The Role of Infrastructure for Electric Passenger Car Uptake in Europe

Abstract

1. Introduction

2. Relevant Research and Policy Background

2.1. Research on PEV Infrastructure Aspects

2.2. Policy Context Development

2.3. Analysis of the Policy Impact on Recharging Infrastructure and PEV Uptake

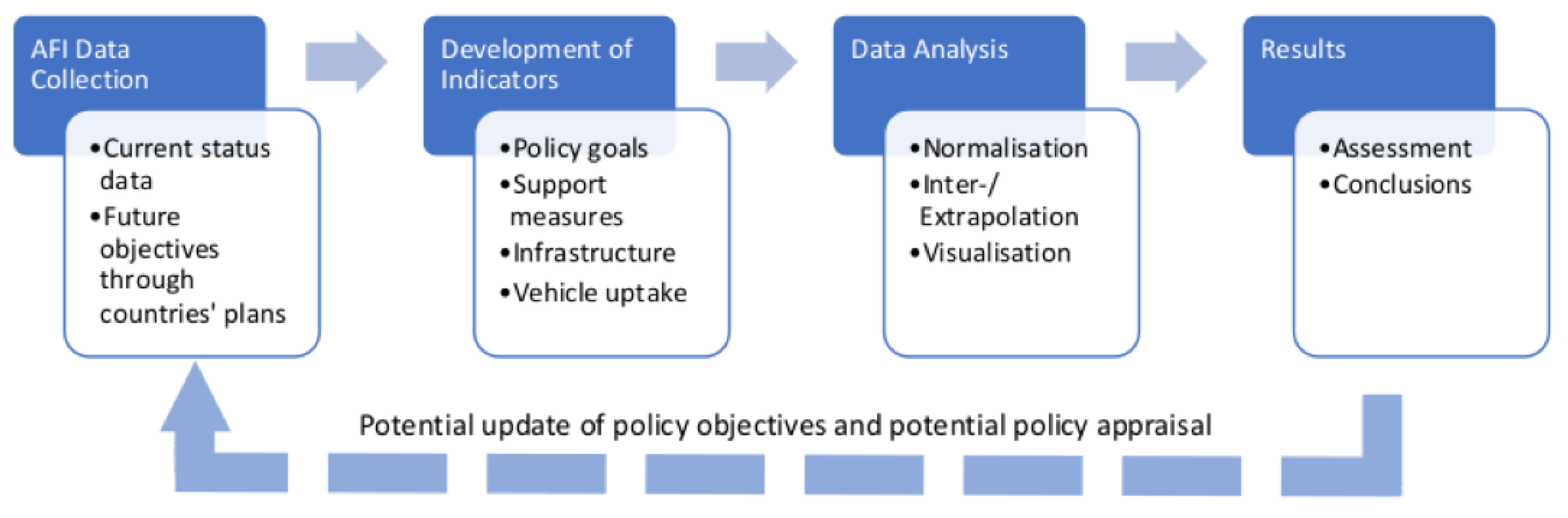

3. Materials and Methods

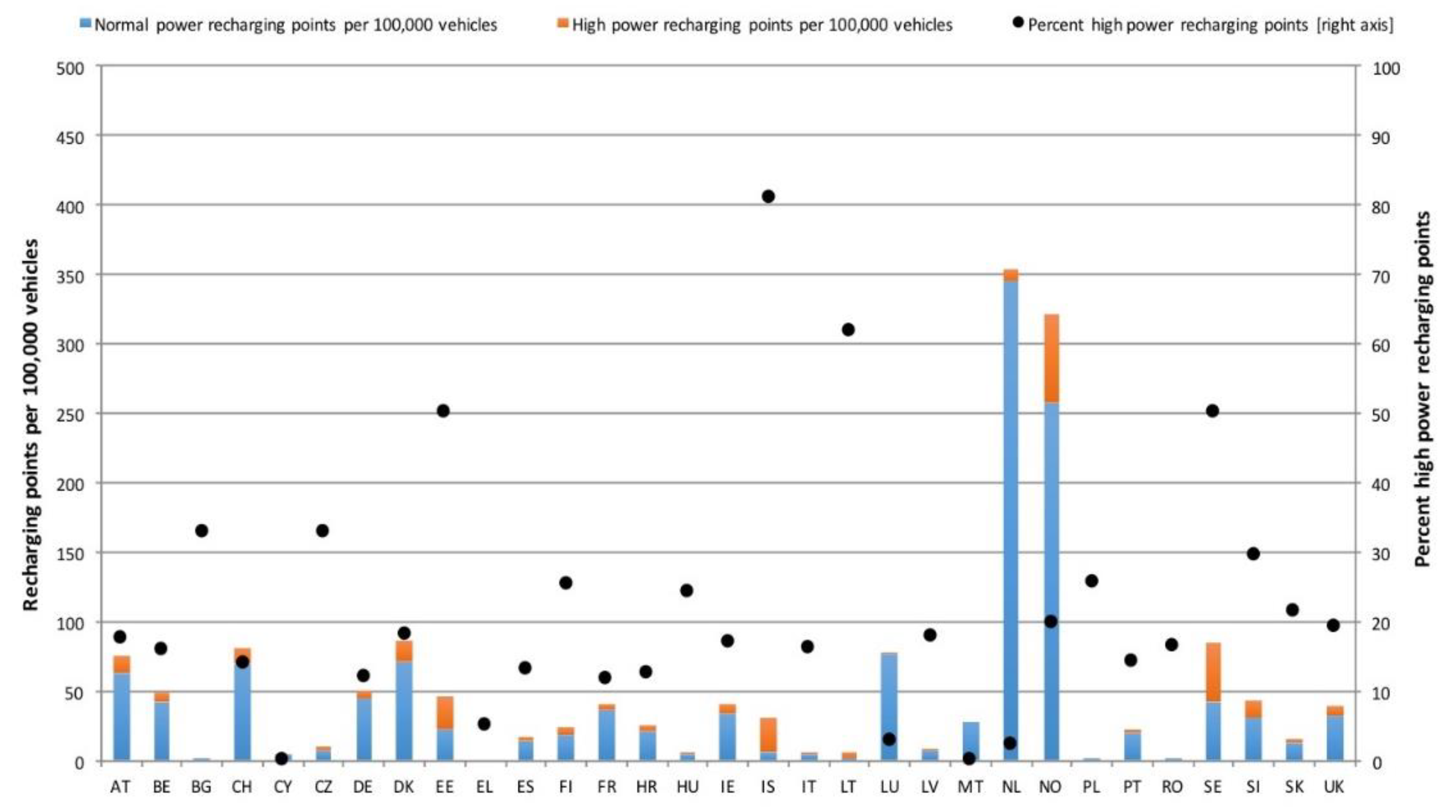

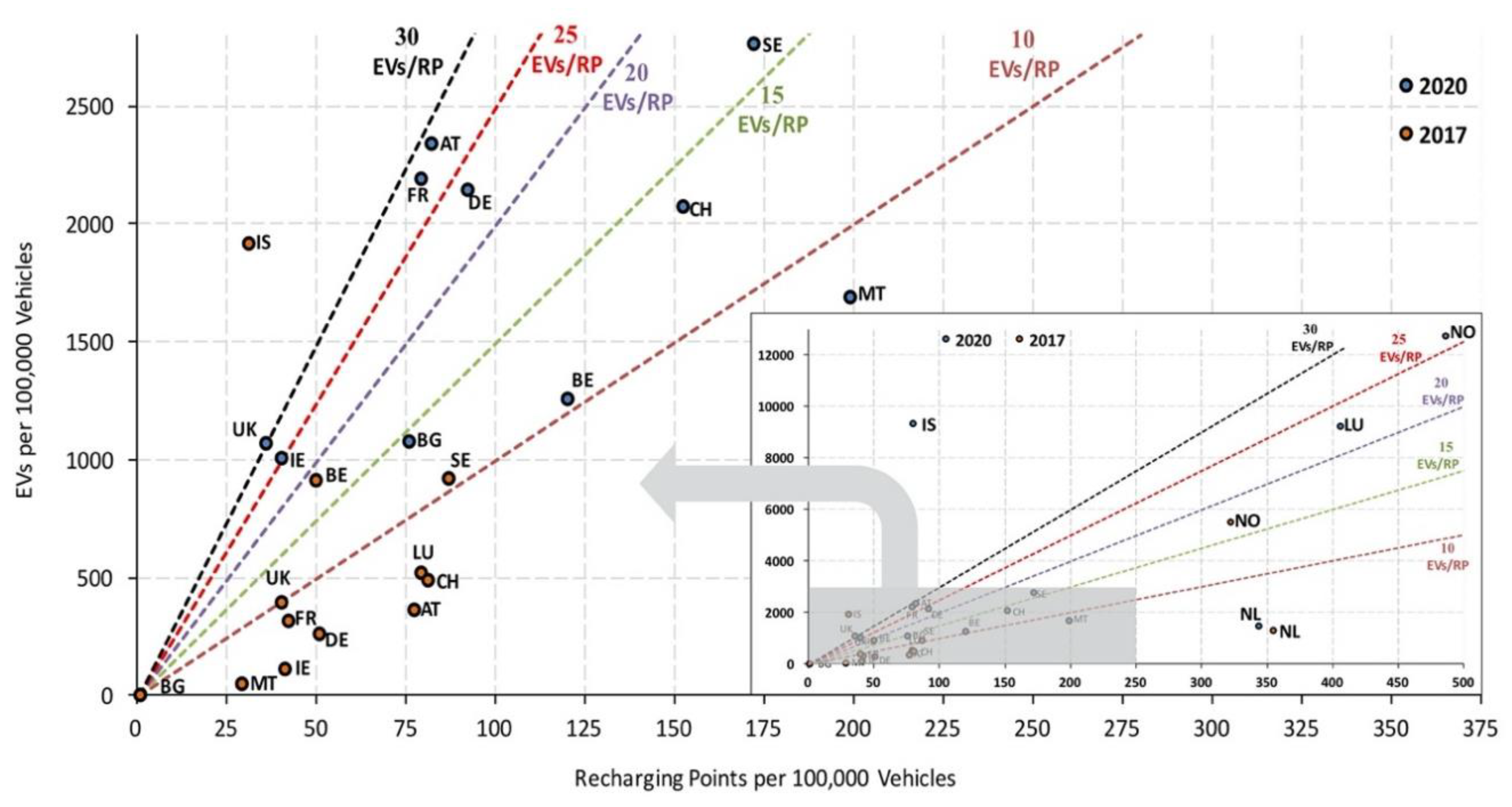

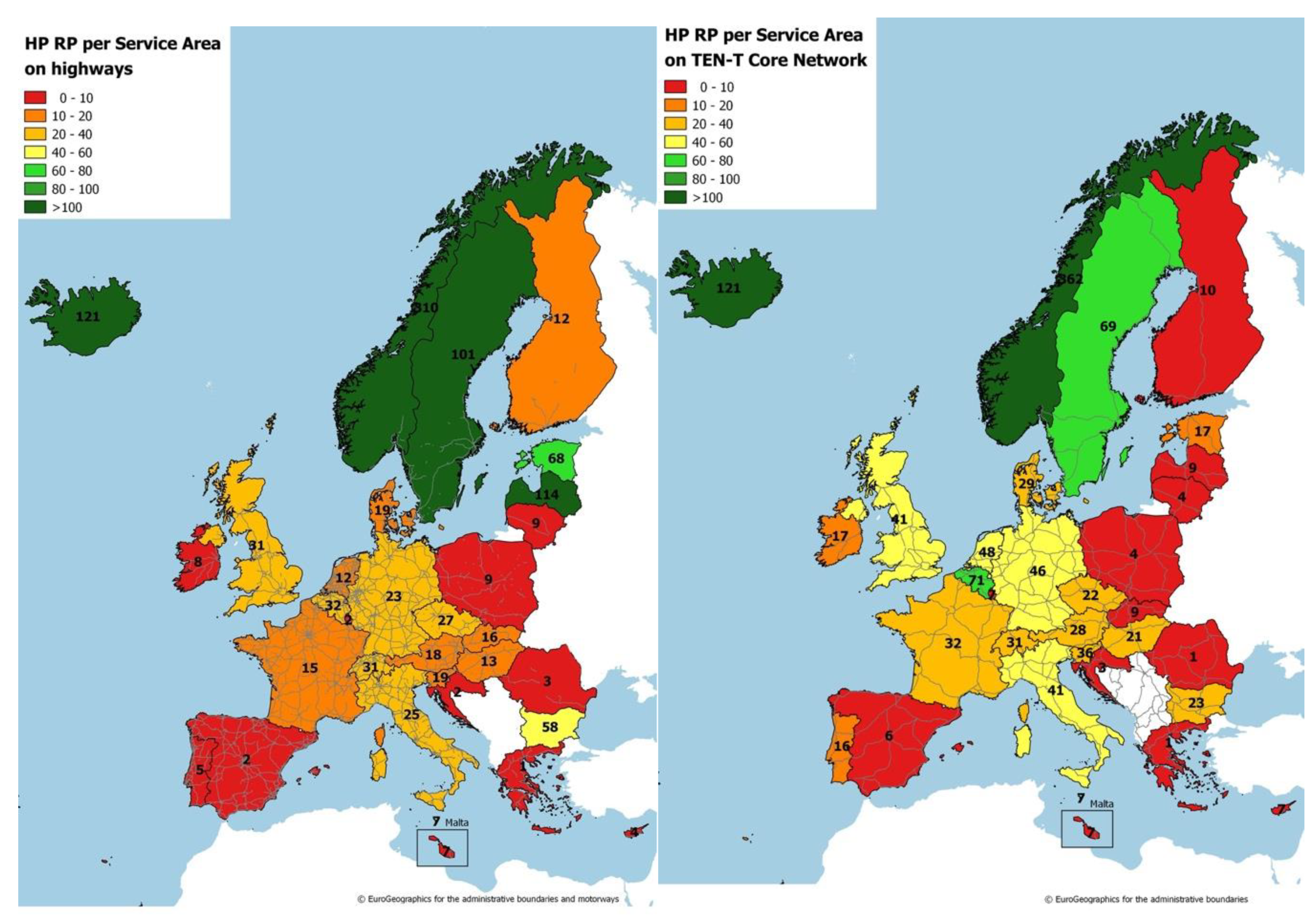

4. Results of the Analysis: Status and Expectations on Recharging Infrastructure in Europe

5. Discussion and Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Glossary

| AI | Acquisition Incentives |

| AF | Alternative Fuels |

| AFI | Alternative Fuels Infrastructure |

| AFV | Alternative Fuel Vehicle |

| BEV | Battery Electric Vehicle |

| CCS | Combined Charging System |

| CNG | Compressed Natural Gas |

| CO2 | Carbon Dioxide |

| CSI | Company-Specific Incentives |

| EAFO | European Alternative Fuels Observatory |

| EC | European Commission |

| EEA | European Environment Agency |

| EFTA | European Free Trade Association |

| EU | European Union |

| EVI-Pro | Electric Vehicle Infrastructure Projection Tool |

| FRLM | Flow-Refuelling Location Model |

| G2V | Grid-to-Vehicle |

| GIS | Geographic Information System |

| HPRP | High Power Recharging Point |

| IEA | International Energy Agency |

| II | Infrastructure Incentives |

| Isuff | Index of Sufficiency (Isuff = PEV number/RP number) |

| LNG | Liquefied Natural Gas |

| LPG | Liquefied Petroleum Gas |

| MS | Member State |

| NPF | National Policy Framework |

| NPRP | Normal Power Recharging Point |

| PEV | Plug-in Electric Vehicle |

| R&I | Research and Innovation |

| RFI | Recurring Financial Incentives |

| RNFI | Recurring Non-Financial Incentives |

| RP | Recharging Point |

| SET | Strategic Energy Technology |

| STRIA | Strategic Transport Research and Innovation Agenda |

| TEN-T | Trans-European Transport Network |

| TOPSIS | Technique for Order of Preference by Similarity to Ideal Solution |

| USA | United States of America |

| V2G | Vehicle-to-Grid |

| VAT | Value Added Tax |

Appendix A

- Purchase incentives—The client benefits from a grant/bonus/premium when purchasing an alternative fuel vehicle (AFV) that could be differentiated on CO2 emission level.

- Reduced loan interest—For an AFV acquisition, the client benefits from loan with reduced interest.

- Public procurement incentives—In the case of public institutions fleet or AFI acquisition.

- Purchase tax reduction/exemption.

- Registration tax reduction/exemption—Benefit on registration tax, where AFV may be excluded or pay less than more polluting vehicles, ICEV.

- Import tax reduction/exemption.

- Income tax reduction.

- Scrappage for replacement schemes—Offering a bonus to exchange an old ICEV for a particular kind of new AFV, stimulate consumers to buy low emissions vehicles.

- VAT tax reduction/exemption.

- Conversion cost credit—For transforming an ICEV in an AFV.

- Bonus/malus schemes—The acquisition price may be affected by a subsidy (bonus) for AFV, or by a surcharge (malus) for ICEV, penalising purchases of high-emission vehicles and rewarding low emission vehicles.

- Other—Any other kind of financial decision that may be considered an acquisition incentive.

- Annual circulation/ownership/road tax reduction/exemption—Exemption or reduction for low emission vehicles that pay less than more polluting vehicles (ICEV).

- Free recharging—At some public points.

- Fuel tax reduction/exemption—Fuel duty is applied to transport fuels, but not to electricity [54]; some AF have tax reductions.

- Road tolls reduction/exemption—a toll road (toll way), is a public or private road (almost always a controlled-access highway) for which a fee (or toll) is assessed for passage. It is a form of road pricing typically implemented to help recoup the cost of road construction and maintenance. Using a low emission AFV these fees may be reduced or exempted. This may be extended to ferries, tunnels or bridges.

- Congestion or low/zero emission zone charges reduction/exemption—For AFV and increased fees for ICEV.

- Parking charges reduction/exemption—Free/reduced charges for AFV parking.

- Reduced VAT on leasing AFV.

- Other—Any other kind of financial decisions that may be considered RFI.

- Parking priorities—Dedicated parking lots for EVs, fixed share for EVs places in parking areas.

- Restricted lane use—Access to bus lanes, to other preferential lanes or to high occupancy vehicle lanes for AFV.

- Access in low/zero emission zones—Where ICEV are prohibited but AFV may access.

- Higher speed limit—For AFV on certain roads.

- Other—any other kind of incentives that may be considered RNFI.

- Incentives to install recharging points for home/business use.

- Charging facilities for PEVs.

- Benefit-in-kind taxation—Taxation on private use of company car. Benefit-in-kind is a tax levied on employees who receive advantages in addition to their salary.

- Capital allowance—Enable companies to write down the cost of purchasing cars and vans against taxable profits (e.g., an EV may be eligible for 100% first year capital allowances, but for a car with higher CO2 emissions only a lower percentage of its cost each year may be written down against the company’s taxable profits) [55].

- Extra depreciation rule—Depreciation allows (or requires) businesses to spread out the cost of long-term assets over the life of the asset. Bonus depreciation for AFVs is a valuable tax-saving tool for businesses. It allows to take an immediate first-year deduction on the purchase of eligible business property, in addition to other depreciation [64].

- VAT deduction—There is VAT deduction on company assets (like AFVs) that are also used for private purposes.

- Annual circulation/ownership/road tax reduction/exemption—Often for low CO2 emitting AFV.

- Public procurement—AFV acquisition for public companies.

- Other—Any other kind of incentives that offer benefits for companies.

References

- European Environment Agency. Monitoring of CO2 Emissions from Passenger Cars—Regulation (EC) No 443/2009. Available online: https://www.eea.europa.eu/data-and-maps/data/co2-cars-emission-14#tab-european-data (accessed on 12 April 2019).

- Hall, D.; Lutsey, N. Emerging Best Practices for Electric Vehicle Charging Infrastructure; International Council on Clean Transportation: Washington, DC, USA, 2017. [Google Scholar]

- Thiel, C.; Krause, J.; Dilara, P. Electric Vehicles in the EU from 2010 to 2014—Is Full Scale Commercialisation Near? Publications Office of the European Union: Luxembourg, 2015. [Google Scholar]

- Gómez Vilchez, J.; Harrison, G.; Kelleher, L.; Smyth, A.; Thiel, C.; Lu, H.; Rohr, C. Quantifying the Factors Influencing People’s Car Type Choices in Europe: Results of a Stated Preference Survey; Publications Office of the European Union: Luxembourg, 2017. [Google Scholar]

- Knupfer, S.M.; Hensley, R.; Hertzke, P.; Schaufuss, P.; Laverty, N.; Kramer, N. McKinsey & Company Electrifying Insights: How Automakers can Drive Electrified Vehicle Sales and Profitability. Available online: https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/electrifying-insights-how-automakers-can-drive-electrified-vehicle-sales-and-profitability (accessed on 12 April 2019).

- Lucas, A.; Prettico, G.; Flammini, M.; Kotsakis, E.; Fulli, G.; Masera, M. Indicator-Based Methodology for Assessing EV Charging Infrastructure Using Exploratory Data Analysis. Energies 2018, 11, 1869. [Google Scholar] [CrossRef]

- Lucas, A.; Bonavitacola, F.; Kotsakis, E.; Fulli, G. Grid harmonic impact of multiple electric vehicle fast charging. Electr. Power Syst. Res. 2015, 127, 13–21. [Google Scholar] [CrossRef]

- Trentadue, G.; Lucas, A.; Otura, M.; Pliakostathis, K.; Zanni, M.; Scholz, H. Evaluation of Fast Charging Efficiency under Extreme Temperatures. Energies 2018, 11, 1937. [Google Scholar] [CrossRef]

- Hardy, K.; Bohn, T.; Slezak, L.; Krasenbrink, A.; Scholz, H. US-EU Joint EV-Smart Grid Interoperability Centers. In Proceedings of the 2013 IEEE World Electric Vehicle Symposium and Exhibition (EVS27), Barcelona, Spain, 7–20 November 2013; pp. 1–8. [Google Scholar]

- Ferwerda, R.; Bayings, M.; van der Kam, M.; Bekkers, R. Advancing E-Roaming in Europe: Towards a Single “Language” for the European Charging Infrastructure. World Electr. Veh. J. 2018, 9, 50. [Google Scholar] [CrossRef]

- Cai, H.; Jia, X.; Chiu, A.S.F.; Hu, X.; Xu, M. Siting public electric vehicle charging stations in Beijing using big-data informed travel patterns of the taxi fleet. Transp. Res. Part D 2014, 33, 39–46. [Google Scholar] [CrossRef]

- Guo, S.; Zhao, H. Optimal site selection of electric vehicle charging station by using fuzzy TOPSIS based on sustainability perspective. Appl. Energy 2015, 158, 390–402. [Google Scholar] [CrossRef]

- Ji, W.; Nicholas, M.; Tal, G. Electric Vehicle Fast Charger Planning for Metropolitan Planning Organizations: Adapting to Changing Markets and Vehicle Technology. Transp. Res. Rec. J. Transp. Res. Board 2015, 2502, 134–143. [Google Scholar] [CrossRef]

- Huang, K.; Kanaroglou, P.; Zhang, X. The design of electric vehicle charging network. Transp. Res. Part D Transp. Environ. 2016, 49, 1–17. [Google Scholar] [CrossRef]

- Zhu, Z.; Gao, Z.; Zheng, J.; Du, H. Charging station location problem of plug-in electric vehicles. J. Transp. Geogr. 2016, 52, 11–22. [Google Scholar] [CrossRef]

- Gong, L.; Gong, L.; Fu, Y.; Li, Z. Integrated planning of BEV public fast-charging stations. Electr. J. 2016, 29, 62–77. [Google Scholar] [CrossRef]

- Jochem, P.; Brendel, C.; Reuter-Oppermann, M.; Fichtner, W.; Nickel, S. Optimizing the allocation of fast charging infrastructure along the German autobahn. J. Bus. Econ. 2016, 86, 513–535. [Google Scholar] [CrossRef]

- Yi, Z.; Bauer, P.H. Optimization models for placement of an energy-aware electric vehicle charging infrastructure. Transp. Res. Part E 2016, 91, 227–244. [Google Scholar] [CrossRef]

- Gkatzoflias, D.; Drossinos, Y.; Zubaryeva, A.; Zambelli, P.; Dilara, P.; Thiel, C. Optimal Allocation of Electric Vehicle Charging Infrastructure in Cities and Regions; Publications Office of the European Union: Luxembourg, 2016. [Google Scholar]

- Reuter-Oppermann, M.; Funke, S.; Jochem, P.; Graf, F. How Many Fast Charging Stations Do We Need Along the German Highway Network? In Proceedings of the EVS30 International Battery, Hybrid and Fuel Cell Electric Vehicle Symposium, Stuttgart, Germany, 9–11 October 2017; pp. 1–11. [Google Scholar]

- Gagarin, A.; Corcoran, P. Multiple domination models for placement of electric vehicle charging stations in road networks. Comput. Oper. Res. 2018, 96, 69–79. [Google Scholar] [CrossRef]

- Vazifeh, M.M.; Zhang, H.; Santi, P.; Ratti, C. Optimizing the deployment of electric vehicle charging stations using pervasive mobility data. Transp. Res. Part A 2019, 121, 75–91. [Google Scholar] [CrossRef]

- National Development and Reform Commission; Guide to The Development of Electric Vehicle Charging Infrastructure. Available online: http://www.ndrc.gov.cn/zcfb/zcfbtz/201511/t20151117_758762.html (accessed on 12 April 2019).

- International Energy Agency. Global EV Outlook 2017; IEA: Paris, France, 2017. [Google Scholar]

- Cooper, A.; Shefter, K. Plug-in Electric Vehicle Sales Forecast through 2025 and the Charging Infrastructure Required; Institute for Electric Innovation and Edison Electric Institute: Washington, DC, USA, 2017. [Google Scholar]

- Wood, E.; Rames, C.; Muratori, M.; Raghavan, S.; Melaina, M. National Plug-In Electric Vehicle Infrastructure Analysis; National Renewable Energy Lab.: Golden, CO, USA, 2017. [Google Scholar]

- Harrison, G.; Thiel, C. An exploratory policy analysis of electric vehicle sales competition and sensitivity to infrastructure in Europe. Technol. For. Social Chang. 2017, 114, 165–178. [Google Scholar] [CrossRef]

- Gnann, T.; Funke, S.; Jakobsson, N.; Plötz, P.; Sprei, F.; Bennehag, A. Fast charging infrastructure for electric vehicles: Today’s situation and future needs. Transp. Res. Part D 2018, 62, 314–329. [Google Scholar] [CrossRef]

- National Renewable Energy Laboratory/California Energy Commission; Electric Vehicle Infrastructure Projection Tool (EVI-Pro) Lite. Available online: https://afdc.energy.gov/evi-pro-lite (accessed on 12 April 2019).

- Pasaoglu, G.; Fiorello, D.; Zani, L.; Zubaryeva, A.; Thiel, C.; Martino, A. Projections for Electric Vehicle Load Profiles in Europe Based on Travel Survey Data; Publications Office of the European Union: Luxembourg, 2013. [Google Scholar]

- De Gennaro, M.; Paffumi, E.; Scholz, H.; Martini, G. GIS-driven analysis of e-mobility in urban areas: An evaluation of the impact on the electric energy grid. Appl. Energy 2014, 124, 94–116. [Google Scholar] [CrossRef]

- Loisel, R.; Pasaoglu, G.; Thiel, C. Large-scale deployment of electric vehicles in Germany by 2030: An analysis of grid-to-vehicle and vehicle-to-grid concepts. Energy Policy 2014, 65, 432–443. [Google Scholar] [CrossRef]

- De Gennaro, M.; Paffumi, E.; Martini, G. Customer-driven design of the recharge infrastructure and Vehicle-to-Grid in urban areas: A large-scale application for electric vehicles deployment. Energy 2015, 82, 294–311. [Google Scholar] [CrossRef]

- Flammini, M.G.; Prettico, G.; Julea, A.; Fulli, G.; Mazza, A.; Chicco, G. Statistical characterisation of the real transaction data gathered from electric vehicle charging stations. Electr. Power Syst. Res. 2019, 166, 136–150. [Google Scholar] [CrossRef]

- Hafez, O.; Bhattacharya, K. Optimal design of electric vehicle charging stations considering various energy resources. Renew. Energy 2017, 107, 576–589. [Google Scholar] [CrossRef]

- Tsakalidis, A.; Thiel, C. Electric vehicles in Europe from 2010 to 2017: Is Full-Scale Commercialisation Beginning? Publications Office of the European Union: Luxembourg, 2018. [Google Scholar]

- Thiel, C.; Alemanno, A.; Scarcella, G.; Zubareyeva, A.; Pasaoglu, G. Attitude of European Car Drivers Towards Electric Vehicles: A Survey; Publications Office of the European Union: Luxembourg, 2012. [Google Scholar]

- Donati, A.V.; Dilara, P.; Thiel, C.; Spadaro, A.; Gkatzoflias, D.; Drossinos, Y. Individual Mobility: From Conventional to Electric Cars; Publications Office of the European Union: Luxembourg, 2015. [Google Scholar]

- Thiel, C.; Julea, A.; Acosta Iborra, B.; De Miguel Echevarria, N.; Peduzzi, E.; Pisoni, E.; Gómez Vilchez, J.J.; Krause, J. Assessing the Impacts of Electric Vehicle Recharging Infrastructure Deployment Efforts in the European Union. Energies 2019, 12, 2409. [Google Scholar] [CrossRef]

- Thiel, C.; Nijs, W.; Simoes, S.; Schmidt, J.; van Zyl, A.; Schmid, E. The impact of the EU car CO2 regulation on the energy system and the role of electro-mobility to achieve transport decarbonisation. Energy Policy 2016, 96, 153–166. [Google Scholar] [CrossRef]

- Lévay, P.Z.; Drossinos, Y.; Thiel, C. The effect of fiscal incentives on market penetration of electric vehicles: A pairwise comparison of total cost of ownership. Energy Policy 2017, 105, 524–533. [Google Scholar] [CrossRef]

- Hardman, S. Understanding the impact of reoccurring and non-financial incentives on plug-in electric vehicle adoption—A review. Transp. Res. Part A Policy Pract. 2019, 119, 1–14. [Google Scholar] [CrossRef]

- European Parliament and Council of the European Union. Directive 2014/94/EU of the European Parliament and of the Council of 22 October 2014 on the deployment of alternative fuels infrastructure, Text with EEA relevance. Off. J. Eur. Union 2014, L307, 1–20. [Google Scholar]

- European Commission. Energy Union Package—A Framework Strategy for a Resilient Energy Union with a Forward-Looking Climate Change Policy; COM/2015/080 Final; European Commission: Brussels, Belgium, 2015. [Google Scholar]

- European Commission. Towards an Integrated Strategic Energy Technology (SET) Plan: Accelerating the European Energy System Transformation; C/2015/6317 Final; European Commission: Brussels, Belgium, 2015. [Google Scholar]

- European Commission. A European Strategy for Low-Emission Mobility; COM/2016/0501 Final; European Commission: Brussels, Belgium, 2016. [Google Scholar]

- European Commission. Accelerating Clean Energy Innovation; COM/2016/0763 Final; European Commission: Brussels, Belgium, 2016. [Google Scholar]

- European Commission. Towards Clean, Competitive and Connected Mobility: the Contribution of Transport Research and Innovation to the Mobility Package; SWD/2017/0223 Final; European Commission: Brussels, Belgium, 2017. [Google Scholar]

- European Commission. A Clean Planet for all A European Strategic Long-Term Vision for a Prosperous, Modern, Competitive and Climate Neutral Economy; COM/2018/773 Final; European Commission: Brussels, Belgium, 2018. [Google Scholar]

- Hardman, S.; Tal, G.; Turrentine, T.; Axsen, J.; Beard, G.; Daina, N.; Figenbaum, E.; Jakobsson, N.; Jenn, A.; Jochem, P.; et al. Driving the Market for Plug-in Vehicles: Developing Charging Infrastructure for Consumers, Policy Guide; International EV Policy Council, Plug-in Hybrid & Electric Vehicle Research Center, University of California: Davis, CA, USA, 2018. [Google Scholar]

- ACEA. ACEA Tax Guide 2018; ACEA—European Automobile Manufacturers Association: Brussels, Belgium, 2018. [Google Scholar]

- German, R.; Pridmore, A.; Ahlgren, C.; Williamson, T.; Nijland, H. Vehicle Emissions and Impacts of Taxes and Incentives in the Evolution of Past Emissions EIONET Report — ETC/ACM 2018/1; ETC/ACM: Bilthoven, The Netherlands, 2018. [Google Scholar]

- Office for Low Emission Vehicles. Tax Benefits for Ultra Low Emission Vehicles, Version 6.1. Available online: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/709655/ultra-low-emission-vehicles-tax-benefits.pdf (accessed on 19 June 2019).

- Bauer Consumer Media Ltd. Your Complete Guide to BIK Tax. Available online: https:/www.parkers.co.uk/company-cars/what-is-bik/ (accessed on 19 June 2019).

- Go Ultra Low Tax Benefits. Available online: https://www.goultralow.com/company-cars-and-fleet-vehicles/tax-benefits/ (accessed on 19 June 2019).

- European Commission. Staff Working Document—Detailed Assessment of the National Policy Frameworks; SWD (2017) 365; European Commission: Brussels, Belgium, 2017. [Google Scholar]

- European Alternative Fuels Observatory European Alternative Fuels Observatory. Available online: http://www.eafo.eu/ (accessed on 19 June 2019).

- European Commission. Staff Working Document—Report on the Assessment of the Member States National Policy Frameworks for the Development of the Market as Regards Alternative Fuels in the Transport Sector and the Deployment of the Relevant Infrastructure Pursuant to Article; Article 10 (2) of Directive 2014/94/EU-SWD(2019) 29 Final; European Commission: Brussels, Belgium, 2019. [Google Scholar]

- Figenbaum, E.; Kolbenstvedt, M. Pathways to Electromobility—Perspectives Based on Norwegian Experiences; Institute of Transport Economics (TØI): Oslo, Norway, 2015. [Google Scholar]

- International Energy Agency. Nordic EV Outlook 2018—Insights from Leaders in Electric Mobility; IEA: Paris, France, 2018. [Google Scholar]

- Iceland Magazine. Government Unveils Steps to Combat Climate Change: Vehicles using Fossil Fuels Banned in 2030. Available online: https://icelandmag.is/article/government-unveils-steps-combat-climate-change-vehicles-using-fossil-fuels-banned-2030 (accessed on 27 June 2019).

- Confédération Suisse-DETEC. Feuille de Route Pour la Mobilité Électrique 2022; Confédération Suisse-DETEC: Bern, Switzerland, 2018. [Google Scholar]

- Incentives for Cleaner Vehicles in Urban Europe (I-CVUE). Available online: https://ec.europa.eu/energy/intelligent/projects/en/printpdf/projects/i-cvue (accessed on 19 June 2019).

- Murray, J. Bonus Depreciation and How It Affects Business Taxes. Available online: https://www.thebalancesmb.com/what-is-bonus-depreciation-398144 (accessed on 19 June 2019).

| Support Measures Categories | Sub-Categories |

|---|---|

| Acquisition incentives (AI) (incentives affecting the vehicle purchase, that are effective in influencing purchasing decisions [51,52]) | Purchase incentives (possibly differentiated on CO2 emission level) |

| Reduced loan interest for acquisition | |

| Public procurement incentives | |

| Purchase tax reduction/exemption | |

| Registration tax reduction/exemption | |

| Import tax reduction/exemption | |

| Income tax reduction | |

| Scrappage for replacement schemes | |

| VAT tax reduction/exemption | |

| Conversion cost credit | |

| Bonus/malus schemes | |

| Other | |

| Recurring financial incentives (operational) (RFI) (fiscal policies affecting the cost of ownership and use, generating financial advantages for consumers [51]) | Annual circulation/ownership/road tax reduction/exemption |

| Free recharging | |

| Fuel tax reduction | |

| Road tolls reduction/exemption | |

| Congestion or low/zero emission zone charges reduction/exemption | |

| Parking incentive | |

| Reduced VAT on leasing | |

| Other | |

| Recurring non-financial incentives (RNFI) (operational non-financial benefits for PEVs and recharging infrastructure use [52]) | Parking priorities |

| Restricted lane use | |

| Access in low/zero emission zones | |

| Other (education, demo, information, outreach programs) | |

| Infrastructure incentives (II) [52] | Incentives to install RPs for home/business use |

| Charging facilities for PEVs | |

| Company-specific incentives (CSI) (leading to benefits for companies and their employees, facilitating investments in clean technology, and making these investments partially deductible from corporate and income taxes [52,53,54,55]) | Benefit-in-kind taxation |

| Capital allowance | |

| Salary sacrifice | |

| Extra depreciation rule | |

| VAT deduction | |

| Annual circulation/ownership/road tax reduction/exemption | |

| Other |

| Country | Code | Acquisition Incentives | Recurring Financial Incentives | Recurring Non-Financial Incentives | Infrastructure Incentives | Company-Specific Incentives |

|---|---|---|---|---|---|---|

| Austria | AT | |||||

| Belgium | BE | |||||

| Bulgaria | BG | |||||

| Switzerland | CH | |||||

| Cyprus | CY | |||||

| Czechia | CZ | |||||

| Germany | DE | |||||

| Denmark | DK | |||||

| Estonia | EE | |||||

| Greece | EL | |||||

| Spain | ES | |||||

| Finland | FI | |||||

| France | FR | |||||

| Croatia | HR | |||||

| Hungary | HU | |||||

| Ireland | IE | |||||

| Iceland | IS | |||||

| Italy | IT | |||||

| Lithuania | LT | |||||

| Luxembourg | LU | |||||

| Latvia | LV | |||||

| Malta | MT | |||||

| Netherlands | NL | |||||

| Norway | NO | |||||

| Poland | PL | |||||

| Portugal | PT | |||||

| Romania | RO | |||||

| Sweden | SE | |||||

| Slovenia | SI | |||||

| Slovakia | SK | |||||

| United Kingdom | UK | |||||

| Planned for the future | ||||||

| Present and planned for the future | ||||||

| Past and discontinued | ||||||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tsakalidis, A.; Julea, A.; Thiel, C. The Role of Infrastructure for Electric Passenger Car Uptake in Europe. Energies 2019, 12, 4348. https://doi.org/10.3390/en12224348

Tsakalidis A, Julea A, Thiel C. The Role of Infrastructure for Electric Passenger Car Uptake in Europe. Energies. 2019; 12(22):4348. https://doi.org/10.3390/en12224348

Chicago/Turabian StyleTsakalidis, Anastasios, Andreea Julea, and Christian Thiel. 2019. "The Role of Infrastructure for Electric Passenger Car Uptake in Europe" Energies 12, no. 22: 4348. https://doi.org/10.3390/en12224348

APA StyleTsakalidis, A., Julea, A., & Thiel, C. (2019). The Role of Infrastructure for Electric Passenger Car Uptake in Europe. Energies, 12(22), 4348. https://doi.org/10.3390/en12224348