A Simple Assessment of Housing Retrofit Policies for the UK: What Should Succeed the Energy Company Obligation?

Abstract

:1. Introduction

2. Background

- (i)

- The technical and economic constraints of retrofit measures must be accounted for.

- (ii)

- (iii)

- System-level drivers (e.g., long-term political goals, supranational policies, and existing infrastructure) must be incorporated [10].

- What are the non-economic barriers to retrofit, perceived by stakeholders, and how well do the policies perform in overcoming these barriers?

- What are the wider governmental objectives linked to energy and climate policies of national and international interest and how well do the policies align with these objectives?

- What are the costs and payback times of retrofit measures to residential energy consumers and organizations delivering the policies under different retrofit policies and the associated techno-economic assumptions?

- A literature review and small-scale stakeholder analysis to identify the main barriers and the wider governmental objectives, which should be addressed by each policy.

- An assessment of the costs to consumers and funding organizations of conducting housing upgrades under each policy.

- A simple ex-ante assessment of each policy based on the performance of the policy in maintaining economic viability, addressing stakeholder barriers, and contributing to the achievement of wider governmental objectives.

3. Materials and Methods

3.1. Introduction

3.2. Policy Proposals Selected for Assessment

3.3. Methodology

3.3.1. Stakeholder Analysis

- The ability to mobilize the solid wall insulation (SWI) market.

- CO2 abatement potential.

- The ability to specifically support fuel-poor households.

3.3.2. Economic Analysis

3.3.3. Final Assessment

4. Results and Discussion

4.1. Stakeholder Analysis

4.2. Economic Analysis

4.2.1. Customer Profit-And-Loss Analysis

Variable Council Tax

Variable Stamp Duty Land Tax

Green Mortgage

4.2.2. Systemic Profit-And-Loss Analysis

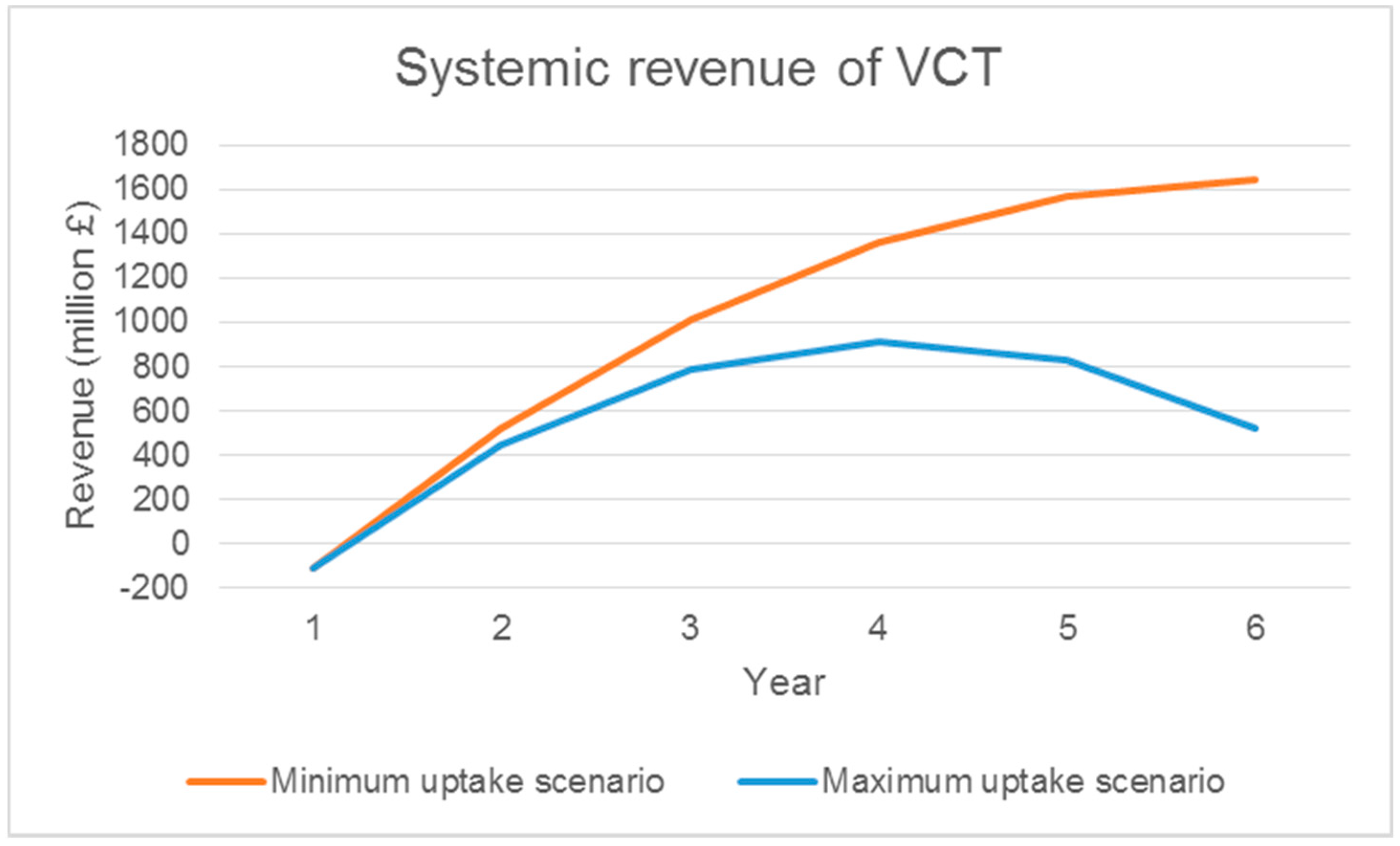

Variable Council Tax

Variable Stamp Duty Land Tax

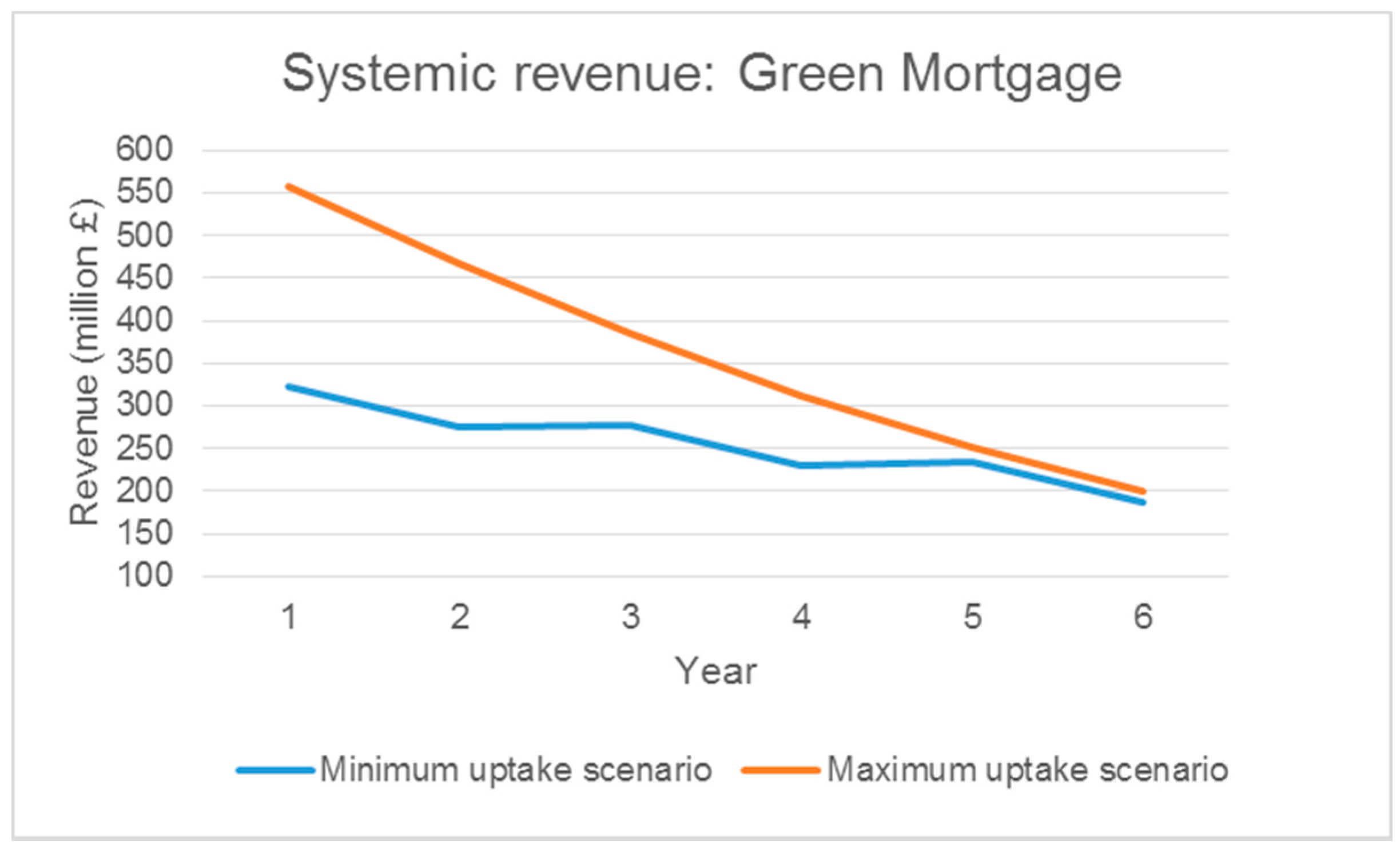

Green Mortgage

4.2.3. Summary of Economic Analysis

4.3. Final Assessment

5. Conclusions and Policy Recommendation

Supplementary Materials

Supplementary File 1Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Department for Energy and Climate Change. Energy Consumption in the UK (2015); Department for Energy and Climate Change: London, UK, 2015.

- Webber, P.; Gouldson, A.; Kerr, N. The Impacts of Household Retrofit and Domestic Energy Efficiency Schemes: A Large Scale, Ex Post Evaluation. Energy Policy 2015, 84, 35–43. [Google Scholar] [CrossRef]

- Howard, R. Efficient Energy Policy: How to Encourage Improvements in Domestic Energy Efficiency; Policy Exchange: London, UK, 2016. [Google Scholar]

- Committee on Climate Change. Meeting Carbon Budgets: Closing the Policy Gap; Committee on Climate Change: London, UK, 2017. [Google Scholar]

- Gooding, L.; Gul, M.S. Achieving Growth within the UK’s Domestic Energy Efficiency Retrofitting Services Sector, Practitioner Experiences and Strategies Moving Forward. Energy Policy 2017, 105, 173–182. [Google Scholar] [CrossRef]

- Thorpe, D. Why the UK Green Deal Failed and Why It Needs a Replacement. Available online: http://energypost.eu/uk-green-deal-failed-needs-replacement (accessed on 27 October 2017).

- Brown, H.S.; Vergragt, P.J. Bounded Socio-Technical Experiments as Agents of Systemic Change: The Case of a Zero-Energy Residential Building. Technol. Forecast. Soc. Chang. 2008, 75, 107–130. [Google Scholar] [CrossRef]

- Nye, M.; Whitmarsh, L.; Foxon, T. Sociopsychological Perspectives on the Active Roles of Domestic Actors in Transition to a Lower Carbon Electricity Economy. Environ. Plan. A 2010, 42, 697–714. [Google Scholar] [CrossRef]

- Vergragt, P.J.; Brown, H.S. The Challenge of Energy Retrofitting the Residential Housing Stock: Grassroots Innovations and Socio-Technical System Change in Worcester, MA. Technol. Anal. Strateg. Manag. 2012, 24, 407–420. [Google Scholar] [CrossRef]

- Moore, T.; Horne, R.; Morrissey, J. Zero Emission Housing: Policy Development in Australia and Comparisons with the EU, UK, USA and California. Environ. Innov. Soc. Transit. 2014, 11, 25–45. [Google Scholar] [CrossRef]

- Platt, R.; Aldridge, J.; Washan, P.; Price, D. Help to Heat: A Solution to the Affordability Crisis in Energy; Institute for Public Policy Research (IPPR): London, UK, 2013. [Google Scholar]

- Parliamentary Office of Science and Technology (POST). Future Energy Efficiency Policy; POST: London, UK, 2017. [Google Scholar]

- Wade, J.; Eyre, N. Energy Efficiency Evaluation: The Evidence for Real Energy Savings from Energy Efficiency Programmes in the Household Sector; UK Energy Research Centre: London, UK, 2015. [Google Scholar]

- Electronic Temperature Instruments. Smart Systems and Heat: Consumer Challenges for Low Carbon Heat; ETI: Worthing, UK, 2015. [Google Scholar]

- Arup Group. Towards the Delivery of a National Residential Energy Efficiency Programme; ARUP: London, UK, 2016. [Google Scholar]

- Darnton, A.; Horne, J. Influencing Behaviours: Moving Beyond the Individual. A User Guide to the ISM Tool; Scottish Government: Edinburgh, UK, 2013.

- Roberts, S.; Redgrove, Z.; Blacklaws, K.; Preston, I. Beyond the ECO: An Exploration of Options for the Future of a Domestic Energy Supplier Obligation; Centre for Sustainable Energy: Bristol, UK, 2014. [Google Scholar]

- Geels, F.W. Technological Transitions as Evolutionary Reconfiguration Processes: A Multi-Level Perspective and a Case-Study. Res. Policy 2002, 31, 1257–1274. [Google Scholar] [CrossRef]

- Geels, F.W. From Sectoral Systems of Innovation to Socio-Technical Systems Insights about Dynamics and Change from Sociology and Institutional Theory. Res. Policy 2004, 33, 897–920. [Google Scholar] [CrossRef]

- Geels, F.W. Ontologies, Socio-Technical Transitions (to Sustainability), and the Multi-Level Perspective. Res. Policy 2010, 39, 495–510. [Google Scholar] [CrossRef]

- Markard, J.; Raven, R.; Truffer, B. Sustainability Transitions: An Emerging Field of Research and Its Prospects. Res. Policy 2012, 41, 955–967. [Google Scholar] [CrossRef]

- Van den Bergh, J.C.J.M.; Truffer, B.; Kallis, G. Environmental Innovation and Societal Transitions: Introduction and Overview. Environ. Innov. Soc. Transit. 2011, 1, 1–23. [Google Scholar] [CrossRef]

- Annunziata, E. Energy Efficiency Governance in Buildings: A Multi-Level Perspective; Scuola Superiore Sant’Anna: Pisa, Italy, 2013. [Google Scholar]

- Tambach, M.; Hasselaar, E.; Itard, L. Assessment of Current Dutch Energy Transition Policy Instruments for the Existing Housing Stock. Energy Policy 2010, 38, 981–996. [Google Scholar] [CrossRef]

- National Audit Office (NAO). Green Deal and Energy Company Obligation—Report Summary; NAO: London, UK, 2016. [Google Scholar]

- Building Research Establishment (BRE). Energy Performance Certificates for Existing Dwellings; BRE: Glasgow, UK, 2012. [Google Scholar]

- Ofgem. Energy Company Obligation. Available online: https://www.ofgem.gov.uk/environmental-programmes/eco (accessed on 29 October 2017).

- Department for Business, Energy and Industrial Strategy (BEIS). Energy Company Obligation; BEIS: London, UK, 2018.

- Hills, J. Fuel Poverty: The Problem and Its Measurement; Council for Advancement and Support of Education: London, UK, 2011. [Google Scholar]

- Department of Energy and Climate Change. Evaluation of the Carbon Emissions Reduction Target and Community Energy Saving Programme: Executive Summary Research Undertaken for DECC by Ipsos MORI, CAG Consultants, UCL and Energy Saving Trust; Department of Energy and Climate Change: London, UK, 2014.

- HM Government. The Clean Growth Strategy: Leading the Way to a Low Carbon Future; HM Government: London, UK, 2018.

- Randall, C.; Beaumont, J. Housing; Office for National Statistics: Newport, UK, 2011.

- Association for the Conservation of Energy (ACE). Fiscal Incentives—Encouraging Retrofitting; ACE: London, UK, 2011. [Google Scholar]

- Energy Saving Trust. Select Committee on Science and Technology Minutes of Evidence: Memorandum by the Energy Saving Trust; Energy Saving Trust: London, UK, 2005. [Google Scholar]

- Dresner, S.; Ekins, P. Economic Instruments for a Socially Neutral National Home Energy Efficiency Programme; PSI: London, UK, 2004. [Google Scholar]

- UK Green Building Council. Retrofit Incentives; UK Green Building Council: London, UK, 2013. [Google Scholar]

- Constructing Excellence. EPCs & Mortgages: Demonstrating the Link between Fuel Affordability and Mortgage Lending; CE: Cardiff, UK, 2015. [Google Scholar]

- Murray, J. Nationwide Launches New Green Home Loan. Available online: https://www.businessgreen.com/bg/news/2242368/nationwide-launches-new-green-home-loan (accessed on 29 October 2017).

- Griffiths, R.; Hamilton, I.; Huebner, G. The Role of Energy Bill Modelling in Mortgage Affordability Calculations; UK Green Building Council: London, UK, 2015. [Google Scholar]

- Britnell, J.; Dixon, T. Retrofitting in the Private Residential and Commercial Property Sectors—Survey Findings. Available online: http://www.retrofit2050.org.uk/sites/default/files/resources/WP20111.pdf (accessed on 7 August 2018).

- Dowson, M.; Poole, A.; Harrison, D.; Susman, G. Domestic UK Retrofit Challenge: Barriers, Incentives and Current Performance Leading into the Green Deal. Energy Policy 2012, 50, 294–305. [Google Scholar] [CrossRef]

- Warren, A.; Steven, A.; Knauf, H.; Aecb, D.P.; Whitefield, J.; Smith, L.; Bba, J.A.; Barnham, J.; Goodfellow, B.; Prewett, R.; et al. An Industry Review of the Barriers to Whole House Energy Efficiency Retrofit and the Creation of an Industry Action Plan; Energy Efficiency Partnership for Buildings: Milton Keynes, UK, 2013. [Google Scholar]

- Technology Strategy Board. Retrofit for the Future; Technology Strategy Board: Swindon, UK, 2014. [Google Scholar]

- Fisher, B.S.; Barrett, S.; Bohm, P.; Kuroda, M.; Mubazi, J.K.E.; Haites, E.; Hinchy, M.; Thorpe, S. An Economic Assessment of Policy Instruments for Combatting Climate Change. In Climate Change 1995: Economic and Social Dimensions of Climate Change; Bruce, J.P., Lee, H., Haites, E.F., Eds.; Cambridge University Press: Cambridge, UK, 1996. [Google Scholar]

- Arcadis. Economic Assessment of Policy Measures for the Implementation of the Marine Strategy Framework Directive; Arcadis: London, UK, 2012. [Google Scholar]

- Estrada, F.; Botzen, W.J.W.; Tol, R.S.J. A Global Economic Assessment of City Policies to Reduce Climate Change Impacts. Nat. Clim. Chang. 2017, 7, 403–406. [Google Scholar] [CrossRef]

- Bergman, N.; Foxon, T.J. Reorienting Finance towards Energy Efficiency: The Case of UK Housing. SSRN Electron. J. 2018, 1, 359–368. [Google Scholar] [CrossRef]

- Platinum Property Partners. Landlords’ Failure to Measure Portfolio Performance Effectively; Platinum Property Partners: Bournemouth, UK, 2015. [Google Scholar]

- Matikainen, S. Consultation Response: House of Commons Environmental Audit Committee’s “Green Finance” Inquiry. Available online: http://www.lse.ac.uk/GranthamInstitute/wp-content/uploads/2017/12/Consultation-response-green-finance-enquiry.pdf (accessed on 7 August 2018).

- UK Government. The Private Rented Property Minimum Standard—Landlord Guidance Documents. Available online: https://www.gov.uk/government/publications/the-private-rented-property-minimum-standard-landlord-guidance-documents (accessed on 14 June 2018).

- Department for Business, Energy and Industrial Strategy. Annual Fuel Poverty Statistics Report (2016 Data); BEIS: London, UK, 2018.

- HM Government. Affordable Home Ownership Schemes. Available online: https://www.gov.uk/affordable-home-ownership-schemes (accessed on 26 June 2018).

- Tholen, L.; Kiyar, D.; Venjakob, M.; Xia, C.; Thomas, S.; Aydin, V. What Makes a Good Policy? Guidance for Assessing and Implementing Energy Efficiency Policies. In European Council for an Energy Efficient Economy Summer Study; Wuppertal Institute for Climate, Environment and Energy: Wuppertal, Germany, 2013. [Google Scholar]

- Karlstrom, H.; Ryghaug, M.; Sorensen, K.H. Towards New National Policy Instruments for Promoting Energy Efficiency in Norway. In European Council for an Energy Efficient Economy Summer Study; Wuppertal Institute for Climate, Environment and Energy: Wuppertal, Germany, 2013. [Google Scholar]

- Chair, A.C.; Al-Moneef, M.; Barnés De Castro, F.; Bundgaard-Jensen, A. Energy Efficiency Policies around the World: Review and Evaluation; World Energy Council: London, UK, 2008. [Google Scholar]

- Kerr, N.; Gouldson, A.; Barrett, J. The Rationale for Energy Efficiency Policy: Assessing the Recognition of the Multiple Benefits of Energy Efficiency Retrofit Policy. Energy Policy 2017, 106, 212–221. [Google Scholar] [CrossRef]

- Fawcett, T.; Gavin, K.; Janda, K. Building Expertise: Identifying Policy Gaps and New Ideas in Housing Eco-Renovation in the UK and France. In European Council for an Energy Efficient Economy Summer Study; Wuppertal Institute for Climate, Environment and Energy: Wuppertal, Germany, 2013. [Google Scholar]

- Rosenow, J. Home Energy Efficiency Policy in Germany and the UK. In Low Carbon Development: Key Issues; Urban, F., Nordensvard, J., Eds.; Routledge: Abingdon, UK, 2013; pp. 309–320. [Google Scholar]

- Sebi, C.; Lapillionne, B.; Fleuriot, F.; Broc, J.-S. Reviewing Successful and/or Innovative Policies to Drive an Energy Efficiency Strategy: Case Study for France. In European Council for an Energy Efficient Economy Summer Study; Wuppertal Institute for Climate, Environment and Energy: Wuppertal, Germany, 2013. [Google Scholar]

- Policy Connect. Warmer & Greener: A Guide to the Future of Domestic Energy Efficiency Policy; Policy Connect: London, UK, 2016. [Google Scholar]

- Berrutto, V.; Eibl, M.; Sansoni, M.; Schoenfeld, J.; Sivitos, S.; Zapfel, B.; Ferreira, S. When European Collaboration Makes Energy Efficiency Policies More Effective. In European Council for an Energy Efficient Economy Summer Study; Wuppertal Institute for Climate, Environment and Energy: Wuppertal, Germany, 2017. [Google Scholar]

- Hamilton, I.; Huebner, G.; Griffiths, R. Valuing Energy Performance in Home Purchasing: An Analysis of Mortgage Lending for Sustainable Buildings. Procedia Eng. 2016, 145. [Google Scholar] [CrossRef]

- Moody’s Investor Service. Moody’s Assigns GB1 Green Bond Assessment to Green STORM 2017 B.V. Available online: https://www.moodys.com/research/Moodys-assigns-GB1-Green-Bond-Assessment-to-Green-STORM-2017--PR_366238 (accessed on 25 July 2018).

- Aldersgate Group. Increasing Investment for Domestic Energy Efficiency; Aldersgate Group: London, UK, 2018. [Google Scholar]

- Rosenow, J.; Fawcett, T.; Eyre, N.; Oikonomou, V. Energy Efficiency and the Policy Mix. Build. Res. Inf. 2016, 44, 562–574. [Google Scholar] [CrossRef]

- Witters, L.; Marom, R.; Steinert, K. The Role of Public-Private Partnerships in Driving Innovation. In The Global Innovation Index; World Intellectual Property Organization: Geneva, Switzerland, 2012; pp. 81–87. [Google Scholar]

- Gardiner, A.; Bardout, M.; Grossi, F.; Dixson-Decleve, S. Public-Private Partnerships for Climate Finance; Nordic Council of Ministers: Copenhagen, Denmark, 2015. [Google Scholar]

| Policy Proposal | Description of the Policy |

|---|---|

| Variable Council Tax (VCT) | Adjusts a household’s Council Tax liability to its Energy Performance Certificate (EPC) rating. Deviation from a ‘neutral’ EPC band (E) results in either a rebate or a penalty applied to the household’s annual Council Tax rate. For the sake of the analysis, this policy is assumed to exclude fuel-poor households. The scheme would be preceded by EPC assessments on all households without a certificate already in place to determine the appropriate level of tax adjustment. Assessments for fuel-poor households would be funded through systemic expenses even if these households do not participate in the scheme. The completion of EPC assessments in fuel-poor households was assumed to be carried out in tandem with those of able-to-pay households due to the current lack of specific information on the fuel poverty status of UK households. The policy would be implemented by local authorities and integrated with the existing Council Tax system. The systemic cost of the policy is calculated by assuming that households in bands F and G (the ‘penalty zone’) are upgraded to band E while households in band E or above (the ‘discount zone’) are upgraded by one band. The VCT scheme was proposed by the UK Association for the Conservation of Energy [33]. |

| Variable Stamp Duty Land Tax (VSDLT) | Adjustment of the stamp duty (SDLT) (a UK tax paid by the buyer upon the purchase of a property) based on the deviation of the property’s EPC band from a ‘neutral’ band D under a rebate-penalty scheme similar to that of the VCT. In this scheme, the financial burden of retrofit falls on the seller while the SDLT rebates or penalties impact the buyer. The policy is aimed exclusively at households with a capital value of over £125,000, attempting to avoid the penalization of fuel-poor households. The VSDLT was previously proposed and analyzed by both a number of professional organizations and academics [3,34,35,36]. |

| Green Mortgage (GM) | The scheme proposes the use of property EPC ratings and resident energy expenses as customer eligibility criteria for new mortgages. It also encourages the offering of re-mortgage products which cover the financing of energy-saving measures (for example, up to £2500 extension per EPC band upgrade, for a maximum of 2 bands) to existing homeowners [37]. A repayment period of 10 years at the interest rates of the Nationwide Green Additional Borrowing Service (1.49% fixed interest rate for the first 2 years and standard variable rate of 3.99% for the remainder of the repayment time) is assumed [38]. This policy has been proposed by both the UK Green Building Council [39] and CE Wales [37]. |

| Stakeholder Group | Definition |

|---|---|

| Tenant | All residents occupying properties that they do not own or which they partially own. |

| Homeowner | All residents occupying properties that they wholly own and all private landlords. |

| Housing association | All social housing associations that own residential property. |

| Manufacturers | Suppliers for retrofit installation and maintenance processes. |

| Designers | Companies or individual experts involved in the planning and design of a retrofit project. |

| Project managers | Companies or individuals managing a retrofit project. Self-build projects are assigned to tenants or homeowners. |

| Consultants | Companies or individuals hired to provide expert advice on a retrofit project. |

| Energy suppliers | Companies delivering energy products to tenants, owner-occupiers, and housing associations. |

| Capital providers | Banks, lenders, or investors providing access to capital for the purpose of financing a retrofit project. |

| Public authorities | Governance agencies responsible for the oversight and strategizing of housing development projects including building codes and standards. |

| Political | Supply Chain | Installation | Performance | Coordination |

|---|---|---|---|---|

| Lack of long-term planning | Lack of skills within the supply chain | Poor installation | Insufficient quality assurance | Retrofit does not comply with business models of stakeholders |

| Lack of certainty in established schemes | Low market and industry capacity | Lack of information on existing buildings | Poor advice | Lack of information on the management of retrofit projects |

| Customer-related barriers | ||||

| Low demand from residents | ||||

| Lack of information on retrofit | ||||

| Split incentives (landlord-tenant ownership issue) | ||||

| Low effectiveness of retrofit | ||||

| Time limitations | ||||

| Barrier | Category | Stakeholders Ranking as “Very Important” | Corresponding Policy Attribute |

|---|---|---|---|

| Lack of certainty in existing schemes | Political | Housing associations, project managers, consultants, energy suppliers, capital providers, public authorities | Ability to be compatible with other policies |

| Retrofit does not comply with business models of stakeholders in charge | Supply chain | Housing associations, project managers, energy suppliers, public authorities | Alignment with business models of delivery organizations |

| Lack of long-term planning from government | Political | Housing associations, project managers, consultants, energy suppliers, capital providers | Ability to improve coordination within the supply chain |

| Split responsibility | Supply chain | Manufacturers, project managers, energy suppliers, public authorities | Ability to improve coordination within the supply chain |

| Landlord-tenant ownership issues | Customer | Tenants, housing associations, manufacturers, consultants, public authorities | Ability to reflect retrofit in property value |

| EPC Band Upgrade | Properties with Solid Walls | Properties with Cavity Walls | ||

|---|---|---|---|---|

| CAPEX (£) | Payback Time (Years) | CAPEX (£) | Payback Time (Years) | |

| G–E | 4325–14,613 | 7–26 | 735–7241 | 1–20 |

| F–E | 4015–14,050 | 9–31 | 515–6678 | 1–24 |

| E–D | 3075–5128 | 17–26 | 3075–5128 | 17–26 |

| E–C | 5275–8128 | 9–15 | 5275–8128 | 9–15 |

| E–B | 5625–8578 | 8–13 | 5625–8578 | 8–13 |

| E–A | 9625–14,578 | 13–22 | 9625–14,578 | 13–22 |

| EPC Band Upgrade | Properties with Solid Walls | Properties with Cavity Walls | ||

|---|---|---|---|---|

| CAPEX (£) | Payback Time (Years) | CAPEX (£) | Payback Time (Years) | |

| G–D | 7310–19,741 | 13–34 | 3810–7241 | 9–16 |

| F–D | 7090–19,176 | 13–36 | 3590–6678 | 9–19 |

| E–D | 3075–5128 | 21–34 | 3075–5128 | 21–34 |

| D–C | 2200–3000 | 7–9 | 2200–3000 | 7–9 |

| D–B | 2550–3450 | 6–9 | 2550–3450 | 6–9 |

| D–A | 6550–9450 | 14–21 | 6550–9450 | 14–21 |

| EPC Band Upgrade | Monthly Instalments | Monthly Bill Savings | ||||

| Properties with Solid Walls | Properties with Cavity Walls | Properties with Solid Walls | Properties with Cavity Walls | |||

| Min. | Max. | Min. | Max. | |||

| G to D | £75 | £200 | £35 | £67 | £47 | £37 |

| F to D | £73 | £195 | £33 | £69 | £43 | £33 |

| E to D | £29 | £53 | £29 | £53 | £12 | £12 |

| D to B | £27 | £36 | £27 | £36 | £32 | £32 |

| D to A | £60 | £97 | £60 | £97 | £37 | £37 |

| Policy Proposal | Financial Burden on Customers | Cumulative Revenue | Scheme Duration (Years) | Average Annual Cost (Million £) | Funding Source |

|---|---|---|---|---|---|

| VCT | Intermediate | Positive | 6 | 112.3–276.9 | Public expenditure |

| VSDLT | High | Negative | 6 | 64.45 | Public expenditure |

| 7 | 134.9 | ||||

| GM | Intermediate | Positive | 6 | 789.8–1,091 | Mortgage lenders |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Miu, L.M.; Wisniewska, N.; Mazur, C.; Hardy, J.; Hawkes, A. A Simple Assessment of Housing Retrofit Policies for the UK: What Should Succeed the Energy Company Obligation? Energies 2018, 11, 2070. https://doi.org/10.3390/en11082070

Miu LM, Wisniewska N, Mazur C, Hardy J, Hawkes A. A Simple Assessment of Housing Retrofit Policies for the UK: What Should Succeed the Energy Company Obligation? Energies. 2018; 11(8):2070. https://doi.org/10.3390/en11082070

Chicago/Turabian StyleMiu, Luciana Maria, Natalia Wisniewska, Christoph Mazur, Jeffrey Hardy, and Adam Hawkes. 2018. "A Simple Assessment of Housing Retrofit Policies for the UK: What Should Succeed the Energy Company Obligation?" Energies 11, no. 8: 2070. https://doi.org/10.3390/en11082070

APA StyleMiu, L. M., Wisniewska, N., Mazur, C., Hardy, J., & Hawkes, A. (2018). A Simple Assessment of Housing Retrofit Policies for the UK: What Should Succeed the Energy Company Obligation? Energies, 11(8), 2070. https://doi.org/10.3390/en11082070