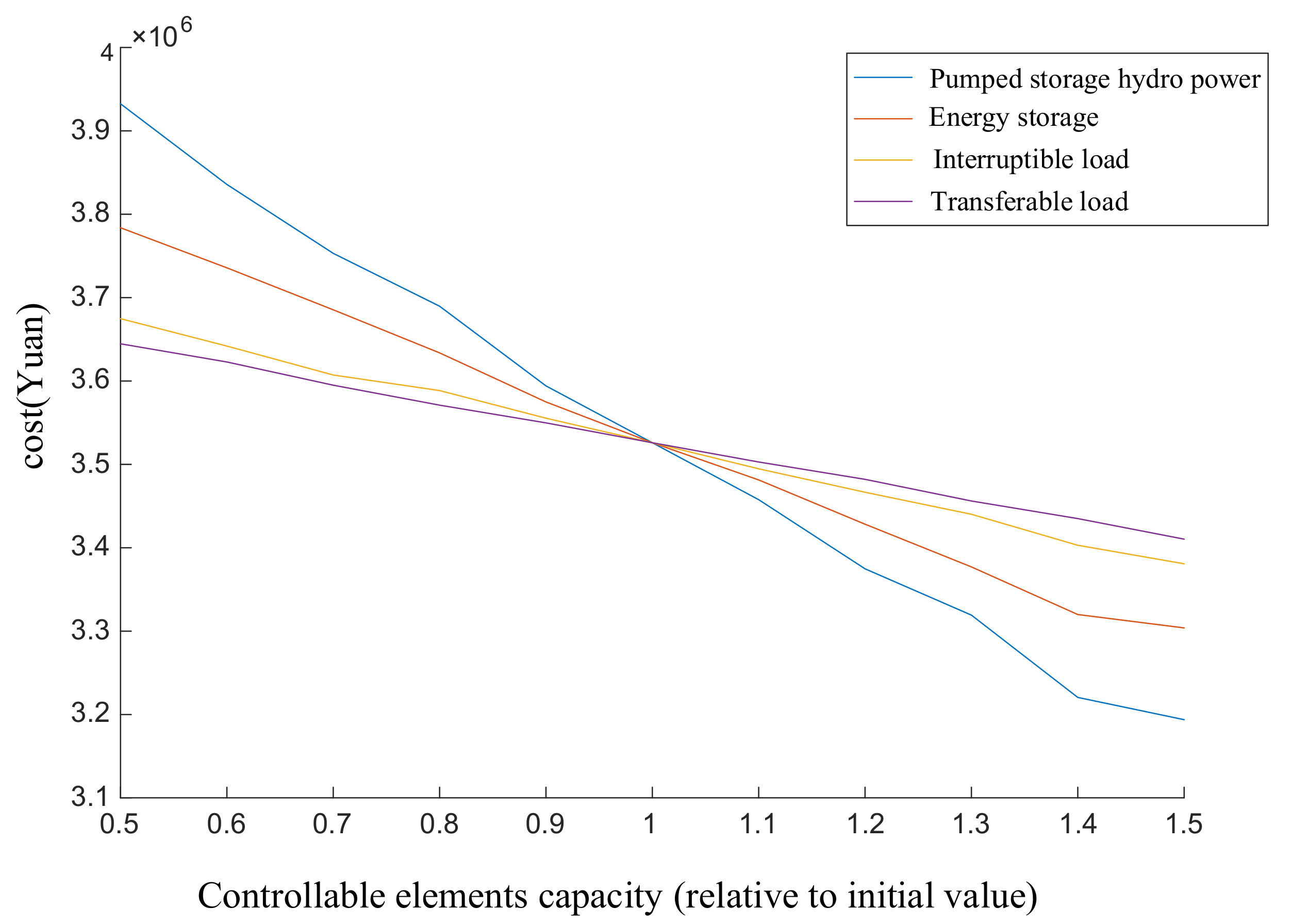

The output result of monthly optimization is whether all kinds of controllable elements are allocated in 30 days. The objective function of optimization includes three parts. One is the expected cost of controllable elements, which includes the reserve capacity cost and the expected value of the daily cost in each scenario. The second is the expected cost of the power exchange strategy to each other. The third is the expected value of the day-ahead and real-time electricity purchase cost.

In the electricity price part, it is described as a robustness variable, so a robust optimization model is used to make the above optimization under certain adverse electricity price conditions andma typical min max robust optimization model is established.

The objective function of monthly optimization is the minimum expected cost for every area as follows:

where

s, i, d, t, k are the indexes of scenarios, areas, dates, time periods and controllable elements, respectively;

is the time interval between adjacent periods;

,

are the reserve cost and state of controllable elements

k within area

i in day d;

is the probability of scenario

s;

,

are the cost and value of the interruptible load within area

i;

,

are the cost and value of the transferable load within area

i from time

t1 to

t2;

,

,

,

are the discharging and charging energy and cost of energy storage equipment within area

i;

is the power exchange cost between area

i and

j;

is the power exchange amount from area

i to

j;

,

,

,

are the day-ahead and real-time market power purchase amount and price, respectively.

The objective Equation (1) can be divided into two levels. The decision variable in the upper level is the stochastic variable described as follows:

The decision variables in the lower level are the worst day-ahead market price and real-time market price , which make the brokers’ power purchase cost the highest.

In the monthly optimization objective function, the first part represents the reserve cost for all kinds of controllable elements, the second and third parts stand for the dispatch costs of interruptible and transferrable loads, respectively, the fourth and fifth parts are charging and discharging cost of energy storage, the sixth part is the power exchange cost, and the last two parts are day-ahead market and real-time market power purchase cost, respectively.

The constraints of monthly optimization are as follows:

The first indicates interruptible load constraint:

The constraints from Equations (3) to (6) are related to the interruptible load. In order to avoid causing inconveniences to users, the minimum and maximum interruptible load values , within area i are set in Equation (3), where is the state vector, while means the interruptible load of area i is dispatched in scenario sat time t in day d and means it not dispatched. In order to avoid too frequent startup/shutdown switching and increase load equipment’s lifespan, the variables and are firstly introduced as a continuous interrupted and non-interrupted time in Equations (4) and (5), respectively. Then, the first constraints in Equations (6) and (7) represent in the intra-day a load should be kept on/off for at least / continuous time before it can be turned off/on, where and are maximum continuous interruption and operation time. The second constraints in Equations (6) and (7) represent in the inter-day a load should meet the maximum continuous interruption and operation time requirement.

Then the constraints of transferable loads are as follows:

The constraint (8) is the limit of transferrable load, where is the upper limit in a time period. In order to enhance users’ satisfaction, Equation (9) represents that the transfer time should not be too long, where is the maximum transferrable time.

Then energy storage constraints are shown as follows:

The constraints from Equations (10) to (15) are related to energy storage. Equations (10) and (11) are the upper limit of charging and discharging energy, where , and , are the state variables and limits. Equation (12) represents the power balance equation between adjacent periods, where and are the charging and discharging efficiency, respectively. Equation (13) is the limit for storage energy in every time period. Equation (14) represents that the charging and discharging state cannot happen simultaneously. Equation (15) represents the initial stored energy in day d equals to the energy in the last time period in previous day (d-1), which makes sure that energy storage can be continuously utilized every day.

The fourth part is the constraints of electricity transfer, as shown below:

The constraints from Equations (16) to (20) are related to the power exchange strategy, where is the state vector, while means the power exchange occurs from area i to j in scenario sat time t in day d and means it not happen. Equations (16) and (17) are the upper limit for power exchange amount. Equation (18) represents the direction of power exchange should be one-way rather than two-way. Equation (19) is the power balance equation when utilizing the power exchange strategy. Equation (20) means in every time period, the internal controllable elements amount within one area should not larger than the power purchase deviation. Otherwise, the power exchange strategy between areas is meaningless.

The last part is the robustness constraint of electricity price, as indicated below:

The relationship between the day-ahead and real-time market price is shown in Equation (21), and they are both stochastic. In comparison with day-ahead market price, the real-time market price is a little higher. The residual price

is defined as the difference between them [

20].

The constraints from Equations (22) to (24) are related to the robustness of power purchase price variables. In monthly optimization, the optimal power purchase decision is obtained based on the worst power purchase price (in general, the impact of higher day-ahead and real-time market prices on broker’s profit is tremendous), so when describing the fluctuation between the actual and forecast price, only the positive fluctuation is considered. The day-ahead market price

can be predicted from an ARIMA model [

21]. In Equation (22), the actual price

is expressed as a linear function of the forecast value

and forecast error factor

and this constraint represents the degree of fluctuation of the actual price relative to the predicted price. Equation (23) represents the upper and lower limit for the forecast error factor [

22]

. Thus the actual day-ahead market price fluctuates between the maximum and forecast price. In Equation (24),

represent the conservative degree of the robust optimization problem, which means the worst positive price fluctuation that brokers could accept.

could be set in range 0 to 720 because there are 720 time period in a month and forecast error factor

could only fluctuates between 0–1 in a time period.

After day-ahead market clearing, brokers would prepare their dispatch schedules for controllable elements according to the result of monthly optimization, and the power exchange amount between areas could be derived post day-ahead optimization.

3.3. Post Day-Ahead Optimization Model of Areas

If the power purchase amount and cost in day-ahead market show an extreme mismatch with the forecast values from monthly optimization, the brokers would generally adjust the controllable elements dispatch schedules to eliminate the deviation between the actual and expected power purchase amount. Because the flexible loads have signed contracts with brokers in advance, changing their dispatch schedule inevitably affect the energy consumption behavior and, in turn, the satisfaction of users. By contrast, the dispatch schedule change for storage energy has a smaller impact. Thus, in order to correct this deviation, it is better to adjust the dispatch schedule of energy storage. In order to adapt to scenarios with different deviation, two strategies are proposed to solve this issue:

- (1)

Executing the controllable elements dispatch schedule with monthly optimization. The objective function of post day-ahead optimization is shown in Equation (25). Since the controllable elements dispatch schedule and power purchase deviation occurred in the day-ahead market are all determined, the scenarios changes into

s’, and

is also removed which is the probability of scenario s. The net value

which equals to the load minus output of run-off hydro power station is the uncertain variable. The other constraints are similar with Equations (3) to (24):

- (2)

Adjusting the energy storage dispatch schedule. Therefore, the objective function of post day-ahead optimization is replaced by Equation (26), where the adjustment cost for energy storage is included;

is defined as adjusted status variable for energy storage.

means the energy storage of the area

i is dispatched and

means it not dispatched:

In addition to the constraints (3) to (24), Equation (27) is the upper quantity limit for the adjusted energy storage:

where

,

represent the adjusted and initial status for energy storage within area

i;

is the upper limit.

In post day-ahead optimization, the areas need to clear some part of their dispatched controllable elements to eliminate internal deviation and exchange cost. Therefore, extra constraints and variables that suggest the relationship of the lender to borrower and controllable elements exchange amount need to be added in these two optimizations:

Equation (29) represents that the power exchange amount from area j to i is consist of and , where is the purchased power exchange amount from area j to i; is the controllable element amount k that area i get from j through power exchange strategy. Equation (30) means that the controllable element k of area i is divided into the internal and exchange dispatch amount, is internal amount which is dispatched by area i to eliminate internal deviation. Equation (31) suggests that the leftover load which equals to total load minus day-ahead and real-time power purchase amount should be fully accommodated by the power exchange strategy.