The Nonlinear Impact of Environmental, Social, Governance on Stock Market Performance Among US Manufacturing and Banking Firms

Abstract

1. Introduction

2. Literature Review

2.1. Effect of ESG Ratings on Financial Performance

| Authors (Date) | Theory | ESG Data Set | Response Variable | Results |

| Christensen et al. (2022) | Stakeholder | Firms worldwide | Absolute CAR | Higher levels of ESG disclosure lead to higher stock market volatility and returns. |

| Ahsan and Qureshi (2020) | Stakeholder | 100 best US corporate citizen firms | Tobin’s Q | ESG boosts Tobin’s Q but not ROE or ROA. |

| Miralles-Quirós et al. (2018) | Stakeholder theory | - | Book value/share; EPS | Environmental practices are valued in environmentally sensitive industries. |

| Koundouri et al. (2022) | Stakeholder | STOXX Europe ESG Leaders 50 | Beta; D/E; ROA/ROE | ESG lowers equity risk and boosts ROA/ROE but not in the automotive sector. |

| Landi and Sciarelli (2019) | Stakeholder | Italian companies | Abnormal returns | ESG has no significant impact on abnormal returns. |

| (Wu & Chang, 2022) | Trade-off | Taiwanese firms | Tobin’s Q | ESG has half-convex effect in low-profit firms and concave effect in median/high-profit firms. |

| (Azmi et al., 2021) | Trade-off | Emerging market banks | Tobin’s Q/ROA | ESG activity boosts bank performance but with diminishing returns. Environmental-friendly projects boost bank value. |

| (Dunn et al., 2018) | Signaling | MSCI World | Book/market, Market cap | Low-ESG-rated firms have higher risk/betas. Social and governance strongly linked to risk. |

| (Kim & Kim, 2014) | Signaling | Hospitality sector | ROA | CSR investments reduce systemic risk in restaurants/casinos but not other segments. |

| (Richardson & Welker, 2001) | Signaling | Canadian firms | ROE | Positive relationship between social disclosures and the cost of equity. |

| (Wong et al., 2021) | Signaling | Malaysian firms | Tobin’s Q/ROA | ESG ratings reduce cost of capital and increase Tobin’s Q. |

2.2. Literature Review on the Nonlinear Effects of Variables

2.3. Differences in E, S, and G Ratings on Financial Performance

3. Data

3.1. Variable Definitions

3.2. Descriptive Statistics

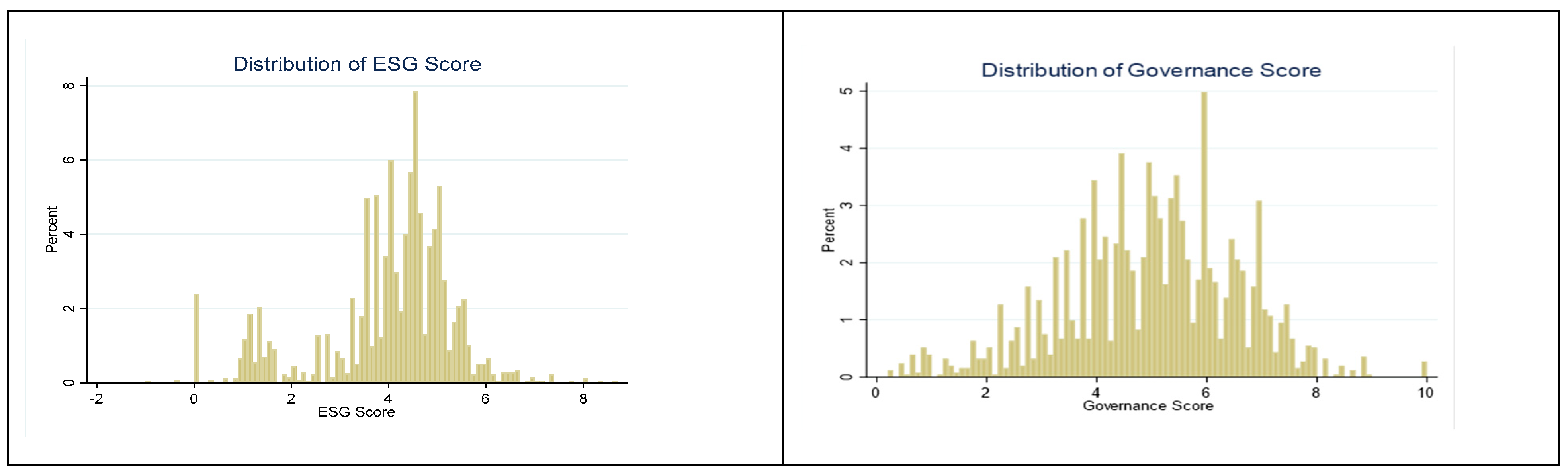

3.3. Exploratory Data Analysis

4. Hypotheses

4.1. Conceptual Foundation: Overall Nonlinear Effects of ESG on Firm Performance

4.2. Dimension-Specific Nonlinearity in Industries

4.2.1. Manufacturing Sector—Conceptual Foundation

4.2.2. Banking Sector—Conceptual Foundation

4.3. Conceptual Foundation: Marginal Effects Conditional on Curve Position

5. Methodology

- The coefficient in Equations (3)–(6) must be positive (for a shape) or negative (for an inverted U shape) and statistically significant.

- Both of the following conditions must hold:

- (a)

- The slope at the lower bound of the ESG value , calculated as . , must be significantly less than zero (for a shape) or greater than zero (for an inverted U shape).

- (b)

- The slope at the upper bound of the ESG value (), calculated as . , must be significantly greater than zero (for a U shape) or less than zero (for an inverted U shape).

- The threshold, calculated as , must lie within the data range, and the Fieller confidence interval for the threshold lies within the data range.

6. Results and Discussion

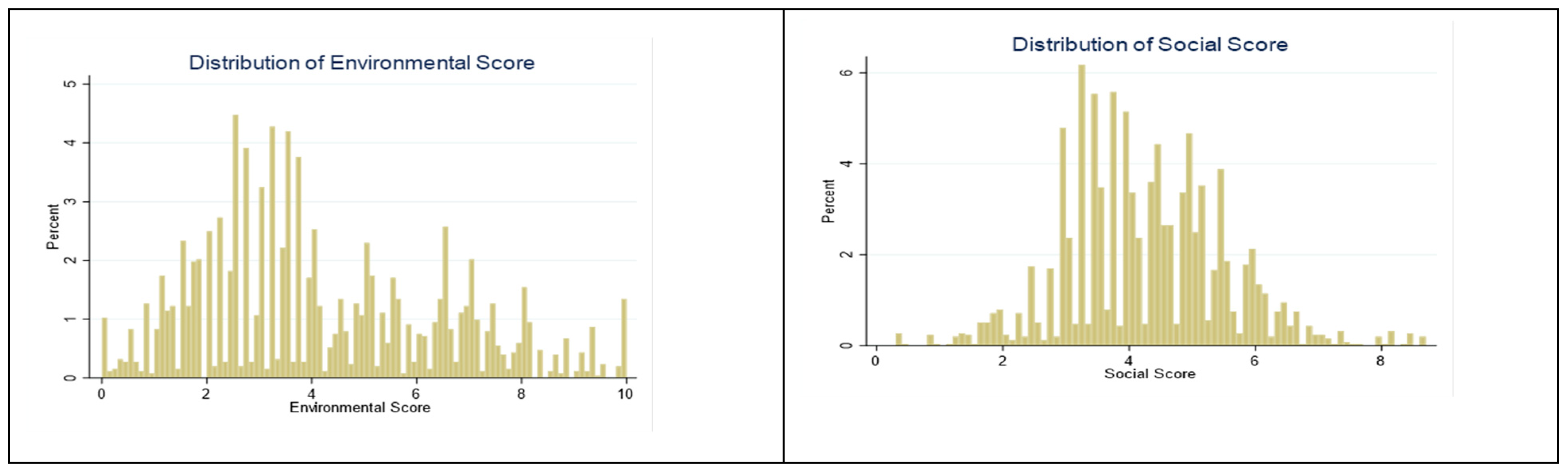

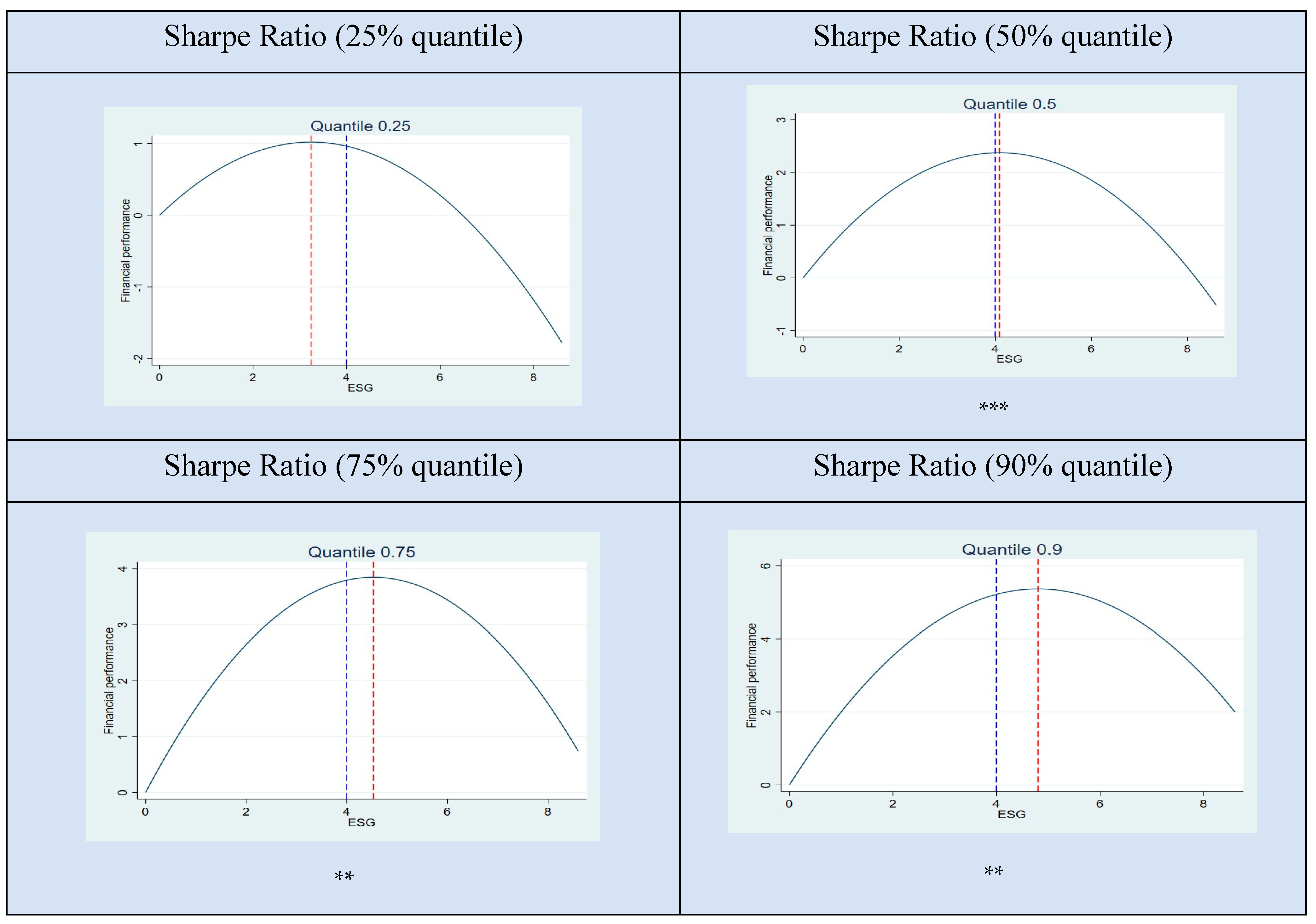

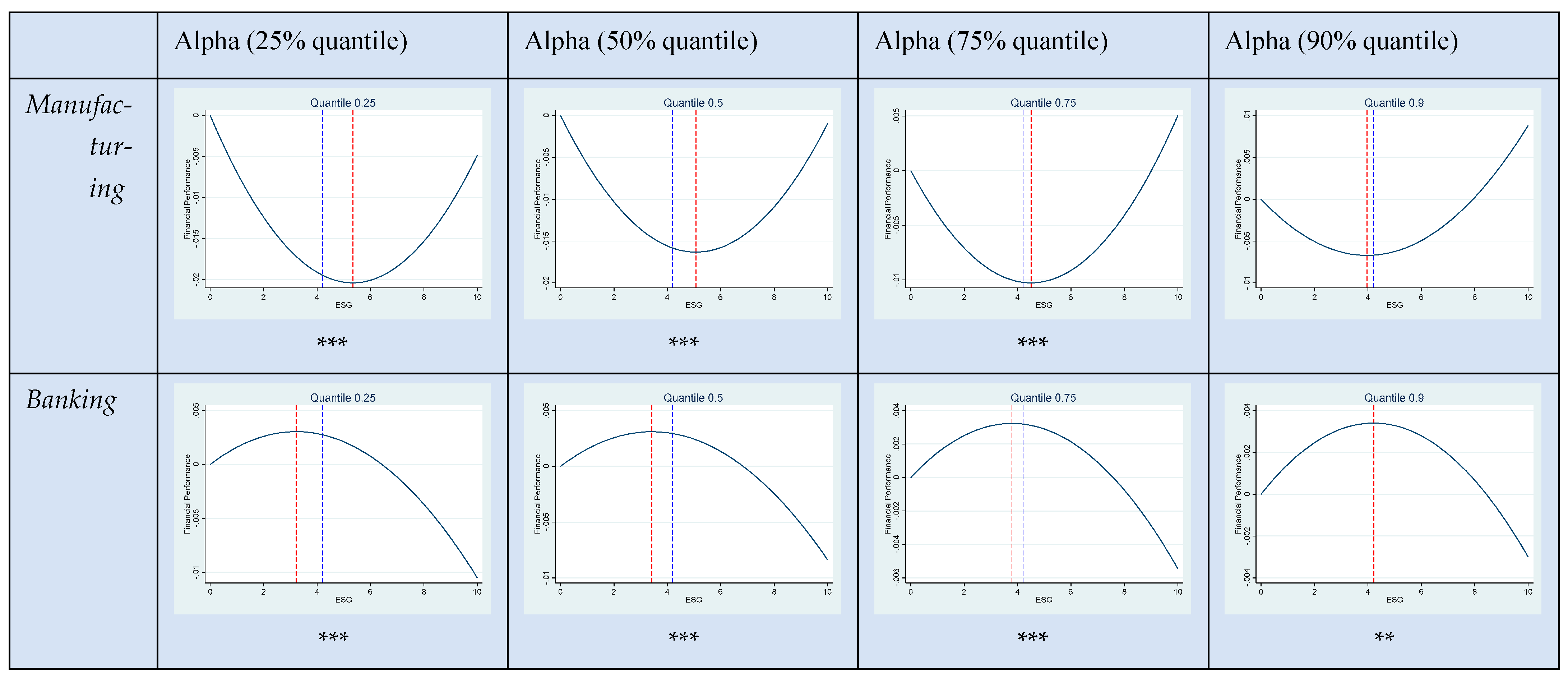

6.1. Subcomponents

6.2. Policy Implications and Recommendations

- A performance- and industry-sensitive ESG framework

- 2.

- Manufacturing (aerospace/automotive)

- 3.

- Banking

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| 1 | Includes MSCI, S&P Global, Sustainalytics, and Refinitiv. |

| 2 | ESG ratings and scores are synonymous and refer to the numeric evaluation that a rating agency gives to the company for E, S, G, and the weighted ESG score. In contrast, ESG investment refers to the dollar amount that a company has spent in a given time period on ESG activities. ESG performance is synonymous with ESG investment. |

| 3 | Manufacturing companies are represented by aerospace and automotive companies. |

| 4 | Service companies are represented by banks. |

| 5 | Revelli and Viviani (2015) and Landi and Sciarelli (2019) also challenge the direct positive impact of ESG on stock performance. |

| 6 | |

| 7 | See Buallay et al. (2022) and El Khoury et al. (2023), who have found inverted U-shaped relationships in the tourism sector and banking performance in the MENAT region. Similarly, research in the Chinese market by Pu (2022) confirms the prevalence of inverted U-shaped patterns. |

| 8 | We only included larger companies because of the significant stock market volatility with smaller companies. |

| 9 | For each company, E, S, and G are weighted based on all the environmental and social key issues as well as the governance pillar score. |

| 10 | Environmental includes 13 issues that are organized into the course subcomponents: climate change, natural capital or resource, pollution and waste, and environmental opportunities. See ESG Ratings Methodology (msci.com) for a list of the 13 items organized into the four subcomponents that comprise the environmental rating. |

| 11 | Social covers health and safety, human capital development, labor management, and supply chain labor standards, which are issues in the human capital subcomponent. Social also covers consumer financial protection, privacy and data security, product safety and quality, and responsible investment, all of which are part of product liability. Lastly, social covers community relations and controversial sources that are part of stakeholder opposition, as well as access to health care and opportunities in nutrition and health that are part of social opportunities. |

| 12 | Corporate governance covers pay, ownership and control, and accounting, while corporate behavior includes business ethics and tax transparency. |

| 13 | To calculate the average annualized monthly equity risk premium, we take the average risk premium over the prior 12 months and multiply this amount by 12. The same method was applied to calculating the average, annualized standard deviation. As a result, the first Sharpe ratio entry for a firm would be in month 13, which covers the average risk premium and standard deviation for the prior 12 months. |

| 14 | We tested our results using a three-factor model (removing momentum). The results were very similar. |

| 15 | A total of 31 quarters were used for the window in the alpha estimation, as that is the average number of quarters for each company in the database. |

| 16 | This index is calculated by subtracting the equal weighted average of the lowest performing firms from the equal weighed average of the highest performing firms, lagged one month (Carhart, 1997). |

| 17 | We restricted the bottom range to -6 n the Lowess smoother figure in order to focus the data on the potential patterns. In doing so, roughly 4 Sharpe ratios were removed, but they remained in the regression analysis and summary data in Table 2. |

| 18 | See Koenker and Bassett (1978) for a discussion of quantile regression. |

| 19 | In the banking sector, there was some collinearity between intangible assets and revenues. |

| 20 | Using the Granger causality test, we also tested for reverse causality in Equations (3)–(6). In all cases, we did not find evidence to suggest reverse causality or that past values of Alpha impacted any of the ESG variables. |

| 21 | Refers to a t-statistic that evaluates whether there is a significant difference between two slopes, with one formed from the minimum X point to the minimum point on a curve versus the slope formed from the maximum X point to the minimum point on a curve. |

References

- Agarwala, N., Jana, S., & Sahu, T. N. (2024). ESG disclosures and corporate performance: A non-linear and disaggregated approach. Journal of Cleaner Production, 437, 140517. [Google Scholar] [CrossRef]

- Ahsan, T., & Qureshi, M. A. (2020). The nexus between policy uncertainty, sustainability disclosure and firm performance. Applied Economics, 53(4), 441–453. [Google Scholar] [CrossRef]

- Aupperle, K. E., Carroll, A. B., & Hatfield, J. D. (1985). An empirical examination of the relationship between corporate social responsibility and profitability. Academy of Management Journal, 28(2), 446–463. [Google Scholar] [CrossRef]

- Azmi, W., Hassan, M. K., Houston, R., & Karim, M. S. (2021). ESG activities and banking performance: International evidence from emerging economies. Journal of International Financial Markets, Institutions and Money, 70, 101277. [Google Scholar] [CrossRef]

- Bagh, T., Zhou, B., Alawi, S. M., & Azam, R. I. (2024). ESG resilience: Exploring the non-linear effects of ESG performance on firms’ sustainable growth. Research in International Business and Finance, 70(Pt A), 102305. [Google Scholar] [CrossRef]

- Barnett, M. L., & Salomon, R. M. (2012). Does it pay to be really good? Addressing the shape of the relationship between social and financial performance. Strategic Management Journal, 33, 1304–1320. [Google Scholar] [CrossRef]

- Bebchuk, L. A., Cohen, A., & Wang, C. C. Y. (2013). Learning and the disappearing association between governance and returns. Journal of Financial Economics, 108(2), 323–348. [Google Scholar] [CrossRef]

- Buallay, A., Al-Ajmi, J., & Barone, E. (2022). Sustainability engagement’s impact on tourism sector performance: Linear and nonlinear models. Journal of Organization Change Management, 35, 361–384. [Google Scholar] [CrossRef]

- Carhart, M. M. (1997). On persistence in mutual fund performance. The Journal of Finance, 52(1), 57–82. [Google Scholar] [CrossRef]

- Chen, C. J., Guo, R. S., & Hsiao, Y. C. (2018). How business strategy in non-financial firms moderates the curvilinear effects of corporate social responsibility and irresponsibility on corporate financial performance. Journal of Business Research, 92, 154–167. [Google Scholar] [CrossRef]

- Christensen, G., Serafeim, G., & Sikochi, A. (2022). Why is corporate virtue in the eye of the beholder. The Case of ESG ratings. Accounting Review, 97(1), 147–155. [Google Scholar] [CrossRef]

- Damodoran, A. (2023, October 22). ESG is beyond redemption: May it RIP. Financial Times. Available online: https://www.ft.com/content/d4082c75-3141-4a58-935b-60a44c22897a (accessed on 1 December 2024).

- Devinney, T. M. (2009). Is the socially responsible corporation a myth? The good, the bad, and the ugly of corporate social responsibility. The Academy of Management Perspectives, 23(2), 44–56. [Google Scholar] [CrossRef]

- Dunn, J., Fitzgibbons, S., & Pomorski, L. (2018). Assessing risk through environmental, social and governance exposures. Journal of Investment Management, 16(1). [Google Scholar]

- El Khoury, R., Nasrallah, N., & Alareeni, B. (2023). The determinants of ESG in the banking sector of MENA region: A trend or necessity? Competitiveness Review: An International Business Journal, 33(1), 7–29. [Google Scholar] [CrossRef]

- Friedman, M. (1970). A theoretical framework for monetary analysis. Journal of Political Economy, 78(2), 193–238. [Google Scholar] [CrossRef]

- Fuente, G., Ortiz, G., & Velasco, P. (2022). The value of a firm’s engagement in ESG practices: Are we looking at the right side? Long Range Planning, 55(4). [Google Scholar] [CrossRef]

- Gompers, P. A., Ishii, J. L., & Metrick, A. (2003). Corporate governance and equity prices. Quarterly Journal of Economics, 118(1), 107–155. [Google Scholar] [CrossRef]

- Haans, R., Pieters, C., & He, Z. (2016). Thinking about U: Theorizing and testing U- and inverted U-shaped relationships in strategy research. Strategic Management Journal, 37(7), 1177–1195. [Google Scholar] [CrossRef]

- Hong, H., & Kacperczyk, M. (2009). The price of sin: The effects of social norms on markets. Journal of Financial Economics, 93(1), 15–36. [Google Scholar] [CrossRef]

- Kim, K. M., & Kim, Y. H. (2014). Corporate social responsibility and shareholder value of restaurant firms. International Journal of Hospitality Management, 40, 120–129. [Google Scholar] [CrossRef]

- Koenker, R., & Basset, G. (1978). Regression quantiles. Econometrica: Journal of the Econometric Society, 46(1), 33–50. [Google Scholar] [CrossRef]

- Koundouri, P., Pittis, N., & Plataniotis, A. (2022). The impact of ESG performance on the financial performance of European area companies: An empirical examination. Environmental Sciences Proceedings, 15(1), 13. [Google Scholar] [CrossRef]

- Lahouel, B. B., Zaied, Y. B., Managi, S., & Taleb, L. (2022). Re-thinking about U: The relevance of regime-switching model in the relationship between environmental corporate social responsibility and financial performance. Journal of Business Research, 140, 498–519. [Google Scholar] [CrossRef]

- Landi, G., & Sciarelli, M. (2019). Towards a more ethical market: The impact of ESG rating on corporate financial performance. Social Responsibility Journal, 15(1), 11–27. [Google Scholar] [CrossRef]

- La Torre, M., Mango, F., Cafaro, A., & Leo, S. (2020). Does the ESG index affect stock return? Evidence from the Eurostoxx50. Sustainability, 12, 6387. [Google Scholar] [CrossRef]

- Lin, Y., Wu, Y., Qian, L., & Lu, Z. (2023). ESG ratings and corporate value, investment returns: A controversial story and an evolving logic. Available online: https://business.sohu.com/a/712759717_121123881 (accessed on 2 March 2025).

- Lind, J. T., & Mehlum, H. (2010). With or without U? The appropriate test for a U-shaped relationship. Oxford Bulletin of Economics and Statistics, 72(1), 109–118. [Google Scholar] [CrossRef]

- Miralles-Quirós, M. M., Miralles-Quirós, J. L., & Gonçalves, L. M. V. (2018). The value relevance of environmental, social, and governance performance: The Brazilian case. Sustainability, 10(3), 574. [Google Scholar] [CrossRef]

- Naimy, V., El Khoury, R., & Iskandar, S. (2021). ESG versus corporate financial performance: Evidence from East Asian Firms in the industrials sector. Studies of Applied Economics, 39(3). [Google Scholar] [CrossRef]

- Nollet, J., Filis, G., & Mitrokostas, E. (2016). Corporate social responsibility and financial performance: A non-linear and disaggregated approach. Economic Modelling, 52, 400–407. [Google Scholar] [CrossRef]

- Nuber, C., Velte, P., & Hörisch, J. (2020). The curvilinear and time-lagging impact of sustainability performance on financial performance: Evidence from Germany. Corporate Social Responsibility Environmental Management, 27(6), 232–243. [Google Scholar] [CrossRef]

- Pedersen, L., Fitzgibbons, S., & Pomorski, L. (2021). Responsible investing: The ESG-efficient frontier. Journal of Financial Economics, 142(2), 572–597. [Google Scholar] [CrossRef]

- Pierce, J. R., & Aguinis, H. (2013). The too-much-of-a-good-thing effect in management. Journal of Management, 39(2), 313–338. [Google Scholar] [CrossRef]

- Plumlee, M. (2015). Voluntary environmental disclosure quality and firm value: Further evidence. Journal of Accounting and Public Policy, 34, 336–361. [Google Scholar] [CrossRef]

- Pu, G. (2022). A non-linear assessment of ESG and firm performance relationship: Evidence from China. Economic Research-Ekonomska Istraživanja, 36(1). [Google Scholar] [CrossRef]

- Revelli, C., & Viviani, J. L. (2015). Financial performance of socially responsible investing: What have we learned? A meta-analysis. Business Ethics: A European Review, 24(2), 158–185. [Google Scholar] [CrossRef]

- Richardson, A., & Welker, M. (2001). Social disclosure, financial disclosure and the cost of equity capital. Accounting, Organizations and Society, 26(7–8), 597–616. [Google Scholar] [CrossRef]

- Sasabuchi, S. (1980). A test of a multivariate normal mean with composite hypotheses determined by linear inequalities. Biometrika, 67(2), 429–439. [Google Scholar] [CrossRef]

- Sun, W., Yao, S., & Govind, R. (2019). Reexamining corporate social responsibility and shareholder value: The inverted-U-shaped relationship and the moderation of marketing capability. Journal of Business Ethics, 160, 1001–1017. [Google Scholar] [CrossRef]

- Teng, X., Ge, Y., Wu, K. S., Chang, B. G., Kuo, L., & Zhang, X. (2022). Too little or too much? Exploring the inverted U-shaped nexus between voluntary environmental, social and governance and corporate financial performance. Frontier Environmental Science, 10, 969721. [Google Scholar] [CrossRef]

- Tensie, W., Ulrich, A., Tracy, V. H., & Casey, C. (2021). ESG and financial performance. uncovering the relationship by aggregating evidence from 1000 plus studies published between 2015–2020. NYU Stern Center for Sustainable Business. [Google Scholar]

- Wong, W. C., Batten, J. A., Mohamed-Arshad, S. B., Nordin, S., & Adzis, A. A. (2021). Does ESG Certification add firm value? Finance Research Letters, 39, 101593. [Google Scholar] [CrossRef]

- Wu, K. S., & Chang, B. G. (2022). The concave-convex effects of environmental, social, and governance on high-tech firm value: Quantile regression approach. Corporate Social Responsibility Environmental Management, 29, 1527–1545. [Google Scholar] [CrossRef]

| ESG Components | ESG Subcomponent and Weight |

|---|---|

| Environmental10 | Climate change Natural capital (natural resource) Pollution and waste (waste management) Environmental opportunities |

| Social11 | Human capital Product liability Stakeholder opposition Social opportunities |

| Governance12 | Corporate governance Corporate behavior |

| Variable | Observations | Mean | Standard Deviation | Range Min, Max | Manufacturing Mean | Banking Mean |

|---|---|---|---|---|---|---|

| Alpha | 2796 | −0.003 | 0.02 | −0.23, 0.34 | −0.0 | −0.03 |

| Sharpe ratio | 2191 | 0.06 | 1.11 | −13, 8 | 0.15 | −0.04 |

| % Banking | 2276 | 0.45 | 0.5 | 0, 1 | - | - |

| Weight-averaged ESG | 2276 | 4.1 | 1.24 | 0, 8.6 | 3.6 | 4.5 |

| Governance | 2276 | 5.03 | 1.6 | 0.2, 10 | 4.7 | 5.4 |

| Environmental | 2276 | 4.25 | 2.38 | 0, 10 | 4.2 | 4.3 |

| Social | 2276 | 4.2 | 1.24 | 0.3, 10 | 4.3 | 4.1 |

| Total revenue (in millions of USD) | 2471 | 5786 | 8972 | 95, 57,776 | 4926 | 6709 |

| Debt/equity | 2471 | 0.9 | 6.8 | −121, 214 | 1.1 | 0.8 |

| Intangible assets (in millions of USD) | 2471 | 7035 | 13,189 | 0, 82,205 | 7766 | 7338 |

| (a) | |||||||||||

| ESG | ESG2 | Gov | Gov2 | Env | Env2 | Soc | Soc2 | Rev | D/E | Int. A | |

| ESG | 1.000 | ||||||||||

| ESG2 | 0.963 | 1.000 | |||||||||

| Gov | −0.113 | −0.152 | 1.000 | ||||||||

| Gov2 | −0.153 | −0.196 | 0.988 | 1.000 | |||||||

| Env | −0.051 | −0.053 | 0.790 | 0.776 | 1.000 | ||||||

| Env2 | −0.050 | −0.073 | 0.749 | 0.713 | 0.934 | 1.000 | |||||

| Soc | −0.115 | −0.142 | 0.925 | 0.923 | 0.730 | 0.680 | 1.000 | ||||

| Soc2 | −0.146 | −0.181 | 0.887 | 0.882 | 0.640 | 0.573 | 0.972 | 1.000 | |||

| Revenue | −0.014 | −0.010 | −0.097 | −0.073 | 0.081 | −0.025 | −0.098 | −0.069 | 1.000 | ||

| Debt/Equi | −0.003 | −0.012 | −0.018 | −0.014 | −0.005 | −0.011 | −0.014 | −0.013 | 0.035 | 1.000 | |

| Int. Ass | −0.011 | −0.029 | −0.046 | −0.033 | −0.049 | −0.017 | −0.029 | −0.024 | −0.410 | −0.005 | 1.000 |

| (b) | |||||||||||

| ESG | ESG2 | Gov | Gov2 | Env | Env2 | Soc | Soc2 | Rev | D/E | Int. A | |

| ESG | 1.00 | ||||||||||

| ESG2 | 0.96 | 1.00 | |||||||||

| Gov | −0.08 | −0.15 | 1.00 | ||||||||

| Gov2 | −0.10 | −0.17 | 0.99 | 1.00 | |||||||

| Env | −0.03 | −0.06 | 0.87 | 0.85 | 1.00 | ||||||

| Env2 | −0.01 | −0.05 | 0.75 | 0.72 | 0.97 | 1.00 | |||||

| Soc | −0.07 | −0.13 | 0.94 | 0.93 | 0.75 | 0.67 | 1.00 | ||||

| Soc2 | −0.10 | −0.16 | 0.88 | 0.86 | 0.66 | 0.56 | 0.97 | 1.00 | |||

| Revenue | −0.02 | −0.04 | −0.06 | −0.05 | −0.02 | −0.05 | −0.11 | −0.05 | 1.00 | ||

| Debt/Equi | 0.01 | 0.01 | 0.17 | 0.02 | −0.01 | −0.01 | −0.01 | −0.02 | 0.05 | 1.00 | |

| Int. Ass | −0.04 | −0.05 | 0.28 | −0.01 | −0.04 | −0.04 | −0.01 | −0.01 | 0.11 | −0.04 | 1.00 |

| (c) | |||||||||||

| ESG | ESG2 | Gov | Gov2 | Env | Env2 | Soc | Soc2 | Rev | D/E | IntA | |

| ESG | 1.00 | ||||||||||

| ESG2 | 0.99 | 1.00 | |||||||||

| Gov | 0.45 | 0.41 | 1.00 | ||||||||

| Gov2 | 0.42 | 0.38 | 0.97 | 1.00 | |||||||

| Env | 0.31 | 0.32 | −0.38 | −0.05 | 1.00 | ||||||

| Env2 | 0.27 | 0.28 | −0.35 | −0.07 | 0.97 | 1.00 | |||||

| Soc | 0.76 | 0.77 | −0.13 | −0.09 | 0.40 | 0.35 | 1.00 | ||||

| Soc2 | 0.75 | 0.78 | −0.13 | −0.09 | 0.40 | 0.35 | 0.99 | 1.00 | |||

| Revenue | −0.10 | −0.10 | −0.52 | −0.35 | 0.52 | 0.49 | 0.013 | 0.12 | 1.00 | ||

| Debt/Equi | −0.03 | −0.02 | −0.12 | −0.16 | 0.02 | −0.01 | 0.01 | 0.02 | 0.09 | 1.00 | |

| Int. Ass | −0.04 | −0.04 | −0.50 | −0.23 | 0.47 | 0.44 | 0.20 | 0.18 | 0.74 | 0.10 | 1.00 |

| 25% | 50% | 75% | 90% | |

| Variable | Alpha | Alpha6 | Alpha | Alpha |

| ESG | −0.010 *** | −0.013 *** | −0.015 *** | −0.017 *** |

| (0.00) | (0.00) | (0.00) | (0.01) | |

| ESG-squared | 0.001 ** | 0.001 ** | 0.002 ** | 0.002 ** |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Total revenue | −3.30 × 10−7 *** | −3.13 × 10−7 *** | −2.90 × 10−7 *** | −2.71 × 10−7 ** |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Debt/equity | 2.70 × 10−5 | −1.06 × 10−5 | −6.11 × 10−5 | −1.04 × 10−4 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Intangible assets | −1.05 × 10−6 *** | −7.38 × 10−7 *** | −3.19 × 10−7 | 3.83 × 10−8 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Slope—low end | −0.011 ** | −0.0131 *** | −0.0159 *** | −0.0182 *** |

| Slope—high end | 0.0102 ** | 0.012 *** | 0.0151 *** | 0.017 *** |

| Sasabuchi test statistic | 2.16 ** | 0.0123 *** | 2.99 *** | 2.46 *** |

| Threshold (−β1/(2 β2))/within data range | 4.460/Yes | 4.432/Yes | 4.406/Yes | 4.391/Yes |

| 95% Fieller interval for extreme point | [3.942; 6.945] | [4.054; 5.323] | [4.017; 5.363] | [3.930; 5.924] |

| Gov | −0.004 ** | −0.004 *** | −0.005 *** | −0.006 *** |

| (0.001) | (0.001) | (0.001) | (0.001) | |

| Gov-squared | 0.0003 ** | 0.0004 * | 0.0004 *** | 0.0004 ** |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Total revenue | −3.36 × 10−7 ** | −3.22 × 10−7 *** | −3.05 × 10−7 *** | −2.91 × 10−7 ** |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Debt/equity | .0000 | −0.0001 | −6.00 × 10−5 | −0.0001 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Intangible assets | −1.36 × 10−6 *** | −9.74 × 10−7 | −4.99 × 10−7 | −1.14 × 10−7 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Slope—low end) | −0.004 ** | −0.004 ** | −0.005 *** | −0.006 ** |

| Slope—high end | 0.003 ** | 0.003 ** | 0.03 *** | 0.04 *** |

| Sasabuchi test statistic | 1.98 ** | 2.99 *** | 3.09 *** | 2.4 ** |

| Threshold (−β1/(2 β2)/within data range | 5.833/Yes | 5.943/Yes | 6.05/Yes | 6.11/Yes |

| 95% Fieller interval for extreme point | [3.218; 9.739] | [4.88; 7.28] | [5.09; 7.32] | [4.84; 8.12] |

| Env | 0.000 | 0.000 | 0.000 | 0.000 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Env-squared | 0.0000 | 0.000 | 0.000 | −3.64 × 10−6 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Total revenue | −3.65 × 10−7 *** | −3.55 × 10−7 *** | −3.42 × 10−7 *** | −3.30 × 10−7 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Debt/equity | 0.000 | −0.0000 | −0.0006 | −1.05 × 10−4 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Intangible assets | −1.35 × 10−6 *** | −9.83 × 10−7 *** | −4.93 × 10−7 | −5.81 × 10−8 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Slope—low end) | −0.0005 | −0.000 | - | - |

| Slope—high end | 0.0007 | 0.0001 | - | - |

| Sasabuchi test statistic | 0.51 | 0.20 | - | - |

| Threshold (−β1/(2 β2)/within data range | 3.837/No | 1.764/No | −7.604/No | 85.473/No |

| 95% Fieller interval for extreme point | [−Inf, Inf] | [−Inf, Inf] | [−Inf; +Inf] | [−Inf; +Inf] |

| Social | 0.009 *** | 0.008 *** | 0.007 ** | 0.006 |

| (0.00) | (0.008) | (0.00) | (0.00) | |

| Social-squared | −0.001 *** | −0.001 *** | −0.001** | −0.001 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Total revenue | −3.70 × 10−7 *** | −3.73 × 10−7 *** | −3.77 × 10−7 *** | −3.81 × 10−7 ** |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Debt/equity | 1.07 × 10−5 | −2.94 × 10−5 | −7.23 × 10−5 | −1.17 × 10−4 * |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Intangible assets | −1.32 × 10−6 *** | −9.39 × 10−7 *** | −5.29 × 10−7 | −1.05 × 10−7 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Slope—low end | −0.004 ** | 0.009 *** | 0.003 *** | 0.007 * |

| Slope—high end | 0.004 ** | −0.009 *** | −0.002 *** | −0.007 * |

| Sasabuchi test statistic | 2.7 ** | 3.04 ** | 2.17 ** | 1.31 * |

| Threshold (−β1/(2 β2)/within data range | 4.35/Yes | 4.962/Yes | 4.34/Yes | 4.32/Yes |

| 95% Fieller interval for extreme point | [3.905; 5.397] | [3.950; 5.140] | [3.741; 6.455] | [−Inf, Inf] |

| Observations | 2276 | 2276 | 2276 | 2276 |

| 25% | 50% | 75% | 90% | |

| VARIABLES | Sharpe | Sharpe | Sharpe | Sharpe |

| ESG | 0.632 | 1.175 *** | 1.687 ** | 2.223 ** |

| (0.53) | (0.41) | (0.53) | (0.80) | |

| ESG-squared | −0.0955 | −0.143 *** | −0.187 ** | −0.223 ** |

| (0.06) | (0.05) | (0.06) | (0.09) | |

| Total revenue | −1 × 10−5 | −1 × 10−5 | −8 × 10−6 | −6 × 10−6 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Debt/equity | 0.001 | −0.003 | −0.007 | −0.010 |

| (0.01) | (0.01) | (0.01) | (0.01) | |

| Intangible assets | −8.26 × 10−5 *** | −7.40 × 10−5 *** | −6.50 × 10−5 ** | −5.60 × 10−5 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Slope—low end | 0.630 | 1.162 *** | 1.699 *** | 2.236 ** |

| Slope—high end | −1.043 ** | −1.284 *** | −1.527 ** | −1.770 ** |

| Sasabuchi test statistic | 1.250 | 2.59 *** | 2.16 ** | 1.69 ** |

| Threshold (−β1/(2 β2)/within data range | 3.238/Yes | 4.086/Yes | 4.529/Yes | 4.798/Yes |

| 95% Fieller interval for extreme point | [−Inf; 8.502] U [4.010; +Inf] | [3.211; 4.771] | [3.902; 6.661] | [4.092; 43.893] |

| Gov | −0.1808 | −0.074 | 0.385 | 0.150 |

| (0.16) | (0.155) | (0.238) | (0.35) | |

| Gov-squared | 0.006 | 0.002 | −0.004 ** | −0.009 ** |

| (0.12) | (0.0157) | (0.024) | (0.036) | |

| Total revenue | 0.000 | −0.0000 | −8.77 × 10−6 | −7.11 × 10−6 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Debt/equity | 0.0006 | −0.003 | −0.0063 | −0.010 |

| (0.01) | (0.07) | (0.01) | (0.02) | |

| Intangible assets | −6.00 × 10−5 *** | −5.00 × 10−5 ** | −0.000 *** | −0.000 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Slope—low end | - | - | 0.038 | 0.15 |

| Slope—high end | - | - | −0.032 | −0.02 |

| Sasabuchi test statistic | - | - | 0.120 | 1.020 |

| Threshold (−β1/(2 β2)/within data range | - | - | 5.46/Yes | 8.77/Yes |

| 95% Fieller interval for extreme point | - | - | [−Inf; +Inf] | [−Inf; +Inf] |

| Env | 0.105 | 0.079 | 0.052 | 0.028 |

| (0.12) | (0.087) | (0.114) | (0.164) | |

| Env-squared | −0.007 | 0.006 | 0.013 | −0.019 |

| (0.012) | (0.010) | (0.013) | (0.018) | |

| Total revenue | 0.000 | 0.000 | −8.09 × 10−6 | −5.76 × 10−6 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Debt/equity | 0.001 | −0.002 | −0.006 | −0.009 |

| (0.01) | (0.005) | (0.01) | (0.01) | |

| Intangible assets | 0.000 | 0.000 | −0.0001 ** | 0.000 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Slope—low end | - | - | - | - |

| Slope—high end | - | - | - | - |

| Sasabuchi test statistic | - | - | - | - |

| Threshold (−β1/(2 β2)/within data range | - | - | - | - |

| 95% Fieller interval for extreme point | - | - | - | - |

| Soc | −0.34 * | −0.258 *** | −0.69 *** | −0.083 |

| (0.09) | (0.161) | (0.213) | (0.32) | |

| Soc-squared | 0.018 ** | 0.009 ** | −0.002 * | −0.012 |

| (0.021) | (0.169) | (0.022) | (0.03) | |

| Total revenue | −0.000 | −8.10 × 10−6 | −4.78 × 10−6 | −1.54 × 10−6 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Debt/equity | 0.002 | −0.002 | −0.006 | −0.010 |

| (0.06) | (0.01) | (0.01) | (0.00) | |

| Intangible assets | −0.001 ** | −5.00 × 10−5 *** | −5.00 × 10−5 * | −0.000 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Slope—low end | - | - | - | - |

| Slope—high end | - | - | - | - |

| Sasabuchi test statistic | - | - | - | - |

| Threshold (−β1/(2 β2)/within data range | - | - | - | - |

| 95% Fieller interval for extreme point | - | - | - | - |

| Observations | 2191 | 2191 | 2191 | 2191 |

| 25% | 25% | 50% | 50% | 75% | 75% | 90% | 90% | |

| Mfg. | Banking | Mfg. | Banking | Mfg. | Banking | Mfg. | Banking | |

| VARIABLES | alpha | alpha | alpha | alpha | alpha | alpha | alpha | alpha |

| ESG | −0.012 ** | −0.004 | −0.013 *** | −0.005 ** | −0.006 ** | −0.016 *** | −0.019 *** | −0.008 * |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.01) | (0.01) | (0.00) | |

| ESG-squared | 0.001 ** | 0.000 | 0.002 *** | 0.000 | 0.000 | 0.002 *** | 0.002 ** | 0.001 |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Total revenue | −1.57 × 10−6 *** | −1.52 × 10−7 ** | −1.53 × 10−6 *** | −1.30 × 10−7 *** | −1.07 × 10−7* | −1.47 × 10−6 *** | −1.43 × 10−6 ** | 0.000 |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Debt/equity | 0.000 | −0.002 ** | 0.000 | −0.003 *** | −0.003 *** | 0.000 | 0.000 | −0.004 *** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Intangible assets | −2.04 × 10−6 *** | 0.000 | −1.58 × 10−6 *** | 2.08 × 10−7 * | 3.39 × 10−7 *** | −8.98 × 10−7 * | 0.000 | 4.67 × 10−7 ** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Slope—low end | −0.0123 *** | - | −0.0146 *** | −0.005 ** | −0.0179 *** | −0.007 *** | −0.020 *** | −0.008 ** |

| Slope—high end | 0.013 ** | - | 0.0152 ** | 0.000 | 0.018 *** | 0.001 | 0.02 ** | 0.003 |

| Sasabuchi test statistic | 2.1 ** | - | 2.94 ** | 0.040 | 2.63 *** | 0.510 | 2.14 ** | 0.670 |

| Threshold (−β1/(2 β2) | 4.178/Yes | - | 4.211/Yes | 8.44/Yes | 4.243/Yes | 7.019/Yes | 4.260/Yes | 6.307/Yes |

| 95% Fieller interval | [3.384; 7.040] | - | [3.684; 5.257] | [−Inf; 5.672] U [−2.066; +Inf] | [3.658; 5.607] | [−Inf; 5.238] U [−3.267; +Inf] | [3.528; 6.919] | [−Inf; 4.802] U [0.374; +Inf] |

| Gov | 0.000 | −0.005 *** | −0.002 | −0.004 *** | −0.005 * | −0.000 | −0.001 * | −0.002 ** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Gov-squared | 0.000 | 0.000 *** | 0.000 | 0.000 *** | 0.000 *** | 0.000 | 0.001 * | 0.000 |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| total revenue | −1.83 × 10−6 *** | −1.24 × 10−7 ** | −1.80 × 10−6 *** | −1.19 × 10−7 *** | −1.75 × 10−6 *** | −1.15 × 10−7 ** | −1.71 × 10−6 *** | 0.000 |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| debt/equity | 3.54 × 10−5 | −0.002 * | 1.22 × 10−5 | −0.002 *** | −2.29 × 10−5 | −0.003 *** | −4.76 × 10−5 | −0.004 *** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| intangible assets | −2.85 × 10−6 *** | 2.87 × 10−8 | −2.33 × 10−6 *** | 1.26 × 10−7 | −1.55 × 10−6 ** | 2.19 × 10−7 * | −1.00 × 10−6 | 3.17 × 10−7 * |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Slope—low end | - | −0.005 *** | −0.2 | −0.004 *** | −0.005 ** | −0.003 *** | −0.001 ** | −0.002 |

| Slope—high end | - | 0.004 *** | 0.001 | 0.003 *** | 0.003 | 0.002 *** | 0.005 * | 0.005 |

| Sasabuchi test statistic | - | 5.57 *** | 0.52 | 4.78 *** | 1.26 | 2.4 *** | 1.36 * | 0.49 |

| Threshold (−β1/(2 β2) | - | 5.664/Yes | 7.03/Yes | 5.979/Yes | 6.19/Yes | 6.546/Yes | 6.023/Yes | 8.116/Yes |

| 95% Fieller interval | [−Inf; +Inf] | [5.103; 6.319] | [−Inf; +Inf] | [5.383; 6.762] | [−Inf; +Inf] | [5.492; 8.750] | [−Inf; +Inf] | [−Inf; 5.343] U [−0.292; +Inf] |

| Env | −0.001 ** | 0.002 *** | −0.001 ** | 0.002 *** | 0.005 *** | 0.002 | 0.000 | 0.002 * |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Env-squared | 0.000 | −0.0003 *** | 0.000 | −0.000 *** | −0.000 *** | 0.000 | 0.000 | −0.000 ** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Total revenue | −1.88 × 10−6 *** | −1.58 × 10−7 ** | −1.89 × 10−6 *** | −1.50 × 10−7 *** | −1.91 × 10−6 *** | −1.38 × 10−7 ** | −1.92 × 10−6 *** | 0.000 |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Debt/equity | 3.28 × 10−5 | −0.00213 ** | 1.19 × 10−5 | −0.003 *** | −2.05 × 10−5 | −0.00323 *** | −4.08 × 10−5 | −0.004 *** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Intangible assets | −2.97 × 10−6 *** | 3.19 × 10−7 ** | −2.40 × 10−6 *** | 3.62 × 10−7 *** | −1.53 × 10−6 ** | 4.22 × 10−7 *** | 0.000 | 4.72 × 10−7 ** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Slope—low end | −0.001 *** | 0.002 *** | −0.006 | 0.002 *** | −0.005 *** | 0.002 | −0.003 | 0.001 ** |

| Slope—high end | 0.007 *** | −0.004 *** | 0.006 | −0.003 *** | 0.006 *** | −0.003 | 0.005 | −0.0002 ** |

| Sasabuchi test statistic | 2.70 *** | 2.96 *** | 2.73 *** | 3.56 *** | 1.36 * | 2.75 *** | 0.75 | 1.83 ** |

| Threshold (−β1/(2 β2) | 5.338/Yes | 3.215/Yes | 5.076 | 3.421/Yes | 4.502/Yes | 2.751/Yes | 3.967/Yes | 4.216/Yes |

| 95% Fieller interval | [4.074; 6.723] | [1.759; 4.099] | [3.637; 6.197] | [2.289; 4.201] | [−Inf; +Inf] | [2.081; 4.938] | [−Inf; +Inf] | [−2.747; 8.455] |

| Social | 0.011 *** | −0.004 ** | 0.011 *** | −0.003 | 0.011 *** | 0.000 | 0.0112 ** | −0.002 |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Social-squared | −0.001 *** | 0.000 | −0.001 *** | 0.000 | −0.001 *** | 0.000 | −0.00123 ** | 0.000 |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Total revenue | −1.76 × 10−6 *** | −1.62 × 10−7 ** | −1.76 × 10−6 *** | −1.39 × 10−7 *** | −1.76 × 10−6 *** | −1.73 × 10−6 *** | −1.76 × 10−6 *** | 0.000 |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Debt/equity | 0.000 | −0.003 *** | −9.73 × 10−6 | −0.003 *** | −4.52 × 10−5 | −0.0034 *** | −7.61 × 10−5 | −0.004 *** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Intangible assets | −2.85 × 10−6 *** | 0.000 | −2.32 × 10−6 *** | 0.000 | −1.73 × 10−6 *** | 3.00 × 10−7 ** | −1.21 × 10−6 | 4.36 × 10−7 ** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Slope—low end | 0.011 *** | −0.004 ** | 0.011 *** | −0.004 ** | 0.011 ** | −0.003 * | 0.011 ** | −0.002 |

| Slope—high end | −0.010 | 0.004 ** | −0.010 | 0.0003 ** | −0.010 | 0.002 * | 0.010 ** | 0.001 |

| Sasabuchi test statistic | 2.70 *** | 1.67 ** | 3.35 *** | 1.67 ** | 2.52 *** | 1.02 * | 1.76 ** | 0.32 |

| Threshold (−β1/(2 β2) | 4.528/Yes | 4.735/Yes | 4.537/Yes | 4.962/Yes | 4.548/Yes | 5.332/Yes | 4.556/Yes | 6.147/Yes |

| 95% Fieller interval | [4.026, 5.7] | [−Inf; 2.324] U [−1.288; +Inf] | [4.127, 5.339] | [3.763; 46.321] | [4.013, 6.033] | [−Inf; +Inf] | [3.765, 21.196] | [−Inf; +Inf] |

| Observations | 1248 | 1028 | 1248 | 1028 | 1248 | 1028 | 1248 | 1028 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Y.; Sonenshine, R. The Nonlinear Impact of Environmental, Social, Governance on Stock Market Performance Among US Manufacturing and Banking Firms. J. Risk Financial Manag. 2025, 18, 293. https://doi.org/10.3390/jrfm18060293

Wang Y, Sonenshine R. The Nonlinear Impact of Environmental, Social, Governance on Stock Market Performance Among US Manufacturing and Banking Firms. Journal of Risk and Financial Management. 2025; 18(6):293. https://doi.org/10.3390/jrfm18060293

Chicago/Turabian StyleWang, Yan, and Ralph Sonenshine. 2025. "The Nonlinear Impact of Environmental, Social, Governance on Stock Market Performance Among US Manufacturing and Banking Firms" Journal of Risk and Financial Management 18, no. 6: 293. https://doi.org/10.3390/jrfm18060293

APA StyleWang, Y., & Sonenshine, R. (2025). The Nonlinear Impact of Environmental, Social, Governance on Stock Market Performance Among US Manufacturing and Banking Firms. Journal of Risk and Financial Management, 18(6), 293. https://doi.org/10.3390/jrfm18060293