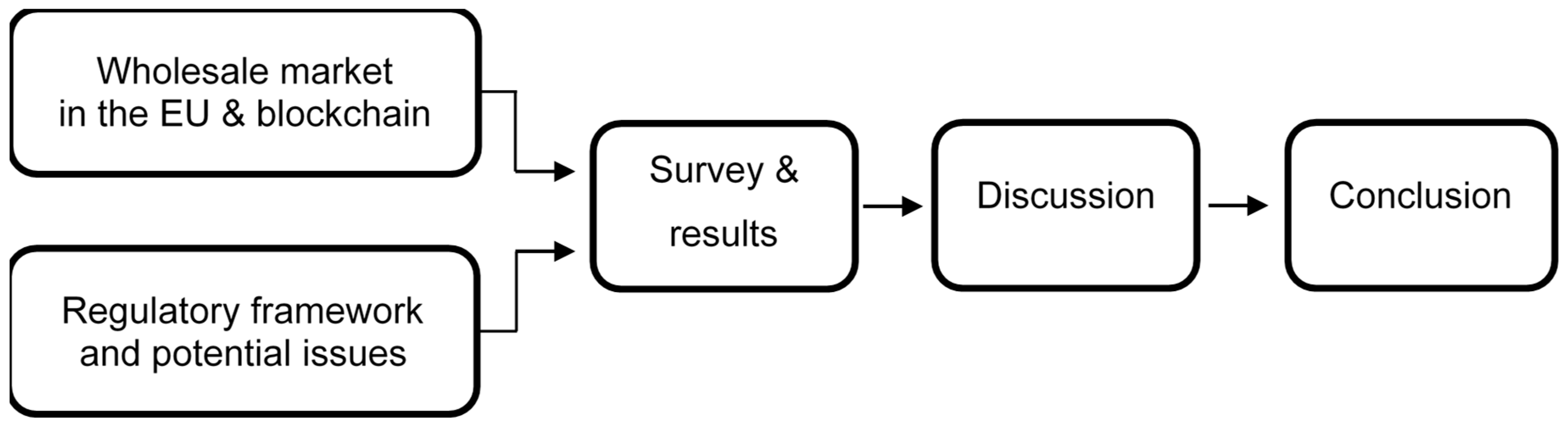

Blockchain Technology and Electricity Wholesale Markets: Expert Insights on Potentials and Challenges for OTC Trading in Europe

Abstract

:1. Introduction

2. The European Electricity Wholesale Market and Blockchain

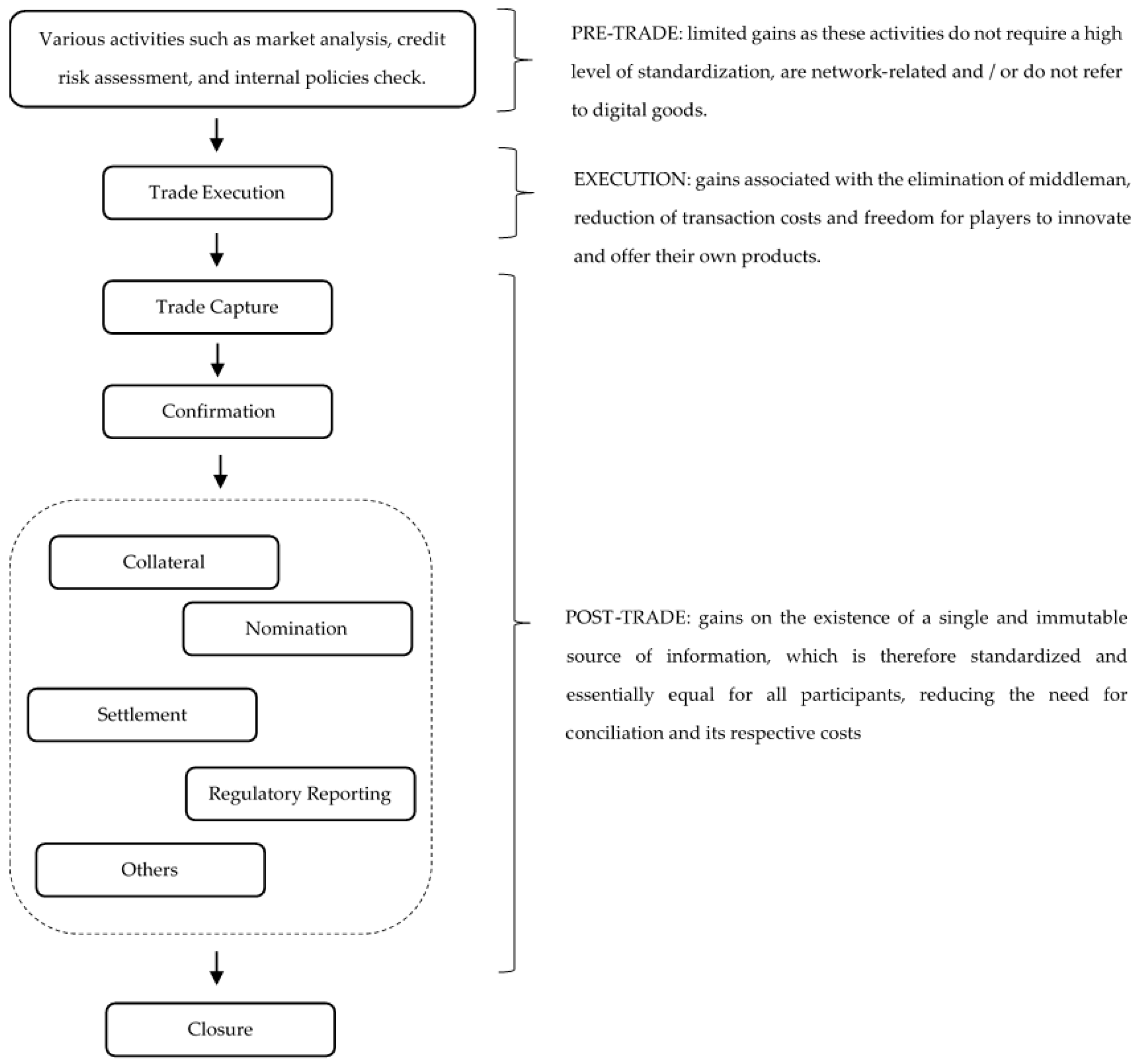

2.1. OTC Bilateral

- Trade capture: Refers to the action taken by each part to input the deal in their own systems. This step is necessary because the platforms used for trading in the market and the internal systems for the deal administration, the Energy Trading Risk Management systems, are different as to their objectives and functionalities.

- Confirmation: Trading companies confirm with each other the transaction’s material terms, such as volume, price and maturity. Although it may seem like a repetitive action, it exists because manual processes during execution and unilateral trade captures create the possibility of inconsistency between the information buyer and seller have in relation to the same transaction. Hence, confirmation is generally the earliest moment possible for risk mitigation.

- Collateral margining: In OTC bilateral this is the most common tool to mitigate risks arising from changes in the commodity’s price or deterioration in counterparties’ payment capacity. The risk offset only happens when resources are effectively transferred between parties, which may take some time since the calculation of mark-to-market positions involves a high volume of data and adjustments.

- Nomination: It is necessary when the instrument traded includes physical delivery. In short, it consists of submitting the scheduling for day-ahead and intraday positions per counterparty and per balancing zone to the Transmission System Operator (TSO) in charge of keeping the grid balanced. Usually both sides of one position submit their respective files.

- Settlement: It encompasses activities related to the fulfillment of financial contractual obligations between parties, such as invoice and payment. The financial settlement requires counterparties to calculate the amounts due to each other from information such as prices, volumes and taxes. This can be a complex task considering that prices may not be fixed or that the increase in the share of renewables and decentral sources brings more complexity to reconcile a high volume of data on their physical delivery.

- Regulatory reporting: Market participants must submit diverse types of reporting so regulators can monitor and protect the market from excessive risks and abusive practices. This is a resource-consuming activity as requirements are very detailed and sometimes overlapping.

- Others: Several other events may occur during the trade life cycle. This may include termination before maturity under mutual agreement or change in the counterparty due to a corporate restructuring, to name a few.

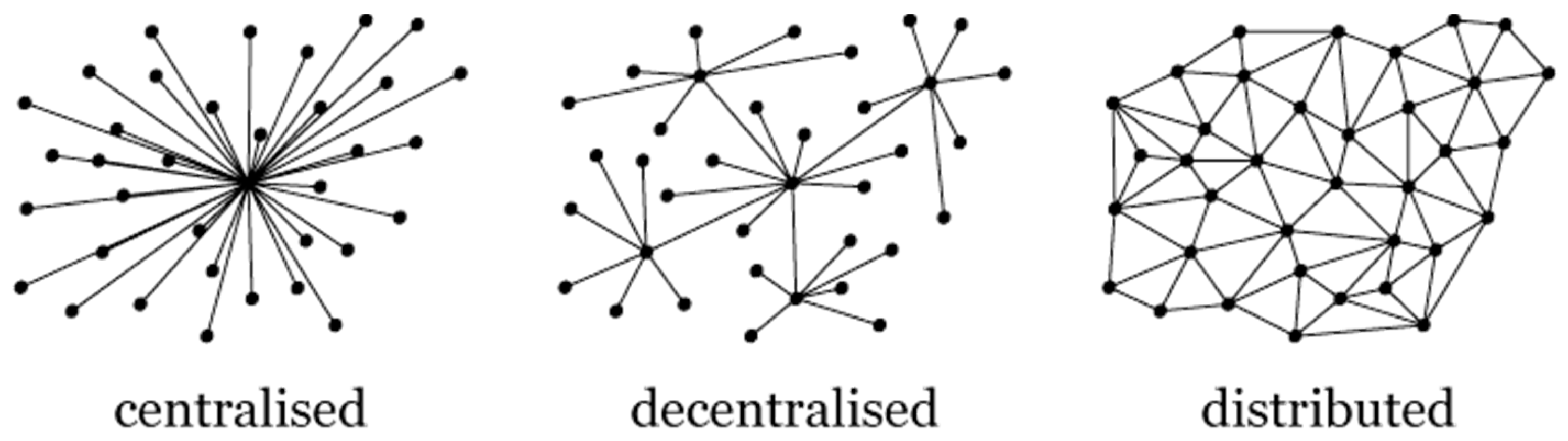

2.2. Blockchain

3. Blockchain under the EU Regulatory Framework for OTC Bilateral Trading

3.1. Core Regulatory Framework

- REMIT covers the power and gas markets in the EU and aims “that prices set on wholesale energy markets reflect a fair and competitive interplay between supply and demand, and that no profits can be drawn from market abuse” [20]. It is an energy regulation to be enforced by the Agency for the Cooperation of Energy Regulators (ACER).

- EMIR aims to “reduce systemic risk, increase transparency in the OTC market and preserve financial stability” [20]. It focuses on OTC derivatives because the lack of transparency on this market generate risks that are hard to identify and to prevent. As a financial regulation, it is not exclusive to the energy sector and it is under the European Securities and Markets Authority’s (ESMA) surveillance.

- MiFID2, also under ESMA’s umbrella, is considered one of the most complex and expensive regulatory reforms in the EU history, whose ultimate goal is to “strengthen investor protection and improve the functioning of financial markets making them more efficient, resilient and transparent” [15]. Given that in bilateral OTC participants trade mostly forward contracts, the immediate consequence is that most of this market is not subject to MiFID2 rules, see [21] for a differentiation between forward and future contracts. However, for the small portion that remains in scope (mainly swaps), the requirements are extensive.

- GDPR is the new regulation determining how to properly protect personal data in the EU. Although most information exchanged on energy trading is market-related or refer to legal persons, there are some situations where professionals participating in the energy sector are required to provide personal data., whose protection is a fundamental right in the EU. GDPR is to be enforced by Supervisory Authorities from each Member State.

3.2. Potential Issues with Blockchain

4. Survey

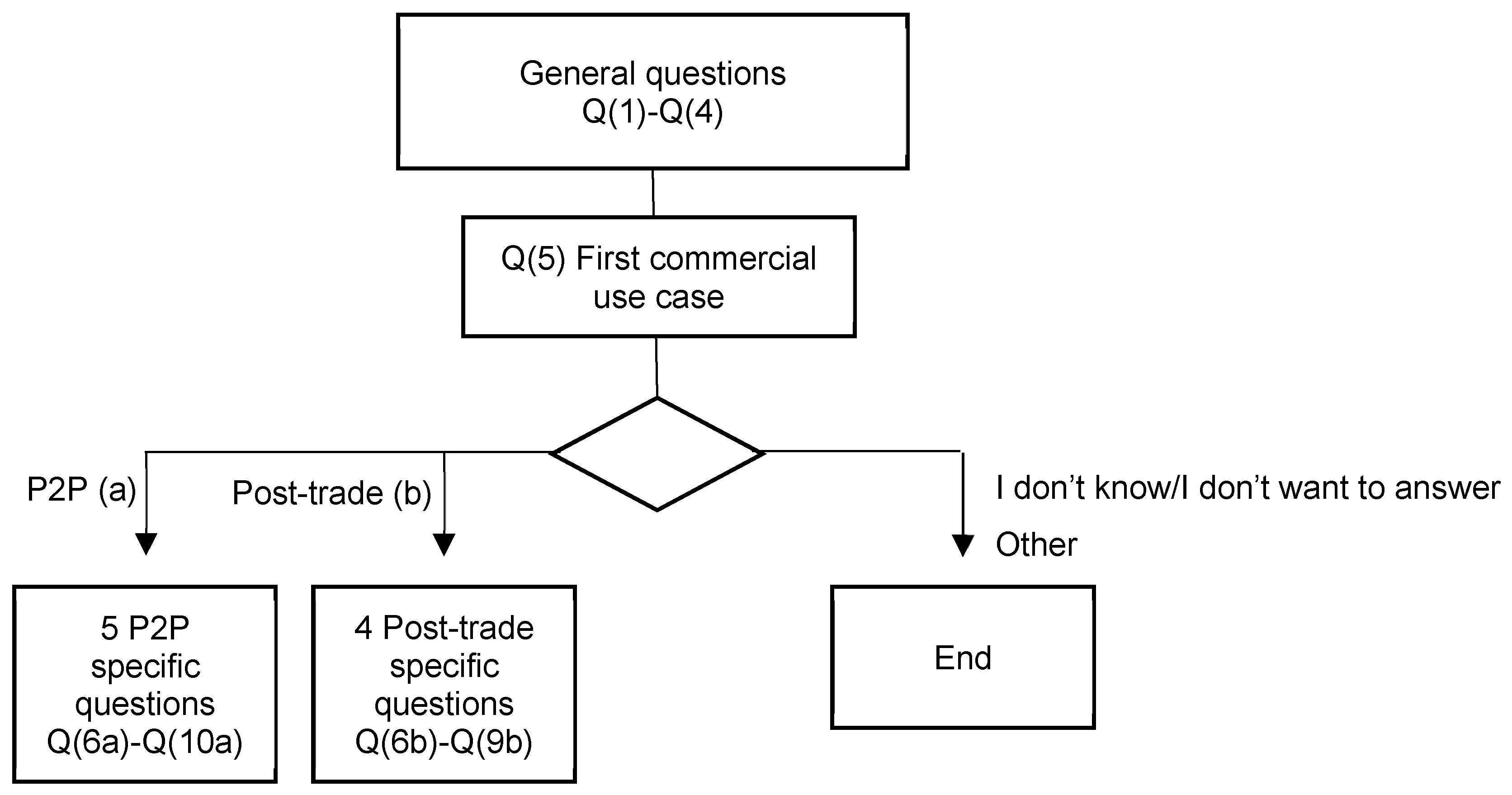

4.1. Methodology

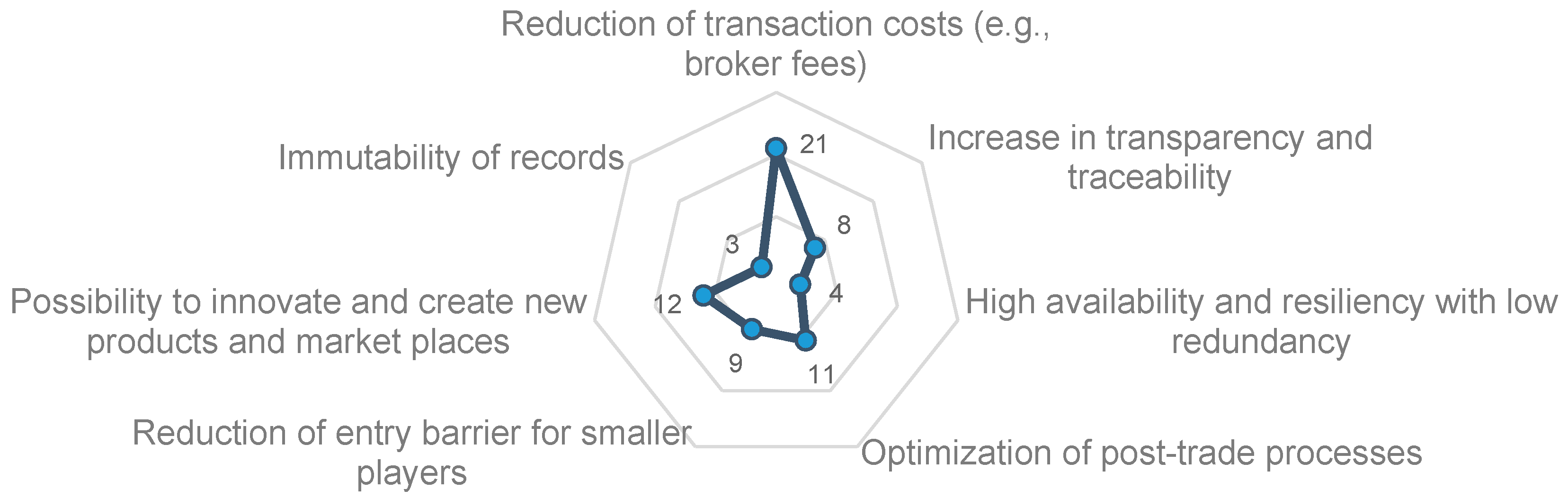

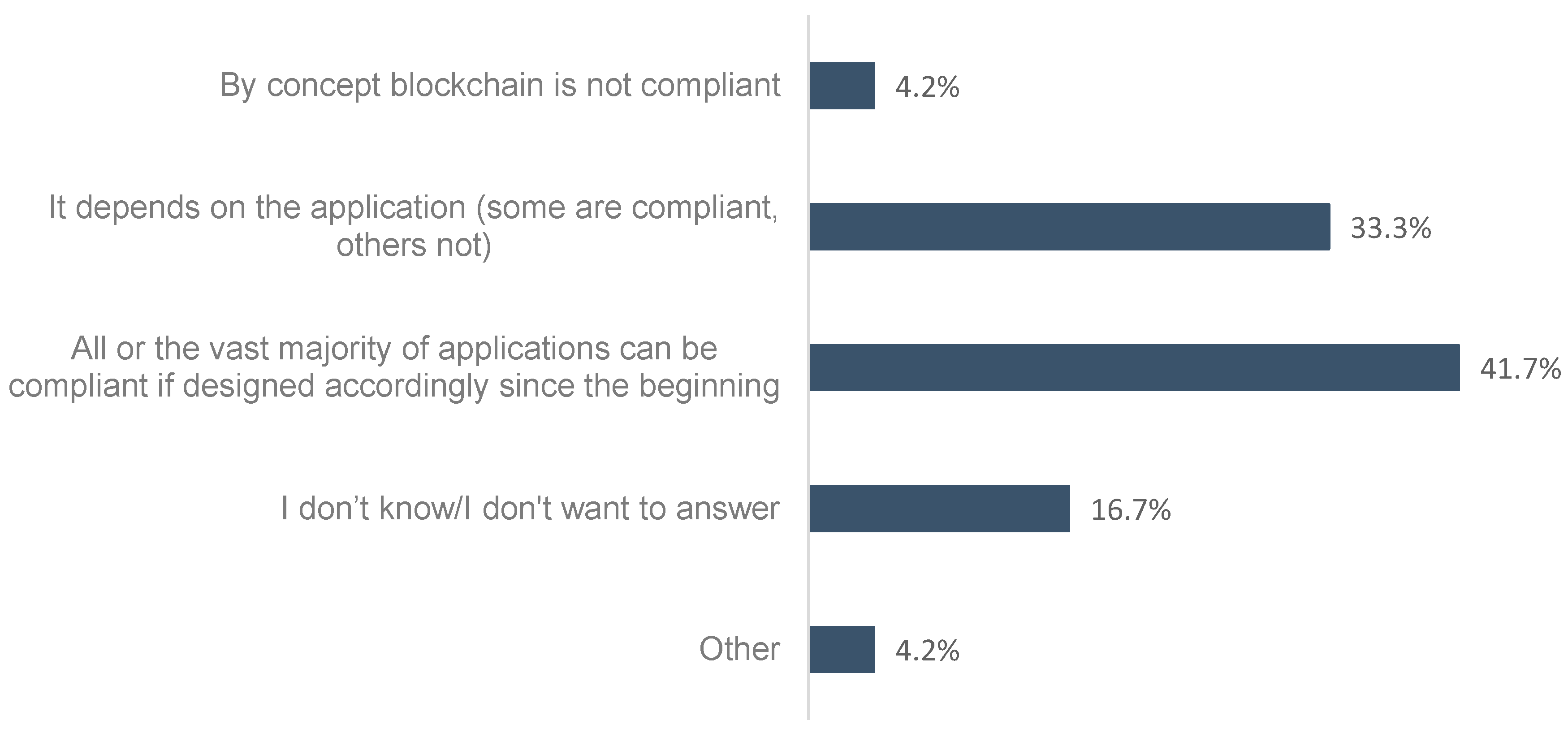

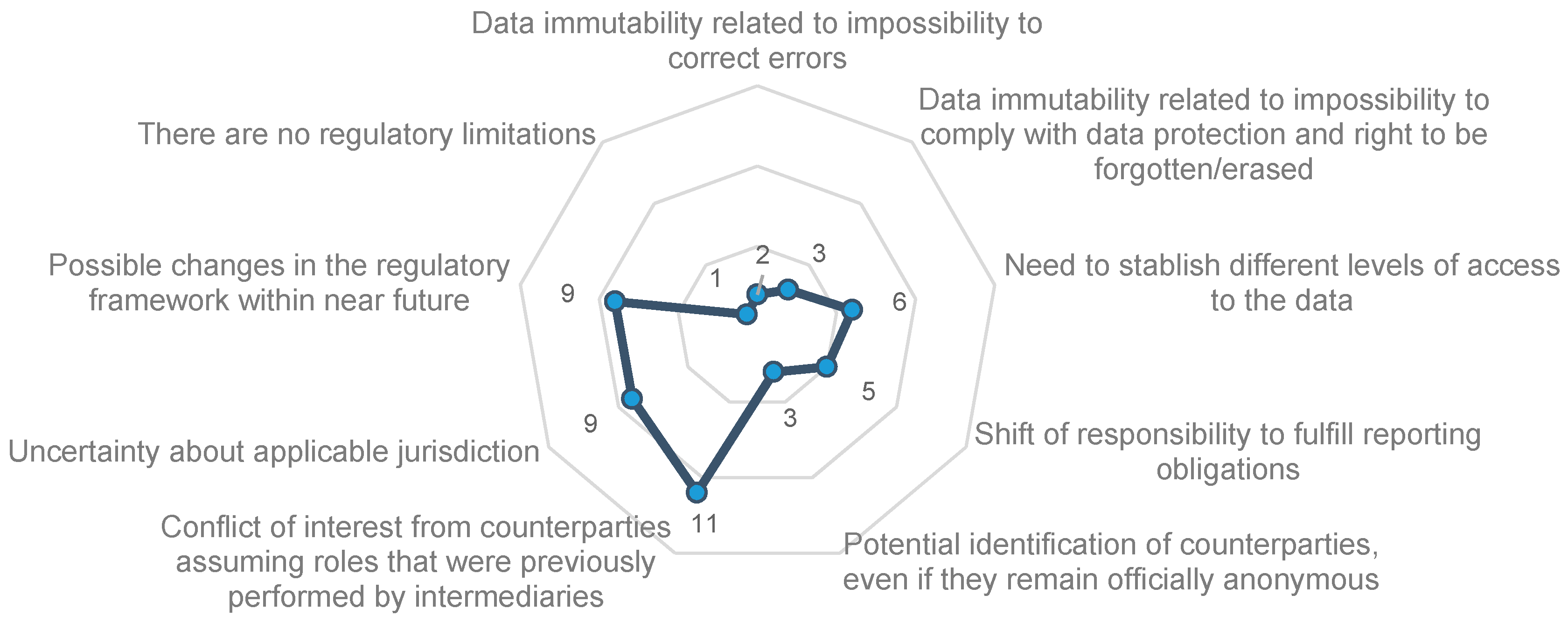

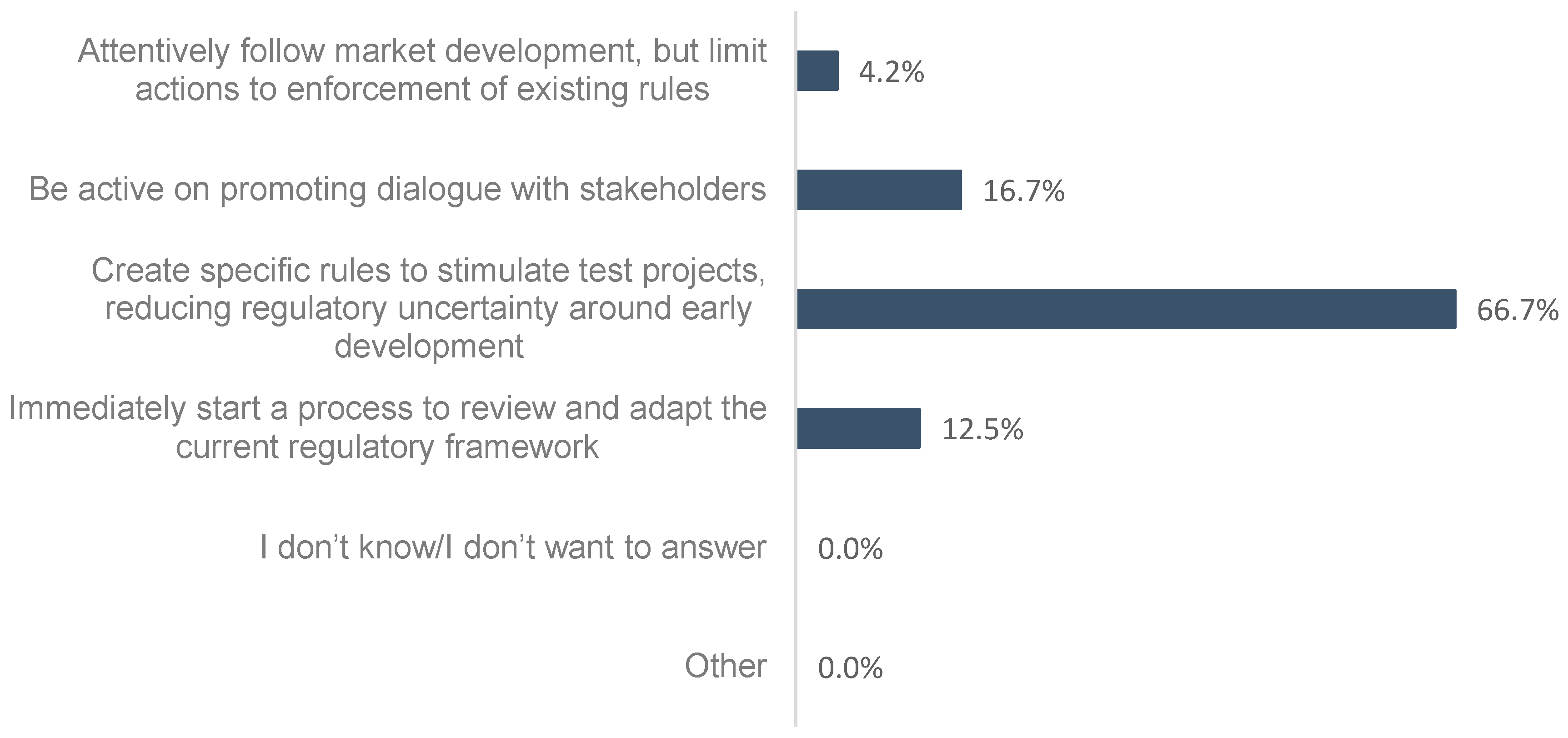

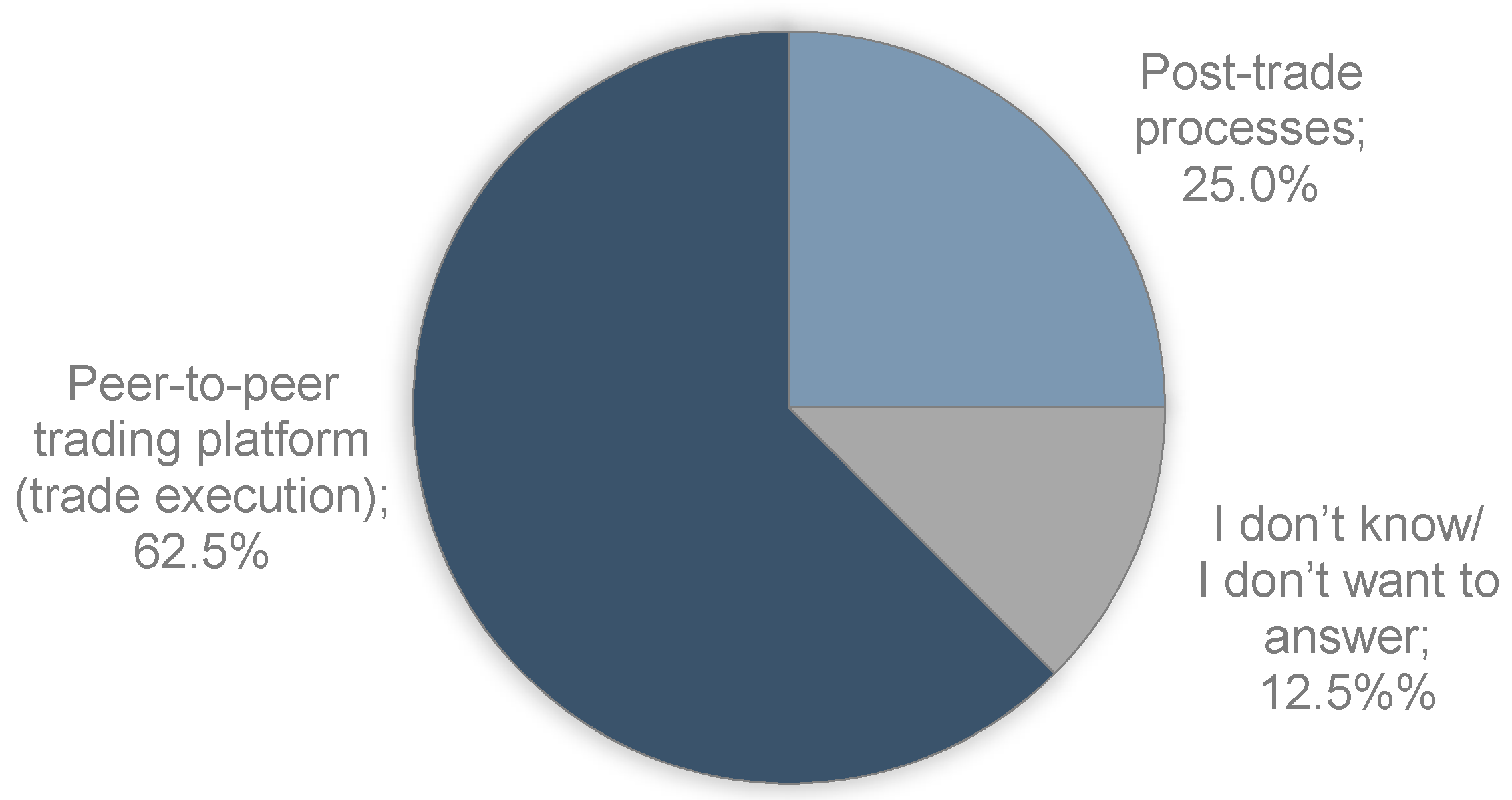

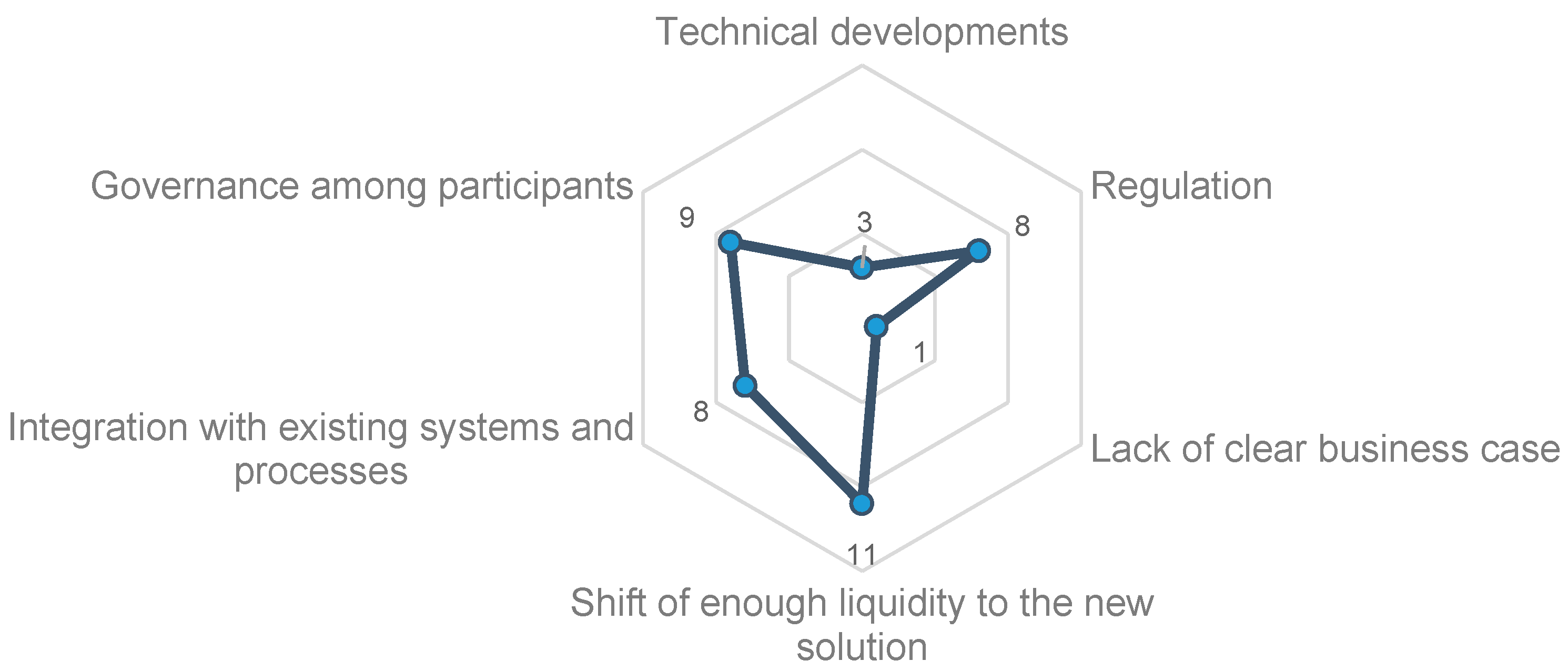

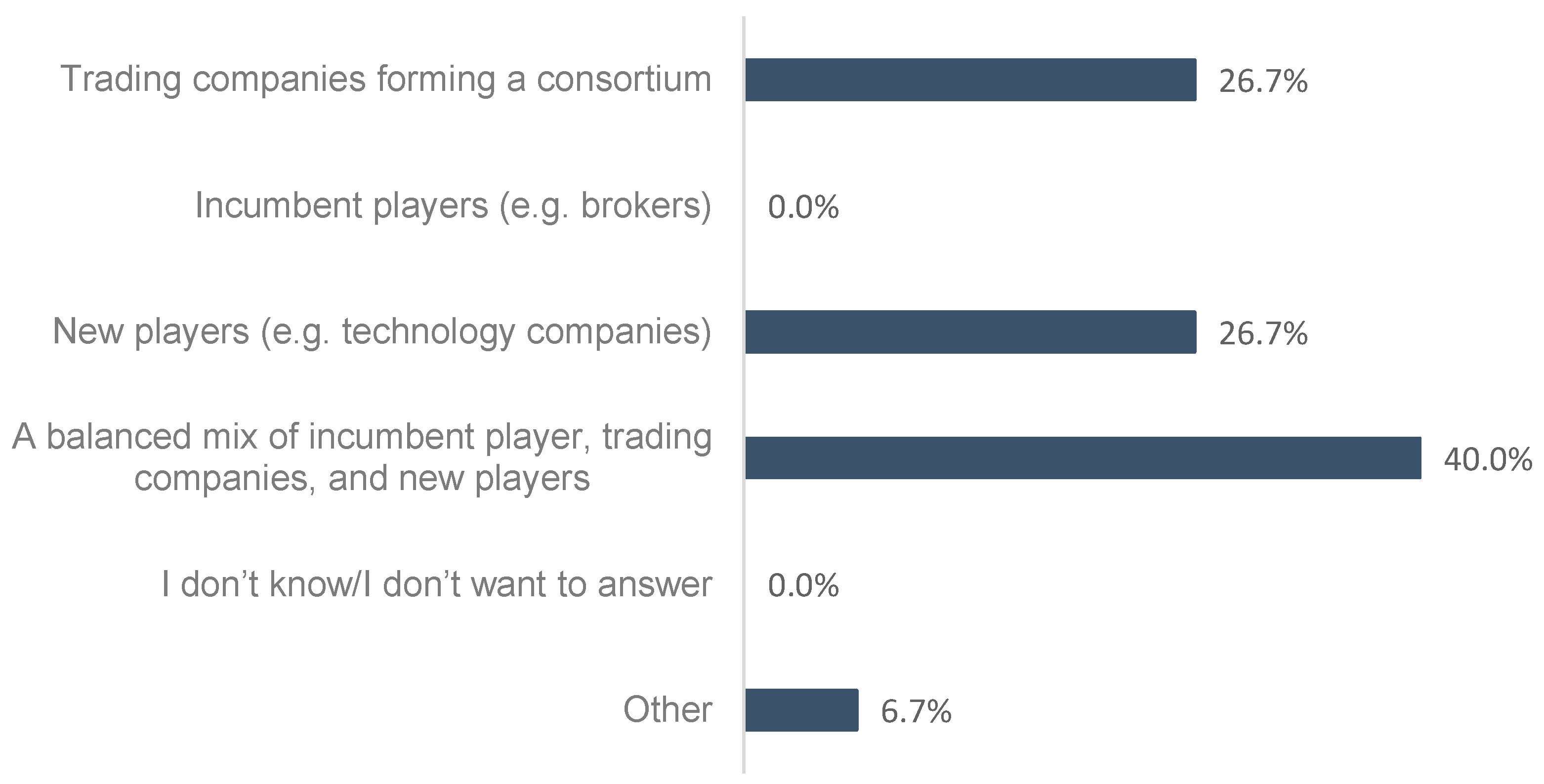

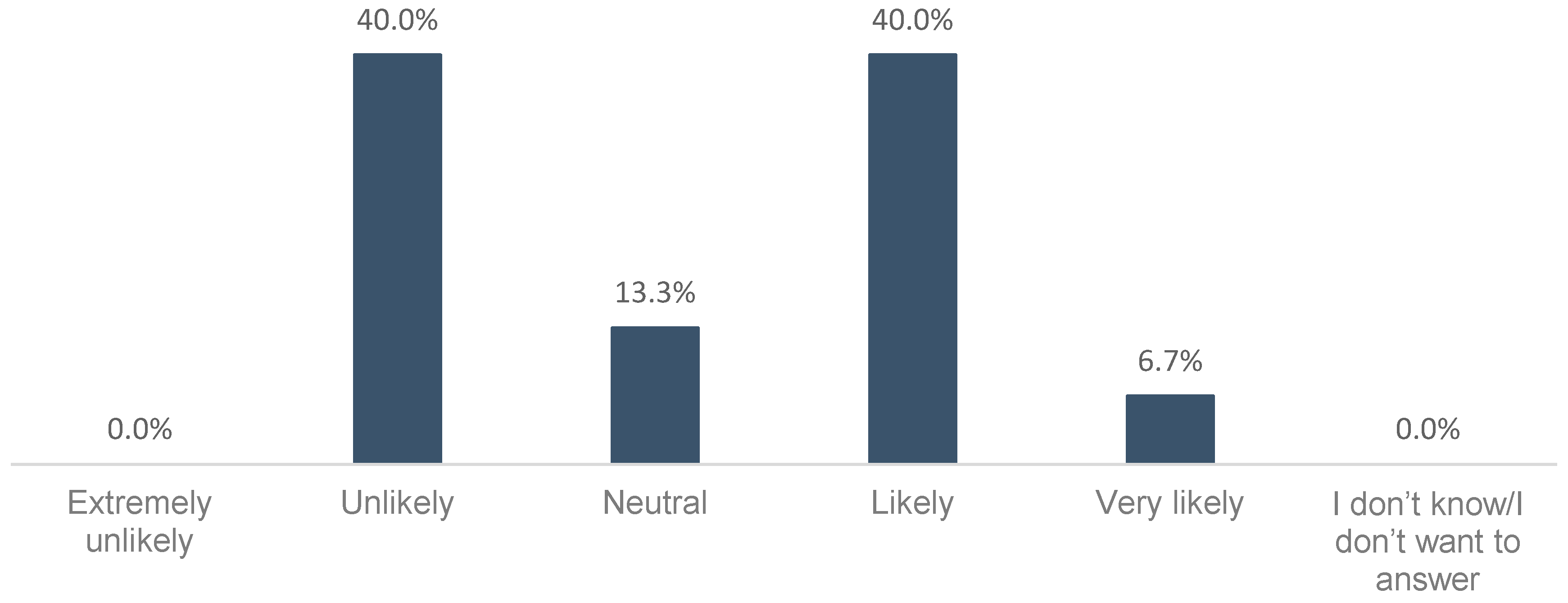

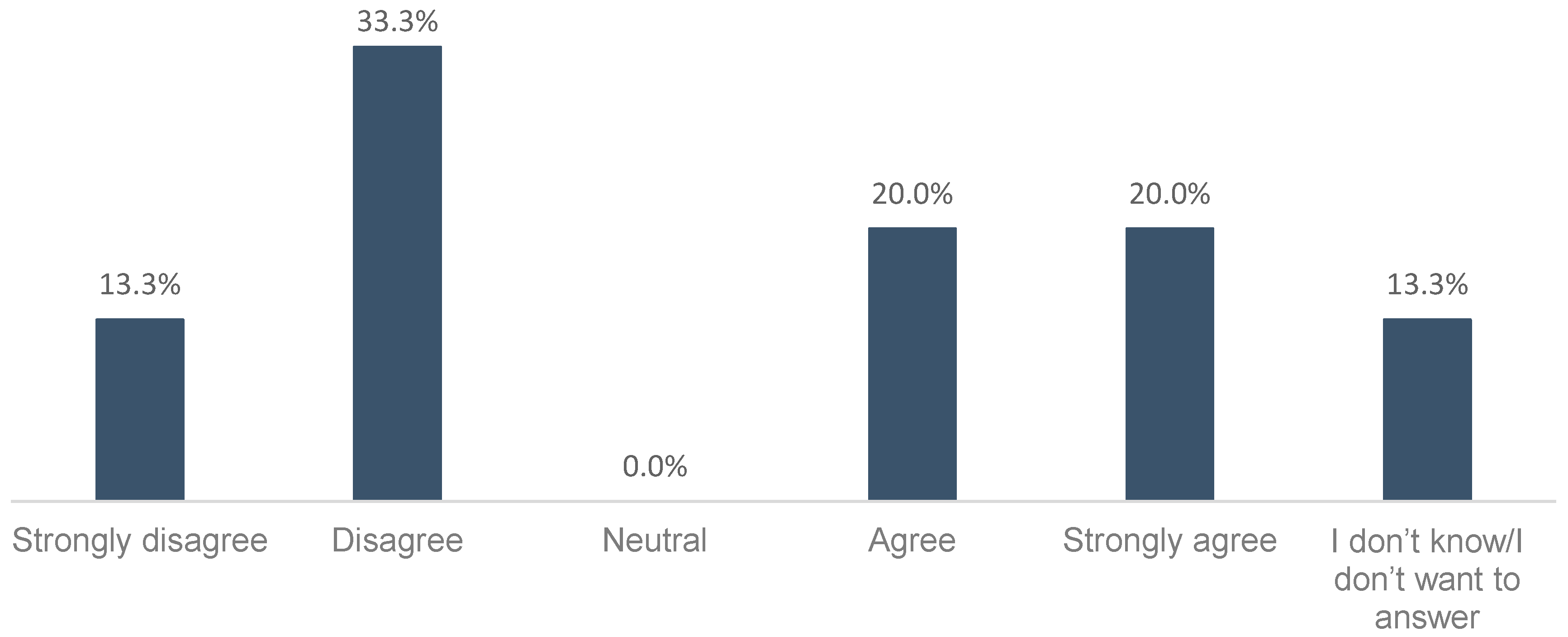

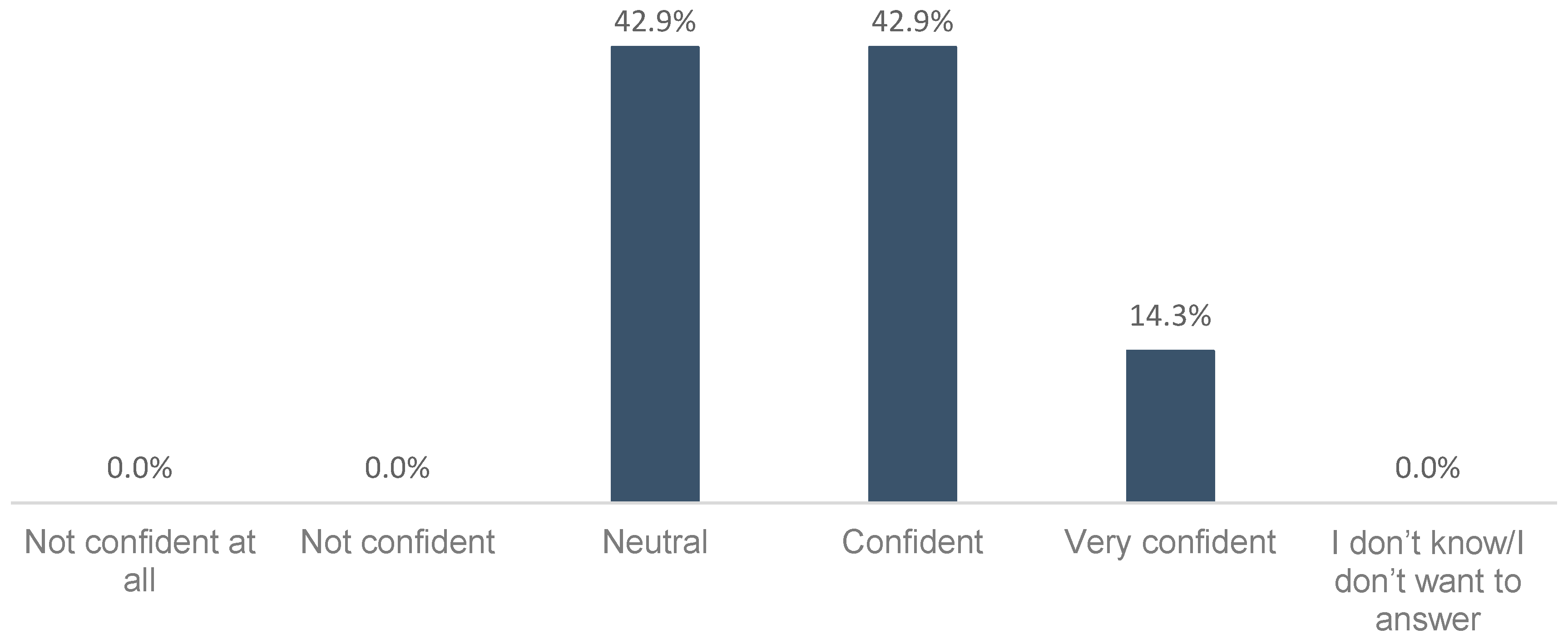

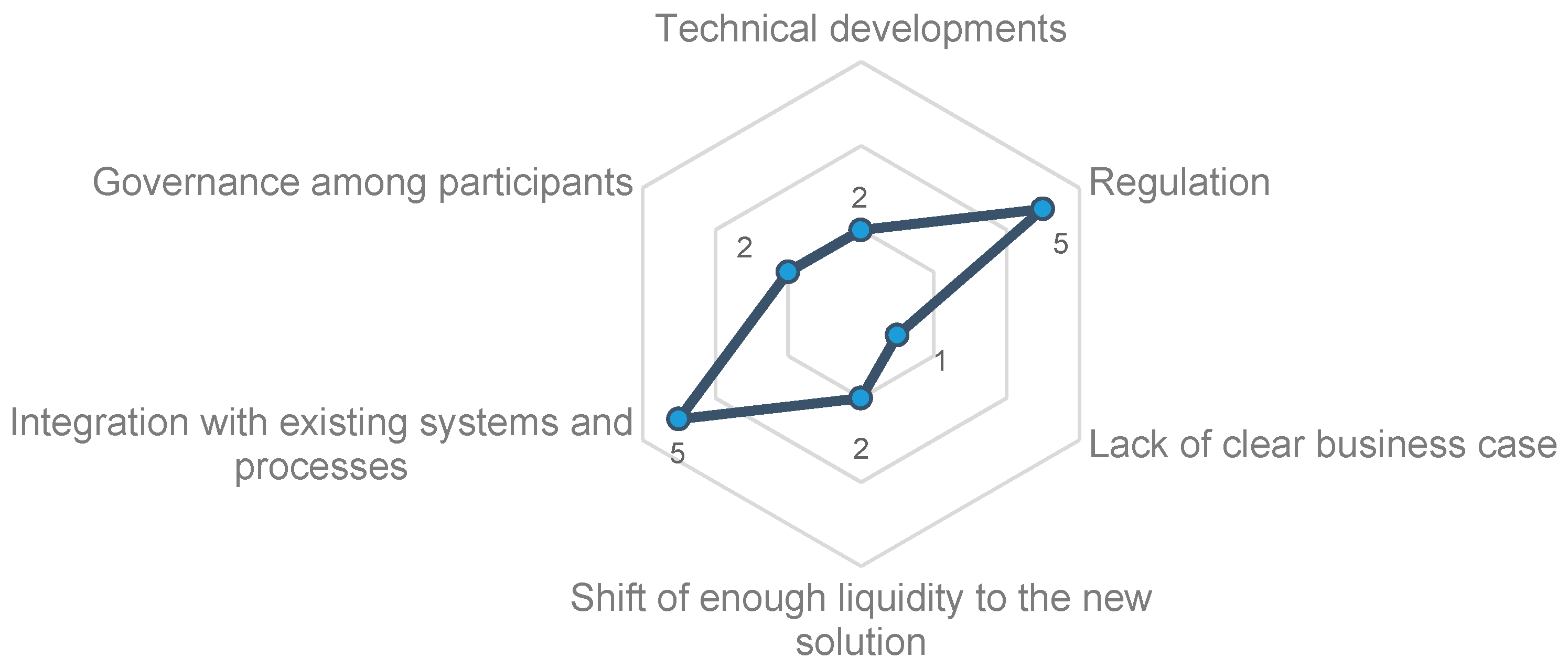

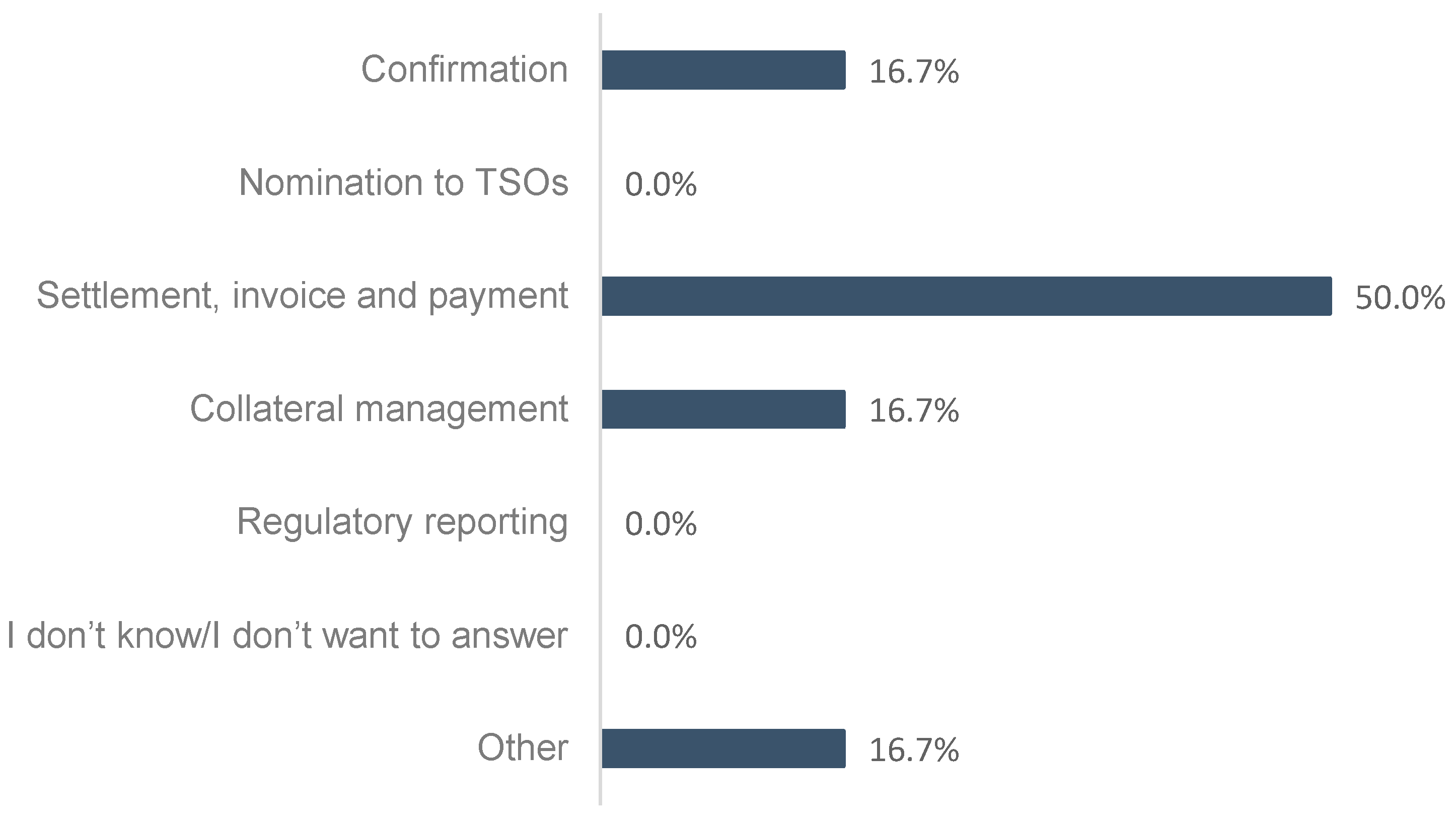

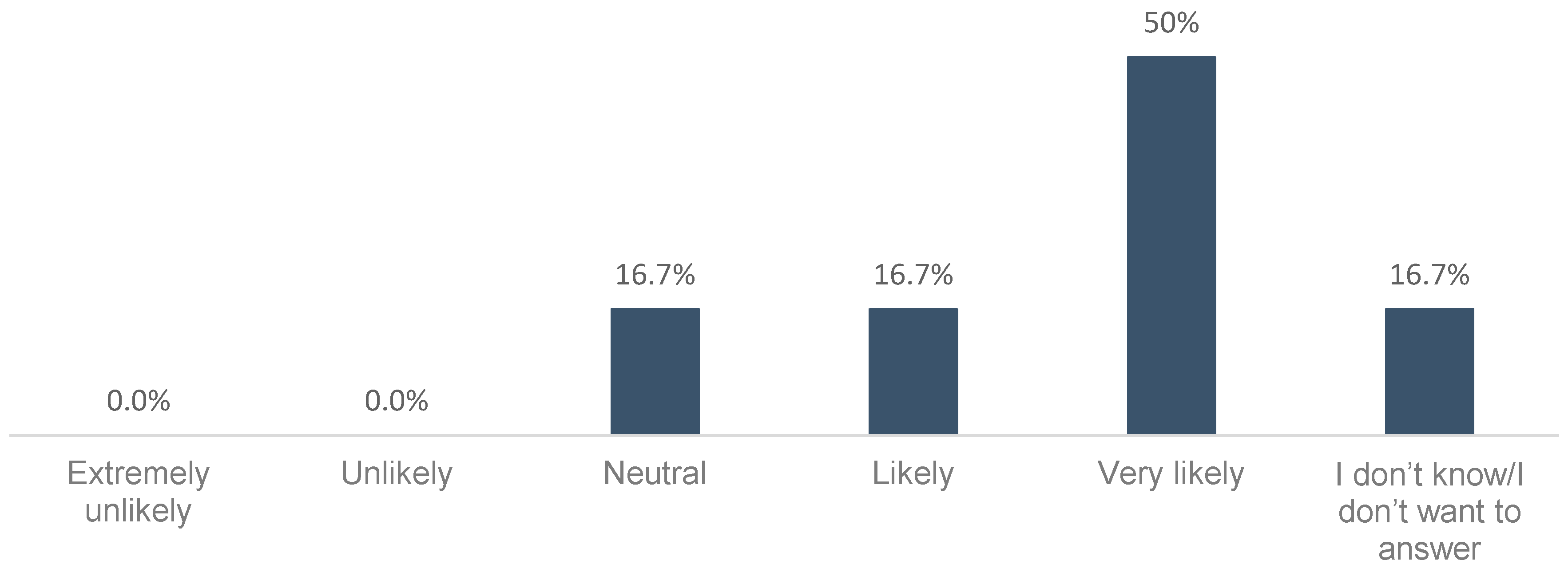

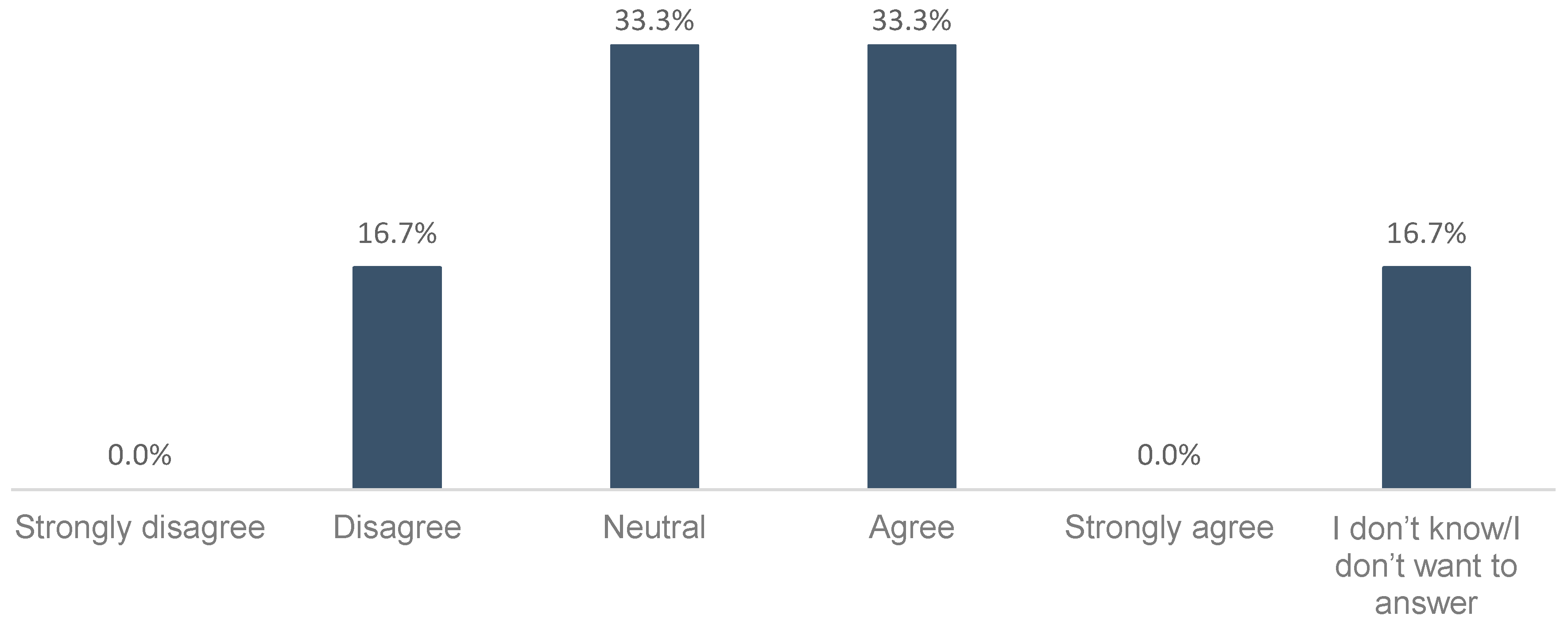

4.2. Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

Abbreviations

| ACER | Agency for the Cooperation of Energy Regulators |

| BIS | Bank for International Settlements |

| DLT | Distributed Ledger Technology |

| EMIR | European Market Infrastructure Regulation (Regulation 648/2012/EU) |

| ESMA | European Securities and Markets Authority |

| EU | European Union |

| GDPR | General Data Protection Regulation (Regulation 679/2016/EU) |

| MiFID2 | Markets in Financial Instruments Directive (Directive 65/2014/EU) |

| NCA | National Competent Authority |

| OTC | Over-the-counter |

| P2P | Peer-to-peer |

| PPAT | Persons Professionally Arranging Transactions |

| REMIT | Regulation on Wholesale Energy Market Integrity and Transparency (Regulation 1227/2011/EU) |

| TR | Trading Repository |

| TSO | Transmission System Operator |

Appendix A. Characteristics of the Survey

- ○

- Period: from 19 February 2018 to 23 May 2018

- ○

- Respondents: by invitation only (e-Mail URL embedded)

- ○

- Pilot (testing): informal, with three respondents (excluded from final sample)

- ○

- Privacy: anonymous

- ○

- Close-ended questions with multiple choice

- ○

- All questions mandatory (with alternatives “Other” and “I don’t know/I don’t want to answer”)

- ○

- Order of questions: pre-defined (general to specific)

- ○

- Order of answers: random, except for alternatives “Other” and “I don’t know/I don’t want to answer” and scale questions

- ○

- Scalar question: five points with radio buttons

- ○

- Length: up to ten questions, funneling at fifth question

- ○

- Multiple page: one page for general questions, another page for specific questions

- ○

- Progress indicator: yes

References

- Tapscott, D.; Tapscott, A. Blockchain Revolution: How the Technology behind Bitcoin Is Changing Money, Business, and the World; Portfolio/Penguin: New York, NY, USA, 2016. [Google Scholar]

- Nussbaum, J. Mapping the Blockchain Project Ecosystem. 2017. Available online: https://techcrunch.com/2017/10/16/mapping-the-blockchain-project-ecosystem/ (accessed on 21 April 2018).

- Blockchain Hub. Blockchains & Distributed Ledger Technologies-Types of Blockchain. Available online: https://blockchainhub.net/blockchains-and-distributed-ledger-technologies-in-general/ (accessed on 23 March 2018).

- IBM. Rewire Your Industry with IBM Blockchain; IBM: Armonk, NY, USA, 2018; Available online: https://www-03.ibm.com/press/us/en/pressrelease/52018.wss (accessed on 21 April 2018).

- Besnainou, J. Blockchain in Energy & Industry Raises $1 Billion–and Heads into Challenging Times. 2018. Available online: https://www.cleantech.com/blockchain-in-energy-industry-raises-1-billion-and-heads-into-challenging-times/ (accessed on 6 February 2019).

- Pollitt, M. Electricity Liberalisation in the European Union: A Progress Report; No. EPRG 0929; Electricity Policy Research Group, University of Cambridge: Cambridge, UK, 2009. [Google Scholar]

- Merz, M. Potential of the Blockchain Technology in Energy Trading. 2016. Available online: https://www.ponton.de/downloads/mm/Potential-of-the-Blockchain-Technology-in-Energy-Trading_Merz_2016.en.pdf (accessed on 2 February 2018).

- Praktiknjo, A.; Erdmann, G. Renewable Electricity and Backup Capacities: An (Un-) Resolvable Problem? Energy J. 2016, 37, 89–106. [Google Scholar] [CrossRef]

- Economic Consulting Associates. European Electricity Forward Markets and Hedging Products–State of Play and Elements for Monitoring; Economic Consulting Associates: London, UK, 2015. [Google Scholar]

- BIS. New Developments in Clearing and Settlement Arrangements for OTC Derivatives; Bank for International Settlements (BIS): Basel, Switzerland, 2007. [Google Scholar]

- European Commission. Quarterly Report on European Electricity Markets; third quarter of 2017; European Commission, Directorate-General for Energy, Market Observatory for Energy: Brussels, Belgium, 2017; Volume 10. [Google Scholar]

- ISDA. OTC Commodity Derivatives Trade Processing Lifecycle Events; International Swaps and Derivatives Association (ISDA): New York, NY, USA, 2012. [Google Scholar]

- Santo, A.; Minowa, I.; Hosaka, G.; Hayakawa, S.; Kondo, M.; Ichiki, S.; Kaneko, Y. Applicability of Distributed Ledger Technology to Capital Market Infrastructure; Japan Exchange Group: Tokyo, Japan, 2016. [Google Scholar]

- ESMA. The Distributed Ledger Technology Applied to Securities Markets (No. ESMA50-1121423017–285); European Securities and Markets Authority: Paris, France, 2017. [Google Scholar]

- ESMA. Questions and Answers on MiFIR Data Reporting; ESMA: Paris, France, 2017. [Google Scholar]

- FCA. Distributed Ledger Technology Feedback Statement on Discussion Paper 17/03; FCA: London, UK, 2017. [Google Scholar]

- Hagström, L.; Dahlquist, O. Scaling Blockchain for the Energy Sector; Uppsala University: Uppsala, Sweden, 2017. [Google Scholar]

- Pilkington, M. Blockchain Technology: Principles and Applications; Research Handbook on Digital Transformations; SSRN Scholarly Paper No. ID 2662660; Xavier Olleros, F., Majlinda, Z., Elgar, E., Eds.; Social Science Research Network: Rochester, NY, USA, 2016. [Google Scholar]

- Finck, M. Blockchains and Data Protection in the European Union; SSRN Scholarly Paper No. ID 3080322; Social Science Research Network: Rochester, NY, USA, 2017. [Google Scholar]

- European Parliament and Council. Regulation (EU) No 648/2012 of the European Parliament and of the Council of 4 July 2012 on OTC Derivatives, Central Counterparties and Trade Repositories; European Parliament and Council: Brussels, Belgium, 2012. [Google Scholar]

- Zweifel, P.; Praktiknjo, A.; Erdmann, G. Energy Economics: Theory and Applications; Springer: Berlin, Germany, 2017. [Google Scholar]

- European Parliament and Council. Regulation (EU) No 1227/2011 of the European Parliament and of the Council of 25 October 2011 on Wholesale Energy Market Integrity and Transparency; European Parliament and Council: Brussels, Belgium, 2011. [Google Scholar]

- European Parliament and Council. Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on Markets in Financial Instruments and Amending Directive 2002/92/EC and Directive 2011/61/EU; European Parliament and Council: Brussels, Belgium, 2014. [Google Scholar]

- European Parliament and Council. Regulation (EU) 2016/679 of the European Parliament and of the Council of 27 April 2016 on the Protection of Natural Persons with Regard to the Processing of Personal Data and on the Free Movement of Such Data, and Repealing Directive 95/46/EC (General Data Protection Regulation); European Parliament and Council: Brussels, Belgium, 2016. [Google Scholar]

- European Commission. Commission Implementing Regulation (EU) No 1348/2014 of 17 December 2014 on Data Reporting Implementing Article 8(2) and Article 8(6) of Regulation (EU) No 1227/2011 of the European Parliament and of the Council on Wholesale Energy Market Integrity and Transparency; European Commission: Brussels, Belgium, 2014. [Google Scholar]

- ACER. ACER Guidance on the Application of REMIT, 4th ed.; ACER: Ljubljana, Slovenia, 2016. [Google Scholar]

- European Parliament and Council. Regulation (EU) No 600/2014 of the European Parliament and of the Council of 15 May 2014 on Markets in Financial Instruments and Amending Regulation (EU) No 648/2012; European Parliament and Council: Brussels, Belgium, 2014. [Google Scholar]

- Finck, M. Blockchain Regulation; SSRN Scholarly Paper No. ID 3014641; Social Science Research Network: Rochester, NY, USA, 2017. [Google Scholar]

- European Commission. Commission Delegated Regulation (EU) No 151/2013 of 19 December 2012 Supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council on OTC Derivatives, Central Counterparties and Trade Repositories, with Regard to Regulatory Technical Standards Specifying the Data to be Published and Made Available by Trade Repositories and Operational Standards for Aggregating, Comparing and Accessing the Data; European Commission: Brussels, Belgium, 2012. [Google Scholar]

- Zetzsche, D.A.; Buckley, R.P.; Arner, D.W. The Distributed Liability of Distributed Ledgers: Legal Risks of Blockchain; SSRN Scholarly Paper No. ID 3018214; Social Science Research Network: Rochester, NY, USA, 2017. [Google Scholar]

- Galvin, R. How many interviews are enough? Do qualitative interviews in building energy consumption research produce reliable knowledge? J. Build. Eng. 2015, 1, 2–12. [Google Scholar] [CrossRef]

- Mason, M. Sample Size and saturation in PhD studies using qualitative interviews. Forum Qual. Soc. Res. 2015. [Google Scholar] [CrossRef]

- Brace, I. Questionnaire Design: How to Plan, Structure and Write Survey Material for Effective Market Research, 3rd ed.; Kogan Page Limited: London, UK, 2013. [Google Scholar]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dick, C.I.; Praktiknjo, A. Blockchain Technology and Electricity Wholesale Markets: Expert Insights on Potentials and Challenges for OTC Trading in Europe. Energies 2019, 12, 832. https://doi.org/10.3390/en12050832

Dick CI, Praktiknjo A. Blockchain Technology and Electricity Wholesale Markets: Expert Insights on Potentials and Challenges for OTC Trading in Europe. Energies. 2019; 12(5):832. https://doi.org/10.3390/en12050832

Chicago/Turabian StyleDick, Carol Inoue, and Aaron Praktiknjo. 2019. "Blockchain Technology and Electricity Wholesale Markets: Expert Insights on Potentials and Challenges for OTC Trading in Europe" Energies 12, no. 5: 832. https://doi.org/10.3390/en12050832

APA StyleDick, C. I., & Praktiknjo, A. (2019). Blockchain Technology and Electricity Wholesale Markets: Expert Insights on Potentials and Challenges for OTC Trading in Europe. Energies, 12(5), 832. https://doi.org/10.3390/en12050832