Abstract

This study investigates the impact of digital transformation on corporate tax avoidance in the banking industry, focusing on banks in the Middle East and North Africa (MENA). This study employs regression analysis on a sample of 123 banks in the MENA region, covering the period from 2011 to 2022. The results indicate a negative relationship between digital transformation and tax avoidance, with conventional banks showing a stronger inclination to adopt these trends compared to Islamic banks. Digital transformation is identified as an effective mechanism that enhances transparency and mitigates tax avoidance activities.

1. Introduction

Digital transformation has fundamentally reshaped global business practices, revolutionizing organizational structures, operational processes, and strategic decision-making across industries. Driven by disruptive innovations—artificial intelligence, big data analytics, cloud computing, and blockchain—this paradigm shift has compelled firms to rapidly adapt their business models to remain competitive. The banking sector has emerged as a focal point for digital transformation, with institutions increasingly using technology to enhance efficiency and customer engagement. Concurrently, governments worldwide are grappling with the implications of digital transformation for tax compliance, implementing policies to modernize tax systems, combat avoidance, and address revenue losses, which are estimated at USD 100–240 billion annually, due to base erosion and profit shifting (BEPS) (OECD, 2024). In this regard, banks’ commitment to digital innovations and technologies may significantly influence their tax avoidance behavior, specifically when they face a stringent tax and digital transformation environment. Although corporate tax avoidance is considered legal, it is often viewed as a form of financial crime that involves the use of sophisticated strategies to minimize tax obligations, which raises serious ethical concerns and undermines public trust in financial institutions (Kirchler & Maciejovsky, 2001).

Despite growing scholarly attention to digital transformation’s corporate impacts, its relationship with tax avoidance remains underexplored, particularly in banking. The existing studies have mainly focused on non-financial firms in China (e.g., Tiantian et al., 2023; Xie & Huang, 2023), leaving significant gaps in the understanding of how institutional heterogeneity—particularly in the banking sector, with its specific regulations—and regional economic priorities shape this relationship.

This study addresses these gaps by investigating how digital transformation impacted the tax avoidance behavior in a sample of Middle Eastern and North African (MENA) banks over the period from 2011 to 2022.

MENA banking offers an interesting context for conducting this study for many reasons. First, digitalizing the economies of MENA countries could significantly boost their economic growth, potentially leading to a 46% increase in GDP per capita and a long-term gain of USD 1.6 trillion over the next 30 years (World Bank, 2022). Second, MENA governments have recently implemented ambitious initiatives and stringent regulations that aim at driving digital transformation in the financial sector, revolutionizing traditional banking services, and stimulating operational efficiency. Third, the MENA region displays lower tax revenues, a trend that is attributed to inefficient tax collection systems and heavy reliance on hydrocarbon revenues (Shekar, 2018).

Two theoretical arguments exist regarding the benefits and costs of digital transformation. According to information processing theory (Premkumar et al., 2005), banks can increasingly adopt cutting-edge technologies to reduce their tax burden and identify tax-reducing opportunities. This could increase tax avoidance, particularly when banks face a rigorous tax environment (Zhou et al., 2022; Agyei et al., 2020). Alternatively, based on the agency theory (Jensen & Meckling, 1976), implementing high-technological strategies can enable banks to enhance their information transparency and thereby improve their internal control systems and governance (Tiantian et al., 2023) and reduce agency costs. In this sense, banks that are committed to digital transformation are less likely to engage in tax avoidance practices (Alqatan et al., 2024).

This paper contributes to the literature in several ways. First, we provide novel empirical evidence on the relationship between digital transformation and tax avoidance in the banking sector, addressing an important gap in the extant literature. Second, we contribute to the financial crime literature by identifying digital transformation as an effective deterrent to harmful tax avoidance behavior and quantifying its effect. Third, we advance the existing literature by deconstructing digital transformation into four distinct dimensions—digital strategy implementation, electronic banking services, digital service offerings, and mobile banking applications—and demonstrating their differential impacts on tax avoidance behavior. Fourth, our research contributes to the literature on corporate governance and financial regulation by demonstrating how digital transformation can serve as an effective monitoring tool that enhances transparency, strengthens oversight mechanisms, and reduces information asymmetry between stakeholders.

The remainder of this paper is structured as follows: Section 2 provides an overview of the institutional framework. Section 3 reviews the relevant literature and develops hypotheses. Section 4 outlines the methodology. Section 5 presents empirical results. Section 6 displays additional evidence. Section 7 discusses the robustness checks and Section 8 recapitulates this paper’s conclusion.

2. Going Digital in the MENA Region

In recent years, numerous MENA countries have concentrated on embracing new technologies and digital trends that may profoundly impact their organizational processes and operations. However, these technological priorities vary widely between nations, which marks significant gaps in their ability to adopt and integrate these advancements.

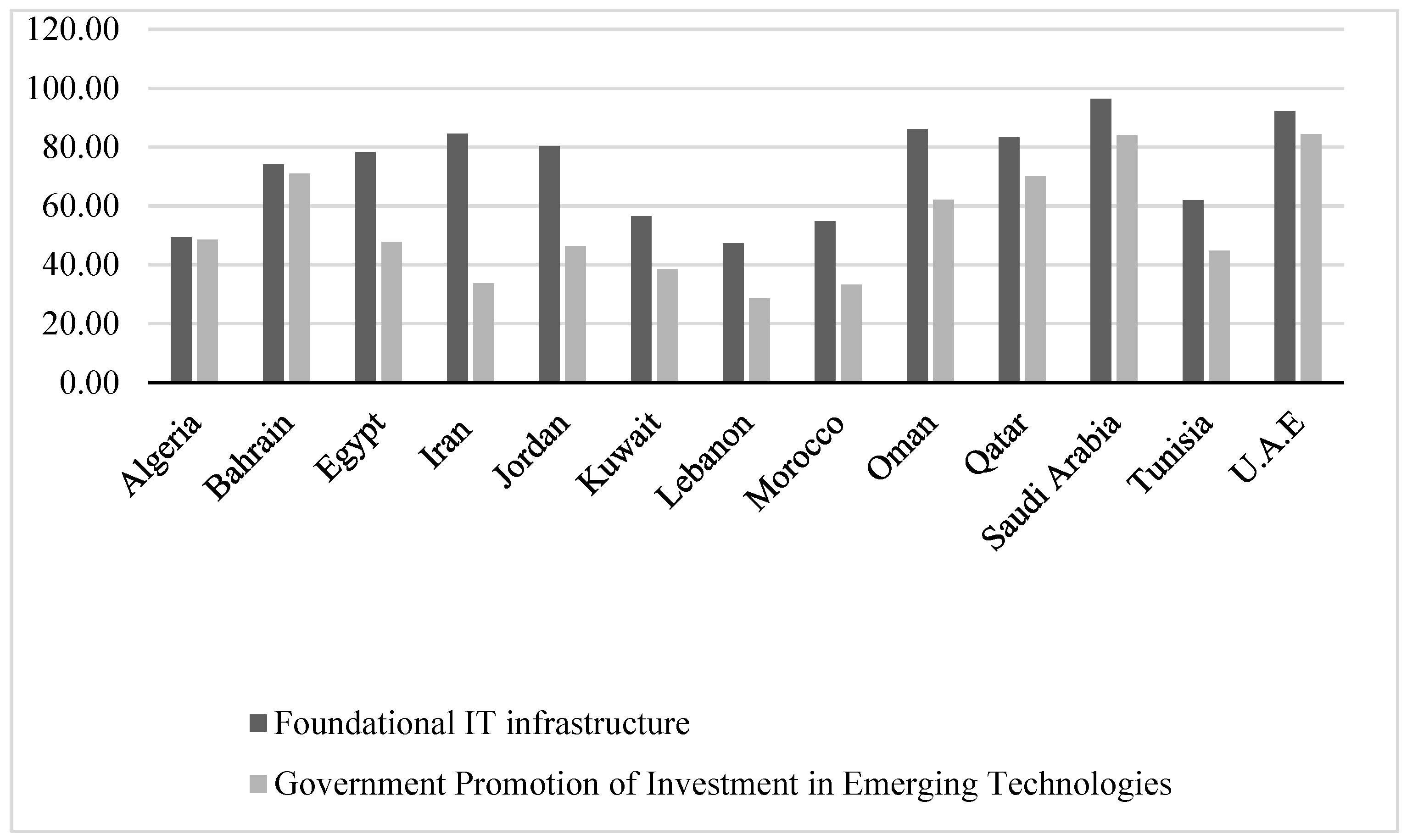

Figure 1 shows remarkable differences in the digital capacity of MENA countries. On one side, Saudi Arabia leads the region in deploying advanced IT infrastructure, followed by United Arab Emirates (UAE) and Oman. In terms of government promotion of investment in emerging technologies, the UAE, Saudi Arabia, and Qatar stand out with the highest scores. Remarkably, the Gulf countries significantly outperform the rest of the MENA region in terms of their digital capabilities. In contrast, Lebanon, Morocco, and Kuwait trail behind, with markedly lower scores, which signals the low adoption of IT infrastructure development and technology investment.

Figure 1.

Digital capacity.

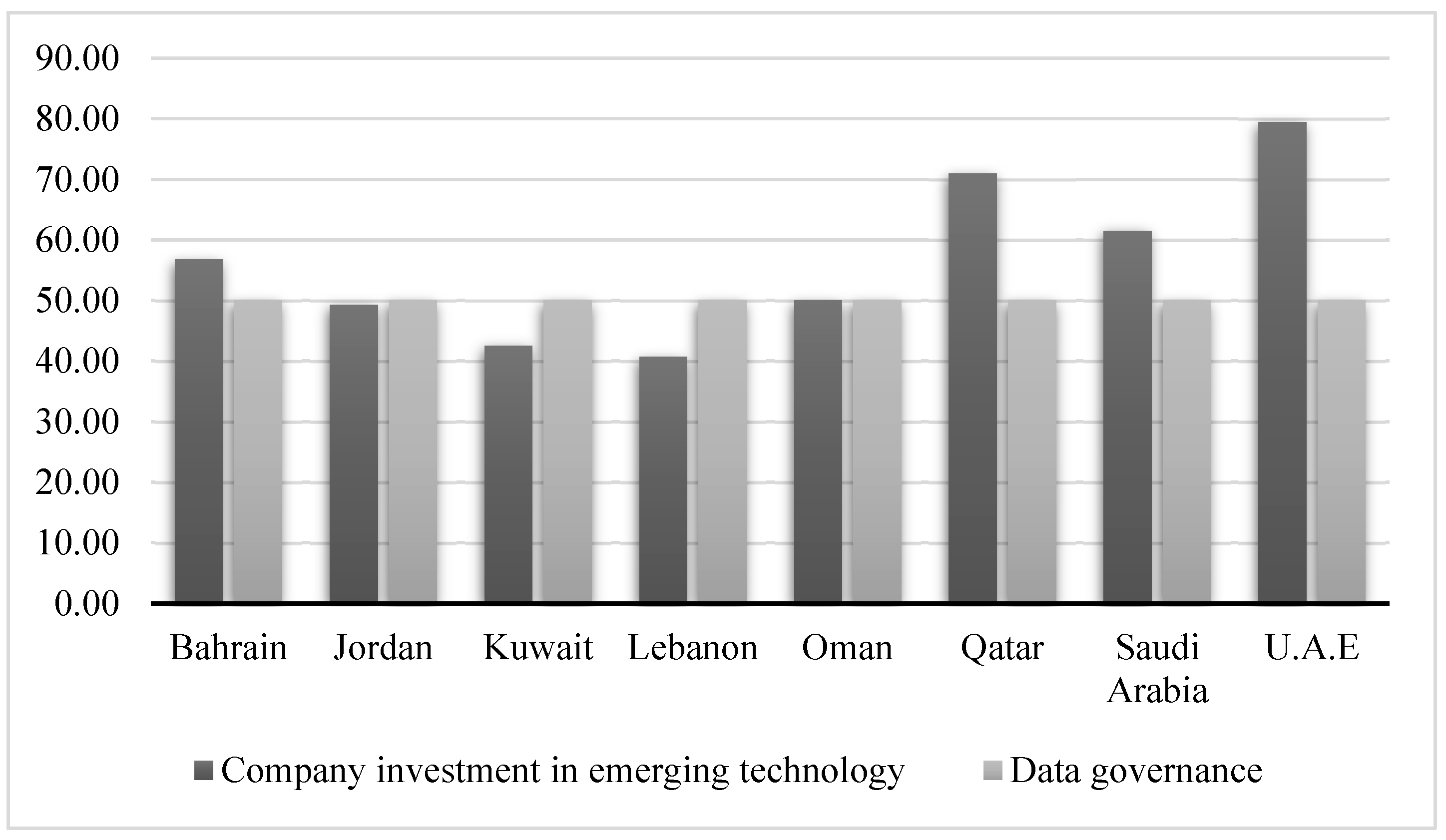

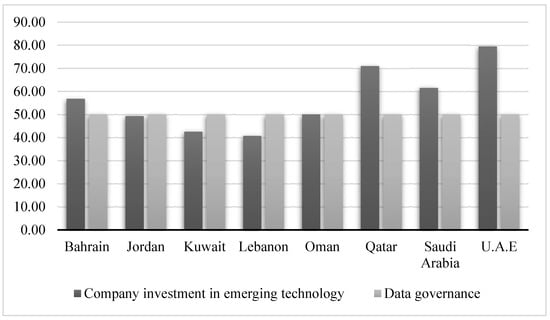

In terms of the innovation capacity of MENA countries, displayed in Figure 2, the highest scores for company investment (>60) are shown in the UAE, Qatar, and Saudi Arabia, whereas Lebanon, Jordan, and Kuwait exhibit the lowest scores (<50). Additionally, the MENA countries all show the same level of data governance, exhibiting a score of 50, which indicates that they need more stringent policies to strengthen data monitoring and supervision.

Figure 2.

Innovation capacity.

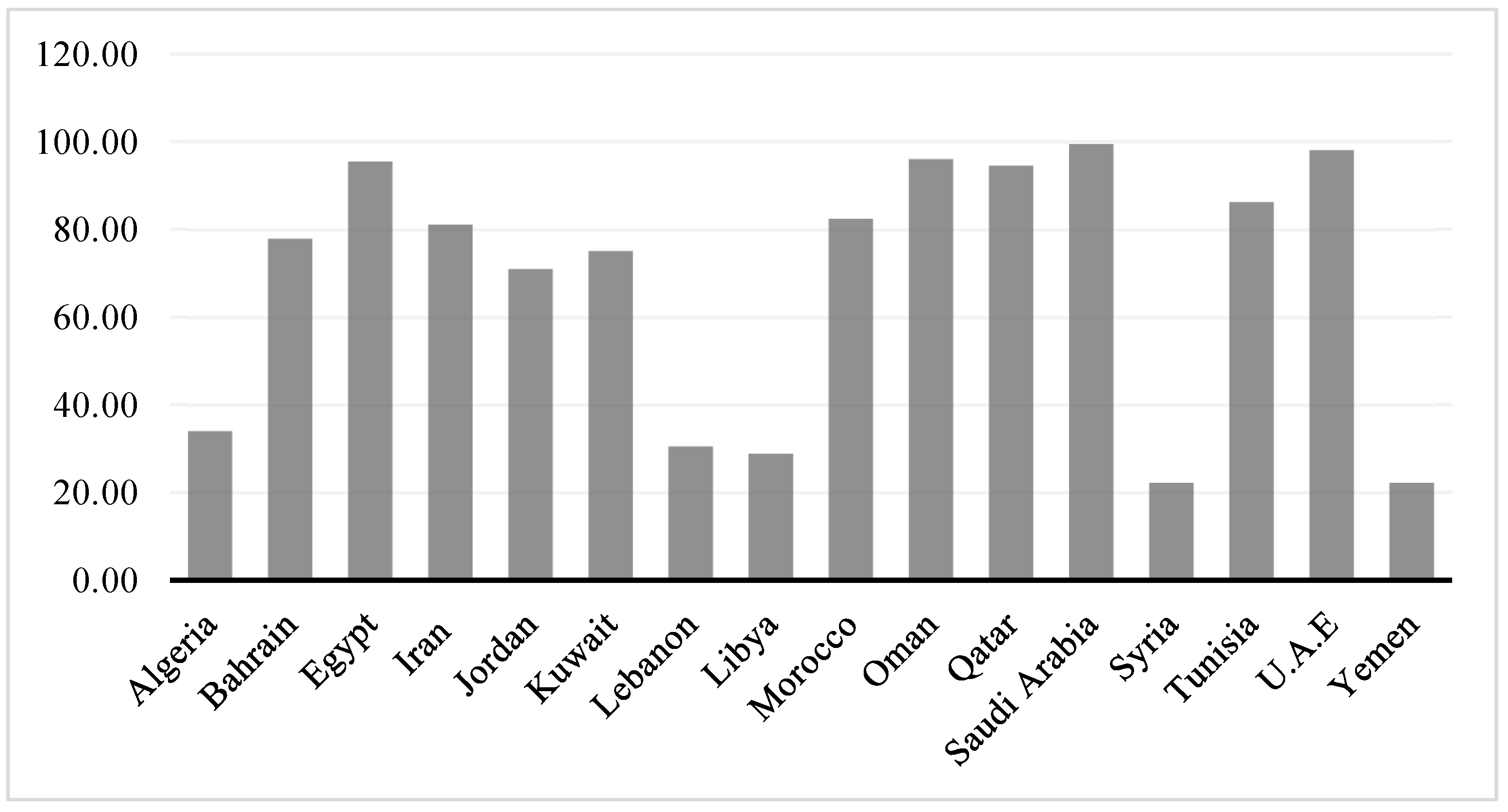

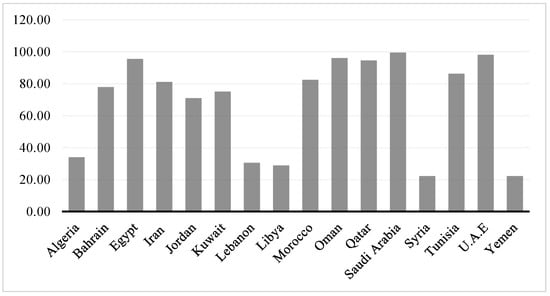

As indicated in Figure 3, the quality of cybersecurity across several MENA countries has seen a significant upward trend, although clear distinctions emerge among the three main groups. The first group —Saudi Arabia, the UAE, Oman, Egypt, and Qatar—boasts the strongest defenses against cyber-attacks, with scores exceeding 90, which highlights their robust internet security measures. The second group, Bahrain, Iran, Jordan, Kuwait, Morocco, and Tunisia, holds moderate scores between 70 and 80. In contrast, the final group, Algeria and Lebanon, records the lowest scores, falling below 50, which reflects vulnerabilities and internet security risks in these countries (Kharroub, 2022).

Figure 3.

Cybersecurity.

3. Literature Review and Hypotheses Development

Digital transformation, seen as a major strategic lever, is profoundly redefining banks’ operational and fiscal practices. This concept covers the integration of advanced technologies to optimize banks’internal activities, strengthen their operational management, and enhance their information processing capacity (Premkumar et al., 2005; Vial, 2021).

According to a World Bank survey (2021), digital transformation has become a strategic priority for commercial banks seeking to improve their performance and resilience in challenging environments (Murinde et al., 2022; Koetter & Noth, 2013; Nguyen-Thi-Huong et al., 2023). This transition alters how banks process information, make decisions, and manage their tax obligations, creating a complex relationship between their technological capabilities and tax behavior.

Despite the absence of specific studies that directly examine the relationship between digital transformation and tax avoidance in the banking sector, we propose two competing hypotheses based on a theoretical framework and related evidence from other industries. First, digital transformation may increase tax avoidance by enhancing banks’ capacity to identify and implement tax optimization strategies. Alternatively, digital transformation may decrease tax avoidance by strengthening regulatory oversight and aligning managerial incentives with long-term shareholder interests.

Drawing on the information processing capacity theory (Premkumar et al., 2005), the first perspective suggests that digital transformation enhances banks’ ability to identify and exploit tax opportunities. Studies show that banks with advanced information systems can exploit tax opportunities more effectively, as these systems improve cross-sector coordination and the management of complex tax structures (Gallemore & Labro, 2015). This enhanced capacity allows banks to implement sophisticated tax planning strategies while remaining within legal boundaries, which reduces their tax burden and increases their after-tax profits. Digital tools provide superior data analysis capabilities, enabling banks to identify tax-saving opportunities across multiple jurisdictions and business lines that would otherwise remain undetected.

Furthermore, digital transformation facilitates the management of complex tax structures by improving cross-functional coordination and information sharing (Zhou et al., 2022). When tax-relevant information flows more efficiently between departments, banks can develop more comprehensive tax strategies that capitalize on the attributes of their operations, investments, and corporate structure.

This perspective suggests that digital transformation empowers banks to engage in more effective tax planning, which will potentially increase their level of tax avoidance.

From a contrasting perspective, and drawing on agency theory (Jensen & Meckling, 1976), digital transformation may instead reduce tax avoidance behaviors. Digital technologies mitigate conflicts between shareholders and managers by improving internal controls and financial transparency (Zhai et al., 2022). While shareholders traditionally prioritize profit maximization, the increased visibility and scrutiny enabled by digital transformation alters the risk–reward calculus of aggressive tax planning.

Digital tools strengthen tax authorities’ ability to detect aggressive avoidance through automated reporting and controls (De Simone et al., 2020). Algorithms can identify atypical transactions, discourage gaps of exploitation, and increase the detection risk of questionable tax practices. This heightened scrutiny raises the potential costs of aggressive tax strategies, including penalties, regulatory interventions, and litigation expenses.

Moreover, enhanced transparency transforms tax avoidance from a purely financial decision into a reputational concern. Aggressive tax strategies that become public can damage a bank’s reputation among customers, investors, and other stakeholders. Chen et al., 2010; Sarhan et al., 2024), potentially eroding trust in an industry where trust is a fundamental asset. The long-term damage from reputational harm may far outweigh the short-term benefits of tax savings, particularly for banks whose business models depend on public confidence.

Digital transformation reduces agency costs not by eliminating tax optimization but by aligning managerial decisions with shareholders’ comprehensive long-term interests. Enhanced transparency and oversight tools discourage managers from pursuing overly aggressive schemes that could harm their firm’s reputation or trigger penalties (López-González et al., 2019; Steijvers & Niskanen, 2014). Technologies like blockchain and AI further promote stakeholder inclusion and audit effectiveness (McComb & Smalt, 2018; Zhang et al., 2020), creating an environment where controversial tax practices become increasingly difficult to implement without detection.

The relationship between digital transformation and tax avoidance appears particularly complex in the MENA banking context. In this region, banks have made heavy investments in digital technologies, including mobile banking applications, online platforms, and cybersecurity measures. Simultaneously, governments actively promote digital banking through rigorous regulations and policies, creating an institutional environment that may intensify scrutiny of tax practices. This combination of enhanced capabilities and heightened oversight creates tension in banks’ approach to tax planning.

Despite the growing number of studies on the relationship between digital transformation and firms’ tax avoidance, no study has yet focused on the MENA banking industry (e.g., Alqatan et al., 2024). Most studies conducted in the MENA context have identified key determinants for tax avoidance, including financial performance (Kateb et al., 2025), corporate governance (Alshabibi et al., 2022), institutional quality (Eldomiaty et al., 2023), and corporate social responsibility (Almutairi & Abdelazim, 2025). However, digital transformation has never been recognized as a determinant of tax avoidance in this context.

Therefore, we attempt to provide robust conclusions on the relationship between digital transformation and tax avoidance in the MENA banking sector—a unique environment shaped by effervescent tax reforms and laws, accelerating digital trends, and evolving governance systems. In this regard, we assume that most MENA banks heavily invest in technology to enhance their infrastructure, which includes mobile banking applications, online platforms, and cybersecurity measures, among others. Additionally, governments actively promote digital banking through the implementation of rigorous regulations and policies. Furthermore, MENA governments have introduced rigorous tax enforcement efforts in a strategic move to diversify their revenues beyond hydrocarbons. These initiatives aim to constrain tax avoidance and foster greater tax transparency and compliance.

H1:

Digital transformation positively affects banks’ tax avoidance.

H2:

Digital transformation negatively affects banks’ tax avoidance.

4. Methodology

4.1. Data Sources and Sample

Our sample is based on banks in the Middle East and North Africa region (MENA): Bahrain, Egypt, Emirates, Jordan, Iraq, Kuwait, Morocco, Lebanon, Oman, Saudi Arabia, Qatar, and Tunisia. The similarities between these nations are obvious, such as their Islamic culture, political systems, ethnicity, and traditions. The choice of this sample will enable us to guarantee that the banks’ financial information is available and that these banks are visible to the public, as their data are available on official websites. Our sample is created by combining three different data sources: Datastream, Thomson Reuters, and banks’ annual reports. The annual reports were collected from the banks’ official websites. Macroeconomic variables are extracted from World Bank website. The final sample comprises 123 banks, covering the period from 2011 to 2022.

4.2. Measures

4.2.1. Dependent Variable: Corporate Tax Avoidance

In the literature, the effective tax rate, which represents the total tax burden relative to pre-tax income, is widely used in recent studies (Lanis & Richardson, 2011; Minnick & Noga, 2010; Chen et al., 2010). It is an inverse function of tax avoidance, where lower values indicate greater involvement in corporate tax avoidance (Hanlon & Heitzman, 2010; Lanis & Richardson, 2018; Schwab et al., 2022; Sarhan et al., 2024).

However, given that the statutory tax rates vary from country to country, this study takes a more nuanced approach by using the difference between the statutory tax rate and the effective tax rate. This method enables a fairer comparison between companies operating in different tax jurisdictions. A larger gap between these two rates indicates a higher level of tax avoidance (Hanlon & Heitzman, 2010). Thus, this approach offers a more robust measure of tax avoidance in an international or multi-jurisdictional context, enabling a more accurate analysis of corporate tax practices, irrespective of variations in national tax regimes.

Therefore, tax avoidance is calculated as follows:

where TAX_AV indicates the tax avoidance of bank i in country j in year t; Stat_TAX is the statutory tax rate. Tax refers to the current tax expense paid and Pre_Inc is the pre-tax income less special items.

4.2.2. Independent Variable: Digital Transformation

To measure banks’ digital transformation, we adopt a textual analysis methodology, which aligns with approaches used in the prior literature on index systems (e.g., Yu & Yu, 2009; Chen et al., 2019; Xie & Wang, 2023) This methodology involves two steps. The first step focuses on data preparation and keyword identification. First, annual reports were sourced directly from the websites of all sample banks, serving as primary records of technological initiatives. Subsequently, four topic-specific DT indices were constructed (Appendix A describes digital transformation dimensions): digital banking strategy (DIG_STRATEGY), mobile-based digitalization (MOBIL_DIG), digital services (DIG_SRV), and E-banking (E_BANKING). The second step involved index calculation for each bank-year report. Topic-specific scores were calculated as the number of keywords for dimension j in the report divided by the total words in the report. This normalization accounted for report length variability. The aggregate index (INDEX_DIG) was computed as the sum of all four dimensions (DIG_STRATEGY, MOBIL_DIG, DIG_SRV, E_BANKING). All scores were standardized to a 0–1 scale for cross-bank comparability1.

The components of each index are detailed in Appendix A.

4.2.3. Control Variables

We use a set of control variables:

Loan loss provisions (LLP): Banks can use LLPs strategically to manipulate their tax base. By increasing LLPs, banks reduce their reported taxable income and thereby lower their tax liabilities. This approach allows banks to optimize their tax position while maintaining an image of financial prudence (Lassoued, 2023).

Capital adequacy ratio (CAR): Defined as shareholders’ equity divided by the total risk-weighted assets, CAR reflects a bank’s financial strength. The previous literature has highlighted that capital levels are crucial in cases of bank insolvency or bankruptcy. Lower capital ratios are associated with a higher likelihood of bank failure (Lassoued et al., 2025; Estrella et al., 2000).

Loan/deposit ratio (LTD): This ratio indicates a bank’s liquidity risk. Tax management strategies may vary depending on a bank’s liquidity position. A high LTD may suggest liquidity pressure, which can lead banks to adopt aggressive tax avoidance strategies to enhance profitability. Conversely, a low LTD may reflect more conservative tax behavior, as such banks face less pressure to generate immediate revenues.

Bank size (SIZE): Measured as the natural logarithm of total assets, bank size serves as a common proxy in tax planning studies. Larger banks typically have more resources and access to sophisticated tax planning mechanisms, which allows them to exploit tax law loopholes and minimize their tax burden (Hanlon & Heitzman, 2010; Law & Mills, 2017).

Return on assets (ROA): Calculated as net income after tax divided by average total assets, ROA reflects a bank’s profitability. Eichfelder and Hechtner (2018) argue that more profitable banks can afford to hire expert tax advisors, which enhances their ability to reduce tax obligations. In contrast, Zemzem and Ftouhi (2013) found a negative relationship between ROA and tax planning, suggesting that better-performing banks may engage less in tax avoidance.

GDP growth (GDP_GR): The real gross domestic product growth rate;

Governance (GOV_IND): Following Rachisan et al. (2017), we construct a composite governance index using PCA applied to six governance dimensions from the World Bank: regulatory quality, government effectiveness, political stability and absence of violence, voice and accountability, rule of law, and control of corruption (Kaufmann et al., 2011). This index reduces these interrelated indicators into a single latent governance factor that captures the overall institutional quality of a country.

The PCA exhibits an eigenvalue of 4.27, explaining approximately 71.2% of the total variance across the six indicators. The internal consistency of the index is also satisfactory, with a Cronbach’s alpha of 0.89, which indicates a high degree of reliability.

Consistent with Zeng (2019), we expect that firms operating in well-governed countries—those with higher governance index values—are less likely to engage in aggressive tax avoidance strategies.

The Gulf Cooperation Council (GCC) variable is a binary indicator that takes the value 1 if the country is a member of the GCC and 0 otherwise. We expect GCC countries to exhibit a significant influence on tax evasion due to their favorable tax regimes and reliance on oil revenues. Specifically, banks operating in GCC countries are likely to demonstrate lower levels of tax evasion, as they benefit from attractive tax incentives and face lower tax pressure compared to banks in other MENA countries.

4.2.4. Statistical Model

To investigate the effect of digital transformation on tax avoidance in the MENA banking industry, we adopt the following equation:

where TAXit represents corporate tax avoidance of firm i in year t, captured by the banks’ TAX_AVijt; DIGITi denotes the digital transformation of bank i in year t, assessed using five indices. Drawing on the prior literature (e.g., Hanlon & Heitzman, 2010; Law & Mills, 2017; Eichfelder & Hechtner, 2018; Zhou et al., 2022), we incorporate a series of control variables that are specific to our research analysis. Year and Country are indicator variables for each year and country, respectively. εit is the residual term. All dependent, independent, and control variables utilized in this study are recapitulated in Appendix B.

5. Empirical Results

5.1. Descriptive Statistics

Table 1 displays the descriptive statistics for our dependent and independent variables. The mean of TAX_AV is −0.01, suggesting that the average effective tax rates (ETRs) are 1 point below the statutory tax rates (STRs). The MENA banks bore, on average, a lower tax burden than the STRs between 2011 and 2022. For digital transformation measures, the average of INDEX_DIG is 0.676, revealing that 67.6% of MENA banks are highly committed to digital transformation. This result differs from that of Xie and Wang (2023) in the Chinese context and Chhaidar et al. (2023) in the European context. Moreover, the mean values of DIG_STRATEGY and MOBIL_DIG are 0.484 and 0.589, respectively, showing that 48.4% of MENA banks adopt highly sophisticated technologies and 58.9% provide mobile banking services. However, the average values of E_BANKING and DIG_SRV are 0.070 and 0.099, respectively, implying that MENA banks are less involved in E-banking and digital services compared to other digital technologies.

Table 1.

Descriptive statistics.

5.2. Correlation Analysis

Table 2 presents a correlation matrix for the variables used in this study. The pairwise matrix shows a positive and significant correlation between TAX_AV and INDEX_DIG. DIG_STRATEGY, E_BANKING, and DIG_SVR are positively and significantly correlated to TAX_AV. These results are congruent with our expectations, suggesting that MENA that are banks highly committed to advanced technologies are less likely to engage in tax avoidance practices. Furthermore, the correlation coefficients are generally weak and below 0.8, indicating the absence of any multicollinearity problems in our analysis.

Table 2.

Pairwise correlations.

5.3. Results and Discussion

Table 3 presents our regression analysis of digital transformation’s impact on corporate tax avoidance among MENA banks.

Table 3.

The impact of digital transformation on corporate tax avoidance.

As reported in column 1, INDEX_DIG is positively and significantly linked to TAX_AV (β = 0.021, p < 0.05), which suggests that MENA banks with high technological adoption are less inclined to engage in tax avoidance practices and confirms our second hypothesis. Moreover, the coefficients of DIG_STRATEGY (β = 0.009, p < 0.1), E_BANKING (β = 0.004, p < 0.01), and DIG_SRV (β = 0.016, p< 0.01) are positive and statistically significant (columns 2–4). However, the coefficients of MOBILE_DIG are positive but insignificant.

Thus, we suggest that adopting cutting-edge technologies, such as digital banking strategies, E-banking, and digital services, decreases tax avoidance within MENA banks, which supports the agency theory viewpoint (Jensen & Meckling, 1976). Our findings align with the regulatory compliance vision outlined in our theoretical framework, where digital transformation enhances transparency and strengthens oversight mechanisms, and thereby reduces the information asymmetry between stakeholders and management.

Our results are consistent with prior studies on digital transformation, asserting that cutting-edge technologies act as effective monitors to lessen banks’ involvement in tax avoidance tactics by allowing enhanced information transparency and improved governance systems, aligning principal–agent interests (e.g., Vial, 2021; Alqatan et al., 2024; Chen et al., 2024). Consequently, going digital enables banks to optimize their tax-related decision-making and strengthen their compliance, which reduces potential risks and costs associated with aggressive tax practices (Zhang et al., 2020). In the Chinese context, Chen et al. (2024) conclude that corporate digital transformation restrains tax avoidance, boosts the quality of information processes, and lowers agency costs. From a financial crime perspective, these results have significant implications. Tax avoidance, while not necessarily illegal, exists on a spectrum with more aggressive practices that potentially cross into non-compliance. Our findings suggest that digital transformation acts as a deterrent to financial misconduct by creating an environment where questionable tax practices are more easily detected and scrutinized.

As MENA governments are deeply involved in digital transformation through intensified investments in IT infrastructure, enhanced cybersecurity measures, and strengthened innovation and digital capacities, the impact of digital transformation on tax avoidance operates through three mechanisms: (1) the standardization of financial reporting, which reduces opportunities for manipulation; (2) enhanced audit capabilities, which increases detection risk; and (3) improved cross-border information sharing, which closes traditional avoidance gaps. Operating within this digital environment, MENA banks have become increasingly committed to integrating cutting-edge digital trends into their services and transactions.

However, our results highlight differential impacts across digital dimensions, which suggests that strategic implementations (DIG_STRATEGY) and digital service offerings (DIG_SRV) (with impacts of 0.9 and 1.6 percentage points, respectively) have greater influence on tax compliance than mobile banking solutions alone (E_BANKING). These findings provide evidence that digital transformation alters the risk–reward calculations in tax planning decisions. From a financial crime prevention perspective, our findings suggest that digital transformation serves as both a deterrent and detection mechanism. The positive coefficients in each model quantify how digital transformation creates an environment where financial misconduct becomes increasingly difficult to conceal, with each digital dimension having different contributions. These results provide actionable intelligence for financial crime investigators and compliance officers by highlighting which digital technologies most effectively promote transparency and reduce opportunities for tax avoidance.

Our results lead us to identify a new potential mechanism for combating financial crime by reducing tax avoidance in the banking sector, digital transformation. Specifically, our results provide regulators and policy makers with concrete evidence for promoting digital adoption as a compliance tool.

6. Additional Evidence

The adoption of digital technologies may differ between conventional and Islamic banking systems (Yudaruddin, 2023). In this subsection, we expand the literature by exploring the connection between digital transformation and corporate tax avoidance while considering two research subsamples: conventional and Islamic banks.

The prior literature highlights the role of Islamic ethical principles in influencing Islamic banking systems, as they enforce social justice and accountability, which is consistent with Shariah law (Haron & Azmi, 2009). Therefore, involvement in tax avoidance tactics is perceived as unethical and inconsistent with Islamic principles and fairness.

Table 4 demonstrates the results of this analysis, revealing a positive and significant relationship within conventional banks and an insignificant relationship for Islamic banks. These findings suggest that the impact of digital transformation on reducing the levels of tax avoidance is more pronounced within conventional banks. Particularly, digital strategies, e-banking, and digital services represent effective governance mechanisms to curb tax avoidance behavior within conventional baking systems.

Table 4.

Conventional banks vs. Islamic banks.

Islamic banks—rooted in religious and ethical principles—are less inclined to combat tax avoidance through digital transformation, unlike their conventional counterparts. However, facing a competitive and innovative technological environment, Islamic institutions should pursue technological solutions to attract investment opportunities, gain stakeholders’ confidence, and ensure financial resilience (Zainuldin & Lui, 2020).

7. Robustness Checks

7.1. Instrumental Variable Approach

The problem of endogeneity may arise between digital tools and the tax avoidance relationship. This problem potentially results from reverse causality, where tax practices influence the choice of digital tools, from unobserved factors that simultaneously affect digital transformation and tax strategies, from a selection bias linked to company characteristics, and from the simultaneity of decisions. This interdependence requires sophisticated econometric methods to isolate causal effects precisely and avoid estimation bias.

To address these issues, we use the two-stage least squares (2SLS) method, which uses instrumental variables to isolate the exogenous part of an explanatory variable, enabling us to estimate its causal effect on the dependent variable. This method is important for establishing more robust causal relationships between negative disclosures and tax avoidance.

As an instrument, we choose an index that reflects the information and communication technologies of countries and that can be used to effectively study the endogeneity between digital tools and tax avoidance.

This indicator, provided by the International Telecommunication Union, influences the digital transformation of companies while remaining independent of specific tax strategies.

The results of this test, presented in Table 5, are similar to the main results.

Table 5.

Instrumental variable approach.

7.2. Alternative Measure of Tax Avoidance

To ensure the robustness of our findings, we employ an alternative measure of tax avoidance. Recognizing that single-year metrics can be skewed by isolated events or short-term fluctuations, we utilize a three-year average effective tax rate (TAX_AV_AV) to provide a more stable, long-term perspective on corporate tax practices.

As indicated in column 1 of Table 6, INDEX_DIG is positively and significantly linked to TAX_AV_AV (β = 0.025, p < 0.05), which suggests that MENA banks with increased digital transformation exhibit lower levels of tax avoidance; this is consistent with our second hypothesis. This indicates that banks with increased digital transformation are more inclined to pay their fair share of taxes. Furthermore, as shown in columns 2 through 4 of Table 6, the coefficients for DIG_STRATEGY, DIG_SRV, and E_BANKING are positive and significant. Our results remain robust and consistent across alternative measures of tax avoidance.

Table 6.

Alternative measures for tax avoidance.

Next, we use book-tax differences (BTD), which reflects the discrepancy between book income and taxable income. Specifically, BTD is calculated by subtracting the taxable income from the pre-tax book income and then dividing the result by the total assets. This measure captures the extent to which firms report higher earnings to shareholders while minimizing their taxable income—a common indicator of aggressive tax behavior. As reported in columns 6–10 of Table 6, the findings remain robust: the digital transformation variables are positively and significantly associated with lower levels of tax avoidance. This confirms that our results are consistent across different proxies and reinforces the reliability and validity of our conclusions.

7.3. Alternative Measures of Variables

To enhance the robustness of our empirical results, we employ alternative measures for our key control variables. First, we replace the loan loss provision ratio (LLP/total loans) with the non-performing loan ratio (NPL), which assesses the quality of banks’ credit portfolios. The results of this analysis are presented in columns 1–5 of Table 7. Next, we use the return on equity (ROE), as an alternative to the return on assets (ROA),to evaluate banking performance, which allows us to capture the efficiency of capital management (columns 6–10 of Table 7). Finally, we substitute the capital adequacy ratio (CAR) with the solvency ratio (SOLV_RATIO), which is calculated as the ratio of total equity to total assets, providing an alternative measure of the banks’ financial strength (columns 11–15 of Table 7). The results corroborate our primary findings.

Table 7.

Alternative measures of variables.

8. Conclusions

The purpose of this study is to examine the effect of digital transformation on corporate tax avoidance within a sample of MENA banks. We employed OLS regression models of 123 banks from 2011 to 2022. The results showed that digital transformation curbs tax avoidance practices, indicating that MENA banks that adopt digital technologies are incentivized to fulfill their tax obligations. As a result, digital transformation serves as a monitoring tool to discourage tax avoidance behavior in banks in MENA. We further evidenced that conventional MENA banks with advanced digital transformation are less likely to avoid taxes compared to Islamic MENA banks. Unlike previous studies that examined the effect of digital practices on tax avoidance among non-financial firms or in different contexts, this is the first study to examine their effect within the MENA banking sector.

These findings have several theoretical implications. First, this research provides robust evidence of the relationship between digital transformation and tax avoidance based on the agency theory, which offers promising avenues for providing answers to the further study of digital transformation as a determinant of other corporate decision-making processes. It also clarifies the relationship between emerging technological trends and tax behavior. Notably, it develops an accrued ability to predict the effect of cutting-edge technologies on tax decisions, particularly within the banking sector. Second, the results indicate that technological practices can reduce banks’ tax avoidance.

This study also offers valuable insights for regulators, tax authorities, investors, and banks themselves by showing how digital transformation is a driver of tax avoidance in the banking sector. First, MENA regulators should develop and enforce policies that closely address the role of digital transformation in curbing tax avoidance dynamics in banks. These policies should incorporate tax incentives and advantages to encourage banks to adopt digital practices. Second, tax authorities must intensify their surveillance in monitoring banks that are less committed to digital transformation to ensure more tax transparency and compliance through stricter monitoring mechanisms. Third, investors should pay close attention when investing in banks that are less engaged in digital transformation, as such institutions are more likely to engage in tax avoidance practices. Fourth, banks should leverage cutting-edge technologies to reinforce their digital infrastructure, as doing so will thereby enhance their decision-making effectiveness, improv their transparency and compliance, bolster their governance systems, and build their stakeholders’ recognition. Notably, implementing advanced digital banking strategies, e-banking, and digital services can effectively bolster banks’ efforts in addressing tax avoidance.

Our research question extends several promising avenues for future investigation. It would be insightful to explore the linkage between digital transformation and tax avoidance in different contexts, particularly within non-financial industries, to ensure an understanding of these dynamics beyond the banking sector. Moreover, it could be interesting to investigate the impact of governance mechanisms on the digital transformation–tax avoidance relationship.

Author Contributions

Z.S. Conceptualization; formal analysis and writing—original draft preparation N.L. methodology; software; validation and investigation; I.K.; review and editing; supervision; project administration and funding acquisition, E.B. Data collection, data curation. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Ministry of Higher Education and Scientific Research of Tunisia as part of an excellence project under Grant Number P2ES2023-D2P1.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data is unavailable due to privacy or ethical restrictions.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Description of Digital Transformation Dimensions

| Index Construct | Dimensions | Description |

| Digital banking strategy | Blockchain | Blockchain represents a new distributed infrastructure and computing paradigm, using cryptographic techniques, smart contracts, and consensus algorithms across decentralized nodes. |

| Big data | Big data refers a large volume of data, structured or unstructured, which traditional data-processing techniques are unable to manage and process due to the complexity and volume of the data. | |

| Investment in AI and machine leaning | Techniques that apply artificial intelligence principles and utilizes algorithms to identify complex patterns within large datasets, enabling data-driven decision-making. | |

| Mobile digital transformation | Mobile transactions and users | The number of transactions and users of mobile banking. |

| Application “Tele-Money center” | Mobile application for transferring money with various options, locally and internationally in a secure way. | |

| M-banking | Techniques enabling banking transactions to be carried out using mobile phone, mobile, tablet, or smartphone. | |

| GSM | Network that allows you to make phone calls, send text messages and access the Internet. | |

| Digital services | ATM | An electronic banking outlet that allows customers to complete self-service transactions. |

| EFTPOS | An electronic device capable of reading bankcard data, recording a transaction and communicating with a remote authentication server. | |

| Tahweel centers | Financial service that offers money transfer services both domestically and internationally. | |

| Electronic payment cards | Credit and debit cards, online banking transfers, mobile payment apps, etc. | |

| Digital cards | Cards stored in an electronic wallet (mobile phone) letting you hold your payment methods in a virtual version. | |

| Banking cards | A means of payment or withdrawing cash from ATMs, and other transactions | |

| E-banking | E-commerce | Buying and selling products and services over the Internet. |

| Digital transactions | Online payment (by computer or mobile phone) exchanging money electronically. | |

| Online brokerage | Online broker (a trading provider) that allows its clients to open and close positions using a digital platform. | |

| E-trade electronic services | An online bank offering brokerage services. | |

| Digital branch | Digital channels offering easier and simpler way for self-service transactions and sales. | |

| Digital transformation | Transition to new technologies. | |

| Digital banking | Internet banking revolutionize the way costumers and companies manage their finance. | |

| Software | The use of set of instructions or commands to automate tasks. | |

| Active digital users | The number of active internet users. | |

| Platforms | A truly participative approach combined with decentralized service delivery. | |

| Information system | Serie of dimensions for data collection, storage, and processes, facilitating decision-making. | |

| Source: Our own creation. | ||

Appendix B. Definitions of Variables

| Variables | Acronym | Descriptions |

| Dependent variables | ||

| Corporate tax avoidance | TAX_AV | The difference between the statutory tax rate and the effective tax rate. |

| Independent variables | ||

| Digital transformation | INDEX_DIG | The aggregate index computed as the sum of all four dimensions (DIG_STRATEGY, MOBIL_DIG, DIG_SRV, E_BANKING) |

| DIG_STRATEGY | The digital banking strategy index that reflects the adoption of cutting-edge technologies such as blockchain and, big data. | |

| MOBIL_DIG | The mobile-based digitalization index that captures the volume of mobile transactions, and mobile banking services. | |

| DIG_SRV | The digital services index representing all digital services provided by a bank. | |

| E_BANKING | The E_banking index that captures a bank’s electronic services such as e-commerce, and -etrading services. | |

| Control variables | ||

| Credit risk | LLP | Loss loan provision reported to total loan |

| Capital adequacy ratio | CAR | Shareholders’ equity/total risk-weighted assets |

| Bank profitability | ROA | Return on Assets: the ratio of after-tax net income /average total assets. |

| Liquidity ratio | LTD | Loan/deposit ratio |

| Bank size | SIZE | Natural logarithm of total assets. |

| Governance | GOV_IND | Index combining six governance indicators—regulatory quality, government effectiveness, political stability, voice and accountability, rule of law, and control of corruption. Estimated using the PCA method and sourced from the World Bank. |

| GDP growth | GDP_GR | Real gross domestic product growth rate |

| Gulf Cooperation Council country | GCC | Binary variable equal to 1 if the country is a Gulf Cooperation Council member, and 0 otherwise. |

| Source: Our own creation. | ||

Note

| 1 | To ensure robustness, we implement two validation procedures. Manual verification involved 30 randomly selected reports that were manually analyzed, yielding a 99.2% correlation (p < 0.001) between algorithmic and human keyword counts. Additionally, principal component analysis (PCA) of keyword-derived scores confirmed high internal consistency (Cronbach’s α = 0.89), aligning with prior index-construction studies (Lyons & Kass-Hanna, 2021). Our methodology offers several advantages over alternative approaches. The keyword frequency technique minimizes researcher bias inherent in manual coding, enhancing objectivity. The transparent keyword lists and formulas enable replication by other researchers, increasing the reliability of findings. Furthermore, the topic-specific indices (e.g., DIG_STRATEGY vs. MOBILE_DIG) allow for nuanced analysis of different digital transformation dimensions, providing more granular insights than a monolithic measure would permit. |

References

- Agyei, S. K., Marfo-Yiadom, E., Ansong, A., & Idun, A. A. A. (2020). Corporate tax avoidance incentives of banks in Ghana. Journal of African Business, 21(4), 544–559. [Google Scholar] [CrossRef]

- Almutairi, A. M., & Abdelazim, S. I. (2025). The impact of CSR on tax avoidance: The moderating role of political connections. Sustainability, 17(1), 195. [Google Scholar] [CrossRef]

- Alqatan, A., Hussainey, K., Hamed, M., & Benameur, K. (2024). Impact of digitalization on reporting, tax avoidance, accounting, and green finance. IGI Global. [Google Scholar]

- Alshabibi, B., Pria, S., & Hussainey, K. (2022). Nationality diversity in corporate boards and tax avoidance: Evidence from Oman. Administrative Sciences, 12(3), 111. [Google Scholar] [CrossRef]

- Chen, M., Zhao, K., & Jin, W. (2024). Corporate digital transformation and tax avoidance: Evidence from China. Pacific-Basin Finance Journal, 85, 102400. [Google Scholar] [CrossRef]

- Chen, R., Lin, B., He, C., & Jin, C. (2019). Internet finance characteristics, internet finance investor sentiment and the return of internet financial products. Economic Research, 7, 78–93. [Google Scholar]

- Chen, S., Chen, X., Cheng, Q., & Shevlin, T. (2010). Are family firms more tax aggressive than non-family firms? Journal of Financial Economics, 95(1), 41–61. [Google Scholar] [CrossRef]

- Chhaidar, A., Abdelhedi, M., & Abdelkafi, I. (2023). The effect of financial technology investment level on European banks’ profitability. Journal of the Knowledge Economy, 14(3), 2959–2981. [Google Scholar] [CrossRef]

- De Simone, L., Lester, R., & Markle, K. (2020). Transparency and tax evasion: Evidence from the foreign account tax compliance act (FATCA). Journal of Accounting Research, 58(1), 105–153. [Google Scholar] [CrossRef]

- Eichfelder, S., & Hechtner, F. (2018). Tax compliance costs: Cost burden and cost reliability. Public Finance Review, 46(5), 764–792. [Google Scholar] [CrossRef]

- Eldomiaty, T. I., Apaydin, M., El-Sehwagy, A., & Rashwan, M. H. (2023). Institutional quality and firm-level financial performance: Implications from G8 and MENA countries. Cogent Economics & Finance, 11(1), 2220249. [Google Scholar]

- Estrella, A., Park, S., & Peristiani, S. (2000). Capital ratios as predictors of bank failure. Economic Policy Review, 6(2), 33–52. Available online: https://www.newyorkfed.org/medialibrary/media/research/epr/00v06n2/0007estr.pdf (accessed on 28 May 2024).

- Gallemore, J., & Labro, E. (2015). The importance of the internal information environment for tax avoidance. Journal of Accounting and Economics, 60(1), 149–167. [Google Scholar] [CrossRef]

- Hanlon, M., & Heitzman, S. (2010). A review of tax research. Journal of Accounting and Economics, 50(2–3), 127–178. [Google Scholar] [CrossRef]

- Haron, S., & Azmi, W. N. W. (2009). Islamic finance and banking system: Philosophies, principles and practices. McGraw-Hill. [Google Scholar]

- Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360. [Google Scholar] [CrossRef]

- Kateb, I., Nafti, O., & Zeddini, A. (2025). How to improve the financial performance of Islamic banks in the MENA region? A Shariah governance perspective. International Journal of Emerging Markets, 20(6), 2559–2580. [Google Scholar] [CrossRef]

- Kaufmann, D., Kraay, A., & Mastruzzi, M. (2011). The worldwide governance indicators: Methodology and analytical issues. Hague Journal on the Rule of Law, 3(2), 220–246. [Google Scholar] [CrossRef]

- Kharroub, T. (2022). Mapping digital authoritarianism in the Arab world. Available online: https://arabcenterdc.org/resource/mapping-digital-authoritarianism-in-the-arab-world/ (accessed on 15 June 2022).

- Kirchler, E., & Maciejovsky, B. (2001). Tax compliance within the context of gain and loss situations, expected and current asset position, and profession. Journal of Economic Psychology, 22(2), 173–194. [Google Scholar] [CrossRef]

- Koetter, M., & Noth, F. (2013). IT use, productivity, and market power in banking. Journal of Financial Stability, 9(4), 695–704. [Google Scholar] [CrossRef]

- Lanis, R., & Richardson, G. (2011). The effect of board of director composition on corporate tax aggressiveness. Journal of Accounting and Public Policy, 30(1), 50–70. [Google Scholar] [CrossRef]

- Lanis, R., & Richardson, G. (2018). Outside directors, corporate social responsibility performance, and corporate tax aggressiveness: An empirical analysis. Journal of Accounting, Auditing & Finance, 33(2), 228–251. [Google Scholar]

- Lassoued, N. (2023). Earnings management and ownership type in microfinance institutions: An international evidence. Afro-Asian Journal of Finance and Accounting, 13(4), 528–549. [Google Scholar] [CrossRef]

- Lassoued, N., Khanchel, I., & Saidani, W. (2025). Comparative Study on the Efficiency of Islamic Banks and Conventional Banks During the COVID-19 Outbreak. SAGE Open, 15(1), 21582440241309726. [Google Scholar] [CrossRef]

- Law, K. K., & Mills, L. F. (2017). Military experience and corporate tax avoidance. Review of Accounting Studies, 22, 141–184. [Google Scholar] [CrossRef]

- López-González, E., Martínez-Ferrero, J., & García-Meca, E. (2019). Does corporate social responsibility affect tax avoidance: Evidence from family firms. Corporate Social Responsibility and Environmental Management, 26(4), 819–831. [Google Scholar] [CrossRef]

- Lyons, A. C., & Kass-Hanna, J. (2021). A methodological overview to defining and measuring “digital” financial literacy. Financial Planning Review, 4(2), e1113. [Google Scholar] [CrossRef]

- McComb, J. M., & Smalt, S. W. (2018). The rise of blockchain technology and its potential for improving the quality of accounting information. Journal of Finance and Accountancy, 23(1), 1–17. [Google Scholar]

- Minnick, K., & Noga, T. (2010). Do corporate governance characteristics influence tax management? Journal of Corporate Finance, 16(5), 703–718. [Google Scholar] [CrossRef]

- Murinde, V., Rizopoulos, E., & Zachariadis, M. (2022). The impact of the FinTech revolution on the future of banking: Opportunities and risks. International Review of Financial Analysis, 81, 102103. [Google Scholar] [CrossRef]

- Nguyen-Thi-Huong, L., Nguyen-Viet, H., Nguyen-Phuong, A., & Van Nguyen, D. (2023). How does digital transformation impact bank performance? Cogent Economics & Finance, 11(1), 2217582. [Google Scholar]

- OECD. (2024). Base erosion and profit shifting (BEPS). Available online: https://www.oecd.org/en/topics/base-erosion-and-profit-shifting-beps.html (accessed on 28 May 2024).

- Premkumar, G., Ramamurthy, K., & Saunders, C. S. (2005). Information processing view of organizations: An exploratory examination of fit in the context of interorganizational relationships. Journal of Management Information Systems, 22(1), 257–294. [Google Scholar] [CrossRef]

- Rachisan, P. R., Bota-Avram, C., & Grosanu, A. (2017). Investor protection and country-level governance: Crosscountry empirical panel data evidence. Economic Research, 30(1), 806–817. [Google Scholar] [CrossRef]

- Sarhan, A. A., Elmagrhi, M. H., & Elkhashen, E. M. (2024). Corruption prevention practices and tax avoidance: The moderating effect of corporate board characteristics. Journal of International Accounting, Auditing and Taxation, 55, 100615. [Google Scholar] [CrossRef]

- Schwab, C. M., Stomberg, B., & Xia, J. (2022). What determines effective tax rates? The relative influence of tax and other factors. Contemporary Accounting Research, 39(1), 459–497. [Google Scholar] [CrossRef]

- Shekar, S. (2018). Taxation in the MENA region. Available online: https://www.exploring-economics.org/en/discover/taxation-in-the-MENA-region/ (accessed on 18 June 2022).

- Steijvers, T., & Niskanen, M. (2014). Tax aggressiveness in private family firms: An agency perspective. Journal of Family Business Strategy, 5(4), 347–357. [Google Scholar] [CrossRef]

- Tiantian, G., Hailin, C., Zhou, X., Ai, S., & Siyao, W. (2023). Does corporate digital transformation affect the level of corporate tax avoidance? Empirical evidence from Chinese listed tourism companies. Finance Research Letters, 57, 104271. [Google Scholar] [CrossRef]

- Vial, G. (2021). Understanding digital transformation: A review and a research agenda. In Managing digital transformation (pp. 13–66). Routledge. [Google Scholar]

- World Bank. (2022). Digital economy could reap huge benefits for middle east and north africa. Available online: https://www.worldbank.org/en/news/press-release/2022/03/16/digital-economy-could-reap-huge-benefits-for-middle-east-and-north-africa#:~:text=Washington%2C%20March%2016%2C%202022%20%E2%80%94,a%20new%20World%20Bank%20report (accessed on 16 March 2022).

- Xie, K., & Huang, W. (2023). The impact of digital transformation on corporate tax avoidance: Evidence from China. Discrete Dynamics in Nature and Society, 2023(1), 8597326. [Google Scholar] [CrossRef]

- Xie, X., & Wang, S. (2023). Digital transformation of commercial banks in China: Measurement, progress and impact. China Economic Quarterly International, 3(1), 35–45. [Google Scholar] [CrossRef]

- Yu, L. C., & Yu, D. H. (2009). The measurement of local administrative monopoly degree in China. Economic Research Journal, 2, 119–131. [Google Scholar]

- Yudaruddin, R. (2023). Financial technology and performance in Islamic and conventional banks. Journal of Islamic Accounting and Business Research, 14(1), 100–116. [Google Scholar] [CrossRef]

- Zainuldin, M. H., & Lui, T. K. (2020). Earnings management in financial institutions: A comparative study of Islamic banks and conventional banks in emerging markets. Pacific-Basin Finance Journal, 62, 101044. [Google Scholar] [CrossRef]

- Zemzem, A., & Ftouhi, K. (2013). Moderating effects of board of directors on the relationship between tax planning and bank performance: Evidence from Tunisia. European Journal of Business and Management, 5(32), 148–154. [Google Scholar]

- Zeng, T. (2019). Country-level governance, accounting standards, and tax avoidance: A cross-country study. Asian Review of Accounting, 27(3), 401–424. [Google Scholar] [CrossRef]

- Zhai, H., Yang, M., & Chan, K. C. (2022). Does digital transformation enhance a firm’s performance? Evidence from China. Technology in Society, 68, 101841. [Google Scholar] [CrossRef]

- Zhang, Y., Xiong, F., Xie, Y., Fan, X., & Gu, H. (2020). The impact of artificial intelligence and blockchain on the accounting profession. Ieee Access, 8, 110461–110477. [Google Scholar] [CrossRef]

- Zhou, S., Zhou, P., & Ji, H. (2022). Can digital transformation alleviate corporate tax stickiness: The mediation effect of tax avoidance. Technological Forecasting and Social Change, 184, 122028. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).