1. Introduction

In recent years, escalating global climate change, progressive depletion of natural resources, and intensifying environmental pollution have propelled sustainable development strategies to the forefront of socioeconomic agendas worldwide. Green finance serves dual functions: combating climate change through capital reallocation to low-carbon sectors and propelling high-quality economic development (

Xu & Dong, 2023;

Liu & Li, 2024). According to the 2023 Statistical Report on Financial Institution Loan Allocations released by the People’s Bank of China (PBOC), China’s outstanding green loans in both domestic and foreign currencies amounted to RMB 30.08 trillion by the end of 2023, reflecting a 36.5% year-on-year growth. Notably, loans allocated to projects with direct and indirect carbon reduction benefits totaled RMB 10.43 trillion and RMB 9.81 trillion, respectively, jointly constituting 67.3% of the aggregate green loan portfolio. The 2024 PBOC Guiding Opinions further outline a five-year blueprint for establishing a world-leading green finance system.

Green finance refers to financing investments that provide environmental benefits within the broader context of environmental sustainability (

G20 Green Finance Study Group, 2016). It refers to a systematic arrangement that uses financial instruments such as green credit, green investment, green insurance, green bonds, green support, green funds, and green equity to guide capital flows toward environmental protection, energy conservation, clean energy, and other areas. It has been widely recognized as a key driver in promoting the development of a low-carbon economy (

Chen & Chen, 2021;

Meo & Karim, 2022;

Umar & Safi, 2023;

Alharbi et al., 2023). However, its specific mechanisms and economic effects require further exploration. Existing research has primarily focused on the micro-level impacts of green finance, such as corporate green technology innovation (

Feng et al., 2022;

H. Huang et al., 2022) and improvements in energy efficiency (

L. Zhang et al., 2022;

Li & Umair, 2023). Studies have also examined the role of green financial instruments—including green bonds and green funds—in directing capital toward low-carbon industries (

Monk & Perkins, 2020;

Appiah & Essuman, 2024). Moreover, China’s green finance policies are transitioning from direct intervention to market-oriented approaches, with the government continuing to play a crucial role in this process (

S. Zhang et al., 2021;

Shao & Huang, 2023). Regarding economic effects, studies suggest that green finance contributes to high-quality economic development and facilitates a green and inclusive transition in China (

Xu & Dong, 2023;

Van Niekerk, 2024).

Government regulation serves as a critical policy tool in facilitating the transition to a low-carbon economy. Scholars widely advocate for the use of composite policy instruments—such as green credit and carbon trading mechanisms—to advance low-carbon objectives (

Chen & Lin, 2021;

Debrah et al., 2023). Research indicates that government regulation can alleviate financing constraints, promote green innovation, and drive green technological transformation through the improvement of environmental legislation (

Yu et al., 2021;

Zhou & Du, 2021). Furthermore, by maintaining market order and enhancing marketization levels, regulation improves the efficiency of financial resource allocation, thereby supporting low-carbon development (

Pereira et al., 2023). In terms of spatial governance, regional collaborative mechanisms and resource integration have also been shown to contribute to achieving emission reduction targets (

Ke et al., 2022). Overall, through market incentives and industrial restructuring—particularly in areas such as green industrial reorganization and carbon emissions trading—government regulation plays an essential role in promoting structural low-carbon transitions (

Gu et al., 2021;

Bayer & Aklin, 2020;

Rahma et al., 2019).

In summary, while existing studies have largely examined the separate impacts of government regulation or green finance on the low-carbon economic transition, few have integrated both to analyze their synergistic effects. From the perspective of government regulation, this study employs quantitative data from 273 Chinese cities to explore how to enhance the low-carbon effects of green finance, and investigates the interplay and mechanisms between the two, thereby proposing practical pathways for urban low-carbon transition. The contributions of this paper are threefold: First, it examines how government interventions—such as market-oriented reforms and land planning—strengthen the carbon reduction effect of green finance, revealing heterogeneous effects under different regulatory and financial instrument interactions. Second, using prefecture-level city data offers finer granularity to verify the internal logic through which green finance, under government regulation, accelerates urban low-carbon transition, enhancing the reliability and policy relevance of the findings. Third, it proposes policy options to deliver practical value for achieving the dual carbon goals, including promoting the integration of land management systems with carbon market mechanisms and advancing context-adapted green finance development that aligns with local conditions.

Examining the mechanisms and effects of green finance in urban low-carbon transitions from the perspective of government regulation not only enriches the theoretical framework of existing research but also provides innovative practical pathways for unleashing the full potential of green finance, holding significant academic and practical implications.

The subsequent sections of the paper are structured as follows:

Section 2 introduces the theoretical framework and research hypotheses regarding how policy regulations enhance the low-carbon effects of green finance;

Section 3 constructs a two-way fixed-effects model using panel data from 273 prefecture-level cities in China between 2006 and 2022;

Section 4 presents the baseline empirical results and robustness checks;

Section 5 examines the underlying mechanisms;

Section 6 explores heterogeneity effects; and

Section 7 concludes with policy implications.

2. Theoretical Analysis and Research Hypotheses

2.1. Green Finance and Urban Low-Carbon Development

Green finance indirectly amplifies the effect of government regulation on carbon emission efficiency by facilitating the efficient flow of capital, technology, information, and resources within the market. From a capital perspective, it lowers barriers to market entry, alleviates corporate financing constraints, and provides sufficient funding for energy-saving technological innovation. Technologically, green finance stimulates enterprises to increase investment in the research, development, and application of energy-saving technologies, thereby promoting green technological upgrading. From an informational angle, it establishes market-based incentive mechanisms that optimize the allocation of energy resources. Through signaling theory and market-driven price signals, it enables more accurate assessment and guidance of carbon usage efficiency, reduces waste, and further enhances overall carbon emission performance. Accordingly, the following hypothesis is proposed:

H1. Green finance facilitates urban low-carbon transition.

2.2. Green Finance, Government Regulation, and Urban Low-Carbon Development

The core of green finance lies in promoting the application and adoption of low-carbon technologies through optimized capital allocation, risk pricing, and enhanced information transparency. However, certain limitations persist in its operational mechanisms. First, there is a conflict between market profit-seeking motives and public environmental goals, leading to frequent instances of greenwashing. Some enterprises utilize green financial instruments to meet public objectives without implementing substantial emission reductions, resulting in superficial compliance. Second, the coverage of green finance remains limited. Small and medium-sized enterprises (SMEs) often struggle to obtain financing due to the high costs associated with green certification. In China, only 12% of green credit is directed toward SMEs, and significant regional disparities exist—80% of global green investments are concentrated in Europe, North America, and East Asia, while most developing countries face substantial financing gaps in clean energy projects. Third, the short-term profit orientation of financial markets conflicts with the long-term nature of low-carbon transition, making it difficult for renewable energy projects with extended development cycles to secure funding.

To address these market failures in green finance, government regulation serves as an essential complementary mechanism. Marketization level reflects the maturity of regional market mechanisms and embodies the dynamic balance between government regulation and market forces. In regions with higher marketization levels, well-developed institutions, transparent market mechanisms, and efficient resource allocation provide a solid foundation for green finance. In contrast, in regions with lower marketization levels, ineffective institutions, market fragmentation, and information asymmetries often hinder the effectiveness of green finance and limit its positive environmental impact. Thus, the following hypothesis is proposed:

H2. Government regulation strengthens the low-carbon effect of green finance by enhancing the level of marketization.

Land use efficiency reflects the intensity of land resource allocation and is a direct outcome of governmental spatial planning and policy constraints. In regions with high urban land use efficiency, the intensive utilization of land resources, rational spatial layout, and well-developed infrastructure provide strong support for the development of green finance. In contrast, in areas where land use efficiency is low, issues such as land resource wastage, inefficient spatial planning, and inadequate infrastructure often hinder the effectiveness of green finance, limiting its potential to contribute meaningfully to environmental improvement. By optimizing the allocation of land resources and promoting intensive development, urban land use efficiency shapes the operational environment of green finance and indirectly enhances the impact of government regulation on environmental outcomes. For instance, the Chengdu–Chongqing Economic Circle has mitigated local protectionism through unified governance standards and incentive mechanisms, facilitating cross-regional flow of production factors and industrial coordination. Meanwhile, Chongqing’s multi-plan integration reform has consolidated spatial resource data—including urban–rural planning, land use, and environmental controls—into a unified One Blueprint platform, enabling highly efficient allocation of regional spatial resources. Thus, the following hypothesis is proposed:

H3. Government regulation strengthens the low-carbon effect of green finance by improving land use efficiency.

The heterogeneous impact of green finance on low-carbon transition in resource-based and high-energy-consuming cities stems from systematic differences in institutional embeddedness and factor restructuring costs. Resource-based cities, constrained by the resource curse and state-capital dominance, face diminishing marginal returns on emission reduction and high transition costs—exemplified by Datong’s 37% increase in financing costs for coal capacity replacement funds over five years, with labor resettlement accounting for a significant portion of total transition expenses. These cities require publicly oriented instruments such as government credit enhancement, ecological compensation, and restoration REITs to offset sunk costs and facilitate transition. In contrast, high-energy-consuming cities are often hindered by technological lock-in. For instance, Suzhou employed patent pledges to advance hydrogen-based steelmaking, demonstrating how green finance can break technological barriers and spur innovation through risk-pricing market tools like carbon futures. Ignoring such heterogeneity may lead to policy mismatch, inefficient green investment, and stalled transitions. Hence, tailored green financial instruments are essential to avoid one-size-fits-all policy pitfalls. Accordingly, the following hypothesis is proposed:

H4. Green finance exerts heterogeneous effects on the low-carbon transition in resource-based and high-energy-consuming cities.

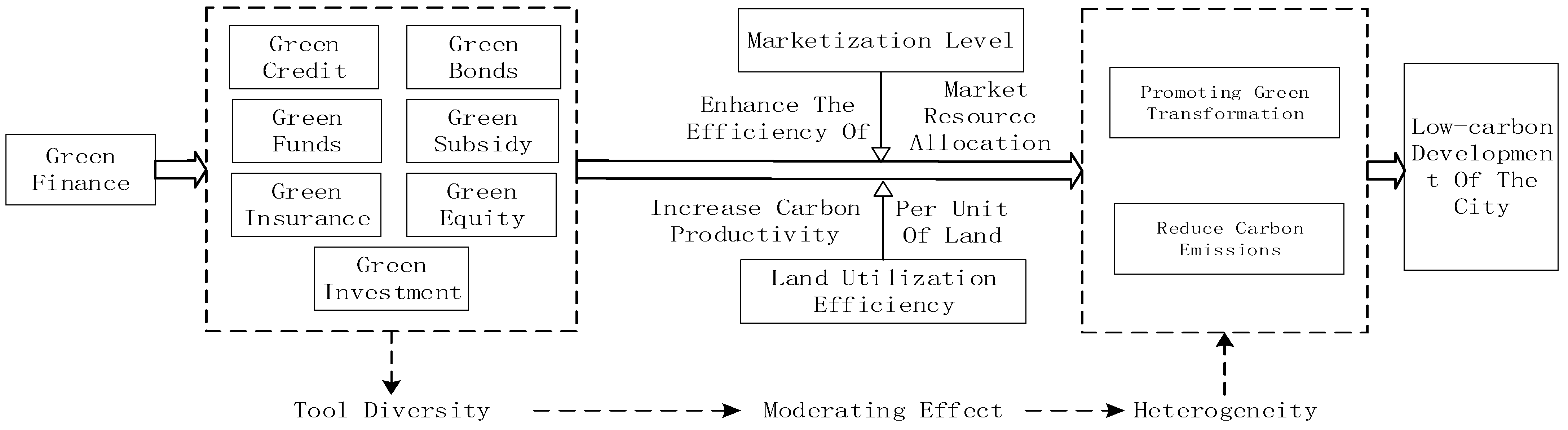

In summary, green finance leverages diverse instruments—including green credit, green bonds, green funds, green subsidies, green insurance, green equity, and green investment—to establish a funding and resource supply network that underpins urban low-carbon development, thereby providing a continuous source of sustained funding for cities’ low-carbon transition. In this process, government regulation exerts moderating effects through two primary pathways: marketization level and land use efficiency. On one hand, by enhancing marketization, it improves the efficiency of green financial resource allocation and directs capital toward low-carbon sectors. On the other hand, by elevating land use efficiency—such as increasing carbon productivity per unit of land—it strengthens the capacity of green finance to enable low-carbon spatial development. Together, these two regulatory mechanisms shape the heterogeneous characteristics of urban carbon emission pathways and green transition processes, thereby ensuring that green financial instruments effectively and precisely contribute to urban low-carbon development goals. The mechanism is illustrated in

Figure 1.

7. Conclusions and Policy Recommendations

Based on the panel data of 273 prefecture-level cities in China from 2006 to 2022, this paper empirically examines the effect and mechanism of green finance on the development of urban low-carbon transition from the perspective of government regulation. It is found that, first, green finance significantly reduces urban carbon emission intensity by guiding capital allocation and technological innovation, and has a robust promotion effect on urban low-carbon transition; second, government regulation strengthens the low-carbon effect of green finance through dual paths—on the one hand, it enhances green finance efficiency by strengthening the city’s environmental pricing mechanism through perfecting market-oriented reforms, and on the other hand, it enhances green finance efficiency through urban land planning to optimize the land use pattern and enhance spatial carrying capacity; third, the heterogeneity analysis shows that resource-based cities and low-energy-consuming cities benefit more significantly from low-carbon transformation, reflecting differences in resource constraints.

Based on the above findings, in order to effectively exert the positive impact of green finance on urban low-carbon development, this paper puts forward the following three suggestions:

First, developing green finance in light of local conditions is a key priority. Resource-based cities should innovate tools such as mine ecological restoration loans and successor industry funds, link resource tax rebates to green credit quotas, and drive industrial restructuring. High-energy-consuming cities need to establish low-carbon technology whitelists and tiered financing incentives and incorporate the rate of reduction in energy intensity into performance evaluations. Additionally, they should develop a city carbon transition financial efficiency index, integrate satellite remote sensing and carbon account data to dynamically assess policy effects, and set a five-year flexible window period—with financial guarantees providing support in the early stage and a shift to market-oriented risk-sharing in the later stage. This approach avoids policy rigidity, promotes the R&D transformation, large-scale application, and iterative upgrading of low-carbon technologies, facilitates the green transformation of high-energy-consuming industries and the optimization of energy consumption structures, and ultimately achieves the goal of low-carbon transition.

From a regional perspective, green financial resources should be strategically directed toward central and western China: Central China’s resource-based cities should prioritize the deployment of green bonds and carbon quota pledge loans, with supporting financial interest subsidies and risk compensation, focusing on supporting low-carbon technological transformation of traditional industries. High-energy-consuming cities in Western China should be provided with targeted green refinancing and energy-consumption-linked interest rate tools to strengthen clean energy substitution and energy efficiency improvement. Eastern China should guide capital to feed back into central and western regions through cross-regional carbon account linkage mechanisms.

Second, establish a coordinated mechanism for market incentives and spatial governance. At the economic level, centered on expanding the carbon emission rights trading market, we should refine the environmental risk pricing mechanism, strengthen the fair competition review system, eliminate monopoly barriers, and improve market resource allocation efficiency. At the spatial level, deeply integrate green financial instruments with land use efficiency: design products such as special bonds for low-carbon land use to advance the green renewal of inefficient land, and concurrently establish a regulatory system to optimize mixed land use and the layout of renewable energy infrastructure. At the regional level, eastern China should prioritize integrated innovation of market mechanisms and spatial planning, while central and western China enhance the value conversion of ecological space.

Third, consolidate the coordinated support system for green finance, market-oriented reform, and land use efficiency. Centering on market-oriented reform, improve supporting mechanisms: establish a unified environmental information disclosure platform and incorporate land use efficiency into the scope of information disclosure; meanwhile, optimize the green finance pricing mechanism, integrate the benefits of low-carbon land use into the risk pricing model, and strengthen the guiding role of market-oriented reform in the allocation of green financial resources. Promote the alignment of domestic low-carbon land use standards with international green financial rules, attract international green capital to participate in local low-carbon land development and infrastructure construction, form a new green finance development ecosystem, and provide a replicable path for similar developing countries to balance resource constraints and low-carbon transition.

This study attempts to provide new empirical evidence for the role of green finance in enhancing the low-carbon effect of cities from the perspective of government regulation, but it still has certain limitations. Among these, the issue of endogeneity is the core challenge that this study has not fully resolved. Although this study has mitigated potential endogeneity problems by constructing Bartik instrumental variables, and a series of robustness test results show that the baseline results remain robust, achieving more rigorous causal inference still requires further control of key confounding variables that may lead to estimation biases—such as the implementation of new energy policies and technology spillover effects—in future research, so as to enhance the generalizability and reliability of the research conclusions. Therefore, a cautious attitude should be maintained when interpreting the heterogeneous causal relationship between green finance and the low-carbon effect of cities under government regulation. Nevertheless, the main conclusions of this study still hold significant reference value for green finance practice.