Who Is Leading in Communication Tone? Wavelet Analysis of the Fed and the ECB

Abstract

1. Introduction

2. Literature Review

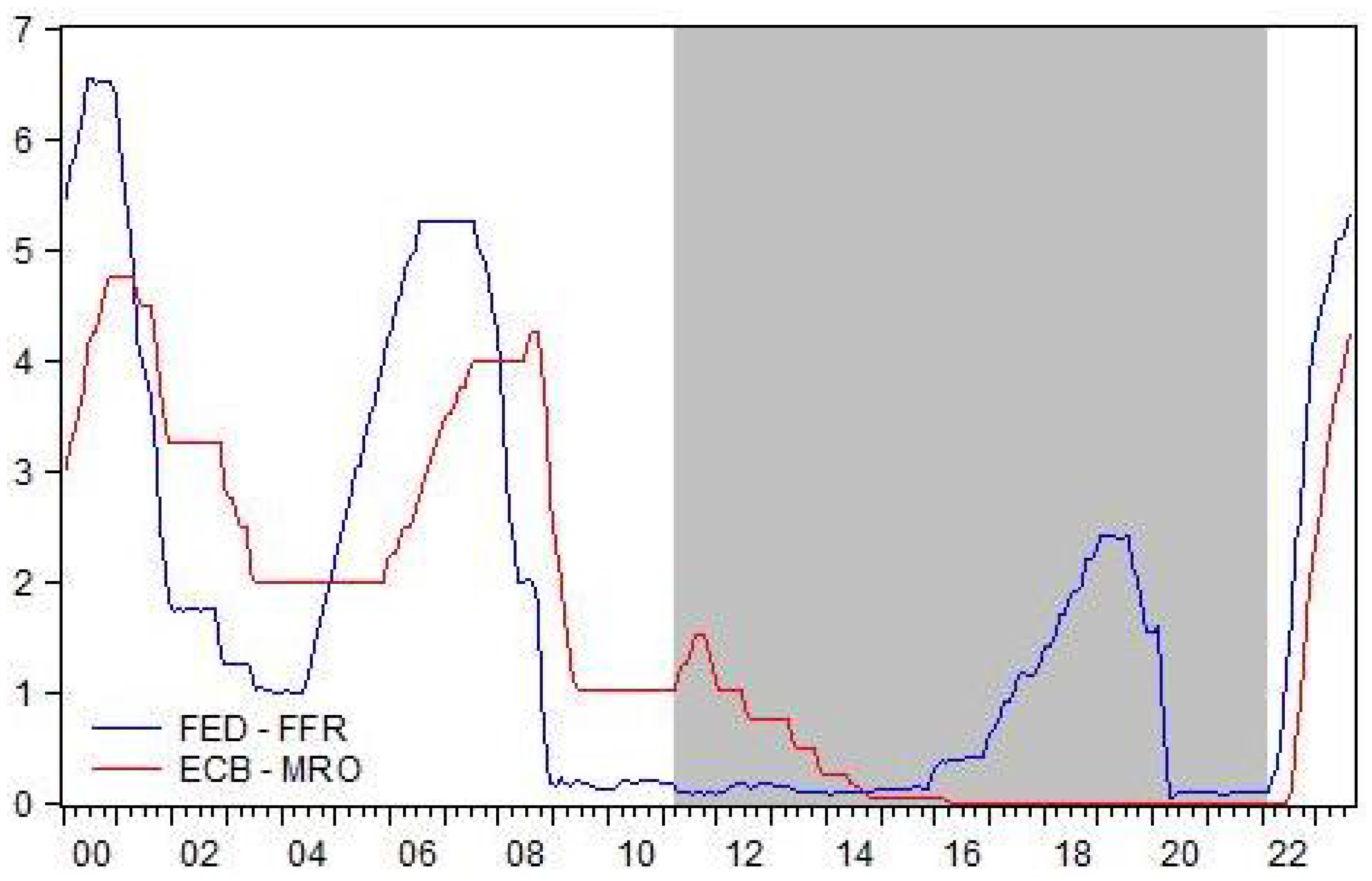

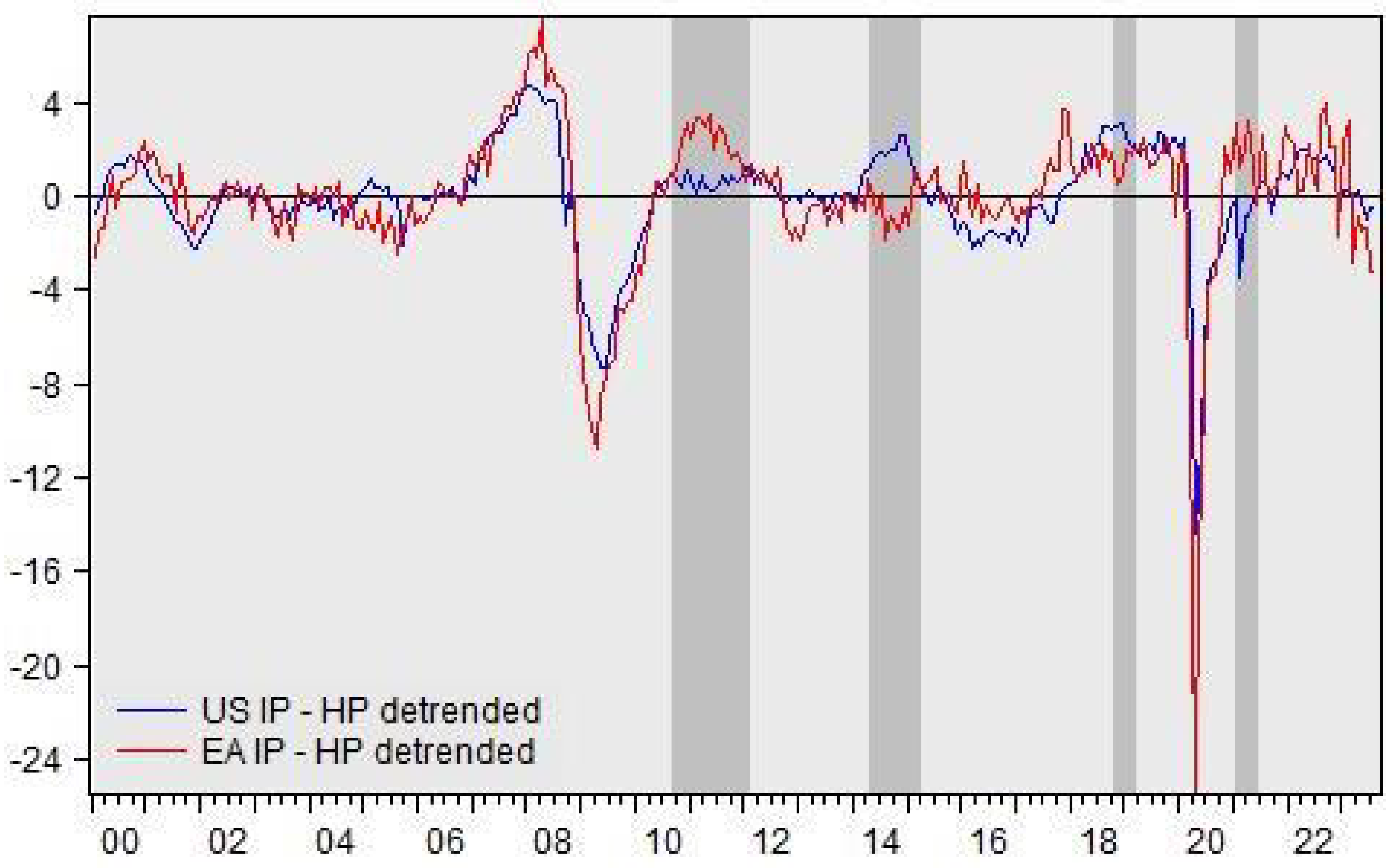

3. A Snapshot to the ECB and the Fed

4. Methodology

4.1. Measuring the Communication Tones

4.1.1. LM Lexicon

4.1.2. FinBERT

4.2. Wavelet Coherence

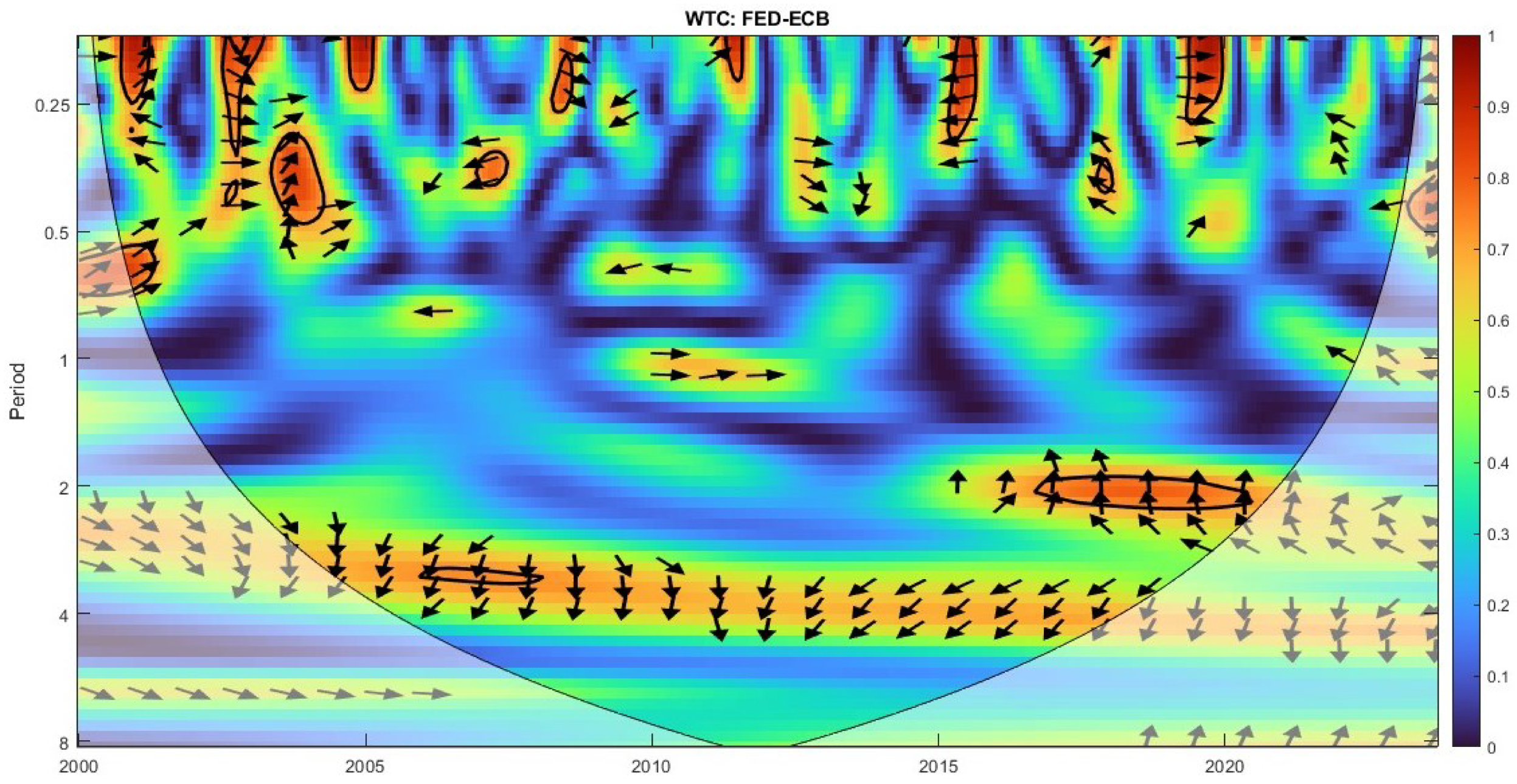

5. Empirical Findings

5.1. Wavelet Coherence for Speeches

5.2. Robustness Check: Wavelet Coherence for Extended Speeches

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

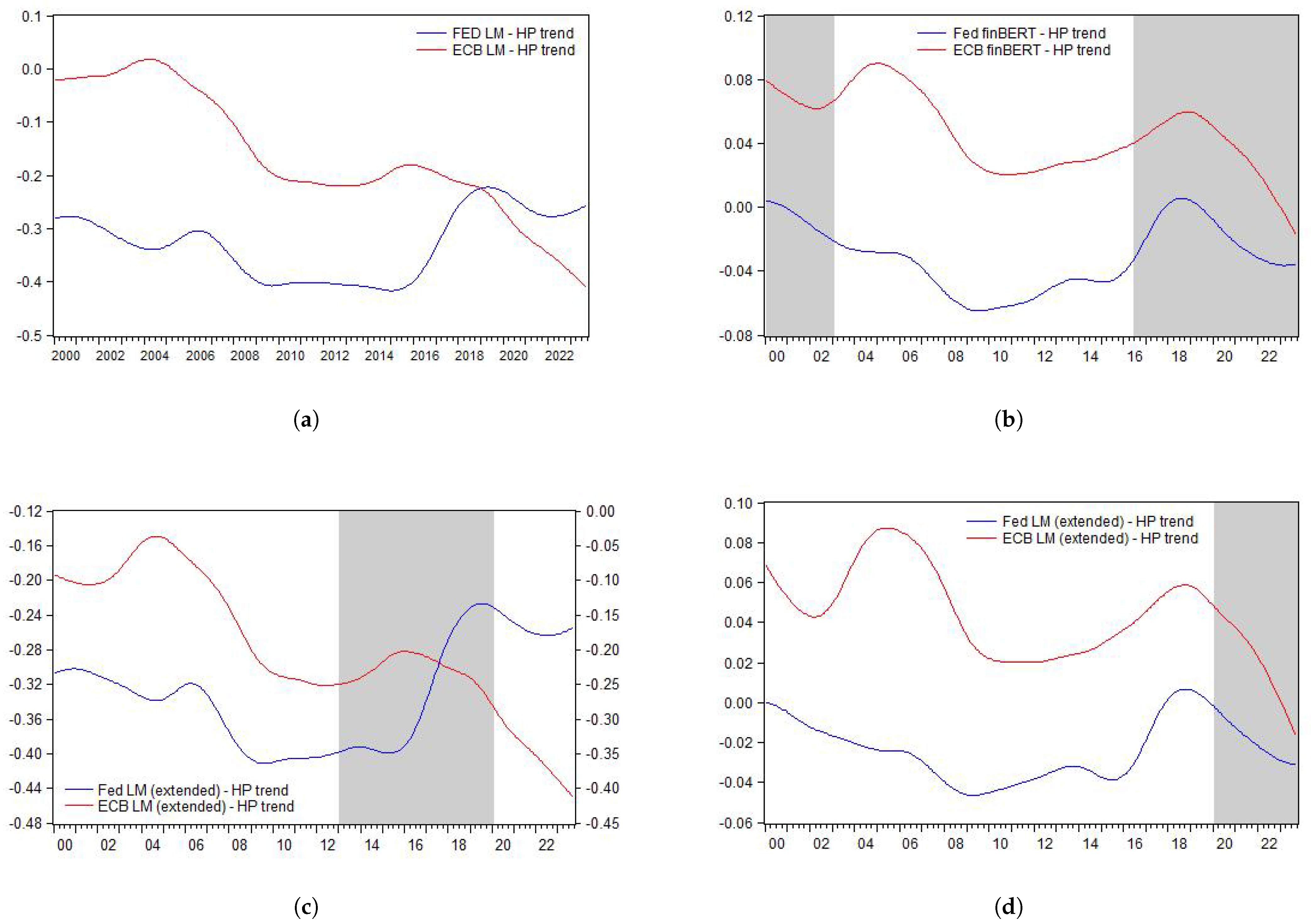

Appendix A. Long-Run Trends of the Lexicons

| 1 | One relatively recent example to highlight the importance of the communication of the central banks is the public statements made several times by the ECB president, Jean-Claude Trichet, disregarding the impact of the US monetary policies on the Eurozone (Willard & Vidaillet, 2009). |

| 2 | While examining the relationship between the two CBs, regression models will neglect the dynamic structure of the relationship between two CBs, which are even dynamic as themselves. For example, Swanson (2023) mentions the change in the importance of the Fed speeches over time. Regarding the interdependence of the two CBs, Vukovic et al. (2021) apply wavelet coherence using money market returns with different maturities using interbank rates and bond returns for the period 2004–2018 taking into account the frequency domain of the relationship |

| 3 | There are some other communication tools, however they are discarded from the analysis due to their low frequency. |

| 4 | https://www.federalreserve.gov/newsevents/testimony.htm, Retrieved by 19 December 2024. |

| 5 | Szyszko et al. (2022) mention about the differences between the tone and the sentiment in the monetary policy literature such that sentiments are the unpredictable component of the tone. |

| 6 | NLP is a subfield of artificial intelligence to analyze human language and text pre-processing part of NLP helps clean and prepare the text. ML is the learning process of the machines from the patterns in the data. DL is a subset and more comprehensive version of ML that mimics the learning process of the brain and helps process unstructured data such as texts, images, etc. |

| 7 | https://www.federalreserve.gov/newsevents/speech/bowman20250131a.htm, Accessed by 22 September 2023. |

| 8 | We use the Matlab package of Grinsted et al. (2004). |

| 9 | We may assume period 1 as a threshold to divide short run (values lower than 1) and long run (values higher than 1) findings. |

References

- Anand, A., Basu, S., Pathak, J., & Thampy, A. (2022). Whose speeches impact European markets: ECB’s or the national central banks’? European Financial Management, 28(5), 1413–1476. [Google Scholar] [CrossRef]

- Anastasiou, D., Krokida, S.-I., Tsouknidis, D., & Drakos, K. (2023). Can the tone of central bankers’ speeches discourage potential bank borrowers in the Eurozone? Journal of International Money and Finance, 139, 102950. [Google Scholar]

- Apel, M., & Grimaldi, M. B. (2014). How informative are central bank minutes? Review of Economics, 65(1), 53–76. [Google Scholar]

- Bailey, A., & Schonhardt-Bailey, C. (2008). Does deliberation matter in FOMC monetary policymaking? The Volcker Revolution of 1979. Political Analysis, 16(4), 404–427. [Google Scholar]

- Batten, D. S., & Ott, M. (1985). The interrelationship of monetary policies under floating exchange rates: Note. Journal of Money, Credit and Banking, 17(1), 103–110. [Google Scholar]

- Belke, A., & Cui, Y. (2010). US–Euro area monetary policy interdependence: New evidence from Taylor rule-based vecms. World Economy, 33(5), 778–797. [Google Scholar]

- Belke, A., & Gros, D. (2005). Asymmetries in transatlantic monetary policy-making: Does the ECB follow the fed? JCMS: Journal of Common Market Studies, 43(5), 921–946. [Google Scholar] [CrossRef]

- Bennani, H., & Neuenkirch, M. (2017). The (home) bias of European central bankers: New evidence based on speeches. Applied Economics, 49(11), 1114–1131. [Google Scholar] [CrossRef]

- Bergin, P. R., & Jordà, Ò. (2004). Measuring monetary policy interdependence. Journal of International Money and Finance, 23(5), 761–783. [Google Scholar]

- Bjerkander, L., & Glas, A. (2024). Talking in a language that everyone can understand? Clarity of speeches by the ECB Executive Board. Journal of International Money and Finance, 149, 103200. [Google Scholar]

- Bligh, M. C., & Hess, G. D. (2007). The power of leading subtly: Alan Greenspan, rhetorical leadership, and monetary policy. The Leadership Quarterly, 18(2), 87–104. [Google Scholar]

- Blinder, A. S., Ehrmann, M., De Haan, J., & Jansen, D.-J. (2024). Central bank communication with the general public: Promise or false hope? Journal of Economic Literature, 62(2), 425–457. [Google Scholar]

- Blinder, A. S., Ehrmann, M., Fratzscher, M., De Haan, J., & Jansen, D.-J. (2008). Central bank communication and monetary policy: A survey of theory and evidence. Journal of Economic Literature, 46(4), 910–945. [Google Scholar]

- Bohl, M. T., Kanelis, D., & Siklos, P. L. (2023). Central bank mandates: How differences can influence the content and tone of central bank communication. Journal of International Money and Finance, 130, 102752. [Google Scholar]

- Burdekin, R. C. (1989). International transmission of US macroeconomic policy and the inflation record of Western Europe. Journal of International Money and Finance, 8(3), 401–423. [Google Scholar]

- Burdekin, R. C., & Burkett, P. (1992). The impact of US economic variables on bank of Canada policy: Direct and indirect responses. Journal of International Money and Finance, 11(2), 162–187. [Google Scholar]

- Canzoneri, M. B., & Gray, J. A. (1985). Monetary policy games and the consequences of non-cooperative behavior. International Economic Review, 547–564. [Google Scholar]

- Chung, J. W. (1993). Monetary interdependence among G-3 countries. Applied Economics, 25(5), 681–688. [Google Scholar]

- de Haan, J., & Hoogduin, L. (2024). ECB communication policies: An overview and comparison with the Federal Reserve. Journal of International Money and Finance, 103050. [Google Scholar]

- de Haan, J., Jansen, D.-J., & de Haan, J. (2007). The importance of being vigilant: Has ecb communication influenced euro area inflation expectations? (Tech. Rep.). CESifo. [Google Scholar]

- Devereux, M. B., & Engel, C. (2003). Monetary policy in the open economy revisited: Price setting and exchange-rate flexibility. The Review of Economic Studies, 70(4), 765–783. [Google Scholar]

- Dominguez, K. M. (1998). Monetary interdependence and coordination. SSRN. [Google Scholar]

- Dybowski, T. P., & Kempa, B. (2020). The European Central Bank’s monetary pillar after the financial crisis. Journal of Banking & Finance, 121, 105965. [Google Scholar]

- Ehrmann, M., & Fratzscher, M. (2002). Interdependence between the euro area and the US: What role for EMU? (Available at SSRN 376184). European Central Bank. [Google Scholar]

- Ehrmann, M., & Fratzscher, M. (2005). Equal size, equal role? Interest rate interdependence between the euro area and the United States. The Economic Journal, 115(506), 928–948. [Google Scholar] [CrossRef]

- Eijffinger, S. C. (2008). How much inevitable US-Euro Area interdependence is there in monetary policy? Intereconomics, 43(6), 341–348. [Google Scholar] [CrossRef]

- El-Shagi, M., & Jung, A. (2015). Does the Greenspan era provide evidence on leadership in the FOMC? Journal of Macroeconomics, 43, 173–190. [Google Scholar] [CrossRef][Green Version]

- Ferrara, F. M., & Angino, S. (2022). Does clarity make central banks more engaging? Lessons from ECB communications. European Journal of Political Economy, 74, 102146. [Google Scholar] [CrossRef]

- Galán Figueroa, J., & Villalba Padilla, F. I. (2022). Coordination and monetary policy among central banks. The NAFTA Case. Revista Economía y Política, 36, 45–66. [Google Scholar] [CrossRef]

- Gertler, P., & Horvath, R. (2018). Central bank communication and financial markets: New high-frequency evidence. Journal of Financial Stability, 36, 336–345. [Google Scholar] [CrossRef]

- Grinsted, A., Moore, J. C., & Jevrejeva, S. (2004). Application of the cross wavelet transform and wavelet coherence to geophysical time series. Nonlinear Processes in Geophysics, 11(5/6), 561–566. [Google Scholar] [CrossRef]

- Hamada, K. (1974). Alternative exchange rate systems and the interdependence of monetary policies. In National monetary policies and the international financial system. University of Chicago Press. [Google Scholar]

- Hamada, K. (1979). Macroeconomic strategy and coordination under alternative exchange rates. In International Economic Policy (pp. 292–324). Johns Hopkins University Press. [Google Scholar]

- Hayo, B., Henseler, K., Rapp, M. S., & Zahner, J. (2022). Complexity of ECB communication and financial market trading. Journal of International Money and Finance, 128, 102709. [Google Scholar] [CrossRef]

- Hayo, B., & Zahner, J. (2023). What is that noise? Analysing sentiment-based variation in central bank communication. Economics Letters, 222, 110962. [Google Scholar] [CrossRef]

- Heinemann, F., & Ullrich, K. (2007). Does it pay to watch central bankers’ lips? The information content of ECB wording. Swiss Journal of Economics and Statistics, 143, 155–185. [Google Scholar] [CrossRef]

- Hilscher, J., Nabors, K., & Raviv, A. (2024). Information in central bank Sentiment: An analysis of fed and ECB communication. (Available at SSRN 4797935). Available online: https://ssrn.com/abstract=4797935 (accessed on 1 February 2025).

- Huang, A. H., Wang, H., & Yang, Y. (2023). FinBERT: A large language model for extracting information from financial text. Contemporary Accounting Research, 40(2), 806–841. [Google Scholar]

- Hüpper, F., & Kempa, B. (2023). Inflation targeting and inflation communication of the Federal Reserve: Words and deeds. Journal of Macroeconomics, 75, 103497. [Google Scholar] [CrossRef]

- Jansen, D.-J., & De Haan, J. (2007). Were verbal efforts to support the euro effective? A high-frequency analysis of ECB statements. European Journal of Political Economy, 23(1), 245–259. [Google Scholar]

- Kahveci, E., & Odabaş, A. (2016). Central banks’ communication strategy and content analysis of monetary policy statements: The case of Fed, ECB and CBRT. Procedia-Social and Behavioral Sciences, 235, 618–629. [Google Scholar] [CrossRef]

- Kaminskas, R., & Jurkšas, L. (2024). ECB communication sentiments: How do they relate to the economic environment and financial markets? Journal of Economics and Business, 13, 106198. [Google Scholar]

- Klejdysz, J., & Lumsdaine, R. L. (2023). Shifts in ECB Communication: A textual analysis of the press conference. International Journal of Central Banking, 19(2), 473–542. [Google Scholar]

- Kokab, S. T., Asghar, S., & Naz, S. (2022). Transformer-based deep learning models for the sentiment analysis of social media data. Array, 14, 100157. [Google Scholar]

- Kotelnikova, A., Paschenko, D., Bochenina, K., & Kotelnikov, E. (2021, December 16–18). Lexicon-based methods vs. BERT for text sentiment analysis. International Conference on Analysis of Images, Social Networks and Texts (pp. 71–83), Tbilisi, GA, USA. [Google Scholar]

- Krampf, A. (2019). Monetary power reconsidered: The struggle between the Bundesbank and the fed over monetary leadership. International Studies Quarterly, 63(4), 938–951. [Google Scholar] [CrossRef]

- Laskar, D. (1986). International cooperation and exchange rate stabilization. Journal of International Economics, 21(1–2), 151–164. [Google Scholar]

- Lastra, R. M., & Dietz, S. (2022). Communication in monetary policy. Banking & Finance Law Review, 38, 365–403. [Google Scholar]

- Loughran, T., & McDonald, B. (2011). When is a liability not a liability? Textual analysis, dictionaries, and 10-Ks. The Journal of Finance, 66(1), 35–65. [Google Scholar]

- Mandler, M. (2010). Explaining ecb and fed interest rate correlation: Economic interdependence and optimal monetary policy. (Tech. Rep.). MAGKS Joint Discussion Paper Series in Economics. [Google Scholar]

- Mishkin, F. S. (2005). The Fed after Greenspan. Eastern Economic Journal, 31(3), 317–332. [Google Scholar]

- Möller, R., & Reichmann, D. (2021). ECB language and stock returns–A textual analysis of ECB press conferences. In The Quarterly Review of Economics and Finance (Volume 80, pp. 590–604). [Google Scholar]

- Obstfeld, M., & Rogoff, K. (2002). Global implications of self-oriented national monetary rules. The Quarterly Journal of Economics, 117(2), 503–535. [Google Scholar]

- Oudiz, G., Sachs, J., Blanchard, O. J., Marris, S. N., & Woo, W. T. (1984). Macroeconomic policy coordination among the industrial economies. Brookings Papers on Economic Activity, 1984(1), 1–75. [Google Scholar]

- Pappa, E. (2004). Do the ECB and the Fed really need to cooperate? Optimal monetary policy in a two-country world. Journal of Monetary Economics, 51(4), 753–779. [Google Scholar]

- Parle, C. (2022). The financial market impact of ECB monetary policy press conferences—A text based approach. European Journal of Political Economy, 74, 102230. [Google Scholar] [CrossRef]

- Picault, M., & Renault, T. (2017). Words are not all created equal: A new measure of ECB communication. Journal of International Money and Finance, 79, 136–156. [Google Scholar] [CrossRef]

- Ranaldo, A., & Rossi, E. (2010). The reaction of asset markets to Swiss National Bank communication. Journal of International Money and Finance, 29(3), 486–503. [Google Scholar] [CrossRef]

- Romer, C. D., & Romer, D. H. (1989). Does monetary policy matter? A new test in the spirit of Friedman and Schwartz. NBER Macroeconomics Annual, 4, 121–170. [Google Scholar]

- Rosa, C. (2011). Words that shake traders: The stock market’s reaction to central bank communication in real time. Journal of Empirical Finance, 18(5), 915–934. [Google Scholar]

- Rosa, C., & Verga, G. (2007). On the consistency and effectiveness of central bank communication: Evidence from the ECB. European Journal of Political Economy, 23(1), 146–175. [Google Scholar]

- Rosa, C., & Verga, G. (2008). The impact of central bank announcements on asset prices in real time. Thirteenth issue (June 2008) of the International Journal of Central Banking, 4(2), 175–217. [Google Scholar]

- Schmeling, M., & Wagner, C. (2016). Does central bank tone move asset prices? Journal of Financial and Quantitative Analysis, 60(1), 36–67. [Google Scholar]

- Scotti, C. (2006). A bivariate model of Fed and ECB main policy rates. FRB International Finance Discussion Paper No. 875. Available online: https://ssrn.com/abstract=953025 (accessed on 14 January 2025).

- Shapiro, A. H., & Wilson, D. J. (2022). Taking the fed at its word: A new approach to estimating central bank objectives using text analysis. The Review of Economic Studies, 89(5), 2768–2805. [Google Scholar]

- Svensson, L. E. (2006). The instrument-rate projection under inflation targeting: The norwegian example. Center for Economic Policy Studies, Princeton University. [Google Scholar]

- Swanson, E. T. (2023). The importance of fed chair speeches as a monetary policy tool. AEA Papers and Proceedings, 113, 394–400. [Google Scholar]

- Szyszko, M., Rutkowska, A., & Kliber, A. (2022). Do words affect expectations? The effect of central banks communication on consumer inflation expectations. The Quarterly Review of Economics and Finance, 86, 221–229. [Google Scholar]

- Tetik, M. (2020). Testing of leader-follower interaction between fed and emerging countries’ central banks. The Journal of Economic Asymmetries, 22, e00181. [Google Scholar]

- Torrence, C., & Webster, P. J. (1999). Interdecadal changes in the ENSO–monsoon system. Journal of Climate, 12(8), 2679–2690. [Google Scholar]

- Ullrich, K. (2003). A comparison between the Fed and the ECB: Taylor rules. (ZEW Discussion Paper). Leibniz Centre for European Economic Research. [Google Scholar]

- Ullrich, K. (2008). Inflation expectations of experts and ECB communication. The North American Journal of Economics and Finance, 19(1), 93–108. [Google Scholar]

- Vukovic, D. B., Lapshina, K. A., & Maiti, M. (2021). Wavelet coherence analysis of returns, volatility and interdependence of the US and the EU money markets: Pre & post crisis. The North American Journal of Economics and Finance, 58, 101457. [Google Scholar]

- Willard, A., & Vidaillet, T. (2009). Trichet says ECB considering more steps but U.S. different. [Newspaper Article, News on 18 March]. Reuters. Available online: https://www.reuters.com/article/business/trichet-says-ecb-considering-more-steps-but-u-s-different-idUSTRE52G78E/ (accessed on 10 January 2025).

- Wischnewsky, A., Jansen, D.-J., & Neuenkirch, M. (2021). Financial stability and the fed: Evidence from congressional hearings. Economic Inquiry, 59(3), 1192–1214. [Google Scholar]

- Yellen, J. (2005). The Yellen View, The International Economy Magazine. Available online: http://www.international-economy.com/TIE_Sp05_Yellen.pdf (accessed on 30 October 2024).

- Yu, Z., Liu, W., & Yang, F. (2023). A central bankers’ sentiment index of global financial cycle. Finance Research Letters, 57, 104161. [Google Scholar]

| Fed | ECB | |||||

|---|---|---|---|---|---|---|

| Speech | Conf | Testimony | Speech | Conf | Hearing | |

| FinBERT | ||||||

| Mean | −0.032 | −0.043 | 0.015 | 0.046 | 0.009 | 0.081 |

| Std | 0.048 | 0.028 | 0.074 | 0.052 | 0.053 | 0.080 |

| Min | −0.160 | −0.117 | −0.179 | −0.179 | −0.123 | −0.066 |

| Max | 0.149 | 0.004 | 0.500 | 0.242 | 0.131 | 0.284 |

| LM | ||||||

| Mean | −0.330 | −0.397 | −0.330 | −0.163 | −0.426 | −0.151 |

| Std | 0.166 | 0.095 | 0.219 | 0.188 | 0.120 | 0.187 |

| Min | −0.742 | −0.617 | −0.838 | −0.597 | −0.686 | −0.590 |

| Max | 0.313 | −0.122 | 0.375 | 0.398 | 0.081 | 0.318 |

| Obs | 285 | 70 | 187 | 285 | 242 | 99 |

| Date start | 01:2000 | 04:2011 | 01:2000 | 01:2000 | 03:2000 | 01:2000 |

| Date end | 09:2023 | 09:2023 | 09:2023 | 09:2023 | 09:2023 | 09:2023 |

| No. of docs | 1470 | 71 | 371 | 2244 | 256 | 102 |

| Sentence | |||

|---|---|---|---|

| “The average pace of job gains over the past year has slowed somewhat and the labor force participation rate has also improved over the same time frame, a sign that labor market supply and demand may be coming into better balance”. | 0.999 | 0 | 0 |

| “Despite this tightening of bank lending standards, we have not seen signs of a sharp contraction in credit that would significantly slow economic activity”. | 0 | 0.742 | 0.258 |

| “This, along with my own expectation that progress on inflation is likely to be slow given the current level of monetary policy restraint, suggests that further policy tightening will be needed to bring inflation down in a sustainable and timely manner”. | 0 | 0.998 | 0.002 |

| Sentiment intensity | 0.33 | 0.58 | 0.09 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Deniz, P.; Stengos, T. Who Is Leading in Communication Tone? Wavelet Analysis of the Fed and the ECB. J. Risk Financial Manag. 2025, 18, 191. https://doi.org/10.3390/jrfm18040191

Deniz P, Stengos T. Who Is Leading in Communication Tone? Wavelet Analysis of the Fed and the ECB. Journal of Risk and Financial Management. 2025; 18(4):191. https://doi.org/10.3390/jrfm18040191

Chicago/Turabian StyleDeniz, Pinar, and Thanasis Stengos. 2025. "Who Is Leading in Communication Tone? Wavelet Analysis of the Fed and the ECB" Journal of Risk and Financial Management 18, no. 4: 191. https://doi.org/10.3390/jrfm18040191

APA StyleDeniz, P., & Stengos, T. (2025). Who Is Leading in Communication Tone? Wavelet Analysis of the Fed and the ECB. Journal of Risk and Financial Management, 18(4), 191. https://doi.org/10.3390/jrfm18040191