AI as a Decision Companion: Supporting Executive Pricing and FX Decisions in Global Enterprises Through LSTM Forecasting

Abstract

1. Introduction

1.1. Background

1.2. Literature Review

1.2.1. AI and Executive Decision-Making

1.2.2. Volatile Environments and Global Strategy

1.2.3. AI Under Global Uncertainty: A Research Gap

1.3. Research Hypotheses

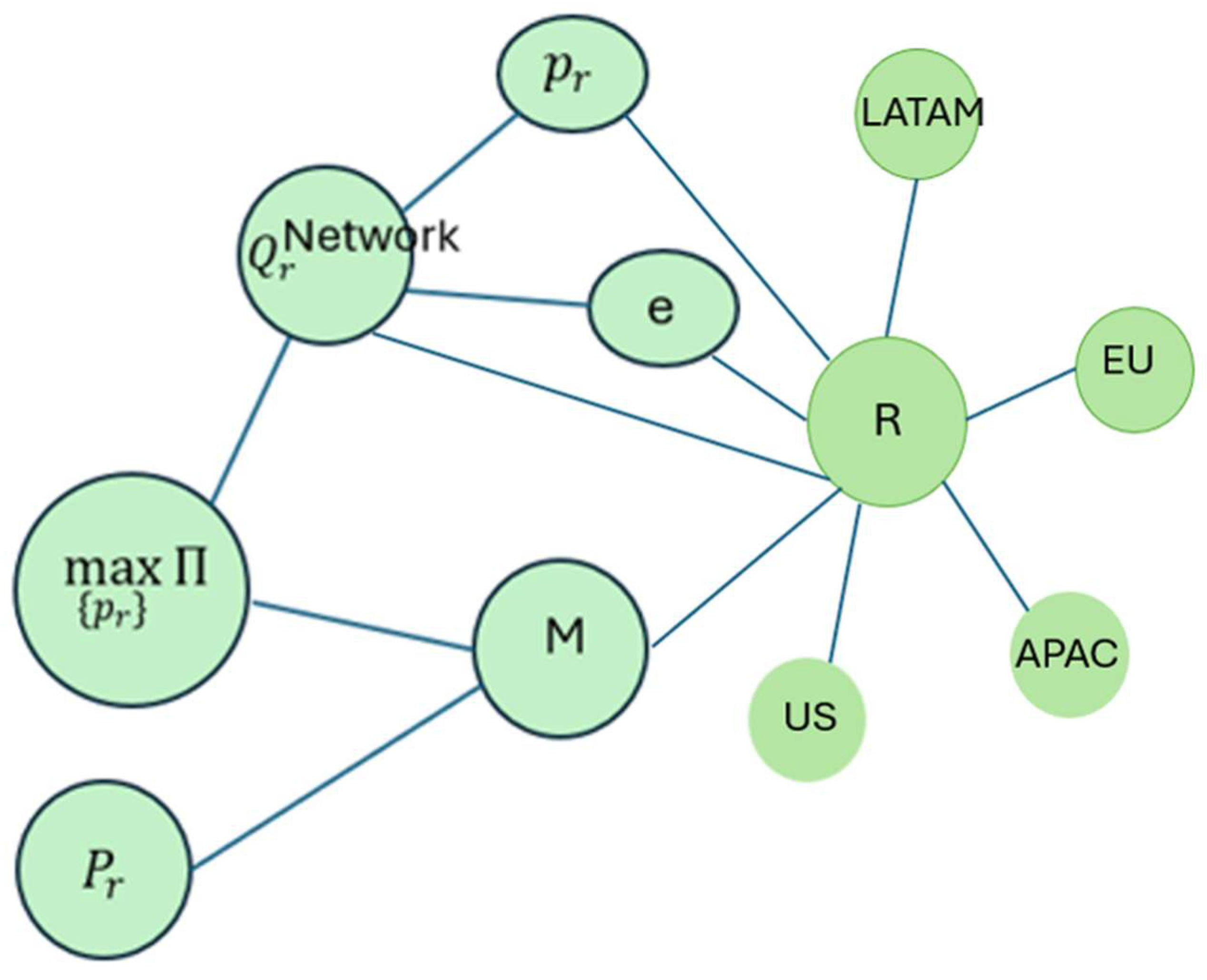

1.4. Theoretical Framework

- pr = local price multiplier in region r,

- Qr(pr, e) = quantity demanded in region r, dependent on both the price decision and the FX shock e,

- Pr = baseline price in USD for region r,

- M = profit margin, and

- R = set of geographic regions (US, EU, LATAM, APAC).

2. Materials and Methods

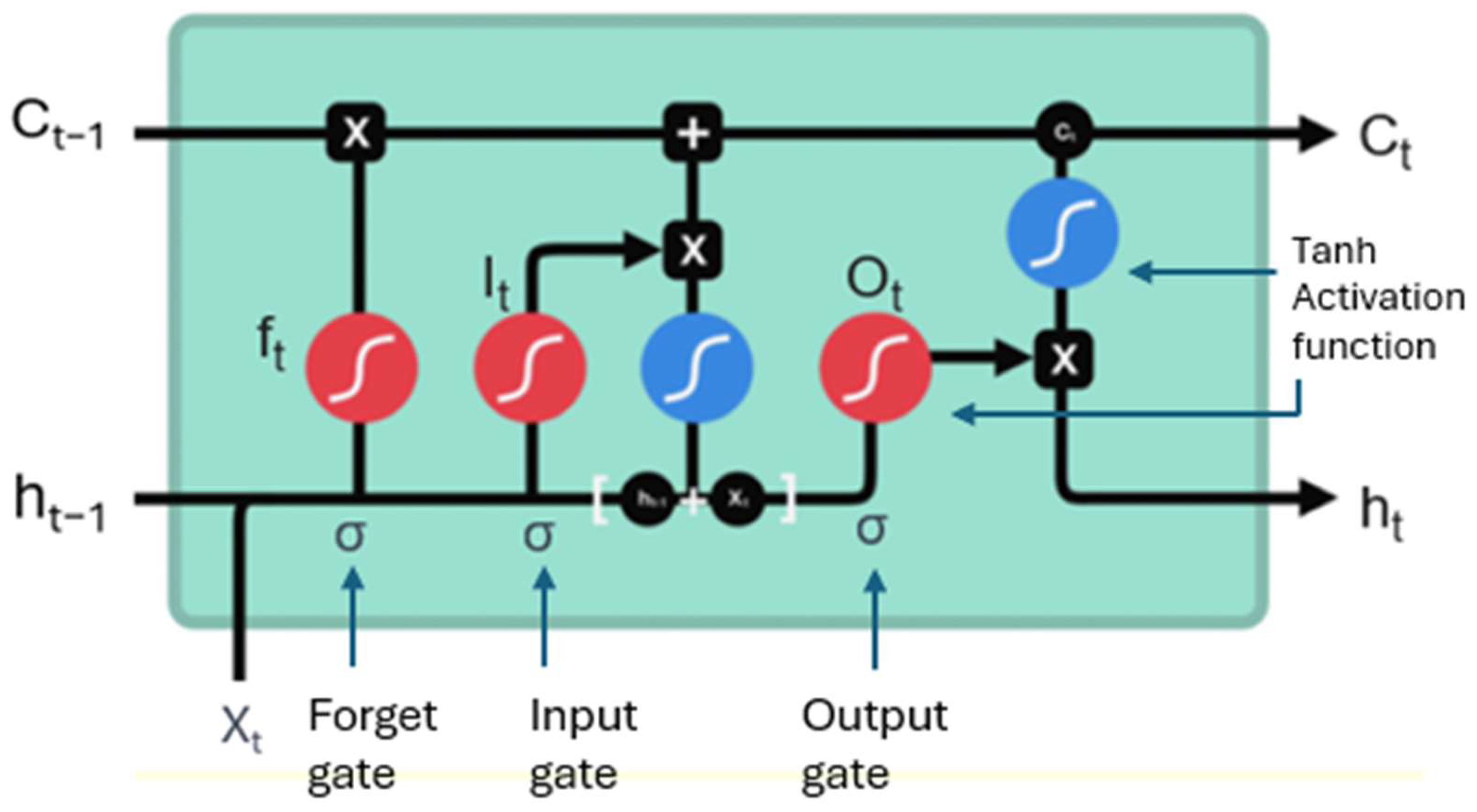

2.1. AI Model: LSTM Forecasting

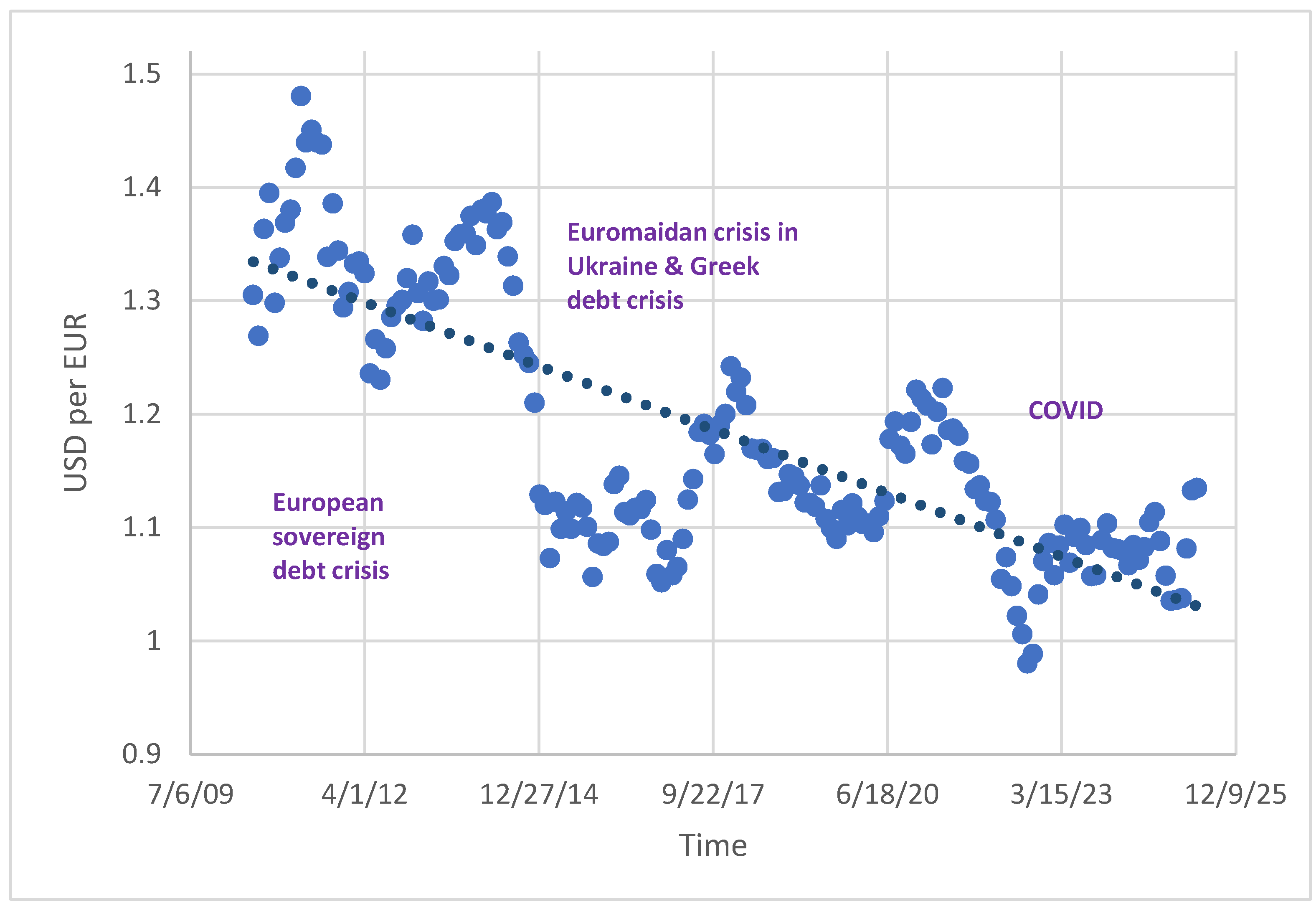

2.1.1. Data and Features

2.1.2. Expanded Data and Features

2.2. Scenario Design

- Baseline scenario. This scenario assumes continuity of existing dynamics, with no exogenous shocks or managerial interventions. It provides a benchmark forecast trajectory.

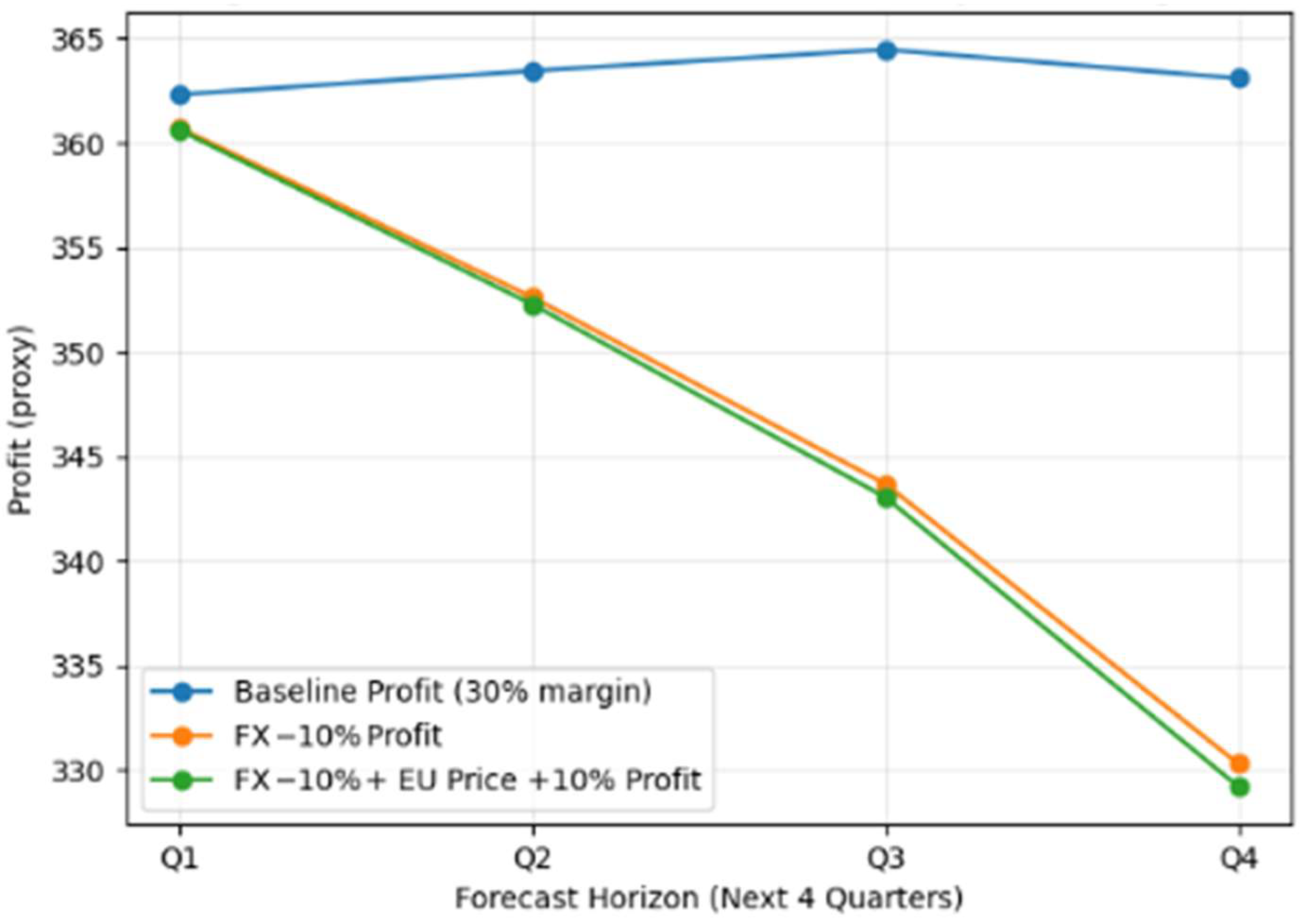

- FX-only shock. In this scenario, the EUR is assumed to depreciate by 10 percent relative to the U.S. dollar. This intervention tests the sensitivity of consolidated bookings to adverse foreign exchange movements, among the most common macroeconomic shocks encountered by multinational firms (Campa & Goldberg, 2005).

- Combined FX + pricing shock. This scenario introduces a strategic response by management to the same 10 percent euro depreciation. Here, the management teams are assumed to increase European prices by 10 percent. The purpose is to evaluate whether managerial action can offset the financial impact of FX depreciation, balancing the trade-off between protecting dollar-denominated profits and sustaining local demand.

3. Results

3.1. Model Performance

3.2. Baseline Forecast

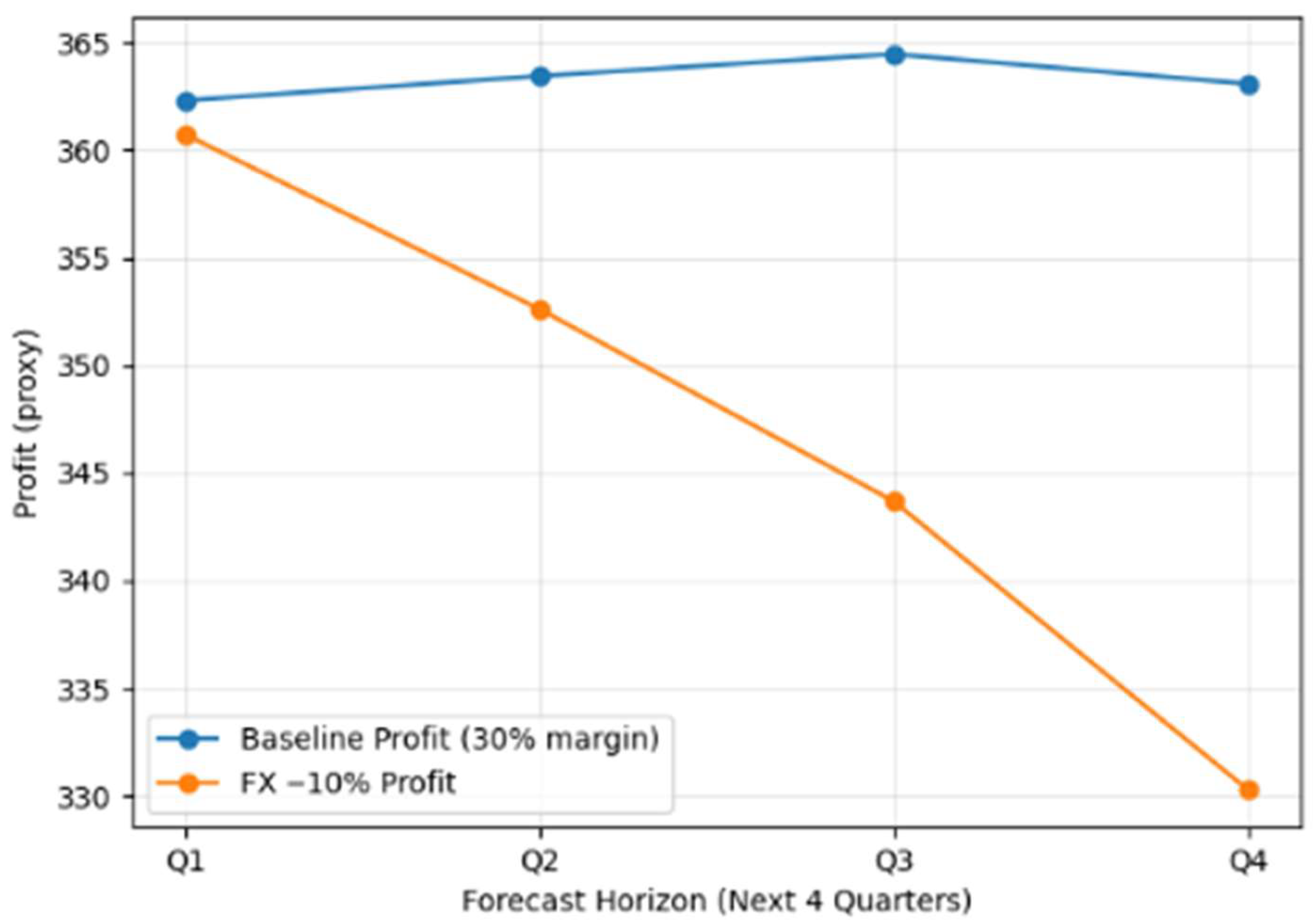

3.3. Scenario 1: FX-Only Shock

3.4. Scenario 2: Combined FX + Pricing Shock

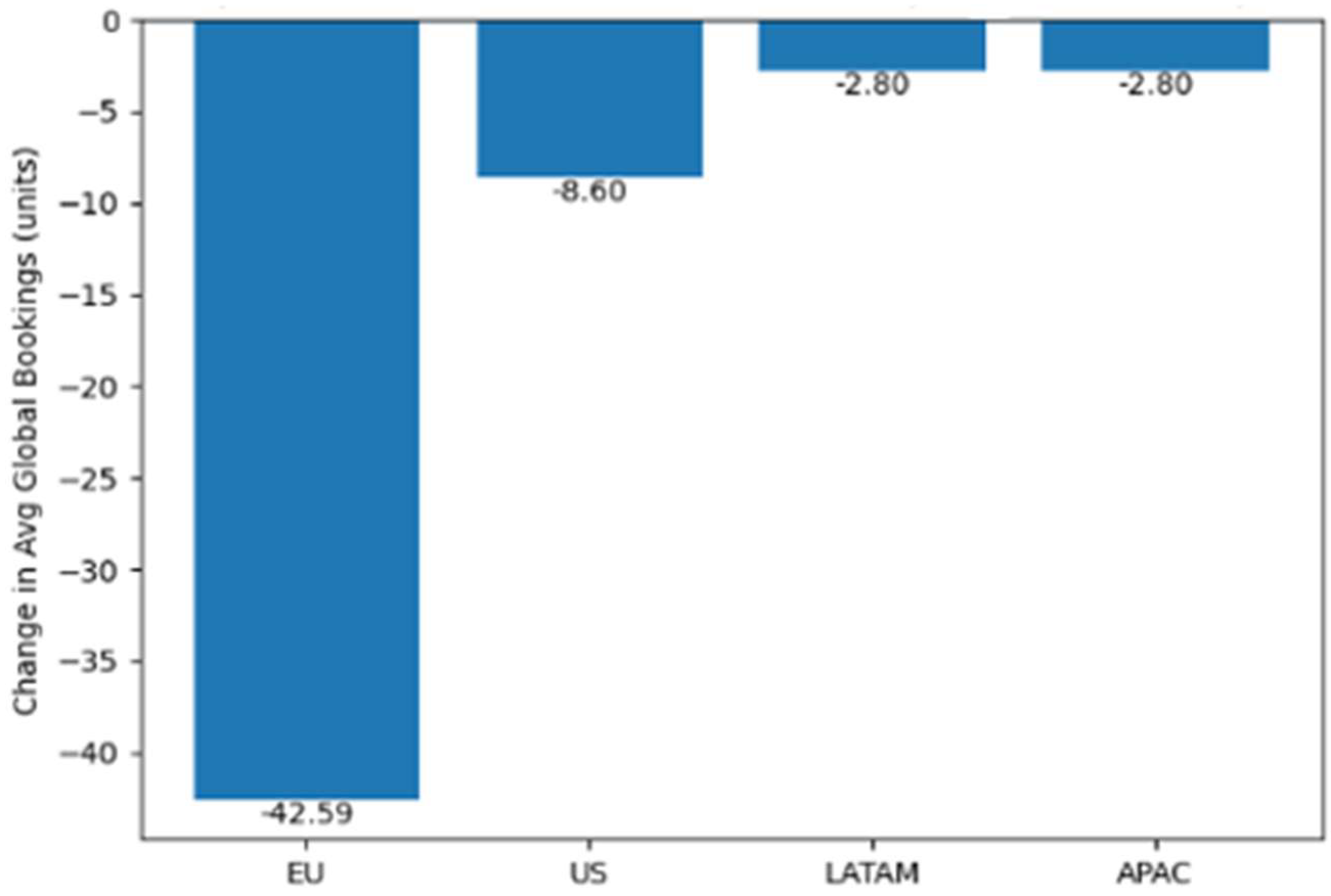

3.5. Regional Attribution of Global Losses

- Europe (EU) contributes −42.6 units (≈74%),

- United States (US) contributes −8.6 units (≈15%),

- LATAM contributes −2.8 units (≈5%),

- APAC contributes −2.8 units (≈5%).

3.6. Summary of Empirical Findings

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| ABM | Agent-Based Modeling |

| ABPDAU | Average Bookings per Daily Active User |

| AI | Artificial Intelligence |

| APAC | Asia-Pacific |

| CEO | Chief Executive Officer |

| DAU | Daily Active Users |

| EU | European Union (Europe region in model) |

| FX | Foreign Exchange |

| JRFM | Journal of Risk and Financial Management |

| LATAM | Latin America |

| LSTM | Long Short-Term Memory (neural network) |

| MAE | Mean Absolute Error |

| SEC | U.S. Securities and Exchange Commission |

| US | United States |

| VUCA | Volatility, Uncertainty, Complexity, and Ambiguity |

Appendix A

References

- Ahmad, A., Sayal, A., Johri, M., Wasiq, A., Ahmed, F., & Ali, F. (2024, October 4–6). AI in managing foreign exchange risks in cash management. 2024 5th IEEE Global Conference for Advancement in Technology (GCAT) (pp. 1–6), Bangalore, India. [Google Scholar] [CrossRef]

- Bouchetara, M., Zerouti, M., & Zouambi, A. R. (2024). Leveraging artificial intelligence (AI) in public sector financial risk management: Innovations, challenges, and future directions. EDPACS, 69(9), 124–144. [Google Scholar] [CrossRef]

- Campa, J. M., & Goldberg, L. S. (2005). Exchange rate pass-through into import prices. Review of Economics and Statistics, 87(4), 679–690. [Google Scholar] [CrossRef]

- Choudhary, J., Sharma, H. K., Malik, P., & Majumder, S. (2025). Price forecasting of crude oil using hybrid machine learning models. Journal of Risk and Financial Management, 18(7), 346. [Google Scholar] [CrossRef]

- Chui, M., Manyika, J., & Miremadi, M. (2018). What AI can and can’t do (yet) for your business. McKinsey Quarterly, 1, 97–108. Available online: https://www.mckinsey.com (accessed on 15 March 2025).

- Davenport, T. H., & Miller, S. (2022). Working with AI: Real stories of human–machine collaboration. MIT Sloan Management Review Press. [Google Scholar]

- Federal Reserve Bank of St. Louis. (2025). FRED, federal reserve economic data. Available online: https://fred.stlouisfed.org (accessed on 15 March 2025).

- Gopinath, G., Itskhoki, O., & Rigobon, R. (2010). Currency choice and exchange rate pass-through. American Economic Review, 100(1), 304–336. [Google Scholar] [CrossRef]

- Hochreiter, S., & Schmidhuber, J. (1997). Long short-term memory. Neural Computation, 9(8), 1735–1780. [Google Scholar] [CrossRef] [PubMed]

- Kogut, B. (1985). Designing global strategies: Comparative and competitive value-added chains. Sloan Management Review, 26(4), 15–28. [Google Scholar]

- Kong, W. (2025). Evaluating corporate currency risk management practices: A case study of multinational companies and their hedging strategies. In Proceedings of the 2025 5th international conference on enterprise management and economic development (ICEMED 2025) (pp. 58–67). Atlantis Press. [Google Scholar]

- Lee, E., & Leeroy, W. (2024). How AI tools can help diagnose market dynamics and curb market power abuse as the nation’s power supply transitions to renewable resources. Energy LJ, 45, 25. [Google Scholar]

- Makridakis, S., Spiliotis, E., & Assimakopoulos, V. (2020). The M4 competition: 100,000 time series and 61 forecasting methods. International Journal of Forecasting, 36(1), 54–74. [Google Scholar] [CrossRef]

- McAfee, A., & Brynjolfsson, E. (2017). Machine, platform, crowd: Harnessing our digital future. W.W. Norton & Company. [Google Scholar]

- Menzies, J., Sabert, B., Hassan, R., & Mensah, P. K. (2024). Artificial intelligence for international business: Its use, challenges, and suggestions for future research and practice. Thunderbird International Business Review, 66(2), 185–200. [Google Scholar] [CrossRef]

- Miller, K. D. (1992). A framework for integrated risk management in international business. Journal of International Business Studies, 23(2), 311–331. [Google Scholar] [CrossRef]

- Roblox Corporation. (2025). Investor relations. Available online: https://ir.roblox.com (accessed on 15 March 2025).

- Shrestha, Y. R., Ben-Menahem, S. M., & von Krogh, G. (2019). Organizational decision-making structures in the age of artificial intelligence. California Management Review, 61(4), 66–83. [Google Scholar] [CrossRef]

- Simon, H. A. (1997). Administrative behavior: A study of decision-making processes in administrative organizations (4th ed.). Free Press. [Google Scholar]

- Tesfatsion, L. (2006). Agent-based computational economics: A constructive approach to economic theory. In L. Tesfatsion, & K. L. Judd (Eds.), Handbook of computational economics (Vol. 2, pp. 831–880). Elsevier. [Google Scholar] [CrossRef]

- U.S. Securities and Exchange Commission. (2025). EDGAR database. Available online: https://www.sec.gov/edgar.shtml (accessed on 15 March 2025).

- Vestergaard, C. L., Génois, M., & Barrat, A. (2014). How memory generates heterogeneous dynamics in temporal networks. Physical Review E, 90, 042805. [Google Scholar] [CrossRef] [PubMed]

- Vyas, A. (2025, April 21). Revolutionizing risk: The role of artificial intelligence in financial risk management, forecasting, and global implementation [Working paper]. SSRN. [Google Scholar] [CrossRef]

| a. LSTM model architecture | ||

| Parameter | Value | |

| Dimension of Input Layer | 6 (lookback = 6 quarters) × 16 features | |

| Dimension of Output Layer | 1 (one-step-ahead prediction, recursive for 4 quarters) | |

| Hidden Dimension for LSTM | 64 units | |

| Dense Hidden Layer | 32 units, ReLU activation | |

| Final Output Layer | 1 unit (scalar bookings forecast) | |

| Activation Function (LSTM) | Tanh (with sigmoid gates internally) | |

| Loss Function | MAE (Mean Absolute Error) | |

| Optimizer | Adam (adaptive learning rates) | |

| Learning Rate | Default (0.001 in TensorFlow/Keras) | |

| b. LSTM Parameter Calculation Summary | ||

| Layer (Type) | Output Shape | Trainable Params |

| LSTM (64 units) | (None, 64) | 20,736 |

| Dense (32 units) | (None, 32) | 2080 |

| Dense (1 unit) | (None, 1) | 33 |

| Non-trainable | – | 0 |

| a. Input Features | |||

| Feature | Description | Source | Notes/Interpretation |

| Bookings | Quarterly gross bookings (Robux) | Roblox SEC filings (10-Q, 10-K) * | Firm-specific dependent variable |

| DAU | Daily active users | Roblox Investor Relations | Proxy for platform engagement |

| Engagement Hours | Total user hours spent | Roblox IR reports ** | Measures intensity of usage |

| ABPDAU | Avg. bookings per DAU | Roblox IR reports | Revenue per user metric |

| USD/EUR | USD to Euro exchange rate | FRED *** | FX driver |

| USD/GBP | USD to Pound exchange rate | FRED | FX driver |

| USD/BRL | USD to Real exchange rate | FRED | FX driver |

| USD Index | Broad trade-weighted USD | FRED | Macro control |

| EU Revenue Share | % revenue from Europe | Roblox IR reports | Regional exposure |

| US Revenue Share | % revenue from U.S. | Roblox IR reports | Regional exposure |

| LATAM Revenue Share | % revenue from LATAM | Roblox IR reports | Regional exposure |

| APAC Revenue Share | % revenue from APAC | Roblox IR reports | Regional exposure |

| Viral Event Flag | Binary shock (1 = major viral growth) | Constructed | Calibrated via historical user spikes |

| Policy Shock Flag | Binary shock (1 = regulatory/policy change) | Constructed | Calibrated to events (e.g., EU tax) |

| Regional Price Multiplier | Adjustment factor (baseline = 1.0) | Scenario design | Simulates ±% price changes |

| Engagement Growth Rate | % change in engagement hours QoQ | Roblox IR reports | Control for platform dynamics |

| b. Model Performance | |||

| Metric | Value | Interpretation | |

| Training samples | 50 | Number of sequences used to train the model. | |

| Validation samples | 8 | Number of sequences reserved for testing model accuracy | |

| Validation loss (MAE) | 0.393 | A low error indicates that forecasts are close to the actual bookings | |

| Scenario | Avg. Bookings | Δ vs. Baseline | Avg. Profit ($M) | Δ vs. Baseline ($M, %) |

|---|---|---|---|---|

| Baseline | 1127 | - | 338 | - |

| FX-only shock (EUR −10%) | 1056 | 70.5 | 317 | −21.1 (−6.2%) |

| FX + EU Price Increase (+10%) | 1057 | 70.0 | 317 | −21.0 (−6.2%) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Leeroy, W.; Leeroy, G.C. AI as a Decision Companion: Supporting Executive Pricing and FX Decisions in Global Enterprises Through LSTM Forecasting. J. Risk Financial Manag. 2025, 18, 542. https://doi.org/10.3390/jrfm18100542

Leeroy W, Leeroy GC. AI as a Decision Companion: Supporting Executive Pricing and FX Decisions in Global Enterprises Through LSTM Forecasting. Journal of Risk and Financial Management. 2025; 18(10):542. https://doi.org/10.3390/jrfm18100542

Chicago/Turabian StyleLeeroy, Wesley, and Gordon C. Leeroy. 2025. "AI as a Decision Companion: Supporting Executive Pricing and FX Decisions in Global Enterprises Through LSTM Forecasting" Journal of Risk and Financial Management 18, no. 10: 542. https://doi.org/10.3390/jrfm18100542

APA StyleLeeroy, W., & Leeroy, G. C. (2025). AI as a Decision Companion: Supporting Executive Pricing and FX Decisions in Global Enterprises Through LSTM Forecasting. Journal of Risk and Financial Management, 18(10), 542. https://doi.org/10.3390/jrfm18100542