1. Introduction

China has established the world’s most complete iron and steel industry chain system, which provides most the iron and steel materials for the national economy [

1]. In 2011, the output was 850 million tons and in 2015 it equaled 1.02 billion tons, after reaching a historical peak of 1.046 billion tons in 2014. The domestic market share of steel is over 99%, effectively satisfying national economic and social development.

Even so, the iron and steel industry faces non-neglected problems, especially the overcapacity. In 2015, China’s steel production capacity reached 1.13 billion tons, far exceeding its 1.02 billion tons of actual production. Steel production capacity has gradually shifted from regional, structural surplus to absolute excess. The concentration degree has ceased to rise, and the first 10 iron and steel enterprises’ concentration degree fell from 49% in 2010 to 34% of 2015. Although energy consumption and pollutant emissions of per ton steel are decreasing year over year, these changes cannot offset the increase in energy consumption and total pollutants caused by the excessive steel output. In particular, in the Beijing-Tianjin-Hebei region and the Yangtze River delta, the environmental carrying capacity has reached its limit. A large area of haze has spurred significant environmental pressure and negative public opinion, forcing the government to enact more stringent industry policies and environmental protection measures in the iron and steel industry.

Therefore, the prediction of a reasonable production interval and calculation of the emissions level can provide data and reference support for eliminating excess capacity and formulating CO2 emissions reduction targets. This is one of the starting points and importance of this paper.

In addition, in the future, sole dependence on technology innovation will no longer fulfill CO2 emissions reduction targets, and this will also increase enterprises’ investment. Therefore reasonable carbon tax policies and government subsidies are imperative. In addition, to better control emissions reduction, carbon capture and sequestration (CCS) represents another way to reduce CO2 on a large-scale. Over the next 15 to 30 years, China’s steel industry CCS demonstration projects will be planned and put into production, so large-scale investment in CCS projects also concerns to the enterprise and government. Therefore, reasonable reduction technologies and system policies can provide a foundation for the subsequent development of regional emissions reduction policies and economic impact assessment, hence the second aim of this paper.

The remainder of this paper is organized as follows:

Section 2 provides a literature review focusing on the carbon tax levy system and production subsidies mechanism research.

Section 3 introduces the two-stage game theory modeling, policy assumptions and data sources. In

Section 4, based on accounting data and statistical analysis, we present and discuss our results in detail.

Section 5 provides conclusions and policy recommendations for China’s iron and steel industry.

2. Literature Review

Many economic scholars have studied CO2 reduction policies, including carbon tax, carbon trading, and carbon sink. Most carbon tax levy systems and production subsidies have focused on the general equilibrium model. By setting different tax rate and output subsidy return conditions, the emissions reduction effect and impact on the economy have been analyzed using the CGE model (computable general equilibrium model, typically composed of a set of equations to describe supply, demand and market relationships). Other academic models have been employed as well.

In the field of CO

2 reduction, Jorgenson et al. [

2,

3] used the CGE model in pioneering research. Manne et al. [

4] introduced a carbon tax module via the MERGE model, in which they calculated and analyzed the differences in cutting emissions costs in different regions of the world. Jorgenson and Wilcoxen [

5] predicted the effect of the energy tax by using a CGE model. Zhang [

6] used the CGE model to examine the economic implications of carbon abatement for the Chinese economy in the first systematic and comprehensive attempt. Later Zhai and Li [

7], Xie et al. [

8,

9] conducted the similar study using the CGE model as well.

Since the beginning of the 21st century, the CGE model has been improved and developed. This model has been applied to many countries, sectors and more policy scenarios. For example, Kemferthe and Welsch [

10] analyzed the economic effects of government carbon tax policy using a dynamic CGE model to discuss different elasticities and tax-returning mechanisms between energy and capital, energy and labor. Wendner [

11] used a general equilibrium model to analyze the carbon tax impact on the Austrian economy. Van Heerden et al. [

12] found that the environment tax can be given back to the industrial sector by reducing labor and capital taxes directly using a CGE model. Abrell [

13] analyzed the use of market-based emissions regulation instruments to address CO

2 emissions in transportation. Benavides et al. [

14] examined the economy-wide implications of a carbon tax applied in the Chilean electricity generation sector via both an energy sectorial model and a dynamic stochastic general equilibrium model. Yahoo and Othman [

15] evaluated the economy-wide impacts of implementing two different types of CO

2 emissions abatement policies in Malaysia using market-based (i.e., carbon tax) and command-and-control mechanism (i.e., sectoral emissions standards). These papers were directed at a particular country or sector, with a specific tax or subsidy value. By calculating the results using CGE models, researchers can gauge the economic and environmental response.

Using the input-output table published by the Chinese Statistical Department, scholars have analyzed the impact in China of imposing an energy tax and subsidy on the economy, energy, environment and production sectors. This research has been extended to provinces and sectors.

Liang et al. [

16] examined how to reduce carbon tax on the export of energy-intensive industry international competitiveness by a CGE model. They suggested offering a tax break on energy-intensive, labor-intensive export industries, and implementing a carbon tax return for other industries Yang et al. [

17] used a CGE model to quantitatively simulate the impact of energy tax scenarios. They found that an energy tax can help to minimize the CO

2 and SO

2 emissions, with increasing marginal emissions reduction costs. Wu et al. [

18] developed the China regional dynamic general equilibrium model and analyzed the marginal cost curve between various provinces and cities from 2007 to 2020, then discussed carbon emissions trading and carbon tax policy choices. Xu and Zhang [

19] applied a multi-sectoral dynamic CGE model to analyze the impacts of a carbon tax on China’s economy and carbon intensity at the rate of 40 yuan/t without tax relief as a baseline scenario. They also compared the change trends of carbon intensity and the proportion of non-fossil energy in primary energy consumption from the perspective of achieving the emissions reduction targets in 2020 and 2030. Chen et al. [

20] established an energy CGE model for Guangdong Province, and simulated the energy-saving and emissions reduction effects from the enactment of an energy tax or carbon tax at various tax rates, they also analyzed the mitigation effects on an economic system given various tax refund plans. Ling et al. [

21] built a multi-sectoral dynamic CGE model with a coal resource tax module, to study the general impacts of such reform policy on the Chinese economy and environment. However, due to specific parameter values and assumptions, along with the rapid development of China’s economy, these studies’ results do not necessarily correspond to the actual situation. Moreover, the social accounting matrix (SAM) requirement is higher and this data is not published every year.

There have also been many papers on environmental regulations using game theoretic approaches. Scholars have applied game theory to the study of carbon tax levy and subsidy mechanism. Extant literatures have focused primarily on constructing a two-stage game model to establish the relationship between the government and enterprise, and between different enterprises. In particular, scholars have studied the optimal level of emissions and the optimal output of subsidy mechanisms.

Much of the early research on environmental regulations using game theoretic approach focused on permits, standards and technological innovation. Montero [

22] and Bruneau [

23] compared the incentives to invest in environmental research and development (R&D) offered by four policy instruments—emissions standards, performance standards, tradeable permits, and auctioned permits- and found the relationship between abatement, innovation, and the production process itself to be critical to a sound understanding of these incentives. Then product differentiation, countervailing incentives and other market-based instruments were incorporated into the theory, such as by Requate [

24,

25], Puller [

26] and Poyago-Theotoky [

27,

28].

In subsequent studies, scholars have applied the game theory approach to environmental regulations and reduction mechanisms. Youssef et al. [

29], Ouchida and Goto [

30], and Moner-Colonques and Rubio [

31] looked into the society economic levels under different environmental policies. Demailly and Quirion [

32] quantified the impact of the European Emission Trading Scheme on two dimensions of competitiveness, production and profitability, for the iron and steel industry. Under a mixed market structure, Cato [

33] proposed an emissions reduction mechanism based on a subsidy reduction, and demonstrated that the mechanism could achieve an optimal social result. Eyland and Zaccour [

34] looked at the optimization of two different governments and their respective firms. Parametric values inside the set [0, 1) were used to represent the possible extents of the border tax adjustment (BTA) depending on both countries’ respective environmental policies allowing countries to have different carbon policies. To examine the applicability of the “Pigouvian tax” in China’s present low-carbon economy, Ouchida and Goto [

35] concluded that social welfare under a time-consistent emissions tax (emissions subsidy) policy was always welfare-enhancing rather than laissez-faire. McDonald and Poyago-Theotoky [

36] found a counterintuitive positive relationship between R&D input spillovers and emissions taxes and a U-shaped relationship between the optimal emissions tax and R&D spillover in the d’Aspremont and Jacquemin (AJ henceforth) model. Lambertini et al. [

37] explored the relationship between competition and innovation when R&D investment attempts to reduce pollutant emissions. They have uncovered an inverted U-shaped relationship between “green” innovation and competition. It can be said that the application of game theory abroad has been more mature and systematic.

In China, there is also much research on environmental regulations from a game theory approach. Li et al. [

38] proposed a two-stage dynamic game model comprising two sub-games involving a government-firm and firm-firm relationship. They also investigated the second-best emissions tax and its revenues refunding scheme based on an output subsidy with exogenous abatement target. Li et al. [

39] constructed a two-stage dynamic game model based on two representative iron and steel firms (eastern and western) to examine the effects of a uniform or discriminated emissions tax levied by the central government on abatement costs, social economic welfare and the firms’ competitiveness. Zhang [

40] built a three-stage game model between the government and enterprises to analyze the feasibility and mode selection of carbon tax policy. In the process of supply chain low-carbonization, a three-stage game model was constructed by Li et al. [

41] between the government and enterprises by considering carbon tax as one regulation mode. Qiao et al. [

42] made the first attempt to use non-cooperation game theory to study airlines’ carbon tax strategies in the EU. Xu et al. [

43] studied joint production and pricing problem in a manufacturing firm with multiple products under cap-and-trade and carbon tax regulations, and compared the effects of the two regulations on the total carbon emissions. However, because China has not yet implemented an emissions trading mechanism, carbon tax mechanism, or other emissions reduction policies, research can only establish models and make scenario assumptions.

Extant literature shows that the research on reduction mechanism is comparatively developed. Firstly, the CGE model and game theory can provide policy references for emissions reduction. Nevertheless, the CGE model used to study tax reduction mechanisms generally focuses on the specific tax rate and output subsidy, to identify the corresponding reduction. Game theory seeks to assess the optimal emissions level and output subsidy mechanism; therefore, this method is more suitable for the government to observe the economic and environmental changes between countries and regions when formulating a certain emissions reduction policy.

Secondly, we found that research has traditionally focused on national-level and overall sectors (e.g., industry, service industry, agriculture), whereas research on the provincial level and a single industry department is limited. Yet the steel industry is a foundational component of the China’s national economy and one of the industrial sectors with the greatest CO2 emissions, which undertakes important emissions reduction tasks to control the nation’s greenhouse gases.

Thirdly, the literature highlights models, but empirical analysis is lacking. The basic parameters of empirical analysis (especially based on enterprises) are usually derived from existing data from developed countries. In developing countries like China, there are significant regional differences and regional economic development imbalances; thus, some areas’ parameters and data, including those of the iron industry, need to be supplemented.

In addition, with the continuous development of China’s economy and the world’s constant attention to environmental problems, the pressure around emissions reduction will only continue to increase. A separate carbon tax or product subsidy policy would not meet the country’s economic development and emissions reduction level needs. Projects such as CCS, carbon sinks and other significant CO2 emissions reductions methods will likely be incorporated into the entire reduction system. Therefore, game theory warrants attention in this respect.

In conclusion, a reasonable reduction policy is the primary focus of this paper. The paper organizes energy, environment and economic data from the six main areas’ of the iron and steel industry in China. Combined with the corresponding long-term plan issued by the government, we consider and integrate the carbon tax, production subsidies, CCS, and external loss of CO2 into the emissions reduction mechanism to build a two-stage dynamic game model. Then, based on different periods of the steel industry’s carbon emissions with decreased demand, we discuss the six main areas’ market game behavior under different reduction targets, and investigate the differential effects of emissions reduction scenarios and their economic impacts on the iron and steel industry.

3. Methods

3.1. Notations and Explanations

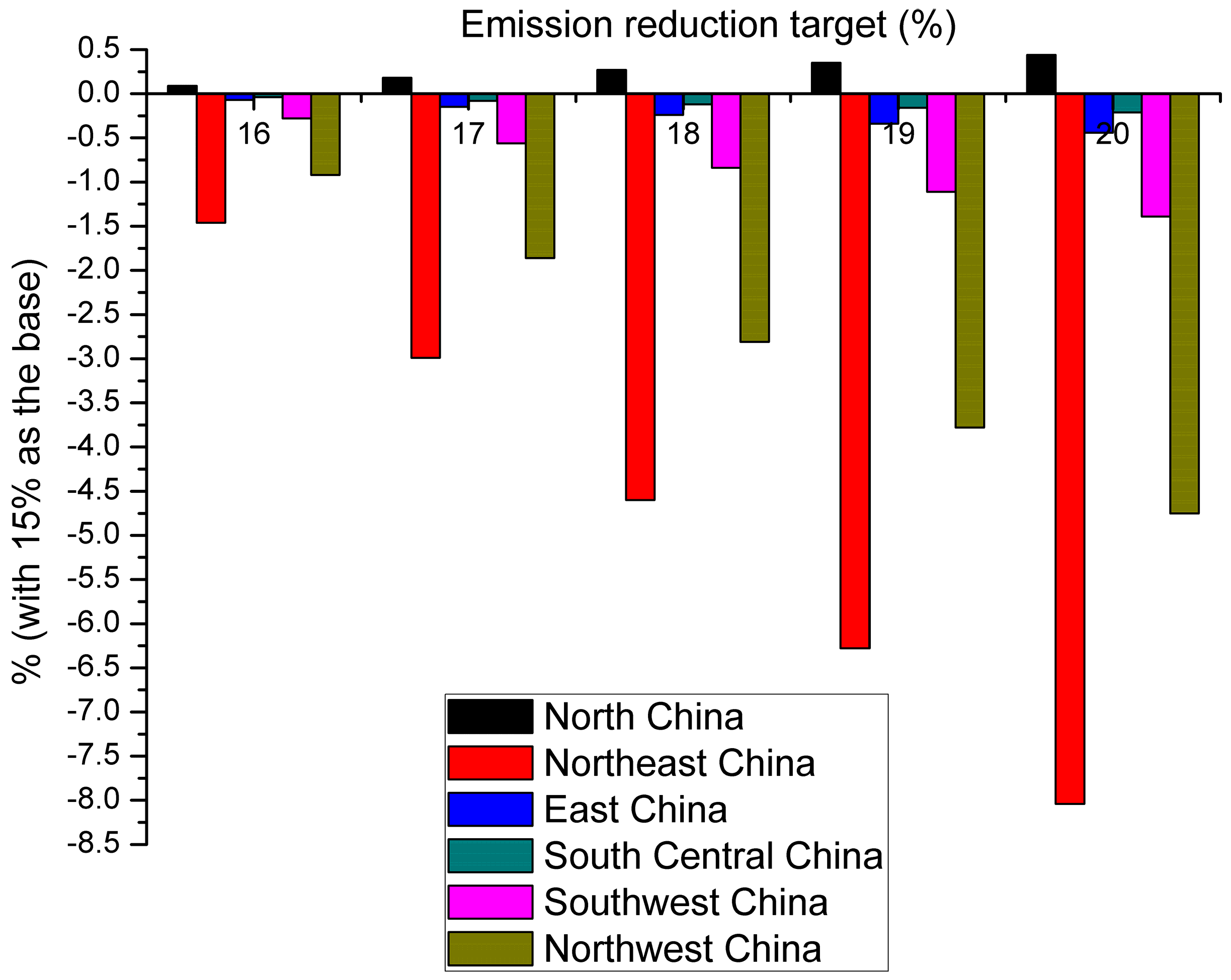

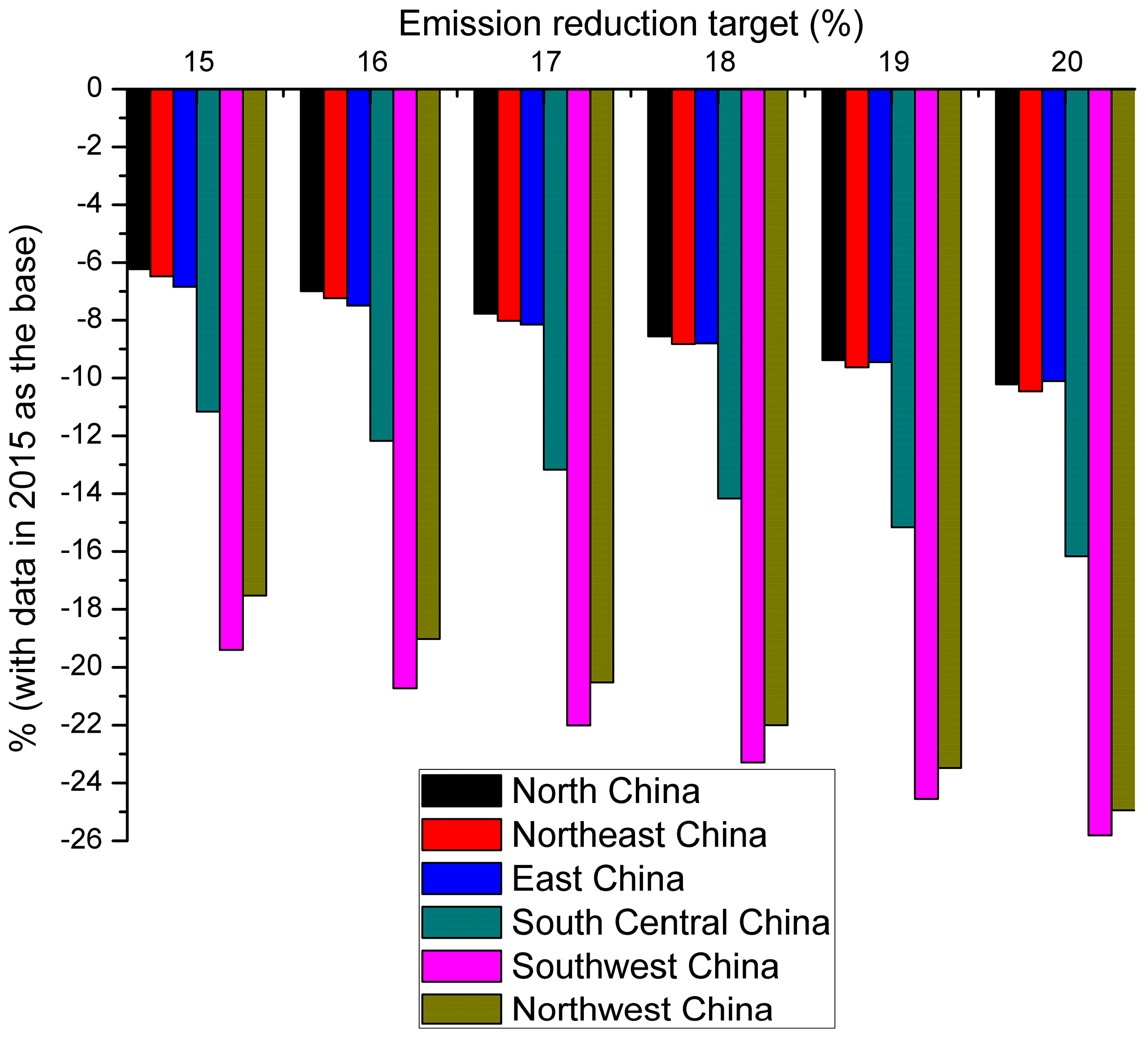

According to the regional division of China, China is divided into six regions: North China (i.e., Beijing, Tianjin, Hebei, Shanxi, and Inner Mongolia), Northeast China (i.e., Liaoning, Jilin, and Heilongjiang), East China (i.e., Shanghai, Jiangsu, Zhejiang, Anhui, Fujian, Jiangxi, and Shandong), South Central China (i.e., Henan, Hubei, Hunan, Guangdong, Guangxi, and Hainan), Southwest China (i.e., Chongqing, Sichuan, Guizhou, Yunnan, and Tibet), Northwest China (i.e., Shanxi, Gansu, Qinghai, Ningxia, and Xinjiang). In this paper, regions are presented by subscripts: 1 represents North China, 2 represents Northeast China, and so on.

The main research focus of this paper includes the government and the above six regions, the regional steel industry data is regarded as a steel enterprise entity). The government emissions reduction policy is a double game problem. Firstly, there is a decomposition game between the government and regional enterprises: government stipulates the emissions reduction target for a certain period, after which the regional enterprises should determine their respective reduction ranges according to their own cost curves. Secondly, there is a game of product output between the six regions, and the different targets of the regional enterprises will affect their respective output levels and market competitiveness.

Therefore, the resultant game order is as follows: in the first stage, the government set corresponding reduction targets and reduction policies (e.g., carbon tax, product subsidies, CCS, independent or mixed); in the second stage, on the premise of guaranteeing profit maximization, the regional enterprises choose their respective reduction targets and output levels simultaneously. Based on this idea, this paper adopts the inverse method to solve the two-stage game problem. The notations used in this paper and their explanations are presented in

Table 1.

It is assumed that each regional enterprise produces homogeneous products and compete for production in the product market. There is no regional variability and the prices of steel are the same. The market reverse demand curve of the enterprise is P(Q). This paper describes the relationship between product price and demand using a linear combination, and P′(Q) < 0, where P indicates price, Q is total output, and . At the same time, the paper assumes that in the future equilibrium market, production and consumption are equal. The production cost of the enterprise is different, while the marginal emissions reduction cost is incorporated into the cost function, namely , where . It is assumed that the cost function satisfies , . D(E) represents an external macro loss to the environment caused by CO2 emissions, . In addition, because the CCS cost curve is still in the valuation stage, and is directly related to the amount of CO2 trapped in the transport storage, the curve approximation is proposed to synthesize the linear relation, M = am + b.

3.2. Modeling

3.2.1. Scenario Analysis

In this section, we discuss three scenarios due to policy uncertainties:

Case 1: Only carbon tax scenario

At present, carbon taxes are likely to be the only policy tool for reducing emissions targets, due to policy and technological constraints.

Case 2: Mixed scenario, Carbon tax and subsidy

With the gradual increase in emission reduction targets, carbon tax reduction will seriously compress producers’ profit, so subsidies based on product output may increase producers’ enthusiasm and ability to produce. This paper assumes that subsidies are derived from carbon taxes. More specifically the carbon tax levy will be partially or entirely returned to the producer in the form of subsidies.

Case 3: Mixed scenario, Carbon tax, subsidy, and CCS

As emissions reduction targets continue to grow, carbon tax and subsidies may not fulfill the criteria for reducing emissions. At the same time, with advancing technology and increasing tax pressure, CCS will be employed over the mid- and long-term as a means of large-scale CO2 emission reduction. A mix of reduction policies will help achieve the CO2 emissions reduction target more easily. This paper assumes that the subsidy comes from carbon tax, and CCS demonstration project is funded through government investment.

3.2.2. Two-Stage Dynamic Game Model

In the second phase of the game, the government sets emissions reduction targets and reduction policies. Regional enterprises choose their own production and reduction targets, and the profit function under different cases are as follows:

where the marginal cost of reducing emissions is

, and the region’s steel industry carbon tax is calculated as

.

In the case of certain carbon tax and subsidy values, CO2 reduction and production yield is maximized in each region, namely .

In this paper, due to the consideration of a various reduction policies, the social welfare function is extended to include consumer surplus, producer surplus, carbon tax levy, product subsidies, CCS investment, macro-environmental emissions losses, and so on. The specific forms are as follows:

In the first stage of the game, based on the achievement of emissions reduction targets and the response of regional enterprises to the government’s emissions reduction policies, the government should formulate corresponding policies to maximize social welfare. The government’s policy can be expressed as follows:

3.2.3. Policy Assumptions

To compare the effects of emissions reduction under different policies, this paper constructs a selection model of the steel industry in six regions in China. Current research is lacking in this area, and the target of emissions reduction and other policy planning is less and more ambiguous in China than in other countries. Therefore, according to relevant policies and planning, the paper assumes three reasonable policy scenarios. Each focuses on the decomposition of the intensity target of CO2 emissions reduction in the steel industry under different policies, the influence of regional steel industry output and the change in social welfare. The main assumptions are as follows:

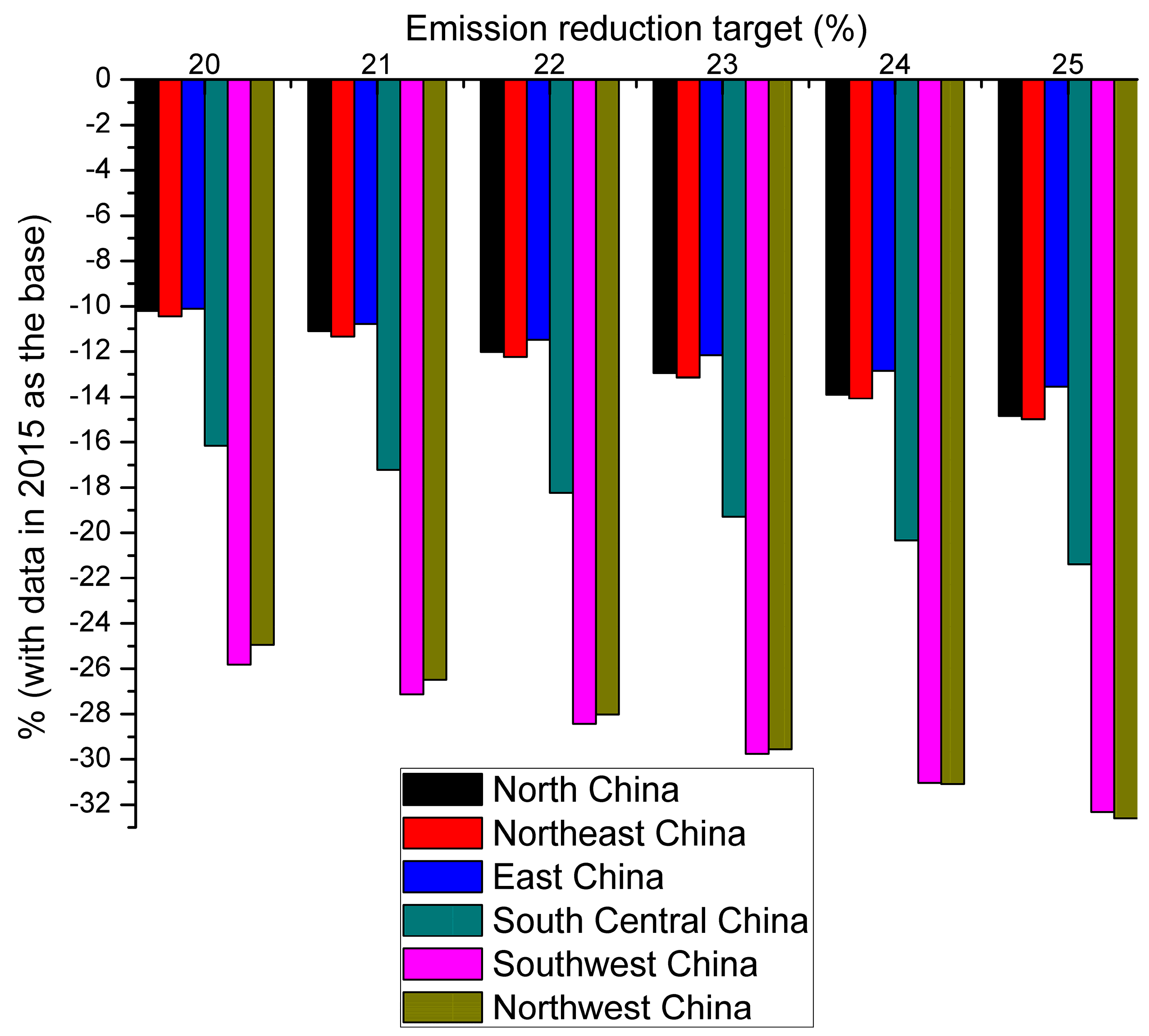

1. Carbon tax scenario in 2020

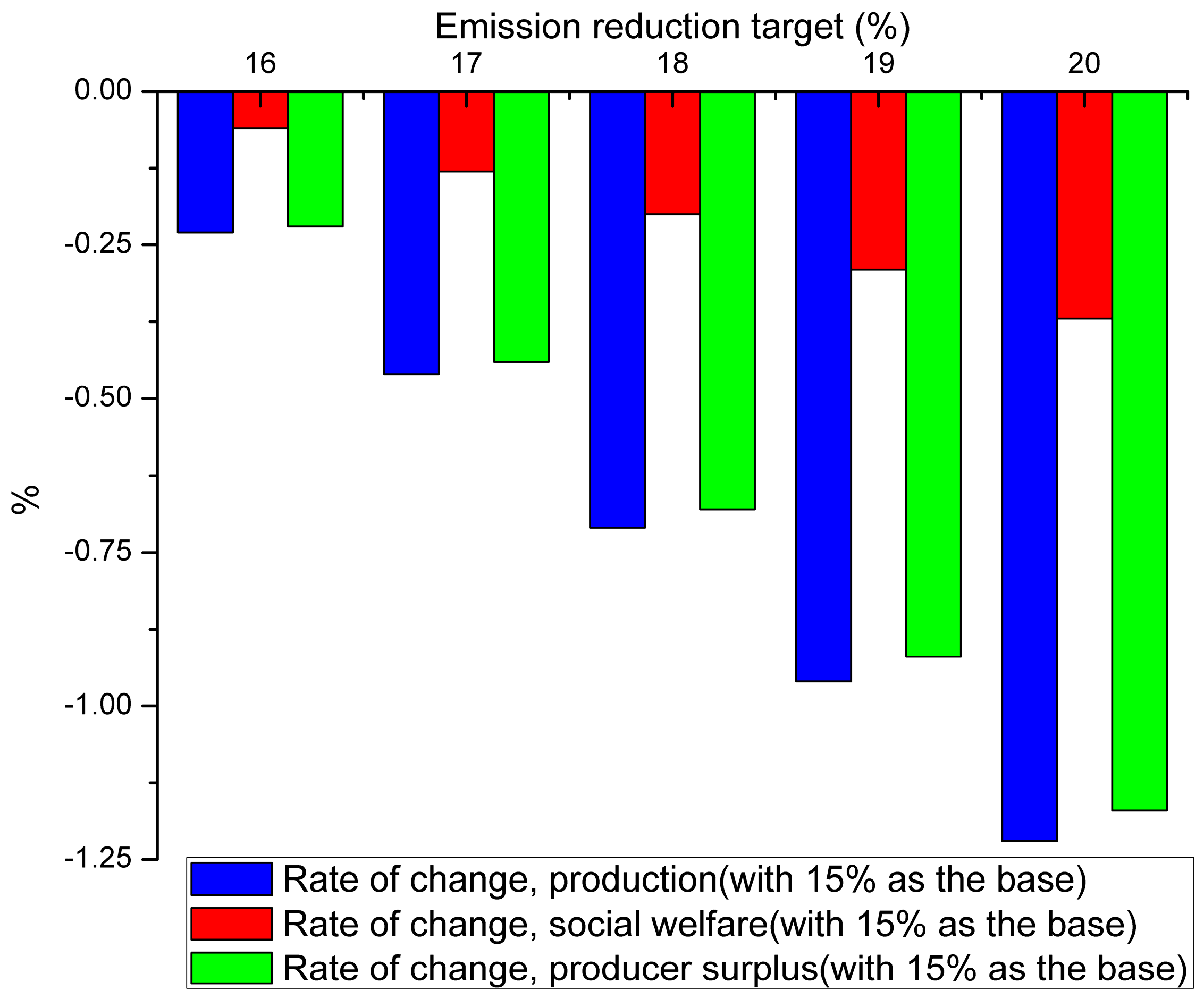

In this scenario, we assume that by 2020, the steel industry’s CO2 intensity will fall by at least 15% compared to in 2010. Given that technological innovation alone will not be sufficient for high carbon-intensity reduction, the carbon tax will be a necessary policy tool. The solution for this scenario is similar to that of Case 1. Then, we calculate the corresponding results of social welfare and investigate scenarios in which the intensity of CO2 emissions dropped from 15 to 20%.

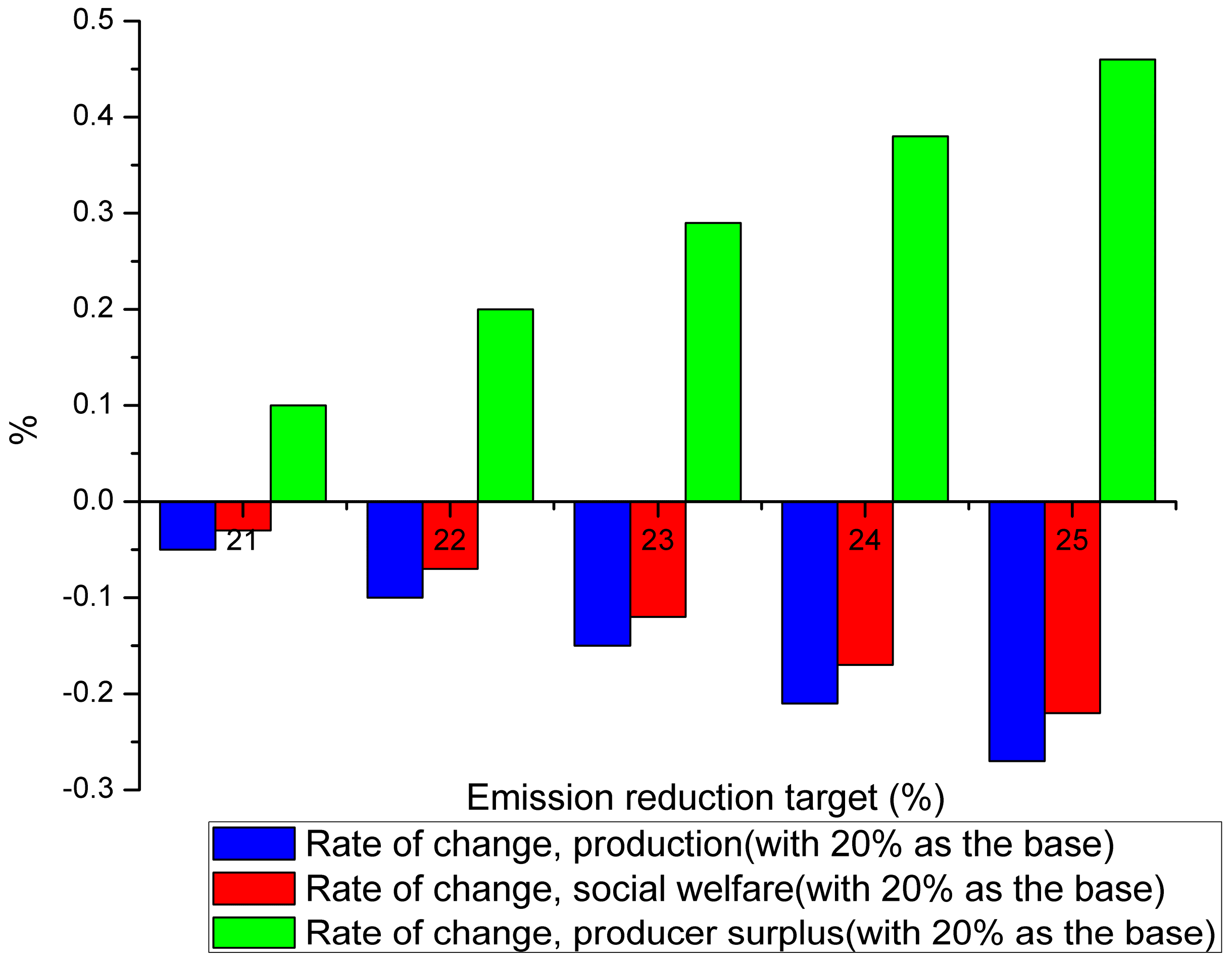

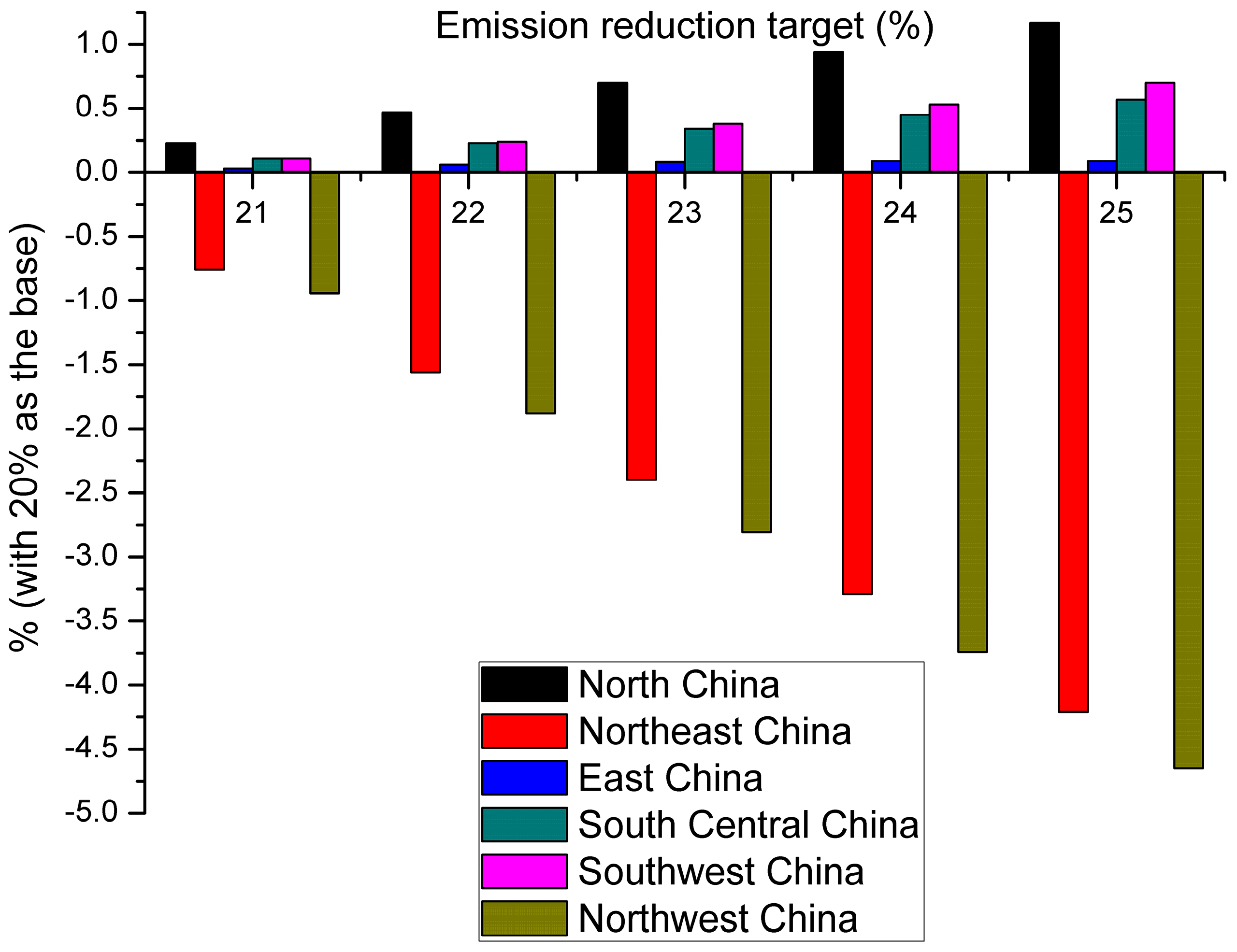

2. Carbon tax and product subsidy scenario in 2025

In this scenario, we assume that by 2025, the CO2 intensity of the steel industry will fall by at least 20% compared to that in 2010. Again, because technological innovation alone will not be sufficient for high carbon-intensity reduction, the carbon tax will be a necessary policy tool. However the carbon tax levy has greatly increased the industry’s investment, and product subsides to producers can reduce the tax burden on producers while also meeting emissions demands. Thus, carbon tax and subsidy will comprise a dual method in 2025. The solution in this scenario corresponds to that of Case 2. Then, we calculate the social welfare results, and investigate scenarios in which the intensity of CO2 emissions dropped by 20–25%.

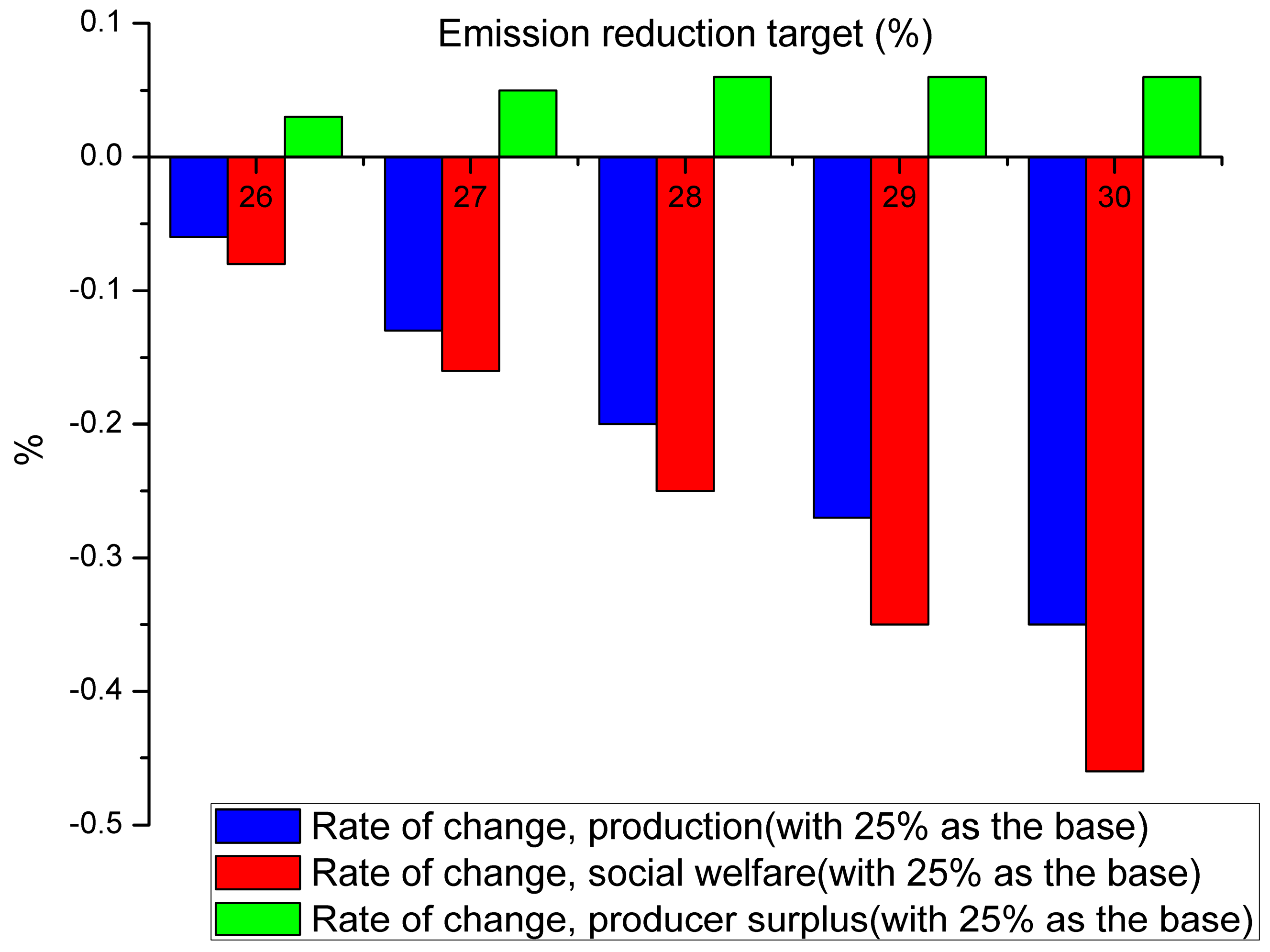

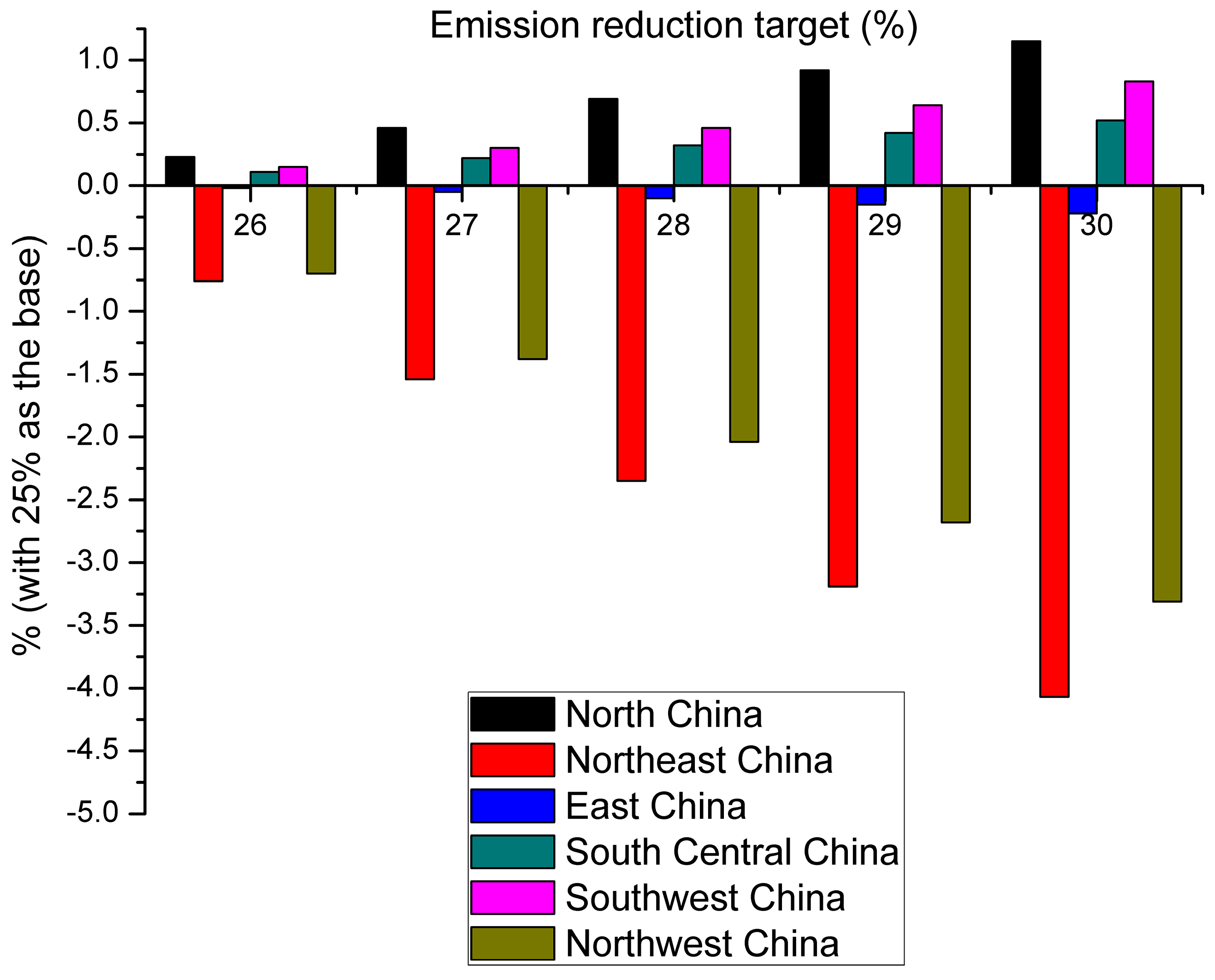

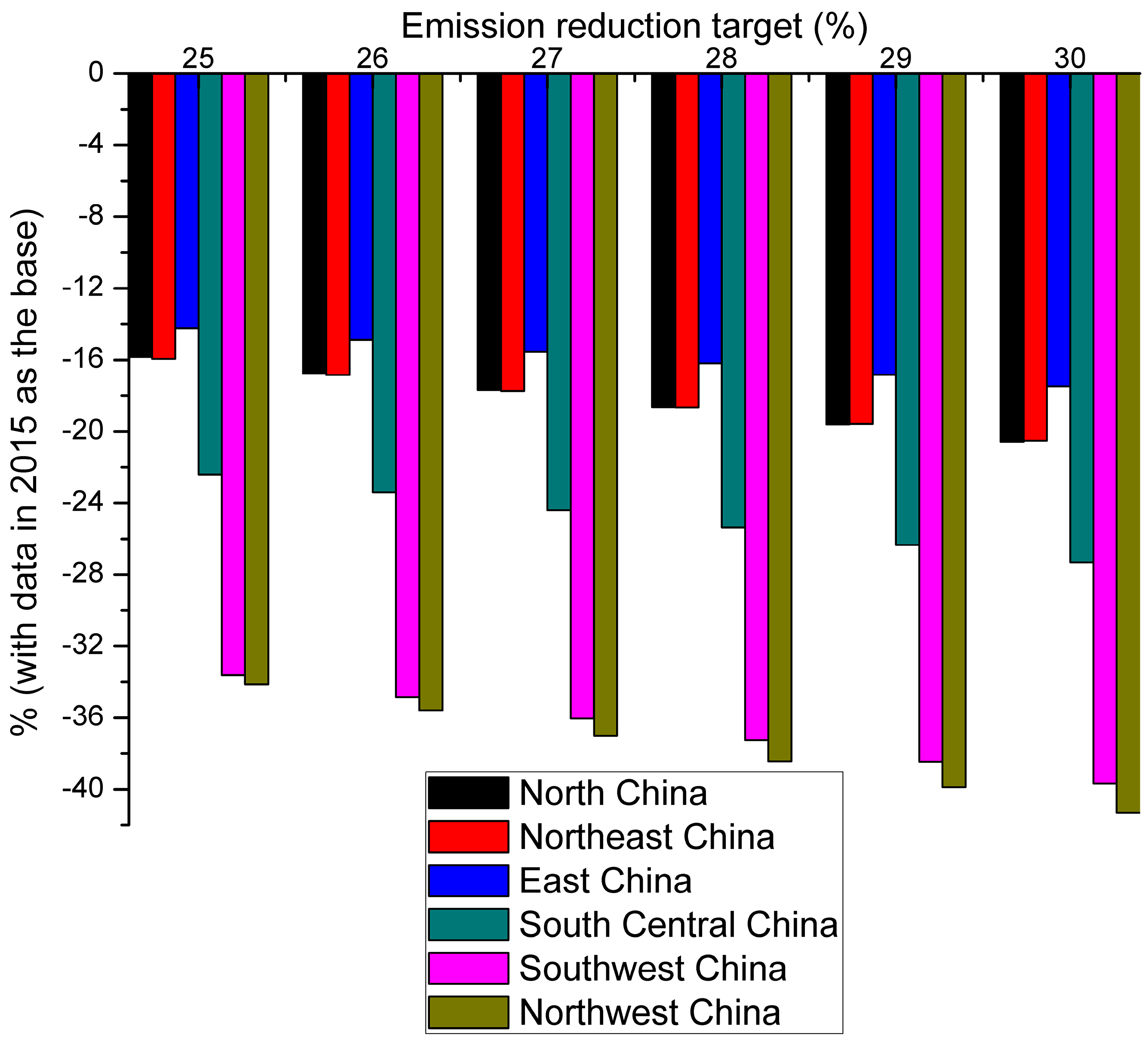

3. Carbon tax, product subsidy, and CCS demonstration project coexistence scenario in 2030

In contrast to 2010, we assume that the steel industry’s CO2 intensity will fall by at least 25% by 2030. Again, because technological innovation alone will not be sufficient for high carbon-intensity reduction, the carbon tax and product subsidies will be necessary policy tools. With the improving CCS technology, large-scale CCS demonstration projects will be able to be applied to the steel industry. As a result, carbon tax, product subsidy, and CCS demonstration projects (i.e., 1–2 million ton CO2 level) will be considered in 2030. The solution to this scenario corresponds to that of case 3. Then, we calculate the corresponding social welfare results, and investigate scenarios in which the intensity of CO2 emissions dropped by 25–30%.

3.3. Parameters and Data Sources

In this paper, the CO

2 MAC (marginal abatement cost) results were derived from the CO

2 shadow price calculations in 2005–2015. According to [

44,

45,

46], in the directional distance model the economic output is considered as desirable output, while CO

2 emissions is the undesirable output. An area’s production possibility is defined as:

. According to Färe’s [

47] description of the directional distance function, we introduce the direction vector

g = (

gy,

gb). The output-based distance function can be defined as follows:

According to the method of nonparameter linear programming, the objective function is calculated as follows:

According to Lee [

48], the undesirable output shadow price calculation formula can be written as:

Then, according to the six regions’ respective shadow price, the MACs of each region were fitted. The main parameters of each region are shown in

Table 2.

The external macroscopic loss parameters of CO

2 emissions refer to Giorgio Guenno and Silvia Tiezzi [

49], converted into 14.55 yuan per ton of CO

2.

In 2030, we assume that the steel industry will plan to build 1-2 million ton demonstration projects funded by the government. The cost curve refers to [

50,

51,

52,

53], and the linear curve is

. The unit is RMB.

Provincial steel production data, economic data, and employee data were collected from the China Statistical Yearbook [

54,

55,

56,

57,

58,

59,

60,

61,

62,

63,

64,

65], China’s Industrial Statistics Yearbook [

66,

67,

68,

69,

70,

71,

72,

73,

74,

75,

76,

77], and the China Steel Industry yearbook from 2005 to 2016 [

78,

79,

80,

81,

82,

83,

84,

85,

86,

87,

88,

89]. Energy consumption data came from the China Energy Statistics Yearbook [

90,

91,

92,

93,

94,

95,

96,

97,

98,

99,

100,

101] and each province’s Statistical Yearbook from 2005 to 2016. Economic data were calculated at the 2010 year price. In addition, CO

2 emissions in industrial production (IPPU CO

2) are included in this paper which also produce large amounts of CO

2. Therefore, CO

2 emissions accounting, emissions intensity and descent amplitude are based on energy consumption + IPPU CO

2 emissions.

Due to data availability, the steel industry’s relevant energy consumption and economic data were derived from the ferrous metal smelting and calendering processing industry in the Statistical Yearbook. The CO

2 accounting of fossil energy consumption and IPPU refer to IPCC2006 [

102] and Duan et al. [

103].

5. Conclusions

In light of the medium-and long-range plan promulgated by the government, a two-stage dynamic game model was constructed which incorporated the carbon tax, product subsidy, CCS, and other factors into the system of emission reduction mechanism. Then, we examined the resultant effects and economic impacts on six regions and China’s overall steel industry. The model is the abstraction and assumption of a practical problem, so the calculation results may exist a little deviate from the actual situation, which makes the research result have some deviations. This paper emphasizes the change trends of corresponding indicators with increasing governmental pressure to reduce emissions. The main conclusions are as follows:

- (I)

Under a certain emissions reduction policy, with the gradual increase in reduction targets, the overall social welfare, consumer surplus, output and emissions losses are trending downward. The carbon tax unit value, total carbon tax, output subsidy unit value, and total subsidies demonstrate a rising trend.

- (II)

With the increasing target of reducing emissions, a variety of emissions reduction policies are more effective than a single reduction policy, which can slow down the indicators’ decreasing range.

- (III)

For enterprises in the sub-regions, each region needs to choose its own reduction range and output. With the gradual increase in reduction targets, regional output has not shown a complete downward trend. Regional output has instead increased in some places likely duo to production function, carbon tax, subsidy and other comprehensive factors.

- (IV)

In the future, East and North China are expected to remain the primary producing areas, however, the proportion of production in the Northeast, Southwest and Northwest regions could rise. With the implementation of various emissions reduction policies, regional output polarization has eased.

Based on the above results and conclusions, when formulating emissions reduction targets and ancillary emissions reduction policies, the Chinese steel industry should use technological advances (i.e., lower production costs) along with several reasonable emissions reduction measures to achieve reduction targets into consideration. CCS can be implemented when the targets are too extreme and the CCS technology reaches a certain level. In future research, the impact of emissions reduction measures on the Chinese steel industry economy will be considered in the context of large-scale investment in CCS projects.

Secondly, China’s steel industry is currently at overcapacity, that is, production capacity is far greater than the actual consumption. This paper’s calculations show that when the market equilibrium is reached, the output and consumption of steel will be lower than they are at present.

Therefore, to alleviate the overcapacity contradiction and bring relief to the entire industry, China’s steel industry needs to ban new steel production and push obsolete companies and backward-producing enterprises out of the market as soon as possible. In the future, the government could levy more emission tax, reduce subsidies and conduct related policy research to address backward capacity, high-pollution emissions enterprises. These methods and impacts will be considered in subsequent research.

Thirdly, to improve the steel layout, the government should consider market demand, transportation, environment capacity and energy resources support conditions overall. Combined with solutions to address excess capacity and deepen regional layout reduction adjustments, the government should also encourage large-scale enterprises to reduce production capacity initiatively. Coastal areas’ government should change their ideas. The blind relocation of steel enterprises from inland to coastal areas should be banned. And no longer layout the new coastal base. Based on the existing coastal base, the government should implement the “group development” to improve the quality and efficiency. Inland regions should take the regional market capacity and energy resources to support as the double bottom line, and withdraw non-competitive enterprises resolutely. Based on existing leading enterprises, the regional government should aim to integrate relief development, achieve a balance between regional steel productions and reduce polarization.