From Boom to Bust: Unravelling the Cyclical Nature of Fiji’s Money Demand

Abstract

1. Introduction

2. Literature Review and Hypotheses Development

3. Methodology

3.1. Models

3.2. Structural Breaks

3.3. ARDL Model

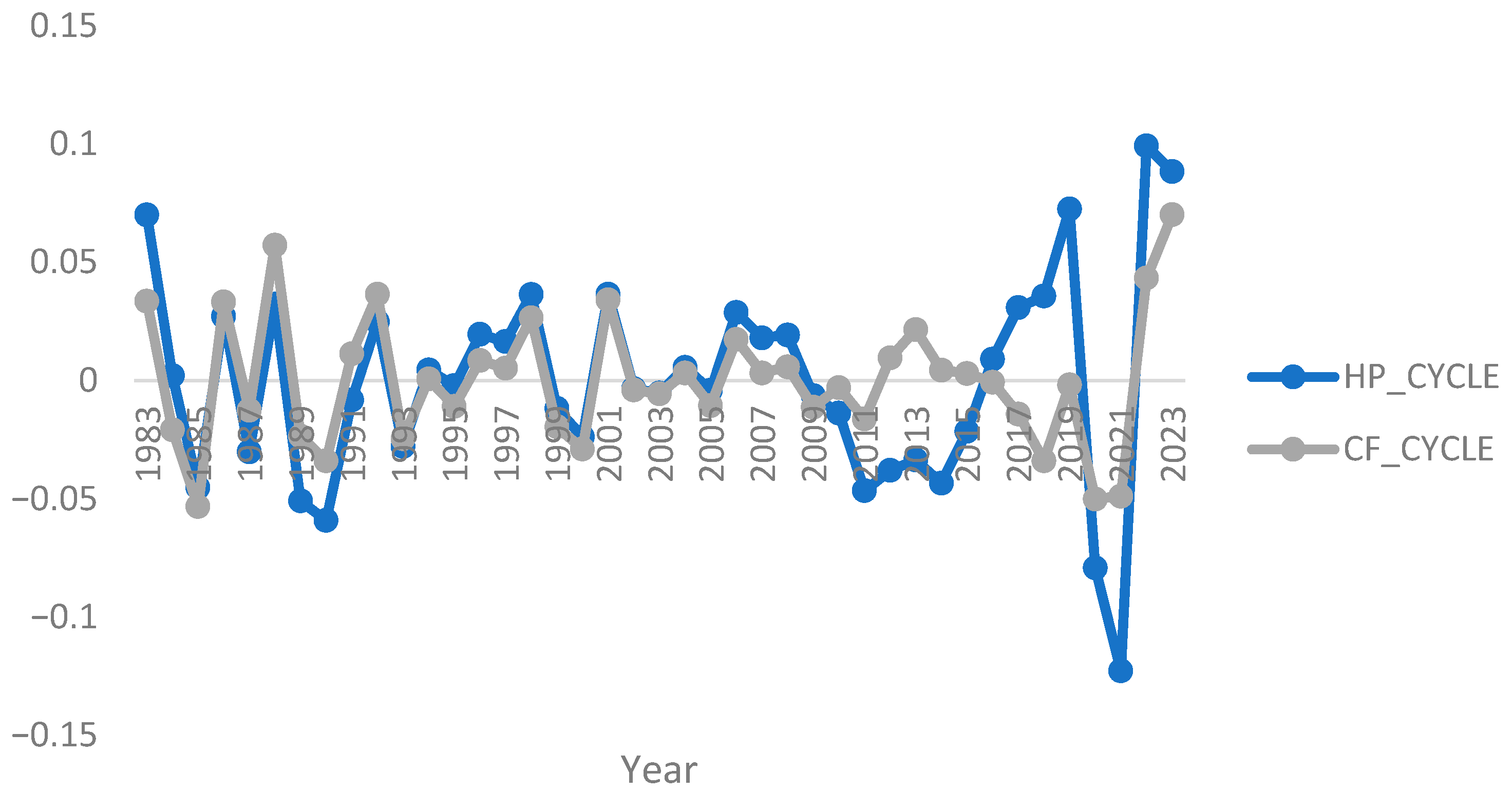

4. Data and Results

4.1. Data and Descriptive Statistics

4.2. Unit Roots

4.3. Structural Breaks Results

4.4. Main Tests

5. Conclusions, Implications, and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Aliyev, F., & Eylasov, N. (2025). The impact of Nasdaq100, U.S. Dollar index and commodities on cryptocurrency: New evidence from augmented ARDL approach. Economics Letters, 247, 112191. [Google Scholar] [CrossRef]

- Badarudin, Z. E., Ariff, M., & Khalid, A. M. (2013). Post-Keynesian money endogeneity evidence in G-7 economies. Journal of International Money and Finance, 33, 146–162. [Google Scholar] [CrossRef]

- Bai, J., & Perron, P. (2003). Computation and analysis of multiple structural change models. Journal of Applied Econometrics, 18(1), 1–22. [Google Scholar] [CrossRef]

- BBC News. (2024). Fiji profile—Timeline. Available online: https://www.bbc.com/news/world-asia-pacific-14919688 (accessed on 20 February 2025).

- Chen, Z., & Valcarcel, V. J. (2025). A granular investigation on the stability of money demand. Macroeconomic Dynamics, 29, e40. [Google Scholar] [CrossRef]

- De Paoli, B., & Zabczyk, P. (2013). Cyclical risk aversion, precautionary saving, and monetary policy. Journal of Money, Credit and Banking, 45(1), 1–36. [Google Scholar] [CrossRef]

- Dornan, M. (2020). Economic (in)security in the Pacific. In Mapping security in the Pacific (pp. 30–40). Routledge. [Google Scholar]

- Dou, X. (2018). The determinants of money demand in China. Cogent Economics & Finance, 6(1), 1564422. [Google Scholar]

- Du, S., He, S., Huang, G., & Kong, D. (2024). Financial development and money market integration in Qing China, 1800–1911. Finance Research Letters, 63, 105347. [Google Scholar] [CrossRef]

- Fiador, V., Sarpong-Kumankoma, E., & Karikari, N. K. (2022). Monetary policy effectiveness in Africa: The role of financial development and institutional quality. Journal of Financial Regulation and Compliance, 30(3), 335–352. [Google Scholar] [CrossRef]

- Frame, W. S., & White, L. J. (2004). Empirical studies of financial innovation: Lots of talk, little action? Journal of Economic Literature, 42(1), 116–144. [Google Scholar] [CrossRef]

- Friedman, M. (1956). The quantity theory of money—A restatement. In M. Friedman (Ed.), Studies in the quantity theory of money. University of Chicago Press. [Google Scholar]

- Gertler, M., & Gilchrist, S. (2018). What happened: Financial factors in the great recession. Journal of Economic Perspectives, 32(3), 3–30. [Google Scholar] [CrossRef]

- Hommes, C., & Lustenhouwer, J. (2019). Managing unanchored, heterogeneous expectations and liquidity traps. Journal of Economic Dynamics and Control, 101, 1–16. [Google Scholar] [CrossRef]

- Karras, G., & Stokes, H. H. (1999). Why are the effects of money-supply shocks asymmetric? Evidence from prices, consumption, and investment. Journal of Macroeconomics, 21(4), 713–727. [Google Scholar] [CrossRef]

- Keynes, J. M. (1936). The general theory of employment, interest and money. MacMillan. [Google Scholar]

- Konstantakopoulou, I. (2023). Financial intermediation, economic growth, and business cycles. Journal of Risk and Financial Management, 16(12), 514. [Google Scholar] [CrossRef]

- Kumar, N. N., Kumar, S., Sharma, M., & Sisodia, G. S. (2024). Modelling the growth and cyclical effects of international remittances in Fiji. Applied Economics Letters. Available online: https://www.researchgate.net/publication/384876085_Modelling_the_growth_and_cyclical_effects_of_international_remittances_in_Fiji (accessed on 20 February 2025).

- Kumar, N. N., & Patel, A. (2022). Modelling the impact of COVID-19 in small pacific island countries. Current Issues in Tourism, 25(3), 394–404. [Google Scholar] [CrossRef]

- Kumar, S., Webber, D. J., & Fargher, S. (2013). Money demand stability: A case study of Nigeria. Journal of Policy Modeling, 35(6), 978–991. [Google Scholar] [CrossRef][Green Version]

- Laidler, D. E. W. (1977). The demand for money: Theories and evidence (2nd ed.). Harper and Row. [Google Scholar]

- Laine, O. M., & Pihlajamaa, M. (2024). Pushing and pulling on a string? Inflationary effects of expansionary and contractionary monetary policies when rates are negative. Economic Modelling, 131, 106620. [Google Scholar] [CrossRef]

- Lenka, S. K. (2022). Relationship between financial inclusion and financial development in India: Is there any link? Journal of Public Affairs, 22, e2722. [Google Scholar] [CrossRef]

- Lu, F., Ma, F., & Bouri, E. (2024). Stock market volatility predictability: New evidence from energy consumption. Humanities and Social Sciences Communications, 11(1), 1624. [Google Scholar] [CrossRef]

- Ma, Y., & Lin, X. (2016). Financial development and the effectiveness of monetary policy. Journal of banking & Finance, 68, 1–11. [Google Scholar]

- Madraiwiwi, J. (2015). The Fijian elections of 2014: Returning to democracy…? The Journal of Pacific History, 50(1), 54–60. [Google Scholar] [CrossRef]

- Mollaahmetoğlu, E., & Akçalı, B. Y. (2019). The missing-link between financial development and economic growth: Financial innovation. Procedia Computer Science, 158, 696–704. [Google Scholar]

- Movaghari, H., Serletis, A., & Sermpinis, G. (2024). Money demand stability: New evidence from transfer entropy. International Economics, 179, 100524. [Google Scholar] [CrossRef]

- Narayan, P. K. (2005). The saving and investment nexus for China: Evidence from cointegration tests. Applied economics, 37(17), 1979–1990. [Google Scholar] [CrossRef]

- Narayan, P. K., & Narayan, S. (2008). Estimating the demand for money in an unstable open economy: The case of the Fiji Islands. Economic Issues, 13(1), 71–91. [Google Scholar]

- Neftci, S. N. (1984). Are economic time series asymmetric over the business cycle? Journal of Political Economy, 92(2), 307–328. [Google Scholar] [CrossRef]

- Rao, B. B., & Singh, R. (2006). Demand for money for Fiji with PcGets. Applied Economics Letters, 13(15), 987–991. [Google Scholar]

- Salas, S. (2025). Precautionary money demand in a cash-in-advance model. Journal of Money, Credit and Banking, 57(2–3), 663–676. [Google Scholar]

- Singh, R., & Kumar, S. (2010). Some empirical evidence on the demand for money in the Pacific Island countries. Studies in Economics and Finance, 27(3), 211–222. [Google Scholar]

- Sobiech, I. (2019). Remittances, finance and growth: Does financial development foster the impact of remittances on economic growth? World Development, 113, 44–59. [Google Scholar]

- United Nations Office for the Coordination of Humanitarian Affairs (UNOCHA). (1999). Fiji/vanuatu—Tropical cyclone dani OCHA situation report No. 2. United Nations. Available online: https://www.unocha.org/publications/report/fiji/fijivanuatu-tropical-cyclone-dani-ocha-situation-report-no-2 (accessed on 20 February 2025).

- Weiping, L. (2024). A walk-through and analysis of US monetary policy. In American monetary policy adjustment and its impacts (pp. 49–79). Springer Nature Singapore. [Google Scholar]

- Woodford, M. (2022). Effective demand failures and the limits of monetary stabilization policy. American Economic Review, 112(5), 1475–1521. [Google Scholar]

- Zakir, N., & Malik, W. S. (2013). Are the effects of monetary policy on output asymmetric in Pakistan? Economic Modelling, 32, 1–9. [Google Scholar]

| Variable | Definition | Source | Range |

|---|---|---|---|

| Natural logarithm of real narrow money. Narrow money is measured using M1 sourced from the Asian Development Bank’s key indicators database. The GDP deflator is used with 2015 as a base year. | KIDB & WDI | 1983–2023 | |

| Natural logarithm of real GDP measured in constant 2015 Fijian dollars. | WDI | 1960–2024 | |

| Bank lending rate. This rate usually meets the short- and medium-term financing needs of the private sector and is normally differentiated according to the creditworthiness of borrowers and objectives of financing. | WDI | 1980–2024 | |

| Consumer price index (CPI)-based inflation rate measuring annual percentage changes in prices. The Laspeyres formula is used to compute consumer prices. | WDI | 1960–2024 | |

| Real effective exchange rates, which are the nominal effective exchange rate measured against a weighted average of foreign currencies divided by the GDP deflator. | WDI | 1980–2024 | |

| Principal component analysis-based financial development index. Financial sector size is measured using the ratio of liquid liabilities to GDP. Financial institutional depth is measured as the ratio of domestic credit granted to private sector to GDP. Financial institution depth is measured by the lending and deposit interest rate spread. | WDI | 1980–2024 |

| Variables | ||||||

|---|---|---|---|---|---|---|

| Panel A. Descriptive statistics | ||||||

| Mean | 21.3831 | 22.6452 | 9.6122 | 5.8663 | 4.7968 | −0.0122 |

| Median | 21.2001 | 22.6620 | 8.3975 | 6.5709 | 4.7611 | −0.1682 |

| Maximum | 22.6078 | 23.0966 | 15.1127 | 18.8096 | 5.1906 | 3.1522 |

| Minimum | 20.7398 | 22.2329 | 5.67732 | −16.4487 | 4.6051 | −1.4288 |

| Std.Dev. | 0.5066 | 0.2570 | 3.1947 | 6.0424 | 0.1667 | 1.0008 |

| Skewness | 0.6860 | −0.0047 | 0.3311 | −1.1315 | 1.3751 | 0.7908 |

| Kurtosis | 2.3527 | 1.8743 | 1.6127 | 6.3840 | 3.7479 | 3.6961 |

| Jarque–Bera | 3.9320 | 2.1646 | 4.0371 | 28.313 A | 13.8769 A | 5.1016 |

| [0.1400] | [0.3388] | [0.1328] | [<0.01] | [<0.01] | [0.0780] | |

| Panel B. Correlation matrix | ||||||

| 0.8997 A | 1 | |||||

| [<0.01] | ||||||

| −0.8648 A | −0.9675 A | 1 | ||||

| [<0.01] | [<0.01] | |||||

| −0.2550 | −0.1533 | 0.1596 | 1 | |||

| [0.1076] | [0.3386] | [0.3188] | ||||

| −0.6553 A | −0.7308 A | 0.8096 A | 0.0566 | 1 | ||

| [<0.01] | [<0.01] | [<0.01] | [0.7248] | |||

| 0.9225 A | 0.8055 A | −0.7791 A | −0.3448 B | −0.6407 A | 1 | |

| [<0.01] | [<0.01] | [<0.01] | [0.03] | [<0.01] | ||

| Variables | ADF Level | ADF 1st Diff. | PP Level | PP 1st Diff. |

|---|---|---|---|---|

| 0.4431 (0) [0.9824] | −7.9849 A (0) [<0.01] | 2.5014 (16) [0.9671] | −9.2471 A (7) [<0.01] | |

| −0.8340 (0) [0.7984] | −6.1360 A (0) [<0.01] | −0.8344 (1) [0.7329] | −6.1383 A (3) [<0.01] | |

| −1.4132 (0) [0.5662] | −5.2151 A (0) [<0.01] | −1.4232 (5) [0.5614] | −5.1340 A (7) [<0.01] | |

| −5.0592 A (0) [<0.01] | −7.3744 A (1) [<0.01] | −5.0584 A (1) [<0.01] | −12.4870 A (5) [<0.01] | |

| −2.1008 (0) [0.2454] | −4.4113 A (0) [<0.01] | −2.0986 (4) [0.2463] | −4.1939 A (6) [<0.01] | |

| 1.3668 (0) [0.9986] | −3.1935 B (0) [0.03] | 0.9414 (1) [0.9951] | −3.2098 B (1) [0.03] |

| Specification | 0 vs. 1 | 1 vs. 2 | 2 vs. 3 | 3 vs. 4 | Break Dates |

|---|---|---|---|---|---|

| Boom | 28.4155 A [8.58] | 4.0527 [10.13] | 2014 | ||

| Boom-positive | 121.9293 A [8.58] | 20.3196 A [10.13] | 40.9063 A [11.14] | 1.3262 [11.83] | 1995, 2005, 2014 |

| Boom-negative | 20.4779 A [8.58] | 10.6019 A [10.13] | 3.6010 [11.14] | 1996, 2016 | |

| Bust * | 38.4697 A [11.47] | 15.8429 A [12.95] | 0.6710 [14.03] | 2000, 2013 | |

| Bust-positive * | 39.1664 A [11.47] | 11.5332 A [12.95] | 9.1533 [14.03] | 2000, 2013 | |

| Bust-negative | 158.8025 A [8.58] | 72.5775 A [10.13] | 33.8195 A [11.14] | 6.7003 [11.83] | 1990, 2008, 2014 |

| Variables | Boom | Boom-Positive | Boom-Negative |

|---|---|---|---|

| Panel A. Long run | |||

| 0.9289 A [0.0816] | 0.9476 A [0.0139] | 0.9358 A [0.0542] | |

| −0.0691 B [0.0277] | −0.0178 A [0.0035] | −0.0061 [0.0125] | |

| 0.0153 [0.0140] | 0.0093 [0.0092] | ||

| 0.1838 [0.4269] | −0.0344 [0.0717] | 0.0199 [0.2800] | |

| Break (1999–2004) | −0.0938 A [0.0174] | ||

| Break (2014) | 0.8571 A [0.3103] | 0.3489 A [0.0327] | |

| Intercept | −0.0455 [0.0424] | −0.0958 B [0.0353] | |

| Panel B. Short run | |||

| −0.0019 B [0.0009] | 0.4455 B [0.1894] | ||

| −0.0001 [0.0006] | |||

| 0.9341 B [0.0392] | 0.9353 A [0.0162] | 0.9332 A [0.0297] | |

| −0.4597 A [0.1859] | |||

| −0.0331 A [0.0149] | −0.0175 A [0.0033] | −0.0035 [0.0051] | |

| −0.0001 [0.0069] | 0.0165 A [0.0023] | ||

| 0.0043 A [0.0015] | |||

| 0.0881 [0.2069] | 0.0053 [0.0811] | 0.0145 [0.1478] | |

| 0.1981 B [0.0783] | |||

| Break (1999–2004) | −0.0925 A [0.0175] | ||

| Break (2014) | 0.4110 A [0.1080] | 0.3443 A [0.0316] | |

| −0.4796 A [0.0882] | −0.4853 A [0.0931] | −0.3994 A [0.1223] | |

| Panel C. Model diagnostics | |||

| Adj. R2 | 0.9689 | 0.9926 | 0.9830 |

| Regression standard error | 0.0715 | 0.0168 | 0.0266 |

| Bounds statistic | 5.5876 A | 42.913 A | 25.6498 A |

| Upper bound | 5.455 | 5.455 | 5.816 |

| Lower bound | 3.967 | 3.967 | 4.428 |

| Serial Correlation | 1.5713 (0.4558) | 0.1046 (0.7463) | 3.2801 (0.1940) |

| Heteroscedasticity | 12.0070 (0.1509) | 5.5432 (0.4991) | 15.7483 (0.1507) |

| Functional Form | 2.1967 (0.1257) | 0.6878 (0.4147) | 2.1686 (0.1550) |

| Normality | 1.8499 (0.4567) | 1.9083 (0.4215) | 1.7879 (0.4781) |

| Cusum & Cusumsq | Stable | Stable | Stable |

| Variables | Bust | Bust-Positive | Bust-Negative |

|---|---|---|---|

| Panel A. Long run | |||

| 1.0237 A [0.1236] | 0.9227 A [0.1392] | 0.9563 A [0.0123] | |

| −0.0623 [0.0470] | −0.1672 A [0.0449] | 0.0101 [0.0059] | |

| −0.0163 [0.0106] | −0.0117 [0.0163] | −0.0001 [0.0013] | |

| −0.1936 [0.6504] | 0.4918 [0.7248] | −0.1160 [0.0677] | |

| Break (2000–2012) | −0.1825 [0.1296] | −1.0732 A [0.1969] | |

| Break (2013) | −0.1825 [0.1336] | −0.2991 [0.2854] | |

| Break (1990, 2007) | −0.2447 A [0.0372] | ||

| Break (2008, 2013) | −0.5241 A [0.0428] | ||

| Break (2014) | −1.2857 A [0.0446] | ||

| Intercept | −0.0478 [0.1047] | 0.8313 [0.4311] | −0.0109 [0.0255] |

| Panel B. Short run | |||

| 0.9950 A [0.0830] | 1.1301 A [0.0919] | 0.9556 A [0.0122] | |

| 0.2057 A [0.0721] | |||

| −0.0430 [0.0319] | −0.0841 A [0.0269] | 0.0101 [0.0059] | |

| 0.0516 B [0.0254] | |||

| −0.0112 [0.0068] | 0.0103 C [0.0055] | −0.0009 [0.0013] | |

| 0.0121 B [0.0059] | |||

| −0.1336 [0.4424] | −0.6897 [0.4772] | −0.1159 C [0.0676] | |

| −1.0797 A [0.3792] | |||

| Break (2000–2012) | −0.1260 [0.0823] | −0.5089 A [0.0997] | |

| Break (2013) | 0.0959 [0.0998] | −0.1418 [0.1334] | |

| Break (1990, 2007) | −0.2445 A [0.0372] | ||

| Break (2008, 2013) | −0.5237 B [0.0428] | ||

| Break (2014) | −1.2848 A [0.0445] | ||

| −0.6901 A [0.1801] | −0.4742 A [0.1059] | −0.8992 A [0.0006] | |

| Panel C. Model diagnostics | |||

| Adj. R2 | 0.9589 | 0.9908 | 0.9830 |

| Regression standard error | 0.1736 | 0.1115 | 0.0373 |

| Bounds statistic | 36.7855 A | 49.2555 A | 36.78550 A |

| Upper bound | 5.455 | 5.455 | 5.455 |

| Lower bound | 3.967 | 3.967 | 3.967 |

| Serial correlation | 2.5194 (0.2837) | 2.0725 (0.3548) | 3.0645 (0.2161) |

| Heteroscedasticity | 8.7099 (0.3674) | 6.6505 (0.9667) | 6.2720 (0.6168) |

| Functional Form | 2.7543 (0.1590) | 0.4438 (0.5125) | 2.4696 (0.2650) |

| Normality | 0.0096 (0.9951) | 0.0721 (0.9646) | 0.9698 (0.6158) |

| Cusum & Cusumsq | Stable | Stable | Stable |

| Variables | Boom | Boom-Positive | Boom-Negative |

|---|---|---|---|

| Panel A. expansions | |||

| 1.0146 A [0.0863] | 0.9476 A [0.0689] | 0.8907 A [0.3398] | |

| −0.0664 B [0.0298] | −0.0334 B [0.0113] | −0.0898 [0.1158] | |

| −0.0101 [0.0133] | −0.0173 [0.0125] | ||

| −0.2201 [0.4520] | −0.0117 [0.3595] | −0.4509 [0.8365] | |

| Break (1999–2004) | −0.1924 B [0.0869] | ||

| Break (2014) | 0.4114 A [0.1312] | 0.5432 A [0.0916] | |

| Intercept | −0.0159 [0.0482] | −0.0098 [0.1213] | 0.0043 [0.7763] |

| Panel B. recessions | |||

| Variables | Bust | Bust−Positive | Bust−Negative |

| 0.9785 A [0.1236] | 0.9357 A [0.0914] | 0.7692 A [0.1006] | |

| −0.0669 [0.0443] | −0.0731 A [0.0256] | −0.0612 [0.0386] | |

| −0.0411 B [0.0169] | −0.0032 [0.0088] | −0.0091 [0.0093] | |

| −0.0079 [0.6099] | 0.2019 [0.4762] | −0.8997 [0.5396] | |

| Break (2000–2012) | −0.1407 [0.1069] | −0.8133 A [0.1357] | |

| Break (2013) | −0.2216 [0.1355] | −0.7474 A [0.2286] | |

| Break (1990, 2007) | −0.2758 [0.2526] | ||

| Break (2008, 2013) | −0.7252 B [0.3020] | ||

| Break (2014) | −0.8706 A [0.3049] | ||

| Intercept | 0.0723 [0.1043] | 0.0858 [0.1991] | −0.0729 [0.1916] |

| Filter | Expansion | Recession |

|---|---|---|

| HP | 3.6739 | 3.6498 |

| CF | 3.7288 | 3.6128 |

| Variables | Boom | Boom-Positive | Boom-Negative |

|---|---|---|---|

| Panel A. expansions | |||

| 1.0769 A [0.0397] | 0.9373 A [0.0194] | 0.9109 A [0.0604] | |

| −0.0220 B [0.0087] | −0.0212 A [0.0042] | −0.0020 [0.0149] | |

| −0.0665 A [0.0077] | −0.0100 A [0.0009] | −0.0021 [0.0027] | |

| −0.7317 A [0.0608] | −0.0193 [0.0180] | −0.0983 [0.1862] | |

| −0.0115 [0.0377] | −0.0110 [0.0302] | ||

| −0.6375 A [0.1998] | −0.0185 [0.0959] | −0.0954 [0.2857] | |

| Break (1999–2004) | −0.1013 A [0.0179] | ||

| Break (2014) | 0.0067 [0.0117] | 0.3340 A [0.0319] | |

| Intercept | −0.0159 [0.0482] | −0.0599 [0.0367] | 0.1989 [0.3509] |

| Panel B. recessions | |||

| Variables | Bust | Bust-Positive | Bust-Negative |

| 1.0586 A [0.0433] | 0.8873 A [0.1330] | 0.9189 A [0.0187] | |

| −0.0334 A [0.0134] | −0.0826 A [0.0227] | −0.0040 [0.0057] | |

| −0.0421 A [0.0107] | −0.0087 A [0.0013] | −0.0011 A [0.0004] | |

| −0.5490 A [0.0939] | −0.5473 A [0.1256] | −0.0976 A [0.0343] | |

| −0.0151 A [0.0049] | −0.0136 A [0.0043] | −0.0026 [0.0017] | |

| −0.5402 A [0.2243] | 0.1114 [0.6613] | −0.0719 [0.0950] | |

| Break (2000–2012) | −0.0231 [0.0307] | −0.4132 A [0.0900] | |

| Break (2013) | −0.0798 B [0.0349] | −0.2261 B [0.1056] | |

| Break (1990, 2007) | −0.2436 A [0.0349] | ||

| Break (2008, 2013) | −0.5000 A [0.0388] | ||

| Break (2014) | −1.2759 A [0.0429] | ||

| Intercept | 0.0465 [0.0298] | 1.5734 A [0.5296] | −0.1319 B [0.0499] |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kumar, N.N.; Bibi, K.; Mohnot, R. From Boom to Bust: Unravelling the Cyclical Nature of Fiji’s Money Demand. J. Risk Financial Manag. 2025, 18, 381. https://doi.org/10.3390/jrfm18070381

Kumar NN, Bibi K, Mohnot R. From Boom to Bust: Unravelling the Cyclical Nature of Fiji’s Money Demand. Journal of Risk and Financial Management. 2025; 18(7):381. https://doi.org/10.3390/jrfm18070381

Chicago/Turabian StyleKumar, Nikeel Nishkar, Kulsoom Bibi, and Rajesh Mohnot. 2025. "From Boom to Bust: Unravelling the Cyclical Nature of Fiji’s Money Demand" Journal of Risk and Financial Management 18, no. 7: 381. https://doi.org/10.3390/jrfm18070381

APA StyleKumar, N. N., Bibi, K., & Mohnot, R. (2025). From Boom to Bust: Unravelling the Cyclical Nature of Fiji’s Money Demand. Journal of Risk and Financial Management, 18(7), 381. https://doi.org/10.3390/jrfm18070381