Cross-Border Energy Exchange and Renewable Premiums: The Case of the Iberian System

Abstract

:1. Introduction

Cross-Border Interconnection of Markets

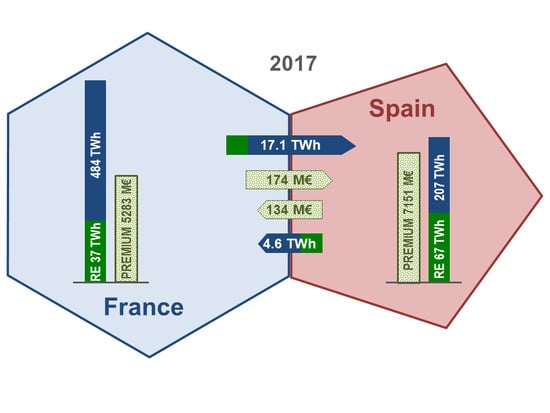

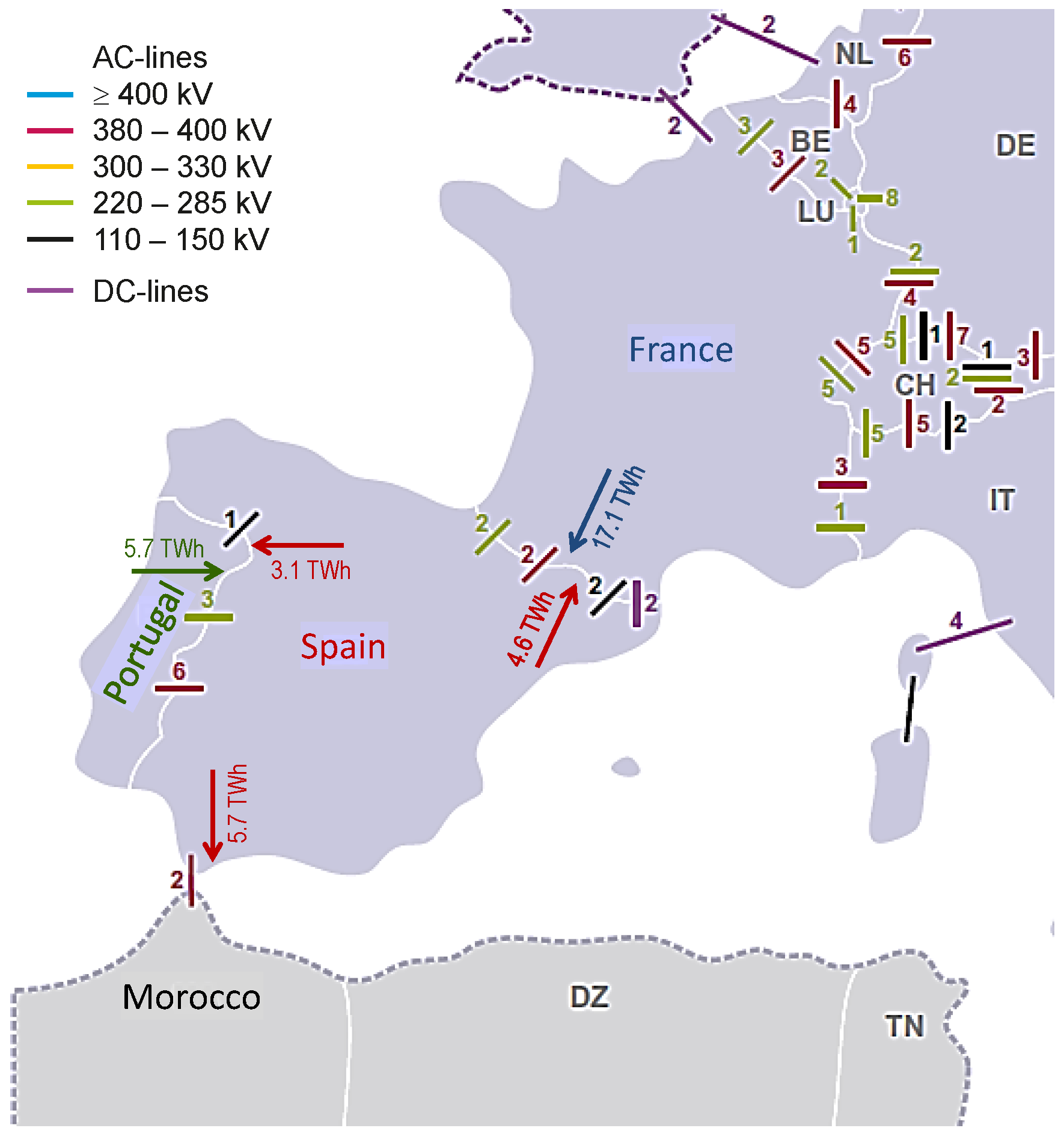

2. An Overview of the Iberian/Spanish Cross-Border Exchanges

State of the Energy Scenario and Policies to Promote Renewable Energies in the Countries Involved

3. Methodology

3.1. Hourly Exchange of Renewable Generation Between Countries

- : hourly net energy exchange between countries A and B (MWh)

- : binary variable indicating the direction of the hourly flow from country A to country B: if country A is supplying; if country A is receiving

- : hourly energy generation in country A (MWh)

- : hourly renewable energy production in country A (MWh)

3.2. Exchange of Premiums Given to Renewable Generation

4. Results and Discussion

Discussion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Jos, D.; Peter, V. EU Climate Policy Explained. Available online: https://ec.europa.eu/clima/sites/clima/files/eu_climate_policy_explained_en.pdf (accessed on 19 November 2018).

- European Commission. Climate Strategies & Targets. Available online: https://ec.europa.eu/clima/policies/strategies_en (accessed on 19 November 2018).

- European Commission. 2050 Energy Strategy. Available online: https://ec.europa.eu/energy/en/topics/energy-strategy-and-energy-union/2050-energy-strategy (accessed on 19 November 2018).

- ETIP SNET. News and Articles. Renewable Energy Sources to Account for 85% of Global Electricity Production by 2050. Tuesday. 19 September 2017. Available online: https://www.etip-snet.eu/renewable-energy-sources-account-85-global-electricity-production-2050/ (accessed on 19 November 2018).

- DNV·GL. Energy Transition Outlook 2017. A Global and Regional Forecast of the Energy Transition to 2050. Available online: https://eto.dnvgl.com/2017/#Energy-Transition-Outlook (accessed on 19 November 2018).

- Scott, M. Half of All Power Set to Come from Renewable Energy by 2050, While Coal Recedes to Just 11%. 22 June 2018. Available online: https://www.forbes.com/sites/mikescott/2018/06/22/half-of-all-power-set-to-come-from-renewable-energy-by-2050-while-coal-recedes-to-just-11/#5acc7c384a1d (accessed on 19 November 2018).

- Rathi, A. One of the Biggest Criticisms against Wind and Solar Energy Has Been Quashed. 17 August 2017. Available online: https://qz.com/1054992/renewable-subsidies-are-already-paying-for-themselves/ (accessed on 19 November 2018).

- Saénz de Miera, G.; del Río González, P.; Vizcaíno, I. Analysing the impact of renewable electricity support schemes on power prices: The case of wind electricity in Spain. Energy Policy 2008, 36, 3345–3359. [Google Scholar] [CrossRef]

- Azofra, D.; Jiménez, E.; Martínez, E.; Blanco, J.; Saenz-Díez, J.C. Wind power merit-order and feed-in-tariffs effect: A variability analysis of the Spanish electricity market. Energy Convers. Manag. 2014, 83, 19–27. [Google Scholar] [CrossRef]

- European Commission. Competition. Available online: http://ec.europa.eu/competition/state_aid/overview/index_en.html (accessed on 19 November 2018).

- European Commision. State Aid: Commission Approves Support to Two Highly Efficient Cogeneration Plants in Germany. 25 September 2018. Available online: https://ec.europa.eu/info/news/state-aid-commission-approves-support-two-highly-efficient-cogeneration-plants-germany-2018-sep-25_en (accessed on 19 November 2018).

- European Commision. Press Release Database. State Aid: Commission Approves €3.5 Billion Support to Three Offshore Windfarms in Belgium. Brussels. 27 September 2018. Available online: http://europa.eu/rapid/press-release_IP-18-5922_en.htm (accessed on 19 November 2018).

- European Commission. Energy. Commission Expert Group on Electricity Interconnection Targets. Available online: https://ec.europa.eu/energy/en/topics/infrastructure/projects-common-interest/electricity-interconnection-targets/expert-group-electricity-interconnection-targets (accessed on 19 November 2018).

- European Commission. Press Release Database. European Solidarity on Energy: Better Integration of the Iberian Peninsula into the EU Energy Market. Brussels. 27 July 2018. Available online: http://europa.eu/rapid/press-release_IP-18-4621_en.htm (accessed on 19 November 2018).

- Roldán-Fernández, J.M.; Burgos-Payan, M.; Riquelme-Santos, J.-M.; Trigo-García, Á.-L. Renewable generation versus demand-side management. A comparison for the Spanish market. Energy Policy 2016, 96, 458–470. [Google Scholar] [CrossRef]

- Roldán-Fernández, J.-M.; Burgos-Payan, M.; Riquelme-Santos, J.-M.; Trigo-García, Á.-L. Renewables versus Efficiency: A Comparison for Spain. Energy Procedia 2016, 106, 14–23. [Google Scholar] [CrossRef]

- Roldán-Fernández, J.-M.; Burgos-Payan, M.; Riquelme-Santos, J.-M.; Trigo-García, Á.-L. The Merit-Order Effect of Energy Efficiency. Energy Procedia 2016, 106, 175–184. [Google Scholar] [CrossRef]

- Roldan-Fernandez, J.-M.; Burgos-Payan, M.; Trigo-Garcia, A.-L.; Diaz-Garcia, J.-L.; Riquelme-Santos, J.-M. Impact of renewable generation in the Spanish Electricity Market. In Proceedings of the 2014 11th International Conference on the European Energy Market (EEM), Krakow, Poland, 28–30 May 2014. [Google Scholar]

- Burgos Payán, M.; Roldán Fernández, J.M.; Trigo García, Á.L.; Bermúdez Ríos, J.M.; Riquelme Santos, J.M. Costs and benefits of the renewable production of electricity in Spain. Energy Policy 2013, 56, 259–270. [Google Scholar] [CrossRef]

- Reuters: Energy. 14 March 2013. Available online: https://www.reuters.com/article/europe-renewables-cooperation/eu-could-save-billions-with-cross-border-renewables-cooperation-idUSL5N0BDDXU20130314 (accessed on 19 November 2018).

- Grande, T.R. Swedish and Norwegian Renewable Energy Policy-the Creation of the World’s First International Green Certificate Market. Masteroppgave ved Institutt for Statsvitenskap, Universitetet I Oslo. Spring 2013. Available online: https://www.duo.uio.no/bitstream/handle/10852/36981/Masteroppgavenxminxfinalx2.pdf?sequence=1 (accessed on 19 November 2018).

- Ecofys and Eclareon. Cross-Border Renewables Cooperation. Study on Behalf of Agora Energiewende. 2018. Available online: https://www.agora-energiewende.de/fileadmin2/Projekte/2017/RES-Policy/144_cross-border_RES_cooperation_WEB.pdf (accessed on 19 November 2018).

- Optimization of the Planning of the Interconnections for the Integration of the European Market with High Renewable Penetration Level (Optimización de la Planificación de las Interconexiones para la Integración del Mercado Europeo con gran Penetración Renovable), ENE2016-77650-R. Available online: https://investigacion.us.es/sisius/sis_proyecto.php?idproy=27691 (accessed on 19 November 2018).

- GEMS. Available online: https://www.ingelectus.com/products/ and https://www.isotrol.com/web/sectores/mercado-electrico/gems/ (accessed on 19 November 2018).

- ENSO-e. Statistical Factsheet 2017. 2018. Available online: https://docstore.entsoe.eu/Documents/Publications/Statistics/Factsheet/entsoe_sfs_2017.pdf (accessed on 19 November 2018).

- REE-Red Eléctrica de España. Spanish Electricity System 2017 Report. 2018. Available online: https://www.ree.es/en/statistical-data-of-spanish-electrical-system/annual-report/spanish-electricity-system-2017-report (accessed on 19 November 2018).

- Royal Decree Law 1/2012 on Revocation of Public Financial Support for New Electricity Plants from Renewable Sources, Waste or CHP. Available online: http://www.boe.es/boe/dias/2012/01/28/pdfs/BOE-A-2012-1310.pdf (accessed on 19 November 2018).

- Royal Decree-Law 413/2014 on Electricity Generation by Means of Renewable, Cogeneration and Waste Facilities. Available online: https://www.boe.es/diario_boe/txt.php?id=BOE-A-2014-6123 (accessed on 19 November 2018).

- Order IET/1045/2014 of 16 June, Approving the Remuneration Parameters for Standard Facilities, Applicable to Certain Electricity Production Facilities Based on Renewable Energy, Cogeneration and Waste. Available online: http://www.boe.es/boe/dias/2014/06/20/pdfs/BOE-A-2014-6495.pdf (accessed on 19 November 2018).

- Eurostat. Statistics Explained; Renewable Energy Statistics. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php/Renewable_energy_statistics (accessed on 19 November 2018).

- INELFE. Interconexión Eléctrica Francia-España or Electricity Interconnection France-Spain. Available online: https://www.inelfe.eu/en/about-inelfe (accessed on 19 November 2018).

- Legal Sources on Renewable Energy. Portugal. Available online: http://www.res-legal.eu/search-by-country/portugal/ (accessed on 19 November 2018).

- European Commission Press Release. State Aid: Commission Authorises Portuguese Demonstration Scheme for Ocean Energy Technologies. Brussels. 23 April 2015. Available online: http://europa.eu/rapid/press-release_IP-15-4836_en.htm (accessed on 19 November 2018).

- Commission de Régulation de l’Énergie. Délibération de la CRE du 13 Juillet 2016 Relative à l’Évaluation des Charges de Service Public de l’Énergie pour 2017. 20 July 2016. Available online: https://www.cre.fr/Documents/Deliberations/Decision/cspe-2017 (accessed on 19 November 2018).

- Commission de Régulation de l’Énergie. Annexe 7. Historique des Charges de Service Public de l’Énergie. Available online: https://www.cre.fr/content/download/14718/174766 (accessed on 23 November 2018).

- International Energy Agency. Available online: https://www.iea.org/policiesandmeasures/renewableenergy/?country=Morocco (accessed on 19 November 2018).

- IESOE. Electricity Interconnection in South-Western Europe. Available online: https://www.iesoe.eu/iesoe/ (accessed on 19 November 2018).

- RTE. Actual Generation per Production Type. Available online: http://clients.rte-france.com/lang/an/visiteurs/vie/prod/realisation_production.jsp (accessed on 19 November 2018).

- ERSE (Entidade Reguladora Dos Serviços Energéticos). PRE-Produção em Regime Especial. Available online: http://www.erse.pt/pt/desempenhoambiental/prodregesp/Paginas/default.aspx (accessed on 19 November 2018).

- OMIE. Available online: http://www.omie.es/reports/index.php?report_id=211# (accessed on 19 November 2018).

- CNMC (Comisión Nacional de los Mercados y la Competencia). Información Mensual de Estadísticas Sobre las Ventas de Régimen Especial. Contiene Información Hasta Mayo de 2018. Available online: https://www.cnmc.es/estadistica/informacion-mensual-de-estadisticas-sobre-las-ventas-de-regimen-especial-contiene-21 (accessed on 19 November 2018).

- The World Bank. Population Data. Available online: https://data.worldbank.org/indicator/sp.pop.totl (accessed on 19 November 2018).

| Country | Median | Mean | Maximum | Standard Deviation |

|---|---|---|---|---|

| Spain—SP | 26.15 | 27.06 | 57.88 | 9.99 |

| France—FR | 6.41 | 7.14 | 21.27 | 3.59 |

| Portugal—PT | 26.09 | 29.07 | 87.23 | 15.18 |

| Countries | 2015 | 2016 | 2017 | Average |

|---|---|---|---|---|

| Spain-France (SP-FR) | 28.45 FR→SP | 1.87 FR→SP | 90.45 FR→SP | 40.26 FR→SP |

| Spain-Portugal (SP-PT) | 74.69 SP→PT | 99.27 PT→SP | 27.11 PT→SP | 17.22 PT→SP |

| Spain-Morocco (SP-MA) | 68.35 SP→MA | 60.79 SP→MA | 69.41 SP→MA | 66.18 SP→MA |

| Spain-Neighbour (SP-NE) | 114.59 SP→NE | 40.37 NE→SP | 48.15 NE→SP | 20.07 SP→NE |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Roldan-Fernandez, J.M.; Gómez-Quiles, C.; Merre, A.; Burgos-Payán, M.; Riquelme-Santos, J.M. Cross-Border Energy Exchange and Renewable Premiums: The Case of the Iberian System. Energies 2018, 11, 3277. https://doi.org/10.3390/en11123277

Roldan-Fernandez JM, Gómez-Quiles C, Merre A, Burgos-Payán M, Riquelme-Santos JM. Cross-Border Energy Exchange and Renewable Premiums: The Case of the Iberian System. Energies. 2018; 11(12):3277. https://doi.org/10.3390/en11123277

Chicago/Turabian StyleRoldan-Fernandez, Juan Manuel, Catalina Gómez-Quiles, Adrien Merre, Manuel Burgos-Payán, and Jesús Manuel Riquelme-Santos. 2018. "Cross-Border Energy Exchange and Renewable Premiums: The Case of the Iberian System" Energies 11, no. 12: 3277. https://doi.org/10.3390/en11123277

APA StyleRoldan-Fernandez, J. M., Gómez-Quiles, C., Merre, A., Burgos-Payán, M., & Riquelme-Santos, J. M. (2018). Cross-Border Energy Exchange and Renewable Premiums: The Case of the Iberian System. Energies, 11(12), 3277. https://doi.org/10.3390/en11123277