Analysis of the Effectiveness of Classical Models in Forecasting Volatility and Market Dynamics: Insights from the MASI and MASI ESG Indices in Morocco

Abstract

1. Introduction

2. Literature Review

2.1. Profitability Models and Market Forecasting: Innovations from the 1970s to 1990s

2.2. The Evolution of Classical Models in Financial Market Forecasting

2.3. Forecasting Models and the Performance of ESG Indices

2.4. Challenges and Opportunities for the Moroccan Financial Market

3. Data and Methodology

3.1. Methodology

3.1.1. Modeling Strategy

- ARIMA and SARIMA models for modeling and forecasting returns.

- ARCH, GARCH, EGARCH, and GJR-GARCH models for modeling and forecasting volatility.

- ARIMA (AutoRegressive Integrated Moving Average): The ARIMA model was applied to predict the returns of both indices after transformation. The parameters (p, d, q) were optimized using the Akaike Information Criterion (AIC). This model captures the linear dependencies in the time series by considering past values (AR), differencing (I), and past forecast errors (MA).

- ✓

- AR (AutoRegressive, order p): This component of the model expresses the current value of the series as a linear combination of its own past values. It thus captures the inertia or memory effect in time series data. Mathematically, it is expressed as a relationship of the form:

- ✓

- I (Integrated, order d): This component represents the number of differencing operations required to make the series stationary. If the data exhibit a trend or instability in variance, differencing is used to stabilize the mean and eliminate trends. The series is transformed as follows:(for first-order differencing), and this operation is repeated d times if necessary.

- ✓

- MA (Moving Average, order q): This component models the current dependence on past errors by smoothing out the random disturbances affecting the data. It is formulated as follows:

- SARIMA (Seasonal ARIMA): A SARIMA model was specifically applied to the MASI ESG index to account for the seasonal effects identified in the data. SARIMA is an extension of ARIMA that includes seasonal components, allowing the model to capture patterns or cycles that repeat over time (such as seasonal variations in market behavior).SARIMA(,,) (P, D, Q):

- ▪

- ,, are the non-seasonal AR, differencing, and MA orders, respectively.

- ▪

- P, D, Q are the seasonal AR, differencing, and MA orders, respectively.

- ▪

- s is the length of the seasonal cycle (e.g., s = 12 for monthly data with yearly seasonality).

- ▪

- B is the backshift operator, where .

- ▪

- is the error term.

- ARCH (Autoregressive Conditional Heteroskedasticity): The ARCH model assumes that the variance of the error term (or residual) at any time t is conditional on the past values of the error terms, and it follows a linear process. Specifically, the model captures the volatility clustering phenomenon, where large changes in asset prices tend to follow other large changes, and small changes tend to follow small changes.

- ▪

- is the mean (or constant) of the time series.

- ▪

- is the residual (or shock) at time t; and , where is a white noise error term with E( and V(.

- ▪

- is the conditional variance at time t, representing the volatility of the time series.

- ▪

- is a constant (usually assumed to be positive).

- ▪

- are the coefficients that measure the impact of past squared residuals (lags of the error term).

- ▪

- is the squared error term at time t − i.

- GARCH (Generalized Autoregressive Conditional Heteroskedasticity: The GARCH (Generalized Autoregressive Conditional Heteroskedasticity) model is an extension of the ARCH (Autoregressive Conditional Heteroskedasticity) model, which models the variance of returns as a function of past squared returns and past variances. Specifically, the GARCH model allows for both past squared returns and past variances to influence the current conditional variance.

- ▪

- is the return at time t.

- ▪

- is the mean.

- ▪

- is the error term (which is assumed to follow , where is i.i.d. normal noise with zero mean and unit variance).

- ▪

- is a constant.

- ▪

- are the coefficients of the lagged squared returns (ARCH terms).

- ▪

- are the coefficients of the lagged variances (GARCH terms).

- ▪

- is the conditional variance at time t.

- EGARCH (Exponential GARCH): The EGARCH model is an extension of the GARCH model that allows for asymmetric effects of positive and negative shocks on volatility. This model was introduced by Nelson (1991) to address the fact that volatility tends to react differently to positive and negative news, which is a common feature in financial markets.

- ▪

- is the conditional variance at time t.

- ▪

- is the innovation or shock at time t (i.e.,

- ▪

- is a constant term.

- ▪

- are the coefficients for the lagged standardized errors (i.e., .

- ▪

- are the coefficients for the lagged values of the logarithm of the conditional variance.

- GJR-GARCH (Glosten–Jagannathan–Runkle GARCH): The GJR-GARCH model is another extension of the GARCH model that specifically incorporates asymmetry in volatility. This model is designed to capture the leverage effect, where negative shocks (bad news) tend to have a larger impact on volatility than positive shocks (good news). The GJR-GARCH model modifies the basic GARCH model by adding a term that allows for the asymmetry of shocks.

- ▪

- is the conditional variance at time t.

- ▪

- is the lagged residual (error term).

- ▪

- is a constant term.

- ▪

- are the coefficients for the squared lagged residuals (ARCH terms).

- ▪

- are the coefficients for the lagged values of the conditional variance (GARCH terms).

- ▪

- is an indicator function that takes the value of 1 if (i.e., if the shock is negative), and 0 otherwise.

- ▪

- are the coefficients that capture the asymmetry in the model.

3.1.2. Tests Evaluation of Forecasting Models

- Calculation of RMSE: Methodology

- ▪

- represents the actual value of the return of the index at time t.

- ▪

- represents the predicted value by the model at time t.

- ▪

- n is the total number of data points in the sample used for validation (in this case, the test set over 252 days).

- Calculation of Mean Absolute Error (MAE): Methodology

- ▪

- represents the actual value of the return of the index at time t.

- ▪

- represents the predicted value by the model at time t.

- ▪

- n is the total number of data points in the sample used for validation (in this case, the test set over 252 days).

- Calculation of Mean Absolute Percentage Error (MAPE): Methodology

- Calculation of Coefficient of Determination (R2): Methodology

- ▪

- is the mean of the actual values. An R2 close to 1 indicates that the model explains most of the variance in the data.

- ⮚

- Data Split: The historical data of the indices were divided into two parts:

- -

- Training Set: Used to fit the models (parameter optimization).

- -

- Test Set: Used to validate the forecasts made by each model.

- ⮚

- Application of Forecasting Models: For each model (ARIMA, SARIMA, GARCH, EGARCH, and GJR-GARCH), forecasts were made based on the training data and then compared with the actual data from the test set.

- ⮚

- Calculation of Forecast Errors: Once the forecasts were generated, forecast errors were calculated by subtracting the actual returns from the predicted returns. These errors were then used to compute several accuracy metrics, including the Root Mean Squared Error (RMSE), Mean Absolute Error (MAE), Mean Absolute Percentage Error (MAPE), and coefficient of determination (R2). Each of these indicators offers complementary insights into model performance.

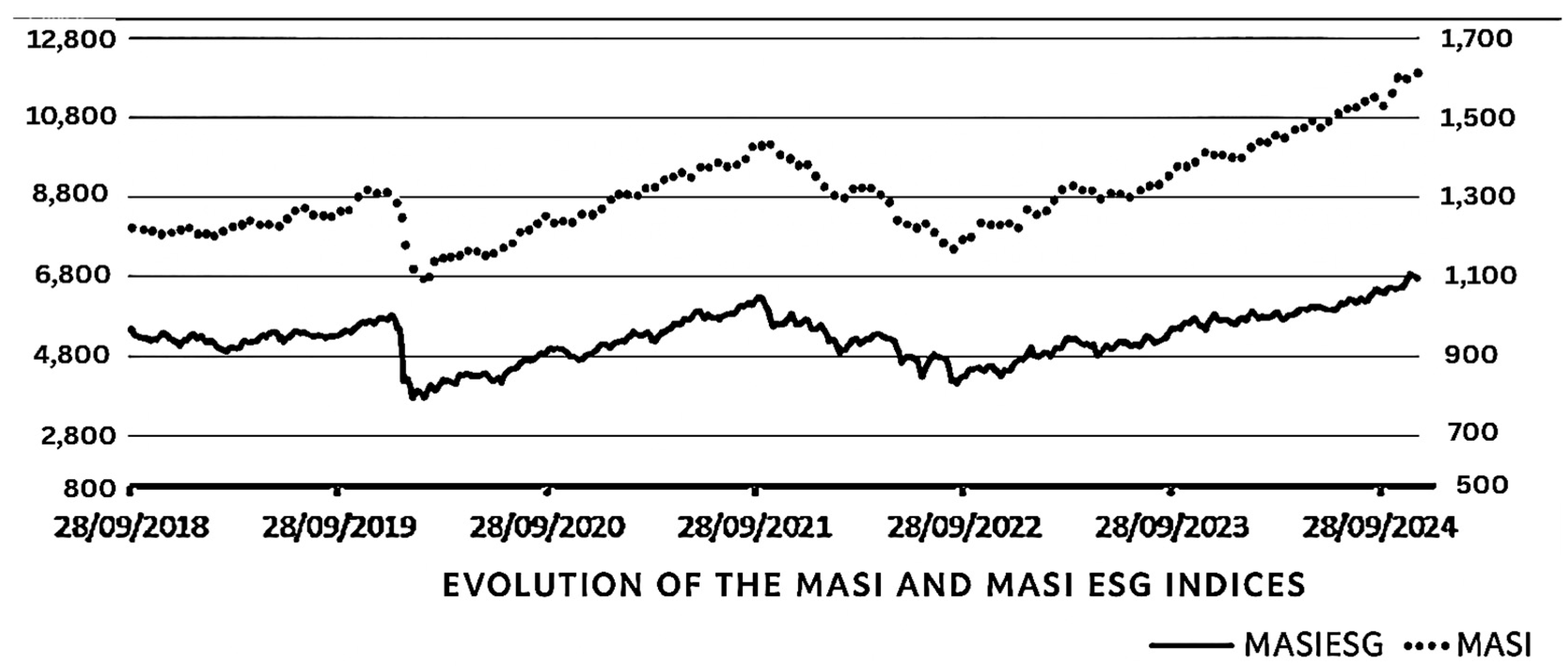

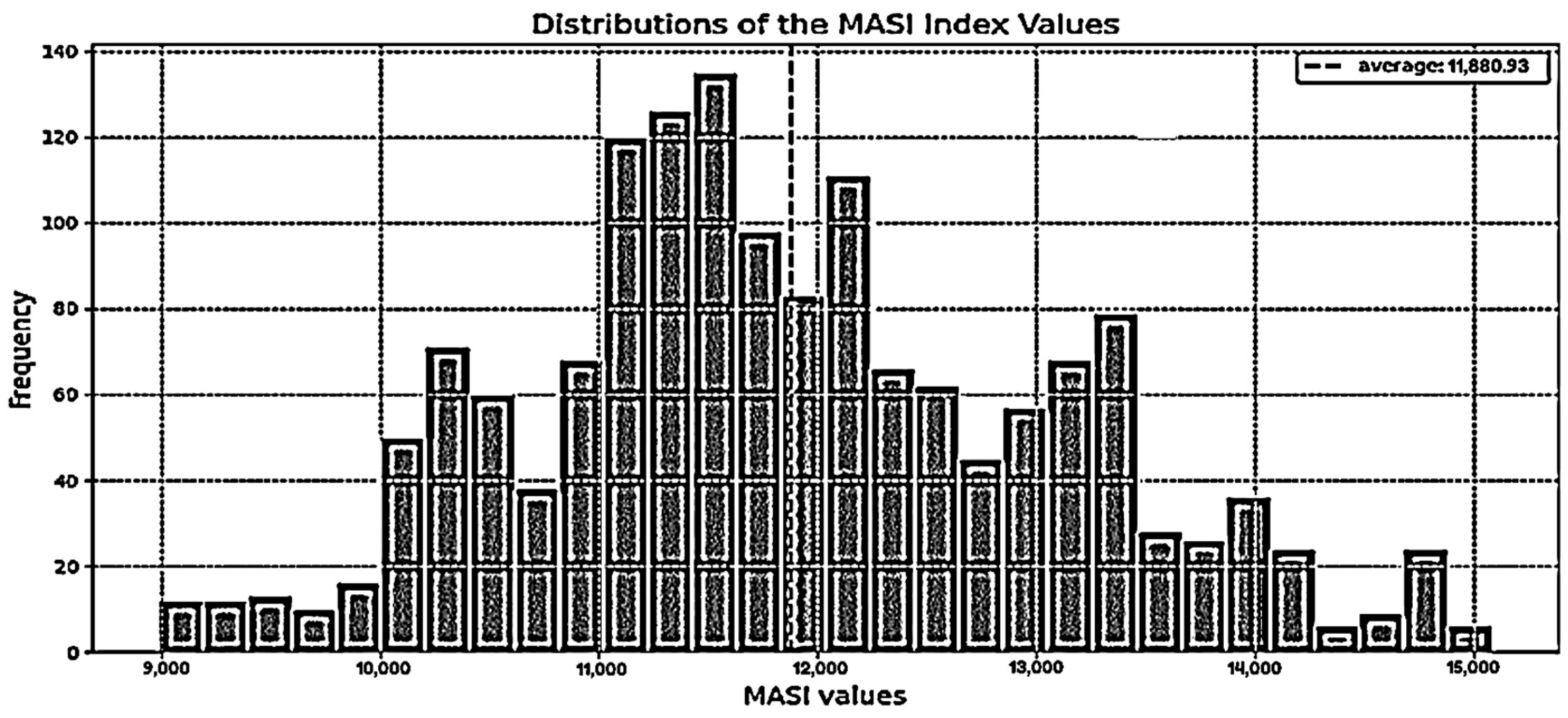

3.2. Data

3.2.1. Return Computation, Volatility Estimation

- Calculation of Daily Returns:

- ▪

- and represent the closing prices at dates t and t−1, respectively. This calculation captures the logarithmic variation between two consecutive days and allows for the evaluation of the relative performance of the indices.

- Estimation of Volatility:

- ▪

- is the volatility (standard deviation of returns).

- ▪

- represents the return on day t.

- ▪

- is the mean return.

- ▪

- is the number of observations (in this case, 252 days).

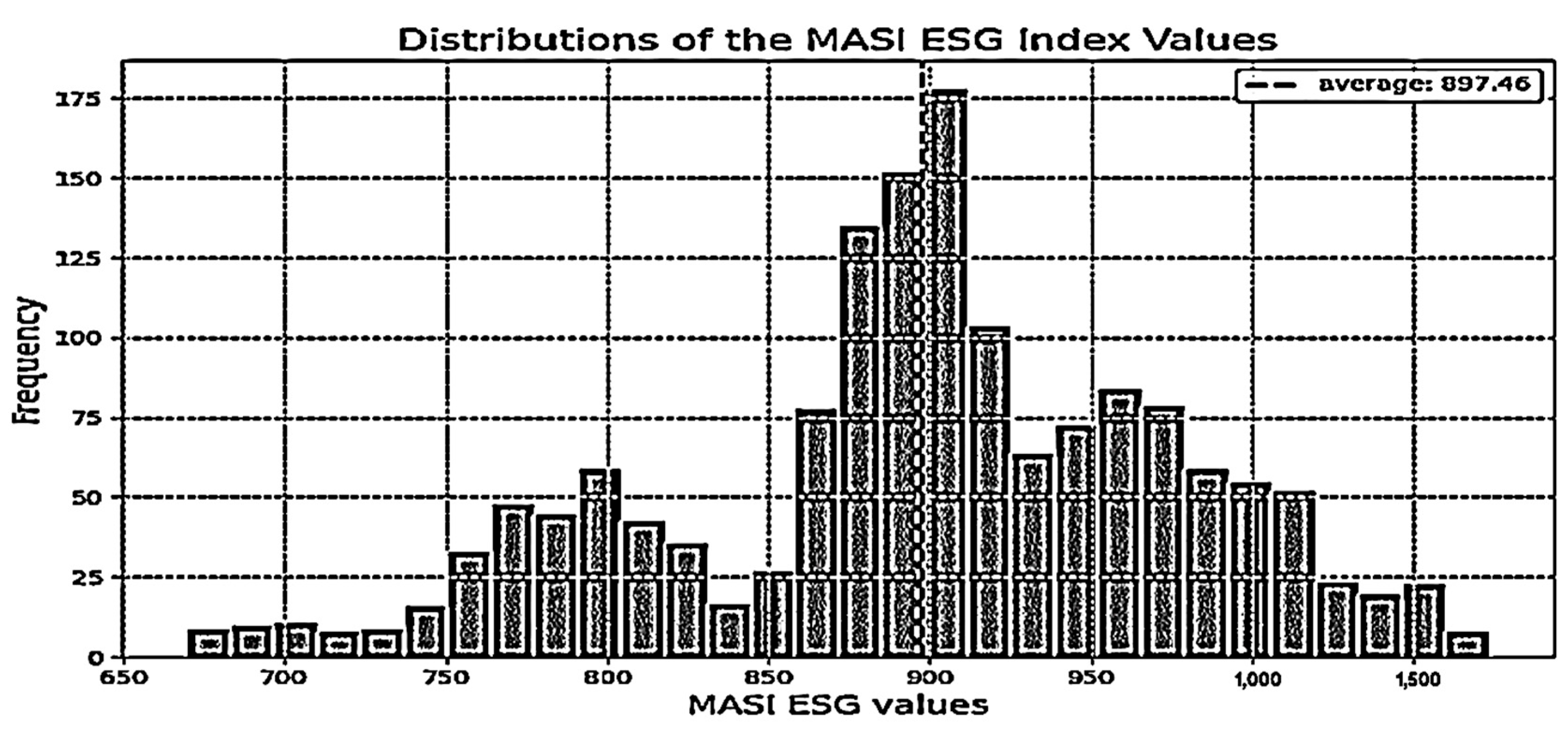

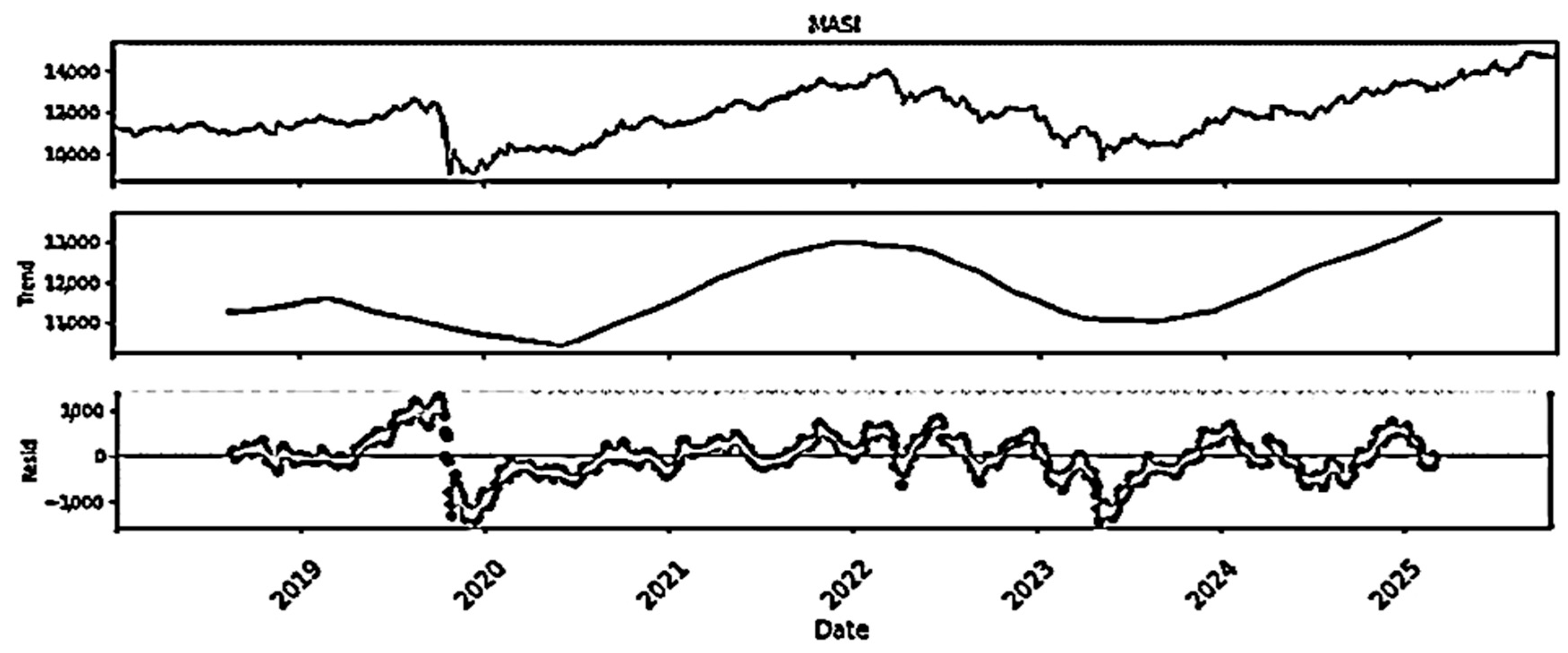

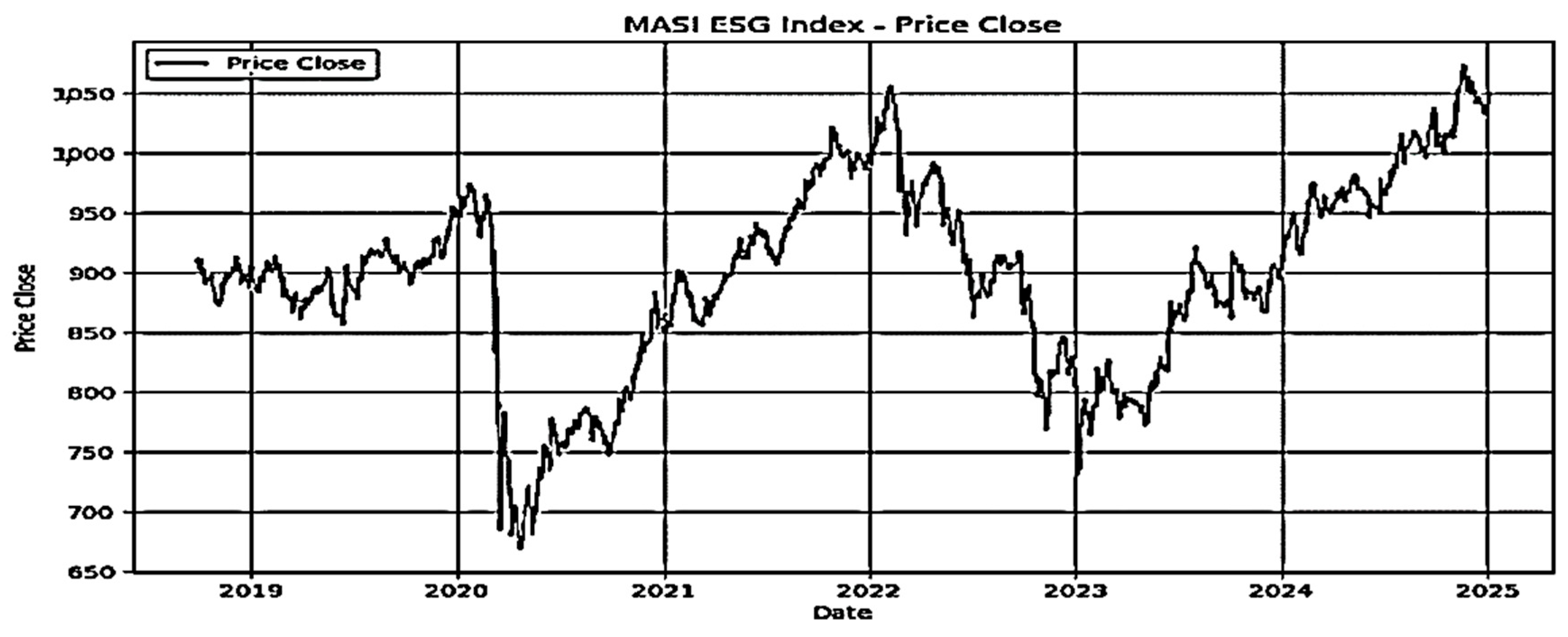

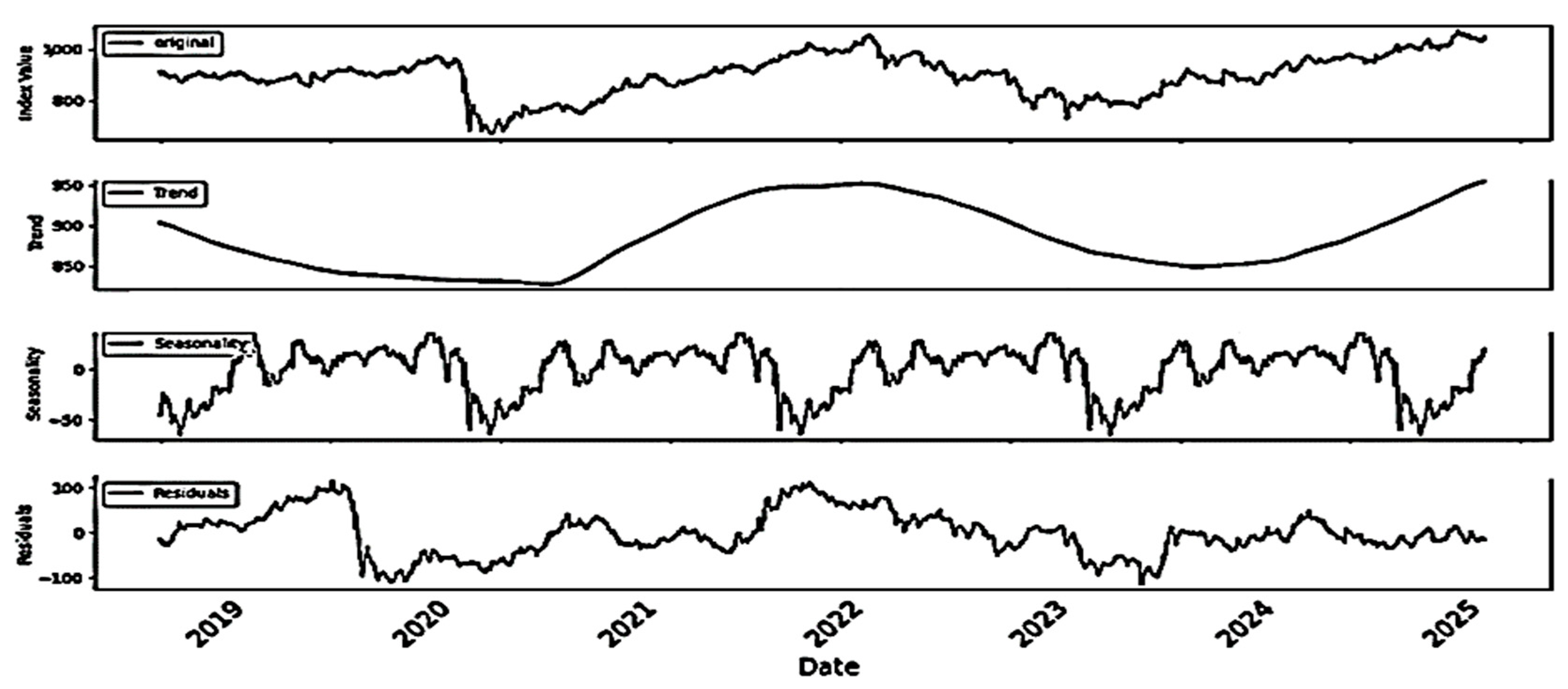

- Visualization of Time Series:

- ⮚

- Average Returns:

- ⮚

- Volatility:

- ⮚

- Skewness and Kurtosis Analysis of Return Distributions:

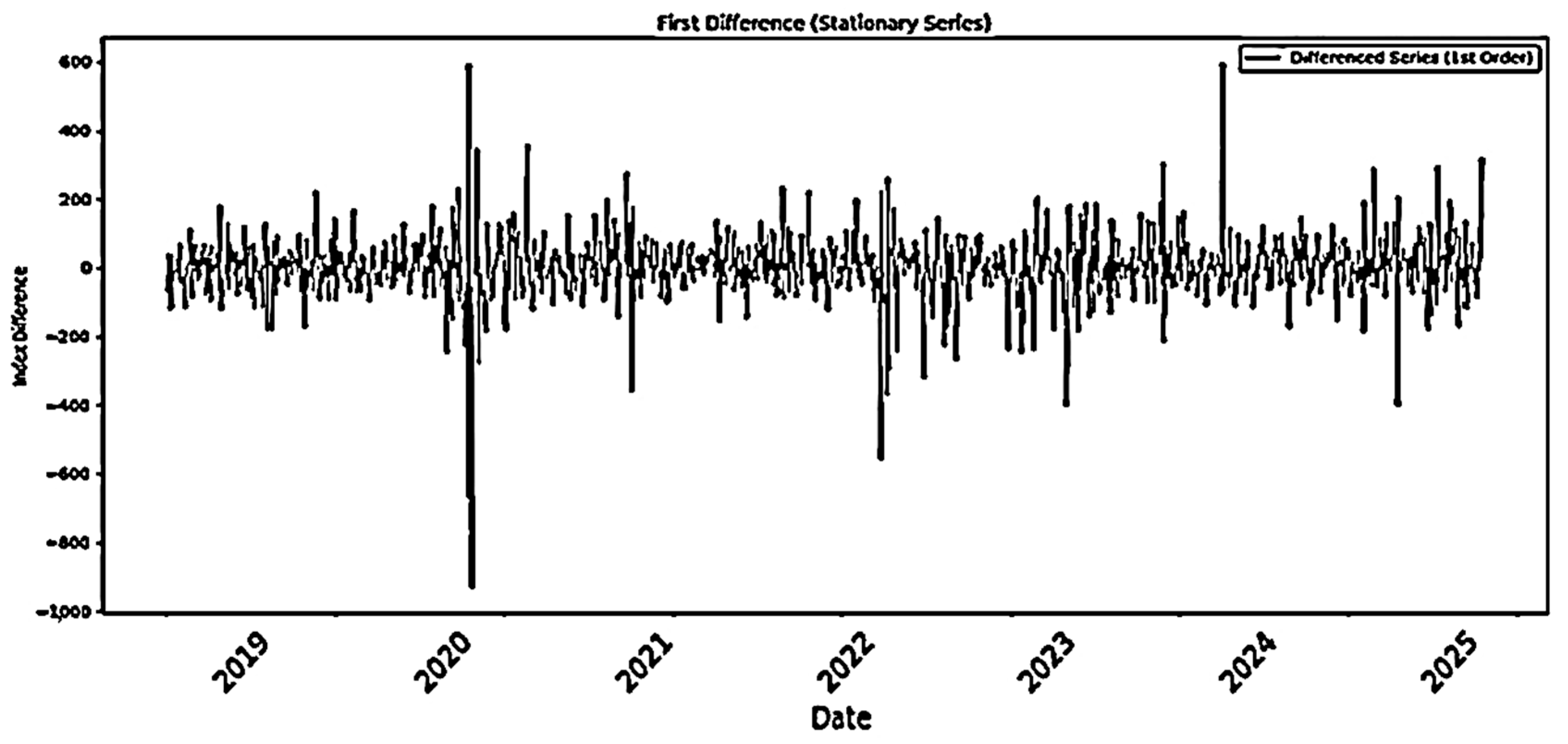

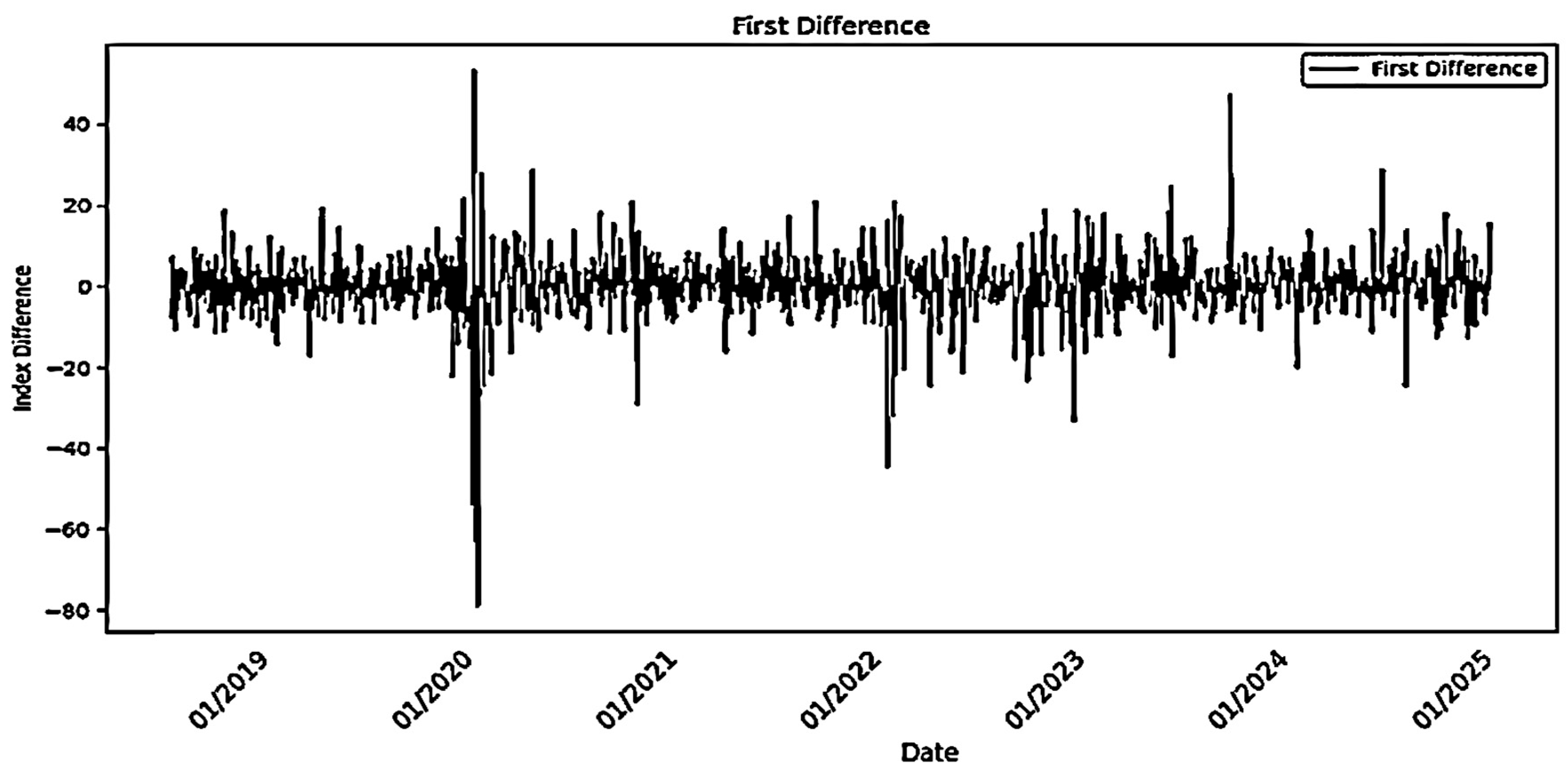

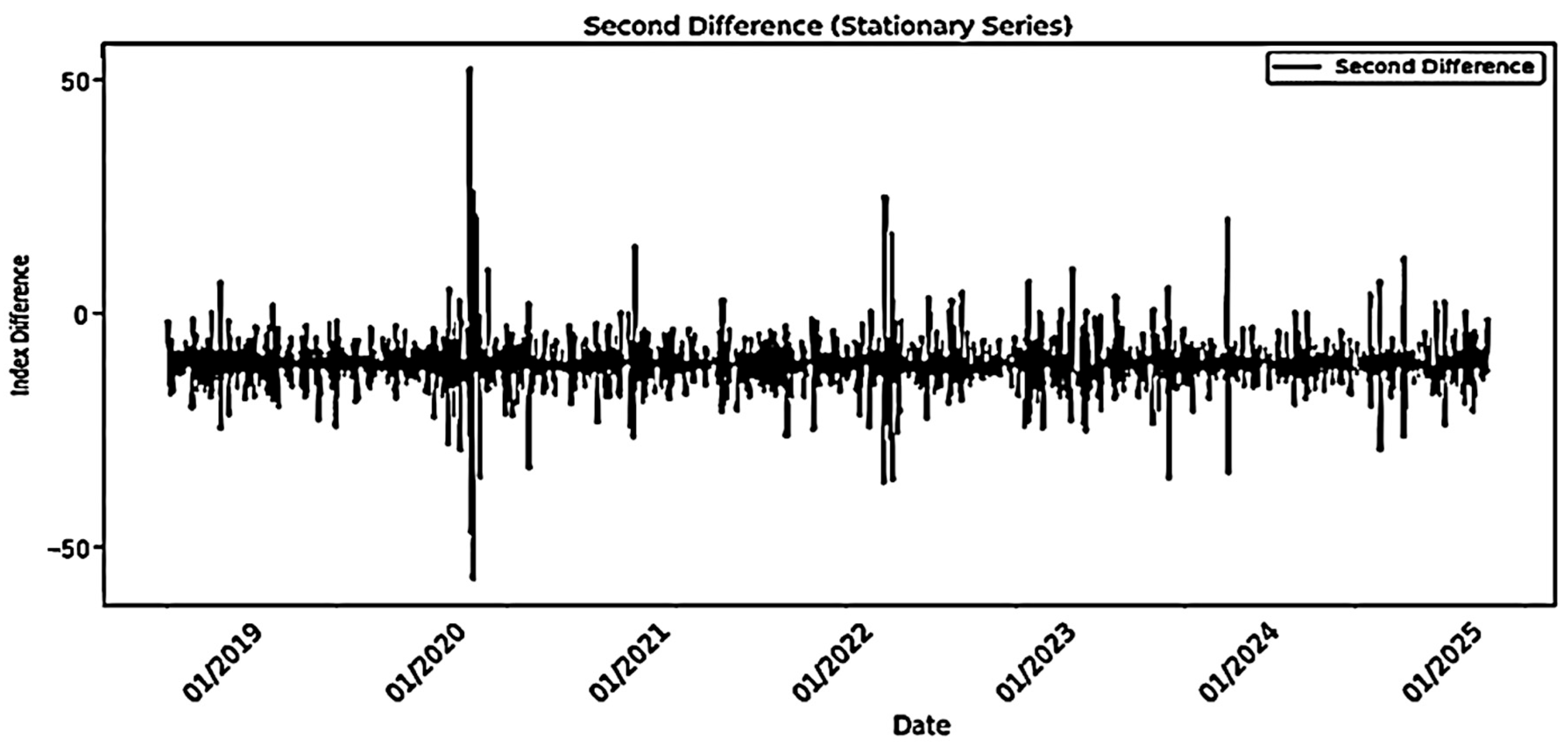

3.2.2. Stationarity Assessment and Differencing of MASI and MASI ESG Indices

- Stationarity Analysis: Application of ADF, KPSS, PP, and Zivot–Andrews Tests:

- ⮚

- Stationarity of the MASI Index

- ⮚

- Stationarity of the MASI ESG Index

3.2.3. Graphical Validation of Differentiation

- Implications of Stationarity for Analysis:

4. Empirical Results

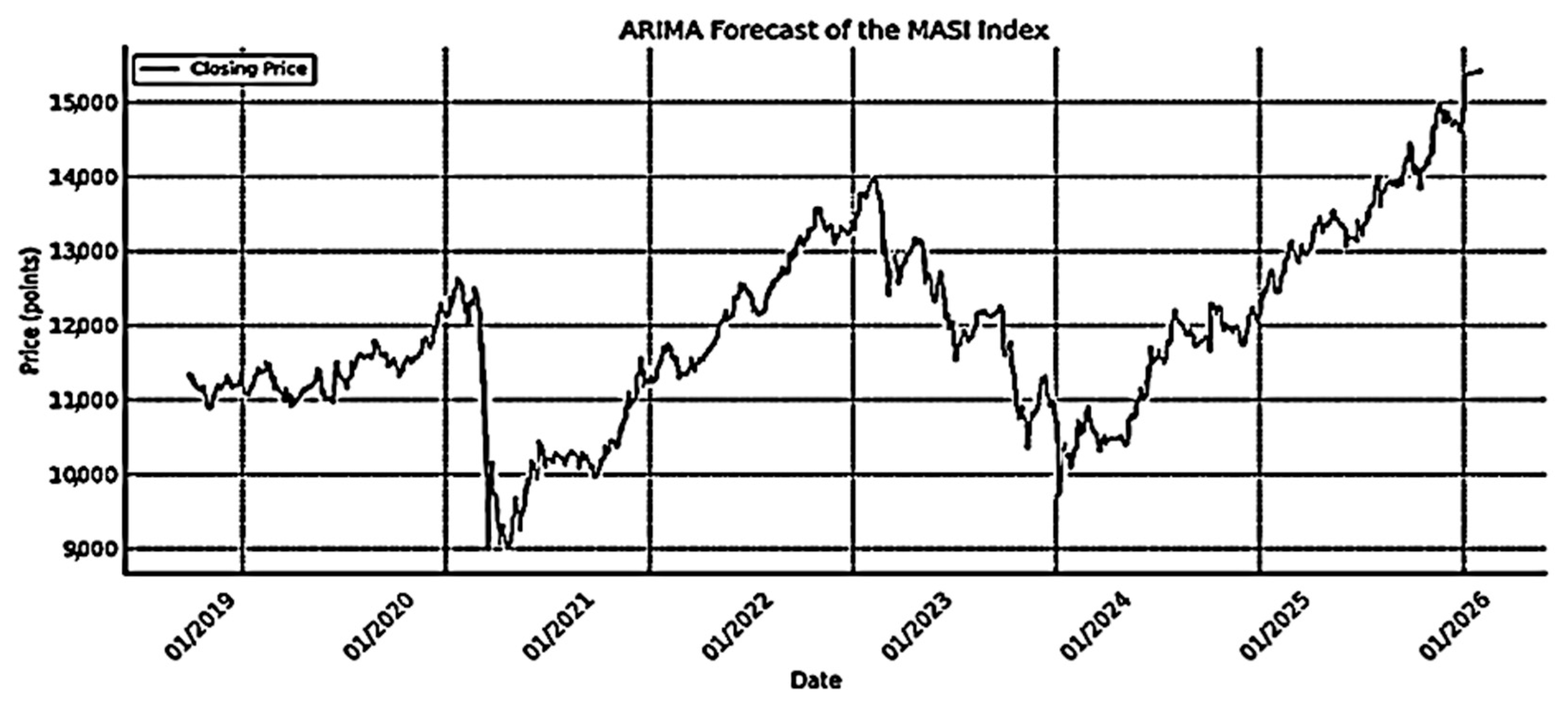

4.1. Forecasting Returns

4.1.1. Return Forecasts (ARIMA and SARIMA)

4.1.2. Regression Coefficients for ARIMA and SARIMA Models of MASI and MASI ESG Indices

4.2. Volatility Forecasting

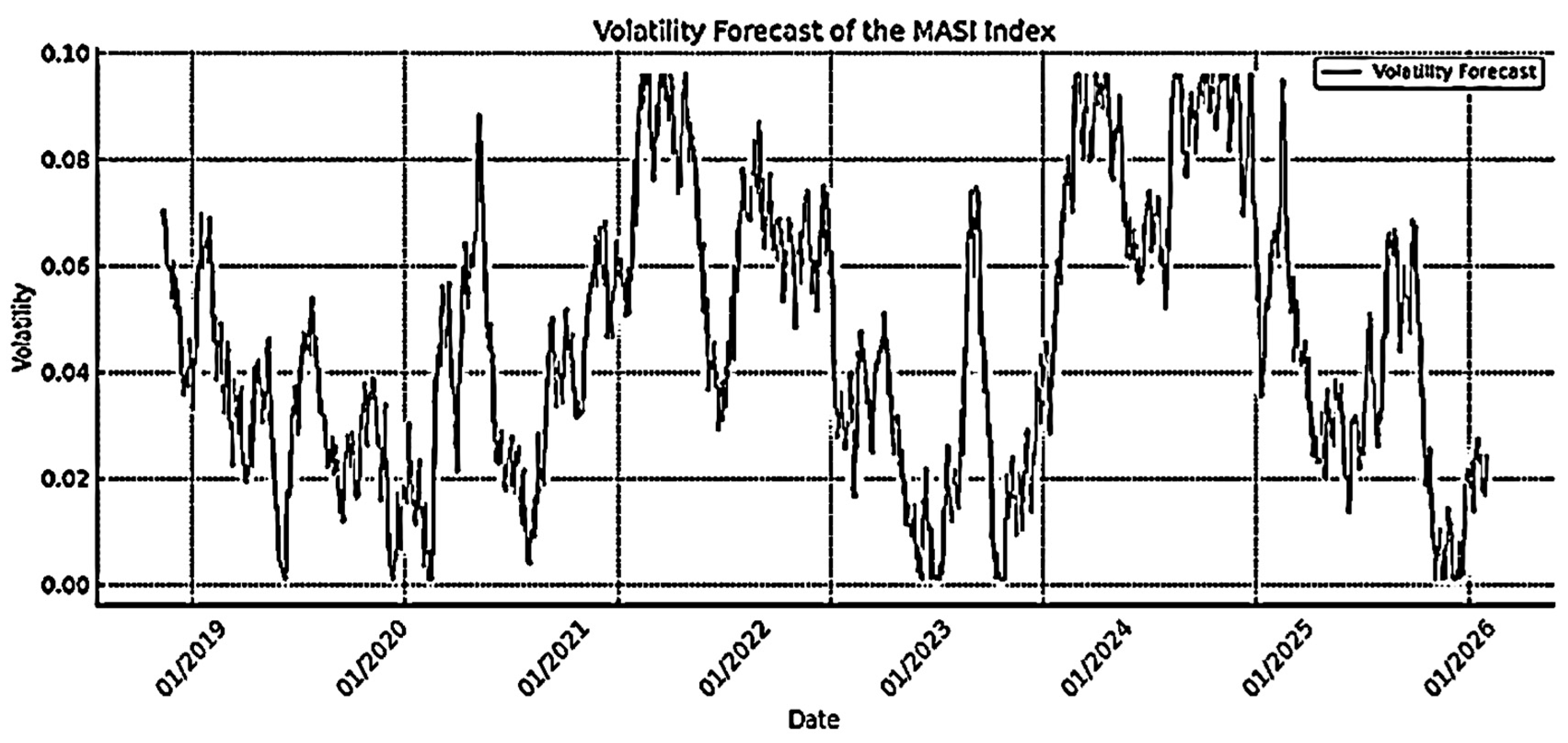

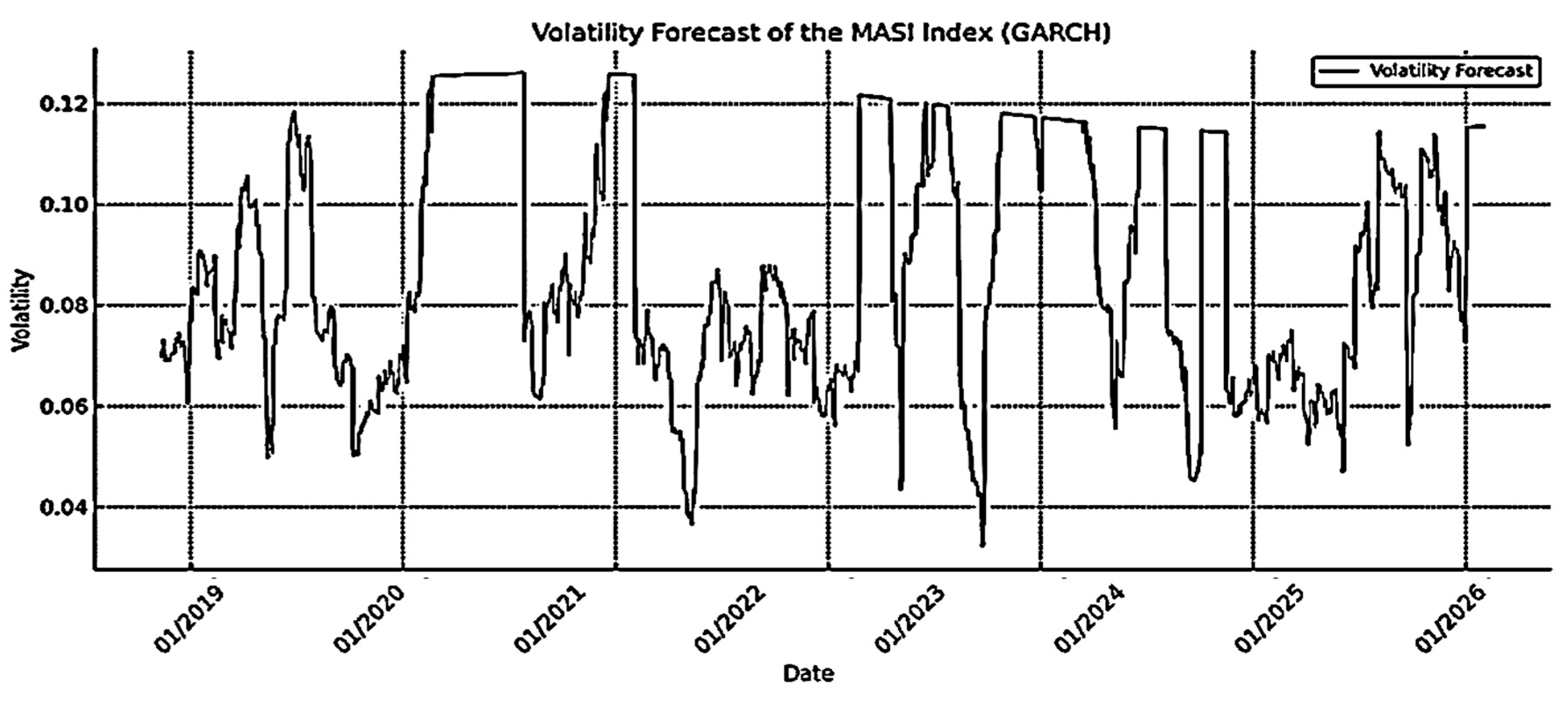

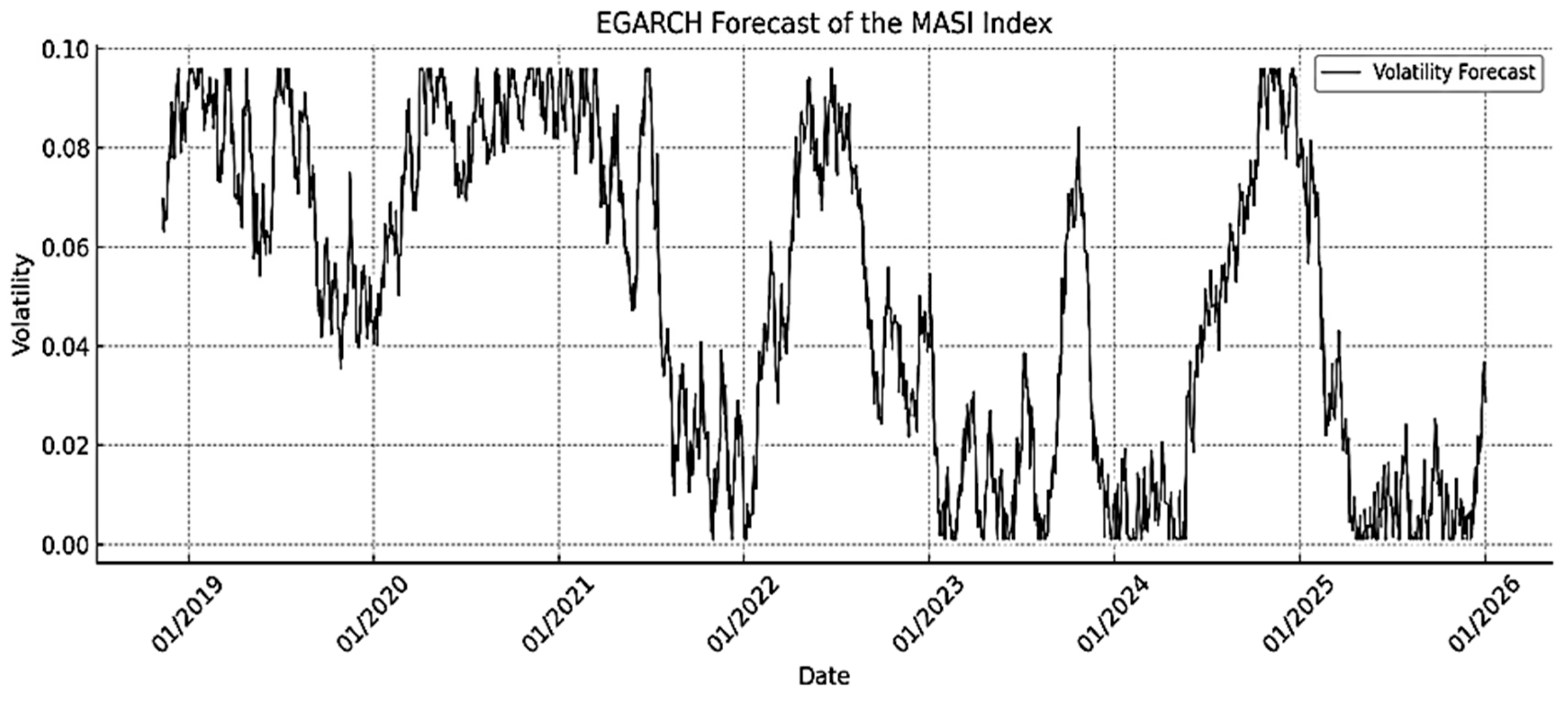

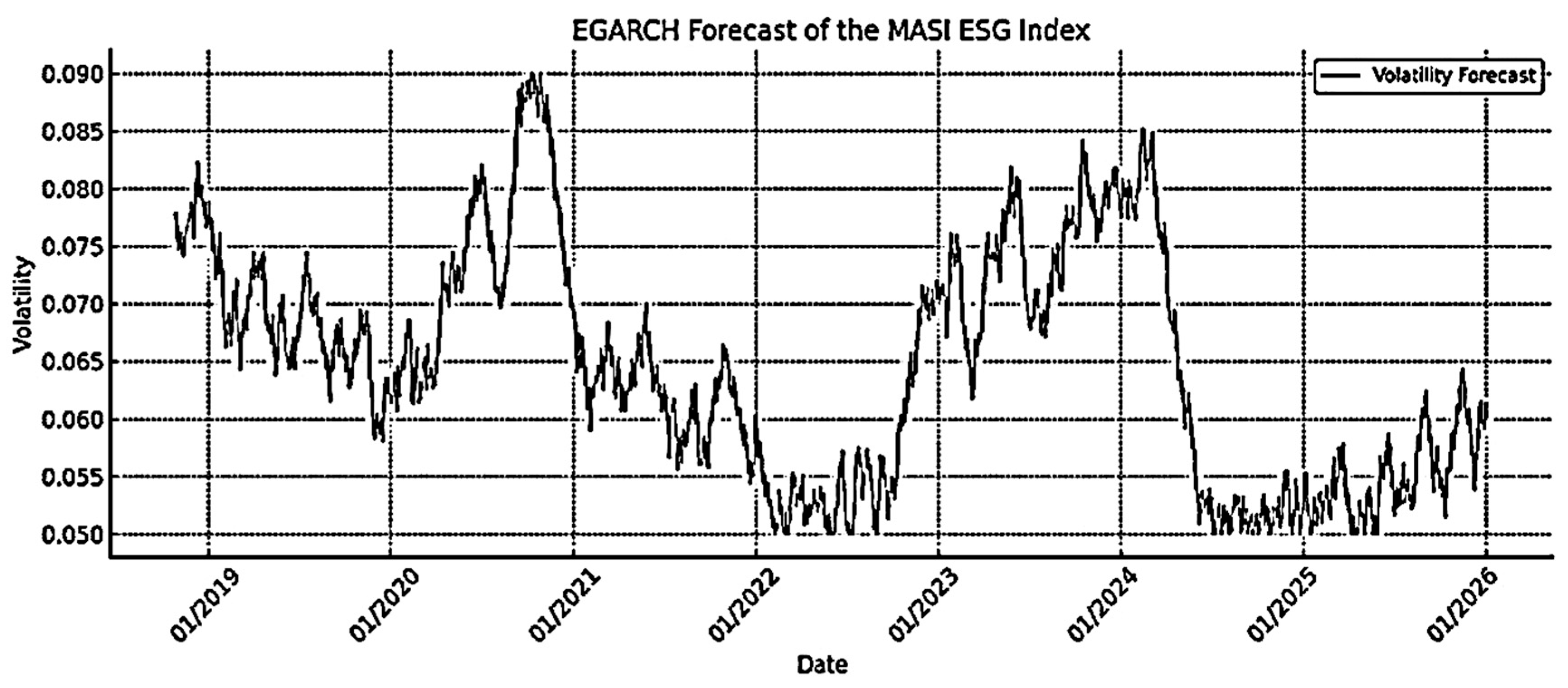

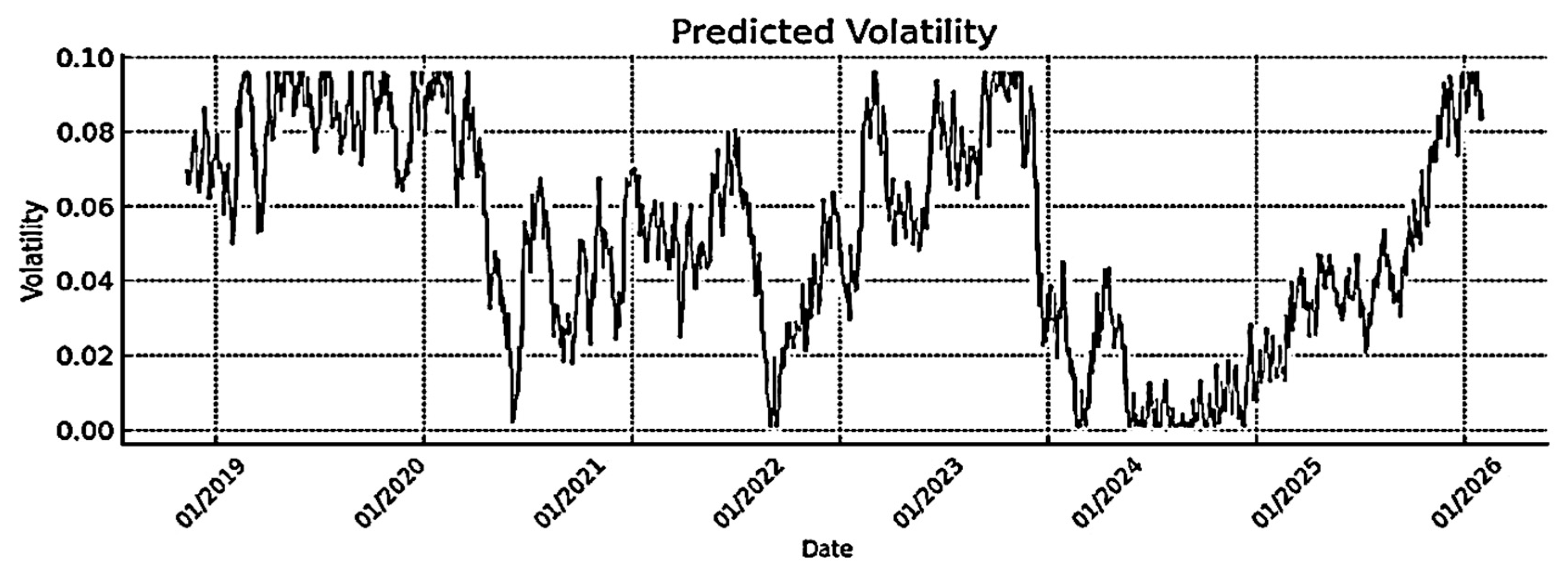

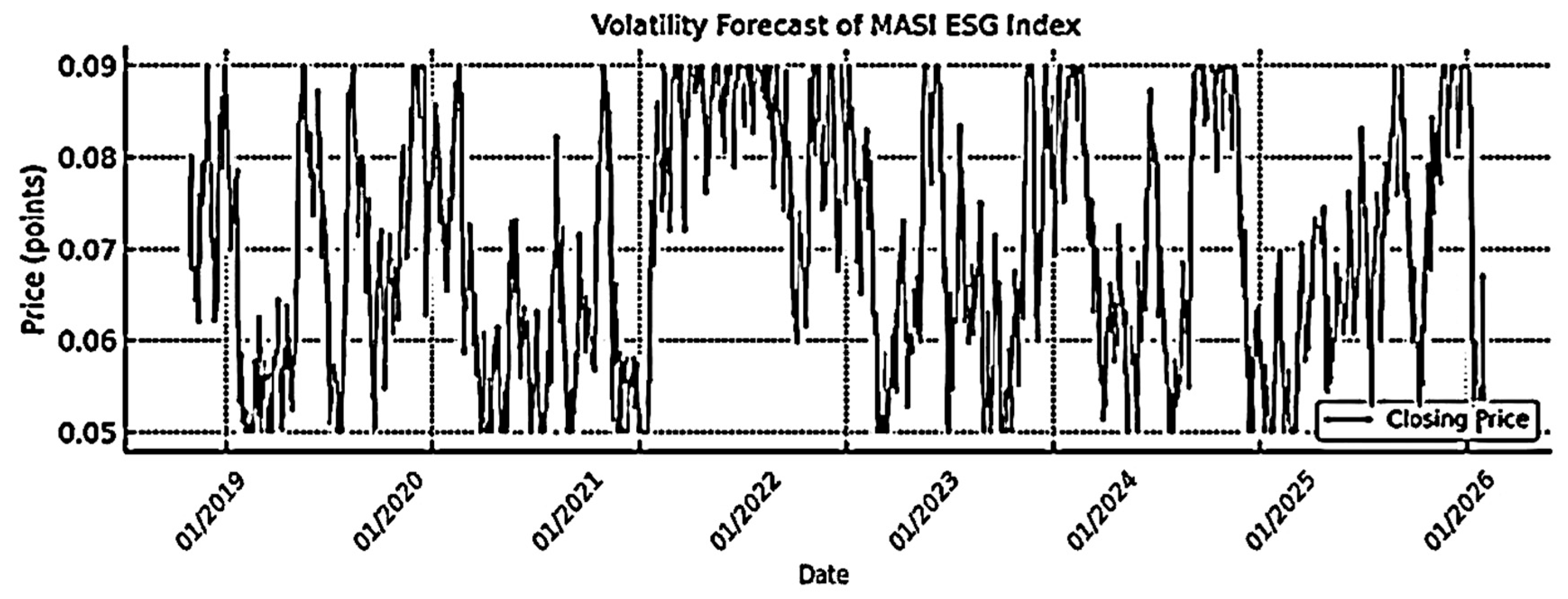

4.2.1. Volatility Forecasts (ARCH, GARCH, EGARCH, and GJR-GARCH)

4.2.2. Regression Coefficients for Forecasting Volatility Models of MASI and MASI ESG Indices

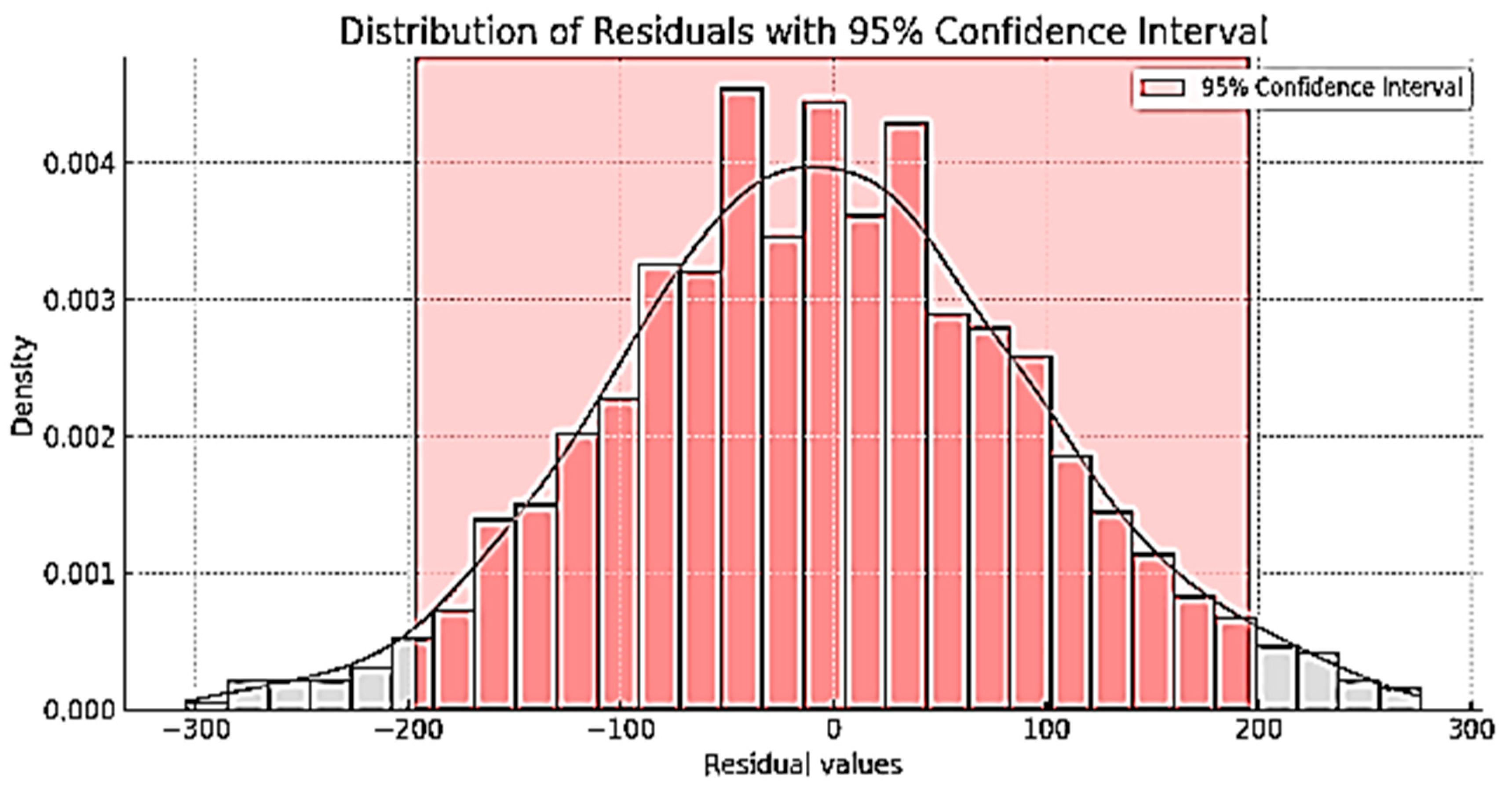

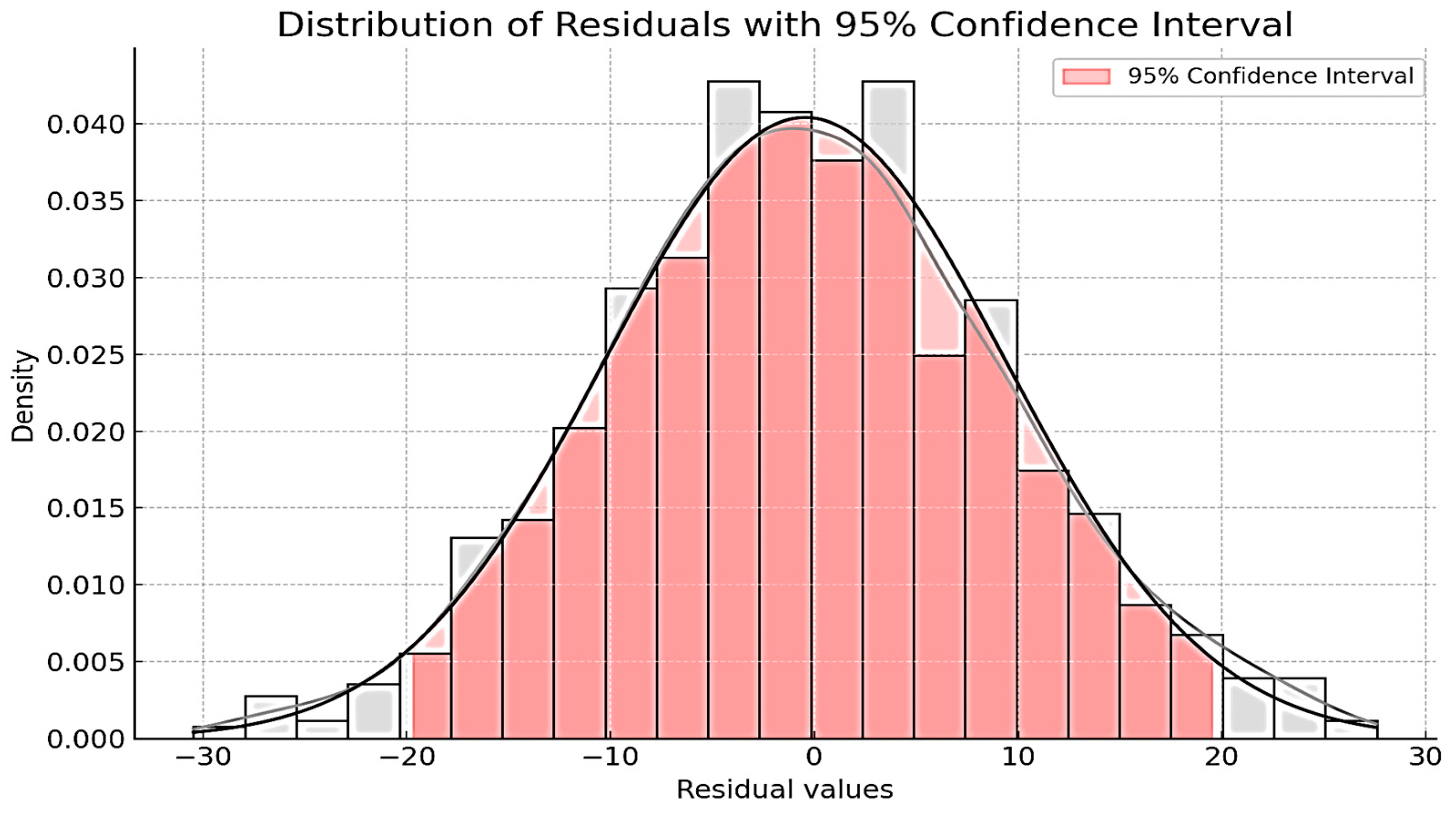

4.3. Residual Analysis of the Models

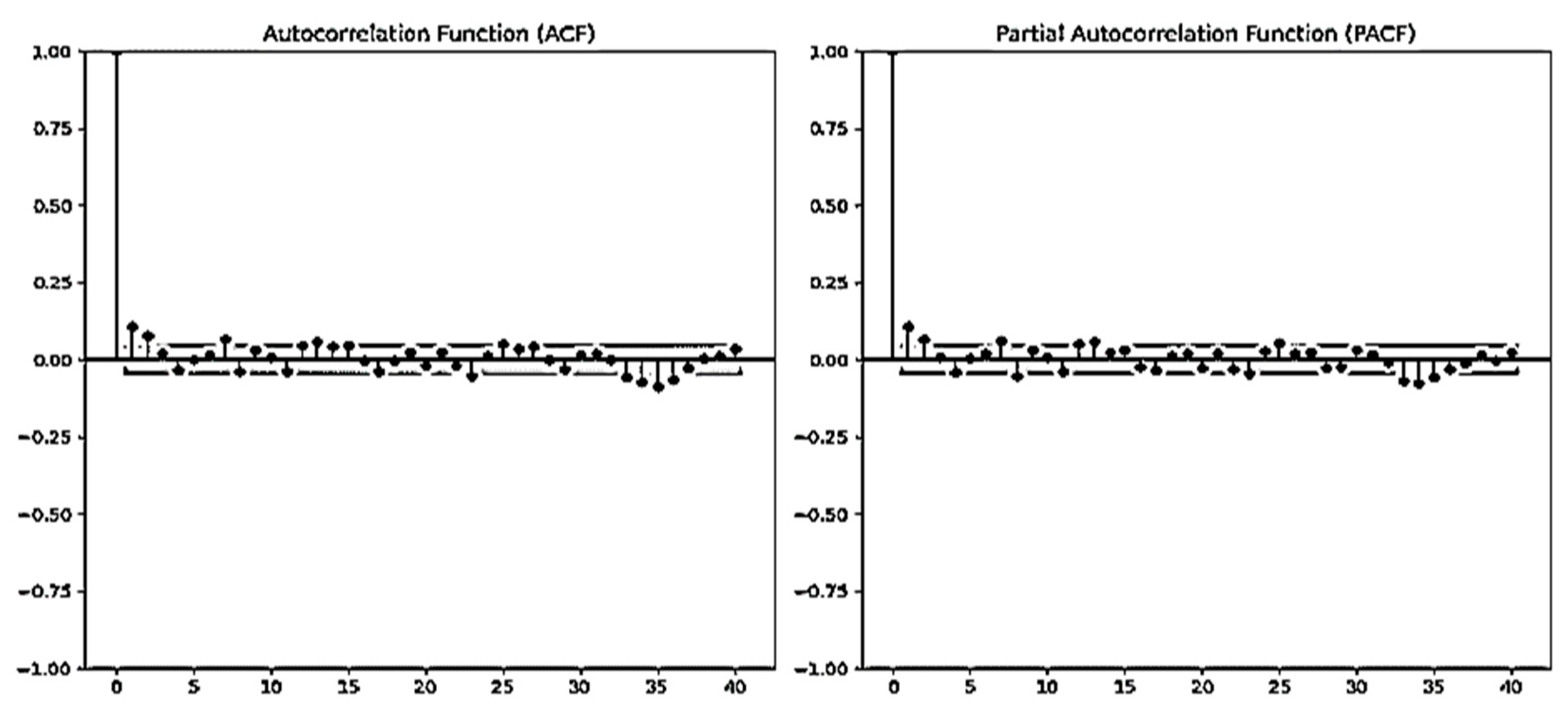

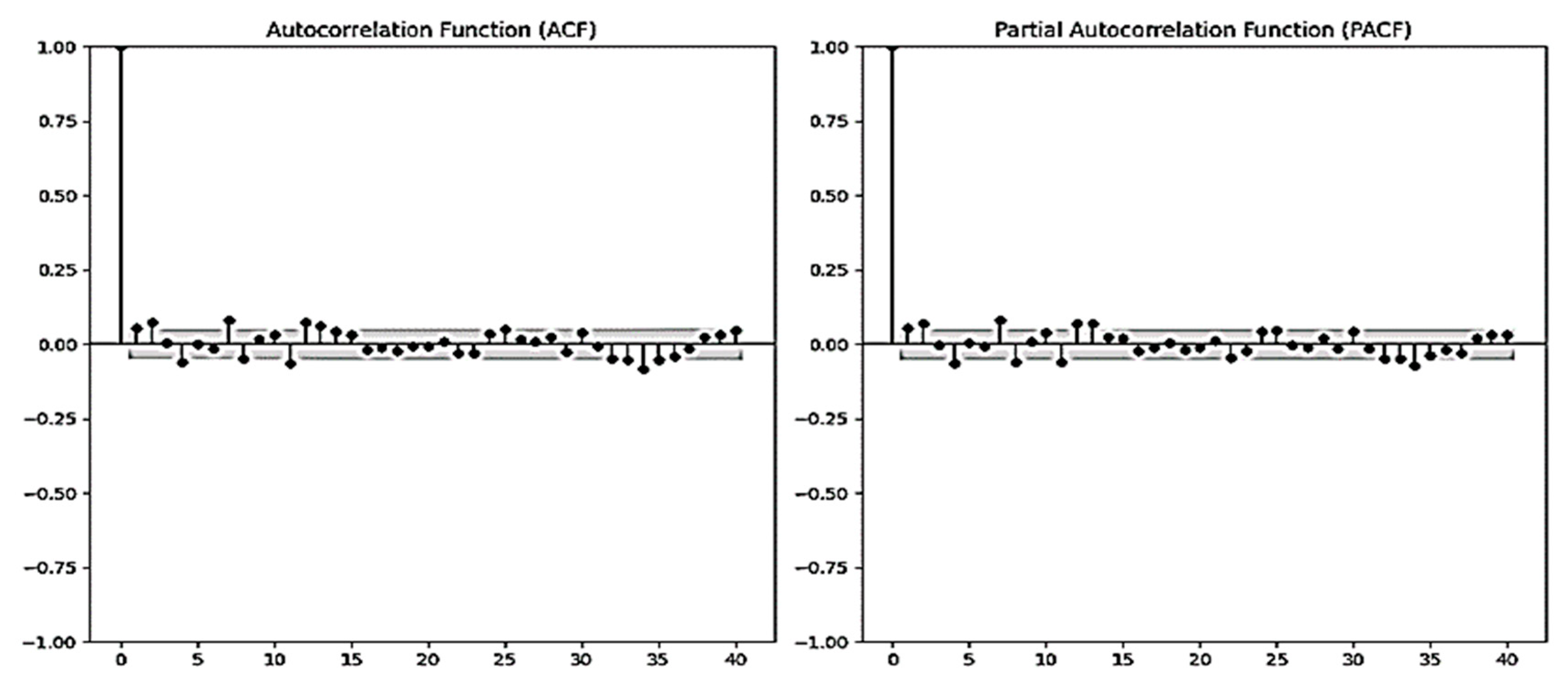

- Partial Autocorrelation Function (PACF) Test: This method is used to check for the presence of residual correlations that have not been modeled after fitting the models. By performing a PACF test on the residuals, we can ensure that the models have captured all the relevant dynamics of the time series. If significant correlations remain in the residuals, it suggests that the model has failed to capture some underlying patterns, indicating the need for further model refinement (see Figure 22 and Figure 23).

4.4. Evaluation of Forecasting Model Performance

- Mean Absolute Error (MAE): This metric calculates the average of the absolute differences between the actual and predicted values. It provides a more interpretable measure of error compared to RMSE, focusing on the magnitude of forecast errors without penalizing larger deviations as strongly.

- Mean Absolute Percentage Error (MAPE): This metric expresses prediction errors as a percentage of the actual value, making it useful for comparing the relative performance of different models across various time periods.

- Coefficient of Determination (R2): This indicator reflects the proportion of variance in the actual values that is explained by the model, assessing the overall goodness of fit and explaining the model’s predictive power.

- Results Visualization

5. Discussion of Results

5.1. Discussion and Hypotheses Validation

5.2. Limitations and Challenges of Forecasting Models

5.3. Comparison with Results Predicted by the Literature

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Akaike, H. (1974). A new look at the statistical model identification. IEEE Transactions on Automatic Control, 19(6), 716–723. [Google Scholar] [CrossRef]

- Banz, R. W. (1981). The relationship between return and market value of common stocks. Journal of Financial Economics, 9(1), 3–18. [Google Scholar] [CrossRef]

- Bekaert, G., & Harvey, C. R. (2000). Foreign speculators and emerging equity markets. The Journal of Finance, 55(2), 565–613. [Google Scholar] [CrossRef]

- Bekaert, G., & Harvey, C. R. (2003). Emerging markets finance. Journal of Empirical Finance, 10(1–2), 3–55. [Google Scholar] [CrossRef]

- Bikhchandani, S., Hirshleifer, D., & Welch, I. (1992). A theory of fads, fashion, custom, and cultural change as informational cascades. Journal of Political Economy, 100(5), 992–1026. [Google Scholar] [CrossRef]

- Black, F., & Scholes, M. (1973). The pricing of options and corporate liabilities. Journal of Political Economy, 81(3), 637–654. [Google Scholar] [CrossRef]

- Bollerslev, T. (1986). Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics, 31(3), 307–327. [Google Scholar] [CrossRef]

- Breiman, L. (2001). Random forests. Machine Learning, 45(1), 5–32. [Google Scholar] [CrossRef]

- Casablanca Stock Exchange. (2023). MASI ESG index factsheet. Available online: https://www.casablanca-bourse.com (accessed on 31 January 2025).

- Casablanca Stock Exchange. (2024). Daily returns data for MASI and MASI ESG indices. Available online: https://www.casablanca-bourse.com/fr/composition-et-historique-des-indices (accessed on 31 January 2025).

- Cheng, B., Ioannou, I., & Serafeim, G. (2014). Corporate social responsibility and access to finance. Strategic Management Journal, 35(1), 1–23. Available online: http://www.jstor.org/stable/24037207 (accessed on 31 January 2025). [CrossRef]

- Dickey, D. A., & Fuller, W. A. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association, 74(366), 427–431. [Google Scholar] [CrossRef]

- Diebold, F. X., Gunther, T. A., & Tay, A. S. (1998). Evaluating density forecasts with applications to financial risk management. International Economic Review, 39(4), 863–883. [Google Scholar] [CrossRef]

- Eccles, R. G., Ioannou, I., & Serafeim, G. (2014). The impact of corporate sustainability on organizational processes and performance. Management Science, 60(11), 2835–2857. Available online: http://www.jstor.org/stable/24550546 (accessed on 31 January 2025). [CrossRef]

- Engle, R. F. (1982). Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica, 50(4), 987–1007. [Google Scholar] [CrossRef]

- Engle, R. F., & Manganelli, S. (2004). CAViaR: Conditional autoregressive value at risk by regression quantiles. Journal of Business & Economic Statistics, 22(4), 367–381. [Google Scholar] [CrossRef]

- Fama, E. F. (1970). Efficient capital markets: A review of theory and empirical work. The Journal of Finance, 25(2), 383–417. [Google Scholar] [CrossRef]

- Fama, E. F., & French, K. R. (1992). The cross-section of expected stock returns. The Journal of Finance, 47(2), 427–465. [Google Scholar] [CrossRef]

- Fatemi, A., Glaum, M., & Kaiser, S. (2018). ESG performance and firm value: The moderating role of disclosure. Global Finance Journal, 38, 45–64. [Google Scholar] [CrossRef]

- Friede, G., Busch, T., & Bassen, A. (2015). ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance & Investment, 5(4), 210–233. [Google Scholar] [CrossRef]

- Glosten, L. R., Jagannathan, R., & Runkle, D. E. (1993). On the relation between the expected value and the volatility of the nominal excess return on stocks. The Journal of Finance, 48(5), 1779–1801. [Google Scholar] [CrossRef]

- Hamilton, J. D. (1989). A new Approach to the economic analysis of nonstationary time series and the business cycle. Econometrica, 57(2), 357–384. [Google Scholar] [CrossRef]

- Hansen, P. R., & Lunde, A. (2005). A forecast comparison of volatility models: Does anything beat a GARCH(1,1)? Journal of Applied Econometrics, 20(7), 873–889. [Google Scholar] [CrossRef]

- He, K., Zhang, X., Ren, S., & Sun, J. (2016, June 26–July 1). Deep residual learning for image recognition. 2016 IEEE Conference on Computer Vision and Pattern Recognition (CVPR) (pp. 770–778), Las Vegas, NV, USA. [Google Scholar] [CrossRef]

- Hinton, G. E., & Salakhutdinov, R. R. (2006). Reducing the dimensionality of data with neural networks. Science, 313(5786), 504–507. [Google Scholar] [CrossRef]

- Hochreiter, S., & Schmidhuber, J. (1997). Long short-term memory. Neural Computation, 9(8), 1735–1780. [Google Scholar] [CrossRef]

- Hosking, J. R. M. (1981). Fractional differencing. Biometrika, 68(1), 165–176. [Google Scholar] [CrossRef]

- Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263–291. [Google Scholar] [CrossRef]

- Khan, M., Serafeim, G., & Yoon, A. (2016). Corporate sustainability: First evidence on materiality. The Accounting Review, 91(6), 1697–1724. [Google Scholar] [CrossRef]

- Kwiatkowski, D., Phillips, P. C. B., Schmidt, P., & Shin, Y. (1992). Testing the null hypothesis of stationarity against the alternative of a unit root. Journal of Econometrics, 54(1–3), 159–178. [Google Scholar] [CrossRef]

- LeCun, Y., Bengio, Y., & Hinton, G. (2015). Deep learning. Nature, 521(7553), 436–444. [Google Scholar] [CrossRef]

- Merton, R. C. (1973). Theory of rational option pricing. The Bell Journal of Economics and Management Science, 4(1), 141–183. [Google Scholar] [CrossRef]

- Migliorelli, M., & Dessertine, P. (2020). The rise of ESG investing: Implications for asset management. Journal of Risk and Financial Management, 13(6), 114. [Google Scholar] [CrossRef]

- Nelson, D. B. (1991). Conditional heteroskedasticity in asset returns: A new approach. Econometrica, 59(2), 347–370. [Google Scholar] [CrossRef]

- Omura, T., Roca, E., & Nakai, M. (2020). Does responsible investing pay during economic downturns? Evidence from the COVID-19 pandemic. Finance Research Letters, 37, 101914. [Google Scholar] [CrossRef] [PubMed]

- Phillips, P. C. B., & Perron, P. (1988). Testing for a unit root in time series regression. Biometrika, 75(2), 335–346. [Google Scholar] [CrossRef]

- Poon, S.-H., & Granger, C. W. J. (2003). Forecasting volatility in financial markets: A review. Journal of Economic Literature, 41(2), 478–539. [Google Scholar] [CrossRef]

- Roll, R. (1977). A critique of the asset pricing theory’s tests Part I: On past and potential testability of the theory. Journal of Financial Economics, 4(2), 129–176. [Google Scholar] [CrossRef]

- Sharpe, W. F. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance, 19(3), 425–442. [Google Scholar] [CrossRef]

- Shiller, R. J. (2000). Measuring bubble expectations and investor confidence. Journal of Psychology and Financial Markets, 1(1), 49–60. [Google Scholar] [CrossRef]

- Tirole, J. (2017). Economics for the common good. Princeton University Press. [Google Scholar] [CrossRef]

- Yule, G. U. (1927). On a method of investigating periodicities in disturbed series, with special reference to Wolfer’s sunspot numbers. Philosophical Transactions of the Royal Society A: Mathematical, Physical and Engineering Sciences, 226(636–646), 267–298. [Google Scholar] [CrossRef]

- Zivot, E., & Andrews, D. W. K. (1992). Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. Journal of Business & Economic Statistics, 10(3), 251–270. [Google Scholar] [CrossRef]

| Variable | ADF Test | KPSS Test | Phillips–Perron Test | Zivot–Andrews Test | Order of Integration |

|---|---|---|---|---|---|

| MASI | ADF: −9.5345 p-value: 2.83 × 10−16 | KPSS: 0.1582 p-value: 0.0152 | PP: −9.8457 p-value: 1.56 × 10−16 | ZA: −10.2235 p-value: 1.08 × 10−15 | I(1) |

| Variable | ADF Test | KPSS Test | Phillips–Perron Test | Zivot–Andrews Test | Order of Integration |

|---|---|---|---|---|---|

| MASI ESG | ADF: −8.55 p-value: 0.1143 | KPSS: 0.1181 p-value: 0.1862 | PP: −8.5422 p-value: 0.1326 | ZA: −8.8210 p-value: 0.1598 | I(1) |

| ADF: −13.6389 p-value: 1.67 × 10−25 | KPSS: 0.0653 p-value: 0.1862 | PP: −13.5374 p-value: 0.0214 | ZA: −13.6458 p-value: 0.0002 | I(2) |

| Model | (p,d,q) | Coefficients | Std. Error | t-Stat | p-Value | AIC |

|---|---|---|---|---|---|---|

| ARIMA | (1,1,1) | AR(1) = 0.45 | 0.12 | 3.75 | 0.0002 | −1125 |

| MA(1) = −0.38 | 0.10 | −3.80 | 0.0001 |

| Model | (p,d,q) | Coefficients | Std. Error | t-Stat | p-Value | AIC |

|---|---|---|---|---|---|---|

| ARIMA | (1,2,1) | AR(1) = 0.52 | 0.14 | 3.71 | 0.0003 | −980 |

| MA(1) = −0.47 | 0.13 | −3.62 | 0.0004 |

| Model | (p,d,q)(P,D,Q)m | Coefficients | Std. Error | t-Stat | p-Value | AIC |

|---|---|---|---|---|---|---|

| SARIMA | (1,2,1)(0,1,1)[12] | AR(1) = 0.49 | 0.11 | 4.45 | 0.00001 | −1038 |

| MA(1) = −0.41 | 0.09 | −4.55 | 0.00000 | |||

| SMA(1) = −0.36 | 0.08 | −4.50 | 0.00000 |

| Coefficient | Estimated Value | Std. Error | z-Stat | p-Value |

|---|---|---|---|---|

| omega (ω) | 0.000015 | 0.000006 | 2.50 | 0.012 |

| alpha (α1) | 0.35 | 0.08 | 4.38 | 0.00001 |

| Coefficient | Estimated Value | Std. Error | z-Stat | p-Value |

|---|---|---|---|---|

| omega (ω) | 0.00002 | 0.000007 | 2.86 | 0.004 |

| alpha (α1) | 0.40 | 0.09 | 4.44 | 0.00001 |

| Coefficient | Estimated Value | Std. Error | z-Stat | p-Value |

|---|---|---|---|---|

| omega (ω) | 0.00001 | 0.000005 | 2.00 | 0.045 |

| alpha (α1) | 0.12 | 0.03 | 4.00 | 0.00006 |

| beta (β1) | 0.85 | 0.04 | 21.25 | 0.00000 |

| Coefficient | Estimated Value | Std. Error | z-Stat | p-Value |

|---|---|---|---|---|

| omega (ω) | 0.000011 | 0.000005 | 2.20 | 0.027 |

| alpha (α1) | 0.11 | 0.03 | 3.67 | 0.0002 |

| beta (β1) | 0.87 | 0.04 | 21.75 | 0.0000 |

| Coefficient | Estimated Value | Std. Error | z-Stat | p-Value |

|---|---|---|---|---|

| omega (ω) | −0.21 | 0.07 | −3.00 | 0.0027 |

| alpha (α1) | 0.12 | 0.03 | 0.12 | 4.00 |

| gamma (γ) | −0.18 | 0.04 | −4.50 | 0.0000 |

| beta (β) | 0.93 | 0.02 | 46.50 | 0.0000 |

| Coefficient | Estimated Value | Std. Error | z-Stat | p-Value |

|---|---|---|---|---|

| omega (ω) | −0.10 | 0.04 | −2.5 | 0.012 |

| alpha (α1) | 0.22 | 0.05 | 4.4 | 0.00001 |

| beta (β1) | 0.88 | 0.02 | 44.0 | 0.00000 |

| gamma (γ1) | −0.14 | 0.03 | −4.7 | 0.00000 |

| Coefficient | Estimated Value | Std. Error | z-Stat | p-Value |

|---|---|---|---|---|

| omega (ω) | 0.00002 | 0.000007 | 2.86 | 0.004 |

| alpha (α1) | 0.10 | 0.02 | 5.00 | 0.000 |

| beta (β1) | 0.84 | 0.03 | 28.00 | 0.000 |

| gamma (γ1) | 0.18 | 0.05 | 3.60 | 0.0003 |

| Coefficient | Estimated Value | Std. Error | z-Stat | p-Value |

|---|---|---|---|---|

| omega (ω) | 0.000009 | 0.000004 | 2.25 | 0.024 |

| alpha (α1) | 0.08 | 0.03 | 2.67 | 0.0075 |

| gamma (γ) | 0.10 | 0.04 | 2.50 | 0.012 |

| beta (β1) | 0.88 | 0.03 | 29.33 | 0.0000 |

| Models | RMSE | MAE | MAPE (%) | R2 |

|---|---|---|---|---|

| ARIMA MASI | 150.50 | 120.30 | 8.50 | 0.85 |

| ARIMA MASI ESG | 160.20 | 125.10 | 9.20 | 0.84 |

| SARIMA MASI ESG | 165.40 | 130.50 | 9.80 | 0.83 |

| Models | RMSE | MAE | MAPE (%) | R2 |

|---|---|---|---|---|

| ARCH MASI | 2.15 | 1.80 | 1.90 | 0.98 |

| ARCH MASI ESG | 6.25 | 4.80 | 3.60 | 0.91 |

| GARCH MASI | 6.90 | 5.10 | 4.20 | 0.87 |

| GARCH MASI ESG | 6.45 | 4.90 | 3.80 | 0.89 |

| EGARCH MASI | 4.60 | 3.80 | 2.90 | 0.91 |

| EGARCH MASI ESG | 4.30 | 3.50 | 2.60 | 0.92 |

| GJR-GARCH MASI | 4.90 | 4.00 | 3.10 | 0.89 |

| GJR-GARCH MASI ESG | 5.30 | 4.30 | 3.40 | 0.88 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hamou, O.; Oudgou, M.; Boudhar, A. Analysis of the Effectiveness of Classical Models in Forecasting Volatility and Market Dynamics: Insights from the MASI and MASI ESG Indices in Morocco. J. Risk Financial Manag. 2025, 18, 370. https://doi.org/10.3390/jrfm18070370

Hamou O, Oudgou M, Boudhar A. Analysis of the Effectiveness of Classical Models in Forecasting Volatility and Market Dynamics: Insights from the MASI and MASI ESG Indices in Morocco. Journal of Risk and Financial Management. 2025; 18(7):370. https://doi.org/10.3390/jrfm18070370

Chicago/Turabian StyleHamou, Oumaima, Mohamed Oudgou, and Abdeslam Boudhar. 2025. "Analysis of the Effectiveness of Classical Models in Forecasting Volatility and Market Dynamics: Insights from the MASI and MASI ESG Indices in Morocco" Journal of Risk and Financial Management 18, no. 7: 370. https://doi.org/10.3390/jrfm18070370

APA StyleHamou, O., Oudgou, M., & Boudhar, A. (2025). Analysis of the Effectiveness of Classical Models in Forecasting Volatility and Market Dynamics: Insights from the MASI and MASI ESG Indices in Morocco. Journal of Risk and Financial Management, 18(7), 370. https://doi.org/10.3390/jrfm18070370