Optimal Decision-Making Strategy of an Electric Vehicle Aggregator in Short-Term Electricity Markets

Abstract

:1. Introduction

- To develop a stochastic decision-making model for scheduling of an EV aggregator in a competitive trading floor, as well as to determine the optimal level of the aggregator’s involvement in DA and balancing markets.

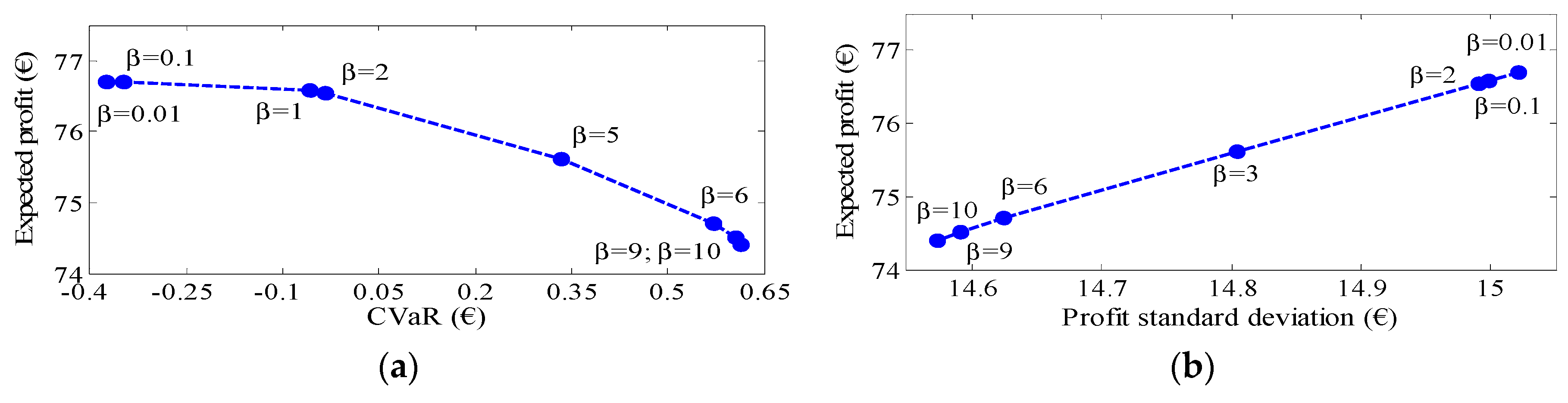

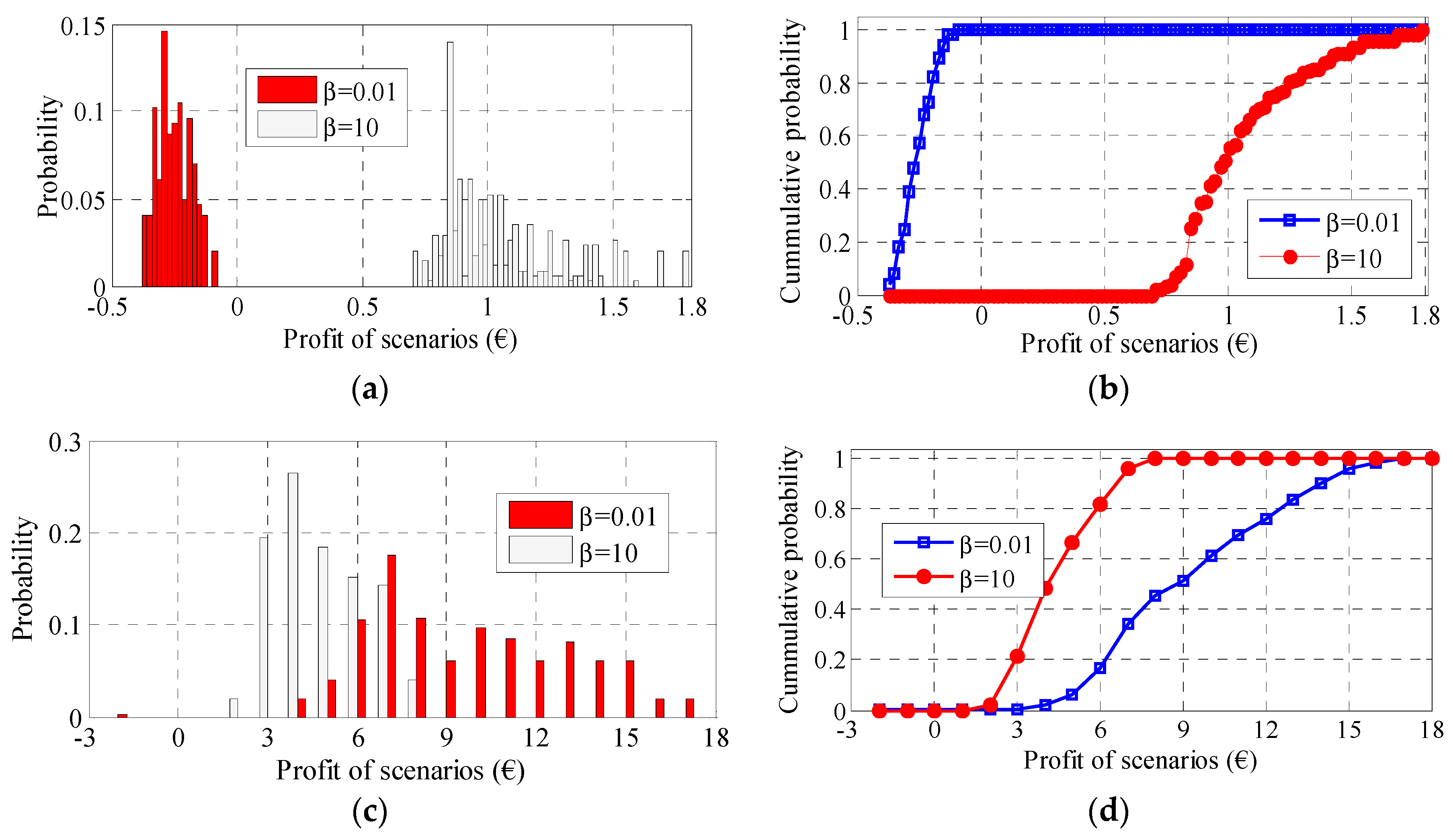

- To investigate the effects of a risk-aversion parameter on the decision-making of the aggregator. Also, the reaction of EV owners to the prices offered by the aggregators under different risk-aversion circumstances is assessed.

- To effectively solve the stochastic optimization framework with sources of uncertainties, the proposed model is reformulated to be an expectation optimization problem with CVaR constraints to reduce the unfavorable effect of undesired scenarios.

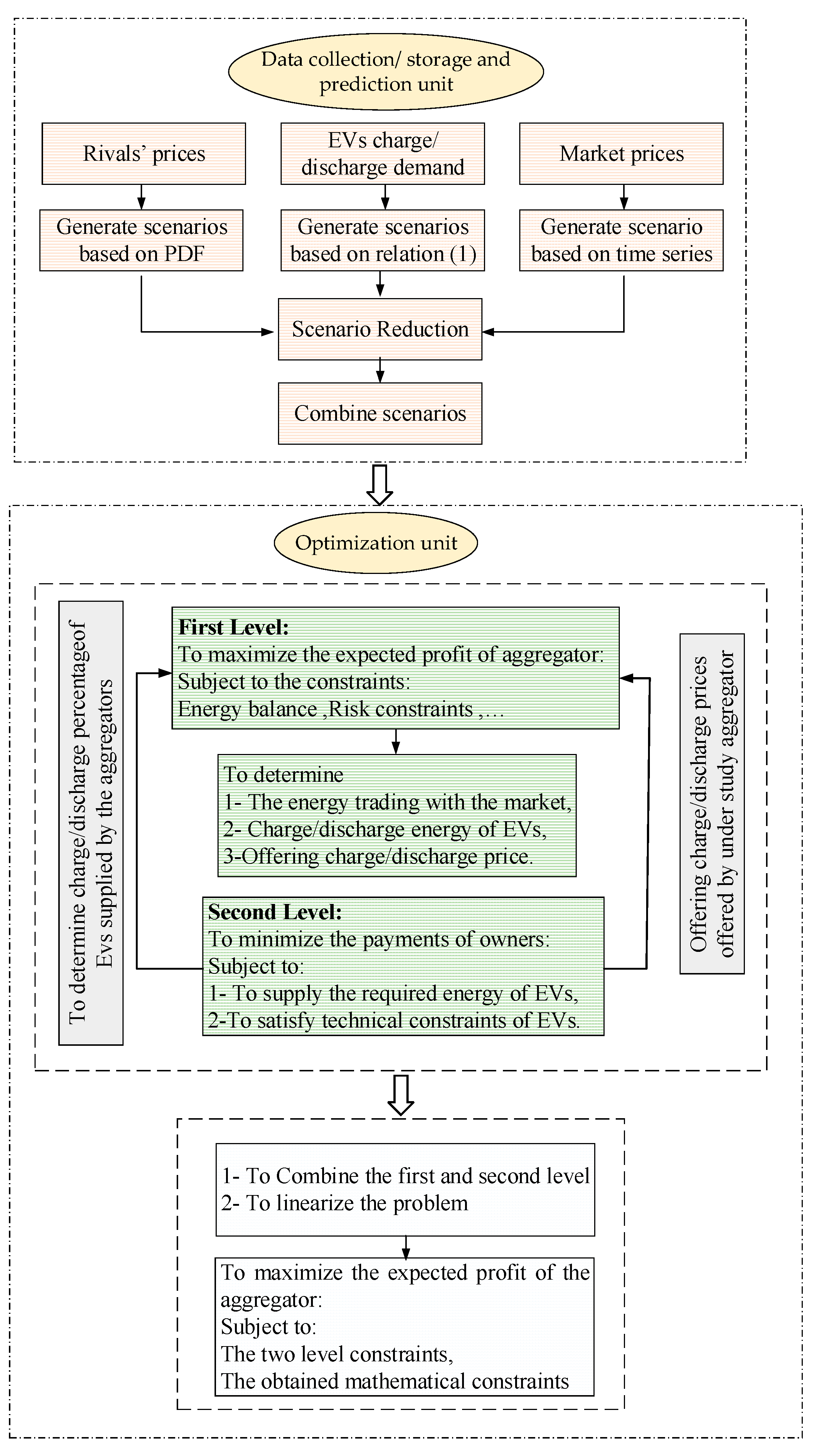

2. Materials and Methods

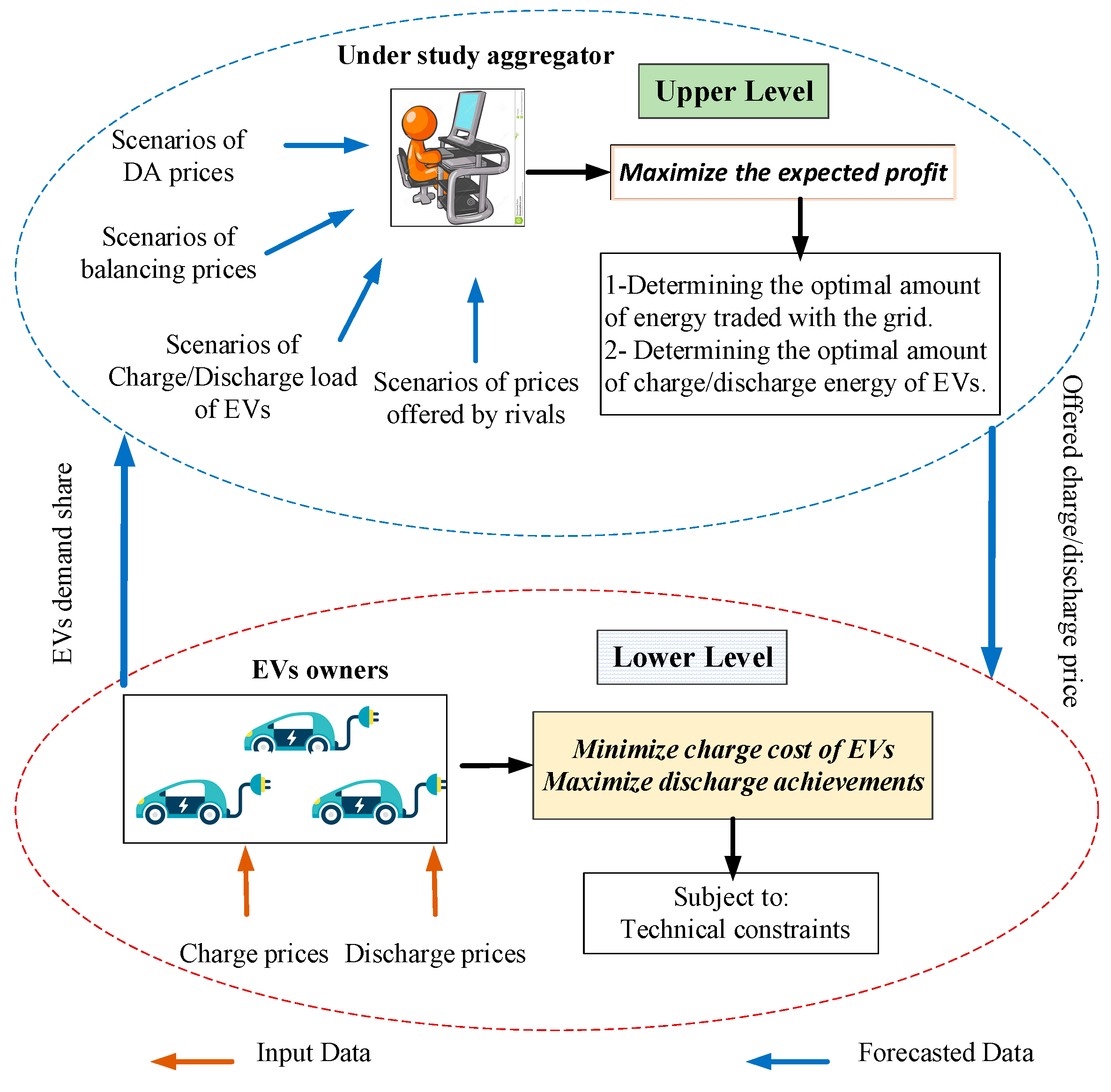

2.1. Problem Description

2.2. Bi-Level Model

2.2.1. Upper-Level Formulation

2.2.2. Lower-Level Formulation

3. Numerical Results and Discussion

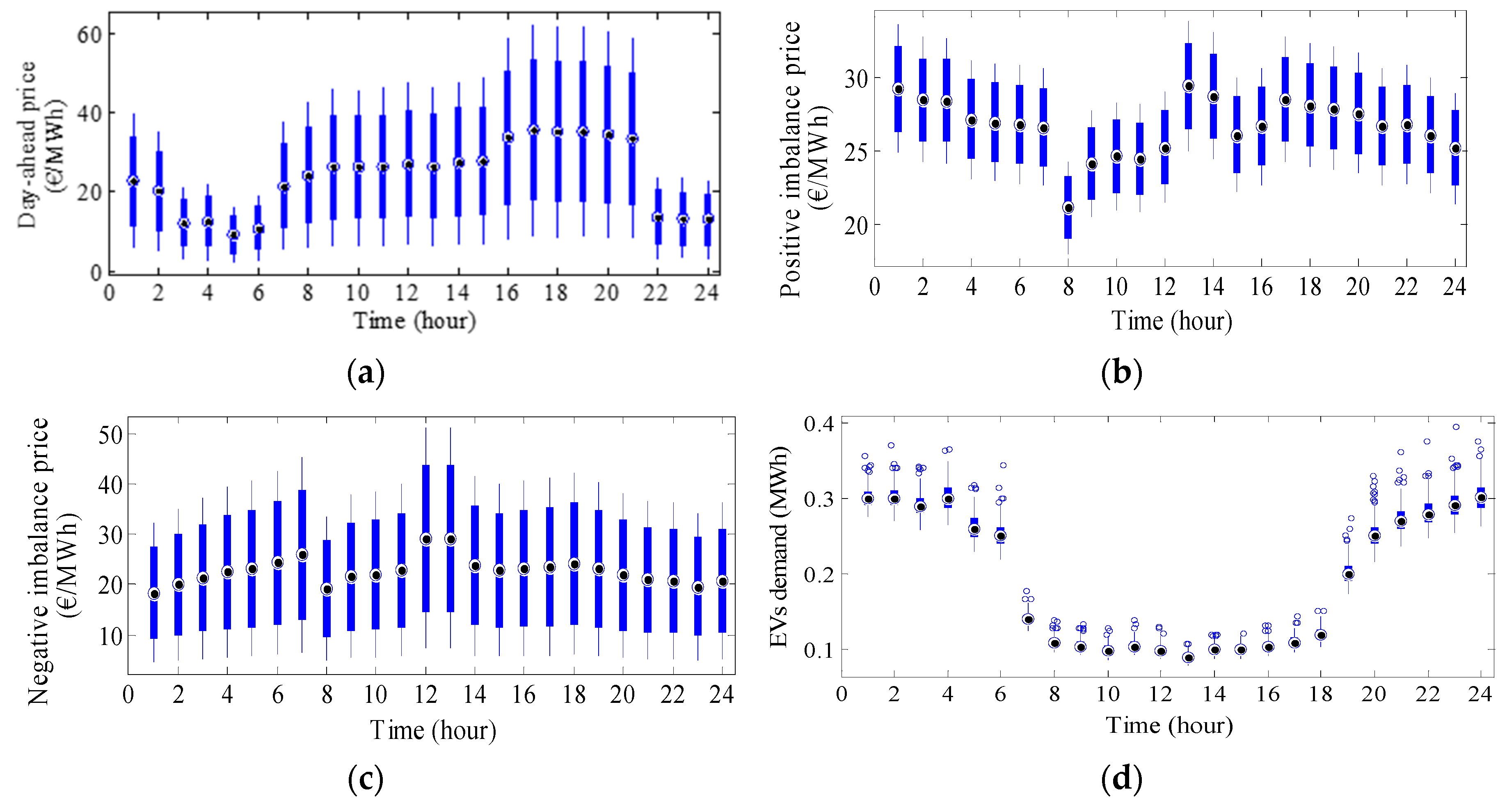

3.1. Test Case Study

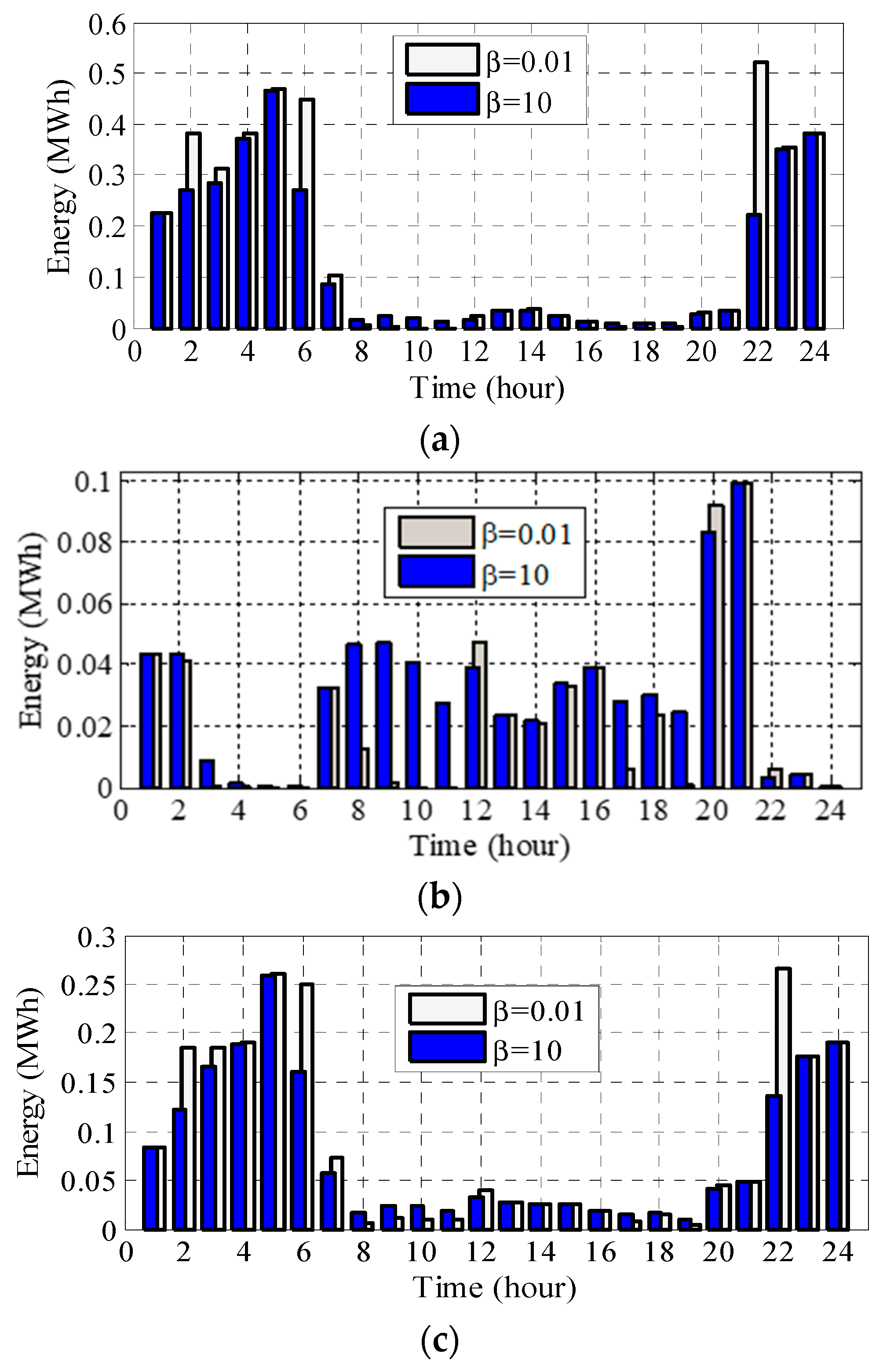

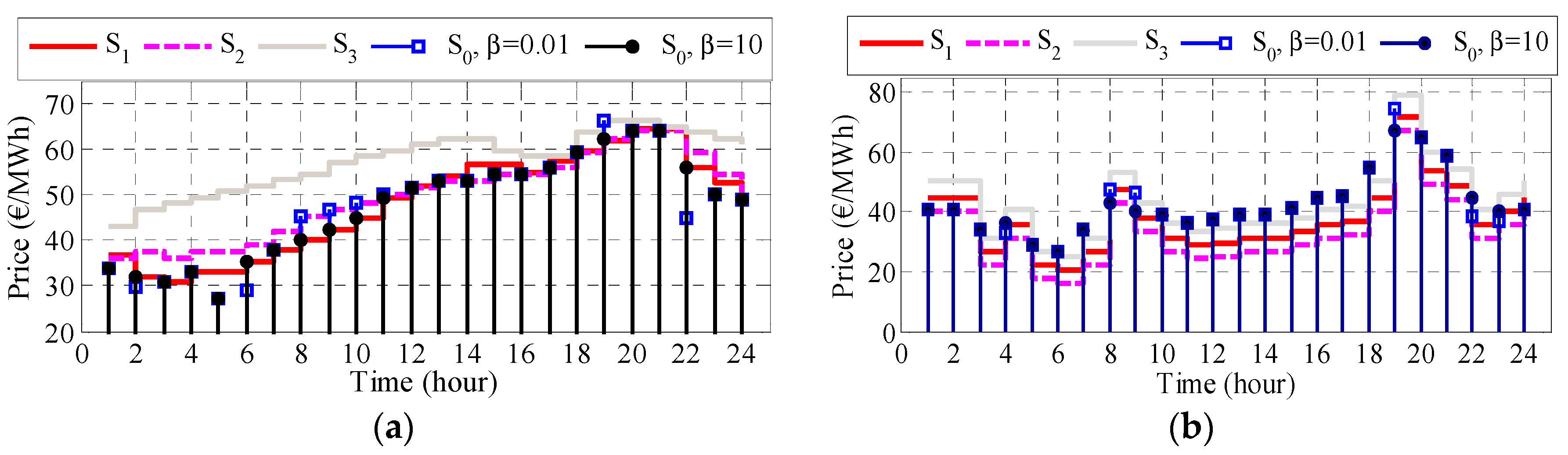

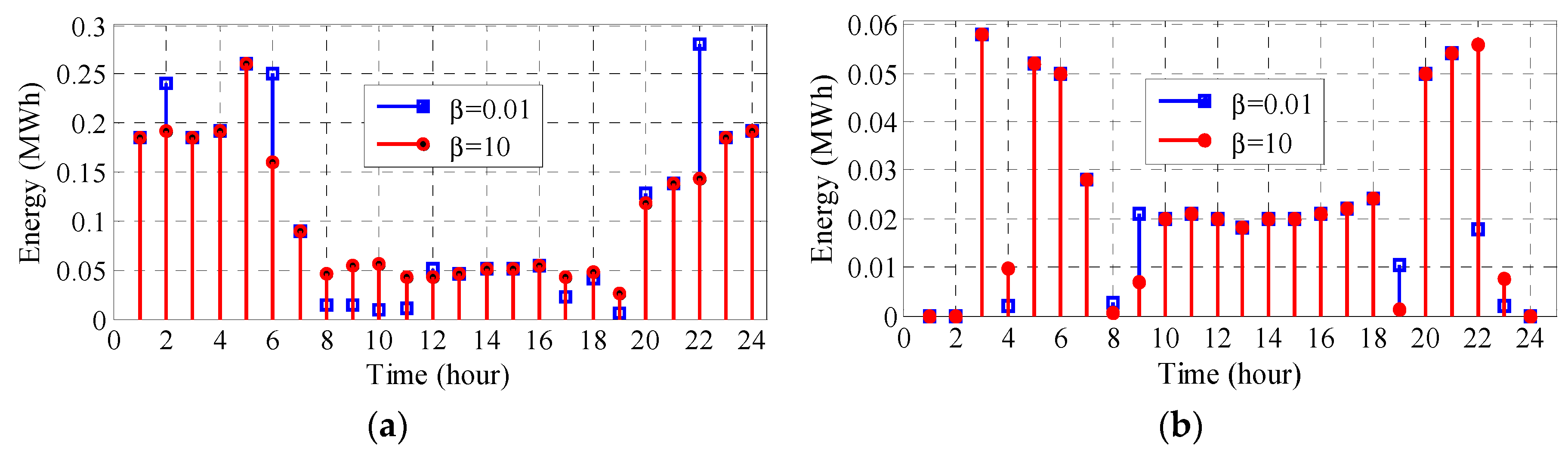

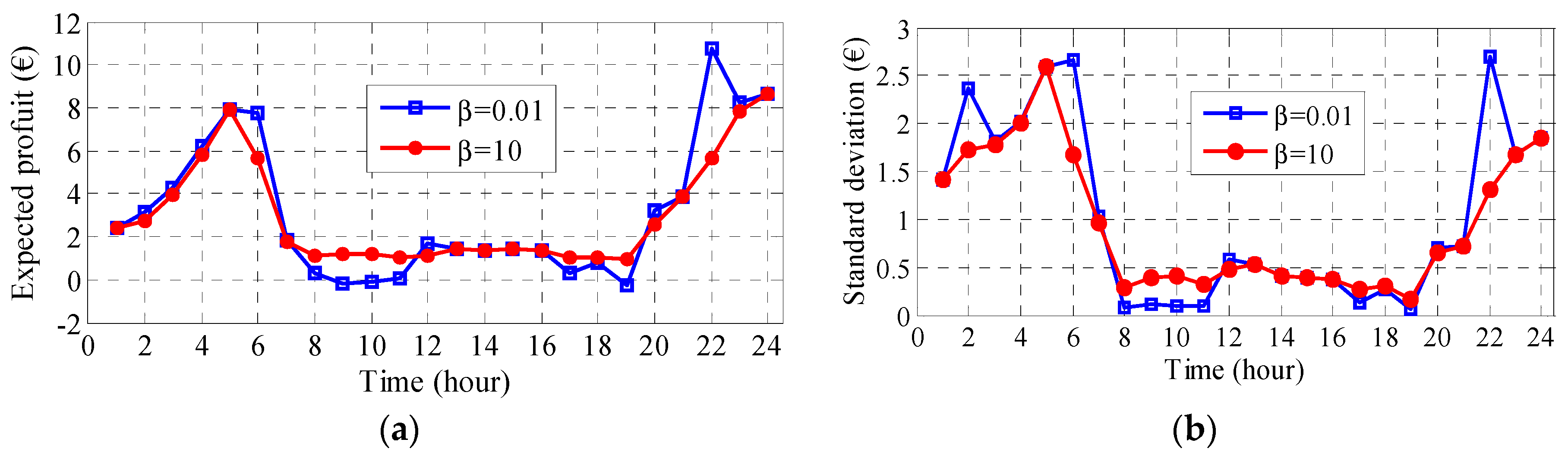

3.2. Simulation

3.3. Discussion

4. Conclusions

- With an increasing risk-aversion parameter, the aggregator’s participation in DA and negative balancing markets is reduced due to more volatile prices of these markets, but its purchases from the positive balancing market increases due to more stable prices, which consequently helps the aggregator to hedge against profit volatility.

- With an increasing risk-aversion factor, the average standard deviation of the aggregator’s profit during the whole scheduling horizon decreases, while CVaR increases, which accordingly denotes that the aggregator makes less profits but in a more reliable way; at some hours, however, the opposite might happen.

- When the aggregator is more risk-averse, the retailer changes its bidding strategy to increase charge prices and decrease discharge prices to make more profit. However, this action is normally followed by lower participation in the market, which, in turn, affects the aggregator’s profit negatively. Therefore, in a competitive environment, considering risk exposure can have significant influence on the decision-making of the aggregator.

Author Contributions

Funding

Conflicts of Interest

Nomenclature

| Sets and indices | |

| At time t and scenario . | |

| At time t and scenario . | |

| Pos (neg) | Positive (negative) balancing market. |

| DA | DA market. |

| ch (dch) | Charge (Discharge) process. |

| Indices of aggregators. | |

| NS | Set of aggregators. |

| () | Scenario index (set) for rival aggregators’ prices. |

| (T) | Index (set) of time periods. |

| (Ω) | Scenario index (set) of market prices and charge/discharge of EVs. |

| The sign which represents that the production of two vectors is zero. | |

| Variables | |

| Auxiliary binary variable used in complementary slackness conditions. | |

| The amount of energy supplied by the under-study aggregator (MWh). | |

| Energy exchanged in positive (negative) balancing markets (MWh). | |

| Energy purchased from DA market (MWh). | |

| The cost modeling the reluctance of EV owners to transfer between aggregator s and aggregator s’(€). | |

| The revenue of the aggregator under study (€). | |

| Percentage of EVs supplied by rival aggregators. | |

| Percentage of EVs supplied by the aggregator under study. | |

| Percentage of EVs transferred between the aggregators. | |

| Lagrange multipliers. | |

| State of charge of EV. | |

| Auxiliary variables to obtain KKT optimality conditions | |

| Parameters | |

| Total demand of EVs (MWh). | |

| Total expected demand of EVs (MWh). | |

| Initial percentage of EVs supplied by each aggregator. | |

| Probability of scenario . | |

| Positive (negative) balancing market prices (€/MWh). | |

| Price of DA market (€/MWh). | |

| Expected DA price (€/MWh). | |

| Price signals offered by rival (under study) aggregator (€/MWh). | |

| Large constants. | |

| Probability of scenario . | |

| Confidence level for calculation of CVaR. | |

| Risk-aversion factor. | |

| Auxiliary variable to control CVaR. | |

| Parameter indicating the relationship between the EVs demand and DA prices. | |

| Coefficient of charge (discharge) efficiency. | |

| () | Minimum (maximum) of SoC. |

| Energy capacity of EV (MWh). | |

| Limitation of maximum energy traded with the network (MWh). | |

Appendix A

References

- Porkar, S.; Abbaspour-Tehrani-fard, A.; Poure, P.; Saadate, S. Distribution system planning considering integration of distributed generation and load curtailment options in a competitive electricity market. Electr. Eng. 2010, 93, 23–32. [Google Scholar] [CrossRef]

- Vahedipour-Dahraie, M.; Rashidizadeh-Kermani, H.; Najafi, H.R.; Anvari-Moghaddam, A.; Guerrero, J.M. Coordination of EVs Participation for Load Frequency Control in Isolated Microgrids. Appl. Sci. 2017, 7, 539. [Google Scholar] [CrossRef]

- Bioki, M.M.H.; Jahromi, M.Z.; Rashidinejad, M. A combinatorial artificial intelligence real-time solution to the unit commitment problem incorporating v2g. Electr. Eng. 2012, 95, 341–355. [Google Scholar] [CrossRef]

- Shafie-khah, M.; Heydarian-Forushani, E.; Golshan, M.E.H.; Siano, P.; Moghaddam, M.P.; Sheikh-El-Eslami, M.K.; Catalão, J.P.S. Optimal trading of plug-in electric vehicle aggregation agents in a market environment for sustainability. Appl. Energy 2016, 162, 601–612. [Google Scholar] [CrossRef]

- Vahedipour-Dahraie, M.; Najafi, H.R.; Anvari-Moghaddam, A.; Guerrero, J.M. Study of the Effect of Time-Based Rate Demand Response Programs on Stochastic Day-Ahead Energy and Reserve Scheduling in Islanded Residential Microgrids. Appl. Sci. 2017, 7, 378. [Google Scholar] [CrossRef]

- Bajpai, P.; Punna, S.K.; Singh, S.N. Swarm intelligence-based strategic bidding in competitive electricity markets. IET Gener. Transm. Distrib. 2008, 2, 175. [Google Scholar] [CrossRef]

- Tan, Z.; Yang, P.; Nehorai, A. An optimal and distributed demand response strategy with electric vehicles in the smart grid. IEEE Trans. Smart Grid 2014, 5, 861–869. [Google Scholar] [CrossRef]

- Wu, H.; Shahidehpour, M.; Alabdulwahab, A.; Abusorrah, A. A game theoretic approach to risk-based optimal bidding strategies for electric vehicle aggregators in electricity markets with variable wind energy resources. IEEE Trans. Sustain. Energy 2016, 7, 374–385. [Google Scholar] [CrossRef]

- Reddy, S.S. Optimizing energy and demand response programs using multi-objective optimization. Electr. Eng. 2016, 99, 397–406. [Google Scholar] [CrossRef]

- Xia, M.; Lai, Q.; Zhong, Y.; Li, C.; Chiang, H.D. Aggregator-Based Interactive Charging Management System for Electric Vehicle Charging. Energies 2016, 9, 159. [Google Scholar] [CrossRef]

- Vagropoulos, S.I.; Bakirtzis, A.G. Optimal bidding strategy for electric vehicle aggregators in electricity markets. IEEE Trans. Power Syst. 2013, 28, 4031–4041. [Google Scholar] [CrossRef]

- Alipour, M.; Mohammadi-Ivatloo, B.; Moradi-Dalvand, M.; Zare, K. Stochastic scheduling of aggregators of plug-in electric vehicles for participation in energy and ancillary service markets. Energy 2017, 118, 1168–1179. [Google Scholar] [CrossRef]

- Pantos, M. Exploitation of electric-drive vehicles in electricity markets. IEEE Trans. Power Syst. 2012, 27, 682–694. [Google Scholar] [CrossRef]

- Momber, I.; Siddiqui, A.; Roman, T.G.S.; Soder, L. Risk averse scheduling by a pev aggregator under uncertainty. IEEE Trans. Power Syst. 2015, 30, 882–891. [Google Scholar] [CrossRef]

- Haghighat, H.; Kennedy, S.W. A Bilevel Approach to Operational Decision Making of a Distribution Company in Competitive Environments. IEEE Trans. Power Syst. 2012, 27, 1797–1807. [Google Scholar] [CrossRef]

- Rashedi, N.; Tajeddini, M.A.; Kebriaei, H. Markov game approach for multi-agent competitive bidding strategies in electricity market. IET Gener. Transm. Distrib. 2016, 10, 3756–3763. [Google Scholar] [CrossRef]

- Aghajani, S.; Kalantar, M. A cooperative game theoretic analysis of electric vehicles parking lot in smart grid. Energy 2017, 137, 129–139. [Google Scholar] [CrossRef]

- Motalleb, M.; Ghorbani, R. Non-cooperative game-theoretic model of demand response aggregator competition for selling stored energy in storage devices. Appl. Energy 2017, 202, 581–596. [Google Scholar] [CrossRef]

- Neyestani, N.; Yazdani Damavandi, M.; Shafie-khah, M.; Catalã, J.P.S. Plug-In Electric Vehicles Parking Lot Equilibria with Energy and Reserve Markets. IEEE Trans. Power Syst. 2017, 32, 2001–2016. [Google Scholar] [CrossRef]

- Momber, I.; Wogrin, S.; Gomez San Roman, T. Retail pricing: A bilevel program for pev aggregator decisions using indirect load control. IEEE Trans. Power Syst. 2016, 31, 464–473. [Google Scholar] [CrossRef]

- Vayá, M.G.; Andersson, G. Optimal Bidding Strategy of a Plug-In Electric Vehicle Aggregator in Day-Ahead Electricity Markets Under Uncertainty. IEEE Trans. Power Syst. 2015, 30, 2375–2385. [Google Scholar] [CrossRef]

- Rashidizadeh-Kermani, H.; Vahedipour-Dahraie, M.; Najafi, H.R.; Anvari-Moghaddam, A.; Guerrero, J.M. A Stochastic Bi-level Scheduling Approach for Participation of EV Aggregators in Competitive Electricity Markets. Appl. Sci. 2017, 7, 1100. [Google Scholar] [CrossRef]

- Box, G.E.P.; Jenkins, G.M.; Reinsel, G.C. Time Series Analysis: Forecasting and Control, 4th ed.; John Wiley & Sons: Hoboken, NJ, USA, 2008; pp. 305–325. ISBN 978-1-118-67502-1. [Google Scholar]

- Vahedipour-Dahraie, M.; Rashidizadeh-Kermani, H.; Najafi, H.R.; Anvari-Moghaddam, A.; Guerrero, J.M. Stochastic Security and Risk-Constrained Scheduling for an Autonomous Microgrid with Demand Response and Renewable Energy Resources. IET Renew. Power Gener. 2017, 11, 1812–1821. [Google Scholar] [CrossRef]

- Carrión, M.; Arroyo, J.M.; Conejo, A.J. A bilevel stochastic programming approach for retailer futures market trading. IEEE Trans. Power Syst. 2009, 24, 1446–1456. [Google Scholar] [CrossRef]

- Relevant Information on the Market Pertaining to Nordpool. 2016. Available online: http://www.nordpool.com (accessed on 5 September 2016).

- Conejo, A.J.; Carrión, M.; Morales, J.M. Decision Making Under Uncertainty in Electricity Markets, 1st ed.; Springer: New York, NY, USA, 2010; pp. 80–84. ISBN 978-1-4419-7421-1. [Google Scholar]

- Rashidizadeh-Kermani, H.; Vahedipour-Dahraie, M.; Shafie-khah, M.; Catalão, J.P.S. A bi-level risk-constrained offering strategy of a wind power producer considering demand side resources. Int. J. Electr. Power Energy Syst. 2019, 104, 562–574. [Google Scholar] [CrossRef]

- The General Algebraic Modeling System (GAMS) Software. 2018. Available online: http://www.gams.com (accessed on 7 February 2018).

| β | |||

| 0.01 | 3.786 | 0.529 | 2.153 |

| 0.1 | 3.785 | 0.529 | 2.152 |

| 1 | 3.747 | 0.530 | 2.118 |

| 2 | 3.732 | 0.535 | 2.108 |

| 3 | 3.466 | 0.615 | 2.007 |

| 5 | 3.22 | 0.716 | 1.897 |

| 6 | 3.20 | 0.721 | 1.882 |

| 10 | 3.199 | 0.722 | 1.880 |

| β | |||

| 0.01 | 2.655 | 1.276 | 0.653 |

| 0.08 | 2.575 | 1.339 | 0.636 |

| 0.13 | 1.773 | 2.031 | 0.525 |

| 0.31 | 1.604 | 2.166 | 0.492 |

| 0.47 | 1.310 | 2.361 | 0.393 |

| 3.89 | 1.181 | 2.457 | 0.360 |

| Aggregator | S0 | S1 | S2 | S3 | S0 | S1 | S2 | S3 |

|---|---|---|---|---|---|---|---|---|

| Charge Process | Discharge Process | |||||||

| β = 0 | 43 | 32 | 15 | 10 | 33 | 22 | 7 | 38 |

| β = 1 | 38 | 37 | 16 | 9 | 32 | 23 | 6 | 39 |

| β = 10 | 33 | 44 | 15 | 8 | 30 | 24 | 6 | 40 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rashidizadeh-Kermani, H.; Najafi, H.R.; Anvari-Moghaddam, A.; Guerrero, J.M. Optimal Decision-Making Strategy of an Electric Vehicle Aggregator in Short-Term Electricity Markets. Energies 2018, 11, 2413. https://doi.org/10.3390/en11092413

Rashidizadeh-Kermani H, Najafi HR, Anvari-Moghaddam A, Guerrero JM. Optimal Decision-Making Strategy of an Electric Vehicle Aggregator in Short-Term Electricity Markets. Energies. 2018; 11(9):2413. https://doi.org/10.3390/en11092413

Chicago/Turabian StyleRashidizadeh-Kermani, Homa, Hamid Reza Najafi, Amjad Anvari-Moghaddam, and Josep M. Guerrero. 2018. "Optimal Decision-Making Strategy of an Electric Vehicle Aggregator in Short-Term Electricity Markets" Energies 11, no. 9: 2413. https://doi.org/10.3390/en11092413

APA StyleRashidizadeh-Kermani, H., Najafi, H. R., Anvari-Moghaddam, A., & Guerrero, J. M. (2018). Optimal Decision-Making Strategy of an Electric Vehicle Aggregator in Short-Term Electricity Markets. Energies, 11(9), 2413. https://doi.org/10.3390/en11092413