Spillovers Among the Assets of the Fourth Industrial Revolution and the Role of Climate Uncertainty

Abstract

1. Introduction

2. The Literature Review

3. Data and Methodology

3.1. The Data

3.2. The Research Methodology

3.2.1. The TVP-VAR Model and GFEVD

3.2.2. The Joint Connectedness Approach

3.2.3. The Extended Joint Connectedness Approach

3.2.4. The Impact of Climate Uncertainty on Return Spillovers

4. Empirical Results and Discussion

4.1. The Results on the Averaged Joint Connectedness

4.2. The Dynamic Total Connectedness

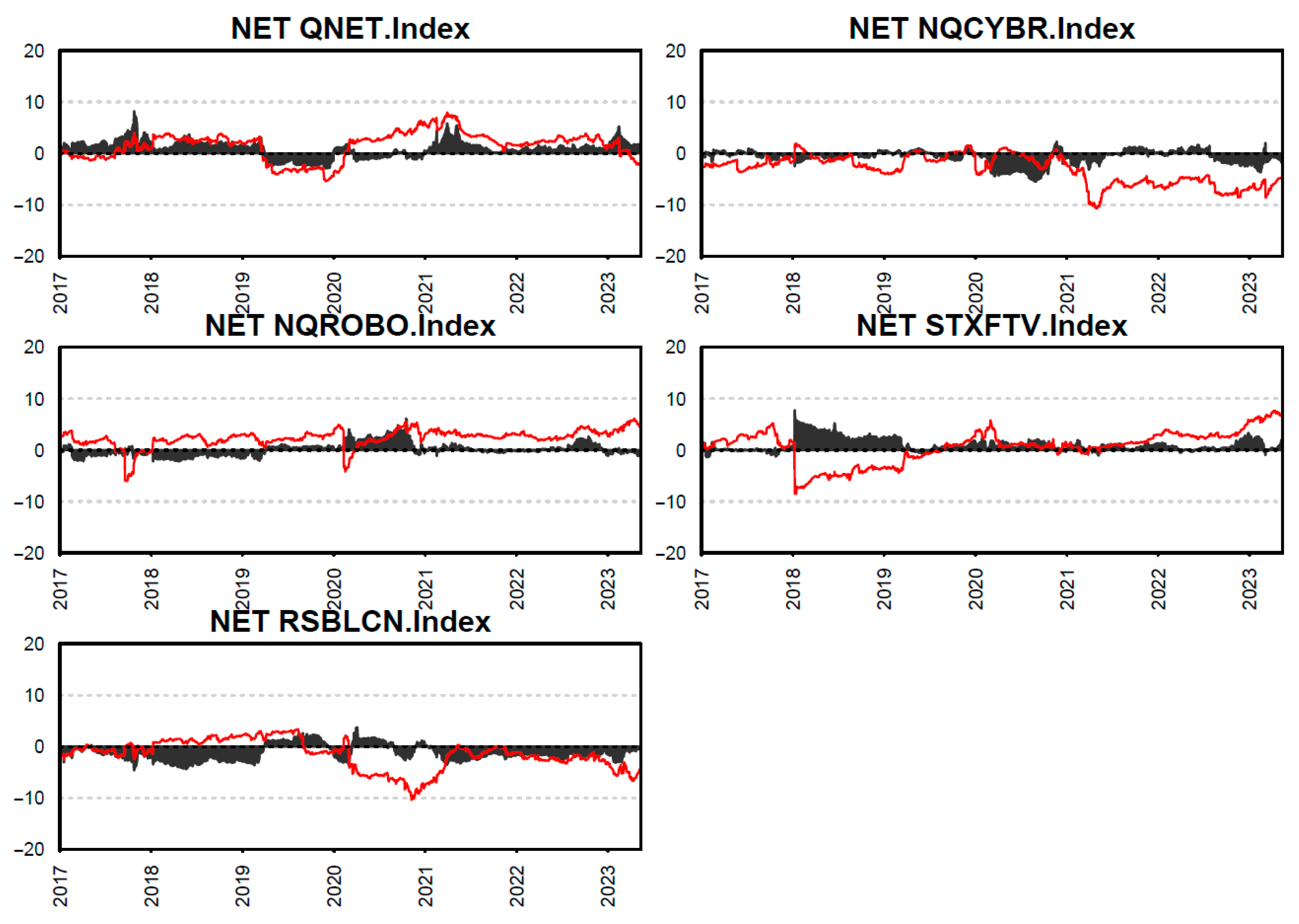

4.3. The Net Total Directional Connectedness

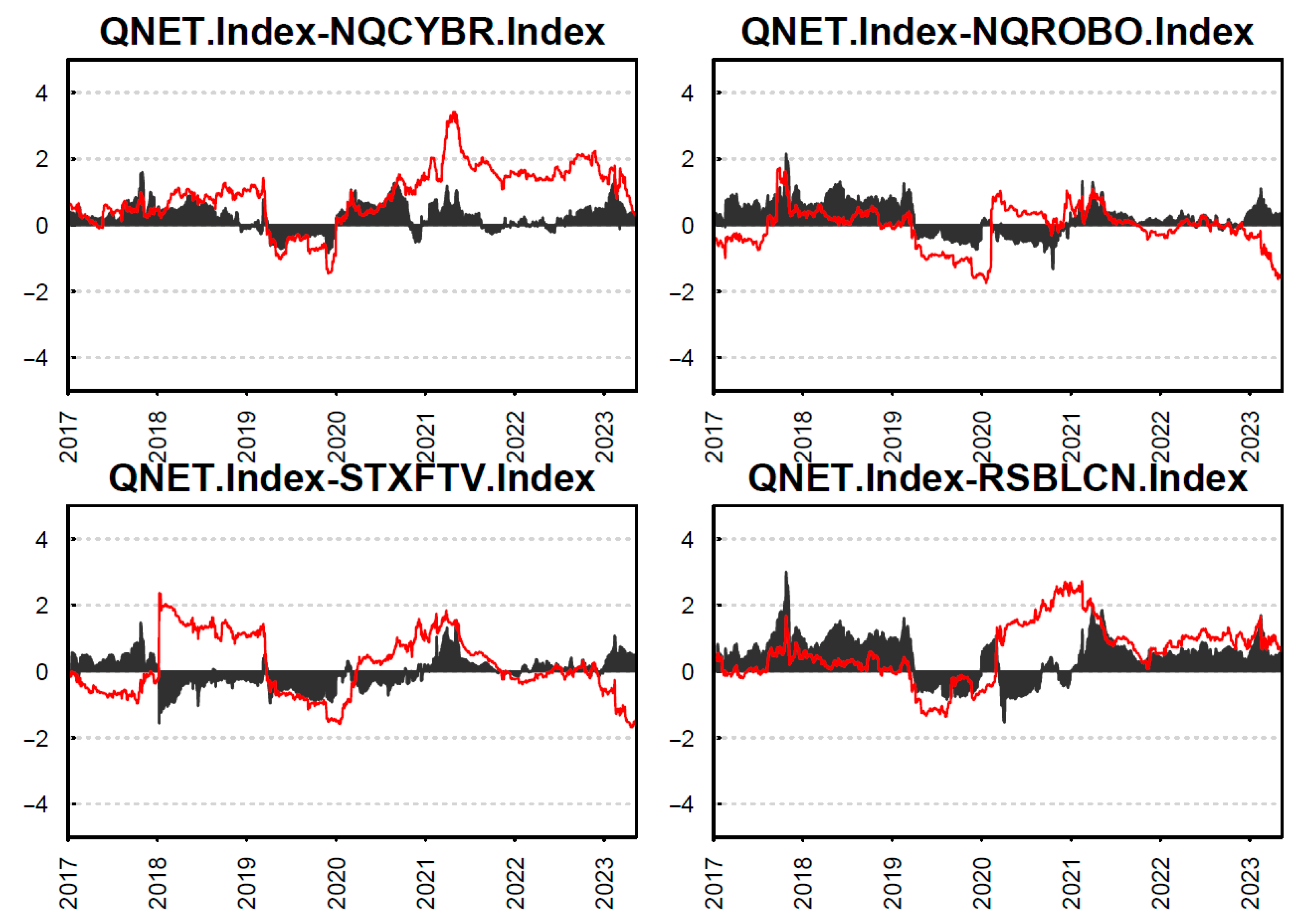

4.4. Pairwise Connectedness

4.5. The Determinants of Joint Total Connectedness

5. Conclusions and Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Adekoya, O. B., Oliyide, J. A., Saleem, O., & Adeoye, H. A. (2022). Asymmetric connectedness between Google-based investor attention and the fourth industrial revolution assets: The case of FinTech and robotics & artificial intelligence stocks. Technology in Society, 68, 101925. [Google Scholar]

- Allen, F., & Gale, D. (2000). Financial contagion. Journal of Political Economy, 108(1), 1–33. [Google Scholar] [CrossRef]

- Almpanopoulou, A., Ritala, P., & Blomqvist, K. (2019, January 8–11). Innovation ecosystem emergence barriers: Institutional perspective. 52nd Hawaii International Conference on System Sciences, Wailea, HI, USA. [Google Scholar]

- Bai, D., Du, L., Xu, Y., & Abbas, S. (2023). Climate policy uncertainty and corporate green innovation: Evidence from Chinese A-share listed industrial corporations. Energy Economics, 127, 107020. [Google Scholar] [CrossRef]

- Bai, Y., & Zhang, J. (2012). Financial integration and international risk sharing. Journal of International Economics, 86(1), 17–32. [Google Scholar] [CrossRef]

- Baker, S. R., Bloom, N., & Davis, S. J. (2016). Measuring economic policy uncertainty. The Quarterly Journal of Economics, 131(4), 1593–1636. [Google Scholar] [CrossRef]

- Balcilar, M., Gabauer, D., & Umar, Z. (2021). Crude oil futures contracts and commodity markets: New evidence from a TVP-VAR extended joint connectedness approach. Resources Policy, 73, 102219. [Google Scholar] [CrossRef]

- Barnett, M., Brock, W., & Hansen, L. P. (2022). Climate change uncertainty spillover in the macroeconomy. NBER Macroeconomics Annual, 36(1), 253–320. [Google Scholar] [CrossRef]

- Batten, S. (2018). Climate change and the macro-economy: A critical review. SSRN Electronic. [Google Scholar] [CrossRef]

- Beatty, T., & Shimshack, J. P. (2010). The impact of climate change information: New evidence from the stock market. The BE Journal of Economic Analysis & Policy, 10(1), 105. [Google Scholar]

- Beckmann, J., Berger, T., & Czudaj, R. (2015). Does gold act as a hedge or a safe haven for stocks? A smooth transition approach. Economic Modelling, 48, 16–24. [Google Scholar] [CrossRef]

- Bonfiglioli, A. (2008). Financial integration, productivity and capital accumulation. Journal of International Economics, 76(2), 337–355. [Google Scholar] [CrossRef]

- Bouri, E., Das, M., Gupta, R., & Roubaud, D. (2018). Spillovers between Bitcoin and other assets during bear and bull markets. Applied Economics, 50(55), 5935–5949. [Google Scholar] [CrossRef]

- Bouri, E., Molnár, P., Azzi, G., Roubaud, D., & Hagfors, L. I. (2017). On the hedge and safe haven properties of Bitcoin: Is it really more than a diversifier? Finance Research Letters, 20, 192–198. [Google Scholar] [CrossRef]

- Chatziantoniou, I., Gabauer, D., & Stenfors, A. (2021). Interest rate swaps and the transmission mechanism of monetary policy: A quantile connectedness approach. Economics Letters, 204, 109891. [Google Scholar] [CrossRef]

- Chen, L. (2017). International competitiveness and the fourth industrial revolution. Entrepreneurial Business and Economics Review, 5(4), 111–133. [Google Scholar]

- Choi, C., & Kim, C. (2019). Towards sustainable environmental policy and management in the fourth industrial revolution: Evidence from big data analytics. The Journal of Asian Finance, Economics and Business, 6(3), 185–192. [Google Scholar] [CrossRef]

- Demiralay, S., Gencer, H. G., & Bayraci, S. (2021). How do Artificial Intelligence and Robotics Stocks co-move with traditional and alternative assets in the age of the 4th industrial revolution? Implications and Insights for the COVID-19 period. Technological Forecasting and Social Change, 171, 120989. [Google Scholar] [CrossRef]

- Diebold, F. X., & Yılmaz, K. (2009). Measuring financial asset return and volatility spillovers, with application to global equity markets. Economic Journal, 119(534), 158–171. [Google Scholar] [CrossRef]

- Diebold, F. X., & Yılmaz, K. (2012). Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting, 28(1), 57–66. [Google Scholar] [CrossRef]

- Diebold, F. X., & Yılmaz, K. (2014). On the network topology of variance decompositions: Measuring the connectedness of financial firms. Journal of Econometrics, 182(1), 119–134. [Google Scholar] [CrossRef]

- Dirican, C. (2015). The impacts of robotics, artificial intelligence on business and economics. Procedia-Social and Behavioral Sciences, 195, 564–573. [Google Scholar] [CrossRef]

- Disli, M., Nagayev, R., Salim, K., Rizkiah, S. K., & Aysan, A. F. (2021). In search of safe haven assets during COVID-19 pandemic: An empirical analysis of different investor types. Research in International Business and Finance, 58, 101461. [Google Scholar] [CrossRef]

- Döring, T., & Schnellenbach, J. (2006). What do we know about geographical knowledge spillovers and regional growth?: A survey of the literature. Regional Studies, 40(03), 375–395. [Google Scholar] [CrossRef]

- Dwyer, G. P. (2015). The economics of Bitcoin and similar private digital currencies. Journal of Financial Stability, 17, 81–91. [Google Scholar] [CrossRef]

- Eckert, C. (2020). Risk and risk management of spillover effects: Evidence from the literature. Risk Management and Insurance Review, 23(1), 75–104. [Google Scholar] [CrossRef]

- Edison, H. J., Levine, R., Ricci, L., & Sløk, T. (2002). International financial integration and economic growth. Journal of International Money and Finance, 21(6), 749–776. [Google Scholar] [CrossRef]

- El Khoury, R., Alshater, M. M., & Li, Y. (2023). Multidimensional connectedness among the fourth industrial revolution assets. Borsa Istanbul Review, 23(4), 953–979. [Google Scholar] [CrossRef]

- Engle, R. F., Giglio, S., Kelly, B., Lee, H., & Stroebel, J. (2020). Hedging climate change news. The Review of Financial Studies, 33(3), 1184–1216. [Google Scholar] [CrossRef]

- Frischmann, B. M., & Lemley, M. A. (2007). Spillovers. Columbia Law Review, 107, 257. [Google Scholar]

- Gao, W., Wei, J., Zhang, H., & Zhang, H. (2024). Does climate policy uncertainty exacerbate extreme risk spillovers between green economy and energy metals? Resources Policy, 91, 104946. [Google Scholar] [CrossRef]

- Giglio, S., Maggiori, M., Rao, K., Stroebel, J., & Weber, A. (2021). Climate change and long-run discount rates: Evidence from real estate. The Review of Financial Studies, 34(8), 3527–3571. [Google Scholar] [CrossRef]

- Gulzar, S., Mujtaba Kayani, G., Xiaofen, H., Ayub, U., & Rafique, A. (2019). Financial cointegration and spillover effect of global financial crisis: A study of emerging Asian financial markets. Economic Research-Ekonomska Istraživanja, 32(1), 187–218. [Google Scholar] [CrossRef]

- Ha, S., Yangchen, S., & Assan, A. (2022). COVID-19 testing: A qualitative study exploring enablers and barriers in the Greater Accra Region, Ghana. Frontiers in Public Health, 10, 908410. [Google Scholar] [CrossRef] [PubMed]

- Haberly, D., MacDonald-Korth, D., Urban, M., & Wójcik, D. (2019). Asset management as a digital platform industry: A global financial network perspective. Geoforum, 106, 167–181. [Google Scholar] [CrossRef]

- Hoque, M. E., Soo-Wah, L., Bilgili, F., & Ali, M. H. (2023). Connectedness and spillover effects of US climate policy uncertainty on energy stock, alternative energy stock, and carbon future. Environmental Science and Pollution Research, 30(7), 18956–18972. [Google Scholar] [CrossRef] [PubMed]

- Huynh, T. L. D., Hille, E., & Nasir, M. A. (2020). Diversification in the age of the 4th industrial revolution: The role of artificial intelligence, green bonds and cryptocurrencies. Technological Forecasting and Social Change, 159, 120188. [Google Scholar] [CrossRef]

- Ji, Q., Ma, D., Zhai, P., Fan, Y., & Zhang, D. (2024). Global climate policy uncertainty and financial markets. Journal of International Financial Markets, Institutions and Money, 95, 102047. [Google Scholar] [CrossRef]

- Khalfaoui, R., Jabeur, S. B., & Dogan, B. (2022). The spillover effects and connectedness among green commodities, Bitcoins, and US stock markets: Evidence from the quantile VAR network. Journal of Environmental Management, 306, 114493. [Google Scholar] [CrossRef]

- Lane, P. R., & Milesi-Ferretti, G. M. (2003). International financial integration. IMF Staff Papers, 50(Suppl. S1), 82–113. [Google Scholar] [CrossRef]

- Lastrapes, W. D., & Wiesen, T. F. P. (2021). The joint spillover index. Economic Modelling, 94, 681–691. [Google Scholar] [CrossRef]

- Le, T. L., Abakah, E. J. A., & Tiwari, A. K. (2021). Time and frequency domain connectedness and spill-over among fintech, green bonds and cryptocurrencies in the age of the fourth industrial revolution. Technological Forecasting and Social Change, 162, 120382. [Google Scholar] [CrossRef]

- Li, J. P., Naqvi, B., Rizvi, S. K. A., & Chang, H. L. (2021). Bitcoin: The biggest financial innovation of fourth industrial revolution and a portfolio’s efficiency booster. Technological Forecasting and Social Change, 162, 120383. [Google Scholar] [CrossRef]

- Liu, X., An, H., Huang, S., & Wen, S. (2017). The evolution of spillover effects between oil and stock markets across multi-scales using a wavelet-based GARCH–BEKK model. Physica A: Statistical Mechanics and Its Applications, 465, 374–383. [Google Scholar] [CrossRef]

- Malhotra, N., & Gupta, S. (2019). Volatility spillovers and correlation between cryptocurrencies and Asian equity market. International Journal of Economics and Financial Issues, 9(6), 208–215. [Google Scholar] [CrossRef]

- Martin, P., & Rey, H. (2000). Financial integration and asset returns. European Economic Review, 44(7), 1327–1350. [Google Scholar] [CrossRef]

- Mhlanga, D. (2023). FinTech and climate-related challenges in the fourth industrial revolution. In FinTech and artificial intelligence for sustainable development: The role of smart technologies in achieving development goals (pp. 213–239). Springer Nature Switzerland. [Google Scholar]

- Naifar, N. (2024a). Climate policy uncertainty and comparative reactions across sustainable sectors: Resilience or vulnerability? Finance Research Letters, 65, 105543. [Google Scholar] [CrossRef]

- Naifar, N. (2024b). Spillover among sovereign credit risk and the role of climate uncertainty. Finance Research Letters, 61, 104935. [Google Scholar] [CrossRef]

- Nyagadza, B., Pashapa, R., Chare, A., Mazuruse, G., & Hove, P. K. (2022). Digital technologies, fourth industrial revolution (4IR) & global value chains (GVCs) nexus with emerging economies’ future industrial innovation dynamics. Cogent Economics & Finance, 10(1), 2014654. [Google Scholar]

- Ortas, E., & Moneva, J. M. (2013). The clean Techs equity indexes at stake: Risk and return dynamics analysis. Energy, 57, 259–269. [Google Scholar] [CrossRef]

- Park, C. Y., & Lee, J. W. (2011). Financial integration in emerging Asia: Challenges and prospects. Asian Economic Policy Review, 6(2), 176–198. [Google Scholar] [CrossRef]

- Park, S. (2011). Co-evolution of policy and emerging technology: Hydrogen energy policies in Iceland, the United Kingdom, and Korea. Korean Journal of Policy Studies, 26(1), 117–143. [Google Scholar] [CrossRef]

- Pesaran, H. H., & Shin, Y. (1998). Generalized impulse response analysis in linear multivariate models. Economics Letters, 58(1), 17–29. [Google Scholar] [CrossRef]

- Pham, S. D., Nguyen, T. T., & Do, H. X. (2024). Impact of climate policy uncertainty on return spillover among green assets and portfolio implications. Energy Economics, 134, 107631. [Google Scholar] [CrossRef]

- Qin, M., Zhu, Y., Xie, X., Shao, X., & Lobonţ, O. R. (2024). The impact of climate risk on technological progress under the fourth industrial era. Technological Forecasting and Social Change, 202, 123325. [Google Scholar] [CrossRef]

- Ratner, M., & Chiu, C. C. J. (2013). Hedging stock sector risk with credit default swaps. International Review of Financial Analysis, 30, 18–25. [Google Scholar] [CrossRef]

- Sadorsky, P. (2012). Correlations and volatility spillovers between oil prices and the stock prices of clean energy and technology companies. Energy Economics, 34(1), 248–255. [Google Scholar] [CrossRef]

- Schindler, M. (2009). Measuring financial integration: A new data set. IMF Staff Papers, 56(1), 222–238. [Google Scholar] [CrossRef]

- Su, C. W., Qin, M., Tao, R., & Umar, M. (2020). Financial implications of fourth industrial revolution: Can bitcoin improve prospects of energy investment? Technological Forecasting and Social Change, 158, 120178. [Google Scholar] [CrossRef] [PubMed]

- Symitsi, E., & Chalvatzis, K. J. (2019). The economic value of Bitcoin: A portfolio analysis of currencies, gold, oil and stocks. Research in International Business and Finance, 48, 97–110. [Google Scholar] [CrossRef]

- Thampanya, N., Nasir, M. A., & Huynh, T. L. D. (2020). Asymmetric correlation and hedging effectiveness of gold & cryptocurrencies: From pre-industrial to the 4th industrial revolution. Technological Forecasting and Social Change, 159, 120195. [Google Scholar]

- Umar, M., Rizvi, S. K. A., & Naqvi, B. (2021). Dance with the devil? The nexus of fourth industrial revolution, technological financial products and volatility spillovers in global financial system. Technological Forecasting and Social Change, 163, 120450. [Google Scholar] [CrossRef]

- Venturini, A. (2022). Climate change, risk factors and stock returns: A review of the literature. International Review of Financial Analysis, 79, 101934. [Google Scholar] [CrossRef]

- Xu, X., Huang, S., Lucey, B. M., & An, H. (2023). The impacts of climate policy uncertainty on stock markets: Comparison between China and the US. International Review of Financial Analysis, 88, 102671. [Google Scholar] [CrossRef]

- Youssef, M., Mokni, K., & Ajmi, A. N. (2021). Dynamic connectedness between stock markets in the presence of the COVID-19 pandemic: Does economic policy uncertainty matter? Financial Innovation, 7(1), 13. [Google Scholar] [CrossRef]

- Zhu, N., Zhang, X., Ren, X., & Wang, L. (2023). The response of corporate innovation to climate policy uncertainty: Evidence from China. Journal of Environmental Assessment Policy and Management, 25(02), 2350008. [Google Scholar] [CrossRef]

| Index | Abbr. | Desription | Source |

|---|---|---|---|

| Internet Index | QNET | The Nasdaq Internet Index is a modified market-capitalization-weighted index designed for tracking the performance of the largest and most liquid US-listed companies engaged in internet-related businesses that are listed on the Nasdaq Stock Market, the New York Stock Exchange (NYSE), or the NYSE Amex. It includes companies engaged in a broad range of internet-related services, including internet software, internet access providers, internet search engines, web hosting, website design, and internet retail commerce. | Bloomberg |

| Cybersecurity Index | NQCYBR | The Nasdaq CTA Cybersecurity IndexSM is designed for tracking the performance of companies engaged in the cybersecurity segment of the technology and industrial sectors. This index includes companies primarily involved in building, implementing, and managing security protocols applied to private and public networks, computers, and mobile devices to protect data integrity and network operations. | Bloomberg |

| (AI) and Robotics Index | NQROBO | The Nasdaq CTA Artificial Intelligence and Robotics Index is designed for tracking the performance of companies engaged in the artificial intelligence and robotics segment of the technology, industrial, medical, and other economic sectors. This index includes companies in artificial intelligence or robotics that are classified as either enablers, engagers, or enhancers. | Bloomberg |

| Fintech | STXFTV | The Global Fintech Index consists of companies associated with financial technology (fintech). These businesses utilize technology to transform the way financial services are delivered to end customers and/or to enhance the competitive edge of traditional financial service providers by improving efficiency and driving new products and solutions. | Bloomberg |

| Blockchain Index | RSBLCN | The Nasdaq Blockchain Economy Index is designed for measuring the returns of companies that commit material resources to developing, researching, supporting, innovating, or utilizing blockchain technology for their proprietary use or use by others. | Bloomberg |

| QNET | NQCYBR | NQROBO | STXFTV | RSBLCN | |

|---|---|---|---|---|---|

| Mean | 0.031 | 0.053 | 0.023 | 0.035 | 0.039 |

| Variance | 3.130 | 2.271 | 1.929 | 1.962 | 2.165 |

| Skewness | −0.363 *** | −0.550 *** | −0.485 *** | −0.514 *** | −0.201 *** |

| Kurtosis | 3.055 *** | 4.364 *** | 5.989 *** | 11.710 *** | 5.042 *** |

| Jarque–Bera | 682.436 *** | 1401.659 *** | 2547.273 *** | 9563.532 *** | 1770.746 *** |

| ERS | −15.970 *** | −18.329 *** | −15.725 *** | −13.612 *** | −17.909 *** |

| Q(20) | 56.012 *** | 66.176 *** | 85.277 *** | 164.235 *** | 53.649 *** |

| Q2(20) | 630.595 *** | 917.198 *** | 760.780 *** | 1426.597 *** | 694.350 *** |

| QNET | NQCYBR | NQROBO | STXFTV | RSBLCN | From | |

|---|---|---|---|---|---|---|

| QNET | 17.66 | 20.44 | 20.81 | 20.71 | 20.38 | 82.34 |

| NQCYBR | 20.71 | 21.98 | 20.56 | 19.77 | 16.98 | 78.02 |

| NQROBO | 21.05 | 20.34 | 15.72 | 21.16 | 21.73 | 84.28 |

| STXFTV | 20.67 | 19.40 | 20.96 | 18.65 | 20.31 | 81.35 |

| RSBLCN | 20.84 | 17.07 | 22.05 | 20.74 | 19.30 | 80.70 |

| To | 83.28 | 77.25 | 84.38 | 82.37 | 79.40 | 406.69 |

| Net | 0.95 | −0.76 | 0.10 | 1.02 | −1.30 | TCI = 81.34 |

| NPDC | 3.00 | 1.00 | 2.00 | 4.00 | 0.00 | 81.34 |

| Coefficient | Q = 0.05 | Q = 0.10 | Q = 0.25 | Q = 0.50 | Q = 0.75 | Q = 0.90 | Q = 0.95 |

|---|---|---|---|---|---|---|---|

| CPU | 0.0061 *** | 0.0054 *** | 0.0023 | 0.0005 | −0.0006 | −0.0009 | −0.0017 |

| EPU | −0.0062 | 0.0032 | −9.44 × 10−6 | 0.0018 | 0.0046 | 0.0118 * | 0.0133 * |

| GPR | −0.0005 | −0.0013 | −0.0009 | −0.0043 | −0.0079 ** | −0.0038 | −0.0012 |

| OVX | −0.0057 | −0.0040 | −0.0042 | −0.0021 | 0.0004 | −0.0098 * | −0.0109 * |

| TPU | 0.0027 | −0.0002 | −0.0007 | −0.0009 | −0.0014 | −0.0047 | −0.0055 |

| VIX | 0.0011 | 0.0012 | 0.0044 | 0.0054 | 0.0002 | 0.0012 | 0.0009 |

| WHCE | −0.0169 * | −0.0032 | −0.0057 | −0.0016 | −0.0039 | −0.0116 | −0.0104 |

| Constant | −0.0065 | −0.005 *** | −0.0024 | −0.0006 | 0.0017 *** | 0.0055 *** | 0.0061 *** |

| R2 (%) | 27.36 | 19.98 | 12.15 | 8.45 | 12.19 | 18.36 | 28.73 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alhashim, M.; Belkhir, N.; Naifar, N. Spillovers Among the Assets of the Fourth Industrial Revolution and the Role of Climate Uncertainty. J. Risk Financial Manag. 2025, 18, 316. https://doi.org/10.3390/jrfm18060316

Alhashim M, Belkhir N, Naifar N. Spillovers Among the Assets of the Fourth Industrial Revolution and the Role of Climate Uncertainty. Journal of Risk and Financial Management. 2025; 18(6):316. https://doi.org/10.3390/jrfm18060316

Chicago/Turabian StyleAlhashim, Mohammed, Nadia Belkhir, and Nader Naifar. 2025. "Spillovers Among the Assets of the Fourth Industrial Revolution and the Role of Climate Uncertainty" Journal of Risk and Financial Management 18, no. 6: 316. https://doi.org/10.3390/jrfm18060316

APA StyleAlhashim, M., Belkhir, N., & Naifar, N. (2025). Spillovers Among the Assets of the Fourth Industrial Revolution and the Role of Climate Uncertainty. Journal of Risk and Financial Management, 18(6), 316. https://doi.org/10.3390/jrfm18060316