Herding Behavior, ESG Disclosure, and Financial Performance: Rethinking Sustainability Reporting to Address Climate-Related Risks in ASEAN Firms

Abstract

1. Introduction

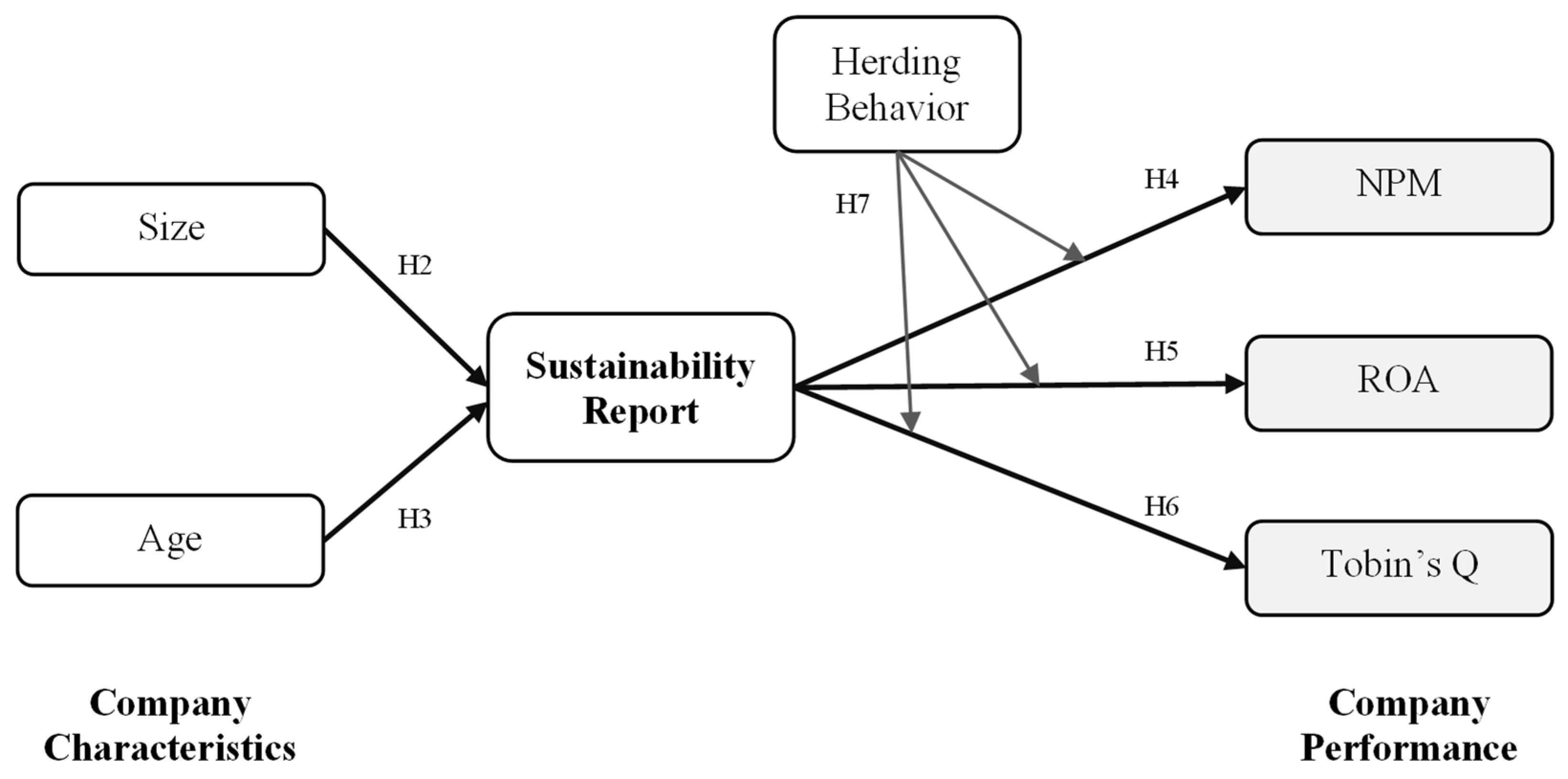

2. Literature Review, Theoretical Framework, and Hypothesis

2.1. Herding Behavior in Capital Structure Decisions

2.2. Company Characteristics and Sustainability Reporting

2.3. Sustainability Reporting and Corporate Financial Performance

2.4. Herding Behavior’s Moderating Role in Sustainability Reporting and Corporate Financial Performance

2.5. Theoretical Framework and Hypotheses

3. Materials and Methods

4. Results

4.1. Descriptive Statistics

4.2. Herding Behavior Analysis

4.3. Measurement Model Evaluation

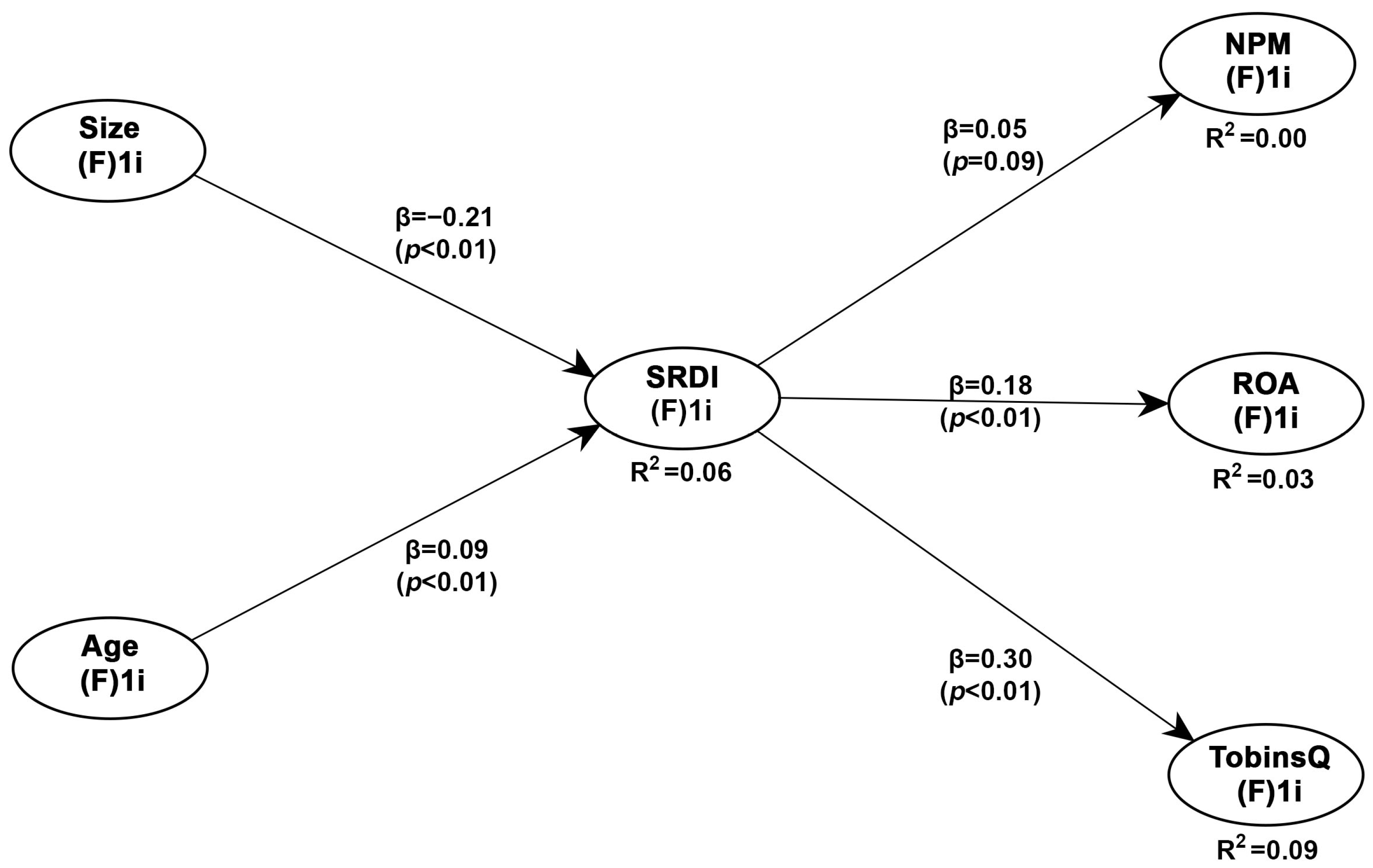

4.4. Structural Model Results

4.5. Multigroup Analysis by Country

4.6. Moderating Effect of Herding Behavior

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Agarwala, N., Pareek, R., & Sahu, T. N. (2024). Do firm attributes impact CSR participation? Evidence from a developing economy. International Journal of Emerging Markets, 19(12), 4526–4542. [Google Scholar] [CrossRef]

- Aharon, D. Y. (2021). Uncertainty, fear and herding behavior: Evidence from size-ranked portfolios. Journal of Behavioral Finance, 22(3), 320–337. [Google Scholar] [CrossRef]

- Ahmad, M., & Wu, Q. (2022). Does herding behavior matter in investment management and perceived market efficiency? Evidence from an emerging market. Management Decision, 60(8), 2148–2173. [Google Scholar] [CrossRef]

- Al Hawaj, A. Y., & Buallay, A. M. (2022). A worldwide sectorial analysis of sustainability reporting and its impact on firm performance. Journal of Sustainable Finance & Investment, 12(1), 62–86. [Google Scholar] [CrossRef]

- Ali, A., & Abdelfettah, B. (2019). Financial disclosure information, board of directors, and firm characteristics among French CAC 40 listed firms. Journal of the Knowledge Economy, 10(3), 941–957. [Google Scholar] [CrossRef]

- Al Natour, A. R., Meqbel, R., Kayed, S., & Zaidan, H. (2022). The role of sustainability reporting in reducing information asymmetry: The case of family- and non-family-controlled firms. Sustainability, 14(11), 6644. [Google Scholar] [CrossRef]

- Alodat, A. Y., Salleh, Z., Hashim, H. A., & Sulong, F. (2024). Sustainability disclosure and firms’ performance in a voluntary environment. Measuring Business Excellence, 28(1), 105–121. [Google Scholar] [CrossRef]

- Al-Qudah, A. A., & Houcine, A. (2024). Firms’ characteristics, corporate governance, and the adoption of sustainability reporting: Evidence from Gulf Cooperation Council countries. Journal of Financial Reporting and Accounting, 22(2), 392–415. [Google Scholar] [CrossRef]

- Alsahali, K. F., & Malagueño, R. (2022). An empirical study of sustainability reporting assurance: Current trends and new insights. Journal of Accounting & Organizational Change, 18(5), 617–642. [Google Scholar] [CrossRef]

- Ang, H. S. (2024). Sustainable environmental, social and governance (ESG) development of China and ASEAN in a volatile, uncertain, complex, and ambiguous (VUCA) world. Global Policy, 15(S6), 106–112. [Google Scholar] [CrossRef]

- Aruta, J. J. B. R., & Paceño, J. L. (2021). Social Responsibility facilitates the intergenerational transmission of attitudes toward green purchasing in a non-western country: Evidence from the Philippines. Ecopsychology, 14(1), 37–46. [Google Scholar] [CrossRef]

- Bansal, M., Samad, T. A., & Bashir, H. A. (2021). The sustainability reporting-firm performance nexus: Evidence from a threshold model. Journal of Global Responsibility, 12(4), 491–512. [Google Scholar] [CrossRef]

- Barral, M. A. A. (2024). The nexus between trade and investment, ESG, and SDG (No. 2024-28). PIDS Discussion Paper Series. PIDS. [Google Scholar] [CrossRef]

- Bebbington, J., Larrinaga-González, C., & Moneva-Abadía, J. M. (2008). Legitimating reputation/the reputation of legitimacy theory. Accounting, Auditing & Accountability Journal, 21(3), 371–374. [Google Scholar] [CrossRef]

- Benameur, K. B., Mostafa, M. M., Hassanein, A., Shariff, M. Z., & Al-Shattarat, W. (2024). Sustainability reporting scholarly research: A bibliometric review and a future research agenda. Management Review Quarterly, 74(2), 823–866. [Google Scholar] [CrossRef]

- Beyer, A., Cohen, D. A., Lys, T. Z., & Walther, B. R. (2010). The financial reporting environment: Review of the recent literature. Journal of Accounting and Economics, 50(2), 296–343. [Google Scholar] [CrossRef]

- Bhatia, A., & Tuli, S. (2017). Corporate attributes affecting sustainability reporting: An Indian perspective. International Journal of Law and Management, 59(3), 322–340. [Google Scholar] [CrossRef]

- Bikhchandani, S., & Sharma, S. (2000). Herd behavior in financial markets. IMF Staff Papers, 47(3), 279–310. [Google Scholar] [CrossRef]

- Bo, H., Li, T., & Sun, Y. (2016). Board attributes and herding in corporate investment: Evidence from Chinese-listed firms. The European Journal of Finance, 22(4–6), 432–462. [Google Scholar] [CrossRef]

- Bocken, N. M. P., Rana, P., & Short, S. W. (2015). Value mapping for sustainable business thinking. Journal of Industrial and Production Engineering, 32(1), 67–81. [Google Scholar] [CrossRef]

- Brendea, G., & Pop, F. (2019). Herding behavior and financing decisions in Romania. Managerial Finance, 45(6), 716–725. [Google Scholar] [CrossRef]

- Brunner, M., & Ostermaier, A. (2019). Peer influence on managerial honesty: The role of transparency and expectations. Journal of Business Ethics, 154(1), 127–145. [Google Scholar] [CrossRef]

- Buallay, A., El Khoury, R., & Hamdan, A. (2021). Sustainability reporting in smart cities: A multidimensional performance measures. Cities, 119, 103397. [Google Scholar] [CrossRef]

- Cai, F., Han, S., Li, D., & Li, Y. (2019). Institutional herding and its price impact: Evidence from the corporate bond market. Journal of Financial Economics, 131(1), 139–167. [Google Scholar] [CrossRef]

- Camara, O. (2017). Industry herd behaviour in financing decision making. Journal of Economics and Business, 94, 32–42. [Google Scholar] [CrossRef]

- Chen, J. (2024). Market reaction to mandatory sustainability disclosures: Evidence from Singapore. Journal of Applied Accounting Research, 25(3), 748–775. [Google Scholar] [CrossRef]

- Chiang, T. C., & Zheng, D. (2010). An empirical analysis of herd behavior in global stock markets. Journal of Banking and Finance, 34(8), 1911–1921. [Google Scholar] [CrossRef]

- Christensen, H. B., Hail, L., & Leuz, C. (2021). Mandatory CSR and sustainability reporting: Economic analysis and literature review. Review of Accounting Studies, 26(3), 1176–1248. [Google Scholar] [CrossRef]

- Chung, R., Bayne, L., & Birt, J. (2024). The impact of environmental, social and governance (ESG) disclosure on firm financial performance: Evidence from Hong Kong. Asian Review of Accounting, 32(1), 136–165. [Google Scholar] [CrossRef]

- Clark, G. L., Feiner, A., & Viehs, M. (2015). From the stockholder to the stakeholder: How sustainability can drive financial outperformance. SSRN. Available online: https://ssrn.com/abstract=2508281 (accessed on 18 July 2024). [CrossRef]

- Clarkson, P. M., Li, Y., Richardson, G. D., & Vasvari, F. P. (2008). Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Accounting, Organizations and Society, 33(4), 303–327. [Google Scholar] [CrossRef]

- Cohen, J. (1988). Statistical power analysis for the behavioral sciences. Erlbaum. [Google Scholar]

- Connelly, B. L., Certo, S. T., Ireland, R. D., & Reutzel, C. R. (2010). Signaling theory: A review and assessment. Journal of Management, 37(1), 39–67. [Google Scholar] [CrossRef]

- Correa-Garcia, J. A., Garcia-Benau, M. A., & Garcia-Meca, E. (2020). Corporate governance and its implications for sustainability reporting quality in Latin American business groups. Journal of Cleaner Production, 260, 121142. [Google Scholar] [CrossRef]

- De Mendonca, T., & Zhou, Y. (2020). When companies improve the sustainability of the natural environment: A study of large U.S. companies. Business Strategy and the Environment, 29(3), 801–811. [Google Scholar] [CrossRef]

- Desai, R. (2022). Determinants of corporate carbon disclosure: A step towards sustainability reporting. Borsa Istanbul Review, 22(5), 886–896. [Google Scholar] [CrossRef]

- Dhaliwal, D. S., Li, O. Z., Tsang, A., & Yang, Y. G. (2011). Voluntary nonfinancial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting. The Accounting Review, 86(1), 59–100. [Google Scholar] [CrossRef]

- Di Leo, A., Sfodera, F., Cucari, N., Mattia, G., & Dezi, L. (2023). Sustainability reporting practices: An explorative analysis of luxury fashion brands. Management Decision, 61(5), 1274–1297. [Google Scholar] [CrossRef]

- DiMaggio, P. J., & Powell, W. W. (1983). The iron cage revisited institutional isomorphism and collective rationality in organizational fields. American Sociological Review, 48(2), 147–160. [Google Scholar] [CrossRef]

- Dincer, B., Keskin, A. İ., & Dincer, C. (2023). Nexus between sustainability reporting and firm performance: Considering industry groups, accounting, and market measures. Sustainability, 15(7), 5849. [Google Scholar] [CrossRef]

- Do, B., & Nguyen, N. (2020). The links between proactive environmental strategy, competitive advantages and firm performance: An empirical study in Vietnam. Sustainability, 12(12), 4962. [Google Scholar] [CrossRef]

- Eccles, R. G., Ioannou, I., & Serafeim, G. (2014). The impact of corporate sustainability on organizational processes and performance. Management Science, 60(11), 2835–2857. [Google Scholar] [CrossRef]

- Economou, F., Hassapis, C., & Philippas, N. (2018). Investors’ fear and herding in the stock market. Applied Economics, 50(34–35), 3654–3663. [Google Scholar] [CrossRef]

- Ezeoha, A. E. (2011). Firm versus industry financing structures in Nigeria. African Journal of Economic and Management Studies, 2(1), 42–55. [Google Scholar] [CrossRef]

- Fandella, P., Sergi, B. S., & Sironi, E. (2023). Corporate social responsibility performance and the cost of capital in BRICS countries. The problem of selectivity using environmental, social and governance scores. Corporate Social Responsibility and Environmental Management, 30(4), 1712–1722. [Google Scholar] [CrossRef]

- Farisyi, S., Musadieq, M. A., Utami, H. N., & Damayanti, C. R. (2022). A systematic literature review: Determinants of sustainability reporting in developing countries. Sustainability, 14(16), 10222. [Google Scholar] [CrossRef]

- Fisch, J. E. (2018). Making sustainability disclosure sustainable. Georgetown Law Journal, 107, 923–966. [Google Scholar]

- Friede, G., Busch, T., & Bassen, A. (2015). ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance & Investment, 5(4), 210–233. [Google Scholar] [CrossRef]

- Friske, W., Hoelscher, S. A., & Nikolov, A. N. (2023). The impact of voluntary sustainability reporting on firm value: Insights from signaling theory. Journal of the Academy of Marketing Science, 51(2), 372–392. [Google Scholar] [CrossRef]

- Frynas, J. G., & Yamahaki, C. (2016). Corporate social responsibility: Review and roadmap of theoretical perspectives. Business Ethics: A European Review, 25(3), 258–285. [Google Scholar] [CrossRef]

- Gallo, P. J., & Christensen, L. J. (2011). Firm size matters: An empirical investigation of organizational size and ownership on sustainability-related behaviors. Business & Society, 50(2), 315–349. [Google Scholar] [CrossRef]

- Gavrilakis, N., & Floros, C. (2023). ESG performance, herding behavior and stock market returns: Evidence from Europe. Operational Research, 23(1), 3. [Google Scholar] [CrossRef]

- Ghorbel, A., Snene, Y., & Frikha, W. (2023). Does herding behavior explain the contagion of the COVID-19 crisis? Review of Behavioral Finance, 15(6), 889–915. [Google Scholar] [CrossRef]

- Githaiga, P. N., & Kosgei, J. K. (2023). Board characteristics and sustainability reporting: A case of listed firms in East Africa. Corporate Governance: The International Journal of Business in Society, 23(1), 3–17. [Google Scholar] [CrossRef]

- Godha, A., & Jain, P. (2015). Sustainability reporting trend in Indian companies as per GRI framework: A comparative study. South Asian Journal of Business and Management Cases, 4(1), 62–73. [Google Scholar] [CrossRef]

- Greenwood, N., & Warren, P. (2022). Climate risk disclosure and climate risk management in UK asset managers. International Journal of Climate Change Strategies and Management, 14(3), 272–292. [Google Scholar] [CrossRef]

- GRI. (2013). GRI G4; G4 sustainability reporting guidelines: Reporting principles and standard disclosures. Global Reporting Initiative. [Google Scholar]

- GRI. (2021). Consolidated set of GRI sustainability reporting standards 2020. Available online: https://www.globalreporting.org/how-to-use-the-gri-standards/resource-center/ (accessed on 21 March 2024).

- Gutiérrez-Ponce, H., & Wibowo, S. A. (2024). Do sustainability practices contribute to the financial performance of banks? An analysis of banks in Southeast Asia. Corporate Social Responsibility and Environmental Management, 31(2), 1418–1432. [Google Scholar] [CrossRef]

- Hair, J. F., Hult, G. T. M., Ringle, C. M., & Sarstedt, M. (2017). A primer on partial least squares structural equation modeling (PLS-SEM). Sage Publications, Inc. [Google Scholar]

- Haladu, A., & Bin-Nashwan, S. A. (2022). The moderating effect of environmental agencies on firms’ sustainability reporting in Nigeria. Social Responsibility Journal, 18(2), 388–402. [Google Scholar] [CrossRef]

- Handoyo, S., & Anas, S. (2024). The effect of environmental, social, and governance (ESG) on firm performance: The moderating role of country regulatory quality and government effectiveness in ASEAN. Cogent Business & Management, 11(1), 2371071. [Google Scholar] [CrossRef]

- He, W., & Wang, Q. (2020). The peer effect of corporate financial decisions around split share structure reform in China. Review of Financial Economics, 38(3), 474–493. [Google Scholar] [CrossRef]

- Hejazi, R., Ghanbari, M., & Alipour, M. (2016). Intellectual, human and structural capital effects on firm performance as measured by Tobin’s Q. Knowledge and Process Management, 23(4), 259–273. [Google Scholar] [CrossRef]

- Herbert, S., & Graham, M. (2022). Applying legitimacy theory to understand sustainability reporting behaviour within South African integrated reports. South African Journal of Accounting Research, 36(2), 147–169. [Google Scholar] [CrossRef]

- Higgins, C., & Larrinaga, C. (2014). Sustainability reporting: Insights from institutional theory. In J. Unerman, J. Bebbington, & B. O’Dwyer (Eds.), Sustainability accounting and accountability (p. 13). Routledge. [Google Scholar]

- Ioannou, I., & Serafeim, G. (2019). Corporate sustainability: A strategy? Harvard Business School Accounting & Management Unit Working Paper, 19-065. Harvard Business School. [Google Scholar]

- Jamil, A., Mohd Ghazali, N. A., & Puat Nelson, S. (2021). The influence of corporate governance structure on sustainability reporting in Malaysia. Social Responsibility Journal, 17(8), 1251–1278. [Google Scholar] [CrossRef]

- Jensen, M. C., & Meckling, W. F. (1976). Theory of the firm: Managerial behavior, agency costs, and ownership structure. Journal of Financial Economics, 3, 305–360. [Google Scholar] [CrossRef]

- Jiang, H. A. O., & Verardo, M. (2018). Does herding behavior reveal skill? An analysis of mutual fund performance. The Journal of Finance, 73(5), 2229–2269. [Google Scholar] [CrossRef]

- Jirasakuldech, B., & Emekter, R. (2021). Empirical analysis of investors’ herding behaviours during the market structural changes and crisis events: Evidence from Thailand. Global Economic Review, 50(2), 139–168. [Google Scholar] [CrossRef]

- Khan, M., Serafeim, G., & Yoon, A. (2016). Corporate sustainability: First evidence on materiality. The Accounting Review, 91(6), 1697–1724. [Google Scholar] [CrossRef]

- Kim, J., & Kim, J. (2018). Corporate sustainability management and its market benefits. Sustainability, 10(5), 1455. [Google Scholar] [CrossRef]

- Kock, N., & Lynn, G. (2012). Lateral collinearity and misleading results in variance-based SEM: An illustration and recommendations. Journal of the Association for Information Systems, 13(7), 546–580. [Google Scholar] [CrossRef]

- Komalasari, P. T., Asri, M., Purwanto, B. M., & Setiyono, B. (2022). Herding behaviour in the capital market: What do we know and what is next? Management Review Quarterly, 72(3), 745–787. [Google Scholar] [CrossRef]

- Kumar, K., Kumari, R., Poonia, A., & Kumar, R. (2023). Factors influencing corporate sustainability disclosure practices: Empirical evidence from Indian National Stock Exchange. Journal of Financial Reporting and Accounting, 21(2), 300–321. [Google Scholar] [CrossRef]

- Kusumawati, N. D. (2024). Balancing profit and planet: How ESG criteria are reshaping capital structure in Indonesia. Jurnal Mebis, 4(2 SE-Articles), 208–213. Available online: https://mebis.upnjatim.ac.id/index.php/mebis/article/view/612 (accessed on 15 April 2025).

- Lee, M. T., & Raschke, R. L. (2020). Innovative sustainability and stakeholders’ shared understanding: The secret sauce to “performance with a purpose”. Journal of Business Research, 108, 20–28. [Google Scholar] [CrossRef]

- Liu, J., Xie, X., Yu, D., & Tang, L. (2023). Peer effects and the mechanisms in corporate capital structure: Evidence from Chinese listed firms. Oeconomia Copernicana, 14(1), 295–326. [Google Scholar] [CrossRef]

- MacKenzie, S. B., Podsakoff, P. M., & Jarvis, C. B. (2005). The problem of measurement model misspecification in behavioral and organizational research and some recommended solutions. The Journal of Applied Psychology, 90(4), 710–730. [Google Scholar] [CrossRef] [PubMed]

- Marano, V., Tashman, P., & Kostova, T. (2017). Escaping the iron cage: Liabilities of origin and CSR reporting of emerging market multinational enterprises. Journal of International Business Studies, 48(3), 386–408. [Google Scholar] [CrossRef]

- Meyer, J. W., & Rowan, B. (1977). Institutionalized organizations: Formal structure as myth and ceremony. American Journal of Sociology, 83(2), 340–363. [Google Scholar] [CrossRef]

- Mihai, F., & Aleca, O. E. (2023). Sustainability reporting based on GRI standards within organizations in Romania. Electronics, 12(3), 690. [Google Scholar] [CrossRef]

- Misani, N. (2010). The convergence of corporate social responsibility practices. Management Research Review, 33(7), 734–748. [Google Scholar] [CrossRef]

- Modigliani, F., & Miller, M. H. (1958). The cost of capital, corporation finance and the theory of investment. The American Economic Review, 48(3), 261–297. [Google Scholar]

- Mohammad, W. M. W., & Wasiuzzaman, S. (2021). Environmental, social and governance (ESG) disclosure, competitive advantage and performance of firms in Malaysia. Cleaner Environmental Systems, 2, 100015. [Google Scholar] [CrossRef]

- Negera, M., Alemu, T., Hagos, F., & Haileslassie, A. (2025). Does financial inclusion enhance farmers’ resilience to climate change? Evidence from rural Ethiopia. Sustainable Development, 33(2), 3008–3022. [Google Scholar] [CrossRef]

- Orazalin, N., & Mahmood, M. (2020). Determinants of GRI-based sustainability reporting: Evidence from an emerging economy. Journal of Accounting in Emerging Economies, 10(1), 140–164. [Google Scholar] [CrossRef]

- Pais, M. F. (2017). Do managers herd when choosing the firm’s capital structure? Evidence from a small European economy. Universidade do Porto (Portugal). [Google Scholar]

- Pauline, K., Ferrer, F. S., & Karen, G. (2019). Sustainability initiatives of the SEC Philippines. Nomura Journal of Asian Capital Markets, 4(1), 14–18. [Google Scholar]

- Prashar, A. (2023). Moderating effects on sustainability reporting and firm performance relationships: A meta-analytical review. International Journal of Productivity and Performance Management, 72(4), 1154–1181. [Google Scholar] [CrossRef]

- Prisandani, U. Y. (2022). Shareholder activism in Indonesia: Revisiting shareholder rights implementation and future challenges. International Journal of Law and Management, 64(2), 225–238. [Google Scholar] [CrossRef]

- Rahmaniati, N. P. G., & Ekawati, E. (2024). The role of Indonesian regulators on the effectiveness of ESG implementation in improving firms’ non-financial performance. Cogent Business and Management, 11(1), 2293302. [Google Scholar] [CrossRef]

- Ramadhani, D. (2019). Understanding environment, social and governance (ESG) factors as path toward ASEAN sustainable finance. APMBA (Asia Pacific Management and Business Application), 7(3), 147–162. [Google Scholar] [CrossRef]

- Rudyanto, A., & Siregar, S. V. (2018). The effect of stakeholder pressure and corporate governance on the sustainability report quality. International Journal of Ethics and Systems, 34(2), 233–249. [Google Scholar] [CrossRef]

- Saeed, A., Thanakijsombat, T., Rind, A. A., & Sarang, A. A. A. (2024). Herding behavior in environmental orientation: A tale of emission, innovation and resource handling. Journal of Cleaner Production, 444, 141251. [Google Scholar] [CrossRef]

- Sarstedt, M., Ringle, C. M., & Hair, J. F. (2017). Partial least squares structural equation modeling. In Handbook of market research. Springer. [Google Scholar]

- Schreck, P., & Raithel, S. (2015). Corporate social performance, firm size, and organizational visibility: Distinct and joint effects on voluntary sustainability reporting. Business & Society, 57(4), 742–778. [Google Scholar] [CrossRef]

- Shah, M. U. D., Shah, A., & Khan, S. U. (2017). Herding behavior in the Pakistan stock exchange: Some new insights. Research in International Business and Finance, 42, 865–873. [Google Scholar] [CrossRef]

- Shah, S. S. H., Khan, M. A., Ahmed, M., Meyer, D. F., & Oláh, J. (2024). A micro-level evidence of how investor and manager herding behavior influence the firm financial performance. Sage Open, 14(1), 21582440231219358. [Google Scholar] [CrossRef]

- Shah, S. S. H., Khan, M. A., Meyer, N., Meyer, D. F., & Oláh, J. (2019). Does herding bias drive the firm value? Evidence from the Chinese equity market. Sustainability, 11(20), 5583. [Google Scholar] [CrossRef]

- Shiller, R. J. (2003). From efficient markets theory to behavioral finance. Journal of Economic Perspectives, 17(1), 83–104. [Google Scholar] [CrossRef]

- Simoni, L., Bini, L., & Bellucci, M. (2020). Effects of social, environmental, and institutional factors on sustainability report assurance: Evidence from European countries. Meditari Accountancy Research, 28(6), 1059–1087. [Google Scholar] [CrossRef]

- Spence, M. (1973). Job market signaling. The Quarterly Journal of Economics, 87(3), 355–374. [Google Scholar] [CrossRef]

- Stone, M. (1974). Cross-validatory choice and assessment of statistical predictions. Journal of the Royal Statistical Society: Series B (Methodological), 36(2), 111–133. [Google Scholar] [CrossRef]

- Swarnapali, R. (2020). Consequences of corporate sustainability reporting: Evidence from an emerging market. International Journal of Law and Management, 62(3), 243–265. [Google Scholar] [CrossRef]

- Tang, K. H. D. (2023). A review of environmental, social and governance (ESG) regulatory frameworks: Their implications on Malaysia. Tropical Aquatic and Soil Pollution, 3(2), 168–183. [Google Scholar] [CrossRef]

- Terdpaopong, K., Nguyen, T. T. H., & Yang, Y. (2025). Financial determinants of ESG disclosures: An empirical analysis of Thailand. In N. T. H. Nguyen, J. A. C. Santos, V. K. Solanki, & A. N. Mai (Eds.), Proceedings of the 5th International conference on research in management and technovation (pp. 303–320). Springer Nature Singapore. [Google Scholar] [CrossRef]

- Upaa, J., & Iorlaha, M. (2023). Sustainability disclosure and information asymmetry of listed industrial companies in Nigeria. International Journal of Accounting, Finance and Risk Management, 8(4), 134–142. [Google Scholar] [CrossRef]

- Vieito, J. P., Espinosa, C., Wong, W.-K., Batmunkh, M.-U., Choijil, E., & Hussien, M. (2024). Herding behavior in integrated financial markets: The case of MILA. International Journal of Emerging Markets, 19(11), 3801–3827. [Google Scholar] [CrossRef]

- Wakibi, A., Ntayi, J., Nkote, I., Tumwine, S., Nsereko, I., & Ngoma, M. (2024). Self-organization, networks and sustainable innovations in microfinance institutions: Does organizational resilience matter? IIMBG Journal of Sustainable Business and Innovation, 2(1), 1–23. [Google Scholar] [CrossRef]

- Wang, K., Yu, S., Mei, M., Yang, X., Peng, G., & Lv, B. (2023). ESG performance and corporate resilience: An empirical analysis based on the capital allocation efficiency perspective. Sustainability, 15(23), 16145. [Google Scholar] [CrossRef]

- Wang, L. (2023). Unlocking the link between company attributes and sustainability accounting in shanghai: Firm traits driving corporate transparency and stakeholder responsiveness. Frontiers in Environmental Science, 11, 1273445. [Google Scholar] [CrossRef]

- Wang, N., Pan, H., Feng, Y., & Du, S. (2024). How do ESG practices create value for businesses? Research review and prospects. Sustainability Accounting, Management and Policy Journal, 15(5), 1155–1177. [Google Scholar] [CrossRef]

- Wang, Q. (2023). Herding behavior and the dynamics of ESG performance in the European banking industry. Finance Research Letters, 58, 104640. [Google Scholar] [CrossRef]

- Xie, H., Ahmed, B., Hussain, A., Rehman, A., Ullah, I., & Khan, F. U. (2020). Sustainability reporting and firm performance: The demonstration of Pakistani firms. Sage Open, 10(3), 2158244020953180. [Google Scholar] [CrossRef]

- Yilmaz, I. (2021). Sustainability and financial performance relationship: International evidence. World Journal of Entrepreneurship, Management and Sustainable Development, 17(3), 537–549. [Google Scholar] [CrossRef]

- Younis, N. M. M. (2023). Sustainability reports and their impact on firm value: Evidence from Saudi Arabia. International Journal of Management and Sustainability, 12(2 SE-Articles), 70–83. [Google Scholar] [CrossRef]

- Youssef, M. (2022). Do oil prices and financial indicators drive the herding behavior in commodity markets? Journal of Behavioral Finance, 23(1), 58–72. [Google Scholar] [CrossRef]

- Zhao, D., Ngan, S. L., Jamil, A. H., Salleh, M. F., & Yusoff, W. S. (2025). Peer effects on ESG disclosure: Drivers and implications for sustainable corporate governance. Sustainability, 17(10), 4392. [Google Scholar] [CrossRef]

| Industry | Frequency | Percentage | Cumulative |

|---|---|---|---|

| Basic materials | 44 | 35.2% | 35.2% |

| Consumer goods | 14 | 11.2% | 46.4% |

| Consumer services | 5 | 4.0% | 50.4% |

| Industrials | 48 | 38.4% | 88.8% |

| Oil and gas | 8 | 6.4% | 95.2% |

| Healthcare | 1 | 0.8% | 96.0% |

| Real estate | 1 | 0.8% | 96.8% |

| Technology | 1 | 0.8% | 97.6% |

| Utilities | 3 | 2.4% | 100.0% |

| Total | 125 | 100.0% |

| Variable | Proxy/Indicator | Measurement | Source | Reference |

|---|---|---|---|---|

| Herding behavior | Managerial Herding Ratio (MHR) | Measured using the absolute deviation of the investment ratio model, where herding is indicated if company managers follow the investment decisions of their peers. The investment ratio is proxied by the Debt-to-Equity Ratio (DER). A lower deviation from the industry average indicates herding behavior. | Bloomberg Terminal | Bo et al. (2016); S. S. H. Shah et al. (2019) |

| Debt-to-Equity Ratio (DER) | Capital structure measure | Calculated as total liabilities divided by shareholders’ equity. Used as a proxy for investment ratio. | Bloomberg Terminal | Modigliani and Miller (1958); Fandella et al. (2023) |

| Company Size | Total Assets | Measured as the natural logarithm of total assets. | Bloomberg Terminal | Al-Qudah and Houcine (2024); Gallo and Christensen (2011) |

| Company Age | Years since establishment | Calculated as the difference between the observation year and the year of establishment. | Bloomberg Terminal | Correa-Garcia et al. (2020); Prashar (2023) |

| Sustainability Reporting | Sustainability Report Disclosure Index (SRDI) | Measured by assessing the extent of disclosures based on GRI-G4 guidelines. Each disclosed item scores 1; undisclosed items score 0. The SRDI score is calculated by dividing the total disclosed indicators by the maximum of 91 indicators, then converting the result into a percentage. | Bloomberg Terminal | Di Leo et al. (2023); Pais (2017) |

| Net Profit Margin (NPM) | Profitability indicator | Measured as net profit divided by total revenue, expressed as a percentage. | Bloomberg Terminal | Buallay et al. (2021) |

| Return on Assets (ROA) | Financial performance indicator | Calculated as net income divided by total assets, expressed as a percentage. | Bloomberg Terminal | Buallay et al. (2021) |

| Tobin’s Q | Market-based performance indicator | Measured as the ratio of the firm’s market value (equity and debt) to total assets. | Bloomberg Terminal | Gutiérrez-Ponce and Wibowo (2024); Hejazi et al. (2016) |

| Moderating Variable (Leader– Follower Classification) | MHR-based and SRDI-based classification | MHR-based: companies with DER closest to the industry average are classified as leaders (Dummy = 1), while those with significantly different DER values are classified as followers (Dummy = 0). SRDI-based: companies ranked in the top 50% of SRDI scores are classified as leaders (Dummy = 1); those in the bottom 50% are followers (Dummy = 0). | Bloomberg Terminal | Bo et al. (2016); Di Leo et al. (2023); Pais (2017) |

| Variable | Mean | Minimum | Maximum | Std. Deviation |

|---|---|---|---|---|

| Size (in billion) | 29.0781 | 0.4339 | 43.7756 | 5.9707 |

| Age (years) | 50.2491 | 6.0000 | 195.0000 | 28.7374 |

| Sustainability Report (SRDI, %) | 51.6484 | 5.4945 | 91.2088 | 16.1538 |

| NPM (%) | 8.0836 | −90.1960 | 636.2842 | 26.9092 |

| ROA (%) | 5.0962 | −53.3193 | 132.5552 | 9.3536 |

| Tobin’s Q | 1.6523 | −0.3806 | 7.4046 | 1.1236 |

| Years | Basic Materials (Total 44) | Consumer Goods (Total 14) | Consumer Services (Total 5) | Industrials (Total 48) | Oil and Gas (Total 8) | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 0 | 1 | 0 | 1 | 0 | 1 | 0 | 1 | 0 | |

| 2018 | 8 | 36 | 4 | 10 | 3 | 2 | 14 | 34 | 3 | 5 |

| 2019 | 11 | 33 | 5 | 9 | 2 | 3 | 14 | 34 | 2 | 6 |

| 2020 | 17 | 27 | 6 | 8 | 2 | 3 | 15 | 33 | 1 | 7 |

| 2021 | 15 | 29 | 4 | 10 | 2 | 3 | 12 | 36 | 2 | 6 |

| 2022 | 11 | 33 | 7 | 7 | 2 | 3 | 14 | 34 | 2 | 6 |

| 2023 | 11 | 33 | 6 | 8 | 3 | 2 | 10 | 38 | 1 | 7 |

| 1 | 2 | 3 | 4 | 5 | 6 | |

|---|---|---|---|---|---|---|

| 1. Size | 1.000 | |||||

| 2. Age | 0.051 | 1.000 | ||||

| 3. Sustainability Report | −0.063 | 0.046 | 1.000 | |||

| 4. NPM | −0.026 | −0.032 | 0.038 | 1.000 | ||

| 5. ROA | −0.063 | −0.052 | 0.151 *** | 0.242 *** | 1.000 | |

| 6. Tobin’s Q | −0.089 ** | −0.045 | 0.271 *** | 0.067 | 0.210 *** | 1.000 |

| Indicator | Result | Criteria | Information |

|---|---|---|---|

| APC | 0.164 (p = <0.01) | p < 0.05 | Accepted |

| ARS | 0.045 (p = 0.054) | p < 0.05 | Not Accepted |

| AARS | 0.043 (p = 0.058) | p < 0.05 | Not Accepted |

| AVIF | 1.021 | 3.3 ≤ AVIF ≤ 5 | Accepted |

| AFVIF | 1.071 | 3.3 ≤ AFVIF ≤ 5 | Accepted |

| GOF | 0.212 | 0.10 ≤ GOF ≤ 0.36 | Small |

| SPR | 1.000 | SPR = 1 or ≥0.7 | Accepted |

| RSCR | 1.000 | RSCR = 1 or ≥0.7 | Accepted |

| SSR | 1.000 | ≥0.7 | Accepted |

| R-Squares | 0.164 (<0.01) | <0.05 | Accepted |

| Sustainability Report | 0.057 | 0.25 ≤ Rs ≤ 0.70 | Weak |

| NPM | 0.002 | 0.25 ≤ Rs ≤ 0.70 | Weak |

| ROA | 0.031 | 0.25 ≤ Rs ≤ 0.70 | Weak |

| Tobin’s Q | 0.089 | 0.25 ≤ Rs ≤ 0.70 | Weak |

| Adjusted R-Squares | Kock and Lynn (2012) | ||

| Sustainability Report | 0.055 | 0.25 ≤ Rs ≤ 0.70 | Weak |

| NPM | 0.001 | 0.25 ≤ Rs ≤ 0.70 | Weak |

| ROA | 0.030 | 0.25 ≤ Rs ≤ 0.70 | Weak |

| Tobin’s Q | 0.088 | 0.25 ≤ Rs ≤ 0.70 | Weak |

| Q2 Predictive | Stone (1974) | ||

| Sustainability Report | 0.056 | >0 | Predictive Value |

| NPM | 0.005 | >0 | Predictive Value |

| ROA | 0.033 | >0 | Predictive Value |

| Tobin’s Q | 0.091 | >0 | Predictive Value |

| Full Collinearity VIFs | |||

| Size | 1.014 | 3.3 ≤ VIFs ≤ 5 | Multicollinearity Free |

| Age | 1.011 | 3.3 ≤ VIFs ≤ 5 | Multicollinearity Free |

| Sustainability Report | 1.097 | 3.3 ≤ VIFs ≤ 5 | Multicollinearity Free |

| NPM | 1.063 | 3.3 ≤ VIFs ≤ 5 | Multicollinearity Free |

| ROA | 1.121 | 3.3 ≤ VIFs ≤ 5 | Multicollinearity Free |

| Tobin’s Q | 1.123 | 3.3 ≤ VIFs ≤ 5 | Multicollinearity Free |

| Effect Size | Cohen (1988) | ||

| Size—Sustainability Report | 0.047 | ≥0.02 | Weak Effect |

| Age—Sustainability Report | 0.010 | ≥0.02 | Weak Effect |

| Sustainability Report—NPM | 0.002 | ≥0.02 | Weak Effect |

| Sustainability Report—ROA | 0.031 | ≥0.02 | Weak Effect |

| Sustainability Report—Tobin’s Q | 0.089 | ≥0.02 | Weak Effect |

| Hypothesis | Path Coeff. | p-Values | Decision | |

|---|---|---|---|---|

| H2 | Size → Sustainability Report | −0.210 | <0.001 | Not Supported |

| H3 | Age → Sustainability Report | 0.088 | 0.008 | Supported |

| H4 | Sustainability Report → NPM | 0.049 | 0.090 | Not Supported |

| H5 | Sustainability Report → ROA | 0.176 | <0.001 | Supported |

| H6 | Sustainability Report → Tobin’s Q | 0.299 | <0.001 | Supported |

| Pair | SR → NPM | SR → ROA | SR → Tobin’s Q |

|---|---|---|---|

| Malaysia–Indonesia | <0.001 | 0.050 | 0.024 |

| Malaysia–Philippines | 0.075 | 0.191 | 0.380 |

| Malaysia–Singapore | 0.247 | 0.059 | <0.001 |

| Malaysia–Thailand | 0.002 | 0.111 | <0.001 |

| Indonesia–Philippines | 0.146 | 0.227 | 0.047 |

| Indonesia–Singapore | 0.018 | 0.003 | 0.352 |

| Indonesia–Thailand | <0.001 | 0.010 | 0.108 |

| Philippines–Singapore | 0.142 | 0.046 | <0.001 |

| Philippines–Thailand | <0.001 | 0.063 | <0.001 |

| Singapore–Thailand | 0.441 | 0.188 | 0.122 |

| Path | Model I | Model II | ||||

|---|---|---|---|---|---|---|

| Leader | Follower | Difference | Leader | Follower | Difference | |

| Size → Sustainability Report | 0.062 | 0.102 | −0.040 | 0.137 | 0.043 | 0.094 |

| Age → Sustainability Report | 0.186 | 0.154 | 0.032 | 0.289 | 0.144 | 0.145 * |

| Sustainability Report → NPM | 0.228 | 0.294 | −0.066 | 0.487 | 0.231 | 0.256 ** |

| Sustainability Report → ROA | 0.062 | 0.102 | −0.040 | 0.137 | 0.043 | 0.094 |

| Sustainability Report → Tobin’s Q | 0.186 | 0.154 | 0.032 | 0.289 | 0.144 | 0.145 * |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Warokka, A.; Woo, J.K.; Aqmar, A.Z. Herding Behavior, ESG Disclosure, and Financial Performance: Rethinking Sustainability Reporting to Address Climate-Related Risks in ASEAN Firms. J. Risk Financial Manag. 2025, 18, 457. https://doi.org/10.3390/jrfm18080457

Warokka A, Woo JK, Aqmar AZ. Herding Behavior, ESG Disclosure, and Financial Performance: Rethinking Sustainability Reporting to Address Climate-Related Risks in ASEAN Firms. Journal of Risk and Financial Management. 2025; 18(8):457. https://doi.org/10.3390/jrfm18080457

Chicago/Turabian StyleWarokka, Ari, Jong Kyun Woo, and Aina Zatil Aqmar. 2025. "Herding Behavior, ESG Disclosure, and Financial Performance: Rethinking Sustainability Reporting to Address Climate-Related Risks in ASEAN Firms" Journal of Risk and Financial Management 18, no. 8: 457. https://doi.org/10.3390/jrfm18080457

APA StyleWarokka, A., Woo, J. K., & Aqmar, A. Z. (2025). Herding Behavior, ESG Disclosure, and Financial Performance: Rethinking Sustainability Reporting to Address Climate-Related Risks in ASEAN Firms. Journal of Risk and Financial Management, 18(8), 457. https://doi.org/10.3390/jrfm18080457