The Impact of ESG Performance on Corporate Investment Efficiency: Evidence from Chinese Listed Companies

Abstract

1. Introduction

2. Literature Review

2.1. Environmental, Social, and Corporate Governance

2.2. Enterprise Investment Efficiency

3. Theoretical Analysis and Research Hypothesis

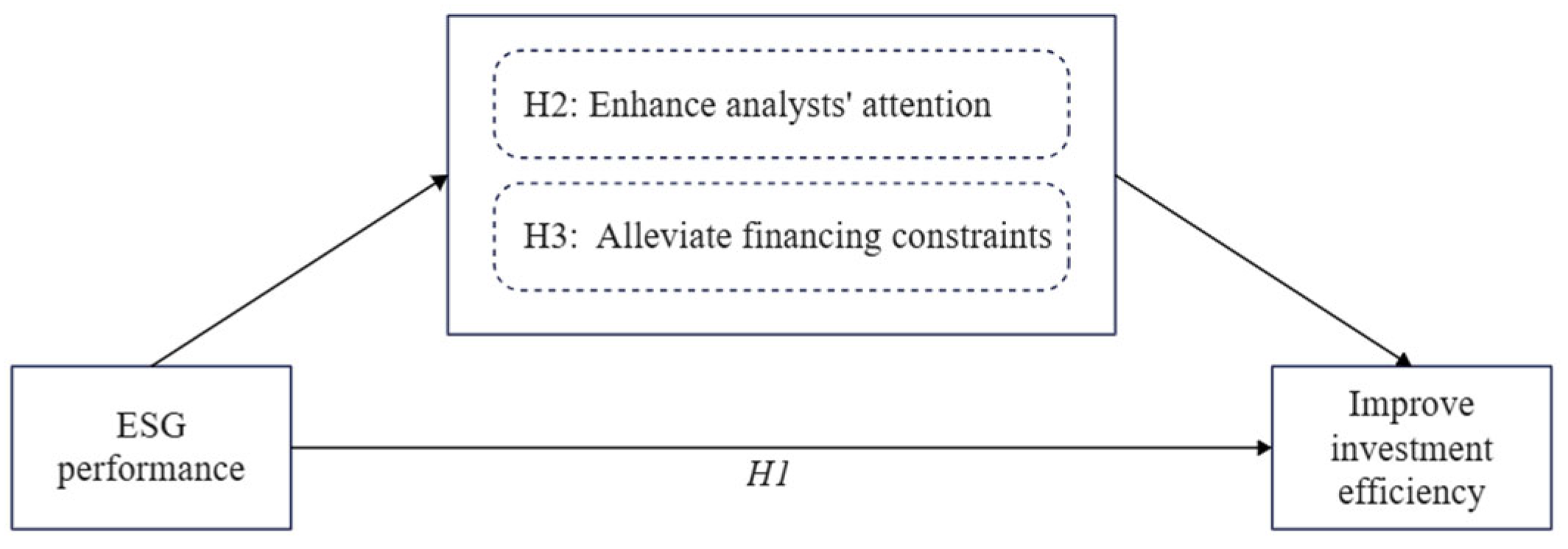

3.1. Direct Impact of ESG Performance on Corporate Investment Efficiency

3.2. The Influence Mechanism of ESG Performance on Corporate Investment Efficiency

4. Research Methods and Data Sources

4.1. Methods

4.2. Variables

4.2.1. Dependent Variable

4.2.2. Independent Variable

4.2.3. Mechanism Variables

- Financing constraints.

- Analyst attention.

4.2.4. Control Variables

4.3. Data Sources

5. Results

5.1. Baseline Regression Results

5.2. Mechanism Analysis

5.2.1. Financing Constraint

5.2.2. Analyst Attention

6. Further Research

6.1. Robustness Test

6.1.1. Replace the Explanatory Variable

6.1.2. Replace the Explained Variable

6.1.3. Adjust the Sample Period

6.2. Endogeneity Analysis

6.2.1. Instrumental Variable Method

6.2.2. GMM Dynamic Panel Analysis

6.3. Heterogeneity Analysis

6.3.1. Property Rights Nature

6.3.2. Carbon Element Emission Intensity

6.3.3. The Scale of the Enterprise

7. Conclusions and Implications

7.1. Conclusions

7.2. Implications

7.2.1. Government

7.2.2. Enterprises

7.3. Research Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Misinv | ESG | Age | Size | ROA | Ret | MB | Cash | Ctrlshare | Supervisors | Dirsize | Tobinq | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MISINV | 1.000 | |||||||||||

| ESG | −0.072 *** | 1.000 | ||||||||||

| Size | −0.127 *** | 0.215 *** | 1.000 | |||||||||

| Age | −0.164 *** | −0.054 *** | 0.395 *** | 1.000 | ||||||||

| Tobinq | 0.125 *** | −0.058 *** | −0.380 *** | −0.079 *** | 1.000 | |||||||

| Ret | 0.015 *** | −0.012 ** | −0.076 *** | −0.029 *** | 0.316 *** | 1.000 | ||||||

| MB | 0.061 *** | −0.123 *** | −0.041 *** | 0.107 *** | 0.583 *** | 0.243 *** | 1.000 | |||||

| Cash | 0.005 | 0.117 *** | −0.200 *** | −0.164 *** | 0.194 *** | 0.024 *** | −0.061 *** | 1.000 | ||||

| ROA | 0.070 *** | 0.180 *** | 0.022 *** | −0.151 *** | 0.204 *** | 0.124 *** | −0.095 *** | 0.240 *** | 1.000 | |||

| Ctrlshare | 0.000 | 0.089 *** | 0.134 *** | −0.153 *** | −0.078 *** | 0.009 * | −0.057 *** | 0.049 *** | 0.157 *** | 1.000 | ||

| Supervisors | −0.052 *** | 0.028 *** | 0.248 *** | 0.246 *** | −0.115 *** | 0.010 * | 0.027 *** | −0.054 *** | −0.016 *** | 0.079 *** | 1.000 | |

| Dirsize | −0.028 *** | 0.012 ** | 0.214 *** | 0.138 *** | −0.102 *** | 0.012 ** | −0.007 | −0.029 *** | 0.041 *** | −0.008 | 0.286 *** | 1.000 |

References

- Abuhommous, A. A. A. (2025). Does the firm’s life cycle matter in the relationship between short-term debt and investment efficiency? International Journal of Finance & Economics, 30(2), 1429–1449. [Google Scholar] [CrossRef]

- Ahmed, B., Akbar, M., Sabahat, T., Ali, S., Hussain, A., Akbar, A., & Hongming, X. (2021). Does Firm Life Cycle Impact Corporate Investment Efficiency? Sustainability, 13(1), 197. [Google Scholar] [CrossRef]

- Aydoğmuş, M., Gülay, G., & Ergun, K. (2022). Impact of ESG performance on firm value and profitability. Borsa Istanbul Review, 22, S119–S127. [Google Scholar] [CrossRef]

- Bhandari, A., & Javakhadze, D. (2017). Corporate social responsibility and capital allocation efficiency. Journal of Corporate Finance, 43, 354–377. [Google Scholar] [CrossRef]

- Biddle, G. C., & Hilary, G. (2006). Accounting Quality and Firm-Level Capital Investment. The Accounting Review, 81(5), 963–982. [Google Scholar] [CrossRef]

- Bushman, R. M., Piotroski, J. D., & Smith, A. J. (2004). What Determines Corporate Transparency? Journal of Accounting Research, 42, 207–252. [Google Scholar] [CrossRef]

- Bushman, R. M., & Smith, A. J. (2001). Financial accounting information and corporate governance. Journal of Accounting and Economics, 32(1), 237–333. [Google Scholar] [CrossRef]

- Chairani, C., & Siregar, S. V. (2021). The effect of enterprise risk management on financial performance and firm value: The role of environmental, social and governance performance. Meditari Accountancy Research, 29(3), 647–670. [Google Scholar] [CrossRef]

- Chen, T., Xie, L., & Zhang, Y. (2017). How does analysts’ forecast quality relate to corporate investment efficiency? Journal of Corporate Finance, 43, 217–240. [Google Scholar] [CrossRef]

- Cheng, M., Dhaliwal, D., & Zhang, Y. (2013). Does investment efficiency improve after the disclosure of material weaknesses in internal control over financial reporting? Journal of Accounting and Economics, 56(1), 1–18. [Google Scholar] [CrossRef]

- Chmielewska, A., & Kluza, K. (2024). Esg risk rating and company valuation: The case of the Warsaw stock exchange. Ruch Prawniczy, Ekonomiczny i Socjologiczny, 86(1), 179–197. [Google Scholar] [CrossRef]

- Chytis, E., Eriotis, N., & Mitroulia, M. (2024). ESG in Business Research: A Bibliometric Analysis. Journal of Risk and Financial Management, 17(10), 460. [Google Scholar] [CrossRef]

- Cook, K. A., Romi, A. M., Sánchez, D., & Sánchez, J. M. (2019). The influence of corporate social responsibility on investment efficiency and innovation. Journal of Business Finance & Accounting, 46(3–4), 494–537. [Google Scholar] [CrossRef]

- Dai, S., & Qin, Y. (2019). Management power, analyst attention, and investment efficiency. Accounting Friend, (12), 80–88. [Google Scholar] [CrossRef]

- Dhaliwal, D., Li, O. Z., Tsang, A., & Yang, Y. G. (2014). Corporate social responsibility disclosure and the cost of equity capital: The roles of stakeholder orientation and financial transparency. Journal of Accounting and Public Policy, 33(4), 328–355. [Google Scholar] [CrossRef]

- Duque-Grisales, E., & Aguilera-Caracuel, J. (2021). Environmental, Social and Governance (ESG) scores and financial performance of multilatinas: Moderating effects of geographic international diversification and financial slack. Journal of Business Ethics, 168(2), 315–334. [Google Scholar] [CrossRef]

- Elaoud, A., & Jarboui, A. (2017). Auditor specialization, accounting information quality and investment efficiency. Research in International Business and Finance, 42, 616–629. [Google Scholar] [CrossRef]

- El Ghoul, S., Guedhami, O., & Kim, Y. (2017). Country-level institutions, firm value, and the role of corporate social responsibility initiatives. Journal of International Business Studies, 48(3), 360–385. [Google Scholar] [CrossRef]

- El Ghoul, S., Guedhami, O., Kwok, C. C. Y., & Mishra, D. R. (2011). Does corporate social responsibility affect the cost of capital? Journal of Banking & Finance, 35(9), 2388–2406. [Google Scholar] [CrossRef]

- Escobar-Saldívar, L. J., Villarreal-Samaniego, D., & Santillán-Salgado, R. J. (2025). The effects of ESG scores and ESG momentum on stock returns and volatility: Evidence from U.S. markets. Journal of Risk and Financial Management, 18(7), 367. [Google Scholar] [CrossRef]

- Fatemi, A., Glaum, M., & Kaiser, S. (2018). ESG performance and firm value: The moderating role of disclosure. Global Finance Journal, 38, 45–64. [Google Scholar] [CrossRef]

- Gao, J., Chu, D., Lian, Y., & Zheng, J. (2021). Can ESG performance improve corporate investment efficiency? Securities Market Herald, (11), 24–34+72. [Google Scholar]

- Ihsani, A. N., Nidar, S. R., & Kurniawan, M. (2023). Does ESG performance affect financial performance? Evidence from Indonesia. Wiga: Jurnal Penelitian Ilmu Ekonomi, 13(1), 46–61. [Google Scholar] [CrossRef]

- Islam, A. R. M., & Luo, R. H. (2018). Financing constraints and investment efficiency: Evidence from a panel of Canadian forest firms. Applied Economics, 50(48), 5142–5154. [Google Scholar] [CrossRef]

- Jiang, T. (2022). Mediating and moderating effects in empirical studies of causal inference. China Industrial Economy, 100–120. [Google Scholar] [CrossRef]

- Kaplan, S. N., & Zingales, L. (1997). Do investment-cash flow sensitivities provide useful measures of financing constraints?*. The Quarterly Journal of Economics, 112(1), 169–215. [Google Scholar] [CrossRef]

- Lai, S.-M., Liu, C.-L., & Chen, S.-S. (2020). Internal Control Quality and Investment Efficiency. Accounting Horizons, 34(2), 125–145. [Google Scholar] [CrossRef]

- Lei, Q., & Chen, H. (2018). Corporate governance boundary, debt constraint, and investment efficiency. Emerging Markets Finance and Trade, 55(5), 1091–1108. [Google Scholar] [CrossRef]

- Li, J., Yang, Z., Chen, J., & Cui, W. (2021). How does ESG promote corporate performance? Evidence from corporate innovation. Journal of Science and Technology Management, 42(9), 71–89. [Google Scholar]

- Li, Y., Zeng, W., Ma, Z., & Chen, K. (2015). External governance environment, ownership and efficiency of listed companies’ investment. Nankai Business Review, 18(1), 25–36. [Google Scholar] [CrossRef]

- Lian, Y., & Su, Z. (2009). Financing constraints, uncertainty, and investment efficiency of listed companies. Management Review, 21(1), 19–26. [Google Scholar]

- Madyan, M., & Widuri, S. K. (2023). Environmental, Social, Governance (ESG) performance and capital structure: The role of good corporate governance. Journal of Theoretical and Applied Management, 16(3), 560–570. [Google Scholar] [CrossRef]

- Miralles-Quirós, M. M., Miralles-Quirós, J. L., & Valente Gonçalves, L. M. (2018). The value relevance of environmental, social, and governance performance: The Brazilian case. Sustainability, 10(3), 574. [Google Scholar] [CrossRef]

- Naeem, K., & Li, M. C. (2019). Corporate investment efficiency: The role of financial development in firms with financing constraints and agency issues in OECD non-financial firms. International Review of Financial Analysis, 62, 53–68. [Google Scholar] [CrossRef]

- Richardson, S. (2006). Over-investment of free cash flow. Review of Accounting Studies, 11(2), 159–189. [Google Scholar] [CrossRef]

- Salehi, M., Zimon, G., Arianpoor, A., & Gholezoo, F. E. (2022). The Impact of Investment Efficiency on Firm Value and Moderating Role of Institutional Ownership and Board Independence. Journal of Risk and Financial Management, 15(4), 170. [Google Scholar] [CrossRef]

- Shu, H., & Tan, W. (2023). Does carbon control policy risk affect corporate ESG performance? Economic Modelling, 120, 106148. [Google Scholar] [CrossRef]

- Stoughton, N. M., Wong, K. P., & Yi, L. (2017). Investment efficiency and product market competition. Journal of Financial and Quantitative Analysis, 52(6), 2611–2642. [Google Scholar] [CrossRef]

- Velte, P. (2017). Does ESG performance have an impact on financial performance? Evidence from Germany. Journal of Global Responsibility, 8, 169–178. [Google Scholar] [CrossRef]

- Wang, B., & Yang, M. (2022). The impact mechanism of ESG performance on corporate value: Evidence from A-share listed companies in China. Soft Science, 36(6), 78–84. [Google Scholar]

- Wang, R., He, X., & Diao, X. (2021). Input-output efficiency of environmental protection enterprises and its influencing factors: An empirical analysis of 279 listed enterprises in China. Journal of Cleaner Production, 279, 123652. [Google Scholar] [CrossRef]

- Wu, R., Li, J., Dai, Y., Shen, X., & Hossain, M. A. (2024). Impact of environmental, social, and governance on innovation in Chinese listed firms. Sustainability, 16(17), 7482. [Google Scholar] [CrossRef]

- Yuan, L., Tao, X., Ramsey, T. S., & Degefu, D. M. (2021). Simulating the principal-agent relationship between enterprise owners and professional managers using evolutionary game theory and system dynamics. Complexity, 2021(1), 3881254. [Google Scholar] [CrossRef]

- Zhai, L., Feng, Y., Li, F., & Zhai, L. (2022). Tax preference, financing constraints and enterprise investment efficiency-Experience, of China’s enterprises investment. PLoS ONE, 17(9), e0274336. [Google Scholar] [CrossRef] [PubMed]

| Variable | Calculation Method |

|---|---|

| Misinv | The absolute value of the residual calculated based on the model (for the convenience of showing the coefficient, proportionally expand the value by 100 times) |

| ESG | Huazheng ESG Performance Ratings are assigned values ranging from 1 to 9 from low to high |

| KZ | The fitted value calculated based on the model |

| ACO | Pay other cash/operating income related to business activities |

| AnaA | The natural logarithm of the number of analysts who have tracked the enterprise in the past year |

| Size | The natural logarithm of total assets at the end of the year |

| Age | The natural logarithm of the difference between the current year and the year of listing plus 1 |

| Ret | Consider the annual individual stock return rate after reinvesting cash dividends |

| MB | The ratio of the book value to the market value of an enterprise’s assets |

| Cash | The ratio of monetary funds to total assets |

| ROA | The ratio of net profit to the average balance of total assets |

| Ctrlshare | The shareholding ratio of the controlling shareholder |

| Supervisors | The number of supervisors on the supervisory board is taken as the logarithm |

| Dirsize | Take the logarithm of the number of directors on the board of directors |

| Tobinq | The ratio of a company’s stock market value to the replacement cost of the assets represented by the stock |

| Variable | Obs | Mean | Std. | Min | Max |

|---|---|---|---|---|---|

| Misinv | 33,304 | 3.622 | 4.024 | −2.279 | 30.477 |

| ESG | 33,304 | 4.181 | 0.987 | 1.000 | 8.000 |

| Size | 33,304 | 22.325 | 1.264 | 19.900 | 26.330 |

| Age | 33,304 | 2.244 | 0.728 | 0.693 | 3.367 |

| Tobinq | 33,304 | 1.932 | 1.080 | 0.263 | 8.391 |

| Ret | 33,304 | 0.120 | 0.492 | −0.941 | 2.428 |

| MB | 33,304 | 3.757 | 2.209 | 1.233 | 20.744 |

| Cash | 33,304 | 0.154 | 0.109 | 0.010 | 0.586 |

| ROA | 33,304 | 0.036 | 0.058 | −0.231 | 0.197 |

| Ctrlshare | 33,304 | 0.360 | 0.148 | 0.075 | 0.748 |

| Supervisors | 33,304 | 1.227 | 0.236 | 1.099 | 1.946 |

| Dirsize | 33,304 | 1.136 | 0.062 | 0.959 | 1.292 |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| ESG | −0.182 *** | −0.163 *** | −0.125 *** |

| (−5.90) | (−5.47) | (−4.22) | |

| Size | 0.369 *** | 0.312 *** | |

| (4.71) | (3.81) | ||

| Age | −2.038 *** | −1.454 *** | |

| (−18.40) | (−8.80) | ||

| Tobinq | 0.459 *** | 0.260 *** | |

| (7.87) | (4.43) | ||

| Ret | −0.488 *** | −0.251 *** | |

| (−8.49) | (−3.54) | ||

| MB | 0.0746 *** | 0.0739 *** | |

| (3.16) | (3.14) | ||

| Cash | −0.139 | 0.200 | |

| (−0.38) | (0.54) | ||

| ROA | 4.958 *** | 4.852 *** | |

| (9.00) | (8.83) | ||

| Ctrlshare | 0.0588 | 0.221 | |

| (0.13) | (0.50) | ||

| Supervisors | −0.270 | −0.327 | |

| (−1.02) | (−1.23) | ||

| Dirsize | 0.576 | 0.852 | |

| (0.73) | (1.10) | ||

| Constant | 4.384 *** | −0.968 | 0.168 |

| (33.96) | (−0.53) | (0.08) | |

| Industry fixed effect | No | No | Yes |

| Year fixed effect | No | No | Yes |

| Observation | 33,304 | 33,304 | 33,304 |

| R2 | 0.001 | 0.057 | 0.073 |

| Variables | Financing Constraint | Analyst Attention | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| KZ | KZ | AnaA | AnaA | |

| ESG | −0.159 *** | −0.020 * | 0.040 *** | 0.025 *** |

| (−10.87) | (−2.07) | (8.13) | (5.38) | |

| Age | 0.070 * | 0.247 *** | ||

| (2.57) | (18.58) | |||

| Size | 0.206 *** | −0.131 *** | ||

| (4.25) | (−5.91) | |||

| ROA | 0.140 *** | 0.138 *** | ||

| (6.74) | (16.52) | |||

| Ret | −0.118 *** | −0.059 *** | ||

| (−5.67) | (−7.13) | |||

| MB | 0.237 *** | 0.010 ** | ||

| (24.53) | (3.05) | |||

| Cash | −9.049 *** | 0.199 *** | ||

| (−67.03) | (3.86) | |||

| Ctrlshare | −10.430 *** | 1.791 *** | ||

| (−41.58) | (21.83) | |||

| Supervisors | 0.092 | −0.103 | ||

| (0.63) | (−1.43) | |||

| Dirsize | 0.064 | −0.026 | ||

| (0.70) | (−0.55) | |||

| Tobinq | −0.283 | 0.261 * | ||

| (−1.17) | (2.21) | |||

| Constant | 2.794 *** | 0.826 | 1.639 *** | −3.963 *** |

| (6.31) | (1.23) | (17.48) | (−12.47) | |

| Industry fixed effect | Yes | Yes | Yes | Yes |

| Year fixed effect | Yes | Yes | Yes | Yes |

| Observation | 33,304 | 33,304 | 33,304 | 33,304 |

| R2 | 0.117 | 0.550 | 0.040 | 0.134 |

| Variables | Re-Examination of ESG Disclosure Transparency | Replace the Explained Variable | Adjust the Sample Period |

|---|---|---|---|

| (1) | (2) | (3) | |

| Misinv | Misinv | Misinv | |

| ESG | −0.007 *** | −0.101 ** | |

| (0.001) | (0.046) | ||

| ESG_Disclosure | −8.440 *** | ||

| (1.418) | |||

| Controls | Yes | Yes | Yes |

| Constant | 2.062 | 6.365 *** | −5.347 |

| (2.224) | (0.073) | (3.442) | |

| Industry fixed effect | Yes | Yes | Yes |

| Year fixed effect | Yes | Yes | Yes |

| Observation | 33,304 | 33,304 | 17,318 |

| R2 | 0.074 | 0.985 | 0.055 |

| Variables | Instrumental Variable Method | GMM Dynamic Panel Analysis | |

|---|---|---|---|

| (1) | (2) | (3) | |

| ESG | Misinv | Misinv | |

| ESG_IV | −0.622 *** | ||

| (−5.31) | |||

| ESG_actual | −1.692 *** | ||

| (−3.72) | |||

| L.Misinv | 0.151 *** | ||

| (8.29) | |||

| ESG | −1.152 *** | ||

| (−3.07) | |||

| Controls | Yes | Yes | Yes |

| Industry fixed effect | Yes | Yes | Yes |

| Year fixed effect | Yes | Yes | Yes |

| Observation | 33,276 | 33,276 | 27,679 |

| R2 | 0.045 | 0.073 | - |

| AR1 | - | - | 0 |

| AR2 | - | - | 0.194 |

| Hansen | - | - | 0.127 |

| Variables | Property Rights Nature Heterogeneity | Carbon Emission Heterogeneity | Enterprise Scale Heterogeneity | |||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| State-Owned | Non-State-Owned | High-Carbon | Non-High-Carbon | Small | Large | |

| ESG | −0.028 | −0.210 *** | −0.021 | −0.149 *** | −0.206 *** | −0.061 |

| (−0.75) | (−4.86) | (−0.32) | (−4.48) | (−4.33) | (−1.62) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry fixed effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Year fixed effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Observation | 12,756 | 20,127 | 5939 | 27,365 | 16,234 | 17,070 |

| R2 | 0.062 | 0.079 | 0.050 | 0.080 | 0.081 | 0.073 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, Z.; Ma, Y.; He, L.; Tan, Z. The Impact of ESG Performance on Corporate Investment Efficiency: Evidence from Chinese Listed Companies. J. Risk Financial Manag. 2025, 18, 427. https://doi.org/10.3390/jrfm18080427

Li Z, Ma Y, He L, Tan Z. The Impact of ESG Performance on Corporate Investment Efficiency: Evidence from Chinese Listed Companies. Journal of Risk and Financial Management. 2025; 18(8):427. https://doi.org/10.3390/jrfm18080427

Chicago/Turabian StyleLi, Zhuo, Yeteng Ma, Li He, and Zhili Tan. 2025. "The Impact of ESG Performance on Corporate Investment Efficiency: Evidence from Chinese Listed Companies" Journal of Risk and Financial Management 18, no. 8: 427. https://doi.org/10.3390/jrfm18080427

APA StyleLi, Z., Ma, Y., He, L., & Tan, Z. (2025). The Impact of ESG Performance on Corporate Investment Efficiency: Evidence from Chinese Listed Companies. Journal of Risk and Financial Management, 18(8), 427. https://doi.org/10.3390/jrfm18080427