Abstract

This study explores the relationship between customer satisfaction and loyalty in mobile banking, emphasizing the moderating role of Technology Readiness. As mobile banking becomes increasingly central to financial service delivery, understanding the nuanced drivers of customer loyalty is essential for strategic growth. Drawing from the Technology Readiness Index, this study examines how four dimensions, optimism, innovativeness, discomfort, and insecurity, moderate the satisfaction–loyalty linkage. Data were collected via a structured survey from 258 mobile banking users in the United States, analyzed using partial least squares structural equation modeling (PLS-SEM). Results show that optimism and innovativeness positively moderate this relationship, while discomfort and insecurity act as negative moderators. Practically, this research introduces a segmented approach to mobile banking service design, underscoring the need for differentiated strategies that address varying levels of user readiness. Theoretically, this study addresses a gap in mobile banking literature by shifting the focus from adoption to sustained usage and satisfaction-based loyalty, enriching the discourse on customer behavior in digital finance.

1. Introduction

Technologies like the Internet and mobile platforms are especially significant in the banking sector and have emerged as a key avenue for mobile banking (Ahmad, 2018). Financial institutions are enhancing their traditional in-person service approaches with technology-driven interactions (Gichuki & Mulu-Mutuku, 2018). These banks are utilizing technologies to assist customers in making decisions and planning their finances (Alsmadi et al., 2022).

Mobile banking enables users to execute banking operations at any time and from any location, free from the limitations of time and space, resulting in improved satisfaction and experiences (Rouse et al., 2025). It offers customers increased efficiency, effectiveness, and control over their financial activities (Palamidovska-Sterjadovska et al., 2025). Nevertheless, studies have shown that the experiences related to technology can be paradoxical for customers, as they yield both advantages and feelings of frustration, anxiety, stress, isolation, and confusion, which can lead to dissatisfaction and result in coping mechanisms like avoidance (Saeed & Donkoh, 2024).

Customer behavior models acknowledge the significant impact of individual traits (such as attitudes and personality characteristics). The way customers utilize and find satisfaction in online services is influenced by their technological readiness, which is a personal inclination to adopt and leverage new technologies to achieve their objectives (Imdad et al., 2025). Technology readiness (TR) serves as a crucial factor or moderator in shaping customers’ perceptions and acceptance of technology (Khatri et al., 2025).

The environment in which technologies are utilized is essential, as it forms the foundation for comprehending customer behavior (Borodako et al., 2023). Considering that the mobile banking landscape is continuously evolving to offer a diverse array of services to customers, the TR variable has become increasingly significant in mobile banking research today (Phan Hong et al., 2025). This study investigates customer experiences with mobile banking. It employs customer encounters with mobile banking as a case study to assess a framework for understanding satisfaction and loyalty in relation to mobile banking.

The emergence of mobile technologies has a significant effect on service delivery across various sectors, especially in the banking industry, and these services greatly influence the experiences of most mobile banking users, which makes TR a crucial concept. As a result, this study aims to (1) explore the connection between customer satisfaction and loyalty within the mobile banking context and (2) assess the influence of TR on the relationship between customer satisfaction and loyalty in the mobile banking sector.

This research addresses the gaps in the field concerning mobile banking, customer satisfaction with mobile banking, and behaviors following service use. To this point, studies related to mobile banking have mainly concentrated on how customers accept or adopt mobile banking services and how technologies influence various aspects of customer behavior and experiences. While gaining a deeper understanding of mobile banking features is crucial, it is equally, if not more, vital to comprehend whether and why customers experience satisfaction with mobile banking. The main reason for emphasizing satisfaction is its strong correlation with important customer outcomes, such as retention and loyalty.

This research also addresses the necessity of incorporating personal traits beyond just demographic variables in comprehending customers’ experiences with mobile banking. Investigating personal traits yields valuable insights since these traits significantly influence the prediction of behavior over time and in various contexts across a broad spectrum of human actions. Prior research on technology acceptance has predominantly focused on the technology acceptance model (TAM) and related theories, often within the realm of information and communication technologies (Apau et al., 2025). There is limited research on technology readiness in mobile banking that investigates customer experiences rather than attitudes and explores only a few dimensions of technology readiness, with minimal emphasis on its impact on customer satisfaction in mobile banking. Scholars from other fields have suggested a direct relationship between technology readiness and satisfaction as a consumption outcome without considering its moderating effect (Shah et al., 2024). This study sets itself apart from earlier research by empirically investigating the moderating influence of technology readiness within the context of the relationship between customer satisfaction and loyalty in mobile banking.

This research enhances the comprehension of customer loyalty within the mobile banking sector by emphasizing the complex role of individual psychological characteristics. Although the positive connection between customer satisfaction and loyalty is well-documented, this study reveals that this relationship varies among different customers. By pinpointing optimism and innovativeness as positive influences, and discomfort and insecurity as negative influences, this research adds depth to existing theories concerning technology adoption and customer behavior. These results indicate that models of customer loyalty should take into account personal traits toward technology to more effectively forecast loyalty outcomes in the mobile banking service setting.

For banking sector managers, these findings provide practical guidance. The outcomes highlight that merely improving customer satisfaction is not enough to boost loyalty; banks must also take into account the various psychological profiles of their clients. Marketing approaches can be refined to appeal to optimistic and innovative customers, who are more inclined to convert satisfaction into loyalty. At the same time, banks should focus on alleviating discomfort and insecurity through user-friendly designs, clear communication, and strong security measures to prevent satisfied customers from disengaging due to negative perceptions of technology. By tackling these influencing factors, banks can cultivate deeper, more resilient customer loyalty within the competitive mobile banking environment.

In the subsequent sections, the theoretical framework, along with the development of hypotheses, is outlined. The research methodology is subsequently detailed, followed by an account of the research findings. Afterward, the theoretical and practical implications are examined. Lastly, conclusions, limitations, and suggestions for future research are presented.

2. Conceptual Framework and Hypothesis Development

2.1. Conceptual Framework

2.1.1. Customer Satisfaction

Customer satisfaction can be generally described as the extent to which a company’s products, services, or overall experiences align with or go beyond customer expectations (Caruana, 2002). It gauges the level of happiness or contentment customers experience after engaging with a business and is frequently evaluated through surveys, feedback, and different performance indicators (Sureshchandar et al., 2002). When a company effectively meets or exceeds what customers look forward to, satisfaction is attained; if it does not, dissatisfaction occurs. This concept encompasses not only the quality of tangible products but also includes intangible elements such as customer support, accessibility, and the conduct of staff members (Daniel & Berinyuy, 2010).

Customer satisfaction serves as both a theoretical concept and a practical measure, evaluated through various tools and metrics that yield actionable insights for businesses (Nunkoo et al., 2025). One common approach is the use of customer satisfaction surveys, which often employ rating scales such as the Customer Satisfaction Score (CSAT), Net Promoter Score (NPS), and Customer Effort Score (CES) (Baquero, 2022). These surveys pose specific questions related to distinct interactions, overall experiences, or the likelihood of recommending the business to others. Furthermore, companies assess feedback from social media, online reviews, and direct customer engagements to pinpoint trends and areas needing enhancement (Thakur, 2018). By consistently measuring and analyzing customer satisfaction, organizations can gain a deeper understanding of customer preferences, tackle pain points, and continually improve their products and services to build stronger customer relationships and promote sustainable growth (Malthouse et al., 2013).

The significance of customer satisfaction stems from its direct influence on business results. High satisfaction levels lead to customer loyalty, promote repeat purchases, and generate positive referrals, all of which enhance long-term profitability and sustainable growth (Nunkoo et al., 2025). On the other hand, low satisfaction may result in complaints, negative feedback, and loss of customers. In the current competitive landscape, customer satisfaction acts as a crucial differentiator and is viewed as an essential performance metric for organizations aiming to stay ahead (Gazi et al., 2025). Ultimately, achieving customer satisfaction necessitates a dedication to understanding and addressing customer needs, ongoing improvement of offerings, and providing consistently positive experiences (Nunkoo et al., 2025).

2.1.2. Customer Loyalty

Customer loyalty refers to the enduring dedication of customers to consistently select and endorse a specific brand, product, or service instead of its rivals (Moretta Tartaglione et al., 2019). This loyalty is evident through regular repeat purchases, a preference for one brand even when other options exist, and a readiness to recommend that brand to others (Strenitzerová & Gaňa, 2018). Genuine customer loyalty transcends mere transactional behavior; it signifies a deeper connection founded on trust, satisfaction, and the positive experiences gathered over time (Das et al., 2019).

The essence of customer loyalty is rooted in the emotional bond and trust that customers establish with a brand (Hussain et al., 2024). This bond is nurtured through the delivery of top-notch products or services, outstanding customer support, and ensuring consistently favorable experiences at every interaction point. Devoted customers are less inclined to be influenced by price fluctuations or competitors’ promotions, and they frequently become champions for the brand, sharing their positive encounters and motivating others to experience the brand as well (Al-Hujri et al., 2025). Even when occasional challenges occur, loyal customers are likely to remain devoted if the business effectively resolves issues and keeps communication open and trustworthy (S. H. Kim & Yang, 2025).

For companies, fostering customer loyalty is essential since dedicated customers promote repeat transactions, create favorable word-of-mouth recommendations, and enhance overall profitability (Salvietti, 2025). Keeping current customers is often more economical than bringing in new ones, and loyal customers usually offer greater lifetime value. By prioritizing the establishment of strong connections and consistently surpassing customer expectations, businesses can develop a committed customer base that aids in achieving sustainable growth and enduring success (So et al., 2025).

2.1.3. Technology Readiness

Technology readiness refers to the extent to which individuals are willing to adopt and utilize new technologies to accomplish their objectives, whether in their personal lives or professional environments (Shah et al., 2024). This notion goes beyond just technical abilities or certain skills; instead, it encompasses a person’s overall attitude towards technology, influenced by a mix of positive and negative perceptions (Khan & Khan, 2025). Parasuraman and Colby (2015) developed the Technology Readiness Index (TRI) to methodically evaluate these attitudes and categorize individuals according to their general inclination toward embracing technological advancements.

The TRI framework outlines four essential dimensions that collectively define an individual’s technology readiness: optimism, innovativeness, discomfort, and insecurity. Optimism denotes a favorable perspective on technology, encompassing beliefs that it provides enhanced control, flexibility, and efficiency (Chang & Chen, 2021). Innovativeness reflects the inclination to be a trailblazer or an early adopter of emerging technologies. Conversely, discomfort is characterized by feelings of being overwhelmed or lacking control while using technology, whereas insecurity represents mistrust or doubt regarding technology’s reliability and effectiveness (Borodako et al., 2023). Optimism and innovativeness serve as facilitators, boosting readiness, while discomfort and insecurity function as barriers, diminishing it (Chen & Chang, 2023).

One distinctive feature of Parasuraman’s concept of technology readiness is that individuals can possess both positive and negative beliefs regarding technology at the same time (Sharma, 2024). For instance, someone might be enthusiastic about the potential advantages of new digital tools (optimism) while simultaneously experiencing concerns about their complexity or dependability (discomfort and insecurity). This complex and at times contradictory aspect of technology readiness serves as a sophisticated framework for understanding and anticipating how various individuals react to technological advancements (J. J. Kim et al., 2020).

The TRI and its enhanced version, TRI 2.0, are extensively utilized in academic studies and industry to differentiate consumer markets, forecast the acceptance of new products, and guide strategies for technology rollout (Yosser et al., 2020). By assessing technology readiness, both in general and across its four dimensions, organizations can customize their strategies to tackle the specific enablers and obstacles that exist within their target demographics. This approach helps facilitate more effective communication, smoother adoption processes, and improved overall success in implementing new technologies (Fam et al., 2025).

2.1.4. Mobile Banking

Mobile banking refers to a type of electronic banking that allows customers to perform financial transactions and access banking services via mobile devices like smartphones and tablets (Palamidovska-Sterjadovska et al., 2025). By using specialized mobile banking apps or websites optimized for mobile, users can carry out various tasks, such as checking their account balances, transferring money, paying bills, and even depositing checks by capturing images of them (Rupasinghe et al., 2025). This technology enables customers to manage their finances remotely, offering flexibility and convenience without needing to go to physical bank branches.

The primary capabilities of mobile banking go beyond just basic transactions. It provides functionalities such as instant alerts and notifications regarding account activities, access to transaction records, and the ability to find nearby ATMs or bank branches (Saeed & Donkoh, 2024). Ensuring security is a key priority, incorporating methods like biometric verification, two-factor authentication, and encrypted communications to safeguard sensitive financial data and facilitate secure transactions (Apau et al., 2025). Mobile banking services are crafted to be user-friendly, enabling both technologically adept and less experienced individuals to effectively navigate and utilize banking options (Khobragade et al., 2024).

From a technical viewpoint, mobile banking functions through a blend of client-side and server-side applications that connect with a bank’s core systems. Client-side applications are directly installed on the user’s device, whereas server-side solutions function remotely and interact with the device via secure channels like SMS, USSD, or mobile internet (Elsaid Elmaasrawy et al., 2025). The effective integration of these technologies guarantees that mobile banking services are accessible around the clock, enabling immediate processing of most transactions and improving the overall customer experience (Kouandou & Laajimi, 2025). Consequently, mobile banking has emerged as an essential element of contemporary financial services, broadening banking access for individuals in both urban and rural areas (Susmitha et al., 2024).

The existing research on the acceptance of mobile banking reveals a complicated interaction of technological, psychological, and contextual elements that influence consumer behavior (Sebayang et al., 2024). A key component of many theoretical models is the Technology Acceptance Model (TAM), which identifies perceived usefulness and ease of use as major factors that affect adoption intentions (Azhari et al., 2025). Consumers are more inclined to embrace mobile banking when they recognize it as a means to enhance their efficiency and find it easy to use. This idea is supported across various settings, where numerous empirical studies consistently show that the perceived advantages and straightforwardness of mobile banking applications foster favorable attitudes and intentions toward their adoption (Le, 2025). Moreover, the extended TAM and related frameworks include additional factors such as consumer innovativeness, enjoyment, and reliability, all of which have a positive impact on adoption (Meselhy & Kortam, 2025).

Security and trust are crucial factors influencing the adoption and continued use of mobile banking services (Apau et al., 2025). Although the convenience and adaptability of mobile banking are well acknowledged, worries regarding privacy, data breaches, and potential fraud still serve as significant obstacles for numerous users (Rouse et al., 2025). Research highlights that strong security measures—such as biometric authentication, encryption, and assurances of privacy—are vital for building trust and promoting adoption, particularly in settings where users are cautious about digital transactions (Riasat et al., 2025). The significance of ongoing trust is also emphasized, with findings indicating that users’ sustained confidence in the security and dependability of mobile banking applications is essential for retention and long-term engagement (Sarwar & Sattar, 2025).

Contextual elements, such as alignment with users’ lifestyles, social norms, and levels of financial knowledge, significantly influence adoption trends (Kumar et al., 2024). The degree to which a technology fits with current tools and everyday habits increases the chances of its uptake, while social pressures and subjective norms can either support or hinder usage based on cultural and demographic factors (Dendrinos & Spais, 2024). In developing nations, further obstacles like digital competency, regulatory issues, and socio-economic disparities can obstruct adoption, despite the promotion of mobile banking as a means of achieving financial inclusion (Dang et al., 2024). For micro-entrepreneurs and low-income groups, the perceived benefits and sense of control over their behaviors are especially impactful (Gichuki & Mulu-Mutuku, 2018).

Recent studies also highlight shifting trends and responses from the industry. Financial institutions are progressively concentrating on improving customer experience, incorporating fintech advancements, and offering customized services to fulfill consumer expectations and address obstacles to adoption (Schilling & Seuring, 2023). The demand for immediate, real-time services and the implementation of robust security measures demonstrate the industry’s adjustment to evolving consumer needs and regulatory frameworks (Agbeve et al., 2025). In summary, the literature emphasizes that effective strategies for mobile banking adoption must tackle both technological facilitators and barriers, customizing solutions to cater to the distinct requirements and concerns of various user groups.

2.2. Hypothesis Development

2.2.1. Mobile Banking Satisfaction and Loyalty

Service quality and satisfaction represent two distinct abstract concepts (Bonang et al., 2025). Assessments of service quality are mainly cognitive, concentrating on efficiency and effectiveness (Gazi et al., 2025). Research on e-service quality examines factors such as delivery speed, user-friendliness, reliability, security, and control (Supriyanto et al., 2025). On the other hand, satisfaction relates to the emotional or affective reaction to a product or service (Cárdenas-Muga et al., 2025). Scholars typically concur that evaluations of service quality occur prior to emotional responses and that service quality serves as a strong indicator of satisfaction in the context of mobile banking. Investigations into mobile banking validate this connection between service quality and satisfaction (Asawawibul et al., 2025).

Customer satisfaction results in positive outcomes for businesses, such as increased word of mouth and higher purchase intentions, as pleased customers share their experiences with family and friends, effectively providing free promotion (Al-Hujri et al., 2025). Satisfaction among customers is a strong indicator of their loyalty, likelihood to revisit the bank’s website, word-of-mouth referrals, repeat purchasing, and recommendations regarding different mobile banking services (Pokhrel & K.C., 2024). Research indicates that satisfaction is determined by comparing services to expectations, influencing future intentions, and this pattern is applicable across various service sectors, including mobile banking (Kumar et al., 2024). The following hypothesis is suggested:

H1.

Customer satisfaction has a positive relationship with customer loyalty towards mobile banking.

2.2.2. Moderating Effect of Mobile Banking Customers’ TR

The degree of connection between customer satisfaction and customer loyalty differs based on various conditions, and research should explore factors that could influence this relationship. Customers possess varying degrees of tolerance when assessing services, and individual customer traits impact their evaluation of services and technologies, indicating a moderating influence of these customer characteristics (Asif & Sarwar, 2025). In particular, factors at the customer level, such as personal traits, affect the relationship between satisfaction and loyalty (Schirmer et al., 2018).

TR is a personal characteristic that assesses an individual’s inclination towards technology (Fam et al., 2025). Limited studies investigating how TR influences satisfaction suggest that TR directly impacts satisfaction, particularly in contexts where technology is critical for delivering products, such as mobile services (Long et al., 2018). Our research is notably different from earlier studies in that TR serves as a moderating factor in the connection between satisfaction and loyalty among mobile banking users.

Customers with high technological readiness (TR) view technologies as more beneficial and consider technology-related elements of the mobile banking experience to be of greater significance, weighing these factors more heavily when assessing the overall experience (Imdad et al., 2025). The perceived significance of a service plays a moderating role in the connection between satisfaction and behavioral outcomes (Shariffuddin et al., 2023). For purchases deemed high in importance, there is a stronger correlation between satisfaction and behavioral results. Since low-TR customers do not value technology-related elements highly, a positive or negative encounter with technology has minimal impact on their overall evaluation of the service (Ashrafi & Easmin, 2023). In contrast to low-TR customers, high-TR customers tend to be more at ease with new technologies, possess greater prior experience with technology, and are generally less likely to face issues. They also tend to be less affected by technical difficulties and are more likely to persist in using the technology, regardless of any problems encountered (Pham et al., 2020). Consequently, a customer’s TR may shape their perception of the complexity of the mobile banking service. Additionally, the psychological processes and attributes associated with satisfaction may differ based on how complex the consumer experience is, and the level of complexity in the service experience can alter how significantly the service process affects a customer’s willingness to try a new service (Huy et al., 2019).

TR also affects customers’ beliefs, perceptions, and expectations regarding technologies, which serve as the basis for how they assess their experiences related to technology. Customers who possess a high level of TR tend to be more demanding and maintain elevated standards for evaluation. Consequently, TR influences the connection between service quality, satisfaction, and loyalty (Khan & Khan, 2025).

TR is a complex abstract variable that encompasses both positive characteristics (such as optimism and innovativeness) and negative characteristics (like discomfort and insecurity) regarding technological innovations. Optimism entails a favorable perspective on technology and the conviction that it can offer customers greater control, flexibility, and efficiency in their personal and professional lives (Simiyu & Kohsuwan, 2019). The perception of control significantly influences satisfaction with self-service technology. Individuals with an optimistic outlook view technology as more valuable, demonstrate greater trust in emerging technologies, and assess the functionalities of new technologies more positively. Optimism is linked positively to customers’ perceived ease of use and perceived usefulness, which, in turn, enhances customer satisfaction (Huy et al., 2019).

Innovativeness refers to the inclination of customers to be early adopters and leaders in embracing new technologies (Parasuraman & Colby, 2015). Customers who are innovative are eager to explore emerging technologies and view themselves as highly skilled in utilizing these technologies and managing the uncertainties they might present. They have a more favorable view of the functions offered by a new technology. The more an individual accepts innovative technologies, the higher the likelihood that they will deem mobile banking to be beneficial (Yosser et al., 2020). Additionally, research indicates that innovativeness is positively correlated with the perceived effects of technology on consumer experience and the likelihood of returning, as it enhances one’s familiarity with the technology (Pattansheti et al., 2016).

Financial institutions implement technological advancements to attain lower costs, increased capacity, enhanced speed, improved security management, and flexibility in products and services. These objectives align with the ambitions of high-tech and resourceful customers who wish to be recognized as innovators in technology (Khadka & Kohsuwan, 2018). Consequently, it is anticipated that a more robust connection will exist between customer satisfaction in mobile banking and customer loyalty. The subsequent hypotheses are put forward:

H2.

Optimism positively moderates the relationship between customer satisfaction and loyalty in the mobile banking environment.

H3.

Innovativeness positively moderates the relationship between customer satisfaction and loyalty in the mobile banking environment.

Discomfort can be described as the sensation of having limited control over technology, coupled with feelings of being inundated by it, whereas insecurity refers to a lack of trust in technology and a negative outlook regarding its reliability (Parasuraman & Colby, 2015). Psychological insecurity plays a crucial role in mediating the combined effects of employee relations behavior and technology usage on service evaluations (Vy et al., 2022). Customers who report high levels of discomfort and insecurity view mobile banking as complicated, often feeling overwhelmed by the technology and experiencing a significant lack of control over their ability to navigate uncertainty, leading to an exaggerated perception of the technology’s complexity (Wiese & Humbani, 2020). Individuals who have doubts about technology also tend to feel a great deal of anxiety when engaging with new technologies and are pessimistic about the technology’s effectiveness (Martens et al., 2017).

Feelings of discomfort and insecurity can result in a lack of trust in new technologies, alongside a diminished perception of their usefulness and functionality, which may influence the bond between satisfaction and loyalty (Mahmood et al., 2023). While an increase in trust towards technology enhances satisfaction with mobile banking, some studies suggest that trust serves more as a mediator or moderator rather than a straightforward predictor of satisfaction (Shin & Lee, 2014). Likewise, perceived usefulness and trust have a positive moderating effect on the link between satisfaction and loyalty across various service contexts (Jahnavi et al., 2024). Additionally, customers who experience confusion regarding technologies are less likely to enjoy a favorable interaction with them, even if the technologies function effectively (Huy et al., 2019). The hypotheses that follow are proposed:

H4.

Discomfort negatively moderates the relationship between customer satisfaction and loyalty in the mobile banking environment.

H5.

Insecurity negatively moderates the relationship between customer satisfaction and loyalty in the mobile banking environment.

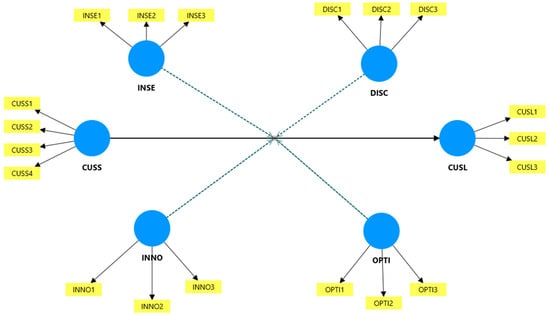

The research model shown in Figure 1 illustrates the connections between the conceptual variables as outlined in the hypotheses.

Figure 1.

Research Model.

3. Methods

This research utilized the banking sector as a case study and employed a quantitative approach, which featured an online survey carried out in the United States. The assessment tool was created based on field research and industry input to gather data on satisfaction, loyalty, as well as demographic details of the participants.

The initial construct relates to mobile banking satisfaction, assessed through five items. The following construct is loyalty, also evaluated with five items. The metrics for these constructs were derived from the works of Yang and Peterson (2004) and Jiang et al. (2016). The third construct, TR, was influenced by Parasuraman and Colby (2015). TR encompasses four elements (Optimism, Innovativeness, Discomfort, and Insecurity), with each element containing four items. Additionally, demographic details are included in the survey. Appendix A presents the purified measurement scales of the research.

The initial questionnaire was distributed to a selection of three academics and two managers with expertise in the mobile banking sector for their assessment of the content and wording. Following their input, several changes were implemented to enhance the questionnaire. The updated questionnaires were trialed with ten students who utilize mobile banking, and these students reported that the questionnaire was entirely clear.

Questionnaires were distributed via email to students at a national university’s School of Business located in the southeastern part of the United States. Specifically, the lecturers from the school were consulted regarding the objectives and content of the survey. Those lecturers who expressed interest assisted in the data collection by sending the survey link to their students. Participation in this survey was entirely voluntary for students; however, some were incentivized with bonus credits for completing it. Respondents rated items on a 5-point Likert scale, with 1 representing ‘totally disagree’ and 5 indicating ‘strongly agree’.

A significant limitation of this research is the lack of diversity in the sample, which was primarily composed of U.S. business students. This narrow demographic limits the applicability of the results to wider populations. The behaviors, attitudes, and comfort with technology of business students may not accurately represent those of the general public or different demographic groups, such as older adults, non-students, or individuals from diverse cultural backgrounds.

However, there are multiple reasons why student samples are frequently utilized in research on technology adoption, including mobile banking:

* High technology adoption: students, especially in business fields, tend to adopt technology early and frequently use mobile applications, making them a relevant demographic for examining new digital services.

* Accessibility and control: student samples are readily available and provide better control over extraneous variables, which can improve the internal validity of the research.

* Theory development: research conducted with students can lay the groundwork for theory development and initial testing prior to expanding studies to more varied populations.

A total of 283 responses were gathered. Out of these 283 responses, 25 questionnaires were significantly incomplete; therefore, they were excluded from the analysis. Consequently, 258 questionnaires were utilized for statistical evaluation. Male participants made up 46.1% of the total. In terms of age distribution, 21.7% are under 20, 68.6% fall between 21 and 29, 5.4% are aged between 30 and 39, and 4.3% are over 39 years old. When considering the highest level of education attained, 51.2% have completed high school; 44.6% hold a 2-year degree; and 4.3% possess a 4-year degree. Concerning pre-tax income, 26.5% earn less than $300; 17.1% earn between $300 and $499; 26.1% earn between $500 and $999; 14% earn between $1000 and $1999; and 16.3% earn $2000 or more. In relation to student classification, 19% are sophomores, 20.2% are juniors, and 60.8% are seniors. Regarding the duration of mobile banking usage, 12.5% have used it for less than one year, 49.6% for between 1 and 3 years, and 37.9% for 4 years or longer. Among the respondents, 67% reported experiencing issues while using mobile banking.

In studies utilizing surveys, a significant concern is non-response bias. According to Armstrong and Overton (1977), non-response bias was investigated using t-tests, and the outcomes of these tests indicated no statistically significant differences at the 5% significance level between early and late respondents across all measures, suggesting that non-response bias is not a significant issue in this study (Armstrong & Overton, 1977).

Statistical methods such as descriptive statistics, correlation coefficients, factor analysis, and structural equation modeling were employed to analyze the data in this research. In particular, structural equation modeling techniques were applied to estimate the path coefficients between different constructs. It is important to ensure that both measurement and structural models are statistically valid and reliable for the overall model to be sound. Consequently, Bollen’s (1989) two-step analytical process is implemented to assess the measurement and structural models. The measurement model is evaluated in the first step, while the structural model is examined with the objective of testing the statistical hypotheses in the second step. The primary statistical software packages utilized for the analyses are SPSS 31 and SmartPLS 4.

4. Results

Exploratory factor analysis (EFA) was performed to assess the measurement items within each scale, focusing on unidimensionality, the structure of factors, and the reliability of factor loadings (Gerbing & Anderson, 1988). We conducted a reliability analysis to evaluate the internal consistency of the scales using Cronbach’s alpha coefficient, where values exceeding 0.7 are deemed satisfactory (Nunnally, 1978).

Following the factor analysis, certain items were eliminated from the constructs to improve the reliability and validity of the measurement model. Items that displayed low factor loadings, significant cross-loadings, or did not conceptually fit with their designated constructs were removed to ensure that each construct was represented by items that effectively and consistently measured the underlying concept. This approach enhances the clarity, internal consistency, and discriminant validity of the constructs, ultimately resulting in more robust and interpretable research findings. Specifically, using these standards, several items were removed, which included one item each from innovativeness, optimism, insecurity, and discomfort, along with two items from satisfaction and one item from loyalty.

The partial least squares method (PLS) used in structural equation modeling, referred to as PLS path modeling (PLS-PM) or PLS structural equation modeling (PLS-SEM), is a component-based estimation technique that differs from the covariance-based methodology, which primarily focuses on testing and validation (Hair et al., 2013). In contrast, PLS-PM addresses the residual variance of latent variables, aiming to predict the main latent constructs. Unlike the covariance-based approach, PLS-PM is not reliant on the assumption of normally distributed data and does not necessitate large sample sizes like other causal modeling methods (do Valle & Assaker, 2016).

The objective of this study is to assess a range of predictive relationships and investigate how TR factors affect the connection between mobile banking customer satisfaction and loyalty. For analyzing the data, PLS-PM is the most suitable analytical method.

It is important to note that the data were collected from a single source, making it essential to evaluate the presence of common method bias. The Harmon test was conducted (Podsakoff et al., 2003), and the findings indicated that when all items were grouped into one factor, that factor accounted for less than 50 percent of the variance. As a result, common method bias does not pose a significant issue. Furthermore, the items constituting each factor do not exhibit any outliers.

The analysis of reliability, convergent validity, and discriminant validity is conducted through factor analysis in SmartPLS 4, following the removal of two items from the “customer satisfaction” factor, one item from the “customer loyalty” factor, one item from the “innovativeness” factor, one item from the “optimism” factor, one item from the “insecurity” factor, and one item from the “discomfort” factor due to their VIF values exceeding 5 or their loading coefficients on the respective factors being below 0.6 (Bagozzi & Yi, 1988). As shown in Table 1, the loading coefficients exceed 0.7; the Cronbach’s alpha coefficients and composite reliability coefficients are above 0.8; and the AVE coefficients are greater than 0.6, confirming the measurement model.

Table 1.

Loadings, Cronbach’s alpha, composite reliability, and average variance extracted.

Discriminant validity is assessed by examining the correlation coefficients of a particular factor in comparison to the other factors and the square root of that factor’s AVE. In Table 2, the correlation coefficients among a specific factor and the other factors are lower than the square root of the AVE for that factor (which is found on the diagonal of the matrix). This validates the convergent validity of the measurement model.

Table 2.

Correlations and square root of AVEs.

One alternative method to evaluate discriminant validity is by employing HTMT (Heterotrait-Monotrait) values. Table 3 displays the HTMT values, which are below 0.85 (with the exception of customer satisfaction, which is at 0.872, slightly exceeding 0.85). This information indicates that the discriminant validity of the measurement model has been established.

Table 3.

HTMT values.

The model demonstrates an acceptable fit based on the reported indices. The SRMR value of 0.063 is below the commonly recommended threshold of 0.08, indicating a good fit between the observed and predicted correlations. The d_ULS (0.76) and d_G (0.36) values are low, further supporting model adequacy. The chi-square statistic (557.442) is provided for reference, though its significance can be influenced by sample size. The NFI value of 0.842 suggests an adequate, though not perfect, level of fit, as values above 0.80 are typically considered acceptable in exploratory research. Overall, these indices collectively indicate that the model fits the data reasonably well.

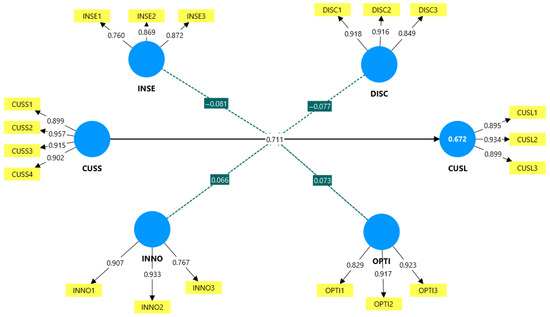

Once the reliability, convergent validity, and discriminant validity of the measurement model have been established, the structural model is assessed to evaluate the hypotheses. In Figure 2, the estimates of path coefficients and R2 values are depicted.

Figure 2.

Path coefficient estimates and R-squared values.

As illustrated in Figure 2, there is a positive path coefficient from customer satisfaction to customer loyalty. In contrast, the path coefficients indicating insecurity and discomfort negatively affect the connection between customer satisfaction and customer loyalty. Additionally, the path coefficients relating to innovativeness and optimism positively influence the relationship between customer satisfaction and customer loyalty. The model’s R-squared value is 67.2%.

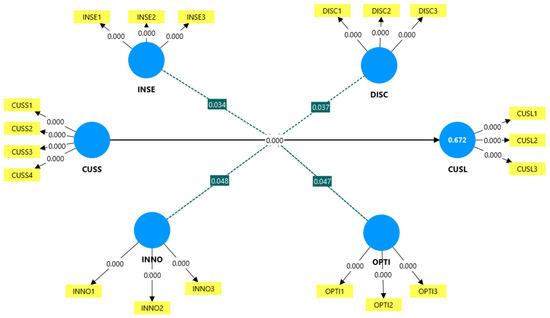

Figure 3 displays the p-values for the estimated coefficients. In this figure, the p-value indicating the relationship between customer satisfaction and customer loyalty is below 0.01. Additionally, p-values below 0.05 are observed for the connections from insecurity, discomfort, innovativeness, and optimism to the link between customer satisfaction and customer loyalty.

Figure 3.

p-value estimates.

Based on Figure 2 and Figure 3, the testing of statistical hypotheses is summarized in Table 4. Specifically, hypotheses H1, H2, H3, H4, and H5 are all statistically supported.

Table 4.

Hypotheses testing.

5. Discussion and Implications

5.1. Discussion

This research improves our understanding of customer experiences within the mobile banking context by examining a research model that reflects the connections between customer satisfaction, customer loyalty, innovativeness, optimism, insecurity, and discomfort. The findings indicate that Hypothesis 1—customer satisfaction has a positive correlation with customer loyalty in the mobile banking setting—is statistically validated (path coefficient 0.711, t-value 10.865, p-value < 0.001). This finding aligns with previous research conducted by Yang and Peterson (2004), Kuo et al. (2009), and Pham et al. (2020).

The Q2 value for customer loyalty is 0.644, indicating a strong level of predictive significance. The f2 value is defined as the change in R2 when an exogenous variable is removed from the model (customer satisfaction). Specifically, f2 measures the effect size. The f2 value is 0.664, implying that the exogenous variable has a large effect.

The contextual factor examined in this research is technology readiness. Numerous studies have investigated the direct effects of technology readiness on outcome variables, including satisfaction, technology adoption, perceived ease of use, and perceived usefulness in both traditional commerce and e-commerce settings (Huy et al., 2019; Pham et al., 2020). Nevertheless, there are no studies that have explored the moderating effect of technology readiness on the relationship between customer satisfaction and customer loyalty within the mobile banking context.

This study proposes four hypotheses concerning the moderating effect of technology readiness: optimism positively influences the connection between customer satisfaction and customer loyalty (Hypothesis 2); innovativeness positively affects the relationship between customer satisfaction and customer loyalty (Hypothesis 3); discomfort negatively impacts the association between customer satisfaction and customer loyalty (Hypothesis 4); and insecurity negatively affects the link between customer satisfaction and customer loyalty (Hypothesis 5).

The findings indicate that Hypothesis 2 has statistical support (path coefficient 0.073, t-value 1.673, p-value < 0.05), and Hypothesis 3 is also statistically supported (path coefficient 0.066, t-value 1.668, p-value < 0.05). These outcomes align with previous research, including that of Wang et al. (2017). In other words, the strength of the connection between customer satisfaction and customer loyalty is influenced positively by the customers’ level of optimism or innovativeness.

The findings also demonstrate that Hypothesis 4 is statistically upheld (path coefficient −0.077, t-value 1.782, p-value < 0.05), and Hypothesis 5 is statistically upheld as well (path coefficient −0.081, t-value 1.828, p-value < 0.05). These findings contradict those of previous research, including that of Wang et al. (2017). In other words, the intensity of the connection between customer satisfaction and customer loyalty is negatively impacted by the level of discomfort and insecurity experienced by customers.

The readiness of customers to embrace technology influences the connection between customer satisfaction and loyalty in mobile banking. Customers who exhibit higher levels of technology readiness—marked by enhanced digital skills, a willingness to embrace innovation, and self-assurance in using new technologies—are more inclined to translate their satisfaction with mobile banking services into enduring loyalty. These technologically adept customers are more capable of valuing sophisticated features, adjusting to new updates, and addressing minor technical challenges, thereby reinforcing the link between satisfaction and loyalty. Conversely, customers with lower technological readiness may face difficulties with usability, experience feelings of insecurity, or hesitate to adopt new features, which makes it less probable for them to remain loyal even if they are pleased with the service. Consequently, technological readiness serves as a vital determinant in how satisfaction with mobile banking evolves effectively into sustained customer loyalty.

This research highlights how individual psychological traits affect customer loyalty in mobile banking. While satisfaction generally boosts loyalty, optimism and innovativeness strengthen this link, whereas discomfort and insecurity weaken it. The findings suggest loyalty models should consider these traits. For managers, improving satisfaction alone is insufficient; targeting optimistic and innovative customers and reducing discomfort and insecurity through better design and security can enhance loyalty.

5.2. Theoretical Contributions

In the age of the Fourth Industrial Revolution, developments in information and communication technology are transforming all areas of the economy, with the service sector also being affected (Huy et al., 2019). An increasing number of innovative technological applications are being implemented to deliver services to customers. The ultimate success of service providers hinges on their ability to achieve customer loyalty. Numerous studies have identified key elements that influence customer loyalty towards service providers, with customer satisfaction being the most significant factor (Pham et al., 2020).

Previous research has confirmed the link between customer satisfaction and customer loyalty. However, there have been no studies that unify these two concepts into a single research framework to explore the moderating effects of technology readiness on the connection between customer satisfaction and customer loyalty, aside from the research by Vy et al. (2022). Vy et al. (2022) investigated the moderating influence of technology readiness on the relationships among perceived value, customer satisfaction, and customer loyalty. Nonetheless, their findings showed that innovativeness, optimism, discomfort, and insecurity did not demonstrate statistically significant moderating effects on the relationships involving perceived value, customer satisfaction, and customer loyalty.

The primary contribution of this study is the integration of the four constructs—technology readiness, optimism, innovativeness, discomfort, and insecurity—into a unified research model, aimed at examining their moderating influences on the connection between customer satisfaction and customer loyalty within the highly dynamic environment of mobile banking. The findings indicate that there is a positive relationship between customer satisfaction and customer loyalty; both optimism and innovativeness exert positive moderating effects on this relationship, while discomfort and insecurity provide negative moderating effects regarding customer satisfaction and customer loyalty.

Table 5 displays the findings of this research alongside those from Vy et al. (2022). Vy et al. (2022) investigated the connection between customer satisfaction and loyalty within the context of online brokerage, whereas this study focuses on mobile banking. As shown in Table 5, while the association between customer satisfaction and customer loyalty is statistically significant in both studies, the moderating effects of technology readiness differ notably. Specifically, all four components of technology readiness—namely, optimism, innovativeness, discomfort, and security—exert statistically significant influences on the relationship between customer satisfaction and customer loyalty in the mobile banking context but have no effects in the online brokerage environment. Further research is required to validate these observations.

Table 5.

Results of this study versus results of Vy et al. (2022).

5.3. Practical Implications

This research emphasizes the important influence of customer satisfaction and technology readiness on developing customer loyalty in the mobile banking industry. These results carry various practical consequences for banks and financial service organizations looking to improve customer retention and gain a competitive edge in a progressively digital environment.

Initially, the findings indicate that mobile banking services should focus on enhancing the personalized user experience design. Given that customers’ technology readiness affects the satisfaction–loyalty connection, banks need to customize their digital interfaces to fit various user types. For clients who are optimistic and innovative, platforms can introduce advanced functionalities, such as AI-powered financial insights, personalized dashboards, and early access to new features. These users tend to be more inclined to explore and embrace new capabilities, so offering them richer and more interactive experiences can strengthen engagement and loyalty (Pattansheti et al., 2016). On the other hand, for customers who express discomfort or harbor security fears, banks should simplify workflows, lessen cognitive load, and present easier navigation. Progressive disclosure—where advanced options are unlocked as users show readiness—can assist in gradually introducing less tech-savvy customers to the platform, thereby reducing anxiety and frustration (Wiese & Humbani, 2020).

Security in mobile banking is a double-edged sword. While strong security measures are crucial, overly complicated systems can decrease user satisfaction, especially among individuals who feel uncomfortable or have security concerns (Jahnavi et al., 2024). Banks should adopt adaptive authentication systems that adjust security needs based on the value of transactions and user behavior. For example, transactions of low value might only need biometric verification, whereas higher-value transactions may necessitate additional authentication steps. Adding behavioral analytics to identify unusual activities can further improve security without overwhelming the typical user. This method strikes a balance between ensuring strong protection and maintaining a smooth user experience, mitigating the negative impact of discomfort and security fears on customer loyalty (Mahmood et al., 2023).

The design of loyalty programs should take into account the varying levels of technological readiness among customers. For those who are innovative and optimistic, banks can offer gamified rewards, early access to beta features, and special digital badges (Pattansheti et al., 2016). These types of incentives not only acknowledge and promote the engagement of early adopters but also create a sense of community and belonging. For clients who prioritize security, loyalty programs could provide benefits such as free cyber insurance, instant fraud alerts, and tailored security consultations. By tailoring rewards to match the fundamental motivations and concerns of customers, banks can enhance the relationship between satisfaction and loyalty across different segments (Pham et al., 2020).

Digital literacy programs represent another important consequence of our research. Since uncertainty with technology can diminish the favorable impact of satisfaction on loyalty, banks ought to focus on providing continuous education for their clients. This could include in-app guides, instructional videos, and interactive demonstrations that assist users in navigating new features or typical transactions (Simiyu & Kohsuwan, 2019). Timely assistance, like contextual hints activated by moments of hesitation or mistakes, can offer immediate help and alleviate anxiety. Furthermore, creating a community where users can exchange advice and troubleshoot collaboratively can empower less experienced customers and enhance trust in the platform.

Training for employees needs to adapt in order to support these strategies. Frontline employees should be trained to identify different levels of technological readiness and customize their assistance accordingly. Ongoing education about new digital trends, security measures, and user experience will empower staff to offer better support and enhance customer trust. Cooperation across customer service, IT, and product development teams can help ensure that customer feedback is quickly incorporated into platform advancements.

Ultimately, banks should establish strong feedback and analytics systems to assess satisfaction, technology readiness, and loyalty in real time. Micro-surveys integrated at critical points in the user journey can capture immediate feedback on new features or security measures. Predictive analytics can pinpoint users who may be at risk of leaving by examining trends in technology readiness, session length, feature usage, and error resolution (Pham et al., 2020). By proactively reaching out to these users with tailored support or incentives, banks can avert attrition and reinforce loyalty.

6. Conclusions, Limitations, and Future Research

This research aimed to explore the interplay between customer satisfaction, technology readiness, and customer loyalty within the realm of mobile banking. The results affirm that customer satisfaction is a key factor driving loyalty in this digital landscape. Additionally, the research indicates that technology readiness—particularly the aspects of innovativeness, optimism, discomfort, and security—significantly influences this relationship. Customers who exhibit greater innovativeness and optimism regarding technology tend to experience a stronger connection between satisfaction and loyalty, whereas those who feel discomfort or have security apprehensions find this link less robust. These findings underscore the necessity of not only providing a satisfying mobile banking experience but also catering to the varied technological perspectives of the customer demographic.

Financial institutions and banks should move away from generic solutions and adopt segmented strategies that address different levels of technological preparedness. Creating personalized user experiences, implementing adaptive security measures, designing customized loyalty programs, and launching comprehensive digital literacy initiatives are crucial for enhancing customer loyalty in the mobile banking realm. In addition, the research highlights the importance of maintaining ongoing feedback mechanisms and providing employee training to promptly meet customer needs and concerns. By incorporating these strategies, banks can build stronger and more resilient relationships with their clients, positioning themselves for lasting success in a rapidly digitizing financial environment.

Although this study presents significant insights, several constraints should be considered. Firstly, the research depends on self-reported survey data, which can introduce biases like social desirability and inaccuracies in recall. Participants may exaggerate their levels of satisfaction or minimize their issues with technology, potentially distorting the findings. Secondly, the sample used in this study may not accurately reflect the larger population of mobile banking users. Variables such as age, socioeconomic status, and geographic location could affect both technology readiness and loyalty, yet these factors were not thoroughly accounted for in the current research design.

Furthermore, the cross-sectional design of the research restricts the capacity to make causal conclusions. Although the connections between satisfaction, technology readiness, and loyalty are strong, longitudinal studies would be necessary to verify the direction and consistency of these effects over time. The focus of this study is specifically on mobile banking, which, while very pertinent, may not reflect the subtleties found in other digital financial services or traditional banking methods. Lastly, while the dimensions of technology readiness were assessed using recognized scales, changing digital trends might necessitate periodic revisions to maintain their relevance and accuracy.

Building on these discoveries, future studies should explore various paths for further investigation. Longitudinal research would be especially useful for establishing causal connections and comprehending how customer satisfaction, technology readiness, and loyalty change as users accumulate more experience with mobile banking platforms. Researchers could also broaden their focus to include additional digital financial services, such as online investment platforms, peer-to-peer payment systems, or digital wallets, to assess whether the identified trends persist across different settings.

Another potential avenue to explore is a more detailed segmentation of the customer demographic. Future research may investigate how demographic elements—such as age, income, education, and digital proficiency—interact with technology readiness to affect satisfaction and loyalty. Qualitative research methods, such as interviews or focus groups, could yield deeper insights into the particular concerns and motivations of various user segments, especially those who feel significant discomfort or anxiety regarding security.

Furthermore, as technology advances swiftly, upcoming studies ought to reconsider and enhance how technology readiness is measured. New technologies like artificial intelligence, biometric authentication, and blockchain could bring about new aspects of readiness or alter current ones. Researchers may also explore how organizational factors, including bank culture and the digital skills of employees, influence the success of personalized strategies.

Ultimately, research that investigates the efficacy of particular interventions, including focused digital literacy initiatives, customized security strategies, or tailored loyalty incentives, would provide actionable insights for banks looking to apply the advice based on this study. By exploring these aspects, forthcoming research can enhance the overall comprehension of how to cultivate customer loyalty in a progressively digital and competitive landscape within the financial services sector.

Author Contributions

Conceptualization, H.H., S.-M.H. and J.C.; methodology, H.H.; writing—original draft preparation, S.-M.H. and L.P.; writing—review and editing, H.H. and L.P.; supervision, J.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki, and approved by the Institutional Review Board (or Ethics Committee) of University of Louisiana at Monroe (IRB#: ULM-IRB-839 dated 21 March 2018).

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors on request.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

| Optimism: |

| OPTI1 New technologies contribute to a better quality of life |

| OPTI2 Technology gives me more freedom of mobility |

| OPTI3 Technology makes me more productive in my personal life |

| Innovativeness: |

| INNO1 Other people come to me for advice on new technologies |

| INNO2 In general, I am among the first in my circle of friends to acquire new technology when it appears |

| INNO3 I keep up with the latest technological developments in my areas of interest |

| Discomfort: |

| DISC1 When I receive technical support from a provider of a high-tech product or service, I sometimes feel as if I am being taken advantage of by someone who knows more than I do |

| DISC2 Technical support lines are not helpful because they do not explain things in terms I understand |

| DISC3 Sometimes, I think that technology systems are not designed for use by ordinary people |

| Insecurity: |

| INSE1 People are too dependent on technology to do things for themselves |

| INSE2 Too much technology distracts people to the point that it is harmful |

| INSE3 Technology lowers the quality of relationships by reducing personal interaction |

| Customer Satisfaction: |

| CUSS1 I am pleased with the reliability and performance of the mobile banking app |

| CUSS 2 My experiences with my bank’s mobile banking service have been consistently positive |

| CUSS3 Mobile banking services meet my expectations |

| CUSS 4 I am satisfied with the overall quality of mobile banking services provided by my bank |

| Customer Loyalty: |

| CUSL 1 I intend to continue using my bank’s mobile banking services in the future |

| CUSL 2 I would recommend my bank’s mobile banking services to others |

| CUSL 3 I am unlikely to switch to another bank’s mobile banking service |

References

- Agbeve, V., Adukpo, T. K., Mensah, N., Appiah, D., & Atisu, J. C. (2025). Comparative analysis of digital banking and financial inclusion in the United States: Opportunities, challenges and policy implications. Asian Journal of Economics, Business and Accounting, 25(3), 452–467. [Google Scholar] [CrossRef]

- Ahmad, M. (2018). Review of the technology acceptance model (TAM) in internet banking and mobile banking. International Journal of Information Communication Technology and Digital Convergence, 3(1), 23–41. [Google Scholar]

- Al-Hujri, A., Al-Hakimi, M. A., Alshageri, S., Vasant Keshavrao, B., & Al Koliby, I. S. (2025). The impact of social media marketing activities on brand loyalty and awareness: The mediating role of customer satisfaction in Yemen’s telecom industry. Cogent Business & Management, 12(1), 2509793. [Google Scholar] [CrossRef]

- Alsmadi, A. A., Shuhaiber, A., Alhawamdeh, L. N., Alghazzawi, R., & Al-Okaily, M. (2022). Twenty years of mobile banking services development and sustainability: A bibliometric analysis overview (2000–2020). Sustainability, 14(17), 10630. [Google Scholar] [CrossRef]

- Apau, R., Titis, E., & Lallie, H. S. (2025). Towards a better understanding of mobile banking app adoption and use: Integrating security, risk, and trust into UTAUT2. Computers, 14(4), 144. [Google Scholar] [CrossRef]

- Armstrong, J. S., & Overton, T. S. (1977). Estimating nonresponse bias in mail surveys. Journal of Marketing Research, 14(3), 396–402. [Google Scholar] [CrossRef]

- Asawawibul, S., Na-Nan, K., Pinkajay, K., Jaturat, N., Kittichotsatsawat, Y., & Hu, B. (2025). The influence of cost on customer satisfaction in e-commerce logistics: Mediating roles of service quality, technology usage, transportation time, and production condition. Journal of Open Innovation: Technology, Market, and Complexity, 11(1), 100482. [Google Scholar] [CrossRef]

- Ashrafi, D. M., & Easmin, R. (2023). The role of innovation resistance and technology readiness in the adoption of QR code payments among digital natives: A serial moderated mediation model. International Journal of Business Science & Applied Management, 18(1), 19–45. [Google Scholar]

- Asif, M., & Sarwar, F. (2025). Investigating trust, awareness and social influence on online banking adoption, moderated by customer relationship management: Technological adoption insights. Global Knowledge, Memory and Communication, 15(1), 1–20. [Google Scholar] [CrossRef]

- Azhari, S. C., Permatasari, A., & Angelus, M. (2025, April 23–25). Implementation of biometric technology in indonesian mobile banking: A TAM perspective on enhancing transaction security and enjoyment. 2025 International Conference on Inventive Computation Technologies (ICICT) (pp. 152–158), Kirtipur, Nepal. [Google Scholar]

- Bagozzi, R. P., & Yi, Y. (1988). On the evaluation of structural equation models. Journal of the Academy of Marketing Science, 16, 74–94. [Google Scholar] [CrossRef]

- Baquero, A. (2022). Net promoter score (NPS) and customer satisfaction: Relationship and efficient management. Sustainability, 14(4), 2011. [Google Scholar] [CrossRef]

- Bollen, K. A. (1989). Structural equations with latent variables. John Wiley & Sons. [Google Scholar]

- Bonang, D., Fianto, B. A., & Sukmana, R. (2025). Bibliometric analysis of service quality and customer satisfaction in Islamic banking: A roadmap for future research. Journal of Islamic Marketing, 16(2), 462–483. [Google Scholar] [CrossRef]

- Borodako, K., Berbeka, J., Rudnicki, M., & Łapczyński, M. (2023). The impact of innovation orientation and knowledge management on business services performance moderated by technological readiness. European Journal of Innovation Management, 26(7), 674–695. [Google Scholar] [CrossRef]

- Caruana, A. (2002). Service loyalty: The effects of service quality and the mediating role of customer satisfaction. European Journal of Marketing, 36(7/8), 811–828. [Google Scholar] [CrossRef]

- Cárdenas-Muga, J., Rodríguez-Zurita, D., Barcia, K. F., & Abad-Moran, J. (2025). The role of service quality and price fairness in explaining customer satisfaction and loyalty in a shrimp industry B2B relationship. The TQM Journal. [Google Scholar] [CrossRef]

- Chang, Y. W., & Chen, J. (2021). What motivates customers to shop in smart shops? The impacts of smart technology and technology readiness. Journal of Retailing and Consumer Services, 58, 102325. [Google Scholar] [CrossRef]

- Chen, J., & Chang, Y. W. (2023). How smart technology empowers consumers in smart retail stores? The perspective of technology readiness and situational factors. Electronic Markets, 33(1), 1. [Google Scholar] [CrossRef] [PubMed]

- Dang, T. T. N., Dao, T. H. T., Nguyen, V. H. T., & Ha, V. D. (2024). Understanding the moderating role of trust on continuance intention towards smartphone banking services: Empirical evidence from Vietnam. Journal for International Business and Entrepreneurship Development, 16(1), 4–33. [Google Scholar] [CrossRef]

- Daniel, C. N., & Berinyuy, L. P. (2010). Using the SERVQUAL model to assess service quality and customer satisfaction. An empirical study of grocery stores in Umea (pp. 1–78). Umea School of Business. Available online: https://d1wqtxts1xzle7.cloudfront.net/32759548/FULLTEXT01-libre.pdf?1391118754=&response-content-disposition=inline%3B+filename%3DUsing_the_SERVQUAL_Model_to_assess_Servi.pdf&Expires=1752682544&Signature=VgMREti5ukFBAn0QZzMHDnsrDUhZ5Dl6-apviPhuM0GuodeWeeTvDvOkJC7NyGjcn3fcd61eerQuiICnFUNLYYxFHy-zH6HSRZpYbOwOpHyEhU5-fj1wr87UNTmYCoTl6Xy0YcXmXjFj0wErejAwR-HJmDHHhAm2ZTYWL1U7Y2WkNP6qLPPSg-CJSUssiiyDFp2LCQbqM5XHhDbwfFTvA~BWrc2FykEUDOV5m7NhCh4LF5GBpNI1LuTLbR7Xx8VZjPhXelJ3DtU62LunTc-a~PKxX2Iqtv6LnbM07ch2QhT7ZTluX4-Qe7QBRKW7Lok2te4vh-aO-gGd5~0FP57KDw__&Key-Pair-Id=APKAJLOHF5GGSLRBV4ZA (accessed on 15 July 2025).

- Das, S., Nayyar, A., & Singh, I. (2019). An assessment of forerunners for customer loyalty in the selected financial sector by SEM approach toward their effect on business. Data Technologies and Applications, 53(4), 546–561. [Google Scholar] [CrossRef]

- Dendrinos, K., & Spais, G. (2024). An investigation of selected UTAUT constructs and consumption values of Gen Z and Gen X for mobile banking services and behavioral intentions to facilitate the adoption of mobile apps. Journal of Marketing Analytics, 12(3), 492–522. [Google Scholar] [CrossRef]

- do Valle, P. O., & Assaker, G. (2016). Using partial least squares structural equation modeling in tourism research: A review of past research and recommendations for future applications. Journal of Travel Research, 55(6), 695–708. [Google Scholar] [CrossRef]

- Elsaid Elmaasrawy, H., Tawfik, O. I., & Ali Ahmed Almashikhi, M. (2025). The impact of disclosing digital financial inclusion indicators through mobile banking on deposits, loans and sustainable growth rate. Cogent Economics & Finance, 13(1), 2457486. [Google Scholar] [CrossRef]

- Fam, K. S., Liu, Y., Wei, S., Edu, T., Zaharia, R., & Negricea, C. (2025). Modeling new technology readiness and acceptance in the case of B2B marketing employees. Journal of Business-to-Business Marketing, 32(1), 1–30. [Google Scholar] [CrossRef]

- Gazi, M. A. I., Masud, A. A., Sobhani, F. A., Islam, M. A., Rita, T., Chaity, N. S., Das, M., & Senathirajah, A. R. B. S. (2025). Exploring the mediating effect of customer satisfaction on the relationships between service quality, efficiency, and reliability and customer retention, loyalty in E-banking performance in emerging markets. Cogent Business & Management, 12(1), 2433707. [Google Scholar]

- Gerbing, D. W., & Anderson, J. C. (1988). An updated paradigm for scale development incorporating unidimensionality and its assessment. Journal of Marketing Research, 25(2), 186–192. [Google Scholar] [CrossRef]

- Gichuki, C. N., & Mulu-Mutuku, M. (2018). Determinants of awareness and adoption of mobile money technologies: Evidence from women micro entrepreneurs in Kenya. In Women’s studies international forum (Vol. 67, pp. 18–22). Pergamon. [Google Scholar]

- Hair, J. F., Ringle, C. M., & Sarstedt, M. (2013). Partial least squares structural equation modeling: Rigorous applications, better results and higher acceptance. Long Range Planning, 46(1–2), 1–12. [Google Scholar] [CrossRef]

- Hussain, M., Javed, A., Khan, S. H., & Yasir, M. (2024). Pillars of customer retention in the services sector: Understanding the role of relationship marketing, customer satisfaction, and customer loyalty. Journal of the Knowledge Economy, 16, 2047–2067. [Google Scholar] [CrossRef]

- Huy, L. V., Nguyen, P. T. H., Pham, L., & Berry, R. (2019). Technology readiness and satisfaction in Vietnam’s luxury hotels. International Journal of Management and Decision Making, 18(2), 183–208. [Google Scholar] [CrossRef]

- Imdad, S., e Zahra, S., Ali, M. K., Abdullah, A., & Ahmed, A. (2025). Impact of digital service innovation on customer-perceived service quality in the pakistani banking sector: The moderating role of technological readiness. Journal of Business and Management Research, 4(2), 358–377. [Google Scholar]

- Jahnavi, M., Bung, P., Nagasubba Reddy, N., & Murugesan, T. K. (2024). Exploring the impact of security, confidentiality, and related factors on m-banking adoption in India: A machine learning perspective. In Harnessing AI, machine learning, and IoT for intelligent business (Volume 1, pp. 467–484). Springer Nature Switzerland. [Google Scholar]

- Jiang, L., Jun, M., & Yang, Z. (2016). Customer-perceived value and loyalty: How do key service quality dimensions matter in the context of B2C e-commerce? Service Business, 10, 301–317. [Google Scholar] [CrossRef]

- Khadka, R., & Kohsuwan, P. (2018). Understanding consumers’ mobile banking adoption in Germany: An integrated technology readiness and acceptance model (TRAM) perspective. Catalyst, 18(1), 56–67. [Google Scholar]

- Khan, S., & Khan, S. U. (2025). Tourist motivation to adopt smart hospitality: The impact of smartness and technology readiness. Journal of Hospitality and Tourism Insights, 8(4), 1268–1287. [Google Scholar] [CrossRef]

- Khatri, B., Saxena, C., & Gawshinde, S. (2025, January 10–11). Moderating role of technology readiness of individuals to embrace telemedicine. 2025 International Conference on Ambient Intelligence in Health Care (ICAIHC) (pp. 1–11), Raipur Chattisgarh, India. [Google Scholar] [CrossRef]

- Khobragade, A., Balachandran, R., Gupta, B., Saroy, R., Awasthy, S., Singh, G., Misra, R., & Dhal, S. (2024). Mobile banking adoption for financial inclusion: Insights from rural West Bengal. Journal of Social and Economic Development, 1–19. [Google Scholar] [CrossRef]

- Kim, J. J., Lee, M. J., & Han, H. (2020). Smart hotels and sustainable consumer behavior: Testing the effect of perceived performance, attitude, and technology readiness on word-of-mouth. International Journal of Environmental Research and Public Health, 17(20), 7455. [Google Scholar] [CrossRef] [PubMed]

- Kim, S. H., & Yang, Y. R. (2025). The Effect of digital quality on customer satisfaction and brand loyalty under environmental uncertainty: Evidence from the banking industry. Sustainability, 17(8), 3500. [Google Scholar] [CrossRef]

- Kouandou, A., & Laajimi, R. (2025). Does mobile banking matter for the adoption of modern agricultural technology? Evidence from Côte d’Ivoire. Development Policy Review, 43(2), e12820. [Google Scholar] [CrossRef]

- Kumar, P., Chauhan, S., Kumar, S., & Gupta, P. (2024). A meta-analysis of satisfaction in mobile banking: A contextual examination. International Journal of Bank Marketing, 42(3), 357–388. [Google Scholar] [CrossRef]

- Kuo, Y. F., Wu, C. M., & Deng, W. J. (2009). The relationships among service quality, perceived value, customer satisfaction, and post-purchase intention in mobile value-added services. Computers in Human Behavior, 25(4), 887–896. [Google Scholar] [CrossRef]

- Le, X. C. (2025). Older consumers’ positive word-of-mouth toward m-banking: Evidence from an emerging market. Journal of Science and Technology Policy Management. [Google Scholar] [CrossRef]

- Long, P., Huy, L., Pham, N., & Donna, L. (2018). Technology readiness and customer satisfaction in luxury hotels: A case study of Vietnam. International Journal of Entrepreneurship, 22(2), 1–23. [Google Scholar]

- Mahmood, A., Imran, M., & Adil, K. (2023). Modeling individual beliefs to transfigure technology readiness into technology acceptance in financial institutions. Sage Open, 13(1), 21582440221149718. [Google Scholar] [CrossRef]

- Malthouse, E. C., Haenlein, M., Skiera, B., Wege, E., & Zhang, M. (2013). Managing customer relationships in the social media era: Introducing the social CRM house. Journal of Interactive Marketing, 27(4), 270–280. [Google Scholar] [CrossRef]

- Martens, M., Roll, O., & Elliott, R. (2017). Testing the technology readiness and acceptance model for mobile payments across Germany and South Africa. International Journal of Innovation and Technology Management, 14(6), 1750033. [Google Scholar] [CrossRef]

- Meselhy, Y. M., & Kortam, W. A. (2025). Using the modified TAM to improve customer retention levels for banks operating in Egypt. Management & Sustainability: An Arab Review. ahead-of-print. [Google Scholar] [CrossRef]

- Moretta Tartaglione, A., Cavacece, Y., Russo, G., & Granata, G. (2019). A systematic mapping study on customer loyalty and brand management. Administrative Sciences, 9(1), 8. [Google Scholar] [CrossRef]

- Nunkoo, R., Sharma, A., So, K. K. F., Hu, H., & Alrasheedi, A. F. (2025). Two decades of research on customer satisfaction: Future research agenda and questions. International Journal of Contemporary Hospitality Management, 37(5), 1465–1496. [Google Scholar] [CrossRef]

- Nunnally, J. C. (1978). An overview of psychological measurement. In Clinical diagnosis of mental disorders: A handbook (pp. 97–146). Springer. [Google Scholar]

- Palamidovska-Sterjadovska, N., Rasul, T., Lim, W. M., Ciunova-Shuleska, A., Ladeira, W. J., De Oliveira Santini, F., & Bogoevska-Gavrilova, I. (2025). Service quality in mobile banking. International Journal of Bank Marketing. [Google Scholar] [CrossRef]

- Parasuraman, A., & Colby, C. L. (2015). An updated and streamlined technology readiness index: TRI 2.0. Journal of Service Research, 18(1), 59–74. [Google Scholar] [CrossRef]

- Pattansheti, M., Kamble, S. S., Dhume, S. M., & Raut, R. D. (2016). Development, measurement and validation of an integrated technology readiness acceptance and planned behaviour model for Indian mobile banking industry. International Journal of Business Information Systems, 22(3), 316–342. [Google Scholar]

- Pham, L., Williamson, S., Lane, P., Limbu, Y., Nguyen, P. T. H., & Coomer, T. (2020). Technology readiness and purchase intention: Role of perceived value and online satisfaction in the context of luxury hotels. International Journal of Management and Decision Making, 19(1), 91–117. [Google Scholar] [CrossRef]