1. Introduction

Economic scholars have long debated the relationship between economic freedom (EF) and economic growth (EG), leading to a variety of empirical findings. EF and macroeconomic performance are generally found to be positively correlated in early works by

Ali (

1997),

Easton and Walker (

1997),

Goldsmith (

1997),

Dawson (

1998),

Wu and Davis (

1999), and

Hanson (

2000). Similar to this,

Heckelman (

2000) contends that better growth outcomes frequently accompany advancements in economic liberalisation. More conditional or attenuated results have been obtained from later studies, though. For instance,

Pitlik (

2002) argues that changes in EF over time are more significant than its static level, whereas

Gwartney et al. (

1998,

2002) and

De Haan and Sturm (

2000) only report modest growth effects.

Weede and Kampf (

2002) share this viewpoint, highlighting the dynamic aspect of EF as a growth driver.

The protection of property rights, the integrity of legal and administrative systems, government size, regulatory freedom, openness to trade, and monetary stability are just a few of the many institutional and policy-related components that are conceptually included in EF. Together, these factors influence how people and businesses can allocate resources and produce productive activity, which in turn shapes the business climate (

Hussain & Haque, 2016). Although EF has been associated with the growth of strong financial systems and effective markets (

Al-Gasaymeh et al., 2020;

Chang et al., 2020), other research contends that these results are largely dependent on the quality of governance, transparency, and institutional maturity (

Kacprzyk, 2016;

Slesman et al., 2019).

In the context of the Western Balkans, this complexity is especially noticeable. Countries like Albania, Bosnia and Herzegovina, Croatia, Kosovo, Montenegro, and Serbia still struggle with high levels of corruption, ineffective public spending, structural labour market mismatches, and weak institutional capacity, despite their modest growth over the last ten years (

Uvalić & Cvijanović, 2018). Despite EF’s recognised potential to boost growth, rent-seeking behaviour, inconsistent policies, and weak state institutions frequently make it difficult to put into practice (

Farah et al., 2021;

Fang & Zhang, 2016).

In light of this, panel data from 2013 to 2023 is used in this study to re-evaluate the EF–EG relationship in the Western Balkans. The aim is to determine the fundamental forces behind economic expansion and evaluate the degree to which different aspects of EF, more especially, property rights (PR), government integrity (GI), government spending (GS), business freedom (BF), and monetary freedom (MF), have an impact on the growth of real GDP per capita. As important markers of institutional quality and macroeconomic stability, these five dimensions were chosen for their theoretical significance and empirical applicability in studies like

Gwartney et al. (

2002) and

Brkić et al. (

2020). Furthermore, because of their established roles in growth theory, trade openness and education spending are included as control variables (

Barro, 1991;

I. Bajraktari, 2023). Two more macro-fiscal variables, the public debt (as a percentage of GDP) and the government budget deficit (as a percentage of GDP), are added to account for fiscal sustainability. This fills in a gap in the literature and gives a more complete picture of economic constraints.

This study uses a triangulated empirical strategy, which is a methodological departure from previous research. It combines Bayesian Vector Autoregression (Bayesian VAR) to investigate persistence and intertemporal dynamics; Random Forest (RF) regression to capture non-linearities and rank variable importance; and the Generalised Method of Moments (GMM) to handle possible endogeneity and dynamic feedback effects. Beyond what conventional linear models can offer, this integrated framework provides a deeper, more complex understanding of the EF–EG relationship.

In three significant ways, this study adds to the body of literature. First, it offers current, geographically specific empirical data from the Western Balkans, a region that is under-represented in the majority of studies on economic freedom. Second, it fills in methodological gaps noted by

Rachdi et al. (

2015) and

Aldiabat et al. (

2019) by using a dynamic GMM estimator to address endogeneity and omitted variable bias. Third, it employs machine learning methods to uncover intricate, non-linear connections between policy variables, providing information that conventional parametric models are unable to detect.

Hypothesis:

Null Hypothesis (H0): There is no significant relationship between economic freedom (EF) and economic growth (EG) in Western Balkan countries.

Alternative Hypothesis (H1): There is a significant positive relationship between economic freedom (EF) and economic growth (EG) in Western Balkan countries.

This paper’s remaining sections are organised as follows: A critical review of the literature is given in

Section 2, the methodological framework and data sources are described in

Section 3, the empirical results are presented in

Section 4, the main conclusions and their implications for policy are discussed in

Section 5, and recommendations and future research directions are concluded in

Section 6.

2. Literature Review

One of the most hotly debated topics in economics is the connection between economic growth (EG) and economic freedom (EF). Although early research, including that of

Ali (

1997),

Easton and Walker (

1997), and

Dawson (

1998), portrays EF as a growth-promoting factor that reduces state intervention, boosts efficiency, and expands private initiative, this perspective is becoming more and more seen as being too simplistic. Over the last 20 years, empirical data have revealed that this relationship is conditional and occasionally contradictory.

Gwartney et al. (

1998) and

De Haan and Sturm (

2000) do, in fact, provide a warning, emphasising the weak or context-dependent effects of EF on long-term growth. They contend that assuming a one-way relationship is insufficient and that institutional and structural preconditions mediate the impact of EF. This criticism is furthered by

Adkins et al. (

2002), who demonstrate that EF only improves policy effectiveness, like monetary control, when supported by strong institutions. Therefore, EF might be little more than an ideological stand-in if institutional fragility is not addressed.

Weede and Kampf’s (

2002) contention that growth trajectories are driven by the direction and quality of change rather than just the level of EF exacerbates this worry. In a similar vein,

Berggren (

2003) challenges aggregate EF indices, arguing that certain elements, like income equality, human capital, and the rule of law, may be more significant than total liberalisation scores.

Thuy (

2022) supports this by showing that while transitions or reforms frequently have more significant effects, static EF levels are not good indicators of macroeconomic performance. A fundamental oversight is indicated by this body of literature: EF alone, without structural reform, runs the risk of becoming irrelevant.

Evidence of corruption’s distorting effects also calls into question EF’s theoretical independence.

Okunlola and Akinlo (

2021) make a strong case that corruption reduces competitiveness and misallocates investment, neutralising EF’s growth dividends. Similarly,

Mo (

2001) notes that corruption reduces EF’s potential through the processes of political instability and the depletion of human capital.

Herrera-Echeverri et al. (

2014) further warn that in developing contexts, EF is virtually impotent without improvements in governance, judicial credibility, and public sector accountability.

The economies of the Western Balkans provide an interesting setting for studying these conflicts. Larger governments, which are generally seen as being incompatible with EF, actually correlate favourably with growth in the region, according to

Bajrami et al. (

2022), particularly in areas where state institutions address market failures. This result highlights the adaptive value of state-led interventions in transitional economies and calls into question conventional EF theory. In line with EF principles,

I. Bajraktari (

2023) emphasises trade openness as a major growth driver. However, as

Puška et al. (

2023) contend, this seeming transparency frequently conceals ingrained institutional weaknesses like cronyism and lax regulatory enforcement, which ultimately limit EF’s ability to effect change.

This scepticism is strengthened by recent empirical contributions. According to

Radulović and Kostić (

2024), the growth effects of globalisation in the Western Balkans are not uniform and rely significantly on a nation’s ability to strategically liberalise trade and absorb technological flows. Likewise,

Cengiz and Manga (

2024) reveal a darker undercurrent: economic globalisation may be exacerbating de-industrialisation in the region, particularly in the absence of strong innovation systems. These results imply that structural regressions may result from economic openness in the absence of institutional modernisation.

The advantages of EU integration mechanisms are also moderated by institutional limitations. According to

Jusufi and Qorraj (

2025), the lack of administrative capacity, disjointed policy implementation, and inadequate domestic reform have caused Stabilisation and Association Agreements (SAAs) to fall short of expectations. This supports

Sharma’s (

2024) finding that EF research is progressively moving away from neoliberal dogma and towards a more institutionally based conception of reform efficacy.

Jaćimović et al. (

2025), who discover a strong and favourable correlation between infrastructure development and economic performance throughout the Western Balkans, support the significance of focused public investment. Their findings cast public infrastructure as a crucial facilitator of convergence with EU standards, defying the minimalist-state presumption frequently linked to EF.

In the meantime,

Vërbovci et al. (

2024) demonstrate that green innovation significantly increases green economic growth in the region and is supported by public–private partnerships and regulatory incentives. Importantly, their analysis indicates that an ecosystem comprising R&D support, institutional stability, and policy coherence is more important for fostering innovation than EF alone. These dynamics are reflected in

Topalli et al. (

2021), who discover that the ability of FDI to reduce poverty in the Balkans depends on domestic institutions, particularly labour market regulators. The implication is obvious: inclusive development goals must be used as a filter for FDI liberalisation.

Delova-Jolevska et al. (

2024) expand on this idea by pointing out that ESG-related risks, in particular environmental deterioration and inadequate governance, are enduring growth inhibitors. In other words, EF becomes growth-agnostic when it is deprived of social and environmental protections. According to

Wencong et al. (

2023), FDI-driven renewable energy expansion in transition economies may exhibit a Kuznets-type curve, where environmental degradation first increases before declining. This trajectory necessitates regulatory vigilance.

This warning tone is echoed by broader research. According to

Akinlo and Okunlola (

2025), EF only raises living standards when there is political stability and risk containment. Given varying legal systems, regulatory cultures, and political cycles,

Payne et al. (

2025) cast doubt on the cross-national comparability of EF measures. Furthermore, in fragile Eurozone economies, a rigid adherence to EF can erode institutional legitimacy and social cohesiveness, according to

Canale and Liotti (

2025).

Brkić et al. (

2020) provide what may be the most well-rounded empirical basis in this critical landscape. Instead of using aggregate indices, their analysis of 28 EU nations ties growth to particular EF subcomponents, such as property rights, fiscal restraint, and administrative effectiveness. However, they have methodological issues to address because they rely on GMM without machine learning or dynamic forecasting tools.

This work is strongly empirically motivated by other Balkan-specific studies. Trade openness is emphasised by

K. Bajraktari et al. (

2023) as a potent growth accelerator, contingent on institutional capacity. The significance of monetary channels is emphasised by

Bajrami et al. (

2025), who contend that growth can be supported by liberalised monetary policy, but only in conjunction with fiscal restraint. Financial health and institutional integrity are directly linked by

Gashi et al. (

2022) and

Hoxha et al. (

2025), demonstrating the need for banking and macroeconomic policy reforms to happen simultaneously.

The literature is further enhanced by recent contributions from the Journal of Private Enterprise, Applied Economics, and the Review of Austrian Economics.

Franck (

2010) emphasises how political-economic and macroeconomic structures influence how EF is interpreted and how effective it is.

Gu et al. (

2017) demonstrate how ideological biases greatly influence the operationalisation of EF, making its policy implications more complex.

Saccone (

2021) cautions that EF gains may be unequally distributed, frequently favouring higher-income groups, based on income decile analysis. While

Cebula (

2011) connects EF and political stability to growth in a panel setting,

Dawson (

2015) identifies EF as a potential stabilising force in volatile economies. Existing EF measurement indices are criticised by

Ram (

2014) and

Balliew et al. (

2020), who highlight their methodological sensitivity.

Jackson et al. (

2015) find a strong correlation between social capital and EF, which is consistent with other studies that link political rights to economic performance, such as

Pourgerami and Assane (

1992). According to

Khan et al. (

2021), EF only improves finance when specific thresholds are met, and

Kacprzyk (

2016) emphasises the heterogeneity in the EF–growth relationship across EU nations. The significance of entrepreneurship and market entry, areas where EF alone is inadequate without institutional reform and tax policy coordination, is highlighted by

Sobel et al. (

2007) and

Clark and Lawson (

2008).

Carden (

2010) goes further, contending that even liberalised aid regimes are unable to generate long-term growth in the absence of structural change (See

Appendix A for summary).

When taken as a whole, these pieces challenge the notion that resilience or convergence can be achieved solely through economic freedom. Rather, they emphasise how important distributive equity, measurement rigour, and institutional alignment are. These studies offer a crucial realisation: economic freedom is not a growth strategy that works for everyone or everywhere. Complementary reforms in infrastructure, innovation, governance, and environmental regulation are essential to its success. This makes the ongoing use of one-size-fits-all liberalisation frameworks or static EF indicators seem more and more out of date.

Three significant gaps are found in this literature review. First, the empirical EF literature is still overly focused on OECD nations, with post-transition regions like the Western Balkans receiving little attention. Second, a large portion of the body of current research is methodologically static and ignores lag structures, feedback effects, and temporal dynamics. Third, despite their ability to identify regional heterogeneities, non-linearities, and interaction effects, machine learning techniques are still underutilised. This study directly addresses these gaps by combining the GMM, Bayesian VAR, and Random Forest methods and applying them to disaggregated EF indicators across six Western Balkan countries, thereby making a significant contribution to methodological advancement and regional relevance.

3. Materials and Methods

3.1. Research Design and Scope

This study investigates the relationship between economic freedom (EF) and real GDP per capita growth (EG) across six Western Balkan countries, Albania, Bosnia and Herzegovina, Croatia, Kosovo, Montenegro, and Serbia, over the period 2013 to 2023. The core objective is to determine how key sub-dimensions of economic freedom influence growth in a region characterised by transitional institutional structures and fiscal fragilities.

The empirical model incorporates five EF indicators drawn from the Heritage Foundation’s Index of Economic Freedom: property rights (PR), government integrity (GI), government spending (GS), business freedom (BF), and monetary freedom (MF). The dependent variable, real GDP per capita growth (expressed as the annual percentage change), is sourced from the

World Bank (

2023).

Two control variables are added based on theoretical precedent: trade openness (exports + imports as a percentage of GDP) and education expenditure (as a percentage of GDP), both of which are known to significantly affect growth trajectories (

Barro, 1991;

I. Bajraktari, 2023). Additionally, two fiscal burden indicators, government budget deficit (as a % of GDP) and public debt (as a % of GDP), are introduced to account for macro-fiscal constraints that may mediate the impact of economic freedom on economic growth.

The underlying functional relationship is specified as follows:

where

: economic growth (real GDP per capita growth rate) for country at time ;

: sub-dimensions of economic freedom;

: control variables;

: fiscal burden indicators;

: error term capturing unobserved shocks.

To robustly estimate this relationship and overcome methodological limitations associated with small samples, omitted variables, and potential endogeneity, a triangulated analytical strategy is employed, comprising the Generalised Method of Moments (GMM), Bayesian Vector Autoregression (Bayesian VAR), and Random Forest (RF) regression models.

3.2. Generalised Method of Moments (GMM)

A dynamic panel estimator, two-step system GMM following the

Arellano and Bond (

1991) framework, is adopted to address potential endogeneity and unobserved heterogeneity. This technique is particularly suited for short panels with more cross-sections than time periods and helps mitigate simultaneity bias, dynamic feedback, and autocorrelation.

The estimated model is specified as follows:

where

: one-period lag of real GDP growth;

: country-specific fixed effects;

: idiosyncratic error term;

and : parameters to be estimated.

The Sargan test is used to evaluate the validity of instruments, while the Arellano–Bond AR(1) and AR(2) tests verify the absence of serial correlation in differenced residuals. Diagnostic tests such as the Jarque–Bera normality test, ARCH-LM, and Ljung–Box Q-statistics are also applied to assess model robustness.

3.3. Machine Learning Approach: Random Forest Regression

To capture possible non-linearities and interaction effects overlooked by traditional econometric methods, this study incorporates a machine learning algorithm—Random Forest Regression. This ensemble method constructs a multitude of decision trees during training and outputs the average prediction, reducing overfitting and enhancing predictive accuracy.

Key steps include the following:

Feature Selection: Economic freedom sub-indicators are evaluated for importance using measures such as IncNodePurity, which reflects each variable’s contribution to model accuracy.

Model Training: A forest of 500 trees is trained using the EF indicators as predictors of GDP growth. A standard 70/30 train–test split is employed.

Cross-Validation: K-fold cross-validation (with ) is conducted to validate the model’s generalisability.

Interpretability: Variable importance rankings are derived, and SHAP (Shapley Additive Explanations) values are proposed for future interpretability enhancement.

Model performance is evaluated using Root Mean Squared Error (RMSE) and R-squared () metrics, providing insight into prediction accuracy and explanatory power.

3.4. Bayesian Vector Autoregression (Bayesian VAR)

To assess the dynamic interdependencies and delayed effects of economic freedom indicators on economic growth, a Bayesian Vector Autoregression (VAR) model is estimated. Bayesian VAR is particularly advantageous for small-sample studies, allowing for the inclusion of prior information to stabilise coefficient estimates.

The Bayesian VAR model is defined as follows:

where

: a vector including GDP growth and the five EF indicators, control variables, and fiscal indicators;

: parameter matrices for lag ;

: intercept vector;

: vector of innovations.

This study employs the Litterman/Minnesota prior, which favours more weight on own lags and shrinks cross-variable influence. Impulse Response Functions (IRFs) are generated to trace the temporal effect of shocks in EF components on GDP growth. Additionally, the model’s fit is evaluated using the Adjusted R-squared, F-statistics, and the Standard Error of Regression.

3.5. Summary of Analytical Strategy

By combining GMM, Bayesian VAR, and Random Forest models, the analysis captures a comprehensive view of the EF–EG nexus. While GMM identifies causal and contemporaneous effects under endogeneity, Bayesian VAR models lag structures and dynamic feedback, and Random Forest allows for complex non-linear interactions and variable importance assessment. This triangulated approach enhances empirical validity and provides policy-relevant insights grounded in methodological pluralism.

4. Results

This section presents the empirical findings from the three methodological approaches employed: Generalised Method of Moments (GMM), Bayesian Vector Autoregression (Bayesian VAR), and Random Forest (RF). The results offer a multi-dimensional understanding of how various subcomponents of economic freedom influence Real GDP per capita growth across six Western Balkan countries between 2013 and 2023.

4.1. Diagnostics for Pre-Estimation

Preliminary tests were performed to evaluate the time series properties of the variables, guaranteeing the validity and robustness of the econometric models used. This study used the Levin–Lin–Chu (LLC) and Im–Pesaran–Shin (IPS) panel unit root tests to confirm stationarity because of the panel structure (six countries over 11 years). The findings showed that while some economic freedom indicators and GDP growth were stationary at first difference, others were stationary at level.

The presence of long-term equilibrium relationships between the variables was also evaluated using the Pedroni panel cointegration test. Long-term relationships were included in the panel regression models due to evidence of cointegration, which helped to reduce the possibility of spurious regression, as warned by

Granger and Newbold (

1974) and

Hamilton (

1994).

In addition to validating the empirical approach, these pre-estimation checks offer a strong statistical basis for subsequent estimation using the Random Forest, Bayesian VAR, and GMM techniques. The utilisation of these advanced methodologies allows for a more nuanced understanding of the dynamics at play. By integrating diverse statistical approaches, this research aims to uncover deeper insights that could inform policy- and decision-making in the relevant fields.

The stationarity properties of the variables used in the empirical analysis are revealed by the results in

Table 1. Two panel unit root tests were performed: the Im–Pesaran–Shin (IPS) test on their initial differences and the Levin–Lin–Chu (LLC) test on the level form of each variable. With

p-values significantly above the traditional 5% significance threshold, the LLC test is unable to reject the null hypothesis of a unit root across all variables, including the fiscal indicators. This shows that the variables are integrated by order one, or I(1), and that their levels are non-stationary and follow stochastic trends.

All variables, however, exhibit strong evidence of stationarity when the IPS method is used to test the initial differences. Every variable’s IPS test statistics are significant at the 1% level, suggesting that they stabilise following initial differencing. This outcome demonstrates that every time series is difference-stationary and appropriate for models built to deal with I(1) processes.

The implications of these findings for model specification are evident. Static panel models like pooled OLS or fixed effects would produce erroneous results unless cointegration is present because the series’ levels are non-stationary. This validates the suitability of Bayesian Vector Autoregression (Bayesian VAR) and dynamic panel estimators like the Generalised Method of Moments (GMM). Both methods are able to capture the dynamic relationships between variables and can handle unit-root processes. The inclusion of lagged dependent variables and the transformation of the data structure for trustworthy inference are both supported by the confirmation of first-difference stationarity.

This backs up this study’s use of dynamic models, such as the Generalised Method of Moments (GMM), which account for differenced variables in order to deal with endogeneity and non-stationarity. One might wonder if the tests’ power is limited by the small sample size, six countries from 2013 to 2023, and if this could obscure country-specific subtleties. This worry is lessened by the IPS test’s flexibility in permitting heterogeneity, but the short time frame raises concerns about capturing long-term relationships. This is addressed by this study’s reference to Pedroni cointegration tests, which validate long-term relationships, though the short data period may still prevent more in-depth understanding.

One minor criticism is that, while differencing guarantees stationarity, it may mask level-based relationships and thus oversimplify the relationship between economic freedom and growth. Despite these limitations, this study’s triangulated approach, which combines GMM, Bayesian VAR, and Random Forest, compensates by capturing both dynamic and non-linear effects, providing a strong framework.

4.2. Descriptive Statistics

The descriptive statistics for this study’s primary variables, which span the years 2013–2023, are shown in

Table 2. The central tendencies and dispersion across the economic and institutional indicators for the sample countries are summarised in the figures.

With a standard deviation of 1.26 percentage points, the average yearly growth rate of real GDP per capita is 2.45%. While the maximum value of 5.8% indicates periods of strong expansion, the minimum value of −0.8% indicates that some countries went through mild recessions during that time.

Property rights have a comparatively high mean score of 61.8 in terms of institutional quality, although the range is broad, ranging from 43.5 to 79.1. With a narrower dispersion and a lower average score of 41.2, government integrity indicates ongoing problems with transparency and corruption in a large portion of the region. Although government spending as a percentage of GDP averages 29.4%, it varies widely between nations, ranging from 18.6% to nearly 40%, which reflects different fiscal philosophies.

Although their standard deviations indicate significant heterogeneity in regulatory environments and price stability, business freedom and monetary freedom also exhibit comparatively high average scores (66.3 and 70.1, respectively). Although it also varies across the sample, trade openness, with a mean of 45.2 and a standard deviation of 7.4, indicates a moderate level of integration with the global economy. The average amount spent on education as a percentage of GDP is 3.8%, though some nations invest as little as 2.1% and others as much as 5.6%.

Public debt and the government budget deficit are two fiscal indicators that show additional structural divergence. The majority of the sample countries have ongoing fiscal deficits, as evidenced by the average budget deficit of −3.2% of GDP, with the highest deficit at −7.8% and a tiny surplus of 0.2% at the upper bound. Averaging 55.6% of GDP, public debt levels are also high; some nations maintain comparatively low debt ratios (28.3%), while others are on the verge of fiscal stress (up to 86.9%).

The results show that the countries under observation differ significantly in terms of macroeconomic performance, fiscal restraint, institutional quality, and openness. The use of dynamic and adaptable econometric models that can account for heterogeneity and non-linear effects is justified by this variability.

4.3. Correlation Matrix

The correlation matrix between the study variables is shown in

Table 3, providing initial understanding of the linear relationships between real GDP growth and different fiscal, institutional, and economic indicators. These correlations show significant associations that can direct the interpretation of later regression results, even though they do not imply causation.

The majority of institutional and macroeconomic variables show positive correlations with real GDP growth (GDP). Trade openness has the strongest correlation (0.35), indicating that increased economic growth is typically linked to increased market integration. Monetary freedom (0.28) and property rights (0.31) also exhibit moderately positive correlations with growth, suggesting that stable price environments and safe property institutions may promote economic growth. In line with their theoretical roles in boosting productivity and human capital, business freedom (0.19) and education spending (0.15) exhibit weaker but still positive associations with growth.

Government spending (GS), on the other hand, has a negative correlation with GDP growth (−0.24), suggesting that higher public spending might be linked to slower growth, perhaps as a result of inefficiencies or crowding out effects in some economies. Its strong negative correlation (−0.33) with the government budget deficit supports this, indicating that larger fiscal imbalances are frequently associated with higher spending.

There are divergent correlations between the two recently added fiscal variables and growth. In the short term, fiscal expansion may boost economic activity, as evidenced by the positive correlation (0.21) between the government budget deficit (GBD) and GDP growth. Nonetheless, there is a negative correlation between public debt (Debt) and growth (−0.27), underscoring the long-term dangers of continuous borrowing. Curiously, there is a moderately negative correlation (−0.45) between the deficit and the debt itself, indicating that, depending on growth, interest rates, and debt management techniques, sustained deficits do not always result in increasing debt loads.

Despite their weak correlations, institutional factors like business freedom, government integrity, and property rights are positively correlated. The majority of other variables, particularly institutional ones, have a negative correlation with government spending. This could be a reflection of different governance models, as states with weaker market institutions tend to implement more extensive fiscal interventions.

The correlation matrix indicates that while excessive government spending and rising debt levels are linked to poorer economic performance, market-friendly institutions, trade integration, and moderate fiscal stimulus are more closely associated with sample growth. In subsequent sections, the causal estimates obtained from GMM, Bayesian VAR, and machine learning models can be interpreted with the help of these patterns.

All correlations fall below the conventional multicollinearity threshold of 0.80, indicating no problematic linear dependence between regressors.

4.4. Multicollinearity Test (Variance Inflation Factor–VIF)

For each explanatory variable in the regression models,

Table 4 displays the Variance Inflation Factors (VIFs). This provides a diagnostic check for multicollinearity, a problem that occurs when independent variables have a high degree of correlation with one another, which can skew coefficient estimates and inflate standard errors.

Multicollinearity is unlikely to be a significant issue when the VIF value is less than 5, which is generally regarded as acceptable. With values ranging from 1.44 (government budget deficit) to 1.91 (business freedom), every variable in this table is significantly below this cutoff. The comparatively low VIFs imply that there is no multicollinearity in the model specification and that the explanatory variables are sufficiently independent from one another.

The variables with the highest VIFs are public debt (1.86), business freedom (1.91), and property rights (1.83), but their values are still comfortably within the safe range. These numbers suggest that although there may be a moderate correlation between these variables and other variables in the model, the overlap is not significant enough to compromise the accuracy of the coefficient estimates.

Furthermore, demonstrating that their inclusion in the model does not introduce problematic levels of collinearity, the fiscal indicators that were introduced—the public debt and the government budget deficit—also display low VIF values (1.44 and 1.86, respectively). This supports their interpretive validity in the regression analysis and reaffirms their suitability in the extended specification.

The model is statistically well-specified and robust in terms of variable selection, and the VIF results reassure that multicollinearity does not obscure or bias the estimated relationships between the macroeconomic and institutional variables and real GDP growth.

These results confirm that the regression estimates presented earlier are not biased or inflated by collinearity among predictors.

4.5. Generalised Method of Moments (GMM) Estimates

The GMM model is estimated using a two-step system GMM framework to correct for endogeneity and unobserved heterogeneity.

Table 5 summarises the coefficient estimates and statistical significance levels.

The results of the dynamic panel Generalised Method of Moments (GMM) estimation are shown in

Table 5, with the annual percentage change in real GDP per capita serving as the dependent variable. In order to account for the persistence of economic growth over time, the lagged dependent variable is included in this specification along with institutional and fiscal variables.

Strong inertia in growth rates is indicated by the coefficient on the lagged GDP growth term, which is 0.9384 and highly significant (p < 0.0001)—past growth is a strong predictor of current performance. This is common in macroeconomic models and demonstrates why a dynamic framework such as GMM is appropriate.

Property rights have a positive and statistically significant effect among the institutional variables (coefficient = 0.0367, p = 0.0208), indicating that faster economic growth is linked to stronger legal protections for contracts and property. Government integrity, on the other hand, enters negatively and significantly (−0.0820, p = 0.0206), suggesting that poor governance or corruption may directly impair economic performance.

Additionally, there is a negative correlation between government spending and growth (−0.0066, p = 0.0312), which supports the idea that excessive or ineffective public spending can discourage private investment or skew incentives. However, business freedom is not statistically significant, indicating that without more extensive institutional reforms, deregulation alone might not result in quantifiable growth gains.

With coefficients of 0.0413 and 0.0254, respectively, monetary freedom and trade openness are both positively signed and significant at the 5% level. These findings suggest that growth is supported by outward-focused trade regimes and steady, market-based pricing systems. Despite possibly delayed returns, education spending has a positive effect and is marginally significant (p = 0.0512), suggesting that investing in human capital will increase productivity over the long run.

Crucially, adding fiscal variables produces illuminating outcomes. Moderate fiscal expansion may spur growth, particularly in developing economies with output gaps, as evidenced by the government budget deficit’s positive and significant entry (0.0498, p = 0.0371). In contrast, public debt is significantly negative (−0.0172, p = 0.0456), indicating that growing debt loads have a negative impact on economic performance, most likely due to increased borrowing costs, uncertainty, or the exclusion of profitable investment. The GMM findings suggest that growth, fiscal policy, and institutional quality have a complex relationship. While some state initiatives, such as temporary deficits or spending on education, can boost growth, these benefits may be outweighed by bad governance and mounting debt. The findings provide empirical evidence in favour of a mixed policy approach that strikes a balance between targeted and financially restrained interventions and pro-market institutions.

The diagnostic tests increase the model’s credibility. With a p-value of 0.0173 and a statistic of −2.38, the Arellano–Bond AR(1) test shows first-order autocorrelation, which is to be expected in a dynamic model with lagged dependent variables. The consistency of the model is supported by the AR(2) test, which displays no second-order autocorrelation with a statistic of 1.22 and p-value of 0.2242. The appropriateness of the GMM instruments is confirmed by the Sargan test, which fails to reject the null hypothesis of valid instruments with a statistic of 18.45 and p-value of 0.241.

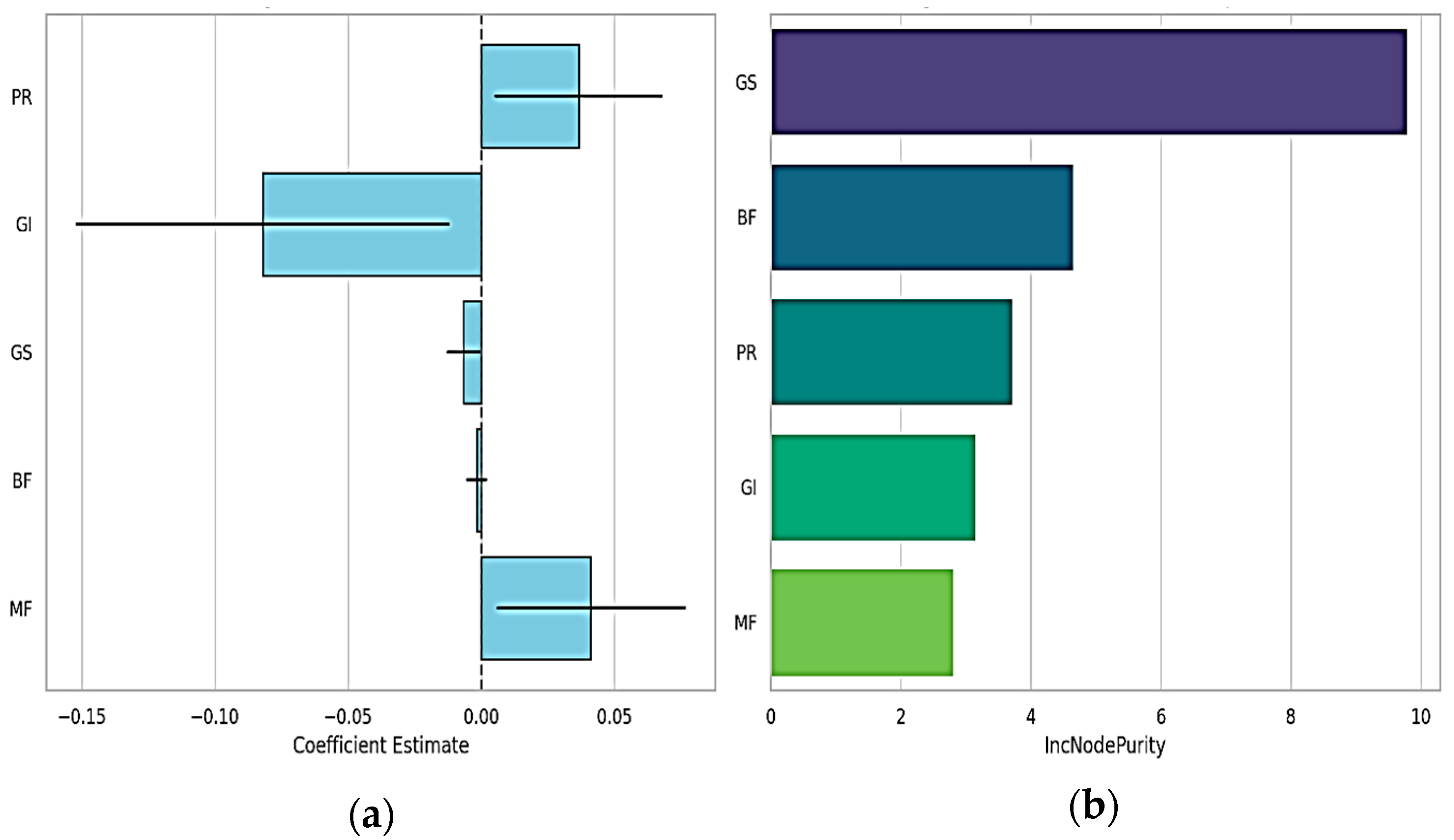

When considering these findings, the benefits of monetary freedom and property rights are consistent with economic theory, but the drawbacks of government integrity raise interesting concerns about the immediate costs of governance reforms in transitional environments. The small sample size (66 observations) raises questions about whether these results are driven by country-specific factors, such as differing EU accession progress. This study’s use of Random Forest to capture non-linearities is justified by the non-significant business freedom coefficient, which indicates that linear models might overlook complex dynamics. There is a minor criticism that the GMM handles endogeneity, but its dependence on a brief time series may make it more difficult to identify long-term effects, especially for variables like education expenditure where effects frequently take time to manifest (see

Figure 1a).

4.6. Bayesian Vector Autoregression (Bayesian VAR)

The Bayesian VAR model includes GDP growth and EF indicators as endogenous variables, using Litterman (Minnesota) priors.

Table 3 presents the coefficients for the GDP growth equation.

The results of estimating the GDP growth equation using Bayesian Vector Autoregression (Bayesian VAR), with the dependent variable being the yearly percentage change in real GDP per capita, are shown in

Table 6. Because it addresses potential endogeneity through a probabilistic structure and permits the joint evolution of variables over time, the model is especially well-suited for dynamic macroeconomic systems.

The strength of the autoregressive components is the model’s most notable characteristic. With coefficients of 0.7169 and 0.2811 for the first and second lags, respectively, both lagged GDP growth values are positive and statistically significant. This demonstrates how persistent economic growth dynamics are—past growth significantly influences present results. The exceptionally high in-sample fit (R2 = 0.9984 and adjusted R2 = 0.9981) indicates that almost all of the growth variation is captured by the combined autoregressive structure. A very strong model is indicated by the incredibly large F-statistic (3983.35) and the remarkably low RMSE (0.0407).

Regarding the structural variables, the fiscal and institutional coefficients are typically modest and statistically insignificant. Property rights, business freedom, monetary freedom, government spending, government integrity, and education spending all show comparatively large standard errors and very small coefficient estimates. After accounting for the autoregressive terms, their effects on GDP growth seem to be negligible. This finding implies that although these factors might be significant in the long run, the economy’s own momentum largely outweighs their short-term effects on growth.

However, the coefficients for trade openness and the government budget deficit are marginally more significant. Trade openness’s positive sign (0.0032) supports the idea that openness, albeit modestly, promotes growth. Additionally, the government budget deficit has a slight but positive effect (0.0046), indicating that modest fiscal loosening might provide a modest short-term increase in output. Public debt, on the other hand, has a negative coefficient (−0.0039), suggesting that even modest increases in debt tend to stifle growth, most likely as a result of unfavourable investor expectations or worries about fiscal sustainability.

When combined, the Bayesian VAR findings support the idea that internal economic inertia is the primary factor influencing short-term GDP growth. After accounting for dynamic feedback, structural and fiscal factors seem to have comparatively small direct effects. Nonetheless, the slight importance of fiscal and trade openness metrics suggests that they might be used as amplifiers or transmission channels during times of economic adjustment. The results support the GMM estimation and show that fiscal policy and institutions are important, but their effects might be more noticeable over longer time periods or in conjunction with cyclical dynamics (see

Figure 2).

4.7. Random Forest Regression Results

The Random Forest (RF) model is used to assess non-linear effects and the relative importance of EF indicators in predicting real GDP per capita growth.

The performance metrics for the Random Forest regression model, which forecasts real GDP per capita growth based on five aspects of economic freedom, are shown in

Table 7a. With 500 decision trees, the model is set up as a regression-type ensemble, guaranteeing strong predictive stability. Three variables are taken into account by the model at each tree split, which helps to add variation among the trees and lowers the possibility of overfitting.

The model explains roughly 90.4% of the variation in real GDP per capita growth across the dataset, according to the R-squared (R2) value of 0.904. Considering the multifaceted and possibly non-linear relationships between institutional and economic indicators in the Western Balkans, this points to a very good model fit. It also suggests that the chosen measures of economic freedom have a significant explanatory capacity for identifying the factors influencing economic growth in this particular setting.

The average difference between the expected and actual GDP growth values is measured by the Root Mean Squared Error (RMSE), and it is 0.408. This low value indicates that, practically speaking, the prediction error is small and that the model’s predictions are fairly close to the observed results. The model’s high accuracy and low residual variance are further supported by the Mean Squared Error (MSE), which is reported at 0.144.

When combined, these metrics show how well the Random Forest model models the connection between GDP growth and economic freedom. It outperforms traditional linear models in capturing underlying patterns and interactions, as evidenced by its high R2 and low RMSE. This lends credence to the notion that the influence of economic freedom on growth in the Western Balkans is not entirely linear and could instead involve threshold effects, non-linearities, or variables, elements that Random Forest algorithms are particularly well-suited to identify.

The variable importance rankings based on the Random Forest model’s Increase in Node Purity (IncNodePurity) are shown in

Table 7b. Higher values indicate a greater influence on the accuracy of the model. This measure shows how much each variable contributes to lowering the prediction error (impurity) in the regression trees.

With a node purity score of 9.80, government spending is clearly the most significant predictor of real GDP growth in the Random Forest framework. This implies that changes in public spending are a major factor in explaining the temporal and cross-country variations in sample growth. Remarkably, public debt also has a very high ranking (5.88), highlighting its importance as a non-linear economic outcome driver. Although the Random Forest model better captures potential thresholds or interaction effects in this case, the results are consistent with the earlier GMM and Bayesian VAR findings, which showed that debt consistently had a negative impact on growth.

The importance of property rights (3.72) and business freedom (4.65) further supports the idea that institutional elements related to legal certainty and market regulation are still crucial for forecasting growth. Even though the government budget deficit (3.58) is marginally lower than debt, it nevertheless makes a significant contribution, bolstering the idea that, in some circumstances, short-term fiscal dynamics like deficit-financed spending can boost output.

Government integrity, trade openness, monetary freedom, and education spending all have lower importance scores (less than 3.2) at the bottom of the ranking. These factors might still be important, but in this machine learning framework, their effects seem more diffuse or context dependent. The marginal role of trade and monetary freedom may result from their interaction with other, more powerful factors, while the relatively low importance of education spending may be due to lag or indirect effects that are difficult to account for in annual growth models.

The Random Forest model’s variable importance rankings demonstrate the significant predictive power of fiscal variables, particularly debt and spending, in addition to more conventional institutional factors. This supports the idea that the composition and management of public finances, in addition to the quality of structural governance, influence sample growth, with machine learning techniques offering more nuance in locating these intricate relationships (see

Figure 1b).

A comparative view of the direction, significance, and relative importance of each explanatory variable in explaining real GDP per capita growth is provided by

Table 8, which summarises the empirical findings from the three modelling approaches—GMM, Bayesian VAR, and Random Forest.

Property rights (PR) and monetary freedom (MF) show positive and statistically significant effects under the GMM estimation, which is in line with the theoretical expectation that growth is fostered by clearly defined institutions and stable macroeconomic environments. Government spending (GS) and integrity (GI), on the other hand, have negative and significant coefficients, indicating that corruption and excessive or inefficient public spending may impair economic performance. In this model, business freedom (BF) has no statistical significance. Both the public debt (Debt) and the government budget deficit (GBD) are noteworthy fiscal indicators. The latter has a negative drag, which probably reflects worries about long-term fiscal sustainability, while the former is positively correlated with growth, indicating some stimulus effect. When taken as a whole, the GMM model exhibits strong explanatory power and validates the importance of both fiscal and institutional factors in growth outcomes.

Since none of the institutional variables in the Bayesian VAR model exhibit significant direct effects, autoregressive dynamics rather than structural factors largely control short-term growth. However, both fiscal variables exhibit marginal significance: public debt has a modestly negative impact, while the government budget deficit has a slight positive effect (significant at the 10% level). These findings imply that, even in an extremely resilient economic system, fiscal policy has some control over short-term growth swings. The model’s lag structure, which captures the internal momentum of GDP growth, is dominant, as evidenced by the weak performance of other explanatory factors.

Each variable’s relative predictive power is ranked using the Random Forest model, a machine learning technique that can capture non-linearities and interaction effects. Public debt and government spending rank highest among growth predictors, closely followed by property rights and business freedom. Monetary freedom is the least important of the factors taken into consideration, and the government budget deficit has a mid-level importance score. This ranking supports the GMM’s conclusion that fiscal factors, especially those pertaining to debt accumulation and spending, are important growth drivers. In addition, the Random Forest model emphasises these effects’ non-linear and potentially threshold-dependent characteristics, which conventional linear models might have overlooked.

The findings across methods converge on several key points. In terms of statistical significance and predictive power, fiscal variables, particularly public debt and government spending, repeatedly show strong relevance. Institutional factors are important, but they might have a greater impact in models that capture medium- to long-term effects, like GMM, than in models that are dominated by autoregressive terms, like Bayesian VAR. Last but not least, the machine learning findings imply that conventional variables might interact in intricate, non-linear ways, calling for prudence in interpreting policy levers. A nuanced growth strategy that strikes a balance between institutional reform and careful fiscal management is supported by the triangulated evidence.

4.8. Residual Diagnostics and Forecast Validation

The residual diagnostic results for the GMM model are summarised in

Table 9, which confirms the model’s robustness. Arellano–Bond tests for autocorrelation (AR1 and AR2) were conducted for the GMM estimator. The internal consistency of the model was supported by the presence of AR1 and the lack of AR2 autocorrelation. The instruments’ validity was further validated by the Sargan test of overidentifying restrictions. Furthermore, residuals were examined using the ARCH-LM test for volatility clustering, the Ljung–Box Q-test for autocorrelation, and the Jarque–Bera test for normality. Robust standard errors were used to correct for the mild conditional heteroskedasticity and minor deviations from normality that these checks revealed.

Both the Random Forest and Bayesian VAR models underwent out-of-sample validation in order to assess generalisability. The dataset was divided into subsets for testing (20%) and training (80%). Mean Absolute Percentage Error (MAPE) and Root Mean Squared Error (RMSE) were used to evaluate performance, as reported in

Table 10. Both the Random Forest and Bayesian VAR models underwent out-of-sample validation in order to assess generalisability. The dataset was divided into subsets for testing (20%) and training (80%). Mean Absolute Percentage Error (MAPE) and Root Mean Squared Error (RMSE) were used to evaluate performance. The Random Forest model produced the lowest RMSE, which is consistent with its superior in-sample fit (R

2 = 0.904), but both models showed sufficient forecasting accuracy. This demonstrates how well the machine learning model captures intricate, non-linear interactions.

5. Discussion

Using a triangulated methodological framework consisting of the Generalised Method of Moments (GMM), Bayesian Vector Autoregression (VAR), and Random Forest regression, this study examines the complex relationship between economic freedom and real GDP per capita growth in the Western Balkans from 2013 to 2023. The empirical findings present a complex story of the interplay between fiscal dynamics, institutional quality, and economic inertia in the context of the region’s transition. The intricacy of post-socialist development, influenced by uneven reforms, EU conditionality, and enduring macroeconomic vulnerabilities, is reflected in these findings.

The GMM model provides the strongest indication of structural, linear effects. Both monetary freedom and property rights have statistically significant positive coefficients, highlighting their fundamental role in fostering macroeconomic discipline, investment confidence, and market trust. These findings are in line with empirical research like

Brkić et al. (

2020) and liberal economic theory (

Easton & Walker, 1997;

Dawson, 1998), which emphasises institutional security as a crucial growth enabler. Additionally,

Jaćimović et al. (

2025) contend that enabling infrastructure is necessary to support market institutions, which may account for the moderate magnitude of the effects that have been observed. The evidence indicates that institutional credibility plays a crucial role in influencing economic expectations, even though the coefficients indicate cross-country variation in the strength of reforms.

The detrimental and substantial impact of government integrity is among the most surprising conclusions drawn from the GMM estimates. This result diverges from mainstream assumptions that transparency and anti-corruption reforms unambiguously support economic performance (

Mo, 2001;

Herrera-Echeverri et al., 2014). The transitional costs of reform could be one reason. According to

Delova-Jolevska et al. (

2024), anti-corruption campaigns in weak governance environments have the potential to upend informal networks and undermine administrative capacity. Additionally, it is possible that perception-based governance indices do not adequately account for institutional changes occurring behind the scenes, which begs the question of whether the negative coefficient represents actual decline or transient friction in reform paths.

Government spending emerges as another critical variable, exhibiting a negative and statistically significant effect in the GMM and dominating the Random Forest model in terms of predictive importance (IncNodePurity = 9.80). Since higher government spending results in lower Freedom Index scores, this suggests that expansionary fiscal policy may limit private sector activity or reflect allocative inefficiencies if it is not delivered effectively. This is in line with

Slesman et al. (

2019) and

Bajrami et al. (

2022), who warn that sizable public sectors can obstruct competition.

Radulović and Kostić (

2024) observe that fiscal expansion frequently makes up for inadequate structural reforms in the Western Balkans, which can stifle long-term growth prospects even though it has short-term stabilising effects.

Importantly, a new level of analytical depth is added by including fiscal balance indicators. Significantly and favourably, the government budget deficit enters the GMM model, indicating that moderate fiscal loosening, possibly countercyclical, can boost economic activity, especially in post-crisis or underperforming economies. On the other hand, public debt has a detrimental and substantial impact, highlighting the longer-term dangers connected to fiscal irresponsibility. A classic Keynesian tension is reflected in this duality: short-term stimulus may increase demand, but debt accumulation eventually hinders growth by raising borrowing costs, reducing policy space, and raising investor scepticism. This asymmetry is further supported by the Random Forest model, which places debt in the top two growth predictors. These findings imply that fiscal policy functions under severe limitations in the Western Balkans, where structural vulnerability and short-term manoeuvrability coexist.

Another area where models differ is in business freedom. In the Random Forest analysis, it ranks second in importance, despite being statistically insignificant in the GMM specification. Perhaps regulatory ease only produces quantifiable economic benefits when paired with strong enforcement mechanisms, infrastructure, or enterprise capacity. This suggests a non-linear or threshold-based relationship with growth (

Jaćimović et al., 2025;

Vërbovci et al., 2024). Reforms may not gain traction in these situations unless they are supported by institutional clarity and depth.

With economic freedom variables mainly failing to show significant direct effects, the Bayesian VAR model presents a more muted image. As noted by

Canale and Liotti (

2025), the model is dominated by autoregressive terms instead, indicating strong path dependency in growth performance. The structural variables seem to be overpowered by historical inertia, despite the model’s high R

2 (0.9984) indicating excellent in-sample fit. The VAR framework’s limitations in capturing structural shocks within brief panels or the gradual and cumulative nature of institutional change could be reflected in this. The policy frameworks imposed by Stabilisation and Association Agreements (SAAs) may encourage economic liberalisation, but their short-term growth impact is limited due to poor implementation, according to

Jusufi and Qorraj (

2025), who provide context.

There are recurring themes in every model. Property rights and monetary freedom continuously promote growth, reaffirming the importance of price stability and institutional predictability. Public debt and government spending are shown to be both significant and troublesome factors that can affect growth but also carry the risk of inefficiency and long-term financial difficulties. The conditional importance of government integrity and business freedom suggests that they may have indirect effects on economic outcomes or non-linearities. According to

Cengiz and Manga (

2024), liberalisation might not be enough for middle-income economies dealing with the effects of globalisation; sectoral upgrading and structural change are necessary to prevent premature de-industrialisation.

The wider implication is that the institutional and fiscal complexity of economic growth in the Western Balkans may be underestimated by linear models alone. Reform signals are frequently unclear or diluted due to political cycles, legacy institutions, and EU-driven reform fatigue. The stakes go beyond GDP, as

Wencong et al. (

2023) contend that economic freedom may moderate broader developmental outcomes, such as environmental and social dimensions.

Larger panels, more detailed datasets, and interaction terms that can identify institutional complementarities would all be advantageous for future studies. It may also be possible to identify the precise mechanisms through which fiscal policy and economic freedom impact growth by incorporating additional controls, such as those related to inflation, investment, and unemployment. In the end, the results indicate that in order to unlock sustainable growth in the Western Balkans, liberal market reforms, while still crucial, must be incorporated into cogent governance structures and sustainable fiscal frameworks.

6. Conclusions

In this study, a triangulated analytical approach comprising the Generalised Method of Moments (GMM), Bayesian Vector Autoregression (VAR), and Random Forest regression was used to examine the relationship between economic freedom and real GDP per capita growth in six Western Balkan countries between 2013 and 2023. The results show a complicated and context-sensitive environment where market-oriented reforms promote economic growth in some circumstances but are ineffectual or even detrimental in others. The conflicts present in post-socialist transitions, outside integration forces, and enduring institutional inertia are all reflected in this complex image.

The significance of property rights and monetary freedom as statistically significant growth-enhancing factors is highlighted by the GMM results. While legal certainty surrounding ownership promotes capital formation and market participation, price stability and reliable monetary frameworks create a predictable macroeconomic environment, which is essential in situations where the economy is unstable. These results are consistent with both modern empirical research and classical liberal viewpoints. But the model also yields unexpected findings. Instead of promoting growth, government integrity has the opposite effect, indicating that anti-corruption initiatives may temporarily upend established networks or lead to institutional instability. Similar to this, government spending has a major detrimental effect and probably indicates inefficient allocation, a lack of private investment, or inadequate accountability in the management of public resources.

Important explanatory power is added by integrating fiscal burden variables, particularly the public debt and government budget deficit. Because of its countercyclical function, a moderate deficit seems to boost short-term growth, but high debt levels have a statistically significant negative impact. This dichotomy encapsulates a significant fiscal conflict: governments can support output through budgetary flexibility, but sustained debt accumulation runs the risk of jeopardising sustainability over the long run. These results emphasise how crucial it is to differentiate between short-term stabilisation instruments and long-term fiscal restraint when formulating growth plans.

Strong autoregressive terms dominate the Bayesian VAR model, which presents a more muted picture. Future results are heavily influenced by past GDP growth, indicating that Western Balkan economies are path-dependent and slow to adapt to structural changes. Despite fiscal variables’ weak significance, economic freedom indicators have a modest overall impact, most likely as a result of the model’s linear constraints or their gradual nature. This supports the notion that it might take longer for institutional reforms to become established and produce quantifiable macroeconomic benefits.

The Random Forest model, on the other hand, ranks government spending, public debt, business freedom, and property rights among the top predictors, demonstrating its proficiency in detecting non-linearities and interaction effects. This method captures complexities like conditional dependencies and threshold effects that are overlooked by conventional econometric models. Significantly, factors like business freedom that are not important in linear models turn out to be strong predictors, indicating that regulatory changes might not be effective until institutional support systems (like the rule of law and infrastructure) reach a critical mass.

When combined, these models demonstrate that although economic freedom can spur growth, its effects are variable, non-linear, and conditional. The effectiveness of liberalisation strategies is mediated by fiscal credibility, policy sequencing, and institutional maturity. Furthermore, taking debt dynamics into account shows that fiscal stability is an essential part of the growth process rather than just an external restraint.

This study is constrained by its relatively short panel (66 observations over 11 years) and the exclusion of other control variables like inflation, investment rates, or political stability, despite its analytical prowess. Especially in transitional economies, these variables may have a substantial impact on the relationship between economic freedom and growth. Furthermore, although the five fundamental aspects of economic freedom were examined, significant supplementary policies, like labour flexibility, trade regimes, and regulations governing foreign direct investment, were left out.

6.1. Policy Recommendations

Enhance property rights by enacting laws that protect ownership titles, encourage judicial independence, and expedite the registration of contracts and land.

Reallocate public funds to productive investments in infrastructure, digitisation, and human capital development instead of ineffective subsidies and ongoing expenses.

To reduce transitional disruption and foster long-term institutional trust, phase in anti-corruption measures using digital tools, civic engagement platforms, and capacity-building initiatives.

Simplify business laws to encourage innovation and entrepreneurship, particularly for SMEs in cutting-edge industries like ICT and green technology.

Maintaining independent central banks and putting in place inflation-targeting schemes that boost investor confidence and macroeconomic predictability will help to ensure monetary stability.

Invest in predictive analytics, real-time statistical systems, and performance-based monitoring of institutional reforms to embrace data-driven policymaking.

6.2. Limitations and Future Research Directions

The size and granularity of the panel dataset restrict this study’s scope by limiting the ability to fully capture dynamic feedback mechanisms and cross-country heterogeneity. Specifically, omitted variable bias may arise from the failure to include important macro-structural controls like capital formation, exchange rates, and inflation. Furthermore, even though this study contains two important fiscal indicators, it does not look at more general facets of public finance, such as tax structure, off-budget liabilities, and debt service ratios. Future studies should think about using more post-transition economies in the country sample, extending the time series, and using sophisticated modelling techniques like agent-based simulations or neural networks. Deeper understanding may also be obtained by examining regional differences within nations as well as sectoral-level effects (such as those in manufacturing, services, and agriculture). The relationship between economic freedom and environmental or social outcomes also merits investigation, especially in light of the increasing importance of sustainability, governance, and resilience in global development agendas.

The effectiveness of economic freedom ultimately depends on prudent fiscal management, institutional depth, and strategic sequencing, even though it is still a fundamental component of contemporary growth strategies. This lesson is especially important for the Western Balkans as they balance the demands of both external alignment and internal reform.