1. Introduction

The appointment of women to corporate boards has become a significant governance trend globally, driven by both regulatory initiatives and growing recognition of the potential benefits of gender diversity (

Adams & Ferreira, 2009;

Terjesen et al., 2009;

Seierstad & Huse, 2017). While this trend has been extensively studied in developed markets, less attention has been paid to emerging economies with distinct institutional and cultural characteristics. Saudi Arabia presents an interesting case, as recent governance reforms under Vision 2030 have encouraged greater female representation in leadership positions, marking a significant departure from historical norms in a traditionally conservative business environment where men have predominantly occupied leadership roles.

Figure 1 shows that only 4.9% of total director seats were held by women in 2024 (sourced from MSCI, Women on Board, Progress Report). The increasing inclusion of women is not only a marker of progress in gender equality but also a signal of broader economic and institutional reforms aimed at diversifying the economy and enhancing corporate accountability. Nevertheless, despite this modest absolute representation, appointments have grown at a 47% compound annual rate since 2019, among the world’s fastest accelerations in board gender diversity, reflecting a transformative pace.

Moreover, Saudi Arabia’s evolving regulatory environment, characterized by reform initiatives in corporate governance and transparency, heightens the importance of understanding market sentiments. Investors’ perceptions of female board appointments can offer valuable insights into how these reforms are interpreted in financial terms—implications that resonate with global and local stakeholders. Analyzing market reactions provides a unique lens to gauge the effectiveness of gender diversity policies and their impact on firm value.

How do investors respond to female board appointments in such contexts? Traditional finance theory suggests that if gender diversity enhances board effectiveness and firm performance, markets should react positively to such appointments (

Fama, 1970;

Carter et al., 2003). However, behavioral perspectives acknowledge that investor reactions may be influenced by prevailing social norms and cognitive biases (

Kahneman & Tversky, 2013;

Eagly & Karau, 2002). The empirical evidence remains mixed, with studies documenting positive, negative, or neutral market reactions depending on the institutional context (

Post & Byron, 2015;

Ahern & Dittmar, 2012;

Gregory et al., 2013).

This study contributes to the literature by examining market reactions to female board appointments in Saudi Arabian firms using an innovative methodological approach. Building on conventional event study methods, we utilize

Jordà’s (

2005) Local Projection (LP) framework, which offers several advantages for analyzing market responses in complex institutional environments. This approach allows us to trace the dynamic effects of female board appointments on stock returns over multiple horizons without imposing restrictive assumptions about the pattern of market adjustment. Additionally, we complement the analysis by employing Quantile-on-Quantile analysis to investigate how market conditions interact with the phases surrounding women’s appointments on board.

These findings contribute to several strands of the literature. First, we extend research on board diversity by providing evidence from an institutional context that differs markedly from the developed markets that dominate existing studies (

Adams et al., 2015;

Kirsch, 2018). Second, we contribute to the literature on market efficiency by documenting a gradual rather than instantaneous price response to corporate governance events, consistent with models of limited attention and information processing constraints (

Hirshleifer & Teoh, 2003;

Cohen & Frazzini, 2008). Third, we advance the methodological toolkit for corporate governance research by demonstrating the utility of the LP approach for capturing dynamic market responses to board composition changes.

The remainder of this paper is organized as follows:

Section 2 reviews the relevant literature.

Section 3 assesses the relevance of the Saudi Arabian context.

Section 4 describes our primary empirical methodology and presents the findings.

Section 5 details the results derived from the Local Projections method.

Section 6 offers a verification of the quantile regression analysis.

Section 7 summarizes and discusses our findings, while

Section 8 concludes this study.

2. Market Reactions to Women’s Board Appointments: A Theoretical and Empirical Literature Review

This literature review investigates the theoretical foundations and empirical evidence concerning market reactions to women’s board appointments, focusing particularly on Saudi Arabia’s unique context.

2.1. Theoretical Frameworks on Board Gender Diversity

The appointment of women to corporate boards has gained significant prominence, driven by global gender diversity initiatives and intensified scrutiny of corporate governance practices, as well as financial scandals and corporate failures in recent decades that have reignited debates about the effectiveness, composition, and role of the board of directors in value creation (

Ben-Amar et al., 2017). Enhancing board composition, particularly through diversity, has emerged as a key focus within these discussions.

While diversity includes both demographic attributes (such as gender, age, and ethnicity) and cognitive differences (like experience, knowledge, and perspectives), gender diversity on boards has received particular attention. Proponents argue that gender diversity can foster new managerial balances crucial for value creation and serve as a source of competitiveness (

Carter et al., 2010;

Gulamhussen & Santos, 2010;

Campbell & Mínguez-Vera, 2008).

Consequently, understanding how the financial market, acting as a governance mechanism and objective arbiter, reacts to the appointment of women to boards offers valuable insights. The direction of this market reaction can shed light on investors’ perceptions of whether gender diversity enhances governance and contributes to value creation.

Several theoretical perspectives offer insights into how gender diversity on corporate boards affects firm outcomes and, consequently, how markets react to female board appointments.

Agency theory, which addresses the principal–agent problem between shareholders and managers, suggests that board diversity may enhance monitoring capabilities (

Jensen & Meckling, 1976). As some scholars argue, women directors may bring independent perspectives and stronger monitoring orientations, potentially reducing agency costs and enhancing shareholder value (

Adams & Ferreira, 2009). This perspective would predict positive market reactions to female board appointments, particularly in contexts with weak governance mechanisms.

The resource dependence theory conceptualizes boards as boundary spanners that connect firms to critical external resources (

Westphal & Zajac, 1997;

Pfeffer & Salancik, 2015). Female directors may provide access to unique networks, perspectives, and legitimacy, especially in markets where women constitute significant consumer segments or stakeholder groups (

Hillman et al., 2007). This theoretical lens suggests that markets might respond favorably to female board appointments when such appointments enhance a firm’s resource acquisition capabilities.

The cognitive and group dynamics theory suggests that diversity enriches group cognition, leading to a better understanding of the market, consideration of customer and employee expectations, enhanced creativity, innovation, and a broader skill set for complex environments (

Robinson & Dechant, 1997;

Hambrick et al., 1996). This can translate into competitive advantages through improved customer strategies (considering feminine norms) and strengthened social legitimacy (

Burgess & Tharenou, 2002;

Williams, 2003). Therefore, women’s appointments are seen as potentially enhancing board effectiveness in value creation.

On the contrary, the social identity theory posits that diversity can also introduce challenges. It suggests that demographic differences, such as gender, can heighten social categorization, influencing behavior and interaction and potentially leading to cognitive conflicts, reduced cohesion, and less effective cooperation within groups (

Turner, 2010), ultimately affecting decision-making processes (

Westphal & Milton, 2000). Because board meetings are infrequent, resolving such conflicts may be difficult, which hinders board function and value creation (

Richard, 2000;

Forbes & Milliken, 1999;

Hillman et al., 2002). The impact of gender diversity is, thus, context dependent. The critical mass theory further suggests that the impact of women directors becomes more pronounced when their representation reaches a threshold that enables them to influence board decisions substantively rather than merely symbolically (

Konrad et al., 2008;

Torchia et al., 2011).

Finally, the signaling theory provides a particularly relevant framework for understanding market reactions to female board appointments. According to this perspective, in contexts of information asymmetry, observable actions can signal unobservable qualities or intentions (

Spence, 1978). The appointment of women to corporate boards may signal a firm’s commitment to progressive governance practices, responsiveness to institutional pressures, or strategic orientation toward diversity and inclusion (

T. Miller & del Carmen Triana, 2009). Market participants may interpret these signals differently depending on the prevailing institutional environment and cultural context.

These contrasting theoretical perspectives highlight the complexity of predicting the overall impact of gender diversity on board effectiveness and, ultimately, market reactions. While each theory provides a different lens for understanding how the market reacts to board gender diversity, they do not function in isolation. Signaling theory and resource dependence theory, in particular, can lead to contrasting interpretations in the Saudi context. Signaling theory views female appointments as a strategic move to align with international governance standards, thereby enhancing market perception. Conversely, resource dependence theory focuses on the director’s functional contribution, such as access to valuable external networks and expertise. However, in a market where institutional barriers may limit women’s influence outside the firm, investors might question the tangible resource value of these appointments. As a result, the market may place more emphasis on the symbolic signal than on actual utility, potentially creating tension between the two frameworks. This theoretical divergence is especially pertinent in the Saudi context, where reforms are recent and investor sentiment may still be influenced by institutional inertia or skepticism.

Table 1 summarizes how these theories differ in mechanisms, predictions, and relevance to the Saudi market.

2.2. Methodological Approaches in Empirical Research

The event study methodology is the predominant empirical approach to examining market reactions to female board appointments. This approach measures abnormal stock returns surrounding the announcement of board appointments to isolate market reactions attributable to the gender of the appointee. Researchers typically employ various event windows (e.g., [−1, +1], [−2, +2], [−5, +5] days) and different models for calculating expected returns, including the market model, Fama–French three-factor model, and Carhart four-factor model.

For instance,

Kang et al. (

2010) utilized a standard event study methodology with a market model to examine market reactions to female board appointments in Singapore. Similarly,

Campbell and Mínguez-Vera (

2010) employed event study methodology to investigate the Spanish market’s response to female director appointments, using both the market model and the Fama–French three-factor model to ensure robustness.

Beyond event studies, researchers have employed regression analyses to examine the relationship between female board appointments and various market-based outcomes. These studies often control for firm characteristics (size, industry, performance), board characteristics (size, independence), and director attributes (age, education, experience).

Post and Byron (

2015) conducted a meta-analysis of 140 studies, employing meta-regression techniques to examine how the relationship between female board representation and firm performance varies across different contexts.

While quantitative methods dominate the literature, some researchers have employed qualitative or mixed-methods approaches to provide deeper insights into the mechanisms underlying market reactions. These studies often involve interviews with investors, board members, and other stakeholders to understand perceptions and decision-making processes.

Kakabadse et al. (

2015) conducted in-depth interviews with female directors in the UK to understand their experiences and contributions, providing context for interpreting quantitative findings on market reactions. Similarly,

Seierstad (

2016) employed a mixed-methods approach, combining quantitative analysis of Norwegian firms with qualitative interviews to understand the implementation and consequences of Norway’s board gender quota.

In summary, each methodological approach has unique strengths and limitations. The event study method is suitable for detecting short-term abnormal stock returns in reaction to specific events and is based on established financial theory. Its benefits include clarity, reproducibility, and direct relevance to market-based research questions. However, it assumes semi-strong market efficiency and may not detect delayed or anticipatory effects. Regression analysis, often used to examine relationships between firm characteristics and market outcomes, allows for statistical control of multiple variables and hypothesis testing. Its drawback is reliance on model assumptions and sensitivity to omitted variables or endogeneity. Lastly, qualitative methods such as interviews and case studies offer detailed insights into decision-making processes, organizational dynamics, and context-specific interpretations. While rich in detail, they have limited generalizability and can be subjective. Considering our focus on immediate investor reactions to board appointments, the event study remains the most suitable primary tool, supported by regression models to confirm observed patterns.

2.3. Market Reactions to Female Board Appointments: Global Evidence

Empirical research on market reactions to female board appointments has yielded mixed findings and revealed significant heterogeneity, reflecting the complexity of the relationship and the importance of contextual factors.

Table 2 provides a summary of some findings.

Several studies found that the appointment of women to corporate boards can generate positive market reactions. They documented positive abnormal returns following announcements of female board appointments (

Campbell & Mínguez-Vera, 2010;

Kang et al., 2010;

Adams et al., 2011;

Cook & Glass, 2011;

D. K. Ding & Charoenwong, 2013;

J. Lee & Shin, 2022;

Huang, 2024), suggesting that markets perceive gender diversity as value enhancing. For instance,

Kang et al. (

2010) found positive market reactions to female board appointments in Singapore, particularly for firms with strong governance structures.

Cook and Glass (

2011) found positive returns from women’s appointments to executive positions in the US.

Conversely, other studies found adverse effects and reported negative market reactions (

P. M. Lee & James, 2007;

Braegelmann & Ujah, 2020;

V. K. Gupta et al., 2018;

Lucey & Carron, 2011;

Friedman, 2020;

Jeong & Harrison, 2017;

Pastore et al., 2018;

Sanford & Tremblay-Boire, 2025).

Ahern and Dittmar’s (

2012) influential study on Norway’s board gender quota found significant negative stock price reactions, which they attributed to the appointment of younger, less experienced directors. Similarly,

Dobbin and Jung (

2010) documented negative market reactions to female board appointments in the United States, suggesting potential investor biases.

P. M. Lee and James (

2007) noted a negative reaction to the appointment of women as chief executive officers (CEOs).

Solal and Snellman (

2019) reported decreased market value associated with increased U.S. board diversity, and

Casteuble et al. (

2023) found long-term adverse effects of quotas on Tobin’s Q internationally.

A third strand of research finds no significant market reaction, indicating that investors may view female board appointments as neutral events concerning firm value.

Farrell and Hersch (

2005) found no significant market reaction to the appointment of women to boards in U.S. Fortune 500 firms.

Gregory et al. (

2013) found no significant short-term market reaction to female board appointments in the United Kingdom but noted positive long-term performance effects.

Brinkhuis and Scholtens (

2018) found no significant gender effect in market reactions to CEO/CFO appointments globally.

What appears is that market reactions are heterogeneous, and various contextual factors can contribute to this inconclusiveness (

Adams & Ferreira, 2009;

Matsa & Miller, 2013;

Post & Byron, 2015;

Bayly et al., 2024;

Loy & Rupertus, 2022). In fact, the regulatory and normative context significantly shapes market reactions. In environments with strong institutional pressure for gender diversity, appointments may be perceived as compliance-driven rather than strategic (

Terjesen et al., 2015). Moreover, firm-specific factors, such as size, industry, existing board composition, and financial health, moderate market reactions (

Post & Byron, 2015). For instance, female board appointments may elicit more positive reactions in consumer-oriented industries where women constitute key stakeholder groups. The qualifications, experience, and roles of appointed female directors also influence market perceptions (

Hillman et al., 2007). Appointments of women with industry-specific expertise or to key committee positions may generate more positive reactions. Finally, societal attitudes toward gender roles and equality significantly influence how markets interpret female board appointments (

Singh et al., 2008). In more gender-egalitarian societies, such appointments may be viewed as normative and elicit minimal market reaction.

However, the most important takeaway is that the divergence in empirical findings across countries highlights the significance of national context in shaping investor perceptions (

Dubois et al., 2025). In fact, formal (regulations and laws) and informal (culture and norms) institutions profoundly shape corporate practices, including diversity and governance (

Acemoglu et al., 2005;

Williamson, 2000;

Lubatkin et al., 2007). Legal frameworks that promote gender equality and cultural norms surrounding women’s roles have a significant influence on board composition (

Carrasco et al., 2015;

Li & Harrison, 2008) and may also impact market reactions. Moreover, Hofstede’s cultural framework (

Hofstede, 2001), particularly dimensions such as Power Distance (tolerance for inequality) and Masculinity (emphasis on achievement versus caring), correlates with women’s representation on boards (

Carrasco et al., 2015). Countries that score high in Power Distance and Masculinity tend to have fewer women on boards. Cultural values also shape investor perceptions; traditional or patriarchal cultures may harbor biases against women in leadership, leading to negative or muted market reactions (

Abdullah et al., 2016). Culture influences how signals associated with female appointments are interpreted (

Guiso et al., 2008).

Furthermore, the relationship between women on boards and performance is contingent upon the formal institutional environment.

Post and Byron (

2015) found that the link is stronger (and positive) in countries with greater gender parity.

Belaounia et al. (

2020) demonstrated that women directors have a more significant impact on performance in countries with higher levels of gender equality.

Marano et al. (

2022) further illustrate how cultural practices shape the focus and effectiveness of women directors.

In conclusion, while theoretical arguments demonstrate both the value-enhancing potential (resource access, improved governance, cognitive diversity) and challenges (conflict, cohesion issues) of gender-diverse boards, empirical evidence on market reactions remains distinctly mixed. This inconsistency strongly implies the significant influence of national context (

Dubois et al., 2025), including cultural norms, institutional frameworks (laws and regulations), and prevailing investor sentiments and biases.

But most existing research focuses on developed markets with longer histories of diversity initiatives. The significant divergence in findings (e.g., neutral US reactions vs. positive Spanish reactions) highlights the need for research in different institutional and cultural settings. In conservative or emerging market contexts, such as Saudi Arabia, where debates and policies concerning gender diversity may take different paths, there are particularly valuable opportunities to deepen our understanding of the complex relationship between board gender diversity, market perceptions, and the underlying drivers of investor reactions. Understanding how investors in such contexts interpret the signals sent by women’s appointments is crucial for advancing both theory and practice in corporate governance.

3. Research Gaps, the Saudi Arabian Context and Relevance

Despite the increasing scholarly interest in gender diversity on corporate boards, our understanding of market reactions remains fundamentally incomplete, especially in contexts where cultural transformation intersects with institutional reform. Three critical gaps become evident when we examine the literature.

First, we lack nuanced insights from traditionally conservative economies going through rapid institutional change. Most evidence comes from either progressive Western markets or emerging Asian economies, leaving a noticeable gap in our understanding of how markets react when female appointments signify not just governance improvements but also profound cultural shifts.

Saudi Arabia presents a unique cultural and institutional landscape that may significantly inform how markets react to women’s board appointments, making it a particularly relevant context for studying this phenomenon (

Alhassan & Al Doghan, 2022;

Aladwey & Alsudays, 2023). One key factor is the country’s deeply rooted traditional norms, which have historically positioned leadership roles predominantly in the hands of men (

Hamdan, 2005). This longstanding tradition can influence investor perceptions, as market participants may initially interpret female board appointments through the lens of these entrenched societal expectations. While reforms have begun to shift these norms, the pace of change can result in mixed sentiments among stakeholders, including investors, reflecting both optimism for modernization and caution rooted in historical practices.

Aladwey and Alsudays (

2023) stipulated that the scarcity of female directors on Saudi boards is linked to cultural and social barriers deeply rooted in traditional masculine norms and demonstrated a negative correlation between the presence of female directors and Saudi firm value. This association is attributed to the prevailing male-dominated societal norms in Saudi Arabia, where boards with more female members may hesitate to prioritize performance-driven actions due to concerns about their perceived legitimacy within traditional gender roles.

Institutionally, the Saudi regulatory environment has undergone substantial transformations in recent years, aimed at diversifying its economy under Vision 2030. These reforms are not only changing economic policies but also reshaping corporate governance frameworks. The Saudi Capital Market Authority (CMA) has encouraged gender diversity on boards without imposing mandatory quotas. The Saudi Stock Exchange (Tadawul) has also promoted corporate governance practices, emphasizing board diversity. However, this regulatory push also introduces uncertainty as firms and investors navigate new expectations and transition strategies. Therefore, the resulting market reactions may reflect a tension between regulatory optimism and the challenges of integrating these changes within existing institutional structures. In addition, the role of state-backed institutions and sovereign wealth funds in Saudi Arabia’s economy cannot be understated. These entities often set the tone for market behavior through their investment strategies and public statements. Their support for gender diversity can lend credibility to female board appointments, positively recalibrating market expectations. Conversely, if these institutions appear uncertain or ambivalent about the long-term benefits of increasing female representation, market reactions may be more muted or even skeptical. In addition, the ownership structure of listed companies often features significant family ownership, which may influence corporate governance practices and responses to diversity initiatives.

The Saudi context offers an opportunity to extend existing theories by examining how they apply in a setting characterized by institutional transition and cultural distinctiveness. For instance, signaling theory might operate differently in an environment where female board appointments represent not only corporate governance signals but also alignment with national reform agendas. The increasing international exposure of Saudi corporations adds another layer of complexity. As these companies become more integrated into the global financial system, they must balance domestic cultural expectations with international standards of corporate governance. This duality can lead to market volatility during the transition period, as investors await evidence that the structural changes will lead to sustainable improvements in performance and governance.

Overall, the interplay of traditional cultural norms, transformative institutional reforms, the strategic influence of state-backed investors, and the pressure to meet global standards creates an environment where market reactions to women’s board appointments are influenced by optimism for progress and caution born out of historical context. These complex dynamics underscore the need for a nuanced approach to understanding the evolution of market behavior in Saudi Arabia. This brings us to the second crucial research gap.

In fact, the field remains constrained by methodological snapshots rather than dynamic portraits. While event studies effectively capture immediate market spikes, they overlook the evolving narrative of investor sentiment, including how reactions mature, reverse, or intensify as markets digest the implications. The Saudi context necessitates this temporal perspective because initial skepticism may give way to appreciation (or vice versa) as investors observe the real-world impacts. Current approaches cannot trace this learning curve, leaving us guessing whether negative reactions represent enduring pessimism or temporary adjustment pains.

And, finally, we have overlooked how market conditions shape reactions. If announcing a female director during a market boom versus a crisis, would investors respond differently? Yet most studies treat appointments as occurring in contextual vacuums. This overlooks a crucial reality: bull markets may amplify optimism about governance changes, while bear markets could intensify skepticism. Without examining these interactions, we risk misattributing reactions to gender factors alone when broader market psychology plays a decisive role.

Our study bridges these gaps through a purpose-built approach. We examine Saudi Arabia not as a footnote to existing theories but as a pivotal case revealing how markets process gender signals amid transformation. By combining traditional event studies with the Local Projections method and quantile regression, we capture both immediate reactions and evolving sentiment, much like time-lapse photography, revealing how initial skepticism deepens or dissipates over time. Crucially, we analyze how market phases (anticipation, event, adjustment) interact with bullish or bearish conditions, answering the “when” alongside the “why.” This multi-layered approach finally lets us see the whole picture: not just whether markets react but how they learn.

In essence, we move beyond asking whether female appointments affect value to understand how and when they reshape investor perceptions in societies that are rewriting their governance narratives. This is not just about Saudi Arabia; it is about decoding market psychology in any context where tradition meets transformation.

Therefore, based on the literature and the specific Saudi Arabian context, we develop the following hypotheses:

Hypothesis 1. Female board appointments in Saudi Arabian firms will elicit significant market reactions, reflecting investors’ assessments of their implications for firm value.

Hypothesis 2. The direction of market reactions will depend on whether investors perceive female board appointments as enhancing board effectiveness (positive reaction) or as disruptive to established norms (negative reaction).

Hypothesis 3. In the context of Saudi Arabia, market reactions to female board appointments will evolve over time as investors process information and update their assessments.

4. Primary Empirical Methodology Framework and Results

4.1. Data and Sample Selection

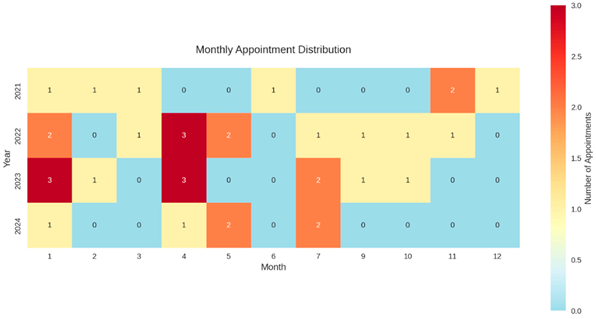

As shown in

Table 3, our sample includes all-female board appointments in publicly listed Saudi companies from January 2021 to July 2024, resulting in 36 distinct appointment events across 34 companies. These board composition data, including details on gender diversity and appointments, were manually gathered from company annual reports, corporate governance reports, and official company websites.

Table 4 illustrates the distribution of these companies across various economic sectors.

To ensure the integrity of our analysis, we performed several criteria checks. To minimize confounding effects, we verified that the appointments did not coincide with other significant corporate announcements (e.g., earnings releases, dividend declarations, merger announcements) within a ±10-day window. Additionally, we verified that the appointed women do not hold multiple new board positions simultaneously to avoid cross-contamination effects.

4.2. Appointed Female Directors’ Attributes

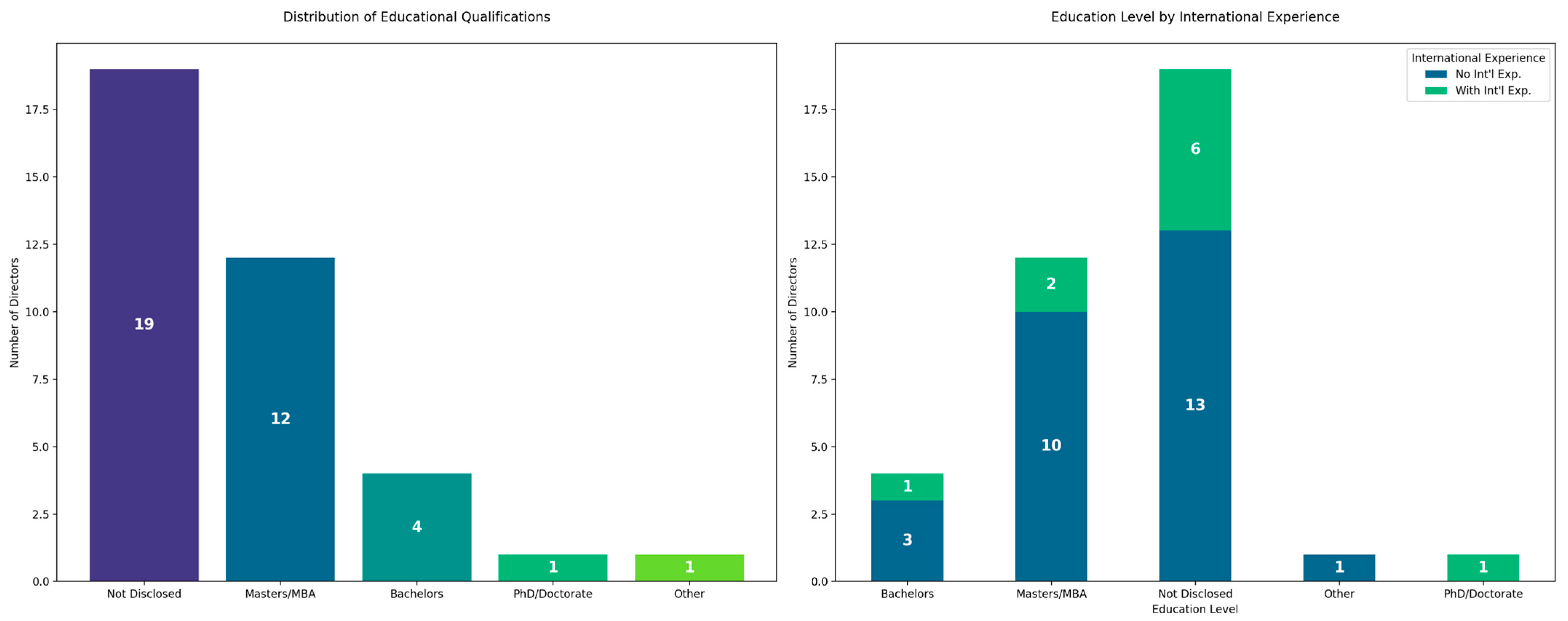

Analyzing female board appointments in Saudi Arabia reveals distinct patterns in directors’ educational qualifications and international experience. However, as shown in

Table 5, it is essential to note that many appointments lack disclosed educational qualification information.

The high rate of non-disclosure, where 48.6% of appointed female directors’ educational qualifications were not publicly available, raises significant concerns about corporate transparency in the Saudi market. Despite our efforts to address this limitation of missing information, no additional data were provided. We were, therefore, limited to what was officially reported in annual reports, governance disclosures, and company websites. This pattern of incomplete disclosure is not merely a data limitation—it reflects a structural issue within the governance environment. From an investor’s perspective, limited transparency at the board level introduces uncertainty and may increase perceived risk. It also hinders the market’s ability to evaluate the qualifications and strategic potential of new board members.

Figure 2 shows that Master’s and MBA degree holders represent the largest identified group of appointed women (32.4%), followed by those with bachelor’s degrees (10.8%). Directors with PhD/Doctorate qualifications and other educational credentials comprise 2.7% of appointments. These high academic credentials align with global standards for board composition, as emphasized by international frameworks such as the OECD Principles of Corporate Governance and the IFC Corporate Governance Methodology, which recommend appointing directors with strong academic and professional backgrounds to enhance board effectiveness. This may bolster investor confidence by signaling a commitment to improved managerial capabilities and innovative leadership. Conversely, the analysis indicates that only a subset of these appointments comes with significant international experience. This limited exposure suggests that while some board members bring a global perspective, a considerable proportion remains predominantly domestically experienced. Market participants, aware of this disparity, might interpret the lack of extensive international experience as a potential limitation in navigating complex global business environments. As such, although the academic credentials of these women serve as a positive signal, the relative scarcity of international experience may contribute to a tempered or cautious market reaction. Investors may weigh these factors carefully, balancing the strengths of high academic and professional qualifications against the competitive advantage that international experience can provide in an increasingly globalized market.

The analysis of the relationship between educational credentials and international experience shows that directors with PhD/Doctorate qualifications exhibit the highest level of international experience, as 100% of this group has global exposure. For Master’s/MBA holders, 16.7% report international experience, and for bachelor’s degree holders, 25% have international exposure. Among directors with undisclosed educational qualifications, 31.6% possess international experience, surpassing the rates observed in both bachelor’s and Master’s degree categories.

The analysis of academic majors among female board directors in

Figure 3 reveals that a significant proportion of the directors have a background in Business & Economics, among the reported majors. This predominance underscores the emphasis on financial expertise, strategic management, and commercial acumen in board appointments. In contrast, other fields, such as Engineering & Technology, Sciences, Law, and those classified as “Other”, appear with much lower frequency, suggesting that these areas, while represented, play a secondary role in the composition of board expertise.

4.3. Event Study Methodology

The event study methodology is our primary analytical approach, following the seminal work of

S. J. Brown and Warner (

1985),

Boehmer et al. (

1991),

Strong (

1992),

MacKinlay (

1997) and

D. L. Miller (

2023). This methodology enables us to isolate the market reaction attributable specifically to the announcement of female board appointments by measuring abnormal returns around the event date. The underlying assumption is that markets are sufficiently efficient to incorporate new information into stock prices, allowing us to detect the valuation effects of female board appointments.

We define the event as the official announcement of a female director’s appointment to the board of a Saudi-listed company. The event date (

t = 0) corresponds to the date of the public announcement, as reported to the Saudi Stock Exchange (Tadawul). We employ the market model (

Farrell & Hersch, 2005;

Adams et al., 2011) to estimate normal returns, representing the expected returns without the event. For each firm

i and day

t, the normal return is estimated as:

where

is the return of firm

i on day

t,

is the return of the market index (Tadawul All Share Index) on day

t, and

is the error term.

The parameters and are estimated using an estimation window of 92 trading days, ending 11 days before the event date (−102, −11) to avoid contamination from potential information leakage. This 92-day estimation window choice balances the need for a stable beta estimation with the constraints of our sample. Specifically, in two firms, the number of trading days between their IPO and the appointment date was only 125 and 145 days, respectively. A longer estimation window (e.g., 120–250 days) would have excluded these firms and reduced the sample size, thereby weakening the power of our analysis.

The abnormal return for firm

i on day

t is then calculated as:

where

and

are the estimated parameters from the market model.

Then, to capture the full effect of the announcement, we calculate cumulative abnormal returns (CARs) over the event window (−10, +10). The CAR for firm

i over the event window

is defined as:

We then calculate the average cumulative abnormal return (ACAR) across all N events:

To test the statistical significance of the ACARs, we employ a parametric test that is based on the T-Statistic: where is the estimated standard deviation of the ACAR.

Additionally, we employ the non-parametric Wilcoxon signed-rank test and the generalized sign test to account for potential non-normality in the distribution of abnormal returns. This is particularly relevant in emerging markets like Saudi Arabia, where stock returns may exhibit higher volatility and non-normal distributions.

4.4. Empirical Findings

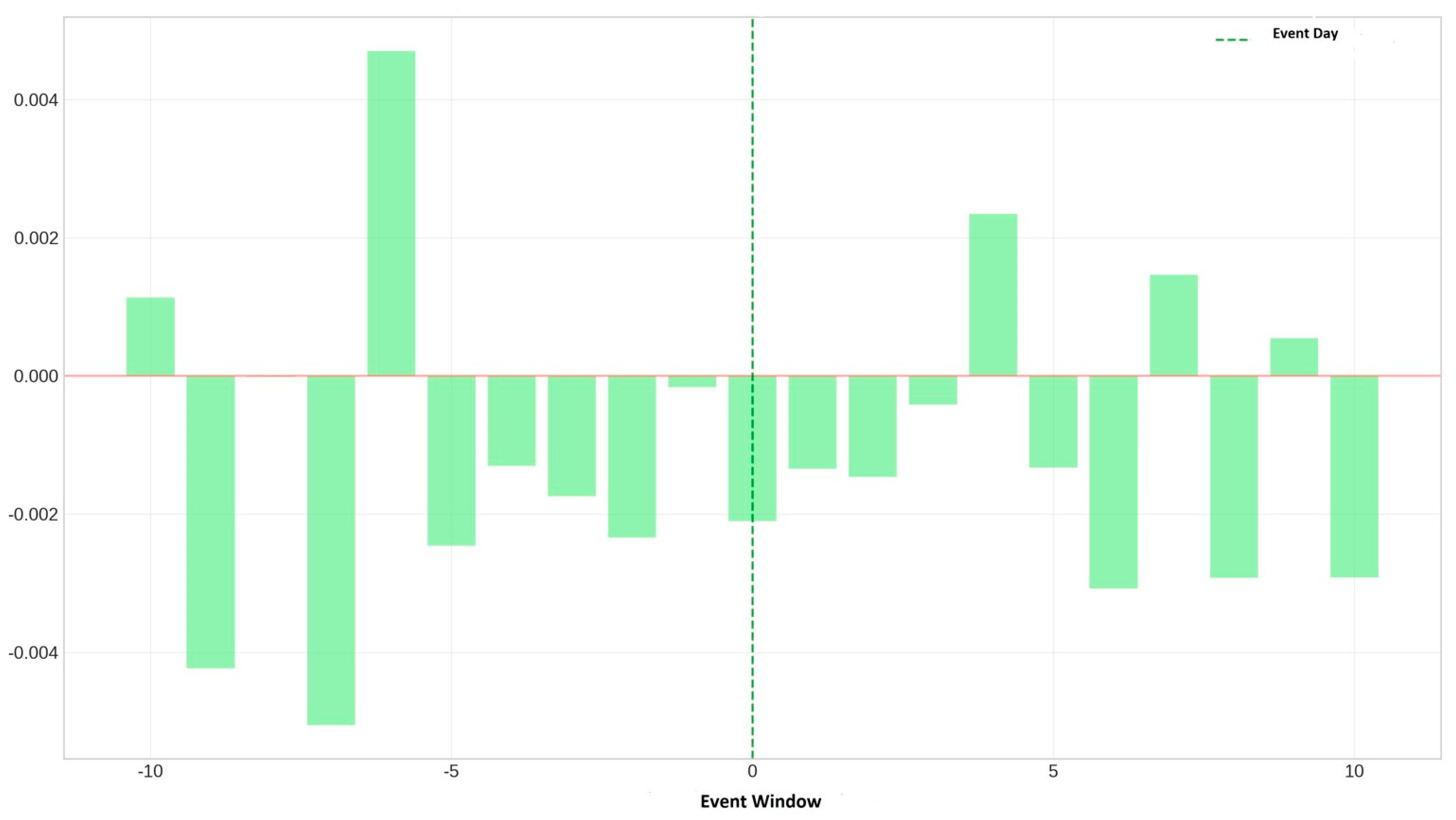

The analysis of average abnormal returns (AR) for each day of the event window in

Figure 4 reveals an interesting trend. On the event day (day 0), the average abnormal return is −0.21%, indicating a slightly negative immediate market reaction to female appointment announcements. This negative reaction continues in the days following the announcement, with negative average abnormal returns for most days of the post-event window.

The temporal evolution and the distribution of the daily average ARs reveal notably considerable volatility throughout the event window. Hence, several observations are worth highlighting.

In fact, two days demonstrate particularly negative average abnormal returns (ARs) in the “Before” period: days −9 (−0.42%) and −7 (−0.50%). These anticipated negative reactions could indicate information leaks or market expectations. Moreover, day −7 exhibits a significant negative average AR of −0.50% (p = 0.034), while day −6 shows a notable positive average AR (+0.47%, p < 0.05), which may reflect a market correction following the negative reactions of prior days. This observation is intriguing because these two significant days fall within the “Before” period, suggesting that the market begins to respond to female appointments even prior to the official announcement. This may indicate information leaks or anticipations based on rumors or early signals. While not a formal test of market efficiency, this pattern is consistent with the partial characteristics of semi-strong form efficiency, where prices reflect available public or semi-public information.

The event day (day 0) reveals a negative average AR (−0.21%), but this value lacks statistical significance according to parametric tests. On the other hand, in the “After” period, we observe a fluctuation in days with both positive and negative average ARs, indicating a phase of adjustment and reassessment by the market. In addition, we observe a decrease in the magnitude of mean ARs from the “Before” period (0.11%) to the “After” period (0.09%), passing through the event day (0.21%). This may suggest a gradual attenuation of the negative reaction. This implies that the market initially revalues companies that appoint women downward, but this revaluation lessens over time.

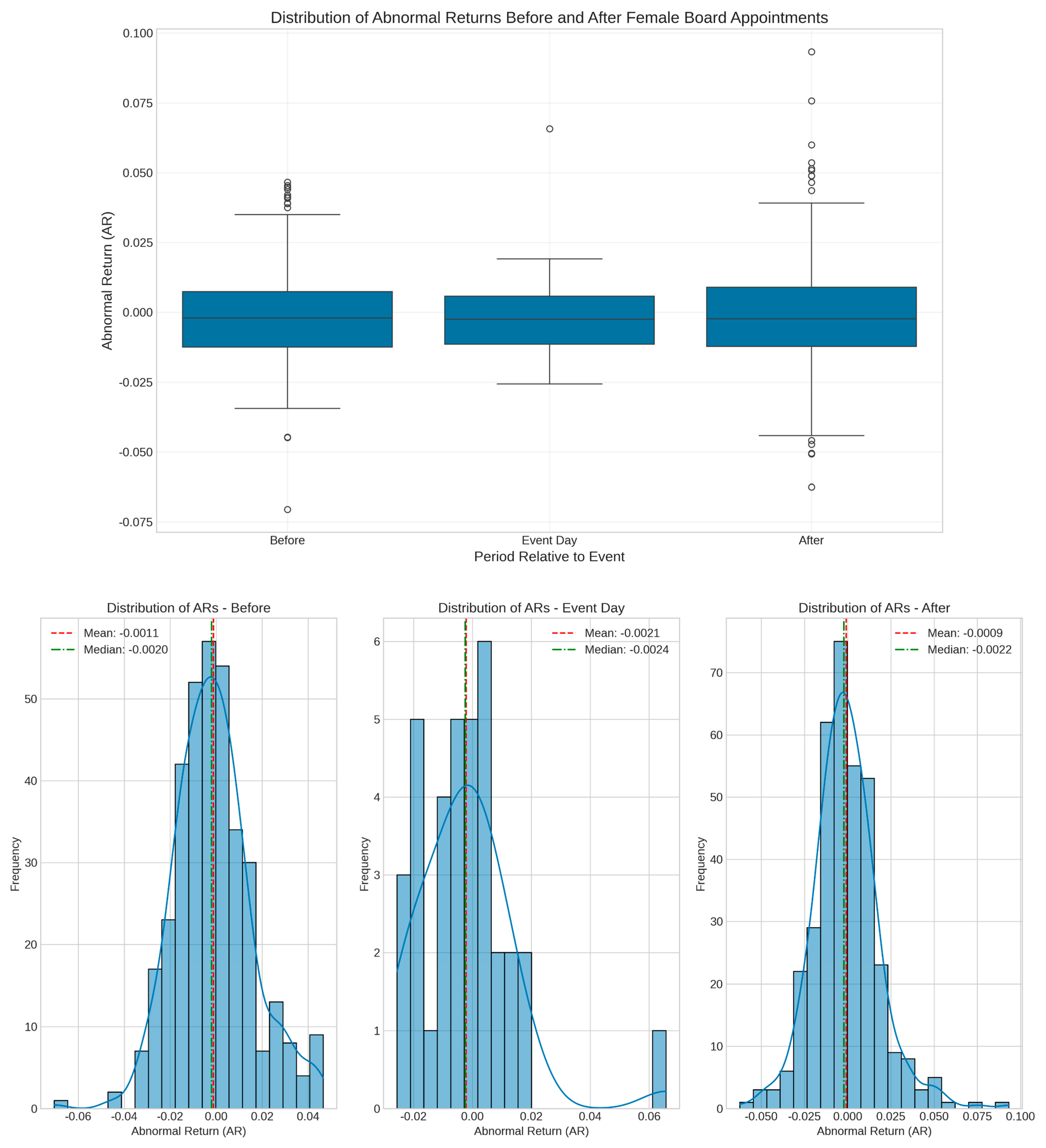

Additionally, the standard deviation of ARs is slightly higher in the “After” period (90%) compared to the “Before” period (69%), indicating increased volatility following announcements. This observation aligns with the hypothesis that female appointments generate uncertainty in the market, leading to a wider dispersion of returns. The “After” period, as shown in

Figure 5, exhibits greater dispersion and more pronounced positive extreme values than the “Before” period, suggesting that some companies significantly benefit from female appointments despite the overall negative trend. Finally, the distributions are not symmetric, showing a longer tail on the positive side, particularly in the “After” period. This positive asymmetry indicates that, while most reactions are negative, some positive reactions can be especially strong.

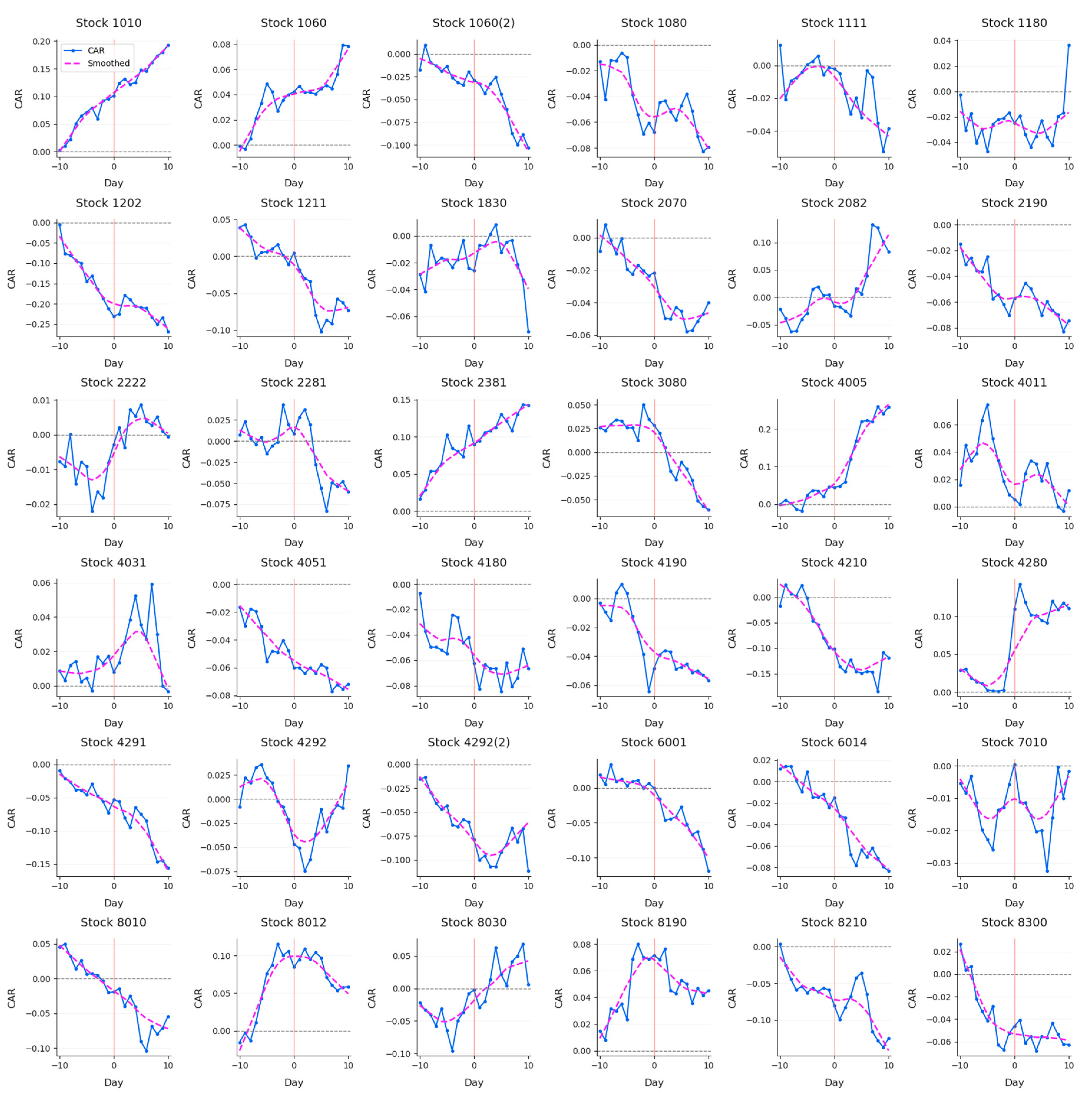

Simultaneously, the cumulative abnormal returns (CARs) for individual companies in

Figure 6 and

Table 6 show considerable variation, ranging from −25.83% to +25.19% over the complete event window (−10, +10). This dispersion suggests that the market reaction to female appointments may depend on company-specific or context-specific factors.

Of the 36 companies in our sample, 23 (64%) reported negative CARs throughout the event window, while 13 (36%) reported positive CARs. This prevalence of negative reactions aligns with the observed negative CAAR (−2.27%). Furthermore, the results indicate that 30 out of 36 companies (83%) have statistically significant CARs at the 5% significance level, as determined by the t-test. Among these companies with significant CARs, 19 have negative CARs, while 11 have positive CARs. This variation in market reactions implies that the effect of female appointments may depend on company-specific factors, such as size, industry sector, prior performance, or specific attributes of the appointed woman (experience, qualifications, etc.).

In summary, the market reactions to female board appointments in Saudi Arabia seem to be shaped by a dual perception: on one side, the academic and professional excellence of many appointees instills optimism, while on the other, the relative lack of international exposure in a considerable number of cases introduces uncertainty about how well these boards can navigate the challenges of global competition and innovation.

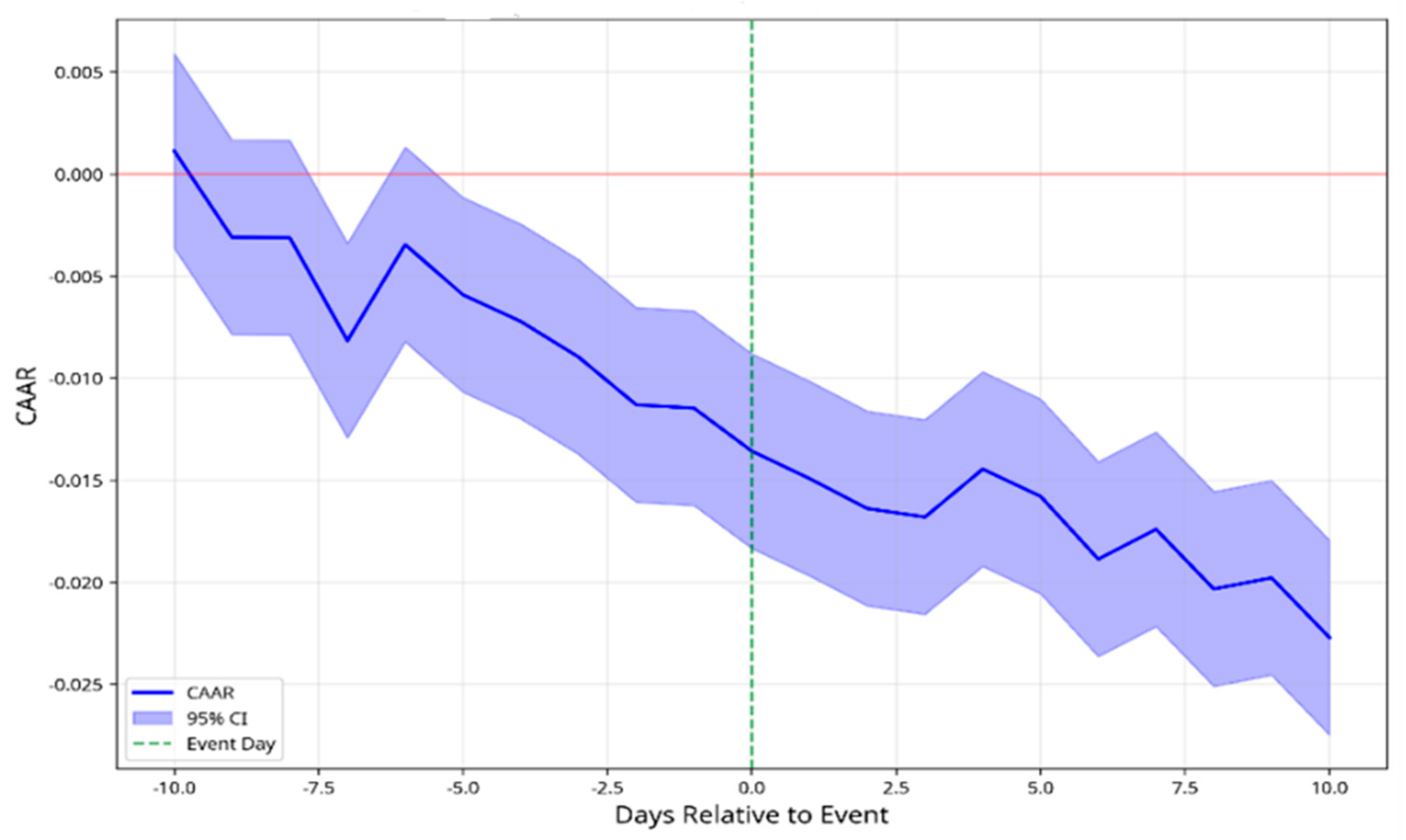

And, as mentioned above, the cumulative average abnormal return (CAAR) over the complete event window (−10, +10) is −2.27%. This negative value suggests that, on average, the Saudi market reacts negatively to announcements of female appointments to corporate boards. However, the analysis of the evolution of the CAAR over time in

Figure 7 and

Table 7 shows that the adverse reaction begins even before the official announcement (possibly due to information leaks or anticipations) and continues to intensify after the announcement. On the event day, the CAAR reaches −1.36%, then decreases in the following days to reach −2.27% at the end of the event window. This trend suggests that the market continues negatively integrating information regarding female appointments even after the initial announcement. The persistence of the negative effect could indicate that investors progressively reassess the implications of these appointments for governance and future company performance rather than simply reacting to the announcement itself.

4.5. Robustness Checks

To assess the robustness of our results and examine how the impact of female appointments evolves over different periods, we analyzed several alternative event windows. The results for the different event windows are presented in

Table 8. These results indicate that the negative market reaction occurs across all analyzed event windows, with relatively similar magnitudes in percentage per day. This implies that the adverse effect of female appointments is not merely a short-term phenomenon that quickly dissipates but reflects a more persistent market response.

Moreover, the statistical significance varies according to event windows and the tests used. The (−1, +1) window presents the most robust significance, being significant according to the Wilcoxon and T-Statistic tests at the 10% threshold. This could suggest that this window better captures the impact of female appointments by excluding potential noise from periods further from the event, while including enough days to observe the full effect.

Additionally, to verify that firm-level abnormal returns were not driven by synchronized market reactions and evaluate the possibility of contemporaneous correlation across them, which may arise if market participants respond jointly to similar events, we tested for cross-sectional dependence in firm-level abnormal returns using the

Pesaran’s (

2004) CD test. The test aggregates all 630 pairwise correlations among our sample and scales the average, rho = −0.0135, by

to generate a statistic that is asymptotically standard normal. The resulting value, CD = −0.34, is small in magnitude, and its two-sided

p-value of 0.73 prevents rejection of the null of cross-sectional independence. The CD results reinforce the conclusion that firms’ abnormal returns behave largely independently during the ten-day window on either side of a female-director appointment.

In practical terms, this independence implies that any econometric specification assuming uncorrelated cross-sectional errors—whether ordinary least squares, cross-sectional regressions, or a traditional event study t-test—remains appropriate for the data at hand. Nonetheless, the finding does not preclude idiosyncratic linkages: a handful of firm pairs display sizeable positive or negative correlations, but these appear to be isolated rather than systematic.

From a corporate-governance perspective, the absence of broad co-movement suggests investors evaluate each female appointment on firm-specific merits rather than extrapolating to peers. Consequently, market learning about the value of female board representation seems to occur on a case-by-case basis rather than through rapid spillovers or herd reactions across the Saudi equity market. Gender-diversity signals are perceived as firm-specific and information-rich, rather than generic news that re-prices an entire industry.

In addition to the standard market model, and for further robustness checking, we estimated abnormal returns using a Saudi-adapted standard Fama–French three-factor model. The model is defined as follows:

where

is return of stock

i on day

t,

is the risk-free rate on day

t,

is the market return on day

t,

is the return difference between small-cap and large-cap portfolios,

is the return difference between high book-to-market and low book-to-market portfolios,

is the error term.

The resulting CAARs from this model, as shown in

Figure 8 and

Table 9, remained negative and were statistically comparable to those obtained from the market model.

4.6. Interpretation of Results

Our results indicate an overall negative reaction of the Saudi market to female appointments to corporate boards. This negative reaction is observed across different event windows and is statistically significant according to some tests.

To illustrate the economic magnitude of this reaction, we calculated the average market capitalization of the firms at the time of the appointments. Based on available data from Tadawul, the average total market capitalization of all firms in our sample (excluding Saudi Aramco, 2222) was approximately SAR 1210 billion (USD 322 billion). A −2.27% CAAR implies an average market value loss of around SAR 832 million (USD 222 million) per firm over the event window. This loss is substantial relative to typical firm-level stock price reactions to other governance events.

To contextualize the magnitude of the −2.27% CAAR we observe, we compared our findings with stock market reactions to various types of executive appointment and departure announcements in Saudi Arabia. Recent empirical evidence (

Almajed, 2020) indicates that the cumulative average abnormal return 10 days after a new appointment announcement is −0.944%, suggesting a modestly negative but limited reaction. Age-related retirements generate a more pronounced negative response (−4.866%), likely reflecting investor concerns over leadership voids. In contrast, forced resignations tend to trigger positive market reactions (+6.147%), signaling the perceived removal of underperforming executives. Top management changes, when not forced or performance-related, yield near-zero reactions (−0.224%), as do voluntary departures (+0.238%), which are generally seen as neutral or routine.

In this context, the −2.27% CAAR associated with female board appointments stands out as substantially more negative than typical new appointments and closer in magnitude to events interpreted as potentially disruptive or sensitive, such as age-related retirements. This finding suggests that investors do not view female board appointments as routine governance updates but instead respond with significant revaluation. The magnitude suggests that the market perceives such events as carrying implications for strategic direction, governance quality, or future firm performance, possibly reflecting uncertainty or adjustment costs in a traditionally male-dominated business environment.

These comparisons further support the interpretation that gender-based board changes and such appointments are not perceived as symbolic alone or just a genuine political act. They are priced events with measurable valuation consequences, with an economic impact that approaches the scale of high-salience management changes, highlighting the weight investors assign to board composition in transitional institutional contexts, where norms are still evolving.

Several interpretations can be proposed to explain this negative reaction. The first explanation involves cultural and traditional perceptions. Saudi Arabia is a traditionally conservative society where gender roles have historically been well defined. Investors might view female appointments as a departure from traditional norms, which creates uncertainty about their impact on corporate governance.

The second plausible explanation relates to experience and qualifications. In a market where women have historically been underrepresented in leadership positions, investors may worry about the lack of experience among appointed women, even if they are qualified on paper. Moreover, the high rate of undisclosed qualifications mentioned earlier (48.6%) limits investors’ ability to assess director capabilities, amplifying skepticism and uncertainty about governance quality. The lack of visibility into director credentials may partially explain the overall negative market reaction observed in our findings. As board diversity initiatives progress, improved disclosure practices will be crucial for enhancing investor confidence and facilitating more accurate market assessments of governance changes. Furthermore, while appointed women may possess strong academic credentials, the dominance of domestic experience (

Figure 3) and lack of disclosure may raise concerns about their global strategic capacity.

The third point is the perception of symbolic appointments. Investors may view these appointments as primarily driven by political or image considerations rather than merit criteria, which could raise concerns about governance effectiveness.

The fourth interpretation is the resistance to change. The negative reaction may reflect a general resistance to change in corporate governance practices rather than specific opposition to female appointments.

Nevertheless, while short-term market responses appear negative, these should not necessarily deter firms or policymakers from promoting board diversity. As our findings suggest, the market may take time to recalibrate expectations. Short-run losses may reflect uncertainty rather than a rejection of the long-term value of diversity.

5. Local Projections (LP) for Board Diversity Event Studies

To validate our previous results, we adopt a different process here by employing

Jordà’s (

2005) Local Projection (LP) framework as an alternative to traditional event study methodologies. Our study introduces Local Projections to corporate governance event analysis, a novel approach that overcomes the limitations of static event windows. In fact, the LP framework is well established in macroeconomics and asset pricing; however, no prior studies have applied LP to board diversity events. This gap is notable given LP’s advantages in tracing dynamic responses, advantages we leverage to capture Saudi investors’ evolving reactions to gender appointments.

Conventional event studies have dominated the literature on market reactions to board appointments for decades, imposing restrictive assumptions that may not adequately capture the complex dynamics of market responses to female board appointments.

Traditional event studies typically assume semi-strong market efficiency, where stock prices rapidly incorporate all publicly available information. Our LP approach relaxes this assumption, allowing for gradual information processing and investor learning, which is particularly relevant in emerging markets where informational frictions may be more pronounced.

The second advantage is flexibility in response dynamics. While traditional event studies often impose a predetermined structure on abnormal returns (e.g., constant mean or market model), our approach allows the data to reveal the temporal pattern of market responses without imposing ex ante restrictions on the shape of the response function.

The third aspect is the robustness of estimation window choices. Traditional event studies necessitate specifying estimation windows for calculating expected returns, with results often sensitive to these choices. Our LP approach addresses this concern by directly modeling cumulative returns without requiring a separate estimation of expected returns.

The fourth is the explicit incorporation of market controls. Instead of constructing abnormal returns based on a market model estimated over a pre-event window, we directly control market returns in our regression framework, allowing for time-varying relationships between firm and market returns.

Finally, statistical inference is transparent. Our approach offers clear statistical inference at each horizon, accompanied by standard errors and confidence intervals that reflect the uncertainty in estimating the event effect across different time frames—a feature often obscured in traditional cumulative abnormal return analyses.

This methodological innovation is particularly well suited for studying female board appointments in Saudi Arabia for several reasons. As female board representation is a relatively recent phenomenon in Saudi Arabia, market participants may lack historical reference points for evaluating its implications. This could lead to gradual information processing, which our LP approach is designed to capture. Moreover, the Saudi market has undergone significant regulatory changes, creating a dynamic environment where market reactions may evolve as investors update their beliefs about the implications of diversity initiatives. Finally, the cultural significance of female leadership in a traditionally conservative business environment may trigger complex investor responses that unfold over time rather than materializing instantaneously.

5.1. Model Specification and Estimation Procedure

The core innovation of our approach lies in the direct estimation of impulse response functions at each forecast horizon without imposing the recursive structure inherent in traditional event study methodologies. For each horizon

h, we estimate:

where:

represents the cumulative stock return from

t − 1 to

t +

h.

is the binary female board appointment indicator.

are lags of the first difference of the dependent variable.

are the lagged market returns that control broader market movements.

controls for firm-specific return persistence through p lags.

captures the horizon-specific effect of the appointment on cumulative returns, while

reflects the sensitivity to market performance.

For each horizon h from 0 to 20 trading days, we calculate the cumulative stock return from day t − 1 to day t + h for each observation. Then, we estimate the horizon-specific regression using ordinary least squares (OLS). We extract the coefficient and its standard error, constructing 95% confidence intervals. Finally, we compile these estimates to trace the dynamic response path of stock returns following female board appointments. This procedure generates a sequence of horizon-specific treatment effects that collectively form the impulse response function, providing a comprehensive picture of how markets process and react to female board appointments over time.

This specification offers several advantages over traditional approaches. First, by estimating separate regressions for each horizon, we allow the effect of female board appointments to vary flexibly across different time frames rather than imposing a constant effect or a predetermined decay structure. It allows for flexible dynamic responses without assuming an instantaneous or uniform market reaction, and it directly controls for time-varying market conditions without requiring a pre-estimation of expected returns. Secondly, the LP method is more robust in modeling misspecification than the cumulative abnormal return (CAR) approach because errors in specifying short-horizon dynamics do not contaminate longer-horizon estimates. Finally, our framework explicitly controls for lagged market returns, addressing concerns that traditional abnormal return calculations may inadequately adjust for market-wide movements in emerging markets with distinct risk characteristics.

This is especially appropriate in the Saudi context, where informational inefficiencies, evolving governance norms, and limited historical precedent for female board appointments may delay or alter investor responses.

Nevertheless, we must mention that Local Projections are not without limitations. In fact, LP can be statistically less efficient than traditional CAR models, particularly with smaller sample sizes, because it estimates a separate regression for each horizon. Also, LP results may be less intuitive for researchers accustomed to cumulative abnormal return analysis. And, finally, the model’s flexibility requires more careful specification of lags and control variables.

To address these limitations and provide a fuller picture, we emphasize that LP is used in our study not as a substitute but as a complement to the conventional event study (CAR) approach. The CAR analysis in

Section 4 provides benchmark results across various event windows (

Table 8), showing a consistently negative market reaction. The LP results, presented below, confirm and enrich these findings by revealing how that reaction unfolds over time, with significance emerging only after several trading days (

Table 10).

This dual approach strengthens the credibility of our findings by combining the clarity of traditional methods with the temporal nuance of LP.

5.2. Local Projections Empirical Results

By adopting

Jordà’s (

2005) Local Projection methodology, our analysis of female board appointments in Saudi Arabian firms reveals a nuanced pattern of market reactions. As illustrated in

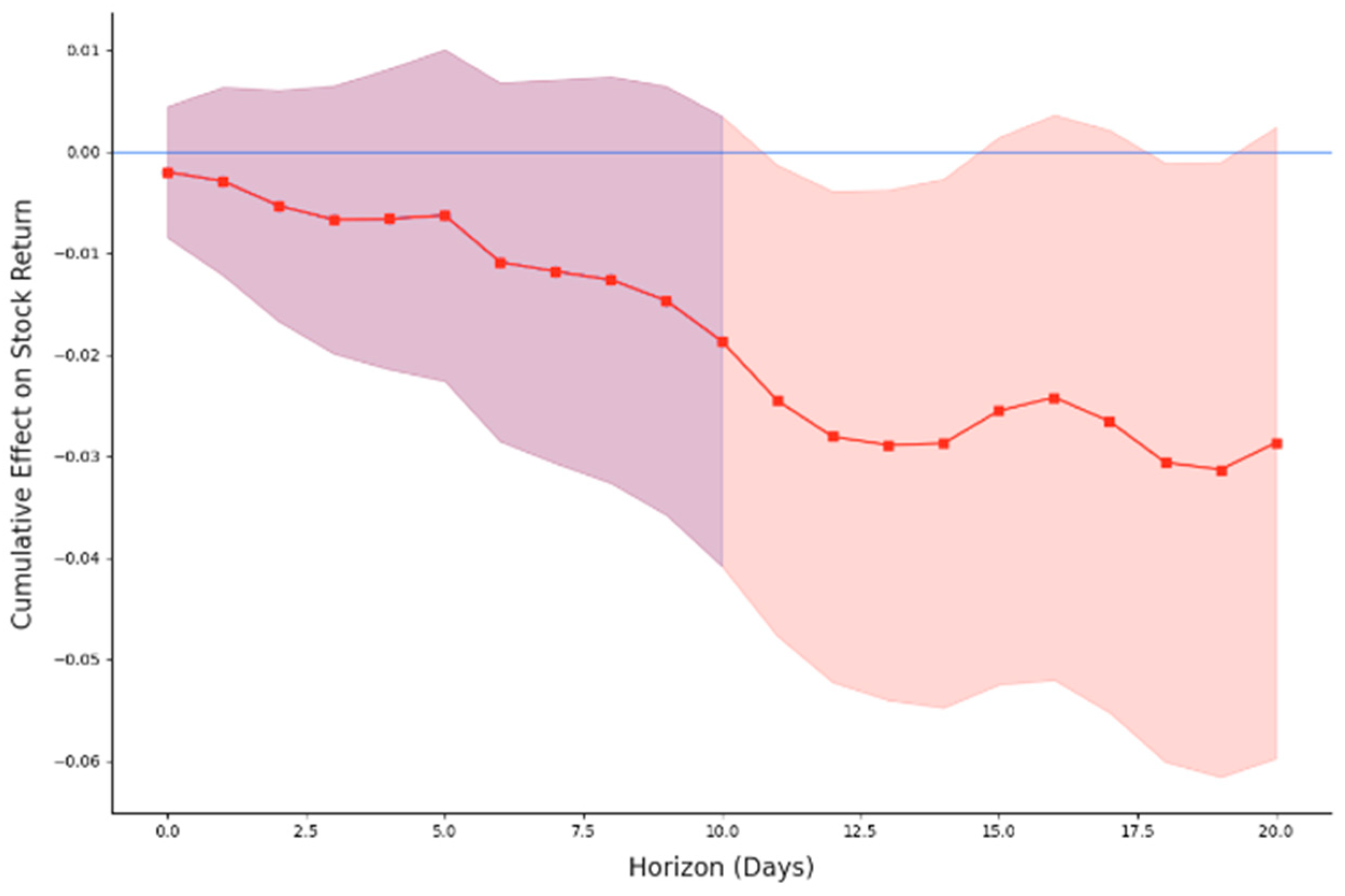

Figure 9, we trace the dynamic effects of these appointments on stock returns over ten-day and twenty-day horizons.

The empirical evidence suggests that the announcement of female board appointments is associated with a modest negative stock price reaction that gradually intensifies over time. Specifically, as presented in

Table 10, we observe an immediate post-announcement effect of approximately −0.20% (day 0), which deepens to −1.87% by the tenth trading day. This pattern is consistent with an initial market skepticism that compounds rather than dissipates in the short term. Notably, the effect becomes marginally significant (

p < 0.1) only at the 10-day horizon, suggesting that the market’s full response materializes gradually rather than instantaneously. This pattern aligns with models of limited attention and information processing constraints (

Hirshleifer & Teoh, 2003;

Cohen & Frazzini, 2008), suggesting that markets may require time to fully process the implications of complex governance changes, particularly in novel institutional contexts.

Several interpretations warrant consideration. First, the negative reaction may reflect investor uncertainty about the impact of gender diversity on firm performance in a traditionally male-dominated business environment. Second, it could indicate concerns about potential disruptions to established board dynamics or decision-making processes. Third, the reaction might stem from investors’ perceptions that these appointments are primarily compliance-driven responses to regulatory pressures rather than strategic governance decisions.

The temporal dimension of our findings, with effects strengthening rather than attenuating over time, is particularly noteworthy. This pattern suggests that market participants may be engaging in a process of collective reassessment, potentially influenced by peer reactions or the gradual incorporation of information beyond the initial announcement. The absence of a rapid price correction indicates that the market’s initial skepticism is not immediately countered by offsetting positive information.

These results highlight the potential short-term costs that firms may incur when increasing board diversity in contexts where such changes represent significant departures from established norms. Corporate leaders should recognize that while the long-term benefits of diversity may eventually materialize, firms may face adverse market reactions in the immediate aftermath of such appointments.

In conclusion, the Local Projections (LP) method complements our event study by uncovering dynamic and horizon-specific effects that traditional approaches may obscure. Unlike the event study, which assumes an immediate and possibly symmetric market response within a fixed event window, LP relaxes these constraints and allows us to trace the evolution of stock returns over time following female board appointments. This flexibility is critical in our context, where investor reactions are likely to adjust gradually due to informational frictions, cultural factors, or institutional novelty.

Specifically, our LP results reveal that the negative market response emerges slowly and becomes marginally significant only by the tenth trading day—an effect not fully captured in the cumulative abnormal returns framework. LP also eliminates dependence on an arbitrary estimation window and provides direct statistical inference for each horizon, making it more robust in settings where the timing and persistence of effects are uncertain. This method, therefore, strengthens the evidence that investors do not immediately internalize the implications of board diversity but update their expectations over time.

In emerging markets like Saudi Arabia, where board gender diversity remains a relatively recent phenomenon, this dynamic framework is particularly appropriate. LP allows us to capture patterns of investor learning and reassessment that would be missed using static event windows alone.

5.3. Dynamic Evolution of Market Perceptions

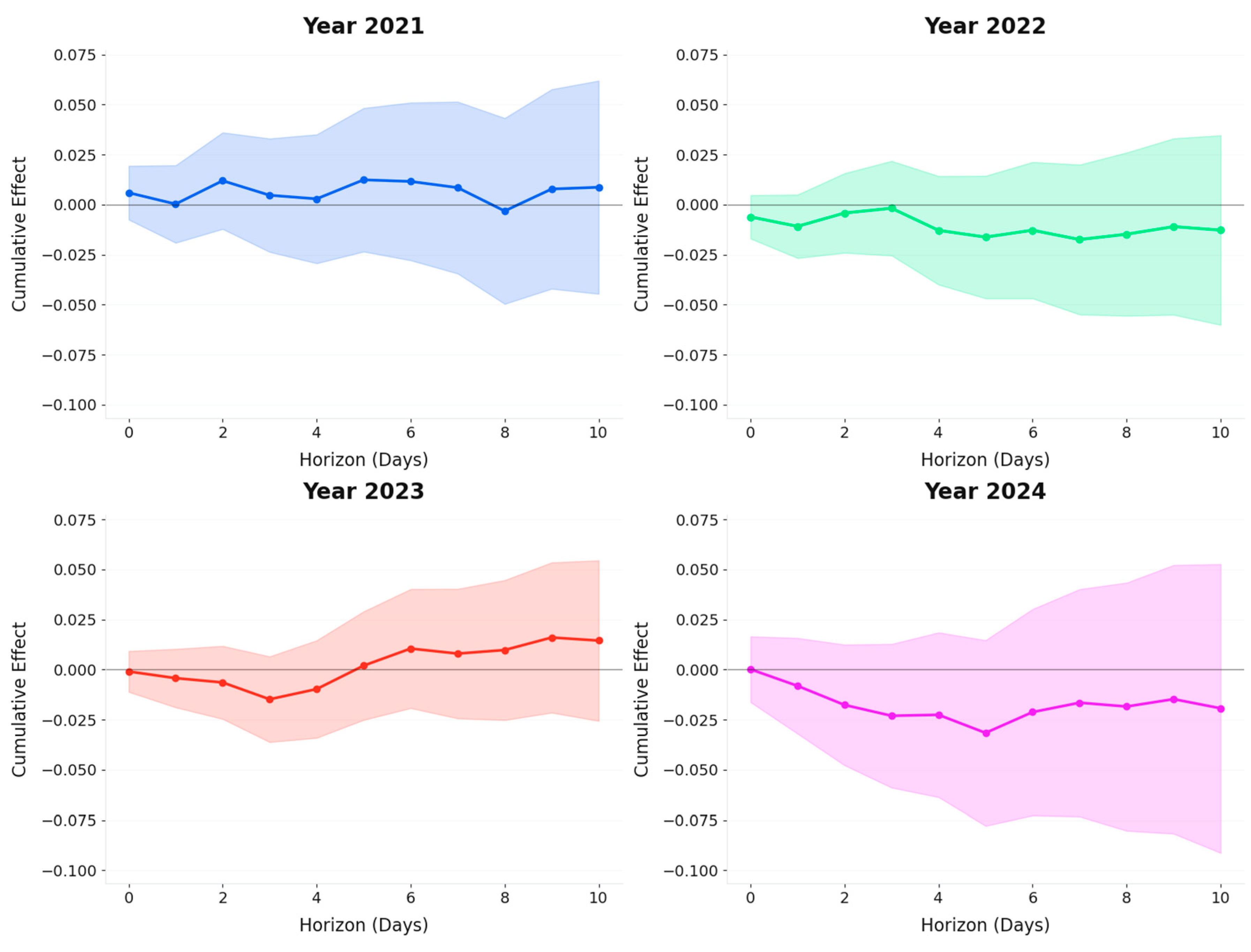

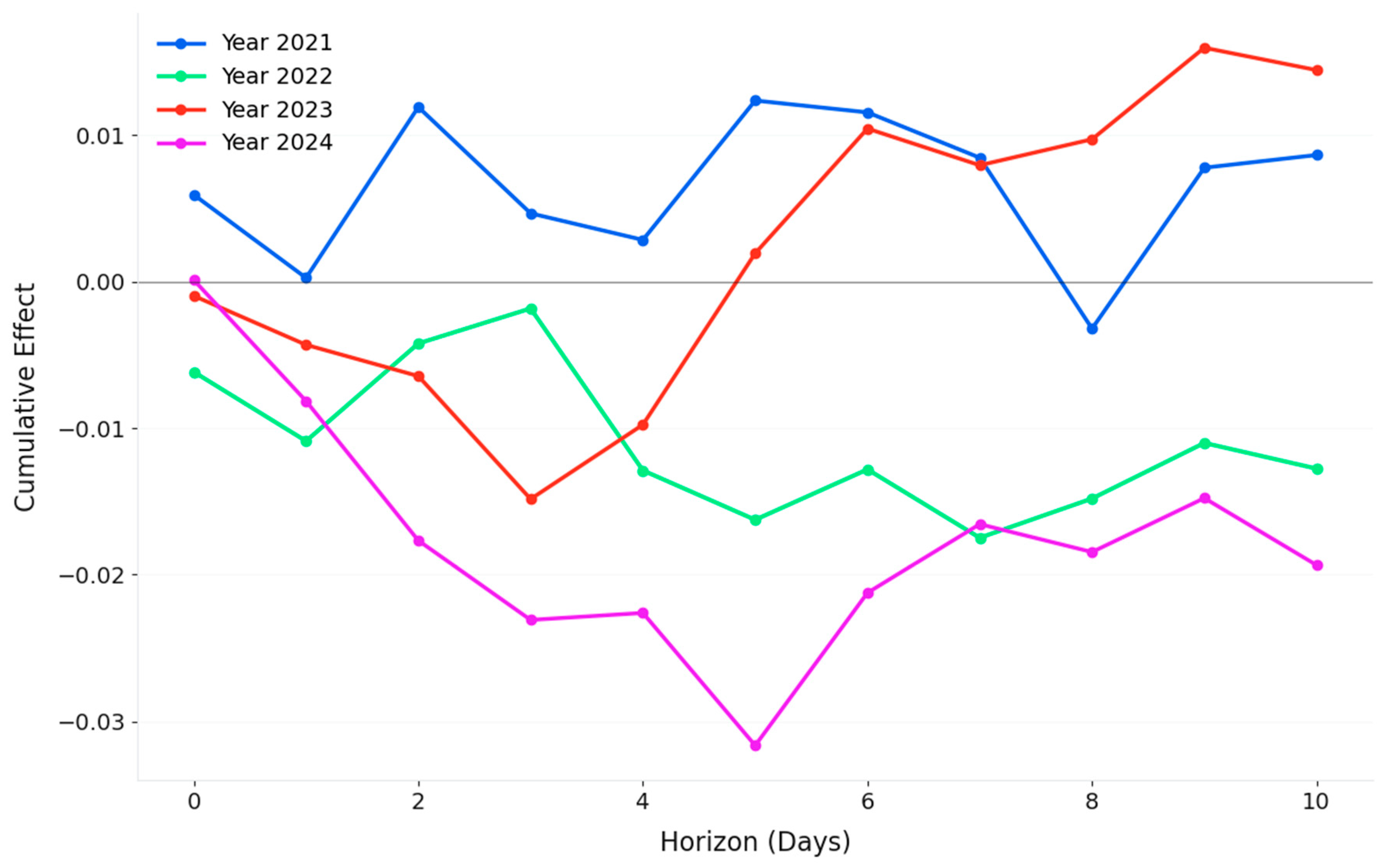

To capture the dynamic evolution of market perceptions regarding the new female board appointments, we conduct our investigation again, this time, year by year. The graphical representation of cumulative market reactions to female board appointments in Saudi Arabia from 2021 to 2024, as shown in

Figure 10, reveals a nuanced and evolving pattern of investor responses that changes over time and in different contexts. These findings provide valuable insights into how market perceptions have shifted during a critical period of corporate governance reform in the Kingdom.

In 2021, we observed a predominantly positive market reaction across all horizons, with cumulative effects reaching approximately +0.86% by the tenth day following appointment announcements. This initial positive response suggests that investors initially viewed female board appointments as potentially value enhancing, possibly reflecting optimism about the implementation of Vision 2030 reforms, particularly those encouraging gender inclusion in leadership roles and the anticipated benefits of increased board diversity. The introduction of ESG reporting guidelines by the Saudi Capital Market Authority that same year may have also contributed to the favorable sentiment, as investors viewed female board appointments as a signal of progressive governance alignment. However, the wide confidence intervals indicate considerable uncertainty in these estimates, suggesting heterogeneous market reactions during this early phase of reform implementation.

A marked shift occurred in 2022, where the cumulative effect turns negative across all horizons, reaching approximately −1.28% by day ten. This reversal may reflect a reassessment by investors as the market accumulated more information about the practical implications of these governance changes. The narrower confidence intervals relative to 2021 suggest more consistent market reactions, potentially indicating a convergence of investor expectations regarding the impact of female board appointments. However, this period also coincides with a highly volatile global and regional environment, including a spike in oil prices and heightened geopolitical uncertainty. Increased risk aversion during this time may have led investors to perceive governance changes, particularly those seen as symbolic, as distractions from core performance objectives.

By 2023, we observe a moderation in the market response, with the cumulative effect returning to a more positive position of approximately +1.44% by day ten. This represents the strongest positive reaction observed across our study period and may indicate an emerging market recognition of potential value creation through board diversity. As board diversity becomes more common and as firms demonstrate continuity in performance post-appointment, markets may begin to recalibrate their initial skepticism. Most importantly, the normalization of female appointments in this period may have diluted the signaling effect of such events, shifting investor focus towards individual qualifications rather than gender alone. The relatively narrow confidence intervals further suggest a more uniform market assessment during this period.

However, the negative trend intensifies again in 2024, with the cumulative effect reaching approximately −1.94% by the tenth day. The most pronounced negative reaction observed across all years occurs on day 5, with a decrease of over 3% and wider confidence intervals. This strengthening negative response may reflect growing investor skepticism regarding the immediate performance benefits of gender diversity initiatives or concerns about disruption to established governance practices, possibly due to cumulative disappointment or unmet performance expectations from earlier appointments. The decline also occurs amid ongoing macro uncertainty and regional political tensions. In this environment, changes in board composition may once again be viewed as introducing risk rather than value.

This temporal evolution, presented in

Table 11, reveals a fascinating learning process in the Saudi market. The trajectory from initial optimism (2021) to pronounced skepticism (2022–2024) and eventual recalibration (2023) suggests that investor perceptions have undergone significant adjustments as the market has gained experience with female board representation. This pattern aligns with an adaptive expectations framework, where market participants continuously update their assessments based on accumulated evidence and experience.

Several factors may explain this evolutionary pattern. First, the initial positive reaction might reflect market enthusiasm about Saudi Arabia’s modernization agenda, with female board appointments viewed as a signal of progressive governance practices that could attract international investment. The subsequent negative reaction could represent a “reality check” phase, where investors reassessed their expectations against early performance outcomes. The moderation might indicate a maturation in market understanding, where appointments are evaluated more on their specific merits rather than as general signals about firm governance.

These findings contribute to the broader literature on market reactions to board diversity initiatives by highlighting the dynamic nature of investor responses in an emerging market context undergoing significant institutional transformation. Unlike studies in developed markets that often find stable reaction patterns, our results emphasize how market perceptions can evolve substantially over relatively short periods in rapidly changing institutional environments.

For Saudi Arabia, these results suggest that the market’s assessment of gender diversity initiatives is still evolving. The moderation observed in 2023 may indicate that as female board representation becomes more normalized, investor reactions will increasingly depend on appointees’ specific qualifications and contributions rather than on gender alone. This highlights the importance of emphasizing the director’s qualifications and strategic fit in appointment announcements to shape market perceptions positively.

Nevertheless, although our current model focuses on firm-level responses, we have to acknowledge that macroeconomic variables, economic uncertainties, and geopolitical risks that characterized the 2021–2024 period may also shape investor reactions (

Ayadi & Ben Mbarek, 2025). Due to the limited sample size, particularly in year-specific subsamples, we have not incorporated these variables into a formal regression model. However, we highlight them as important directions for future research. A panel data approach with interaction terms could help disentangle the roles of director characteristics, firm fundamentals, and macro conditions in driving market response to governance changes.

Overall, the temporal evolution captured in

Figure 9 is not random. It reflects market behavior shaped by the intersection of regulatory change, social norms, economic cycles, and informational asymmetries. As board diversity policies advance, we expect market reactions to become increasingly dependent on director-specific qualifications and firm context, rather than the gender signal alone.

However, while the Local Projections approach allows us to track the dynamic evolution of average treatment effects over time, it does not account for heterogeneity across firms. To address this, we extend our analysis using quantile regression, which captures how market reactions to female board appointments vary across different segments of the stock return distribution. This step is crucial for identifying whether certain types of firms—or specific market phases—amplify or dampen investor responses.

6. Quantile Regression: Capturing Asymmetries in Investor Behavior

Building on our analysis with the Local Projections method, which provided valuable insights into the dynamic response of stock returns to market signals and event-related shocks, we now extend our investigation by employing a quantile regression framework. While local projections offer a robust approach for capturing average dynamic effects, quantile regression enables us to explore the heterogeneous effects across the entire distribution of stock returns. This new analysis is essential as it clarifies the impact of market conditions and event-specific interactions at various quantile levels. It enhances our understanding of nonlinear and asymmetrical responses in financial markets. It provides complementary information that enriches the primary Local Projections analysis. It goes beyond merely confirming or refuting the average effect to offer a nuanced view. Discovering significant heterogeneity via quantile regression adds depth and context, leading to more robust and credible overall conclusions about the effect of women board appointments on the Saudi stock market. Quantile regression is employed to complement our earlier findings by capturing heterogeneity in stock return responses that standard event study and Local Projection methods may miss.

We began by estimating the following equation to capture the different impacts at various performance levels:

Event represents the woman’s appointment on the board; anticipation signifies the period “before” the appointment (5 days); adjustment denotes the period “after” the appointment (5 days); and MKT represents the market return.

Next, to further understand how market conditions shape investor responses to female board appointments, and to investigate the evidence of the moderating role of market conditions on the relationship between our key determinant variables and stock returns, as well as to capture any interaction effects, we adopt the following specification:

Equation (8) includes interaction terms between the event, anticipation, and adjustment periods and daily market return, as well as a squared market return term. The purpose of this quadratic term is to explore and capture nonlinear moderation and dynamics, particularly whether extreme market conditions—either bullish or bearish—amplify or dampen investor reactions to board diversity announcements. This inclusion is theoretically grounded in the behavioral finance literature. Prior work suggests that investor responses to corporate events are often asymmetric under different market regimes (

Kahneman & Tversky, 2013). For example, positive governance signals may be overreacted to in bull markets or disregarded in bear markets. The squared market return term allows us to model such nonlinearities explicitly.

By examining the effects before, during, and after appointment events, we gain valuable insights into market efficiency and investor sentiment about board diversity.

6.1. The Primary Equation Results

The quantile regression analysis shown in

Figure 11 and

Table 12 reveals nuanced patterns in how stock returns respond to women board appointments across various segments of the return distribution.

The anticipation variable, which captures market reactions in the periods leading up to women board appointments, shows a predominantly negative association with stock returns. This relationship is especially pronounced at the 0.2 quantile, where it reaches statistical significance. The negative coefficients indicate that markets may anticipate these governance changes and incorporate this information into pricing decisions prior to formal announcements.

This finding aligns with semi-strong market efficiency theories, indicating that information about potential board appointments may leak into markets through informal channels or be anticipated based on corporate governance trends. The more substantial effect at lower quantiles suggests that poorly performing stocks may be more sensitive to anticipated governance changes, possibly reflecting investor expectations that underperforming firms are more likely to alter board composition as a remedial strategy.

The event variable, which represents the immediate impact of women board appointments, consistently exhibits negative coefficients across all quantiles of the return distribution. While these effects do not reach statistical significance at conventional levels for most quantiles, the persistent negative direction warrants attention. The magnitude of these negative coefficients appears more pronounced and statistically significant at higher quantiles (0.8–0.9), suggesting that high-performing stocks may experience stronger immediate reactions to women’s board appointments. This pattern could reflect market uncertainty regarding how these appointments might affect already-successful firms or possibly indicate short-term adjustment costs associated with board transitions that investors temporarily price into returns.

The adjustment variable, which captures market reactions in periods following women board appointments, reveals an intriguing transition from negative coefficients at lower quantiles to positive coefficients at higher quantiles. Although statistically significant only for the second and seventh quantiles, this directional shift suggests a differential market response based on the firm’s position in the return distribution. For underperforming stocks (lower quantiles), the continued negative effect may reflect investor skepticism about whether board diversity alone can address fundamental performance issues. Conversely, for outperforming stocks (higher quantiles), the positive coefficients indicate that markets may gradually recognize the potential benefits of diverse leadership in already-successful firms, leading to favorable post-appointment adjustments in valuation.

The market return variable demonstrates a strong, statistically significant positive relationship with stock returns across all quantiles, confirming the dominant influence of broader market movements on individual stock performance. The effect is particularly pronounced at the lowest quantile (0.1), underscoring that poorly performing stocks remain highly sensitive to overall market conditions despite firm-specific governance changes.