A Two-Stage Dispatch Mechanism for Virtual Power Plant Utilizing the CVaR Theory in the Electricity Spot Market

Abstract

:1. Introduction

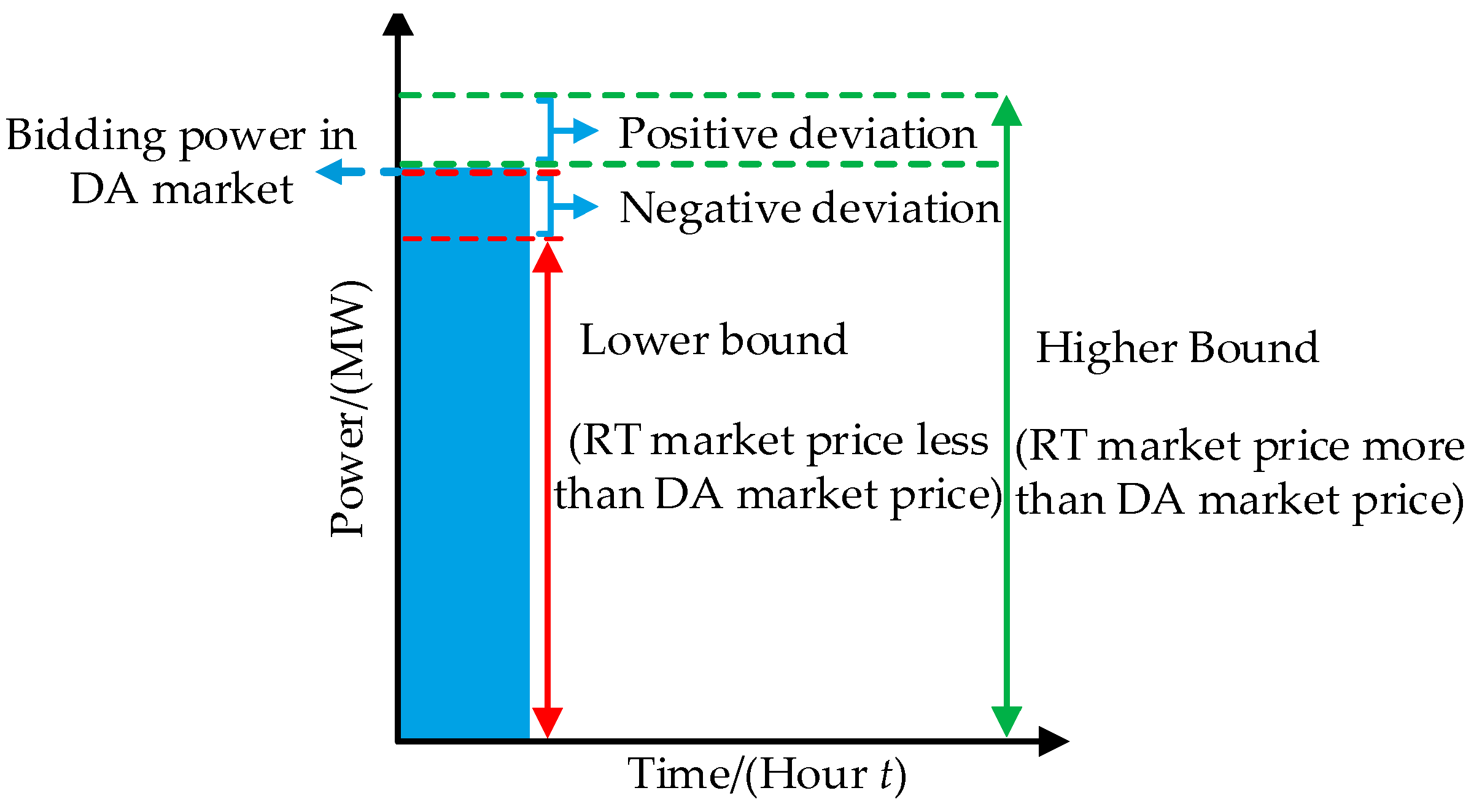

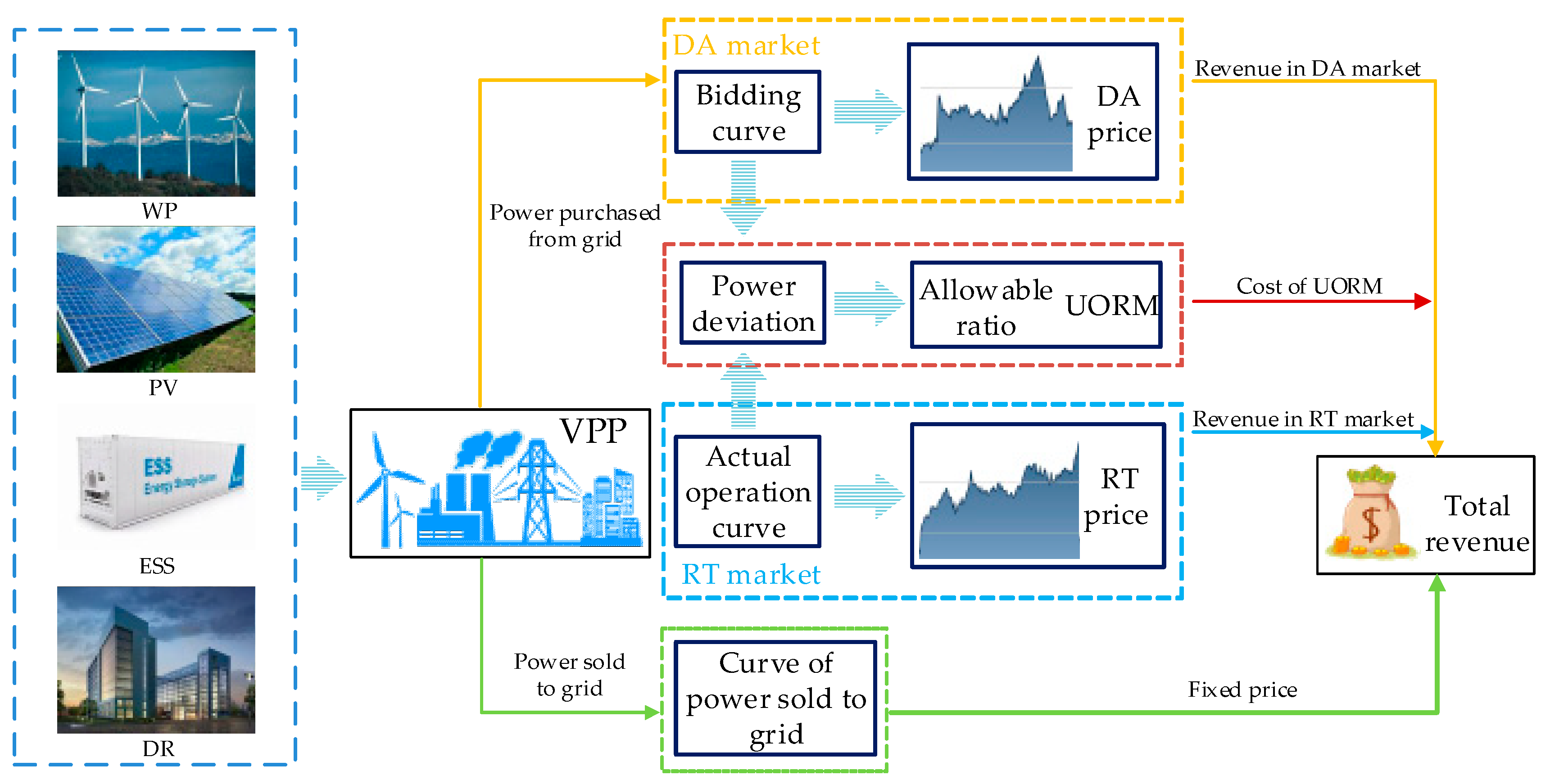

- The trading mechanism of China’s electricity spot market is introduced. Specifically, the DA and RT markets together with the UORM trading rule, are illustrated in detail to elaborate on the China electricity spot market.

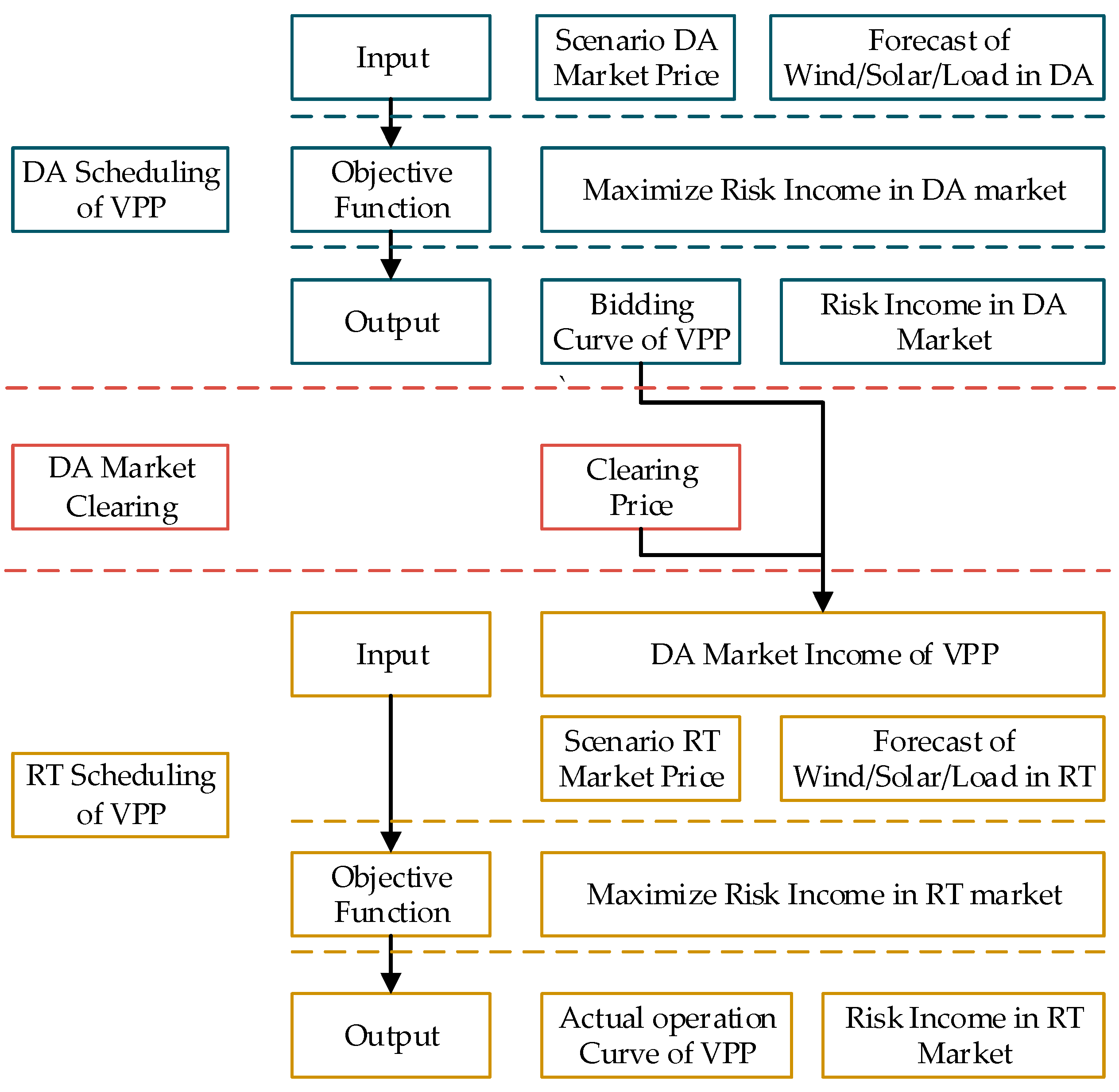

- A two-stage scheduling model of the VPP incorporating the market rules of China’s electricity spot market is proposed. In detail, the first stage of the model decides the bidding curves of VPP in the DA market while the second stage regulates its actual operation curve in the RT market. Via the proposed mechanism, the behaviors of VPP internal resources and its overall output in the DA/RT market can be optimized.

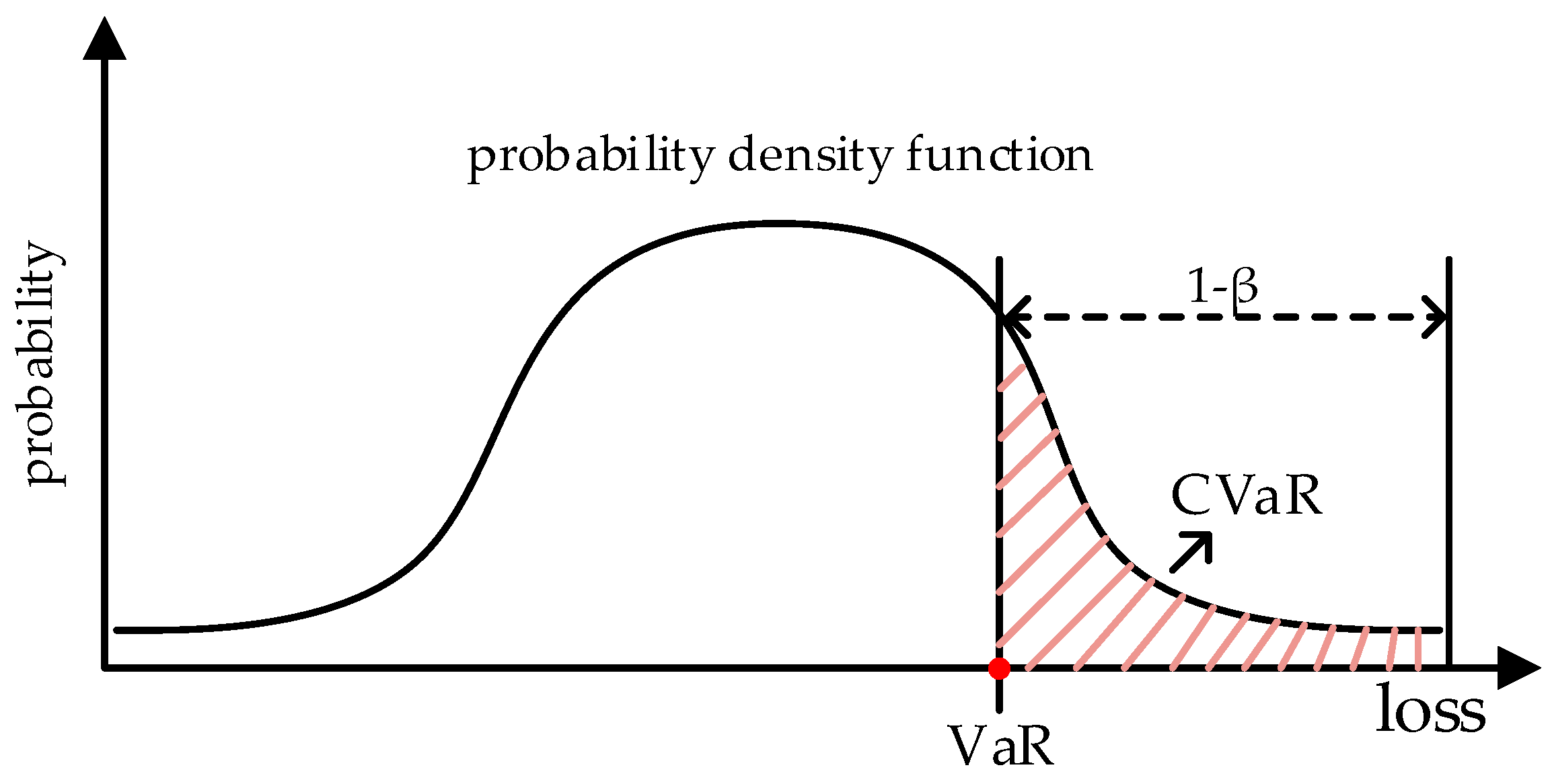

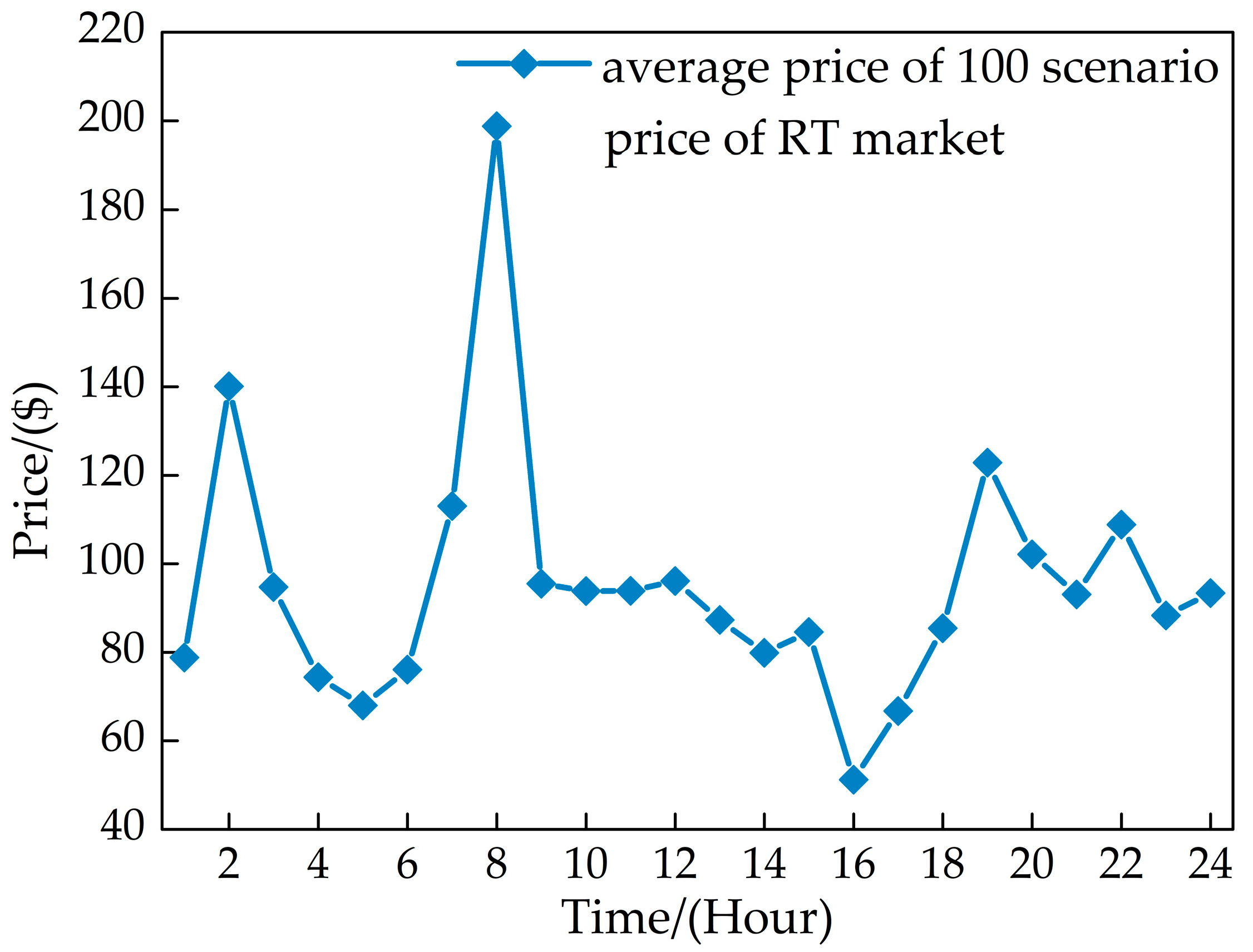

- The uncertainty of market price is studied. Specifically, the CVaR is adopted to investigate the influence of price uncertainties on VPP behaviors, and the income considering price uncertainty and VPP output and have been comprehensively evaluated.

- The influence of the UORM on the revenue of the VPP is also analyzed. This gives more insights into user behaviors and demonstrates that the VPP can help mitigate the deviation between the bidding curve and the actual operation curve.

2. Trading Mechanism of China Electricity Spot Market

3. VPP Model Formulation

4. Two-Stage Scheduling CVaR Model

4.1. CVaR Theory

4.2. DA Dispatch Model

4.3. RT Dispatch Model

4.4. Solving Mechanism

5. Case Study

5.1. VPP Parameters

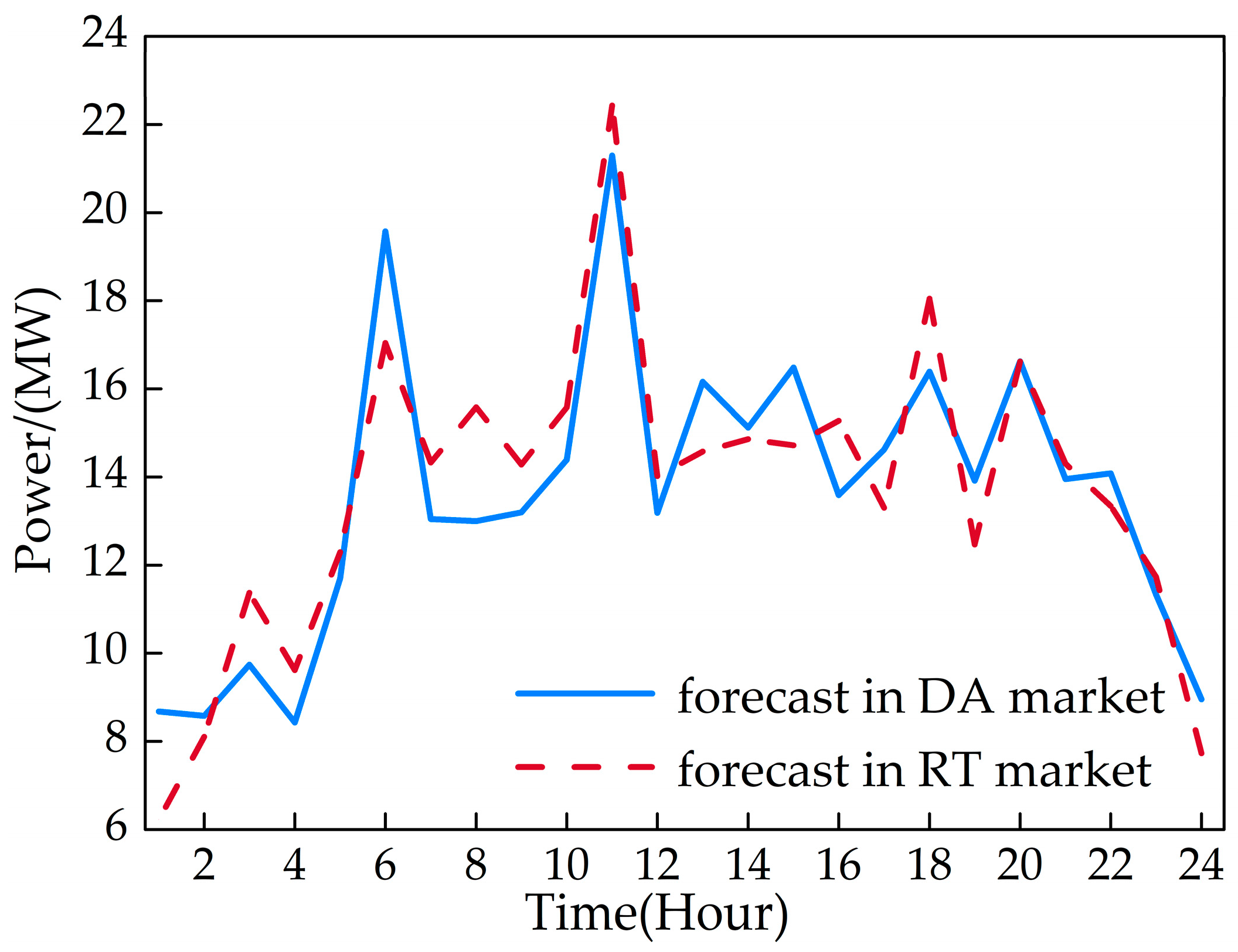

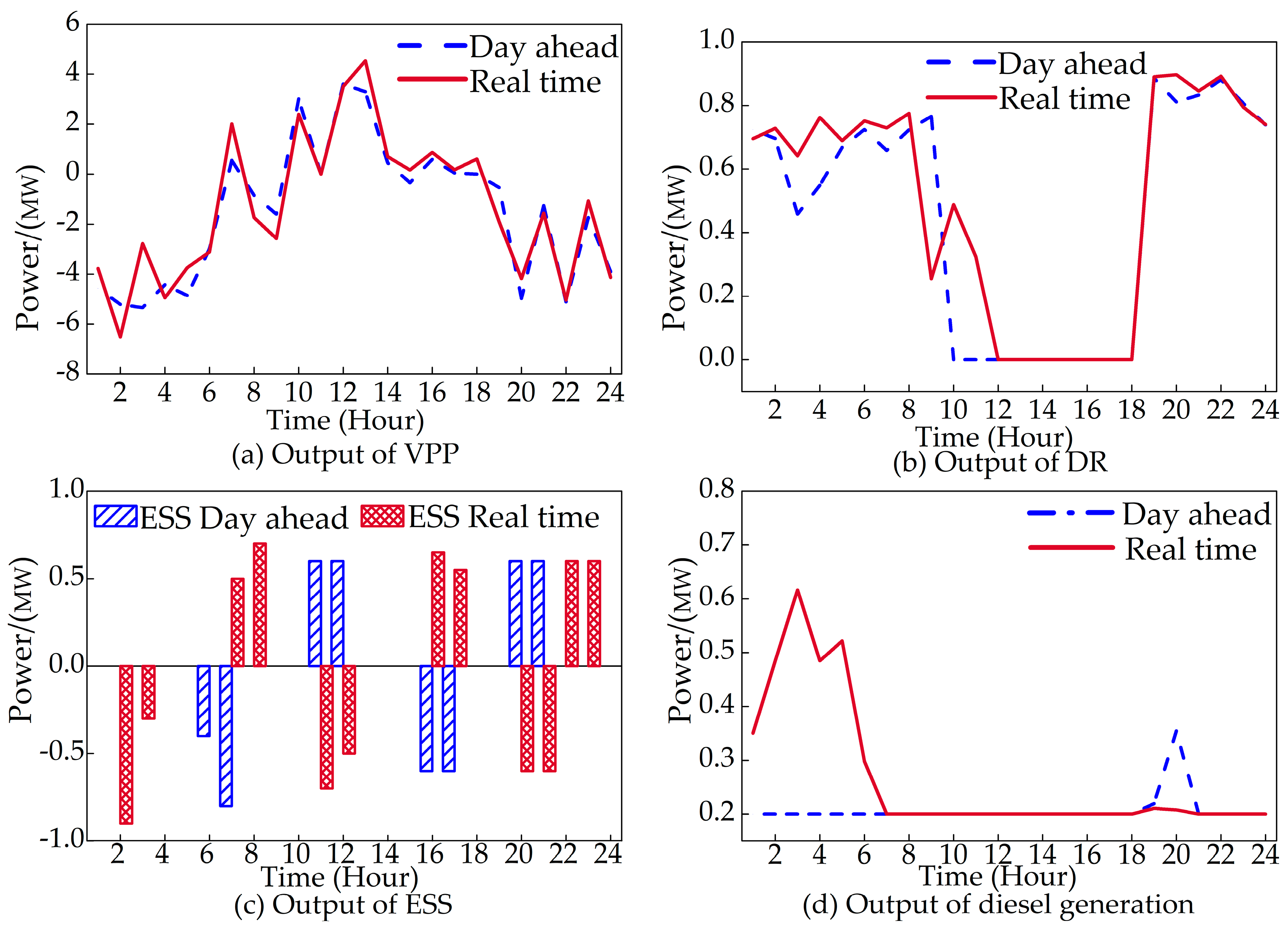

5.2. VPP Scheduling Outcome

5.3. Impact of the Allowable Deviation Ratio

- The return cost with the allowable ratio was calculated via the price deviation between the DA market and RT market multiplied by the energy deviation of the DA and RT market. The power deviation was generally small. Meanwhile, the product of power deviation and the price difference was also small, so the cost caused by the allowable deviation ratio was not high.

- The VPP had a variety of DERs, such as the ESS, which can accurately adjust their outputs to cope with the error lead by the prediction values.

5.4. Impact of the Risk Preference Coefficient

5.4.1. Risk Income of the RT Market

5.4.2. Income of the DA Market

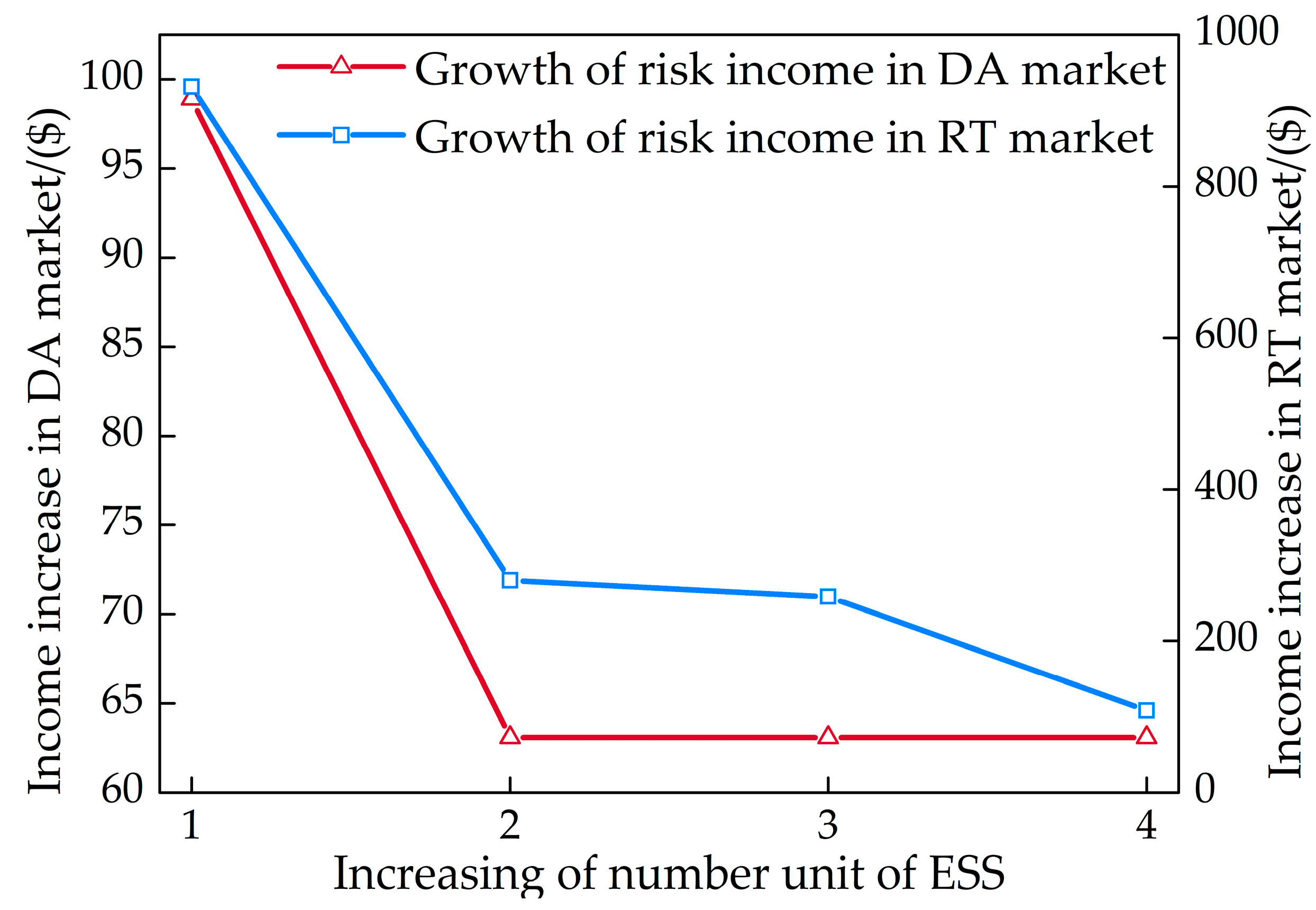

5.5. Impact on the ESS

6. Conclusions

- A two-stage dispatching model with optimized bidding and operating strategy in DA and RT market for VPP was proposed. As demonstrated, the mechanism can optimize the behaviors of VPP internal resources and its overall output under DA/RT price signals.

- The influence of UORM on the revenue of VPP was studied. As can be seen, the UORM did not result in too much cost to the VPP. The reason lies in that the price difference between DA and RT market at the same hour being small, and the VPP can change the output of its controlled DERs to mitigate the deviation between the bidding curve of the DA market and the actual operation curve in the RT market.

- The uncertainty of market price on VPP was investigated via the CVaR theory. As a result, the VPP tended to sell more electricity to the grid with an increase in the risk preference coefficient. Since the average cost of the electricity purchased from the grid was lower than the selling price to the grid under the DA market clearing price, the income of the DA market decreased with the increase in the risk preference coefficient.

- For a full evaluation, the participation of ESS was detailly analyzed. The outcome showed that ESS can effectively improve the risk income of VPP, but its growth was not proportional to the ESS unit numbers. With the increased capacity in the ESS, the risk income of VPP increased significantly but began to saturate as it kept growing. The outcome also demonstrated that the ESS has limited effect on improving the VPP profit.

Author Contributions

Funding

Conflicts of Interest

References

- China Electricity Council. National Electricity Market Transactions in 2018. Available online: http://www.cec.org.cn/guihuayutongji/dianligaige/2019-03-04/189190.html (accessed on 28 May 2018).

- National Development and Reform Commission. Several Opinions on Further Reform of Power System. Available online: http://tgs.ndrc.gov.cn/zywj/201601/t20160129_773852.html (accessed on 25 May 2018).

- Zhejiang Provincial Development and Reform Commission. Comprehensive Pilot Program for the Reform of the Electric Power System in Zhejiang Province. Available online: http://www.zjdpc.gov.cn/art/2018/1/5/art_8_1739097.html (accessed on 15 May 2018).

- South China Energy Regulatory Office of National Energy Administration. The South China Energy Regulatory Office of National Energy Administration Conducts Comprehensive Guidance and Supervision on the Daily Spot Settlement Work of the Southern Power Market (Starting in Guangdong). Available online: http://nfj.nea.gov.cn/adminContent/initViewContent.do?pk=7344988 (accessed on 7 June 2018).

- South China Energy Regulatory Office of National Energy Administration. Introduction to South China Energy Regulatory Office of National Energy Administration. Available online: http://nfj.nea.gov.cn/frontIndex/indexJggk.do (accessed on 4 June 2018).

- National Development and Reform Commission, and National Energy Administration. Notice on Printing Supporting Documents for Power System Reform. Available online: http://www.ndrc.gov.cn/zcfb/zcfbtz/201511/t20151130_760016.html (accessed on 28 May 2018).

- Nosratabadi, S.M.; Hooshmand, R.A.; Gholipour, E. A comprehensive review on microgrid and virtual power plant concepts employed for distributed energy resources scheduling in power systems. Renew. Sustain. Energy Rev. 2017, 67, 341–363. [Google Scholar] [CrossRef]

- Othman, M.M.; Hegazy, Y.; Abdelaziz, A.Y. A Review of virtual power plant definitions, components, framework and optimization. Int. Electr. Eng. J. 2015, 6, 2010–2024. [Google Scholar]

- Li, P.; Liu, Y.; Xin, H.; Jiang, X. A robust distributed economic dispatch strategy of virtual power plant under cyber-attacks. IEEE Trans. Ind. Inform. 2018, 14, 4343–4352. [Google Scholar] [CrossRef]

- Huang, C.; Yue, D.; Xie, J.; Li, Y.; Wang, K. Economic dispatch of power systems with virtual power plant based interval optimization method. CSEE J. Power Energy Syst. 2016, 2, 74–80. [Google Scholar] [CrossRef]

- Shabanzadeh, M.; Sheikh-El-Eslami, M.K.; Haghifam, M.R. The design of a risk-hedging tool for virtual power plants via robust optimization approach. Appl. Energy 2015, 155, 766–777. [Google Scholar] [CrossRef]

- Giuntoli, M.; Poli, D. Optimized thermal and electrical scheduling of a large scale virtual power plant in the presence of energy storages. IEEE Trans. Smart Grid 2013, 4, 942–955. [Google Scholar] [CrossRef]

- Ko, R.; Kang, D.; Joo, S.K. Mixed Integer Quadratic Programming Based Scheduling Methods for Day-Ahead Bidding and Intra-Day Operation of Virtual Power Plant. Energies 2019, 12, 1410. [Google Scholar] [CrossRef]

- Luo, F.; Dong, Z.Y.; Meng, K.; Qiu, J.; Yang, J.; Wong, K.P. Short-term operational planning framework for virtual power plants with high renewable penetrations. IET Renew. Power Gener. 2016, 10, 623–633. [Google Scholar] [CrossRef]

- Pandžić, H.; Kuzle, I.; Capuder, T. Virtual power plant mid-term dispatch optimization. Appl. Energy 2013, 101, 134–141. [Google Scholar] [CrossRef]

- Xu, Z.Y.; Qu, H.N.; Shao, W.H.; Xu, W.S. Virtual power plant-based pricing control for wind/thermal cooperated generation in China. IEEE Trans. Syst. Man Cybern. Syst. 2015, 46, 706–712. [Google Scholar] [CrossRef]

- Zamani, A.G.; Zakariazadeh, A.; Jadid, S.; Kazemi, A. Stochastic operational scheduling of distributed energy resources in a large scale virtual power plant. Int. J. Electr. Power Energy Syst. 2016, 82, 608–620. [Google Scholar] [CrossRef]

- Ghavidel, S.; Li, L.; Aghaei, J.; Yu, T.; Zhu, J. A review on the virtual power plant: Components and operation systems. In Proceedings of the 2016 IEEE International Conference on Power System Technology (POWERCON), Wollongong, Australia, 28 September–1 October 2016. [Google Scholar]

- Shayegan-Rad, A.; Badri, A.; Zangeneh, A. Day-ahead scheduling of virtual power plant in joint energy and regulation reserve markets under uncertainties. Energy 2017, 121, 114–125. [Google Scholar] [CrossRef]

- Liang, Z.; Alsafasfeh, Q.; Jin, T.; Pourbabak, H.; Su, W. Risk-constrained optimal energy management for virtual power plants considering correlated demand response. IEEE Trans. Smart Grid 2017, 10, 1577–1587. [Google Scholar] [CrossRef]

- Dabbagh, S.R.; Sheikh-El-Eslami, M.K. Risk-based profit allocation to DERs integrated with a virtual power plant using cooperative Game theory. Electr. Power Syst. Res. 2015, 121, 368–378. [Google Scholar] [CrossRef]

- Kasaei, M.J.; Gandomkar, M.; Nikoukar, J. Optimal management of renewable energy sources by virtual power plant. Renew. Energy 2017, 114, 1180–1188. [Google Scholar] [CrossRef]

- Zhang, G.; Jiang, C.; Wang, X.; Li, B.; Zhu, H. Bidding strategy analysis of virtual power plant considering demand response and uncertainty of renewable energy. IET Gener. Transm. Distrib. 2017, 11, 3268–3277. [Google Scholar] [CrossRef]

- South China Energy Regulatory Office of National Energy Administration. Trading Rule of Spot Electricity Market. Available online: http://nfj.nea.gov.cn/adminContent/initViewContent.do?pk=402881e56579be6301658d7123c2001a (accessed on 30 May 2018).

- Nguyen, H.T.; Le, L.B.; Wang, Z. A Bidding Strategy for Virtual Power Plants with the Intraday Demand Response Exchange Market Using the Stochastic Programming. IEEE Trans. Ind. Appl. 2018, 54, 3044–3055. [Google Scholar] [CrossRef]

- Ding, T.; Bo, R.; Gu, W.; Guo, Q.; Sun, H. Absolute value constraint based method for interval optimization to SCED model. IEEE Trans. Power Syst. 2013, 29, 980–981. [Google Scholar] [CrossRef]

- Korn, R.; Zeytun, S. Solving optimal investment problems with structured products under CVaR constraints. Optimization 2009, 58, 291–304. [Google Scholar] [CrossRef]

- Rockafellar, R.T.; Uryasev, S. Optimization of conditional value-at-risk. J. Risk 2000, 2, 21–42. [Google Scholar] [CrossRef]

| Diesel | ESS | ||

|---|---|---|---|

| 1.50 MW | 1 MW | ||

| 0.2 MW | 2 MWh | ||

| 180 kg/(MWh) | 27.5 $/(MWh) | ||

| 1 $/kg | 0.6 | ||

| 1 $/(MWh) | 0.95 | ||

| Allowable Deviation Ratio | Return Cost with the Allowable Ratio/$ | Risk Income in DA Market/$ |

|---|---|---|

| 0.01 | 13.24 | 10,913.72 |

| 0.05 | 12.58 | 10,884.50 |

| 0.1 | 11.43 | 10,785.78 |

| 0.2 | 11.04 | 10,771.61 |

| 0.3 | 10.24 | 10,633.15 |

| 0.4 | 8.94 | 10,609.03 |

| 0.5 | 8.51 | 10,581.24 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gao, R.; Guo, H.; Zhang, R.; Mao, T.; Xu, Q.; Zhou, B.; Yang, P. A Two-Stage Dispatch Mechanism for Virtual Power Plant Utilizing the CVaR Theory in the Electricity Spot Market. Energies 2019, 12, 3402. https://doi.org/10.3390/en12173402

Gao R, Guo H, Zhang R, Mao T, Xu Q, Zhou B, Yang P. A Two-Stage Dispatch Mechanism for Virtual Power Plant Utilizing the CVaR Theory in the Electricity Spot Market. Energies. 2019; 12(17):3402. https://doi.org/10.3390/en12173402

Chicago/Turabian StyleGao, Rui, Hongxia Guo, Ruihong Zhang, Tian Mao, Qianyao Xu, Baorong Zhou, and Ping Yang. 2019. "A Two-Stage Dispatch Mechanism for Virtual Power Plant Utilizing the CVaR Theory in the Electricity Spot Market" Energies 12, no. 17: 3402. https://doi.org/10.3390/en12173402

APA StyleGao, R., Guo, H., Zhang, R., Mao, T., Xu, Q., Zhou, B., & Yang, P. (2019). A Two-Stage Dispatch Mechanism for Virtual Power Plant Utilizing the CVaR Theory in the Electricity Spot Market. Energies, 12(17), 3402. https://doi.org/10.3390/en12173402