A Decentralized Local Flexibility Market Considering the Uncertainty of Demand

Abstract

1. Introduction

1.1. Research Gaps

1.2. Literature Review

1.3. Contribution

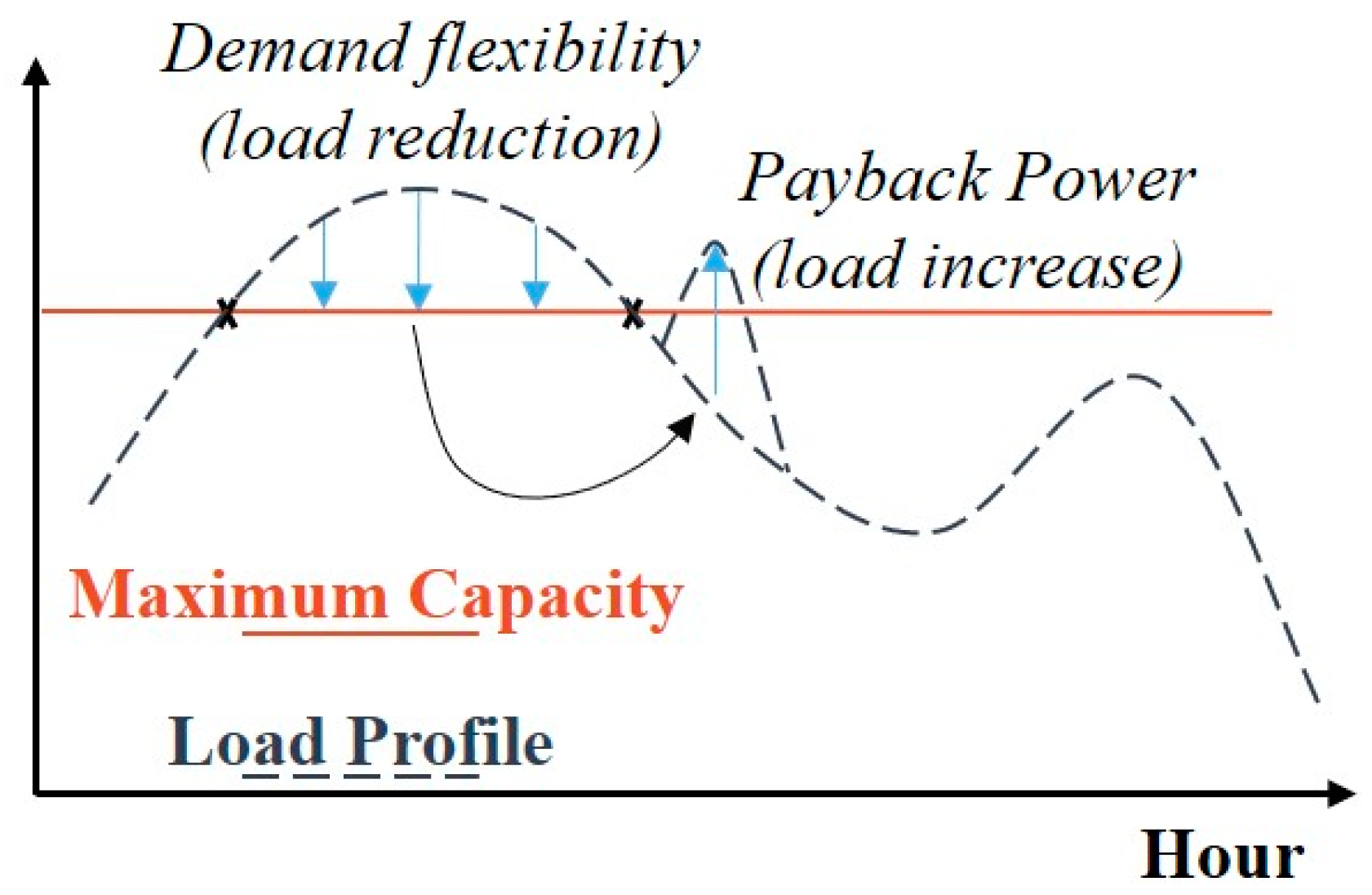

- The payback effect within the market design to ensure that the activated demand flexibility will solve the intended congestion and not lead to further network congestions during other hours of the day;

- Network constraints within the decision-making process of flexibility procurement;

- Energy variation and imbalances within the wholesale electricity market as a result of demand adjustments to provide flexibility; and

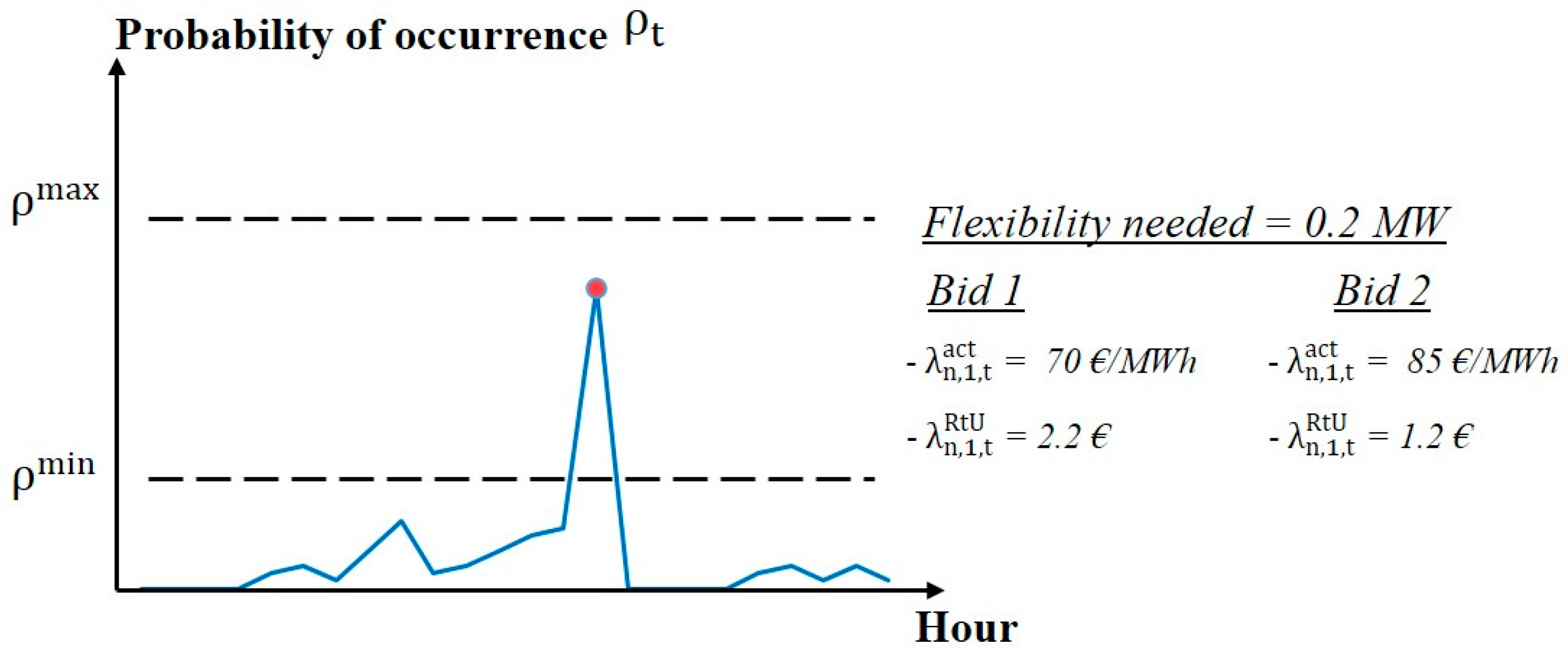

- Uncertainty in demand to eliminate the risk of DSOs over- or under-procuring flexibility services.

2. Demand Flexibility

- Location: Flexibility is traded at the distribution-level of the grid.

- Purpose: The objective is congestion management at the distribution network.

- Direction: While flexibility can either take the form of load reduction or load increase, this paper focuses on the load reduction flexibility.

- Duration: Flexibility is scheduled and dispatched on hourly basis.

- The payback effect derived from the flexibility activation is taken into consideration.

2.1. The Need for Demand Flexibility

2.2. The Payback Effect

2.3. Demand Flexibility Providers

2.4. Demand Flexibility Buyers

3. Framework for Demand Flexibility

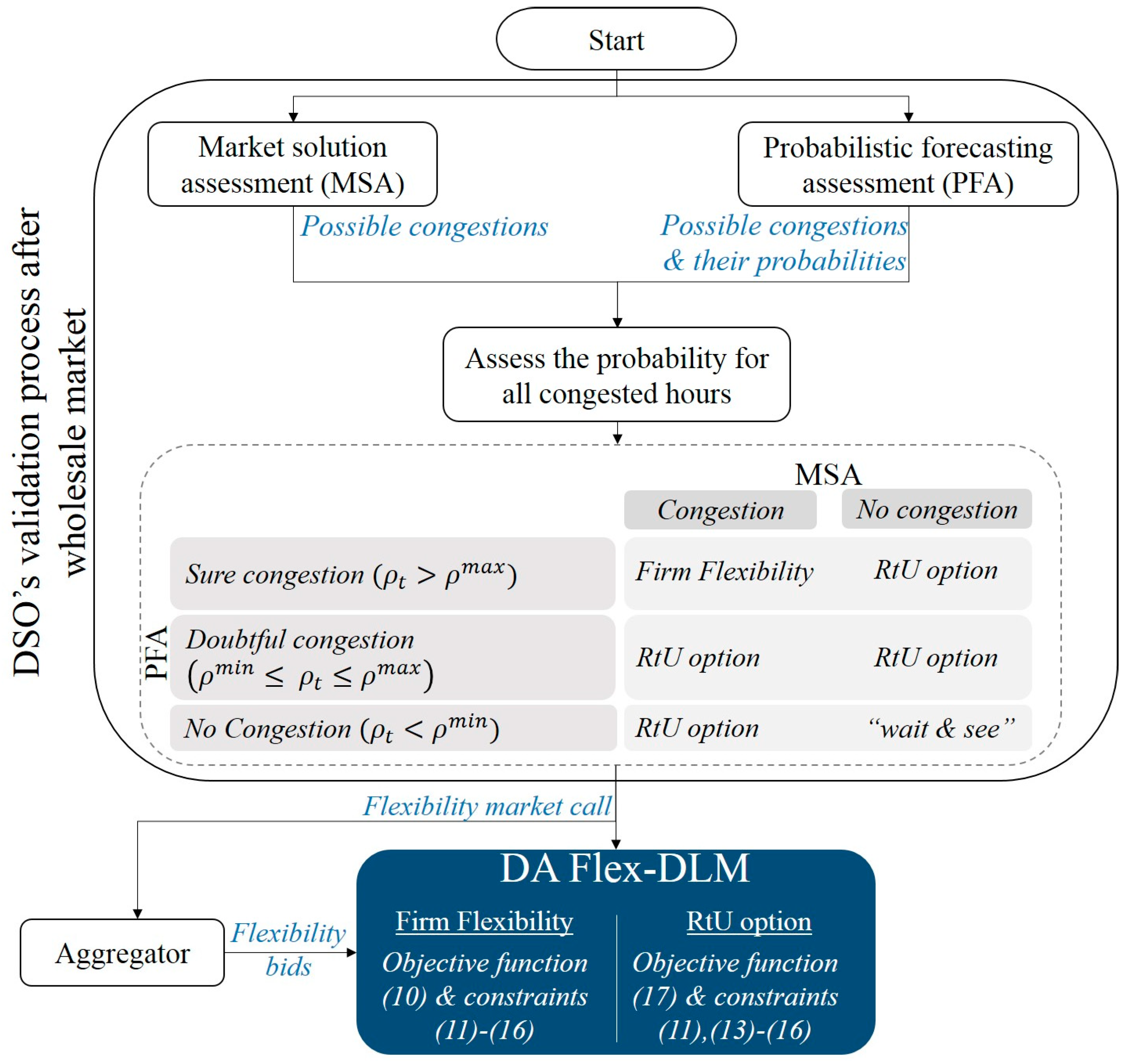

- Optimally manage the flexibility procurement process between the involved parties, that is, DSO and aggregators.

- Provide an efficient service to the DSO that allows it to mitigate network congestion at the distribution level.

- Consider the uncertainty of congestion occurrence and prevent the DSO from procuring unneeded flexibility in the day-ahead timeframe.

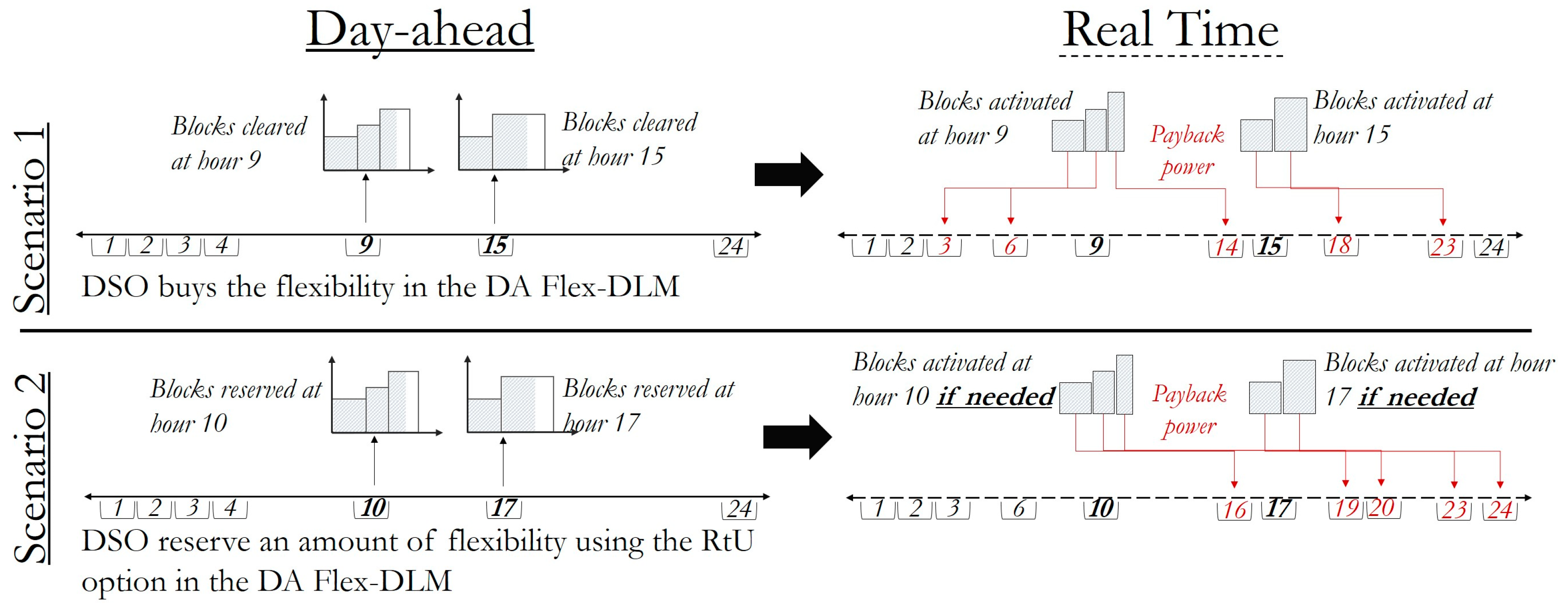

- Introduce a new option for reserving demand flexibility for network congestions that have medium probabilities of occurring.

- Implement a flexibility market operating in the real-time frame to reduce the effect of forecast errors during operation.

3.1. Flex-DLM Features and Products

3.2. Flex-DLM Architecture

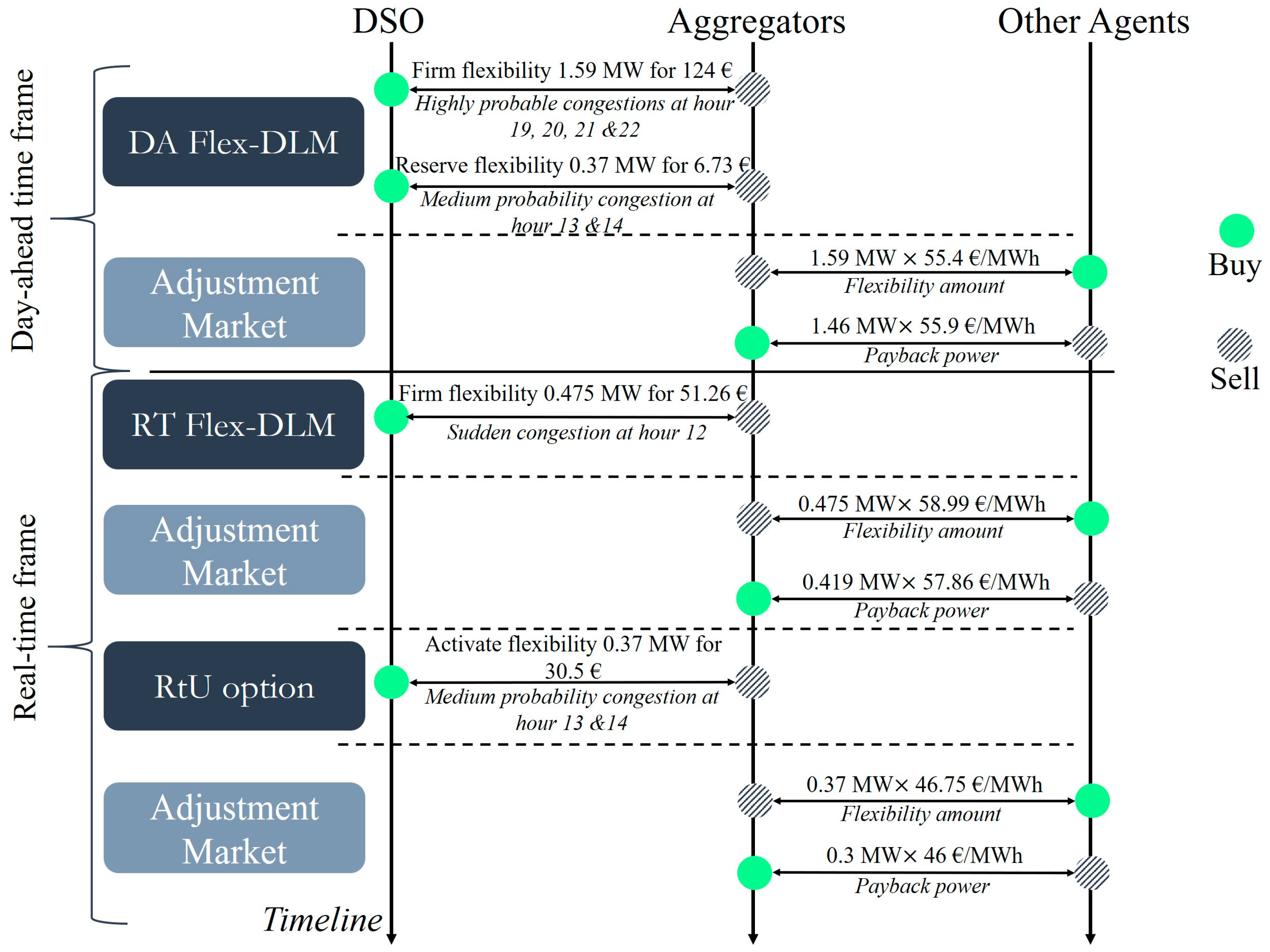

3.2.1. DA Flex-DLM

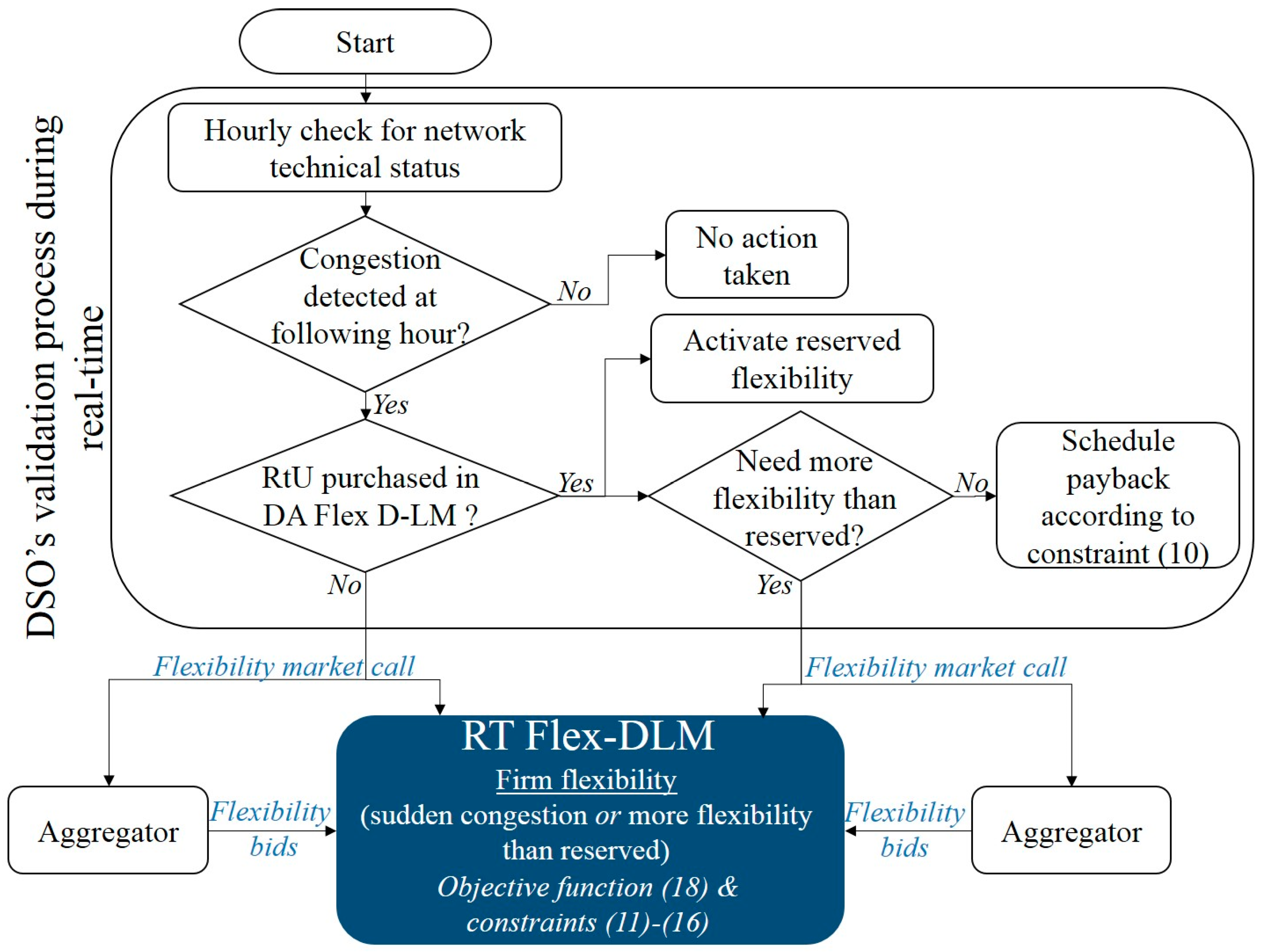

3.2.2. RT Flex-DLM

3.3. The Trading Processes

4. DSO’s Optimization Problem

4.1. Day-Ahead Time Frame

4.1.1. Optimizing Flexibility Purchase for the High Probability Congestion

4.1.2. Optimizing Flexibility Purchase for the Medium Probability Congestion

4.2. Real-Time Frame

4.3. Methodology

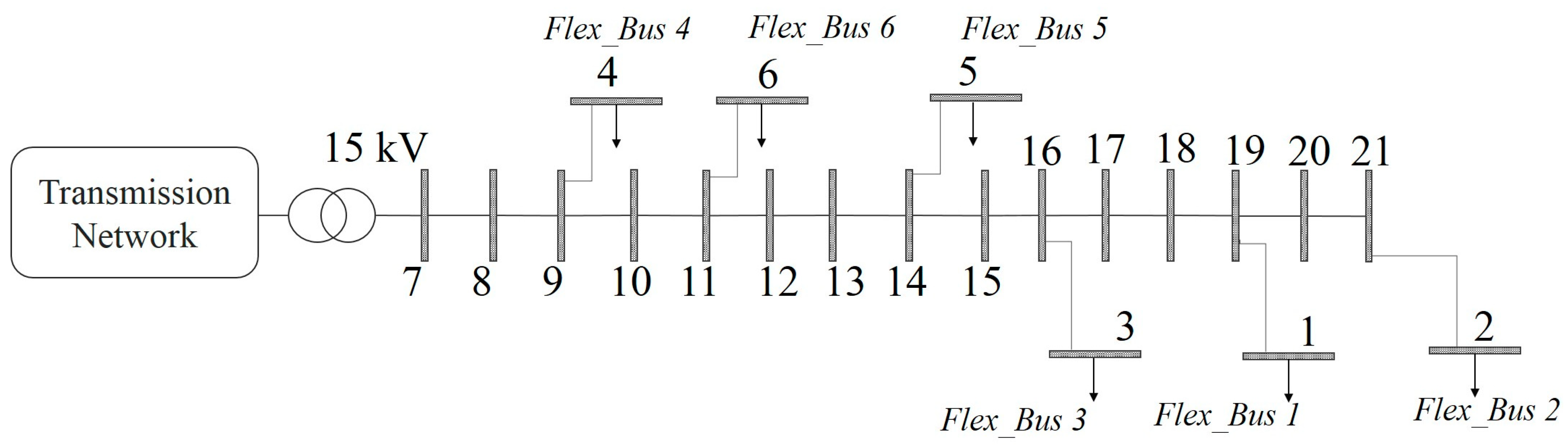

5. Case Study

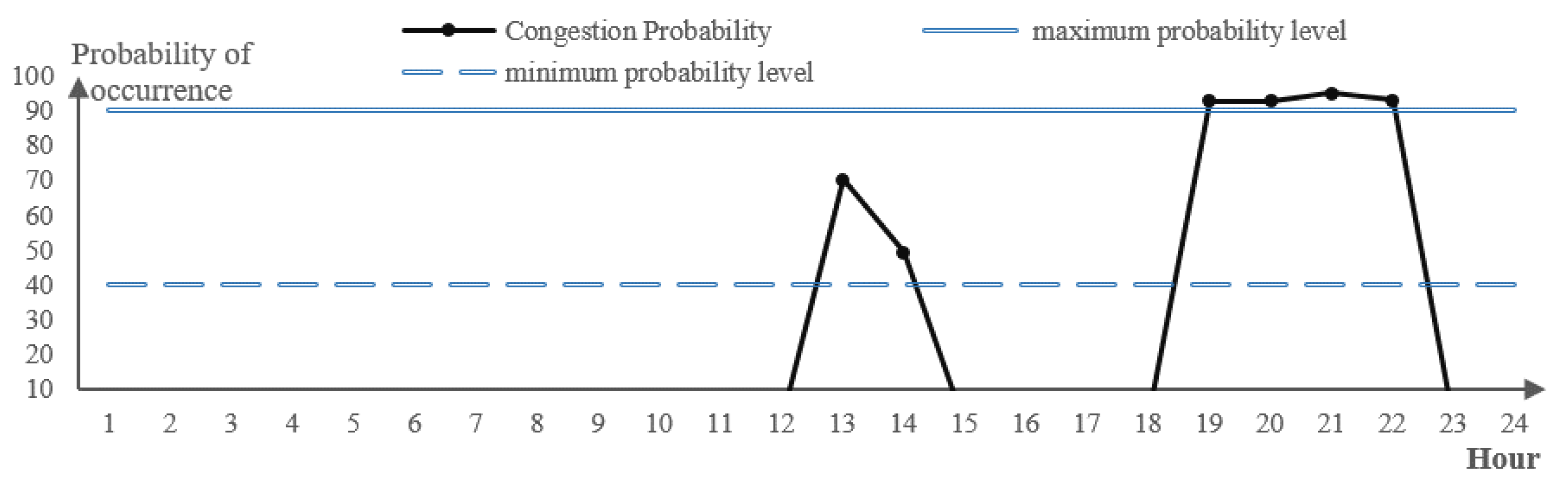

5.1. Probabilistic Assessment (Scenarios-Generating Tool)

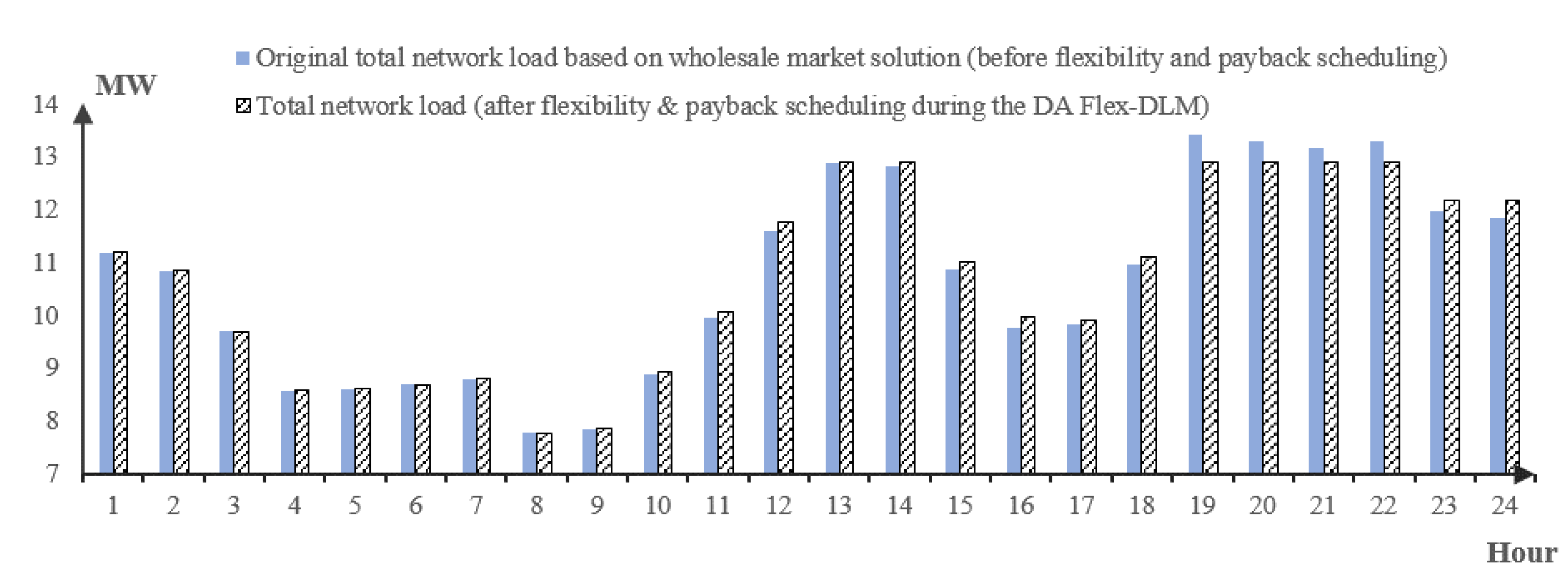

5.2. Day-Ahead Operation

5.2.1. Flexibility Transactions for High Probability Congestions

5.2.2. Flexibility Transactions for Medium Probability Congestions

5.3. Real-Time Operation

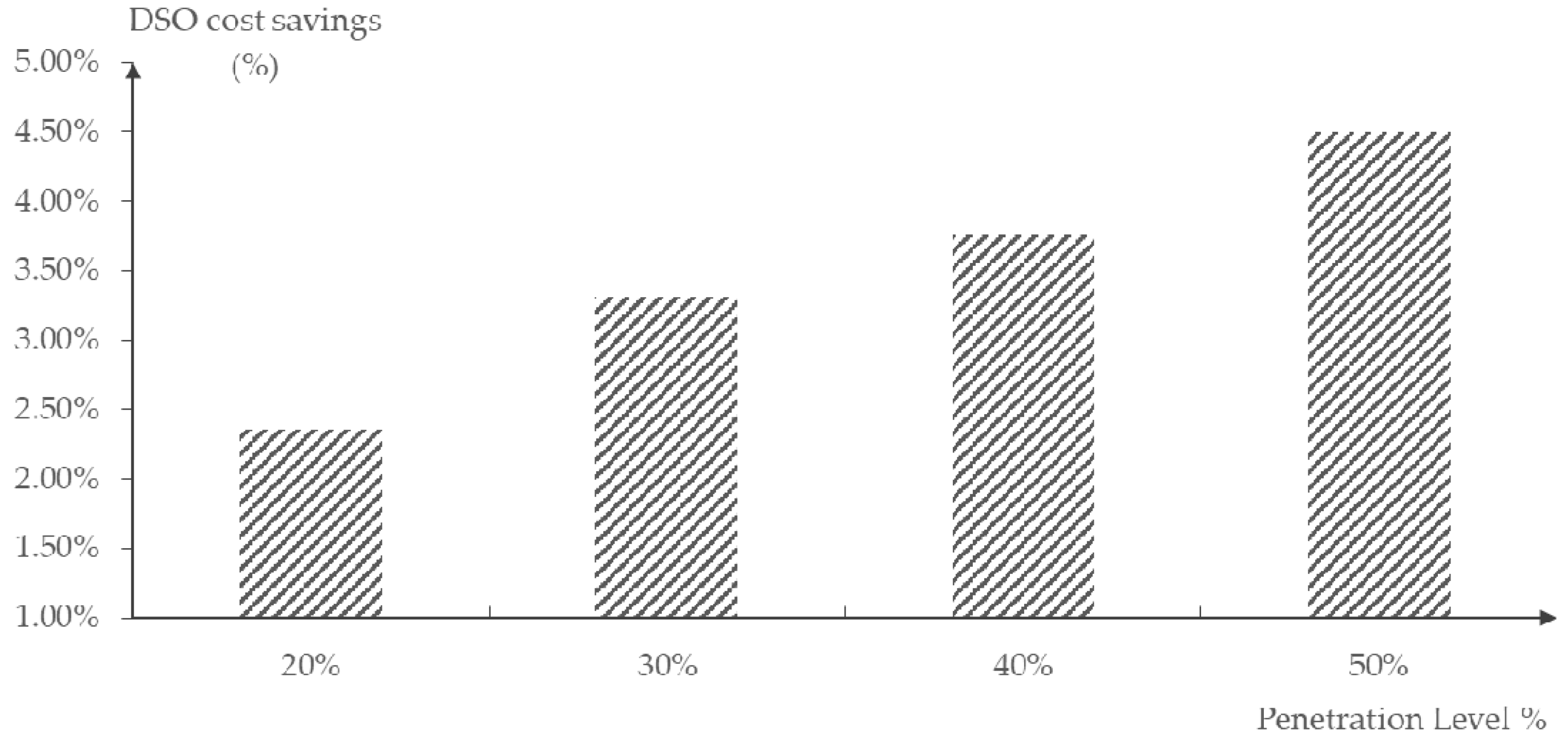

5.4. Effect of Flexibility Penetration Level on the DSO Cost

6. Conclusions

- Congestions can be efficiently managed with the introduction of demand flexibility services as a tool for the DSO to mitigate network congestions.

- The payback effect and grid power flow constraints are key to realistically model the process of demand flexibility trading.

- Day-ahead wholesale market solution is subject to forecasting errors from generation and demand profiles, which can lead to an inaccurate estimation of the network congestions in the following day and unnecessary procurement of demand flexibility. Thus, the DSO needs to carry out its own forecasting process to ensure the need for obtaining flexibility services.

- Demand consumption deviations during real-time are bound to happen, which can cause unforeseen network congestions. As a result, the DSO requires real-time flexibility markets to be able to mitigate such congestions.

- The amount of available flexibility, or the penetration level of flexibility as described before, has a high impact on the DSO’s optimization process and final cost of purchase. More availability can be beneficial for all involved parties, as it means less cost for the DSO to pay and better operation for its grid and more income for the aggregator and the customers.

Author Contributions

Acknowledgments

Conflicts of Interest

Nomenclature

| Indices: | |

| n,m | Indices for nodes |

| Indices for time | |

| Constants: | |

| Number of nodes in the system | |

| Number of flexibility blocks at node n and time t | |

| Optimization variables: | |

| Flexible active power in node n, at block k and hour t (MW) | |

| Total cost incurred by the DSO due to flexibility activations at node n during the DA and RT period (€) | |

| Cost of firm flexibility traded at node n in the DA Flex-DLM in day-ahead time (€) | |

| Cost of flexibility from the right-to-use option traded from node n from in the DA Flex-DLM (€) | |

| Cost of firm flexibility traded at node n in the RT Flex-DLM in real-time (€) | |

| Other variables: | |

| Net injected active power at bus n, at hour t (MW) | |

| Net injected reactive power at bus n, at hour t (Mvar) | |

| Flexible reactive power in node n, at block k and hour t (Mvar) | |

| Active payback power for bus n at hour t (MW) | |

| Reactive payback power for bus n at hour t (Mvar) | |

| Apparent power flowing through line nm at hour t (MVA) | |

| Voltage magnitude and angle in node n at hour t (p.u., rad) | |

| Parameters: | |

| Firm flexibility price in the DA Flex-DLM in node n, for block k and hour t (€/MWh) | |

| Right-to-use reservation fee in the DA Flex-DLM in node n, for block k and hour t (€) | |

| Flexibility price for activating the right-to-use option in node n, for block k and hour t (€/MWh) | |

| Firm flexibility price in the RT Flex-DLM in node n, for block k and hour t (€/MWh) | |

| Payback coefficient at node n (p.u.) | |

| Maximum apparent power rating of line n-m (MVA) | |

| Base power (MVA) | |

| Magnitude and angle of the (n,m) element of the bus admittance matrix (p.u.) | |

| Minimum and maximum value of voltage magnitude in node n (p.u.) | |

| Maximum flexible power allowed in node n, at hour t (MW) | |

| Total flexible active power activated from node n, at hour t (MW) | |

| Probability of occurrence for a given congestion at hour t. | |

| Minimum and maximum probability levels set by the DSO for the probabilistic forecasting assessment | |

| Aggregator revenue for selling the required energy to commit to the flexibility activation at node n (€) | |

| Aggregator cost for procuring the required payback power for node n (€) | |

| Aggregator net profit after all trading processes take place at node n (€) | |

| Adjustment market price at hour t (€/MWh) | |

References

- Eid, C.; Koliou, E.; Valles, M.; Reneses, J.; Hakvoort, R. Time-based pricing and electricity demand response: Existing barriers and next steps. Util. Policy 2016, 40, 15–25. [Google Scholar] [CrossRef]

- European Commission. Study on Tariff Design for Distribution Systems-Directorate B-Internal Energy Market; European Commission: Brussels, Belgium, 2015. [Google Scholar]

- Steen, D.; Le, A.T.; Tjernberg, L.B. Price-Based demand-side management for reducing peak demand in electrical distribution systems–with examples from Gothenburg. In Proceedings of the Nordic Conference on Electricity Distribution System Management and Development (NORDAC), Helsinki, Finland, 10–11 September 2012. [Google Scholar]

- Ponnaganti, P.; Pillai, J.R.; Bak-Jensen, B. Opportunities and challenges of demand response in active distribution networks. Wiley Interdiscip. Rev. Energy Environ. 2018, 7, e271. [Google Scholar] [CrossRef]

- Vallés, M.; Bello, A.; Reneses, J.; Frías, P. Probabilistic characterization of electricity consumer responsiveness to economic incentives. Appl. Energy 2018, 216, 296–310. [Google Scholar] [CrossRef]

- Deng, R.; Yang, Z.; Chow, M.Y.; Chen, J. A Survey on Demand Response in Smart Grids: Mathematical Models and Approaches. IEEE Trans. Ind. Inform. 2015, 11, 570–582. [Google Scholar] [CrossRef]

- Paterakis, N.G.; Erdinç, O.; Catalão, J.P.S. An overview of Demand Response: Key-elements and international experience. Renew. Sustain. Energy Rev. 2017, 69, 871–891. [Google Scholar] [CrossRef]

- Gils, H.C. Assessment of the theoretical demand response potential in Europe. Energy 2014, 67, 1–18. [Google Scholar] [CrossRef]

- Stromback, J. Explicit Demand Response in Europe-Mapping the Markets; Smart Energy Demand Coalition (SEDC): Brussels, Belgium, 6 April 2017. [Google Scholar]

- Torriti, J.; Hassan, M.G.; Leach, M. Demand response experience in Europe: Policies, programmes and implementation. Energy 2010, 35, 1575–1583. [Google Scholar] [CrossRef]

- Flexibility in the Energy Transition: A Toolbox for Electricity DSOs; EDSO for Smart Grids: Brussels, Belgium, 28 February 2018.

- Mandatova, P.; Mikhailova, O. Flexibility and Aggregation: Requirements for Their Interaction in the Market; EURELECTRIC: Brussels, Belgium, 4 January 2014. [Google Scholar]

- Ceseña, E.A.M.; Good, N.; Mancarella, P. Electrical network capacity support from demand side response Techno-economic assessment of potential business cases for small commercial and residential end-users. Energy Policy 2015, 82, 222–232. [Google Scholar] [CrossRef]

- Bahrami, S.; Amini, M.H.; Shafie-khah, M.; Catalao, J.P.S. A decentralized electricity market scheme enabling demand response deployment. IEEE Trans. Power Syst. 2017, 33, 4218–4227. [Google Scholar] [CrossRef]

- Haque, A.N.M.M.; Vo, T.H.; Nguyen, P.H.; Slootweg, J.G.; Bliek, F.W. Smart real-time multi-node congestion management in active distribution networks. In Proceedings of the 2017 IEEE Power and Energy Society General Meeting, Chicago, IL, USA, 16–20 July 2017. [Google Scholar] [CrossRef]

- Pavlovic, M.; Gawron-deutsch, T.; Neureiter, C.; Diwold, K. SGAM business layer for a local flexibility market. In Proceedings of the CIRED Workshop 2016, Helsinki, Finland, 14–15 June 2016. [Google Scholar]

- Diekerhof, M.; Peterssen, F.; Monti, A. Hierarchical Distributed Robust Optimization for Demand Response Services. IEEE Trans. Smart Grid 2017, 1. [Google Scholar] [CrossRef]

- Barth, L.; Ludwig, N.; Mengelkamp, E.; Staudt, P. A comprehensive modelling framework for demand side flexibility in smart grids. Comput. Sci.-Res. Dev. 2018, 33, 13–23. [Google Scholar] [CrossRef]

- Torbaghan, S.S.; Blaauwbroek, N.; Nguyen, P.; Gibescu, M. Local market framework for exploiting flexibility from the end users. In Proceedings of the 13th International Conference on the European Energy Market (EEM), Porto, Portugal, 6–9 June 2016; pp. 1–6. [Google Scholar]

- Chen, T.; Pourbabak, H.; Liang, Z.; Su, W. An Integrated eVoucher Mechanism for Flexible Loads in Real-Time Retail Electricity Market. IEEE Access 2017, 5, 2101–2110. [Google Scholar] [CrossRef]

- Haque, A.N.M.M.; Nguyen, P.H.; Bliek, F.W.; Slootweg, J.G. Demand response for real-time congestion management incorporating dynamic thermal overloading cost. Sustain. Energy Grids Netw. 2017, 10, 65–74. [Google Scholar] [CrossRef]

- Regional Flexibility Markets: Using Market Based Flexibility for Integration of Power from Renewables in Distribution Grids; Technical Report for VDE: Frankfurt, Germany, 14 January 2015.

- Decentralized Flexibility Market; Bundesverband Neue Energiewirtschaft: Berlin, Germany, 30 January 2016.

- Decentralized Flexibility Market 2.0; Bundesverband Neue Energiewirtschaft: Berlin, Germany, 30 January 2016.

- Horta, J.; Kofman, D.; Menga, D.; Silva, A. Novel market approach for locally balancing renewable energy production and flexible demand. In Proceedings of the 2017 IEEE International Conference on Smart Grid Communications (SmartGridComm), Dresden, Germany, 23–27 Octomber 2017. [Google Scholar]

- Song, M.; Amelin, M. Price-maker bidding in day-ahead electricity market for a retailer with flexible demands. IEEE Trans. Power Syst. 2017, PP, 1. [Google Scholar] [CrossRef]

- Song, M.; Amelin, M. Purchase Bidding Strategy for a Retailer with Flexible Demands in Day-Ahead Electricity Market. IEEE Trans. Power Syst. 2017, 32, 1839–1850. [Google Scholar] [CrossRef]

- Kouzelis, K.; Bak-Jensen, B.; Pillai, J.R. The geographical aspect of flexibility in distribution grids. In Proceedings of the 2015 IEEE Power Energy Society Innovative Smart Grid Technologies Conference (ISGT), Washington, DC, USA, 17–20 February 2015; pp. 1–5. [Google Scholar]

- Santoro, P. Demand flexibility: The Unlocked Capacity in Smart Power Systems. Ph.D. Thesis, Università degli Studi di Salerno, Fisciano, Provincia di Salerno, Italy, 7 April 2017. [Google Scholar]

- Villar, J.; Bessa, R.; Matos, M. Flexibility products and markets: Literature review. Electr. Power Syst. Res. 2018, 154, 329–340. [Google Scholar] [CrossRef]

- Aalami, H.A.; Moghaddam, M.P.; Yousefi, G.R. Modeling and prioritizing demand response programs in power markets. Electr. Power Syst. Res. 2010, 80, 426–435. [Google Scholar] [CrossRef]

- Kostková, K.; Omelina, L.; Kyčina, P.; Jamrich, P. An introduction to load management. Electr. Power Syst. Res. 2013, 95, 184–191. [Google Scholar] [CrossRef]

- Satchwell, A.; Hledik, R. Analytical frameworks to incorporate demand response in long-term resource planning. Util. Policy 2014, 28, 73–81. [Google Scholar] [CrossRef]

- Jamasb, T.; Pollitt, M.G. The Future of Electricity Demand: Customers, Citizens and Loads; Cambridge University Press: Cambridge, UK, September 2011; pp. 88–103. [Google Scholar]

- Directive 2012/27/EU of The European Parliament and of The Council of 25 October 2012 on Energy Efficiency, Amending Directives 2009/125/EC and 2010/ 30/EU and Repealing Directives 2004/8/EC and 2006/32/EC. Available online: https://ec.europa.eu/energy/en/topics/energyfficiency/energyfficiencyirective (accessed on 8 March 2018).

- Martínez Ceseña, E.A.; Mancarella, P. Practical recursive algorithms and flexible open-source applications for planning of smart distribution networks with Demand Response. Sustain. Energy Grids Netw. 2016, 7, 104–116. [Google Scholar] [CrossRef]

- Martínez Ceseña, E.A.; Turnham, V.; Mancarella, P. Regulatory capital and social trade-offs in planning of smart distribution networks with application to demand response solutions. Electr. Power Syst. Res. 2016, 141, 63–72. [Google Scholar] [CrossRef]

- Ruester, S.; Schwenen, S.; Batlle, C.; Pérez-Arriaga, I. From distribution networks to smart distribution systems: Rethinking the regulation of European electricity DSOs. Util. Policy 2014, 31, 229–237. [Google Scholar] [CrossRef]

- Behrangrad, M.; Sugihara, H.; Funaki, T. Integration of Demand Response Resource of Payback Effect in Social Cost Minimization Based Market Scheduling. In Proceedings of the 17th Power Systems Computation Conference, Stockholm, Sweden, 22–26 August 2011. [Google Scholar]

- Bergaentzlé, C.; Clastres, C.; Khalfallah, H. Demand-side management and European environmental and energy goals: An optimal complementary approach. Energy Policy 2014, 67, 858–869. [Google Scholar] [CrossRef]

- Drysdale, B.; Wu, J.; Jenkins, N. Flexible demand in the GB domestic electricity sector in 2030. Appl. Energy 2015, 139, 281–290. [Google Scholar] [CrossRef]

- Koliou, E.; Muhaimin, T.A.; Hakvoort, R.A.; Kremers, R. Complexity of demand response integration in European electricity markets. In Proceedings of the 12th International Conference on the European Energy Market (EEM), Lisbon, Portugal, 20–25 May 2015; pp. 1–5. [Google Scholar]

- USEF: The Framework Explained; Universal Smart Energy Framework: Arnhem, The Netherlands, 2 November 2015.

- Burger, S.; Chaves-Ávila, J.P.; Batlle, C.; Pérez-Arriaga, I.J. A review of the value of aggregators in electricity systems. Renew. Sustain. Energy Rev. 2017, 77, 395–405. [Google Scholar] [CrossRef]

- Ikäheimo, J.; Evens, C.; Kärkkäinen, S. DER Aggregator Business: The Finnish Case; Technical Research Centre of Finland (VTT): Espoo, Finland, 2010. [Google Scholar]

- Bertoldi, P.; Zancanella, P.; Boza-Kiss, B. Demand Response Status in EU Member States; Technical Report for Joint Research Centre: Ispra, Italy, 2016. [Google Scholar] [CrossRef]

- Curtis, M. Demand side response aggregators: How they decide customer suitability. In Proceedings of the 14th International Conference on the European Energy Market (EEM), Dresden, Germany, 6–9 June 2017; pp. 1–6. [Google Scholar]

- Aggregators: Barriers and External Impacts: A report by PA Consulting; Technical Report for Office of Gas and Electricity Markets: London, UK, 10 November 2016.

- Overview of the Main Concepts of Flexibility Management; European Committee for Electrotechnical Standardization (CENELEC): Brussels, Belgium, November 2014.

- Abdul Muhaimin, T. Electricity Market of the Future: Assessing Economic Feasibility and Regulatory Constraints for Demand Response Aggregators in Europe; Delft University of Technology: Delft, The Netherlands, 30 June 2015. [Google Scholar]

- Shoreh, M.H.; Siano, P.; Shafie-khah, M.; Loia, V.; Catalão, J.P.S. A survey of industrial applications of Demand Response. Electr. Power Syst. Res. 2016, 141, 31–49. [Google Scholar] [CrossRef]

- Paulus, M.; Borggrefe, F. The potential of demand-side management in energy-intensive industries for electricity markets in Germany. Appl. Energy 2011, 88, 432–441. [Google Scholar] [CrossRef]

- Starke, M.; Letto, D.; Alkadi, N.; George, R.; Johnson, B.; Dowling, K.; Khan, S. Demand-Side Response from Industrial Loads. In Proceedings of the 2013 Clean Technology Conference and Trade Show, Washington, DC, USA, 2 May 2013; p. 4. [Google Scholar]

- Yin, R.; Kara, E.C.; Li, Y.; DeForest, N.; Wang, K.; Yong, T.; Stadler, M. Quantifying flexibility of commercial and residential loads for demand response using set point changes. Appl. Energy 2016, 177, 149–164. [Google Scholar] [CrossRef]

- Kiliccote, S.; Olsen, D.; Sohn, M.D.; Piette, M.A. Characterization of demand response in the commercial, industrial, and residential sectors in the United States. Wiley Interdiscip. Rev. Energy Environ. 2016, 5, 288–304. [Google Scholar] [CrossRef]

- Tindemans, S.H.; Trovato, V.; Strbac, G. Decentralized Control of Thermostatic Loads for Flexible Demand Response. IEEE Trans. Control Syst. Technol. 2015, 23, 1685–1700. [Google Scholar] [CrossRef]

- Garulli, A.; Paoletti, S.; Vicino, A. Models and Techniques for Electric Load Forecasting in the Presence of Demand Response. IEEE Trans. Control Syst. Technol. 2015, 23, 1087–1097. [Google Scholar] [CrossRef]

- Deetjen, T.A.; Reimers, A.S.; Webber, M.E. Can storage reduce electricity consumption? A general equation for the grid-wide efficiency impact of using cooling thermal energy storage for load shifting. Environ. Res. Lett. 2018, 13, 024013. [Google Scholar] [CrossRef]

- Murphy, M.D.; O’Mahony, M.J.; Upton, J. Comparison of control systems for the optimisation of ice storage in a dynamic real time electricity pricing environment. Appl. Energy 2015, 149, 392–403. [Google Scholar] [CrossRef]

- Ghiasnezhad Omran, N.; Filizadeh, S. A semi-cooperative decentralized scheduling scheme for plug-in electric vehicle charging demand. Int. J. Electr. Power Energy Syst. 2017, 88, 119–132. [Google Scholar] [CrossRef]

- Wu, F.; Sioshansi, R. A two-stage stochastic optimization model for scheduling electric vehicle charging loads to relieve distribution-system constraints. Transp. Res. Part B Methodol. 2017, 102, 55–82. [Google Scholar] [CrossRef]

- Shinde, P.; Swarup, K.S. Optimal Electric Vehicle charging schedule for demand side management. In Proceedings of the First International Conference on Sustainable Green Buildings and Communities (SGBC), Chennai, India, 18–20 December 2016; pp. 1–6. [Google Scholar]

- Vayá, M.G.; Andersson, G. Self Scheduling of Plug-In Electric Vehicle Aggregator to Provide Balancing Services for Wind Power. IEEE Trans. Sustain. Energy 2016, 7, 886–899. [Google Scholar] [CrossRef]

- Olivella-Rosell, P.; Lloret-Gallego, P.; Munné-Collado, Í.; Villafafila-Robles, R.; Sumper, A.; Ottessen, S.Ø.; Rajasekharan, J.; Bremdal, B.A. Local Flexibility Market Design for Aggregators Providing Multiple Flexibility Services at Distribution Network Level. Energies 2018, 11, 822. [Google Scholar] [CrossRef]

- Wang, F.; Xu, H.; Xu, T.; Li, K.; Shafie-khah, M.; Catalão, J.P.S. The values of market-based demand response on improving power system reliability under extreme circumstances. Appl. Energy 2017, 193, 220–231. [Google Scholar] [CrossRef]

- SmartNet-Integrating Renewable Energy in Transmission Networks. Available online: http://smartnet-project.eu/ (accessed on 23 February 2018).

- Esmat, A.; Usaola, J.; Moreno, M.Á. Distribution-Level Flexibility Market for Congestion Management. Energies 2018, 11, 1056. [Google Scholar] [CrossRef]

- Ramos, A.; De Jonghe, C.; Gómez, V.; Belmans, R. Realizing the smart grid’s potential: Defining local markets for flexibility. Util. Policy 2016, 40, 26–35. [Google Scholar] [CrossRef]

- Nordpool Spot. Available online: http://www.nordpoolspot.com/ (accessed on 30 January 2017).

- Berntsen, S.A.; Vatn, H.G. Business Models for Extracting the Value of Flexibility in Electricity Systems: A Contractual and Market Based Approach; Norwegian University of Science and Technology: Trondheim, Norway, June 2014. [Google Scholar]

- Flexibility from Residential Power Consumption: A New Market Filled with Opportunities; USEF: Arnhem, The Netherlands, November 2016.

- Su, P.; Tian, X.; Wang, Y.; Deng, S.; Zhao, J.; An, Q.; Wang, Y. Recent Trends in Load Forecasting Technology for the Operation Optimization of Distributed Energy System. Energies 2017, 10, 1303. [Google Scholar]

- Hayes, B.; Prodanovic, M. State forecasting and operational planning for distribution network energy management systems. In Proceedings of the IEEE Power and Energy Society General Meeting (PESGM), Boston, MA, USA, 17–21 July 2016; p. 1. [Google Scholar]

- Hayes, B.P.; Prodanovic, M. Short-Term Operational Planning and State Estimation in Power Distribution Networks; CIRED Workshop: Rome, Italy, 2014; pp. 1–5. [Google Scholar]

- Ding, Y.; Hansen, L.H.; Cajar, P.D.; Brath, P.; Bindner, H.W.; Zhang, C.; Nordentoft, N.C. Development of a DSO-Market on Flexibility Services; DTU Orbit of Technical University of Denmark: Lyngby, Denmark, 18 March 2013. [Google Scholar]

- Zimmerman, R.D.; Murillo-Sánchez, C.E.; Thomas, R.J. MATPOWER: Steady-State Operations, Planning, and Analysis Tools for Power Systems Research and Education. IEEE Trans. Power Syst. 2011, 26, 12–19. [Google Scholar] [CrossRef]

- Ayón, X.; Moreno, M.Á.; Usaola, J. Aggregators’ Optimal Bidding Strategy in Sequential Day-Ahead and Intraday Electricity Spot Markets. Energies 2017, 10, 450. [Google Scholar] [CrossRef]

- Inicio | OMIE. Available online: http://www.omie.es/inicio (accessed on 9 March 2018).

| Ref | The Payback Effect | The Grid Constraints | Complementary Trading Processes | Uncertainty of Demand |

|---|---|---|---|---|

| [17] | ||||

| [18] | ||||

| [19] | ||||

| [20,21] | ||||

| [22] | ||||

| [23,24] | ||||

| [25] | ||||

| [26,27] |

| Payback Conditions | Type | Description |

|---|---|---|

| Payback Hour | Payback power must be on following hour of flexibility activation. | |

| Payback power is in between a predefined time interval (before or after flexibility activation). | ||

| Payback power can be at any hour during the day. | ||

| Payback power is not needed. | ||

| Payback Power | Payback power is equal to the flexibility activated. | |

| Payback power is a factor of the flexibility activated. | ||

| Payback power is not needed. |

| Indicator | MSA | ||

|---|---|---|---|

| Congestion | No Congestion | ||

| PFA | Sure congestion | Firm flexibility | RtU option |

| Unsure congestion | RtU option | RtU option | |

| No Congestion | RtU option | “wait-and-see” | |

| Bids | Bid 1 | Bid 2 | Bid 1 | Bid 2 | Bid 1 | Bid 2 | Bid 1 | Bid 2 |

|---|---|---|---|---|---|---|---|---|

| 0.3 | 0.5 | 0.8 | No Probability Considered | |||||

| (€/MWh) | 70 | 85 | 70 | 85 | 70 | 85 | 70 | 85 |

| (€) | 2.2 | 1.2 | 2.2 | 1.2 | 2.2 | 1.2 | 2.2 | 1.2 |

| (€) | 6.4 | 6.3 | 9.2 | 9.7 | 13.4 | 14.8 | 16.2 | 18.2 |

| Hour | Flex_Bus 1 | Flex_Bus 2 | Flex_Bus 3 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MW | €/MWh | MW | MW | MW | €/MWh | €/MWh | €/MWh | MW | MW | €/MWh | €/MWh | |

| 19 | 0.123 | 76.82 | 0.036 | 0.051 | 0.015 | 73.80 | 76.06 | 77.57 | 0.022 | 0.065 | 72.29 | 76.06 |

| 20 | 0.125 | 80.78 | 0.038 | 0.054 | 0.016 | 77.60 | 79.98 | 81.57 | 0.023 | 0.069 | 76.02 | 79.98 |

| 21 | 0.120 | 83.00 | 0.036 | 0.052 | 0.016 | 79.74 | 82.19 | 83.82 | 0.022 | 0.067 | 78.11 | 82.19 |

| 22 | 0.125 | 79.98 | 0.039 | 0.056 | 0.017 | 76.84 | 79.20 | 80.77 | 0.024 | 0.072 | 75.27 | 79.20 |

| 0.85 | - | 0.80 | 0.95 | 0.70 | - | 0.82 | 0.95 | - | ||||

| Payback hour | 1–24 | - | 13–24 | 1–16 | 17–24 | - | 12–20 | 6–16 | - | |||

| Hour | Flex_Bus 4 | Flex_Bus 5 | Flex_Bus 6 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MW | MW | MW | €/MWh | €/MWh | €/MWh | MW | MW | €/MWh | €/MWh | MW | MW | €/MWh | €/MWh | |

| 19 | 0.030 | 0.050 | 0.020 | 72.29 | 73.80 | 78.33 | 0.066 | 0.054 | 76.82 | 77.57 | 0.035 | 0.065 | 76.06 | 76.82 |

| 20 | 0.027 | 0.045 | 0.018 | 76.02 | 77.60 | 82.36 | 0.060 | 0.049 | 80.78 | 81.57 | 0.032 | 0.059 | 79.98 | 80.78 |

| 21 | 0.026 | 0.044 | 0.018 | 78.11 | 79.74 | 84.63 | 0.058 | 0.047 | 83.00 | 83.82 | 0.031 | 0.057 | 82.19 | 83.00 |

| 22 | 0.027 | 0.045 | 0.018 | 75.27 | 76.84 | 81.55 | 0.059 | 0.049 | 79.98 | 80.77 | 0.032 | 0.059 | 79.20 | 79.98 |

| 0.90 | 0.95 | 0.80 | - | 0.88 | 0.92 | - | 0.94 | 1.00 | - | |||||

| Payback hour | 8–13 | 9–18 | 1–24 | - | 1–24 | 12–16 | - | 1–24 | 1–24 | - | ||||

| Flex_Bus 1 | Flex_Bus 2 | Flex_Bus 3 | Flex_Bus 4 | Flex_Bus 5 | Flex_Bus 6 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Firm Flexibility (MW) | ||||||||||||||

| Hour | 19 | 0.123 | 0.036 | 0.051 | - | 0.022 | 0.065 | 0.030 | 0.050 | - | 0.066 | - | 0.035 | 0.056 |

| 20 | - | 0.038 | 0.054 | - | 0.023 | 0.069 | 0.027 | 0.045 | - | 0.060 | - | 0.032 | 0.043 | |

| 21 | - | 0.036 | 0.052 | - | 0.022 | 0.067 | 0.026 | 0.044 | - | - | - | 0.022 | - | |

| 22 | - | 0.039 | 0.056 | - | 0.024 | 0.072 | 0.027 | 0.045 | - | 0.039 | - | 0.032 | 0.059 | |

| Payback power (MW) | ||||||||||||||

| Hour | 9 | - | - | - | - | - | - | 0.020 | - | - | - | - | - | - |

| 10 | - | - | - | - | - | - | 0.030 | - | - | - | - | - | - | |

| 11 | - | - | 0.035 | - | - | 0.044 | 0.030 | - | - | - | - | - | - | |

| 12 | - | - | 0.056 | - | - | 0.072 | 0.030 | - | - | - | - | - | - | |

| 13 | - | - | - | - | 0.006 | - | - | - | - | - | - | - | - | |

| 14 | - | 0.039 | - | - | 0.024 | - | - | - | - | - | - | - | - | |

| 15 | - | - | 0.056 | - | - | 0.072 | - | 0.025 | - | - | - | - | - | |

| 16 | - | - | 0.056 | - | - | 0.072 | - | 0.050 | - | - | - | - | - | |

| 17 | - | - | - | - | 0.021 | - | - | 0.050 | - | - | - | 0.009 | - | |

| 18 | - | 0.002 | - | - | 0.024 | - | - | 0.050 | - | 0.013 | - | 0.035 | 0.028 | |

| 23 | - | 0.039 | - | - | - | - | - | - | - | 0.066 | - | 0.035 | 0.065 | |

| 24 | 0.104 | 0.039 | - | - | - | - | - | - | - | 0.066 | - | 0.035 | 0.065 | |

| (€) | 124 | |||||||||||||

| Hour | Flex_Bus 2 | Flex_Bus 4 | Flex_Bus 6 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MW | MW | MW | €/MWh | €/MWh | €/MWh | MW | MW | MW | €/MWh | €/MWh | €/MWh | MW | MW | €/MWh | €/MWh | |

| 13 | 0.046 | 0.053 | 0.020 | 85.22 | 85.50 | 85.68 | 0.035 | 0.042 | 0.037 | 85.04 | 85.22 | 85.77 | 0.041 | 0.060 | 85.50 | 85.59 |

| 14 | 0.046 | 0.052 | 0.020 | 89.40 | 89.68 | 89.87 | 0.034 | 0.041 | 0.036 | 89.21 | 89.40 | 89.97 | 0.039 | 0.058 | 89.68 | 89.78 |

| (€) | - | 0.78 | 0.90 | 0.34 | - | 0.59 | 0.72 | 0.64 | - | 0.69 | 1.02 | |||||

| (€) | - | 0.82 | 0.94 | 0.35 | - | 0.60 | 0.73 | 0.65 | - | 0.71 | 1.04 | |||||

| Flex_Bus 2 | Flex_Bus 4 | Flex_Bus 6 | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Flexibility Reserved (MW) | |||||||||

| Hour | 13 | 0.047 | 0.054 | 0.020 | 0.035 | 0.042 | - | 0.024 | - |

| 14 | 0.046 | 0.052 | 0.020 | 0.034 | - | - | - | - | |

| Reservation cost (€) | 6.73 | ||||||||

| Hour | Flex_Bus 1 | Flex_Bus 2 | Flex_Bus 3 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MW | €/MWh | MW | MW | MW | €/MWh | €/MWh | €/MWh | MW | MW | €/MWh | €/MWh | |

| 12 | 0.081 | 108.61 | 0.052 | 0.074 | 0.022 | 106.89 | 108.18 | 109.04 | 0.028 | 0.085 | 106.03 | 108.18 |

| 0.85 | - | 0.80 | 0.95 | 0.70 | - | 0.82 | 0.95 | - | ||||

| Payback hour | 10–24 | - | 13–24 | 10–16 | 17–24 | - | 12–20 | 10–16 | - | |||

| Hour | Flex_Bus 4 | Flex_Bus 5 | Flex_Bus 6 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MW | MW | MW | €/MWh | €/MWh | €/MWh | MW | MW | €/MWh | €/MWh | MW | MW | €/MWh | €/MWh | |

| 12 | 0.031 | 0.052 | 0.021 | 106.03 | 106.89 | 109.46 | 0.051 | 0.042 | 108.61 | 109.04 | 0.024 | 0.045 | 108.18 | 108.61 |

| 0.90 | 0.95 | 0.80 | - | 0.88 | 0.92 | - | 0.94 | 1.00 | - | |||||

| Payback hour | 10–13 | 10–18 | 10–24 | - | 10–24 | 12–16 | - | 10–24 | 10–24 | - | ||||

| Flex_Bus 1 | Flex_Bus 2 | Flex_Bus 3 | Flex_Bus 4 | Flex_Bus 5 | Flex_Bus 6 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Firm Flexibility (MW) | ||||||||||||||

| Hour | 12 | 0.062 | 0.052 | 0.074 | - | 0.028 | 0.085 | - | 0.052 | - | 0.051 | - | 0.024 | 0.045 |

| Payback power (MW) | ||||||||||||||

| Hour | 16 | - | - | - | - | - | 0.081 | - | - | - | - | - | - | - |

| 17 | - | - | - | - | - | - | - | - | - | - | - | - | - | |

| 18 | 0.053 | 0.041 | 0.070 | - | - | - | - | 0.050 | - | 0.045 | - | 0.023 | 0.045 | |

| 20 | - | - | - | - | 0.023 | - | - | - | - | - | - | - | - | |

| (€) | 51.26 | |||||||||||||

| Flex_Bus 2 | Flex_Bus 4 | Flex_Bus 6 | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Payback Power (MW) | |||||||||

| Hour | 17 | 0.038 | 0.043 | 0.016 | 0.028 | 0.034 | - | 0.019 | - |

| 18 | 0.037 | 0.042 | 0.016 | 0.027 | - | - | - | - | |

| Activation cost (€) | 30.5 | ||||||||

| (€) | 37.23 | ||||||||

| Flexibility Penetration Level | Flex_Bus 1 | Flex_Bus 2 | Flex_Bus 3 | Flex_Bus 4 | Flex_Bus 5 | Flex_Bus 6 |

|---|---|---|---|---|---|---|

| MW | MW | MW | MW | MW | MW | |

| 10% | 0.123 | 0.362 | 0.365 | 0.295 | 0.165 | 0.279 |

| 20% | 0 | 0.519 | 0.270 | 0.590 | 0 | 0.209 |

| 30% | 0 | 0.450 | 0.274 | 0.759 | 0 | 0.105 |

| 40% | 0 | 0.391 | 0.365 | 0.832 | 0 | 0 |

| 50% | 0 | 0.482 | 0.457 | 0.650 | 0 | 0 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Esmat, A.; Usaola, J.; Moreno, M.Á. A Decentralized Local Flexibility Market Considering the Uncertainty of Demand. Energies 2018, 11, 2078. https://doi.org/10.3390/en11082078

Esmat A, Usaola J, Moreno MÁ. A Decentralized Local Flexibility Market Considering the Uncertainty of Demand. Energies. 2018; 11(8):2078. https://doi.org/10.3390/en11082078

Chicago/Turabian StyleEsmat, Ayman, Julio Usaola, and Mª Ángeles Moreno. 2018. "A Decentralized Local Flexibility Market Considering the Uncertainty of Demand" Energies 11, no. 8: 2078. https://doi.org/10.3390/en11082078

APA StyleEsmat, A., Usaola, J., & Moreno, M. Á. (2018). A Decentralized Local Flexibility Market Considering the Uncertainty of Demand. Energies, 11(8), 2078. https://doi.org/10.3390/en11082078