Electricity Markets for DC Distribution Systems: Design Options

Abstract

1. Introduction

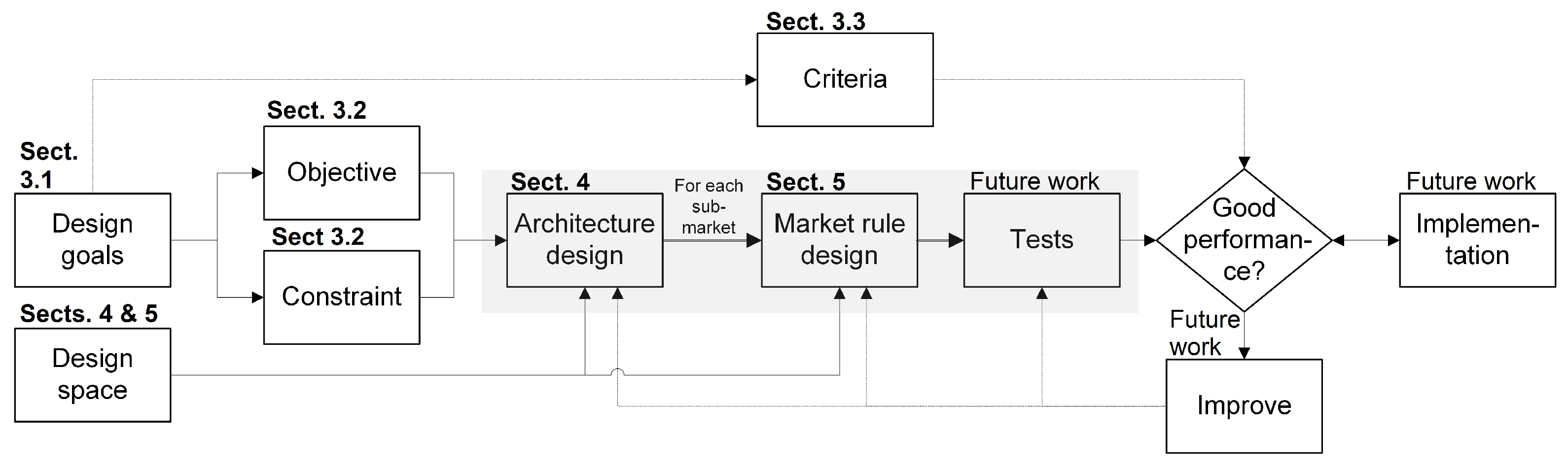

2. Market Design Framework

3. Design Goals

3.1. Listing of the Design Goals

3.2. Objectives and Constraints

3.3. Criteria

4. Market Architecture Design Variables

4.1. Choice of Sub-Markets

4.2. Market Type

4.3. Linkage Between Sub-Markets

4.4. Linkage to Wholesale Markets

4.5. Summary

5. Sub-Market Design Variables

5.1. General Organisation

5.2. Bid Format

5.3. Allocation and Payment

5.4. Settlement

5.5. Summary

6. Three Promising Market Designs

6.1. Integrated Market (IM) Design

6.2. Locational Energy Market (LEM) Design

6.2.1. Flex Market for Voltage Regulation

6.2.2. The DSO Provides Voltage Regulation

6.3. Locational Flex Market (LFM) Design

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

Abbreviations

| AC | Alternating Current |

| DC | Direct Current |

| DCDS | Direct Current Distribution Systems |

| DSO | Distribution System Operator |

| Flex | (local) flexibility |

| IM | integrated market |

| LEM | locational energy market |

| LFM | locational flexibility market |

| PV | photovoltaics |

References

- Newbery, D.; Pollitt, M.G.; Ritz, R.A.; Strielkowski, W. Market design for a high-renewables European electricity system. Renew. Sustain. Energy Rev. 2018, 91, 695–707. [Google Scholar] [CrossRef]

- Cetin, E.; Yilanci, A.; Ozturk, H.K.; Colak, M.; Kasikci, I.; Iplikci, S. A micro-DC power distribution system for a residential application energized by photovoltaic–wind/fuel cell hybrid energy systems. Energy Build. 2010, 42, 1344–1352. [Google Scholar] [CrossRef]

- Kumar, M.; Singh, S.N.; Srivastava, S.C. Design and control of smart DC microgrid for integration of renewable energy sources. In Proceedings of the 2012 IEEE Power and Energy Society General Meeting, San Diego, CA, USA, 22–26 July 2012; pp. 1–7. [Google Scholar] [CrossRef]

- Torreglosa, J.P.; García-Triviño, P.; Fernández-Ramirez, L.M.; Jurado, F. Control strategies for DC networks: A systematic literature review. Renew. Sustain. Energy Rev. 2016, 58, 319–330. [Google Scholar] [CrossRef]

- Mackay, L.; Vandeventer, E.; Ramirez-Elizondo, L.; Bauer, P. Capacitive Grounding for DC Distribution Grids with Multiple Grounding Points. In Proceedings of the 2017 IEEE Second International Conference on DC Microgrids (ICDCM), Nuremburg, Germany, 27–29 June 2017; pp. 76–80. [Google Scholar]

- Justo, J.J.; Mwasilu, F.; Lee, J.; Jung, J.W. AC-microgrids versus DC-microgrids with distributed energy resources: A review. Renew. Sustain. Energy Rev. 2013, 24, 387–405. [Google Scholar] [CrossRef]

- Planas, E.; Andreu, J.; Gárate, J.I.; Martínez De Alegría, I.; Ibarra, E. AC and DC technology in microgrids: A review. Renew. Sustain. Energy Rev. 2015, 43, 726–749. [Google Scholar] [CrossRef]

- Larruskain, D.M.; Zamora, I.; Abarrategui, O.; Aginako, Z. Conversion of AC distribution lines into DC lines to upgrade transmission capacity. Electr. Power Syst. Res. 2011, 81, 1341–1348. [Google Scholar] [CrossRef]

- Hammerstrom, D.J. AC versus DC distribution systems-did we get it right? In Proceedings of the 2007 IEEE Power Engineering Society General Meeting, Tampa, FL, USA, 24–28 June 2007; pp. 1–5. [Google Scholar] [CrossRef]

- Mackay, L. Steps Towards the Universal Direct Current Distribution System. Ph.D. Thesis, Delft University of Technology, Delft, The Netherlands, 2018. [Google Scholar] [CrossRef]

- Federal Energy Regulatory Commission (FERC). Wholesale Competition in Regions with Organized Electric Markets: Final Rule (RM07-19-000, AD07-7-000); Federal Energy Regulatory Commission (FERC): Washington, DC, USA, 2008.

- European Commission. Proposal for a Directive of the European Parliament and of the Council on Common Rules for the Internal Market in Electricity (Recast); COM(2016) 864 Final/2; European Commission: Brussels, Belgium, 2016. [Google Scholar]

- Piao, L.; de Weerdt, M.; de Vries, L. Electricity Market Design Requirements for DC Distribution Systems. In Proceedings of the 2017 IEEE Second International Conference on DC Microgrids (ICDCM), Nuremburg, Germany, 27–29 June 2017; pp. 95–101. [Google Scholar] [CrossRef]

- Mackay, L.; van der Blij, N.H.; Ramirez-Elizondo, L.; Bauer, P. Towards the Universal DC Distribution System. Elect. Power Compon. Syst. 2017, 45, 1032–1042. [Google Scholar] [CrossRef]

- Mackay, L.; Hailu, T.G.; Mouli, G.C.; Ramirez-Elizondo, L.; Ferreira, J.A.; Bauer, P. From DC nano- and microgrids towards the universal DC distribution system—A plea to think further into the future. In Proceedings of the 2015 IEEE Power & Energy Society General Meeting, Denver, CO, USA, 26–30 July 2015. [Google Scholar] [CrossRef]

- Yang, N.; Paire, D.; Gao, F.; Miraoui, A.; Liu, W. Compensation of droop control using common load condition in DC microgrids to improve voltage regulation and load sharing. Int. J. Electr. Power Energy Syst. 2015, 64, 752–760. [Google Scholar] [CrossRef]

- Ilieva, I.; Bremdal, B.; Olivella, P. D6.1 Market Design; Technical Report; EMPOWER: Local Electricity Retail Markets for Prosumer Smart Grid Power Services. 2015. Available online: http://empowerh2020.eu/wp-content/uploads/2016/05/D6.1_Market-design.pdf (accessed on 8 July 2019).

- Disfani, V.R.; Fan, L.; Miao, Z. Distributed DC Optimal Power Flow for radial networks through partial Primal Dual algorithm. In Proceedings of the 2015 IEEE Power & Energy Society General Meeting, Denver, CO, USA, 26–30 July 2015. [Google Scholar] [CrossRef]

- Li, C.; de Bosio, F.; Chen, F.; Chaudhary, S.K.; Vasquez, J.C.; Guerrero, J.M. Economic Dispatch for Operating Cost Minimization Under Real-Time Pricing in Droop-Controlled DC Microgrid. IEEE J. Emerg. Sel. Top. Power Electron. 2017, 5, 587–595. [Google Scholar] [CrossRef]

- Sousa, T.; Soares, T.; Pinson, P.; Moret, F.; Baroche, T.; Sorin, E. Peer-to-peer and community-based markets: A comprehensive review. Renew. Sustain. Energy Rev. 2019, 104, 367–378. [Google Scholar] [CrossRef]

- Lüth, A.; Zepter, J.M.; Crespo del Granado, P.; Egging, R. Local electricity market designs for peer-to-peer trading: The role of battery flexibility. Appl. Energy 2018, 229, 1233–1243. [Google Scholar] [CrossRef]

- Huang, S.; Wu, Q.; Liu, Z.; Nielsen, A.H. Review of congestion management methods for distribution networks with high penetration of distributed energy resources. In Proceedings of the IEEE PES Innovative Smart Grid Technologies, Europe, Istanbul, Turkey, 12–15 October 2014; pp. 1–6. [Google Scholar] [CrossRef]

- Picciariello, A.; Reneses, J.; Frias, P.; Söder, L. Distributed generation and distribution pricing: Why do we need new tariff design methodologies? Electr. Power Syst. Res. 2015, 119, 370–376. [Google Scholar] [CrossRef]

- Ramos, A. Coordination of Flexibility Contracting in Wholesale and Local Electricity Markets. Ph.D. Thesis, Katholieke Universiteit Leuven, Leuven, Belgium, 2017. [Google Scholar]

- Minniti, S.; Haque, N.; Nguyen, P.; Pemen, G. Local Markets for Flexibility Trading: Key Stages and Enablers. Energies 2018, 11, 3074. [Google Scholar] [CrossRef]

- Mendes, G.; Nylund, J.; Annala, S.; Honkapuro, S.; Kilkki, O.; Segerstam, J. Local Energy Markets: Opportunities, Benefits, and Barriers; CIRED: Ljubljana, Slovenia, 2018. [Google Scholar]

- Stoft, S. Market Architecture. In Power System Economics: Designing Markets for Electricity; Wiley-IEEE Press: Piscataway, NJ, USA, 2002; pp. 82–92. [Google Scholar]

- Wu, T.; Rothleder, M.; Alaywan, Z.; Papalexopoulos, A.D. Pricing Energy and Ancillary Services in Integrated Market Systems by an Optimal Power Flow. IEEE Trans. Power Syst. 2004, 19, 339–347. [Google Scholar] [CrossRef]

- Herder, P.M.; Stikkelman, R.M. Methanol-based industrial cluster design: A study of design options and the design process. Ind. Eng. Chem. Res. 2004, 43, 3879–3885. [Google Scholar] [CrossRef]

- Brhel, M.; Meth, H.; Maedche, A.; Werder, K. Exploring principles of user-centered agile software development: A literature review. Inf. Softw. Technol. 2015, 61, 163–181. [Google Scholar] [CrossRef]

- Stoft, S. Designing and Testing Market Rules. In Power System Economics: Designing Markets for Electricity; Wiley-IEEE Press: Piscataway, NJ, USA, 2002; pp. 93–106. [Google Scholar]

- World Energy Council. World Energy Trilemma Index 2018; Technical Report; World Energy Council: London, UK, 2018. [Google Scholar]

- Parkinson, A.R.; Balling, R.J.; Hedengren, J.D. Optimization Methods for Engineering Design: Applications and Theory; Brigham Young University: Provo, UT, USA, 2013. [Google Scholar]

- Morey, M.J. Power Market Auction Design: Rules and Lessons in Market Based Control for the New Electricity Industry; Edison Electric Institute: Washington, DC, USA, 2001. [Google Scholar]

- Federal Energy Regulatory Commission (FERC). Working Paper on Standardized Transmission Service and Wholesale Electric Market Design; Technical Report; FERC: Washington, DC, USA, 2002.

- Ampatzis, M.; Nguyen, P.H.; Kling, W. Local electricity market design for the coordination of distributed energy resources at district level. In Proceedings of the IEEE PES Innovative Smart Grid Technologies, Europe, Istanbul, Turkey, 12–15 October 2014. [Google Scholar]

- Strbac, G.; Mutale, J. Framework and Methodology for Pricing of Distribution Networks with Distributed Generation (A Report to OFGEM). Centre for Distributed Generation and Sustainable Electrical Energy, UK. 2005. Available online: https://www.ofgem.gov.uk/ofgem-publications/44458/10147-strbacmutalepdf (accessed on 10 July 2019).

- European Commission. Proposal for a Regulation of the European Parliament and of the Council on Risk-Preparedness in the Electricity Sector and Repealing Directive 2005/89/EC; European Commission: Brussels, Belgium, 2016. [Google Scholar]

- Cramton, P. Electricity market design. Oxf. Rev. Econ. Policy 2017, 33, 589–612. [Google Scholar] [CrossRef]

- Divshali, P.H.; Choi, B.J. Electrical market management considering power system constraints in smart distribution grids. Energies 2016, 9, 405. [Google Scholar] [CrossRef]

- Pérez-Arriaga, I.J.; Ruester, S.; Schwenen, S.; Battle, C.; Glachant, J.M. From Distribution Networks to Smart Distribution Systems: Rethinking the Regulation of European Electricity DSOs; Technical Report; European University Institute: Fiesole, Italy, 2013. [Google Scholar] [CrossRef]

- European Commission. Proposal for a Regulation of the European Parliament and of the Council on the Internal Market for Electricity (Recast). COM(2016) 861 Final; European Commission: Brussels, Belgium, 2016. [Google Scholar]

- Cuijpers, C.; Koops, B.J. Smart Metering and Privacy in Europe: Lessons from the Dutch Case. In European Data Protection: Coming of Age; Springer: Dordrecht, The Netherlands, 2013; Chapter 12; pp. 269–293. [Google Scholar] [CrossRef]

- Conejo, A.J.; Sioshansi, R. Rethinking restructured electricity market design: Lessons learned and future needs. Int. J. Electr. Power Energy Syst. 2018, 98, 520–530. [Google Scholar] [CrossRef]

- USEF. The Framework Explained; Technical Report; Universal Smart Energy Framework (USEF): Arnhem, The Netherlands, 2015; Available online: https://www.usef.energy/download-the-framework/ (accessed on 10 July 2019).

- Jong, J.D.; Genoese, F.; Egenhofer, C. Reforming the Market Design of EU Electricity Markets: Addressing the Challenges of a Low-Carbon Power Sector; Technical Report; Centre for European Policy Studies (CEPS): Brussels, Belgium, 2015; Available online: https://www.ceps.eu/ceps-publications/reforming-market-design-eu-electricity-markets-addressing-challenges-low-carbon-power/ (accessed on 10 July 2019).

- Reinders, A.; Übermasser, S.; van Sark, W.; Gercek, C.; Schram, W.; Obinna, U.; Lehfuss, F.; van Mierlo, B.; Robledo, C.; van Wijk, A. An Exploration of the Three-Layer Model Including Stakeholders, Markets and Technologies for Assessments of Residential Smart Grids. Appl. Sci. 2018, 8, 2363. [Google Scholar] [CrossRef]

- Biskas, P.N.; Chatzigiannis, D.I.; Bakirtzis, A.G. Market coupling feasibility between a power pool and a power exchange. Electr. Power Syst. Res. 2013, 104, 116–128. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Gärttner, J.; Rock, K.; Kessler, S.; Orsini, L.; Weinhardt, C. Designing microgrid energy markets: A case study: The Brooklyn Microgrid. Appl. Energy 2018, 210, 870–880. [Google Scholar] [CrossRef]

- Ries, S.; Neumann, C.; Glismann, S.; Schoepf, M.; Fridgen, G. Rethinking short-term electricity market design: Options for market segment integration. In Proceedings of the 2017 14th International Conference on the European Energy Market (EEM), Dresden, Germany, 6–9 June 2017. [Google Scholar] [CrossRef]

- O’Neill, R.P.; Fisher, E.B.; Hobbs, B.F.; Baldick, R. Towards a complete real-time electricity market design. J. Regul. Econ. 2008, 34, 220–250. [Google Scholar] [CrossRef]

- Tohidi, Y.; Farrokhseresht, M.; Gibescu, M. A review on coordination schemes between local and central electricity markets. In Proceedings of the 2018 15th International Conference on the European Energy Market (EEM), Lodz, Poland, 27–29 June 2018; pp. 1–5. [Google Scholar] [CrossRef]

- Hu, J.; Harmsen, R.; Crijns-Graus, W.; Worrell, E.; van den Broek, M. Identifying barriers to large-scale integration of variable renewable electricity into the electricity market: A literature review of market design. Renew. Sustain. Energy Rev. 2018, 81, 2181–2195. [Google Scholar] [CrossRef]

- Ela, E.; Helman, U. Wholesale Electricity Market Design Initiatives in the United States: Survey and Research Needs; Technical Report; Electric Power Research Institute (EPRI): Palo Alto, CA, USA, 2016. [Google Scholar]

- Abbasy, A.; Hakvoort, R.A. Exploring the design space of balancing services markets—A theoretical framework. In Proceedings of the 2009 Second International Conference on Infrastructure Systems and Services: Developing 21st Century Infrastructure Networks (INFRA), Chennai, India, 9–11 December 2009. [Google Scholar]

- Van der Veen, R.A.; Hakvoort, R.A. The electricity balancing market: Exploring the design challenge. Utilities Policy 2016, 43, 186–194. [Google Scholar] [CrossRef]

- Rosen, C. Design Considerations and Functional Analysis of Local Reserve Energy Markets for Distributed Generation. Ph.D. Thesis, RWTH Aachen University, Aachen, Germany, 2014. [Google Scholar]

- Chao, H.P. Demand response in wholesale electricity markets: The choice of customer baseline. J. Regul. Econ. 2011, 39, 68–88. [Google Scholar] [CrossRef]

- Layton, B. The Markets for Electricity in New Zealand (Report to the Electricity Commission); Technical Report; The New Zealand Institute of Economic Research: Wellington, New Zealand, 2007. [Google Scholar]

- Roth, A.E. The art of designing markets. Harv. Bus. Rev. 2007, 85, 118–126. [Google Scholar] [CrossRef]

- Zheng, Q.P.; Wang, J.; Liu, A.L. Stochastic Optimization for Unit Commitment—A Review. IEEE Trans. Power Syst. 2015, 30, 1913–1924. [Google Scholar] [CrossRef]

- Albadi, M.H.; El-Saadany, E.F. A summary of demand response in electricity markets. Electr. Power Syst. Res. 2008, 78, 1989–1996. [Google Scholar] [CrossRef]

- Alagna, V.; Cauret, L.; Entem, M.; Evens, C.; Fritz, W.; Hashmi, M.; Mutale, J.; Linares, P.; Lombardi, M.; Melin, S.; et al. D5.1 Description of Market Mechanisms Which Enable Active Demand Participation in the Power System. Technical Report; ADDRESS Project. 2011. Available online: http://www.addressfp7.org/config/files/ADD-WP5-ContractsMarketsandRegulation.pdf (accessed on 10 July 2019).

- Roques, F.; Perekhodtsev, D.; Hirth, L. Electricity Market Design and RE Deployment; Technical Report; IEA Renewable Energy Technology Deployment: Utrecht, The Netherlands, 2016. [Google Scholar]

- Maurer, L.; Barroso, L. Electricity Auctions: An Overview of Efficient Practices; The World Bank: Washington, DC, USA, 2011. [Google Scholar]

- Chao, H.P.; Wilson, R. Design of Wholesale Electricity Markets. 2001. Available online: http://web.mit.edu/esd.126/www/StdMkt/ChaoWilson.pdf (accessed on 10 July 2019).

- Scharff, R.; Amelin, M. Trading behaviour on the continuous intraday market Elbas. Energy Policy 2016, 88, 544–557. [Google Scholar] [CrossRef]

- Aien, M.; Hajebrahimi, A.; Fotuhi-Firuzabad, M. A comprehensive review on uncertainty modeling techniques in power system studies. Renew. Sustain. Energy Rev. 2016, 1077–1089. [Google Scholar] [CrossRef]

- Stoft, S. The Two-Settlement System. In Power System Economics: Designing Markets for Electricity; Wiley-IEEE Press: Piscataway, NJ, USA, 2002. [Google Scholar]

- Pineda, S.; Conejo, A.J. Using electricity options to hedge against financial risks of power producers. J. Mod. Power Syst. Clean Energy 2013, 1, 101–109. [Google Scholar] [CrossRef]

- Huang, S.; Wu, Q.; Oren, S.S.; Li, R.; Liu, Z. Distribution Locational Marginal Pricing Through Quadratic Programming for Congestion Management in Distribution Networks. IEEE Trans. Power Syst. 2015, 30, 2170–2178. [Google Scholar] [CrossRef]

- Olivella-Rosell, P.; Lloret-Gallego, P.; Munne-Collado, I.; Villafafila-Robles, R.; Sumper, A.; Odegaard Ottessen, S.; Rajasekharan, J.; Bremdal, B.A. Local Flexibility Market Design for Aggregators Providing Multiple Flexibility Services at Distribution Network Level. Energies 2018, 11, 822. [Google Scholar] [CrossRef]

- Eid, C.; Koliou, E.; Valles, M.; Reneses, J.; Hakvoort, R. Time-based pricing and electricity demand response: Existing barriers and next steps. Utilities Policy 2016, 40, 15–25. [Google Scholar] [CrossRef]

- Kim, D.; Kwon, H.; Kim, M.K.; Park, J.K.; Park, H. Determining the flexible ramping capacity of electric vehicles to enhance locational flexibility. Energies 2017, 10, 2028. [Google Scholar] [CrossRef]

- Bucher, M.A.; Delikaraoglou, S.; Heussen, K.; Pinson, P.; Andersson, G. On quantification of flexibility in power systems. In Proceedings of the 2015 IEEE Eindhoven PowerTech, Eindhoven, The Netherlands, 29 June–2 July 2015. [Google Scholar] [CrossRef]

| Category | Goal | Role |

|---|---|---|

| Economic efficiency | efficient production | objective |

| efficient allocation | objective | |

| completeness | constraint | |

| incentive-compatibility | constraint | |

| complete risk-hedging | constraint | |

| cost recovery | constraint | |

| liquidity & competitiveness | objective | |

| System reliability | sufficient network capacity | constraint |

| voltage regulation | constraint | |

| power balance | constraint | |

| Prosumer involvement | non-discriminatory access | constraint |

| information transparency | objective | |

| privacy | objective | |

| fairness | objective | |

| simplicity | objective | |

| Implementability | technical feasibility | constraint |

| scalability | objective | |

| stakeholder agreement | objective | |

| compatibility with wholesale markets | objective | |

| consistency with regulations | objective |

| Design Variable | Design Options |

|---|---|

| Choice of sub-markets | energy/substation capacity/voltage regulation |

| Market type | bilateral/organised |

| Linkage between sub-markets | explicit/implicit |

| Linkage to wholesale markets | complete/partial |

| Category | Design Variable | Design Options |

|---|---|---|

| General organisation | buyer and seller | one-sided/double-sided |

| entry requirements | universal/tech-specific, voluntary/mandatory | |

| info disclosure | fully transparent–fully hidden | |

| Bid format | bid content | simple/complex |

| time resolution | 1 s–15 min | |

| gate closure time | 1 s–24 h | |

| locational info | global/zonal/nodal | |

| Allocation & payment | objective | economic efficiency/renewables/self-sufficiency/… |

| pricing mechanism | uniform/discriminatory | |

| price cap | yes/no (or sufficiently high) | |

| Settlement | method | physical/financial |

| pricing directions | one-price/two-price | |

| risk-hedging tools | no/forward market/options/stochastic clearing/… |

| Market Design | IM | LEM | LFM |

|---|---|---|---|

| Explicit linkage | all sub-markets | energy–network capacity | Flex–network capacity |

| Commodity | integrated product | locational energy + Flex | energy + locational Flex |

| Flex payment | implicit | explicit, non-location-specific | explicit, location-specific |

| Advantages | optimal dispatch in theory, incentive-compatible price | promoting Flex deployment, liquid Flex market | promoting free energy trading and Flex deploy- ment, Flex at right places |

| Challenges | privacy issue, sophisti- cated clearing algorithm, unpredictable price | standard Flex contract, Flex pricing, Flex at wrong places; if a DSO sells Flex: distorted incentive, tariff fairness | standard Flex contract, Flex pricing, less liquid Flex market |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Piao, L.; de Vries, L.; de Weerdt, M.; Yorke-Smith, N. Electricity Markets for DC Distribution Systems: Design Options. Energies 2019, 12, 2640. https://doi.org/10.3390/en12142640

Piao L, de Vries L, de Weerdt M, Yorke-Smith N. Electricity Markets for DC Distribution Systems: Design Options. Energies. 2019; 12(14):2640. https://doi.org/10.3390/en12142640

Chicago/Turabian StylePiao, Longjian, Laurens de Vries, Mathijs de Weerdt, and Neil Yorke-Smith. 2019. "Electricity Markets for DC Distribution Systems: Design Options" Energies 12, no. 14: 2640. https://doi.org/10.3390/en12142640

APA StylePiao, L., de Vries, L., de Weerdt, M., & Yorke-Smith, N. (2019). Electricity Markets for DC Distribution Systems: Design Options. Energies, 12(14), 2640. https://doi.org/10.3390/en12142640