Abstract

This study investigates the interactive link between bank performance and financial innovation in Tunisian banking using a mixed-methods research framework that combines econometric approaches and institutional factors. The empirical analysis uses a panel data of 11 commercial banks from the period of 2000–2024 and employs an Autoregressive distributed lag (ARDL) model to estimate short- and long-run impacts of innovation on return on equity (ROE). A composite indicator of Fintech investment, digital service adoption, and innovation productivity characterizes financial innovation. Governance factors like the presence of risk management departments and executive compensation are taken into account. The results reveal a robust positive impact of financial innovation on bank performance in the long run, especially in more concentrated market settings. Risk management supports performance, while inefficient executive compensation is negatively associated with profitability. These findings are confirmed by robustness tests with HAC standard errors. This research contributes to the literature by situating financial innovation in the context of an emerging North African market and produces practitioner-relevant information for policymakers and bank executives interested in ensuring that performance results are consistent with innovation strategy.

JEL Classification:

Q4; E7; D27

1. Introduction

The concept of financial innovation is not only the formulation of new financial instruments and products but also the creation of more complex and efficient financial market frameworks. The situation of Tunisian banks has changed enormously in recent times; these modifications impose a system of innovation at different levels. Innovation is one of the key tools of development strategies to enter recent markets, increase existing market share, and provide the institution with a competitive advantage. The COVID-19 pandemic has profoundly affected global financial systems and real economies, with Tunisia being no exception. The crisis has significantly influenced Tunisia’s economic stability, innovation capacity, and banking performance (Arnaboldi & Rossignoli, 2015).

The banking sector of Tunisia is the backbone of the economic development of the country, as it serves as the primary financial intermediary that channels funds obtained to meet investment and consumption requirements. Between 1995 and 2017, commercial banks extended approximately 81% of all domestic credit to the private sector, underlining their dominance in financial intermediation. In 2017, domestic credit to the private sector was 85.6% of GDP, showing the sector’s significance in catalyzing economic activity (Beck et al., 2012; Dow, 2007; Ebrahim & Hussain, 2010).

This records an increase from the previous number of 21.196% for 2024. Tunisia’s domestic credit to the private sector as a percentage of GDP data is updated yearly, averaging 58.945% from Dec 1965 to 2023, with 63 observations. The data reached an all-time high of 85.584% in 2017 and a record low of 29.287% in 1965. Tunisia’s domestic credit to the private sector as a percentage of GDP data remains active in CEIC and is reported by the World Bank (2023) report titled “The Unfinished Revolution: Bringing Opportunity, Good Jobs and Greater Wealth to All Tunisians”.

Andersen and Tarp (2003) and Chan and Karim (2010) and Sghaier (2019) suggest that, due to the important role played by banks of providing money to the economy, the government should call on them to improve their efficiency. Banking efficiency was acknowledged as the main player in the overall financial development of any emerging economy.

Beginning in the 1990s, Tunisia’s enthusiasm to integrate into the world economy pushed the government to launch several economic and financial reform programs. Substantial programs centered around the deregulation and reconstruction of the banking sector started as a key to the government’s development plan. In this context, the Tunisian government’s continuous support to modifying banking operational efficiency included various regulations instituted over the last three decades (Abdelaziz et al., 2011; Short, 1979; Silber, 1983).

Nonetheless, the essential question is: How efficiently were banks operating in Tunisia? Alternatively, did their practical efficiency progress over time, in agreement with the central authority’s objectives? What is the central determining factor of the banks’ technical efficiency? Many questions can be studied not only for the Tunisian economy but also for any country. In this way, we cite the studies of Berger and Humphrey (1997), demonstrating that examining banking efficiency can bring about many insights to decision makers and policymakers.

In parallel with domestic banking developments, the global financial ecosystem has undergone a major transformation due to the rise of financial technologies (Fintech), particularly blockchain and artificial intelligence (AI). Blockchain technology has introduced decentralized, secure, and transparent frameworks for executing financial transactions, with applications spanning smart contracts, digital identity verification, and cross-border payments (World Economic Forum, 2023; Arner et al., 2022). Simultaneously, AI is used with increasing frequency for credit risk modeling, fraud detection, personalized banking, and operational automation, enhancing both efficiency and customer engagement in banks (Buchak et al., 2023; McKinsey & Company, 2022). These innovations are not only disrupting traditional banking structures in advanced economies but also shaping the financial inclusion agenda in developing markets. However, empirical research remains limited regarding how such disruptive technologies affect banking performance in North African contexts. By situating this study within the broader global Fintech revolution, we aim to bridge this gap and provide insights into how technological adoption intersects with financial performance in Tunisia (Batiz-Lazo & Woldesenbet, 2004; Gurhan et al., 2005).

This study examines the relationship between Tunisian bank attributes and their performance. Focusing on 11 listed deposit banks on the Tunisian Stock Exchange (TSE), this research brings to the forefront the central role-played by such banks in financing the Tunisian economy. Commercial banks are highlighted as they dominate the channeling of funds to business and individuals and are hence at the center of the nation’s financial system (Amblard, 2007; Ben Naceur & Goaied, 2001).

This study uses balance sheets and profit/loss accounts obtained from the Professional Association of Tunisian Banks (PABT) and TSE reports covering 2000–2024. Although the sample size is constrained by the modest number of banks, the database creates a solid basis for measuring trends in performance across two decades (John et al., 2003) and (Loukil & Chaabane, 2009).

Tunisia has also drawn international focus for its trail-blazing economic reform and domestic leadership (Fleischer et al., 2018), with the World Bank (2014) labeling it an exemplar of lessons for development. Backed by the European Union and foreign agencies, Tunisia’s development strategy has involved the liberalization of industry and trade and industrialization. Yet, the authorities were conscious that sustained success required simultaneous enhancement of the efficiency of banking, which resulted in collaboration with the IMF and World Bank.

Traditionally, state banks offered preferential lending to connected companies at a liberal risk assessment (World Bank, 2014). This study puts into perspective how those practices evolved following reformations and how they affect current bank performance. The banking world is undergoing a seismic change with the rise of financial technologies (Fintech), evolving customer demands, and increasing regulatory demands. Financial technologies such as blockchain, artificial intelligence (AI), and mobile banking have altered how banks operate, manage risk, and deliver value. While much interest has been raised regarding the impact of such innovations on the developed markets, their impact on the banking systems of emerging economies remains under-researched. In this context, an investigation into the impact of financial innovation on bank performance in transition economies becomes highly relevant, from both an academic and a practical standpoint (Guermazi, 2017; Zouari & Abdelmalek, 2020).

Tunisia presents an interesting case for such investigation. As a post-revolutionary emerging economy, Tunisia’s banking industry has undergone significant reforms to enhance competitiveness, transparency, and digital inclusion in its banking sector. Tunisian banks have progressively embraced digital instruments, invested in mobile channels, and tested Fintech collaborations over the last two decades. The performance consequences of such innovation efforts remain uncertain, however, due to the sector’s structural limitations and macroeconomic instability.

The term financial innovation has referred merely to the creation of new instruments and services but now encompasses revolutionary technology as well as institution restructurings in financial systems. The banking sector globally—and particularly in developing nations like Tunisia—has been experiencing revolutionary change due to expanded use of Fintech, artificial intelligence (AI), and blockchain technology. These technologies are reshaping the operation, competition, and delivery of financial institutions’ value to clients (Abir & Chokri, 2010; Arthur, 2017; Baiquan & Kebao, 2010).

Recent studies (e.g., Buchak et al., 2023; McKinsey & Company, 2022) reflect the accelerating tendency of Fintech and AI in changing operational models and risk mechanisms in global banking industries, especially in the post-pandemic emerging economies. The COVID-19 pandemic was a drivers’ impetus in accelerating digital transformation in banking, increasing the demand for digital infrastructure investment, distance banking operations, and cybersecurity resilience. In local regions such as the Middle East and North Africa (MENA), IMF and World Bank (2023) reports highlight the point that financial innovation and digital banking are fundamental drivers in assisting financial inclusion, efficiency, and economic recovery.

Tunisia has seen the impact of financial innovation as large and pervasive. Banks have become more willing to employ digital distribution channels, mobile banking, and AI-driven analytics to complement credit risk management, customer engagement, and flexibility with evolving regulatory requirements. These transformations are implemented amidst structural limitations, institutional rigidities, and macroeconomic uncertainty, making the impact of innovation on performance highly condition-dependent.

This study explores the interactive dynamic between financial innovation and bank performance in Tunisia using a mixed-methods approach. Empirical data were taken from 11 listed commercial banks in the Tunisian Stock Exchange (TSE) during the period 2000–2024. This study employs the autoregressive distributed lag (ARDL) model to estimate the short- and long-run effects while considering institutional variables such as risk management and executive compensation in explaining performance dynamics under a changing financial landscape.

2. Literature Review and Research Gap

The intersection between bank performance and financial innovation has been the subject of significant academic debate, premised on competitive theory, efficiency, and technological change. The Schumpeterian theoretical postulation of innovation as a driver of economic growth was the precursor to understanding how banks adopt new technology with a view to enhancing profitability and resilience. Empirical evidence supports a positive correlation between innovation and financial performance. For instance, Geroski et al. (1993) and Loof (2000) found that innovative firms are likely to achieve greater margins and growth. For the banking sector, Mabrouk and Mamoghli (2010) proved that financial innovation improves performance by leveraging enhanced product coverage and service efficiency, while De Jonghe (2010) pointed out the significance of the availability of financial resources towards financing growth through innovation.

Furthermore, the expansion of Fintech innovations like digital payment, robo-advisors, and blockchain has been associated with enhanced efficiency of operations and competition in markets for developed and emerging markets (Arner et al., 2022; Mustapha, 2018; Karim et al., 2010). However, evidence continues to be inconclusive as, according to some reports, innovation could also increase vulnerability to risk or erode core capabilities where inappropriately aligned with institutional capabilities (Lerner & Tufano, 2011; Chipeta & Muthinja, 2018). For Tunisia, the existing literature has mainly accounted for profitability indicators at the cost of multidimensional performance factors like risk-adjusted return, market share, and sustainability.

Moreover, there has been limited research focusing on the mediating role of market structure and governance, or applying econometric models that could handle dynamic relationships with mixed integration properties. This study contributes to the literature by employing the panel ARDL approach to examine the short- and long-term impacts of financial innovation on bank performance, with the inclusion of institutional and macroeconomic control variables that are of interest to the Tunisian banking sector.

The relationship between financial innovation and bank performance has been of interest to economists for several years, with its theoretical basis being Schumpeter and Nichol’s idea (1934) that innovation is a driver of economic growth. In banking, innovation is typically a weapon to promote efficiency, expand services, and cope with regulatory reforms: mixed results, which are founded in empirical research. On the other hand, studies indicate that financial innovation has a positive impact on profitability and efficiency in operations (Mabrouk & Mamoghli, 2010; Arner et al., 2022). Technologies like digital lending, e-platforms, and AI risk scoring improve service provision while saving costs and the errors associated with human involvement.

On the other hand, scholars such as Lerner and Tufano (2011) caution that financial innovation introduces complexity and opacity, hence increasing system risk. In the context of emerging economies, poor institutional environments and low absorptive capacity (Chipeta & Muthinja, 2018) compound the situation. The success of innovation may also depend on contextual factors such as market structure, governance, and economic stability.

Recent works have equally underscored the moderating effect of governance mechanisms in determining innovation performance. De Jonghe (2010) and Barros et al. (2007) set out that risk management practices are positively associated with bank resilience, although over-compensation of CEOs has the effect of distorting incentives and reducing performance (Mustapha, 2018). However, few publications have integrated these aspects in a unifying model in a North African context.

This study contributes to the literature by employing a mixed-methods approach to examine how financial innovation—coupled with internal governance and market pressures—shapes bank performance in Tunisia. Unlike other works, we employ an ARDL model that estimates short-run variation and long-run equilibrium, which allows for better impact evaluation of innovation in a transitioning banking sector.

Despite the growing recognition of financial innovation as a key driver of banking sector growth, the literature exhibits some essential shortcomings that this study seeks to address. First, while existing research (e.g., Mabrouk & Mamoghli, 2010; Ammar, 2016) has noted the influence of financial innovation, there is scant overall empirical proof of its long-run structural influence on banks’ performance, particularly in stock-market-listed banks. Many studies focus on short-term effects, leaving a gap in the understanding of how sustained innovation shapes financial efficiency, profitability, and market competitiveness over extended periods. Second, methodological limitations persist, as much of the existing research does not adequately account for variables with mixed integration orders (I (0) and I (1)), potentially leading to biased estimations.

This study addresses this gap by applying the more suitable ARDL cointegration approach to examine long-term relationships in such a context. Second, while current studies narrowly concentrate on profitability metrics only, they overlook other significant dimensions of bank performance, such as operating efficiency, market share development, and competitive differentiation. Finally, the majority of studies are either time-outdated or geographically constrained, failing to capture the transformative effects of recent technological advancements—such as Fintech, blockchain, and AI—on banking operations. Using data spanning from 2000 to 2024, this research provides an updated and extensive assessment of the way financial innovation structurally transforms the operations of banks within an evolving financial landscape.

3. Materials and Methods

The traditional interpretation of the innovation-firm performance synergy is based on Schumpeter and Nichol’s (1934) own work, who identified innovation as a key driving force of economic and corporate development. Empirical research has consistently relied on this presumption. Han et al. (1998), for instance, examined the interaction dynamics of market orientation, innovation, and firm performance for the U.S. industrial economy. Their findings indicated that administrative and technological innovations alike positively affected corporate performance. Similarly, Wood et al. (1999) investigated the role of product innovation to sustain long-term profitability and established a highly significant positive effect (Halim et al., 2017).

To support this, Varis and Littunen (2010) posited that the underlying motive of a firm’s participation in innovation activities is to enhance its performance and ensure long-run survival. In Tunisian context, Daadaa and Rajhi (2008) analyzed the contribution of new technology to the performance of 13 commercial banks between 1995 and 2000. Their findings highlighted that technological adoption is significant to the expansion of banking activity, locating innovation at the forefront of sectorial development.

Geroski et al. (1993), in their work analyzing 721 UK manufacturing firms, found that the count of innovations was positively associated with operating profit margins. Separately, innovations contributed a modest direct effect, but innovative firms overall outperformed their non-innovative peers. Loof (2000) further confirmed this evidence by showing that there is a high positive correlation between innovation performance, in terms of new product sales per employee, and five firm performance measures: employment growth, value added, turnover, operating profit, and return on assets.

The broader innovation literature stresses that innovation is essential for a firm to survive and compete in knowledge-intensive environments (Cho & Pucik, 2005). Financial sector innovation has linked with economic development according to Nadeau et al. (2012) and Aghion et al. (2009). Financial innovations have a growing core role in assisting banks in extending more credit and responding to evolving market needs.

In spite of these observations, empirical evidence on the relationship between financial innovation and bank performance remains ambiguous. The previous literature has generally ignored the mediating effect of risk management for this relationship. Drawing from our research, here, we test whether risk governance structures influence the direction and size of the financial innovation–performance relationship. We argue that with Tunisian banks continuing to pursue performance driven by innovation, more emphasis should be placed on training bank managers responsible for selecting financial innovations and managing their corresponding risks.

4. Research Methodology, Sample, and Model Presentation

Despite the growing literature addressing bank governance, there remains a relevant gap in empirical studies that address the internal governance practices of banks operating in Tunisia. Perhaps most importantly, recent developments and reforms aimed at improving the internal supervision process remain underexplored in terms of their impact on bank performance. This study seeks to bridge that gap and contribute to the body of research on banking governance by examining how internal governance structures affect financial performance in Tunisian banks.

We propose that internal governance is a little-researched driver of bank performance, particularly in emerging economies like Tunisia. While numerous earlier studies have considered the relationship between governance and performance, there remains no strong consensus yet regarding what matters most in terms of governance characteristics. The present study attempts to contribute to this ongoing debate by focusing on critical dimensions such as the presence of risk monitoring institutions, effective governance, and heterogeneity of bank size.

As the Tunisian economy is bank-financed in a majority of cases, the performance, stability, and quality of governance of its banking system is vital for national economic solidity. Under these circumstances, we would like to propose that board size—a fundamental internal governance element—may have a significant effect on performance outcomes. Based on the institutional characteristics of Tunisian banks, being mostly specialized in traditional banking activities, we assume that the optimal board size is of medium size to strike the optimal balance between control and managerial flexibility. To this end, we establish the following hypotheses:

- H0: A board of medium size is positively associated with bank performance.

- H1: CEO–Chairman duality in the Board of Directors causes a decline in the level of banking performance.

- H2: A great proportion of individual managers on the board of directors is related to greater performance.

- H3: Government contribution increases the performance of banks.

- H4. The proportion of foreign directors is interconnected with bank performance.

- H5: The authority of institutional investors decreases the performance of banks.

- H6: The presence of a risk management agency improves bank performance.

- H7: CEO compensation decreases banking performance.

- Assumption 1:

Holding multiple formal titles within a bank—such as simultaneously serving as both CEO and board chair—does not inherently increase an individual’s influence on the institution’s performance. In cases of hierarchical overlap, the added title often has limited impact, as the responsibilities of governance (board leadership) and executive management (CEO) remain functionally and institutionally distinct.

- Assumption 2:

According to Dryflor et al. (2016), banks that were more resilient and performing better during the 2007–2008 global financial crisis were those that had more independent and larger boards. It confirms that independent oversight can improve risk management and strategic decision making, particularly when facing financial strain.

- Assumption 3:

In developing nations, state control and interference within public banks can positively affect development. Assuming that Tunisia is a developing nation, and based on the situation in Tunisia, we assume that state intervention in banking—specifically in the form of capital injections and regulatory support—is positively related to bank stability and long-term performance.

- Assumption 4:

Assuming that foreign directors have non-board membership with high knowledge and a profit standing, we suppose that they should enhance banking governance and confirm better performance.

- Assumption 5:

Consistent with Vincent et al. (2012), we consider risk management to be closely linked to corporate governance structures. Accordingly, the fifth hypothesis can be stated as follows: when a significant portion of a bank’s shares—specifically, at least 5%—is held by large shareholders, both the bank’s performance and its risk profile are likely to be impacted (Asensio-López et al., 2019).

- Assumption 6:

A better management practice confirmed by the risk commission ensures better stability and banking performance. We observe that the supervision of financial information release and the supervision of the efficiency of the domestic control process are essential to increase banking performance.

- Assumption 7:

Bhagat and Bolton (2017) argues that compensation schemes that are linked to short-term performance metrics may induce bank managers to assume excessive risk, which triggered the 2008 global financial crisis and, in some cases, led to reduced profitability. Taking this logic further, our article examines the relationship between CEO pay and bank performance with the view that exorbitant or poorly designed pay can erode financial stability and long-term value creation. Accordingly, we examine whether CEO compensation in Tunisian banks moderates the innovation–performance relationship (European Central Bank, 2010).

Since its independence in 1956, Tunisia has relied chiefly on bank-based finance to fund its economic development. The financial system is highly concentrated around the banking system, which is the primary provider of credit to economic agents in the public and private sectors. Over the decades, Tunisia’s banking landscape has evolved considerably through institutional reforms, the transformation of specialized banks into universal banks, and the emergence of Islamic finance.

Table 1 presents the evolution in Tunisian banks’ number and structure during the 1957–2024 period. The data are from the Central Bank of Tunisia and are based on monthly and yearly financial reports submitted by the respective banks. The data were constructed by reclassifying ten-day banks’ reports into monthly sectorial and retrospective annual statements.

Table 1.

Evolution of Tunisian bank numbers.

The main institutional landmarks are the following:

- ▪

- December 1989: Inclusion of Citibank, BH-Bank (formerly CNEL), and BNDA (acquired by BNA) in national statistics.

- ▪

- January 1998: Opening of the Tunisian Solidarity Bank (BTS), included in national statistics.

- ▪

- March 2005: Establishment of the Bank for Financing Small and Medium-Sized Enterprises (BFPME), with its figures being recorded from December 2005.

- ▪

- December 2000: Merger of the Bank for Economic Development (BDET) and the National Tourism Development Bank (BNDT) with STB, reorienting them from development banks to commercial banks.

- ▪

- 2004–2005: A number of banks (Qatar National Bank, BTK, BTE, TSB, and BTL) switched from specialized to universal banking institutions.

- ▪

- March 2010: The launch of Banque Zitouna heralded the entry of the sector into Islamic finance.

- ▪

- January 2014: Al Baraka Bank, an offshore bank, transformed into a universal bank.

- ▪

- November 2015: Al Wifak Leasing reconstructed as Al Wifak Bank with a specialty in Islamic finance.

- ▪

- April 2019: Habitat Bank was officially renamed BH-Bank following a decision from the shareholders.

Historically, the 1967 Banking Law, which enforced specialization, governed Tunisia’s banking system, with the commercial banks in short-term credit and the investment banks in medium- and long-term financing. Monetary policy during this era focused on the management of liquidity and the orientation of credit towards priority sectors such as agriculture, tourism, and exports. This system remained in force in the sector until reforms initiated in the early 2000s increasingly directed the sector towards liberalization, diversification, and financial innovation (Table 1).

4.1. Variables Description

To investigate the determinants of banking performance in Tunisia, the current study utilizes a set of six basic variables, selected for their empirical relevance and role in the literature on financial innovation and banking performance. The dependent variable is return on equity (ROE), a widely utilized bank profitability indicator. Independent variables employed are bank size (SIZE), a financial innovation indicator (RF), market concentration (IHH), diversification (DIV), and inflation (INFL) as a macroeconomic control. All of these variables were drawn from previous studies such as Mabrouk & Mamoghli (2010), Anwar and Mughal (2016) and Mustapha (2018), and may be utilized for carrying out a comprehensive evaluation of how internal bank characteristics, as well as external economic factors, influence performance outcomes (Lieven et al., 2006; Rahmouni et al., 2010; Roberts, 1999).

Variable Definitions

The choice of variables was guided by recent studies on the performance of Tunisian banks; see Naceur (2003), Bonin et al. (2005), Mabrouk and Mamoghli (2010), and Anwar and Mughal (2016).

- (a)

- Return on Equity (ROE):

This is the main performance measure utilized in the study. It is calculated as net profit divided by total equity, representing how profitable the bank is for its shareholders. “Return on capital” is the ratio of net profit/total equity. It measures the ability of the bank to remunerate its shareholders.

Degree of diversification (DIV) is measured by the average of D, where D = (1 − |2X − 1|) and X = non-interest-related income/operational income.

This measure indicates the extent to which a bank is diversified in terms of earning streams of income from activities other than interest-generating activities. It is computed using the following formula:

- (b)

- Market Concentration (IHH):

The Herfindahl–Hirschman Index (IHH) is used to capture the extent of competition in the banking sector. As the index value rises, the market is more concentrated with fewer big players, and this might influence performance through price power.

Competition or degree of concentration of the banking system (IHH): In our study, we use this last measure to determine the impact of the degree of competition of banks in Tunisia on their financial performance:

- (c)

- Bank Size (SIZE):

Size refers to the natural logarithm of total assets. It serves as a proxy measure of economies of scale and resources capacity. It is applied extensively as a control variable for research in banking. According to the authors, the size is measured by the logarithm of the total assets. This latter measure is adopted in our study.

Variable Name: RF (Financial Innovation Index). This is used to capture the intensity of financial innovation activities in Tunisian banks, accounting for both product/service innovation and technology adoption.

This aggregate measure captures financial innovation depth at the bank level. It includes normalized scores on (1) Fintech investment, (2) take-up of digital services, and (3) patent-based and R&D proxy-based innovation-related patents. Patent and R&D proxies in emerging markets are scaled down, where feasible, based on available survey-based and financial indicators. We create a composite index combining three proxies commonly used in the financial innovation literature, variables are determined from (OECD, 2005, 2007; World Bank, 2015, 2016; World Economic Forum, 2017):

- (d)

- R&D Expenditure (R&D):

This is proxied by each bank’s annual investment in research and development or equivalent innovation spending (e.g., Fintech partnership expenses, digitalization budget) (Zouari & Zouari-Hadiji, 2014a, 2014b).

- (e)

- Fintech Investment (Fintech):

This is measured as the ratio of annual Fintech-related investments (e.g., mobile banking upgrades, blockchain adoption, AI/ML applications) to total assets.

Innovation-Related Patents (Patents): These are measured by the number of patents filed by the bank in financial technology, digital banking processes, or product innovation.

As these indicators are on different scales, we normalize each indicator using min–max normalization:

Here,

Xit = value of the indicator for bank i in year t.

Min(X) and max(X) = minimum and maximum values of the indicator across banks and years.

Then, we calculate RF as the average of the normalized values:

In our case, if detailed R&D and patent data are not available (common in emerging markets), we adjust this to:

Here, the derived is from survey data or proxy metrics like number of digital banking products, availability of internet banking, and mobile banking adoption rates (Fernandes & Fernandes, 2016).

A composite indicator (RF) that adds up three normalized indicators measures financial innovation: (1) bank-level R&D expenditure, (2) Fintech investment as a share of total assets, and (3) bank and financial technology patents. Each indicator is normalized using min–max scaling to make it comparable, and then the RF measure is calculated as the mean of these normalized values. This approach captures the multidimensional nature of financial innovation in Tunisia’s banking sector and is in line with best practices reported in the literature (Mabrouk & Mamoghli, 2010; Mustapha, 2018).

Inflation (INFL): A macroeconomic control variable defined by the level of annual inflation. It takes into account changes in the general price level that can influence bank expenses and profitability. This is a macroeconomic variable and it is measured by the annual rate of change.

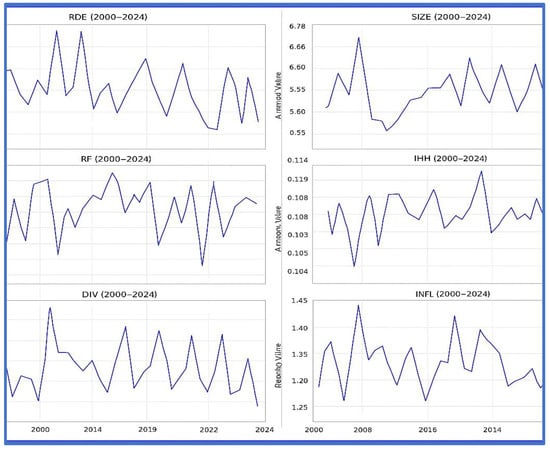

This indicator captures the financial capacity of banks to invest in innovation and manage risk, aligning with studies such as De Jonghe (2010) and Mamoghli & Dhouibi (2007) (Figure 1).

Figure 1.

Graphical representation of all variables.

Financial innovation is multidimensional in nature. Concentrating on this study, we constructed a composite Financial Innovation Index (RF) by combining three components: Fintech investment, digital service adoption score, and R&D/proxy innovation inputs. Digital service adoption scores—though survey-based—were experimented with by more recent empirical studies (e.g., Mustapha, 2018; Chipeta & Muthinja, 2018) as valid proxies where information are scarce. They capture banks’ technological maturity, customer reach, and operating transformation, which are at the core of innovation drivers in emerging economies like Tunisia (Ben Fredj, 2004).

The graphical analysis of the study variables in the case of Tunisian banks during the period 2000–2024 presents important trends and implications on the dynamics of banking operation. The return on equity (ROE) displays fluctuating bank profitability with various levels of financial performance that are most likely influenced by internal management efficiency and macroeconomic conditions. The steady growth in bank size (log of assets) suggests overall expansion in banking operations, possibly driven by increased deposits, asset accumulation, and strategic plans for growth. Dividend payout ratios (DIVs) are highly variable, reflecting different dividend policies that can respond to volatility in earnings or new regulatory requirements. A pronounced upward trend in the Herfindahl–Hirschman Index (IHH) shows increasing market concentration, which can reduce competition and enhance the market power of dominant banks. Lastly, the log-transformed inflation variable (ln (Inf)) shows moderate volatility, pointing to the necessity of macroeconomic stability for the financial sector. Cumulatively, these patterns provide a solid foundation for investigating the determinants of bank performance in Tunisia, and they justify the introduction of these variables in the econometric specification.

4.2. Distributed Lag Autoregressive (ARDL)

ARDL was selected because it is practical when handling variables of different orders of integration (I (0) and I (1)) and is, therefore, well suited to our data where unit root tests had shown mixed stationarity. Unlike panel co-integration approaches such as Pedroni or Kao tests that require all variables to be I (1), or dynamic GMM models that require strict exogeneity and large panels, ARDL is better in small-sample environments and provides short- and long-run dynamics. This is particularly helpful given the modest size of our panel (11 banks for 25 years).

The ARDL uses standard least squares regressions that include offsets of the dependent variable and explanatory variables as regressors (Greene, 2008). Although ARDL models have been used in econometrics for decades, they have gained popularity in recent years as a method of examining the co-integration relationship among variables by Pesaran and Shin (1998) and Pesaran et al. (2001).

There is empirical evidence that exists which indicates that the ARDL surpasses earlier and traditional co-integration methods. The first is that the ARDL does not need all the variables studied integrated in the same order and is employed when the basic variables are integrated in order one, order zero, or fractional integration. The second benefit is that the ARDL test is relatively more effective for small and limited sample sizes of data.

To verify the hypothetical relations, our study follows the usually recommended two-stage process. The normality of the variables taken as number of observations is 231. Following the Pearson correlation, as is evident from Table 2, there are no correlations between our explanatory variables, which is a sign that there are no problems of multicollinearity among the independent variables.

Table 2.

Statistical analyses of variables.

The descriptive statistics presented in Table 2 show that the average asset profitability of our sample is (9.02%). Thus, the average of the size is 6.52 with a standard deviation of 0.387.

To assess the presence of autocorrelation in the residuals, the Breusch–Godfrey Serial Correlation LM test was conducted. This diagnostic test is appropriate for both time-series and panel data settings and helps ensure the reliability of the estimated model. The results, summarized in Table 3, indicate whether the null hypothesis of no serial correlation can be rejected. These findings are critical for validating the model’s specification and ensuring that subsequent inferences are not biased due to serially correlated errors.

Table 3.

Breusch–Godfrey serial correlation LM test.

As the p-value of the test statistic is above the 5% threshold, we fail to reject the null hypothesis of no serial correlation. This suggests that no significant autocorrelation exists in the residuals up to lag two.

To examine the presence of heteroscedasticity in the model residuals, the White test and the Breusch–Pagan test were employed. These tests are commonly used to detect non-constant variance in the error terms, which, if present, can undermine the efficiency of the estimators. The test results, presented in Table 4, provide evidence on whether the null hypothesis of homoscedasticity can be rejected. Ensuring the absence of heteroscedasticity is essential for the validity of standard error estimates and the robustness of statistical inference.

Table 4.

White test for heteroscedasticity.

The result of the Breusch–Godfrey serial correlation LM test indicates that the error terms from the model estimation do not significantly display autocorrelation. In fact, the test gives a p-value greater than 0.05, so we cannot reject the null hypothesis of no serial correlation. That is, the error terms of the model are not serially correlated in a systematic fashion; hence, the estimates are not biased due to autocorrelation.

In contrast, the White test for heteroscedasticity shows that the residuals are heteroscedastic, as the statistically significant F-statistic and Obs*R2 (p < 0.01) confirm. The inference is that the variance of the error terms is not the same across observations, which is against one of the key assumptions of classical linear regression. Heteroscedasticity can lead to inefficient estimates and biased standard errors if left unresolved.

To account for this, the regression estimates are re-run with heteroscedasticity and autocorrelation consistent (HAC) standard errors, specifically the Newey–West estimator. The correction makes the coefficient estimates consistent and the standard errors robust to autocorrelation and heteroscedasticity, rendering statistical inferences derived from the model more credible.

The null hypothesis of Jarque–Bera test for normality is accepted when either of the following two conditions is met:

(1) The calculated value of the Jarque–Bera statistic is lower than the critical chi-squared value at the 5% significance level with two degrees of freedom (i.e., 5.99); or

(2) The probability (p-value) associated with the Jarque–Bera statistic, as reported by EViews 13, exceeds the 5% threshold (i.e., p > 0.05).

In addition, we note that there is the presence of heteroscedasticity (the distribution does not follow a normal law) for all variables. Therefore, we reject the hypothesis of normality H0 for all variables.

Table 5 presents the results of the four unit root tests employed to determine the order of integration of the series. The Levin, Lin, and Chu (Levin et al., 2002; Levin & Lin, 1992) test assumes a common unit root process across cross-sectional units under the alternative hypothesis, implying cross-sectional dependence. To address this limitation, the Im, Pesaran, and Shin (Im et al., 2003) test allows for individual unit root processes across the series, offering greater flexibility in panel data settings.

Table 5.

Unit root tests.

We observe that the null unit root hypothesis is not rejected for the series at the level except for the variables ROE and INFL, but the unit root hypothesis is rejected for the rest of the variables at the first difference. The PP unit root tests show the same results, validating that the results of the ADF and PP unit root tests are reliable and robust when data is missing.

Thus, the results indicate that the ROE and INFL variables are stationary at level I (0); however, the rest of the variables have all become stationary at the first difference I (1). The results are presented in Table 5, and we find a mixed integration order such as I (0) and I (1). Therefore, to avoid this problem, we can use the ARDL (autoregressive distributed lag) model, which was introduced by Pesaran et al. (2001) to incorporate variables I (0) and I (1) in the same estimate.

4.3. Model Presentation

This study aims to pinpoint the unique characteristics of Tunisian banks and their effect on financial performance. While the literature indicates significant growth in studies that examine the role of financial innovation in bank performance, there remains a glaring dearth of studies that focus on the African case—particularly Tunisia. Despite ongoing reforms and increased Fintech adoption across the region, there have been few empirical studies examining how innovation affects banking outcomes in North African economies.

In order to guarantee that this void is filled, our sample data were obtained from publicly available Tunisian banks, including Amen Bank, ATB, Attijari Bank, BH, BIAT, BNA, BT, BTE, STB, UB-CI, and UIB. Official documents from the Conseil du Marché Financier (CMF), the Tunis Stock Exchange (BVMT), and the Professional Association of Banks in Tunisia (APBT) were consulted to secure data. These institutions provide reliable and timely financial disclosures that form the empirical foundation for our analysis.

In addition, the interval of study of 25 years, covering the period from 2000 to 2024, saw that the number of banks is relatively small, but our number of observations is 251 because of panel data structure.

This gives a panel of 275 comments of how the explanatory variables included in the model relate to the characteristics of the Tunisian banks. By using data between 2000 and 2024, this article empirically examines financial innovation’s contribution to the performance of Tunisia’s 11 listed banks

We consider the following model:

Here, is the error of the model, which expresses, or summarizes, the missing information in the linear explanation of the values of from exogenous variables (problem of specifications, variables not considered, etc.).

The empirical study, as undertaken in our work, is based on using hierarchical panel data econometric regression models to test the research of advanced hypotheses.

There is extensive research supporting the view that financial innovation may negatively influence diversification. For instance, Boot and Thakor (1997a, 1997b), argue that financial innovation will be less innovative in universal banking systems—where, in commercial and investment banks these functions operate jointly, as opposed to frameworks in which they are functionally divided. The combination of bank activities can deter innovation by resulting in institutional complexity or regulatory prohibitions.

On the other hand, many studies have made a positive link between financial innovation and market competition. Schumpeter (1950) emphasized that heightened market competition compels firms to innovate as a means of attaining or maintaining competitive edge. Empirical findings by Yildirim & Philippatos (2007), based on a study of banks in 11 Latin American countries, support this view. Their findings show that competition prompts banks to differentiate their products, thereby inducing financial innovation as a strategic response to maintain market share.

The estimation of the long-run ARDL model, presented in Table 6, informs about the structural bank performance–financial innovation relationship. The model is estimated with panel data covering 11 Tunisian banks over the period 2000–2024. The adjusted R-squared of 0.5532 indicates the satisfactory explanatory power of the model. In addition, the F-statistic of 9.3278 with a significance level (p < 0.05) indicates the joint significance of the explanatory variables and enables us to reject the null hypothesis that all the coefficients are equal to zero.

Table 6.

Long-run coefficients (ARDL model).

The long-run regression results show bank size and diversification to have statistically significant effects on performance, as measured by return on equity (ROE). The implication is that larger banks and those more diversified in operations tend to perform better, possibly due to economies of scale and risk diversification. In contrast, variables such as capital resources and competitive rivalry are not statistically predictive of long-term performance in the Tunisian context. The implications are that operating strategies internal to the firm, rather than market competition or the size of capital, are more predictive of bank profitability in the longer term.

The use of this approach was guided by the short data interval. We selected a maximum delay order of one for the conditional ARDL model using the Akaike information criteria (AIC). The results of the estimation of the ARDL model (1, 1, 1, 1, 1) selected according to the AIC are presented as follows in Table 7.

Table 7.

Short-run dynamics and error correction model (ECM).

The coefficient of the interaction term IHH × RF is positive and significant at the 5% level. This indicates the effect of financial innovation on bank performance. The impact of financial innovation is more pronounced in highly concentrated markets with limited competition. In other words, innovation works better to enhance ROE when banks are in a more monopolistic or oligopolistic environment (Table 7).

Δ (IHH × RF) is positive and significant, suggesting that short-term innovations are more successful when they are introduced in less competitive (more concentrated) banking markets. This offers evidence in support of the argument that market structure plays a significant moderating role in the performance payoffs of innovation strategies, even in the short term.

The long-run estimation results in Table 6 demonstrate that inflation (INF), financial innovation (RF), and market concentration (IHH) are statistically significant and have positive contributions to the performance of Tunisian banks as measured by return on equity (ROE). Specifically, the RF coefficient is positive and significant at the 5% level, which suggests that banks that invest more in innovation activity, e.g., in Fintech solutions or digital infrastructure, experience higher profitability in the long- run. In addition, the IHH index, measuring market concentration, is positively related to ROE, suggesting that banks operating in a more concentrated market tend to benefit from reduced competition and better pricing power. Inflation is also discovered to have a positive and highly significant influence in the long run, which is caused by the banks’ ability to adjust lending interest rates with respect to inflationary trends, thereby increasing their interest margins.

The size variable of bank size was found to be significantly and negatively correlated with ROE, which indicates that larger banks are plagued by inefficiencies or structural rigidities that inhibit their profitability. The DIV variable of diversification, however, not found to have a statistically significant influence on bank performance in the long term, which indicates that diversification by itself could not lead to improved financial performance.

The short-run dynamics, as given in Table 6, show that all explanatory variables except one have statistically irrelevant effects on ROE in the short run, and inflation (INF) has a detrimental effect on performance. This shows that while inflation can ultimately make banks richer through price adjustment policies, it can place immediate operational and cost pressures that lead to a short-term decline in returns. Interestingly, the error correction term (ECM) is negative and statistically significant with a coefficient of −0.27022, confirming that there is a long-run stable equilibrium relationship. This outcome indicates that approximately 27% of any deviation from the long run is corrected in a single period, indicating a moderate adjustment speed towards equilibrium.

Overall, these findings validate the strategic role of financial innovation for bank performance enhancement over time and highlight structural and macroeconomic determinants. Thus, policymakers and bank executives must focus on producing innovation capabilities, optimizing bank size, and mitigating inflationary impacts in order to sustain financial performance in both the short and long run.

The size of the bank negatively (0.08804) and significantly at the 5% thresholds explains the performance of Tunisian banks (ROE). A 1% increase in the size of the bank will reduce the banking performance by (0.088%). The variables that are confused in our results are very rare.

The results obtained lead us to believe that even if their sizes increase, Tunisian banks are unable to exploit the economies of scale and scope present in their product innovation activity. Public banks and large banks do not have the necessary funds to finance the high costs of adopting and implementing certain monetary innovations.

The main mission of these banks is to finance priority sectors such as agriculture, industry, and tourism, which have reduced their resources. In addition, large banks do not have flexible structures, and their adoption requires higher implementation and training costs for their staff. This is responsible for the negative impact of size (Mabrouk & Mamoghli 2010).

Our results are consistent with those of Mamoghli and Dhouibi (2007), using financial resources as a variable measuring financial innovation and improving banking performance. In addition, De Jonghe (2010) found that banks that perform better in financial terms are those with financial resources. The results show that a large quantity of resources encourages the bank (at the 5% level) to adopt product innovations related to its main activity and, therefore, to face the credit risk associated with it.

In another analysis register, diversification at the level of products and/or services offered by Tunisian banks is related to a non-significant impact on financial profitability. In addition, diversification strategies implemented in the banking sector and Tunisian banks choose this concept to expand their range of products and services to meet the financial needs of customers.

The results obtained show that there is a significant positive relationship between the level of concentration of the banking system in Tunisia, as measured by the IHH index, and the return on capital at the 5% threshold. A 1% increase in concentration level increases ROE by 2.93%.

That is to say, the increase in competition in the Tunisian banking sector between 2000 and 2020 has led to a significant increase in the market share of banks and, therefore, the improvement of their financial performance. Competition is pushing all banks to introduce the electronic clearing system, as this is an innovation imposed by the Central Bank of Tunisia (Ammar 2016; Mabrouk & Mamoghli 2010).

Our empirical results suggest a mixed impact of macroeconomic conditions indicators on bank performance. Afanasieff et al. (2002) concluded that macroeconomic variables are the most relevant to explain banks’ performance in emerging markets.

This variable is a speed at which the general level of prices of goods and services is increasing and, thereafter, purchasing power is decreasing. The variable INF (T = 0.063 and p = 0.000) does not keep the direction of the expected sign. Different contexts have shown that inflation has a negative relationship with the profitability of banks in Bangladesh Sufian and Habibullah (2009). Inflation, on the other hand, is associated with the extension and overvaluation of bank charges, but the swelling of the latter is recovered on depositors and borrowers.

Inflation leads to higher investment costs but also high credit rates, and therefore higher interest and profit revenues. These procedures satisfy the (long-term) co-integration relationship between the variables considered.

In accordance with the literature, our results show that bank size is, in fact, the natural log of total assets positively related to short-term financial performance. Throughout model estimates, the bank size coefficient is significant and consistent with the notion that bigger banks are more profitable over the short term. This corroborates the established opinion in the finance literature that bigger institutions enjoy economies of scale, more diversification of risks, and higher efficiency of operations, which all manifest in higher performance compared to smaller banks.

These findings are consistent with those of Mabrouk and Mamoghli (2010) and Naceur (2003) in the Tunisian banking sector. They validate that bank size is a significant determinant of the degree of profitability. Further, previous research by Philip Bourke (1989), Michael Smirlock (1985), Bikker and Haaf (2002), and Pasiouras et al. (2007) provides several explanations for this positive relationship. These include the following:

- ▪

- Lower average operating costs for large banks;

- ▪

- Improved access to finance;

- ▪

- Improved bargaining strength in financial markets;

- ▪

- Improved shock-absorbing ability, contributing to short-term stability.

Generally, the evidence shows that in the short term, large Tunisian banks operate more efficiently than small banks, due to both structural advantages and their greater scope to implement and benefit from financial innovation strategies.

First, an important size allows one to decrease costs because of the economies of scale that this entails.

Second, larger banks may benefit from lower capital-raising costs. However, our analysis of the financial resource variable reveals an insignificant coefficient with a negative sign (−0.485), which contradicts our initial hypothesis. This finding aligns with Mabrouk and Mamoghli (2010) and Mabrouk et al. (2016), who similarly observed negative significance—though only in cases involving imitation, rather than genuine innovation processes.

In contrast, our results indicate that product/service diversification among Tunisian banks has a statistically significant positive effect (p < 0.05) on financial profitability. Tunisian banks have increasingly adopted diversification strategies to broaden their offerings and better meet client financial needs, reflecting a deliberate shift toward expanding their product and service portfolios.

The results of the estimate show that not all the variables are significant, except size and financial resources, with a significant effect (at the 1% threshold), and the variable significant competition at the 10% threshold on the profitability of the asset.

To test Hypothesis H6 and H7, we added the variable Risk_Mgmt as a dummy variable equal to 1 if there is a bank with a formal risk management agency, and 0 if not. This variable serves as a proxy for having sole risk governance arrangements, and it tells us whether banks have formalized procedures for managing, controlling, and reducing different types of financial risk. By making this variable, we aim to determine to what extent the existence of a special risk monitoring function is able to influence bank performance.

The variable Ceo_Comp is also a dummy variable that takes on the value of 1 if CEO compensation in a given year is above the sample median for the corresponding year, and 0 otherwise. This variable reflects to what extent executive compensation is above the norm within Tunisian banking. Including Ceo_Comp allows us to look at how executive compensation structure is connected with bank performance, alleviating agency theory worries that excessive compensation can warp managerial incentives and produce riskier or less optimal financial policies. The results are shown in Table 8:

Table 8.

Hypothetical estimation results for governance variables (ARDL long run).

The results of the long-run ARDL model provide empirical support for hypotheses H6 and H7. The risk management agency (Risk_Mgmt) variable is positively and statistically significant at the 5% level, confirming that banks with dedicated risk governance arrangements achieve enhanced financial performance (ROE). The outcome supports previous research in emphasizing the importance of internal control systems in mitigating operational and credit risks and, hence, enhancing stability and efficiency the same results for (Teti et al., 2018; Tufano, 2002; Wanjohi et al., 2017).

On the other hand, the Ceo_Comp coefficient is statistically significant and negative, validating hypothesis H7. It shows that higher executive compensation may be associated with weaker financial performance due to misaligned incentives, risk-taking behavior, or rent extraction behavior—consistent with agency theory expectations.

With Tunisia’s economic and political transformations—most significantly post-2011 revolution and the periods of the COVID-19 pandemic—we tested for possible structural breaks using the Bai–Perron multiple breakpoint test. Robustness tests also included structural break dummies to account for any eventual regime change that may affect model stability Table 9 and Table 10.

Table 9.

Regression results: ROE with structural break dummies.

Table 10.

Test CUSUM.

To estimate the potential effect of big structural events, i.e., the 2011 Tunisian Revolution and the COVID-19 pandemic, two dummy variables were included in the regression model. The post-2011 dummy captures political and regulatory adjustments after the revolution, and the COVID dummy detects effects during the 2020–2021 global health crisis. The results show that the two variables have negative coefficients, which suggest a downward pressure on bank profitability during these periods. Neither of the two variables, however, proves to be statistically significant at conventional levels (p = 0.2042 for post-2011 and p = 0.7855 for COVID); thus, it can be inferred that the long-run determinants of bank performance were quite insensitive to these external shocks. This outcome is consistent with the earlier CUSUM test that identified no severe structural break in the model. The findings overall validate temporal model resilience and suggest that while external shocks hit the overall economy, their immediate impact on the average profitability of Tunisian banks may have been weakened or delayed.

In order to test the stability of our findings with regard to institutional size, we re-specified the baseline model using subsamples of the largest three and largest five banks in terms of average total assets. The findings confirm that estimated coefficients are, for the most part, consistent with the full-sample model, testifying to the robustness of the underlying relationships. Notably, the diversification factor (DIV) was significant at the 5% level (p = 0.036) in the top-three banks model, implying that larger banks can derive more tangible performance gains from diversified revenues. This is related to economies of scale in providing non-interest services, more customer bases, and stronger digital capabilities. On the other hand, there was no statistically significant variable in the top-five banks model, although the direction and magnitude of coefficients were identical. These results suggest that while financial innovation has a contribution towards bank performance on a consistent basis over institution size, the magnitude of particular effects—namely, income diversification—may be more extreme in very large institutions (Table 11).

Table 11.

Robustness test: Top-3 vs. top-5 banks.

To assess the robustness of our results and investigate the role of institutional size, we re-estimated the ARDL model using subsamples comprising the top three and top five banks based on average total assets. These estimates were then compared with those obtained from the full sample of 11 banks, as reported in Table 12.

Table 12.

Robustness of our results.

Diversification effect (DIV) has a positive impact on the top-three banks to a large degree, which shows that the larger institutions benefit more from diversified income streams as they have broader product lines, larger and more segmented customer bases, and superior digital infrastructure to offer non-interest products. On the other hand, small banks lack the size and resources to implement such strategies to any impact, hence the statistically insignificant results in the top-five and full samples. In terms of size and structural rigidities, the full sample indicates a negative correlation between size and ROE, implying diseconomies of scale—such as bureaucratic inefficiencies, higher coordination costs, and slower implementation of innovations—in larger or incumbent institutions. Yet, this effect levels off in the top-three and top-five banks, where operational efficiency could offset these drawbacks. Financial innovation (RF) positively affects profitability for the whole sample, highlighting its long-run value, but its effect decreases in the largest banks, possibly due to innovation saturation or slow returns from Fintech investment. Market concentration (IHH) also raises profitability across the full sample, as banks in more concentrated markets have pricing power, better margins, and stable client relationships—though there are statistical significance declines in the upper-tier samples as sample sizes reduce. These differences underline the importance of bank size and resource capacity in the effectiveness of diversification and innovation. While very large banks benefit from diversification, smaller banks face structural challenges in leveraging such strategies. The full sample captures broader market forces, including innovation-induced performance gaps and inefficiencies, yielding stronger statistical inferences. Last, the findings underscore the need for policy prescriptions tailored to institutional size and market heterogeneity.

5. Discussion

This part outlines the empirical findings of the relationship between financial innovation and bank performance in Tunisia using panel data over the period 2000–2024. The results offer some significant insights. First, financial innovation positively affects bank profitability statistically significantly, where the usage of digital banking and investment in Fintech translate into higher ROA and ROE. Second, innovative banks gain the competitive edge by securing larger market shares due to improved operating efficiency and customer-driven services.

The results are supported by the panel regression analysis after controlling for bank-specific factors, with robustness checks using the ARDL model for addressing endogeneity issues. Surprisingly, however, the results show that while large banks have scale advantages, they are affected by slower introduction of innovations compared to smaller, and therefore more agile, competitors. These findings are in line with global trends but also highlight Tunisia’s unique regulatory environment as both a facilitator and constraint to financial innovation. This paper contributes new evidence on how technological change reshapes banking performance in developing economies, while also underlining the need for even-handed policies that foster innovation without compromising financial stability.

The findings of this study have important policy implications for policymakers, financial regulators, and financial institutions in Tunisia.

- ▪

- First, regulators can adopt innovation-friendly regulatory policies such as regulatory sandboxes to encourage Fintech experimentation while maintaining financial stability.

- ▪

- Second, policymakers have to revise the banking regulations in Tunisia to keep pace with digital transformation in order to prevent compliance frameworks from slowing down technological take-up.

- ▪

- Third, banks should be incentivized—through tax relief or subsidies—to invest in digital infrastructure and cybersecurity, particularly smaller banks that trail behind in adopting innovations.

In addition, banks need to make efforts in areas of financial literacy to enhance public confidence in digital banking services, promoting more adoption. Lastly, based on the positive interplay between bank performance and innovation, the financial authorities and central bank of Tunisia should promote public–private partnerships so that the process of Fintech uptake is accelerated, thus keeping the banking industry competitive within a more digitalized economy. Such measures would not only enhance the performance of each bank but also the overall stability and inclusiveness of Tunisia’s financial system.

The contrast between the top three, top five, and the whole sample shows substantial differences in the impact of financial innovation and other controls on bank performance in Tunisia. Most notable is the result that diversification has a positive and significant effect on performance only in the top-three banks, which may suggest that larger and more capable institutions with improved digital infrastructure and broader customer bases are best, positioned to convert diversification into profitability. On the other hand, small banks may lack the scale to implement such moves effectively. While RF is positive and significant with ROE in the full sample, it is insignificant in the top banks, possibly an indication of initial high innovation levels or delayed profitability effects of new investment. In addition, bank size (SIZE) also shows a statistically significant negative impact on performance in the full sample, indicating that large banks experience diseconomies of scale or structural inefficiencies. Market concentration (IHH) is also a significant positive only in the full sample, indicating the advantage of pricing power and stability in more concentrated banking environments. These variations imply that institutional size and competitive market environments significantly influence the manner in which financial innovation and diversification affect the financial performance of banks

6. Conclusions

This study aimed to examine the relationship between financial innovation and the performance of deposit banks in Tunisia by analyzing key determinants of financial performance. This research was satisfactory to cross the inputs of theoreticians and practitioners on the performance of the banks to inform the relationship between financial innovations and financial performance of Tunisian banks, considering internal and external factors of the banks, which are likely to affect this relationship.

The empirical evaluation observed a sample composed of 11 Tunisian banks on the stock exchange in the period 2000–2024. The results of the model show that the connections between the size, diversification, and the dependent variable (ROE) are statically significant.

Through this research, we analyzed the impact of financial innovation on the performance of Tunisian banks listed on the BVMT, focusing on financial performance determinants.

The empirical findings of this study confirm the existence of the long-run equilibrium relationship between bank performance and financial innovation. As the estimated ARDL model indicates, bank size, concentration of the market (IHH), financial funds, and inflation exert statistically significant long-term effects on return on equity (ROE). Bank size shows a negative correlation with ROE, suggesting that as banks grow, they may face diminishing returns resulting from greater structural complexity or inefficiency. Competitiveness, financial solidity, and inflation are positive long-run determinants of bank performance. However, the diversification variable failed to show a material impact in the long run.

To verify the suitability of the ARDL model, we conducted unit root tests like LLC, PP, IPS, and ADF, and the findings show that there was mixed order of integration in the variables—some first level I (0) stationary and some I (1) first difference. This rendered it suitable to apply the ARDL bounds testing technique compatible with such characteristics of integration. Results are consistent with the hypothesis that financial innovation contributes to competitive edge, improved profitability, financial efficiency, and perhaps increased market share for emerging economy banks.

More broadly, evidence suggests that financial innovation is a strategic instrument to spur capital accumulation, saving, and economic growth. Financial innovation in emerging markets like Tunisia is, therefore, not an automatism technological progress but more of a welfare-enhancing instrument with significant effects on the evolution of the banking sector (Chen & Peng, 2020; Nejad, 2016).

In order to test the research hypotheses, we estimated multiple regression analysis within the framework of ARDL based on a panel of 275 observations. Model two forecasted the impact of financial innovation on bank performance. The quality of the overall model is statistically good, but findings indicate that financial innovation has no direct contribution to ROE. However, evidence was observed for the indirect positive impact of innovation on banking business and competitive positioning.

This is in agreement with the arguments of Mabrouk and Mamoghli (2010), Xiangying et al. (2015), Love et al. (1996) and Aayale (2017), who argue that innovation enhances operational capability despite the fact that its financial impact is not immediately observed in profitability metrics. The findings also agree with Mustapha (2018), who emphasizes that investing in technological innovation eventually improves bank performance. However, our findings contrast with those of DeYoung and Torna (2007) and Chipeta and Muthinja (2018) in that they indicate a direct positive influence of innovation on ROE. This variation may be due to differences in institutional environments, innovation maturity levels, and regulatory frameworks across countries.

We offer empirical support that RF is positive for bank performance in the long run, especially when banks are highly concentrated within their markets (as identified by the statistically significant interaction IHH × RF). Risk management exists in cases of good performance, and greater CEO remuneration is negatively correlated with profitability. The ARDL model outperformed competing methods by reproducing short-run dynamics and long-run equilibrium without requiring strict stationarity.

For practitioners, the results indicate that strategic investment in innovation, alongside control of governance, enhances bank performance, especially for markets with weaker competition. For researchers, the article makes a methodological contribution by applying an ARDL-based dynamic framework to an under-researched North African banking sector in the literature.

Limitations include the following: The study was conducted in a single nation (Tunisia), there were measurement problems with innovation (RF), and there was limited access to good-quality data on R&D spending. Future studies can take the analysis to other MENA countries, and use machine-learning-based innovation indices or dynamic GMM if panel dimensions allow. Qualitative methods can also complement these findings by ascertaining managerial orientations towards innovation.

The results offer actionable insights for the Central Bank of Tunisia and financial regulators seeking to foster innovation-driven performance. Policymakers can consider incentives for digital transformation, such as tax relief for R&D or targeted innovation grants. Commercial banks may use the findings to benchmark their innovation maturity and recalibrate strategic investment. Investors and analysts can apply the model to evaluate the future performance prospects of banks based on innovation intensity.

Funding

This work was supported and funded by the Deanship of Scientific Research at Imam Mohammad Ibn Saud Islamic University (IMSIU) (grant number IMSIU-DDRSP2504).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data that support the findings of this study are openly accessible on the official website of the World Bank https://www.databank.worldbank.org (accessed on 14 May 2023) and the Financial Access Survey of the International Monetary Fund website https://www.imf.org/ (accessed on 23 February 2024).

Acknowledgments

The author extends their appreciation to the Deanship of Scientific Research, Imam Mohammad Ibn Saud Islamic University (IMSIU), Saudi Arabia, for their support of this study. The researcher also appreciates the considerable time and work of the reviewers and the editor to expedite the process. Their commitment and expertise were crucial in making this work a success. I appreciate your unwavering help.

Conflicts of Interest

The author declares no conflicts of interest.

References

- Aayale, J. (2017). The impact of financial innovations on the financial industry’s performance: A study of BRICS and G6 nations. International Journal of Economics, Commerce and Management, 7(11), 138–152. [Google Scholar]

- Abdelaziz, H., Mouldi, D., & Helmi, H. (2011). Financial liberalization and banking profitability: A panel data analysis for Tunisian banks. International Journal of Economics and Financial Issues, 1, 19–32. [Google Scholar]

- Abir, M., & Chokri, M. (2010). Is financial innovation influenced by financial liberalization? Evidence from the Tunisian banking industry. Journal of Banks and Bank Systems, 5(3), 97–111. [Google Scholar]

- Afanasieff, T. S., Lhacer, P. M., & Nakane, M. I. (2002). The determinants of bank interest spread in Brazil. Money Affairs, 15(2), 183–207. [Google Scholar]

- Aghion, P., Blundell, R., Griffith, R., Howitt, P., & Prantl, S. (2009). The effects of entry on incumbent innovation and productivity. The Review of Economics and Statistics, 91(1), 20–32. [Google Scholar] [CrossRef]

- Amblard, M. (2007). Performance financière: Vers une relecture critique du résultat comptable. In Performance financière: Vers une relecture critique du résultat comptable (Vol. 2, pp. 61–109). HAL Id: halshs-00266955 XVIème Conférence de l’Association Internationale de Management Stratégique (AIMS). [Google Scholar]

- Ammar, S. (2016). Innovation and performance of Tunisian banks. International Journal of Economics, Finance and Management Sciences, 4(2), 87–92. [Google Scholar] [CrossRef][Green Version]

- Andersen, T. B., & Tarp, F. (2003). Financial liberalization, financial development and economic growth in LDCs. Journal of International Development, 15(2), 189–209. [Google Scholar] [CrossRef]

- Anwar, A. I., & Mughal, M. Y. (2016). Migrant remittances and fertility. Applied Economics, 48(36), 3399–3415. [Google Scholar] [CrossRef]

- Arnaboldi, F., & Rossignoli, B. (2015). Financial innovation in banking. In E. Beccalli, & F. Poli (Eds.), Bank risk, governance and regulation (Palgrave Macmillan Studies in Banking and Financial Institutions). Palgrave Macmillan. [Google Scholar] [CrossRef]

- Arner, D. W., Barberis, J., & Buckley, R. P. (2022). Fintech and the future of finance. Asian Journal of Law and Economics, 13(1), 1–20. [Google Scholar]

- Arthur, K. N. A. (2017). The emerging financial innovation and its governance: A historical literature review. Journal of Innovation Management, 5(4), 48–73. [Google Scholar] [CrossRef]

- Asensio-López, D., Cabeza-García, L., & González-Álvarez, N. (2019). Corporate governance and innovation: A theoretical review. European Journal of Management and Business Economics, 28(3), 266–284. [Google Scholar] [CrossRef]

- Baiquan, S., & Kebao, W. (2010, August 24–26). Managing the risks of financial innovations in banking. 2010 International Conference on Management and Service Science, Wuhan, China. [Google Scholar] [CrossRef]

- Barros, C. P., Ferreira, C., & Williams, J. (2007). Analysing the determinants of performance of best and worst European banks: A mixed logit approach. Journal of Banking & Finance, 31(7), 2189–2203. [Google Scholar] [CrossRef]