Financial Auditing as an Effective Tool for Fraud Detection: A Systematic Review

Abstract

1. Introduction

2. Theoretical Framework

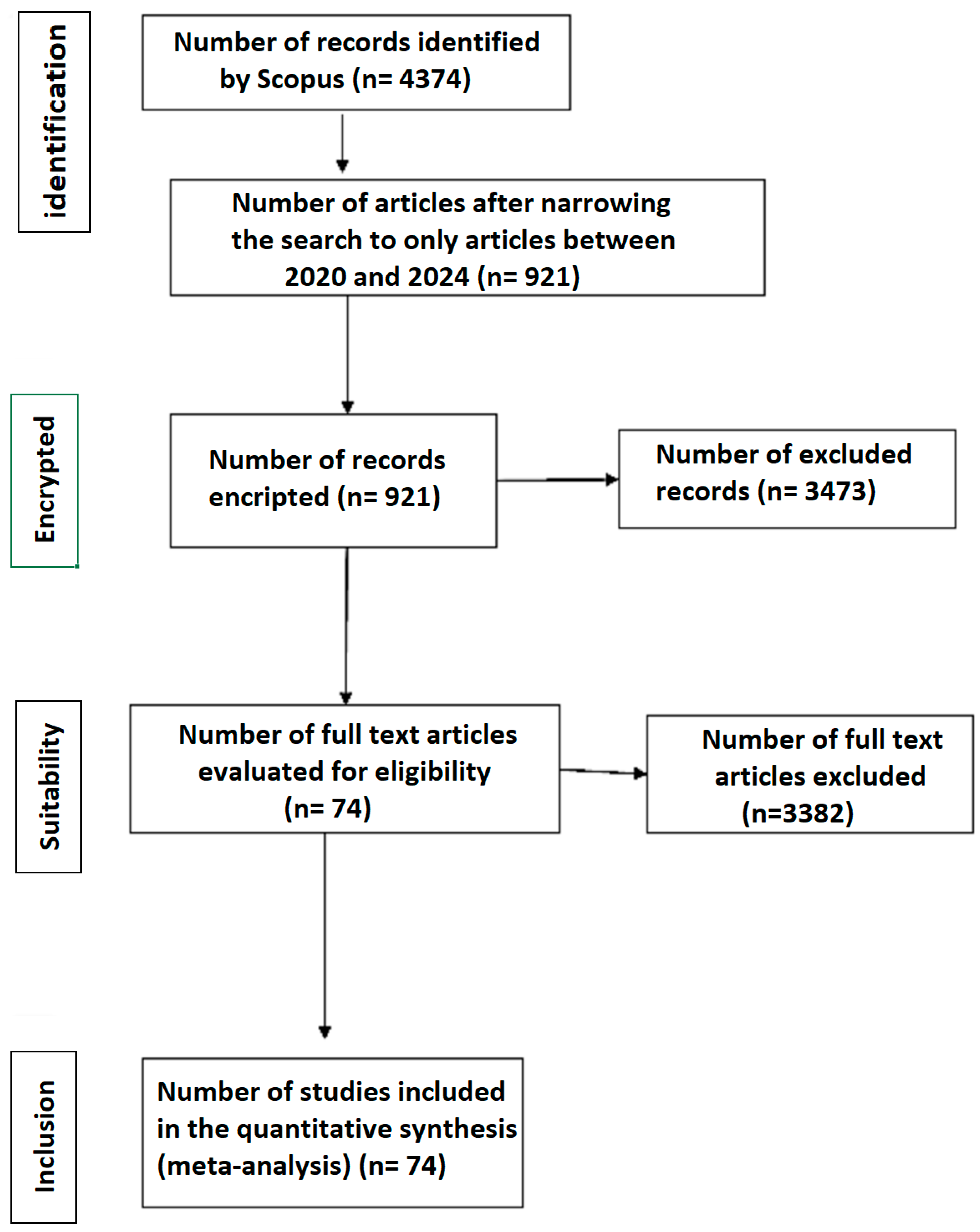

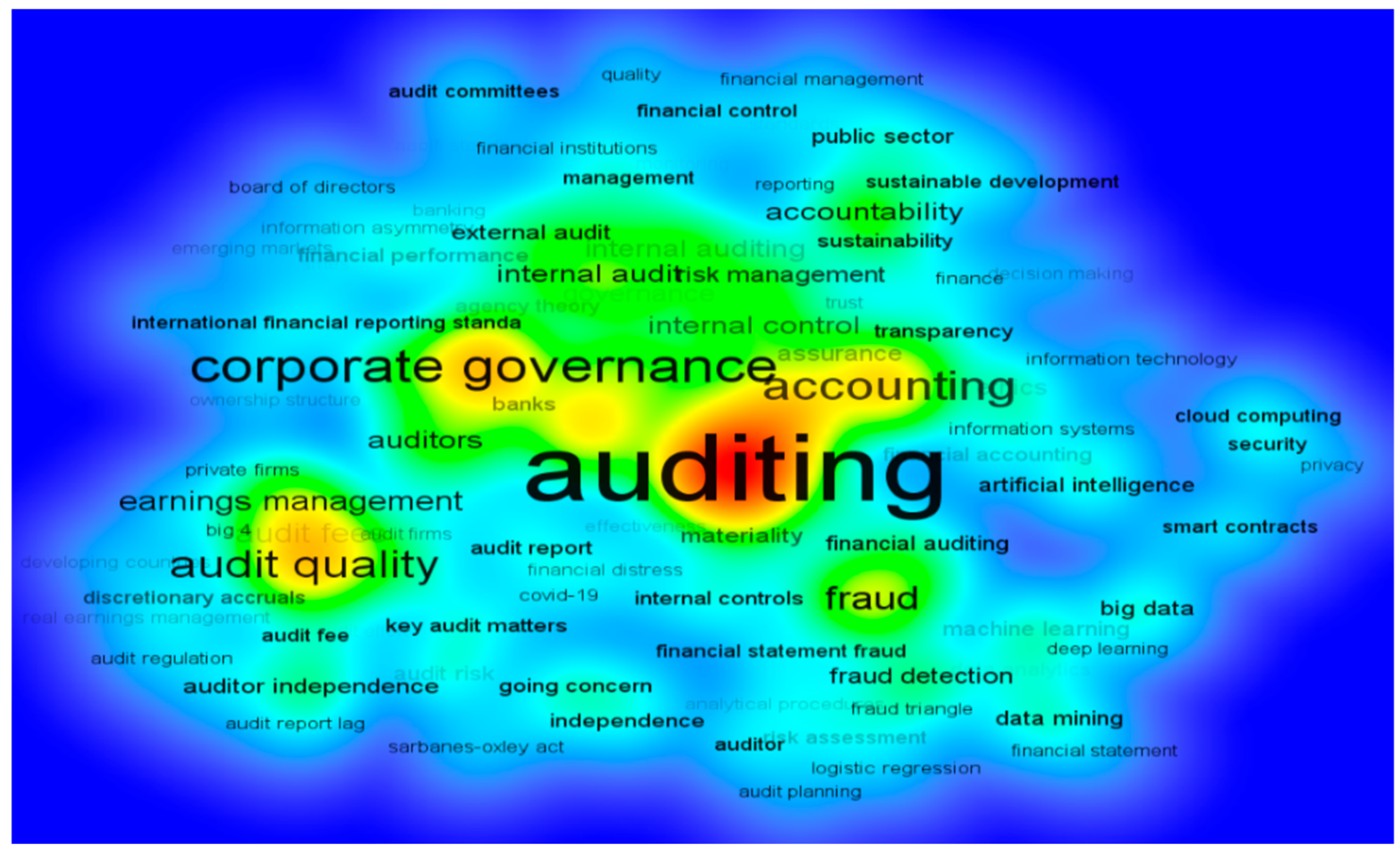

3. Materials and Methods

3.1. Eligibility Criteria

3.2. Sources of Information

3.3. Search Strategy

3.4. Data Management

3.5. Selection Process

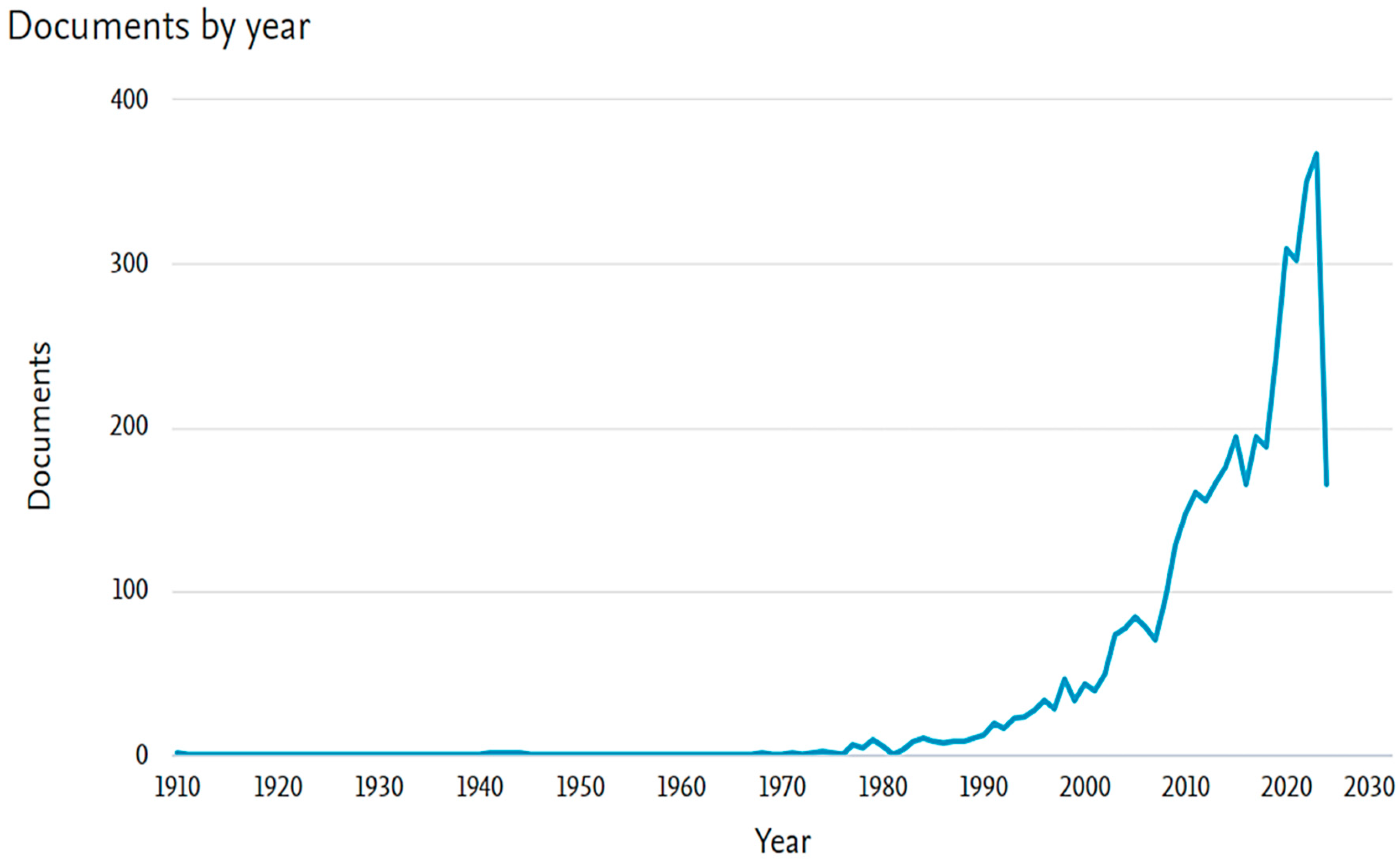

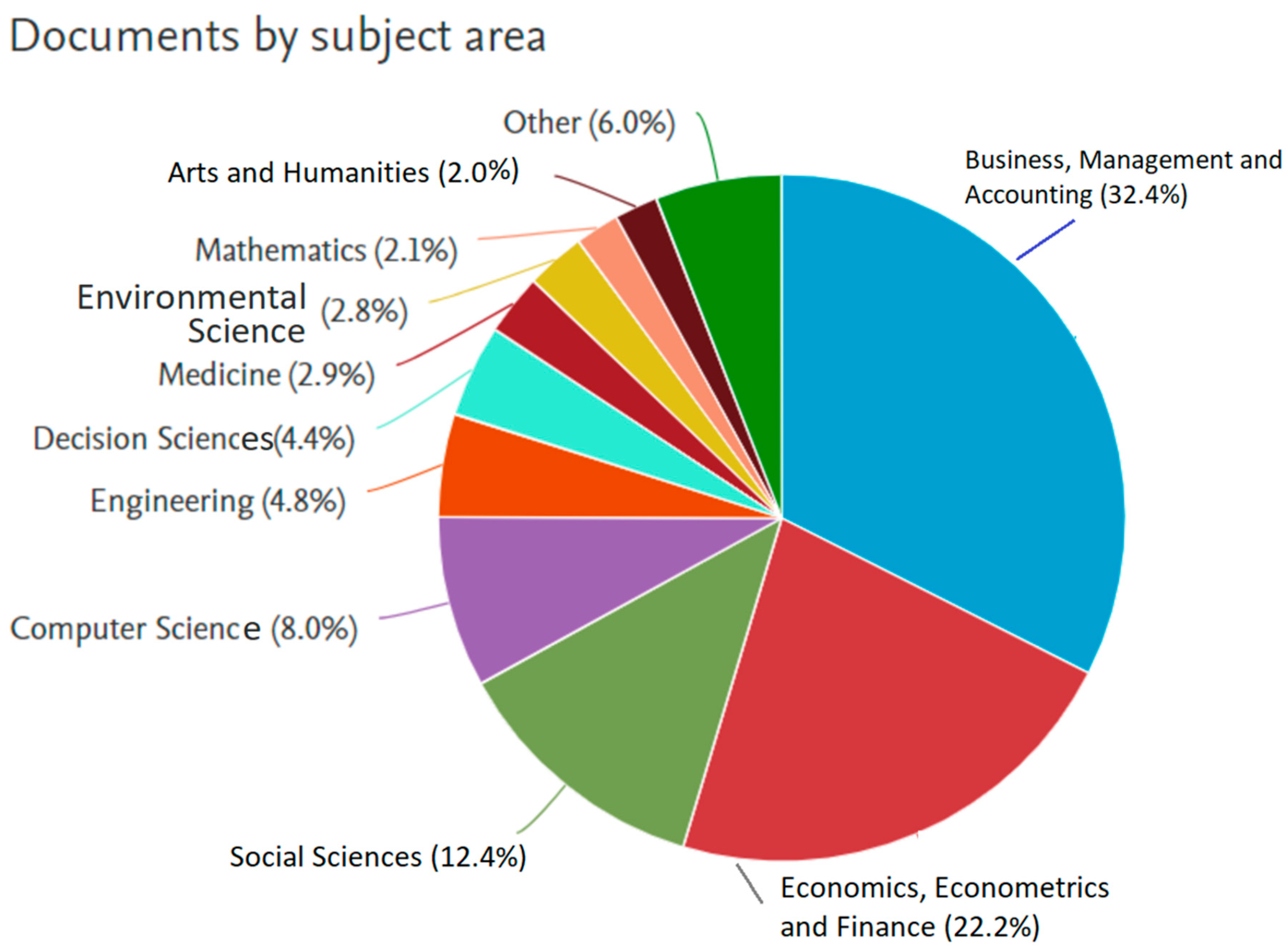

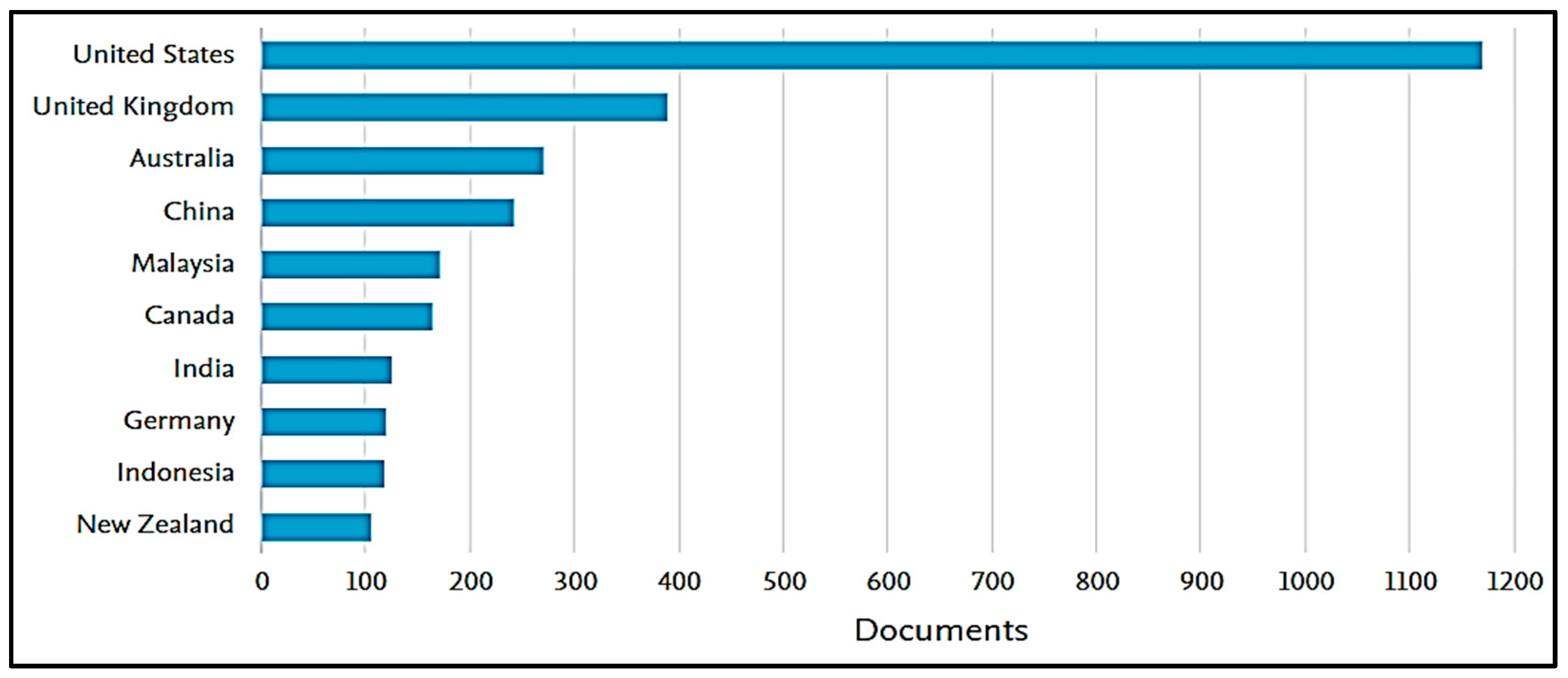

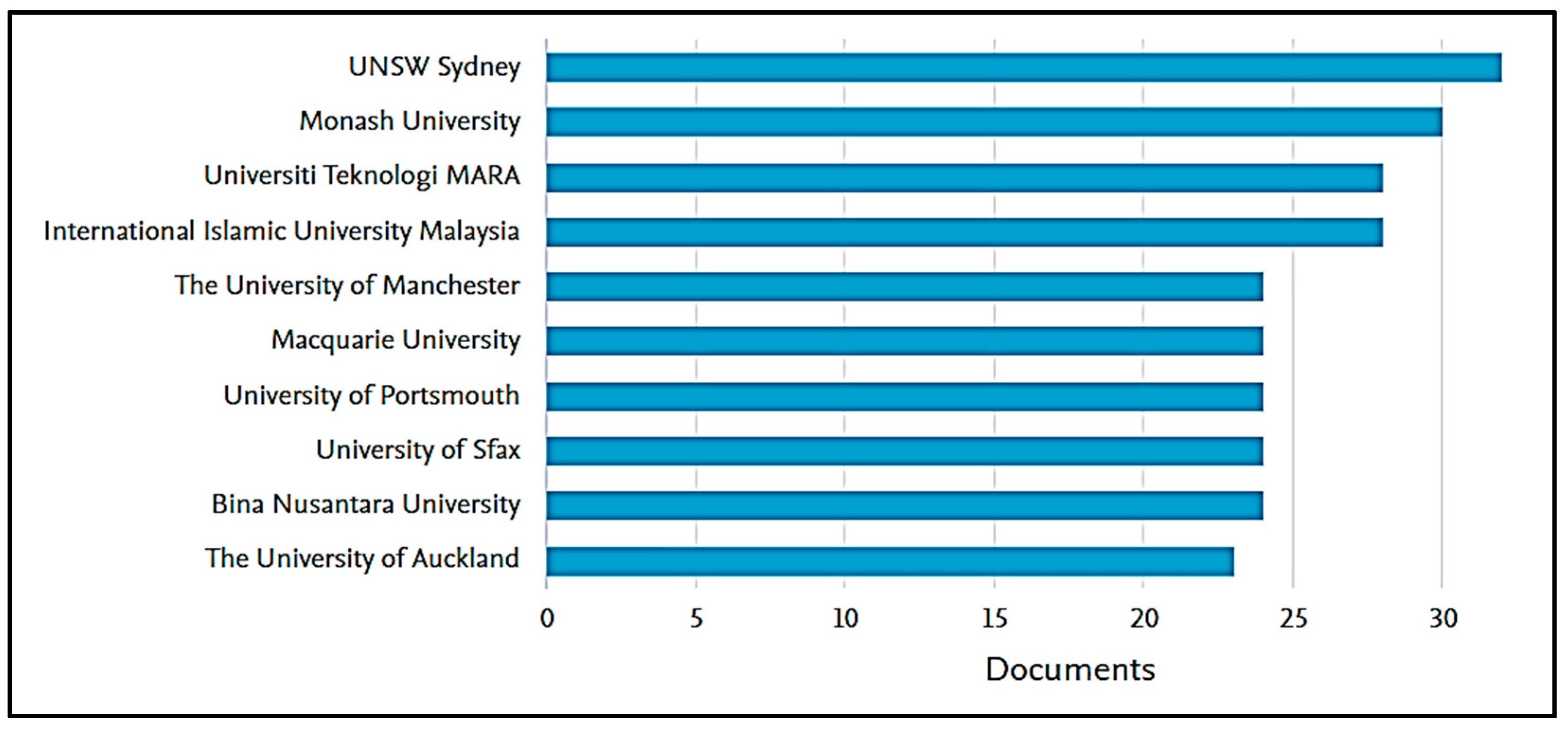

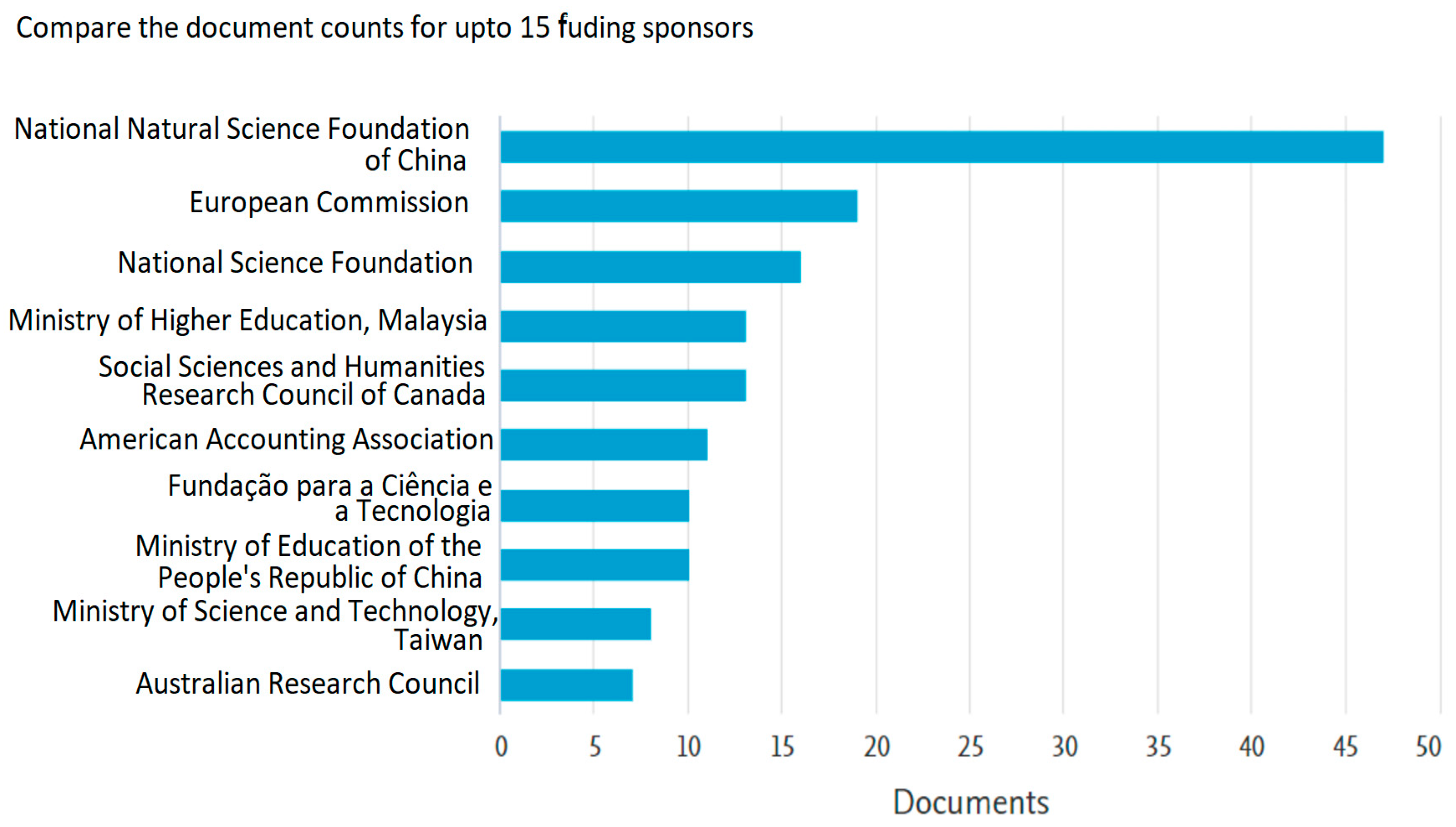

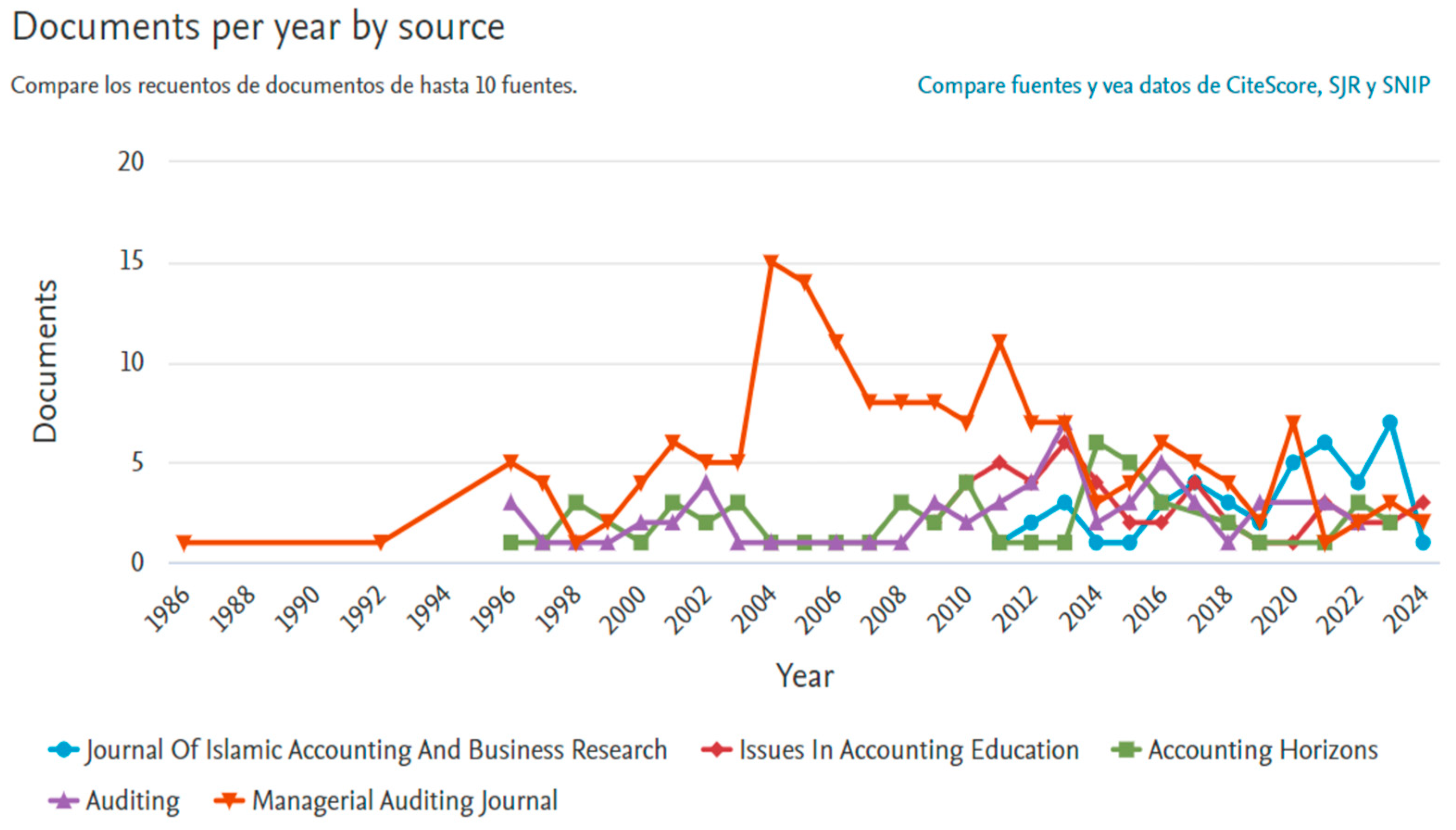

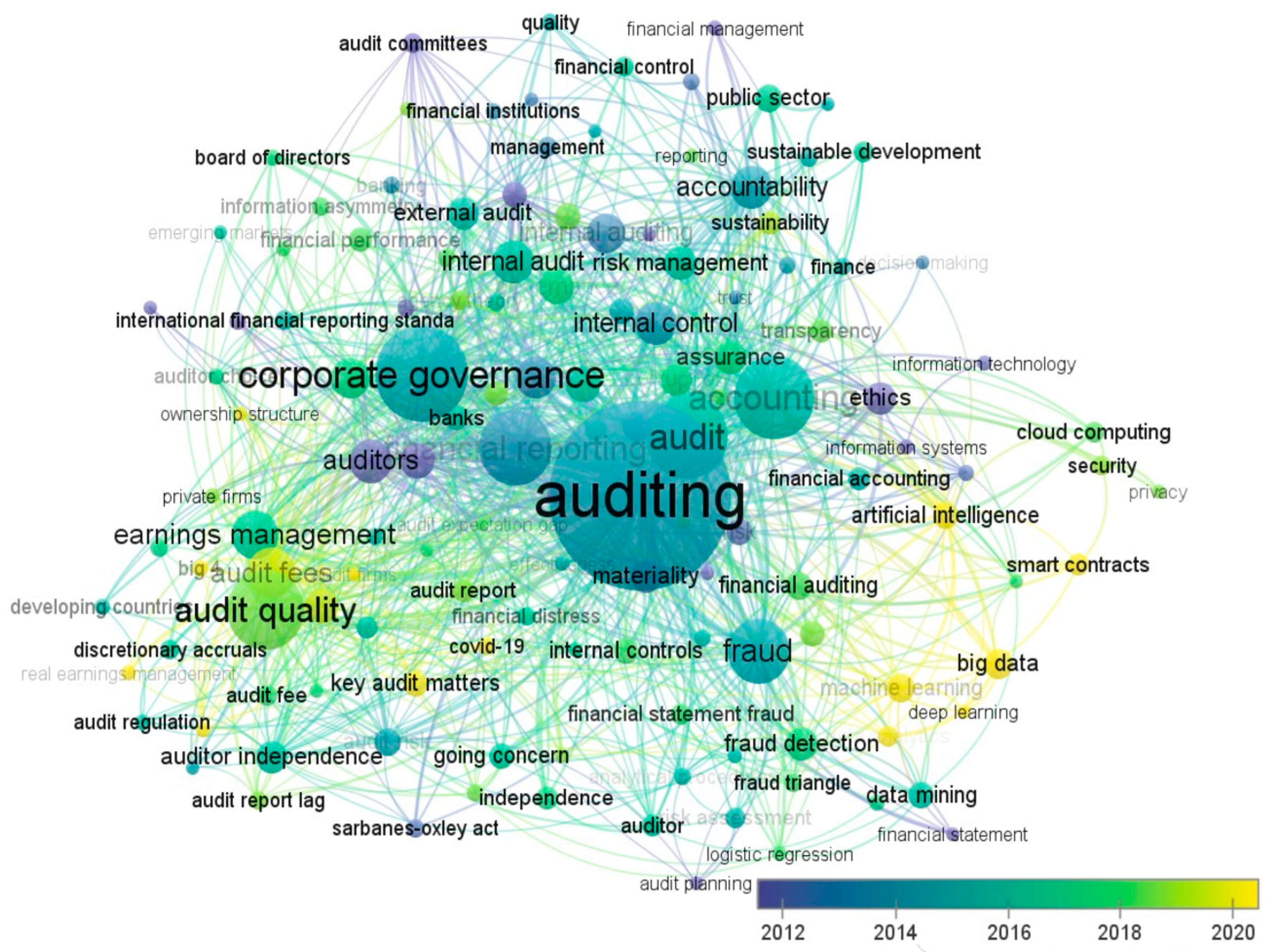

4. Results

5. Discussion

5.1. Analysis of the Results

5.2. Implications and Limitations of the Research

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abdullah, A. A. H., & Almaqtari, F. A. (2024). The impact of artificial intelligence and industry 4.0 on transforming accounting and auditing practices. Journal of Open Innovation Technology Market and Complexity, 10(1), 100218. [Google Scholar] [CrossRef]

- Alharasis, E. E., Alkhwaldi, A. F., & Hussainey, K. (2024). Key audit matters and auditing quality in the era of COVID-19 pandemic: The case of Jordan. International Journal of Law and Management, 66(4), 417–446. [Google Scholar] [CrossRef]

- Al-Khasawneh, R. (2022). Challenges facing external auditor while auditing banking accounting systems in the light of the use of digital technologies of fourth industrial revolution in Jordan. American Journal of Industrial and Business Management, 12, 672–698. [Google Scholar] [CrossRef]

- Al-Qadasi, A., Baatwah, S., & Omer, W. (2022). Audit fees under the COVID-19 pandemic: Evidence from Oman. Journal of Accounting in Emerging Economies, 13, 806–824. [Google Scholar] [CrossRef]

- Al Qazaawi, M., Izadinia, N., & Kiani, G. (2023). The effect of forensic accounting expertise on independent audit quality in Iraq and Iran: A comparative study. Heritage and Sustainable Development, 5(2), 351–362. [Google Scholar] [CrossRef]

- Aman, Q. (2022). Forensic accounting: An innovative tool for corporate fraud risk management. International Journal of Scientific Research in Engineering and Management, 6(9), 1–12. [Google Scholar] [CrossRef]

- Anwar, P. (2021). Revealing creative accounting practices: A professional ethics perspective Indonesia. ISAFIR: Universitas Islam Negeri Alauddin Makassar, 2, 253–270. [Google Scholar] [CrossRef]

- Ardillah, K., & Chandra, R. (2022). Auditor independence, auditor ethics, auditor experience, and due professional care on audit quality. Accounting Profession Journal (APAJI), 4, 369185. [Google Scholar] [CrossRef]

- Auliani, A., Pramesti, D., & Yunita, L. (2023). The role of auditor in sustainability reporting. International Journal of Social Science Education Communication and Economics (Sinomics Journal), 1(6), 825–830. [Google Scholar] [CrossRef]

- Awadallah, E., & Saadullah, S. (2024). Expanding the scope of professional skepticism in Qatar: Developing an Arabic Hurtt scale and examining influential factors among accountants/emad awadallah and shahriar saadullah. Management & Accounting Review, 23(1), 1–38. Available online: https://ir.uitm.edu.my/id/eprint/93587/ (accessed on 30 November 2024).

- Baldini, M. (2023). Risks of false accounting: Some reflections on the new regulation in Italy. Risk Governance and Control: Financial Markets & Institutions, 13, 62–69. [Google Scholar] [CrossRef]

- Baranidharan, D., Suganya, D., Pavitha, R., Manoj, K., Akaash, A., & Kabildev, S. (2023). An investigation into the field of cloud accounting. International Journal of Advanced Research in Science, Communication and Technology (IJARSCT), 3(2), 221–233. [Google Scholar] [CrossRef]

- Bîrcă, A., & Babuci, P. (2023). Aspecte problematice în evaluarea controlului intern = Internal control and its dilemmas in organization, operation and reporting. In International scientific conference on accounting, ISCA 2023 [online]: Collection of scientific articles = Culegere de articole științifice, 12 edition, April 6–7, 2023 (pp. 222–226). SEP ASEM. [Google Scholar] [CrossRef]

- Bobrova, A., & Kovalenko, Y. (2023). Evaluation of the effectiveness of the internal control system in organizations. Ekonomika I Upravlenie: Problemy, Resheniya, 11(14), 117–124. [Google Scholar] [CrossRef]

- Bulău, V. (2021). Ways of maintaining the quality of financial audit in the context of validating financial statements. Journal of Public Administration, Finance and Law, 10, 181–188. [Google Scholar] [CrossRef]

- Chávez, J., Boluarte, E., Aquiño-Perales, L., Monterroso-Unuysuncco, N., Arévalo-Tuesta, J., De Velazco, J., & Villagómez-Chinchay, J. (2024). Work overload, time pressure and social influence on the work efficiency of the financial and tax auditor: Evidence from Peru. International Journal of Religion, 5(5), 805–815. [Google Scholar] [CrossRef]

- Choi, J., & Park, H. (2023). Financial distress and audit report lags: An empirical study in Korea. Gadjah Mada International Journal of Business, 25(3), 301–326. [Google Scholar] [CrossRef]

- Cruceano, A. (2019). The influence of the risk of fraud and accounting errors in the financial statements on the opinion of the financial auditor. European Journal of Accounting, Finance & Business, 7(1), 1–9. [Google Scholar] [CrossRef]

- Deb, S., & Deb, D. (2023). The rise and fall of Enron: A cautionary tale of corporate greed and betrayal. International Journal of Multidisciplinary Research and Growth Evaluation, 4(5), 94–100. [Google Scholar] [CrossRef]

- Deepal, A., & Jayamaha, A. (2022). Audit expectation gap: A comprehensive literature review. Asian Journal of Accounting Research, 7, 308–319. [Google Scholar] [CrossRef]

- Deliu, D., & Olariu, A. (2023). The orbital dynamics of auditor firm rotation: Implications for auditor independence and audit quality. Journal of Accounting and Auditing: Research & Practice, 2023(1), 173471. [Google Scholar] [CrossRef]

- Dolgi, H., & Petryanu, O. (2021). Internal audit in the period of economic changes and its role in evaluation of the entity’s internal control. Theoretical characteristics and practical approaches. Problems of Theory and Methodology of Accounting, Control and Analysis, 2(49), 19–28. [Google Scholar] [CrossRef]

- Driskill, M., Knechel, W., & Thomas, E. (2022). Financial auditing as an economic service. Current Issues in Auditing, 16(2), 39–50. [Google Scholar] [CrossRef]

- El Badlaoui, A., Naji, S., & Chegri, B. (2024). Audit expectation gap: Evidence from Morocco. Investment Management and Financial Innovations, 21(2), 167–179. [Google Scholar] [CrossRef]

- Elliott, W., Fanning, K., & Peecher, M. (2020). Do investors value higher financial reporting quality, and can expanded audit reports unlock this value? The Accounting, 95(2), 141–165. [Google Scholar] [CrossRef]

- Esq, D. (2023). The fall of arthur andersen, LLP and enron corporation, and the rise of the sarbanes-oxley act of 2002. International Journal of Social Science and Human Research, 6, 6317–6343. [Google Scholar] [CrossRef]

- Everhart, J. (2023). Audit, fraud, and forensic accounting. International Journal of Business & Management Studies, 4, 9–12. [Google Scholar] [CrossRef]

- Federación Internacional de Contadores [IFAC]. (n.d.). Objetivos globales del auditor independiente y realización de la auditoría de conformidad con las normas internacionales de auditoría (NIA 200). Available online: https://www.auditorscensors.com/uploads/20160405/NIA_ES_200.pdf (accessed on 30 November 2024).

- Feghali, K., Najem, R., & Metcalfe, B. (2022). Financial auditing during crisis: Assessing and reporting fraud and going concern risk in Lebanon. Journal of Accounting and Management Information Systems, 21(4), 575–603. [Google Scholar] [CrossRef]

- Gunawan, I., & Indarto, S. L. (2022). Independence as moderating factors influencing audit judgment. Asian Journal of Law and Governance. Revista Asiática de Derecho y Gobernanza, 4, 1–10. [Google Scholar] [CrossRef]

- Gutterman, A. (2020). Corporate governance and sustainability. In Sostenibilidad y gobierno corporativo (pp. 1–14). Routledge. [Google Scholar] [CrossRef]

- Holovach, V., & Holovach, T. (2022). Conceptual basis of an auditor’s professional judgment—Professional skepticism. Economics Finances Law, 40–43. [Google Scholar] [CrossRef]

- Horton, J., Livne, G., & Pettinicchio, A. (2020). Empirical evidence on audit quality under a dual mandatory auditor rotation rule. European Accounting Review, 30(1), 1–29. [Google Scholar] [CrossRef]

- Isaković-Kaplan, Š., Muratović-Dedić, A., Demirović, L., & Pločo, S. (2021). Forensic review of financial statements of legal entity tuš-trade. Journal of Forensic Accounting Profession, 1(2), 64–79. [Google Scholar] [CrossRef]

- Ivakhnenkov, S. (2023). Artificial intelligence application in auditing. Scientific Papers NaUKMA. Economics, 8(1), 54–60. [Google Scholar] [CrossRef]

- Jannat, T. (2022). Investigation of expectation gap between auditors and investors in Bangladesh. International Journal of Current Science Research and Review, 5, 640–646. [Google Scholar] [CrossRef]

- Kadhim, L. T., & Bougatef, K. (2024). The impact of international accounting and auditing standards on the quality of financial reporting. Revista De Gestão Social e Ambiental, 18(8), e06215. [Google Scholar] [CrossRef]

- Kassem, R. (2022). Elucidating corporate governance’s impact and role in countering fraud. Corporate Governance, 22(7), 1523–1546. [Google Scholar] [CrossRef]

- Kazakova, N. (2022). Institutional aspect of disclosing key audit matters in the auditor’s report. Auditor, 8(4), 18–23. [Google Scholar] [CrossRef]

- Kitiwong, W., & Sarapaivanich, N. (2020). Consequences of the implementation of expanded audit reports with key audit matters (KAMs) on audit quality. Managerial Auditing Journal, 35(8), 1095–1119. [Google Scholar] [CrossRef]

- Kuzey, C., Elbardan, H., Uyar, A., & Karaman, A. S. (2023). Do shareholders appreciate the audit committee and auditor moderation? Evidence from sustainability reporting. International Journal of Accounting and Information Management, 31(5), 808–837. [Google Scholar] [CrossRef]

- Kwack, S. (2024). CEO-executive connections and auditor resignations. Applied Economics, 57, 1291–1296. [Google Scholar] [CrossRef]

- Lazarides, M., Lazaridou, I., & Papanas, N. (2023). Bibliometric analysis: Bridging informatics with science. The International Journal of Lower Extremity Wounds, 24, 15347346231153538. [Google Scholar] [CrossRef]

- Lee, L., Casterella, G., & Wray, B. (2020). Preparing for audit data analytics with the AICPA general ledger audit data standards. Journal of Emerging Technologies in Accounting, 18(1), 131–157. [Google Scholar] [CrossRef]

- Li, Y., & Goel, S. (2025). Artificial intelligence auditability and auditor readiness for auditing artificial intelligence systems. International Journal of Accounting Information Systems, 56, 100739. [Google Scholar] [CrossRef]

- Lindermüller, D., Lindermüller, I., & Nitzl, C. (2024). Error culture, auditors’ error communication, and the performance of the auditee: A study among German local public sector auditors. Schmalenbach Journal of Business Research, 76(1), 245–266. [Google Scholar] [CrossRef]

- Liu, Z. (2023). Research on the quality of accounting information disclosure by listed companies under the new “Securities Law”. Frontiers in Business, Economics and Management, 11(3), 130–133. [Google Scholar] [CrossRef]

- Lubenchenko, O., & Korinko, M. (2021). Using the international standard of auditing 315 “identifying and assessing the risks of material misstatement through understanding the entity and its environment” in the auditing practice. Scientific Bulletin of the National Academy of Statistics, Accounting and Audit, 3(4), 51–63. [Google Scholar] [CrossRef]

- Magri, C., & Marchini, P. L. (2024). Audit quality and debt restructuring: Evidence from Italy. Managerial Auditing Journal, 39(1), 50–70. [Google Scholar] [CrossRef]

- Marcelo, L. A., Papanicolau, J. N. A., Pajuelo, J. A., Carrasco, R. E., De la Cruz, D., & Ramírez Lau, S. C. (2024). Business management as a link between competitiveness and sustainable development in the textile sector. Revista De Investigación Educativa Y Social, 14(3), 27. [Google Scholar] [CrossRef]

- Martínez, R., De La Hoz, B., & Carrera, J. (2019). La auditoría financiera como apoyo a la transparencia contable. E-IDEA Journal of Business Sciences, 1(3), 34–41. Available online: https://revista.estudioidea.org/ojs/index.php/eidea/article/view/15 (accessed on 30 November 2024).

- McLean, B. (2024, June 17). Is enron overpriced? (fortune, 2001). Fortune. Available online: https://fortune.com/article/is-enron-overpriced-fortune-2001/ (accessed on 25 October 2024).

- Midecha, A. (2023). Internal auditor’s role and corporate financial performance in Kenya. African Journal of Commercial Studies, 1(1), 36–42. [Google Scholar] [CrossRef]

- Miti, M., & Çika, N. (2024). Financial reporting, criminal-juridical protection, and corruption in Albania. Revista De Gestão—RGSA, 18(1), e6724. [Google Scholar] [CrossRef]

- Momchilov, G. (2022). Informes de sostenibilidad de las empresas: Motivos y beneficios económicos. Revisión de VUZF. [Google Scholar] [CrossRef]

- Moral-Muñoz, J., Herrera-Viedma, E., Santisteban-Espejo, A., & Cobo, M. (2020). Software tools for conducting bibliometric analysis in science: An up-to-date review. El Profesional De La Información, 29(1), 1–20. [Google Scholar] [CrossRef]

- Munteanu, V., Zuca, M., Horaicu, A., Florea, L., Poenaru, C., & Anghel, G. (2024). Auditing the risk of financial fraud using the red flags technique. Applied Sciences, 14, 757. [Google Scholar] [CrossRef]

- Naseer, K., & Ahmed, H. (2025). Effectiveness and reliability of artificial intelligence in fraud detection: A mixed-method study on financial audit. Journal of Management and Informatics, 4, 706–722. [Google Scholar] [CrossRef]

- Ndreca, P. D. (2023). Correct relationships between audit and corporate governance provide economic effectiveness and added value to the organization. Quality-Access to Success, 24(197), 35–47. [Google Scholar] [CrossRef]

- Nunes, T., Leite, J., & Pedrosa, I. (2020, June 24–27). Intelligent process automation: An overview over the future of auditing. 2020 15th Iberian Conference on Information Systems and Technologies (CISTI) (pp. 1–5), Seville, Spain. [Google Scholar] [CrossRef]

- Patel, D., & Chauhan, D. (2023). Transforming auditing practices: Unravelling the challenges and opportunities of technology. International Journal of Foreign Trade and International Business, 5(1), 36–39. [Google Scholar] [CrossRef]

- Payamta, P., & Setyaningsih, T. (2025). Enhancing audit quality to detect financial statement fraud at public accounting firms member of OAI Solusi Manajemen Nusantara. Journal of Infrastructure, Policy and Development, 9, 7403. [Google Scholar] [CrossRef]

- Petrescu, A., Bîlcan, F., Petrescu, M., Oncioiu, I., Türkeș, M., & Căpușneanu, S. (2020). Assessing the benefits of the sustainability reporting practices in the top Romanian companies. Sustainability, 12, 3470. [Google Scholar] [CrossRef]

- Prameswari, A., Purwohedi, U., & Respati, D. (2022). Factors affecting auditor’s ability to detect fraud. Jurnal Akuntansi, Perpajakan Dan Auditing, 3(1), 78–96. [Google Scholar] [CrossRef]

- Puspitarani, P., & Mapuasari, S. (2020). Does auditor independence, skepticism, and professionalism influence audit quality? Jurnal Muara Ilmu Ekonomi Dan Bisnis, 4(2), 251. [Google Scholar] [CrossRef]

- Quick, R. (2020). The audit expectation gap: A review of the academic literature. Maandblad Voor Accountancy En Bedrijfseconomie, 94(2), 5–25. [Google Scholar] [CrossRef]

- Rashid, M., Khan, U. N., Riaz, U., & Burton, B. (2023). Auditors’ perspectives on financial fraud in Pakistan—Audacity and the need for legitimacy. Journal of Accounting in Emerging Economies, 13(1), 167–194. [Google Scholar] [CrossRef]

- Rudyanto, A. (2021). ¿Sigue siendo beneficioso el informe de sostenibilidad obligatorio? Jurnal Akuntansi y Keuangan Indonesia, 18(2), 148–167. [Google Scholar] [CrossRef]

- Saleeb Agaiby Bakhiet, B. (2024). Is mandatory sustainability report still beneficial? Jurnal Akuntansi Dan Keuangan Indonesia, 18(2), 148–167. [Google Scholar] [CrossRef]

- Salinas-Ríos, K., & López, A. (2022). Bibliometrics, a useful tool within the field of research. Journal of Basic and Applied Psychology Research, 3(6), 9–16. [Google Scholar] [CrossRef]

- Sherine, S. (2023). The contemporary role of internal audit and its effect on the credibility of financial reports. Journal of Financial and Business Research, 24(2), 188–205. [Google Scholar] [CrossRef]

- Singh, S. (2021). Capital market frauds: Concepts and cases. In A. Rafay (Ed.), Handbook of research on theory and practice of financial crimes (pp. 332–354). IGI Global Scientific Publishing. [Google Scholar] [CrossRef]

- Song, D., Xu, C., Fu, Z., & Yang, C. (2023). How does a regulatory minority shareholder influence the ESG performance? A quasi-natural experiment. Sustainability, 15(7), 6277. [Google Scholar] [CrossRef]

- Şavlı, T. (2022). Türkiye’de bağimsiz denetçilerin iç denetçi çalişmalarindan faydalanmasi üzerine bir araştirma. Muhasebe Bilim Dünyası Dergisi, 24(Modavica Özel Sayısı), 184–201. [Google Scholar] [CrossRef]

- Tessema, A., & Abou-El-Sood, H. (2023). Audit rotation, information asymmetry and the role of political connections: International evidence. Meditari Accountancy Research, 31(5), 1352–1385. [Google Scholar] [CrossRef]

- Ugalde Herrera, M. d. P. (2023). Obtener la evidencia en una Auditoría Forense ¿Es suficiente la NIA-240, NIA-500? Ciencia Latina Revista Científica Multidisciplinar, 7(3), 3057–3077. [Google Scholar] [CrossRef]

- Vasile, E., & Croitoru, I. (2020). Financial statements—Object of the financial audit. Internal Auditing & Risk Management, 60(1), 51–58. [Google Scholar] [CrossRef]

- Verma, M., & Verma, R. (2022). Forensic accounting and audit to strengthen corporate governance. Sachetas, 1(4), 56–61. [Google Scholar] [CrossRef] [PubMed]

- Wessels, B., & Madaus, S. (2020). Rescue of business in Europe. Oxford University Press. [Google Scholar] [CrossRef]

- Wuarlela, Y., Assih, P., & Parawiyati, P. (2023). The effect of government internal control systems and organizational commitment on organizational performance through work accountability as an intervening variable (Case study on the organization of the regional apparatus of the Tanimbar islands regency). Journal of Economics Finance and Management Studies, 6(6), 2487–2499. [Google Scholar] [CrossRef]

- Yang, Y. (2023). Audit data and management platform based on intelligent algorithm. Frontiers in Business Economics and Management, 11(1), 239–244. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Becerra Huamán, C.; De la Cruz-Montoya, D.; Gutierrez-Cuadros, J.; Pilco Labajos, S.; Lopez-Almeida, M. Financial Auditing as an Effective Tool for Fraud Detection: A Systematic Review. J. Risk Financial Manag. 2025, 18, 523. https://doi.org/10.3390/jrfm18090523

Becerra Huamán C, De la Cruz-Montoya D, Gutierrez-Cuadros J, Pilco Labajos S, Lopez-Almeida M. Financial Auditing as an Effective Tool for Fraud Detection: A Systematic Review. Journal of Risk and Financial Management. 2025; 18(9):523. https://doi.org/10.3390/jrfm18090523

Chicago/Turabian StyleBecerra Huamán, Cindy, David De la Cruz-Montoya, Joseph Gutierrez-Cuadros, Sonia Pilco Labajos, and Mercedes Lopez-Almeida. 2025. "Financial Auditing as an Effective Tool for Fraud Detection: A Systematic Review" Journal of Risk and Financial Management 18, no. 9: 523. https://doi.org/10.3390/jrfm18090523

APA StyleBecerra Huamán, C., De la Cruz-Montoya, D., Gutierrez-Cuadros, J., Pilco Labajos, S., & Lopez-Almeida, M. (2025). Financial Auditing as an Effective Tool for Fraud Detection: A Systematic Review. Journal of Risk and Financial Management, 18(9), 523. https://doi.org/10.3390/jrfm18090523