Sustainable Investments in the Blue Economy: Leveraging Fintech and Adoption Theories

Abstract

1. Introduction

2. Grounding Theories and Literature Review

2.1. Diffusion of Innovation Theory (DOI)

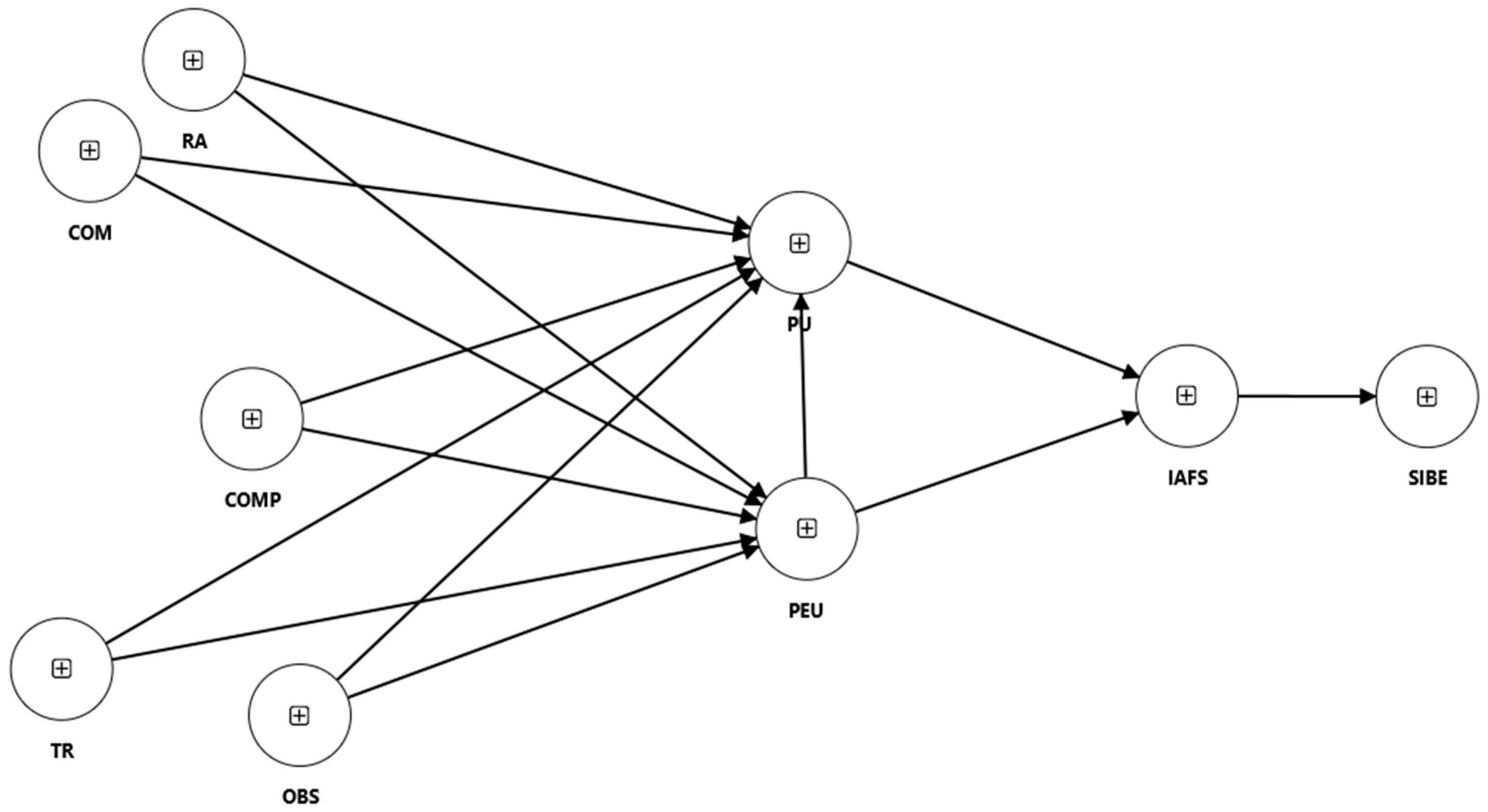

2.2. Technology Acceptance Model (TAM)

2.3. Intention to Adopt Fintech Services (IAFS)

2.4. Sustainable Investment Decisions in the Blue Economy (SIBE)

2.5. Hypothesis Development

3. Research Methods

- Academic experts: four professors and researchers from leading universities in India and internationally, specializing in fintech, sustainable finance, and technology adoption models, with a focus on applications within the blue economy;

- Industry experts: four professionals from the fintech sector, including senior executives, product managers, and consultants with practical experience in fintech solutions and their implementation in sustainable investment contexts, particularly within the blue economy.

- A total of 224 responses were accurately completed and considered valid for analysis;

- A total of 124 responses were excluded due to incomplete or improperly completed questionnaires;

- A total of 52 questionnaires did not receive any response and were consequently excluded from the examination.

- Factor analysis was conducted to validate the constructs and ensure that the items were loaded appropriately onto their respective factors. Factor analysis helped to confirm that the questionnaire items accurately represented the underlying theoretical constructs;

- Reliability analysis was completed to assess the internal consistency of the constructs. This analysis ensured that the items within each construct reliably measured the same fundamental concept, typically evaluated using Cronbach’s alpha;

- Regression analysis was used to test the associations between the latent variables and validate the hypothetical model. This step involved inspecting the direct and indirect effects of the constructs on each other, thereby providing insights into the merits and direction of these relationships.

4. Results

4.1. Sample Demographics

4.2. Structural Model and Discriminant Validity

4.3. Hypothesis Testing Results

5. Discussion

6. Conclusions

6.1. Theoretical Implications

6.2. Practical Implications

6.3. Study Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Constructs | Statements |

|---|---|

| Relative Advantage (Al-Rahmi et al., 2021; Sin et al., 2016; Yoon et al., 2020) | Fintech services offer significant advantages over traditional investment methods. |

| Using fintech platforms saves me time in managing my investments. | |

| Fintech tools provide better insights into market trends than other methods. | |

| Fintech services enhance the overall efficiency of my investment activities. | |

| The benefits of fintech services outweigh those of traditional investment methods. | |

| Compatibility (Gomber et al., 2017; Thiele & Gerber, 2017) | Fintech services fit well with my existing investment strategies. |

| The fintech platforms I use are compatible with my financial goals. | |

| Fintech services integrate seamlessly into my current investment processes. | |

| Fintech services align with my investment preferences and habits. | |

| The use of fintech services complements my overall financial planning. | |

| Complexity (Färe et al., 1994; Gai et al., 2017; Liu et al., 2024) | Fintech platforms seem too complex for my investment needs. |

| It is difficult to understand how to use fintech solutions effectively. | |

| Fintech tools require significant effort to operate efficiently. | |

| The complexity of fintech services hinders my ability to use them. | |

| I find it challenging to navigate fintech platforms. | |

| Trialability (Park, 2024; Roh et al., 2024; Yoon et al., 2020) | I had the opportunity to try out fintech services before fully adopting them. |

| Fintech services allow me to experiment with different features before committing to them. | |

| The ability to try fintech solutions before adoption increased my confidence in using them. | |

| Trial periods for fintech services help me understand their benefits. | |

| I value the option to test fintech services before making a full commitment. | |

| Observability (Park, 2024; Rashidi et al., 2015; Valizadeh et al., 2020; Yoon et al., 2020) | The benefits of using fintech services are clear and visible in my investment outcomes. |

| The success of fintech platforms is evident from their performance in sustainable investments. | |

| Fintech services provide visible improvements to my investment strategies. | |

| I can easily observe the positive impact of fintech services on my investments. | |

| The results of using fintech services are apparent and measurable. | |

| Perceived Ease of Use (Hendrickson & Latta, 1996; Kumar et al., 2025; Madi et al., 2024) | I find the fintech solution easy to use for sustainable investment decisions. |

| My interaction with the fintech platform is strong and reasonable. | |

| I believe I can quickly learn how to use fintech tools for investments. | |

| The user interface of the fintech platform is intuitive. | |

| Fintech services are user-friendly and straightforward. | |

| Perceived Usefulness (Dahleez et al., 2024; Kumar et al., 2025; Venkatesh & Davis, 2000) | Fintech tools improve my efficiency in making sustainable investment decisions. |

| Using fintech platforms enhances the quality of my investment analysis. | |

| The fintech platform enables me to manage my investments more effectively. | |

| Fintech services provide valuable insights that aid my investment decisions. | |

| The usefulness of fintech tools positively impacts my investment performance. | |

| Intention to Adopt Fintech Services (Bajunaied et al., 2023; Senyo & Osabutey, 2020) | I plan to adopt fintech services for sustainable investments. |

| I intend to utilize fintech services for handling my financial transactions in the future. | |

| I am considering using fintech services to improve my investment strategies. | |

| I intend to integrate fintech services into my regular financial activities. | |

| I am likely to recommend fintech services to others for investment purposes. | |

| Sustainable Investment Decisions in the Blue economy (Colgan & Scorse, 2020; Pace et al., 2023; Spalding, 2016; Thompson, 2022; Zhang, 2023) | I make investment decisions that consider the sustainability of the blue economy. |

| My investment choices are influenced by the potential environmental impact of my actions. | |

| I prioritize investments that support the conservation and sustainable use of ocean resources. | |

| I focus on sustainable financial decisions that contribute to the growth of the blue economy. | |

| Fintech services help me make more informed sustainable investment decisions. |

References

- Abdul-Rahim, R., Bohari, S. A., Aman, A., & Awang, Z. (2022). Benefit–risk perceptions of FinTech adoption for sustainability from bank consumers’ perspective: The moderating role of fear of COVID-19. Sustainability, 14(14), 8357. [Google Scholar] [CrossRef]

- Ahn, H., & Park, E. (2023). Motivations for user satisfaction of mobile fitness applications: An analysis of user experience based on online review comments. Humanities and Social Sciences Communications, 10(1), 3. [Google Scholar] [CrossRef]

- Alam, S., Omar, N. A., Ariffin, A. A., & Nik Hashim, N. M. H. (2018). Integrating TPB, TAM and DOI theories: An empirical evidence for the adoption of mobile banking among customers in Klang valley, Malaysia. International Journal of Business and Management Science, 8, 385–403. [Google Scholar]

- Alamsyah, D. P., Mazia, L., Hakim, L., Sukajie, B., Noor, C. M., & Solihat, A. (2021). Utilization of technology and perceived complexity. In 2nd south American international conference on industrial engineering and operations management (pp. 1004–1010). IEOM Society International. [Google Scholar] [CrossRef]

- Al-Rahmi, W. M., Yahaya, N., Alamri, M. M., Alyoussef, I. Y., Al-Rahmi, A. M., & Kamin, Y. B. (2021). Integrating innovation diffusion theory with technology acceptance model: Supporting students’ attitude towards using a massive open online courses (MOOCs) systems. Interactive Learning Environments, 29(8), 1380–1392. [Google Scholar] [CrossRef]

- Amnas, M. B., Selvam, M., Raja, M., Santhoshkumar, S., & Parayitam, S. (2023). Understanding the determinants of FinTech adoption: Integrating UTAUT2 with trust theoretic model. Journal of Risk and Financial Management, 16(12), 505. [Google Scholar] [CrossRef]

- Aysan, A. F., & Bergigui, F. (2021). Sustainability, trust, and blockchain applications in Islamic finance and circular economy: Best practices and fintech prospects. In S. N. Ali, & Z. H. Jumat (Eds.), Islamic finance and circular economy: Connecting impact and value creation (pp. 141–167). Springer. [Google Scholar] [CrossRef]

- Bajunaied, K., Hussin, N., & Kamarudin, S. (2023). Behavioral intention to adopt FinTech services: An extension of unified theory of acceptance and use of technology. Journal of Open Innovation: Technology, Market, and Complexity, 9(1), 100010. [Google Scholar] [CrossRef]

- Bakkabulindi, F. (2014). A call for return to Rogers’ innovation diffusion theory. Makerere Journal of Higher Education, 6(1), 55. [Google Scholar] [CrossRef]

- Baudry, M., Bukowski, S. I., & Lament, M. B. (Eds.). (2024). Financial stability, economic growth and sustainable development. Routledge. [Google Scholar] [CrossRef]

- Bergmann, H., Hundt, C., & Sternberg, R. (2016). What makes student entrepreneurs? On the relevance (and irrelevance) of the university and the regional context for student start-ups. Small Business Economics, 47(1), 53–76. [Google Scholar] [CrossRef]

- Bharadwaj, S. (2021). Behavioural intention towards investment in cryptocurrency: An integration of Rogers’ diffusion of innovation theory and the technology acceptance model. Forum Scientiae Oeconomia, 9, 137–159. [Google Scholar] [CrossRef]

- Bollaert, H., Lopez-de-Silanes, F., & Schwienbacher, A. (2021). Fintech and access to finance. Journal of Corporate Finance, 68, 101941. [Google Scholar] [CrossRef]

- Boot, A., Hoffmann, P., Laeven, L., & Ratnovski, L. (2021). Fintech: What’s old, what’s new? Journal of Financial Stability, 53, 100836. [Google Scholar] [CrossRef]

- Bose, D., & Srinivasan, K. S. (2024). Artificial intelligence-powered competency framework for Robo-advisory services in the era of digital economy. In AI-oriented competency framework for talent management in the digital economy. CRC Press. [Google Scholar]

- Bureshaid, N. K. (2021). An investigation into factors enabling the diffusion and adoption intention of fintech services for bank consumers [Ph.D. thesis, Brunel Business School]. Available online: https://bura.brunel.ac.uk/bitstream/2438/24183/1/FulltextThesis.pdf (accessed on 15 May 2025).

- Capital Market. (2025). News. Available online: https://www.capitalmarket.com/markets/news/economy-news/FM-says-India-has-87percent-Fintech-adoption-rate-compared-to-67percent-globally/1612672?utm_source=chatgpt.com (accessed on 9 March 2025).

- Cheung, K. K. C., Pun, J. K. H., & Li, W. (2024). Students’ holistic reading of socio-scientific texts on climate change in a ChatGPT scenario. Research in Science Education, 54(5), 957–976. [Google Scholar] [CrossRef]

- Cohen, J. (1988). Statistical power analysis for the behavioral sciences (2nd ed.). L. Erlbaum Associates. [Google Scholar]

- Colgan, C. S., & Scorse, J. (2020). Ocean climate policy. In The Palgrave handbook of climate resilient societies (pp. 1–22). Springer International Publishing. [Google Scholar] [CrossRef]

- Dadabada, P. K. (2025). Analyzing the impact of ESG integration and FinTech innovations on green finance: A comparative case studies approach. Journal of the Knowledge Economy, 16, 7959–7978. [Google Scholar] [CrossRef]

- Dahleez, K., Abdelfattah, F., Al Halbusi, H., Salah, M., & Madi, H. (2024). An investigation of government involvement and green information systems in driving management practices. In B. Alareeni, & A. Hamdan (Eds.), Navigating the technological tide: The evolution and challenges of business model innovation (pp. 327–335). Springer Nature. [Google Scholar] [CrossRef]

- Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly, 13(3), 319. [Google Scholar] [CrossRef]

- Davis, F. D. (1993). User acceptance of information technology: System characteristics, user perceptions and behavioral impacts. International Journal of Man-Machine Studies, 38(3), 475–487. [Google Scholar] [CrossRef]

- Dorfleitner, G., Hornuf, L., Schmitt, M., & Weber, M. (2017). FinTech in Germany. Springer International Publishing. [Google Scholar] [CrossRef]

- Dwianto, A., Rahman, A. N., Ulynnuha, O. I., Anam, K., & Saif, G. M. S. (2024). The impact of technology readiness, usefulness, and ease of use on AI-based accounting software adoption. Advances in Accounting Innovation, 1(1), 10–11. [Google Scholar] [CrossRef]

- Färe, R., Grosskopf, S., Norris, M., & Zhang, Z. (1994). Productivity growth, technical progress, and efficiency change in industrialized countries. The American Economic Review, 84(1), 66–83. [Google Scholar]

- Fishbein, M., & Ajzen, I. (1975). Belief, attitude, intention and behavior: An introduction to theory and research. Addison-Wesley. [Google Scholar]

- Gai, K., Qiu, M., Sun, X., & Zhao, H. (2017). Security and privacy issues: A survey on FinTech. In M. Qiu (Ed.), Smart computing and communication (pp. 236–247). Springer International Publishing. [Google Scholar] [CrossRef]

- Ganjipour, H., & Edrisi, A. (2023a). Applying the integrated model to understanding online buyers’ intention to adopt delivery drones in Iran. Transportation Letters, 15(2), 98–110. [Google Scholar] [CrossRef]

- Ganjipour, H., & Edrisi, A. (2023b). Consumers’ intention to use delivery robots in Iran: An integration of NAM, DOI, and TAM. Case Studies on Transport Policy, 13, 101024. [Google Scholar] [CrossRef]

- Gomber, P., Koch, J.-A., & Siering, M. (2017). Digital finance and FinTech: Current research and future research directions. Journal of Business Economics, 87(5), 537–580. [Google Scholar] [CrossRef]

- Gosain, S. (2004). Enterprise information systems as objects and carriers of institutional forces: The new iron cage? Journal of the Association for Information Systems, 5, 151–182. [Google Scholar] [CrossRef]

- Gregor, S., & Benbasat, I. (1999). Explanations from intelligent systems: Theoretical foundations and implications for practice. MIS Quarterly, 23(4), 497–530. [Google Scholar] [CrossRef]

- Grover, P., Kar, A. K., Janssen, M., & Ilavarasan, P. V. (2019). Perceived usefulness, ease of use and user acceptance of blockchain technology for digital transactions—Insights from user-generated content on Twitter. Enterprise Information Systems, 13(6), 771–800. [Google Scholar] [CrossRef]

- Gupta, K., Wajid, A., & Gaur, D. (2024). Determinants of continuous intention to use FinTech services: The moderating role of COVID-19. Journal of Financial Services Marketing, 29(2), 536–552. [Google Scholar] [CrossRef]

- Ha, L. T. (2024). Gauging the dynamic interlinkage level between Fintech and the global blue economy performance. Journal of Economic Studies, 52, 55–71. [Google Scholar] [CrossRef]

- Hafner, S., Jones, A., Anger-Kraavi, A., & Pohl, J. (2020). Closing the green finance gap—A systems perspective. Environmental Innovation and Societal Transitions, 34, 26–60. [Google Scholar] [CrossRef]

- Hair, J., & Alamer, A. (2022). Partial Least Squares Structural Equation Modeling (PLS-SEM) in second language and education research: Guidelines using an applied example. Research Methods in Applied Linguistics, 1(3), 100027. [Google Scholar] [CrossRef]

- Hair, J., Hollingsworth, C. L., Randolph, A. B., & Chong, A. Y. L. (2017). An updated and expanded assessment of PLS-SEM in information systems research. Industrial Management & Data Systems, 117(3), 442–458. [Google Scholar] [CrossRef]

- Hair, J. F., Risher, J. J., Sarstedt, M., & Ringle, C. M. (2019). When to use and how to report the results of PLS-SEM. European Business Review, 31(1), 2–24. [Google Scholar] [CrossRef]

- Hendrickson, A. R., & Latta, P. D. (1996). An evaluation of the reliability and validity of Davis’ perceived usefulness and perceived ease of use instrument. Journal of Computer Information Systems, 36(3), 77–82. Available online: https://www.tandfonline.com/doi/abs/10.1080/08874417.1996.11647210 (accessed on 23 February 2025).

- Henseler, J. (2017). Bridging design and behavioral research with variance-based structural equation modeling. Journal of Advertising, 46(1), 178–192. [Google Scholar] [CrossRef]

- Henseler, J., Ringle, C. M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science, 43(1), 115–135. [Google Scholar] [CrossRef]

- Holden, R. J., McDougald Scott, A. M., Hoonakker, P. L. T., Hundt, A. S., & Carayon, P. (2015). Data collection challenges in community settings: Insights from two field studies of patients with chronic disease. Quality of Life Research: An International Journal of Quality of Life Aspects of Treatment, Care and Rehabilitation, 24(5), 1043–1055. [Google Scholar] [CrossRef] [PubMed]

- Hu, L., Joyce Lin, J.-Y., & Ji, J. (2021). Variable selection with missing data in both covariates and outcomes: Imputation and machine learning. Statistical Methods in Medical Research, 30(12), 2651–2671. [Google Scholar] [CrossRef]

- Jagtiani, J., & Lemieux, C. (2019). The roles of alternative data and machine learning in fintech lending: Evidence from the LendingClub consumer platform. Financial Management, 48(4), 1009–1029. [Google Scholar] [CrossRef]

- Jahangir, W., & Zia-ul-Haq. (2023). Integrating technology acceptance model, theory of diffusion of innovations and theory of planned behaviour to study the adoption of Facebook marketplace. NMIMS Management Review, 31(3), 214–222. [Google Scholar] [CrossRef]

- Jain, R., Kumar, S., Sood, K., Grima, S., & Rupeika-Apoga, R. (2023). A systematic literature review of the risk landscape in Fintech. Risks, 11(2), 36. [Google Scholar] [CrossRef]

- Jangir, K., Sharma, V., Taneja, S., & Rupeika-Apoga, R. (2022). The moderating effect of perceived risk on users’ continuance intention for FinTech services. Journal of Risk and Financial Management, 16(1), 21. [Google Scholar] [CrossRef]

- Jetzek, T. (2017). Innovation in the open data ecosystem: Exploring the role of real options thinking and multi-sided platforms for sustainable value generation through open data. In E. G. Carayannis, & S. Sindakis (Eds.), Analytics, innovation, and excellence-driven enterprise sustainability (pp. 137–168). Palgrave Macmillan. [Google Scholar] [CrossRef]

- Jha, S., & Dangwal, R. C. (2024). Fintech services and financial inclusion: A systematic literature review of developing nations. Journal of Science and Technology Policy Management. ahead-of-print. [Google Scholar] [CrossRef]

- Julious, S. A. (2005). Sample size of 12 per group rule of thumb for a pilot study. Pharmaceutical Statistics, 4(4), 287–291. [Google Scholar] [CrossRef]

- Kang, H. (2021). Sample size determination and power analysis using the G*Power software. Journal of Educational Evaluation for Health Professions, 18, 17. [Google Scholar] [CrossRef] [PubMed]

- Kock, N. (2015). Common method bias in PLS-SEM: A full collinearity assessment approach. International Journal of e-Collaboration, 11(4), 1–10. [Google Scholar] [CrossRef]

- KPMG. (2024). Unlocking India’s blue economy: A pathway to sustainable growth and prosperity. KPMG. Available online: https://kpmg.com/in/en/blogs/2024/10/unlocking-indias-blue-economy-a-pathway-to-sustainable-growth-and-prosperity.html (accessed on 23 February 2025).

- Kumar, A., Haldar, P., & Chaturvedi, S. (2025). Factors influencing intention to continue use of e-wallet: Mediating role of perceived usefulness. Vilakshan—XIMB Journal of Management, 22, 45–61. [Google Scholar] [CrossRef]

- Laidroo, L., Koroleva, E., Kliber, A., Rupeika-Apoga, R., & Grigaliuniene, Z. (2021). Business models of FinTechs—Difference in similarity? Electronic Commerce Research and Applications, 46, 101034. [Google Scholar] [CrossRef]

- Lee, I., & Shin, Y. J. (2018). Fintech: Ecosystem, business models, investment decisions, and challenges. Business Horizons, 61(1), 35–46. [Google Scholar] [CrossRef]

- Liu, Q., Chan, K.-C., & Chimhundu, R. (2024). Fintech research: Systematic mapping, classification, and future directions. Financial Innovation, 10(1), 24. [Google Scholar] [CrossRef]

- Lun, R., Liu, W., Li, G., & Luo, Q. (2024). Does digital agricultural technology extension service enhance sustainable food production? Evidence from maize farmers in China. Agriculture, 14(2), 292. [Google Scholar] [CrossRef]

- Madi, J., Khasawneh, M. A., & Dandis, A. O. (2024). Visiting and revisiting destinations: Impact of augmented reality, content quality, perceived ease of use, perceived value and usefulness on E-WOM. International Journal of Quality & Reliability Management, 41(6), 1550–1571. [Google Scholar] [CrossRef]

- Mahmud, K., Joarder, M. M. A., & Muheymin-Us-Sakib, K. (2022). Adoption factors of FinTech: Evidence from an emerging economy country-wide representative sample. International Journal of Financial Studies, 11(1), 9. [Google Scholar] [CrossRef]

- Ministry of Shipping, GOI, Government of India. (2025). SagarMala. Available online: https://sagarmala.gov.in/ (accessed on 13 May 2025).

- Montiel, I., Cuervo-Cazurra, A., Park, J., Antolín-López, R., & Husted, B. W. (2021). Implementing the United Nations’ sustainable development goals in international business. Journal of International Business Studies, 52(5), 999. [Google Scholar] [CrossRef]

- Moore, G. C., & Benbasat, I. (1991). Development of an instrument to measure the perceptions of adopting an information technology innovation. Information Systems Research, 2(3), 192–222. [Google Scholar] [CrossRef]

- Moore, M., Gelfeld, B., Okunogbe, A. T., & Paul, C. (2016). Identifying future disease hot spots: Infectious disease vulnerability index. RAND Corporation. Available online: https://www.rand.org/pubs/research_reports/RR1605.html (accessed on 8 June 2025).

- Narwal, S., Kaur, M., Yadav, D. S., & Bast, F. (2024). Sustainable blue economy: Opportunities and challenges. Journal of Biosciences, 49(1), 18. [Google Scholar] [CrossRef]

- Nizar, N. N. M., Zulnaidi, H., Basar, A., & Maaruf, S. Z. (2024). A structural model of pre-service teachers’ attitude, acceptance, and continuance intention towards mobile augmented reality. Contemporary Educational Technology, 16(4), ep531. [Google Scholar] [CrossRef] [PubMed]

- Novaglio, C., Bryndum-Buchholz, A., Tittensor, D. P., Eddy, T. D., Lotze, H. K., Harrison, C. S., Heneghan, R. F., Maury, O., Ortega-Cisneros, K., Petrik, C. M., Roberts, K. E., & Blanchard, J. L. (2024). The past and future of the fisheries and marine ecosystem model intercomparison project. Earth’s Future, 12(9), e2023EF004398. [Google Scholar] [CrossRef]

- Pace, L. A., Saritas, O., & Deidun, A. (2023). Exploring future research and innovation directions for a sustainable blue economy. Marine Policy, 148, 105433. [Google Scholar] [CrossRef]

- Park, E. (2024). Examining metaverse game platform adoption: Insights from innovation, behavior, and coolness. Technology in Society, 77, 102594. [Google Scholar] [CrossRef]

- Pokhrel, L., & K.C., A. (2024). Mobile banking service quality and continuance intention: Mediating role of satisfaction: A two-stage structural equation modeling-artificial neural network approach. International Journal of Bank Marketing, 42(3), 389–413. [Google Scholar] [CrossRef]

- Poorangi, M., Wong, E., Nikoonejad, S., & Kardevani, A. (2013). E-commerce adoption in Malaysian small and medium enterprises practitioner firms: A revisit on rogers’ model. Anais Da Academia Brasileira de Ciências, 185, 1593–1604. [Google Scholar] [CrossRef]

- Putra, T. R. I., Yunus, M., & Fakhreza, T. H. (2021). Total quality management in affecting company operational performance in convection Smes with organizational commitment as a mediator. Jurnal Aplikasi Manajemen, 19(3), 662–677. [Google Scholar] [CrossRef]

- Rahman, M., Ming, T. H., Baigh, T. A., & Sarker, M. (2023). Adoption of artificial intelligence in banking services: An empirical analysis. International Journal of Emerging Markets, 18(10), 4270–4300. [Google Scholar] [CrossRef]

- Rashidi, F., Abiri, E., Niknam, T., & Salehi, M. R. (2015). Optimal placement of PMUs with limited number of channels for complete topological observability of power systems under various contingencies. International Journal of Electrical Power & Energy Systems, 67, 125–137. [Google Scholar] [CrossRef]

- Remer, L. (2023). Sustainable investment. In S. O. Idowu, R. Schmidpeter, N. Capaldi, L. Zu, M. Del Baldo, & R. Abreu (Eds.), Encyclopedia of sustainable management (pp. 3550–3553). Springer International Publishing. [Google Scholar] [CrossRef]

- Rogers, E. M. (1962). Diffusion of innovations (Macmillan). Free P. of Glencoe. [Google Scholar]

- Rogers, E. M. (2003). Diffusion of innovations (5th ed.). Simon and Schuster. [Google Scholar]

- Roh, T., Yang, Y. S., Xiao, S., & Park, B. I. (2024). What makes consumers trust and adopt fintech? An empirical investigation in China. Electronic Commerce Research, 24(1), 3–35. [Google Scholar] [CrossRef]

- Rupeika-Apoga, R., & Wendt, S. (2022). FinTech development and regulatory scrutiny: A contradiction? The case of Latvia. Risks, 10(9), 167. [Google Scholar] [CrossRef]

- Sanchez, M., Exposito, E., & Aguilar, J. (2020). Industry 4.0: Survey from a system integration perspective. International Journal of Computer Integrated Manufacturing, 33(10–11), 1017–1041. [Google Scholar] [CrossRef]

- Selamoglu, M. (2021). Blue economy and blue ocean strategy. Journal of Ecology & Natural Resources, 5(4), 000263. [Google Scholar] [CrossRef]

- Senyo, P., & Osabutey, E. L. C. (2020). Unearthing antecedents to financial inclusion through FinTech innovations. Technovation, 98, 102155. [Google Scholar] [CrossRef]

- Shahzad, A., Zahrullail, N., Akbar, A., Mohelska, H., & Hussain, A. (2022). COVID-19’s impact on Fintech adoption: Behavioral intention to use the financial portal. Journal of Risk and Financial Management, 15(10), 428. [Google Scholar] [CrossRef]

- Sharma, V., Gupta, M., & Taneja, S. (2024a). Does FinTech adoption impact on sustainability of small businesses: Mediating role of financial well-being. Global Knowledge, Memory and Communication, ahead-of-print. [Google Scholar] [CrossRef]

- Sharma, V., Jangir, K., Gupta, M., & Rupeika-Apoga, R. (2024b). Does service quality matter in FinTech payment services? An integrated SERVQUAL and TAM approach. International Journal of Information Management Data Insights, 4(2), 100252. [Google Scholar] [CrossRef]

- Sin, K. Y., Osman, A., Salahuddin, S. N., Abdullah, S., Lim, Y. J., & Sim, C. L. (2016). Relative advantage and competitive pressure towards implementation of E-commerce: Overview of small and medium enterprises (SMEs). Procedia Economics and Finance, 35, 434–443. [Google Scholar] [CrossRef]

- Singh, S., Sahni, M. M., & Kovid, R. K. (2020). What drives FinTech adoption? A multi-method evaluation using an adapted technology acceptance model. Management Decision, 58(8), 1675–1697. [Google Scholar] [CrossRef]

- Spalding, M. (2016). The new blue economy: The future of sustainability. Journal of Ocean and Coastal Economics, 2(2), 8. [Google Scholar] [CrossRef]

- Taherdoost, H. (2018). A review of technology acceptance and adoption models and theories. Procedia Manufacturing, 22, 960–967. [Google Scholar] [CrossRef]

- Tamasiga, P., Onyeaka, H., & Ouassou, E. h. (2022). Unlocking the green economy in African countries: An integrated framework of FinTech as an enabler of the transition to sustainability. Energies, 15(22), 8658. [Google Scholar] [CrossRef]

- Thiele, T., & Gerber, L. R. (2017). Innovative financing for the High Seas. Aquatic Conservation: Marine and Freshwater Ecosystems, 27(S1), 89–99. [Google Scholar] [CrossRef]

- Thompson, B. S. (2022). Blue bonds for marine conservation and a sustainable ocean economy: Status, trends, and insights from green bonds. Marine Policy, 144, 105219. [Google Scholar] [CrossRef]

- Thottoli, M. M., Islam, M. A., Ahsan, A., Yusof, M. F., Hassan, M. S., & Chowdhury, R. S. (2024). Exploring mediating and moderating factors of FinTech adoption for innovations in SMEs. Cogent Economics & Finance, 12(1), 2387443. [Google Scholar] [CrossRef]

- Valizadeh, N., Rezaei-Moghaddam, K., & Hayati, D. (2020). Analyzing Iranian farmers’ behavioral intention towards acceptance of drip irrigation using extended technology acceptance model. Journal of Agricultural Science and Technology, 22(5), 1177–1190. [Google Scholar]

- Venkatesh, V., & Davis, F. D. (2000). A theoretical extension of the technology acceptance model: Four longitudinal field studies. Management Science, 46(2), 186–204. [Google Scholar] [CrossRef]

- Venkatesh, V., Speier, C., & Morris, M. G. (2002). User acceptance enablers in individual decision making about technology: Toward an integrated model. Decision Sciences, 33(2), 297–316. [Google Scholar] [CrossRef]

- Viechtbauer, W., Smits, L., Kotz, D., Budé, L., Spigt, M., Serroyen, J., & Crutzen, R. (2015). A simple formula for the calculation of sample size in pilot studies. Journal of Clinical Epidemiology, 68(11), 1375–1379. [Google Scholar] [CrossRef] [PubMed]

- Wejnert, B. (2002). Integrating models of diffusion of innovations: A conceptual framework. Annual Review of Sociology, 28, 297–326. [Google Scholar] [CrossRef]

- Wenhai, L., Cusack, C., Baker, M., Tao, W., Mingbao, C., Paige, K., Xiaofan, Z., Levin, L., Escobar, E., Amon, D., Yue, Y., Reitz, A., Neves, A. A. S., O’Rourke, E., Mannarini, G., Pearlman, J., Tinker, J., Horsburgh, K. J., Lehodey, P., … Yufeng, Y. (2019). Successful blue economy examples with an emphasis on international perspectives. Frontiers in Marine Science, 6, 261. [Google Scholar] [CrossRef]

- Wischnewski, C. (2020). The disruptive potential of FinTechs in the German consumer finance sector—A blue ocean scenario? arXiv, arXiv:2007.03603. [Google Scholar] [CrossRef]

- Yeh, R. K.-J., & Teng, J. T. C. (2012). Extended conceptualisation of perceived usefulness: Empirical test in the context of information system use continuance. Behaviour & Information Technology, 31(5), 525–540. [Google Scholar] [CrossRef]

- Yoon, C., Lim, D., & Park, C. (2020). Factors affecting adoption of smart farms: The case of Korea. Computers in Human Behavior, 108, 106309. [Google Scholar] [CrossRef]

- Yousef, M. (2024). Blue economy: A review of concepts, definitions, benefits, and risks. American Academic & Scholarly Research Journal, 16(4), 12. [Google Scholar]

- Yuniarti, Y. (2022). Influence interpersonal communication and leadership on work discipline and their impact on teacher performance of SMK Negeri 8 palembang. Nusantara Journal of Behavioral and Social Sciences, 1(4), 105–112. [Google Scholar] [CrossRef]

- Zhang, J. (2023). Role of green financial assets, financial technology and the green energy on the development of a green economy. Environmental Science and Pollution Research, 30(56), 118588–118600. [Google Scholar] [CrossRef]

- Zhou, G., Zhu, J., & Luo, S. (2022). The impact of fintech innovation on green growth in China: Mediating effect of green finance. Ecological Economics, 193, 107308. [Google Scholar] [CrossRef]

| Construct | No. of Items | Key References |

|---|---|---|

| Relative Advantage | 5 | Al-Rahmi et al. (2021); Sin et al. (2016); Yoon et al. (2020) |

| Compatibility | 5 | Gomber et al. (2017); Thiele and Gerber (2017) |

| Complexity | 5 | Färe et al. (1994); Gai et al. (2017); Liu et al. (2024) |

| Trialability | 5 | Park (2024); Roh et al. (2024); Yoon et al. (2020) |

| Observability | 5 | Park (2024); Rashidi et al. (2015); Valizadeh et al. (2020) |

| Perceived Ease of Use | 5 | Hendrickson and Latta (1996); Kumar et al. (2025); Madi et al. (2024) |

| Perceived Usefulness | 5 | Dahleez et al. (2024); Kumar et al. (2025); Venkatesh and Davis (2000) |

| Intention to Adopt FinTech Services | 5 | Bajunaied et al. (2023); Senyo and Osabutey (2020) |

| Sustainable Investment Decisions in the Blue Economy | 5 | Colgan and Scorse (2020); Pace et al. (2023); Spalding (2016); Thompson (2022); Zhang (2023) |

| Demographics | Respondents | % |

|---|---|---|

| Gender | ||

| Male | 190 | 84.82 |

| Female | 34 | 15.18 |

| Age | ||

| 20–24 | 20 | 8.93 |

| 25–29 | 25 | 11.16 |

| 30–34 | 64 | 28.57 |

| 35–39 | 71 | 31.70 |

| Above 40 | 44 | 19.64 |

| Annual income (in INR) | ||

| Less than five lakhs | 35 | 15.63 |

| More than five lakhs | 189 | 84.37 |

| Organizational affiliation | ||

| Fintech companies | 78 | 34.82 |

| Maritime/Blue economy firms | 61 | 27.23 |

| Investment funds/Asset managers | 43 | 19.20 |

| Government/Regulatory bodies | 24 | 10.71 |

| Consulting/NGOs/Advisory firms | 18 | 8.04 |

| Geographic Region (States Represented) | ||

| West Coast (Maharashtra, Goa, Gujarat) | 60 | 26.79 |

| East Coast (Tamil Nadu, Andhra Pradesh, Odisha) | 50 | 22.32 |

| South (Inland) (Karnataka, Telangana) | 32 | 14.29 |

| North (Delhi, Haryana, Punjab) | 40 | 17.86 |

| East and Northeast (West Bengal, Assam, Jharkhand) | 22 | 9.82 |

| Central India (Madhya Pradesh, Chhattisgarh) | 20 | 8.93 |

| Constructs | R-Square | R-Square Adjusted |

|---|---|---|

| PEU | 0.622 | 0.613 |

| PU | 0.524 | 0.511 |

| IAFS | 0.559 | 0.555 |

| SIBE | 0.442 | 0.439 |

| Constructs | Coding | Factor Loadings | Cronbach’s | Alpha rhoA | Composite | Reliability AVE |

|---|---|---|---|---|---|---|

| Relative Advantage | RA | 0.392 | 0.812 | 0.858 | 0.878 | 0.608 |

| 0.893 | ||||||

| 0.924 | ||||||

| 0.899 | ||||||

| 0.654 | ||||||

| Compatibility | COM | 0.645 | 0.820 | 0.827 | 0.875 | 0.585 |

| 0.742 | ||||||

| 0.830 | ||||||

| 0.814 | ||||||

| 0.780 | ||||||

| Complexity | COMP | 0.774 | 0.854 | 0.861 | 0.895 | 0.630 |

| 0.766 | ||||||

| 0.804 | ||||||

| 0.839 | ||||||

| 0.784 | ||||||

| Trialability | TR | 0.882 | 0.931 | 0.934 | 0.948 | 0.785 |

| 0.878 | ||||||

| 0.880 | ||||||

| 0.890 | ||||||

| 0.899 | ||||||

| Observability | OBS | 0.904 | 0.949 | 0.949 | 0.961 | 0.830 |

| 0.917 | ||||||

| 0.922 | ||||||

| 0.914 | ||||||

| 0.898 | ||||||

| Perceived Ease of Use | PEU | 0.778 | 0.859 | 0.865 | 0.897 | 0.635 |

| 0.804 | ||||||

| 0.795 | ||||||

| 0.813 | ||||||

| 0.793 | ||||||

| Perceived Usefulness | PU | 0.813 | 0.867 | 0.868 | 0.903 | 0.650 |

| 0.830 | ||||||

| 0.848 | ||||||

| 0.774 | ||||||

| 0.762 | ||||||

| Intention to Adopt FinTech Services | IAFS | 0.768 | 0.827 | 0.828 | 0.878 | 0.590 |

| 0.806 | ||||||

| 0.782 | ||||||

| 0.762 | ||||||

| 0.721 | ||||||

| Sustainable Investment Decisions in the Blue Economy | SIBE | 0.875 | 0.877 | 0.885 | 0.918 | 0.699 |

| 0.915 | ||||||

| 0.900 | ||||||

| 0.925 |

| Heterotrait–Monotrait Ratio Matrix | RA | COM | COMP | TR | OBS | PEU | PU | IAFS |

|---|---|---|---|---|---|---|---|---|

| COM | 0.625 | |||||||

| COMP | 0.514 | 0.473 | ||||||

| TR | 0.416 | 0.627 | 0.345 | |||||

| OBS | 0.442 | 0.677 | 0.428 | 0.434 | ||||

| PEU | 0.808 | 0.570 | 0.358 | 0.500 | 0.640 | |||

| PU | 0.737 | 0.718 | 0.372 | 0.468 | 0.503 | 0.660 | ||

| IAFS | 0.561 | 0.666 | 0.461 | 0.539 | 0.747 | 0.711 | 0.815 | |

| SIBE | 0.426 | 0.658 | 0.308 | 0.430 | 0.802 | 0.635 | 0.584 | 0.766 |

| Constructs | RA | COM | COMP | TR | OBS | PEU | PU | IAFS | SIBE |

|---|---|---|---|---|---|---|---|---|---|

| RA | 0.765 | ||||||||

| COM | 0.410 | 0.794 | |||||||

| COMP | 0.565 | 0.398 | 0.768 | ||||||

| TR | 0.550 | 0.313 | 0.486 | 0.886 | |||||

| OBS | 0.600 | 0.395 | 0.683 | 0.410 | 0.911 | ||||

| PEU | 0.489 | 0.322 | 0.623 | 0.446 | 0.584 | 0.797 | |||

| PU | 0.598 | 0.331 | 0.706 | 0.424 | 0.457 | 0.603 | 0.806 | ||

| IAFS | 0.469 | 0.416 | 0.450 | 0.346 | 0.384 | 0.695 | 0.608 | 0.780 | |

| SIBE | 0.560 | 0.274 | 0.665 | 0.387 | 0.731 | 0.549 | 0.514 | 0.341 | 0.836 |

| Latent Construct | VIF |

|---|---|

| Relative Advantage (RA) | 2.45 |

| Compatibility (COM) | 2.31 |

| Complexity (COMP) | 2.67 |

| Trialability (TR) | 2.18 |

| Observability (OB) | 2.49 |

| Perceived Ease of Use (PEU) | 2.83 |

| Perceived Usefulness (PU) | 2.71 |

| Intention to Adopt Fintech Services (IAFS) | 2.94 |

| Sustainable Investment Decisions in the Blue Economy (SIBE) | 2.56 |

| Hypothesis | Path Coefficient (β) | Sample Mean (M) | Standard Deviation (STDEV) | T Statistic | p-Value | Significance |

|---|---|---|---|---|---|---|

| H1: RA -> PU | 0.283 | 0.284 | 0.097 | 2.913 | 0.004 *** | Yes |

| H2: RA -> PEU | 0.557 | 0.559 | 0.064 | 8.715 | 0.000 *** | Yes |

| H3: COM -> PU | 0.334 | 0.340 | 0.089 | 3.772 | 0.000 *** | Yes |

| H4: COM -> PEU | −0.041 | −0.035 | 0.073 | 0.569 | 0.569 | No |

| H5: COMP -> PU | −0.010 | −0.003 | 0.074 | 0.141 | 0.888 | No |

| H6: COMP -> PEU | −0.086 | −0.083 | 0.051 | 1.689 | 0.091 | No |

| H7: TR -> PU | 0.044 | 0.040 | 0.087 | 0.508 | 0.611 | No |

| H8: TR -> PEU | 0.153 | 0.150 | 0.067 | 2.280 | 0.023 ** | Yes |

| H9: OBS -> PU | 0.003 | 0.000 | 0.094 | 0.032 | 0.974 | No |

| H10: OBS -> PEU | 0.367 | 0.361 | 0.064 | 5.759 | 0.000 *** | Yes |

| H11: PEU -> PU | 0.225 | 0.222 | 0.097 | 2.324 | 0.020 ** | Yes |

| H12: PU -> IAFS | 0.519 | 0.519 | 0.060 | 8.582 | 0.000 *** | Yes |

| H13: PEU -> IAFS | 0.310 | 0.311 | 0.068 | 4.553 | 0.000 *** | Yes |

| H14: IAFS -> SIBE | 0.665 | 0.667 | 0.042 | 15.693 | 0.000 *** | Yes |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sharma, V.; Rupeika-Apoga, R.; Singh, T.; Gupta, M. Sustainable Investments in the Blue Economy: Leveraging Fintech and Adoption Theories. J. Risk Financial Manag. 2025, 18, 368. https://doi.org/10.3390/jrfm18070368

Sharma V, Rupeika-Apoga R, Singh T, Gupta M. Sustainable Investments in the Blue Economy: Leveraging Fintech and Adoption Theories. Journal of Risk and Financial Management. 2025; 18(7):368. https://doi.org/10.3390/jrfm18070368

Chicago/Turabian StyleSharma, Vikas, Ramona Rupeika-Apoga, Tejinder Singh, and Munish Gupta. 2025. "Sustainable Investments in the Blue Economy: Leveraging Fintech and Adoption Theories" Journal of Risk and Financial Management 18, no. 7: 368. https://doi.org/10.3390/jrfm18070368

APA StyleSharma, V., Rupeika-Apoga, R., Singh, T., & Gupta, M. (2025). Sustainable Investments in the Blue Economy: Leveraging Fintech and Adoption Theories. Journal of Risk and Financial Management, 18(7), 368. https://doi.org/10.3390/jrfm18070368