Abstract

The aim of this study is to examine the impact of VBM success on the corporate sustainability of Thai listed firms. The effects of successful VBM on decision-making effectiveness, business value creation, and corporate competency are also investigated. Both contingency theory and the relevant literature are utilized to aid in effectively comprehending the consequences of successful VBM. Thai listed companies were selected as the sample for this study, and data collected from 101 accounting directors through questionnaires were used as the research instrument. PLS-SEM was employed to test the hypothesized relationships. The results found that successful VBM has a considerable impact on company sustainability, owing primarily to indirect effects through mediating variables, such as business value generation and corporate competence, rather than direct effects, which are not significant. As a result, it is possible to conclude that good VBM implementation will increase business sustainability through processes or mediating variables, rather than directly affecting it. In addition, the success of VBM significantly improves the business value creation and corporate competency. Lastly, effective decision-making, the creation of company value, and corporate competency all significantly enhance corporate sustainability. Contributions from management and theoretical perspectives are openly provided. Recommendations, conclusions, and future study directions are also highlighted and discussed herein.

1. Introduction

At present, businesses both in Thailand and abroad are suffering from the impact of the global economic slowdown. The spread of the coronavirus disease (COVID-19) affected many aspects of business, and its impact continues to be felt to this day. This situation has resulted in a reduction in consumers’ purchasing power. This issue has arisen due to the dual effect of production material shortages and excessive inflation. When issues then arise in supply chains, this can result in disruption, often known as “Global Supply Disruption” (Mishra et al., 2023; Bank of Thailand, 2022). In addition, business operations are currently being impacted by trade wars among world powers and global conflicts such as the Russian–Ukrainian war and the Israeli–Palestinian war. As a result, goods are becoming increasingly expensive around the globe (Bianchi, 2023). To address these challenges, present-day business operations must be based on caution, with it being more difficult for businesses to operate effectively. At present, numerous measures are available to business, both traditional management accounting, including budgeting, standard costing, and cost–volume–profit (CVP) analysis, and contemporary management accounting, including activity-based costing (ABC), cost management, and supply chain management. By using these management accounting measures, it is anticipated that decision-making in an uncertain environment will be supported and operating results can be improved. It is expected that the adoption of these management accounting measures will help in improving operational performance to higher levels and support decision-making in an uncertain environment (Nowotny et al., 2022; Firk et al., 2021; Elgharbawy & Abdel-Kader, 2021; Kumar & Nagpal, 2011; Nishimura, 2007; Sulaiman et al., 2004).

Value-based management (VBM), or value-based management accounting (VBMA), is a concept within contemporary management accounting that emerged in the late 1990s. It can be used as a measure for creating added value for a business in the future (Ittner & Larcker, 2001; Nicolaou, 2000; Anderson & Lanen, 1999). Current research on management accounting lacks empirical support for examining the effects of successful VBM. For example, Firk et al. (2019) note in their study that the effective use of VBM is positively impacted by corporate sustainability; however, there is a dearth of empirical research that takes into account the characteristics that determine VBM applications. Oke and Ajeigbe (2024) concluded that the findings of their VBM investigation were contradictory. Based on the findings of Malmi and Ikaheimo (2003), few studies exist that examine the impact of applying VBM, with conflicting findings being reported. In light of this research gap, the effects of VBM success need to be examined and confirmed through academic research (Firk et al., 2021; Poulsen et al., 2009; Cooper & Crowther, 2008; Nishimura, 2007; Ittner & Larcker, 2001). In this study, efforts were made to use contingency theory to describe the phenomena of applied VBM in corporations in order to significantly broaden the existing understanding of VBM and to address this research gap (Chenhall, 2003; Reid & Smith, 2000).

The term “successful VBM” in this study refers to achieving the primary objective of VBM adoption in six different ways: (1) strategic planning collaboration, (2) efficient re-source allocation, (3) control budgeting effectiveness, (4) effective performance measure-ment, (5) management compensation system, and (6) successful organizational communication (Elgharbawy & Abdel-Kader, 2021; Firk et al., 2021; Poulsen et al., 2009; Tokusaki, 2003; Ittner & Larcker, 2001). The primary aims of this study are as follows: (1) to investi-gate how successful VBM contributes to corporate sustainability and (2) to investigate how successful VBM is in enhancing corporate competency, business value creation, and decision-making effectiveness. The impact of successful VBM on company sustainability is therefore the main research focus of this study. An additional aim was to answer the following questions: (1) how does the success of VBM affect the efficiency of decision-making, the generation of business value, and organizational competency? (2) How do decision-making effectiveness, business value creation, and corporate competency affect corporate sustainability?

2. Theoretical Foundation and Research Model

In this study, contingency theory, a common theoretical framework in managerial accounting research, is incorporated to bolster the outcomes of successful VBM implementation (Reid & Smith, 2000; Chenhall, 2003). Contingency theory hypothesizes that organizational structure is a function of context, a context that is simultaneously determined by both the external and internal environment, including organizational factors (Anderson & Lanen, 1999). Organizational structure has been considered by researchers to encompass cost management, performance evaluation, and planning and controlling management accounting strategies that can improve organizational performance (Cadez & Guilding, 2008; Hayes, 1977). Similar to this concept, organizational structure comprises numerous exogenous and endogenous contextual elements. Exogenous factors include environmental factors or external factors, such as competition and environmental uncertainty, whereas endogenous factors include organizational factors or internal factors, such as resources, technology, and culture (Baines & Langfield-Smith, 2003; Anderson & Lanen, 1999).

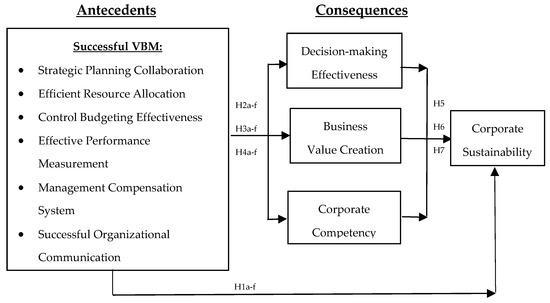

The main concept of contingency theory is that for an organization to function properly, its strategy, structure, and managerial procedures must all be coordinated with one another (Chenhall, 2003; Drazin & Van de Van, 1985). Based on contingency theory, a firm’s operating environment and cost system functionality must align for performance to improve (Chenhall, 2003; McKeen et al., 1994). Contingency theory helps tailor the implementation of VBM based on specific organizational and environmental factors. Numerous studies in the field of contingency theory have therefore focused on the connections between key components of an organization and how they affect performance (Reid & Smith, 2000; Nicolaou, 2000). Moreover, the contingency factor serves as a lens through which VBM implementation can be tailored to ensure that business performance and value-creation tools are used (Serebryakova et al., 2021; Haldma & Laats, 2002). Therefore, contingency theory is applied in this study to explain the subsequent successful application of VBM, which has an impact on the sustainability of the enterprise, using corresponding literature on both contingency theory and the successful application of VBM. The following Figure 1 depicts the research model and hypothesis.

Figure 1.

Model of the results of successful VBM.

3. Literature Review and Hypothesis Development

3.1. Successful VBM and Corporate Sustainability

The VBM concept primarily focuses on the methods or resources used to create strategies for profitable business operations. Poulsen et al. (2009) suggest that in order to maximize shareholder wealth and returns, the main VBM systems and processes are concentrated on creating value and profits from operations. Bukvic (2016) states that applying VBM to a variety of performance metrics, including free cash flow, economic value added (EVA), net profit after tax (NOPAT), depreciation and amortization (EBITDA), and earnings before interest and taxes (EBITDA), will improve a company’s performance over time.

The success of value-based management accounting (VBM) in this study was measured by achieving the primary objective of VBM adoption in six distinct ways: (1) strategic planning collaboration, (2) efficient resource allocation, (3) control budgeting effectiveness, (4) effective performance measurement, (5) management compensation system, and (6) successful organizational communication (Elgharbawy & Abdel-Kader, 2021; Firk et al., 2021; Poulsen et al., 2009; Tokusaki, 2003; Tokusaki, 2003; Ittner & Larcker, 2001). For this study, the concept of corporate sustainability focuses on a mixed performance measurement that prioritizes the organization’s long-term survival (Cadez & Guilding, 2008; Nishimura, 2007; Ainnuddin et al., 2007).

In previous VBM studies, researchers found that the relationships between VBM suc-cess and corporate sustainability are becoming increasingly important in modern strate-gic management (Oke & Ajeigbe, 2024; Corazza, 2019). Maximizing long-term shareholder value is VBM’s goal, and the goal of corporate sustainability is to guarantee the long-term economic, environmental, and social success of the business (Firk et al., 2019). Based on previous studies by Elgharbawy and Abdel-Kader (2021), Paul and Claes (2006), and Ittner and Larcker (2001), the authors found that the successful application of VBM was related to the sustainability of both the firm’s financial and nonfinancial performance. This finding is also consistent with the results of previous studies by Corazza (2019) and Bukvic (2016) who found that the successful application of VBM has a positive effect on corporate sustainability and increases the confidence of investors in the firm. Based on these findings, the following hypothesis was proposed:

Hypothesis 1.

The greater VBM success, the more likely it is that the firm will achieve greater corporate sustainability.

3.2. Consequences of Successful VBM

3.2.1. Successful VBM and Decision-Making Effectiveness

In this study, decision-making effectiveness focused on the degree to which decision-makers in a corporation can accomplish business decision objectives (Firk et al., 2021; Pizzini, 2006; Lawson et al., 2009). In previous studies, researchers have found that VBM provides the framework, tools, and mindset that help managers make better, more value-oriented decisions (Firk et al., 2019). Effective decision-making is a byproduct of successful VBM—because when all members of management understand what creates value and how to measure it, they make better choices more rapidly and consistently (Malmi & Ikaheimo, 2003). In previous studies by Firk et al. (2021), Wu et al. (2013), Lawson et al. (2009), and Paul and Claes (2006), the authors also found that the use of VBM improves the business’s ability to make decisions. This is also in line with earlier research by Tokusaki (2003) and Foster and Swenson (1997), who discovered that effective VBM implementation will support future company management decision-making. Based on these findings, the following hypothesis was proposed:

Hypothesis 2.

The greater VBM success, the more likely it is that the firm will achieve greater decision-making effectiveness.

3.2.2. Successful VBM and Business Value Creation

The foundation of VBM is a strategy framework to promote, quantify, and maintain value creation throughout the company; it does not simply concern financial management (Malmi & Ikaheimo, 2003). Business value generation is both a cause and an effect of VBM success, as value creation is ingrained in the organization’s DNA when VBM is completely implemented, rather than being left to chance (Nowotny et al., 2022; Firk et al., 2021; Cooper & Crowther, 2008). Moreover, Corazza (2019), Tokusaki (2003), and Ittner and Larcker (2001) also discovered that there is a correlation between the application of VBM and the creation of added value for the company, both in terms of shareholders and the creation of added value for the organization. This finding is also in line with earlier re-search by Bukvic (2016), who discovered that the company’s EVA and Cash Value Added (CVA) are impacted by the use of VBM. Based on these findings, the following hypothesis was proposed:

Hypothesis 3.

The greater VBM success, the more likely it is that the firm will achieve greater business value creation.

3.2.3. Successful VBM and Corporate Competency

Corporate competency is the key outcome of successfully implementing VBM (Paul & Claes, 2006; Tokusaki, 2003). VBM requires companies to identify and focus on its effective capabilities and helps focus and strengthen those competencies that matter most to success in the long term (Firk et al., 2019). Serebryakova et al. (2021) and Paul and Claes (2006) found that the appropriate application of VBM that focuses on creating firm value is related to the firm’s competitive advantage. Grant (1996) states that a firm’s competitive advantage is related to the appropriate implementation of VBM that concentrates on generating firm value. Based on these findings, the following hypothesis was proposed:

Hypothesis 4.

The greater VBM success, the more likely it is that the firm will achieve greater corporate competency.

3.3. The Relationships Among Decision-Making Effectiveness, Business Value Creation, Corporate Competency, and Corporate Sustainability

When businesses make decisions effectively—with clarity, foresight, inclusivity, and data—they build a foundation for success in the long term (Pizzini, 2006). The results of previous studies have shown that decision-making efficacy and business sustainability are related (Cadez & Guilding, 2008; Nishimura, 2007; Pizzini, 2006). Beyer et al. (2010) and Anderson and Lanen (1999) concluded that the main goal of good decision-making is to improve business sustainability. Furthermore, Ainnuddin et al. (2007) and Chenhall (2003) also suggest that effective decision-making may increase the potential for business sustainability. Based on these findings, the following hypothesis was proposed:

Hypothesis 5.

The greater decision-making effectiveness, the more likely it is that the firm will achieve greater corporate sustainability.

Value creation and business sustainability are characterized by a solid relationship that is becoming more widely acknowledged as strategic and complementary (Hahn, 2007). Cooper and Crowther (2008), Nishimura (2007), and Tokusaki (2003) also found that there is a relationships between firm value development and company sustainability. Based on these findings, the following hypothesis was proposed:

Hypothesis 6.

The higher the company’s value creation, the more likely it is to achieve greater corporate sustainability.

Business sustainability and corporate competency are interdependent and characterized by a close relationship (Cooper & Crowther, 2008). A company’s ability to operate sustainably depends heavily on its internal competencies that can yield greater competitive advantages and enhance performance (Almohtaseb et al., 2025; Paul & Claes, 2006). Serebryakova et al. (2021) and Wu et al. (2013) found that corporate competency and business sustainability are related. Consistent with the findings of Paul and Claes (2006), Anderson and Dekker (2009) also discovered that corporate competency can improve corporate sustainability. Based on these findings, the following hypothesis was proposed:

Hypothesis 7.

The higher the corporate competency, the more likely it is that the firm will achieve greater corporate sustainability.

4. Research Method

4.1. Sample and Data Collection Procedure

The companies listed on the Stock Exchange of Thailand (SET) constitute the population and sample used in this study. Their size, hierarchical organization, centralized decision-making, substantial allowed capital, and standardized processes are the primary factors responsible for their inclusion in this study (Pavabutr & Prangwattananon, 2009). In addition, Bukvic (2016) proposed that large companies focus on successful VBM and the effective deployment of business operations. Therefore, Thai listed companies were selected as the study’s sample. Because they directly impact each company’s VBM application, accounting directors were selected as key participants. In addition, they are qualified to supply the organizational data and VBM details required for this investigation (Cooper & Crowther, 2008).

The SET database, which is accessible at www.set.or.th as of December 2023, was used to identify the addresses of a number of businesses and companies. Data were gathered through a mail survey, which respondents completed and sent back to the researcher directly to maintain confidentiality. The sample size consisted of all 569 Thai listed companies. Regarding the distribution of the surveys, eight surveys could not be distributed because some businesses had ceased operations or had relocated to undisclosed locations. After subtracting the undeliverable surveys from the database list, 561 questionnaires were distributed, of which 109 were returned. Only 101 of the returned and completed questionnaires, or around 18.00%, were usable. The majority of statisticians concur that a sample size of 100 is necessary to obtain any form of significant results (Cridland, 2022; Aguirre-Urreta & Rönkkö, 2015).

4.2. Questionnaire Development and Variable Measurement

The questionnaire used in this study consists of five parts. Part one asks the participant to provide their personal information. Part two consists of general information about Thai listed companies. Parts three through four are related to evaluating each of the constructs in the research model, designed using a five-point Likert scale, ranging from 1 (strongly disagree) to 5 (strongly agree). Part three comprises the measurement of successful VBM application. Part four details the consequences of successful VBM application, including company sustainability, decision-making effectiveness, business value creation, and corporate competency. Lastly, an open-ended question for the accounting directors’ suggestions and opinions is included in part five. All dimensions of successful VBM and the consequence variable of VBM were measurement variables that were based on the relevant literature on VBM and test contract validity by using confirmatory factor analysis (CFA) in Table 1. Only the corporate sustainability variable is measured using five items, with all other variables being measured using four items. Lastly, the variable measurement process can also be explained as follows:

Table 1.

Results of contracts.

4.2.1. The Antecedent Variable: Successful VBM

In this study, successful VBM is defined as achieving the primary objective of VBM adoption in six distinct ways: (1) strategic planning collaboration, (2) efficient resource al-location, (3) control budgeting effectiveness, (4) effective performance measurement, (5) management compensation system, and (6) successful organizational communication (Elgharbawy & Abdel-Kader, 2021; Firk et al., 2021; Poulsen et al., 2009; Tokusaki, 2003; Tokusaki, 2003; Ittner & Larcker, 2001).

In this study, strategic planning collaboration is defined as the participation of staff members at all organizational levels in formulating and choosing plans for each depart-ment’s efficient operation (Poulsen et al., 2009; Paul & Claes, 2006; Agbejule & Saarikoski, 2006; Chenhall & Langfield-Smith, 1998). Efficient resource allocation is defined as the capacity of a business to distribute scarce resources across its departments so that each department is able to perform its functions effectively to meet the objectives of the company (Poulsen et al., 2009; Paul & Claes, 2006). Controlled budgeting effectiveness is defined as the business having a budget system that is planned and controlled carefully to minimize unacceptable budget variances, and the related personnel are able to analyze and resolve any budget variances that do not conform to the plan quickly and promptly (Elgharbawy & Abdel-Kader, 2021; Nishimura, 2007). Effective performance measurement is defined as the company placing a strong emphasis on accurate assessment, which includes applying suitable criteria and both financial and non-financial measurements (Paul & Claes, 2006; Van der Stade et al., 2006; Bryant et al., 2004). The management compensation system is defined as the company having put in place a suitable and equitable system for managing and allocating compensation to workers and other stakeholders in a timely and reasonable manner (Paul & Claes, 2006; Tokusaki, 2003). Successful organizational communication is defined as delivering strategies and information to stakeholders in a comprehensive, timely, and efficient manner, with the organization being able to effectively communicate both internally and externally (Leach-Lopez et al., 2007; Paul & Claes, 2006; Tokusaki, 2003).

4.2.2. The Consequences of Successful VBM

Firstly, corporate sustainability is defined as a business performance measurement that prioritizes the organization’s long-term survival by taking into account both financial and non-financial metrics, such as revenue and market share growth, profitability, return on investment, the company’s ongoing interest from investors, employee satisfaction, and stakeholder acceptance (Cadez & Guilding, 2008; Nishimura, 2007; Ainnuddin et al., 2007). Secondly, decision-making effectiveness is defined as an evaluation of the degree to which information users can accomplish business decision objectives, including the ability to make decisions about adding or reducing a product line, making decisions about the production mix or sales mix, making decisions about pricing, and making decisions about capital project selection (Firk et al., 2021; Lawson et al., 2009; Pizzini, 2006). Thirdly, business value creation is defined as recognizing the increased worth of the company by concentrating on generating money for it in a variety of ways, such as generating EVA, creating a complete business ecosystem, encouraging the use of contemporary technological systems, and fostering people’s potential at work (Cooper & Crowther, 2008; Nishimura, 2007; Tokusaki, 2003). Lastly, corporate competency is defined as the company’s unique qualities that distinguish it from its competitors and result in performance that consistently surpasses its objectives, such as risk management, cost control, research and development, and competitive advantages (Tokusaki, 2003; Fulwiler, 1995).

4.3. Validity and Reliability

For the assessment of validity of the contract measurements, this research follows a confirmatory factor analysis (CFA) by using the statistical software program SPSS 26.0 (Statistical Package for Social Sciences) and measured variables from relevant previous research, as given in the Table 1. In the initial stages, factor analysis was used to examine the underlying connections between a large numbers of items and ascertain whether they might be reduced to a more manageable number of factors. Due to a lack of observations, CFA was performed independently on each group of items that represented a certain scale (Hair et al., 2010). In Table 1, based on a higher empirical cut-off value of 0.40, CFA has a high likelihood of inflating the construct loadings, convergent validity (Hair et al., 2010). Every factor loading is above the 0.40 limit (0.61–0.94) and statistically significant. The factor loading demonstrated that the measurement instrument had good construct validity, particularly for the BVC, ERA, and MCS variables, which had consistently high loading values, indicating a clear and stable structure. This suggests that the instrument is effective in capturing the intended constructs, allowing for reliable comparisons across different populations. Furthermore, the Kaiser–Meyer–Olkin, KMO, measure of sampling adequacy is also used to determine whether the data are eligible for use with the factor analysis. Kaiser (1974) offers using a normalized quartimax criterion (bounded between zero and one) to assess the simplicity of a factor pattern in a particular factor analysis and identifies KMO of more than 0.60 and Eigenvalue of more than 1 as acceptable (Hair et al., 2011). For this research, every KMO is above 0.60 (0.62–0.78) and the Eigenvalue is more than 1, and every one indicated that the data are suitable for the factor analysis approach.

Moreover, this research tested the scale using Cronbach’s alpha (CR) to assess the quality of the scale. Cronbach’s alpha coefficient was used to evaluate the internal consistency of the measurement items that define the construct; a coefficient greater than 0.70 indicates internal consistency (Hair et al., 2010). The Cronbach’s alpha coefficients for this study are higher than the 0.70 cut-off (0.71–0.83), indicating that it is internally consistent. As demonstrated by the findings presented in Table 1, this study was therefore found to be valid and reliable. The significant relationships between each independent variable were tested using the variance inflation factor (VIF) method in Table 1. The results show that the VIFs range from 1.17 to 5.14, well below the cut-off value of 10 recommended by Kutner et al. (2005), indicating that the independent variables are not correlated with one another. From these results, it can be concluded that no substantial multicollinearity issues were encountered in this study.

4.4. Statistical Test

The data analysis was tested using partial least squares structural equation modeling (PLS-SEM) to analyze the data, since it is a well-established research method that is especially suitable for small-size samples (Nitzl, 2016; Aguirre-Urreta & Rönkkö, 2015; Hair et al., 2011). Furthermore, PLS-SEM is recommended by scholars as an effective statistical technique for management, business management behaviors, and management accounting (Nitzl, 2016; Hair et al., 2011). SEM is a family of multivariate statistical analytic techniques, including observed variable path analysis and latent variable path analysis. SEM provided a comprehensive framework for investigating the interactions within a model, allowing researchers to analyze the link between observed variables and latent factors (Hair et al., 2011). Ringle (2014) recommended that PLS-SME should be initially employed to examine the outcomes of consequence variables and evaluate linear structural models. For this research, all hypotheses were tested using the smart PLS 4.0, which is an appropriate technique for investigating the hypothesized links to analyze factors influencing the corporate performance in management accounting (Nowotny et al., 2022; Nitzl, 2016).

5. Results

The PLS-SEM model is separated into two parts: the outside model (or measurement model) and the inside model (or structural model). The measurement model illustrates the link between the observable and latent variables. The structural model depicts the relationships between the latent variables. The measurement model takes into account the average variance extracted (AVE), composite reliability, convergent validity, and Fornell–Larcker criterion (AVE2). The path coefficient (direct effect) is considered the most important feature in the structural model, and the inner model in this study is a reflective model. Moreover, the model’s quality is determined by the measure’s validity and reliability. The weight (loading) measures equivalent validity. The indicator should be greater than 0.60, positive, and statistically significant. Discriminant validity was considered when the correlation between latent variables was less than the square root of the AVE (Fornell & Larcker, 1981) and the reliability measured based on Cronbach’s alpha, Dijkstra-Henseler’s rho (ρA), and Jöreskog’s rho (ρc) was greater than 0.7 (Henseler et al., 2016).

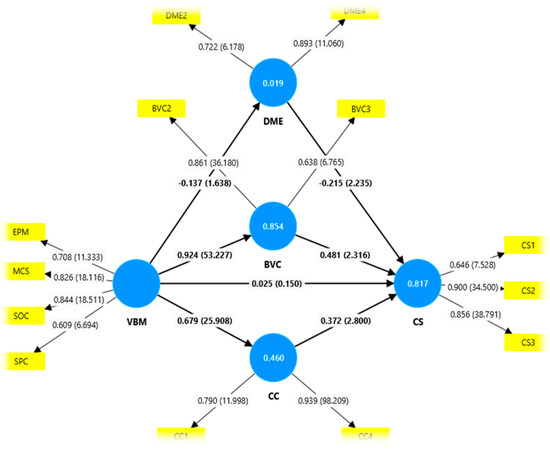

Table 2 shows the statistics for the measuring model, and the results of PLS-SEM are shown in Figure 2. This model consists of 23 observable variables and 5 latent variables. Hair et al. (2011) proposed removing the observable variables with weights less than 0.60 from the structural equation, which consists of 10 variables, including the CBE (weight 0.551), ERA (weight 0.538), CC2 (weight 0.538), CC3 (weight 0.558), DEM1 (weight −0.490), DEM3 (weight 0.248), BVC1 (weight 0.382), BVC2 (weight −0.262), CS4 (weight 0.513), and CS5 (weight 0.435), thus, leaving 13 observable variables.

Table 2.

Statistics of the measurement model.

Figure 2.

PLS results.

The first stage in the PLS-SEM analysis is to evaluate the measurement model for reliability and discriminant validity, measured based on the weight of each observed variable being more than 0.60, including the AVE, Dijkstra-Henseler’s rho (ρA), Jöreskog’s rho (ρc), and Cronbach’s alpha statistics, in which the AVE should be greater than 0.5 (Hair et al., 2011). Table 2 shows that the measurement model of latent variables has values ranging from 0.567 to 0.753, meaning that the average value of variance (AVE) of the observed variables can be explained by the latent variables. When compared to the variance of measurement error, it is equal to 0.567, meaning that the successful latent variable VBM can explain the variance of the observed variable by 56.7 percent. Dijkstra-Henseler’s rho (ρA), values for all latent variables, ranges from 0.709 to 0.853. The Jöreskog’s rho (ρc) statistics range from 0.725 to 0.858, while the Cronbach’s alpha values range from 0.701 to 0.755, indicating an adequate value of greater than 0.70. Hair et al. (2011) established three categories for considering the R2 value in social science research, weak 0.25, moderate 0.50, and substantial 0.75.

Measuring the discriminant validity of each construct (latent variables) according to Table 3 shows the AVE matrix along the diagonal and the correlation values of the latent variables, which Fornell and Larcker (1981) proposed that the (AVE)2 of each latent variable be more than the correlation between the latent variables. The values in the table range between 0.753 and 0.868, which is more than the correlation between the latent variables.

Table 3.

Discriminant validity: Fornell–Larcker criterion.

Table 4 displays the discriminant validity, the Heterotrait–Monotrait ratio of correlations (HTMT). For this study, the values range between 0.671 and 0.894. Henseler et al. (2016) proposed utilizing the Heterotrait–Monotrait ratio of correlations (HTMT) to directly quantify the discriminant validity at values less than one.

Table 4.

Discriminant validity: Heterotrait–Monotrait ratio of correlations (HTMT).

Figure 2 depicts the PLS results for effective VBM and research hypothesis testing. Figure 2 illustrates that in the structural or latent variable model, the weight value of each observed variable has a loading value greater than 0.60. There are a total of 13 detected variables, with values ranging from 0.609 of SPC for 0.939 for CC4. Various statistical data show that the measurement model or outer model for all structures is dependable and interpretable (Ringle, 2014; Hair et al., 2011). The inner model analysis is primarily concerned with the route coefficient. This value is the direct effect seen in Figure 2, and it is the same number used to test the hypothesis in Table 5, which includes the indirect effect and the overall effect. From Figure 2, the R2 value of the four latent variables, where the R2 value of decision-making effectiveness (DME) is 0.019, which is lower than the weak level, the R2 value of business value creation (BVC), is 0.854, and the R2 value of corporate sustainability (CS) is 0.817, which is at a high level. However, the R2 value of corporate competence (CC) is 0.460, which is at a medium level.

Table 5.

The results of hypothesis testing.

Table 5 shows that the path coefficients in the structural equation model were statistically significant at the 0.01 level, indicating three paths. The path with the highest path coefficient, which was positively related, was the relationship between successful VBM and business value creation with a coefficient value of 0.924 (H3, p < 0.01), followed by the relationship between successful VBM and corporate competency with a coefficient value of 0.679 (H4, p < 0.01) and the relationship between corporate competency and corporate sustainability with a coefficient value of 0.372 (H7, p < 0.01). Thus, Hypotheses 3, 4, and 6 are supported.

In Table 5, the path coefficients in the structural equation model that were statistically significant (p-value < 0.05) with one positive and one negative relationship were the relationship between business value creation and corporate sustainability, with a coefficient value of 0.481 (H6, p < 0.05), and the relationship between decision-making effectiveness and corporate sustainability, with a coefficient value of −0.215 (H5, p < 0.05). Thus, Hypotheses 5 and 6 are supported.

However, the route coefficients in the structural equation model were statistically insignificant (p-value greater than 0.05). The route of the association between successful VBM and decision-making effectiveness had a coefficient value of 0.025, whereas the path of the relationship between successful VBM and corporate sustainability had a coefficient value of −0.137. Thus, hypotheses 1 and 2 are not supported. To give a more extensive examination of the data, an analysis of the mediating variable was performed. Table 6 shows an analysis of the influence of the successful VBM on corporate sustainability through the mediating effect of decision-making effectiveness, business value creation, and corporate competency. Table 6 shows that successful VBM has a positive (p-value < 0.01) influence on corporate sustainability through the mediator effect of business value creation (coefficient value = 0.444). At the 0.05 level (p-value < 0.05), only one path of influence transmission was found to be positively related: successful VBM through corporate competency to corporate sustainability, with a coefficient value of 0.252. Meanwhile, the influence transmission with no statistical significance at the 0.05 level (p-value > 0.05) had one path: influence transmission from the successful VBM through the variable decision-making effectiveness to corporate sustainability, which had a coefficient value of 0.029.

Table 6.

The results of the mediator effect.

Table 7 displays the direct, indirect, and total effects of all variables. The results found the total influence on the causal relationship of factors that influence corporate sustainability. It was found that the highest total effect of successful VBM had a coefficient value equal to 0.751, which came from the direct effect a coefficient value of 0.025 and the indirect effect a coefficient value of 0.726 through the mediator effect of the decision-making effectiveness, the business value creation, and the corporate competency. Next, the total influence of the business value creation had a coefficient value equal to 0.481, which came from the total direct influence with a coefficient value of 0.481, the total influence of the corporate competency, which had a coefficient value equal to 0.372, the total direct influence with a coefficient value of 0.372, and the total influence of the decision-making effectiveness variable, which had a coefficient value equal to −0.215; the total direct influence had a coefficient value of −0.215.

Table 7.

Direct and indirect effect on corporate sustainability.

Furthermore, while assessing the total influence on the causal relationship of factors influencing decision-making effectiveness, it was observed that successful VBM had a total direct influence coefficient value of −0.137, which resulted from the overall direct influence of −0.137. The total direct influence of successful VBM on the causal relationship of factors driving business value creation had a coefficient value of 0.924, which resulted from the overall direct influence of 0.924. Finally, the entire influence on the causal relationship of factors influencing successful VBM on corporate competency was and had a coefficient value of 0.679, which resulted from the overall direct influence of 0.679.

6. Discussion

The general research findings are shown in Table 5. Hypothesis 1 is not supported. However, the results in Table 6 and Table 7 indicate that successful VBM does not have a direct effect on corporate sustainability, but it has a highly significant indirect effect from business value creation and corporate competency. This finding is also consistent with previous research, such as that of Corazza (2019), Bukvic (2016), and Baines and Langfield-Smith (2003), who discovered that effective VBM implementation improves a company’s financial performance and increases investor confidence through the mediator effect of business value creation and corporate competency. Poulsen et al. (2009) and Paul and Claes (2006) suggest that the VBM process is an organization’s operational plan that determines the resources and commitment needed to achieve a goal, corporate compentncy, and enhanced business value cration. Moreover, the results illustrated in Table 5 show that Hypothesis 2 is not supported. However, the data in Table 6 and Table 7 show that successful VBM has no direct influence on decision-making effectiveness. Moreover, the effect was negative but minor, showing that successful VBM had no direct effect on decision-making effectiveness (Paul & Claes, 2006; Tokusaki, 2003). The findings revealed that successful VBM had no direct effect on decision-making effectiveness, a topic that merits additional investigation (Nitzl, 2016).

The results shown in Table 5 provide support for Hypothesis 3. The hypothesis testing results show that when successful VBM increases, so does business value creation. The results demonstrate that VBM may increase corporate value creation. These findings are consistent with those of Corazza (2019), Cooper and Crowther (2008), Tokusaki (2003), and Ittner and Larcker (2001), who found that there is a correlation between the application of VBM and the creation of added value for a company, both in terms of shareholders and the creation of added value for the organization. Moreover, the results illustrated in Table 5 show that Hypothesis 4 is supported. The findings show that successful VBM can enhance corporate competency. These findings are consistent with those of Grant (1996), who asserts that the effective application of VBM, focusing on creating business value, is linked to the organization’s competitive advantage. These results indicate that organizational competency is linked to successful VBM (Firk et al., 2019; Van der Stade et al., 2006).

The results illustrated in Table 5 show that Hypotheses 5, 6, and 7 are supported. When business value creation and corporate competency increase, corporate sustainability improves. However, increasing decision-making effectiveness has a negative impact on corporate sustainability. This outcome is in line with past research that decision-making efficacy and business sustainability are related (Beyer et al., 2010; Cadez & Guilding, 2008). Moreover, the findings show that companies with greater levels of corporate competency and business value creation also have more sustainable businesses. Consistently, Cooper and Crowther (2008), Nishimura (2007), and Tokusaki (2003) also found that there is a correlation between firm value creation and corporate sustainability. Lastly, Serebryakova et al. (2021), Wu et al. (2013), Paul and Claes (2006), and Anderson and Dekker (2009) also found that corporate sustainability can be enhanced by corporate competency.

7. Implications of the Research Findings

7.1. Theoretical Implications

The primary aim of this study was to gain a clearer understanding of the connections between successful VBM implementation and firm sustainability. The findings of this study make a significant contribution to the existing understanding and related research regarding effective VBM implementation. The research model of successful VBM application is explained in this study using contingency theory. The findings demonstrate that a company’s sustainability is significantly increased by effective VBM. In addition, successful VBM significantly improves corporate competency and business value creation. This finding supports the contingency theory perspective, which proposes a framework for customizing VBM implementation to ensure the use of measures for long-term value creation and business performance.

7.2. Managerial Implications

The findings presented in this study can aid accounting directors in identifying and defending essential elements of effective VBM implementation that can contribute to the long-term performance of the company. Accounting directors should effectively manage and utilize the components of successful VBM, such as strategic planning collaboration, effective performance measurement, management compensation systems, and successful organizational communication, within the business to succeed in the long term. Due to the organizational technique employed, i.e., VBM application, and easily manageable concept of contingency theory, these managers might place greater emphasis on the successful implementation of VBM than on outside variables. This finding suggests that members of upper management should make plans to grow their VBM system in order to sustain and increase levels of company success and competitive advantage over time.

7.3. Limitations and Suggestions for Future Research

The study findings indicate that the construct measurement used in this study was created based on earlier studies. Therefore, in order to adequately comprehend the measurement of constructs, the authors of future studies should investigate the scale using various methods, such as in-depth interviews or observation. Lastly, the only data collection method used in this study was a questionnaire. The development of longitudinal data and/or mixed methodologies for observing successful VBM application that influences company success could therefore be the focus of future research.

8. Conclusions

There are currently insufficient empirical data in the management accounting domain to examine the effects of effective VBM implementation. In light of this gap, the purpose of this study was to experimentally examine how effective VBM implementation affects business sustainability. Moreover, the effects of successful VBM application on decision-making effectiveness, business value creation, and corporate competency were also examined. In this study, the concept of contingency theory is also incorporated to aid in a better understanding of this relationship. A questionnaire was distributed to gather information from accounting directors of Thai listed companies who were chosen as the sample. Overall, 101 mail surveys were used in this study. The data analysis was tested using SPSS 26.0 and smart PLS 4.0. The results found that successful VBM is an important variable for corporate sustainability; however, it has an indirect impact via business value creation and corporate competency. Moreover, successful VBM has a strong direct influence on business value creation and corporate competency, both of which play important roles in generating corporate sustainability. There results clearly show that business value creation and corporate competency play major roles in driving corporate sustainability following successful VBM implementation. In addition, the results of this study offer managerial and theoretical additions to the body of knowledge and literature on management accounting, in addition to crucial points for future research.

Funding

This research project was financially supported by fast track3.2568, Mahasalakham Business School, Mahasalakham University, Thailand.

Institutional Review Board Statement

The study was conducted in accordance with the Mahasalakham University for research involving human subjects, and the protocol was approved by the Ethics Committee of 132-151/2024 on 13 March 2024. The approval IRB certificate number is MSUEC-132-151/2004 under the research project number ECMSU01-01.01.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Data are made available upon request.

Conflicts of Interest

The author declares no conflicts of interest.

References

- Agbejule, A., & Saarikoski, L. (2006). The effect of cost management knowledge on the relationship between budgetary participation and managerial performance. The British Accounting Review, 38(4), 427–440. [Google Scholar] [CrossRef]

- Aguirre-Urreta, M., & Rönkkö, M. (2015). Sample size determination and statistical power analysis in PLS using R: An annotated tutorial. Communications of the Association for Information Systems, 36(3), 33–51. [Google Scholar] [CrossRef]

- Ainnuddin, R. A., Beamish, P. W., Hulland, J., & Rouse, M. J. (2007). Research attributes and firm performance in international joint ventures. Journal of World Business, 42(1), 47–60. [Google Scholar] [CrossRef]

- Almohtaseb, A., Alabaddi, Z., & Gangoor, V. (2025). Relationship of CSR, Innovation, human resource practices, and competitive advantage: Test of two mediation models. Business: Theory & Practice, 26(1), 117–152. [Google Scholar]

- Anderson, S. W., & Dekker, H. C. (2009). Strategic cost management in supply chains, part 1: Structural cost management. Accounting Horizons, 23(2), 201–220. [Google Scholar] [CrossRef]

- Anderson, S. W., & Lanen, W. N. (1999). Economic transition, strategy and the evolution of management accounting practices: The case of India. Accounting, Organization, and Society, 24(5–6), 387–412. [Google Scholar] [CrossRef]

- Baines, A., & Langfield-Smith, K. (2003). Antecedents to management accounting change: A structural equation approach. Accounting, Organizations and Society, 28(7–8), 675–698. [Google Scholar] [CrossRef]

- Bank of Thailand. (2022). Analyst meeting No. 1/2022. Available online: https://www.bot.or.th/content/dam/bot/documents/en/our-roles/monetary-policy/mpc-publication/monetary-policy-forum/AnalystMeeting_2022_01.pdf (accessed on 5 December 2023).

- Beyer, A., Cohen, D. A., Lys, T. Z., & Walther, B. R. (2010). The financial reporting environment: Review of the recent literature. Journal of Accounting and Economics, 50(2–3), 296–343. [Google Scholar] [CrossRef]

- Bianchi, D. (2023). How the Israel-Hamas war could affect the world economy and worsen global trade tensions. Available online: https://www.qmul.ac.uk/media/news/2023/hss/how-the-israel-hamas-war-could-affect-the-world-economy-and-worsen-global-trade-tensions.html (accessed on 1 November 2024).

- Bryant, L., Jones, D. A., & Widener, S. K. (2004). Managing value creation within the firm: An examination of multiple performance measures. Journal of Management Accounting Research, 16(1), 107–131. [Google Scholar] [CrossRef]

- Bukvic, V. (2016). Value based management with some practical examples in Slovenia industries. Advanced in Business-Related Scientific Research, 7(2), 1–9. [Google Scholar]

- Cadez, S., & Guilding, C. (2008). An exploratory investigation of an integrated contingency model of strategic management accounting. Accounting, Organizations, and Society, 33(7–8), 1–19. [Google Scholar] [CrossRef]

- Chenhall, R. H. (2003). Management control systems design within its organizational context: Findings from contingency-based research and direction for the future. Accounting, Organizations and Society, 28(2–3), 127–168. [Google Scholar] [CrossRef]

- Chenhall, R. H., & Langfield-Smith, K. (1998). The relationship between strategic priorities, management techniques and management accounting: An empirical investigation using a systems approach. Accounting, Organizations, and Society, 23(3), 243–264. [Google Scholar] [CrossRef]

- Cooper, C., & Crowther, D. (2008). The adoption of value-based management in large UK companies: A case for diffusion theory. Journal of Applied Accounting Research, 9(3), 148–167. [Google Scholar] [CrossRef]

- Corazza, G. (2019, May 29–June 1). Value based management systems and firm performance: An analysis of the literature. Management International Conference 2019 (pp. 77–89), Opatija, Croatia. [Google Scholar]

- Cridland, J. (2022). How to choose a sample size (for the statistically challenged). Available online: https://tools4dev.org/resources/how-to-choose-a-sample-size (accessed on 22 May 2024).

- Drazin, R., & Van de Van, A. H. (1985). Alternative forms of fit in contingency theory. Administration Science Quarterly, 30(4), 514–539. [Google Scholar] [CrossRef]

- Elgharbawy, A., & Abdel-Kader, M. (2021). Value-based management, corporate governance and organizational performance: Evidence from the UK. The Journal of Developing Areas, 55(2), 115–120. [Google Scholar] [CrossRef]

- Firk, S., Richter, S., & Wolff, M. (2021). Does value-based management facilitate managerial decision-making? An analysis of divestiture decisions. Management Accounting Research, 51(10736), 1–18. [Google Scholar] [CrossRef]

- Firk, S., Schmidt, T., & Wolff, M. (2019). CFO emphasis on value-based management: Performance implication and the challenge of CFO concession. Management Accounting Research, 44, 26–43. [Google Scholar] [CrossRef]

- Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39–50. [Google Scholar] [CrossRef]

- Foster, G., & Swenson, D. W. (1997). Measuring the success of activity-based cost management and its determinants. Journal of Management Accounting Research, 9, 109–141. [Google Scholar]

- Fulwiler, R. (1995). Leadership: Key to building organizational capability. Occupational Hazards, 57(7), 43–45. [Google Scholar]

- Grant, R. M. (1996). Toward a knowledge based theory of the firm. Strategic Management Journal, 17(S2), 109–122. [Google Scholar] [CrossRef]

- Hahn, T. (2007). Sustainable value creation among companies in the manufacturing sector. International Journal of Environmental Technology and Management, 7(5/6), 496–512. [Google Scholar] [CrossRef]

- Hair, J. F., Black, W., Babin, B. J., & Anderson, R. E. (2010). Multivariate data analysis. Pearson Prentice Hall. [Google Scholar]

- Hair, J. F., Ringle, C. M., & Sarstedt, M. (2011). PLS-SEM: Indeed, a silver bullet. Journal of Marketing Theory and Practice, 19(2), 139–152. [Google Scholar] [CrossRef]

- Haldma, T., & Laats, K. (2002). Contingencies influencing the management accounting practices of Estonian manufacturing companies. Management Accounting Research, 13(4), 379–400. [Google Scholar] [CrossRef]

- Hayes, D. (1977). The contingency theory of management accounting. The Accounting Review, 52(1), 22–39. [Google Scholar]

- Henseler, J., Hubona, G., & Ray, P. A. (2016). Using PLS path modeling in new technology research: Updated guidelines. Industrial Management & Data Systems, 116(1), 2–20. [Google Scholar]

- Ittner, C. D., & Larcker, D. F. (2001). Assessing empirical research in management accounting: A value based management perspective. Journal of Accounting and Economics, 32(1–3), 349–410. [Google Scholar] [CrossRef]

- Kaiser, H. F. (1974). An index of factorial simplicity. Psychometrika, 39(1), 31–36. [Google Scholar] [CrossRef]

- Kumar, A., & Nagpal, S. (2021). Strategic cost management–suggested framework for 21st. Journal of Business and Retail Management Research, 5(2), 1–13. [Google Scholar]

- Kutner, M. H., Nachtsheim, C. J., Neter, J., & Li, W. (2005). Applied linear statistical models. McGraw-Hill. Irwin, Inc. [Google Scholar]

- Lawson, R., Stratton, W., Hatch, T., & Desroches, D. (2009). Best practices in cost and profitability systems. Cost Management, 23, 13–19. [Google Scholar]

- Leach-Lopez, M. A., Stammerjohan, W. W., & McNair, F. M. (2007). Differences in the role of job-relevant information in the budget participation-performance relationship among U.S. and Mexican managers: A question of culture or communication. Journal of Management Accounting Research, 19(1), 105–136. [Google Scholar] [CrossRef]

- Malmi, T., & Ikaheimo, S. (2003). Value based management practices-some evidence for the filed. Management Accounting Research, 14(3), 235–254. [Google Scholar] [CrossRef]

- McKeen, J. D., Guimaraes, T., & Wetherbe, J. C. (1994). The relationship between user participation and user satisfaction: An investigation of four contingency factors. MIS Quarterly, 18(4), 427–451. [Google Scholar] [CrossRef]

- Mishra, P., Singh, S., Tripathi, S., Srivastava, A., & Yadav, A. K. (2023). Global supply chain disruption during COVID 19. International Journal of Innovative Research in Engineering & Management, 10(2), 86–92. [Google Scholar]

- Nicolaou, A. I. (2000). A contingency model of perceived effectiveness in accounting information systems: Organizational coordination and control effects. International Journal of Accounting Information Systems, 1(2), 91–105. [Google Scholar] [CrossRef]

- Nishimura, A. (2007). Conceptual analysis of value-based management and accounting: With reference to Japanese practices. Asian-Pacific Management Accounting Journal, 2(1), 71–88. [Google Scholar]

- Nitzl, C. (2016). The use of partial least square structural equation modeling (PLS-SEM) in management accounting research: Direction for future theory development. Journal of Accounting Literature, 37, 19–35. [Google Scholar] [CrossRef]

- Nowotny, S., Hirsch, B., & Nitzl, C. (2022). The influence of organizational structure on value-based management sophistication. Management Accounting Research, 56(4), 1–13. [Google Scholar] [CrossRef]

- Oke, O., & Ajeigbe, K. B. (2024). Evaluating the relationship between accounting variable, value-based management variable, and shareholder returns: An empirical approach. Journal of Risk and Financial Management, 17, 371–387. [Google Scholar] [CrossRef]

- Paul, C., & Claes, M. (2006). Management control and value-based management: Compatible or not? Studies in Managerial and Financial Accounting, 16, 269–301. [Google Scholar]

- Pavabutr, P., & Prangwattananon, S. (2009). Tick size change on the Stock Exchange of Thailand. Review of Quantitative Finance and Accounting, 4, 351–371. [Google Scholar] [CrossRef][Green Version]

- Pizzini, M. J. (2006). The relation between cost-system design, managers’ evaluations of the relevance and usefulness of cost data and financial performance: An empirical study of US hospitals. Accounting, Organizations, and Society, 31(2), 179–210. [Google Scholar] [CrossRef]

- Poulsen, T., Thomas, P., & Carsten, R. (2009). Strategy implementation through a VBM control system (pp. 1–35). Department of Accounting and Auditing, Copenhagen Business School. Available online: https://research.cbs.dk/en/publications/strategy-implementation-through-a-vbm-control-system (accessed on 10 June 2024).

- Reid, G. C., & Smith, J. A. (2000). The impact of contingencies on management accounting system development. Management Accounting Research, 11(4), 427–450. [Google Scholar] [CrossRef]

- Ringle, C. M. (2014). Structural equation modeling with the smart PLS. Brazilian Journal of Marketing, 13(2), 56–73. [Google Scholar]

- Serebryakova, T., Gordeeva, O., Kurtaeva, O., & Anisimov, A. (2021). Theoretical framework of accounting and analysis for value-based management. SHS Web of Conferences, 2021, 1–6. [Google Scholar] [CrossRef]

- Sulaiman, M. B., Nik Ahmad, N. N., & Alwi, N. (2004). Management accounting practices in selected Asian countries: A review of literature. Managerial Auditing Journal, 19(4), 493–508. [Google Scholar] [CrossRef]

- Tokusaki, S. (2003). Strategic management system design in vbm context: Findings from value-based literature review and implications for the divisional performance measurement and control. Business & Accounting Review, 11(3), 35–55. [Google Scholar]

- Van der Stade, W. A., Chow, C. W., & Lin, T. W. (2006). Strategy, choice of performance measure, and performance. Behavioral Research in Accounting, 18, 185–205. [Google Scholar] [CrossRef]

- Wu, C. L., Huang, P. H., & Brown, D. (2013). Target costing as a role of strategic management accounting in real-estate investment industry. African Journal of Business Management, 7(8), 641–648. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).