1. Introduction

The UAE’s economy has long been deeply rooted in oil revenues, solidifying its position as one of the world’s leading oil-exporting nations. However, the volatility of global oil prices—driven by geopolitical tensions, fluctuating demand, and evolving supply dynamics—poses critical challenges to the country’s financial markets. Beyond oil price fluctuations, the UAE is undergoing a significant economic transformation, integrating sustainability-driven policies aimed at reducing its dependency on hydrocarbons. This study examines how oil price volatility and sustainability initiatives collectively shape the performance of the MSCI UAE Index, offering insights into the broader economic implications for oil-dependent markets in transition. As of 2023, the UAE derives over 30% of its GDP from oil-related activities, making it one of the most oil-reliant economies in the Gulf region (

OPEC, 2023). Simultaneously, the country has positioned itself as a regional leader in sustainability, committing to net-zero emissions by 2050. This unique economic structure—combining resource dependency with aggressive sustainability ambition—makes the UAE an ideal case for investigating how traditional oil-market dynamics interact with emerging sustainability-driven policy frameworks.

Existing literature has extensively explored the relationship between oil prices and stock markets, particularly in developed economies such as the US and the UK, where the dynamics between oil shocks and equity returns have been thoroughly analyzed (

Jones & Kaul, 1996;

Huang et al., 1996;

Ciner, 2001). However, studies on emerging oil-exporting economies—especially those in the Gulf region—remain relatively limited (

Fasanya et al., 2021;

Agarwalla et al., 2021). Although

Banerjee et al. (

2023) provide evidence for long-term cointegration between oil prices and UAE stock indices, their analysis does not fully account for the recent evolution of sustainability policy frameworks or their influence on financial market stability. This gap is increasingly relevant as the UAE occupies a unique dual role: a leading oil exporter and a frontrunner in sustainability-led economic diversification (

Iacobuţă et al., 2021;

Mhadhbi & Guelbi, 2024). As highlighted by

Kruse et al. (

2024), the growing relevance of ESG signals in financial markets warrants a deeper investigation into how sustainability policies interact with traditional oil-market dynamics in shaping investor behavior and market resilience.

The relationship between oil prices and stock market performance is further complicated by the evolving emphasis on sustainability, particularly in oil-dependent economies like the UAE. Historical evidence suggests that oil price fluctuations drive investor sentiment, impacting stock prices and market stability (

Kim et al., 2022). While rising oil prices typically generate economic surpluses that can be reinvested in sustainability projects, global financial markets are now placing increasing value on firms with strong environmental, social, and governance (ESG) profiles, rewarding them with favorable stock performance (

Kruse et al., 2024).

Within the UAE, sustainability policies are playing an increasingly central role in shaping economic and investment landscapes. Initiatives such as the Dubai Clean Energy Strategy 2050, UAE Net Zero 2050, and ADNOC’s low-carbon commitments highlight the country’s strategic efforts to balance economic growth with environmental sustainability (

Mhadhbi & Guelbi, 2024). Moreover, platforms like Abu Dhabi Sustainability Week and regulatory frameworks such as the UAE Green Bond Framework signal the nation’s commitment to integrating sustainability into its financial system. These initiatives are reshaping investor expectations and attracting capital inflows into green investments, positioning the UAE as a leader in sustainable finance.

This study contributes to the literature by integrating sustainability-driven announcements into traditional oil price volatility models, offering a novel empirical and conceptual perspective on how financial markets in oil-exporting nations respond to the sustainability transition. Unlike existing studies that view oil price shocks in isolation, this research develops an integrated framework in which sustainability policies act as key moderating factors within the oil-stock market relationship. The analysis focuses on the UAE—an oil-dependent yet rapidly diversifying economy—through the application of advanced econometric techniques.

To operationalize this framework, we employ a dataset of 2707 daily observations from January 2014 to December 2024 and apply linear regression, ARCH, GARCH, and TARCH models to examine volatility dynamics in the MSCI UAE Index. This methodological approach allows for a multifaceted investigation of stock market responses to oil price movements and sustainability signals. The study contributes empirically in four main ways: it assesses the sensitivity of equity returns to oil price changes, identifies volatility clustering patterns in response to external shocks, investigates asymmetries in market reactions to negative versus positive oil movements, and incorporates major sustainability announcements to analyze their dual impact—initially disruptive, but ultimately stabilizing for market dynamics. By focusing on two pivotal periods—the 2014–2016 oil price collapse and the 2019–2023 phase of geopolitical tension and sustainability rollouts—this research offers unique insights into the behavior of financial markets under compounded external pressures.

Beyond its empirical findings, this study contributes theoretically to the evolving literature on sustainable finance by proposing that sustainability signals can both mitigate short-term volatility and enhance long-term investor confidence in resource-dependent economies. This dual-lens approach enriches our understanding of financial resilience in transitional markets and highlights the strategic importance of ESG integration for policymakers and investors. Building on this perspective, the study further explores how oil price volatility and sustainability initiatives jointly shape stock market dynamics. As global investment priorities increasingly emphasize ESG considerations (

Friede et al., 2015;

Gillan et al., 2021), assessing the financial impact of the UAE’s sustainability agenda becomes essential. The country’s balanced strategy—linking hydrocarbon reliance with green finance frameworks—highlights the critical role of policy-driven mechanisms in enhancing market stability and promoting sustainable growth in oil-reliant economies (

Iacobuţă et al., 2021).

The remainder of this paper is structured as follows: The next section presents a literature review on oil price volatility, stock market returns, and sustainability policy impacts. This is followed by a detailed discussion of the research methodology and econometric modeling approach. The subsequent analysis examines the MSCI UAE Index’s response to oil price fluctuations and sustainability-driven announcements. Finally, the paper concludes with actionable recommendations for investors and policymakers aimed at fostering market stability, economic diversification, and sustainable growth.

2. Literature Review

The interplay between oil prices, stock market performance, and sustainability has gained prominence in economic research, particularly in the context of a global transition toward sustainable practices. This literature review aims to refine the understanding of the relationships among oil price fluctuations, the impacts of sustainability-driven announcements, and their consequences for financial markets.

The relationship between oil prices and stock prices has garnered significant attention from economists and financial analysts over the years. Research indicates that fluctuations in oil prices are critical predictors of stock market returns due to their direct and indirect impacts on macroeconomic indicators, such as gross domestic product (GDP), interest rates, consumer price index (CPI), and employment levels (

Jones & Kaul, 1996;

Huang et al., 1996). This correlation reflects a broader economic context where oil price movements can generate significant shifts in overall market performance, especially in oil-dependent economies.

In oil-exporting countries, rising oil prices often translate into enhanced national income, which can foster increased consumer spending and investment.

Liu et al. (

2020) noted that while certain sectors benefit from rising oil prices, others might encounter increased operational costs that could dampen profitability. For instance, industries heavily reliant on oil, such as transportation and manufacturing, experience cost pressures that can adversely affect their market performance. Furthermore, the type of shock to oil prices—be it supply- or demand-based—affects the stock market’s reaction, illustrating the complexity of this relationship (

Sadorsky, 1999).

The effects of oil price fluctuations have intensified in light of recent global events, particularly the COVID-19 pandemic and geopolitical tensions (

Salman & Ali, 2021;

Shehzad et al., 2021). Studies by

Hung and Vo (

2021) highlighted a noteworthy negative impact of rising oil prices on stock market returns during the pandemic, especially in nations with a high dependency on oil revenues. The volatility observed during this period has underscored the interlinked nature of global economic activities and the oil sector, particularly revealing the vulnerabilities of oil-dependent economies during economic shocks.

Xiao et al. (

2023) further emphasized how investor sentiment and behavior shift during crises, leading to altered investment strategies that reflect heightened market sensitivity to oil price dynamics (

Zarrouk & Ayachi, 2009;

Ayachi & Zarrouk, 2012). The COVID-19 pandemic introduced unprecedented volatility in commodity markets, influencing oil prices dramatically (

Mensi et al., 2020). During the early months of the pandemic, a collapse in demand led to negative oil prices, which had a cascading effect on financial markets, highlighting the interconnectedness of global economic activities with the oil sector. This phenomenon revealed vulnerabilities in economies heavily reliant on oil revenues, exemplifying the need for diversification and sustainability (

Memon & Yao, 2021).

Building upon foundational studies,

Ågren (

2006) explored the transmission of volatility from oil prices to stock markets. Utilizing GARCH modeling to examine the volatility spillover effects, the study provided strong evidence of such transmissions across various national stock markets, with exceptions like the Swedish market. The findings indicate that while stock markets generally respond predictably to oil price shocks, the magnitude of these responses varies significantly based on the structural characteristics of each stock market.

Moreover, the asymmetric behavior in volatility dynamics suggests that negative oil price shocks have a more profound impact on stock market volatility than positive shocks (

Mork et al., 1994;

Sadorsky, 1999). This asymmetric relationship is particularly evident in developed markets, where investor behavior often overreacts to negative news. For instance, the volatility spillover effects from oil prices to stock market indices have been empirically established for various markets, including the US, the UK, and emerging markets, often attributed to the inherent dependence of many sectors on oil as a critical input (

Huang et al., 1996;

Ciner, 2001).

Amid these established dynamics, the growing prominence of sustainability has emerged as a transformative force shaping the relationship between oil price fluctuations and stock market performance. The increasing global focus on sustainable finance has driven a re-evaluation of how sustainability initiatives influence investor behavior and market outcomes. Investors now expect firms to demonstrate not only strong financial performance but also a clear commitment to environmentally and socially responsible practices (

Eccles et al., 2014). The heightened emphasis on ESG (environmental, social, and governance) considerations underscores this shift, with studies by

Friede et al. (

2015) and

Gillan et al. (

2021) revealing a growing investor preference for companies with robust ESG profiles. This trend intersects with the volatility associated with oil price fluctuations, highlighting the evolving complexity of investment decision-making in modern markets (

Kruse et al., 2024).

Moreover, the relationship between sustainability and financial performance is well-documented.

Zhang et al. (

2022) demonstrate that companies exhibiting strong ESG practices tend to achieve lower capital costs and higher resilience during market downturns.

Thun et al. (

2024) further posit that integrating sustainability into core corporate strategies allows firms to not only mitigate risks linked to environmental regulations but also capitalize on growth opportunities in emerging renewable energy markets. This alignment with global sustainability trends underscores a paradigm shift in how markets assess the value of companies.

Responsible investment approaches are gaining traction. Investors are encouraged to allocate capital to businesses that actively reduce their carbon footprint and bolster societal well-being.

Krueger et al. (

2020) illustrate how sustainability considerations significantly shape portfolio management, signaling that investors are increasingly inclined to align investments with environmental stewardship and social responsibility.

The literature on the role of divestment in shaping market dynamics adds another dimension to this discussion.

Dordi and Weber (

2019) investigate the implications of divestment announcements, providing empirical evidence that such announcements can influence share prices in the fossil fuel industry. Their findings echo the sentiments of growing investor consciousness regarding climate change and its financial repercussions.

In exploring the interplay between oil dependency and the advancement of sustainable practices, we acknowledge that many OPEC++ participating countries, including the UAE, face significant challenges. As the world increasingly concentrates on climate change and transitioning toward low-carbon economies, understanding the relationship between oil markets and sustainability initiatives becomes paramount. Studies that assess how sustainability initiatives affect stock market performance in oil-dependent economies are lacking, highlighting the importance of further research in this area.

In exploring the interplay between oil dependency and the advancement of sustainable practices, we acknowledge that many OPEC++ participating countries, including the UAE, face significant challenges. As the world increasingly concentrates on climate change and transitioning toward low-carbon economies, understanding the relationship between oil markets and sustainability initiatives becomes paramount (

Iacobuţă et al., 2021).

Studies that assess how sustainability initiatives affect stock market performance in oil-dependent economies are lacking (

Okeke, 2021;

Pham et al., 2021), highlighting the importance of further research in this area.

While extensive research has examined the relationship between oil price volatility and stock market dynamics, existing studies have primarily focused on developed markets or treated oil price fluctuations in isolation. Few have explored the compounded effects of sustainability-driven policy announcements within oil-dependent emerging economies. In particular, there is limited empirical investigation into how such sustainability initiatives interact with oil price shocks to influence stock market volatility—especially in structurally transforming economies like the UAE. This study fills that gap by integrating sustainability policy signals into the GARCH and TARCH models applied to the MSCI UAE Index, offering a unique lens on volatility behavior under dual economic pressures.

Building on this conceptual foundation, this study formulates a set of empirically testable hypotheses that capture the key dimensions of the oil–stock–sustainability nexus. Each hypothesis is derived from the theoretical literature and is closely aligned with the modeling approach employed, thus ensuring coherence between the study’s analytical objectives and its methodological execution.

Rooted in the UAE’s heavy reliance on hydrocarbon revenues, previous research has demonstrated a significant correlation between oil prices and stock market performance in oil-exporting economies (

Jones & Kaul, 1996;

Banerjee et al., 2023). Given this context, the first hypothesis tests whether fluctuations in oil prices exert a measurable impact on daily equity returns in the UAE.

H1: Oil price fluctuations have a statistically significant effect on the daily returns of the MSCI UAE Index.

A well-documented characteristic of financial markets is volatility clustering, where periods of high volatility tend to be followed by similar episodes (

Engle, 1982;

Bollerslev & Mikkelsen, 1996). This study employs GARCH models to assess whether the volatility of the UAE stock market exhibits such behavior in response to oil price shocks.

H2: The volatility of the UAE stock market exhibits clustering behavior in response to oil price shocks.

Financial literature also suggests that markets may react more strongly to negative shocks than to positive ones—a phenomenon known as asymmetric volatility (

Mork et al., 1994;

Sadorsky, 1999). This study explores whether the UAE stock market is disproportionately sensitive to downside oil price movements, particularly during periods marked by geopolitical instability or sustainability-related uncertainty.

H3: The market response to oil price shocks is asymmetric, particularly during periods of heightened geopolitical or sustainability-driven uncertainty.

Finally, the integration of sustainability policies into financial systems may initially generate short-term volatility due to shifts in investor expectations, but these same signals are also expected to foster long-term market stability (

Kruse et al., 2024;

Dordi & Weber, 2019). This hypothesis investigates the dual effect of key UAE sustainability policy announcements on stock market volatility, highlighting both their disruptive and stabilizing phases.

H4: Sustainability-related policy announcements contribute to short-term volatility but support long-term stabilization of financial markets.

3. Data and Methodology

This study investigates the relationship between oil price fluctuations and the performance of the UAE stock market, as represented by the MSCI UAE Index. The analysis is based on daily data from the MSCI UAE Index and Brent oil prices collected from Investing.com website and the official FRED database, spanning the period from 4 January 2014 to 11 December 2024. The MSCI UAE index serves as a benchmark for the equity market performance in the UAE, while oil prices are a critical economic indicator, given the UAE’s reliance on oil revenue.

To prepare the data for econometric modeling, logarithmic transformations were applied to both the MSCI UAE Index and Oil prices. This transformation was employed to stabilize variance, reduce potential heteroscedasticity, and improve the interpretability of the results. The stationarity of the time series data, a perquisite for time series analysis, was examined using widely accepted unit root test: the Augmented Dickey–Fuller (ADF) test.

This study employs a combination of linear regression and advanced econometric models—Generalized Autoregressive Conditional Heteroscedasticity (GARCH(1,1)) and Threshold GARCH (TARCH(1,1))—to analyze the relationship between oil price changes and stock market returns. The dependent variable in all models is the daily returns of the MSCI UAE Index, while the independent variable is the daily percentage change in oil prices. The inclusion of GARCH and TARCH models accounts for volatility clustering and asymmetry in the data, as stock market returns often exhibit periods of heightened and subdued volatility. This methodological approach provides a comprehensive assessment of the market’s response to oil price fluctuations, focusing on the magnitude of shocks, the persistence of volatility, and potential asymmetries in volatility patterns, particularly during periods of increased market turbulence.

3.1. Linear Regression Analysis

To examine the direct impact of oil price changes on stock market performance, we begin with a baseline linear regression model. This model serves as the primary test for Hypothesis 1, which posits that oil price fluctuations have a statistically significant effect on the daily returns of the MSCI UAE Index. The specification is as follows:

where

is the daily return of the MSCI UAE index at time ;

is the daily change in oil prices at time ;

represents the constant term;

is the coefficient capturing the sensitivity of stock returns to oil price fluctuations;

is the error term.

The linear regression model serves as a baseline to estimate the direct impact of daily oil price changes on daily MSCI UAE Index returns. This approach provides a static average relationship across the full sample.

3.2. Volatility Modelling: GARCH(1,1)

To assess time-varying volatility and determine whether shocks exhibit persistence, we employ the GARCH(1,1) model developed by

Bollerslev and Mikkelsen (

1996). This specification is central to testing Hypothesis 2, which suggests that the UAE stock market demonstrates volatility clustering in response to oil price shocks. The conditional variance equation is defined as follows:

where

is the conditional variance (volatility) at time ;

represents the baseline variance;

is the squared residual from time ;

is the conditional variance from the prior period ;

measures the impact of past shocks on current volatility;

represents the persistence of volatility.

The GARCH model estimates how past shocks and variances affect current volatility levels in the MSCI UAE Index.

3.3. Asymmetric Volatility: TARCH(1,1)

To explore whether negative oil price shocks have a greater impact on market volatility than positive shocks—a phenomenon known as asymmetric volatility—we apply the Threshold GARCH (TARCH) model developed by

Glosten et al. (

1993). This model is used to test Hypothesis 3, which addresses whether market responses differ under adverse versus favorable oil price movements. The conditional variance specification is

where

is an indicator function equal to 1 if (negative shock) and 0 otherwise;

represents the differential effect of negative shocks (asymmetric response) on volatility;

The other terms , , and are as defined in the standard GARCH model.

By including the parameter, the TARCH model allows us to determine whether downside risks amplify volatility disproportionately—a key feature in oil-exporting economies subject to geopolitical and sustainability uncertainties.

To comprehensively examine volatility dynamics within the financial markets of the UAE, this study employed a multi-faceted approach. The methodology incorporates econometric modeling scenario analysis to assess relationships between oil price shocks, financial market performance, and sustainability trends. These techniques ensure a robust investigation that is both historically grounded and forward-looking.

In addition to modeling asymmetries, the TARCH specification also facilitates the evaluation of Hypothesis 4, which posits that sustainability-related announcements trigger short-term volatility but contribute to long-term market stabilization. This is achieved by incorporating policy event dummies and examining their interaction with volatility regimes. These enhancements ensure that the model captures shock asymmetry and the unique market effects arising from policy transitions.

3.4. Sub-Period Analysis

To investigate how the relationship between oil prices and UAE stock market volatility evolved under different economic conditions, the dataset was segmented into two distinct sub-periods. The first sub-period (2014–2016) captures heightened oil price volatility and structural adjustments in response to geopolitical uncertainty and falling demand (

Baumeister & Kilian, 2016). The second sub-period (2019–2023) reflects a phase of economic turbulence marked by COVID-19 disruptions, the Russia–Ukraine war, and increasing sustainability policy rollouts (

Narayan, 2021).

For each sub-period, both GARCH(1,1) and TARCH(1,1) models were re-estimated to assess time-varying conditional volatility in the MSCI UAE Index and identify the persistence and asymmetry of shocks.

This segmented approach strengthens the paper’s core objective of understanding how oil price volatility interacts with market dynamics across changing macroeconomic and policy environments. It also directly supports the comparative insights discussed in

Section 4.1 and enhances the interpretation of time-specific shocks within the UAE financial market.

To further quantify the impact of shocks on the UAE stock market across these timeframes, a linear regression model was applied. Market shocks were identified based on significant identified events (

Table 1). The regression results provide a deeper understanding of the relationship between oil price dependency and market resilience during key economic transitions.

4. Empirical Results

The findings of this study provide valuable insights into the relationship between oil prices and the MSCI UAE Index, along with the volatility dynamics in this context.

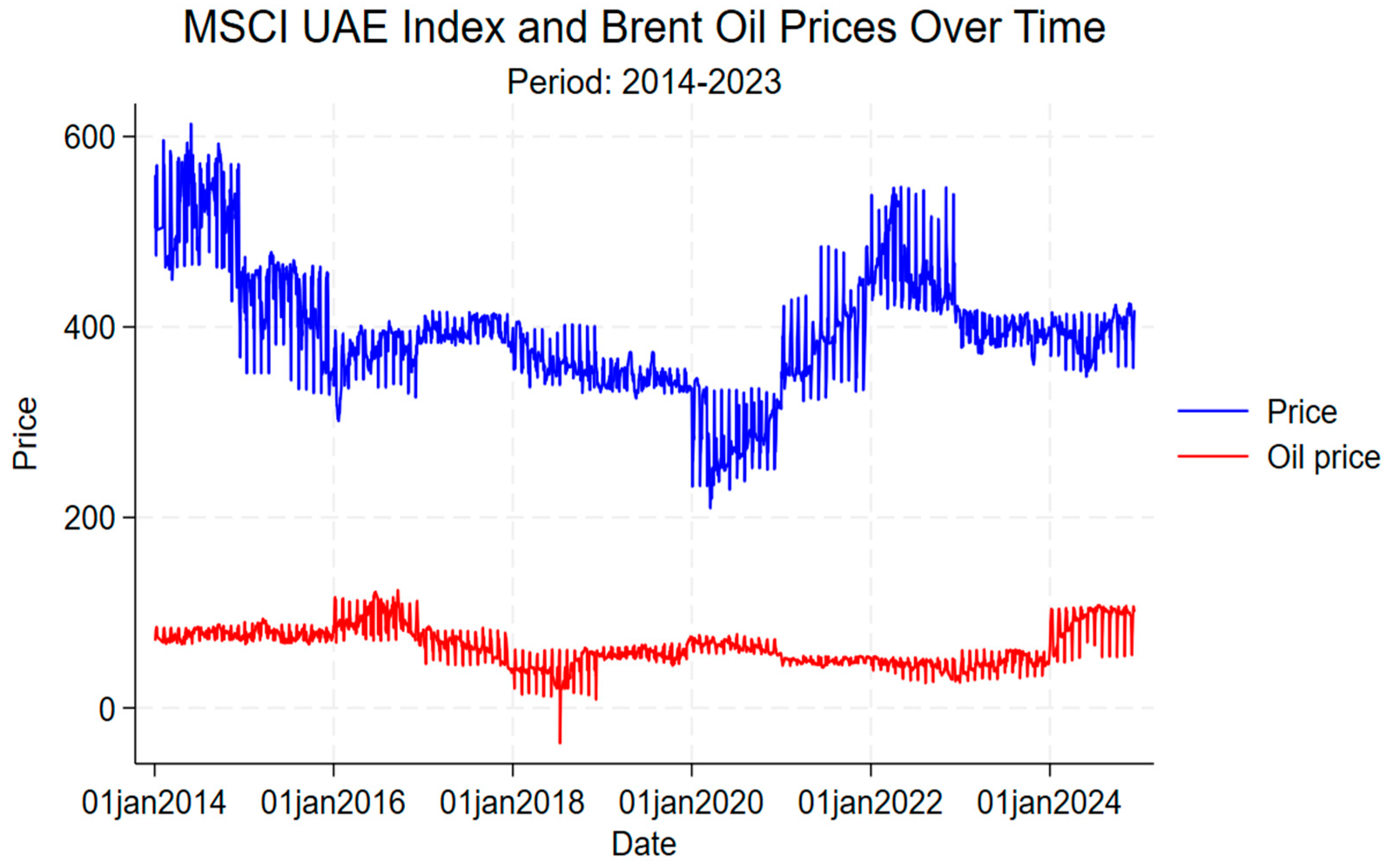

Figure 1 illustrates a clear correlation between the MSCI UAE Index and Brent Oil Prices from 2014 to 2023, reaffirming earlier evidence that stock markets in oil-dependent economies are significantly influenced by oil price movements (

Jones & Kaul, 1996;

Sadorsky, 1999). The pronounced declines observed during the 2014 oil price collapse and the 2020 COVID-19 pandemic are consistent with prior studies showing that oil shocks amplify market uncertainty and depress investor sentiment (

Hung & Vo, 2021;

Mensi et al., 2020). Notably, the post-2020 period is characterized by a dual narrative: global recovery and the intensification of sustainability efforts in the UAE. This includes major initiatives such as the UAE Net Zero 2050 Strategy and ADNOC’s low-carbon projects, positioning 2019–2023 as a defining period of policy-driven transformation (

Iacobuţă et al., 2021;

Mhadhbi & Guelbi, 2024). The MSCI UAE Index’s relatively muted fluctuations during this time suggest the market may have started responding to the stabilizing influence of long-term sustainability commitments, aligning with

Kruse et al. (

2024), who highlight the role of ESG integration in buffering volatility and promoting investor confidence.

The summary statistics (

Table 2) reveal that the MSCI UAE Index has a mean of 395.32, with a range from 209.91 to 613.16, and a standard deviation of 63.67. The ADF test (

p-value = 0.000) confirms stationarity. In comparison, the Brent Oil Prices have a lower mean of 64.65, a wider range (8.91 to 123.64), and a standard deviation of 20.11, reflecting greater volatility. Overall, oil prices display greater variability than the relatively stable MSCI UAE Index.

Through the application of the linear regression, GARCH, and TARCH models, this study highlights distinct patterns in the relationship between oil prices and stock market performance, emphasizing the role of volatility clustering.

The linear regression analysis, based on 2707 observations, elucidates the impact of oil prices on the MSCI UAE Index. The results reveal a statistically significant relationship, with the model producing an F-statistic of 18.07 and an R-squared of 0.0066, which, while statistically robust, indicates that oil prices explain only a small portion of the variance in the index. The oil price coefficient, estimated at 0.258 with a standard error of 0.061, is highly significant (t-statistic = 4.25,

p-value = 0.000), suggesting a positive relationship between oil prices and the UAE stock market performance. The 95% confidence interval for this coefficient ranges between 0.139 and 0.377. However, the Root Mean Squared Error (Root MSE) of 63.479 reflects the limited explanatory power of the model. Overall, these findings provide empirical support for Hypothesis 1, confirming that daily oil price fluctuations exert a statistically significant—though economically moderate—influence on the UAE stock market returns (

Table 3).

To capture the volatility dynamics and their relationship with oil prices, advanced econometric models—namely, the GARCH and TARCH models—were employed. The GARCH model effectively models time-varying volatility by incorporating persistence effects and recent volatility shocks. The results (

Table 4) reveal a large and statistically significant ARCH term (coefficient = 1.038956), confirming the presence of volatility clustering, where periods of high volatility are followed by similarly volatile periods. The variance constant (77.33923) reflects the long-term average variance, while the overall model fit demonstrates the GARCH model’s ability to capture persistent volatility patterns in the UAE stock market. These findings validate Hypothesis 2, demonstrating that volatility clustering is a persistent feature of the UAE financial market in response to oil price shocks.

To further explore the possibility of asymmetric responses to oil price shocks, the TARCH model introduces an indicator function that distinguishes between positive and negative shocks. In the mean equation, the oil price coefficient (0.03885) remains positive and statistically significant, reinforcing the view that oil price fluctuations exert a tangible influence on market returns. The ARCH term (1.093259) continues to confirm volatility clustering, consistent with GARCH results. However, the TARCH term representing asymmetry is not statistically significant (coefficient = –0.083831, p-value = 0.438), suggesting an absence of leverage effects in the full sample. Meanwhile, the GARCH term (0.0175188) is statistically significant, although smaller in magnitude, indicating moderate volatility persistence. Given the insignificance of the TARCH term, Hypothesis 3 is not supported over the full period, suggesting that market responses to oil price shocks are symmetric in non-crisis conditions.

A comparison of log-likelihood values further highlights the relative performance of the models. The TARCH model (−13,786.96) marginally outperforms the GARCH model (−13,842.96), demonstrating a better fit to the data. Despite this, both models consistently confirm the presence of volatility clustering and the critical role of oil prices as a significant driver of returns.

4.1. Impact of Oil Price Fluctuations on Stock Market Volatility: Insights from the 2014–2016 and 2019–2023 Turbulent Periods

Periods of economic turbulence, such as the 2014–2016 oil price collapse and the 2019–2023 period marked by the COVID-19 pandemic and geopolitical tensions, offer a unique context for examining the impact of oil price fluctuations on financial markets. These years were characterized by extreme market volatility driven by oil price shocks, global economic slowdowns, and international conflicts. Understanding how these events influenced the UAE stock market, particularly through the MSCI UAE Index, provides critical insights into the interplay between energy markets and financial systems in oil-dependent economies.

The analysis explores the dynamic relationship between oil prices and the performance of the MSCI UAE Index from 2014 to 2016, employing GARCH and TARCH models to investigate price series volatility. This approach allows for a comprehensive understanding of how oil price fluctuations affect the conditional mean and of the UAE stock market.

The conditional mean equation reveals a positive and highly significant oil price coefficient in both models (0.489 and 0.503,

p < 0.001), indicating a direct and substantial relationship between oil price changes and the market index. A one-unit increase in oil prices corresponds to an estimated rise of 0.489 to 0.503 in the index, demonstrating oil’s critical role in influencing the UAE stock market returns (

Table 5).

The volatility dynamics captured through the ARCH–GARCH process confirm significant past-shock effects on current volatility, consistent with the concept of volatility clustering. The statistically significant and positive ARCH coefficients (0.678 for GARCH and 0.489 for TARCH) indicate that prior shocks continue to exert influence on subsequent market movements, supporting previous findings by

Huang et al. (

1996) and

Ågren (

2006) that volatility in oil-dependent markets is highly path-dependent. Additionally, the GARCH coefficients (0.305 for GARCH and 0.331 for TARCH) demonstrate persistent volatility, reflecting a memory effect where conditional volatility remains influenced by past variances but gradually stabilizes, satisfying stationarity conditions (α + β < 1)—a behavior commonly observed in energy and emerging financial markets (

Fasanya et al., 2021).

The TARCH model’s asymmetric term (0.207,

p = 0.242) is not statistically significant, suggesting an absence of asymmetric effects between positive and negative shocks. This implies that the impact of oil price fluctuations on the MSCI UAE Index is symmetrical, with no significant difference in how the market reacts to price increases versus decreases during this period. This finding aligns with prior evidence that asymmetric volatility tends to emerge more strongly under heightened systemic uncertainty or during policy shifts (

Sadorsky, 1999;

Xiao et al., 2023). Model fit assessments based on log-likelihood values (−3974.004 for GARCH and −3971.776 for TARCH) indicate that both models adequately capture the volatility structure, though the inclusion of asymmetry does not considerably enhance explanatory power, likely due to the non-significance of the asymmetric term.

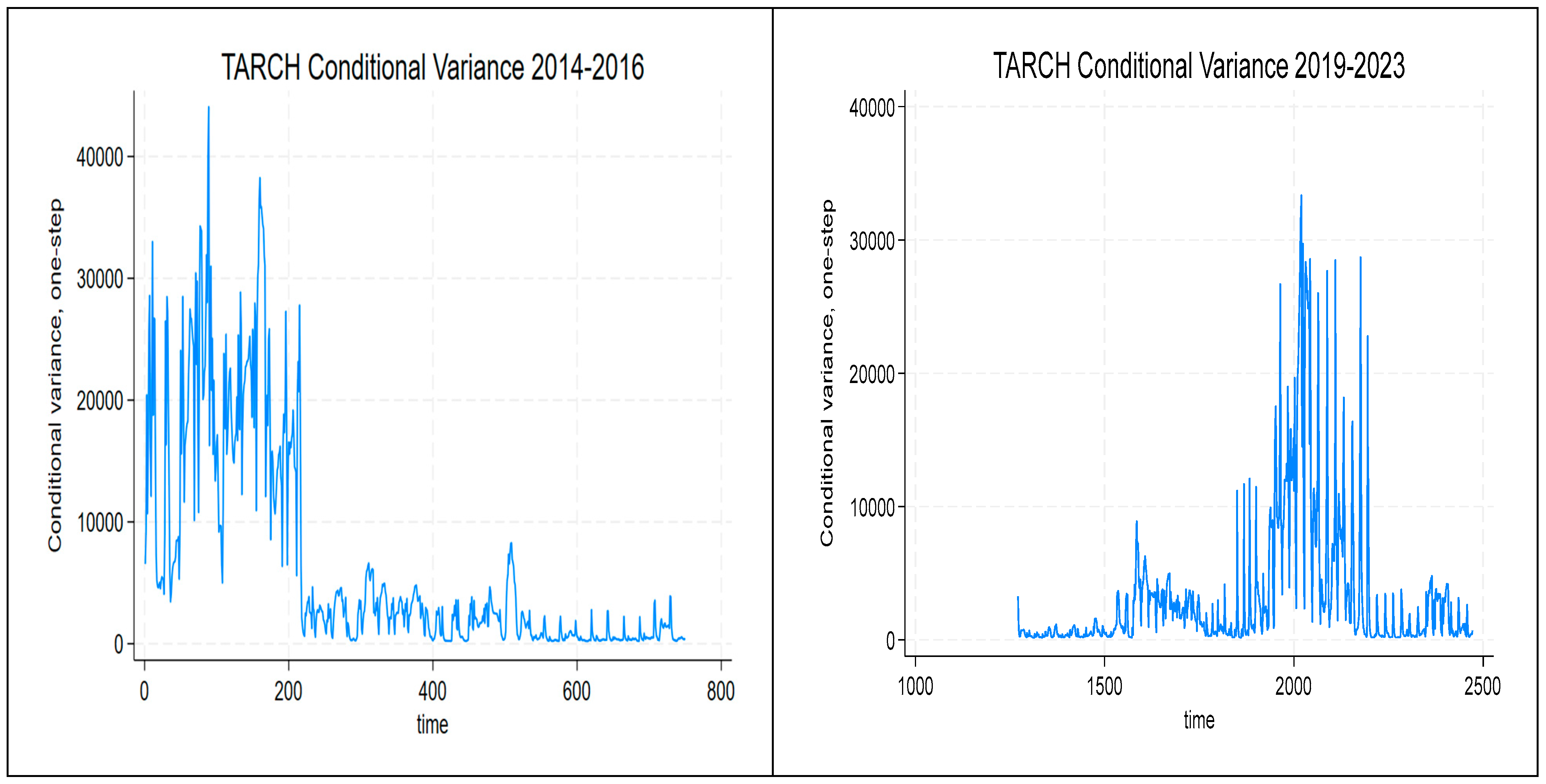

The conditional variance patterns illustrated in

Figure 2 highlight critical market responses. Volatility peaks during the 2014–2015 oil price collapse—approaching 40,000—mirror the stress documented in global energy markets and underscore the UAE market’s exposure to oil-linked shocks (

Baumeister & Kilian, 2016). As the period progresses, conditional variance declines, reflecting mean-reverting volatility behavior, consistent with the models’ coefficients being below unity.

The absence of significant asymmetry indicates that volatility shocks affect the market uniformly, irrespective of the direction of oil price changes. This behavior aligns with established financial theories on volatility persistence and clustering (

Engle, 1982). The findings affirm that oil prices exert a dominant influence on the UAE stock market, with persistent but eventually stabilizing volatility patterns.

From 2019 to 2023, the UAE stock market exhibited heightened sensitivity to oil price fluctuations, shaped by a convergence of global disruptions and the rollout of major domestic sustainability policies. This period coincides with unprecedented events—including the COVID-19 pandemic and the Russia–Ukraine war—that amplified financial volatility worldwide. The TARCH model results for this sub-period capture pronounced conditional variance spikes, reflecting elevated uncertainty and risk aversion among investors. The surge in volatility during 2020 mirrors global patterns, where collapsing oil demand, supply chain disruptions, and lockdowns destabilized both commodity and equity markets (

Hung & Vo, 2021;

Liu et al., 2020;

Mensi et al., 2020). This aligns with the findings of

Memon and Yao (

2021), who identified structural breaks in global market topologies during the pandemic, especially in oil-reliant economies.

Similar volatility surges occurred in 2022 following the onset of the Russia–Ukraine war and its economic fallout on oil prices and energy markets. These events caused significant price shocks, further increasing market fragility as reflected in pronounced peaks in conditional variance, consistent with the findings of

Xiao et al. (

2023), who emphasize the role of geopolitical risk in amplifying market reactions in commodity-sensitive economies. While volatility began tapering off later in the timeline, it did not return to pre-2020 levels, suggesting persistent underlying economic fragility driven by inflation, oil supply shocks, and geopolitical uncertainties. These trends are further complicated by simultaneous sustainability policy announcements—such as the UAE Net Zero 2050 Strategy and COP28 commitments—which introduced both investor optimism and short-term speculative behavior, confirming the relevance of this sub-period as a critical window for studying dual-shock volatility dynamics (

Iacobuţă et al., 2021;

Kruse et al., 2024).

The TARCH model’s asymmetric coefficient of 0.2184 reveals that markets responded disproportionately to negative shocks, amplifying volatility during adverse events—a feature consistent with the leverage effect in financial markets. This contrasts with the 2014–2016 period, where no significant asymmetry was detected, reflecting evolving market behavior amid shifting global dynamics.

The ARCH and TARCH models both indicate a strong and statistically significant negative relationship between oil prices and the MSCI UAE Index. In the ARCH model, the oil price coefficient is estimated at −2.5906, while in the TARCH model, it slightly increases to −2.6199, confirming a robust inverse relationship. Rising oil prices exert inflationary pressures, reduce corporate profitability, and elevate production costs, explaining this negative market response.

The ARCH model’s ARCH (L1) coefficient of 0.6277 highlights the significance of past squared returns in determining current volatility, reinforcing the presence of volatility clustering. This pattern confirms that market shocks persist, with periods of high variance following initial shocks. The GARCH (L1) coefficient of 0.3872 indicates sustained volatility persistence, showing that market risks remain elevated even after initial disturbances dissipate.

The TARCH model’s inclusion of an asymmetric threshold component adds further explanatory power, with its significant coefficient of 0.2184 indicating that negative news—such as sharp oil price declines or geopolitical crises—induces sharper spikes in conditional variance. This finding is consistent with the well-documented leverage effect in financial markets, where negative news elicits stronger volatility responses due to heightened investor fear and risk aversion (

Mork et al., 1994;

Sadorsky, 1999). It also aligns with more recent evidence from

Fasanya et al. (

2021), who observed that such asymmetries are especially pronounced in oil-dependent economies exposed to both commodity shocks and external geopolitical risks.

In comparison, the TARCH framework offers a more nuanced understanding of market volatility by differentiating the reactions to positive and negative shocks. Its higher log-likelihood value underscores its better fit, capturing real-world market dynamics during turbulent periods more effectively (

Das et al., 2022;

Xiao et al., 2023). Notably, the emergence of a statistically significant asymmetric term in the 2019–2023 sub-period model provides empirical support for Hypothesis 3, suggesting that the UAE stock market becomes more sensitive to negative oil price shocks during periods marked by geopolitical instability and sustainability policy shifts.

These results demonstrate the deep interconnectedness between oil prices and the UAE stock market, highlighting the persistent influence of oil-driven shocks. The models’ insights on conditional variance dynamics, coupled with historical event-driven analysis, affirm that volatility clustering and asymmetric shock responses are critical to understanding market behavior in oil-dependent economies during turbulent times (

Kruse et al., 2024;

Iacobuţă et al., 2021).

4.2. Sustainability-Driven Announcements, Oil Price, and Stock Market Reactions

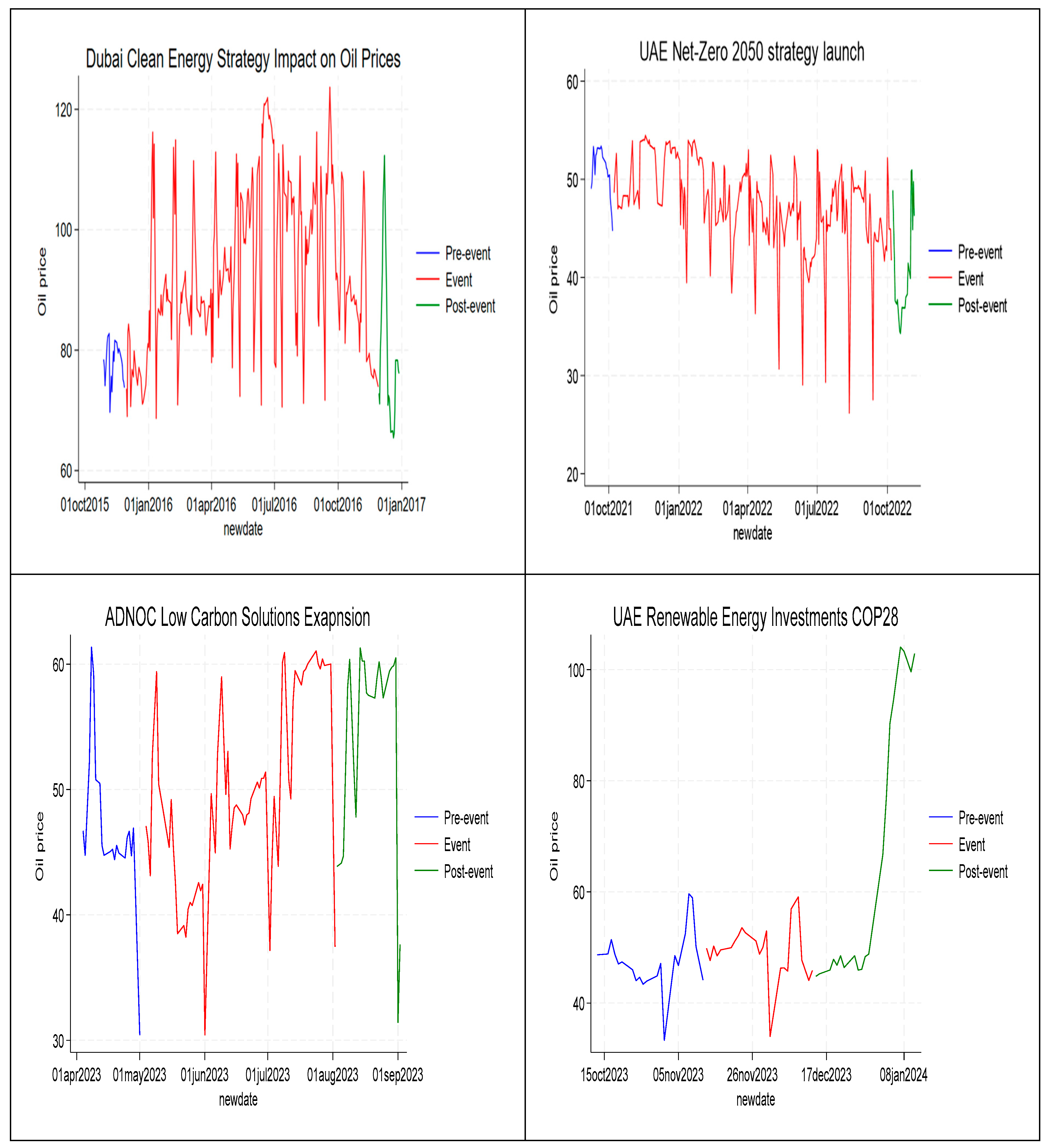

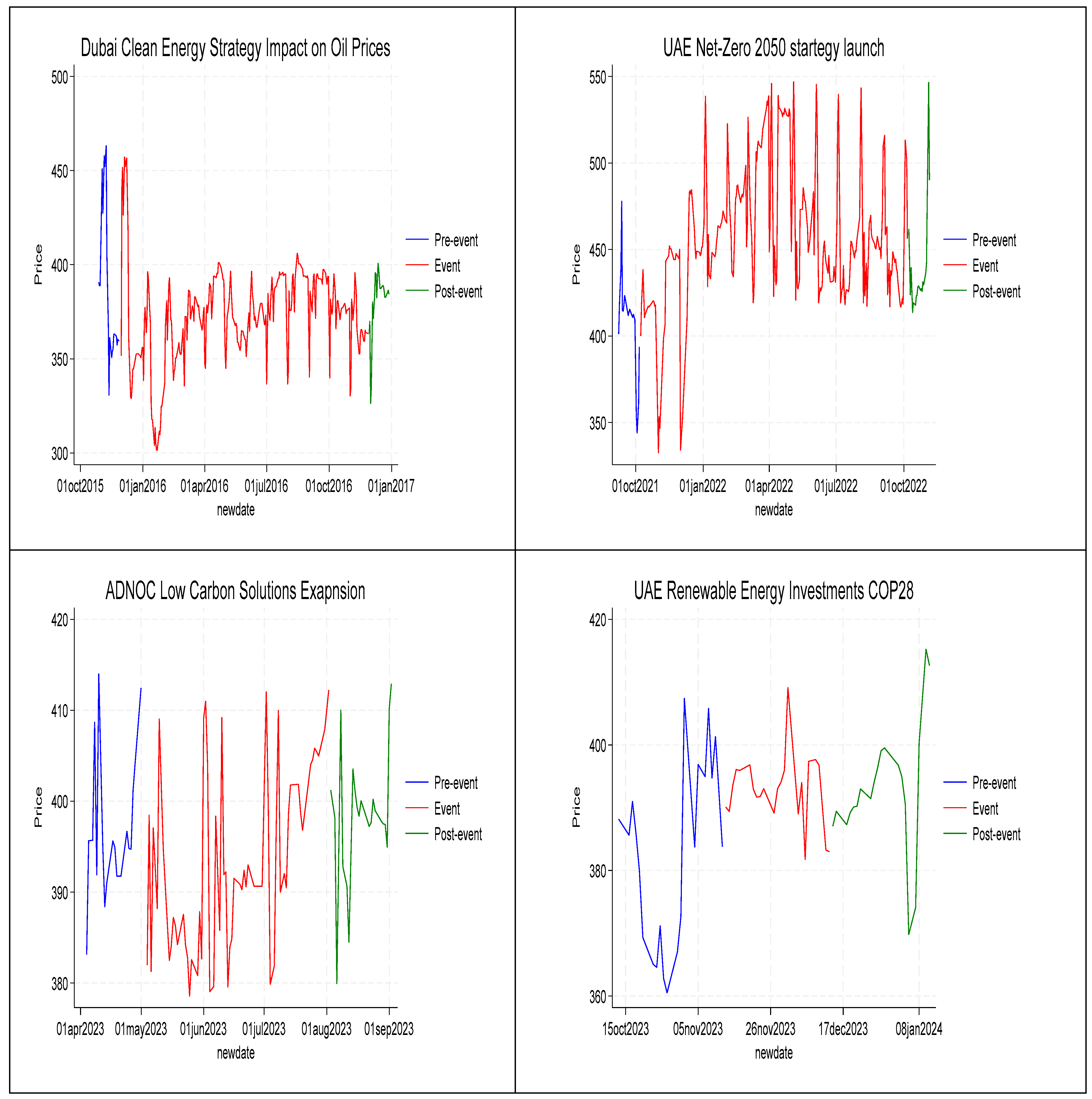

The analysis of key sustainability and green energy announcements in the UAE’s oil sector from 2013 to 2024 reveals a complex interplay between policy-driven initiatives and oil price dynamics. By examining the regression and graphical analyses associated with these pivotal announcements, we can derive actionable insights for navigating the uncertainties of the energy transition (

Figure 3). Similar to observations in

Dordi and Weber (

2019), such announcements can exert immediate market effects that diverge from their anticipated long-term impacts, depending on timing, investor sentiment, and perceived credibility of implementation.

The Dubai Clean Energy Strategy 2050 announcement on 28 November 2015 signaled the UAE’s long-term commitment to reducing reliance on fossil fuels. The regression analysis indicates a positive and statistically significant coefficient of 33.03 (

p < 0.000) for the event variable, suggesting that oil prices rose considerably around the event period. This paradoxical outcome aligns with the findings by

Kruse et al. (

2024), who argue that sustainability announcements often generate initial market uncertainty and speculative activity before stabilizing expectations.

Figure 3 reveals heightened oil price volatility during the event window, reflecting speculative trading and uncertainty about the strategy’s impact. Post-event, oil prices experienced a gradual decline, aligning with the anticipated bearish long-term implications of transitioning to renewable energy sources. The R-squared value of 0.236 indicates a moderate explanatory power, suggesting that other market forces also played significant roles.

The announcement of the UAE’s Net Zero 2050 Strategic Initiative on 7 October 2021 demonstrates its dual commitment to sustainability and continued oil production. The regression analysis highlights a significant positive event coefficient of 81.39836 (p < 0.000), indicating a strong market reaction. However, the modest R-squared value of 0.129 suggests the presence of unaccounted variables influencing oil prices.

Graphical analysis reveals increased volatility during the announcement period, reflecting market uncertainty regarding potential oil supply adjustments. Prices eventually stabilized, indicating market adaptation and confidence in the UAE’s ability to balance sustainability goals with oil export commitments. This dual strategy illustrates how green energy announcements can initially disrupt oil markets before stabilizing as markets recalibrate.

ADNOC’s expansion into low-carbon initiatives, including carbon capture and hydrogen projects, on 2 May 2023 represents a strategic response to the global energy transition, as identified by

Iacobuţă et al. (

2021). Despite its transformative potential, the regression analysis reveals an event coefficient of 1.914103 with a

p-value of 0.810, indicating an insignificant immediate impact on oil prices.

This muted response is consistent with findings by

Dordi and Weber (

2019), who note that markets often underreact to green transition announcements when they lack immediate implications for production or revenues. This is further evidenced in the graphical analysis (

Figure 4), which shows a decline in oil prices leading up to the event, followed by increased volatility during and after the announcement. This suggests that broader market conditions, including geopolitical factors and global supply–demand dynamics, overshadowed the event’s direct influence. The low R-squared value of 0.0067 further indicates the limited explanatory power of the model, emphasizing the need for broader contextual analysis. As emphasized by

Krueger et al. (

2020), the signaling value of sustainability initiatives often requires consistent follow-through and market reinforcement before achieving measurable financial impact.

The UAE’s major renewable energy investments announced at COP28 in November 2023 reinforce its strategic pivot toward sustainability. The regression model yields a similarly insignificant event coefficient of 1.499834 (

p-value 0.910), suggesting limited immediate oil price impact. This finding aligns with literature suggesting that when sustainability strategies are well-anticipated or previously signaled, financial markets may exhibit muted short-term responses (

Friede et al., 2015;

Kruse et al., 2024).

The lack of a statistically significant market reaction can also be interpreted through the lens of expectation-based pricing. As

Eccles et al. (

2014) argue, capital markets tend to internalize structural policy shifts when investor expectations have already adjusted to long-term ESG narratives. This explanation is supported by the graphical evidence (

Figure 3), which shows relative price stability prior to COP28, brief volatility during the announcement period, and subsequent normalization. The lack of a pronounced price shift suggests that markets may have already priced in the anticipated long-term energy transition, reflecting investor confidence in the UAE’s balanced approach to managing oil and renewable energy sectors (

Zhang et al., 2022). The regression and event-study analyses of major UAE sustainability announcements support Hypothesis 4, showing short-term volatility effects during event windows, followed by stabilization patterns in line with long-term investor adjustment to sustainability policy commitments.

6. Conclusions

This conclusion synthesizes the empirical results presented in this study and reflects on their theoretical and practical implications. The study offers empirical insights into the complex relationship between oil price fluctuations, sustainability initiatives, and stock market behavior in the UAE. By applying the linear regression, GARCH, and TARCH models to the MSCI UAE Index over a decade-long period, the analysis enhances our understanding of how financial markets in resource-dependent economies respond to external shocks and evolving policy frameworks.

The results confirm that oil prices remain a significant driver of market returns, although their explanatory power has diminished over time—suggesting growing market resilience and a shift toward diversification. This trend illustrates how oil dependency in financial markets is gradually being moderated by broader structural transformation. The persistence of volatility clustering underscores the enduring influence of past shocks, while the emergence of asymmetry—particularly during the 2019–2023 period—signals evolving investor sensitivity to policy-driven uncertainty. Notably, this asymmetry was absent in earlier years, indicating a broader transition in market behavior amid escalating geopolitical risks and the intensification of sustainability policy adoption.

The results from the periods of 2014–2016 and 2019–2023 further illustrate the sensitivity of the UAE stock market to oil price shocks, especially during significant economic disruptions, such as the global oil price crash, the COVID-19 pandemic, and the episodes of geopolitical tensions. These windows of heightened volatility underscore the market’s exposure to external shocks and reinforce the necessity for ongoing monitoring and adaptive policy interventions to mitigate systemic financial risk.

Building on this, the analysis of key sustainability-driven policy announcements from 2013 to 2024 sheds light on the evolving role of green finance and economic diversification. Initiatives such as the Dubai Clean Energy Strategy 2050 and Net Zero 2050 initially introduced market uncertainty yet ultimately contributed to a recalibration of investor confidence, signaling a dual-track transition—balancing hydrocarbon reliance with long-term sustainability goals. In contrast, the immediate market impact of ADNOC’s low-carbon projects and COP28 sustainability initiatives remained limited, suggesting that broader macroeconomic conditions and geopolitical factors continued to exert a stronger influence on market reactions. Nevertheless, the gradual integration of sustainability policies into financial expectations highlights a foundational shift toward more structurally resilient market behavior.

While oil price volatility continues to influence the UAE financial markets, its effects appear to be moderating as sustainability-linked financial instruments and diversification policies gain traction. These instruments were shown to moderate volatility over time, reinforcing the value of sustainability-linked financial architecture in oil-exporting economies. From an investor’s perspective, these findings highlight the growing importance of integrating sustainability signals into portfolio strategies. As oil price volatility becomes increasingly intertwined with sustainability-driven policy shifts, investors should consider adjusting the risk models to account for both macroeconomic shocks and regulatory developments. Institutional investors, in particular, may benefit from forward-looking exposure to green sectors in the UAE, as these are increasingly supported by national policy and global investment trends. This transition points to the importance of developing forward-looking risk mitigation tools and strategic investment channels that support green finance and enhance economic stability. Stabilization funds, enhanced ESG disclosure frameworks, and real-time market monitoring mechanisms could all contribute to reducing the systemic vulnerabilities.

Further research should examine alternative market drivers, such as monetary policy, global trade linkages, and foreign direct investment, to assess their role in shaping the UAE stock market performance. Expanding the study to other Gulf Cooperation Council (GCC) countries would facilitate comparative analyses of regional economic stability and diversification efforts. Additionally, investigating the long-term impact of sustainability policies on market volatility, particularly in the context of global ESG investment trends and carbon pricing mechanisms, would provide deeper insights into market resilience. Applying advanced econometric models, such as EGARCH or Markov-switching models, could further capture nonlinear dependencies and assess the asymmetric effects of oil price shocks more effectively.

As the UAE continues its trajectory toward a more diversified and sustainable economic model, the ability to anticipate and adapt to financial volatility will be critical. In this context, aligning financial innovation with sustainability policy will be key to advancing long-term resilience and investment competitiveness in the post-oil era.