Multi-Level Market Transaction Optimization Model for Electricity Sales Companies with Energy Storage Plant

Abstract

:1. Introduction

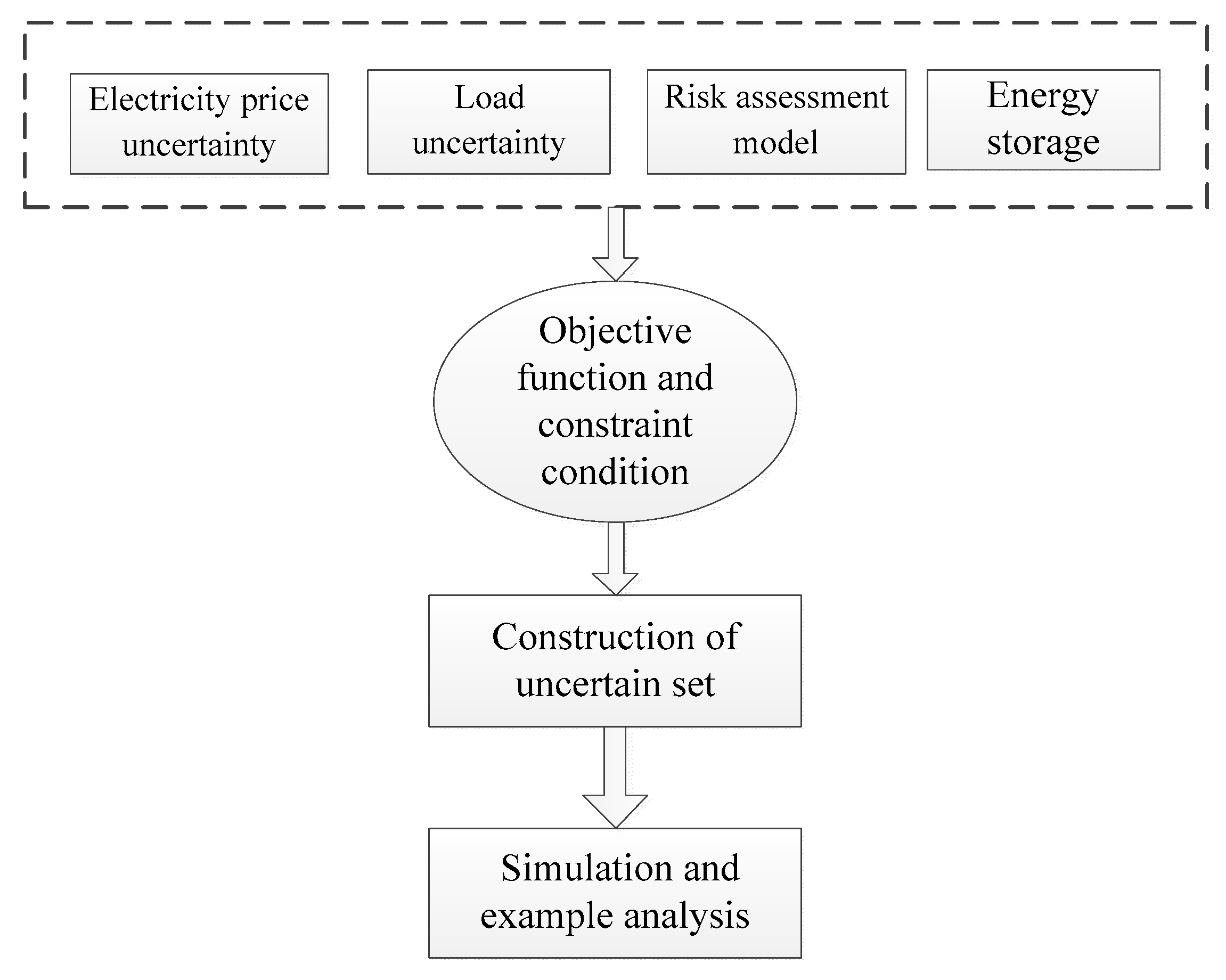

2. Multi-Level Market Risk Assessment and Energy Storage Station Output Model

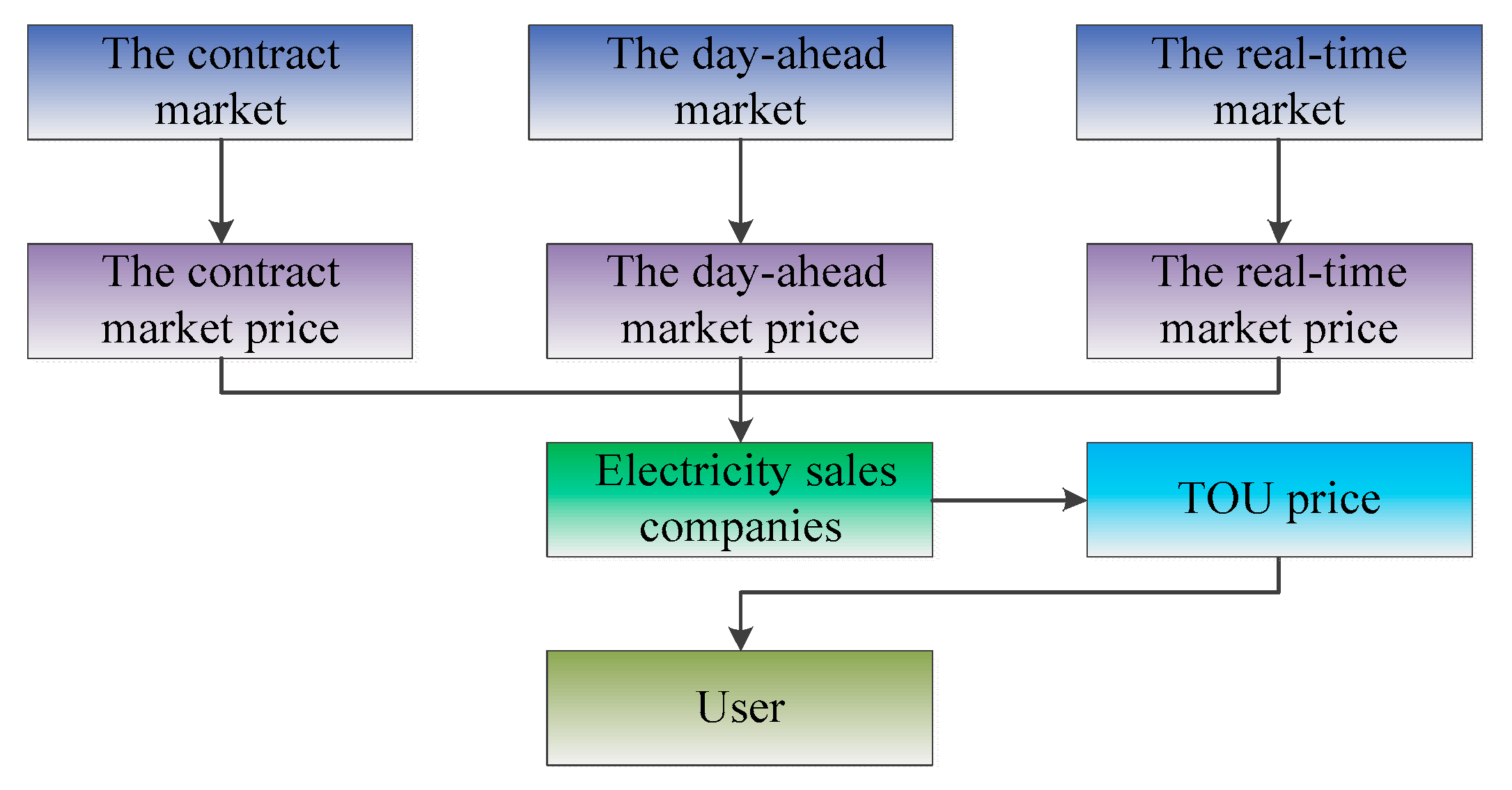

2.1. Multi-Level Power Market

2.2. Construction of Uncertain Sets

2.2.1. Load Uncertainty

2.2.2. Electricity Price Uncertainty

2.3. Output Model of Energy Storage Power Station

3. Construction of Multi-Level Market Optimization Strategy

3.1. Pricing Scheme Design

3.1.1. Design of TOU Price Scheme

3.1.2. Design of Reserve Service Price Scheme

3.2. Construction of Objective Function

3.2.1. Multi-Level Market Purchase and Sale Model

3.2.2. The Minimum Peak-Valley Difference

3.3. Constraint Condition

4. Example Analysis

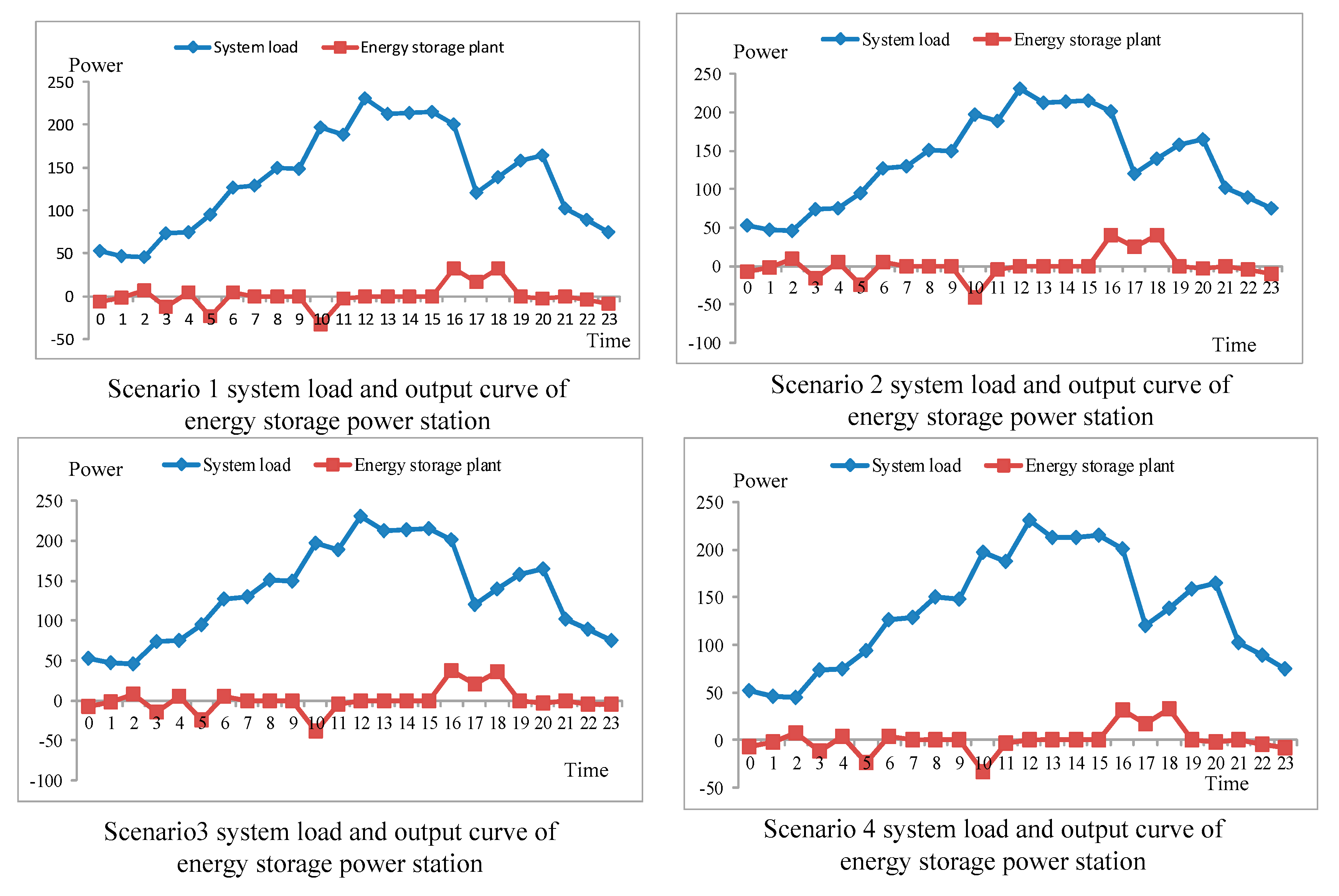

4.1. Scenario Setting

4.2. Basic Data

4.3. Comparative Analysis

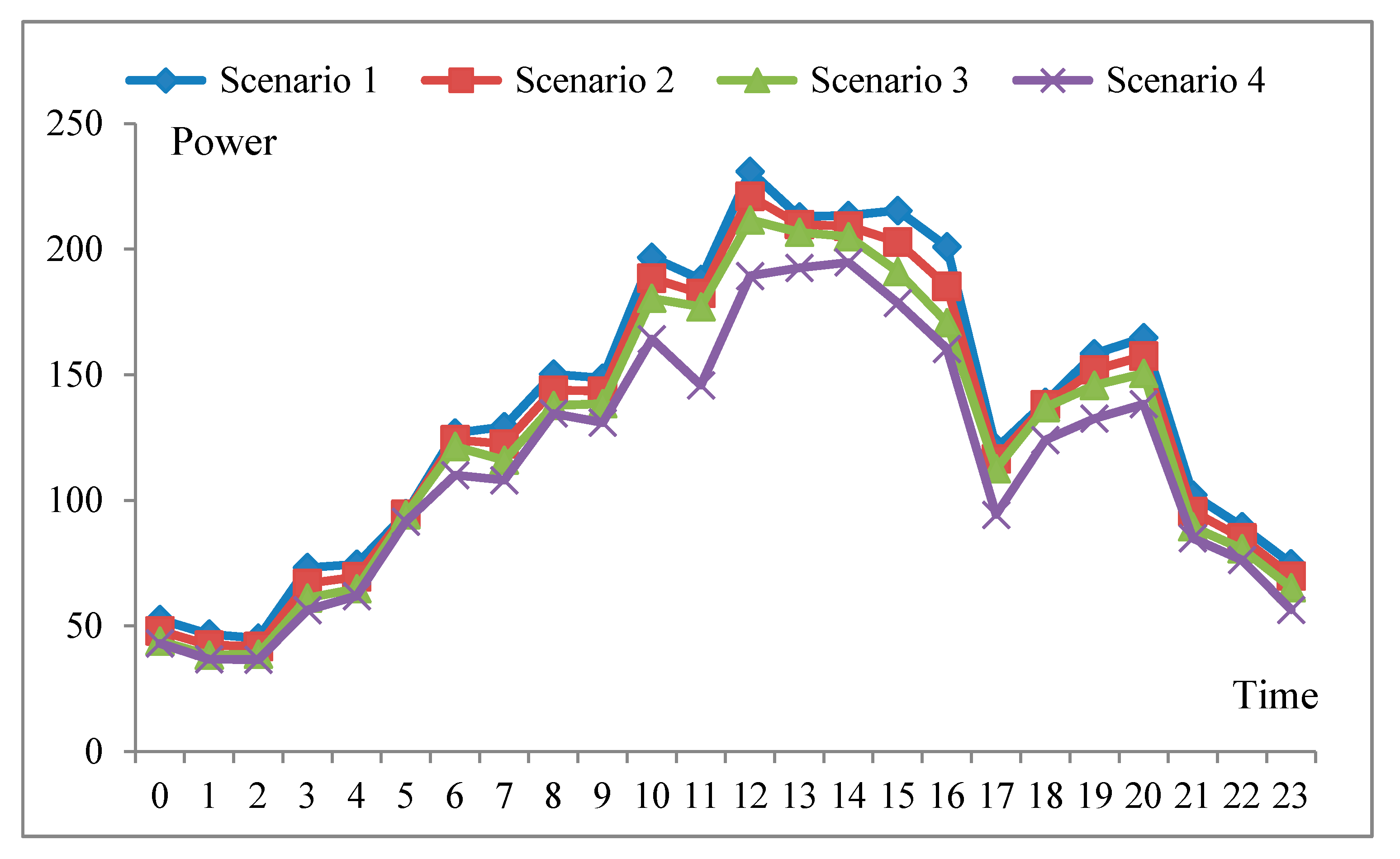

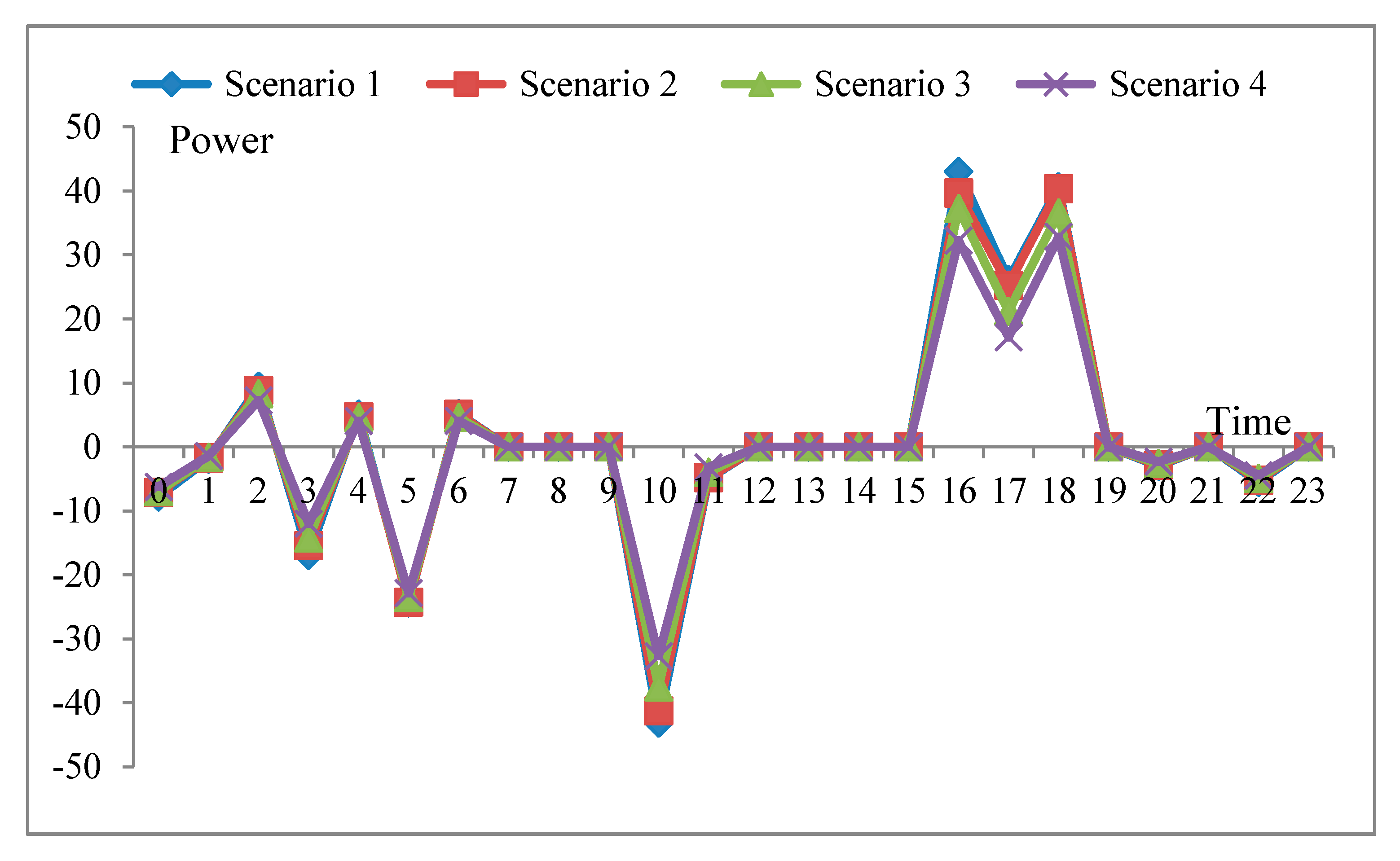

4.3.1. Analysis of System Load and Output of Storage Power Station under Different Scenarios

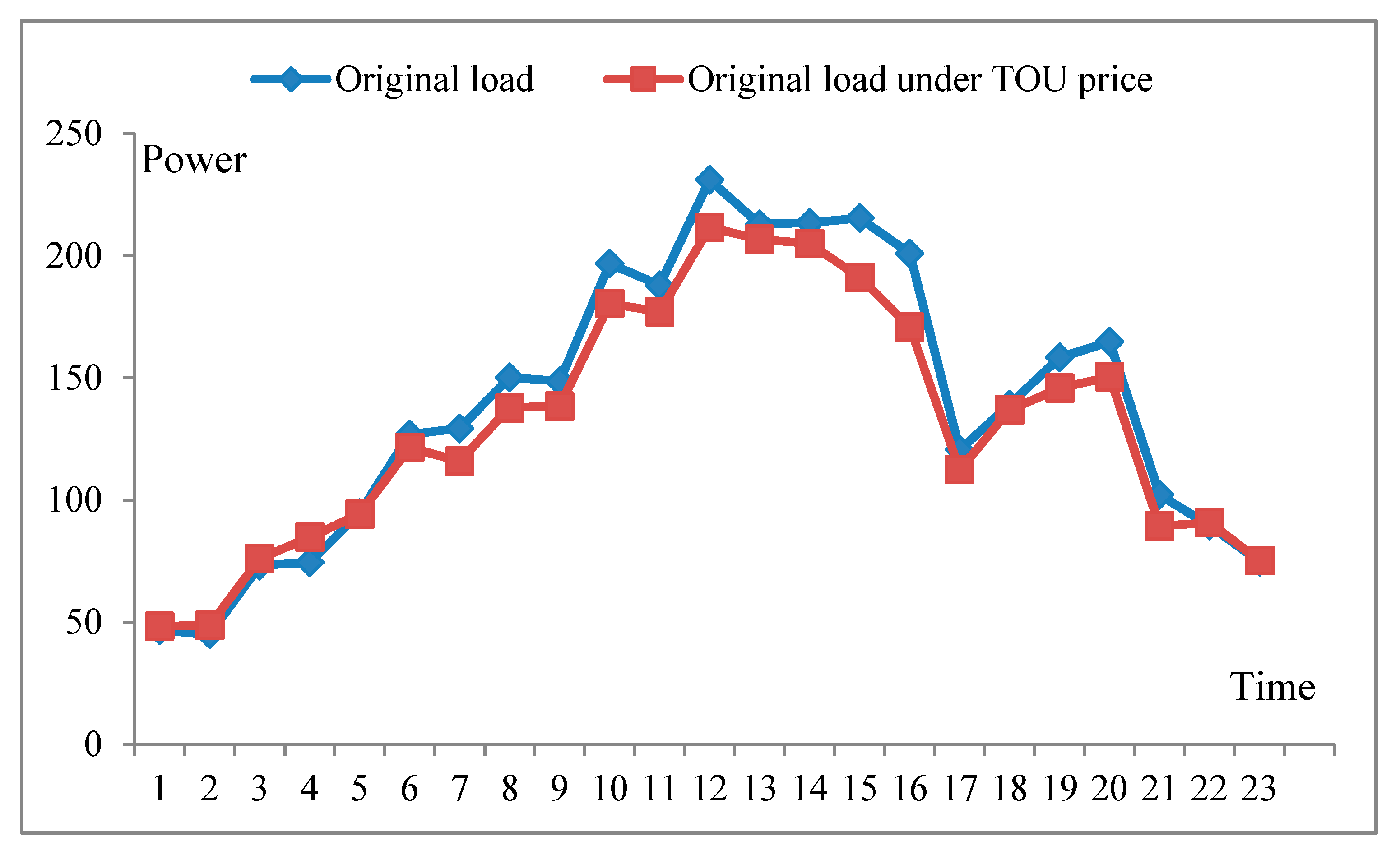

4.3.2. Analysis of Load under the Influence of TOU Price

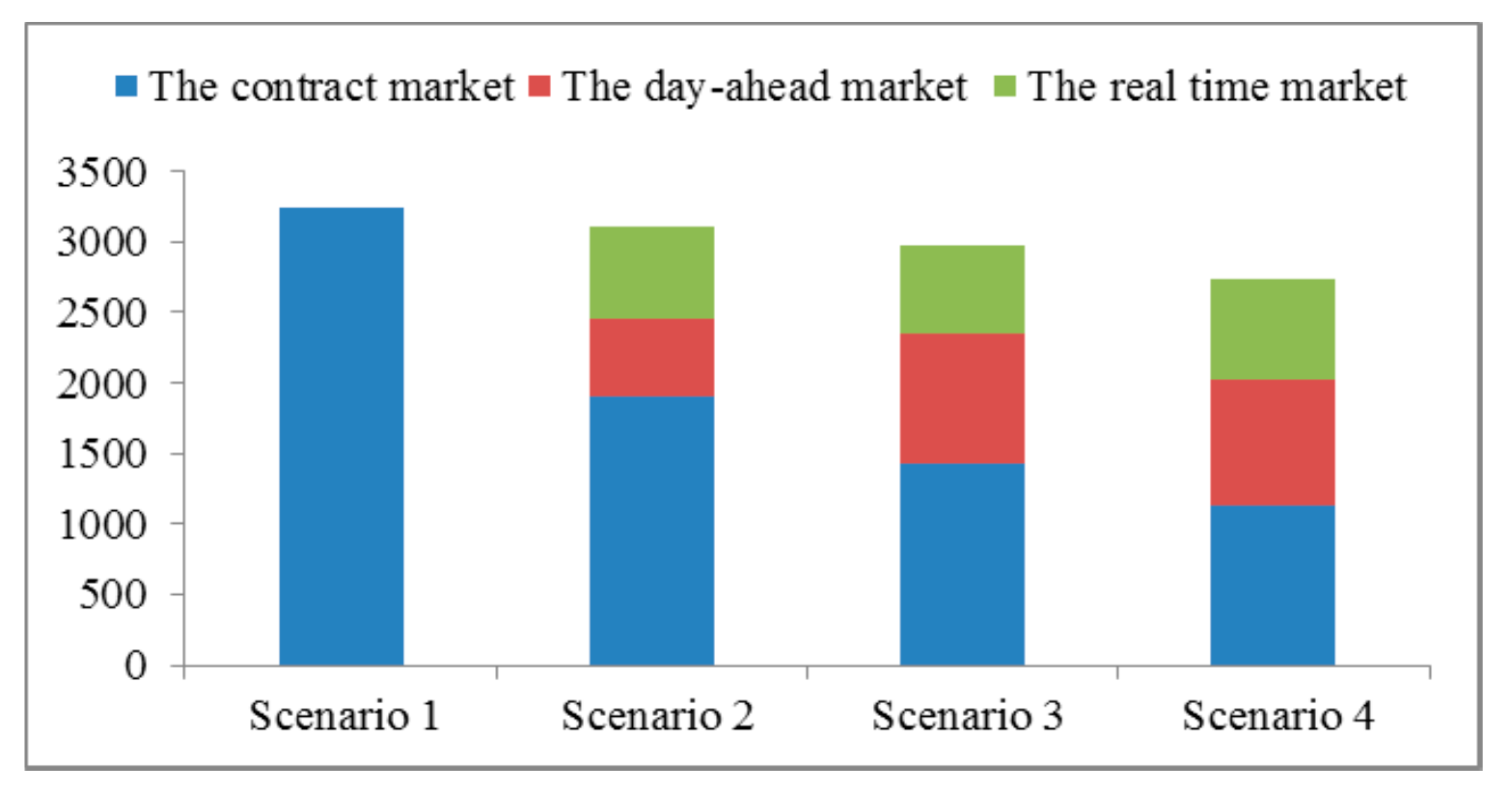

4.3.3. Analysis of Multi-Level Market Structure under Different Confidence Levels

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Nomenclature

| The weighted average absolute load error in statistics | |

| The minimum load for user at time t | |

| The minimum load for user at time t | |

| The customer load | |

| The actual forecasting customer load | |

| The day-ahead market price at time t | |

| The day-ahead market maximum price at time t | |

| The day-ahead market minimum price at time t | |

| The weighted average absolute price error in statistics | |

| The actual electricity forecasting price | |

| The TOU price | |

| The user load after transferring at time t | |

| The price elastic coefficient transferred load from time k to time t | |

| The TOU price at time k | |

| The electricity price in peak period | |

| The electricity price in flat period | |

| The electricity price in valley period | |

| The real time price | |

| , , | The proportion of electricity purchased |

| The electricity in peak period | |

| The electricity in flat period | |

| The electricity in valley period | |

| The purchase of electricity in the contract market at time t period | |

| The purchase of electricity in the day-ahead market at time t period | |

| The purchase of electricity in the real time market at time t period | |

| The purchase of price in the contract market at time t period | |

| The purchase of price in the day-ahead market at time t period | |

| The purchase of price in the real time market at time t | |

| The cost of the electricity sales companies | |

| The revenue of the electricity sales companies | |

| The peak-valley difference | |

| power output of energy storage plant | |

| The original power supply price |

References

- O’Mahoney, A.; Denny, E. Electricity prices and generator behavior in gross pool electricity markets. Energy Policy 2013, 63, 628–637. [Google Scholar] [CrossRef]

- Imran, K.; Kockar, I. A technical comparison of wholesale electricity markets in North America and Europe. Electric Power Syst. Res. 2014, 108, 59–67. [Google Scholar] [CrossRef]

- Qin, Z.; Xifan, W.; Jianxue, W. Electricity purchasing and selling risk decision for power supplier under real-time pricing. Autom. Electric Power Syst. 2010, 34, 22–27. [Google Scholar]

- Gang, L.; Jichun, L.; Zhenbo, W.; Junyong, L.; Yang, L.; Dan, L.; Hu, T. Analysis of game among multi-agents in electrical power market with integration of distributed generation. Power Syst. Prot. Control 2016, 44, 1–9. [Google Scholar]

- Li, J.; Liu, J.; Xie, L.; Quan, H.; Liu, Y. Dynamic game linkage of TOU pricing between generating side and retailside. Electric Power Autom. Equip. 2012, 32, 16–19. [Google Scholar]

- Bompard, E.F.; Han, B. Market-based control in emerging distribution system operation. IEEE Trans. Power Deliv. 2013, 28, 2373–2382. [Google Scholar] [CrossRef]

- Xiaoshou, Z.; Song, X.; Su, Y. The open international experience of the power-selling market and its enlightenment. Autom. Electric Power Syst. 2016, 40, 1–8. [Google Scholar]

- Gang, L.; Zhongrong, W.; Zhanjun, M.; Yu, W. Electricity market based on the sale side Transaction Research. Manag. Obs. 2016, 630, 32–35. [Google Scholar]

- Xiaomeng, L.; Wei, L.; Jian, Z.; Jiehai, Y. Analysis of EU’s unified power marketization reform. Power Grid Technol. 2014, 38, 431–439. [Google Scholar]

- Arange, S.; Laraen, E. Cycles in deregulated electricity markets: Empirical evidence from two decades. Energy Policy 2011, 39, 2457–2466. [Google Scholar] [CrossRef]

- Wang, Z.; Chen, B.; Wang, J.; Chen, C. Networked Microgrids for Self-Healing Power Systems. IEEE Trans. Smart Grid 2016, 7, 310–319. [Google Scholar] [CrossRef]

- Ampatzis, M.; Nguyen, P.H.; Kling, W.L. Implementation and evaluation of an electricity market operated at district level. In Proceedings of the 2015 IEEE Eindhoven PowerTech, Eindhoven, The Netherlands, 29 June–2 July 2015; IEEE: Eindhoven, The Netherlands, 2015; pp. 1–6. [Google Scholar]

- Khazaei, H.; Vahidi, B.; Hosseinian, S.H.; Rastegar, H. Two-level decision-making model for a distribution company in day-ahead market. IET Gener. Transm. Distrib. 2015, 9, 1308–1315. [Google Scholar] [CrossRef]

- An, W.; Weifang, H.; Wei, Z. Analysis of the pricing mechanism of UK transmission network fees. Mingnan Power Grid Technol. 2015, 9, 3–8. [Google Scholar]

- Li, M.; Xiaodong, Z.; Zhe, W. Experience and Enlightenment of the Opening of the Electricity-selling Market in France. China South. Power Grid Technol. 2015, 9, 9–12. [Google Scholar]

- Chen, H.; Songhuai, D.; Juan, S. Discussion on the power purchase route and business model of China’s electricity sales companies under the background of new electricity reform. Power Syst. Technol. 2016, 40, 3293–9299. [Google Scholar]

- Algarni, A.A.; Bhattacharya, K. A Generic Operations Framework for Discos in Retail Electricity Markets. IEEE Trans. Power Syst. 2009, 24, 356–367. [Google Scholar] [CrossRef]

- Hatami, A.; Seifi, H.; Sheikh-El-Eslami, M.K. Stochastic-Based Decision-Making Framework for an Electricity Retailer: Time-of-Use Pricing and Electricity Portfolio Optimization. IEEE Trans. Power Syst. 2011, 26, 1808–1816. [Google Scholar] [CrossRef]

- Hao, Z.; Fuqiang, Z. Calculation of Short-Term Financial Risk in Electricity Market by VAR Historical Simulation Method. Autom. Electric Power Syst. 2004, 28, 14–18. [Google Scholar]

- Mianbin, W.; Zhongfu, T.; Rong, Z. Purchase Power Portfolio Model and an Empirical Analysis Based on Risk Measure with Fractal Value-at-Risk. Proc. CSUEPSA 2009, 21, 11–16. [Google Scholar]

- Chen, Y.; Zhao, J.; Wen, F.; Yang, S.; Fang, R. A Skewness-VaR Based Dynamic Electricity Purchasing Strategy for Power Supply Companies/Electricity sales company. Autom. Electric Power Syst. 2011, 35, 25–29. [Google Scholar]

- Liu, W.; Shang, J.; Zhou, W.; Wen, F.; Lin, Z. Evaluation of Value-at-Risk in Electricity Markets Based on Multifractal Theory. Autom. Electric Power Syst. 2013, 37, 48–54. [Google Scholar]

- Yang, W.; Yu, R.; Nambiar, M. Quantifying the Benefits to Consumers for Demand Response with a Statistical Elasticity Model. IET Gener. Transm. Distrib. 2014, 8, 503–515. [Google Scholar] [CrossRef]

- Fangzheng, S.; Jianhua, J. Optimal Purchasing Strategy of the Electricity Supply Company Under Multi-options. Autom. Electric Power Syst. 2007, 31, 36–39, 107. [Google Scholar]

- Zhang, Q.; Wang, X. Hedge Contract Characterization and Risk-Constrained Electricity Procurement. IEEE Trans. Power Syst. 2009, 24, 1547–1558. [Google Scholar] [CrossRef]

- Çelebi, E.; Fuller, J.D. A Model for Efficient Consumer Pricing Schemes in Electricity Markets. IEEE Trans. Power Syst. 2007, 22, 60–67. [Google Scholar] [CrossRef]

- Stanton, P.J.; Cummings, S.; Molesworth, J.; Sewell, T. Marketing Strategies of Australian Electricity Distributors in an Opening Market. J. Bus. Ind. Mark. 2001, 16, 81–93. [Google Scholar] [CrossRef]

- Müllera, M.; Sensfuß, F.; Wietschel, M. Simulation of Current Pricing Tendencies in the German Electricity Market for Private Consumption. Energy Policy 2007, 35, 4283–4294. [Google Scholar] [CrossRef]

- Tan, Z.; Tan, Q.; Wang, Y. Bidding Strategy of Virtual Power Plant with Energy Storage Power Station and Photovoltaic and Wind Power. J. Eng. 2018, 2018, 6139086. [Google Scholar] [CrossRef]

| Scenario | Confidence Factor |

|---|---|

| Scenario 1 | = 0, = 0 |

| Scenario 2 | = 1, = 1 |

| Scenario 3 | = 3, = 3 |

| Scenario 4 | = 5, = 5 |

| Peak | Flat | Valley | |

|---|---|---|---|

| Period | 8:30–11:30 18:00–23:00 | 07:00–8:30 11:30–18:00 | 23:00–07:00 |

| Price ($/MW) | 192.5075 | 126.0149 | 62.50746 |

| Time | Price | Time | Price |

|---|---|---|---|

| 0 | 20.36 | 12 | 31.95 |

| 1 | 17.01 | 13 | 33.01 |

| 2 | 15.01 | 14 | 32.80 |

| 3 | 14.99 | 15 | 30.97 |

| 4 | 17.91 | 16 | 31.25 |

| 5 | 24.98 | 17 | 31.01 |

| 6 | 29.44 | 18 | 31.53 |

| 7 | 30.15 | 19 | 32.91 |

| 8 | 30.51 | 20 | 31.31 |

| 9 | 30.64 | 21 | 31.37 |

| 10 | 31.25 | 22 | 32.23 |

| 11 | 32.02 | 23 | 29.01 |

| Time | Price | Time | Price |

|---|---|---|---|

| 0 | 14.67 | 12 | 24.06 |

| 1 | 17.28 | 13 | 24.14 |

| 2 | 15.84 | 14 | 24.07 |

| 3 | 15.59 | 15 | 24.02 |

| 4 | 15.92 | 16 | 25.95 |

| 5 | 16.16 | 17 | 28.05 |

| 6 | 17.16 | 18 | 29.12 |

| 7 | 19.03 | 19 | 31.99 |

| 8 | 24.06 | 20 | 31.12 |

| 9 | 24.18 | 21 | 31.97 |

| 10 | 23.15 | 22 | 30.40 |

| 11 | 24.05 | 23 | 27.11 |

| Violation of Probability | Profits ($) | Peak and Valley Difference | Maximum Load (MW) | ||||

|---|---|---|---|---|---|---|---|

| 0 | 53.64 | 1 | 0 | 0 | 378,669.8268 | 185.89 | 231 |

| 1 | 50 | 0.61 | 0.18 | 0.21 | 363,149.0559 | 179.28 | 221.1 |

| 3 | 41.36 | 0.48 | 0.31 | 0.21 | 348,412.9272 | 173.28 | 211.6 |

| 5 | 33.13 | 0.41 | 0.33 | 0.26 | 320,199.1801 | 158.19 | 194.7 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, G.; Tan, Z.; Lin, H.; Tan, Q.; Yang, S.; Ju, L.; Ren, Z. Multi-Level Market Transaction Optimization Model for Electricity Sales Companies with Energy Storage Plant. Energies 2019, 12, 145. https://doi.org/10.3390/en12010145

Wang G, Tan Z, Lin H, Tan Q, Yang S, Ju L, Ren Z. Multi-Level Market Transaction Optimization Model for Electricity Sales Companies with Energy Storage Plant. Energies. 2019; 12(1):145. https://doi.org/10.3390/en12010145

Chicago/Turabian StyleWang, Guan, Zhongfu Tan, Hongyu Lin, Qingkun Tan, Shenbo Yang, Liwei Ju, and Zhongrui Ren. 2019. "Multi-Level Market Transaction Optimization Model for Electricity Sales Companies with Energy Storage Plant" Energies 12, no. 1: 145. https://doi.org/10.3390/en12010145

APA StyleWang, G., Tan, Z., Lin, H., Tan, Q., Yang, S., Ju, L., & Ren, Z. (2019). Multi-Level Market Transaction Optimization Model for Electricity Sales Companies with Energy Storage Plant. Energies, 12(1), 145. https://doi.org/10.3390/en12010145