Optimizing Investments in the Portfolio Intelligence (PI) Model

Abstract

1. Introduction

- (I)

- to investigate in-depth investors’ genitive behavior in higher moments, seeking more information on earnings and exposure to risk preferences.

- (II)

- to introduce an improvement of the isoelastic utility as a more optimal function that supports higher moments.

- (III)

- to further develop Markowitz’s portfolio theory, evaluate the fundamentals, prices, and other available information, clear unnecessary noise, and determine healthy firms, excluding manipulation, fraud, etc.

- (IV)

- to examine the efficiency of the AI networks in neuro-genetic hybrids or neural net forms on various topologies as a new learning process, compared to past results of Radial Basis Functions-RBF, Support Vector Machines-SVM, Multi-Layer Perceptrons-MLPs, defining the optimal model on firms’ classification to a dynamic, competitive investment portfolio.

- (V)

- to introduce the integrated model PI as a modern solution to portfolio selection and optimization problems inspired by cutting-edge technologies.

2. Investments Behavior and Financial Modeling

Corporate Events, Returns

3. Higher Moments Addressing the Free Will of Investors

4. Methodology

4.1. Past Models

4.2. Problem Definition

Fractals in Investors’ Behavior

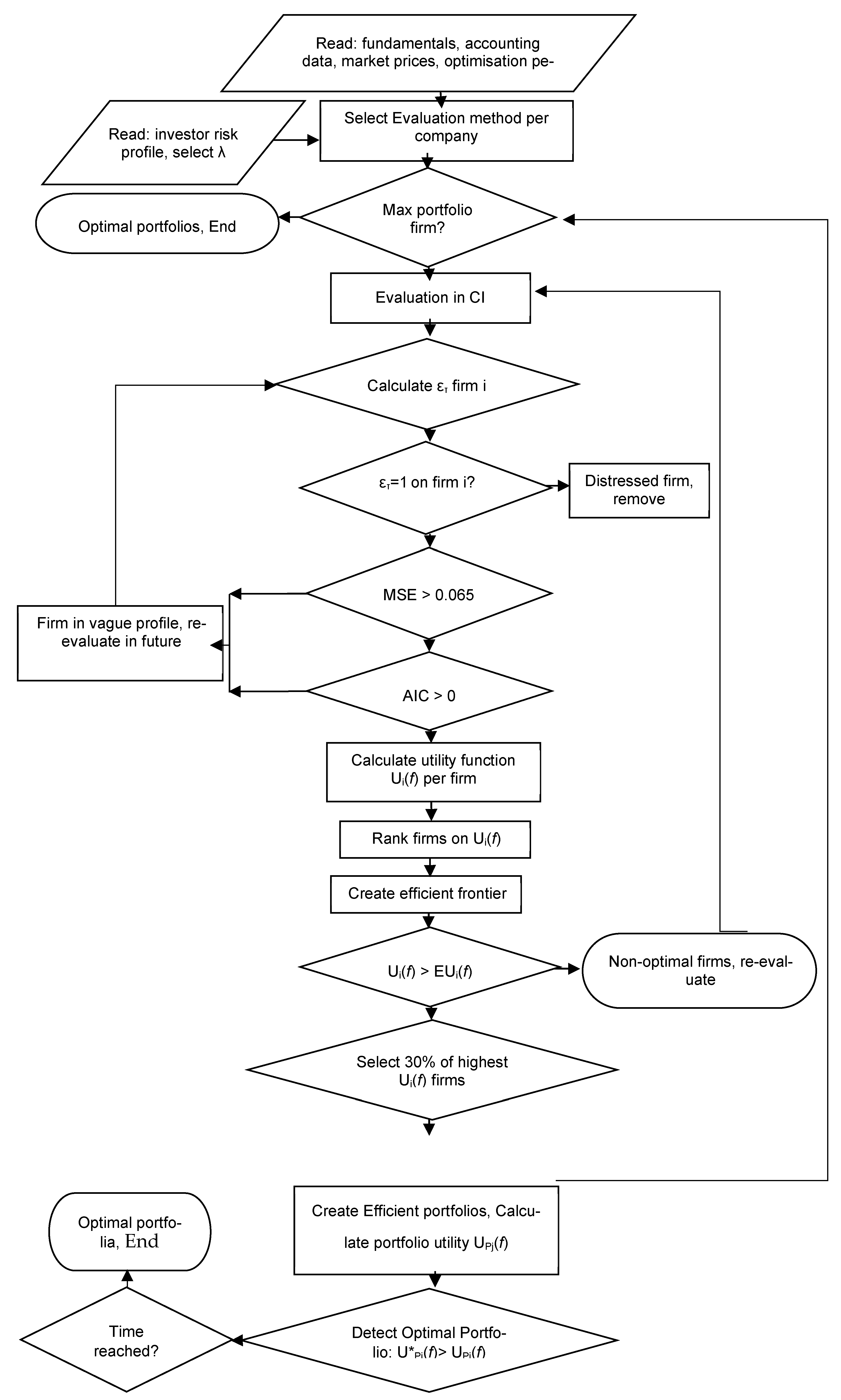

4.3. The Portfolio Intelligence—PI Model

4.4. The Genetic Algorithms in the Neural Hybrids

- (i)

- on the inputs layer only,

- (ii)

- on the inputs and outputs layers only,

- (iii)

- into all the layers,

- (iv)

- into all the layers with cross-validation,

- (a)

- the Step Size and

- (b)

- the Momentum Rate.

5. Data

- (1)

- EBIT/Total Assets,

- (2)

- Net Income/Net Worth,

- (3)

- Sales/Total Assets,

- (4)

- Gross Profit/Total Assets,

- (5)

- Net Income/Working Capital,

- (6)

- Net Worth/Total Liabilities,

- (7)

- Total Liabilities/Total assets,

- (8)

- Long Term Liabilities/(Long Term Liabilities + Net Worth),

- (9)

- Quick Assets/Current Liabilities

- (10)

- (Quick Assets-Inventories)/Current Liabilities,

- (11)

- Floating Assets/Current Liabilities,

- (12)

- Current Liabilities/Net Worth,

- (13)

- Cash Flow/Total Assets,

- (14)

- Total Liabilities/Working Capital,

- (15)

- Working Capital/Total Assets,

- (16)

- Inventories/Quick Assets,

6. The Classifiers

6.1. Support Vector Machines

6.2. Radial Basis Functions

Hybrid RBFNs in Genetic Algorithms

7. Conclusions and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Athayde, G., & Flores, R. (2003). Incorporating skewness and Kurtosis in portfolio optimization: A multidimensional efficient set. In S. Satchell, & A. Scowcroft (Eds.), Advances in portfolio construction and implementation (pp. 243–257). Butterworth-Heinemann. [Google Scholar]

- Baker, M., & Wurgler, J. (2000). The equity share in new issues and aggregate stock returns. Journal of Finance, 55, 2219–2257. [Google Scholar] [CrossRef]

- Baker, M., & Wurgler, J. (2006). Investor sentiment and the cross–section of stock returns. Journal of Finance, 61, 1645–1680. [Google Scholar] [CrossRef]

- Barber, B., Lee, Y. T., Liu, Y. J., & Odean, T. (2004). Who gains from trade? Evidence from Taiwan. Working Paper. University of California at Berkeley. [Google Scholar]

- Barber, B., & Odean, T. (2001). Boys will be boys: Gender, overconfidence and common stock investment. Quarterly Journal of Economics, 116, 261–292. [Google Scholar] [CrossRef]

- Barber, B., & Odean, T. (2002). Online investors: Do the slow die first? Review of Financial Studies, 15, 455–488. [Google Scholar] [CrossRef]

- Barber, B., Odean, T., & Zhu, N. (2005). Systematic noise. Working Paper. University of California at Davis. [Google Scholar]

- Barberis, N., & Huang, M. (2001). Mental accounting, loss aversion, and individual stock returns. Journal of Finance, 56, 1247–1292. [Google Scholar] [CrossRef]

- Barberis, N., Huang, M., & Santos, J. (2001). Prospect theory and asset prices. Quarterly Journal of Economics, 141, 1–53. [Google Scholar] [CrossRef]

- Barberis, N., & Shleifer, A. (2003). Style investing. Journal of Financial Economics, 68, 161–199. [Google Scholar] [CrossRef]

- Barberis, N., Shleifer, A., & Vishny, R. (1998). Model of investor sentiment. Journal of Financial Economics, 49, 307–343. [Google Scholar] [CrossRef]

- Barberis, N., Shleifer, A., & Wurgler, J. (2005). Comovement. Journal of Financial Economics, 75, 283–317. [Google Scholar] [CrossRef]

- Benartzi, S., & Thaler, R. H. (2001). Naive diversification strategies in defined contribution saving plans. American Economic Review, 91, 79–98. [Google Scholar] [CrossRef]

- Bernard, V. L., & Thomas, J. K. (1989). Post-earnings-announcement drift: Delayed price response or risk premium? Journal of Accounting Research, Supplement, 27, 1–48. [Google Scholar] [CrossRef]

- Bernard, V. L., & Thomas, J. K. (1990). Evidence that stock prices do not fully reflect the implications of current earnings for future earnings. Journal of Accounting and Economics, 13, 305–340. [Google Scholar] [CrossRef]

- Bernardo, A., & Welch, I. (2001). On the evolution of overconfidence and entrepreneurs. Journal of Economics and Management Strategy, 10, 301–330. [Google Scholar] [CrossRef]

- Boyle, P., & Ding, B. (2005). Portfolio selection with skewness. In M. Breton, & H. Ben-Ameur (Eds.), Numerical methods in finance. GERAD Groupe D’études et de Recherche en Analyse des Decisions. Springer. [Google Scholar]

- Brav, A., Graham, J. R., Harvey, C. R., & Michaely, R. (2005). Payout policy in the 21st century. Journal of Financial Economics, 77, 483–527. [Google Scholar] [CrossRef]

- Broomhead, D. S., & Lowe, D. (1988). Multivariable functional interpolation and adaptive networks. Complex Systems, 2, 321–355. [Google Scholar]

- Chan, L. K., Jegadeesh, N., & Lakonishok, J. (1996). Momentum strategies. Journal of Finance, 51, 1681–1714. [Google Scholar] [CrossRef]

- Colasante, A., & Riccetti, L. (2021). Financial and non-financial risk attitudes: What does it matter? Journal of Behavioral and Experimental Finance, 30, 100494. [Google Scholar] [CrossRef]

- Cortes, C., & Vapnik, V. (1995). Support-vector networks. Mach Learn, 20, 273–297. [Google Scholar] [CrossRef]

- Corwin, S., & Coughenour, J. (2005). Limited attention and the allocation of effort in securities trading. Working Paper. University of Notre Dame. [Google Scholar]

- Coval, J. D., & Moskowitz, T. J. (1999). Home bias at home: Local equity preference in domestic portfolios. Journal of Finance, 54, 145–166. [Google Scholar] [CrossRef]

- Daniel, K. D., Hirshleifer, D., & Subrahmanyam, A. (1998). Investor psychology and security market under and over-reactions. Journal of Finance, 53, 1839–1886. [Google Scholar] [CrossRef]

- DeLong, J. B., Shleifer, A., Summers, L., & Waldmann, R. J. (1991). The survival of noise traders in financial markets. Journal of Business, 64, 1–20. [Google Scholar] [CrossRef]

- Desai, H., & Jain, P. C. (1997). Long-run common stock returns following stock splits and reverse splits. Journal of Business, 70, 409–434. [Google Scholar] [CrossRef]

- Edmans, A., Garcia, D., & Norli, O. (2007). Sports sentiment and stock returns. Journal of Finance, 62, 1967–1998. [Google Scholar] [CrossRef]

- Frieder, L., & Subrahmanyam, A. (2005). Brand perceptions and the market for common stock. Journal of Financial and Quantitative Analysis, 40, 57–85. [Google Scholar] [CrossRef]

- Gervais, S., & Goldstein, I. (2004). Overconfidence and team coordination. Working Paper. University of Pennsylvania. [Google Scholar]

- Gervais, S., & Odean, T. (2001). Learning to be overconfident. Review of Financial Studies, 14, 1–27. [Google Scholar] [CrossRef]

- Goetzmann, W. N., & Kumar, A. (2003). Why do individual investors hold underdiversified portfolios? Working Paper. Yale ICF. [Google Scholar]

- Goetzmann, W. N., & Zhu, N. (2005). Rain or shine: Where is the weather effect? European Financial Management, 11, 559–578. [Google Scholar] [CrossRef]

- Griffin, D., & Tversky, A. (1992). The weighing of evidence and the determinants of overconfidence. Cognitive Psychology, 24, 411–435. [Google Scholar] [CrossRef]

- Grinblatt, M., & Han, B. (2005). Prospect theory, mental accounting, and momentum. Journal of Financial Economics, 78, 311–339. [Google Scholar] [CrossRef]

- Grinblatt, M., & Keloharju, M. (2001). What makes investors trade? Journal of Finance, 56, 589–616. [Google Scholar] [CrossRef]

- Grinblatt, M., Masulis, R. W., & Titman, S. (1984). The valuation effects of stock splits and stock dividends. Journal of Financial Economics, 13, 97–112. [Google Scholar] [CrossRef]

- Hirshleifer, D., & Shumway, T. (2003). Good day sunshine: Stock returns and the weather. Journal of Finance, 58, 1009–1032. [Google Scholar] [CrossRef]

- Hirshleifer, D., Subrahmanyam, A., & Titman, S. (2006). Feedback and the success of irrational traders. Journal of Financial Economics, 81, 311–388. [Google Scholar] [CrossRef]

- Hirshleifer, D., & Teoh, S. H. (2003). Limited attention, information disclosure, and financial reporting. Journal of Accounting & Economics, 36, 337–386. [Google Scholar] [CrossRef]

- Holland, J. (1992). Adaptation in natural and artificial system. MIT Press. First edition 1975 Michigan University Press. (Original work published 1975). ISBN 978-0262581110. [Google Scholar]

- Hong, H., Kubik, J., & Stein, J. (2004). Social interactions and stock market participation. Journal of Finance, 59, 137–163. [Google Scholar] [CrossRef]

- Hong, H., Kubik, J., & Stein, J. (2005). Thy neighbor’s portfolio: Word-of-mouth effects in the holdings and trades of money managers. Journal of Finance, 60, 2801–2824. [Google Scholar] [CrossRef]

- Hong, H., Lim, T., & Stein, J. (2000). Bad news travels slowly: Size, analyst coverage and the profitability of momentum strategies. Journal of Finance, 55, 265–295. [Google Scholar] [CrossRef]

- Hong, H., Scheinkman, J., & Xiong, W. (2006). Asset float and speculative bubbles. Journal of Finance, 61, 1073–1117. [Google Scholar] [CrossRef]

- Hong, H., & Stein, J. C. (1999). A unified theory of underreaction, momentum trading and overreaction in asset markets. Journal of Finance, 54, 2143–2184. [Google Scholar] [CrossRef]

- Hvidkjaer, S. (2005). Small trades and the cross-section of stock returns. Working Paper. University of Maryland. [Google Scholar]

- Hvidkjaer, S. (2006). A trade-based analysis of momentum. Review of Financial Studies, 19, 457–491. [Google Scholar] [CrossRef]

- Kamstra, M. J., Kramer, L. A., & Levi, M. D. (2000). Losing sleep at the market: The daylight-savings anomaly. American Economic Review, 90, 1005–1011. [Google Scholar] [CrossRef]

- Kausar, A., & Taffler, R. (2006). Testing behavioral finance models of market under and overreaction: Do they really work? Working Paper. University of Edinburgh. [Google Scholar]

- Kumar, A. (2009a). Hard-to-Value stocks, behavioral biases, and informed trading. Journal of Financial and Quantitative Analysis, 44, 1375–1401. [Google Scholar] [CrossRef]

- Kumar, A. (2009b). Who gambles in the stock market? Journal of Finance, 54, 1889–1933. [Google Scholar] [CrossRef]

- Kyle, A., & Wang, F. A. (1997). Speculation duopoly with agreement to disagree: Can overconfidence survive the market test? Journal of Finance, 52, 2073–2090. [Google Scholar] [CrossRef]

- Lai, K. K., Yu, L., & Wang, S. (2006, June 20–24). Mean-variance-skewness-kurtosis-based portfolio optimization. First International Multi-Symposiums on Computer and Computational Sciences (IMSCCS’06) (Vol. 2, pp. 292–297), Hangzhou, China. [Google Scholar]

- Latham, A. J. (2019). The conceptual impossibility of free will error theory. European Journal of Analytic Philosophy, 15, 99–120. [Google Scholar] [CrossRef]

- Li, K., & Wu, X. (2025). Research on the optimization of commercial bank technology credit asset portfolio model under fractal distribution. Computational Economics. forthcoming. [Google Scholar]

- Loughran, T., & Ritter, J. (1995). The new issues puzzle. Journal of Finance, 50, 23–52. [Google Scholar] [CrossRef]

- Loukeris, N. (2008). Radial basis functions networks to hybrid neuro-genetic RBF Networks in financial evaluation of corporations. International Journal of Computers, 2(2), 812–819. [Google Scholar]

- Loukeris, N., Donelly, D., Khuman, A., & Peng, Y. (2009). A numerical evaluation of meta-heuristic techniques in Portfolio Optimisation. Operational Research: An International Journal, 9(1), 81–103. [Google Scholar] [CrossRef]

- Loukeris, N., & Eleftheriadis, I. (2012, August 1–5). Bankruptcy prediction into hybrids of time lag recurrent networks with genetic optimisation, multi layer perceptrons neural nets, and bayesian logistic regression [Research Paper Award]. Proceedings of the International Summer Conference of the International Academy of Business and Public Administration Disciplines (IABPAD), Library of Congress, Honolulu, HI, USA, ISSN 547-4836. [Google Scholar]

- Loukeris, N., & Eleftheriadis, I. (2013, December 12–15). A novel approach on hybrid support vector machines into optimal portfolio selection. IEEE International Symposium on Signal Processing and Information Technology, Athens, Greece. [Google Scholar]

- Loukeris, N., & Eleftheriadis, I. (2016). The Portfolio Heuristic Optimisation System (PHOS). Computational Economics, 48(4), 627–648. [Google Scholar] [CrossRef]

- Loukeris, N., & Eleftheriadis, I. (2024). Optimal investments in the Portfolio Yield Reactives (PYR). Journal of Risk Financial Management, 17(8), 376. [Google Scholar] [CrossRef]

- Loukeris, N., Eleftheriadis, I., Boutalis, Y., & Gikas, G. (2024). Optimizing portfolio in the evolutional portfolio optimization system (EPOS). Mathematics, 12(17), 2729. [Google Scholar] [CrossRef]

- Loukeris, N., Eleftheriadis, I., & Livanis, E. (2014a, July 1–3). Optimal asset allocation in radial basis functions networks, and hybrid neuro-genetic RBFΝs to TLRNs, MLPs and bayesian logistic regression. World Finance Conference, Venice, Italy. [Google Scholar]

- Loukeris, N., Eleftheriadis, I., & Livanis, E. (2014b, July 7–9). Portfolio selection into radial basis functions networks and neuro-genetic RBFN hybrids. IEEE 5th International Conference on Information, Intelligence, Systems and Applications IISA, Chania, Greece. [Google Scholar]

- Loukeris, N., & Matsatsinis, N. (2006). Corporate financial evaluation and bankruptcy prediction implementing artificial intelligence methods. WSEAS Transactions on Business and Economics, 4(3), 938–942. [Google Scholar]

- Malmendier, U., & Tate, G. A. (2005a). CEO overconfidence and corporate investment. Journal of Finance, 60, 2661–2700. [Google Scholar] [CrossRef]

- Malmendier, U., & Tate, G. A. (2005b). Superstar CEOs. Working Paper. Stanford University. [Google Scholar]

- Maringer, D., & Parpas, P. (2009). Global optimization of higher order moments in portfolio selection. Journal of Global Optimization, 43, 219–230. [Google Scholar] [CrossRef]

- Markowitz, H. M. (1952). Portfolio selection. Journal of Finance, 7(1), 77–91. [Google Scholar]

- Merton, R. C. (2009). Continuous-time finance (revised edition, 1992 ed.). Blackwell. [Google Scholar]

- Michaely, R., Thaler, R. H., & Womack, K. L. (1995). Price reactions to dividend initiations and omissions: Overreaction or drift? Journal of Finance, 50, 573–608. [Google Scholar] [CrossRef]

- Nagel, S. (2005). Short sales, institutional investors and the cross-section of stock returns. Journal of Financial Economics, 78(2), 277–309. [Google Scholar] [CrossRef]

- Odean, T. (1998). Are investors reluctant to realize their losses? Journal of Finance, 53, 1775–1798. [Google Scholar] [CrossRef]

- Odean, T. (1999). Do investors trade too much? American Economic Review, 89, 1279–1298. [Google Scholar] [CrossRef]

- Pink, T. (2004). Free will: A very short introduction. Oxford University Press. [Google Scholar]

- Ranaldo, A., & Favre, L. (2003). How to price hedge funds: From two- to four-moment CAPM. Technical report. EDHEC Risk and Asset Management Research Centre. [Google Scholar]

- Saunders, J. (1993). Stock prices and wall street weather. American Economic Review, 83, 1337–1345. [Google Scholar]

- Scheinkman, J. A., & Xiong, W. (2003). Overconfidence, short-sale constraints, and bubbles. Journal of Political Economy, 111, 1183–1219. [Google Scholar] [CrossRef]

- Shefrin, H., & Statman, M. (1984a). The disposition to sell winners too early and ride losers too long: Theory and evidence. Journal of Finance, 40, 777–790. [Google Scholar] [CrossRef]

- Sorescu, S., & Subrahmanyam, A. (2006). The cross section of analyst recommendations. Journal of Financial and Quantitative Analysis, 41, 139–168. [Google Scholar] [CrossRef]

- Spiess, D. K., & Affleck-Graves, J. (1995). Underperformance in long-run stock returns following seasoned equity offerings. Journal of Financial Economics, 38, 243–268. [Google Scholar] [CrossRef]

- Stein, J. (1996). Rational capital budgeting in an irrational world. Journal of Business, 69, 429–455. [Google Scholar] [CrossRef]

- Subrahmanyam, A. (2005). A cognitive theory of corporate disclosures. Financial Management, 34, 5–33. [Google Scholar] [CrossRef]

- Subrahmanyam, A. (2007). Behavioral finance: A review and synthesis. European Financial Management, 14, 12–29. [Google Scholar] [CrossRef]

- Sun, Z., Bebis, G., & Miller, R. (2004). Object detection using feature subset selection. Pattern Recognition, 37(11), 2165–2176. [Google Scholar] [CrossRef]

- Teoh, S. H., Welch, I., & Wong, T. J. (1998). Earnings management and the underperformance of seasoned equity offerings. Journal of Financial Economics, 50, 63–99. [Google Scholar] [CrossRef]

- Thaler, R. H., & Benartzi, S. (2004). Save more tomorrow: Using behavioural economics to increase employee saving. Journal of Political Economy, 112, 164–187. [Google Scholar] [CrossRef]

- Zhang, X. F. (2006). Information uncertainty and analyst forecast behavior. Journal of Finance, 61, 105–136. [Google Scholar] [CrossRef]

| Neural Network | Active Confusion Matrix | Performance | Time | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Layers | 0→0 | 0→1 | 1→0 | 1→1 | MSE | NMSE | r | %Error | AIC | MDL | ||

| SVM 500 epochs | 100 | 0 | 0 | 100 | 0.035 | 0.072 | 0.999 | 5.4367 | 23,073.68 | 39,305.4 | 1′52″ | |

| SVM 1000 epochs | 100 | 0 | 0 | 100 | 0.035 | 0.066 | 0.999 | 4.8573 | 23,016.76 | 39,248.5 | 4′11″ | |

| Hybrid SVM 500 epochs GA input | 100 | 0 | 0 | 100 | 0.045 | 0.086 | 0.999 | 6.5558 | 16,159.80 | 27,896.0 | 14 h 39′31″ | |

| Hybrid SVM 500 epochs GA output | 100 | 0 | 0 | 100 | 0.065 | 0.125 | 0.999 | 6.8050 | 23,457.92 | 39,689.6 | 1 h 07′34″ | |

| Hybrid SVM 1000 epochs GA output | 100 | 0 | 0 | 100 | 0.049 | 0.095 | 0.999 | 6.2354 | 23,253.32 | 39,485.0 | 4 h 23′35″ | |

| Hybrid SVM 500 epochs GA in, C. V. | 100 | 0 | 0 | 100 | 0.023 | 0.045 | 0.999 | 4.0133 | 12,044.20 | 21,524.3 | 26 h 56′14″ | |

| 94.29 | 5.69 | 22.01 | 77.98 | 0.309 | 0.591 | 0.949 | 12.728 | 13,931.09 | 23,409.9 | |||

| Hybrid SVM 1000 epoc. GA out., CV | 100 | 0 | 0 | 100 | 0.098 | 0.505 | 0.999 | 6.1344 | 23,292.73 | 39,540.5 | 5 h 38′12″ | |

| 94.63 | 5.36 | 24.31 | 75.68 | 0.522 | 0.679 | 0.971 | 1.7162 | 24,663.75 | 40,911.5 | |||

| Hybrid SVM 500 epoc. GA All, CV | 100 | 0 | 0 | 100 | 0.091 | 0.175 | 0.999 | 9.0672 | 12,375.85 | 21,401.5 | 21 h 16′32″ | |

| 95.88 | 4.10 | 25.22 | 74.76 | 0.541 | 1.037 | 0.983 | 25,126 | 13,646.24 | 22,672.4 | |||

| RBF input-output GA | 3 | 97.24 | 2.76 | 27.52 | 72.48 | 0.166 | 0.393 | 0.925 | 9.039 | 672.93 | 1912.74 | 5 h 48′56″ |

| RBF GA All | 0 | 98.15 | 1.85 | 39.91 | 60.09 | 0.188 | 0.445 | 0.815 | 13.00 | 37.12 | 820.831 | 5 h 02′28″ |

| RBF inputs GA | 0 | 97.73 | 2.26 | 46.32 | 53.67 | 0.219 | 0.519 | 0.791 | 12.383 | 282.78 | 1154.02 | 4 h 19′42″ |

| MLP N. N. | 1 | 100 | 0 | 98.62 | 1.37 | 0.418 | 0.989 | 0.107 | 19.432 | −468.25 | −374.8 | 15″ |

| Hybrid Networks | Active Confusion Matrix | Performance | Time | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Layers | 0→0 | 0→1 | 1→0 | 1→1 | MSE | NMSE | R | %Error | AIC | MDL | ||

| RBF input-output GA | 3 | 97.24 | 2.76 | 27.52 | 72.48 | 0.166 | 0.393 | 0.9256 | 9.039 | 672.93 | 1912.74 | 5 h 48′56″ |

| RBF GA | 0 | 98.15 | 1.85 | 39.91 | 60.09 | 0.188 | 0.445 | 0.8158 | 13.009 | 37.12 | 820.831 | 5 h 02′28″ |

| RBF inputs GA | 0 | 97.73 | 2.26 | 46.32 | 53.67 | 0.219 | 0.519 | 0.7916 | 12.383 | 282.78 | 1154.02 | 4 h 19′42″ |

| Neural Network | Active Confusion Matrix | Performance | Time | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Layers | 0→0 | 0→1 | 1→0 | 1→1 | MSE | NMSE | r | %Error | AIC | MDL | ||

| RBF input-output GA | 3 | 97.24 | 2.76 | 27.52 | 72.48 | 0.166 | 0.393 | 0.925 | 9.039 | 672.93 | 1912.74 | 5 h 48′56″ |

| RBF GA All | 0 | 98.15 | 1.85 | 39.91 | 60.09 | 0.188 | 0.445 | 0.815 | 13.00 | 37.12 | 820.83 | 5 h 02′28″ |

| SVM 500 epochs | 100 | 0 | 0 | 100 | 0.035 | 0.072 | 0.999 | 5.436 | 23,073.68 | 39,305.4 | 1′52″ | |

| SVM 1000 epochs | 100 | 0 | 0 | 100 | 0.035 | 0.066 | 0.999 | 4.857 | 23,016.76 | 39,248.5 | 4′11″ | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Loukeris, N.; Maltoudoglou, L.; Boutalis, Y.; Eleftheriadis, I. Optimizing Investments in the Portfolio Intelligence (PI) Model. J. Risk Financial Manag. 2025, 18, 521. https://doi.org/10.3390/jrfm18090521

Loukeris N, Maltoudoglou L, Boutalis Y, Eleftheriadis I. Optimizing Investments in the Portfolio Intelligence (PI) Model. Journal of Risk and Financial Management. 2025; 18(9):521. https://doi.org/10.3390/jrfm18090521

Chicago/Turabian StyleLoukeris, Nikolaos, Lysimachos Maltoudoglou, Yannis Boutalis, and Iordanis Eleftheriadis. 2025. "Optimizing Investments in the Portfolio Intelligence (PI) Model" Journal of Risk and Financial Management 18, no. 9: 521. https://doi.org/10.3390/jrfm18090521

APA StyleLoukeris, N., Maltoudoglou, L., Boutalis, Y., & Eleftheriadis, I. (2025). Optimizing Investments in the Portfolio Intelligence (PI) Model. Journal of Risk and Financial Management, 18(9), 521. https://doi.org/10.3390/jrfm18090521