The Impact of Financial Development on Energy Consumption: Evidence from an Oil-Rich Economy

Abstract

1. Introduction

2. Theoretical and Empirical Literature Review

3. Model and Data

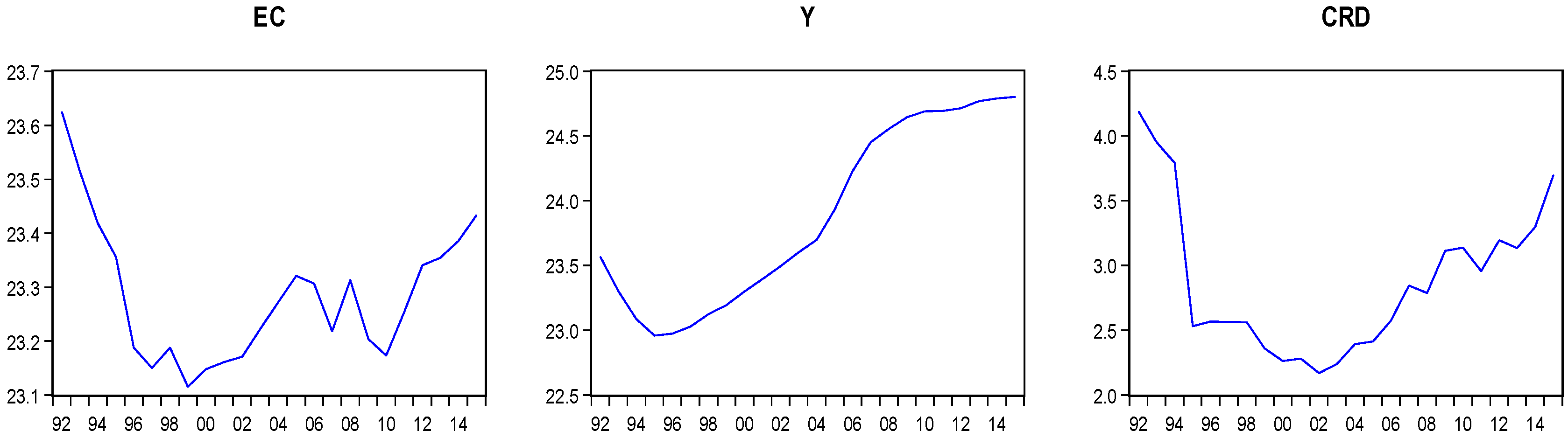

3.1. Data

3.2. Econometric Methodology

4. Empirical Results and Discussion

5. Conclusions and Policy Implications

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- World Bank. Available online: http://databank.worldbank.org/data (accessed on 28 April 2018).

- Jones, C.I.; Vollrath, D. Introduction to Economic Growth; W.W. Norton and Company, Inc.: New York, NY, USA, 2013. [Google Scholar]

- Solow, R.M. Resources and Economic Growth. Am. Econ. 2016, 61, 52–60. [Google Scholar] [CrossRef]

- Meadows, D.H.; Meadows, D.L.; Randers, J.; Behrens, W. The Limits to Growth; Universe Books: New York, NY, USA, 1972. [Google Scholar]

- Karanfil, F. How many times again will we examine the energy–income nexus using a limited range of traditional econometric tools? Energy Policy 2009, 37, 1191–1194. [Google Scholar] [CrossRef]

- Sadorsky, P. The impact of financial development on energy consumption in emerging economies. Energy Policy 2010, 38, 2528–2535. [Google Scholar] [CrossRef]

- Johansen, S. Statistical analysis of cointegration vectors. J. Econ. Dyn. Control 1988, 12, 231–254. [Google Scholar] [CrossRef]

- Johansen, S.; Juselius, K. Maximum likelihood estimation and inference on cointegration with applications to the demand for money. Oxf. Bull. Econ. Stat. 1990, 52, 169–210. [Google Scholar] [CrossRef]

- Gregory, A.W.; Hansen, B.E. Residual-Based Tests for Cointegration in Models with Regime Shifts. J. Econom. 1996, 70, 99–126. [Google Scholar] [CrossRef]

- Pesaran, M.; Shin, Y. An autoregressive distributed lag modeling approach to cointegration analysis. In Econometrics and Economic Theory in the 20th Century: The Ragnar Frisch centennial Symposium; Strom, S., Ed.; Cambridge University Press: Cambridge, UK, 1996. [Google Scholar]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Schumpeter, J.A. The Theory of Economic Development; Harvard University Press: Cambridge, MA, USA, 1911. [Google Scholar]

- Goldsmith, R.W. Financial Structure and Development; Yale University Press: New Haven, CT, USA, 1969. [Google Scholar]

- McKinnon, R.I. Money and Capital in Economic Development; Brookings Institution: Washington, DC, USA, 1973. [Google Scholar]

- Shaw, E.S. Financial Deepening in Economic Development; Oxford University Press: New York, NY, USA, 1973. [Google Scholar]

- King, R.G.; Levine, R. Finance and Growth: Schumpeter Might Be Right. Q. J. Econ. 1993, 108, 713–737. [Google Scholar] [CrossRef]

- Ang, J.B. What are the mechanisms linking financial development and economic growth in Malaysia? Econ. Model. 2005, 25, 38–53. [Google Scholar] [CrossRef]

- Adjasi, C.K.D.; Biekpe, N.B. Stock Market Development and Economic Growth: The Case of Selected African Countries. Afr. Dev. Rev. 2006, 18, 144–161. [Google Scholar] [CrossRef]

- Akinlo, A.E.; Akinlo, O.O. Stock Market Development and Economic Growth: Evidence from Seven Sub-Sahara African Countries. J. Econ. Bus. 2009, 61, 162–171. [Google Scholar]

- Wu, J.L.; Hou, H.; Cheng, S.Y. The dynamic impacts of financial institutions on economic growth: Evidence from the European Union. J. Macroecon. 2010, 32, 879–891. [Google Scholar] [CrossRef]

- Hassan, K.M.; Sanchez, B.; Yu, J. Financial Development and Economic Growth: New Evidence from Panel Data. Q. Rev. Econ. Financ. 2011, 51, 88–104. [Google Scholar] [CrossRef]

- Adu, G.; Marbuah, G.; Mensah, J.T. Financial Development and Economic Growth in Ghana: Does the Measure of Financial Development Matter? Rev. Dev. Financ. 2013, 3, 192–203. [Google Scholar] [CrossRef]

- Chortareas, G.; Magkonis, G.; Moschos, D.; Panagiotidis, T. Financial Development and Economic Activity in Advanced and Developing Open Economies: Evidence from Panel Cointegration. Rev. Dev. Econ. 2015, 19, 163–177. [Google Scholar] [CrossRef]

- Mishkin, F.S. Globalization and financial development. J. Dev. Econ. 2009, 89, 164–169. [Google Scholar] [CrossRef]

- Xu, S. The impact of financial development on energy consumption in China: Based on SYS-GMM estimation. Adv. Mater. Res. 2012, 524–527, 2977–2981. [Google Scholar] [CrossRef]

- Shahbaz, M.; Hye, Q.M.; Tiwari, A.; Leitão, N. Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew. Sustain. Energy Rev. 2013, 25, 109–121. [Google Scholar] [CrossRef]

- Coban, S.; Topcu, M. The nexus between financial development and energy consumption in the EU: A dynamic panel data analysis. Energy Econ. 2013, 39, 81–88. [Google Scholar] [CrossRef]

- Islam, F.; Shahbaz, M.; Ahmed, A.U.; Alam, M.M. Financial development and energy consumption nexus in Malaysia: A multivariate time series analysis. Econ. Model. 2013, 30, 435–441. [Google Scholar] [CrossRef]

- Ozturk, I.; Acaravci, A. The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ. 2013, 36, 262–267. [Google Scholar] [CrossRef]

- Tang, C.F.; Tan, B.W. The linkages among energy consumption, economic growth, relative price, foreign direct investment, and financial development in Malaysia. Qual. Quant. 2014, 48, 781–797. [Google Scholar] [CrossRef]

- Salah, A.; Shahbaz, M.; Sbia, R. The links between energy consumption, financial development, and economic growth in Lebanon: Evidence from cointegration with unknown structural breaks. J. Energy 2015, 2015, 965825. [Google Scholar] [CrossRef]

- Kraft, J.; Kraft, A. On the relationship between energy and GNP. J. Energy Financ. Dev. 1978, 3, 401–403. [Google Scholar]

- Lise, W.; Montfort, K.V. Energy consumption and GDP in Turkey: Is there a co-integration relationship? Energy Econ. 2007, 29, 1166–1178. [Google Scholar] [CrossRef]

- Huang, B.N.; Hwang, M.J.; Yang, C.W. Does more energy consumption bolster economic growth? An application of the nonlinear threshold regression model. Energy Policy 2008, 36, 755–767. [Google Scholar] [CrossRef]

- Mallick, H. Examining the linkage between energy consumption and economic growth in India. J. Dev. Areas 2009, 43, 249–280. [Google Scholar] [CrossRef]

- Saad, S. Energy consumption and economic growth: Causality relationship for Nigeria. OPEC Energy Rev. 2010, 34, 15–24. [Google Scholar] [CrossRef]

- Binh, P.T. Energy consumption and economic growth in Vietnam: Threshold cointegration and causality analysis. Int. J. Energy Econ. Policy 2011, 1, 1–17. [Google Scholar]

- Narayan, P.K.; Popp, S. The energy consumption-real GDP nexus revisited: Empirical evidence from 93 countries. Econ. Model. 2012, 29, 303–308. [Google Scholar] [CrossRef]

- Qazi, A.Q.; Ahmed, K.; Mudassarm, M. Disaggregate energy consumption and industrial output in Pakistan: An empirical analysis. Econ. Discuss. Pap. 2012, 29, 1–14. [Google Scholar]

- Soile, I.O. Energy-economy nexus in Indonesia: A bivariate cointegration. Asian J. Empir. Res. 2012, 2, 205–218. [Google Scholar]

- Kasman, A.; Duman, Y.S. CO2 emissions, economic growth, energy consumption, trade and urbanization in new EU member and candidate countries: A panel data analysis. Econ. Model. 2015, 44, 97–103. [Google Scholar] [CrossRef]

- Sadorsky, P. Financial development and energy consumption in Central and Eastern European frontier economies. Energy Policy 2011, 39, 999–1006. [Google Scholar] [CrossRef]

- Kakaer, Z.K.; Khilji, B.A.; Khan, M.J. Financial Development and Energy Consumption: Empirical Evidence from Pakistan. Int. J. Trade Econ. Financ. 2011, 2, 469–471. [Google Scholar] [CrossRef]

- Al-Mulali, U.; Sab, C.N.B.C. The impact of energy consumption and CO2 emission on the economic growth and financial development in the Sub Saharan African countries. Energy 2012, 39, 180–186. [Google Scholar] [CrossRef]

- Al-Mulali, U.; Sab, C.N.B.C. The impact of energy consumption and CO2 emission on the economic and financial development in 19 selected countries. Renew. Sustain. Energy Rev. 2012, 16, 4365–4369. [Google Scholar] [CrossRef]

- Shahbaz, M.; Lean, H.H. Does financial development increase energy consumption? The role of industrialization and urbanization in Tunisia. Energy Policy 2012, 40, 473–479. [Google Scholar] [CrossRef]

- Mehrara, M.; Musai, M. Energy consumption, financial development and economic growth: An ARDL approach for the case of Iran. Int. J. Bus. Behav. Sci. 2012, 2, 92–99. [Google Scholar]

- Shahbaz, M.; Khan, S.; Tahir, M.I. The dynamic links between energy consumption, economic growth, financial development and trade in China: Fresh evidence from multivariate framework analysis. Energy Econ. 2013, 40, 8–21. [Google Scholar] [CrossRef]

- Khan, M.A.; Khan, Z.K.; Zaman, K.; Irfan, D.; Khatab, H. Questing the three key growth determinants: Energy consumption, foreign direct investment and financial development in South Asia. Renew. Energy 2014, 68, 203–215. [Google Scholar] [CrossRef]

- Omri, A.; Kahouli, B. Causal relationships between energy consumption, foreign direct investment and economic growth: Fresh evidence from dynamic simultaneous-equations models. Energy Policy 2014, 67, 913–922. [Google Scholar] [CrossRef]

- Alam, A.; Malik, I.A.; Abdullah, A.B.; Hassan, A.; Faridullah, A.U.; Ali, G.; Zaman, K.; Naseem, I. Does financial development contribute to SAARC’S energy demand? From energy crisis to energy reforms. Renew. Sustain. Energy Rev. 2015, 41, 818–829. [Google Scholar] [CrossRef]

- Paramati, S.R.; Mo, D.; Gupta, R. The effects of stock market growth and renewable energy use on CO2 emissions: Evidence from G20 countries. Energy Econ. 2017, 66, 360–371. [Google Scholar] [CrossRef]

- Mahalik, M.K.; Babub, M.S.; Loganathan, N.; Shahbaz, M. Does financial development intensify energy consumption in Saudi Arabia? Renew. Sustain. Energy Rev. 2017, 75, 1022–1034. [Google Scholar] [CrossRef]

- Bekhet, H.A.; Matar, A.; Yasmin, T. CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: Dynamic simultaneous equation models. Renew. Sustain. Energy Rev. 2017, 70, 117–132. [Google Scholar] [CrossRef]

- Mukhtarov, S.; Mikayilov, J.I.; Ismayilov, V. The Relationship between Energy Consumption and Economic Growth: Evidence from Azerbaijan. Int. J. Energy Econ. Policy 2017, 7, 32–38. [Google Scholar]

- Hasanov, F.; Mikayilov, J. The impact of age groups on consumption of residential electricity in Azerbaijan. Communist Post-Communist Stud. 2017, 50, 157–244. [Google Scholar] [CrossRef]

- Hasanov, F.; Hunt, L.; Mikayilov, C. Modeling and forecasting electricity demand in Azerbaijan using Co-integration techniques. Energies 2016, 9, 1045. [Google Scholar] [CrossRef]

- Mikayilov, J.I.; Hasanov, F.J.; Bollino, C.A.; Mahmudlu, C. Modeling of Electricity Demand for Azerbaijan: Time-Varying Coefficient Cointegration Approach. Energies 2017, 10, 1918. [Google Scholar] [CrossRef]

- Hasanov, F.J.; Bulut, C.; Suleymanov, E. Do population age groups matter in the energy use of the oil-exporting countries? Econ. Model. 2016, 54, 82–99. [Google Scholar] [CrossRef]

- Chang, S.C. Effects of financial developments and income on energy consumption. Int. Rev. Econ. Financ. 2015, 35, 28–44. [Google Scholar] [CrossRef]

- Polat, A.; Shahbaz, M.; Rehman, I.; Satti, S.L. Revisiting linkages between financial development, trade openness and economic growth in South Africa: Fresh evidence from combined cointegration test. Qual. Quant. 2015, 49, 785–803. [Google Scholar] [CrossRef]

- Shahbaz, M.; Mallick, H.; Mahalick, M.K.; Sadorsky, P. The role of globalization on the recent evolution of energy demand in India: Implications for sustainable development. Energy Econ. 2016, 55, 52–68. [Google Scholar] [CrossRef]

- Kahouli, B. The short and long run causality relationship among economic growth, energy consumption and financial development: Evidence from South Mediterranean Countries (SMCs). Energy Econ. 2017, 68, 19–30. [Google Scholar] [CrossRef]

- Dickey, D.; Fuller, W. Likelihood Ratio Statistics for Autoregressive Time Series with a Unit Root. Econometrica 1981, 49, 1057–1072. [Google Scholar] [CrossRef]

- Phillips, P.B.; Perron, P. Testing for Unit Roots in Time Series Regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Zivot, E.; Donald, W.K.A. Further Evidence on the Great Crash, the Oil-Price Shock, and the Unit-Root Hypothesis. J. Bus. Econ. Stat. 1992, 10, 251–270. [Google Scholar]

- Mikayilov, J.; Hasanov, F.; Yusifov, S. Residential electricity use effects of population in Kazakhstan. Int. J. Energy Technol. Policy 2018, 14, 114–132. [Google Scholar] [CrossRef]

- Mackinnon, J.G. Numerical Distribution Functions for Unit Root and Cointegration Test. J. Appl. Econom. 1996, 11, 601–618. [Google Scholar] [CrossRef]

- Mahadevan, R.; Asafu-Adjaye, J. Energy consumption, economic growth and prices: A reassessment using panel VECM for developed and developing countries. Energy Policy 2007, 35, 2481–2490. [Google Scholar] [CrossRef]

- Komal, R.; Abbas, F. Linking financial development, economic growth and energy consumption in Pakistan. Renew. Sustain. Energy Rev. 2015, 44, 211–220. [Google Scholar] [CrossRef]

- Urzua, C.M. Omnibus Test for Multivariate Normality Based on a Class of Maximum Entropy Distributions. Adv. Econom. 1997, 12, 341–358. [Google Scholar]

- CBAR, Central Bank of the Republic of Azerbaijan. Annual Reports 2000–2015. Available online: https://en.cbar.az/pages/publications-researches/annual-reports/ (accessed on 5 May 2018).

- Mallick, H.; Mahalik, M.K. Energy consumption, economic growth and financial development: A comparative perspective on India and China. Bull. Energy Econ. 2014, 2, 72–84. [Google Scholar]

- WB. Available online: http://www.doingbusiness.org/reports/~/media/WBG/DoingBusiness/Documents/Profiles/Regional/DB2018/ECA.pdf (accessed on 28 April 2018).

| Author(s) | Time Period | Country | Method(s) | Result |

|---|---|---|---|---|

| Sadorsky [42] | 1996–2006 | 9 CEE frontier economies | GMM | Strong and positive impact of FD on EC |

| Kakar et al. [43] | 1980–2009 | Pakistan | 1. CT 2. VECM, GCT | 1. CR between FD to EC. 2. UC from FD to EC |

| Al-Mulali and Sab [44] | 1980–2008 | 30 SSA countries | 1. Pedroni CT 2. VECM, GCT | 1. CR between FD, EG and EC 2. LRC between EC, FD and EG |

| Al-Mulali and Sab [45] | 1980–2008 | 19 countries | 1. Pedroni CT 2. VECM, GCT | 1. CR between FD, EG and EC 2. NC between FD and EC |

| Shahbaz and Lean [46] | 1971–2008 | Tunisia | 1. ARDL 2. VECM, GCT | 1. CR between FD, EG and EC 2. LRC between FD and EC |

| Mehrara and Musai [47] | 1970–2009 | Iran | ARDL | 1. CR between EC, EG and, FD |

| Islam et al. [28] | 1971–2009 | Malaysia | 1. ARDL 2. VECM, GCT | 1. CR between FD, EG and EC 2. SRC from FD to EC |

| Shahbaz et al. [48] | 1971–2011 | China | 1. ARDL 2. GCT | 1. CR between FD, EG and EC 2. NC between FD and EC |

| Çoban and Topcu [27] | 1990-2011 | EU countries | GMM | NC between FD and EC |

| Shahbaz et al. [26] | 1975–2011 | Indonesia | 1. ARDL bounds CT 2. VECM, GCT | 1. CR between FD, EG and EC 2. NC between FD and EC |

| Tang and Tan [30] | 1972–2009 | Malaysia | 1. ARDL 2. Johansen CT | 1. CR between FD, EG and EC 2. LRC between FD and EC |

| Khan et al. [49] | 1975–2011 | South Asia | 1. ARDL 2. GCT | 1. CR between FD, EG and EC 2. Bidirectional LRC between FD and EC |

| Omri and Kahouli [50] (2014) | 1990–2011 | 65 countries | GMM | UC from FD to EC |

| Alam et al. [51] | 1975–2011 | SAARC countries | Panel CT | Significant relationship between EC, EG and FD |

| Salah et al. [31] | 2000–2010 | Lebanon | 1. ARDL 2. VECM, GCT | 1. CR between FD, EG and EC 2. Bidirectional LRC between FD and EC |

| Paramati et al. [52] | 1991–2012 | 20 emerging market economies | 1. Westerlund panel CT 2. Dumitrescu and Hurlin heterogeneous panel causality test | 1. EG, FD positively impact on EC UC from FD to clean EC |

| Mahalik et al. [53] | 1971–2011 | Saudi Arabia | 1. CT 2. VECM | UC from FD to clean EC |

| Bekhet et al. [54] | 1980–2011 | GCC countries | 1. ARDL | CR between EC and FD |

| Legend: ARDL = Autoregressive Distributed Lags Bounds Testing, GMM = Generalized Method of Moments and VECM = Vector Error Correction Method. CT = cointegration test, GCT = Granger causality test, CR = cointegration relationship, UC = Unidirectional causality, NC = No causality, LRC = Long-run causality, SRC = Short-run causality. | ||||

| Notes: CEE = Central and Eastern Europe, SSA = Sub-Saharan Africa, EU = European Union, SAARC = South Asian Association for Regional Cooperation, GCC = Gulf Cooperation Council, FD = Financial Development, EG = Economic Growth, EC = Energy Consumption. | ||||

| Mean | Standard Deviation | Coefficient of Variation, % | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 1992–2015 | 2006–2015 | 2011–2015 | 1992–2015 | 2006–2015 | 2011–2015 | 1992–2015 | 2006–2015 | 2011–2015 | |

| EC | 13,053.8 ×106 | 13,167 × 106 | 13,895.8 × 106 | 1729.5 × 106 | 1052.9 × 106 | 809.5 × 106 | 13 | 8 | 6 |

| Crd | 21.24 | 22.58 | 22.76 | 14.99 | 7.50 | 8.04 | 71 | 33 | 30 |

| GDP | 29,349.3 × 106 | 50,607.7 × 106 | 56,337.3 × 106 | 18,935.6 × 106 | 7738.9 × 106 | 2399 × 106 | 65 | 15 | 4 |

| Variable | The ADF Test | The PP Test | The ZA Test | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Level | k | First Difference | k | Level | First Difference | Level | k | First Difference | k | |

| EC | −2.941 | 0 | −6.786 *** | 0 | −2.859 | −3.629 ** | −2.253 | 0 | −5.387 *** | 0 |

| Crd | −2.938 | 0 | −4.692 *** | 0 | −2.141 | −3.890 *** | −2.581 | 0 | −5.649 *** | 0 |

| y | −2.212 | 1 | −3.240 ** | 1 | −0.268 | −2.921 * | −0.305 | 1 | −3.377 * | 0 |

| Information Criteria | ||||||

|---|---|---|---|---|---|---|

| Lag | LogL | LR | FPE | AIC | SC | HQ |

| 0 | 49.93246 | NA | 1.15 × 10−5 | −2.902951 | −2.010280 | −2.692664 |

| 1 | 103.2121 | 62.96688 | 2.29 × 10−7 | −6.928375 | −5.589368 | −6.612945 |

| 2 | 125.4650 | 20.22991 * | 8.78 × 10−8* | −8.133184 * | −6.347842 * | −7.712611 * |

| Panel A: LM test for Serial Correlation a | Panel E: Johansen Cointegration Rank Test (Trace) | ||||||||

| Lags | LM-Statistic | P-value | Null hypothesis | Eigenvalue | Trace statistics | 0.05 Critical value | P-value | ||

| 1 | 14.576 | 0.103 | None * | 0.828983 | 48.91819 | 29.79707 | 0.0001 | ||

| 2 | 15.766 | 0.071 | At most 1 | 0.329521 | 10.06641 | 15.49471 | 0.2756 | ||

| 3 | 7.8435 | 0.550 | At most 2 | 0.056163 | 1.271634 | 3.841466 | 0.2595 | ||

| 4 | 11.096 | 0.26 | |||||||

| Panel B: Normality Test b | Panel F: Johansen Cointegration Rank Test (Maximum Eigenvalue) | ||||||||

| Statistic | d.f. | P-value | Null hypothesis: | Eigenvalue | Max-Eigen Statistic | 0.05 Critical value | P-value | ||

| Jarque-Bera | 12.065 | 6 | 0.060 | None * | 0.828983 | 38.85177 | 21.13162 | 0.0001 | |

| At most 1 | 0.329521 | 8.794780 | 14.26460 | 0.3036 | |||||

| At most 2 | 0.056163 | 1.271634 | 3.841466 | 0.2595 | |||||

| Panel C: Test for Heteroscedasticity c | |||||||||

| White | d.f. | P-value | |||||||

| Statistic | 112.16 | 114 | 0.531 | ||||||

| Panel D: Test for Stability d | |||||||||

| Modulus | Root | ||||||||

| 0.8784 | 0.856 − 0.196i | ||||||||

| 0.8784 | 0.856 + 0.196i | ||||||||

| 0.7198 | 0.610 − 0.381i | ||||||||

| 0.7198 | 0.610 + 0.381i | ||||||||

| Panel: A | Panel: B | |||||||

|---|---|---|---|---|---|---|---|---|

| TT | MT | GH | GDP | Crd | Price | c | c1 | trend |

| ADF | C | −4.016 | 0.007 | 0.122 | −0.045 ** | 22.918 *** | 0.063 | |

| C/T | −4.734 | 0.037 | 0.113 * | −0.040 | 22.266 *** | 0.076 | −0.004 | |

| C/S | NA | Panel: C | ||||||

| Za | C | −20.374 | 0.115 *** | 0.188 *** | −0.286 *** | 21.140 *** | ||

| C/T | −21.225 | Panel: D | ||||||

| C/S | NA | F-stat | LM stat | White test | JB test | Ramsey RESET | ||

| Zt | C | −4.107 | 14.568 *** | 1.665 *** | 0.536 | 0.823 | 0.189 | |

| C/T | −4.269 | |||||||

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mukhtarov, S.; Mikayilov, J.I.; Mammadov, J.; Mammadov, E. The Impact of Financial Development on Energy Consumption: Evidence from an Oil-Rich Economy. Energies 2018, 11, 1536. https://doi.org/10.3390/en11061536

Mukhtarov S, Mikayilov JI, Mammadov J, Mammadov E. The Impact of Financial Development on Energy Consumption: Evidence from an Oil-Rich Economy. Energies. 2018; 11(6):1536. https://doi.org/10.3390/en11061536

Chicago/Turabian StyleMukhtarov, Shahriyar, Jeyhun I. Mikayilov, Jeyhun Mammadov, and Elvin Mammadov. 2018. "The Impact of Financial Development on Energy Consumption: Evidence from an Oil-Rich Economy" Energies 11, no. 6: 1536. https://doi.org/10.3390/en11061536

APA StyleMukhtarov, S., Mikayilov, J. I., Mammadov, J., & Mammadov, E. (2018). The Impact of Financial Development on Energy Consumption: Evidence from an Oil-Rich Economy. Energies, 11(6), 1536. https://doi.org/10.3390/en11061536