Abstract

This study examines the role of artificial intelligence (AI) tools in enhancing tax fraud detection within the ambit of the OECD Tax Administration 3.0, focusing on how these technologies streamline the detection process through a new “Adaptive AI Tax Oversight” (AATO) framework. Through a textometric systematic review covering the period from 2014 to 2024, the integration of AI in tax fraud detection is explored. The methodology emphasizes the evaluation of AI’s predictive, analytical, and procedural benefits in identifying and combating tax fraud. The research underscores AI’s significant impact on increasing detection accuracy, predictive capabilities, and operational efficiency in tax administrations. Key findings reveal the ways by which the development and application of the AATO framework improves the tax fraud detection process. The implications highlight not only the governance benefits and ethical challenges that arise, but also provide practical guidance for tax authorities worldwide in leveraging AI to reduce compliance costs and strengthen regulatory frameworks. Finally, the study offers recommendations for future research, particularly in refining AI methodologies, differentiating policy implications across high-income and low- and middle-income countries, and addressing governance and ethical issues to ensure equitable and sustainable tax administration practices.

1. Introduction

Tax fraud is a global challenge with profound implications for societal trust and economic stability (Alm, 2023; Belahouaoui, 2025; De Roux et al., 2018). Defined as the intentional falsification of tax return information to illegally gain financial benefits or reduce tax liabilities, this phenomenon affects both high-income and low- and middle-income economies (Tax Justice Network, 2024). As a deliberate act of deception aimed at evading rightful tax payments, tax fraud not only deprives governments of essential revenue, but also undermines the integrity of tax systems (Gale & Krupkin, 2019; Murorunkwere et al., 2023a; Ruzgas et al., 2023). Given its widespread impact, recent international reports have sought to quantify the scale of tax fraud and its consequences for global public finances.

According to the Global Tax Evasion Report 2024, tax fraud continues to pose significant challenges to global tax revenues, despite international efforts to curb these practices. The report estimates that corporate tax revenue losses exceed USD 1 trillion annually, representing approximately 10 percent of global corporate tax revenues. These losses disproportionately affect non-Organization for Economic Co-operation and Development (OECD) countries, where tax fraud strategies significantly erode public finances. Additionally, findings from the OECD Corporate Tax Statistics 2024 reveal that while corporate tax revenues represent 16 percent of total tax revenues globally, the share of corporate taxes as a percentage of Gross Domestic Product (GDP) varies widely across jurisdictions. For instance, in 2021, corporate tax revenues accounted for more than 25 percent of total tax revenues in 17 countries. These figures highlight the persistent disparities in the effects of profit shifting and the urgency of implementing more effective global tax policies to reduce these losses (Alstadsaeter et al., 2023; OECD, 2024; Belahouaoui & Attak, 2025).

Building on these global estimates, the Tax Justice Network (2024) provided more detailed insights into the distributional effects of tax abuse across income levels, estimating that global tax abuse results in an annual loss of USD 492 billion in tax revenues. Of this, USD 347.6 billion is lost due to corporate tax abuse by multinational companies, while USD 144.8 billion is attributed to offshore tax fraud by wealthy individuals. The financial burden is disproportionately heavier on lower-income countries, which lose USD 46 billion annually, equivalent to 36 percent of their public health budgets. In contrast, higher-income countries face an estimated loss of USD 446 billion per year, amounting to 7 percent of their public health budgets. If no significant policy changes are implemented, the Tax Justice Network (2024) projected that countries will collectively lose USD 4.92 trillion in tax revenue to tax havens over the next decade, exacerbating economic inequalities and weakening public services worldwide.

In response to these persistent challenges, the OECD has advanced its Tax Administration 3.0 vision, which seeks to harness digital transformation to strengthen tax systems. The OECD Tax Administration 3.0 vision aims for a thorough digital revamp of tax systems, both to respond to societal changes and also to harness digital advancements for reducing administrative burdens, fostering policy innovation, and curtailing tax fraud (OECD, 2020). This vision encapsulates the following six fundamental components: digital identity, taxpayer touchpoints, data management and standards, tax management and enforcement, the cultivation of new skill sets, and the establishment of governance frameworks. These components are pivotal for an effective, modern tax administration system. Reflecting on the Tax Technology Initiatives Inventory data, it is evident that this shift towards digitalization is substantial (OECD, 2023a, 2023b), underscoring the critical role of digital technologies in enhancing the operational efficiency and effectiveness of tax administrations, particularly in combating tax fraud (OECD, 2023a, 2023b).

In the context of Tax Administration 3.0, the integration of artificial intelligence (AI) tools plays a pivotal role in enhancing tax administration and benefiting taxpayers. AI tools, through advanced algorithms, improve liability assessment, enhance decision making, and provide an unprecedented efficiency in processing vast amounts of fiscal data, thereby reducing the need for human intervention and strengthening governments’ oversight capacities. Recent studies illustrate how AI integration has advanced fraud detection. Gaie (2023) proposed a comprehensive approach to enhance e-Government and optimize fraud detection, while Mpofu (2024) highlighted the effectiveness of AI algorithms in identifying fraudulent activities. Tax et al. (2021) emphasized the critical role of machine learning within anti-fraud frameworks. Saragih et al. (2023) and Shakil and Tasnia (2022) showed how AI audits reduced fraud risks and improved tax collection efficiency. Relatedly, Reslan and Al Maalouf (2024) found that AI adoption in accounting had positive effects on financial reporting and fraud detection in accounting practices, and Louati et al. (2024) showed that AI adoption reduced fraud and enhanced security in blockchain transactions. More broadly, Bao et al. (2022) analyzed the wider implications of AI and big data for fraud detection, and Murorunkwere et al. (2022) demonstrated the effectiveness of neural networks in detecting income tax fraud in Rwanda. Collectively, these contributions underscore the transformative impact of AI in building more secure and efficient tax systems (Belahouaoui, 2025).

Several recent studies have highlighted the need for further research to understand how artificial intelligence aids in detecting tax fraud, pointing out future directions for exploration in this field (Matheus et al., 2021; Tax et al., 2021; Zuiderwijk et al., 2021; Bassey et al., 2022; Bharosa, 2022; Gaie, 2023). These studies underscore the necessity for a comprehensive review over time, focusing on the benefits of AI and its role in enabling tax authorities to detect fraud in the era of digital transformation. Even so, this literature also suggests theoretical, methodological, and practical gaps.

This study addresses a significant research gap by clarifying the theoretical, methodological, and practical dimensions of AI-based technologies in tax fraud detection. Theoretically, although prior studies have acknowledged the potential of AI, there is still a lack of comprehensive understanding of which AI-based technologies are actually being deployed and how they contribute to the detection process. Methodologically, few systematic literature reviews have applied advanced analytical techniques—such as content analysis, lexicographic analysis, and textometry—supported by specialized textual analysis software, leaving an important gap in evidence synthesis. From a practical standpoint, existing studies do not sufficiently explore how the integration of AI into tax fraud detection can be made more effective through structured frameworks like the proposed “Adaptive AI Tax Oversight” (AATO). This study seeks to bridge these gaps by providing both a critical review of the literature and a conceptual framework to guide future applications.

Specifically, this study sets out to accomplish two main goals. First, we survey the AI-based tools predominantly used by global tax administrations for detecting tax fraud, focusing on their benefits and challenges. Second, we develop a conceptual framework detailing the application of artificial intelligence in tax fraud detection within the innovative landscape of the OECD Tax Administration 3.0. We attempt to not only map out the current utilization of AI in combating tax fraud, but also to guide the future integration of AI technologies in enhancing tax regulatory frameworks and operational efficiencies.

To meet these research objectives, we conduct a systematic literature review using the Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA) method, analyzing studies published between 2014 and 2024 from the Scopus and Web of Science databases. This comprehensive review involves a detailed textometric analysis of 163 studies, utilizing both bibliometric and textometric analyses of titles, abstracts, and keywords. Such approaches significantly enrich the depth and breadth of analysis in systematic literature reviews (Bueno et al., 2021). Furthermore, tools like IRAMUTEQ 0.7 alpha 2 are used for advanced statistical analysis of textual data, enhancing the quality of insights derived from the literature (Figura et al., 2023). These methodologies are not widely applied in systematic literature reviews, but they highlight existing gaps and present opportunities for generating more nuanced and extensive research findings in future studies. By adopting this combined bibliometric and textometric approach, this study constitutes the first systematic review to present the AI-based tools currently employed in tax fraud detection, to analyze the benefits and challenges associated with their use, and to propose a novel implementation framework that outlines the process of integrating these technologies into tax administrations. This underlines both the originality and significance of the study’s contribution.

The paper is structured to provide a comprehensive exploration of the research. We start with the methods and data section, in which we detail the systematic review process and analytical approaches. We then present the results and discussions sections, first providing an initial descriptive analysis summarizing the broad findings, followed by detailed results for an in-depth exploration. We conclude with a summary of our core insights and their broader implications.

2. Materials and Methods

Systematic literature reviews (SLRs) are celebrated for their structured and rigorous approach in consolidating existing research, crucially offering a comprehensive and unbiased perspective on studies concerning a specific subject (Boell & Cecez-Kecmanovic, 2015; Okoli, 2015). This method stands out in disciplines such as economics and business, aiding in the assimilation of varied methodologies amidst swiftly evolving and segmenting bodies of knowledge. Particularly for those delving into emerging fields like digital transformation and artificial intelligence (Aguilar et al., 2021; Guandalini, 2022), SLRs have proven to be an invaluable resource, both in spotting research voids and in establishing a robust groundwork for subsequent inquiries (Snyder, 2019).

We adopted the PRISMA method for its clarity and systematic approach in literature reviews. PRISMA provides a four-phase selection process, aiming to reduce bias and ensure comprehensive reporting (Liberati et al., 2009). We chose this methodology for its suitability to our research goals, allowing for a detailed and impartial exploration of the available literature in this evolving field (Page et al., 2021). Following PRISMA’s guidelines facilitated a disciplined review process, culminating in a visual representation of the approach from study selection to inclusion. This method ensured the reliability and depth of the review, contributing to the understanding of how AI technologies help detect tax fraud in a variety of contexts.

2.1. Data Selection

We selected data from the following three primary databases: Scopus, Web of Science, and ScienceDirect, chosen for their high volume of quality publications, comprehensive coverage, advanced search capabilities, and reproducibility, making them the leading databases for systematic searches in this field (Mengist et al., 2020; Paul et al., 2021; Shaffril et al., 2021). This strategic combination of databases was aimed at achieving the most balanced search possible (Mourão et al., 2020), particularly valued for research in economics, management, and areas focusing on technological development and artificial intelligence. Our choice of these databases is supported by their efficiency and effectiveness in capturing the relevant literature in these specific domains (de la Torre-López et al., 2023; Gomes et al., 2022; Pranckutė, 2021). This methodological approach ensures a broad yet targeted review of the existing body of work, facilitating a comprehensive understanding of the subject matter.

The data collection process for this study followed the PRISMA research protocol (Figure 1) and adopted a multi-stage approach. In the identification phase, we conducted systematic searches across three major databases—Scopus, Web of Science, and ScienceDirect—using a comprehensive set of keywords combining terms related to “tax fraud detection”, “artificial intelligence”, “machine learning”, “neural networks”, and “big data”. This search initially yielded 215 records. In the screening phase, records were filtered according to publication period (2014–2024) and subject relevance, reducing the corpus to 195 articles. During the eligibility phase, non-English publications and inaccessible papers were excluded, resulting in 180 records. The remaining studies were assessed by carefully reviewing titles, abstracts, keywords, and full texts, which led to the identification of 168 potentially relevant articles. After applying our final inclusion and exclusion criteria—focusing on peer-reviewed studies directly addressing AI-based technologies in tax fraud detection and excluding papers that dealt solely with broader issues such as general digitalization or unrelated financial technologies—we retained 163 studies for the systematic literature review. In addition, grey literature, including selected OECD reports and policy papers from international organizations, was consulted to provide further contextual insights and ensure comprehensive coverage.

Figure 1.

PRISMA research protocol.

The advanced search applied a precise combination of keywords and codes, as detailed in Table 1. Search strings combined “Artificial Intelligence” with terms related to tax administration, fraud, avoidance, evasion, and compliance. Keywords such as “Machine learning”, “Blockchain”, and “Neural networks” were part of the filter applied to the scanned items, which included article titles, abstracts, and keywords within the last decade (2014–2024).

Table 1.

Keywords and codes used in advanced search.

2.2. Data Analysis

We begin our data analysis with a bibliometric review to map the landscape of the research, covering publication trends over time (Figure 2), geographical contributions (Figure 3), the variety of paper types (Figure 4), and the range of subject areas within the dataset (Table 2). This step is critical for identifying patterns and establishing a contextual understanding of the field’s development and focus areas regarding the use of AI for tax fraud detection.

Figure 2.

Documents by year. Source: Created by authors.

Figure 3.

Country of affiliation. Source: Created by the authors.

Figure 4.

Type of papers. Source: Created by the authors.

Table 2.

Documents by subject area.

Taking a more detailed approach to data analysis, we then conduct textometric analysis using IRAMUTEQ 0.7 alpha 2 software (Ratinaud, 2009), which allows for sophisticated analysis in line with the overarching goals of the study (Figura et al., 2023; Ramos et al., 2018). The choice of IRAMUTEQ 0.7 alpha 2 is justified by its ability to combine lexicographic, statistical, and textometric techniques within a single open-source platform, enabling rigorous, rapid, and replicable analysis of large corpora. Compared to other software such as NVivo and Leximancer, IRAMUTEQ 0.7 alpha 2 offers specific advantages for systematic reviews by automating similarity analyses and classification, thereby ensuring both depth and transparency in data interpretation (Figura et al., 2023). To reinforce the robustness of our findings, we also rely on triangulation and expert cross-checking of classifications to enhance reliability.

From the 163 papers gathered for the SLR, we create a general text corpus folder, containing the titles, abstracts, and keywords of the selected papers. We start with a global assessment, including a statistical summary (Table 3), identification of the 50 most frequently occurring words (Table 4), and a cluster dendrogram (Figure 5). We then conduct a detailed analysis that examines the 30 most important words per class (Table 5), performing factorial correspondence analyses (Figure 6) and conducting similarity analyses (Figure 7). These steps allow us to dissect the textual data thoroughly, providing a nuanced understanding of the prevalent themes and terms within the literature on AI and tax fraud detection.

Table 3.

Statistical summary of corpus.

Table 4.

The 50 most frequently used active words.

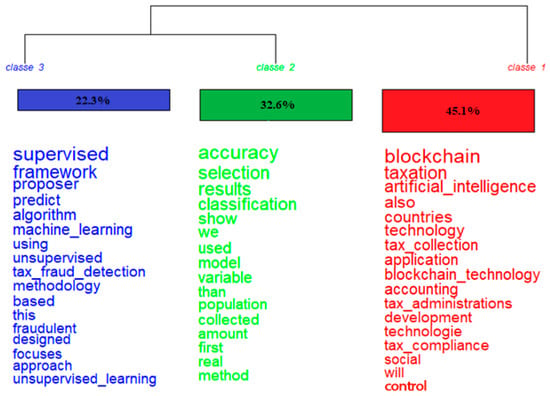

Figure 5.

Dendrogram of the clusters. Source: Created by the authors using IRAMUTEQ software.

Table 5.

The 25 most used words per class.

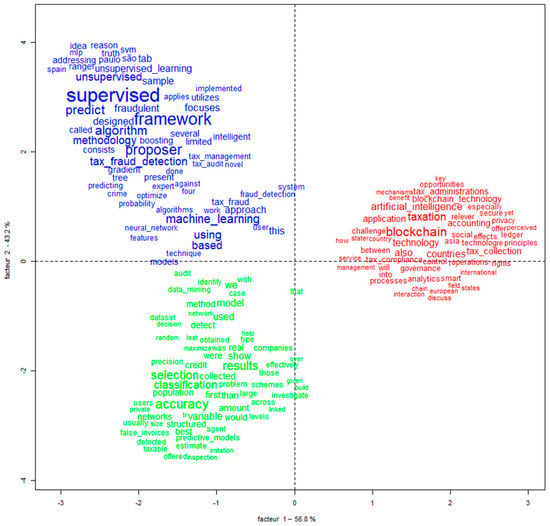

Figure 6.

Factorial correspondence analyses. Source: Created by the authors using IRAMUTEQ software.

Figure 7.

Similarity analysis. Source: Created by the authors using IRAMUTEQ software.

3. Results (1): Descriptive and Bibliometric Analysis

In this section, we conduct descriptive and bibliometric analyses to provide a foundational overview of AI research in tax fraud detection, including trends, contributions, and geographic insights. Figure 2 illustrates the number of publications by year, showing a continuous increase in research output over time. Notably, there has been a sharp rise in recent years, with 53 documents in 2024, 33 in 2023, 22 in 2022, and 21 in 2021. This upward trend underscores a growing scholarly focus on AI in tax fraud detection, likely driven by its increasing relevance and the need for advanced methodologies to address evolving economic and regulatory challenges.

Figure 3 indicates that research contributions on AI in tax fraud detection are geographically diverse, with China (n = 20) leading in the number of documents published, closely followed by the United States (n = 19). Indonesia (n = 12) then follows, reflecting a significant body of work emanating from this country as well. Brazil and the United Kingdom are tied (n = 11 each), also contributing to the research output. This spread suggests a wide international interest and investment in exploring AI applications for tax fraud detection, indicating the global relevance of the issue.

These many papers are predominantly (Figure 5) made up of articles (51.9 percent) and conference papers (44.4 percent), indicating a strong representation in both formal publications and academic gatherings. Book chapters and reviews each constitute a small fraction (1.9 percent), suggesting a lesser focus on these formats within the current discourse on AI in tax fraud detection. This distribution underscores the research community’s preference for disseminating findings through articles and presentations at conferences.

The subjects addressed in the collected documents predominantly fall under Computer Science, indicating its central role in the discussion of AI for tax fraud detection. Other fields such as Engineering, Business, Management and Accounting, and Social Sciences also contribute significantly, demonstrating the interdisciplinary nature of this research (see Table 2). Contributions from Economics, Econometrics and Finance, Decision Sciences, and even Materials Science reflect the broad relevance and application of AI across various facets of research connected to tax fraud.

The bibliometric analysis reveals an upsurge in AI and tax fraud detection research, especially in recent years, with a global spread of contributions led by China and the United States. Computer Science dominates among the subject areas, with interdisciplinary input from various fields, illustrating the wide-ranging impact of AI in enhancing tax fraud detection and the diverse academic interest it garners.

We now engage in text analysis, extracting key findings in order to capture essential insights from the exploration of AI in tax fraud detection.

The statistical summary provided in Table 3, generated using IRAMUTEQ software, offers insightful metrics on the corpus post lemmatization. The table highlights a total of 24,951 occurrences across the corpus, with an average of 3836 occurrences per text and a total of 3607 lexical forms (words) identified. Among these, only 3 forms are categorized as active, with 1607 being unique occurrences (hapaxes legomenon), signifying a diverse range of vocabulary with a substantial portion being used only once. This diversity and the ratio of unique terms to total occurrences (6.44 percent) and forms (43.16 percent) suggest a wide breadth of topics and concepts covered within the texts analyzed. Such detailed analysis underscores the complexity and richness of the language surrounding AI in tax fraud detection research.

Table 4 showcases the 50 most frequently used active words in the corpus, illustrating key focus areas within AI and tax fraud detection research. Terms like “tax”, “machine learning”, “tax evasion”, and “blockchain” are among the most used words, reflecting the core subjects and technologies under investigation (Alm, 2021; Alm et al., 2019). The prominence of “artificial intelligence” alongside specific methods like “data mining” and “neural networks” underscores the technological emphasis of the studies (De Roux et al., 2018; Delgado et al., 2023; Murorunkwere et al., 2022; Pérez López et al., 2019). Additionally, the inclusion of “fraud detection”, “tax authorities”, and “government” highlights the practical applications and stakeholders involved. This frequency analysis not only identifies the primary topics and tools explored, but also indicates an interdisciplinary approach encompassing technology, regulatory concerns, and the broader economic and management implications in addressing tax fraud.

The dendrogram in Figure 6, created by IRAMUTEQ software, illustrates the clustering of concepts within the corpus. The three distinct classes show a thematic division. Class 1, the largest group, focuses on foundational technologies and their application in the field, with keywords like blockchain, taxation, and artificial intelligence (Mazur, 2022; Morton & Curran, 2023). Class 2 centers on research methodologies, with terms like accuracy and classification indicating a focus on the precision and categorization aspects of the studies (Murorunkwere et al., 2022). Class 3 addresses specific types of machine learning, highlighted by terms such as supervised and unsupervised learning, suggesting an emphasis on the algorithms used in tax fraud detection (Alm et al., 2019; De Roux et al., 2018; Savić et al., 2022). Each cluster represents a significant area of focus in the literature, providing a visual breakdown of the key topics and approaches in the use of AI for detecting tax fraud (Table 5).

The first cluster in Table 5 centers on “Blockchain and AI in tax modernization”, and it is characterized by a strong focus on the integration of blockchain technology and artificial intelligence within the domain of taxation (Fatz et al., 2019; Mazur, 2022; Morton & Curran, 2023; Owens & Hodžić, 2022). This theme reflects an intersection between advanced technological applications and their role in transforming tax collection, administration, and compliance strategies (Baghdasaryan et al., 2022; Cobham & Janský, 2018; Martínez et al., 2022). The presence of terms such as blockchain, tax collection, accounting, and tax compliance suggests an exploration of how these digital tools can improve the efficiency, transparency, and effectiveness of tax systems (Baghdasaryan et al., 2022; Martínez et al., 2022). It also implies a consideration of the challenges, opportunities, and legal aspects related to the adoption of these technologies in an international context, indicating a comprehensive discussion on the modernization of tax regimes through tech advancements. For Cluster 2, which makes up 33 percent of the focus, a suitable theme might be “Precision and predictive analysis in tax control”. This cluster is dominated by terms like accuracy, selection, and structured, which align with the precision required for effective tax monitoring and the use of predictive models for foresight in tax-related issues (Sampa & Phiri, 2023; Xu et al., 2023). Additionally, the cluster reflects on the importance of detection, data mining, and audit, all of which are crucial for identifying and addressing tax evasion and avoidance with accuracy (De Roux et al., 2018; Sampa & Phiri, 2023). These terms, along with efficiency and resources, suggest a focus on optimizing the tax assessment process and improving the accuracy of identifying tax-related discrepancies. Cluster 3 accounts for 22 percent of the data, and could be themed as “Learning algorithms in tax fraud detection”. It is characterized by a focus on supervised and unsupervised learning methods, as well as the utilization of specific algorithms and machine learning techniques tailored for tax fraud detection (Masrom et al., 2022; Murorunkwere et al., 2023a, 2023b; Savić et al., 2022). The cluster also signifies an emphasis on fraudulent behaviors and the approaches developed to predict and identify them within tax systems. This cluster suggests an analysis of the effectiveness of different AI methodologies, such as deep learning and neural networks, in enhancing the precision of fraud detection and tax audits (Baghdasaryan et al., 2022).

The factorial correspondence analysis in Figure 6 visualizes the relationship and correlation between the various keywords used in the literature on AI and tax fraud detection. In this graph, the closer the words are to each other, the more frequently they are associated within the documents. It is clear from the dense clustering of terms like supervised, framework, and predict that there is a strong focus on predictive models and structured approaches in AI. Another dense cluster includes blockchain, taxation, and artificial intelligence, highlighting the technological convergence in this research area. This type of analysis allows us to observe how different concepts within the field are interconnected, offering a graphic representation of the thematic structures that underpin the research corpus.

Figure 7 presents a similarity analysis, which visually groups related concepts in the field of AI and tax fraud detection into clusters. These clusters represent interconnected themes, with one focusing on the core subject of tax, surrounded by related terms like evasion and compliance, another emphasizing machine learning and its link to fraud and fraud detection, and a third highlighting taxpayers and associated aspects such as data mining and tax administration (Belahouaoui & Attak, 2024b). Each cluster is shaped by the frequency and co-occurrence of terms in the literature, indicating how different topics are conceptually related to each other within the research field.

The text analysis crystallizes the focus on cutting-edge AI technologies and methods like blockchain and machine learning in enhancing tax fraud detection, as reflected in the literature’s predominant themes and the clustering of related research topics.

4. Results (2): Key Findings

In this section, we examine the key findings from a carefully selected set of studies, highlighting major contributions and challenges in the use of AI for tax fraud detection. We chose the ten studies presented in Table 6 by using a comprehensive literature analysis, considering citation impact, relevance to the research objectives, and thematic alignment. Selection criteria focused on the most cited studies, ensuring strong methodological foundations and direct connections to AI-driven tax fraud detection. This synthesis provides essential perspectives on the effectiveness, limitations, and future developments of AI in tax administration.

Table 6.

Key findings from the top 10 most cited studies directly related to the subject.

To further elucidate the practical applications and implications of various AI tools in the realm of tax fraud detection, we present a detailed comparative analysis in Table 7. This table synthesizes essential aspects of each AI technology, including their specific applications in detecting tax fraud, the benefits they offer, the challenges they pose, and the associated costs. This structured overview serves as a comprehensive guide for tax authorities and policymakers to assess the suitability of different AI tools in enhancing their fraud detection capabilities, balancing technological advantages against operational challenges and cost considerations.

Table 7.

AI tools used to detect tax fraud.

In this analysis, we explore how AI tools function in a tax administration context, focusing on their effectiveness, efficiency, cost implications, and the challenges they pose. Machine learning and deep learning stand out for their pattern recognition capabilities, essential for sifting through complex taxpayer data to spot subtle fraud indicators. The resource demands of each technology, including computational and human resources, are assessed, highlighting how technologies like data analytics and predictive modeling streamline the fraud detection process by minimizing the need for extensive manual labor. Moreover, the financial aspects of implementing AI solutions are discussed. Blockchain technology, for instance, provides transparency and security but comes with high setup and ongoing maintenance costs. Additionally, the analysis tackles the hurdles that each technology might face, such as data privacy concerns associated with big data applications and the steep learning curve associated with neural networks, which often require specialized knowledge and training. This comparative overview aims to arm tax authorities and policymakers with information to make informed decisions regarding the integration of AI tools into their systems, identifying which tools best align with their specific needs by balancing effectiveness, efficiency, and cost to optimize their tax fraud detection approach.

The ten most cited studies highlight the strong potential of AI-based technologies, such as machine learning, neural networks, and data mining, for improving tax fraud detection, often achieving high accuracy rates and efficiency gains. However, these contributions remain fragmented and heavily context-specific, limiting the generalizability of the findings. Most studies focus primarily on technical performance while overlooking institutional, regulatory, and ethical challenges, including costs, data privacy, and skill shortages. Moreover, the link between technological effectiveness and broader outcomes such as taxpayer trust and compliance remains underexplored. This indicates a clear need for more integrative and critical research that connects technological innovation with governance, equity, and sustainability in tax administration.

To provide a clearer understanding of how different AI technologies operate in tax fraud detection, Table 7 presents a structured comparison of the main tools identified in the literature.

While Table 7 provides a comparative overview of AI tools used in tax fraud detection, their adoption and effectiveness are not solely determined by technological performance. According to the literature, several categories of factors influence the implementation of AI-based technologies in tax administrations. Table 8 presents these categories and specifies the key factors within each, highlighting the interplay between technological, organizational, institutional, and socio-economic dimensions.

Table 8.

Factors influencing AI adoption in tax fraud detection.

Building on the bibliometric and textometric analyses, we now present the “Adaptive AI Tax Oversight” (AATO) framework, depicted in Figure 8. Rather than being a purely descriptive taxonomy, the framework derives directly from the systematic synthesis of the most cited studies and clusters identified through our analyses, thereby linking empirical evidence with theoretical reflection. The AATO framework integrates key AI functions—data aggregation, anomaly detection, predictive analysis, adaptive learning, decision support, and continuous evolution—into a dynamic process that resonates with broader models of digital governance, institutional theory, and public choice approaches. By grounding its components in both the literature review and established theoretical perspectives, the framework not only validates the themes that emerged from the bibliometric findings, but also provides practical implications for tax authorities. Specifically, it offers a structured guide for leveraging AI within the OECD’s Tax Administration 3.0 vision, helping policymakers move beyond descriptive discussions toward actionable strategies that balance technological innovation, institutional capacity, and governance principles in combating tax fraud.

Figure 8.

Adaptive AI Tax Oversight (AATO) framework. Source: Created by the authors.

Delving into the intricacies of Tax Administration 3.0, it is essential to examine both the advantages and challenges of deploying AI in tax fraud detection. Table 8 attempts to present a balanced view, juxtaposing the benefits that AI brings to the efficiency and effectiveness of tax fraud detection against the challenges it poses in terms of technical implementation, data management, and ethical considerations. This dichotomy is crucial for understanding the full spectrum of AI’s impact on modern tax administration practices.

Table 9 aims to summarize the potential advantages and obstacles that come with integrating AI into tax fraud detection processes, highlighting considerations for tax administrations moving towards a more digital and AI-driven future.

Table 9.

Benefits and challenges of AI in tax fraud detection within the framework of Tax Administration 3.0.

A critical analysis of the reviewed studies indicates that while AI applications in tax fraud detection demonstrate considerable potential, most contributions remain short-term and highly context-specific, with limited integration into broader theoretical or institutional frameworks. The literature often emphasizes technical accuracy and efficiency, yet pays insufficient attention to long-term trends such as the scalability of AI tools, the sustainability of their integration within tax administrations, and their impact on taxpayer trust and compliance. Moreover, the key factors influencing adoption, ranging from data quality and technological infrastructure to governance, ethical safeguards, and organizational readiness, are frequently underexplored or treated in isolation. Addressing these dimensions more explicitly would not only strengthen the theoretical contributions of the field by linking AI adoption to models of digital governance and institutional theory, but also generate more practical insights for policymakers seeking the sustainable and equitable integration of AI into tax fraud detection systems.

5. Conclusions

This study contributes to the literature on AI and tax fraud detection by providing one of the first systematic reviews that integrates bibliometric and textometric approaches. Theoretically, it clarifies how AI-based technologies such as machine learning, neural networks, and blockchain are positioned within the evolving framework of Tax Administration 3.0, highlighting both their potential and their limitations. Methodologically, the adoption of a combined bibliometric–textometric strategy enriches evidence synthesis and offers a replicable model for future research in the field. Practically, the development of the Adaptive AI Tax Oversight (AATO) framework provides policymakers and tax authorities with a structured guide to assess the suitability of AI tools, balancing efficiency gains with governance, ethical, and financial considerations. By addressing theoretical, methodological, and practical gaps, the study advances the academic debate while also offering actionable insights for the sustainable integration of AI into tax administration systems.

The insights derived from the reviewed studies were synthesized into the AATO framework (Figure 8). This framework outlines a structured process in which AI technologies support tax fraud detection, progressing from data aggregation to pattern recognition, predictive analysis, adaptive learning, decision support, and blockchain-enabled transparency. By integrating supervised and unsupervised learning with secure distributed ledgers, the model illustrates how AI can transform tax administration into a more dynamic, accurate, and efficient system. Nonetheless, the findings also underscore the dual nature of AI in this domain: while offering scalability, predictive capacity, and real-time monitoring, significant challenges persist. These include data privacy concerns, integration barriers with legacy systems, the need for highly skilled expertise, and ethical risks such as algorithmic bias.

At the same time, the study acknowledges that the technical achievements of introducing AI have been more extensively addressed than their broader consequences. The causal connection between technological performance and social or institutional outcomes such as taxpayer trust, institutional change, and governance remains insufficiently explained. This gap calls for future research to explicitly examine how the adoption of AI in tax administrations translates into long-term changes in institutional practices, public trust, and the legitimacy of tax systems. The AATO framework, therefore, emphasizes not only the potential of AI to modernize tax fraud detection, but also the necessity of robust governance mechanisms, ethical safeguards, and institutional adaptation to ensure its sustainable adoption.

5.1. Implications of the Study

5.1.1. Theoretical Implications

This study contributes to the theoretical advancement of research on AI-driven tax fraud detection by deepening the understanding of how different methodological approaches, particularly supervised and unsupervised learning, interact to address the complexity of tax evasion. Beyond enriching the existing literature on taxation and technology, it highlights the potential of AI to serve as a bridge between predictive modeling and adaptive oversight in fiscal systems. From a broader perspective, the study underscores the importance of adopting an interdisciplinary lens, combining insights from data science, legal scholarship, and economic theory. Such a convergence not only strengthens the conceptual foundations of AI applications in tax administration, but also provides a theoretical basis for developing more robust, scalable, and context-sensitive frameworks. By doing so, the research opens avenues for future inquiries into how AI can be theoretically integrated with established models of governance, institutional theory, and public choice, thereby embedding technological innovation within recognized academic paradigms.

5.1.2. Implications for Governments and Tax Administrations

The findings of this study carry significant implications for governments and tax administrations, with recommendations that vary according to the level of technological maturity of each context.

In advanced economies, where tax administrations are already supported by sophisticated digital infrastructures, the priority lies in enhancing interoperability, strengthening ethical governance, and addressing challenges related to algorithmic bias and data privacy. These administrations should also focus on integrating AI into predictive and real-time fraud detection systems, while aligning with broader digital governance frameworks to maintain transparency and taxpayer trust.

In contrast, for low- and middle-income countries, the emphasis should first be placed on building robust digital infrastructures and ensuring access to reliable and standardized data. Gradual adoption of AI tools is recommended, beginning with low-cost data analytics and supervised learning models before transitioning toward more complex technologies such as blockchain and deep learning. Policymakers in these contexts must also prioritize capacity-building programs, including specialized training for tax officials, partnerships with universities and technology providers, and phased regulatory reforms. Such incremental approaches can help mitigate implementation risks while allowing administrations to progressively harness the benefits of AI.

Taken together, these differentiated policy implications highlight the need for context-sensitive strategies: advanced economies must refine and regulate AI applications, while low- and middle-income countries must first establish foundational capacities to support their sustainable integration. This dual perspective ensures that AI-driven tax fraud detection becomes a feasible and equitable instrument across diverse institutional and economic environments.

5.1.3. Implications for Audit Companies and Professionals

For audit companies and professionals, the adoption of AI in tax fraud detection brings significant transformations. On the positive side, AI strengthens audit quality by enhancing the detection of irregularities, improving risk-based approaches, and allowing real-time monitoring of complex financial operations. These technologies also enable auditors to shift from routine manual tasks toward higher value-added analytical and advisory roles. However, the integration of AI also poses challenges: professionals must continuously update their digital, statistical, and legal knowledge, adapt to evolving technologies, and ensure the ethical use of algorithms. Maintaining professional judgment and independence becomes essential to avoid over-reliance on automated systems, highlighting the need for continuous training and ethical guidelines in the audit profession.

5.1.4. Implications for Taxpayers

For taxpayers, AI-driven tax fraud detection systems have the potential to reinforce fairness, transparency, and consistency in tax administration, thereby improving overall trust in public institutions. Automated processes may reduce discretionary errors and ensure that similar cases are treated equally. At the same time, taxpayers face new concerns related to data privacy, surveillance, and the risk of algorithmic mistakes that could unfairly classify compliant taxpayers as fraudulent. Ensuring clear communication, legal safeguards, and accessible channels for contesting automated decisions is, therefore, crucial. These measures will help balance efficiency gains with the protection of taxpayers’ rights, fostering greater acceptance of AI-based tax systems.

5.2. Limitations of the Study

This study presents certain limitations that should be acknowledged. First, the temporal scope of the analysis was limited to the period between 2014 and 2024. While this range captures recent and relevant developments, it may exclude earlier foundational contributions and very recent emerging works. Second, the selection of articles relied primarily on the use of keywords. This approach, while systematic, did not distinguish journals according to their scientific quality or level of expertise, which may influence the overall representativeness of the sample. Third, the textual analysis conducted was largely based on the frequency and presence of terms rather than their full contextual meaning. As in any lexical study, this raises the possibility of misinterpretation, particularly in cases where terms may have been used ironically or in a nuanced context. Finally, the study remains secondary in nature, as it is based exclusively on previously published works without access to the original data. This implies that any potential errors, omissions, or biases present in the primary studies are likely reproduced, with no possibility of correction within this research.

5.3. Recommendations for Future Research

Future research should focus on developing a specific implementation guide that explains how AI-based technologies can be concretely applied within tax administrations, as well as conducting empirical validation to assess the applicability and effectiveness of the proposed AATO framework in real institutional contexts. Another direction concerns the integration of AI within broader tax governance frameworks, particularly in the context of Tax Administration 3.0, to better understand how these technologies affect compliance costs, taxpayer trust, and the overall efficiency of tax systems.

In addition, comparative studies between high-income and low- and middle-income countries could shed light on the uneven adoption of AI tools in tax administration. Such work would highlight not only the technological and institutional challenges faced by emerging economies, but also identify context-specific strategies to ensure equitable and effective fraud detection. Finally, future research should explore the ethical and governance dimensions of AI adoption in tax systems, particularly issues of transparency, algorithmic bias, and taxpayer rights, in order to strengthen the legitimacy and sustainability of AI-driven tax oversight.

Author Contributions

Conceptualization, R.B. and J.A.; methodology, R.B.; software, R.B.; validation, J.A.; formal analysis, R.B.; investigation, R.B.; resources, R.B.; data curation, R.B.; writing—original draft preparation, R.B.; writing—review and editing, J.A.; visualization, J.A.; supervision, J.A.; project administration, J.A.; funding acquisition, R.B. and J.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data used in this study were exported from the Scopus, Web of Science and ScienceDirect databases. The datasets are available from the corresponding author upon reasonable request.

Conflicts of Interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

References

- Aguilar, J., Garces-Jimenez, A., R-Moreno, M. D., & García, R. (2021). A systematic literature review on the use of artificial intelligence in energy self-management in smart buildings. Renewable and Sustainable Energy Reviews, 151, 111530. [Google Scholar] [CrossRef]

- Alm, J. (2021). Tax evasion, technology, and inequality. Economics of Governance, 22(4), 321–343. [Google Scholar] [CrossRef]

- Alm, J. (2023). Tax compliance, technology, trust, and inequality in a post-pandemic world. eJournal of Tax Research, 21(2), 152–172. [Google Scholar]

- Alm, J., Beebe, J., Kirsch, M. S., Marian, O., & Soled, J. A. (2019). New technologies and the evolution of tax compliance. Virginia Tax Review, 39(3), 287–356. [Google Scholar]

- Alsadhan, N. (2023). A multi-module machine learning approach to detect tax fraud. Computer Systems Science and Engineering, 46(1), 241–253. [Google Scholar] [CrossRef]

- Alstadsaeter, A., Godar, S., Nicolaides, P., & Zucman, G. (2023). Global tax evasion report 2024 [Doctoral dissertation, Eu-Tax Observatory]. [Google Scholar]

- Baghdasaryan, V., Davtyan, H., Sarikyan, A., & Navasardyan, Z. (2022). Improving tax audit efficiency using machine learning: The role of taxpayer’s network data in fraud detection. Applied Artificial Intelligence, 36(1), 2012002. [Google Scholar] [CrossRef]

- Bao, Y., Hilary, G., & Ke, B. (2022). Artificial intelligence and fraud detection. In Innovative technology at the interface of finance and operations: Volume I (pp. 223–247). Springer. [Google Scholar]

- Bassey, E., Mulligan, E., & Ojo, A. (2022). A conceptual framework for digital tax administration—A systematic review. Government Information Quarterly, 39(4), 101754. [Google Scholar] [CrossRef]

- Belahouaoui, R. (2025). Effect of tax fairness and trust in tax authorities on tax compliance: The moderating role of tax pressure in the post COVID-19 Moroccan reform context. International Journal of Public Administration, 1–15. [Google Scholar] [CrossRef]

- Belahouaoui, R., & Attak, E. H. (2024a). Digital taxation, artificial intelligence and Tax Administration 3.0: Improving tax compliance behavior—A systematic literature review using textometry. Accounting Research Journal, 37(2), 172–191. [Google Scholar] [CrossRef]

- Belahouaoui, R., & Attak, E. H. (2024b). Exploring the relationship between taxpayers and tax authorities in the digital era: Evidence on tax compliance behavior in emerging economies. International Journal of Law and Management. ahead-of-print. [Google Scholar] [CrossRef]

- Belahouaoui, R., & Attak, E. H. (2025). Tax policy responses to economic crises: The case of post-COVID-19 reform in Morocco (2023–2026). In Assessing policy landscapes in taxation dynamics (pp. 357–384). IGI Global. [Google Scholar]

- Bharosa, N. (2022). The rise of GovTech: Trojan horse or blessing in disguise? A research agenda. Government Information Quarterly, 39(3), 101692. [Google Scholar] [CrossRef]

- Boell, S. K., & Cecez-Kecmanovic, D. (2015). On being ‘systematic’ in literature reviews. In Formulating research methods for information systems (Vol. 2, pp. 48–78). Palgrave Macmillan. [Google Scholar]

- Bueno, S., Banuls, V. A., & Gallego, M. D. (2021). Is urban resilience a phenomenon on the rise? A systematic literature review for the years 2019 and 2020 using textometry. International Journal of Disaster Risk Reduction, 66, 102588. [Google Scholar] [CrossRef]

- Calafato, A., Colombo, C., & Pace, G. J. (2016). A controlled natural language for tax fraud detection. In Controlled natural language: 5th international workshop, CNL 2016, Aberdeen, UK, 25–27 July 2016, proceedings (pp. 1–12). Springer International Publishing. [Google Scholar]

- Cobham, A., & Janský, P. (2018). Global distribution of revenue loss from corporate tax avoidance: Re-estimation and country results. Journal of International Development, 30(2), 206–232. [Google Scholar] [CrossRef]

- de la Torre-López, J., Ramírez, A., & Romero, J. R. (2023). Artificial intelligence to automate the systematic review of scientific literature. Computing, 105(10), 2171–2194. [Google Scholar] [CrossRef]

- Delgado, F. J., Fernández-Rodríguez, E., García-Fernández, R., Landajo, M., & Martínez-Arias, A. (2023). Tax avoidance and earnings management: A neural network approach for the largest European economies. Financial Innovation, 9(1), 19. [Google Scholar] [CrossRef]

- De Roux, D., Perez, B., Moreno, A., Villamil, M. d. P., & Figueroa, C. (2018, August 19–23). Tax fraud detection for under-reporting declarations using an unsupervised machine learning approach. 24th ACM SIGKDD International Conference on Knowledge Discovery & Data Mining (pp. 215–222), London, UK. [Google Scholar]

- Fatz, F., Hake, P., & Fettke, P. (2019, July 15–17). Towards tax compliance by design: A decentralized validation of tax processes using blockchain technology. 2019 IEEE 21st Conference on Business Informatics (CBI) (Vol. 1, pp. 559–568), Moscow, Russia. [Google Scholar]

- Figura, M., Fraire, M., Durante, A., Cuoco, A., Arcadi, P., Alvaro, R., Vellone, E., & Piervisani, L. (2023). New frontiers for qualitative textual data analysis: A multimethod statistical approach. European Journal of Cardiovascular Nursing, 22(5), 547–551. [Google Scholar] [CrossRef]

- Gaie, C. (2023). Struggling against tax fraud: A holistic approach using artificial intelligence. In Recent advances in data and algorithms for e-government (pp. 87–102). Springer. [Google Scholar]

- Gale, W. G., & Krupkin, A. (2019). How big is the problem of tax evasion? Policy Brief. Urban-Brookings Tax Policy Center. [Google Scholar]

- Gomes, P., Verçosa, L., Melo, F., Silva, V., Filho, C. B., & Bezerra, B. (2022). Artificial intelligence-based methods for business processes: A systematic literature review. Applied Sciences, 12(5), 2314. [Google Scholar] [CrossRef]

- Guandalini, I. (2022). Sustainability through digital transformation: A systematic literature review for research guidance. Journal of Business Research, 148, 456–471. [Google Scholar] [CrossRef]

- Khaltar, O. (2024). Tax evasion and governance quality: The moderating role of adopting open government. International Review of Administrative Sciences, 90(1), 276–294. [Google Scholar] [CrossRef]

- Liberati, A., Altman, D. G., Tetzlaff, J., Mulrow, C., Gøtzsche, P. C., Ioannidis, J. P. A., Clarke, M., Devereaux, P. J., Kleijnen, J., & Moher, D. (2009). The PRISMA statement for reporting systematic reviews and meta-analyses of studies that evaluate health care interventions: Explanation and elaboration. Annals of Internal Medicine, 151(4), W-65–W-94. [Google Scholar] [CrossRef]

- Louati, H., Louati, A., Almekhlafi, A., ElSaka, M., Alharbi, M., Kariri, E., & Altherwy, Y. N. (2024). Adopting artificial intelligence to strengthen legal safeguards in blockchain smart contracts: A strategy to mitigate fraud and enhance digital transaction security. Journal of Theoretical and Applied Electronic Commerce Research, 19(3), 2139–2156. [Google Scholar] [CrossRef]

- Martínez, Y. U., Arzoz, P. P., & Arregui, I. Z. (2022). Tax collection efficiency in OECD countries improves via decentralization, simplification, digitalization and education. Journal of Policy Modeling, 44(2), 298–318. [Google Scholar] [CrossRef]

- Masrom, S., Rahman, R. A., Mohamad, M., Abd Rahman, A. S., & Baharun, N. (2022). Machine learning of tax avoidance detection based on hybrid metaheuristics algorithms. IAES International Journal of Artificial Intelligence, 11(3), 1153. [Google Scholar] [CrossRef]

- Matheus, R., Janssen, M., & Janowski, T. (2021). Design principles for creating digital transparency in government. Government Information Quarterly, 38(1), 101550. [Google Scholar] [CrossRef]

- Mazur, O. (2022). Can blockchain revolutionize tax administration? Penn State Law Review, 127, 115–170. [Google Scholar] [CrossRef]

- Mengist, W., Soromessa, T., & Legese, G. (2020). Method for conducting systematic literature review and meta-analysis for environmental science research. MethodsX, 7, 100777. [Google Scholar] [CrossRef] [PubMed]

- Morton, E., & Curran, M. (2023). Exemplifying the opportunities and limitations of blockchain technology through corporate tax losses. In Handbook of big data and analytics in accounting and auditing (pp. 177–205). Springer. [Google Scholar]

- Mourão, E., Pimentel, J. F., Murta, L., Kalinowski, M., Mendes, E., & Wohlin, C. (2020). On the performance of hybrid search strategies for systematic literature reviews in software engineering. Information and Software Technology, 123, 106294. [Google Scholar] [CrossRef]

- Mpofu, F. Y. (2024). Digital transformation by tax authorities. In Digital transformation in South Africa: Perspectives from an emerging economy (pp. 151–170). Springer. [Google Scholar]

- Murorunkwere, B. F., Haughton, D., Nzabanita, J., Kipkogei, F., & Kabano, I. (2023a). Predicting tax fraud using supervised machine learning approach. African Journal of Science, Technology, Innovation and Development, 15(6), 731–742. [Google Scholar] [CrossRef]

- Murorunkwere, B. F., Ihirwe, J. F., Kayijuka, I., Nzabanita, J., & Haughton, D. (2023b). Comparison of tree-based machine learning algorithms to predict reporting behavior of electronic billing machines. Information, 14(3), 140. [Google Scholar] [CrossRef]

- Murorunkwere, B. F., Tuyishimire, O., Haughton, D., & Nzabanita, J. (2022). Fraud detection using neural networks: A case study of income tax. Future Internet, 14(6), 168. [Google Scholar] [CrossRef]

- OECD. (2020). Tax administration 3.0: The digital transformation of tax administration. OECD Publishing. [Google Scholar]

- OECD. (2023a). Inventory of tax technology initiatives. OECD Publishing. [Google Scholar]

- OECD. (2023b). Tax administration 2023. OECD Publishing. [Google Scholar]

- OECD. (2024). Corporate tax statistics 2024. OECD Publishing. [Google Scholar]

- Okoli, C. (2015). A guide to conducting a standalone systematic literature review. Communications of the Association for Information Systems, 37, 43. [Google Scholar] [CrossRef]

- Owens, J., & Hodžić, S. (2022). Policy note: Blockchain technology—Potential for digital tax administration. Intertax, 50(11), 813–823. [Google Scholar] [CrossRef]

- Page, M. J., McKenzie, J. E., Bossuyt, P. M., Boutron, I., Hoffmann, T. C., Mulrow, C. D., Shamseer, L., Tetzlaff, J. M., Akl, E. A., & Brennan, S. E. (2021). The PRISMA 2020 statement: An updated guideline for reporting systematic reviews. International Journal of Surgery, 88, 105906. [Google Scholar] [CrossRef]

- Paul, J., Lim, W. M., O’Cass, A., Hao, A. W., & Bresciani, S. (2021). Scientific procedures and rationales for systematic literature reviews (SPAR-4-SLR). International Journal of Consumer Studies, 45(4), O1–O16. [Google Scholar] [CrossRef]

- Pérez López, C., Delgado Rodríguez, M. J., & de Lucas Santos, S. (2019). Tax fraud detection through neural networks: An application using a sample of personal income taxpayers. Future Internet, 11(4), 86. [Google Scholar] [CrossRef]

- Pranckutė, R. (2021). Web of Science (WoS) and Scopus: The titans of bibliographic information in today’s academic world. Publications, 9(1), 12. [Google Scholar] [CrossRef]

- Prolhac, J., & Gaie, C. (2023). Providing an open framework to facilitate tax fraud detection. International Journal of Computer Applications in Technology, 73(1), 24–41. [Google Scholar] [CrossRef]

- Ramos, M. G., do Rosário Lima, V. M., & Amaral-Rosa, M. P. (2018). IRAMUTEQ Software and discursive textual analysis: Interpretive possibilities. In World conference on qualitative research (pp. 58–72). Springer International Publishing. [Google Scholar]

- Ratinaud, P. (2009). IRaMuTeQ: Interface de R pour les analyses multidimensionnelles de textes et de questionnaires [Computer software]. Available online: http://www.iramuteq.org/ (accessed on 10 March 2009).

- Reslan, F. B., & Al Maalouf, N. J. (2024). Assessing the transformative impact of AI adoption on efficiency, fraud detection, and skill dynamics in accounting practices. Journal of Risk and Financial Management, 17(2), 577. [Google Scholar] [CrossRef]

- Ruzgas, T., Kižauskienė, L., Lukauskas, M., Sinkevičius, E., Frolovaitė, M., & Arnastauskaitė, J. (2023). Tax fraud reduction using analytics in an East European country. Axioms, 12(3), 288. [Google Scholar] [CrossRef]

- Sampa, A. W., & Phiri, J. (2023). Prediction model for tax assessments using data mining and machine learning. In Computer science on-line conference (pp. 1–14). Springer International Publishing. [Google Scholar]

- Saragih, A. H., Reyhani, Q., Setyowati, M. S., & Hendrawan, A. (2023). The potential of an artificial intelligence (AI) application for the tax administration system’s modernization: The case of Indonesia. Artificial Intelligence and Law, 31(3), 491–514. [Google Scholar] [CrossRef]

- Savić, M., Atanasijević, J., Jakovetić, D., & Krejić, N. (2022). Tax evasion risk management using a hybrid unsupervised outlier detection method. Expert Systems with Applications, 193, 116409. [Google Scholar] [CrossRef]

- Shaffril, H. A. M., Samah, A. A., & Samsuddin, S. F. (2021). Guidelines for developing a systematic literature review for studies related to climate change adaptation. Environmental Science and Pollution Research, 28, 22265–22277. [Google Scholar] [CrossRef] [PubMed]

- Shakil, M. H., & Tasnia, M. (2022). Artificial intelligence and tax administration in Asia and the Pacific. In Taxation in the digital economy (pp. 45–55). Routledge. [Google Scholar]

- Snyder, H. (2019). Literature review as a research methodology: An overview and guidelines. Journal of Business Research, 104, 333–339. [Google Scholar] [CrossRef]

- Tax Justice Network. (2024). State of tax justice 2024. Tax Justice Network. [Google Scholar]

- Tax, N., de Vries, K. J., de Jong, M., Dosoula, N., van den Akker, B., Smith, J., Thuong, O., & Bernardi, L. (2021). Machine learning for fraud detection in e-commerce: A research agenda. In Deployable machine learning for security defense: Second international workshop, MLHat 2021, virtual event, 15 August 2021, proceedings (pp. 30–54). Springer International Publishing. [Google Scholar]

- Xu, X., Xiong, F., & An, Z. (2023). Using machine learning to predict corporate fraud: Evidence based on the gone framework. Journal of Business Ethics, 186(1), 137–158. [Google Scholar] [CrossRef]

- Zuiderwijk, A., Chen, Y. C., & Salem, F. (2021). Implications of the use of artificial intelligence in public governance: A systematic literature review and a research agenda. Government Information Quarterly, 38(3), 101577. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).