Increasing the Competitiveness of Tidal Systems by Means of the Improvement of Installation and Maintenance Maneuvers in First Generation Tidal Energy Converters—An Economic Argumentation

Abstract

:1. Introduction

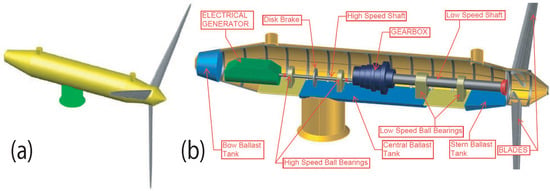

2. Description of Installation and Maintenance Maneuvers for Gravity-Based First Generation TECs

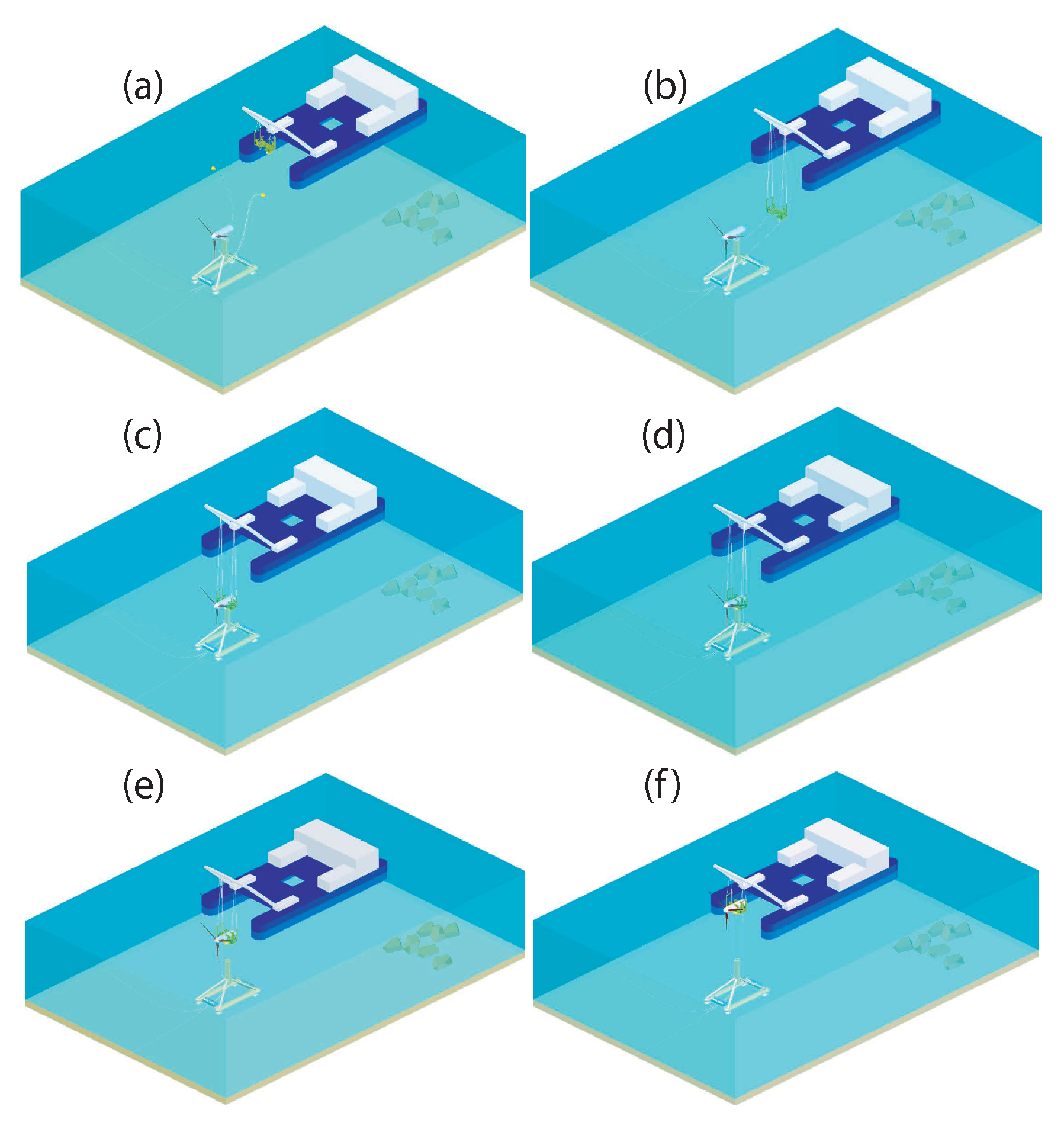

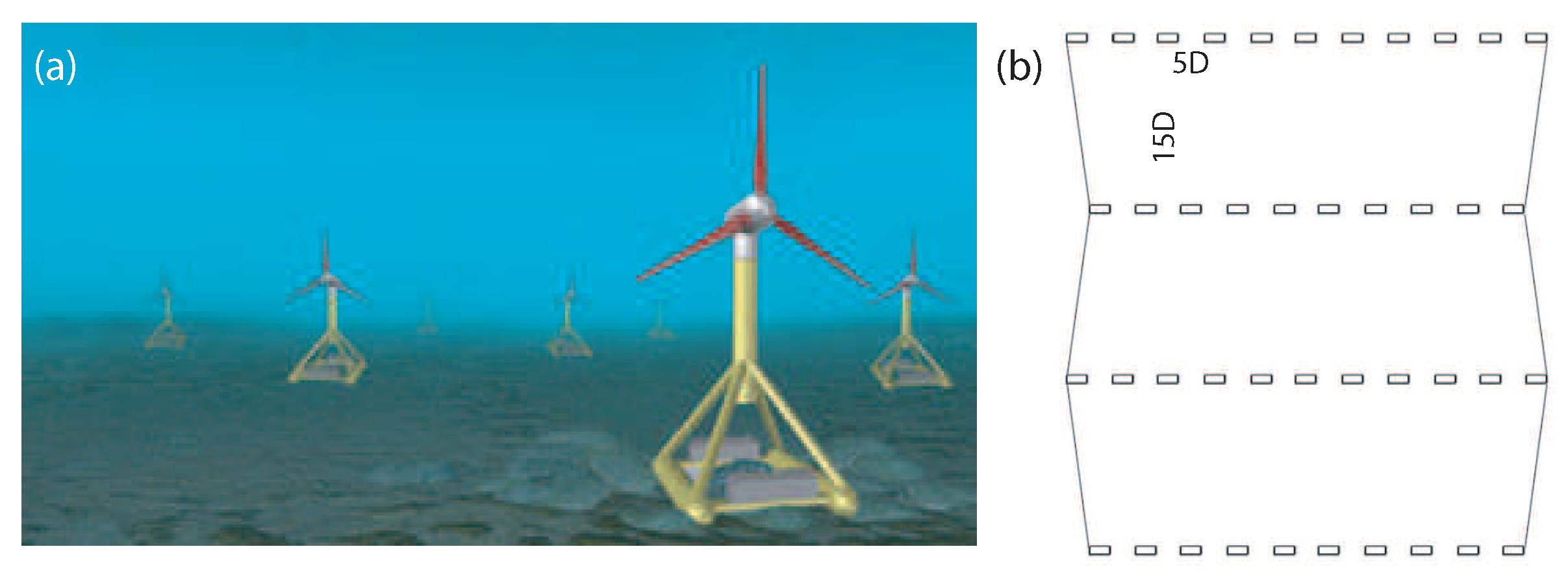

- Installation sequence at the tidal farm level: The first elements to be installed are the transformation platform and the converters. Bearing in mind the depth and the composition of the seabed on which the TEF is installed (around 40 m), the use of a jacket platform is recommended owing to the fact that it is very safe, in addition to being highly adaptable and reliable [36,37]. The following element to be installed is the exportation cable, which requires the use of a cable-laying vessel (Figure 1a). The cable-laying vessel transports the umbilical cable from the transformation platform to the special vessel in charge of transporting the TEC (Figure 1b), and the connection between the base structure and the transformation platform is, therefore, achieved (Figure 1c). The cable-laying vessel waits until the base TEC has been installed (Figure 1d), after which it is possible to install the base structure on the seabed by means of gravity (the procedure employed to install the base structure will be described below and is illustrated in Figure 2). Once the base support has been installed, the cable is extended in order to connect it to the adjacent TEC. During this procedure, the installation vessel has sufficient time to return to the base port and then return to the TEF with a new device. The cable-laying vessel waits to be given the end of the cable in order to perform the connection between the end of that cable and the new TEC structure and to repeat the cable connection process that will join it to the next TEC. This process is repeated until the TEF is completely installed.

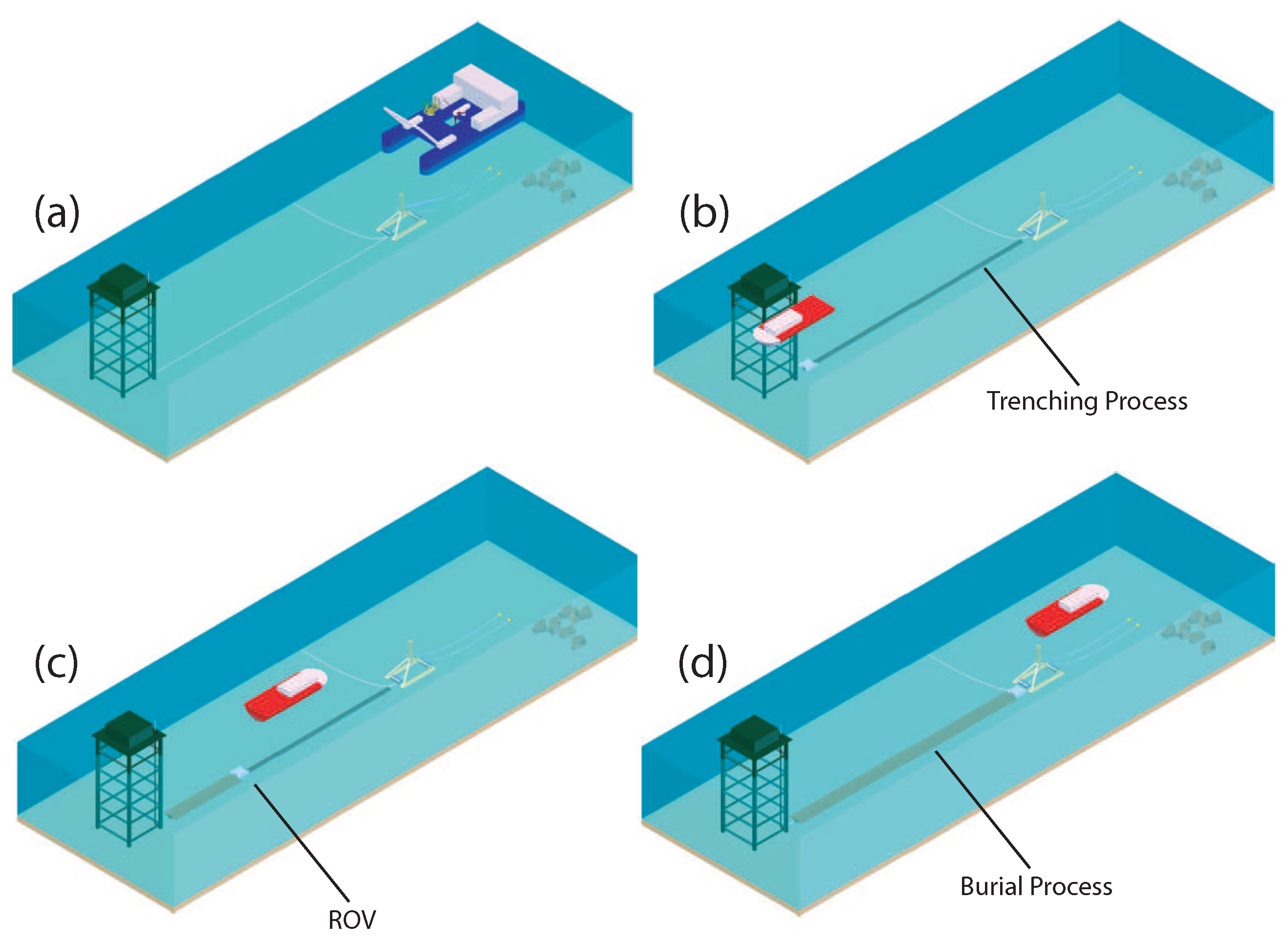

- Installation of the submarine cables: It should be noted that it is fundamental to provide the interconnection cables and the exportation cables with adequate protection in order to avoid possible natural damage (resulting from earthquakes or movements caused by waves and currents) or damage caused by human activities (anchors or fishing artifacts, among others). The protection usually employed is that of burying the cables to a sufficient depth (from 0.5 m to 1 m) [38]. The following equipment is required to install the submarine cables: (i) a cable-laying vessel with its auxiliary equipment; (ii) ROVs to perform the trenching and burial processes; (iii) tug vessels with cranes and a diving team; and (iv) ground equipment, such as excavators, winches, trucks, etc. The procedure employed is the following: the cable-laying vessel is in charge of depositing the cables on the seabed following the most homogeneous path in order to avoid zones with rocks (Figure 2a). The trenching process is carried out in the opposite direction to the cable-laying process and is performed by a ROV-trencher (Figure 2b). This device is in charge of removing the cable, making the trench and placing the cable inside the trench [39]. The same ROV (but using a different tool) then performs the burying process in the opposite manner to the trenching process, thus leaving the cable completely covered (Figure 2c,d).

2.1. Manual Installation and Maintenance Maneuvers for First Generation TECs

- Installation of the support structure of the TECs:

- -

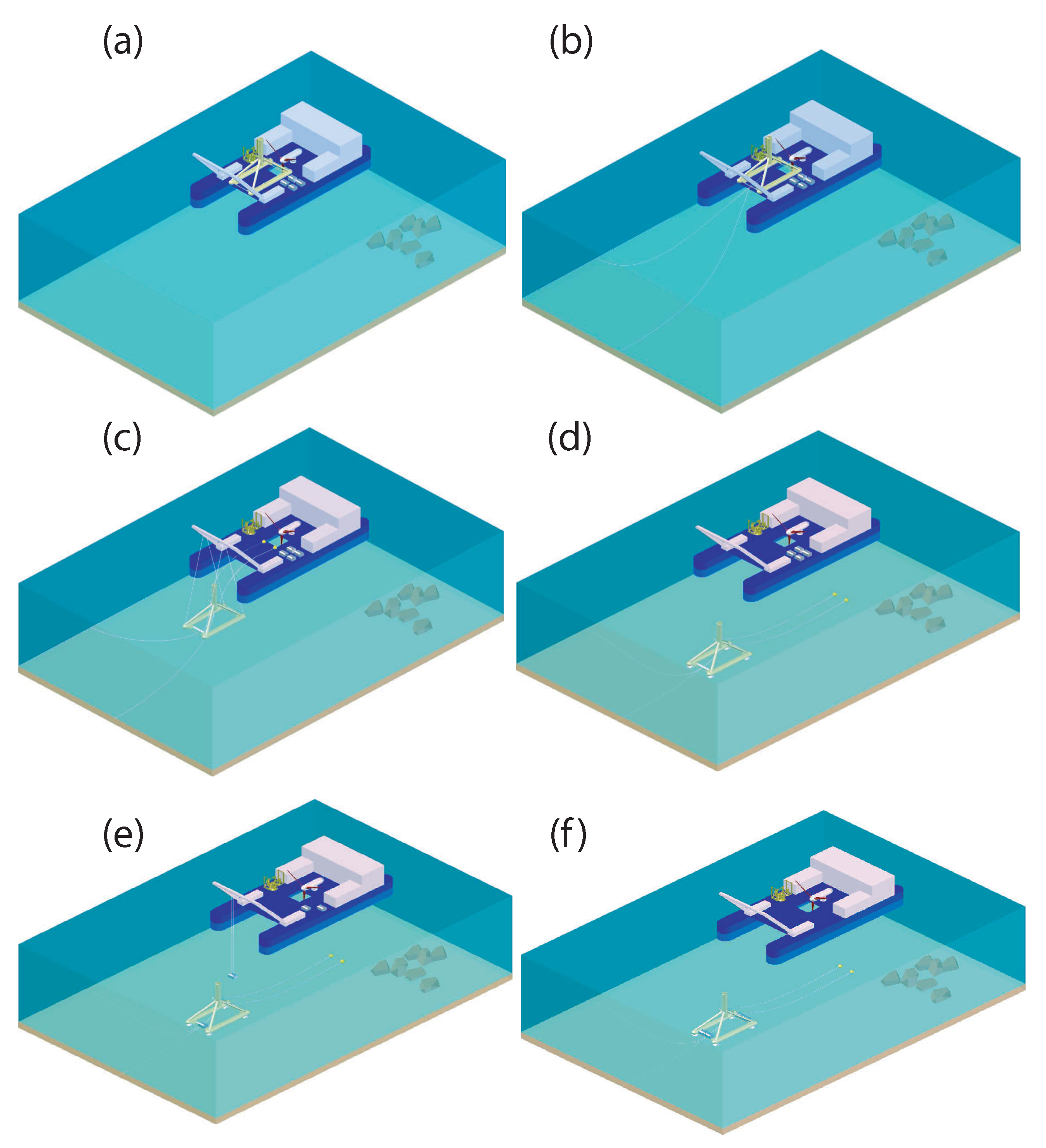

- The special vessel transports the complete TEC and the equipment required (support structure, ballasts, gondola, etc.) simultaneously (see Figure 4a), and moves from the base port towards the TEF. When it is at the TEF, it uses its dynamic positioning system to place all the necessary items in the exact position in which the TEC will be installed.

- -

- The umbilical cables are then connected to the base structure and the guide cables used to recover the gondola are attached to the deck of the vessel, thus preparing the TEC structure for its installation (see Figure 4b).

- -

- The crane on the special vessel raises the TEC structure off the special vessel by means of four cables, and the descent process begins. The descent process is performed thanks to the weight of the TEC structure and the guide cables, and the descent velocity and the orientation of the TEC structure with regard to the special vessel are controlled (see Figure 4c). When the structure is correctly positioned, special concrete bags are released in order to fix the TEC structure to the seabed (see Figure 4d). The cables used during the descent process are subsequently removed.

- -

- The ballasts are placed on the TEC structure. This operation is performed by the crane, and the ballasts are lowered one by one (see Figure 4e).

- -

- Finally, the guide cables are detached from the vessel and are submerged by means of a ballast and a buoy in order to recover them during the future gondola installation process. These cables are placed on the seabed in a zone that does not involve risks as regards the installation procedures of the other devices, the farm or the umbilical cables. The TEC structure is now considered to be completely installed (see Figure 4f).

- Installation of the gondolas:

- -

- Once the support structure has been completely installed, the special vessel is placed on the TEC structure and the guide cables of the gondola are recovered by means of an acoustic signal (see Figure 5a).

- -

- In order to work with the gondolas, a specific tool equipped with a hydraulic system will be used, whose objective is to wrap itself around the gondola that is to be installed or recovered. Its operation is similar to that of a clamp (see Figure 6).

- -

- The guide cables are connected to the tool used to lower the gondola (see Figure 5b). These cables facilitate the descent of the gondola and the insertion of the gondola into the structure.

- -

- -

- The final step is that of removing the tool used to install the gondola and the retrieval of the guide cables. Figure 5e illustrates the removal process. When the tool is on the deck of the vessel, the guide cables are removed from the tool and are submerged in a safe location by means of a ballast and a buoy in order to recover them during the next intervention. Figure 5f shows the installation of the whole TEC once the process has been completed.

- Recovery of a submerged gondola:

- -

- The starting point is that of locating the special vessel above the gondola to be recovered. The first step is the recovery of the cables from the seabed. The ends of the cables are released from the seabed by means of an acoustic signal (see Figure 7a) and these cables are connected to the tool used to recover the gondola.

- -

- The tool starts its descent, following a trajectory with an inclination angle that permits the tool to wrap itself around the back of the gondola (see Figure 7b).

- -

- -

- The process of raising the gondola begins. As the cables are tightened, the displacements are very small and the operation is carried out under safe conditions (see Figure 7e).

- -

- When the whole system (gondola + tool) is outside the water, the cables are removed from the tool and are submerged again by means of a ballast and a buoy in order to recover them in the future (see Figure 7f).

2.2. Automated Installation and Maintenance Maneuvers for First Generation TECs

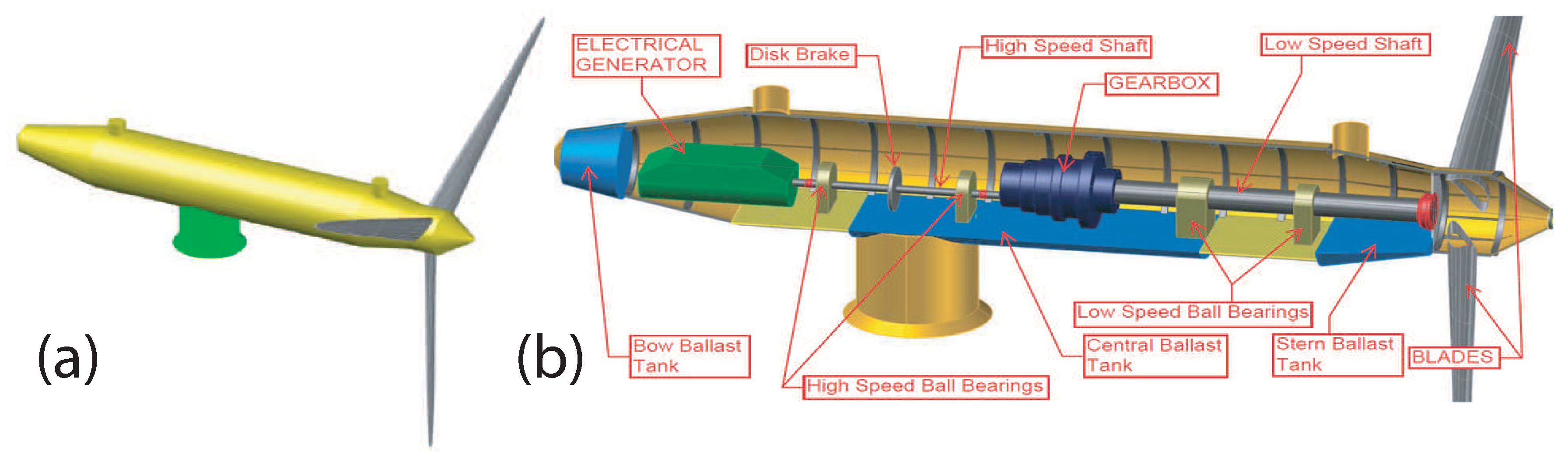

2.2.1. Modifications Made to TECs in Order to Perform Automated Maneuvers

2.2.2. Automated Installation and Maintenance Maneuvers

- Installation of the base structure of the TECs: Note that the structure of the TECs designed for manual maneuvers is the same as the structure designed for automated maneuvers. The installation methodology of the structure of these TECs is, therefore, similar to that used in traditional installation maneuvers.

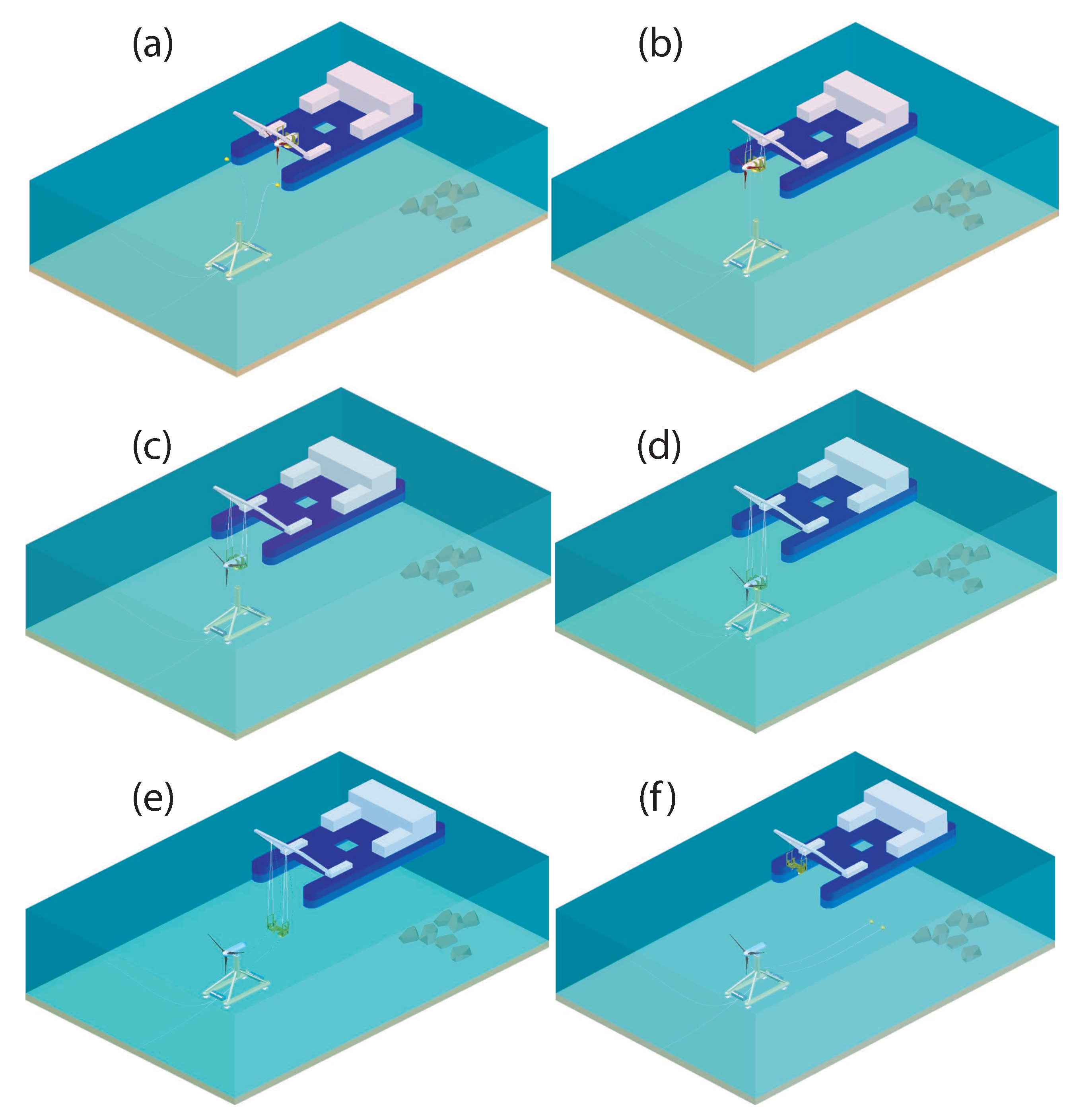

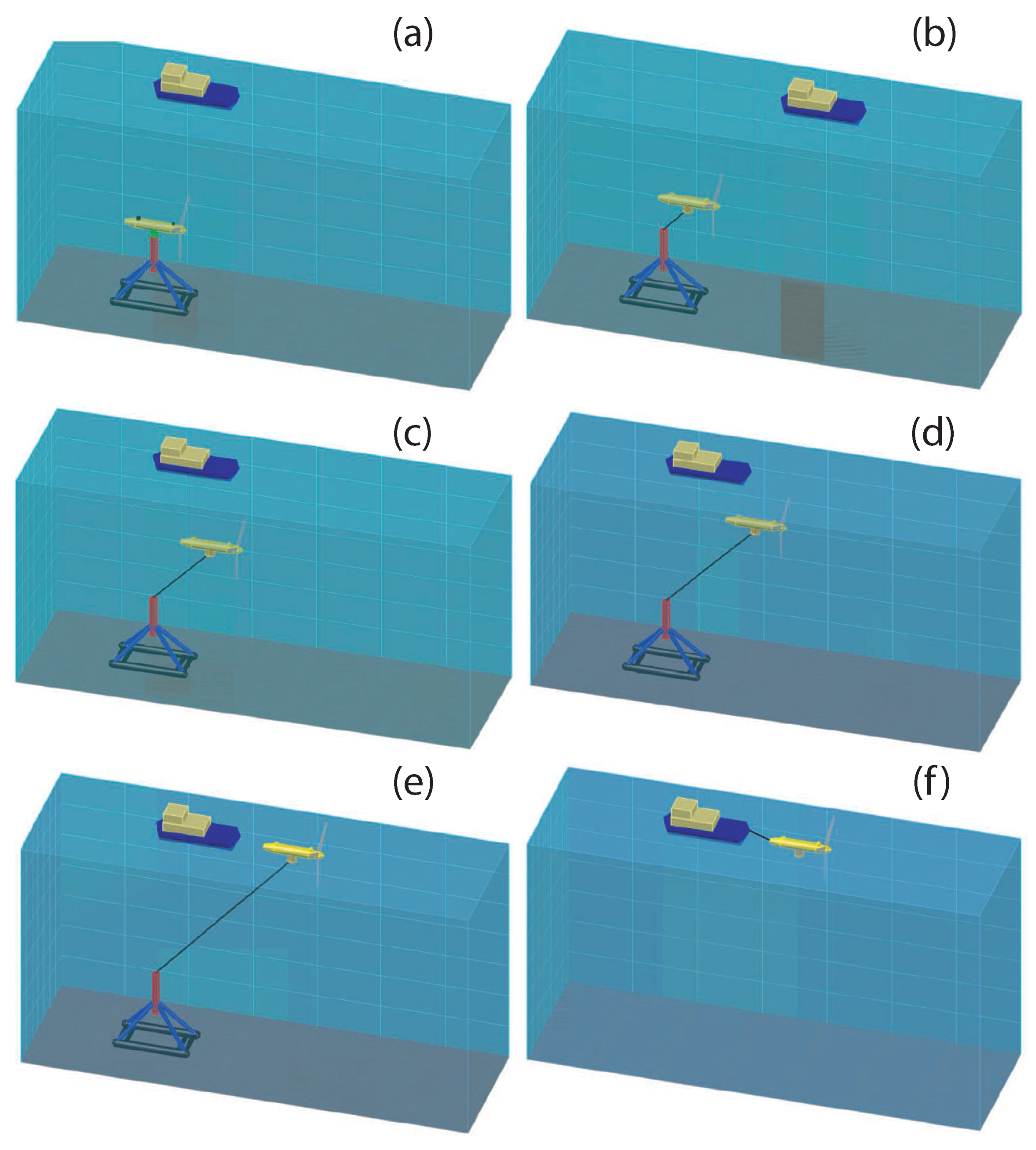

- Installation of the gondolas (immersion sequence): As the gondola is modified to be able to perform automated maneuvers, the installation sequence of the gondolas is different to that used in traditional maneuvers. Figure 9 provides a graphical sequence of the complete process, which is detailed as follows:

- -

- Once the base structure that supports the gondola is completely installed, the gondola is moved using a tugboat. The tugboat will move one gondola per trip (see Figure 9a).

- -

- When the tugboat arrives in the position in which the gondola will be placed, the guide cables connected to the structure of the TEC are recovered by using an acoustic signal (see Figure 9b).

- -

- In the following step, the gondola is lowered onto the seabed. The inner ballast water inside the device is controlled, signifying that the gondola starts filling with water and its inner ballasts permit the gondola to descend. If the difference between the weight of the gondola and the buoyancy force is small, the descent process will be performed slowly. The descent velocity is completely controlled by changing the amount of water inside the inner ballasts (see Figure 9c,d). The gondola descends to a depth close to the base structure that will support the gondola.

- -

- When the gondola is at the desired depth, but not in a vertical position as regards the base structure owing to the tidal currents, the guide cable will help install the gondola on the base (see Figure 9e).

- -

- When the gondola is on the structure of the TEC, the inner ballasts of the gondola are filled with water in order to achieve an adequate coupling with the base structure. The installation of the TEC is, therefore, completed (see Figure 9f).

- Recovery of a submerged gondola (emersion sequence):Figure 10 shows a visual sequence of the procedure, and a detailed description is provided below.

- -

- -

- The controlled emersion process of the gondola now begins. Water is emptied out of the inner ballast of the gondola in a controlled manner in order to obtain a smooth emersion movement (see Figure 10c,d). A guide cable is used during the emersion process.

- -

- When the gondola is on the surface of the sea, the inner ballast is completely emptied in order to increase the buoyancy of the gondola, after which, the control system is disconnected.

- -

- -

- All the steps explained for the installation of the gondola (immersion maneuver) are repeated to achieve the connection between the base structure of the TEC and the gondola.

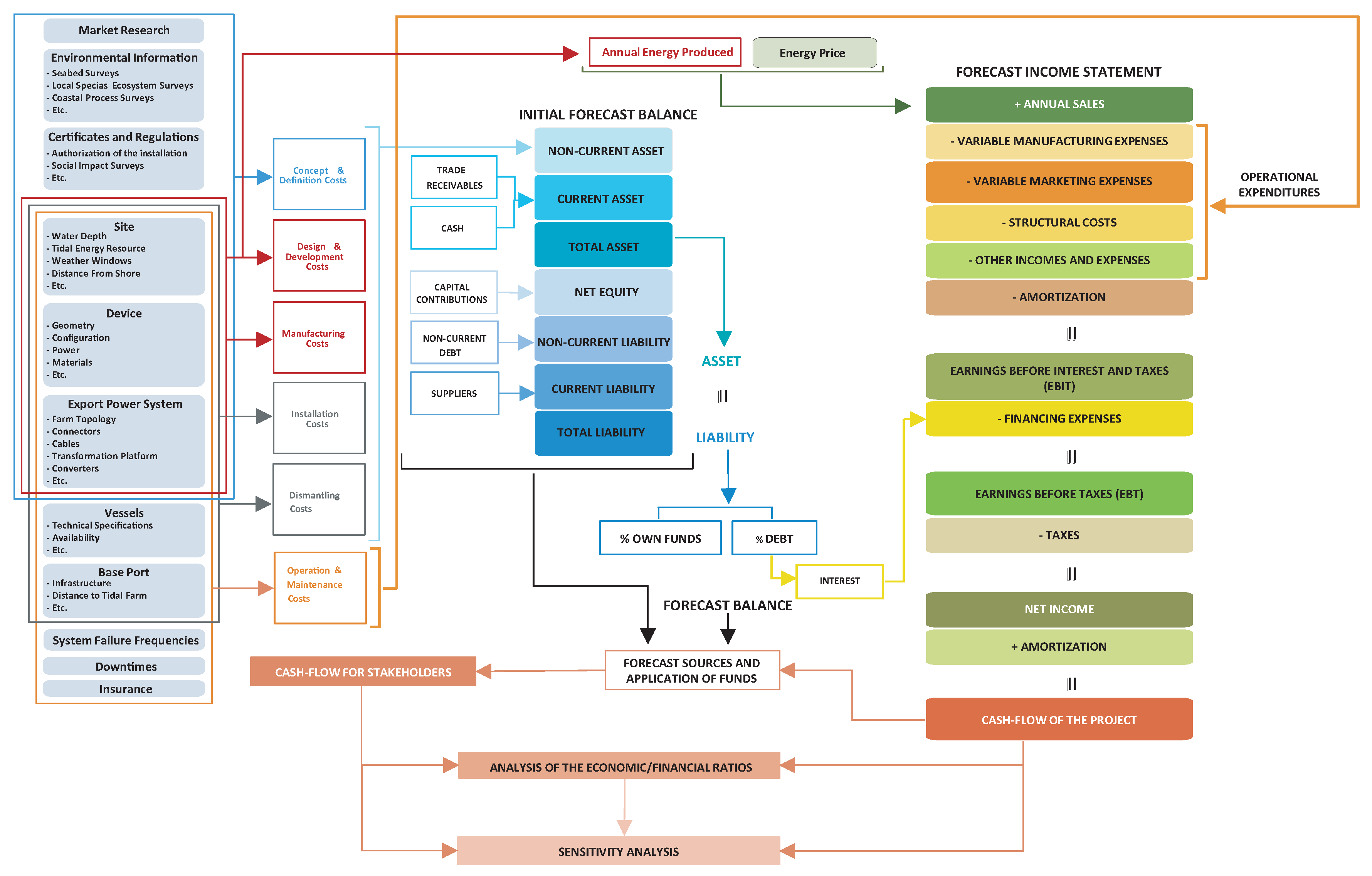

3. Economic-Financial Feasibility Procedure

3.1. Study of the Costs throughout the Service Life of the Project and Estimation of the Annual Sales

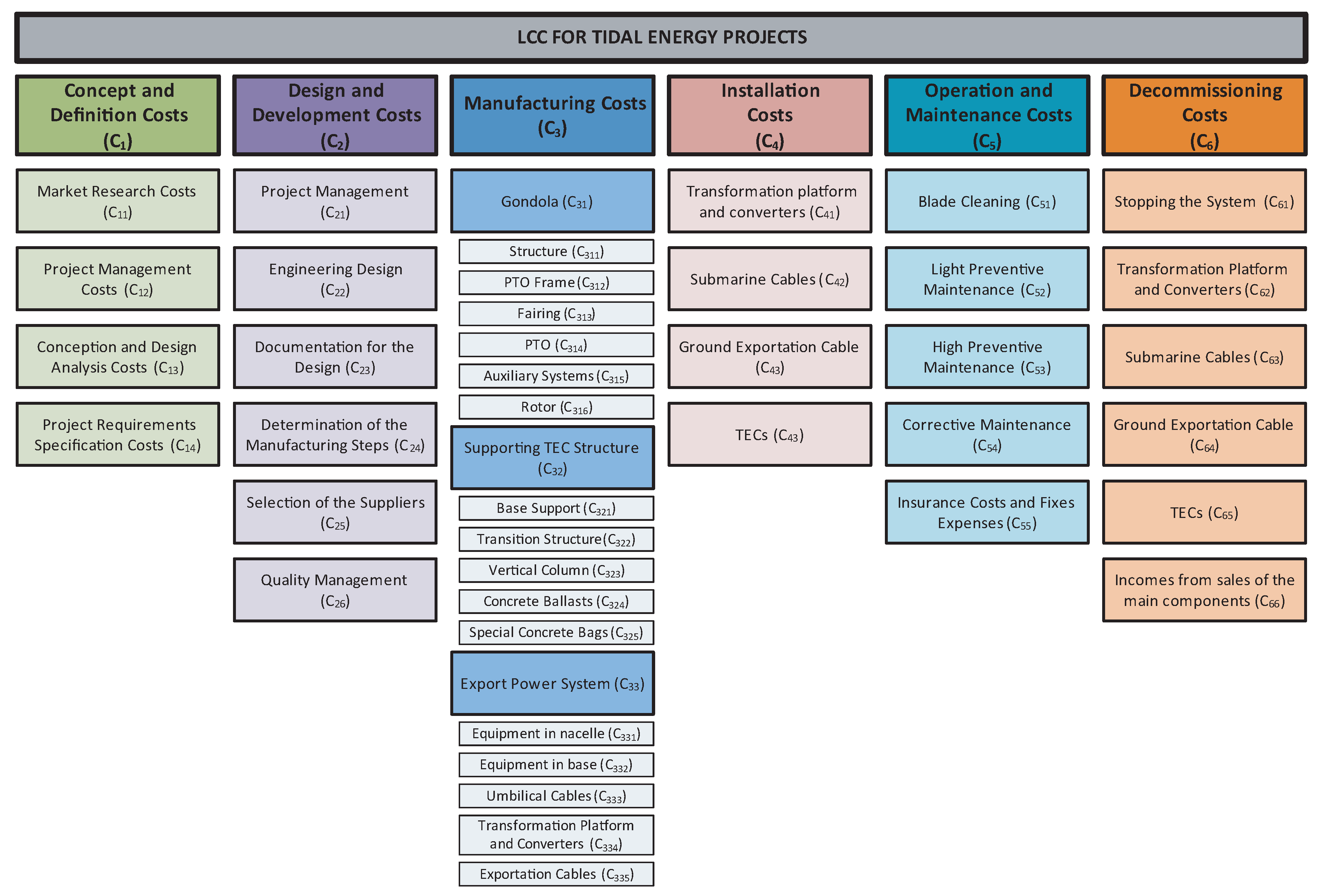

3.1.1. LCC for TEPs

- Concept and definition costs (): These costs correspond to those activities whose objective is to guarantee the feasibility of the project. The costs typically included are the following: (i) market research costs; (ii) project management costs; (iii) conception of the tidal farm and design analysis costs; and (iv) project requirement specification costs.

- Design and development costs (): These costs comprise the specification of the requirements of the project and also provide proof that the project has been carried out. They typically include costs regarding: (i) the management of the project; (ii) a technical design and activities for the protection of the environment; (iii) the documentation required for the design; (iv) the definition of the manufacturing steps for the TEF; (v) the inclusion of the selected suppliers; or (vi) quality management.

- Manufacturing costs (): These encompass all the costs of manufacturing the elements employed to construct the tidal energy farm and, at this stage, principally consist of: (i) the gondola; (ii) the support structure of the TEC; and (iii) the export power system.

- Installation costs (): These are related to the activities required to install all the elements required to construct the TEF, which are, at this stage, typically: (i) the installation of the transformation platform and converters; (ii) the installation of the submarine cables; (iii) the installation of the ground exportation cable; and (iv) the installation of the TECs.

- Operation and maintenance costs (): These are all the costs of exploiting the tidal energy project, and include: (i) blade cleaning; (ii) light preventive maintenance; (iii) high preventive maintenance; (iv) corrective maintenance; and (v) insurance costs and fixed expenses.

- Decommissioning costs (): These concern the activities required to remove and dispose of the components related to the project, so as to leave the sea as it was before the project started. The principal costs are, in this case: (i) stopping the system; (ii) dismantling the transformation platform and the converters; (iii) dismantling the submarine cables; (iv) dismantling the exportation cable; (v) dismantling the TECs; and (vi) incomes obtained from the sales of the main components (this value will be modeled in the cost structure as a negative value because it is an income).

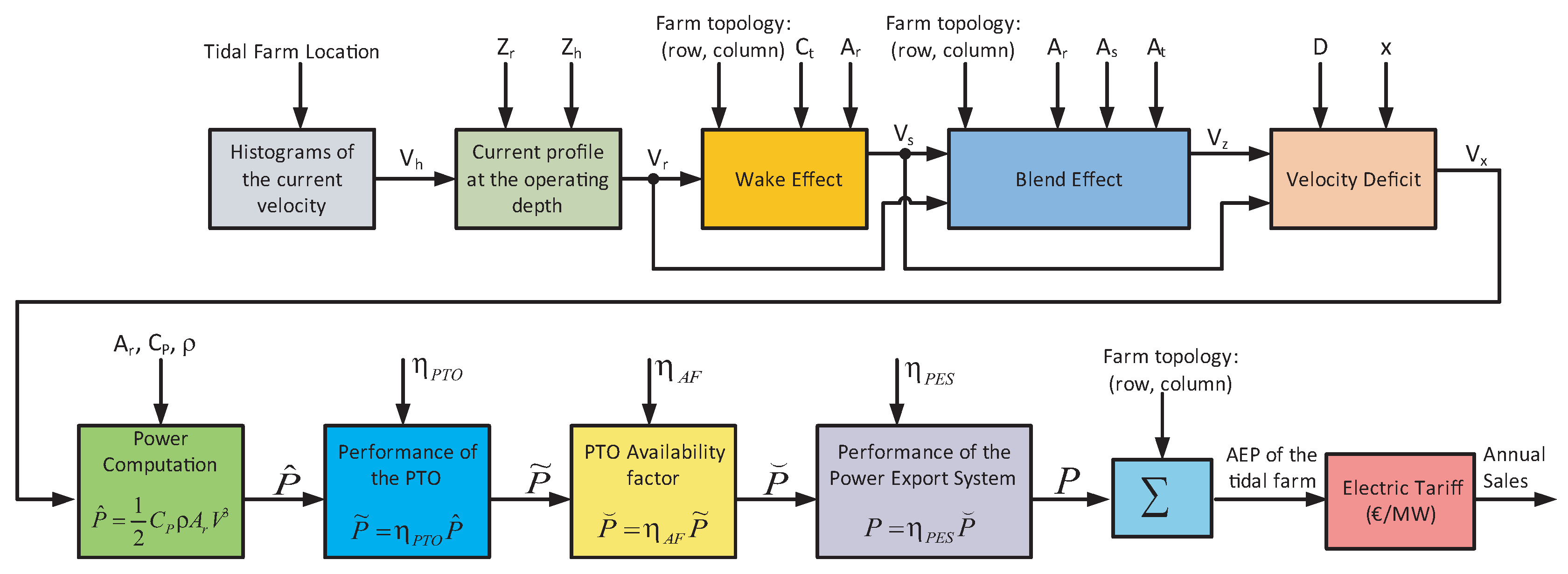

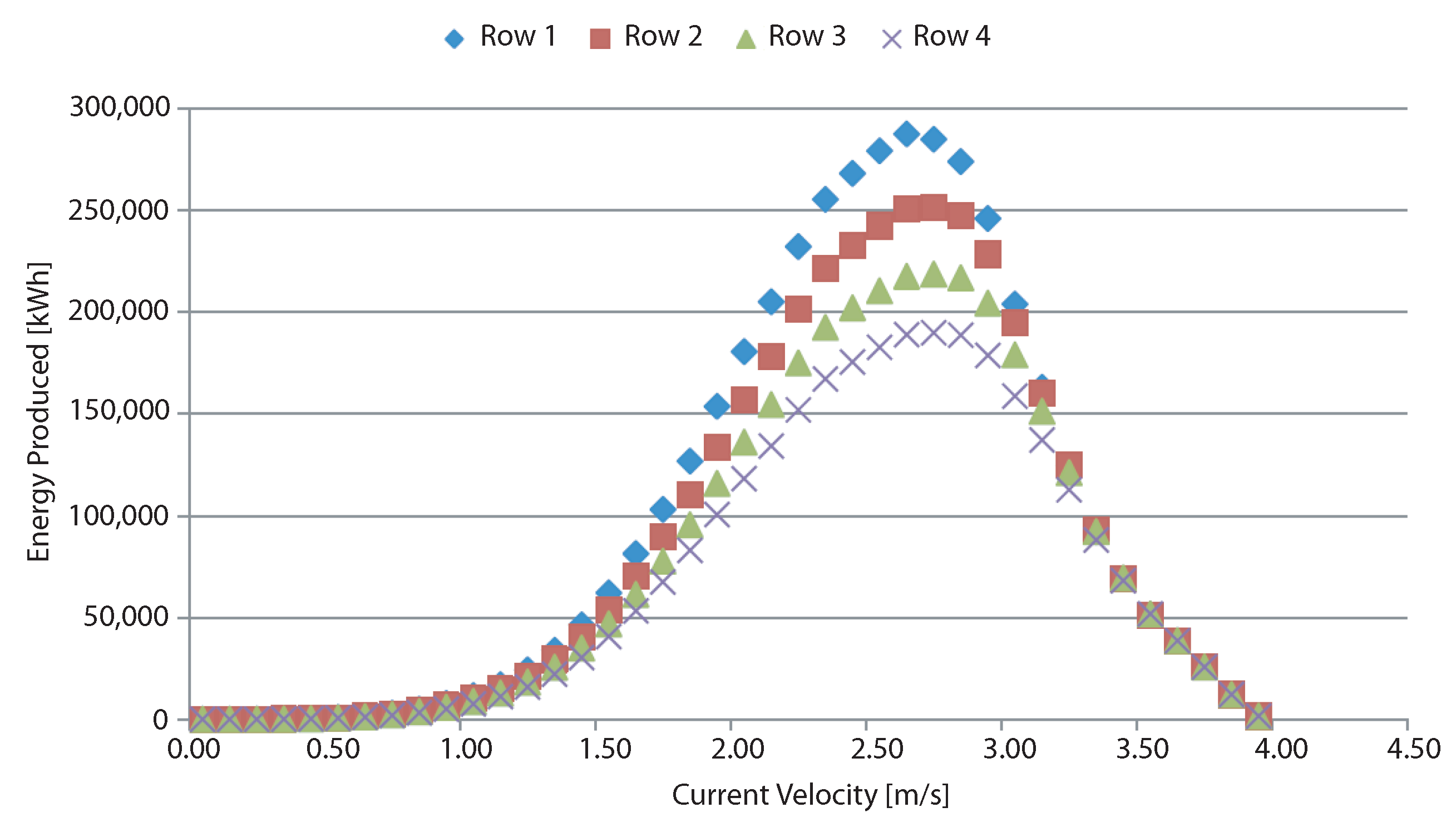

3.1.2. Estimation of the Annual Sales

3.2. Financing Structure of the Model

3.3. Forecast Balance, Forecast Income Statement, and Forecast Sources and Application of Funds in the Model

3.3.1. Forecast Balance

3.3.2. Forecast Income Statement

3.3.3. Forecast Sources and Application of Funds

3.4. Analysis of the Economic and Financial Ratios

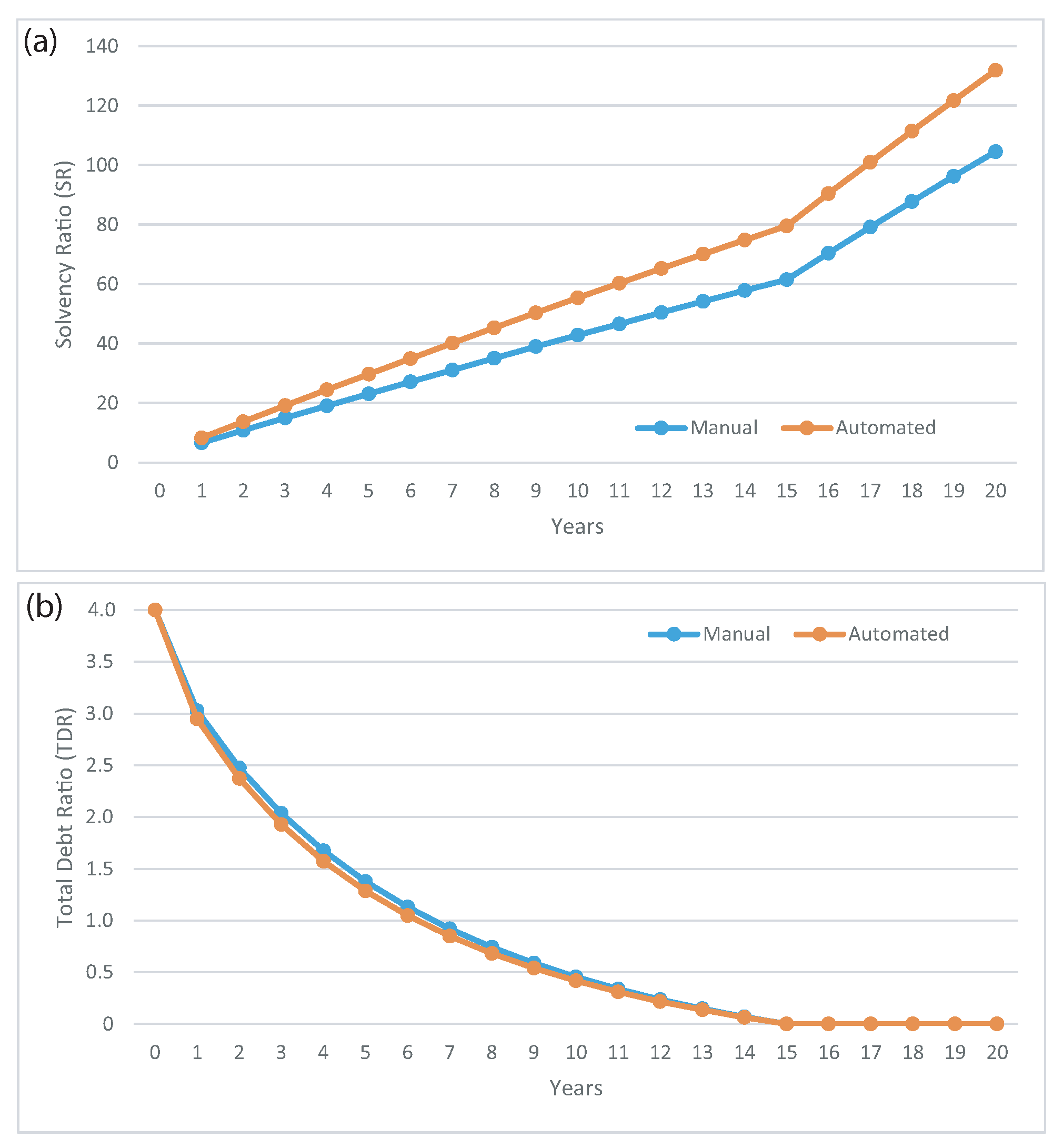

- Financial Ratios: The information obtained in the forecast balance is utilized to determine the project’s short-term situation and its liquidity, in addition to its degree of long-term sustainability and its solvency. The following financial ratios will be studied: (i) Solvency Ratio (SR), which will make it possible to ascertain how effective the project must be if it is to produce sufficient liquid financial resources in order to punctually meet its commitments as regards the payment of short-term debts resulting from their cycle of operation, in addition to the short-term practicable payments in the same cycle, and (ii) Total-Debt Ratio (TDR), which makes it possible to determine the financial dependence degree by means of the structural composition of funding sources.

- Economic Ratios: These make it possible to discover whether the assets are efficiently employed with regard to the management of the operations of said project. The following ratios are employed: (i) Return of assets (ROA), which shows how effective the assets are as regards producing value and; (ii) Return of Equity (ROE), which illustrates how effective the capital contributed by the investors has been. This depends on the net income attained that year.

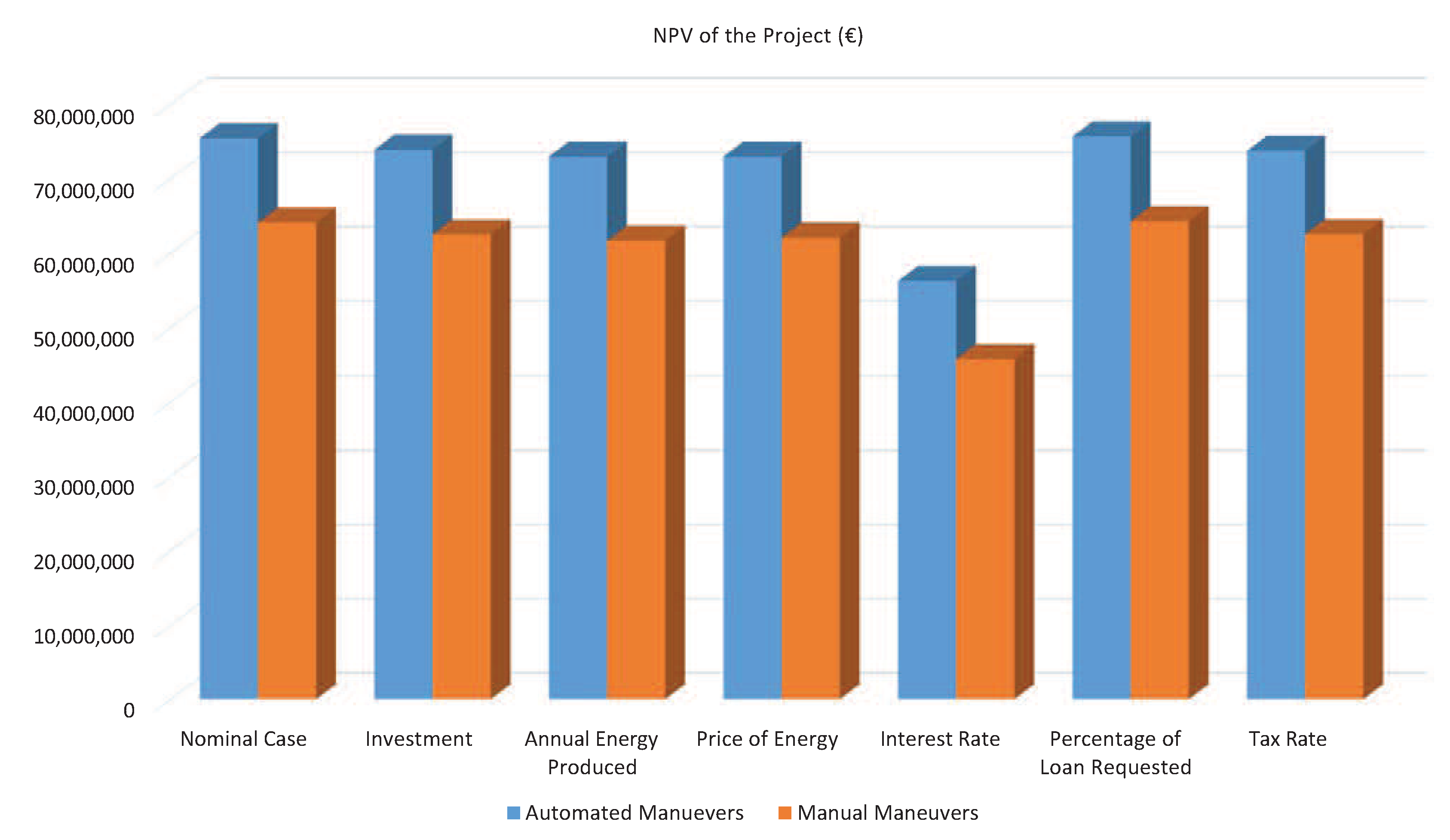

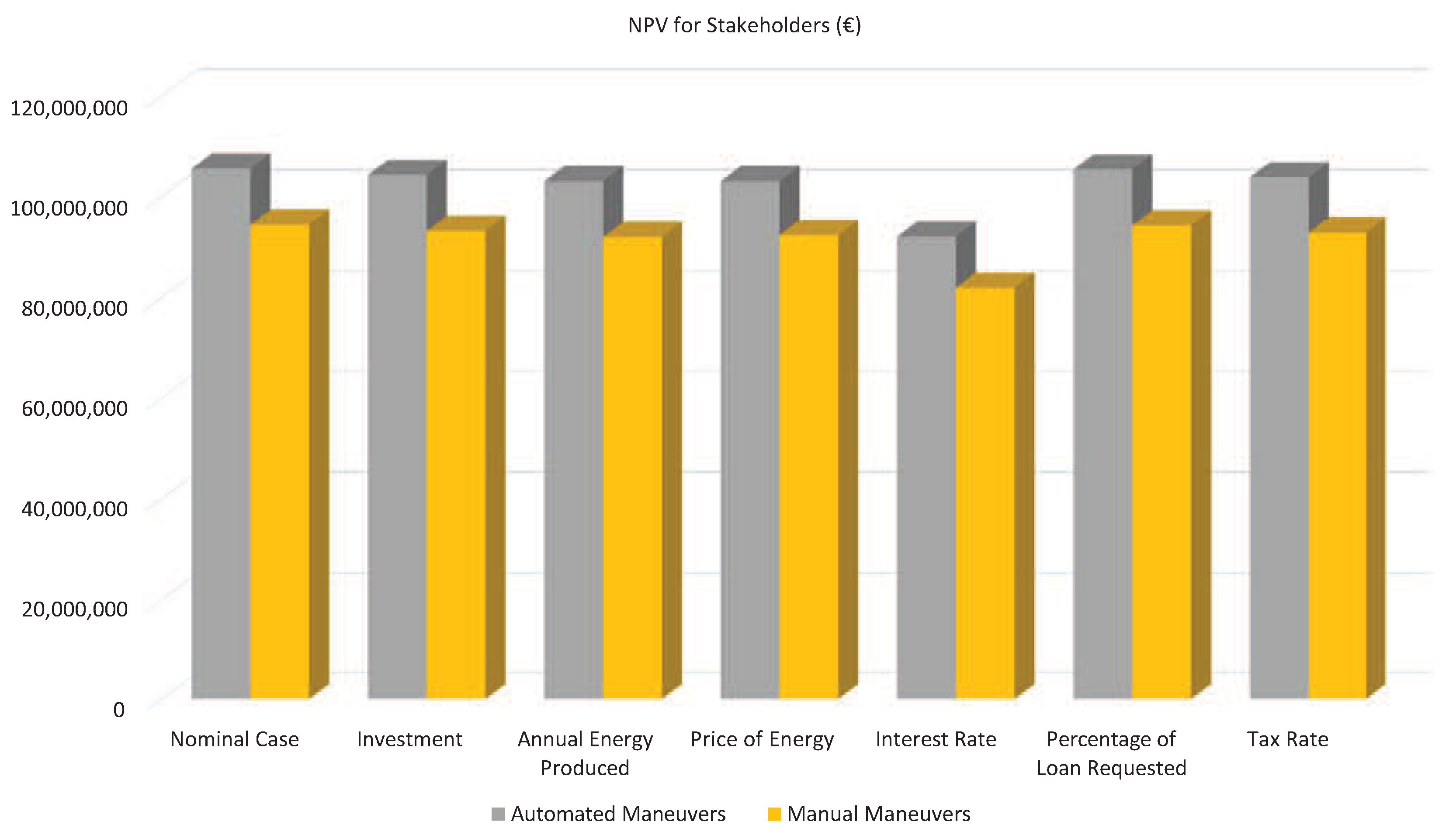

3.5. Sensitivity Analysis

4. Case Study

4.1. Description of the Design and Economic-Financial Parameters

- The electric tariff that has been contemplated is 0.14 €/kWh, increasing by 1.5% every year [16].

- The costs included in the model increase by 1.5% each year.

- The nominal annual discount rate contemplated is 6%, and a value of 2% has also been contemplated for the rate of inflation.

- We assume that: (i) 80% of the investment will be achieved from financing, there will be a fifteen year term and a 3% interest rate for the debt; and (ii) 20% of the total investment will be financed by the partners by means of the project funds.

- The average collection period contemplated is 30 days. The average period of payment is assumed to be 90 days after the service has been provided.

- A system annual depreciation of 5% is assumed in order to achieve a more realistic result.

- The tax rate applied will be 30%.

- There is a particular difficulty as regards the decommissioning costs for TEFs. This is because of the weather windows, the volatility of the costs of the vessels used in this type of operations, the characteristics and uncertainty of offshore operations, etc. Furthermore, there is, at present, no accurate information regarding the quantification of the costs of TEFs because none have been dismantled to date. The decision was, therefore, made not to include the dismantling costs in this case study owing to the aforementioned considerations and uncertainties.

4.2. Results for Gravity-Based First Generation TECs Maintained with Manual and Automated Maneuvers

4.2.1. Analysis of the Economic-Financial Ratios

4.2.2. Sensitivity Analysis

4.3. Comparative Sensitivity Analysis

5. Conclusions and Future Works

Author Contributions

Funding

Conflicts of Interest

Abbreviations

| AEP | Annual Energy Produced |

| AM | Amortization |

| AS | Annual Sales |

| DPBP | Discounted Payback Period |

| EBT | Earnings Before Taxes |

| EU | European Union |

| FE | Financing Expenses |

| GIT-ERM | Grupo de Investigación Tecnológico en Energías Renovables Marinas |

| IRR | Internal Rate of Return |

| LCC | Life Cycle Costs |

| OPEX | Operational Expenditures |

| MRE | Marine Renewable Energy |

| NI | Net Income |

| NPV | Net Present Value |

| O & M | Operation and Maintenance |

| ROA | Return of Assets |

| ROE | Return of Equity |

| ROV | Remotely Operated Vehicle |

| SR | Solvency Ratio |

| T | Corporate Taxes |

| TDR | Total-Debt Ratio |

| TEC | Tidal Energy Converter |

| TEF | Tidal Energy Farm |

| TEP | Tidal Energy Projects |

| UK | United Kingdom |

References

- Rodríguez-Delgado, C.; Bergillos, R.A.; Iglesias, G. Dual wave farms for energy production and coastal protection under sea level rise. J. Clean. Prod. 2019, 222, 364–372. [Google Scholar] [CrossRef]

- Atilgan, B.; Azapagic, A. Life cycle environmental impacts of electricity from fossil fuels in Turkey. J. Clean. Prod. 2015, 106, 555–564. [Google Scholar] [CrossRef]

- Sequeira, T.N.; Santos, M.S. Renewable energy and politics: A sistematic review and new evidence. J. Clean. Prod. 2018, 192, 553–568. [Google Scholar] [CrossRef]

- Sinha, A.; Shahbaz, M.; Sengupta, T. Renewable energy and policies and contratictions in causality: A case of next 11 countries. J. Clean. Prod. 2018, 197, 73–84. [Google Scholar] [CrossRef]

- Directive 2009/28/EC of the European Parliament and of the Council of 23 April 2009 on the promotion of the use of energy from renewable sources and amending and subsequently repealing directives 2001/77/EC and 2003/30/EC. Off. J. Eur. Union 2009, 16–60.

- Magagna, D.; MacGillivray, A.; Jeffrey, H.; Hanmer, C.; Raventos, A.; Badcock-Broe, A.; Tzimas, E. Wave and Tidal Energy Strategic Technology Agenda; SI Ocean: Brussels, Belgium, 2014. [Google Scholar]

- Jeffrey, H.; Jay, B.; Winskel, M. Accelerating the development of marine energy: Exploring the prospects, benefits and challenges. Technol. For. Soc. Chang. 2013, 80, 1306–1316. [Google Scholar] [CrossRef]

- United Nations Framework Convention on Climate Change, 2015. Paris Agreement; UNFCCC Secretariat: Bonn, Germany, 2016. [Google Scholar]

- Overcoming Research Challenges for Ocean Renewable Energy; Energy Research Knowledge Centre: Brussels, Belgium, 2013.

- Ocean Energy Strategic Roadmap 2016, Building Ocean Energy for Europe. Ocean Energy Forum, 8 November 2016.

- Hardisty, J. The Analysis of Tidal Stream Power; Wiley: Hoboken, NJ, USA, 2009; ISBN 978-0-470-72451-4. [Google Scholar]

- Portilla, M.P.; Somolinos, J.A.; López, A.; Morales, R. Modelado dinámico y control de un dispositivo sumergido provisto de actuadores hidrostáticos. Revista Iberoamericana de Automática e Informática Industrial 2018, 15, 12–23. [Google Scholar] [CrossRef]

- Alstom Tidal Turbines Web Page. Available online: https://marineenergy.biz/tag/alstom/ (accessed on 3 April 2019).

- Andritz Hydro Hammerfest. How It Works. Available online: http://www.andritz.com/hy-hammerfest.pdf (accessed on 3 April 2019).

- Fallon, D.; Hartnett, M.; Olbert, A.; Nash, S. The effects of array configuration on the hydro-environmental impacts on tidal turbines. Renew. Energy 2014, 64, 10–25. [Google Scholar] [CrossRef]

- Segura, E.; Morales, R.; Somolinos, J.A. A strategic analysis of tidal current energy conversion systems in the European Union. Appl. Energy 2018, 212, 527–551. [Google Scholar] [CrossRef]

- Denny, E. The economics of tidal energy. Energy Policy 2009, 37, 1914–1924. [Google Scholar] [CrossRef]

- Segura, E.; Morales, R.; Somolinos, J.A.; López, A. Techno-economic challenges of tidal energy conversion systems: Current status and trends. Renew. Sustain. Energy Rev. 2017, 77, 536–550. [Google Scholar] [CrossRef]

- Segura, E.; Morales, R.; Somolinos, J.A. Cost assessment methodology and economic viability of tidal energy projects. Energies 2017, 10, 1806. [Google Scholar] [CrossRef]

- Nautricity Web Page. 2016. Available online: http://www.nautricity.com/cormat/ (accessed on 3 April 2019).

- Tocardo Web Page. 2016. Available online: http://www.tocardo.com/ (accessed on 3 April 2019).

- Somolinos, J.A.; López, A.; Portilla, M.P.; Morales, R. Dynamic model and control of a new underwater three-degree-of-freedom tidal energy converter. Math. Probl. Eng. 2015, 2015, 948048. [Google Scholar] [CrossRef]

- López, A.; Somolinos, J.A.; Núñez, L.R.; Morales, R. Dynamic Model and Experimental Validation for the Control of Emersion Maneuvers of Devices for Marine Currents Harnessing. Renew. Energy 2017, 103, 333–345. [Google Scholar]

- Morales, R.; Fernández, L.; Segura, E.; Somolinos, J.A. Maintenance Maneuver Automation for an Adapted Cylindrical Shape TEC. Energies 2016, 9, 746. [Google Scholar] [CrossRef]

- Fernández, L.; Segura, E.; Portilla, M.P.; Morales, R.; Somolinos, J.A. Dynamic model and nonlinear control for a two degrees of freedom first generation tidal energy converter. IFAC-PapersOnLine 2016, 49–23, 373–379. [Google Scholar] [CrossRef]

- Castro-Santos, L.; Filgueira-Vizoso, A.; Lamas-Galdo, I.; Carral-Couce, L. Methodology to calculate the installation costs of offshore wind farms located in deep waters. J. Clean. Prod. 2018, 170, 1124–1135. [Google Scholar] [CrossRef]

- Castro-Santos, L.; Silva, D.; Rute Bento, A.; Salvaçao, N.; Guetes Soares, C. Economic Feasibility of Wave Energy Farms in Portugal. Energies 2018, 11, 3149. [Google Scholar] [CrossRef]

- Castro-Santos, L.; Martins, E.; Guedes-Soares, C. Cost assessment methodology for combined wind and wave floating offshore renewable energy systems. Renew. Energy 2016, 97, 866–880. [Google Scholar] [CrossRef]

- Castro-Santos, L.; Martins, E.; Guedes-Soares, C. Economic comparison of technological alternatives to harness offshore wind and wave energies. Energy 2017, 140, 1121–1130. [Google Scholar] [CrossRef]

- Voith. Tidal Current Power Stations. Available online: http://voith.com/en/productsservices/hydro-power/ocean-energies/tidal-current-power-stations--591.html (accessed on 3 April 2019).

- Tidal Energy: Technology Brief. International Renewable Energy Agency (IRENA). June 2014. Available online: https://www.irena.org/documentdownloads/publications/tidal_energy_v4_web.pdf (accessed on 4 April 2019).

- BVG Associates. A Guide to an Offshore Wind Farm. The Crown Estate. 2010. Available online: http://www.thecrownestate.co.uk/media/5408/ei-a-guide-to-an-offshore-wind-farm.pdf (accessed on 4 April 2019).

- TradeWinds. The Global Shipping News Source. 2017. Available online: http://www.tradewindsnews.com/ (accessed on 4 April 2019).

- Altlantis Resources. AR1000. 2017. Available online: https://www.atlantisresourcesltd.com/services/turbines/ (accessed on 4 April 2019).

- ABR Company Ltd. International Tug & OSV, Incorporating Salvage News. 2017. Available online: https://www.tugandosv.com/about_the_magazine.php (accessed on 4 April 2019).

- Somolinos, J.A. Control de operaciones de dispositivos marinos de aprovechamiento de la energía hidrocinética. Proyecto RETOS de la Sociedad DPI2014m bn-53499-R. 2015. Available online: http://www.upm.es/observatorio/vi/index.jsp?pageac=grupo.jsp&idGrupo=391 (accessed on 20 May 2019).

- Espín, M. Modelado Dinámico y Control de Maniobras de Dispositivos Submarinos. Ph.D. Thesis, ETSIN-UPM, Madrid, Spain, 2015. [Google Scholar]

- Sánchez, G. Diseño de un dispositivo para el aprovechamiento de la energía de las corrientes (DAEC) y su integración en un parque marino. Master’s Thesis, Escuela Técnica Superior de Ingenieros Navales, Universidad Politécnica de Madrid (ETSIN-UPM), Madrid, Spain, 2014. [Google Scholar]

- Subsea Power Cables in Shallow Water Renewable Energy Applications. Det Norske Veritas (DNV) AS. February 2014. Available online: https://rules.dnvgl.com/docs/pdf/DNV/codes/docs/2014-02/RP-J301.pdf (accessed on 29 May 2019).

- Bryden, I.G.; Couch, S.J. ME1–Marine energy extraction: Tidal resource analysis. Renew. Energy 2006, 31, 133–139. [Google Scholar] [CrossRef]

- Charlier, R.H. A Sleeper awakes: Tidal current power. Renew. Sustain. Energy Rev. 2003, 7, 515–529. [Google Scholar] [CrossRef]

- Marine Current Turbines (MCT). An Atlantis Company. Tidal Energy Section. 2017. Available online: http://www.marineturbines.com/Tidal-Energy (accessed on 4 April 2019).

- López, A.; Somolinos, J.A.; Núñez, L.R. Dispositivo para el aprovechamiento de las corrientes marinas multi-rotor con estructura poligonal. Patent Number P201430182. ES2461440, 25 November 2014. [Google Scholar]

- López, A.; Somolinos, J.A.; Núñez, L.R. Underwater electrical generator for the harnessing of bidirectional flood currents. U.S. Patent Application 12/978993, 30 June 2011. [Google Scholar]

- López, A.; Núñez, L.R.; Somolinos, J.A. Generador electrico submarino para el aprovechamiento de las corrientes de flujo bidireccional. Patent Number ES 2341311, 30 December 2009. [Google Scholar]

- Segura, E.; Morales, R.; Somolinos, J.A. Economic-Financial Modeling for Marine Current Harnessing Projects. Energy 2018, 158, 859–880. [Google Scholar] [CrossRef]

- Delogu, M.; Zanchi, L.; Maltese, S.; Boloni, A.; Pierini, M. Environmental and economic life cycle assessment of a lightweight solution for an automotive component: A comparison between talc-filled and hollow glass microspheres-reinforced polymer composites. J. Clean. Prod. 2016, 139, 548–560. [Google Scholar] [CrossRef]

- IEC 60300-3-3:2004 - Dependability Management - Part 3-3: Application Guide - Life Cycle Costing; IEC: Geneva, Switzerland, 2004.

- Dhillon, B.S. Life-Cycle Costing for Engineers; CRC Press: Boca Raton, FL, USA, 2010. [Google Scholar]

- Vail Farr, J. Systems Life Cycle Costing—Economic Analysis, Estimation and Management; CRC Press: Boca Raton, FL, USA, 2011. [Google Scholar]

- Hirt, G.; Block, S. Fundamentals of Investment Management, 10th ed.; McGraw-Hill Education: New York, NY, USA, 2011. [Google Scholar]

- Kimmel, P.D.; Weygandt, J.J.; Kieso, D.E. Accounting: Tools for Business Decision Making, 4th ed.; John Wiley & Sons Ltd: Hoboken, NJ, USA, 2011. [Google Scholar]

- Wild, J.J. Financial Accounting Fundamentals, 6th ed.; McGraw-Hill Education: New York, NY, USA, 2017. [Google Scholar]

- Short, W.; Packey, D.; Holt, T. A Manual for the Economic Evaluation of Energy Efficiency and Renewable Energy Technologies; NREL/TP-462-5173; National Renewable Energy Laboratory: Colorado, CO, USA, 1995.

- Det Norske Veritas AS. Det Norske Veritas (DNV), DNV–OS–J101. Design of Offshore Wind Turbine Structures; Det Norske Veritas AS.: Oslo, Norway, 2010; pp. 1–142. [Google Scholar]

| Manual Maneuvers | |||||

|---|---|---|---|---|---|

| Cost Category | Total Value (€) | ||||

| Concept and Definition Costs () | 7,350,000 | ||||

| Design and Development Costs () | 200,000 | ||||

| Manufacturing Costs () | 103,613,936 | ||||

| gondola | 39,563,656 | ||||

| Supporting TEC Structure | 21,938,280 | ||||

| Export Power System | 42,112,000 | ||||

| Installation Costs () | 27,700,000 | ||||

| Transformation Platform and Converters | 3,700,000 | ||||

| Submarine and Ground Exportation Cables | 7,200,000 | ||||

| TECs | 16,800,000 | ||||

| O&M (Operation & Maintenance) Costs () | 4,905,071 | ||||

| Material | Transport | Labour | Production Losses | ||

| Blade Cleaning | 0 | 81,120 | 4,080 | 1,256 | 86,456 |

| Light Preventive Maintenance | 142,293 | 533,513 | 53,660 | 32,394 | 761,860 |

| High Preventive Maintenance | 221,784 | 777,459 | 39,454 | 25,669 | 1,064,366 |

| Corrective Maintenance | 0 | 197,123 | 7,068 | 10,919 | 215,110 |

| Insurance and Fixed Expenses | 2,777,279 | ||||

| Decommissioning Costs () | 0 | ||||

| Automated Maneuvers | |||||

| Cost Category | Total Value (€) | ||||

| Concept and Definition Costs () | 7,550,000 | ||||

| Design and Development Costs () | 300,000 | ||||

| Manufacturing Costs () | 105,558,244 | ||||

| gondola | 41,456,364 | ||||

| Supporting TEC Structure | 21,938,280 | ||||

| Export Power System | 42,163,600 | ||||

| Installation Costs () | 24,388,000 | ||||

| Transformation Platform and Converters | 3,700,000 | ||||

| Submarine and Ground Exportation Cables | 7,200,000 | ||||

| TECs | 13,488,000 | ||||

| O&M Costs () | 4,182,328 | ||||

| Material | Transport | Labour | Production Losses | ||

| Blade Cleaning | 0 | 41,371 | 2,489 | 1,256 | 45,116 |

| Light Preventive Maintenance | 148,901 | 277,426 | 34,342 | 32,394 | 493,063 |

| High Preventive Maintenance | 231,666 | 450,926 | 26,040 | 25,669 | 734,301 |

| Corrective Maintenance | 0 | 137,986 | 5,018 | 10,918 | 153,922 |

| Insurance and Fixed Expenses | 2,755,926 | ||||

| Decommissioning Costs () | 0 | ||||

| Manual Maneuvers | ||||||

|---|---|---|---|---|---|---|

| Project | Stakeholders | |||||

| Investment is increased to 1% | –2.46% | –1.66% | 1.23% | –1.29% | –2.0% | 2.49% |

| Annual energy produced by the farm decreases to 1% | –3.82% | –1.84% | 1.38% | –2.52% | -2.23% | 2.79% |

| Price of the energy decreases to 1% | –3.14% | –1.52% | 1.13% | –2.07% | –1.83% | 2.28% |

| Interest rate increases to 1% | –28.56% | ∼0% | 7.88% | –13.21% | ∼0% | 3.09% |

| Percentage of the loan requested decreases to 1% | –0.34% | –0.20% | 0.17% | –0.17% | -1.40% | 3.61% |

| Tax rate increases to 1% | –2.41% | –0.20% | 0.78% | –1.57% | –1.40% | 1.35% |

| Automated Maneuvers | ||||||

| Project | Stakeholders | |||||

| Investment is increased to 1% | –2.06% | –1.64% | 1.22% | –1.18% | –2.0% | 2.33% |

| Annual energy produced by the farm decreases to 1% | –3.28% | –1.84% | 1.32% | –2.34% | –2.23% | 1.69% |

| Price of the energy decreases to 1% | –3.27% | –1.52% | 1.32% | –2.34% | –1.83% | 2.49% |

| Interest rate increases to 1% | –25.45% | ∼0% | 7.36% | –12.76% | ∼0% | 2.77% |

| Percentage of the loan requested decreases to 1% | –0.29% | –0.18% | 0.16% | –0.15% | –1.41% | 3.6% |

| Tax rate increases to 1% | –2.25% | –0.18% | 0.82% | –1.61% | –1.41% | 1.35% |

| Project | Stakeholders | |||||

|---|---|---|---|---|---|---|

| Nominal Case | 17.74% | ∼0% | −6.23% | 11.75% | ∼0% | −11.45% |

| Investment is increased to 1% | 18.24% | ∼0% | −6.23% | 11.94% | ∼0% | −11.74% |

| Annual energy produced by the farm decreases to 1% | 18.39% | ∼0% | −6.25% | 12.03% | ∼0% | −11.84% |

| Price of the energy decreases to 1% | 17.58% | ∼0% | −6.02% | 11.52% | ∼0% | −11.41% |

| Interest rate increases to 1% | 22.88% | ∼0% | −6.64% | 12.40% | ∼0% | −11.86% |

| Percentage of the loan requested decreases to 1% | 18.48% | ∼0% | −6.51% | 11.77% | ∼0% | −11.46% |

| Tax rate increases to 1% | 17.93% | ∼0% | −6.16% | 11.78% | ∼0% | −11.60% |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Segura, E.; Morales, R.; Somolinos, J.A. Increasing the Competitiveness of Tidal Systems by Means of the Improvement of Installation and Maintenance Maneuvers in First Generation Tidal Energy Converters—An Economic Argumentation. Energies 2019, 12, 2464. https://doi.org/10.3390/en12132464

Segura E, Morales R, Somolinos JA. Increasing the Competitiveness of Tidal Systems by Means of the Improvement of Installation and Maintenance Maneuvers in First Generation Tidal Energy Converters—An Economic Argumentation. Energies. 2019; 12(13):2464. https://doi.org/10.3390/en12132464

Chicago/Turabian StyleSegura, Eva, Rafael Morales, and José A. Somolinos. 2019. "Increasing the Competitiveness of Tidal Systems by Means of the Improvement of Installation and Maintenance Maneuvers in First Generation Tidal Energy Converters—An Economic Argumentation" Energies 12, no. 13: 2464. https://doi.org/10.3390/en12132464

APA StyleSegura, E., Morales, R., & Somolinos, J. A. (2019). Increasing the Competitiveness of Tidal Systems by Means of the Improvement of Installation and Maintenance Maneuvers in First Generation Tidal Energy Converters—An Economic Argumentation. Energies, 12(13), 2464. https://doi.org/10.3390/en12132464