The Impact of Climate Change on Financial Stability in South Africa

Abstract

1. Introduction

- Climate change has no statistically significant impact on South Africa’s financial stability.

2. Literature Review

3. Empirical Approach

3.1. Sample Selection and Data Source

3.2. Justification of Variables

3.3. Pre-Estimation Tests

- Unit Root Tests: Unveiling the Order of Integration

- Lag Length in VAR

- Random Forest Test

3.4. Bayesian VAR Model: Model Specification

3.5. Prior Selection and Specification

Σ ∼ IW(Ψ, d),

3.6. Impulse Response Function and Variance Decomposition

3.7. Diagnostic Test

4. Empirical Results

4.1. Descriptive Statistics and Random Forest Analysis (RF)

4.2. Unit Root Tests

4.3. The Prior Setup and Configuration of the Model

4.4. Model Estimated Threshold of the BVAR Model

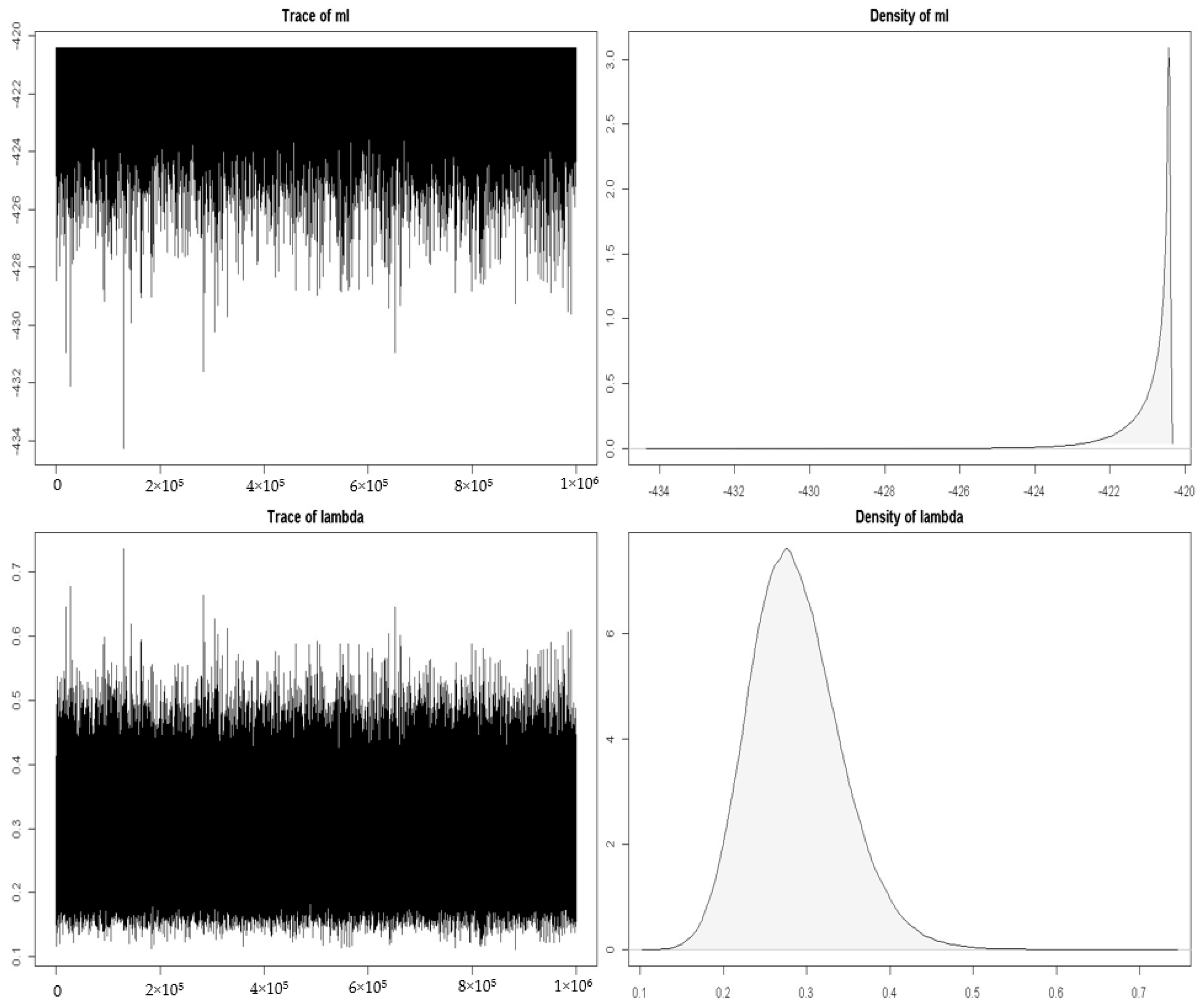

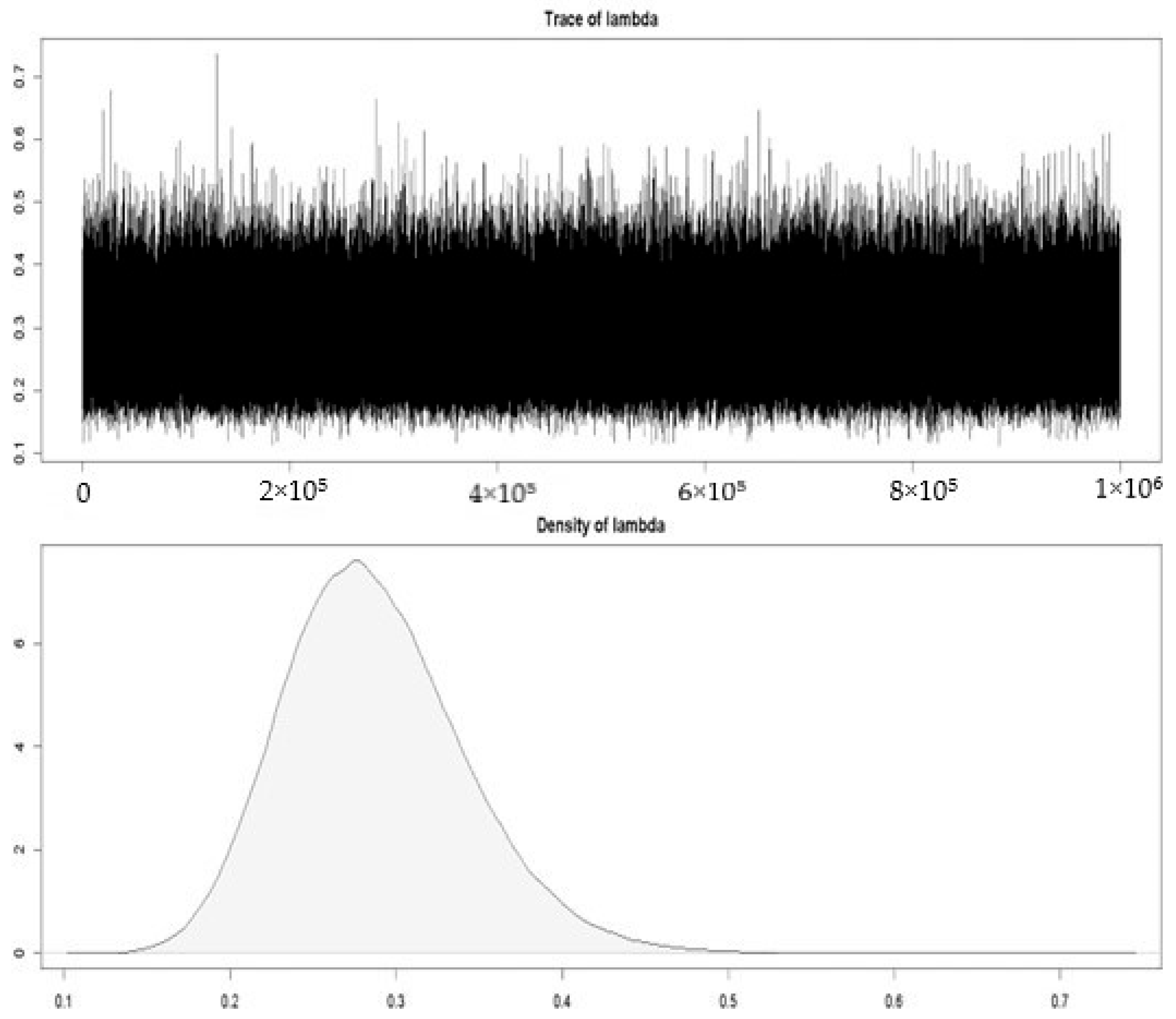

4.4.1. Result of the Convergence of Markov Chain Monte Carlo in a BVAR Model

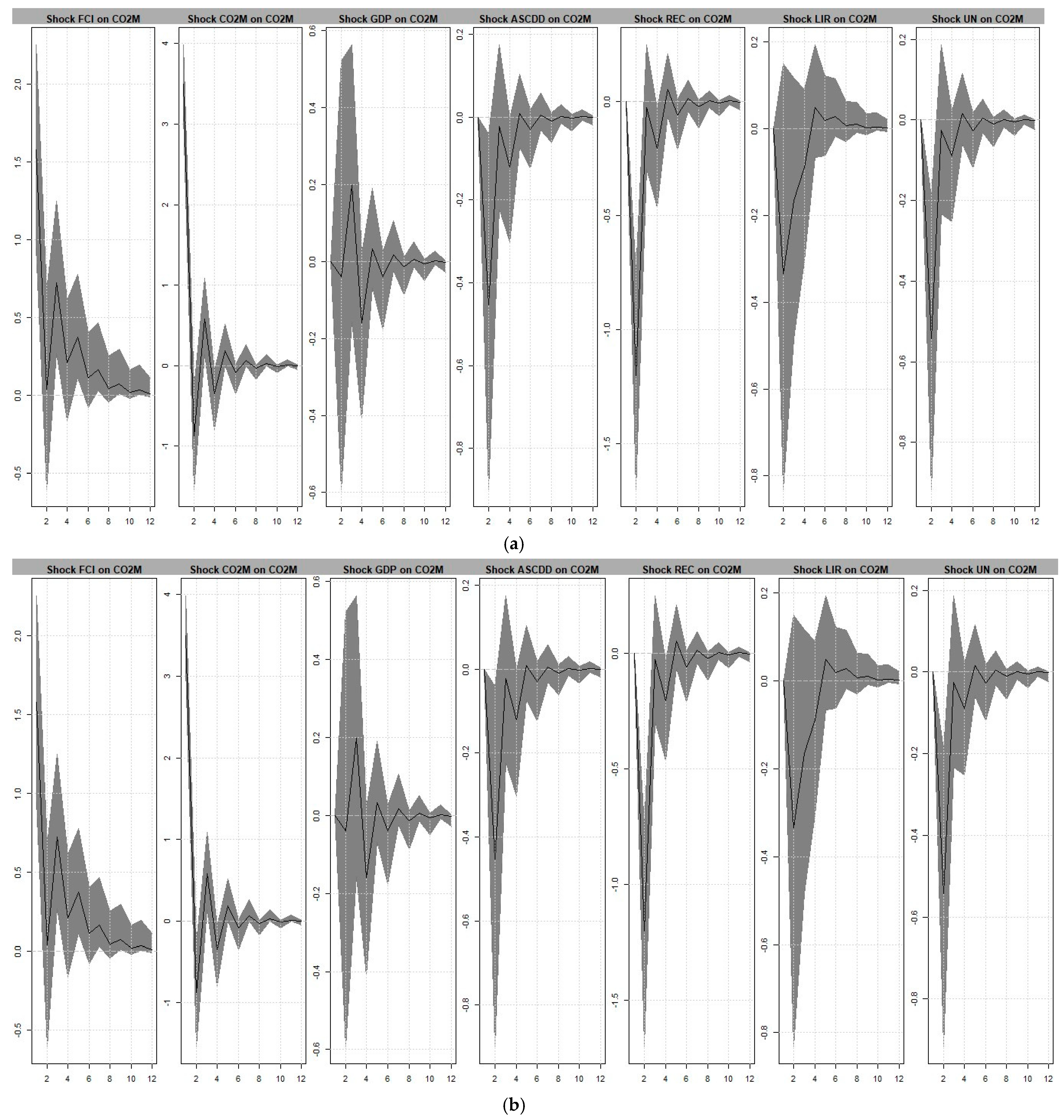

4.4.2. Impulse Responses of the Bayesian VAR

4.4.3. Forecast Error Variance Decomposition (FEVD)

4.5. Diagnostics Test

4.5.1. Density Plot

4.5.2. Residuals Plot

4.6. Discussion of the Bayesian VAR Results

5. Robustness Analysis

6. Conclusions and Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| BVAR Results | ||||||

| Bayesian VAR consisting of 30 observations, 6 variables and 1 lags. Time spent calculating: 53.75 min Hyperparameters: lambda Hyperparameter values after optimisation: 0.27491 Iterations (burnt/thinning): 1,500,000 (500,000/1) Accepted draws (rate): 394,593 (0.395) | ||||||

| Numeric array (dimensions 7, 6) of coefficient values from a BVAR. Median values: FCI COM2 ASCDD REC LIR UN constant 31.862 1.139 −1.245 −3.547 1.447 8.360 FCI-lag1 0.712 0.005 0.012 −0.006 −0.043 −0.556 COM2-lag1 −0.252 −0.040 −0.115 −0.036 0.047 0.085 ASCDD-lag1 −1.341 −0.587 0.151 0.090 0.186 0.007 REC-lag1 0.172 −2.734 0.020 0.233 −0.485 0.042 LIR-lag1 0.635 −0.093 −0.023 0.117 0.112 −0.062 UN-lag1 −0.761 −1.198 0.047 0.187 0.011 −0.162 | ||||||

| Numeric array (dimensions 6, 6) of variance–covariance values from a BVAR. Median values: | ||||||

| FCI | COM2 | ASCDD | REC | LIR | UN | |

| FCI | 27.006 | 7.142 | −1.546 | −0.062 | −1.648 | 1.628 |

| COM2 | 7.142 | 315.906 | −0.210 | 1.193 | 1.709 | 0.057 |

| ASCDD | −1.546 | −0.210 | 0.126 | 0.062 | 0.928 | 0.057 |

| REC | −0.062 | −0.031 | 0.060 | 0.252 | 0.005 | 0.070 |

| LIR | −1.648 | 1.793 | 0.253 | 0.152 | 2.577 | 0.044 |

| UN | 1.628 | 0.700 | −0.057 | 0.070 | −0.044 | 0.554 |

| Log-Likelihood: −274.7856 | ||||||

References

- Altavilla, C., Pariès, M. D., & Nicoletti, G. (2019). Loan supply, credit marketsand the euro area financial crisis. Journal of Banking and Finance, 109, 105658. [Google Scholar] [CrossRef]

- Ayele, G. M., & Fisseha, F. L. (2024). Does climate change affect thefinancial stability of Sub-Saharan African countries? Climatic Change, 177(10), 158. [Google Scholar] [CrossRef]

- Bańbura, M., Giannone, D., & Reichlin, L. (2010). Large Bayesian Vector AutoRegressions. Journal of Applied Econometrics, 25(1), 71–92. [Google Scholar] [CrossRef]

- Batten, S., Sowerbutts, R., & Tanaka, M. (2016). Let’s talk about theweather: The impact of climate change on central banks. Bank of England. [Google Scholar]

- Breiman, L. (2001). Random forests. Machine Learning, 45, 5–32. [Google Scholar] [CrossRef]

- Brunetti, C., Caramichael, J., Crosignani, M., Dennis, B., Kotta, G., Morgan, D., Shin, C., & Zer, I. (2022). Climate-related financial stability risks for the United States: Methods and applications. Federal Reserve Board. [Google Scholar]

- Carney, M. (2015). Breaking the tragedy of the horizon–climate changeand financial stability. Speech Given at Lloyd’s of London, 29, 220–230. [Google Scholar]

- Chabot, M., & Bertrand, J.-L. (2023). Climate risks and financial stability: Evidence from the European financial system. Journal of Financial Stability, 69, 101190. [Google Scholar] [CrossRef]

- Climate Change Knowledge Portal. (2021). What is climate change? The World Bank Group. Available online: https://climateknowledgeportal.worldbank.org/overview#::text=Observed (accessed on 25 June 2024).

- Conlona, T., Dingb, R., Huanc, X., & Zhangc, Z. (2022). Climate risk and financial stability: Evidence from bank lending, working paper. Indian Institute of Management Bangalore. [Google Scholar]

- Curcio, D., Gianfrancesco, I., & Vioto, D. (2023). Climate change and financial systemic risk: Evidence from US banks and insurers. Journal of Financial Stability, 66, 101132. [Google Scholar] [CrossRef]

- Dafermos, Y., Nikolaidi, M., & Galanis, G. (2018). Climate change, financial stability, andmonetary policy. Ecological Economics, 152, 219–234. [Google Scholar] [CrossRef]

- Del Negro, M., & Schorfheide, F. (2004). Priors from general equilibrium models for VARs. International Economic Review, 45(2), 643–673. [Google Scholar] [CrossRef]

- Diamond, D. W., & Dybvig, P. H. (1983). Bank runs, deposit insurance, and liquidity. Journal of Political Economy, 91(3), 401–419. [Google Scholar] [CrossRef]

- Dietz, S., Bowen, A., & Hepburn, C. (2016). The effects of climatechange on financial stability, with particular reference to Sweden (A report for Finansinspektionen). The Swedish Financial Supervisory Authority. [Google Scholar]

- Doan, T., Litterman, R., & Sims, C. (1984). Forecasting and conditional projection using realistic prior distributions. Econometric Reviews, 3, 1–100. [Google Scholar] [CrossRef]

- Enders, W. (2010). Applied econometrics using time series data. Wiley Global Education. [Google Scholar]

- Fabris, N. (2020). Financial stability and climate change. Journal ofCentral Banking Theory and Practice, 9(3), 27–43. [Google Scholar] [CrossRef]

- Friedman, G. (2013). Europe, unemployment and instability. Stratfor Global Intelligence. [Google Scholar]

- Giannone, D., Lenza, M., & Primiceri, G. E. (2015). Prior selection for vector autoregressions. Review of Economics and Statistics, 97(2), 436–451. [Google Scholar] [CrossRef]

- Grippa, P., & Demekas, M. D. G. (2021). Financial regulation, climate change, and the transition to a low-carbon economy: A survey of the issues (IMF Working Papers). International Monetary Fund. [Google Scholar]

- Gujarati, D. N., & Porter, D. C. (2009). Basic econometrics. McGraw-Hill. [Google Scholar]

- Ho, T. K. (1998). The random subspace method for constructing decision forests. IEEE Transactions on Pattern Analysis and Machine Intelligence, 20, 832–844. [Google Scholar] [CrossRef]

- International Monetary Fund. (2008). National bank of Romania regional seminar on financial stability issues. International Monetary Fund. [Google Scholar]

- IPCC. (2021). Climate change 2021: The physical science basis. Contribution of working group I to the sixth assessment report of the intergovernmental panel on climate change (V. Masson-Delmotte, P. Zhai, A. Pirani, S. L. Connors, C. Péan, S. Berger, N. Caud, Y. Chen, L. Goldfarb, M. I. Gomis, M. Huang, K. Leitzell, E. Lonnoy, J. B. R. Matthews, T. K. Maycock, T. Waterfield, O. Yelekçi, R. Yu, & B. Zhou, Eds.). Cambridge University Press. [Google Scholar] [CrossRef]

- Ivanov, V. V., & Kilian, L. (2005). A practitioner’s guide to structuralVAR analysis. Federal Reserve Bank of St. Louis Review, 87(4), 79–104. [Google Scholar]

- Kilian, L., & Lütkepohl, H. (2017). Structural vector autoregressive analysis. Cambridge University Press. [Google Scholar] [CrossRef]

- Koop, G. M. (2013). Forecasting with medium and large Bayesian VARs. Journal of Applied Econometrics, 28, 177–203. [Google Scholar] [CrossRef]

- Kuschnig, N., & Vashold, L. (2021). BVAR: Bayesian vector autoregressions with hierarchical prior selection in R. Journal of Statistical Software, 100(14), 1–27. [Google Scholar] [CrossRef]

- Le, A. T., Tran, T. P., & Mishra, A. V. (2023). Climate risk and bank stability: Internationalevidence. Journal of Multinational Financial Management, 70, 100824. [Google Scholar] [CrossRef]

- Lee, R., Rojas-Romagosa, H., Ruxandra Teodoru, I., & Zhang, X. (2024). Climate transition risk and financial stability in France (IMF Working Paper 2024/144). International Monetary Fund. [Google Scholar]

- Litterman, R. B. (1980). A bayesian procedure for forecasting with vector autoregressions (MIT Working Paper). Massachusetts Institute of Technology. [Google Scholar]

- Liu, L. (2019). Impacts of RMB internationalization on China’s foreign trade: A comparative case study of the coastal areas of eastern China and the border areas of western China. Journal of Yunnan Normal University (Humanities and Social Sciences Edition), 51, 66–75. [Google Scholar]

- Liu, Z., He, S., Men, W., & Sun, H. (2024). Impact of climate risk on financial stability: Cross-country evidence. International Review of Financial Analysis, 92, 103096. [Google Scholar] [CrossRef]

- Liu, Z., Sun, H., & Tang, S. (2021). Assessing the impacts of climate change to financial stability: Evidence from China. International Journal of Climate Change Strategies and Management, 13(3), 375–393. [Google Scholar] [CrossRef]

- Lütkepohl, H. (2005). New introduction to multiple time series analysis. Springer Science & Business Media. [Google Scholar]

- McCracken, M. W., & Ng, S. (2016). FRED-MD: A monthly database for macroeconomic research. Journal of Business and Economic Statistics, 34, 574–589. [Google Scholar] [CrossRef]

- Meng, Z., Wang, X., & Ding, Y. (2023). The impact of climate change policies onfinancial stability of China. Frontiers in Environmental Science, 11, 1295951. [Google Scholar] [CrossRef]

- Minsky, H. P. (1992). The financial instability hypothesis. The JeromeLevy Economics Institute of Bard College. [Google Scholar]

- Mol, D., Giannone, D., & Reichlin, L. (2008). Forecasting using alarge number of predictors: Is Bayesian shrinkage a valid alternative to principal components? Journal of Econometrics, 146, 318–328. [Google Scholar] [CrossRef]

- Mueller, V., Gray, C., & Hopping, D. (2020). Climate-Induced migration and unemployment in middle-income Africa. Global Environmental Change, 65, 102183. [Google Scholar] [CrossRef] [PubMed]

- Mwangi, S. M. (2014). The effect of lending interest rates on financial performance of deposit taking micro finance institutions in Kenya. University of Nairobi. [Google Scholar]

- Nieto, M. J. (2019). Banks, climate risk and financial stability. Journalof Financial Regulation and Compliance, 27(2), 243–262. [Google Scholar] [CrossRef]

- Pagnottoni, P., Spelta, A., Flori, A., & Pammolli, F. (2022). Climate change and financial stability: Natural disaster impacts on global stock markets. Physica A: Statistical Mechanics and Its Applications, 599, 127514. [Google Scholar] [CrossRef]

- Pointner, W., & Ritzberger-Grünwald, D. (2019). Climate change asa risk to financial stability. Financial Stability Report, 38, 30–45. [Google Scholar]

- Safarzyńska, K., & van den Bergh, J. C. (2017). Financial stability atrisk due to investing rapidly in renewable energy. Energy Policy, 108, 12–20. [Google Scholar] [CrossRef]

- Sims, C. A. (1980). Macroeconomics and reality. Econometrica, 48, 1–48. [Google Scholar] [CrossRef]

- Sims, C. A., & Zha, T. (1998). Bayesian methods for dynamic multivariate models. International Economic Review, 39, 949–968. [Google Scholar] [CrossRef]

- Stein, C. (1956). Inadmissibility of the usual estimator for the meanof a multivariate normal distribution. In proceedings of the third berkeley symposium on mathematical statistics and probability, volume 1: Contributions to the theory of statistics (pp. 197–206). University of California Press. Available online: https://projecteuclid.org/euclid.bsmsp/1200501656 (accessed on 7 September 2024).

- The World Bank Group. (2021). Climate risk profile: South Africa. The World Bank Group. [Google Scholar]

- Varntanian, S., & Pancera, D. (2020). Does climate change pose a risk to financial stability? Available online: https://www.researchgate.net/profile/Stefanos-Varntanian/publication/340464065_Does_climate_change_pose_a_risk_to_financial_stability/links/5e8b7cac92851c2f52866606/Does-climate-change-pose-a-risk-to-financial-stability.pdf (accessed on 13 April 2025).

- Villani, M. (2009). Steady-State priors for vector autoregressions. Journal of Applied Econometrics, 24(4), 630–650. [Google Scholar] [CrossRef]

- Wang, Y. C., Tsai, J. J., & Dong, Y. (2021). Research on impulse response and variance decomposition analysis of co-integrated systems. Journal of Physics: Conference Series, 1941, 012057. [Google Scholar] [CrossRef]

- Wu, L., Liu, D., & Lin, T. (2023). The impact of climate change on financial stability. Sustainability, 15(15), 11744. [Google Scholar] [CrossRef]

- Zhou, Z., Zhou, Z., & Pan, Y. (2018). RMB exchange rate trend and RMBinternationalization—An empirical study based on VAR and SVAR models. Shaghai Finance, 10, 65–70. [Google Scholar]

- Ziervogel, G., New, M., Archer van Garderen, E., Midgley, G., Taylor, A., Hamann, R., Stuart-Hill, S., Myers, J., & Warburton, M. (2014). Climate change impacts and adaptation inSouth Africa. Wiley Interdisciplinary Reviews: Climate Change, 5(5), 605–620. [Google Scholar]

- Zungu, L. T., & Greyling, L. (2023). Investigating the asymmetric effect of income inequality on financial fragility in South Africa and selected emerging markets: A Bayesian approach with hierarchical priors. International Journal of Emerging Markets, ahead-of-print. [Google Scholar] [CrossRef]

| Credit Risk | Market Risk | Operation Risk | |

| Physical Risk |

|

|

|

| Transitional Risk |

|

|

|

| Indirect risk |

|

|

|

| Variable Name | Abbreviation | Unit of Measurement | Source | Variable Type |

|---|---|---|---|---|

| Financial Conditions Index | FS | Index | Statista | Dependent |

| CO2 Emissions | CO2M | Kt (kiloton) | The World Bank | Independent |

| Lending interest rate | LIR | percentage | The World Bank | Control |

| Unemployment rate | UN | percentage | The World Bank | Control |

| Renewable Energy Consumption | REC | percentage | The World Bank | Control |

| Adjusted Savings: Carbon Dioxide Damage | ASCDD | Percentage | The World Bank | Control |

| FCI | CO2M | ASCDD | REC | LIR | UN | |

|---|---|---|---|---|---|---|

| Mean | 109.4245 | 361658.1 | 3.587648 | 12.17438 | 13.10747 | 21.68844 |

| Median | 107.4504 | 386590.7 | 3.421272 | 9.895000 | 11.50000 | 20.52650 |

| Maximum | 121.0472 | 448298.1 | 5.286674 | 18.59000 | 21.79167 | 28.84000 |

| Minimum | 92.19162 | 238780.6 | 2.221507 | 7.720000 | 7.041667 | 19.34200 |

| Std. Dev. | 8.324919 | 72326.47 | 0.887311 | 4.088553 | 4.243861 | 2.550015 |

| Skewness | −0.100597 | −0.463658 | 0.254646 | 0.501333 | 0.487856 | 1.457476 |

| Kurtosis | 1.806274 | 1.647791 | 1.971339 | 1.542004 | 1.981075 | 4.498750 |

| Jarque–Bera | 1.953948 | 3.584515 | 1.756696 | 4.174789 | 2.653629 | 14.32426 |

| Probability | 0.376448 | 0.166584 | 0.415469 | 0.124010 | 0.265321 | 0.000775 |

| Sum | 3501.583 | 11573060 | 114.8047 | 389.5800 | 419.4392 | 694.0300 |

| Sum Sq. Dev. | 2148.432 | 1.62 × 1011 | 24.40695 | 518.2043 | 558.3211 | 201.5798 |

| Observations | 32 | 32 | 32 | 32 | 32 | 32 |

| South Africa 1991–2022: ADF Test | |||||

|---|---|---|---|---|---|

| Variables | Lev | Prob | 1st | Prob | Intr |

| FCI | −4.681018 | 0.0040 | −5.190807 | 0.0015 | I(0) |

| CO2M | −0.879152 | 0.9459 | −7.471624 | 0.0000 | I(1) |

| ASCDD | −3.047866 | 0.1367 | −4.730924 | 0.0007 | I(1) |

| RES | 0.510173 | 0.9988 | −8.156026 | 0.0000 | I(1) |

| LIR | −3.972418 | 0.0210 | −5.340142 | 0.0009 | I(1) |

| UN | 0.176748 | 0.9966 | −7.124334 | 0.0000 | I(1) |

| South Africa 1991–2022: PP Test | |||||

| Variables | Lev | Prob | 1st | Prob | Intr |

| FCI | −5.481249 | 0.0005 | −11.81431 | 0.0000 | I(0) |

| CO2M | −0.413672 | 0.9824 | −6.870246 | 0.0000 | I(1) |

| ASCDD | −2.217267 | 0.4640 | −4.985761 | 0.0003 | I(1) |

| RES | −0.328432 | 0.9860 | −9.261465 | 0.0000 | I(1) |

| LIR | −2.146104 | 0.5013 | −5.131408 | 0.0002 | I(1) |

| UN | −0.477767 | 0.9793 | −11.77755 | 0.0000 | I(1) |

| Optimisation concluded. |

| Posterior marginal likelihood: −420.406 |

| Hyperparameters: lambda = 0.27491 |

| |===================================================| 100% |

| Finished MCMC after 47.33 min |

| Bayesian VAR consisting of 30 observations, 6 variables, and 1 lags. |

| Time spent calculating: 47.33 min |

| Hyperparameters: lambda |

| Hyperparameter values after optimisation: 0.27491 |

| Iterations (burnt/thinning): 1,500,000 (500,000/1) |

| Accepted draws (rate): 394,593 (0.395) |

| S’FCI | ||||||

|---|---|---|---|---|---|---|

| Period | FCI | CO2M | ASCDD | REC | LIR | UN |

| [1,] | 100.0000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| [2,] | 99.43515 | 0.265124 | 0.000273 | 0.009889 | 0.181493 | 0.108066 |

| [3,] | 98.52625 | 0.590214 | 0.000313 | 0.030422 | 0.615240 | 0.237560 |

| [4,] | 97.46115 | 0.864520 | 0.000247 | 0.055926 | 1.278548 | 0.339612 |

| [5,] | 96.31640 | 1.068595 | 0.000373 | 0.080893 | 2.128511 | 0.405228 |

| [6,] | 95.12921 | 1.212348 | 0.000888 | 0.101570 | 3.116539 | 0.439446 |

| [7,] | 93.92351 | 1.311424 | 0.001827 | 0.116169 | 4.196523 | 0.450543 |

| [8,] | 92.71796 | 1.379645 | 0.003108 | 0.124458 | 5.328676 | 0.446147 |

| [9,] | 91.52784 | 1.427431 | 0.004587 | 0.127192 | 6.480750 | 0.432204 |

| [10,] | 90.36537 | 1.462106 | 0.006105 | 0.125612 | 7.627823 | 0.412983 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mbotho, S.; Zhou, S. The Impact of Climate Change on Financial Stability in South Africa. J. Risk Financial Manag. 2025, 18, 334. https://doi.org/10.3390/jrfm18060334

Mbotho S, Zhou S. The Impact of Climate Change on Financial Stability in South Africa. Journal of Risk and Financial Management. 2025; 18(6):334. https://doi.org/10.3390/jrfm18060334

Chicago/Turabian StyleMbotho, Siyabonga, and Sheunesu Zhou. 2025. "The Impact of Climate Change on Financial Stability in South Africa" Journal of Risk and Financial Management 18, no. 6: 334. https://doi.org/10.3390/jrfm18060334

APA StyleMbotho, S., & Zhou, S. (2025). The Impact of Climate Change on Financial Stability in South Africa. Journal of Risk and Financial Management, 18(6), 334. https://doi.org/10.3390/jrfm18060334