1. Introduction

At present, the world’s energy development is faced with three major problems: resource shortage, environmental pollution, and climate change. The Belt and Road Initiative proposes the concept of global green energy and low-carbon development, which has to be in conformity with the theme of the global green energy transformation [

1]. With the support of China’s “one belt and one way” initiative, transnational power networking projects also contribute to balancing the development of the power industry and decreasing the population without electricity [

2]. Transnational power networking along the “one belt and one road” has been large-scale. By the end of 2015, 50 countries in 64 core countries along the route have built-up transnational transmission lines and have carried out cross-border power trade with neighboring countries [

3]. In recent years, many power enterprises have carried out overseas electric power construction projects [

4]. Because of its huge scale and high complexity, there are many core project stakeholders, such as construction units, material supply units, and supervision units. Meanwhile, governments, media, and social public welfare organizations have participated in the large-scale transnational power networking projects [

5]. Therefore, under the rubric of the “one belt and one road” power interconnection, a comprehensive systematic and scientific benefit evaluation system for transnational networking engineering was constructed from the perspective of project stakeholders, which can provide certain theoretical support for different stakeholders in making relevant decision-making activities.

With the deepening of research, the benefit evaluation of power grid construction projects has gradually expanded from economic benefits to social and ecological environment. He et al. [

6] proposed an improved evaluation index system including net present value, internal rate of return, etc. Bakhshi et al. [

7] evaluated the economic benefits of a photovoltaic grid connected power generation system. Tian et al. [

8] established an evaluation index of ultra-high voltage grid social benefits based on lifecycle cost. Sidhu et al. [

9] analyzed the benefits of grid-scale power storage location and system-wide determined the realistic combination of those social benefits, and juxtaposed them against the social costs across the useful lifecycle of the battery to determine the techno-economic performance. Zeng et al. [

10] designed the Smart distribution network environmental benefit evaluation index system covering four aspects. Zeng et al. [

11] constructed an evaluation index system for ecological environment sensitivity of typical power grid projects on the Qinghai Tibet Plateau.

In recent years, the comprehensive benefit evaluation of power grid construction projects has become a research hotspot. Xu et al. [

12] proposed a method to evaluate probabilistic comprehensive benefits of joint wind power and storage systems considering constraints of peak load regulation capacity. According to the characteristics of distribution network, Wu et al. [

13] used the analytic hierarchy process and extension evaluation method improved by interval number theory to quantify the comprehensive benefits of a distribution network project. Büyüközkan et al. [

14] used multi-criteria decision-making technology and an analytic hierarchy process to build a comprehensive evaluation index system for comprehensive evaluation of energy investment project. Du et al. [

15] introduced group judgment and exponential scaling and used improved grey system whitening weight function to evaluate the comprehensive benefits of power grid companies. Li et al. [

16] proposed an improved grey target decision model based on moment estimation method, in which combinatorial weight integration technology and the Mahalanob distance are coupled. Zhang et al. [

17] introduced variable weight theory to modify and improve the accuracy of abnormal weight and used a cloud model to evaluate a distribution network comprehensively. Zeng, et al. [

18] proposed a new development direction in the field of future integrated energy system modeling and benefit evaluation system research.

Literature on the comprehensive benefit evaluation of a power grid based on different stakeholders are scarce at home and abroad. Xia et al. [

19] identified the stakeholders of hydropower projects and their input–output factors based on stakeholder theories and highlights the four most important core stakeholders. Rahmani-andebili et al. [

20] presented details of changes in the power market regulations. In this paper, the power market players are independently modeled in the agent-based virtual power market environment, and then the power market is simulated from the regulator’s viewpoint. Ma et al. [

21] explored the decisive risks attributed to each stakeholder by considering a green development project’s stage. Xia et al. [

22] identified four linkage modes between risk and stakeholder management.

Previous studies have made some achievements, but the comprehensive benefits of multi-stakeholder transnational power networking projects have not yet formed a systematic evaluation system. In the whole project cycle, especially in the decision-making stage, different stakeholders will exert different influences on transnational power networking projects. In view of the characteristics of such projects, this paper constructs a comprehensive benefit evaluation index system from the perspective of multi-agent and proposes a matter-element extension model based on grey relational projection value. On the one hand, it verifies that the focus and evaluation results of the comprehensive benefits of such projects are quite different from the perspective of different stakeholders. On the other hand, it provides references for different stakeholders to make investment decisions and improves the comprehensiveness and objectivity of the comprehensive benefit research of such projects.

The main contributions of this paper are as follows:

- (1)

The idea of multi-stakeholders is introduced into the comprehensive benefit evaluation of such projects.

- (2)

The improved comprehensive evaluation method improves the accuracy of the results.

- (3)

The results of evaluation of such projects provide references for different stakeholders to make investment decisions.

The rest of this paper is structured as follows:

Section 2 introduces the research procedure and the method employed in this paper;

Section 3 describes the benefit index system of such projects.

Section 4 proposes a case analysis to validate the index system and the evaluation model established in this paper. The conclusions are drawn in

Section 6.

2. Methods

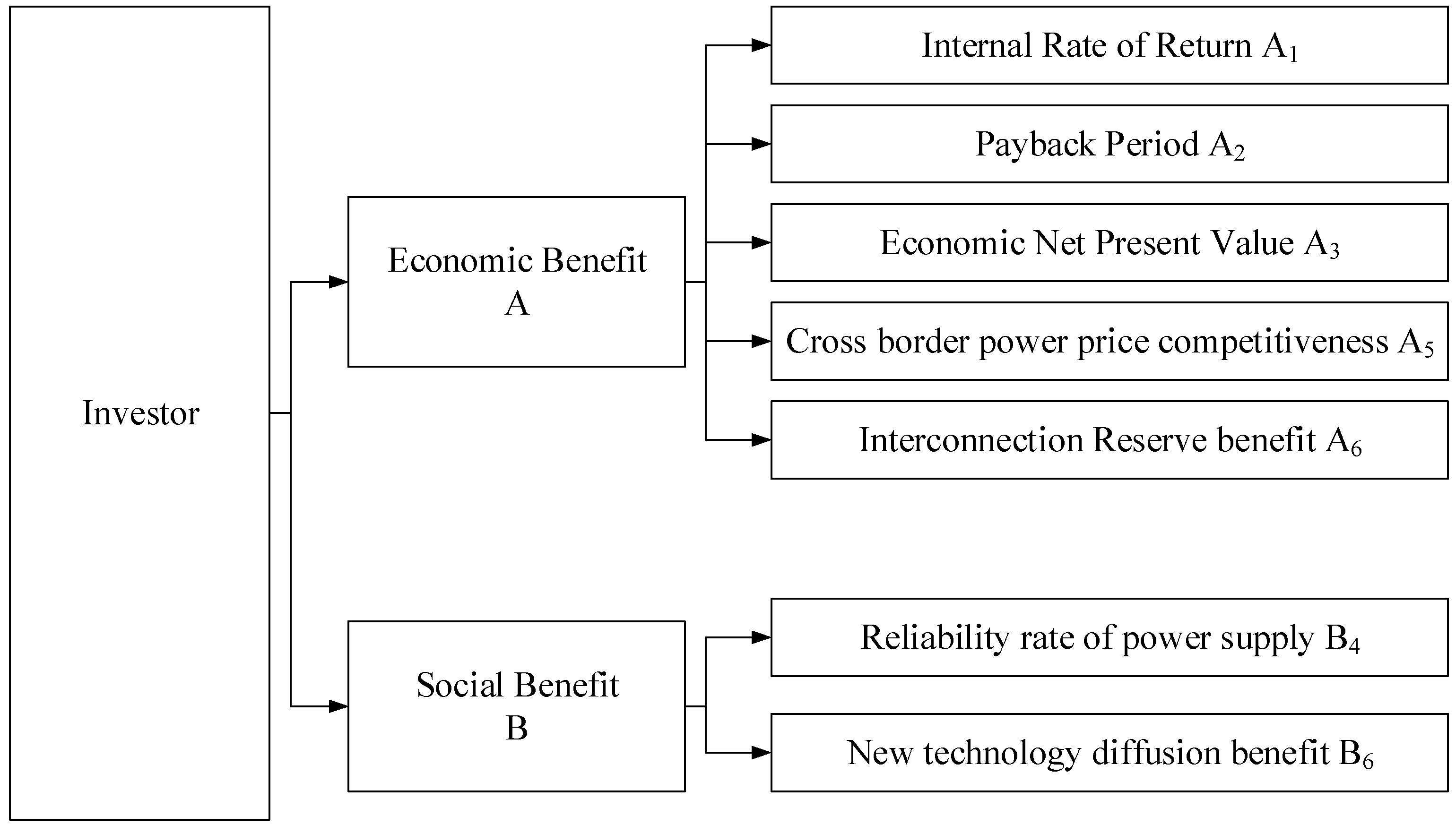

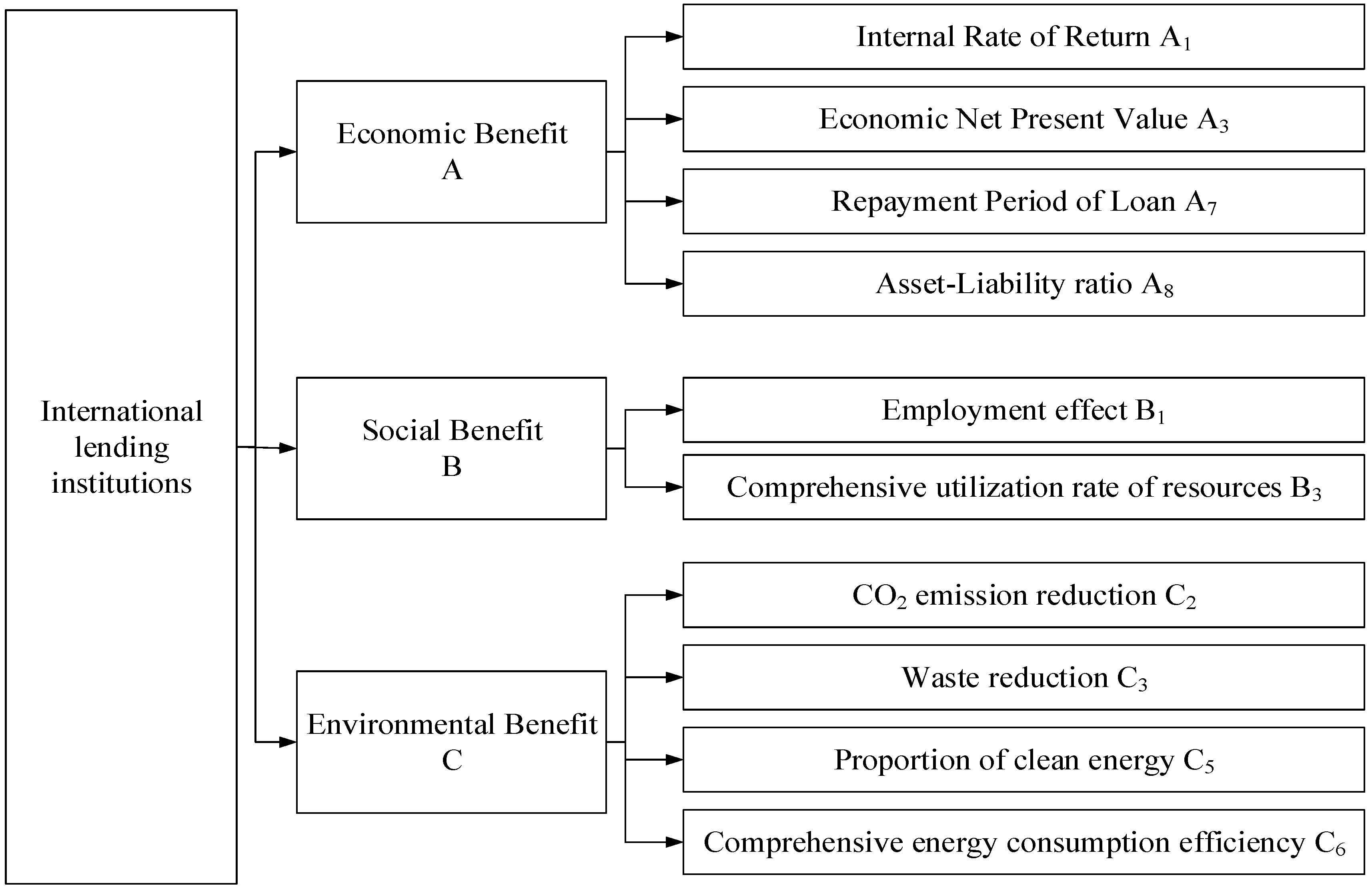

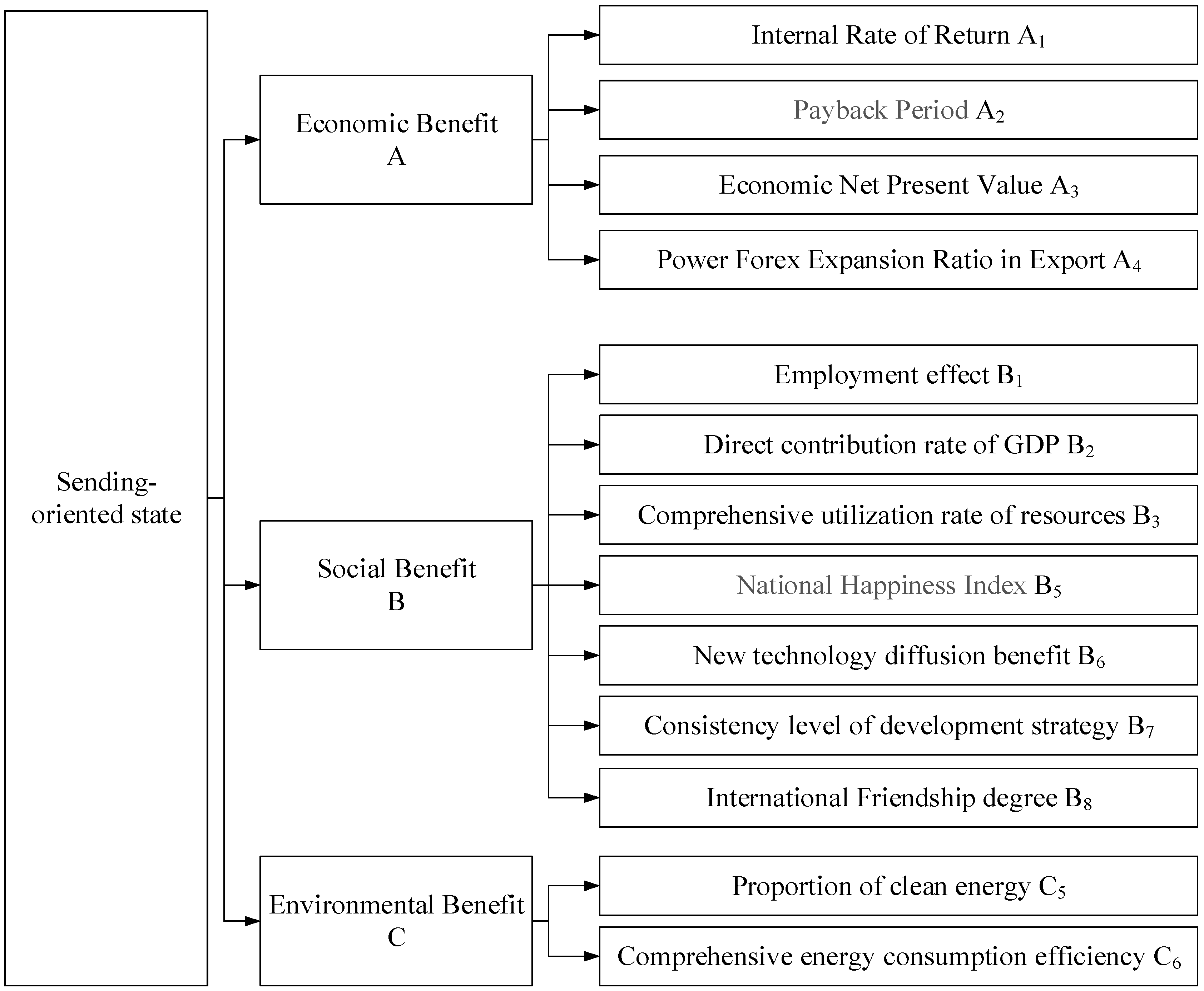

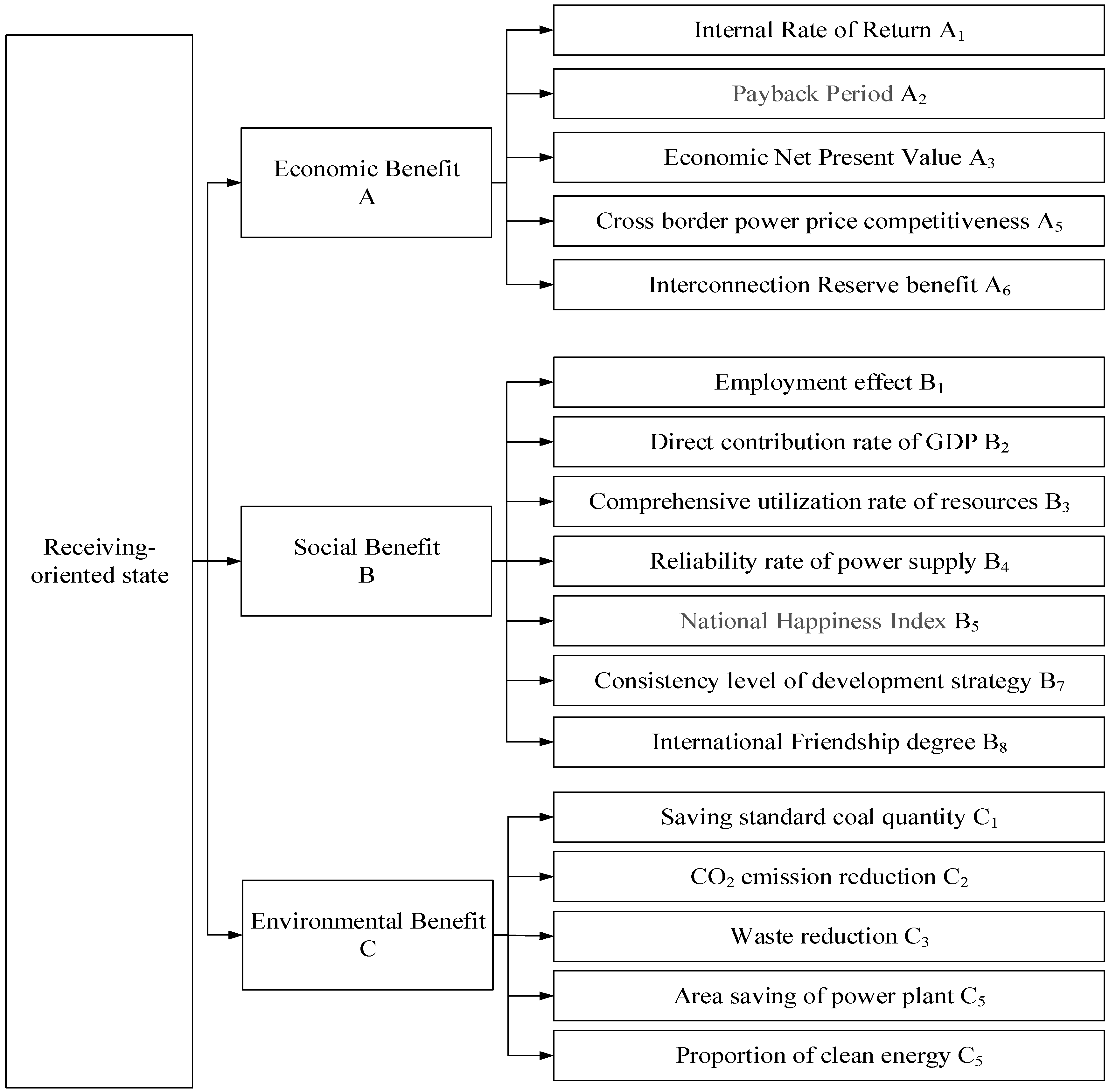

As system engineering, transnational networking projects involve many stakeholders in the whole lifecycle of the project. Among them, investors, international lending institutions, sending countries, and receiving countries are most closely related to projects. Therefore, it is necessary to stand in the perspective of different stakeholders before the implementation of the project to conduct comprehensive benefits evaluation, so as to improve the accuracy of decision-making. The research process in this paper is illustrated in

Figure 1.

2.1. Weight Determination

Index weight reflects the importance of indicators to the assessed objects [

23]. In this paper, the order relation method and Gini coefficient weighting method are combined to determine the index weight by the least squares method, which effectively improves the rationality of the results.

2.1.1. Order Relations Method

Order relations method is an intuitive and effective method to determine subjective weights. It makes full use of experts’ experience and obtains the importance ranking of all indices [

24]. The following steps constitute the order relations method:

Step 1: Determine Order Relations

The index order relation of the evaluation criterion is .

Step 2: Determine the relative importance degree of adjacent index.

The relative importance degree of adjacent index can be described as:

where

is the ratio of the importance of expert evaluation indices

and

(

).

Step 3: Determine the weight .

The weight can be calculated by following equations.

2.1.2. Gini Coefficient Weighting Method

Gini coefficient weighting method is an objective weighting method which calculates Gini coefficient and normalizes it to get index weight [

25].

Step 1: Calculating the Gini coefficient value of the evaluation index.

where

is Gini coefficient value of index

;

is the total number of objects to be evaluated;

and

are the index

of data

and

, respectively;

is the expected value of index

.

Step 2: Calculating the Gini coefficient weight of index.

where

is Gini coefficient weight of index

;

is the total number of indices.

2.1.3. Least Squares Method

The subjective weighting method embodies the value of the index, the objective weight reflects the information of the index; each has its own characteristics and the comprehensive evaluation should reflect the unification of the two. The weight of each index given by the objective weighting method is

. The optimal combination weight of each index is

. The standardized data matrix with

evaluation indices and

evaluation objects is

. The evaluation value of the evaluation object

is

,

, so as to establish the combinational evaluation model optimized by least squares method. The model is shown in the following equation [

26]:

2.2. Matter-Element Extension Model Based on Grey Relational Projection Value

The fuzzy matter-element evaluation method can synthesize multiple evaluation indexes into one index to evaluate ranking according to the degree of similarity between the sample to be evaluated and the standard sample [

27]. In this paper, the Euclid approach degree which describes the similarity degree between the sample to be evaluated and the standard sample in the fuzzy matter element analysis method is improved by combining the grey relational projection method. Moreover, the projection value of the sample to be evaluated on the standard sample is used for comprehensive evaluation. The concrete steps of the matter-element extension model based on grey relational projection value are as follows:

Step 1: Constructing dimensional compound fuzzy matter-element of things.

The characteristics of are , and its corresponding fuzzy value is . At that time, dimensional fuzzy matter element is formed. If there are things in common: , and each thing has the same characteristics: , then the dimensional compound fuzzy matter element of things is formed.

Step 2: According to the principle of preferred subjection degree, the composite fuzzy matter-element is calculated.

The evaluation indices

are transformed into “effective” indices and normalized. The equations are as follows:

Then the composite fuzzy matter-element of preferred subjection degree

is represented by:

Step 3: Calculating projection weights and projection values.

If the weight of the index

is

, then the weight of the composite fuzzy matter-element is considered as

.

is represented by:

In order to fully consider the degree of “similarity” with the standard matter element, the size of the matrix and the angle cosine are comprehensively considered by combining the correlation projection method of grey system theory. That is to say, considering the projection value of the fuzzy matter element

on the standard fuzzy matter element

, the proximity between each fuzzy matter element

and standard fuzzy matter element

can be reflected comprehensively and accurately [

28]. The projection value of

on

can be calculated by the following Formula (8).

where

is called projection weight, and comprehensive evaluation can be made according to the size of the projection value

.

Step 4: The projection values are sorted according to the numerical value so as to determine the optimal scheme.

5. Discussion

The evaluation index system established in this paper not only covers the economic, social, and environmental benefits, but also divides them from the perspective of different stakeholders.

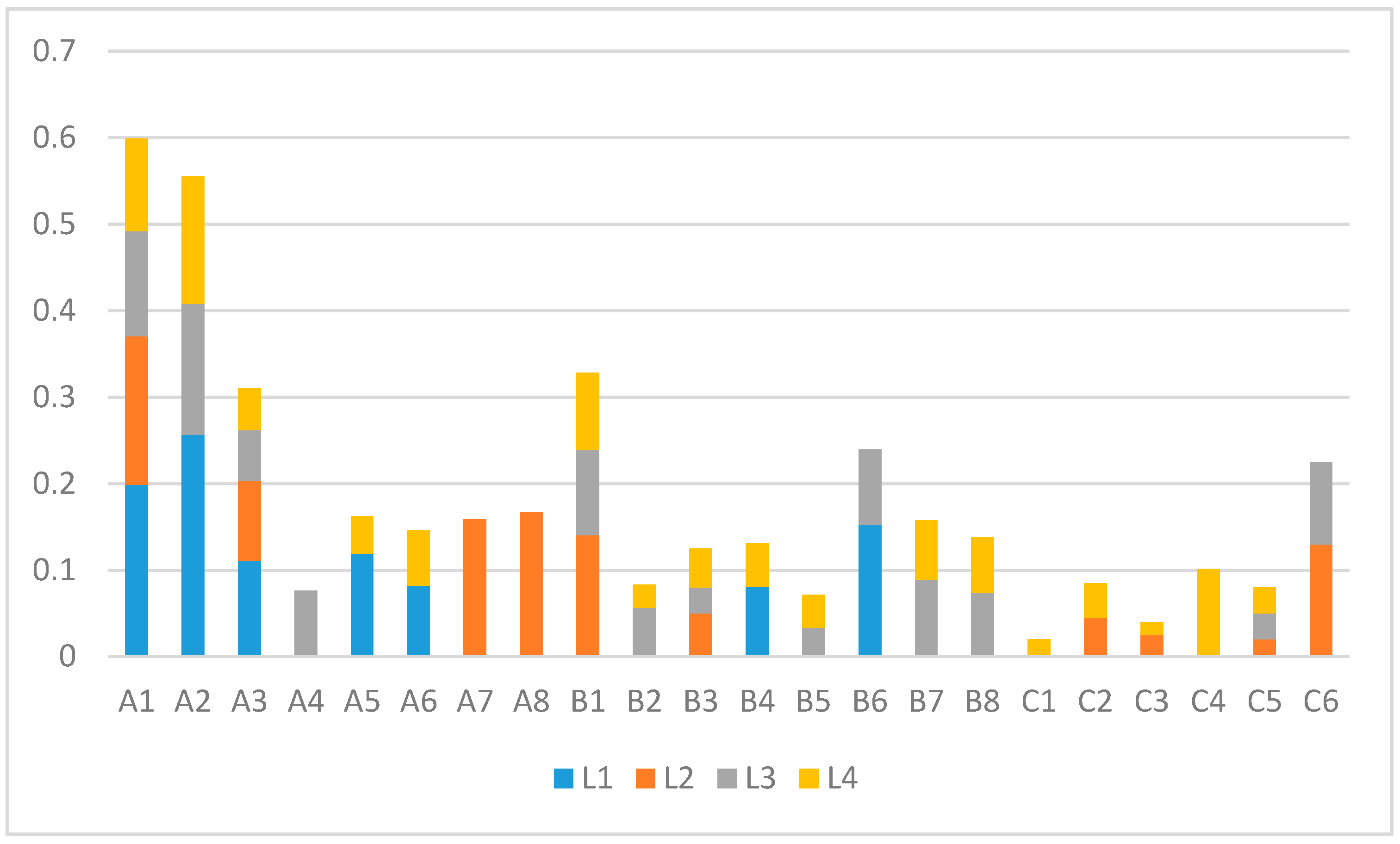

Figure 6 shows that the weight of the same index varies greatly among different stakeholders, which reflects the necessity and rationality of establishing the index system for different stakeholders. Internal rate of return and economic net present value are indices considered in the comprehensive benefit evaluation of the four stakeholders. In particular, the power forex expansion ratio is only included in the index system of the sending-oriented states, and the payback period and asset-liability ratio are only considered by the international lending institutions. Area saving of power plant is only within the scope of comprehensive benefit study in receiving-oriented states.

It is also shown intuitively in

Figure 7 that different stakeholders pay different attention to economic, social, and environmental benefits in the process of comprehensive benefit research. The proportions of economic, social, and environmental benefits indices in L3 were 41%, 47%, and 12%, respectively; those in L4 were 41%, 38%, and 21%, respectively; L1 only paid attention to economic and social benefits, accounting for 77% and 23%, respectively; and the proportions of economic, social, and environmental benefits indices in L2 were 59%, 19%, and 22%, respectively.

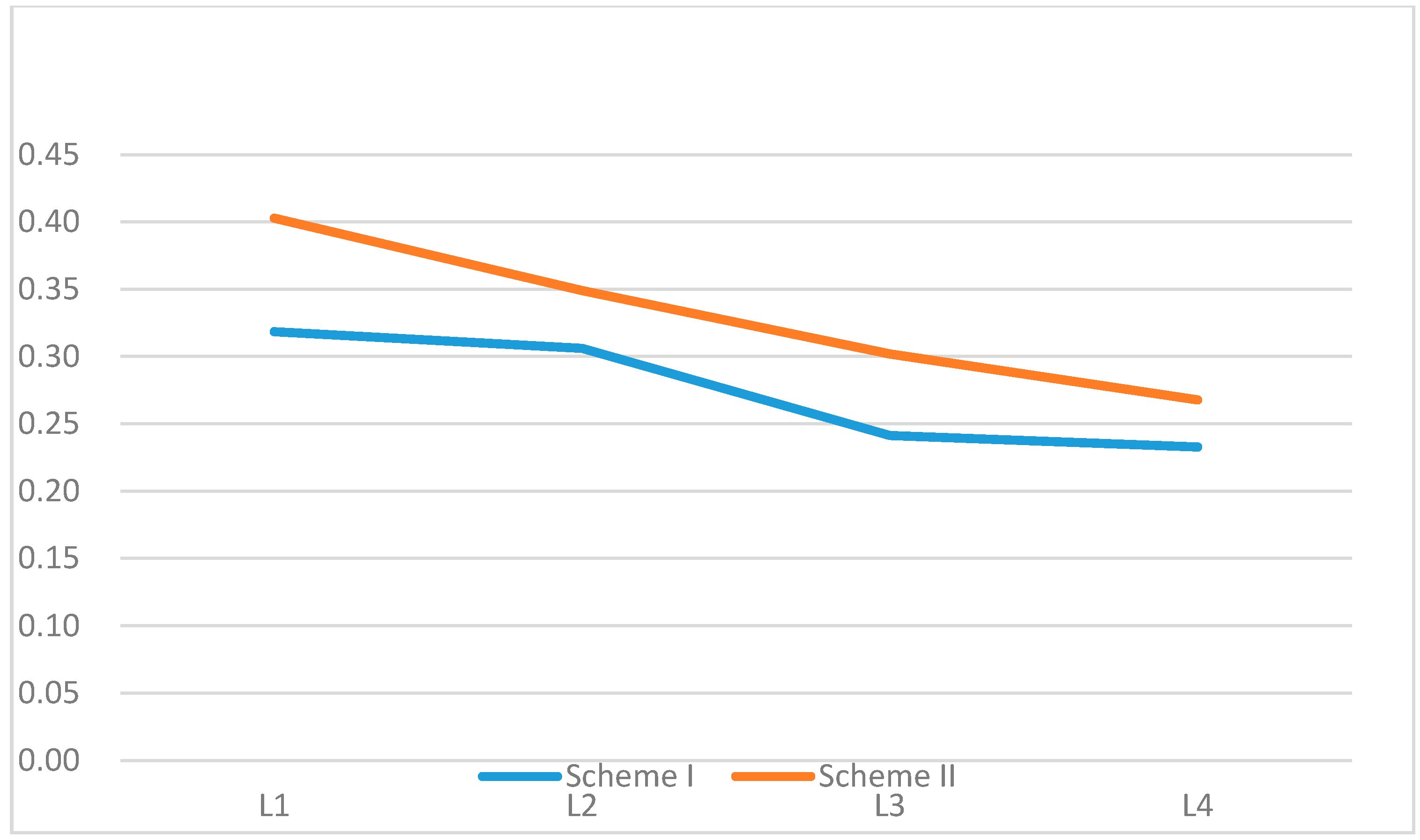

From the evaluation results of transnational power networking projects (

Figure 8), the benefit level of Scheme II is better than that of Scheme I in terms of the stakeholder evaluation of four projects. These two schemes are gradually decreasing in the comprehensive benefit evaluation results of L1, L2, L3, and L4, which reflects that such projects rely on the financial support of the power industry and L2 and need more guidance and support from national governments. As an L1 who initiates and transfers a project, the decision-making willingness of the L3 and L4 can be foreseen through the evaluation results. In addition, the scheme can be adjusted reasonably according to the weight analysis of the indices, so as to improve the project pass rate at the decision-making stage.

6. Conclusions

Combining with the trend of interconnection of transnational power grids, this paper established a comprehensive benefit evaluation index system based on L1, L2, L3, and L4, which covers economic, social, and environmental perspectives. In the process of determining the weights, the Gini coefficient weighting method and ordinal relation method were combined to take both subjective and objective information into account. Moreover, on the basis of the improved grey projection value matter-element extension evaluation model, the scientific nature of the comprehensive benefit evaluation results was improved. Through the study of two different schemes of domestic high-voltage direct current transmission projects, it was proved that the weights and evaluation results were quite different from each stakeholder’s perspective, and the rationality of the comprehensive benefit evaluation system based on different stakeholders was verified, thus improving the comprehensiveness and objectivity of the comprehensive benefit research of transnational networking projects.