1. Introduction

On 15 March 2015, the Communist Party of China’s (CPC’s) Central Committee and State Council proposed opinions on further deepening the reforms of the electric power system, marking the beginning of a new round of electricity market reform in China [

1], after a series of reforms in 1985, 1996, and 2002 [

2]. This new round of reform aims to break the monopoly, introduce competition, and achieve optimum allocation of power resources in a broader scope. Over the past four years, most provinces and regions have been actively trying to get involved in the reform and have continuously improved the market operation rules. Although the market is still constrained by many factors, the hydropower plants in some provinces of southwestern China have successfully participated in the yearly and monthly electricity markets [

3,

4]. It is foreseeable that a competitive and stable electricity market environment will be formed in the future.

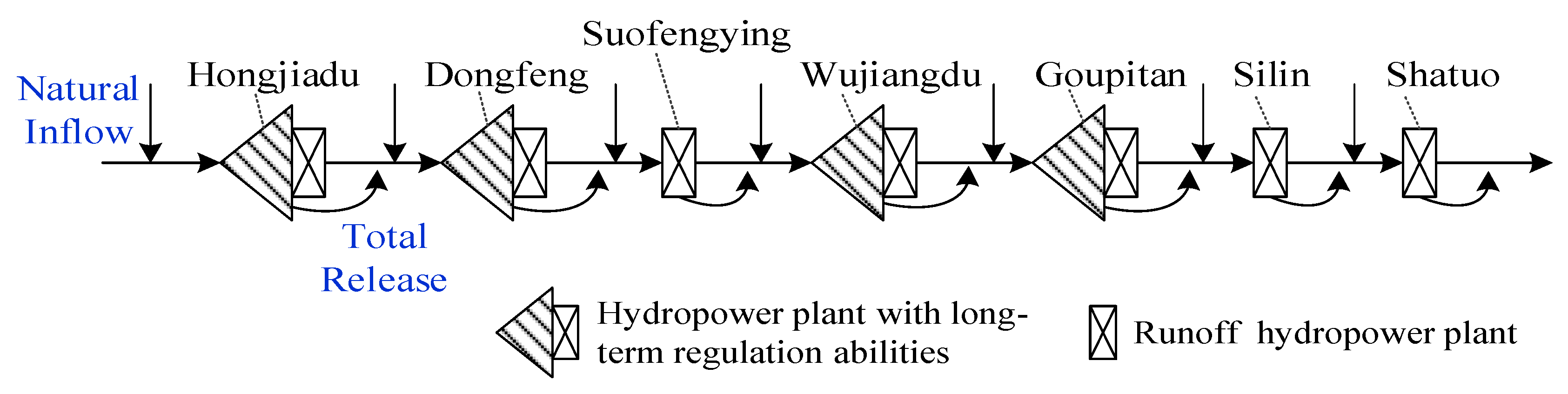

With extremely rich hydropower resources, many huge cascaded hydropower plants have been constructed in southwestern China. As the main sending end for the West-to-East Electricity Transmission (WEET) Project, these hydropower plants face a special multi-market environment. They not only have to supply the load for the local provincial market, but also need to deliver electricity to the central and eastern load centers in the external market [

5], which has a direct impact on the supply and demand balance of the two markets and, as a result, the electricity prices of the two markets are closely correlated. Under such circumstances, optimizing the generation scheduling for cascades in different markets, improving the overall benefits, and coping with the market risks is a practical problem to be solved by the hydropower enterprises. However, this problem becomes much more complicated due to the uncertainty of electricity prices and the correlation of prices in different markets. In addition, the hydraulic and market constraints of the cascade hydropower plants increase the complexity further [

6].

The generation scheduling for hydropower plants is a typical multi-variable and non-linear problem [

7,

8], especially for cascade hydropower plants. It has close internal cascade dependency, indicating that the water release from the upstream reservoir is the inflow of the downstream reservoir [

9]. In the deregulated market, which is different from a conventional centralized operation, producers most important objectives are to generate power with more benefits [

10,

11] and lower market risks [

12]. To get hydropower producers involved in the electricity market, scholars have carried out many studies and have made great achievements. The electricity price policies, such as the market clearing price (MCP), peak-valley price, time-of-use (TOU) price, and so on, are considered in the generation scheduling models of hydropower plants [

13,

14], as the electricity prices directly affect the market benefits. Accordingly, an uncertainty description of electricity prices is also proposed to improve the robustness of the models, in which the electricity prices are treated as variables rather than fixed constants [

15,

16,

17]. At the same time, with the expansion of wind power, for photovoltaic power, and other distributed energy sources, the uncertainties in the power system have increased dramatically, and research on uncertainty-based models [

18] and stochastic models [

19] have drawn more and more attention. Corresponding to the hydropower generation scheduling models, some scholars have introduced market risk constraints to further improve the reliability of optimizing the trading strategies [

20,

21]. Overall, from the perspective of the time horizon, most existing studies focus on optimization in the daily market, and, as a result, the medium- and long-term studies are in a small quantity [

22]. Price uncertainty has been included in the generation scheduling models, but it is mainly for a single market and the correlation of stochastic prices between multiple markets has not been considered. Despite the fact Under the background of fact that that hydropower plants in southwestern China challenge a new multi-market environment, a new generation scheduling model needs to be developed.

To solve the aforesaid problem and achieve a successful implementation for cascade hydropower plants in the multi-market environment, a novel long-term generation scheduling model for cascade hydropower plants is proposed. The main contributions are summarized as follows:

(1) The correlations of the MCP between different markets is described. The prediction price is treated as a random variable that consists of its prediction value and a random prediction error. The MCP scenarios for the multi-market environment are then generated by using the Copula theory, and are further reduced by the hierarchical clustering method combined with inconsistent values.

(2) A novel long-term generation scheduling model is constructed, based on the stochastic programming theory and the reduced MCP scenarios, in which the market-to-market supply energy ratio constraint and the minimum constraint of supply energy in the provincial market are creatively taken into consideration, so as to meet the actual engineering needs.

(3) The effectiveness and robustness of the proposed model have been validated by applying it to perform the long-term generation scheduling of the Wu River cascade hydropower plants in China. Compared with the conventional scheduling model, the proposed model can better respond to the MCP signals and gain the optimal trading strategy for different time periods and markets. It can also adapt to different MCP scenarios, and thus provides a theoretical reference for large-scale hydropower consumption in southwestern China under the new electricity market environment.

The remainder of this paper is organized as follows: In

Section 2, the MCP scenarios for multiple markets are described.

Section 3 is devoted to the detailed presentation of the proposed optimization model. In

Section 4, the solution method for the proposed model is introduced. In

Section 5, the case study and optimization results are carefully discussed. Finally,

Section 6 outlines the main conclusions.

2. Description of MCP Scenarios for Multiple Markets

The market electricity price derives from a complex process with uncertain factors [

23,

24], and is generally obtained through prediction methods in the stage of reporting transactions [

25]. However, the prediction price is subject to many factors, such as the accuracy of the input data and the fitting parameters, and there may be a certain prediction error, objectively. Directly using the deterministic prediction value will bring participants many more market risks. In this paper, the MCP is firstly described as a variable of its prediction value and random prediction error. Then, considering the correlation between the multiple markets, a joint distribution function of the MCP for the multi-market environment is constructed and further discretized into several independent and identical distribution scenarios. Finally, these scenarios are reduced based on the balance of the result’s accuracy and the computation workload.

2.1. Building MCP Scenarios Based on the Copula Theory

For any time period of

, the predicted MCP of market

is denoted by

, and the prediction error is

. The actual MCP

can be described as a random variable of

and

. That is:

where,

indicates the serial number of the market, and the total number of markets,

;

and

, indicate the upper and lower bounds for

, respectively.

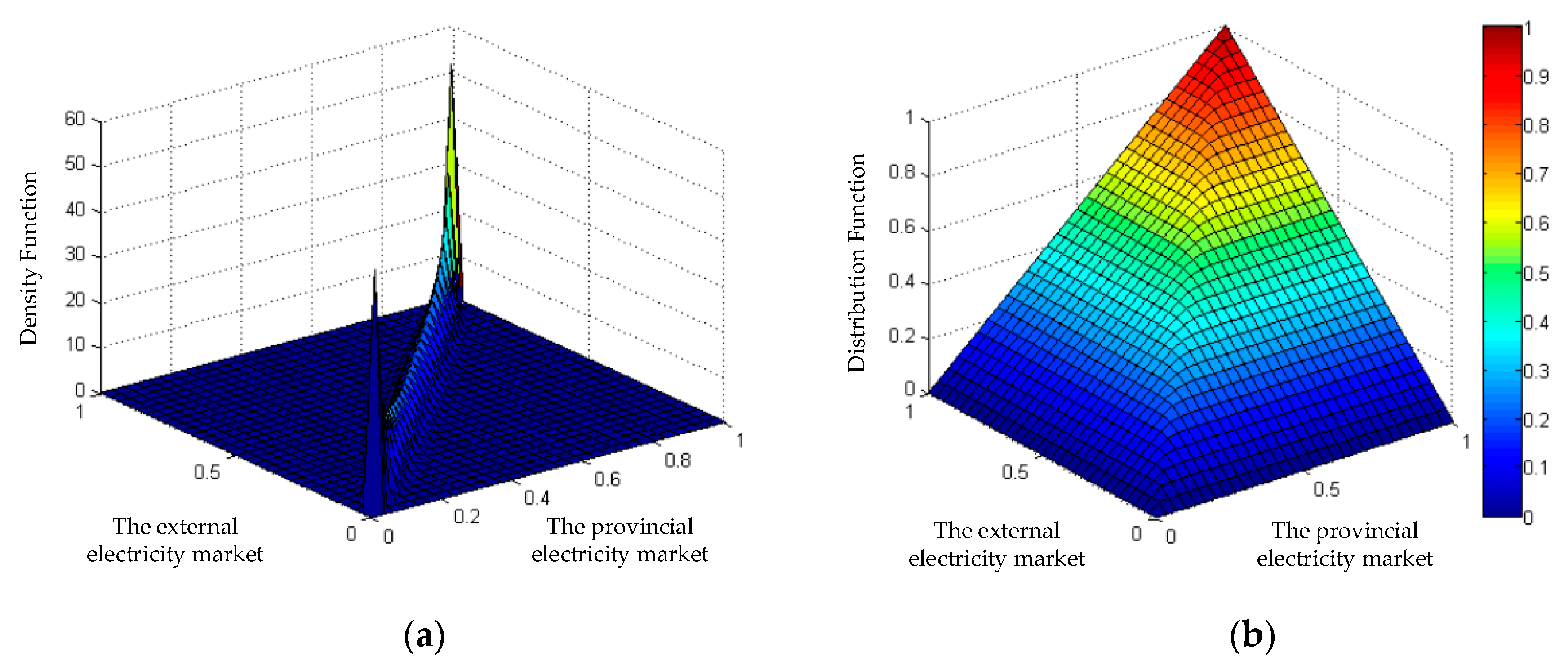

Due to the complex correlation between supply and demand of multiple markets, the MCPs of these markets can fluctuate greatly and are related to each other, thus the MCP of each market is not appropriate for separate description. In this paper, the Copula theory in econometrics is introduced to describe the correlation of MCPs in multiple markets, and a method for generating combined MCP scenarios (i.e., MCP scenarios for multi-markets) based on the Copula function is proposed. The Copula theory was firstly proposed by Sklar in 1959 to describe complex nonlinear correlations between random variables, which is now widely used in the financial sector as it has no restrictions on the marginal distribution of variables [

26]. The Copula function can put the marginal distributions together to form a joint distribution, and its strict definition is given later by Nelsen [

27]. That is, there is a function

that makes:

where,

is the joint distribution function of the random vectors

, and its marginal distribution is

, respectively. It has been proved that if all these marginal distributions are continuous, the Copula function

is unique.

Defining

as the inverse function of

, the Copula function can be expressed as:

where,

is a variable obeying uniform distribution in

. Obviously, the Copula function

is a joint distribution function constructed by

marginal distributions of uniform distribution in

. There are five commonly used Copula functions, including Gaussian-, t-, Gumbel-, Clayton- and Frank-Copula functions. Their expressions, characteristics, and density distribution plots are listed in

Table 1.

As mentioned above, the cascade hydropower plants in southwestern China mainly participate in two electricity markets, i.e., the provincial and external markets. Based on the Copula theory, the combined MCP scenarios were generated using the following steps:

(1) Construct MCP marginal cumulative distribution functions for the provincial and external markets. As the MCP

is related to its prediction value

and prediction error

, the distribution function for

needs to be firstly determined. At the early stage of reform, the monthly MCP data were accumulated for a short time and the distribution of prediction error was not clear. Therefore, according to the central limit theorem, suppose that

, then

, namely, the MCP of market

is subject to the Gaussian distribution with the mean value

and variance

. The probability density function (PDF) is:

Then, the marginal cumulative distribution function

H is obtained by the integral of

. That is:

(2) Identify parameters for the Copula function. According to the characteristics of marginal distribution functions, appropriate Copula functions were firstly selected, and the unknown parameter

was estimated by the maximum likelihood estimate method, and the estimated value is:

where,

is the density function of the Copula function

.

(3) Check the fitting performance of the Copula function. The squared Euclidean distance

is used and its expression is:

where,

is the number of samples,

is the Copula function, and

is the empirical distribution function. The smaller the value is, the better the fitting performance is.

(4) Generate the combined MCP scenarios. dimensional data samples were generated by means of uniform discretization. and indicate, respectively, the number of samples and random variables. For each sample , its combined MCP scenario vector could be obtained by the inverse operation of the marginal distribution function, i.e., , and the probability of the scenario is .

2.2. Reducing MCP Scenarios

Generally, the results will be more accurate with more simulated scenarios, but the computation scale and time will increase accordingly. To guarantee the result accuracy and simultaneously strike a balance with the computing workload, the number of scenarios needed to be properly determined. Clustering is a commonly used scenario reduction method, but the number of reserved clusters is difficult to determine. In this paper, the hierarchical clustering method combined with inconsistent values is introduced to reduce the MCP scenarios, and the silhouette value was used to measure the rationality of clustering results. The process of reducing scenarios is detailed below:

(1) Take each MCP scenario as a cluster and calculate the distance between every two clusters. Then, the absolute distance is adopted.

(2) Merge the nearest two clusters into a new cluster and calculate the distance between the new cluster and other clusters.

(3) Repeat steps (1) and (2) until all MCP scenarios are merged together.

(4) Calculate the inconsistent values after each merging and express them as

, and

where,

is the inconsistent value after the

th merging.

is the number of total original scenarios,

is the distance between the two clusters of the

th merging,

is the mean value of the distances calculated in the

th merging, and

is the standard deviation of the distances calculated in the

th merging. The inconsistent value was calculated by the inconsistent function in MATLAB. Each inconsistent value was a measure of separation between the two merged clusters, compared to the separation between subclusters merged within those clusters. If only two original MCP scenarios are merged in the

th merging, the inconsistent value is 0. Defining

, the larger the

was, the worse clustering result of the

th merging was, and the better the clustering result of the

th merging was.

Generally, the larger the number of reserved clusters, the more the reserved scenarios remain consistent with the original MCP scenarios, and the computation time will increase accordingly. The final number of reserved clusters could be determined by reference to the variation of inconsistent values .

(5) The silhouette value proposed by Rousseeuw [

28] is often used to evaluate the result of the cluster analysis, which can be calculated by Equation (9):

where,

is the silhouette value of scenario

,

,

is the cluster index that scenario

belongs to,

is the average distance between scenario

and other scenarios in the cluster

, and

,

is the average distance between scenario

and all scenarios in the cluster

,

. The range of

is

, and the larger the

, the better the clustering result of scenario

.

(6) Define the number of reserved clusters as

. For cluster

, the representative scenario is

, and can be calculated as below:

The occurrence probability of scenario

is derived from Equation (11):

where,

is the set of scenarios involved in cluster

,

is the scenario

involved in cluster

,

is the electricity price of market

in period

under scenario

,

is the electricity price of market

in period

under representative scenario

,

is the scenario index involved in cluster

,

,

is the time period,

,

is the market index,

, and

is the total number of sub markets for the participation of hydropower cascades.

3. Optimization Model

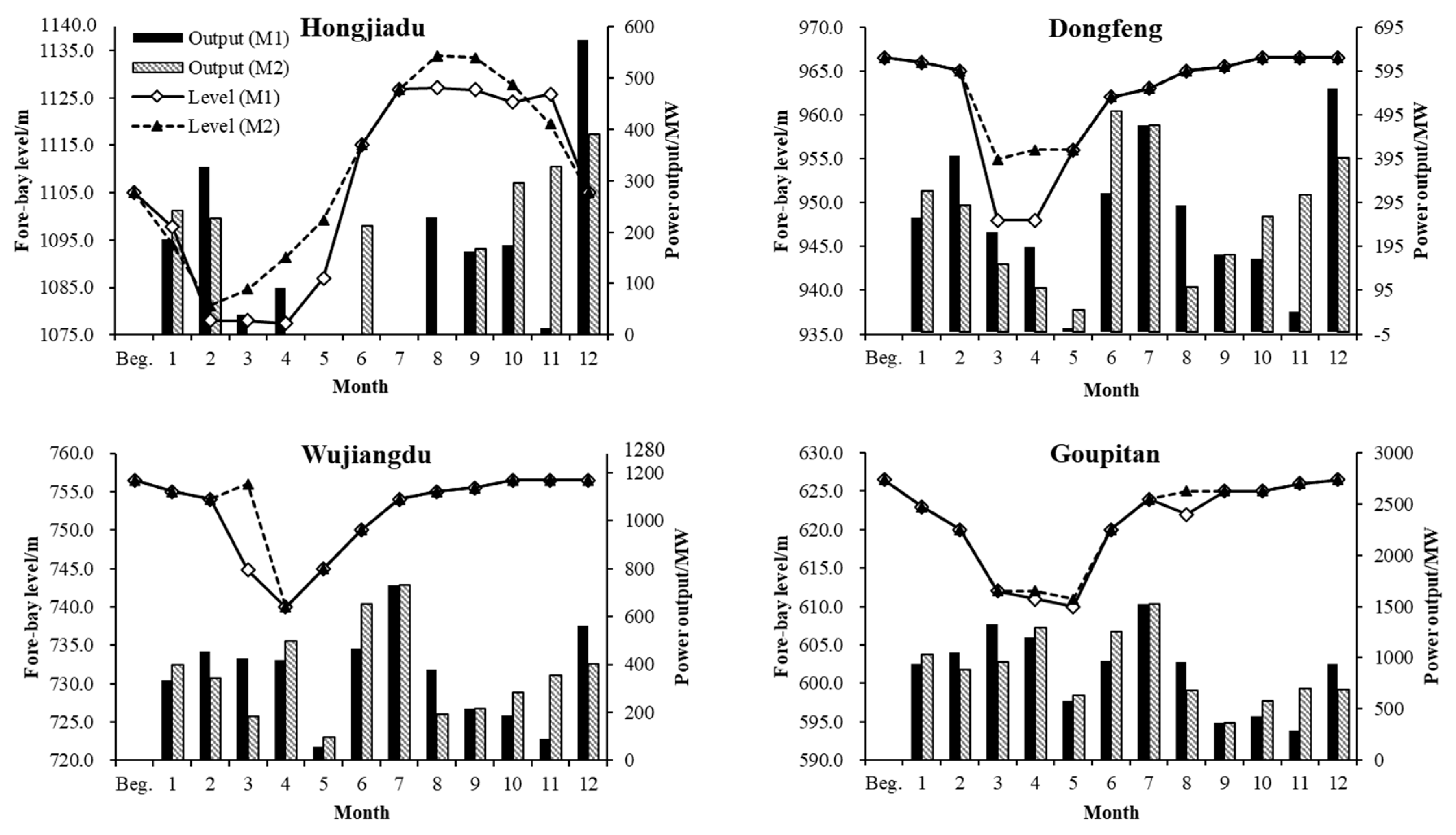

In this paper, the cascade hydropower plants are assumed as one generator in the electricity market and cleared by the MCP. The annual market is considered and each time period represents one month. The operation objective was to maximize the market benefits. Considering the different MCP scenarios in the future period, the objective function can be defined as Equation (12).

where,

is the supply energy for market

in the time period

under the representative scenario

,

is the number of reserved scenarios in period

. The hydropower generation cost mainly involved the constant cost with little influence on the optimization results, and so it was not considered in the optimization model. For the cascade hydropower plants in southwestern China, the provincial and external markets are considered,

for the provincial market and

for the external market.

To get the proposed model more applicable to the scheduling in practice, the energy ratio for different electricity markets and the minimum supply energy for the provincial market, during the whole scheduling period, were also included in the constraints. The constraints involved in the model were as follows, in which the hydraulic constraints also can be seen in [

8,

9,

13].

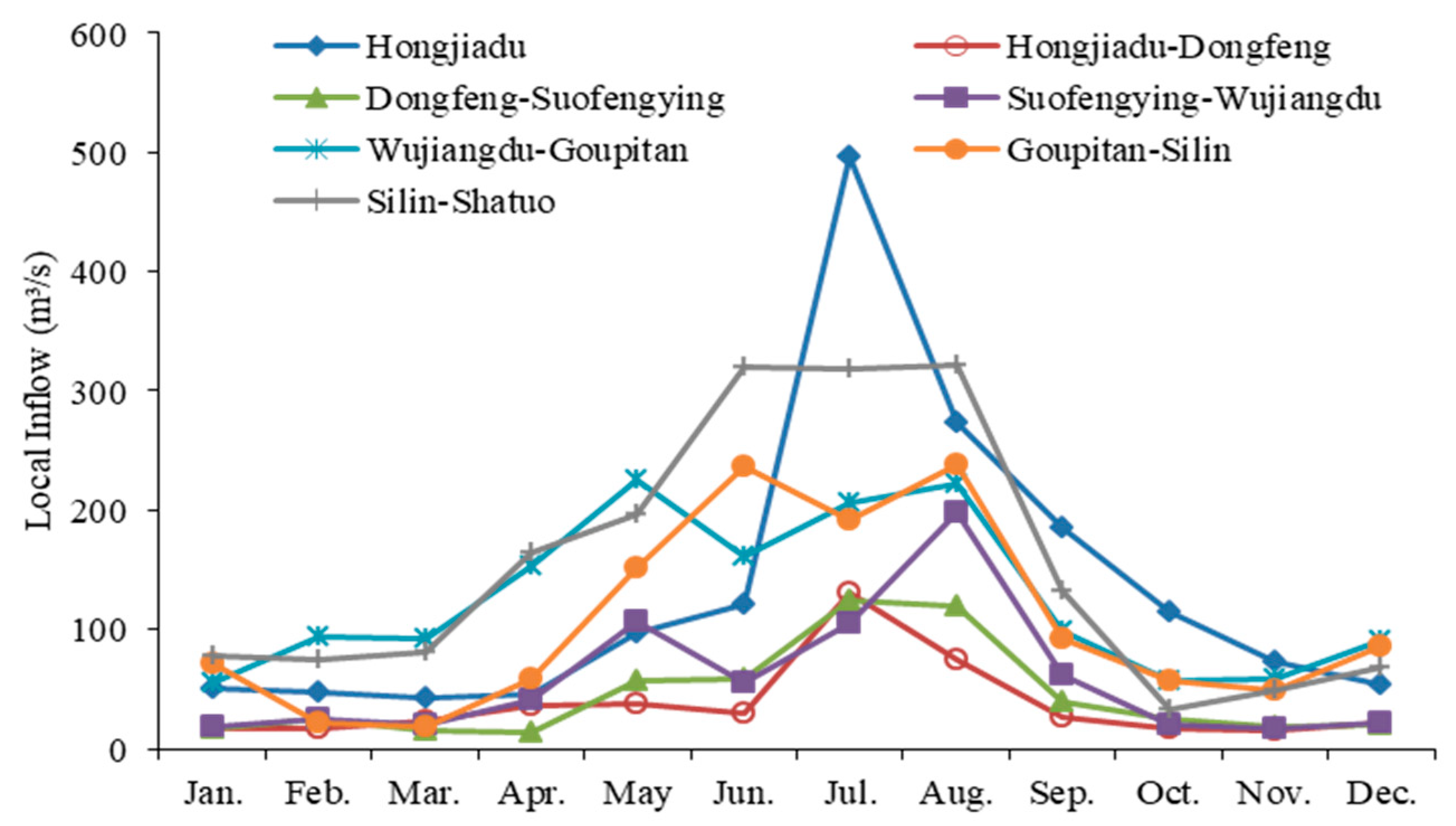

(1) Water balance equation:

where,

and

are the storage of reservoir

at the beginning and end of the time period

, respectively, m

3;

is the total inflow of reservoir

in the period

,

,

, and

are the power release, non-power release, and natural inflow of reservoir

in the time period

, respectively, m

3/s,

is the reservoir index,

is the index of the upstream reservoir of reservoir

, and

is the number of seconds in the period

.

(2) Initial and end reservoir level constraints:

where,

and

are the initial and end reservoir levels of planning horizon, respectively, which are specified before the optimization process,

m. In the case study,

and

were specified based on the historical records for practical operation.

(3) Outflow constraint:

where,

and

are the minimum and maximum outflow of plant

in the time period

, m

3/s.

(4) Power generation constraint:

where,

and

are the minimum and maximum power generation of plant

in the time period

, MW.

(5) Storage boundary constraint:

where,

and

are the minimum and maximum storage for reservoir

at the beginning of the time period

, respectively, m

3.

(6) Market-to-market energy ratio constraint:

where,

is the energy ratio of cascade hydropower plants involved in the provincial and external markets, which is agreed by the power producers in the river basin, the provincial development and reform commission, and other parties,

is the supply energy of cascade hydropower plants for market

in the time period

, MWh, and

and

are the supply energy of cascade hydropower plants in the provincial and external markets, respectively, during the whole optimization horizon, MWh.

(7) Minimum supply energy for provincial market:

where,

is the minimum supply energy of the cascade hydropower plants in the provincial market in period

, MWh.

(8) Relationship between fore-bay water level and reservoir storage:

where,

is the fore-bay water level for reservoir

in period

, m

is the storage for reservoir

in the period

, m

3, and the coefficients

are fitting parameters for reservoir

.

(9) Relationship between tailrace level and total release:

where,

is the tailrace level for reservoir

in the time period

, m, and the coefficients

are fitting parameters for reservoir

.

(10) Generation of cascade power plants:

where,

and

are the generation efficiency coefficient and water head of plant

in the time period

, respectively, and

.

4. Solution Method

The solution method typically depends on the characteristics of the optimization model. The commonly used solution methods for cascaded hydropower plants fall into three categories: Mathematical programming, dynamic programming and its improved algorithms, and artificial intelligence algorithms. The aforesaid optimization problem, including Equation (19), Equation (21), Equation (22), and other nonlinear constraints, is a typical nonlinear problem. Especially, the proposed model cannot meet the Markovian character, because the market-to-market energy ratio constraint, i.e., constraint (6), is included. Consequently, the dynamic programming and similar algorithms are not applicable. Moreover, the intelligent algorithms have problems, such as long computing time, easily trapped into local optimization, and unstable calculation results. Therefore, nonlinear programming (NLP) in mathematical programming is chosen in this paper.

In this paper, the solution procedure involves two main steps. At step 1, the combined MCP scenarios are generated and reduced by using MATLAB software; at step 2, based on the reduced scenarios, the NLP is implemented by the Global Solver, available in LINGO 17.0 (

http://www.lindo.com/), to solve the proposed model. LINGO is a special software for solving mathematical programming problems, such as linear programming, non-linear programming, quadratic programming, and integer programming problems. It has the advantages of easy operation, fast computation, and stable calculation results. The basic computational principle and detailed computational procedure of the Global Solver for solving NLP problems have been given in literatures [

29,

30]. It mainly includes three steps: (1) With the branch-and-bound algorithm, the entire feasible solution spaces are segmented into series sub-problems; (2) a slack problem for each sub-problem can be obtained by convexity and linearization transformation and solved by the linear programming method; and (3) the global optimal solution is obtained by traversing all the sub-problems (i.e., the whole feasible space).

Figure 1 shows the detailed calculating process. To set the parameters and calibrate the Global Solver, read the manual provided in LINDO.

6. Conclusions

The large-scale cascade hydropower plants in southwestern China challenge a new multi- market environment. Considering the price uncertainty and the correlations between multiple markets, this paper has proposed a novel optimization model of long-term generation scheduling for cascade hydropower plants to seek for the overall benefits. The main contributions and conclusions were as follows:

(1) The correlation of MCP between multiple markets was described. The prediction price was treated as a random variable that consists of its prediction value and a random prediction error. Then, the MCP scenarios for the hybrid market environment were generated by using the Copula theory and further reduced by the hierarchical clustering method combined with inconsistent values.

(2) A novel long-term generation scheduling model was constructed based on the stochastic programming theory and the reduced MCP scenarios, in which the market-to-market supply energy ratio constraint and the minimum constraint of supply energy in the provincial market were creatively taken into consideration, so as to meet the actual engineering needs.

(3) The scenarios analysis showed that the Gaussian-Copula function has better fitting performance in describing the correlation between the MCPs of the provincial and external markets than other functions. The proposed reduction strategy for the MCP scenarios was effective, after the reduction of scenarios. The minimum number of scenarios from January to December was 47, and the maximum number was 64.

(4) The effectiveness analysis showed that the proposed model could better respond to the changing of MCP signals, and so the arrangement of power generation in different months and markets was more reasonable. This resulted in an increase of 106.93 million yuan for the total income, although the power generation was less, compared with the conventional model.

(5) The robustness analysis showed that the proposed model could better adapt to different price scenarios in the future, even in the adverse scenario, with a serious deviation in the price prediction. This enhanced profitability and robustness for the generation scheduling.

It should be mentioned that the market reform in China is still at an early stage and the available samples are in a relatively small quantity. This paper only analyzed qualitatively the price correlation between the provincial and external markets but did not give the specific influence factors and their different roles. With continuous accumulation of data in the future, the interaction characteristics between the markets, consumers, and producers can be analyzed in detail, so as to better describe the price correlation between multiple markets.