1. Introduction

Organizational efficiency is a key principle in resource management, particularly in sectors operating under budgetary or capital constraints (

Ranjbar et al., 2017). In the financial sphere, efficiency is not only linked to profitability, but also to the fulfilment of social objectives such as economic inclusion, the democratization of credit, and systemic stability (

Duho et al., 2020;

Martínez-Campillo & Fernández-Santos, 2017;

San-Jose et al., 2018). In this context, technical efficiency—understood as the ability of an institution to maximize its outputs from a given set of inputs—becomes a key indicator for assessing the operational performance of banks and credit unions (

Farrell, 1957;

Charnes et al., 1978;

Cooper et al., 2007).

In emerging economies such as Ecuador’s, the financial system is made up of a heterogeneous set of institutions that includes both private banks and credit unions. The latter have become increasingly important in recent decades by channeling resources to segments traditionally excluded from the formal banking system, such as rural communities, informal entrepreneurs, and popular sectors. However, doubts persist about the sustainability of their operating model and how efficient they are compared to traditional banks. Despite their importance, comparative empirical studies that simultaneously and longitudinally address the performance of both types of institutions are scarce in the Ecuadorian case.

The Ecuadorian financial system offers a relevant setting due to the coexistence of private banks and savings and credit cooperatives, which balance profitability goals with social objectives. This institutional heterogeneity provides a unique framework to assess efficiency under conditions of financial inclusion (

Proaño-Rivera & Feria-Domínguez, 2023;

Escandón & Fernández, 2023). The COVID-19 pandemic accentuated differences in resilience and adaptability between these sectors (

Elnahass et al., 2021;

OECD, 2021), reinforcing the importance of this analysis. Thus, the Ecuadorian case provides valuable evidence to guide policy design in emerging economies (

Arora et al., 2025).

The health crisis caused by the COVID-19 pandemic between 2020 and 2022 tested the robustness, adaptability, and efficiency of the financial system. Both banks and cooperatives faced unprecedented challenges, such as rising non-performing loans, pressure on liquidity, and the need to rapidly digitize their services. In this context, the postulates of the agency theory are examined, particularly with regard to efficiency in the allocation and management of resources under conditions of information asymmetry and possible conflicts of interest between different institutional actors. These exceptional circumstances provide a favorable backdrop for analyzing how efficiency levels have varied over time and what structural factors have influenced this variation. Among these factors, the regulatory and normative differences between banks and cooperatives stand out, which have a direct impact on their operating structures and relative performance. Beyond the conjunctural impact of the pandemic, it is necessary to understand whether there are persistent differences in the technical efficiency of banks and credit unions, and how these relate to their operational and governance characteristics.

This study seeks to fill this gap by benchmarking the technical efficiency of private banks and credit unions in Ecuador over the period of 2015–2023. A database composed of financial information from 213 entities (153 cooperatives and 60 banks) is used. This sample allows for a balanced panel with approximately 1700 observations, providing a solid basis for longitudinal analysis of technical efficiency in the financial sector. Likewise, we employ a mixed methodological strategy that combines Data Envelopment Analysis (DEA), as a non-parametric technique for estimating relative efficiencies, with linear mixed models (MLMs), which allows us to incorporate the time dimension and analyze the influence of explanatory variables at both the entity and context levels. This methodological combination overcomes the limitations of traditional static analyses and provides a more comprehensive understanding of the factors that condition financial performance. The findings indicate that cooperatives exhibit, on average, a higher technical efficiency than banks, also showing a greater operational stability in the face of the impact of the COVID-19 crisis.

The results of this research provide updated empirical evidence on the efficiency of the Ecuadorian financial system and have implications for the design of public policies aimed at optimizing resources, improving financial intermediation, and promoting differentiated strategies according to the type of institution. It is argued that efficiency does not depend exclusively on institutional size or the volume of assets under management, but on the capacity for organizational adaptation, the management model, and the alignment between economic and social objectives. In this sense, the study contributes to a research agenda oriented towards the sustainability and comprehensive performance of the financial sector in the context of high institutional heterogeneity and structural vulnerability.

The article is structured as follows.

Section 1 presents a review of the conceptual and empirical background of financial efficiency, highlighting the different theoretical and methodological approaches used in the literature, as well as the contributions and limitations of previous studies applied to banks and cooperatives. The Data Envelopment Analysis (DEA) model is also introduced, highlighting its relevance for the assessment of relative performance in heterogeneous financial institutions.

Section 2 describes the methodology employed, including the characteristics of the sample, the variables selected, the DEA approach adopted, and the integration of linear mixed models (MLMs) for longitudinal analysis of the data.

Section 3 presents the empirical results, comparing the levels of technical efficiency between banks and cooperatives, as well as the factors that explain their variation over time.

Section 4 offers a critical discussion of the findings, linking them to the existing literature and the operational context of the institutions analyzed. Finally,

Section 5 draws conclusions and proposes policy recommendations and practical implications for strengthening the efficiency and resilience of the Ecuadorian financial system.

2. Background to the Research

2.1. Financial Efficiency: Importance and Measurement Tools

Financial efficiency is defined as the ability of an organization to optimally use its financial resources (

Ranjbar et al., 2017) in order to maximize economic results, maintain operational sustainability, and generate value for its different stakeholders. This efficiency implies not only the profitability obtained, but also the adequate management of costs, risks, and assets, in coherence with the strategic objectives of the institution (

Duho et al., 2020).

In the analysis of financial efficiency, it is essential to recognize the conceptual differences that underlie banks and credit unions. In banks, efficiency is predominantly understood through a logic of maximizing profits, while in cooperatives, a dual approach is adopted that combines financial objectives with social goals, in line with the principle of the double bottom line (

Martínez-Campillo & Fernández-Santos, 2017). This distinction implies that, for cooperatives, efficiency is not only measured in terms of profitability, but also in terms of their ability to generate social value and serve their communities (

San-Jose et al., 2018).

The analysis of financial efficiency has been widely addressed in the economic literature through different methodologies. Among the most widely used are Stochastic Frontier Analysis (SFA), proposed by

Aigner et al. (

1977), which allows the random error component to be separated from technical inefficiency; Data Envelopment Analysis (DEA), developed by

Charnes et al. (

1978), which is a non-parametric approach to measure the relative efficiency between comparable units without requiring a specific functional form; and the Malmquist Productivity Index, introduced by

Caves et al. (

1982), useful for assessing changes in efficiency and technology over time.

In addition, metrics based on value creation such as Economic Value Added (EVA) and Market Value Added (MVA) have been incorporated, aimed at assessing efficiency from a shareholder wealth generation perspective (

Biddle et al., 1997). More recently, artificial intelligence and machine learning methodologies, along with evolutionary algorithms such as JAYA, have gained ground for their ability to process large volumes of data and improve the accuracy of analysis (

Wang & Abdalla, 2022). Furthermore, qualitative variables have increasingly been integrated into efficiency assessments, offering explanatory insights through models such as the Dominance-based Rough Set Approach (D-RSA) (

Singh et al., 2023).

Several empirical studies have applied these tools in different geographical contexts. In Europe,

Gallizo et al. (

2018) analyzed banking efficiency in the Baltic countries after their accession to the European Union, while

Moreno (

2013) identified that opening to new markets and regulatory integration substantially improved efficiency in economies that had recently joined the European bloc. In Latin America,

Sousa de Abreu et al. (

2018) used a social DEA approach to evaluate Brazilian cooperatives, integrating economic goals with social impact indicators.

In Ecuador, recent studies have assessed the technical efficiency of both banks and cooperatives. The authors

Proaño-Rivera and Feria-Domínguez (

2023) analyzed 24 private banks between 2015 and 2019, identifying significant differences in their performance. Later,

Escandón and Fernández (

2023) applied the DEA methodology to credit unions, finding both operational strengths and structural weaknesses.

Arora et al. (

2025) conducted a comparative analysis in emerging countries that, like Ecuador, have coexisting banking and cooperative sectors, concluding that institutional and regulatory factors play a significant role in observed efficiency. However, so far, no comparative studies have been developed that comprehensively and longitudinally examine technical efficiency among banks and cooperatives, or that investigate the determinants of their performance levels.

The DEA model, the methodological pillar of this research, has proven to be a versatile and robust tool for assessing technical efficiency in organizations that employ multiple inputs and generate multiple outputs. Since its initial formulation by

Charnes et al. (

1978), based on

Farrell’s (

1957) notion of efficiency, DEA has been extended with variants such as the BCC model (

Banker et al., 1984), which allows analysis under variable returns to scale. This methodology has been widely applied in sectors such as health, education, agriculture, energy, transportation, and especially in financial institutions (

Emrouznejad & Yang, 2018).

2.2. Variables Used in AED Analysis: A Review from the Specialized Literature

Building on this foundation, the present study applies a refined set of variables to evaluate the efficiency of Ecuadorian banks and credit unions using DEA. The selected inputs include personnel expenses, professional fees, available funds, and investments, capturing both human resource costs and the core financial resources that sustain day-to-day operations. These inputs align with prior applications in emerging markets (

Gulati, 2015;

H. Nguyen & Ryu, 2022;

Van Nguyen et al., 2024;

Ullah et al., 2023), where staff-related expenditures and capital allocation play pivotal roles in determining operational efficiency.

On the output side, this study uses total operating income, net financial margin, loan portfolio, and public liabilities (

Sathye, 2001;

Paradi et al., 2012). These indicators provide a comprehensive view of institutional performance by assessing revenue generation, credit intermediation, and deposit mobilization capabilities (

Floros et al., 2020;

Milenković et al., 2022). Net financial margin is a robust measure of profitability and financial intermediation efficiency, while public liabilities reflect institutions’ capacity to attract and retain customer deposits.

By incorporating both conventional and context-sensitive variables, this study ensures methodological rigor and enhances the model’s relevance to local financial dynamics. The selection is consistent with the principle that DEA models should rely on empirically validated indicators with theoretical coherence (

Cooper et al., 2007;

Liu et al., 2016), especially in comparative analyses involving heterogeneous institutions such as banks and cooperatives.

2.3. Usefulness of the DEA Model for Managerial Decision Making in Financial Institutions Before and After COVID-19

Among the main advantages of DEA is its ability to identify not only which units are efficient, but also the causes of inefficiency, which is useful for formulating strategies for institutional improvement (

Cooper et al., 2011). This feature makes it an ideal tool for assessing financial efficiency in a sector as heterogeneous as the Ecuadorian one.

Moreover, when combined with advanced statistical models such as linear mixed models (MLMs), it is possible not only to analyze efficiency at a point in time, but also to understand how it varies over time and what contextual factors influence these changes. This methodological integration allows for a more complete reading of financial performance, overcoming the limitations of static approaches.

Moreover, it is important to note that banks and cooperatives operate under different regulatory frameworks. While banks are subject to homogeneous rules and strict supervision, cooperatives enjoy greater regulatory flexibility, which can translate into operational and efficiency differences (

World Bank, 2018). During the pandemic, these differences became more evident: while banks faced severe challenges related to NPLs and profitability (

Elnahass et al., 2021), many cooperatives were able to sustain their operations thanks to their community focus and rapid adoption of digital technologies (

OECD, 2021).

In this context, it is relevant and necessary to comparatively examine the technical efficiency of banks and cooperatives in Ecuador, also considering the effects of the pandemic and subsequent developments. This study aims to fill to this gap by integrating the DEA approach with linear mixed models (MLMs), which will allow us to analyze the performances of these institutions over time and identify the structural factors that influence their efficiency. Based on the above context, this study aims to analyze the evolution and determinants of financial efficiency in banks and credit unions in Ecuador during the period of 2015–2023. The aim is to generate useful evidence for the formulation of policies that promote the sustainability and competitiveness of the country’s financial system. This conceptual framework allows the establishment of the following hypotheses that will be empirically tested:

H1. Credit union exhibit a lower scale efficiency but higher pure technical efficiency than banks.

H2. The determinants of efficiency vary significantly by institution type.

3. Materials and Methods

3.1. Data and Sample

The sample used in this study consists of institutions representative of the Ecuadorian financial system, specifically private banks and savings and credit cooperatives belonging to segment 1, which groups together the largest and most operationally significant entities in the sector. These institutions were chosen based on the availability of information and their relative weight in terms of assets, liabilities, and volume of operations, which guarantees a representative analysis of the performance of the national financial system (

Proaño-Rivera & Feria-Domínguez, 2023). We performed a sensitivity analysis comparing the general characteristics of the excluded entities with those included. We did not find statistically significant differences in terms of type, size, or location, so we consider that selection bias is limited.

The non-random nature of missing data, particularly the absence of records in the early years for certain cooperatives or banks, prevented the application of imputation techniques without the risk of introducing bias into the analysis. Consequently, it was decided to omit these initial periods and use only the information available from the time that each entity began to report data consistently.

In total, the following 74 financial institutions were analyzed: 31 private banks and 43 savings and credit cooperatives in segment 1, according to the official records for 2023 issued by the Superintendency of Banks and the Superintendency of Popular and Solidarity Economy (SEPS). The selection of these institutions was conditioned by the availability of complete and audited data for the period 2015–2023.

It is important to note that the sample is longitudinal in nature, allowing for observation of the evolution of institutions over time. In the initial year of analysis (2015), there were 28 banks and 24 cooperatives in segment 1, while by 2023, these figures had risen to 31 banks and 43 cooperatives, showing a substantial improvement in the availability and coverage of data by financial supervisory bodies (

Superintendency of Banks of Ecuador, 2023;

Superintendency of Popular and Solidarity Economy, 2023).

This group of entities was also selected for its suitability for the application of the Data Envelopment Analysis (DEA) model, widely recognized as a robust tool for measuring efficiency in internationally comparable financial organizations (

Cooper et al., 2007;

Emrouznejad & Yang, 2018).

The composition of the sample is presented in

Table 1.

This study was conducted using a quantitative approach, with an observational, retrospective, and longitudinal design. The research was structured in the following three methodological phases: first, the technical efficiency of financial institutions was estimated using the Data Envelopment Analysis (DEA) model; second, the evolution of this efficiency over time was analyzed using mixed linear models (MLMs); and finally, the impact of structural financial management variables on the observed efficiency levels was evaluated.

In order to guarantee the statistical validity of the proposed model, several diagnoses were carried out. The autocorrelation of the residuals was evaluated using the Durbin–Watson statistic, with no values indicating significant problems detected. Likewise, the variance inflation factors (VIFs) were analyzed, which remained below the threshold of 3, suggesting low multicollinearity between the explanatory variables.

3.2. Variables

In this study, the inputs and outputs selected for the DEA model are defined in a way that reflects operational objectives common to banks and credit unions, while recognizing their strategic differences. This approach allows for a more balanced comparative evaluation, respecting the institutional particularities and regulatory frameworks that, as the institutional theory proposes, condition their structures and levels of efficiency.

This study’s inputs include operating expenses, personnel and professional fees, and available assets (funds, investments, and credit portfolio), in line with

Menéndez et al. (

2024) and

Montoya and Boyero (

2016). As outputs, it considers operating income, net financial margin, loan volume, ROA, and ROE, following

Cunuhay et al. (

2019),

Macías and Tello (

2024), and

Anggraini and Abidin (

2025).

The selection of these variables is based on theoretical relevance and empirical validation, as recommended by

Cooper et al. (

2007) and

Liu et al. (

2016), ensuring the robustness and comparability of the results in the applied DEA model.

3.3. DEA Model

The DEA model is particularly useful for comparing the relative efficiencies of institutions that perform similar functions, such as banks and cooperatives, without assuming a specific functional form in the production process (

Charnes et al., 1978;

Cooper et al., 2007). In this study, an input-oriented model is adopted under the assumption of constant returns to scale (CRS).

Formally, the model is specified as follows:

where:

and represent the inputs and outputs of each unit, respectively.

and correspond to the inputs and outputs of the unit being evaluated.

are non-negative weights assigned to each unit.

denotes the measure of technical efficiency

The selection of variables is guided by the empirical literature. The following four input variables are defined: personnel expenses, fees, available funds, and investments.

The output variables include the following:

Both technical efficiency, which assesses the optimal use of resources, and allocative efficiency, which considers the combination of resources according to their market prices, are analyzed (

Cooper et al., 2007;

Emrouznejad & Yang, 2018). This comprehensive perspective allows us to assess not only internal production processes, but also the operating environment in which these institutions operate (

Tone & Tsutsui, 2014).

3.4. Linear Mixed Model

To explain the estimated efficiency levels and their evolution over time, a mixed linear model (MLM) is applied, which allows for the incorporation of fixed and random effects, adjusting to the longitudinal and grouped nature of the data set.

The model is specified as follows:

where:

Efficiencyij represents the technical efficiency of entity j in year i,

β0 is the intercept,

β1, β2 and β3 are coefficients associated with the fixed effects of the model,

uj ~ (0, σu2) represents the specific random effect of each institution,

εij ~ N (0, σ2) is the random error term.

In addition to the categorical variables (type of entity and year), operating expenses, equity, and share capital were incorporated as structural covariates to assess whether these factors have a significant impact on efficiency beyond institutional and temporal effects.

To ensure the statistical validity of the model, the assumptions of normality (using the Kolmogorov–Smirnov and Shapiro–Wilk tests), homoscedasticity, and linearity (using residual plots and Q-Q diagrams) were verified. Although slight deviations from normality were observed, the results were considered robust. The estimation was performed in R software, 4.3.1 version, using the bobyqa optimizer and the Satterthwaite method for calculating degrees of freedom.

3.5. Procedure for Obtaining Results

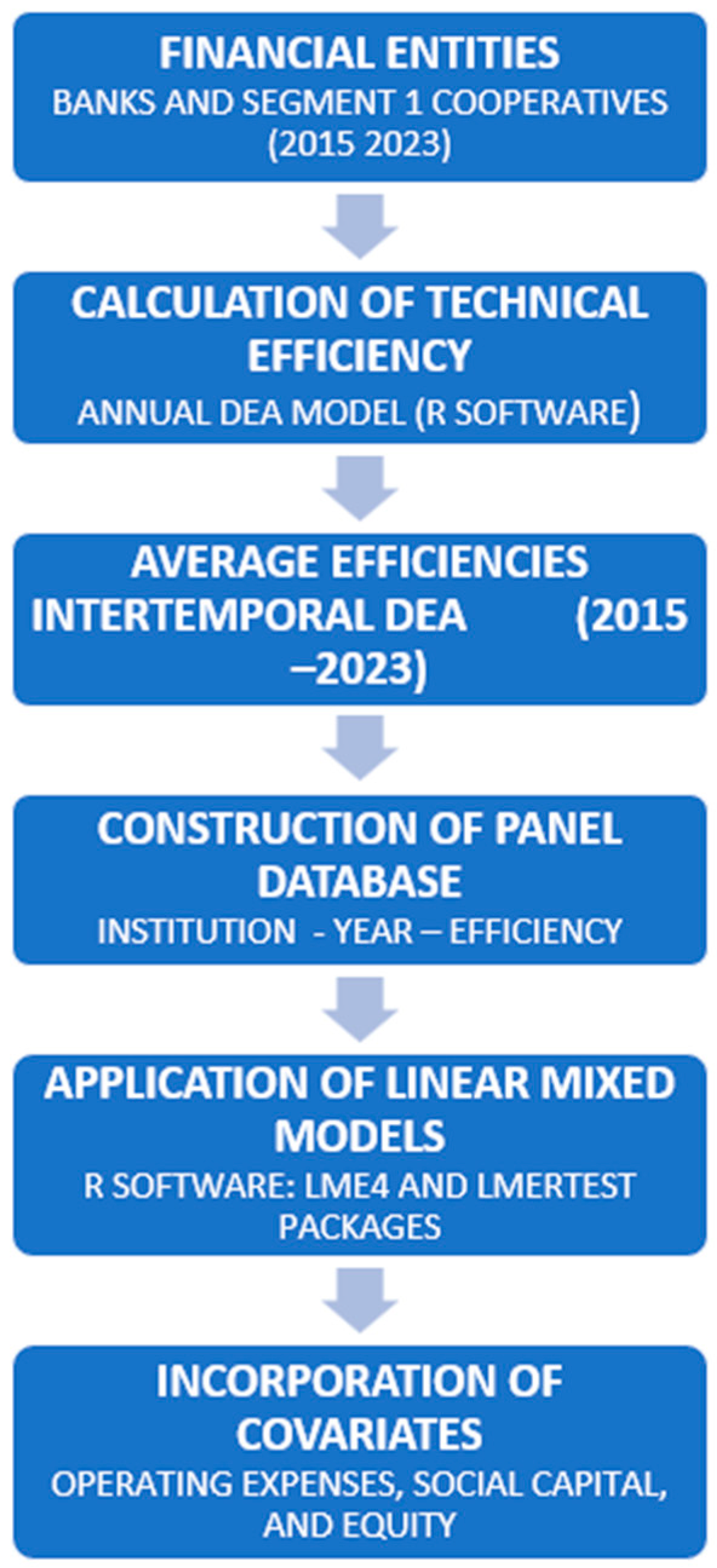

To conduct this study, several steps were carried out, as shown in

Figure 1.

First, an efficiency model was constructed using the Data Envelopment Analysis (DEA) method with the help of R software. This model was used to calculate the technical efficiency levels of each financial institution for each year of the period analyzed. These results were then averaged, allowing us to observe how the institutions changed and how stable they had been over time.

During data processing, records with incomplete information were removed, and quality controls were applied to ensure that the financial data was consistent and reliable. With the efficiency results obtained, a database was created in panel format, organized by institution and year, which allowed for the analysis of changes over time.

Using this database, statistical models called ‘mixed linear models’ were applied, also in R, using the lme4 and lmerTest packages. This technique made it possible to study how efficiency behaved over time, considering both the differences between types of institutions and years (fixed effects) and the particularities of each entity (random effects).

In the final stage, some structural variables were included, such as operating expenses, share capital, and equity. The objective was to analyze whether these factors have any effect on the financial efficiency of the banks and cooperatives included in the study.

4. Results

4.1. Technical Efficiency According to the DEA Model

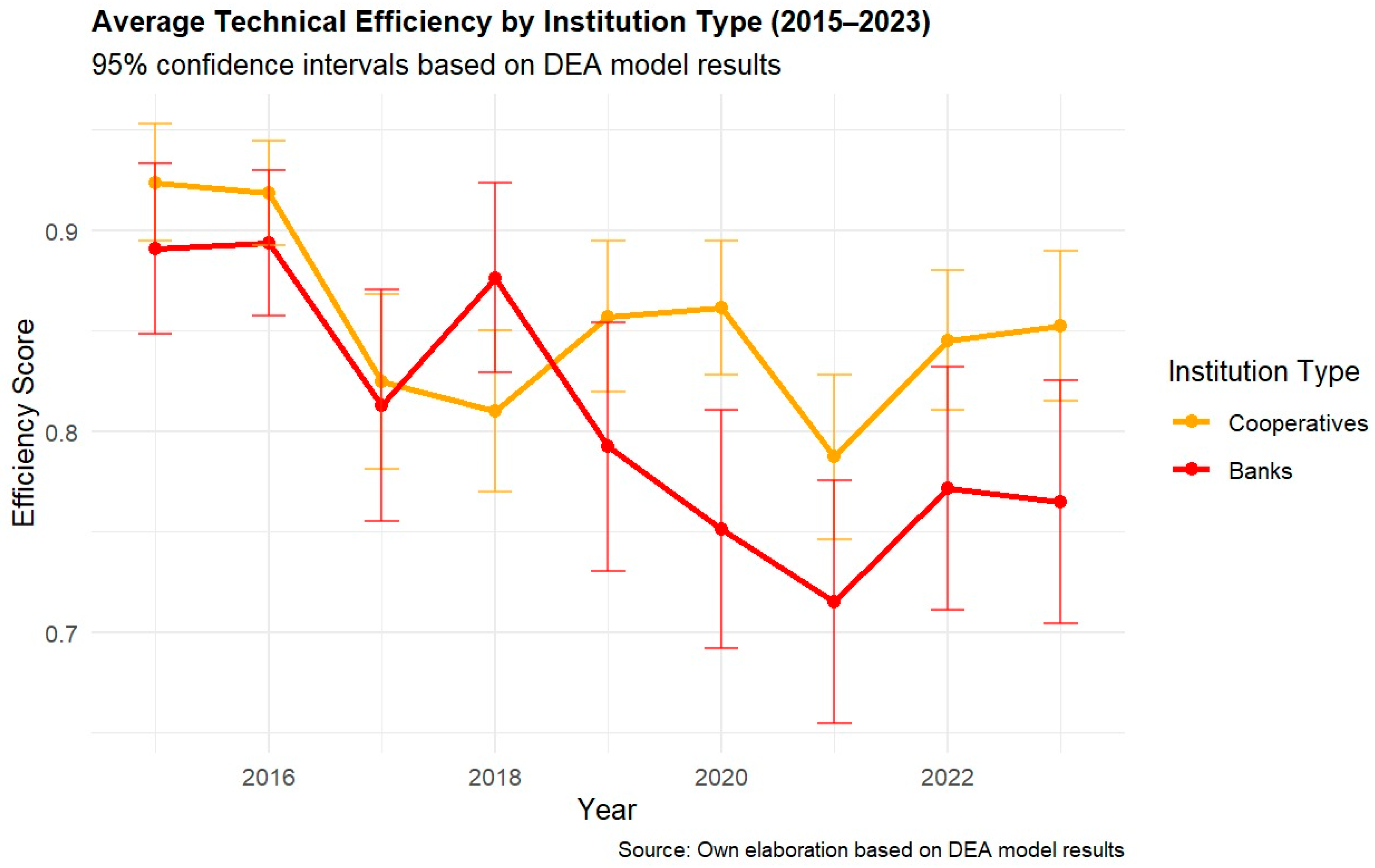

The results of the DEA model reveal that, on average, savings and credit cooperatives showed a higher technical efficiency than private banks during the period of 2015–2023. Over time, both efficiency curves show a similar evolution: a sustained upward trend until 2019, followed by a significant decline in 2020 and 2021, coinciding with the economic impact of the COVID-19 pandemic.

In 2019, the average technical efficiency peaked at 0.964 for cooperatives and 0.914 for banks, reflecting an optimal operational performance prior to the global health disruption. However, in 2021, both institutions experienced a notable decline in efficiency: 0.912 for cooperatives and 0.852 for banks, highlighting the difficulties faced in this crisis context.

Starting in 2022, a gradual recovery in technical efficiency is observed, which is more accelerated and sustained in the case of cooperatives. This upturn suggests that these organizations are more adaptable and resilient in the face of adverse scenarios.

The intertemporal analysis, based on global DEA averages, confirms this relative advantage: throughout the study period, cooperatives recorded an average efficiency of 0.931, while banks achieved 0.889. This difference indicates that, in general terms, the cooperative sector has achieved more efficient management of its resources, even in critical conditions, which could be related to its operating model, greater customer proximity, and organizational flexibility.

The differences in efficiency levels between banks and cooperatives shown in

Figure 2 can be attributed to several structural factors. First, savings and credit cooperatives tend to operate with more horizontal organizational structures, which allows them to make decisions quicker and adapt more easily to the needs of their members. This proximity to the community also fosters a better understanding of their customers’ risk profiles, which can translate into more efficient credit management and lower delinquency rates in times of uncertainty.

In contrast, private banks tend to be more exposed to global financial market dynamics, with more complex corporate structures and stricter regulations, which can limit their ability to maneuver in crisis situations. In addition, their primary focus on maximizing returns for shareholders could mean less operational flexibility in relation to the social and local development objectives that many cooperatives incorporate into their management.

Another relevant aspect is the use of technology. While banks have historically led the way in digitalization, many cooperatives have accelerated the adoption of digital tools in the wake of the pandemic, optimizing processes and reducing operating costs. This technological transformation, combined with a user-centric approach, has strengthened their relative efficiency in the post-pandemic period.

Finally, their different regulatory environment also has an influence. Cooperatives operate under more flexible regulatory frameworks in some respects, which can translate into lower administrative burdens and a greater capacity to customize products and services. However, this advantage also entails risks if it is not accompanied by adequate control and supervision systems.

Taken together, these factors help explain why cooperatives showed a greater technical efficiency in the period analyzed. However, it is important to note that high efficiency does not guarantee long-term sustainability, especially if it is not accompanied by adequate risk management, constant innovation, and institutional strengthening.

4.2. Longitudinal Analysis Results (Mixed Models)

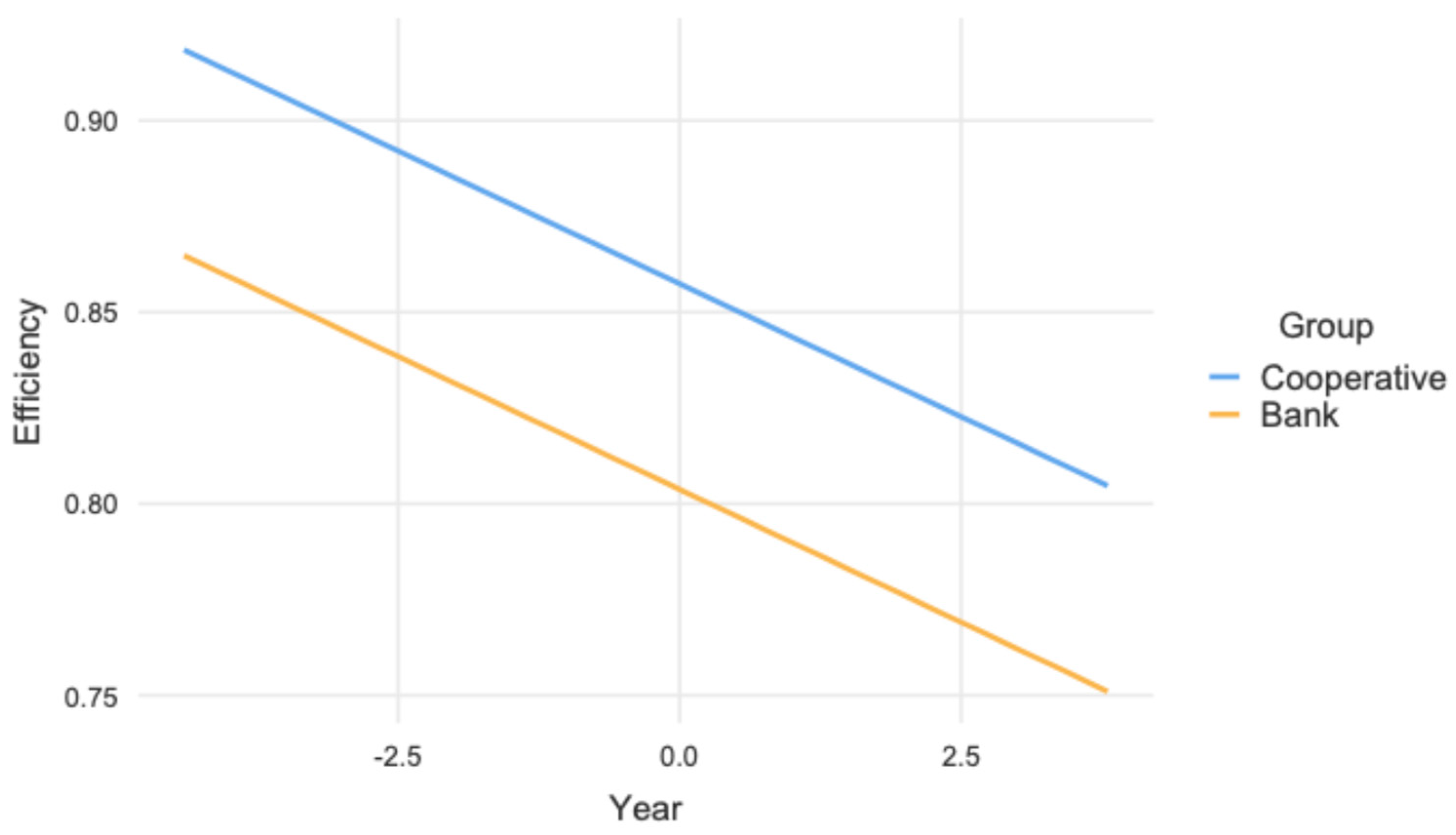

The mixed base model revealed a statistically significant effect of entity type on efficiency, with cooperatives being more efficient than banks (p < 0.001). The effect of the year was also significant, confirming the existence of a temporal dynamic in financial efficiency.

The interaction between group and year was relevant, indicating that the efficiency trajectories of banks and cooperatives did not evolve in parallel. Specifically, the decline in efficiency during 2020 and 2021 was more pronounced in banks, while cooperatives showed greater operational resilience.

Figure 3 shows a negative trend in both groups, indicating that efficiency steadily declined over the years. This decline was more pronounced among banks, which reinforces the statistical significance of the interaction between group and year. In other words, efficiency not only changes over time, but it does so differently depend on whether the entity is a bank or a cooperative.

When management covariates were included, operating expenses were found to have a significant negative impact on efficiency (negative coefficient, p < 0.05), confirming that higher operating expenses reduce relative efficiency. In contrast, neither equity nor share capital showed statistically significant effects.

4.3. Efficiency Calculation

In this case, the input-oriented DEA model with constant returns to scale (CRS) was chosen because of its suitability for contexts where the objective is to minimize the resources used to achieve a given level of production (

Banker et al., 1984).

The assumption of constant returns to scale (CRS) is justified in this analysis because it assumes that entities operate at an optimal level of scale. This implies that proportional changes in inputs result in proportional changes in outputs, a common assumption in studies where the size of entities varies but no adjustment for differences in scale is sought. Although in certain cases, Variable Returns to Scale (VRS) could be considered, it was decided to work with CRS to facilitate comparisons between entities in different years under homogeneous conditions.

Efficiency calculations for each year, from 2015 to 2023, were carried out by selecting input and output variables that reflect the operating costs and financial results of the entities analyzed. Input variables included personnel expenses, fees, available funds, and investments, following the methodology of previous studies (e.g.,

Gulati, 2015;

T. T. Nguyen et al., 2022), which identify these inputs as being representative of key resources in financial management. On the other hand, the selected output variables, such as income, net financial margin, loan portfolio, and obligations to the public, allow for measuring the entities’ ability to generate financial and operating results, which is consistent with research such as that of

Milenković et al. (

2022).

The results of these efficiency estimations are summarized in

Figure 4, which shows the average technical efficiency of banks and cooperatives for the period 2015–2023.

5. Discussion

The results obtained provide a better understanding of the different behaviors between banks and savings and credit cooperatives in the Ecuadorian financial system, especially under adverse conditions such as those caused by the COVID-19 pandemic. Cooperatives consistently demonstrated a higher level of technical efficiency, suggesting that their more flexible and customer-oriented operating model offers comparative advantages over the traditional private banking model.

This finding is consistent with previously mentioned international studies, such as those by

Gallizo et al. (

2018) on the Baltic banking system and

Moreno (

2013) on structural factors and ownership models, which significantly affected the efficiency levels in new European Union member states, with entities with less administrative rigidity and stronger territorial ties performing better.

In the case of Ecuador, the DEA analysis confirms that cooperatives manage to maintain high technical efficiencies over time, despite systemic shocks. This can be explained by their lower cost structure, their proximity to customers, and their operational adaptability, factors that were highlighted by

Escandón and Fernández (

2023) in their assessment of the cooperative sector. In contrast, banks show greater vulnerability to crisis scenarios, which could be linked to their more rigid structure, higher operating expenses, and predominantly commercial orientation.

This result also coincides with the findings of

Campoverde Campoverde et al. (

2019), who studied 18 savings and credit cooperatives in Ecuador using a DEA model focused on efficient resource use. They analyzed data from 2007 to 2016 and found that, on average, cooperatives operated at 77% efficiency, with only one achieving full efficiency. This type of analysis is very useful, because it not only shows how well institutions are performing, but also helps us to understand what factors could be affecting their performance. The presence of information asymmetries and conflicts of interest among institutional actors significantly affects operational efficiency and the outcomes achieved (

García-Sánchez & Noguera-Gámez, 2017;

Bergh et al., 2019). In this regard, the availability and quality of information are critical for informed decision making. Furthermore, a thorough stakeholder analysis allows for the identification and prioritization of stakeholder needs, facilitating more efficient resource allocation and improving institutional communication (

Sedereviciute & Valentini, 2011).

Longitudinal analysis using mixed models provides additional evidence of this differentiation, showing that the type of entity has a significant effect on efficiency, even after controlling for the year and the characteristics of each institution.

On the other hand, the inclusion of covariates allows us to identify that operating expenses negatively affect efficiency, while variables such as equity and social capital do not show a significant impact. This result is consistent with the findings of

Milenković et al. (

2022), who argue that financial efficiency depends more on cost structure than on size or equity strength.

The findings also reinforce the importance of using mixed approaches to assess efficiency, given that the DEA model allows for the identification of efficient units but does not explain the factors that influence the observed differences on its own. By combining DEA with mixed models, it is possible to incorporate structural and contextual effects, which improves the quality of the analysis and its usefulness for decision making.

6. Conclusions and Recommendations

This study, which analyzes the performance of the Ecuadorian financial system between 2015 and 2023, offers a detailed and up-to-date overview of how private banks and savings and credit cooperatives performed over this period, both in normal times and during crises such as the COVID-19 pandemic.

One of the most interesting conclusions is that the cooperatives analyzed were consistently more efficient than banks. Even in the most difficult moments of the pandemic, they managed to maintain a better performance, which speaks to their ability to adapt and respond quickly to uncertainty.

This good result is not necessarily related to the size of the institution or how much capital it has, but rather to how it is organized and managed.

It is found that the most efficient institutions were those that controlled their operating expenses well, demonstrating that austere and focused management can make a big difference. Cooperatives seem to have simpler, less bureaucratic structures and maintain closer relationships with their members, which allows them to act quicker in response to changes in the environment.

From a technical standpoint, this study combines the following two very powerful approaches: DEA analysis (which measures efficiency by comparing multiple factors without imposing rigid assumptions) and longitudinal statistical models (which help explain how efficiency evolves over time). This combination offers a much completer and more accurate picture than if only one of the methodologies were used and constitutes a model that could well be applied in other similar studies or even to guide public policy decisions.

Some practical recommendations derived from the research are proposed. Banks in Ecuador should focus on reducing their operating expenses and strengthening the ongoing training of their teams. Process automation, performance evaluation, and robust internal auditing can significantly increase their efficiency without compromising service quality. It is suggested that both banks and credit cooperatives in Ecuador permanently adopt methods such as DEA and mixed statistical models. These tools can be integrated into their management systems and supervisory frameworks to promote continuous improvement based on evidence. Although the performance of cooperatives has been positive, many still have room for growth. Investing in digital transformation, improving governance, and strengthening internal controls are key steps in preparing for an increasingly competitive and digitized financial environment. It is important that regulations recognize the differences between banks and cooperatives, as they are supervised by different entities. A differentiated but fair policy will contribute to creating a more balanced, competitive, and inclusive financial system. Finally, it is proposed to maintain a permanent research agenda that not only evaluates efficiency, but also considers aspects such as digitalization, financial inclusion, risk, sustainability, and governance. This will generate useful information for strategic decision making, both at the institutional level and in the design of public policies.

7. Limitations and Future Lines of Research

This study has several limitations that must be considered when interpreting its results. First, the presence of unobserved heterogeneity among the institutions analyzed is recognized. Although fixed effects and mixed linear models were incorporated to capture some of this variability, it is possible that there are structural or contextual factors not included in the model that influenced the estimated efficiency levels.

Second, we worked with a partial operational definition of resource management, focused exclusively on quantifiable financial variables. Variables related to human resource management, innovation, and organizational culture were not included, which limits the scope of the study. This omission may have prevented the comprehensive capture of all the factors that affect institutional efficiency, especially those of a qualitative nature.

Third, the regulatory differences between banks and cooperatives, although conceptually recognized, could not be incorporated directly into the model due to limitations in data availability. This absence could introduce bias into the estimation of relative efficiency. In future research, it would be advisable to include regulatory proxies, such as capital requirements or regulatory compliance rates, to quantify the impact of regulation on institutional performance.

Finally, the study did not allow for longitudinal causal relationships to be established between contextual factors and changes in efficiency over time. However, the use of mixed linear models allowed for the capture of year-on-year trends and variations. More robust methodological approaches—such as dynamic panel models—are required to move towards more accurate causal inference.

These limitations highlight the need to include qualitative variables to understand the determinants of efficiency in the financial sector in a deeper and more contextualized way.