Corporate Governance and Shareholders’ Value: The Mediating Role of Internal Audit Performance—Empirical Evidence from Listed Companies in Ghana

Abstract

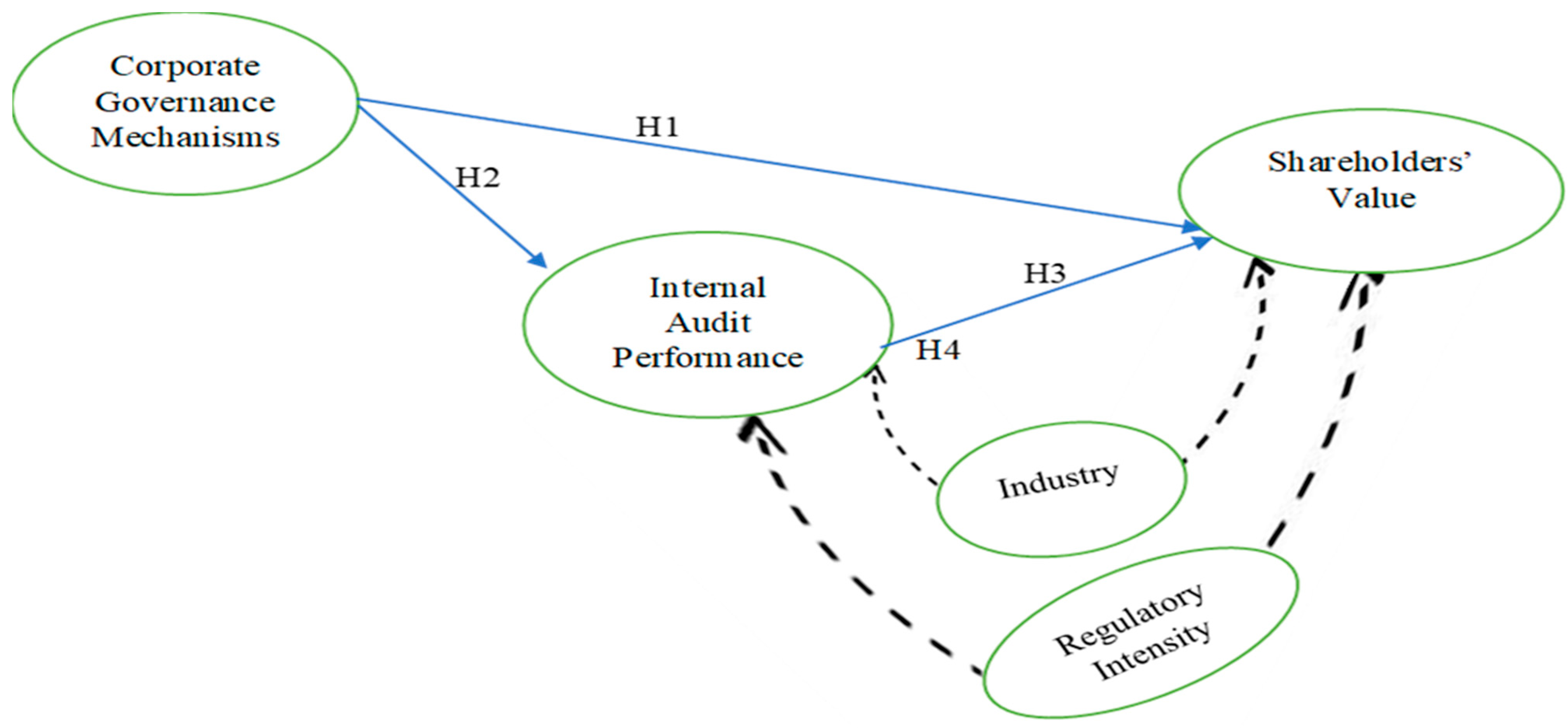

1. Introduction

- Does corporate governance directly influence shareholder value?

- To what extent does corporate governance improve internal audit performance?

- Does internal audit performance significantly affect shareholder value?

- Does internal audit performance mediate the relationship between corporate governance and shareholder value?

2. Literature Review

2.1. Corporate Governance Practice in Ghana

2.2. Theoretical Framework

2.3. Empirical Literature and Hypotheses Development

2.4. Conceptual Framework

3. Research Methodology

3.1. Research Design and Sample

3.2. Variable Definition and Measurement

3.3. Structural Equations with Controls

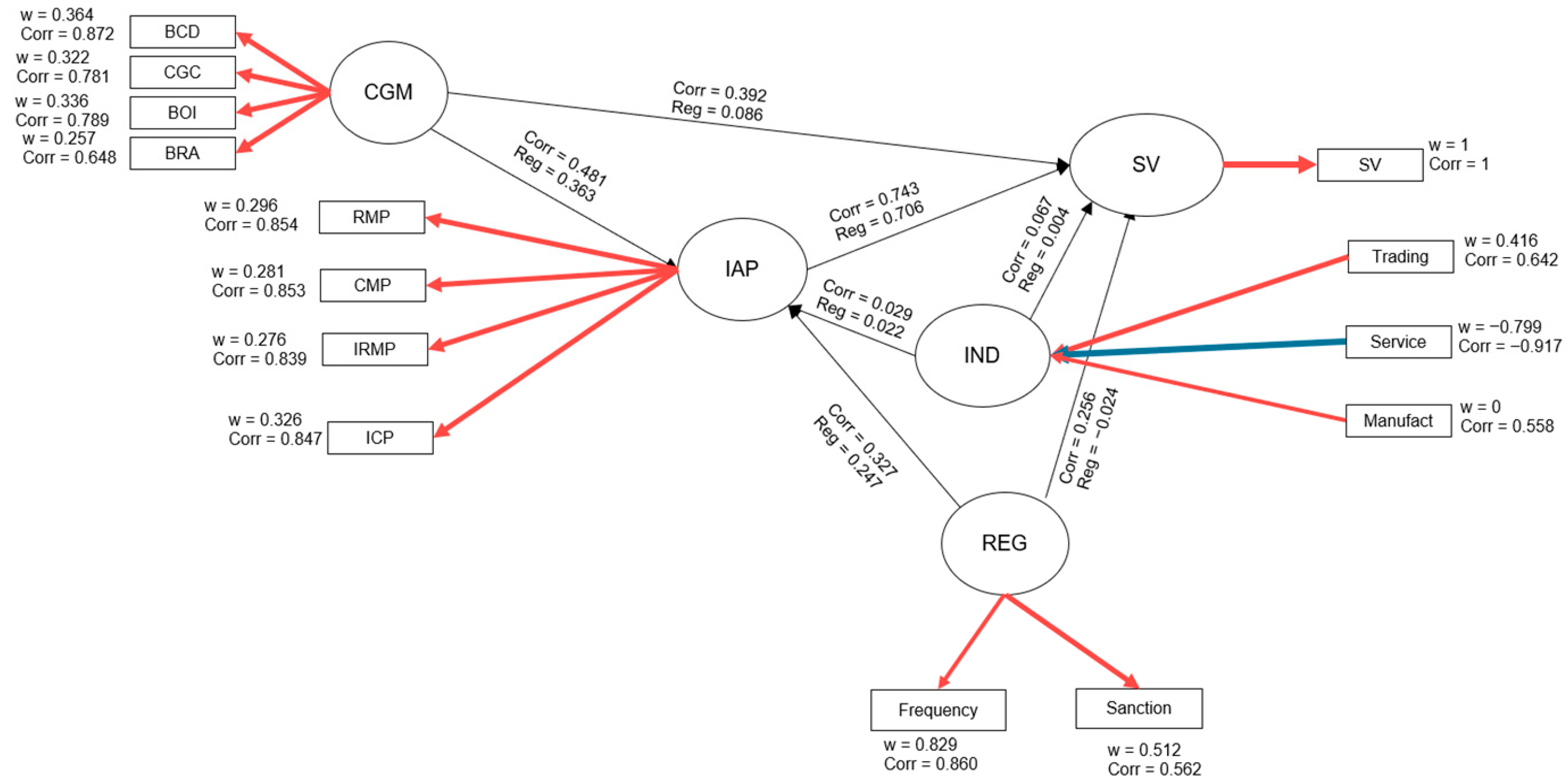

3.3.1. Measurement Models

- 1.

- CG = λ1 BI + λ2 BCD + λ3 CGC + λ4 BRA + εCG

- 2.

- IAP = λ5 CMP + λ6 RMP + λ7 ICP + λ8 IRMP + ε_IAP

3.3.2. Structural (Mediation) Model with Controls

- 3.

- IAP = β1 CG + γ1 IND_M + γ2 IND_S + γ3 IND_T + γ4 REG_INT + ζ1

- 4.

- SV = β2 CG + β3 IAP + γ5 IND_M + γ6 IND_S + γ7 IND_T + γ8 REG_INT + ζ2

- β = structural path coefficients of interest (direct and mediated effects).

- γ = coefficients for control variables.

- λ = factor loadings in the measurement model.

- ε, ζ = measurement and structural error terms, respectively.

4. Results

4.1. Descriptive Statistics

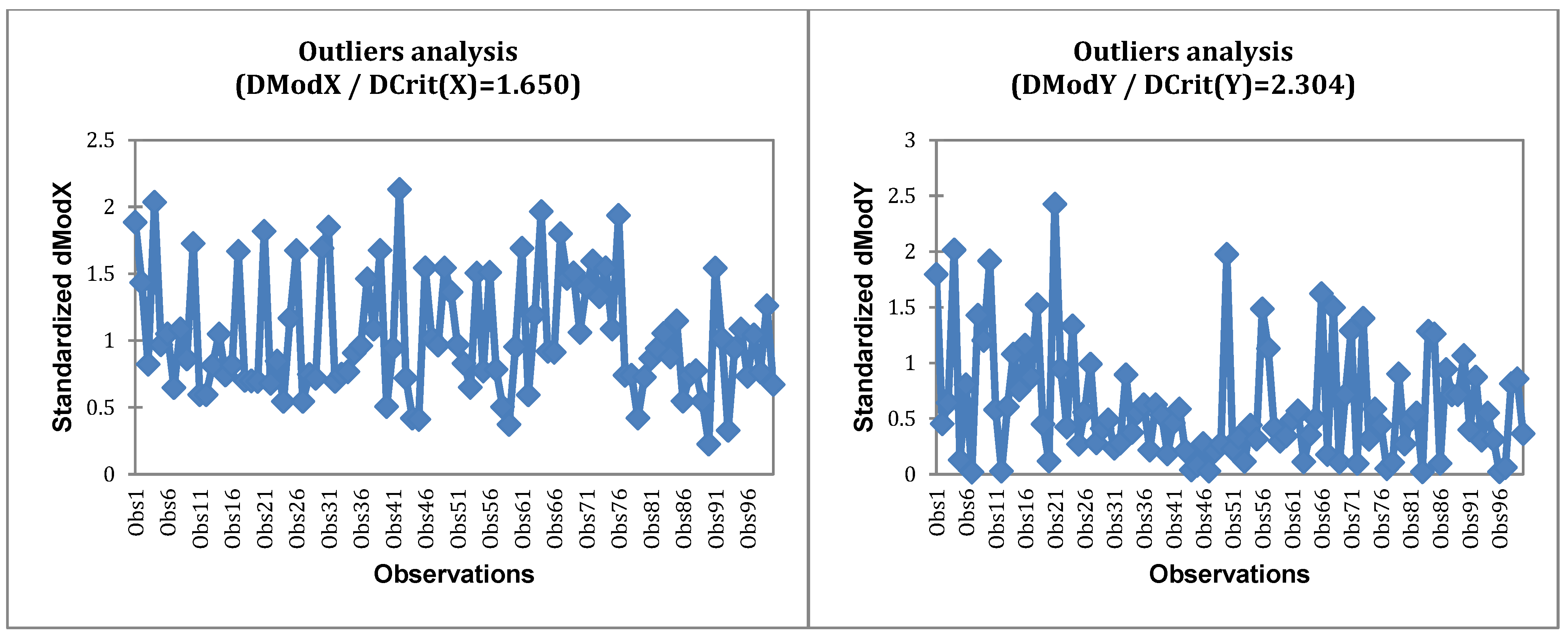

4.2. Data Quality and Measurement Model Assessment

4.3. Structural Model and Hypotheses Testing

5. Discussion of Results

6. Conclusions

Policy and Practical Implications

- Boards and executives should prioritize investment in internal audit by appointing skilled staff, granting them adequate budgets, and ensuring direct access to governance structures.

- Regulators and standard-setters should embed minimum requirements for internal audit capability within corporate governance codes and mandate disclosure of audit resources, scope, and performance.

- Chief internal auditors must position the function as a strategic partner, extending beyond compliance to risk-based reviews and forward-looking advisory services.

- Shareholders should also play an active role by supporting independent audit committees and demanding transparent reporting at annual general meetings.

7. Limitations of the Study

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Statistical Analysis

| Var. | RMP | CMP | IRMP | ICP | BCD | CGC | BOI | BRA |

|---|---|---|---|---|---|---|---|---|

| RMP | 1.198 | 0.824 | 0.847 | 0.712 | 0.378 | 0.351 | 0.378 | 0.234 |

| CMP | 0.824 | 1.362 | 0.827 | 0.837 | 0.462 | 0.437 | 0.4 | 0.292 |

| IRMP | 0.847 | 0.827 | 1.345 | 0.761 | 0.315 | 0.316 | 0.291 | 0.234 |

| ICP | 0.712 | 0.837 | 0.761 | 1.216 | 0.529 | 0.356 | 0.471 | 0.297 |

| BCD | 0.378 | 0.462 | 0.315 | 0.529 | 1.033 | 0.613 | 0.66 | 0.433 |

| CGC | 0.351 | 0.437 | 0.316 | 0.356 | 0.613 | 1.14 | 0.523 | 0.373 |

| BOI | 0.378 | 0.4 | 0.291 | 0.471 | 0.66 | 0.523 | 1.103 | 0.296 |

| BRA | 0.234 | 0.292 | 0.234 | 0.297 | 0.433 | 0.373 | 0.296 | 0.86 |

| Statistic | Value |

|---|---|

| Cronbach’s α (pooled scale) | 0.850 |

| Standardised Cronbach’s α | 0.849 |

| Guttman λ1/λ2/λ3/λ4/λ5/λ6 | 0.744/0.859/0.850/0.904/0.835/0.868 |

| (ANOVA Between Measures: F(7, 1554) ANOVA Between Measures: F(7,1554) | 14.101, p < 0.0001 |

| (ANOVA Between Subjects: F(222, 1554) ANOVA Between Subjects: F(222,1554) | 6.676, p < 0.0001 |

| Item | Mean_if_del | Var_if_del | Item–total r | R2 | α_if_del | Guttman L6_if_del |

|---|---|---|---|---|---|---|

| RMP | 23.056 | 27.506 | 0.649 | 0.556 | 0.825 | 0.846 |

| CMP | 23.007 | 26.632 | 0.677 | 0.56 | 0.821 | 0.844 |

| IRMP | 22.93 | 27.627 | 0.589 | 0.534 | 0.832 | 0.85 |

| ICP | 22.765 | 27.013 | 0.691 | 0.556 | 0.819 | 0.844 |

| BCD | 22.661 | 28.338 | 0.627 | 0.555 | 0.828 | 0.848 |

| CGC | 22.807 | 29.075 | 0.516 | 0.378 | 0.841 | 0.861 |

| BOI | 22.756 | 29.012 | 0.534 | 0.423 | 0.839 | 0.858 |

| BRA | 22.41 | 30.973 | 0.418 | 0.24 | 0.85 | 0.867 |

| Indicator | R2 | Tolerance | VIF |

|---|---|---|---|

| RMP | 0.556 | 0.444 | 2.25 |

| CMP | 0.56 | 0.44 | 2.272 |

| IRMP | 0.534 | 0.466 | 2.146 |

| ICP | 0.556 | 0.444 | 2.25 |

| BCD | 0.555 | 0.445 | 2.245 |

| CGC | 0.378 | 0.622 | 1.608 |

| BOI | 0.423 | 0.577 | 1.732 |

| BRA | 0.24 | 0.76 | 1.316 |

| CGM | IND | REG | IAP | SV | Mean Communalities (AVE) | |

|---|---|---|---|---|---|---|

| CGM | 1 | 0.014 | 0.113 | 0.231 | 0.154 | 0.603 |

| IND | 0.014 | 1 | 0.007 | 0.001 | 0.005 | 0.522 |

| REG | 0.113 | 0.007 | 1 | 0.107 | 0.066 | 0.527 |

| IAP | 0.231 | 0.001 | 0.107 | 1 | 0.552 | 0.719 |

| SV | 0.154 | 0.005 | 0.066 | 0.552 | 1 | |

| Mean Communalities (AVE) | 0.603 | 0.522 | 0.527 | 0.719 | 0 |

| Indicator | CGM | IAP | SV | IND | REG |

|---|---|---|---|---|---|

| BCD | 0.872 | 0.438 | 0.327 | 0.135 | 0.327 |

| CGC | 0.781 | 0.356 | 0.321 | 0.098 | 0.141 |

| BOI | 0.789 | 0.387 | 0.32 | 0.075 | 0.301 |

| BRA | 0.648 | 0.299 | 0.242 | 0.024 | 0.256 |

| RMP | 0.39 | 0.852 | 0.634 | 0.042 | 0.251 |

| CMP | 0.433 | 0.853 | 0.595 | 0.022 | 0.231 |

| IRMP | 0.316 | 0.839 | 0.727 | −0.009 | 0.215 |

| ICP | 0.48 | 0.848 | 0.574 | 0.028 | 0.396 |

| SV1 | 0.392 | 0.743 | 1 | 0.072 | 0.256 |

| Trading | 0.039 | 0.041 | 0.021 | 0.638 | 0.051 |

| Service | −0.127 | −0.014 | −0.073 | −0.904 | −0.081 |

| Manufacturing | −0.004 | −0.015 | 0.048 | 0.347 | −0.004 |

| Frequency | 0.342 | 0.17 | 0.145 | 0.022 | 0.54 |

| Sanction | 0.194 | 0.29 | 0.22 | 0.084 | 0.873 |

References

- Abudu, D., Gariba, O. A., & Alnaa, S. E. (2015). The organisational independence of internal auditors in Ghana: Empirical evidence from local government. Asian Journal of Economic Modelling, 3(2), 33–45. [Google Scholar]

- Agyei-Mensah, B. K. (2018). The impact of corporate governance attributes and financial reporting lag on corporate financial performance. African Journal of Economic and Management Studies, 9(3), 349–366. [Google Scholar] [CrossRef]

- Almashhadani, M., Almashhadani, H. A., & Almashhadani, H. A. (2022). Corporate governance as an internal control mechanism and its impact on corporate performance. International Journal of Business and Management Invention, 11(8), 53–59. [Google Scholar]

- Alofaysan, H., Jarboui, S., & Binsuwadan, J. (2024). Corporate sustainability, sustainable governance, and firm value efficiency: Evidence from saudi listed companies. Sustainability, 16(13), 5436. [Google Scholar] [CrossRef]

- Babbie, E. (2020). The practice of social research (15th ed.). Cengage Learning. [Google Scholar]

- Berhe, A. G., Mihret, A. G., & Ali, M. S. (2016). The effects of internal audit on the performance of ethiopian financial institutions. Journal of Finance, Accounting & Management, 7(2). [Google Scholar]

- Boutrik, S., Meghari, R., & Brahiti, I. (2021). The contribution of the audit committee to the improvement of the quality of the internal audit. La Revue des Sciences Commerciales, 20(1), 184–204. [Google Scholar]

- Bozkus, K. S., & Caliyurt, K. (2018). Cyber security assurance process from the internal audit perspective. Managerial Auditing Journal, 33(4), 360–376. [Google Scholar] [CrossRef]

- Carcello, J. V., Hermanson, D. R., Neal, T. L., & Riley, R. A., Jr. (2002). Board characteristics and audit fees. Contemporary Accounting Research, 19(3), 365–384. [Google Scholar] [CrossRef]

- Dalton, D. R., Daily, C. M., Ellstrand, A. E., & Johnson, J. L. (1998). Meta-analytic reviews of board composition, leadership structure, and financial performance. Strategic Management Journal, 19(3), 269–290. [Google Scholar] [CrossRef]

- Danoshana, S., & Ravivathani, T. (2019). The impact of corporate governance on firm performance: A study on financial institutions in Sri Lanka. SAARJ Journal on Banking and Insurance Research, 8(1), 62–67. [Google Scholar] [CrossRef]

- Davis, J. H., Schoorman, F. D., & Donaldson, L. (1997). Toward a stewardship theory of management. Academy of Management Review, 22(1), 20–47. [Google Scholar] [CrossRef]

- dos Reis Cardillo, M. A., & Basso, L. F. C. (2025). Revisiting knowledge on ESG/CSR and financial performance: A bibliometric and systematic review of moderating variables. Journal of Innovation & Knowledge, 10(1), 100648. [Google Scholar]

- Egbunike, P. A., & Egbunike, F. C. (2017). An empirical examination of challenges faced by internal auditors in public sector audit in South-Eastern Nigeria. Asian Journal of Economics, Business and Accounting, 3(2), 1–13. [Google Scholar] [CrossRef]

- Elkington, J. (1994). Towards the sustainable corporation: Win-win-win business strategies for sustainable development. California Management Review, 36(2), 90–100. [Google Scholar] [CrossRef]

- Eulerich, A. K., & Eulerich, M. (2020). What is the value of internal auditing?—A literature review on qualitative and quantitative perspectives—A literature review on qualitative and quantitative perspectives (22 April 2020). Maandblad Voor Accountancy en Bedrijfseconomie, 94, 83–92. [Google Scholar] [CrossRef]

- Fariha, R., Hossain, M. M., & Ghosh, R. (2022). Board characteristics, audit committee attributes and firm performance: Empirical evidence from an emerging economy. Asian Journal of Accounting Research, 7(1), 84–96. [Google Scholar] [CrossRef]

- Friedman, M. (1970). The social responsibility of business is to increase its profits. In L. B. Pincus (Ed.), Perspectives in business ethics (pp. 246–251). McGraw-Hill. [Google Scholar]

- Ganguli, S. K., & Guha Deb, S. (2021). Board composition, ownership structure and firm performance: New Indian evidence. International Journal of Disclosure and Governance, 18(3), 256–268. [Google Scholar] [CrossRef]

- Gyamera, E., Abayaawien Atuilik, W., Eklemet, I., Adu-Twumwaah, D., Baba Issah, A., Alexander Tetteh, L., & Gagakuma, L. (2023). Examining the effect of financial accounting services on the financial performance of SME: The function of information technology as a moderator. Cogent Business & Management, 10(2), 2207880. [Google Scholar] [CrossRef]

- Hair, J. F., Jr., Matthews, L. M., Matthews, R. L., & Sarstedt, M. (2017). PLS-SEM or CB-SEM: Updated guidelines on which method to use. International Journal of Multivariate Data Analysis, 1(2), 107–123. [Google Scholar] [CrossRef]

- Hassan, L., Rasheed, B., Malik, Z. F., Fraz, S. T., & Aslam, N. (2025). The effect of audit committee characteristics on financial reporting quality with the moderating role of audit quality. Centre for Management Science Research, 3(3), 695–710. [Google Scholar]

- Helfat, C. E., & Peteraf, M. A. (2009). Understanding dynamic capabilities: Progress along a developmental path. Strategic Organisation, 7(1), 91–102. [Google Scholar] [CrossRef]

- Hilmi, Y., & Fatine, F. E. (2022). The contribution of internal audit to corporate performance: A proposal of measurement indicators. International Journal of Performance & Organizations (IJPO), 1(10), 45–50. [Google Scholar]

- How, S. M., Lee, C. G., & Brown, D. M. (2019). Shareholder theory versus stakeholder theory in explaining financial soundness. International Advances in Economic Research 25, 133–135. [Google Scholar] [CrossRef]

- Hui, K. J. (2018). Cash holdings, corporate governance and firm performance in the hospitality industry [Doctoral dissertation, University of Malaya]. [Google Scholar]

- IIA. (2020). International professional practices framework (IPPF). The Institute of Internal Auditors, Altamonte Springs. Available online: https://na.theiia.org/standards-guidance/Pages/Standards-and-Guidance-IPPF.aspx (accessed on 9 December 2022).

- Inyang, O. E., Enya, E. F., & Otuagoma, O. F. (2021). Internal audit effectiveness in the public health sector in South-South Nigeria. United International Journal for Research & Technology, 2(8), 127–132. [Google Scholar]

- Jacoby, G., Liu, M., Wang, Y., Wu, Z., & Zhang, Y. (2019). Corporate governance, external control, and environmental information transparency: Evidence from emerging markets. Journal of International Financial Markets, Institutions and Money, 58, 269–283. [Google Scholar] [CrossRef]

- Jensen, M. C. (2001). Value maximisation, stakeholder theory, and the corporate objective function. Journal of Applied Corporate Finance, 14(3), 8–21. [Google Scholar] [CrossRef]

- Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behaviour, agency costs and ownership structure. Journal of Financial Economics, 3(1), 305–360. [Google Scholar] [CrossRef]

- Johri, A., Singh, R. K., Alhumoudi, H., & Alakkas, A. (2024). Examining the influence of sustainable management accounting on sustainable corporate governance: Empirical evidence. Sustainability, 16(21), 9605. [Google Scholar] [CrossRef]

- Khan, Y., Arshad, M. W., ul Hassan, J., Batool, S., & Usman, M. (2024). The influence of various corporate governance dimensions on financial performance indicators: An empirical study of cement companies listed on the pakistan stock exchange. Dialogue Social Science Review (DSSR), 2(5), 233–254. [Google Scholar]

- Kieback, S., Thomsen, M., & Watrin, C. (2022). Market reactions to the appointment of audit committee directors with financial and industry expertise in Germany. International Journal of Auditing, 26(4), 446–466. [Google Scholar] [CrossRef]

- Klapper, L. F., & Love, I. (2004). Corporate governance, investor protection, and performance in emerging markets. Journal of Corporate Finance, 10(5), 703–728. [Google Scholar] [CrossRef]

- Konak, O. (2023). Internal audit of governance in Turkey: An analysis in BIST-100 companies [Doctoral dissertation, Marmara Universitesi]. [Google Scholar]

- Lenz, R., & Enslin, B. (2025). The gardener of governance: A call to action for effective internal auditing. CRC Press. [Google Scholar]

- Lois, P., Drogalas, G., Karagiorgos, A., & Tsikalakis, K. (2020). Internal audits in the digital era: Opportunities, risks and challenges. EuroMed Journal of Business, 15(2), 205–217. [Google Scholar] [CrossRef]

- Maurović, L., & Hasić, T. (2014). Reducing agency costs by selecting an appropriate system of corporate governance. Ekonomska Istraživanja—Economic Research, 26(1), 225–242. [Google Scholar] [CrossRef]

- Mbate, M. M. (2023). Effects of CEO duality, board independence, ownership concentration, company age on profit persistence and firm Value: An empirical study of manufacturing companies in West Java, Indonesia. The ES Accounting and Finance, 1(02), 54–60. [Google Scholar] [CrossRef]

- Mwape, A. (2022). The impact of poor corporate governance on the effectiveness of internal audit at the Road Development Agency (RDA) in Zambia. Open Journal of Business and Management, 10(5), 2325–2365. [Google Scholar] [CrossRef]

- Nagy, J., & Cenker, W. J. (2021). Evaluating the impact of the internal audit function on the audit committee’s oversight of financial reporting. Journal of Accounting and Public Policy, 40(4), 106883. [Google Scholar]

- Nguyen, H. C. (2011). Factors causing enron’s collapse: An investigation into corporate governance and corporate culture. Corporate Ownership and Control Journal, 8(3), 565–644. [Google Scholar] [CrossRef]

- Nwadike, A., & Wilkinson, S. (2022). Challenges to building code compliance in New Zealand. International Journal of Construction Management, 22(13), 2493–2503. [Google Scholar] [CrossRef]

- O’Connell, M., & Ward, A. M. (2020). Shareholder theory/shareholder value. In Encyclopedia of sustainable management (pp. 1–7). Springer. [Google Scholar] [CrossRef]

- OECD. (2015). G20/OECD principles of corporate governance. OECD Publishing. Available online: https://www.oecd.org/content/dam/oecd/en/publications/reports/2015/11/g20-oecd-principles-of-corporate-governance_g1g56c3d/9789264236882-en.pdf (accessed on 2 November 2022).

- Olawale, A., & Obinna, E. (2023). An empirical analysis of capital structure, liquidity and banking sector performance in Nigeria (2011–2021). Journal of Finance and Economics, 11(3), 149–159. [Google Scholar] [CrossRef]

- Omran, M. M., Bolbol, A., & Fatheldin, A. (2008). Corporate governance and firm performance in Arab equity markets: Does ownership concentration matter? International Review of Law and Economics, 28(1), 32–45. [Google Scholar] [CrossRef]

- Oppong, C., Atchulo, A. S., Dargaud Fofack, A., & Afonope, D. E. (2024). Internal control mechanisms and financial performance of ghanaian banks: The moderating role of corporate governance. African Journal of Economic and Management Studies, 15(1), 88–103. [Google Scholar] [CrossRef]

- Osei, A. A., Yusheng, K., Caesar, A. E., Tawiah, V. K., & Angelina, T. K. (2019). Collapse of big banks in Ghana: Lessons on its corporate governance. International Institute for Science, Technology, and Education, 10(10), 27–36. [Google Scholar]

- Oseni, N. A. (2021). Determinants of internal audit effectiveness in public universities in South-West Nigeria [Master’s thesis, Kwara State University]. [Google Scholar]

- Pandey, P., & Pandey, M. M. (2021). Research methodology tools and techniques. Bridge Centre. [Google Scholar]

- Pfeffer, J., & Salancik, G. R. (1978). The external control of organisations: A resource dependence perspective. Harper & Row. [Google Scholar]

- Pickett, K. H. S. (Ed.). (2012). The internal auditing handbook. John Wiley & Sons. [Google Scholar] [CrossRef]

- Postula, M., Irodenko, O., & Dubel, P. (2020). Internal audit as a tool to improve the efficiency of public service. European Research Studies Journal, XXIII(3), 700–715. [Google Scholar] [CrossRef]

- Puni, A., & Anlesinya, A. (2020). Corporate governance mechanisms and firm performance in a developing country. International Journal of Law and Management, 62(2), 147–169. [Google Scholar] [CrossRef]

- Ramadhan, Y., Ramzy, W., Munawaroh, F., & Sunardi, D. (2023). The role of internal auditors in the implementation of social environmental governance. JASA (urnal Akuntansi, Audit dan Sistem Informasi Akuntansi), 7(3), 544–554. [Google Scholar] [CrossRef]

- Rezaee, Z. (2025). Business sustainability framework: Theory and practice. Taylor & Francis. [Google Scholar]

- Roffia, P. (2025). The evolution of the OECD corporate governance principles—A comparative analysis (1999–2023). In Proceedings of IAC 2025 in Prague (Vol. 1, pp. 48–54). Czech Institute of Academic Education. [Google Scholar]

- Sarens, G., & De Beelde, I. (2006). Building a research model for internal auditing: Insights from literature and theory specification cases. International Journal of Accounting, Auditing and Performance Evaluation, 3(4), 452–470. [Google Scholar] [CrossRef]

- Shin, T. (2013). The shareholder value principle: The governance and control of corporations in the United States. Sociology Compass, 7(10), 829–840. [Google Scholar] [CrossRef]

- Teece, D. J., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic Management Journal, 18(7), 509–533. [Google Scholar] [CrossRef]

- Torku, K., & Laryea, E. (2021). Corporate governance and bank failure: Ghana’s 2018 banking sector crisis. Journal of Sustainable Finance & Investment, 1–21. [Google Scholar] [CrossRef]

- Turetken, O., Jethefer, S., & Ozkan, B. (2020). Internal audit effectiveness: Operationalisation and influencing factors. Managerial Auditing Journal, 35(2), 238–271. [Google Scholar] [CrossRef]

- Wang, Q., Zhang, H., & Hu, C. (2024). China’s competition regulation in the maritime industry: Regulatory concerns, problems and potential implications. Ocean & Coastal Management, 251, 107082. [Google Scholar]

- Weekes-Marshall, D. (2020). The role of internal audit in the risk management process: A developing economy perspective. Journal of Corporate Accounting and Finance, 31(4), 154–165. [Google Scholar] [CrossRef]

- Zaidan, A. M., & Neamah, I. S. (2022). The effect of the quality of the internal audit function on improving the operational efficiency of companies: An empirical study. Webology, 19(1), 6990–7019. [Google Scholar]

| Construct | Conceptual Definition | Key Indicators | Measurement Approach | Empirical Support (Illustrative Studies) |

|---|---|---|---|---|

| Corporate Governance (CG) | Formal structures, policies, and board attributes that ensure accountability, transparency, and alignment of managerial actions with shareholder interests | Board Independence (BI); Board Composition & Diversity (BCD); Corporate Governance Committees (CGC) and Board Risk Attitude (BRA). | Reflective Likert-type items, 1–5 | Adapted from Agyei-Mensah (2018); Puni and Anlesinya (2020); Danoshana and Ravivathani (2019); Fariha et al. (2022); Konak (2023) |

| Internal Audit Performance (IAP) (Second-order) | The extent to which the internal audit function delivers assurance and advisory services that strengthen risk governance, compliance, internal controls, and resource optimization | First-order dimensions: Compliance Management Performance (CMP), Risk Management Performance (RMP), Internal Control Systems (ICS), and Internal Resource Management Performance (IRMP) | Reflective Likert-type items, 1–5 | Adapted from Berhe et al. (2016); Turetken et al. (2020); Oppong et al. (2024); dos Reis Cardillo and Basso (2025) |

| Shareholders’ Value (SV) | Perceived economic benefits delivered to equity owners | Perceptions of long-term value creation for shareholders | Reflective Likert-type perception items | Omran et al. (2008); Klapper and Love (2004); O’Connell and Ward (2020) |

| Industry (Control) | Sectoral context shaping governance demands and audit scope | Dummy variables: Manufacturing (IND_M), Services (IND_S), Trading (IND_T); baseline = Other | Dummy coding | Dalton et al. (1998); Rezaee (2025) |

| Regulatory Intensity (Control) | Degree of external oversight and compliance burden imposed on the firm’s sector | Frequency of inspections and sanction severity (fines measured in monetary terms and disciplinary actions) | Likert items 5-point | Carcello et al. (2002) Wang et al. (2024) |

| Variable | Observations | Minimum | Maximum | Mean | Std. Deviation |

|---|---|---|---|---|---|

| BCD | 223 | 1.000 | 5.000 | 3.395 | 1.014 |

| CGC | 223 | 1.000 | 5.000 | 3.249 | 1.065 |

| BOI | 223 | 1.000 | 5.000 | 3.300 | 1.048 |

| BRA | 223 | 1.000 | 5.000 | 3.646 | 0.926 |

| RMP | 223 | 1.000 | 5.000 | 3.000 | 1.092 |

| CMP | 223 | 1.000 | 5.000 | 3.049 | 1.165 |

| IRMP | 223 | 1.000 | 5.000 | 3.126 | 1.157 |

| ICP | 223 | 1.000 | 5.000 | 3.291 | 1.100 |

| SV | 223 | 1.000 | 5.000 | 3.085 | 1.074 |

| Trading | 223 | 0.000 | 1.000 | 0.085 | 0.279 |

| Service | 223 | 0.000 | 1.000 | 0.462 | 0.499 |

| Manufacturing | 223 | 0.000 | 1.000 | 0.453 | 0.498 |

| Frequency | 223 | 1.000 | 5.000 | 3.475 | 0.951 |

| Sanction | 223 | 1.000 | 5.000 | 2.919 | 1.149 |

| Construct | R2 | R2 (Bootstrap) | Standard Error | Critical Ratio (CR) | Lower Bound (95%) | Upper Bound (95%) | Q2 cum |

|---|---|---|---|---|---|---|---|

| IAP | 0.256 | 0.273 | 0.048 | 5.306 | 0.177 | 0.377 | 0.203 |

| SV | 0.552 | 0.571 | 0.060 | 9.217 | 0.447 | 0.679 | 0.487 |

| Endogenous Construct | Metric/Path | β (Boot) | SE (Boot) | t/CR | VAF | Decision |

|---|---|---|---|---|---|---|

| IAP | Model fit | 0.046 | 5.553 | |||

| CGM → IAP | 0.365 | 0.04 | 9.189 | Supported | ||

| REG → IAP | 0.24 | 0.051 | 4.826 | Control sig. | ||

| IND → IAP | 0.019 | 0.069 | 0.28 | Not significant | ||

| SV | Model fit/predictive relevance | 0.06 | 9.217 | |||

| IAP → SV | 0.706 | 0.057 | 12.392 | Supported | ||

| CGM → SV | 0.086 | 0.048 | 1.787 | Not significant | ||

| REG → SV | −0.024 | 0.06 | −0.394 | Not significant | ||

| IND → SV | 0.004 | 0.074 | 0.048 | Not significant | ||

| Indirect effects (bootstrapped) | CGM → IAP → SV | 0.257 | 0.032 | 75% (substantial) | Substantial mediation | |

| REG → IAP → SV | 0.17 | 0.041 | Indirect-only | |||

| IND → IAP → SV | 0.018 | 0.047 | Not significant |

| No. | Theme | Illustrative Quote | Support for Hypotheses |

|---|---|---|---|

| 1 | Tick-box Board Membership | “The cost of running the corporate board outweighs the benefits, especially when large boards include members who merely fulfil governance code requirements.” | This explains H1 (CG → SV not supported). Weak board effectiveness limits direct governance impact. |

| 2 | Lack of Relevant Expertise | “Board selection often reflects external influence rather than industry-relevant expertise.” | Weakens H1 (CG → SV) and supports H2 (CG → IAP). Corporate governance adds value only if boards empower internal audit. |

| 3 | Minimal Oversight | “Boards seldom engage in continuous oversight, only wait at the end of the year to receive reports.” | Reinforces H1 null result. Corporate governance intent is not operationalized without strong audit follow-through. |

| 4 | Burden on Internal Audit | “Internal Auditors must compensate for infrequent board engagement by bridging the gap between governance and operations.” | Supports H2 and H4. IAP mediates governance effects, operationalizing board intent into value. |

| 5 | Skills Gap in Audit | “Internal Auditors often lack the technical expertise to move beyond compliance checks.” | Supports H3 (IAP → SV): IAP adds value only when audit teams have the requisite capabilities. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Abudu, D.; Salman, S.A. Corporate Governance and Shareholders’ Value: The Mediating Role of Internal Audit Performance—Empirical Evidence from Listed Companies in Ghana. J. Risk Financial Manag. 2025, 18, 499. https://doi.org/10.3390/jrfm18090499

Abudu D, Salman SA. Corporate Governance and Shareholders’ Value: The Mediating Role of Internal Audit Performance—Empirical Evidence from Listed Companies in Ghana. Journal of Risk and Financial Management. 2025; 18(9):499. https://doi.org/10.3390/jrfm18090499

Chicago/Turabian StyleAbudu, Dawuda, and Syed Ahmed Salman. 2025. "Corporate Governance and Shareholders’ Value: The Mediating Role of Internal Audit Performance—Empirical Evidence from Listed Companies in Ghana" Journal of Risk and Financial Management 18, no. 9: 499. https://doi.org/10.3390/jrfm18090499

APA StyleAbudu, D., & Salman, S. A. (2025). Corporate Governance and Shareholders’ Value: The Mediating Role of Internal Audit Performance—Empirical Evidence from Listed Companies in Ghana. Journal of Risk and Financial Management, 18(9), 499. https://doi.org/10.3390/jrfm18090499