Modeling Behavioral and Attitudinal Drivers of Life Insurance Selection and Premiums: Polynomial Approaches to Perceived Affordability in Term and Cash Value Products

Abstract

1. Introduction

2. Methodology

2.1. Data Source and Sample Design

2.2. Main Variables

2.2.1. Dependent Variables

2.2.2. Independent Variables

Main Variable

Consumer Characteristics

- Binary Scoring of Items: For each respondent i and question j (), define the binary response

- 2PL IRT Model: Each item j is characterized by a discrimination parameter and a difficulty parameter . The probability of a correct response, given latent trait , is

- Likelihood Function: The joint likelihood of respondent i’s response vector is

- Expected a Posteriori (EAP) Estimation: The EAP estimate of is given bywhere is the assumed prior (typically standard normal).

- Rescaling: To ensure all values are positive (e.g., for modeling purposes), a linear shift is applied:where is a small positive constant (e.g., ) to ensure strictly positive values.

Underwriting Factors

Exclusion Restriction

2.3. Econometric Model

- Distributional Assumptions

- Weighted Log-Likelihood

- Premium Measure and Treatment

- Limitation in Data Collection

- Justification for Analytical Strategy

3. Result

Post-Estimation Analysis

4. Discussion

4.1. Policy and Managerial Implications

4.2. Future Research

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abaluck, J., & Gruber, J. (2011). Choice inconsistencies among the elderly: Evidence from plan choice in the Medicare Part D program. American Economic Review, 101(4), 1180–1210. [Google Scholar] [CrossRef] [PubMed]

- Abaluck, J., Gruber, J., & Swanson, A. (2018). Prescription drug use under Medicare Part D: A linear model of nonlinear budget sets. Journal of Public Economics, 164, 106–138. [Google Scholar] [CrossRef] [PubMed]

- Afoakwah, C., Byrnes, J., Scuffham, P., & Nghiem, S. (2023). Testing for selection bias and moral hazard in private health insurance: Evidence from a mixed public-private health system. Health Economics, 32(1), 3–24. [Google Scholar] [CrossRef] [PubMed]

- Albert, A., & Anderson, J. A. (1984). On the existence of maximum likelihood estimates in logistic regression models. Biometrika, 71(1), 1–10. [Google Scholar] [CrossRef]

- Alemán, H. M., & Marrugo, E. A. B. (2023). Analysis of the psychology of price and its application in marketing. Journal of Psychology & Clinical Psychiatry, 14(2), 46. [Google Scholar] [CrossRef]

- Ali, B. J., & Anwar, G. (2021). Marketing Strategy: Pricing strategies and its influence on consumer purchasing decision. International Journal of Rural Development, Environment and Health Research, 5(2), 26–39. [Google Scholar] [CrossRef]

- Anagol, S., Cole, S., & Sarkar, S. (2017). Understanding the advice of commissions-motivated agents: Evidence from the Indian life insurance market. Review of Economics and Statistics, 99(1), 1–15. [Google Scholar] [CrossRef]

- Anderson, D. R., & Nevin, J. R. (1975). Determinants of young marrieds’ life insurance purchasing behavior: An empirical investigation. Journal of Risk and Insurance, 42, 375–387. [Google Scholar] [CrossRef]

- Ansolabehere, S., & Rivers, D. (2013). Cooperative survey research. Annual Review of Political Science, 16(1), 307–329. [Google Scholar] [CrossRef]

- Avraham, R., Logue, K. D., & Schwarcz, D. (2013). Understanding insurance antidiscrimination law. Southern California Law Review, 87, 195. [Google Scholar]

- Awopeju, O., Afolabi, E., & Opesemowo, O. (2017). An investigation of invariance properties of one, two and three parameter logistic item response theory models. Bulgarian Journal of Science and Education Policy, 11(2), 197–219. [Google Scholar]

- Babbel, D. F., & Merrill, C. (1998). Economic valuation models for insurers. North American Actuarial Journal, 2(3), 1–15. [Google Scholar] [CrossRef][Green Version]

- Baicker, K., Congdon, W. J., & Mullainathan, S. (2012). Health insurance coverage and take-up: Lessons from behavioral economics. Milbank Quarterly, 90(1), 107–134. [Google Scholar] [CrossRef] [PubMed]

- Baicker, K., Mullainathan, S., & Schwartzstein, J. (2015). Behavioral hazard in health insurance. The Quarterly Journal of Economics, 130(4), 1623–1667. [Google Scholar] [CrossRef]

- Barcellos, S. H., Wuppermann, A., Carman, K. G., Bauhoff, S., McFadden, D., & Winter, J. K. (2014). Health plan choice and utilization: Evidence from medicare advantage (NBER Working Paper No. 19954). National Bureau of Economic Research. Available online: https://www.nber.org/papers/w19954 (accessed on 3 June 2025).

- Barseghyan, L., Prince, J., & Teitelbaum, J. C. (2011). Are risk preferences stable across contexts? Evidence from insurance data. American Economic Review, 101(2), 591–631. [Google Scholar] [CrossRef]

- Barsky, R. B., Juster, F. T., Kimball, M. S., & Shapiro, M. D. (1997). Preference parameters and behavioral heterogeneity: An experimental approach in the health and retirement study. The Quarterly Journal of Economics, 112(2), 537–579. [Google Scholar] [CrossRef]

- Bartels, L. M. (2023). Measuring political inequality. In Unequal democracies: Public policy, responsiveness, and redistribution in an era of rising economic inequality (pp. 77–97). Cambridge University Press. [Google Scholar]

- Battaglia, M. P., Hoaglin, D. C., & Frankel, M. R. (2009). Practical considerations in raking survey data. Survey Practice, 2(5). [Google Scholar] [CrossRef]

- Bernard, D. M., Selden, T. M., & Fang, Z. (2023). The joint distribution of high out-of-pocket burdens, medical debt, and financial barriers to needed care. Health Affairs, 42(11), 1517–1526. [Google Scholar] [CrossRef] [PubMed]

- Bernheim, B. D. (1991). How strong are bequest motives? Evidence based on estimates of the demand for life insurance and annuities. Journal of Political Economy, 99(5), 899–927. [Google Scholar] [CrossRef]

- Bhatia, R., Bhat, A. K., & Tikoria, J. (2021). Life insurance purchase behaviour: A systematic review and directions for future research. International Journal of Consumer Studies, 45(6), 1149–1175. [Google Scholar] [CrossRef]

- Bhattacharya-Craven, A., Heitmueller, A., & Schanz, K.-U. (2025). Insurance and the longevity economy: Navigating protection in the era of 100-year lives (Tech. Rep.). The Geneva Association. Available online: https://www.genevaassociation.org/sites/default/files/2025-02/insurance_and_longevity_report_1902_final.pdf (accessed on 3 June 2025).

- Bhattacharya-Craven, A., Jackson, R., & Schanz, K.-U. (2022). Financial wellbeing: Is it the key to reinventing life insurance? (Tech. Rep.). The Geneva Association. Available online: https://www.genevaassociation.org/sites/default/files/2022-06/financial_wellbeing_report_0.pdf (accessed on 3 June 2025).

- Bordalo, P., Gennaioli, N., & Shleifer, A. (2022). Salience. Annual Review of Economics, 14, 521–544. [Google Scholar] [CrossRef]

- Brav, A., Graham, J. R., Harvey, C. R., & Michaely, R. (2005). Payout policy in the 21st century. Journal of Financial Economics, 77(3), 483–527. [Google Scholar] [CrossRef]

- Brown, J. R., & Goolsbee, A. (2002). Does the Internet make markets more competitive? Evidence from the life insurance industry. Journal of Political Economy, 110(3), 481–507. [Google Scholar] [CrossRef]

- Brown, S., Bucciol, A., Montagnoli, A., & Taylor, K. (2025). Financial advice and household financial portfolios. Oxford Bulletin of Economics and Statistics, 87(2), 382–413. [Google Scholar] [CrossRef]

- Browne, M. J., & Kim, K. (1993). An international analysis of life insurance demand. Journal of Risk and Insurance, 60(4), 616–634. [Google Scholar] [CrossRef]

- Bruhin, A., Fehr-Duda, H., & Epper, T. (2010). Risk and rationality: Uncovering heterogeneity in probability distortion. Econometrica, 78(4), 1375–1412. [Google Scholar] [CrossRef]

- Cardon, J. H., & Hendel, I. (2001). Asymmetric information in health insurance: Evidence from the National Medical Expenditure Survey. RAND Journal of Economics, 32, 408–427. [Google Scholar] [CrossRef] [PubMed]

- Carpini, M. X. D., & Keeter, S. (1996). What americans know about politics and why it matters. Yale University Press. [Google Scholar]

- Center for Insurance Policy and Research (CIPR). (2020). Milestones in racial discrimination within the insurance sector (Tech. Rep.). National Association of Insurance Commissioners (NAIC). Available online: https://content.naic.org/sites/default/files/cipr-report-milestones-racial-discrimination.pdf (accessed on 15 June 2025).

- Charles, D., Dumontet, M., Etner, J., & Jeleva, M. (2024). Behavioral drivers of individuals’ term life insurance demand: Evidence from a discrete choice experiment. HAL Open Science. [Google Scholar]

- Chen, C., Tan, Z., & Liu, S. (2024). How does financial literacy affect households’ financial fragility? The role of insurance awareness. International Review of Economics and Finance, 95, 103518. [Google Scholar] [CrossRef]

- Chen, H., Hardesty, D., Rao, A., & Bolton, L. E. (2021). Introduction to special issue on behavioral pricing. Journal of the Association for Consumer Research, 6(1), 4–9. [Google Scholar] [CrossRef]

- Chiappori, P.-A., & Salanie, B. (2000). Testing for asymmetric information in insurance markets. Journal of Political Economy, 108(1), 56–78. [Google Scholar] [CrossRef]

- Code, T. I. (2023). Chapter 544: Unfair discrimination and rebates (Tech. Rep.). State of Texas. Available online: https://statutes.capitol.texas.gov/Docs/IN/htm/IN.544.htm (accessed on 15 April 2025).

- Cohen, A., & Einav, L. (2007). Estimating risk preferences from deductible choice. American Economic Review, 97(3), 745–788. [Google Scholar] [CrossRef]

- Cole, C. R., & Fier, S. G. (2021). An examination of life insurance policy surrender and loan activity. Journal of Risk and Insurance, 88(2), 483–516. [Google Scholar] [CrossRef]

- Colorado Division of Insurance. (2021). Sb21-169: Protecting consumers from unfair discrimination in insurance practices (Technical Report). Available online: https://doi.colorado.gov/for-consumers/sb21-169-protecting-consumers-from-unfair-discrimination-in-insurance-practices (accessed on 15 April 2025).

- Crockett, D., & Wallendorf, M. (2004). The role of normative political ideology in consumer behavior. Journal of Consumer Research, 31(3), 511–528. [Google Scholar] [CrossRef]

- Dahlen, A., & Charu, V. (2023). Analysis of sampling bias in large health care claims databases. JAMA Network Open, 6(1), e2249804. [Google Scholar] [CrossRef] [PubMed]

- DeBell, M., & Krosnick, J. A. (2009). Computing weights for American national election study survey data (p. nes012427). (Technical Report Series). American National Election Study. [Google Scholar]

- De Jong, A. (2006). Capital structure policies in Europe: Survey evidence. Journal of Banking & Finance, 30, 1409–1442. [Google Scholar] [CrossRef]

- Delgadillo, L. M., & Lee, Y. G. (2021). Association between financial education, affective and cognitive financial knowledge, and financial behavior. Family and Consumer Sciences Research Journal, 50(1), 59–75. [Google Scholar] [CrossRef]

- Dhanya, M., Anusree, K., & Varier, S. S. (2023). The role of fear on the purchase intention of life insurance products during COVID-19: An empirical investigation among male and female. International Journal of Business and Economics, 22(2), 113–131. [Google Scholar]

- Dohmen, T., Falk, A., Huffman, D., Sunde, U., Schupp, J., & Wagner, G. G. (2011). Individual risk attitudes: Measurement, determinants, and behavioral consequences. Journal of the European Economic Association, 9(3), 522–550. [Google Scholar] [CrossRef]

- Domurat, R., Menashe, I., & Yin, W. (2021). The role of behavioral frictions in health insurance marketplace enrollment and risk: Evidence from a field experiment. American Economic Review, 111(5), 1549–1574. [Google Scholar] [CrossRef]

- Douven, R., Van der Heijden, R., McGuire, T., & Schut, F. (2020). Premium levels and demand response in health insurance: Relative thinking and zero-price effects. Journal of Economic Behavior & Organization, 180, 903–923. [Google Scholar] [CrossRef]

- Dragoş, S. L., Mare, C., & Dragoş, C. M. (2019). Institutional drivers of life insurance consumption: A dynamic panel approach for European countries. The Geneva Papers on Risk and Insurance-Issues and Practice, 44, 36–66. [Google Scholar]

- Edwards, J. R., & Parry, M. E. (1993). On the use of polynomial regression equations as an alternative to difference scores in organizational research. Academy of Management Journal, 36(6), 1577–1613. [Google Scholar] [CrossRef]

- Einav, L., & Finkelstein, A. (2011). Selection in insurance markets: Theory and empirics in pictures. Journal of Economic Perspectives, 25(1), 115–138. [Google Scholar] [CrossRef] [PubMed]

- Einav, L., & Finkelstein, A. (2023). Empirical analyses of selection and welfare in insurance markets: A self-indulgent survey (Tech. Rep. No. 31146) [NBER Working Paper Series. Prepared for the Geneva Risk and Insurance Review]. National Bureau of Economic Research. Available online: http://www.nber.org/papers/w31146 (accessed on 3 June 2025).

- Einav, L., Finkelstein, A., & Levin, J. (2010). Beyond testing: Empirical models of insurance markets. Annual Review of Economics, 2(1), 311–336. [Google Scholar] [CrossRef]

- Embretson, S. E., & Reise, S. P. (2013). Item response theory for psychologists. Psychology Press. [Google Scholar]

- Fang, H., Keane, M. P., & Silverman, D. (2008). Sources of advantageous selection: Evidence from the Medigap insurance market. Journal of Political Economy, 116(2), 303–350. [Google Scholar] [CrossRef]

- Fels, M. (2020). Mental accounting, access motives, and overinsurance. The Scandinavian Journal of Economics, 122(2), 675–701. [Google Scholar] [CrossRef]

- Finkelstein, A., Hendren, N., & Shepard, M. (2019). Subsidizing health insurance for low-income adults: Evidence from Massachusetts. American Economic Review, 109(4), 1530–1567. [Google Scholar] [CrossRef]

- Finkelstein, A., & McGarry, K. (2006). Multiple dimensions of private information: Evidence from the long-term care insurance market. American Economic Review, 96(4), 938–958. [Google Scholar] [CrossRef]

- Gale, W. G., Logue, K. D., Cahill, N., Gu, R., & Joshi, S. (2022). Racial discrimination in life insurance. University of Michigan Law School. [Google Scholar]

- Geruso, M., Layton, T. J., McCormack, G., & Shepard, M. (2023). The two-margin problem in insurance markets. Review of Economics and Statistics, 105(2), 237–257. [Google Scholar] [CrossRef]

- Gigerenzer, G., & Todd, P. M. (2000). Simple heuristics that make us smart (ABC Research Group Ed.). Oxford University Press. [Google Scholar]

- Giri, M. (2018). A behavioral study of life insurance purchase decisions. Indian Institute of Technology Kanpur. [Google Scholar]

- Gladstone, J., & Barrett, J. A. M. (2023). Understanding the functional form of the relationship between childhood cognitive ability and adult financial well-being. PLoS ONE, 18(6), e0285199. [Google Scholar] [CrossRef] [PubMed]

- Gourville, J. T., & Soman, D. (1998). Payment depreciation: The behavioral effects of temporally separating payments from consumption. Journal of Consumer Research, 25(2), 160–174. [Google Scholar] [CrossRef]

- Graham, J. R., Harvey, C. R., & Puri, M. (2013). Managerial attitudes and corporate actions. Journal of Financial Economics, 109(1), 103–121. [Google Scholar] [CrossRef]

- Greene, W. H. (2000). Econometric analysis (4th ed., pp. 201–215). [International Edition]. Prentice Hall. [Google Scholar]

- Gropper, M. J., & Kuhnen, C. M. (2025). Wealth and insurance choices: Evidence from US households. The Journal of Finance, 80(2), 1127–1170. [Google Scholar] [CrossRef]

- Groves, R. M. (2006). Nonresponse rates and nonresponse bias in household surveys. International Journal of Public Opinion Quarterly, 70(5), 646–675. [Google Scholar] [CrossRef]

- Guiso, L., Sapienza, P., & Zingales, L. (2008). Trusting the stock market. The Journal of Finance, 63(6), 2557–2600. [Google Scholar] [CrossRef]

- Gutter, M. S., & Hatcher, C. B. (2008). Racial differences in the demand for life insurance. Journal of Risk and Insurance, 75(3), 677–689. [Google Scholar] [CrossRef]

- Hackethal, A., Haliassos, M., & Jappelli, T. (2012). Financial advisors: A case of babysitters? Journal of Banking & Finance, 36(2), 509–524. [Google Scholar] [CrossRef]

- Handel, B., Hendel, I., & Whinston, M. D. (2015). Equilibria in health exchanges: Adverse selection versus reclassification risk. Econometrica, 83(4), 1261–1313. [Google Scholar] [CrossRef]

- Handel, B. R. (2013). Adverse selection and inertia in health insurance markets: When nudging hurts. American Economic Review, 103(7), 2643–2682. [Google Scholar] [CrossRef]

- Handel, B. R., & Kolstad, J. T. (2015). Health insurance for “humans”: Information frictions, plan choice, and consumer welfare. American Economic Review, 105(8), 2449–2500. [Google Scholar] [CrossRef]

- Handel, B. R., Kolstad, J. T., & Spinnewijn, J. (2019). Information frictions and adverse selection: Policy interventions in health insurance markets. Review of Economics and Statistics, 101(2), 326–340. [Google Scholar] [CrossRef]

- Harrell, F. E., & Levy, D. G. (2022). Regression modeling strategies (p. 6–3). R Package Version. Springer. [Google Scholar]

- Harris, T. F., & Yelowitz, A. (2018). Racial disparities in life insurance coverage. Applied Economics, 50(1), 94–107. [Google Scholar] [CrossRef]

- Hastings, J. S., Madrian, B. C., & Skimmyhorn, W. L. (2013). Financial literacy, financial education, and economic outcomes. Annual Review of Economics, 5(1), 347–373. [Google Scholar] [CrossRef]

- Heckman, J. J. (1979). Sample selection bias as a specification error. Econometrica: Journal of the Econometric Society, 47, 153–161. [Google Scholar]

- Heinze, G., & Schemper, M. (2002). A solution to the problem of separation in logistic regression. Statistics in Medicine, 21(16), 2409–2419. [Google Scholar] [CrossRef]

- Heo, W., Lee, J. M., & Park, N. (2021). Who demands which type of life insurance?: Various factors in life insurance ownership. Financial Services Review, 29(2), 101–119. [Google Scholar] [CrossRef]

- Hermansson, C., & Jonsson, S. (2021). The impact of financial literacy and financial interest on risk tolerance. Journal of Behavioral and Experimental Finance, 29, 100450. [Google Scholar] [CrossRef]

- Hodula, M., Janku, J., Casta, M., & Kucera, A. (2021). On the macrofinancial determinants of life and non-life insurance premiums. The Geneva Papers on Risk and Insurance-Issues and Practice, 48, 1–39. [Google Scholar] [CrossRef] [PubMed]

- Homburg, C., Koschate, N., & Hoyer, W. D. (2005). Do satisfied customers really pay more? A study of the relationship between customer satisfaction and willingness to pay. Journal of Marketing, 69(2), 84–96. [Google Scholar] [CrossRef]

- Hsee, C. K., & Kunreuther, H. C. (2000). The affection effect in insurance decisions. Journal of Risk and Uncertainty, 20, 141–159. [Google Scholar] [CrossRef]

- Hwang, I. D. (2016). Prospect theory and insurance demand. Social Science Research Network. [Google Scholar]

- International Association of Insurance Supervisors. (2025). Public consultation: Draft issues paper on structural shifts in the life insurance sector (Tech. Rep.). IAIS. Available online: https://www.iais.org/uploads/2025/04/Public-consultation-Draft-Issues-Paper-on-structural-shifts-in-the-life-insurance-sector.pdf (accessed on 3 June 2025).

- Jost, J. T., Federico, C. M., & Napier, J. L. (2009). Political ideology: Its structure, functions, and elective affinities. Annual Review of Psychology, 60(1), 307–337. [Google Scholar] [CrossRef] [PubMed]

- Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263. [Google Scholar] [CrossRef]

- Kahneman, D., & Tversky, A. (1984). Choices, values, and frames. American Psychologist, 39(4), 341. [Google Scholar] [CrossRef]

- Kalton, G. (2009). Methods for oversampling rare subpopulations in social surveys. Survey Methodology, 35(2), 125–141. [Google Scholar]

- Kaustia, M., & Torstila, S. (2011). Stock market aversion? Political preferences and stock market participation. Journal of Financial Economics, 100(1), 98–112. [Google Scholar] [CrossRef]

- Key, E. M., & Donovan, K. M. (2017). The political economy: Political attitudes and economic behavior. Political Behavior, 39(3), 763–786. [Google Scholar] [CrossRef]

- Kim, K. T., Gutter, M. S., & Hanna, S. D. (2020). The decrease in life insurance ownership: Implications for financial planners. Financial Services Review, 28(1), 1–16. [Google Scholar] [CrossRef]

- Kling, J. R., Mullainathan, S., Shafir, E., Vermeulen, L. C., & Wrobel, M. V. (2012). Comparison friction: Experimental evidence from Medicare drug plans. The Quarterly Journal of Economics, 127(1), 199–235. [Google Scholar] [CrossRef]

- Kohl, S., & Römer, M. (2024). Insurance demand: A historical long-run perspective (1850–2020). The Geneva Papers on Risk and Insurance-Issues and Practice, 50, 1–24. [Google Scholar] [CrossRef]

- Kohn, S. (2023). Life Insurance for Millennials and Gen Z. RateHub. Available online: https://www.ratehub.ca/blog/life-insurance-for-millennials-and-gen-z/ (accessed on 21 September 2024).

- Koijen, R. S., & Yogo, M. (2015). The cost of financial frictions for life insurers. American Economic Review, 105(1), 445–475. [Google Scholar] [CrossRef]

- Kolenikov, S. (2014). Calibrating survey data using iterative proportional fitting (raking). The Stata Journal, 14(1), 22–59. [Google Scholar] [CrossRef]

- Kölln, A.-K. (2018). Political sophistication affects how citizens’ social policy preferences respond to the economy. West European Politics, 41(1), 196–217. [Google Scholar] [CrossRef]

- Kőszegi, B., & Rabin, M. (2006). A model of reference-dependent preferences. The Quarterly Journal of Economics, 121(4), 1133–1165. [Google Scholar]

- Kőszegi, B., & Rabin, M. (2007). Reference-dependent risk attitudes. American Economic Review, 97(4), 1047–1073. [Google Scholar] [CrossRef]

- Kunreuther, H., & Pauly, M. (2006). Insurance decision-making and market behavior. Foundations and Trends® in Microeconomics, 1(2), 63–127. [Google Scholar] [CrossRef]

- Kuzniak, S., Rabbani, A., Heo, W., Ruiz-Menjivar, J., & Grable, J. (2015). The Grable and Lytton risk-tolerance scale: A 15-year retrospective. Financial Services Review, 24(2), 177–192. [Google Scholar] [CrossRef]

- Lent, A. B., Garrido, C. O., Baird, E. H., Viela, R., & Harris, R. B. (2022). Racial/ethnic disparities in health and life insurance denial due to cancer among cancer survivors. International Journal of Environmental Research and Public Health, 19(4), 2166. [Google Scholar] [CrossRef]

- Lewis, F. D. (1989). Dependents and the demand for life insurance. The American Economic Review, 79(3), 452–467. [Google Scholar]

- Life Happens. (2023). Millennials and gen Z lead growing need for life insurance in 2023 (Tech. Rep.). NAIFA Community. Available online: https://lifehappens.org/research/millennials-and-gen-z-lead-growing-need-for-life-insurance-in-2023/ (accessed on 21 September 2024).

- Lin, J. T., Bumcrot, C., Ulicny, T., Lusardi, A., Mottola, G., Kieffer, C., & Walsh, G. (2017). Financial capability in the united states 2016 (Tech. Rep.). FINRA Investor Education Foundation. Available online: https://gflec.org/wp-content/uploads/2016/07/NFCS-2016-Final-Report-2.pdf (accessed on 3 June 2025).

- Lin, Y., & Grace, M. F. (2007). Household life cycle protection: Life insurance holdings, financial vulnerability, and portfolio implications. Journal of Risk and Insurance, 74(1), 141–173. [Google Scholar] [CrossRef]

- Lind, J. T., & Mehlum, H. (2010). With or without U? The appropriate test for a U-shaped relationship. Oxford Bulletin of Economics and Statistics, 72(1), 109–118. [Google Scholar] [CrossRef]

- Lusardi, A., & Mitchell, O. S. (2014). The economic importance of financial literacy: Theory and evidence. Journal of Economic Literature, 52(1), 5–44. [Google Scholar] [CrossRef]

- Lusardi, A., & Tufano, P. (2017). Debt literacy, financial experiences, and overindebtedness. Journal of Pension Economics and Finance, 16(4), 332–368. [Google Scholar]

- Luskin, R. C. (1990). Explaining political sophistication. Political Behavior, 12, 331–361. [Google Scholar] [CrossRef]

- Mantis, G., & Farmer, R. N. (1968). Demand for life insurance. Journal of Risk and Insurance, 35(2), 247–256. [Google Scholar] [CrossRef]

- Mulholland, B., Finke, M., & Huston, S. (2016). Understanding the shift in demand for cash value life insurance. Risk Management and Insurance Review, 19(1), 7–36. [Google Scholar] [CrossRef]

- National Center for Health Statistics. (2023). Excess deaths associated with COVID-19 (Tech. Rep.). Centers for Disease Control and Prevention. Available online: https://www.cdc.gov/nchs/nvss/vsrr/covid19/excess_deaths.htm (accessed on 20 August 2025).

- Nkouaga, F. (2024a). Comparative effects of self-evaluated and test-based financial literacy on choosing life insurance policies in a multi-racial context. Financial Metrics in Business, 5(1), 352–371. [Google Scholar]

- Nkouaga, F. (2024b). Pandemic-era trends in US automatic payment adoption: A 2022 behavioral analysis. International Business Research, 17(6), 1. [Google Scholar] [CrossRef]

- Norman, G. (2010). Likert scales, levels of measurement and the “laws” of statistics. Advances in Health Sciences Education, 15(5), 625–632. [Google Scholar] [CrossRef] [PubMed]

- OECD. (2024). Global insurance market trends 2024. OECD Publishing. [Google Scholar] [CrossRef]

- Office of Health Policy. (2025). Healthcare insurance coverage, affordability of coverage, and access to care, 2021–2024 (Issue Brief). ASPE. Available online: https://aspe.hhs.gov/sites/default/files/documents/9a943f1b8f8d3872fc3d82b02d0df466/coverage-access-2021-2024.pdf (accessed on 8 January 2025).

- Outreville, J. F. (2013). The relationship between insurance and economic development: 85 empirical papers for a review of the literature. Risk Management and Insurance Review, 16(1), 71–122. [Google Scholar] [CrossRef]

- Pasek, J., & Pasek, M. J. (2018). Package ‘anesrake’. The Comprehensive R Archive Network, 1–13. [Google Scholar] [CrossRef]

- Poterba, J., Venti, S., & Wise, D. A. (2013). Health, education, and the postretirement evolution of household assets. Journal of Human Capital, 7(4), 297–339. [Google Scholar] [CrossRef]

- Prelec, D., & Loewenstein, G. (1998). The red and the black: Mental accounting of savings and debt. Marketing Science, 17(1), 4–28. [Google Scholar] [CrossRef]

- Puhani, P. (2000). The Heckman correction for sample selection and its critique. Journal of Economic Surveys, 14(1), 53–68. [Google Scholar] [CrossRef]

- Rabbani, A. G. (2020). Cash value life insurance ownership among young adults: The role of self-discipline and risk tolerance. Journal of Behavioral and Experimental Finance, 27, 100385. [Google Scholar] [CrossRef]

- Rabin, M., & Thaler, R. H. (2001). Anomalies: Risk aversion. Journal of Economic Perspectives, 15(1), 219–232. [Google Scholar] [CrossRef]

- Reiter, M., & Heckman, S. (2017). Black-white differences in life insurance ownership among middle-income couples. In 2018 academic research colloquium for financial planning and related disciplines. SSRN. [Google Scholar] [CrossRef]

- Robinson, P. J., Botzen, W. W., Kunreuther, H., & Chaudhry, S. J. (2021). Default options and insurance demand. Journal of Economic Behavior & Organization, 183, 39–56. [Google Scholar] [CrossRef]

- Ropponen, O., Kuusi, T., & Valkonen, T. (2023). Mind the gap–assessing the size and determinants of the life insurance gap. Journal of the Finnish Economic Association, 4(1). [Google Scholar] [CrossRef]

- Rothschild, C., & Thistle, P. D. (2022). Supply, demand, and selection in insurance markets: Theory and applications in pictures. Risk Management and Insurance Review, 25(4), 419–444. [Google Scholar] [CrossRef]

- Royston, P., & Altman, D. G. (1994). Regression using fractional polynomials of continuous covariates: Parsimonious parametric modelling. Journal of the Royal Statistical Society Series C: Applied Statistics, 43(3), 429–453. [Google Scholar] [CrossRef]

- Royston, P., & Sauerbrei, W. (2008). Multivariable model-building: A pragmatic approach to regression anaylsis based on fractional polynomials for modelling continuous variables. John Wiley & Sons. [Google Scholar]

- Schanz, K.-U. (2020). Addressing obstacles to life insurance demand (Tech. Rep.). The Geneva Association—International Association for the Study of Insurance Economics. Available online: https://www.genevaassociation.org/sites/default/files/research-topics-document-type/pdf_public/addressing_obstacles_to_life_insurance_demand_web.pdf (accessed on 3 June 2025).

- Shah, A. K., & Oppenheimer, D. M. (2008). Heuristics made easy: An effort-reduction framework. Psychological Bulletin, 134(2), 207. [Google Scholar] [CrossRef] [PubMed]

- Shampanier, K., Mazar, N., & Ariely, D. (2007). Zero as a special price: The true value of free products. Marketing Science, 26(6), 742–757. [Google Scholar] [CrossRef]

- Silva, E. M., Moreira, R. d. L., & Bortolon, P. M. (2023). Mental accounting and decision making: A systematic literature review. Journal of Behavioral and Experimental Economics, 107, 102092. [Google Scholar] [CrossRef]

- Simonsohn, U. (2018). Two lines: A valid alternative to the invalid testing of u-shaped relationships with quadratic regressions. Advances in Methods and Practices in Psychological Science, 1(3), 538–555. [Google Scholar] [CrossRef]

- Soman, D. (2001). Effects of payment mechanism on spending behavior: The role of rehearsal and immediacy of payments. Journal of Consumer Research, 27(4), 460–474. [Google Scholar] [CrossRef]

- Spinnewijn, J. (2017). Heterogeneity, demand for insurance, and adverse selection. American Economic Journal: Economic Policy, 9(1), 308–343. [Google Scholar]

- Srinivasan, M., & Mitra, S. (2024). Determinants of life insurance consumption in OECD countries using FMOLS and DOLS techniques. Risks, 12(2), 35. [Google Scholar] [CrossRef]

- Stapleton, J. (2021). Tort, insurance and ideology. In Governing risks (pp. 227–252). Routledge. [Google Scholar]

- Stenhaug, B. A., & Domingue, B. W. (2022). Predictive fit metrics for item response models. Applied Psychological Measurement, 46(2), 136–155. [Google Scholar] [CrossRef]

- Tebaldi, P., Torgovitsky, A., & Yang, H. (2023). Nonparametric estimates of demand in the california health insurance exchange. Econometrica, 91(1), 107–146. [Google Scholar] [CrossRef]

- Thaler, R. (1985). Mental accounting and consumer choice. Marketing Science, 4(3), 199–214. [Google Scholar] [CrossRef]

- Thaler, R. H. (1999). Mental accounting matters. Journal of Behavioral Decision Making, 12(3), 183–206. [Google Scholar] [CrossRef]

- Tolbert, J., Cervantes, S., Bell, C., & Damico, A. (2024, December). Key facts about the uninsured population (Tech. Rep.). Kaiser Family Foundation. Available online: https://www.kff.org/uninsured/issue-brief/key-facts-about-the-uninsured-population/ (accessed on 3 June 2025).

- Tversky, A., & Kahneman, D. (1981). The framing of decisions and the psychology of choice. Science, 211(4481), 453–458. [Google Scholar] [CrossRef]

- Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5, 297–323. [Google Scholar] [CrossRef]

- Tversky, A., Kahneman, D., & Slovic, P. (1982). Judgment under uncertainty: Heuristics and biases. Cambridge University Press. [Google Scholar]

- Vella, F. (1998). Estimating models with sample selection bias: A survey. Journal of Human Resources, 33, 127–169. [Google Scholar] [CrossRef]

- Vis, B. (2019). Heuristics and political elites’ judgment and decision-making. Political Studies Review, 17(1), 41–52. [Google Scholar] [CrossRef]

- Von Gaudecker, H.-M. (2015). How does household portfolio diversification vary with financial literacy and financial advice? The Journal of Finance, 70, 489–507. [Google Scholar] [CrossRef]

- Von Neumann, J., & Morgenstern, O. (2007). Theory of games and economic behavior: 60th anniversary commemorative edition. In Theory of games and economic behavior. Princeton University Press. [Google Scholar]

- Weyland, K. (2009). Bounded rationality and policy diffusion: Social sector reform in latin america. Princeton University Press. [Google Scholar]

- Wolff, M. J. (2006). The myth of the actuary: Life insurance and Frederick L. Hoffman’s race traits and tendencies of the American negro. Public Health Reports, 121(1), 84. [Google Scholar] [CrossRef]

- Wooldridge, J. M. (2010). Econometric analysis of cross section and panel data. MIT Press. [Google Scholar]

- Zhang, J. (2024). An empirical study on the factors affecting life insurance charge premiums (Vol. 6). EAI. [Google Scholar] [CrossRef]

- Zhao, H., Yao, X., Liu, Z., & Yang, Q. (2021). Impact of pricing and product information on consumer buying behavior with customer satisfaction in a mediating role. Frontiers in Psychology, 12, 720151. [Google Scholar] [CrossRef]

- Zietz, E. N. (2003). An examination of the demand for life insurance. Risk Management and Insurance Review, 6(2), 159–191. [Google Scholar] [CrossRef]

- Zyphur, M. J., Zammuto, R. F., & Zhang, Z. (2016). Multilevel latent polynomial regression for modeling (in) congruence across organizational groups: The case of organizational culture research. Organizational Research Methods, 19(1), 53–79. [Google Scholar] [CrossRef]

| Label | Mean | Median | SD | Min | Max | Skew | Kurt | N |

|---|---|---|---|---|---|---|---|---|

| Psychological price | 3.9963 | 4.00 | 1.3497 | 1.00 | 6.00 | −0.587 | −0.385 | 3211 |

| Level of income | 5.0009 | 5.00 | 2.0549 | 1.00 | 9.00 | −0.576 | −0.744 | 3211 |

| Being married | 0.4780 | 0.00 | 0.4996 | 0.00 | 1.00 | 0.088 | −1.993 | 3211 |

| Number of dependents | 1.5111 | 1.00 | 0.6680 | 1.00 | 4.00 | 1.066 | 0.418 | 3211 |

| Employed | 0.8122 | 1.00 | 0.3906 | 0.00 | 1.00 | −1.598 | 0.554 | 3211 |

| Age | 49.1548 | 49.00 | 18.1502 | 18.00 | 93.00 | 0.087 | −1.123 | 3211 |

| Female | 0.5058 | 1.00 | 0.5000 | 0.00 | 1.00 | −0.023 | −2.000 | 3211 |

| Perceived physical health | 3.6185 | 4.00 | 0.9993 | 1.00 | 5.00 | −0.650 | −0.046 | 3211 |

| Financial knowledge | 1.5328 | 1.55 | 0.7882 | 0.01 | 2.55 | −0.277 | −1.144 | 3211 |

| Risk tolerance | 0.2100 | 0.10 | 0.2417 | 0.00 | 1.00 | 1.321 | 0.960 | 3211 |

| Liberal | 0.2401 | 0.00 | 0.4272 | 0.00 | 1.00 | 1.216 | −0.521 | 3211 |

| Centrist | 0.2547 | 0.00 | 0.4358 | 0.00 | 1.00 | 1.125 | −0.734 | 3211 |

| Conservative | 0.3476 | 0.00 | 0.4763 | 0.00 | 1.00 | 0.640 | −1.591 | 3211 |

| Other political ideology | 0.0258 | 0.00 | 0.1587 | 0.00 | 1.00 | 5.973 | 33.690 | 3211 |

| Black people | 0.1345 | 0.00 | 0.3413 | 0.00 | 1.00 | 2.141 | 2.585 | 3211 |

| Latino | 0.1859 | 0.00 | 0.3891 | 0.00 | 1.00 | 1.614 | 0.605 | 3211 |

| Native American | 0.0221 | 0.00 | 0.1471 | 0.00 | 1.00 | 6.497 | 40.221 | 3211 |

| Asian | 0.0511 | 0.00 | 0.2202 | 0.00 | 1.00 | 4.076 | 14.622 | 3211 |

| Face value (term) | 3.8910 | 4.00 | 1.8134 | 1.00 | 7.00 | −0.026 | −0.996 | 2036 |

| Premium (term) | 2.4777 | 2.00 | 1.0476 | 1.00 | 6.00 | 0.874 | 1.179 | 381 |

| Face value (cash) | 3.9516 | 4.00 | 1.7079 | 1.00 | 7.00 | 0.084 | −0.883 | 805 |

| Premium (cash) | 2.4476 | 2.00 | 1.0966 | 1.00 | 6.00 | 0.794 | 0.527 | 420 |

| Level of education | 4.7938 | 4.00 | 1.6238 | 1.00 | 9.00 | 0.393 | −0.577 | 3211 |

| Rural | 0.1292 | 0.00 | 0.3355 | 0.00 | 1.00 | 2.209 | 2.882 | 3211 |

| Professional advisor | 0.3142 | 0.00 | 0.4643 | 0.00 | 1.00 | 0.800 | −1.360 | 3211 |

| Term Insurance | Cash Insurance | |||

|---|---|---|---|---|

| Selection (Uptake) | Outcome (Premium) | Selection (Uptake) | Outcome (Premium) | |

| (Intercept) | −2.7912 *** | −3.0221 *** | −2.6054 *** | 3.0449 *** |

| (0.2677) | (0.4838) | (0.2777) | (0.5781) | |

| Main variables | ||||

| Attitudinal Variable | ||||

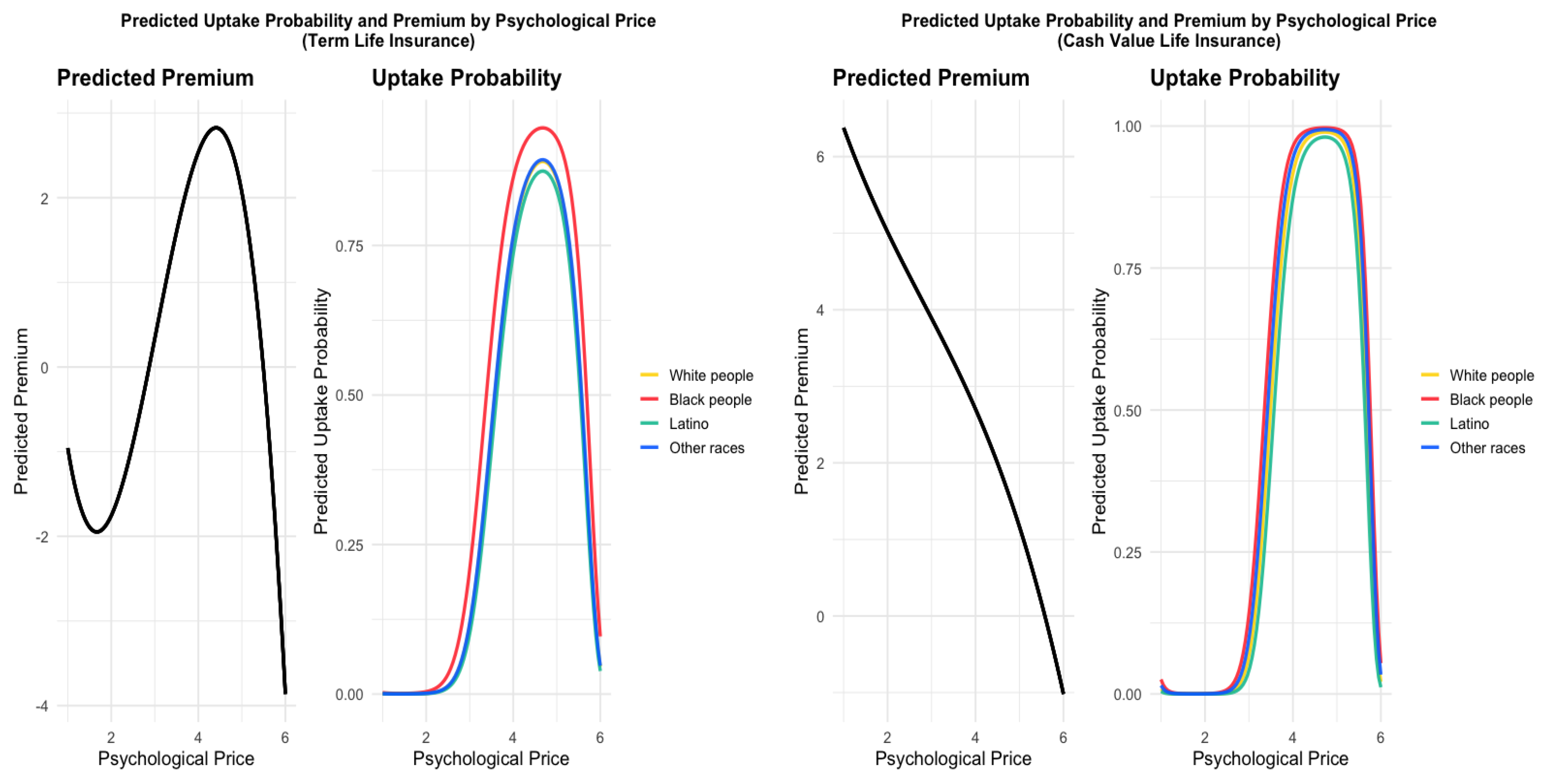

| Psychological Price (First Order, Linear) | 27.7700 *** | 15.8459 ** | 35.1325 *** | −39.6661 *** |

| (2.7393) | (5.2498) | (2.6727) | (6.9652) | |

| Psychological Price (Second Order, Quadratic) | −13.9883 *** | −24.3731 *** | −13.5477 *** | −3.9057 |

| (2.5152) | (4.7325) | (2.3668) | (4.7817) | |

| Psychological Price (Third Order, Cubic) | −12.9947 *** | −22.5624 *** | −22.7937 *** | −2.3766 |

| (2.5162) | (4.6772) | (2.4914) | (4.9720) | |

| Control Variables | ||||

| Consumer Characteristics | ||||

| Level of Education | 0.1243 *** | 0.2007 *** | −0.0053 | 0.0305 |

| (0.0257) | (0.0415) | (0.0275) | (0.0374) | |

| Living in a Rural area | 0.3213 ** | 0.2766 | 0.2707 * | −0.0860 |

| (0.1167) | (0.1833) | (0.1203) | (0.1526) | |

| Financial Knowledge score | 0.2602 *** | 0.1483 | 0.1608 * | −0.2756 ** |

| (0.0644) | (0.1084) | (0.0639) | (0.0852) | |

| Risk Tolerance | 0.8274 *** | 1.1141 ** | 0.0189 | 0.3871 |

| (0.2333) | (0.3603) | (0.2622) | (0.3405) | |

| Number of dependents | 0.1615 * | 0.1364 | 0.0278 | −0.1393 |

| (0.0723) | (0.1158) | (0.0737) | (0.0873) | |

| Underwriting Factors | ||||

| Age | 0.0041 | 0.0112 * | 0.0127 *** | −0.0062 + |

| (0.0027) | (0.0045) | (0.0026) | (0.0036) | |

| Female | −0.0773 | −0.2291 + | −0.0826 | 0.1346 |

| (0.0850) | (0.1361) | (0.0849) | (0.1104) | |

| Employed | 0.2679 * | 0.4632 ** | 0.5053 *** | 0.2029 |

| (0.1039) | (0.1646) | (0.1092) | (0.1682) | |

| Level of Income | 0.1123 *** | 0.1196 ** | 0.0465 + | 0.0813 * |

| (0.0260) | (0.0422) | (0.0273) | (0.0338) | |

| Perceived Physical Health | −0.0045 | 0.1123 + | 0.0006 | 0.0590 |

| (0.0418) | (0.0667) | (0.0416) | (0.0542) | |

| Being Married | 0.0693 | −0.0095 | 0.0929 | 0.2723 * |

| (0.0985) | (0.1607) | (0.0997) | (0.1200) | |

| Face Value | 0.0375 | −0.0530 + | ||

| (0.0295) | (0.0301) | |||

| Exclusion Restriction | ||||

| Source of Financial Advice (Ref. = Personal Network) | ||||

| Professional Advisor | −0.0956 | 0.1893 * | ||

| (0.0638) | (0.0949) | |||

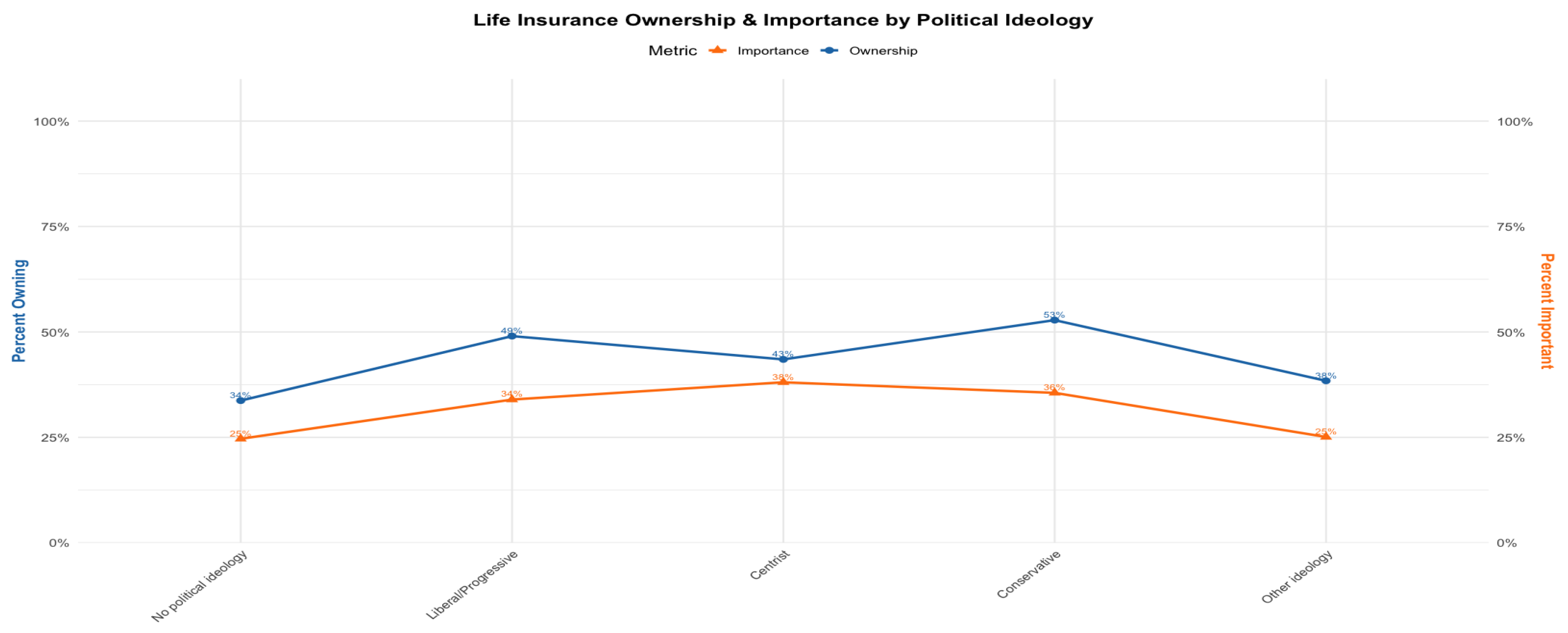

| Political Ideology (Ref. = No Ideology) | ||||

| Conservative | −0.2886 *** | 0.2864 * | ||

| (0.0858) | (0.1416) | |||

| Centrist | −0.2149 * | 0.3407 * | ||

| (0.0872) | (0.1474) | |||

| Liberal | −0.3652 *** | 0.1781 | ||

| (0.0884) | (0.1486) | |||

| Other Ideology | −0.7414 *** | 0.7065 ** | ||

| (0.1847) | (0.2315) | |||

| Race (Ref. = White People) | ||||

| Latino | −0.0817 | −0.2405 + | ||

| (0.0768) | (0.1229) | |||

| Black People | 0.3838 *** | 0.4186 *** | ||

| (0.0934) | (0.1246) | |||

| Native American | 0.0121 | 0.1365 | ||

| (0.3446) | (0.4911) | |||

| Asian | 0.0034 | 0.0629 | ||

| (0.1074) | (0.1861) | |||

| Observations | 1556 (1175/381) | 1595 (1175/420) | ||

| Log-Lik | −916.634 | −1088.264 | ||

| 1.5029 *** | 0.9406 *** | |||

| 0.9829 *** | −0.3774 * | |||

| Term Model | Cash Value Model | |||

|---|---|---|---|---|

| No | Yes | No | Yes | |

| Mean | ||||

| t-statistic | ||||

| p-value | ||||

| 95% CI for diff. | ||||

| Term Premium Outcome | Cash Value Premium Outcome | |||

|---|---|---|---|---|

| Linear IMR | IMR + IMR2 + IMR3 | Linear IMR | IMR + IMR2 + IMR3 | |

| IMR | 1.977 (0.373) [0.000] | 0.081 (1.416) [0.954] | −0.784 (0.305) [0.011] | −1.039 (1.008) [0.303] |

| IMR2 | 1.645 (1.045) [0.116] | 0.197 (0.662) [0.767] | ||

| IMR3 | −0.420 (0.255) [0.100] | −0.043 (0.138) [0.757] | ||

| 0.323 | 0.328 | 0.281 | 0.282 | |

| Adj. | 0.293 | 0.295 | 0.253 | 0.249 |

| Residual SE | 0.758 | 0.757 | 0.835 | 0.837 |

| Observations | 381 | 381 | 420 | 420 |

| Wald test (IMR2 = IMR3 = 0) | F = 1.40, p = 0.247 | F = 0.05, p = 0.953 | ||

| Selection | Outcome | ||

|---|---|---|---|

| Uptake | Term Premium | Cash Value Premium | |

| Psychological Price (poly degree 3) | 1.0264 | 1.0345 | 1.0387 |

| Level of Income | 1.3172 | 1.3581 | 1.4381 |

| Being Married | 1.1669 | 1.3433 | 1.2093 |

| Number of dependents | 1.1208 | 1.1798 | 1.1133 |

| Employed | 1.1112 | 1.0977 | 1.0847 |

| Age | 1.1770 | 1.2887 | 1.2257 |

| Level of Education | 1.1482 | 1.1177 | 1.2961 |

| Female | 1.0363 | 1.0522 | 1.1234 |

| Perceived physical health | 1.0663 | 1.0657 | 1.0775 |

| Financial Knowledge | 1.2209 | 1.3269 | 1.3761 |

| Living in a Rural area | 1.0312 | 1.0365 | 1.0994 |

| Risk Tolerance | 1.0760 | 1.0742 | 1.0919 |

| Face Value | 1.3494 | 1.0526 | |

| Professional Advisor | 1.0476 | ||

| Conservative | 1.5077 | ||

| Centrist | 1.4338 | ||

| Liberal | 1.4420 | ||

| Other ideology | 1.1245 | ||

| Asian | 1.0299 | ||

| Black People | 1.0907 | ||

| Latino | 1.0752 | ||

| Native Americans | 1.0168 | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nkouaga, F.; Czajkowski, J.; Edmiston, K.; Rourke, B. Modeling Behavioral and Attitudinal Drivers of Life Insurance Selection and Premiums: Polynomial Approaches to Perceived Affordability in Term and Cash Value Products. J. Risk Financial Manag. 2025, 18, 512. https://doi.org/10.3390/jrfm18090512

Nkouaga F, Czajkowski J, Edmiston K, Rourke B. Modeling Behavioral and Attitudinal Drivers of Life Insurance Selection and Premiums: Polynomial Approaches to Perceived Affordability in Term and Cash Value Products. Journal of Risk and Financial Management. 2025; 18(9):512. https://doi.org/10.3390/jrfm18090512

Chicago/Turabian StyleNkouaga, Florent, Jeffrey Czajkowski, Kelly Edmiston, and Brenda Rourke. 2025. "Modeling Behavioral and Attitudinal Drivers of Life Insurance Selection and Premiums: Polynomial Approaches to Perceived Affordability in Term and Cash Value Products" Journal of Risk and Financial Management 18, no. 9: 512. https://doi.org/10.3390/jrfm18090512

APA StyleNkouaga, F., Czajkowski, J., Edmiston, K., & Rourke, B. (2025). Modeling Behavioral and Attitudinal Drivers of Life Insurance Selection and Premiums: Polynomial Approaches to Perceived Affordability in Term and Cash Value Products. Journal of Risk and Financial Management, 18(9), 512. https://doi.org/10.3390/jrfm18090512