IGDT-Based Wind–Storage–EVs Hybrid System Robust Optimization Scheduling Model

Abstract

:1. Introduction

2. Wind–Storage–EVs Hybrid System Joint Scheduling Model

2.1. Objective Function

2.2. Constraints

3. IGDT-Based Robust Scheduling Decision Model

3.1. Overview of IGDT-Based Robust Model

3.2. Derivation of Robust Scheduling Decision Model

4. Model Solving

5. Numerical Results

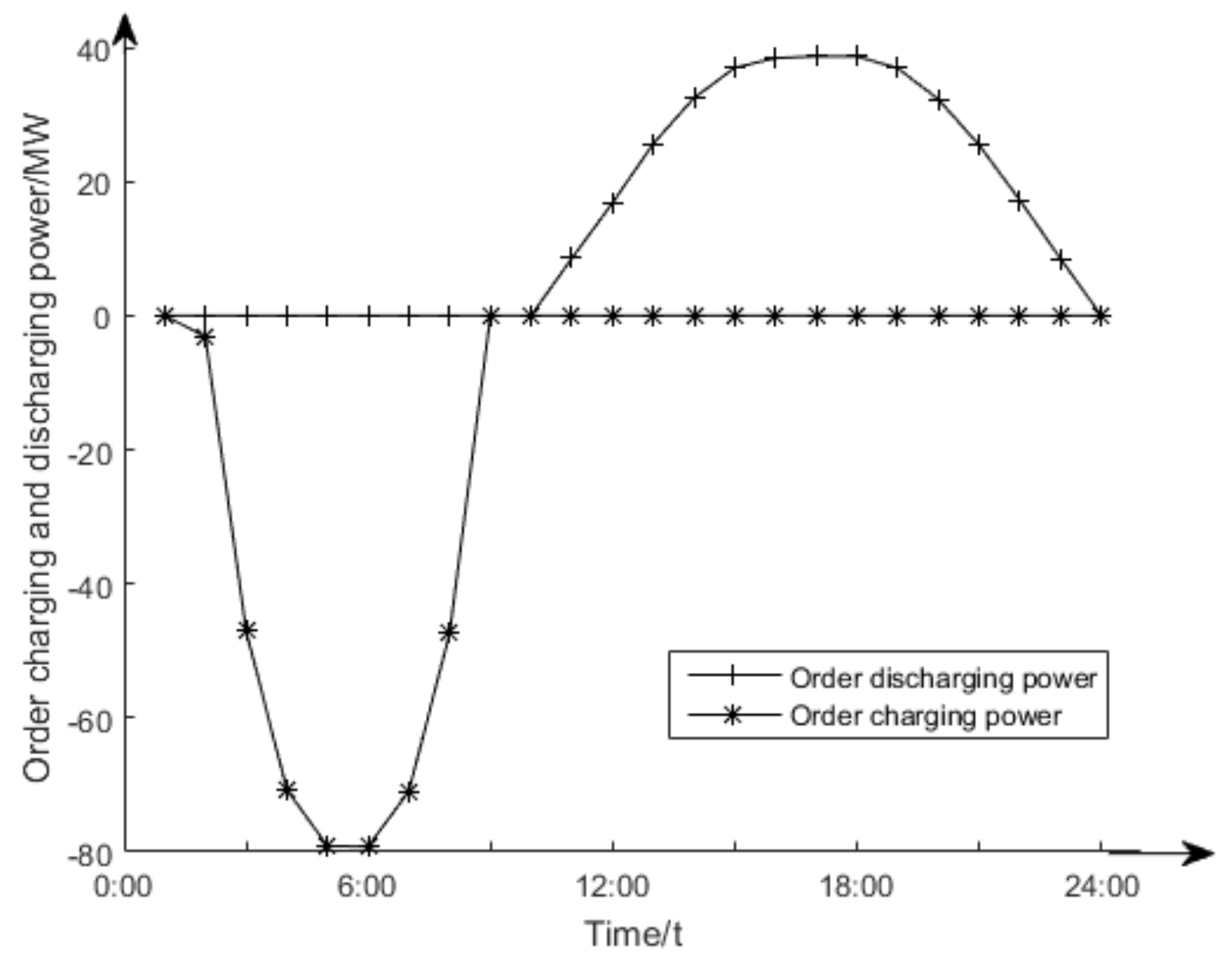

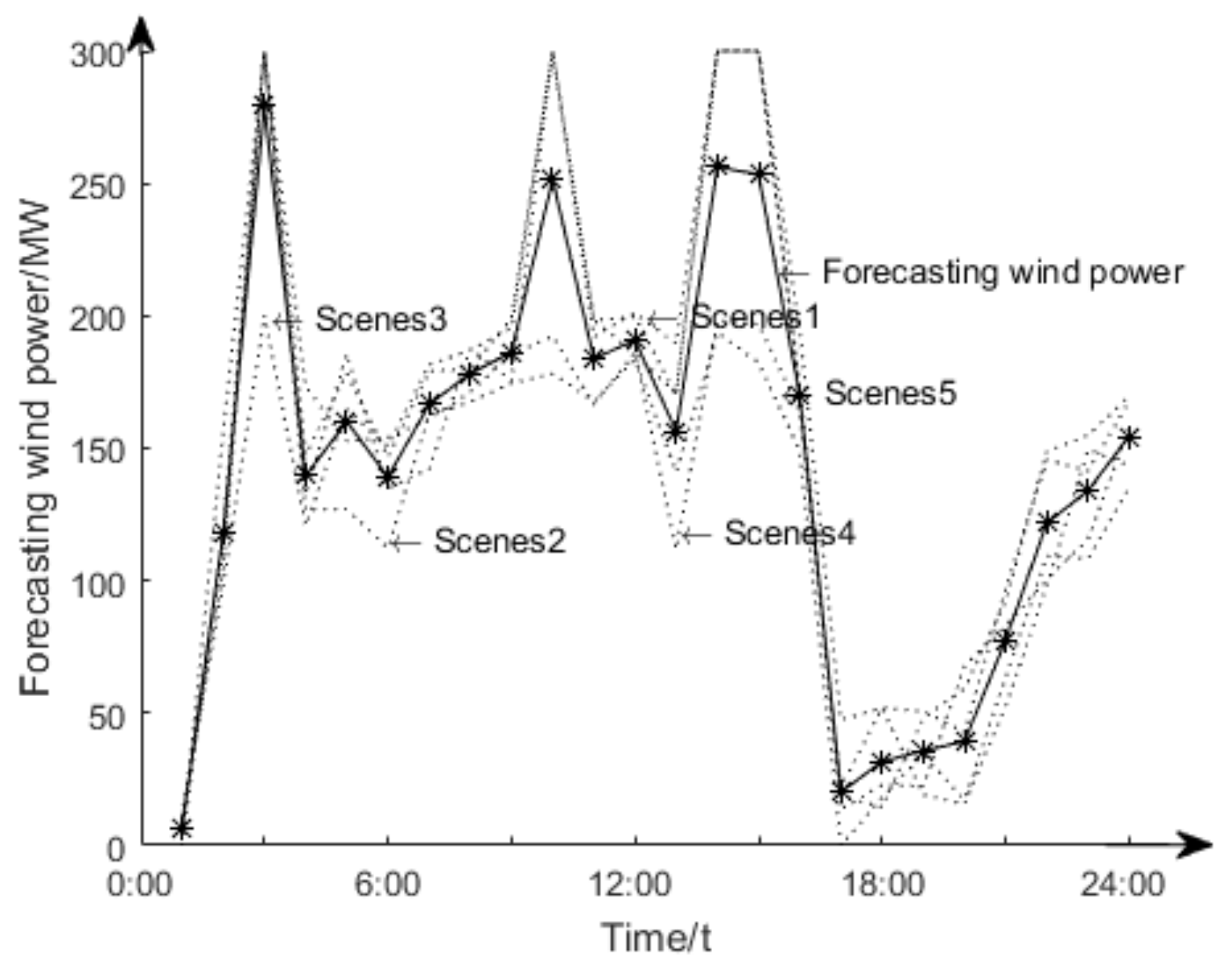

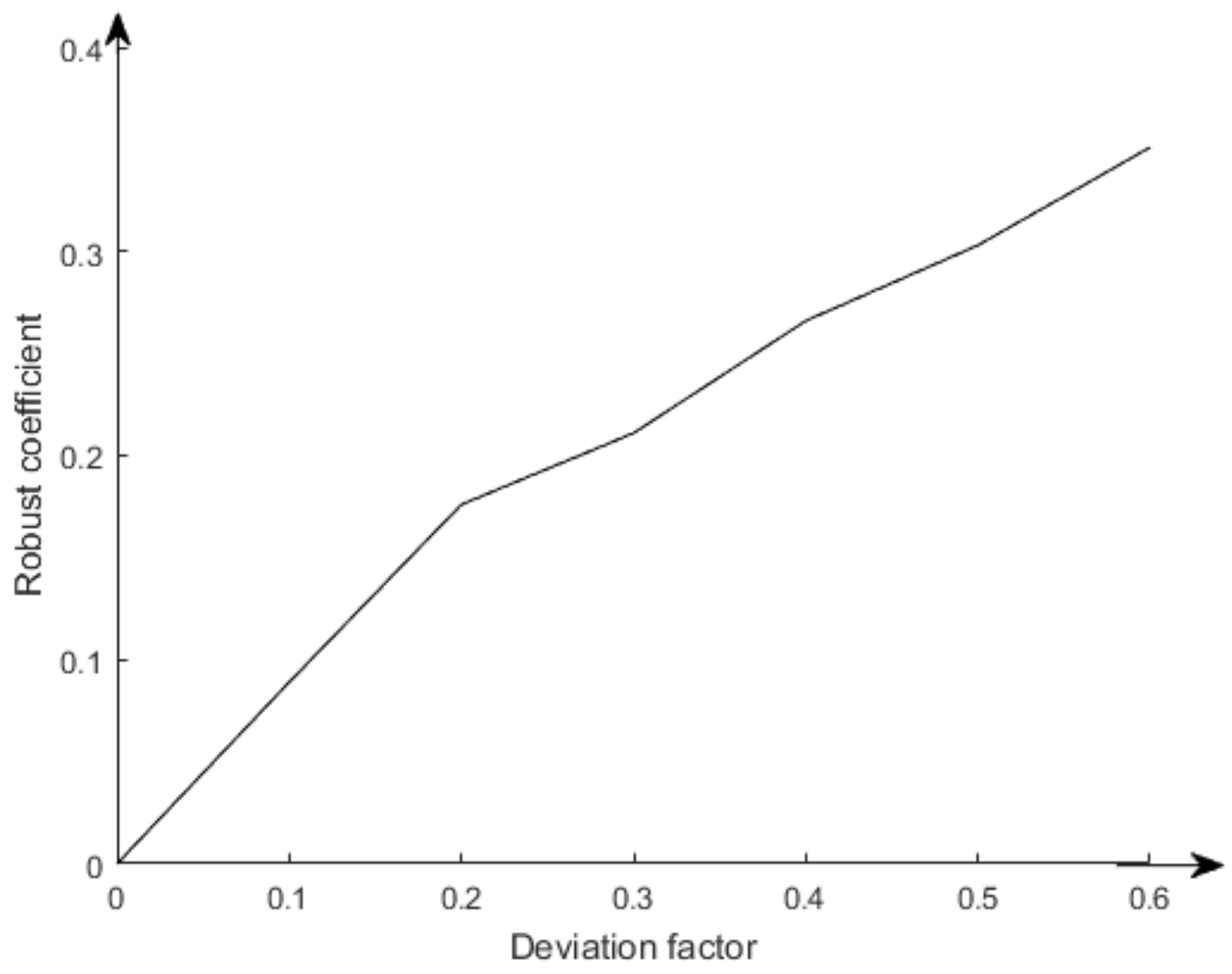

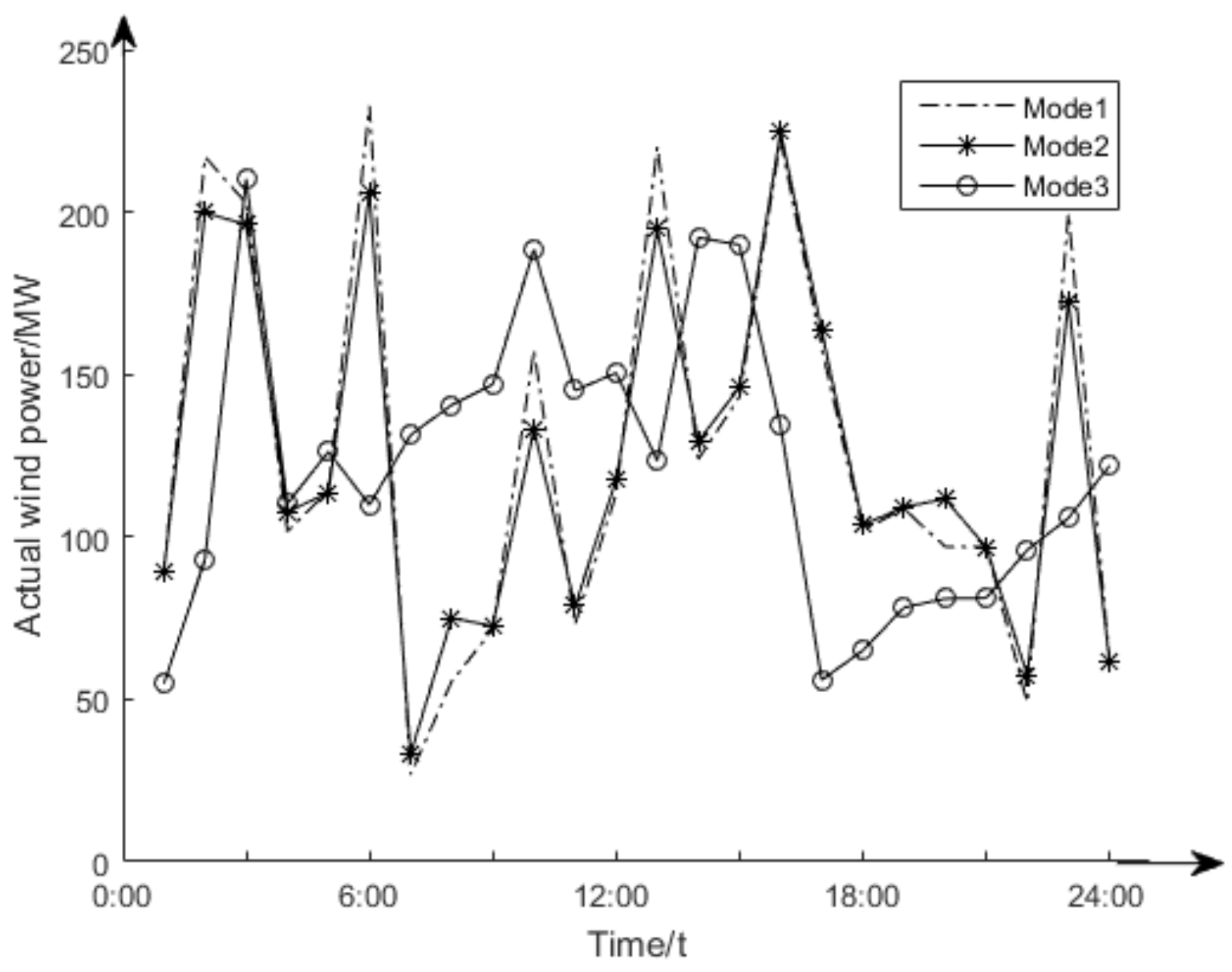

5.1. Simulation Results

5.2. Analysis of Simulation Results

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

Nomenclature

| t | Time index (h) |

| G | The total number of EVs |

| Energy content at the initial time (MW) | |

| Energy content at the stop time (MW) | |

| Limit of charging and discharging conversion frequency | |

| Maximum power limit (MW) | |

| Minimum power limit (MW) | |

| Maximum and minimum discharge power (MW) | |

| Maximum and minimum charge power (MW) | |

| Charging efficiency of EVs | |

| Discharging efficiency of EVs | |

| Forecasting wind power output at time t (MW) | |

| Maximum wind power output at time t (MW) | |

| Uncertainty variable | |

| On-grid price ($/MWh) | |

| Wind power scheduling at time t (MW) | |

| Discharge power of EVs at time t (MW) | |

| Charge power of EVs at time t (MW) | |

| Charging and discharging power of vehicle at time (MW) | |

| Demand response costs at time t ($) | |

| Binary variable, which is equal to 1,if the EV is selected to charge at time t; otherwise, it is 0 | |

| Binary variable, which is equal to 1,if the EV is selected to discharge at time t; otherwise, it is 0 | |

| “Robustness” function |

References

- Lv, Q. Dynamic Economic Dispatching and Energy Saving Dispatching of Power Systems with Wind/water/thermal Power. Master’s Thesis, Chongqing University, Chongqing, China, 2012. [Google Scholar]

- Ignatieva, K.; Trvck, S. Modeling spot price dependence in Australian electricity markets with applications to risk management. Comput. Oper. Res. 2016, 66, 415–433. [Google Scholar] [CrossRef]

- Maghouli, P.; Hosseini, S.H.; Buygi, M.O.; Shahidehpour, M. A Scenario-Based Multi-Objective Model for Multi-Stage Transmission Expansion Planning. IEEE Trans. Power Syst. 2011, 26, 470–478. [Google Scholar] [CrossRef]

- Cui, M.; Sun, Y.; Ke, D. Prediction of wind power hill climbing events based on atomic sparse decomposition and BP neural network. Autom. Electr. Power Syst. 2014, 38, 6–11. [Google Scholar]

- National Energy Administration. 2017 wind power grid operation. Chin. Energy 2018. [Google Scholar]

- Wu, X.; Wang, X.; Li, J.; Guo, J.; Zhang, K.; Chen, J. Joint scheduling model and solution for wind power storage hybrid system. Proc. Chin. Soc. Electr. Eng. 2013, 33, 10–17. [Google Scholar]

- Gill, S.; Ault, G.W.; Kockar, I. The optimal operation of energy storage in a wind power curtailment scheme. In Proceedings of the 2012 IEEE Power and Energy Society General Meeting, San Diego, CA, USA, 22–26 July 2012; pp. 1–8. [Google Scholar]

- Sun, H.; Liu, X.; Qi, C.; Yu, J.; Hu, W.; Zhou, W. Multi-objective risk scheduling model for power system with integrated wind power storage station. Autom. Electr. Power Syst. 2018, 42, 94–101. [Google Scholar]

- Zhang, N.; Kang, C.; Kirschen, D.S.; Xia, Q.; Xi, W.; Huang, J.; Zhang, Q. Planning pumped storage capacity for wind power integration. IEEE Trans. Sustain. Energy 2013, 4, 393–401. [Google Scholar] [CrossRef]

- Dukpa, A.; Duggal, I.; Venkatesh, B.; Chang, L. Optimal participation and risk mitigation of wind generators in an electricity market. IET Renew. Power Gener. 2010, 4, 165–175. [Google Scholar] [CrossRef]

- Yu, D.; Song, S.; Zhang, B.; Han, X. Analysis of Electric Vehicle Charging and Wind Power Coordination Scheduling in Regional Power Grid. Autom. Electr. Power Syst. 2011, 35, 24–29. [Google Scholar]

- Fu, Y.; Jia, C.; Xue, C.; Zhang, B. Application of Electric Vehicles in Improving the Reliability of Wind Power Grids. Electr. Power Syst. Autom. 2018, 30, 29–34. [Google Scholar]

- Abreu, L.V.; Khodayar, M.E.; Shahidehpour, M.; Wu, L. Risk-constrained coordination of cascaded hydro units with variable wind power generation. IEEE Trans. Sustain. Energy 2012, 3, 359–368. [Google Scholar] [CrossRef]

- Wang, J.; Shahidehpour, M.; Li, Z. Security constrained unit commitment with volatile wind power generation. IEEE Trans. Power Syst. 2008, 23, 1319–1327. [Google Scholar] [CrossRef]

- Hargreaves, J.J.; Hobbs, B.F. Commitment and dispatch with uncertain wind generation by dynamic programming. IEEE Trans. Sustain. Energy 2012, 3, 724–734. [Google Scholar] [CrossRef]

- Wang, G.; Zhao, J.; Wen, F.; Xue, Y.; Xin, J. Synchronous Cooperative Scheduling of Electric Vehicles and Renewable Energy in Distribution Systems. Autom. Electr. Power Syst. 2012, 36, 22–29. [Google Scholar]

- Venkatesh, B.; Yu, P.; Gooi, H.B.; Choling, D. Fuzzy MILP Unit Commitment Incorporating Wind Generators. IEEE Trans. Power Syst. 2008, 23, 1738–1746. [Google Scholar] [CrossRef]

- Andreoni, A.M.; Agreda, A.G.; Strada, T.J.; Saraiva, J.T. Strategies for power systems expansion planning in a competitive electrical market. Electr. Eng. 2007, 89, 433–441. [Google Scholar] [CrossRef]

- Vome, A.F. Info-gap Decision Theory. Ecol. Model. 2006, 211, 249. [Google Scholar]

- Wright, L.F. Information Gap Decision Theory: Decisions under Severe Uncertainty by Y. Ben-Haim. J. R. Stat. Soc. 2010, 167, 185–186. [Google Scholar] [CrossRef]

- Fortuna, L.; Nunnari, G.; Nunnari, S. Nonlinear Modeling of Solar Radiation and Wind Speed Time Series; Springerbriefs in Energy; Springer: Cham, Switzerland, 2016; Volume 10. [Google Scholar] [CrossRef]

- Chen, K.; Wu, W.; Zhang, B.; Sun, H. Robust restoration decision-making model for distribution networks based on information gap decision theory. IEEE Trans. Smart Grid 2015, 6, 587–597. [Google Scholar] [CrossRef]

- Mohammadi-Ivatloo, B.; Zareipour, H.; Amjady, N.; Ehsan, M. Application of information-gap decision theory to risk-constrained self-scheduling of GenCos. IEEE Trans. Power Syst. 2013, 28, 1093–1102. [Google Scholar] [CrossRef]

- Chen, Y.; Wu, W.; Zhang, B. Robust Restoration Decision Method for Active Distribution Network Based on IGDT. Proc. CSEE 2014, 34, 3057–3062. [Google Scholar]

- Ma, H.; Liu, Y. Coordinated Scheduling Decision of Wind Power Climbing Event Based on IGDT Robust Model. Proc. CSEE 2016, 36, 4580–4588. [Google Scholar]

- Rabiee, A.; Soroudi, A.; Keane, A. Information gap decision theory based OPF with HVDC connected wind farms. IEEE Trans. Power Syst. 2015, 30, 3396–3406. [Google Scholar] [CrossRef]

- Murphy, C.; Soroudi, A.; Keane, A. Information Gap Decision Theory-based congestion and voltage management in the presence of uncertain wind power. IEEE Trans. Sustain. Energy 2016, 7, 841–849. [Google Scholar] [CrossRef]

- Zhao, J.; Wan, C.; Xu, Z.; Wang, J. Risk-Based Day-Ahead Scheduling of Electric Vehicle Aggregator Using Information Gap Decision Theory. IEEE Trans. Smart Grid 2017, 8, 1609–1618. [Google Scholar] [CrossRef]

- Nojavan, S.; Zare, K.; Feyzi, M.R. Optimal bidding strategy of generation station in power market using information gap decision theory (IGDT). Electr. Power Syst. Res. 2013, 96, 56–63. [Google Scholar] [CrossRef]

- Mathuria, P.; Bhakar, R. GenCo’s integrated trading decision making to manage multimarket uncertainties. IEEE Trans. Power Syst. 2015, 30, 1465–1474. [Google Scholar] [CrossRef]

- Zhao, W.; Zhang, S. Power Generation Strategy of Power Generation Based on Information Clearance Decision Theory. Control Decis. 2017, 32, 751–754. [Google Scholar]

- Volpe, R.; Frasca, M.; Fichera, A. The role of autonomous energy production systems in urban energy networks. J. Complex Netw. 2017, 3, 461–472. [Google Scholar] [CrossRef]

- Nojavan, S.; Ghesmati, H.; Zare, K. Robust optimal offering strategy of large consumer using IGDT considering demand response programs. Electr. Power Syst. Res. 2016, 130, 46–58. [Google Scholar] [CrossRef]

- Dai, Y.; Chen, L.; Yong, Y. Optimized scheduling of combined operation of wind farms and cogeneration with heat storage. Proc. Chin. Soc. Electr. Eng. 2017, 37, 3470–3489. [Google Scholar]

- Yao, W.; Zhao, J.; Wen, F.; Xue, Y.; Xin, J. Charge and Discharge Scheduling Strategy of Electric Vehicle Based on Double Layer Optimization. Autom. Electr. Power Syst. 2012, 36, 30–37. [Google Scholar]

- Tian, L.; Shi, S.; Jia, Z. Statistical Modeling Method for Charging Power Demand of Electric Vehicles. Power Grid Technol. 2010, 34, 126–130. [Google Scholar]

- Ghofrani, M.; Arabali, A.; Etezadi-Amoli, M.; Fadali, M.S. Smart Scheduling and Cost-Benefit Analysis of Grid-Enabled Electric Vehicles for Wind Power Integration. IEEE Trans. Smart Grid 2014, 5, 2306–2313. [Google Scholar] [CrossRef]

- Matevosyan, J.; Svder, L. Minimization of imbalance cost trading wind power on the short-term power market. IEEE Trans. Power Syst. 2006, 21, 1396–1404. [Google Scholar] [CrossRef]

| Time Division | Time | Purchase Price ($/MW) | Sale Price ($/MW) |

|---|---|---|---|

| Peak period | 10:00–23:00 | 106 | 92 |

| Flat period | 23:00–01:00; 08:00–10:00 | 71 | 54 |

| Valley period | 01:00–08:00 | 35 | 18 |

| Mode | Joint Operating Profit ($) | Wind Power Standard Deviation (MW) |

|---|---|---|

| Mode 1 | 16.00 | 61.45 |

| Mode 2 | 16.23 | 52.79 |

| Mode 3 | 16.12 | 48.62 |

| Mode | Joint Operating Profit ($) | Wind Power Standard Deviation (MW) |

|---|---|---|

| Mode 3 | 16.22 | 51.10 |

| Mode 4 | 15.67 | 55.69 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sun, B.; Li, S.; Xie, J.; Sun, X. IGDT-Based Wind–Storage–EVs Hybrid System Robust Optimization Scheduling Model. Energies 2019, 12, 3848. https://doi.org/10.3390/en12203848

Sun B, Li S, Xie J, Sun X. IGDT-Based Wind–Storage–EVs Hybrid System Robust Optimization Scheduling Model. Energies. 2019; 12(20):3848. https://doi.org/10.3390/en12203848

Chicago/Turabian StyleSun, Bo, Simin Li, Jingdong Xie, and Xin Sun. 2019. "IGDT-Based Wind–Storage–EVs Hybrid System Robust Optimization Scheduling Model" Energies 12, no. 20: 3848. https://doi.org/10.3390/en12203848

APA StyleSun, B., Li, S., Xie, J., & Sun, X. (2019). IGDT-Based Wind–Storage–EVs Hybrid System Robust Optimization Scheduling Model. Energies, 12(20), 3848. https://doi.org/10.3390/en12203848