1. Introduction

Undoubtedly, the drastic change in the global risk profile has a significant impact on both the business environment and the global economy. Companies have faced growing and escalating challenges in recent years against the backdrop of complex environmental, socioeconomic, and governance (ESG) issues in addition to economic ones [

1]. The pandemic crisis, the climate crisis, the social justice crisis, and the global economic crisis are significant problems that organizations are currently confronting. They also demonstrate how systemic and interrelated risk is in a society that is really intertwined. It is now more important than ever to consider how growing risks may affect institutions’ business strategies and future financial results due to the shifting risk landscape. As a result, ESG risks, which have the largest potential to damage firms, must now be considered in business strategy beyond just compliance. As a result, ESG risks, which have the biggest potential to harm businesses, must now be included in corporate strategy rather than just being something that institutions should think about.

Additionally, a growing number of investors are asking institutions to find efficient strategies to recognize and manage ESG risks and opportunities across the short, medium, and long term. Established in 2006, the United Nations Principles for Responsible Investment (PRI) continues to grow with worldwide responsible investment momentum. The number of institutions that signed the PRI increased by more than 50% in 2021, reaching 4700, compared to the previous year. Finally, as of September 2022, the initiative surpassed 5000 signatories representing US

$121 trillion in managed assets (AUM) [

2]. At COP26, more than 450 financial institutions managing more than

$130 trillion in assets from 45 countries committed to transforming the economy to net zero over the next three decades through Glasgow Financial Alliance for Net Zero (GFANZ) [

3]. As a result, investors scrutinize organizations not just for what they produce now but also for how they do it and what specific efforts they have taken to protect their ability to generate value in the future. Beyond the numbers, the corporate value notion highlights the current profit maximization paradigm’s shortcomings. The expanding body of research demonstrating the beneficial effects of ESG materiality on financial performance is one of the primary factors behind the increasing importance of ESG integration among investment firms [

4].

One of the main drivers behind the development of the ESG landscape is regulations. To improve stakeholder and investor communication and to promote corporate transparency and accountability, an increasing number of businesses are also using voluntary reporting. A total of 96% of the world’s 250 largest companies and 80% of the 5200 companies covering the top 100 companies in 52 countries disclose their sustainability performance [

5]. According to theoretical viewpoints including legitimacy, stakeholder, and institutional theories, there are a number of reasons why businesses choose to freely share their sustainability information and implement sustainable policies. In the legitimacy procedures, ESG reporting becomes very important and helps to increase credibility with all stakeholders. A substantial contribution to reaching the goal of legitimacy in the corporate environment is made by engaging in not only the financial elements but also the ESG components and voluntary disclosures [

6].

Although voluntary or required adoption and integration of ESG strategies into business models are becoming more common, this does not guarantee that they will meet investors’ needs and expectations. Stakeholders are unable to obtain the precise information they require if the relationship and interaction between the revealed environmental, social, and corporate governance indicators and financial performance are not considered. It is “complicated, confusing, and nuanced” how sustainability performance and firm value relate to one another [

7]. On the academic front, there has been a great amount of work on the link between ESG and firm value since the 1970s. However, the number of specific studies on the relevance of ESG materiality to investment decision-making is scarce and much more recent. Khan et al. (2016) [

8] generated materiality and immateriality ratings by adopting the SASB’s notion of materiality and the findings show that superior financial performance is not correlated with a strong performance on immaterial ESG issues [

8]. Kotsantonis and Bufalari (2019) [

9], working with the top 100 largest worldwide banks, achieved the same results by employing the technique of Khan, Serafeim, and Yoon (2016) [

8]. Additionally, materiality is shown to increase the predictability of financial performance in contrast to total ESG or immateriality scores in the study by van Heijningen (2019) [

10]. According to Consolandi et al. (2020), the concentration of ESG materiality operates as a concentration risk factor, and the market appears to favor companies that operate in sectors with high levels of ESG materiality concentration [

11].

Moreover, due to their considerable power to choose investment projects, manage risks, determine who has access to capital, and determine which activities are financed, banks have always taken an active part in the economic and social development of nations. Banks significantly influence society and, in turn, sustainable development through carrying out this function. However, mostly due to their special characteristics—different accounting rules, reporting incentives, or risk exposures—compared to other institutions, as well as the fact that they operate under particular regulations, banks are frequently left out of samples in empirical research in this area. In this sense, it is necessary and vital to take into account the banking industry in terms of measuring both the value and ESG materiality performance.

Differentiated by the limited number of academic studies mentioned above in terms of the scope and methodology in this study, the relationship between the materiality-oriented ESG performance of the banking sector and firm value is tested with a multiple-layer methodology. In this paper, we generate a unique set of indicators for the ESG performance assessment which is aligned with SASB’s materiality map for the banking sector [

12]. We use this indicator set to calculate the ESG materiality score as a measure of the level of ESG performance and concentration of ESG materiality for each bank. We also test the impact of the ESG materiality on firm value based on a sample of banks operating in OECD countries for a period of 5 years (2016–2020) estimating a linear regression model.

The remainder of the paper is organized as follows. In

Section 2, we present the literature review and hypotheses development. In

Section 3, we introduce the data and sample, and methodology while we discuss the results in

Section 4. Finally,

Section 5 provides the conclusion.

2. Literature Review and Hypotheses Development

For many years, financial accounting standards gave businesses and investors consistent language to discuss financial performance. However, standard accounting was created at a time when the majority of a company’s market valuation was made up of tangible assets. Considering the noteworthy switch in the market value components in almost half a century, the percentage of intangible assets grew from 17% to 90% [

13]. As a result, a significant portion of the market value today is made up of intangible assets, such as corporate trust, reputation, business strategy, risk management strategy, human capital, operational legitimacy, and supply chain. The notable change in tangible and intangible assets shows that the worth of the businesses as a whole is not well represented by the financial statements taken on their own. Due to this historic change, businesses are now disclosing information beyond their financial results and supporting the expansion of the reporting framework to include ESG and sustainability disclosures.

Sustainable business practices have an effect on a company’s financial health, operational efficiency, and enterprise value in the modern economy. Since demand prices are discounted by potential buyers when there is doubt about the product’s quality, according to Brickley et al. (2002) [

14]. A company can also distinguish its products and raise demand by credibly pledging to behave ethically. On the other side, a business that develops a bad reputation for unethical behavior would lose both present and potential new clients, as well as the revenue they would have brought in. According to Chami et al. (2002), a corporation should be concerned with ethics because this is a significant intangible asset that will influence the market value of its shares [

15]. Companies in the software business place a lot of emphasis on data security, a social concern. A beverage producer must manage water effectively because it is an environmental concern. A governance issue, managing conflicts of interest is crucial for an investment bank. Long-term management of these problems successfully is expected to enhance business performance through lower operational costs, a better reputation, more risk tolerance, the possibility for competitive advantage, and higher long-term enterprise value [

16].

According to the cost of capital theory, implementing sustainability measures would entail higher operating costs, which would eventually result in lower capital costs [

17]. The findings of El Ghoul et al. (2011) [

18], which showed that better sustainability ratings are connected with a lower cost of capital for a large sample of US enterprises, provide evidence in favor of this argument. According to research on the banking sector, improved financial performance and stable revenue would offset the costs associated with implementing ESG regulations. According to Buallay (2019) [

17], who conducted a study on 235 European banks and found a favorable correlation between ESG and operational performance, each ESG component needs to be further examined. On the other hand, according to a different study by the same author [

19], there is a negative correlation between ESG and the financial, operational, and market performance of 530 banks worldwide. Furthermore, Nguyen et al. (2021) [

20] showed that CSR activities tend to offer risk-mitigating benefits in Vietnam however unconstrained banks, on the other hand, are more likely to invest in unnecessary CSR, thus reducing bank performance and increasing bank risk-taking. The reason for the negative results is that banks still need to take extra steps to incorporate sustainability policies into their operational activities [

19] and should be focused on sustainability issues material for the industry.

In addition to ethical considerations, ESG Materiality Performance may be a useful tool for maintaining the reputation and ensuring financial sustainability [

21]. Existing research indicates that default risk and bank sustainability performance seem to have a negative or insignificant relationship [

22,

23]. Bolton (2013) [

24] discovers data pointing to the possibility that enhancing corporate sustainability quality could significantly boost bank performance and lower risk for US banks. As a result, it is reasonable to assume that banks’ ESG Materiality Performance will help them adjust to their new operating environment. However, there is scant evidence on the relationship between ESG and firm value in the banking industry; this research gap is what the current study will attempt to fill.

ESG data is available to investors from a variety of sources, including stock exchanges, data and index providers, and rating agencies. However, experts urge businesses to pay more attention to material ESG concerns that have the potential to significantly impact their bottom line [

25]. Moreover, Madison and Schiehll (2021) revealed that financial materiality has an impact on how meaningful ESG scores and rankings are, allowing investment opportunities in companies with strong ESG ratings on business-critical issues to be identified [

26]. Despite the fact that more and more rating agencies are evaluating the ESG performance of companies, studies have revealed that each agency uses a different assessment methodology [

27]. Furthermore, to our knowledge, no rating agency has used a methodology designed particularly to take into account the financial materiality of ESG risks and opportunities, with the exception of Factset Truvalue Insight [

28].

In order to assist companies and investors in establishing a common vocabulary regarding the financial effects of sustainability, SASB was established as a nonprofit organization in 2011. The corporate sustainability disclosure landscape becomes increasingly complicated over time. Clarity and simplification were demanded in this market by several multinational corporations and investors. In response, the Value Reporting Foundation (VRF), which was formally established in June 2021, was created by the merger of the International Integrated Reporting Council (IIRC) and SASB in November 2020 [

29]. The merger represented a significant step toward simplification by joining two organizations that were committed to generating enterprise value. On 1 August 2022, the VRF formally merged with the IFRS Foundation [

30].

The Sustainability Accounting Standards Board (SASB) aims to establish a connection between investors and institutions by considering the financial effects of sustainability. In this direction, SASB standards have been developed based on the feedback of market participants, especially investors. SASB’s mission is to help businesses worldwide identify, manage and report on the sustainability issues most material to their investors. In addition, SASB standards are industry-specific, allowing investors and companies to compare the performance of companies in an industry (Guidelines for 11 Sectors, 77 Industries have been published) [

12]. The SASB notion of materiality, which highlights sustainability issues that are material from an investor’s standpoint, is the one we use in this paper.

The Impetus for our study stems from the mismatch of ESG scores and lack of materiality perspective for ESG performance assessment in the banking industry, which raises the following questions: Would ESG scores change if the Sustainability Accounting Standard Board’s (SASB’s) ESG financial materiality framework is taken into account? If so, how do the adjusted scores affect firm value?

Finally, we propose the following hypothesis in light of the more substantial empirical evidence and the applicability of the arguments in favor of a positive relationship between ESG Materiality and firm value:

Hypothesis 1. ESG Materiality performance exerts positive effects on firm value.

Hypothesis 1a. ESG Materiality performance exerts positive effects on PBV.

Hypothesis 1b. ESG Materiality performance exerts positive effects on Tobin’s Q.

This study clarifies if the consideration of financial materiality as per the SASB’s materiality map has a substantial impact on the ESG performance scores of banks as reported by the data provider Refinitiv in its Eikon database. The importance of our analysis stems from the fact that investors, who are the main consumers of these ratings, do not exactly match the financial materiality standards used by the major ESG data providers and rating agencies.

4. Empirical Results and Discussion

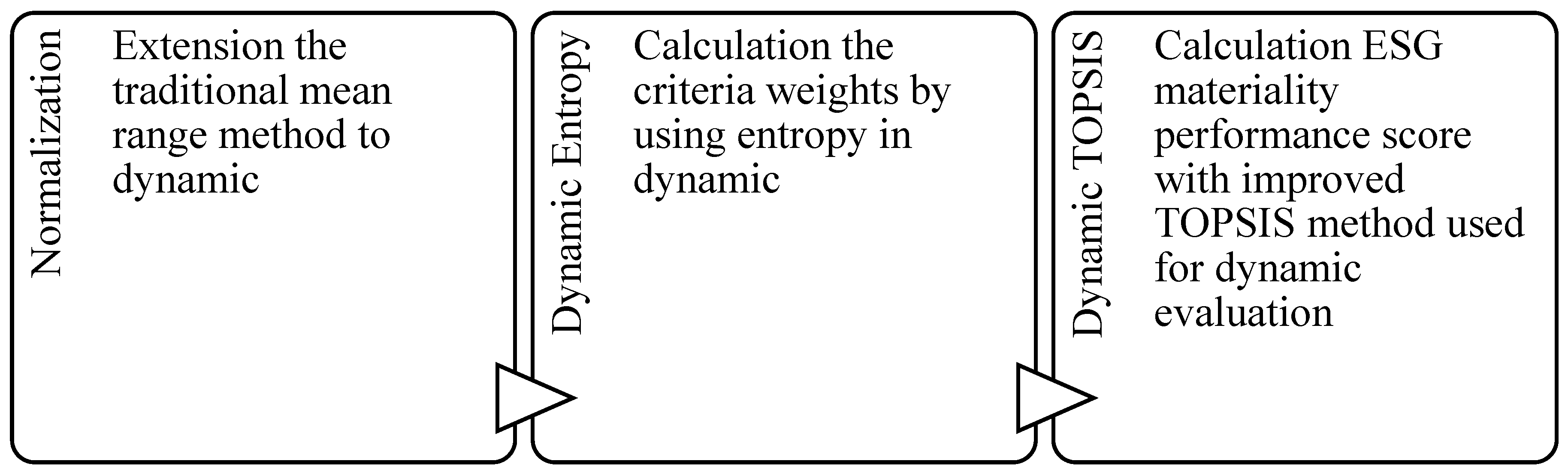

We structure this section into four parts. In the first three subsections, we convey our empirical results for dynamic entropy, dynamic TOPSIS, and regression, respectively. Finally, in the last subsection, we discuss the results by relating them to the previous literature and the theoretical framework.

4.1. Dynamic Entropy Results

Before employing the dynamic TOPSIS method, the dynamic entropy method was used for evaluating the weights of the criteria, objectively. Based on the dynamic entropy method results, the main indicators of ESG materiality for the banking sector can be determined, as well as the superior aspects and differences of the bank’s ESG materiality were demonstrated.

On that basis, as shown in

Table 5, for ESG materiality, “IESG_2: Environmental Assets Under Management Score”, “FICB_3: Product Access Low Price Score”, “SRM_6: Policy Environmental Supply Chain Score”, “SRM_2: Climate Change Commercial Risks Opportunities Score”, and “SRM_7: Environmental Supply Chain Management Score” were five leading indicators having weight range between 0.13 and 0.08. On the other hand, “BE_8: Product Responsibility Monitoring”, “BE_15: Policy Shareholder Engagement”, “BE_12: Audit Board Committee”, “FICB_2: Product Sales at Discount to Emerging Markets”, and “BE_7: Policy Responsible Marketing” were the least weighted five indicators with the weight range between (0.0022–0.0005).

Table 5 also indicates the general and category order for all indicators.

4.2. Dynamic TOPSIS Results

To evaluate the ESG materiality performance of the 1115 bank-year observations during the 2016–2020 period, we employed the dynamic TOPSIS method using objective weights calculated by the dynamic entropy method in order to avoid subjective judgments. In line with results obtained from the dynamic TOPSIS method, a performance score that lies between 0 and 1 was obtained for each observation. In order to examine the performance trend of banks over the years, we calculated the average score by year by filtering the scores. Also, to investigate the differentiation between the ESG Combined score calculated by Refinitiv and including an extended spectrum of ESG topics [

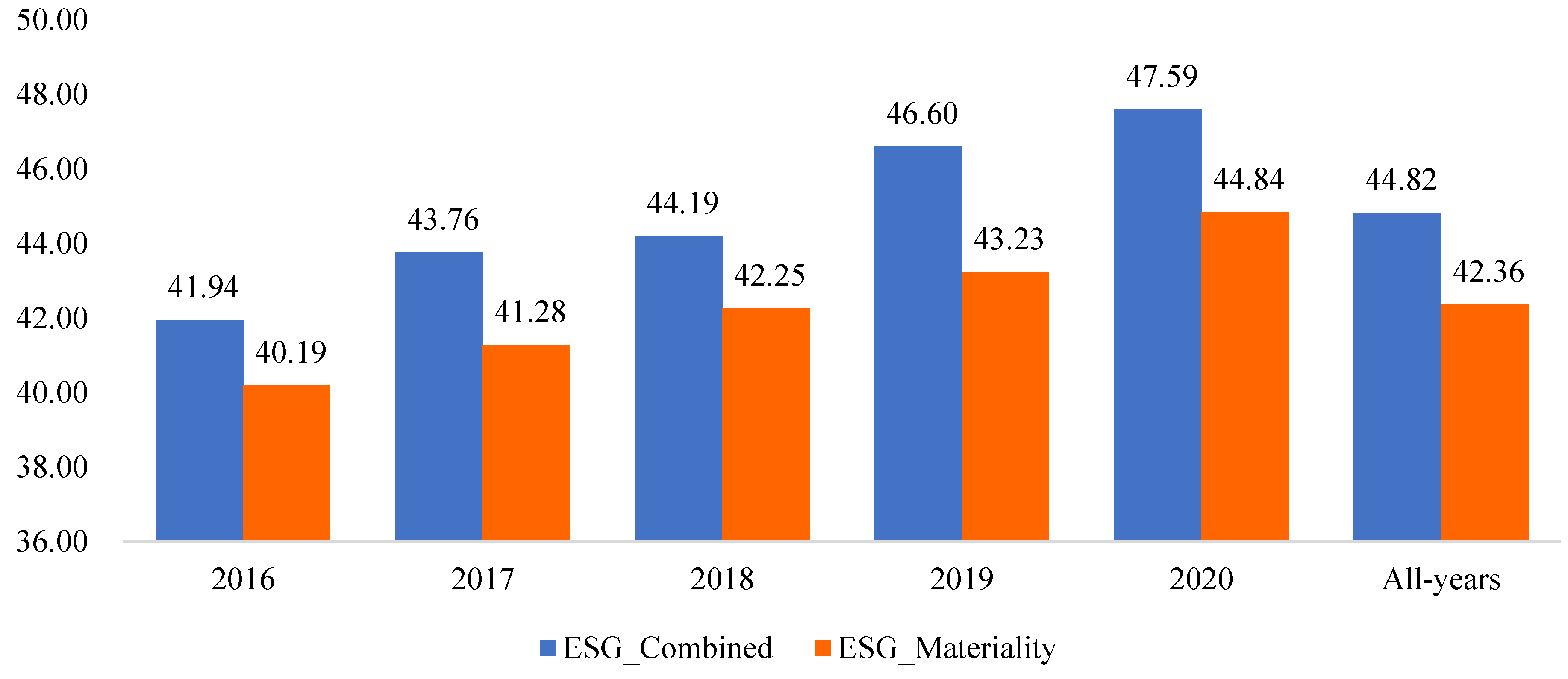

31], and the ESG Materiality score calculated by us, we normalized ESG Materiality scores into 0–100.

Figure 2 gives that the ESG performance of the sample tends to be increased over the years according to both scoring systems, while the ESG Materiality score is lower than ESG Combined score in all years and overall.

Figure 3 depicts the country-based average ESG performance scores of the sample. In terms of ESG Materiality performance, France (69.88), Netherlands (65.19), Spain (62.31), Australia (60.99) and Austria (60.48) are the five top countries (performance score) leading the banking sector, while United States (34.76), Japan (34.99), Czech Republic (40.44), Russia (41.44) and Mexico (41.70) are the five bottoms. From the Refinitiv point, country-based results differ substantially. Spain (69.63), Norway (69.36), Korean Republic (68.42), Portugal (68.21), and Greece (66.83) are the best performer countries (performance score) in terms of ESG Combined score, whereas Japan (33.89), United States (34.76), Denmark (41.52), Switzerland (44.05) and Mexico (44.69) are the five countries having the worst performance.

4.3. Correlations

The correlations between the dependent variables and the main predictors are presented in

Table 6. The highest correlation is between the independent variables for different models, ESG_Materiality and ESG_Combined, with a 0.748 correlation coefficient (r). There are significant, but small negative correlations between the ESG_Materiality and T1C, CAR, Cons, GDPcap, GDPgr, Inf, and GEPU (r = −0.236, −0.428, 0.594, −0.293, −0.087, 0.135, and 0.081, respectively). On the other hand, the accounting-based measure of financial performance, ROE is significantly correlated with T1C (r = −0.067), and CAR (r = 0.107). The ESG_Combined score is also negatively but weakly correlated with CAR, GDPcap, GDPgr, and CGS (r = −0,311, −0.350, −0.038, and −0.191 respectively), while positively correlated with ROE, Conc, Inf, PMIS and GEPU. In general, the Correlation matrix reveals that there is no high correlation between the explanatory variables and shows that there is no serious multicollinearity problem in this study.

4.4. Regression Results

We processed the data by using SPSS software and R Studio. After testing the classical assumptions on the initial 1260 bank-year observations, we carried out data-gap and outlier analyses on the data. After the data preprocessing, 1115 bank-year observations remained for our sample. We performed multiple linear regression to investigate whether ESG Materiality enhances the firm value based on four models, formulated specifically in Equations (11)–(14). The results of the regression analyses were shown in

Table 7 and

Table 8.

As highlighted in

Table 7, the overall results for all regression models were significant (Significance = 0.000). In

Table 7 and

Table 8, according to the adjusted R square value, in Model 1 and Model 3, the independent variables explained the variance in PBV (dependent variable) as of 53.1% and 52.6% respectively. Moreover, in Model 2 and Model 4, the variance of TQ (dependent variable) was explained by independent variables of 12.7% and 12.3%, respectively. Our results also show that the ESG_Materiality (in the same period) is a significant predictor of PBV and TQ at a significance level of 0.000 (B = 0.684,

p = 0.000, fixed effects) and 0.01 (β = 0.127,

p = 0.01, fixed effects), respectively. (

Table 7). On the other hand, the ESG_Combined is also a significant predictor of PBV although having a lower impact relative to ESG Materiality. Moreover, Model 4 also shows that the ESG_Combined score did not contribute significantly to TQ (

Table 8).

As seen in

Table 7, ESG Materiality contributed significantly to the firm value represented by PBV (significant value = 0.033, <0.05) in Model 1 and TQ (significant value = 0.01, <0.05) as we expected. Moreover, the coefficient on the ESG Materiality is significantly positive at 0.684 and 0.127, implying a positive valuation effect of ESG materiality for the banking sector in OECD countries. In the Model 1, ROE, Size, T1C, Conc, GDPcap, Inf, and GEPU also contributed significantly to PBV. The results of the coefficient values revealed that ROE was the most prominent variable contributing to PBV with a positive value (6.073) and followed by T1C at 1.695. In Model 2, coefficient on the ESG Materiality is also positive at 0.127 (significant value = 0.01, <0.05). On the other hand, as shown in

Table 8, Models 3 and 4 show that the ESG Combined scores contributed significantly to PBV, but not to TQ. Considering Models 1 and 3, the results depicted that the ESG Materiality score contributed higher than the ESG Combine score in terms of explaining PBV.

4.5. Discussion

This study first sheds light on whether the ESG performance scores of banks as provided by the data provider Refinitiv in its Eikon database are significantly impacted by the consideration of financial materiality as per the SASB’s materiality map. Our study’s relevance arises from the fact that investors, who are the primary consumers of such ratings, do not precisely correspond to the financial materiality criteria employed by the major ESG data suppliers and rating agencies. We showed that for the banking industry, incorporating financial materiality in the evaluation of ESG performance leads to appreciable score differences and makes it possible to differentiate between banks that address significant ESG issues and those that focus on issues that are mostly immaterial to the industry, though a broad spectrum of ESG relevance. As a result, we demonstrated how the inclusion of financial materiality can enhance the informative value of ESG scores, which could lead to more precise investment assessments and wiser investment choices, in alignment with the previous studies focused on ESG materiality.

A recent study by Madison and Schiehll (2021) [

16] revealed that financial materiality has an impact on how relevant ESG scores and rankings are, making it possible to identify investment opportunities in companies that score highly on business-critical ESG concerns. Similarly, Consolandi et al. (2020) [

11] also demonstrated that ESG materiality had a greater impact on stock performance when it came to financially significant concerns. In its analysis of investment strategies, Kaiser [

67] found that adding ESG risk materiality investors to a portfolio improved its risk-adjusted performance. Moreover, align with the other studies [

8,

15,

25,

68], our study bolsters the notion that using SASB mapping to evaluate companies’ ESG materiality performance can greatly enhance the usefulness of ESG scores and rankings.

Our findings also revealed that the SASB-adjusted score “ESG materiality score” diverged significantly from the initial Refinitiv ESG Combined score for all years and nations included in our sample (ESGC). For all years and nations, it is noteworthy that the ESG materiality scores—as calculated by us using the dynamic entropy and TOPSIS methods—were lower than the ESGC. Our findings support Madison and Schiehll’s [

16] findings in that the SASB-adjusted scores for their sample firms were also lower than the MSCI initial scores. According to the results of our entropy analysis, the topics of “systemic risk management”, “financial inclusion and capacity building”, and “incorporating ESG factors in credit analysis” and their key ESG indicators ‘environmental assets under management’, ‘product access at a low price’, ‘climate change commercial risks opportunities’, and ‘environmental supply chain management’ were primarily responsible for this difference.

Another notable finding relying on regression results in this study concerned that ESG Materiality had a positive valuation effect of ESG materiality for the banking sector in OECD countries. ESG Materiality score contributed significantly to the firm value represented by PBV and TQ while the ESG Combined score did merely for PBV with a lower contribution. This finding supports the value-enhancing theory, pointing to a positive ESG–value relationship. However, we would like to also point out that the results of the study assume that there is a linear relationship between ESG scores and dependent variables. We examined the relationship between ESG scores and dependent variables in our sample using scatter plots. Since there is no significant difference in the R-square values of linear and non-linear (quadratic, cubic, etc.) fitted lines, we studied linear models within the scope of this study as a starting point. In this regard, investigating the nonlinear relationship is pointing out the direction for further research.

5. Conclusions

The literature has yet to address the connection between ESG performance and firm value. However, a rising body of research suggests that a firm’s ESG performance, particularly when materiality is taken into account, has a beneficial impact on its market value. The value-enhancing theory contends that corporate sustainability initiatives can increase a firm’s market value, both directly and indirectly. However, this idea has not been put to the test yet using financial materiality-adjusted ESG ratings, but rather original ESG scores. Furthermore, research looking at ESG materiality has not focused on the banking sector. Thus, the dearth of thorough research on the value relevance of ESG Materiality in the banking industry served as the driving force behind our effort.

In addition, the banking sector is dealing with growing investor demand and business challenges associated with legislation such as EU Taxonomy, Sustainable Finance Disclosure Regulation (SFDR), and Corporate Sustainability Due Diligence (CSDD) Directive. These new issues offer a special circumstance that enables us to test an intriguing study hypothesis: the applicability of ESG Materiality-valuation impacts in the sector. We looked into the relationship between the ESG Materiality performance and the market value of banks doing business in OECD nations.

This study contributes to the literature on the evaluation of ESG materiality performance and its impact on valuation. Since stakeholders are requesting greater information about ESG risks and management practices, banks are increasingly sharing ESG-related data. Focusing on the informational requirements of investors, we demonstrate how SASB-oriented ESG rankings and scores differ from the original ESG scores and are therefore more likely to deliver pertinent data to investors. Investors want to be aware of the financial materiality of ESG concerns before making investment decisions since responsible investment is fundamentally based on the financial logic of profit maximization. We also contributed methodologically in terms of calculating ESG materiality performance by integrating deeper techniques, unlike previous studies.

We have two limitations in our study, as with any empirical investigation. First, and related to the scope of our analysis, the focus was narrowed to banks included in the Refinitiv Eikon ESG database. The creation of a map on ESG material issues between SASB and Refinitiv is another potential drawback. Although the descriptions of each business and the major ESG issues were thoroughly examined to create these equivalences, there is still some subjectivity at play.

Finally, we conclude by pointing out the direction for further research. Future research could pursue this direction by (1) extending our methodology to other industries, (2) examining the contribution of SASB-identified materiality in the relationship between ESG performance and financial performance, and (3) estimating firm value enhanced by ESG materiality using machine learning techniques, considering both linear and non-linear modeling. Finally, we hope that our findings would support additional studies into how ESG Materiality affects business value.