An Examination of G10 Carry Trade and Covered Interest Arbitrage Before, During, and After Financial Crises

Abstract

1. Introduction

2. Literature Review and Hypothesis

2.1. Literature Review

2.2. Hypotheses

- H1a: CT and CIAT strategies will yield profits.

- H1b: CT and CIAT strategies will yield losses.

- H1c: There is a statistically significant difference in profits from both strategies.

- H2: Crisis will have significant impact on profitability of both strategies.

- H3: We will observe different regimes around crisis.

- H4: We will observe ARCH or GARCH effects in the data.

3. Data and Methodology

3.1. Data

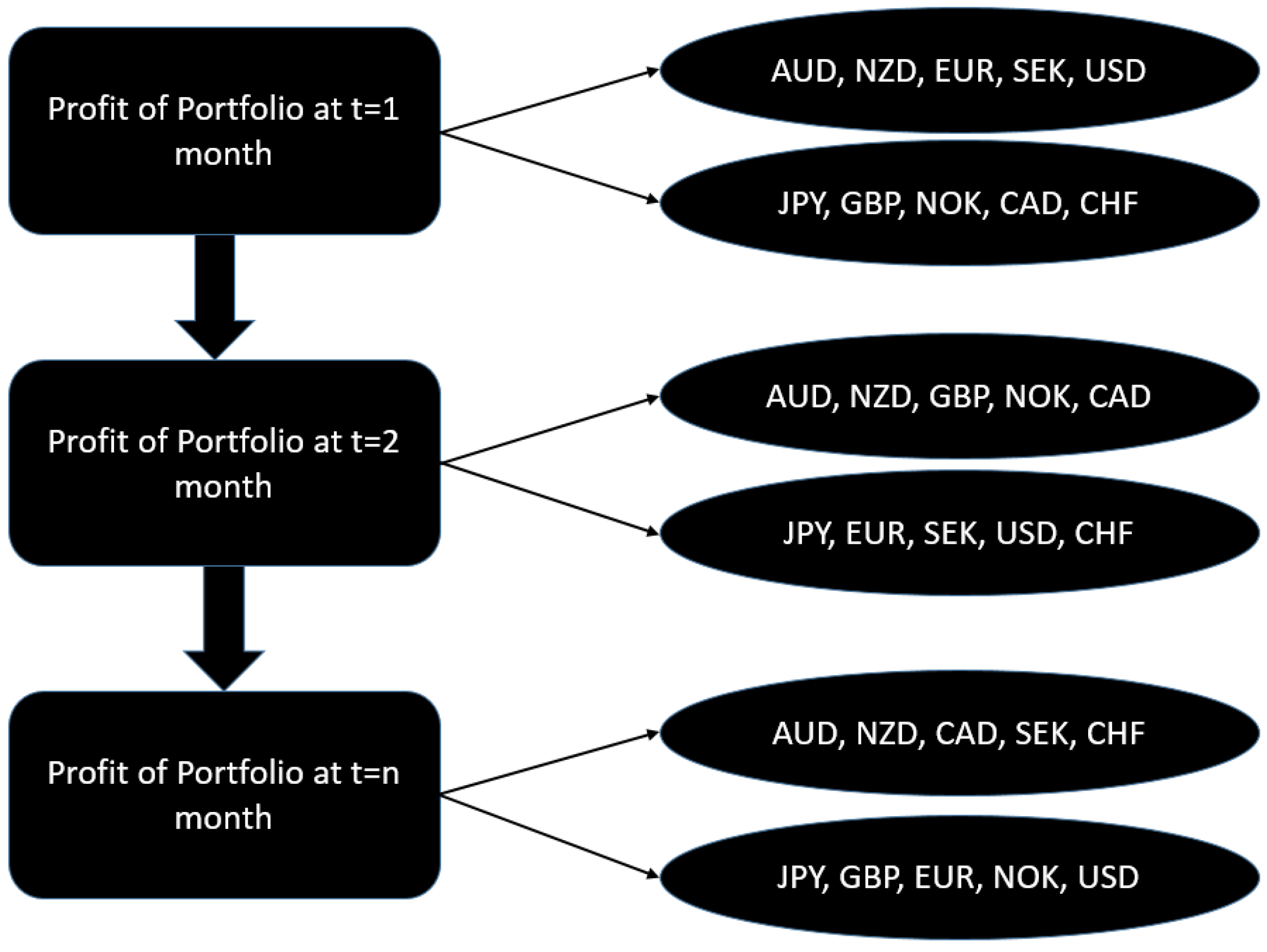

3.2. Methodology

4. Results and Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | Made prominent and fully described by C. Engel and Hamilton (1990) and Hamilton (1994); many other papers provide a summarized technical description, e.g., Chen and Lin (2022). |

| 2 | The sample begins in 2000 because the euro is adopted that year. This restriction does not allow us to examine periods before 2000 because data on the countries in the Euro zone will be in the original currencies before euro adoption. |

| 3 | Retrieved one from website: https://www.nber.org/research/data/us-business-cycle-expansions-and-contractions (accessed on 2 October 2024). |

| 4 | Eviews software version 12. |

| 5 | Data limitations affect some of these analyses. |

References

- Baillie, R. T., & Chang, S. S. (2011). Carry trades, momentum trading and the forward premium anomaly. Journal of Financial Markets, 14(3), 441–464. [Google Scholar]

- Bansal, R., Kiku, D., & Shaliastovich, I. (2012). The profitability of carry trades. Journal of Financial Economics, 105(3), 452–470. [Google Scholar]

- Beer, C., Ongena, S., & Peter, M. (2008). Borrowing in foreign currency: Austrian households as carry traders (pp. 1–50). Swiss National Bank Working Papers. Swiss National Bank. [Google Scholar]

- Bilson, J. F. O. (1981). The “Speculative Efficiency” hypothesis. The Journal of Business, 54(3), 435–451. [Google Scholar] [CrossRef]

- Brunnermeier, M. K., Nagel, S., & Pedersen, L. H. (2008). Carry trades and currency crashes. Working Paper No. 14473. National Bureau of Economic Research. [Google Scholar]

- Burnside, C., Eichenbaum, M., & Rebelo, S. (2007). The returns to currency speculation in emerging markets. American Economic Review, American Economic Association, 97(2), 333–338. [Google Scholar] [CrossRef]

- Burnside, C., Han, B., Hirshleifer, D., & Wang, T. (2011). Investor overconfidence and the forward premium puzzle. Review of Economic Studies, 78(2), 523–558. [Google Scholar]

- Chen, C., & Lin, C. (2022). Optimal carry trade portfolio choice under regime shifts. Review of Quantitative Finance & Accounting, 59(2), 483–506. [Google Scholar]

- Cho, D., Han, H., & Lee, N. K. (2019). Carry trades and endogenous regime switches in exchange rate volatility. Journal of International Financial Markets, Institutions and Money, 58, 255–268. [Google Scholar] [CrossRef]

- Coudert, V., & Mignon, V. (2013). The “forward premium puzzle” and the sovereign default risk. Journal of International Money and Finance, 32(1), 491–511. [Google Scholar]

- Daniel, K., Hodrick, R. J., & Lu, Z. (2014). The carry trade: Risks and drawdowns (No. w20433). National Bureau of Economic Research. [Google Scholar]

- Domowitz, I., & Hakkio, C. S. (1985). Conditional variance and the risk premium in the foreign exchange market. Journal of International Economics, 19, 47–66. [Google Scholar]

- Du, W., Tepper, A., & Verdelhan, A. (2018). Deviations from covered interest rate parity. The Journal of Finance, 73(3), 915–957. [Google Scholar] [CrossRef]

- Elias, N., Smyrnakis, D., & Tzavalis, E. (2024). The forward premium anomaly and the currency carry trade hypothesis. Quarterly Review of Economics & Finance, 95, 203–218. [Google Scholar]

- Engel, C. (1996). The forward discount anomaly and the risk premium: A survey of recent evidence. Journal of Empirical Finance, 3(2), 123–192. [Google Scholar]

- Engel, C., & Hamilton, J. (1990). Long swings in the dollar: Are they in the data and do markets know it? American Economic Review, 80, 689–713. [Google Scholar]

- Engel, C. M. (1984). Testing for the absence of expected real profits from forward market speculation. Journal of International Economics, 17(3–4), 299–308. [Google Scholar]

- Fama, E. F. (1984). Forward and spot exchange rates. Journal of Monetary Economics, 14, 319–338. [Google Scholar]

- Fama, E. F., & Bliss, R. R. (1987). The information in long-maturity forward rates. The American Economic Review, 77, 680–692. [Google Scholar]

- Fan, Z., Paseka, A., Qi, Z., & Zhang, Q. (2022). Currency carry trade: The decline in performance after the 2008 global financial crisis. Journal of International Financial Markets, Institutions and Money, 76, 1–16. [Google Scholar]

- Faugere, C. (2013). The fear premium and daily comovements of the S&P 500 E/P ratio and treasury yields before and during the 2008 financial crisis. Financial Markets, Institutions, & Instruments, 22(3), 171–207. [Google Scholar]

- Froot, K. A., & Frankel, J. A. (1989). Forward discount bias: Is it an exchange risk premium? Quarterly Journal of Economics, 104, 139–161. [Google Scholar]

- Froot, K. A., & Thaler, R. H. (1990). Anomalies: Foreign exchange. Journal of Economic Perspectives, 4(3), 179–192. [Google Scholar]

- Galati, G., & Melvin, M. (2004). Why has FX trading surged? Explaining the 2004 triennial survey. BIS Quarterly Review, 4, 67–74. [Google Scholar]

- Hamilton, J. D. (1994). Time series analysis. Princeton University Press. [Google Scholar]

- Hassan, T. A. (2013). Country size, currency unions, and international asset returns. The Journal of Finance, 68(6), 2269–2308. [Google Scholar] [CrossRef]

- Hassan, T. A., & Mano, R. (2019). Forward and spot exchange rates in a multi-currency world. Quarterly Journal of Economics, 134(1), 397–450. [Google Scholar] [CrossRef]

- James, J., Kasikov, K., & Secmen, A. (2009). Uncovered interest parity and the FX carry trade. Quantitative Finance, 9(2), 123–127. [Google Scholar] [CrossRef]

- Ma, Y., & Meredith, G. (2002). The premium puzzle revisited. IMF Working Papers: 02/28. IMF. [Google Scholar]

- Mancini, L., Ranaldo, A., & Wrampelmeyer, J. (2013). Liquidity in the foreign exchange market: Measurement, commonality, and risk premiums. The Journal of Finance, 68(5), 1805–1841. [Google Scholar] [CrossRef]

- McKinnon, R., Lee, B., & Wang, Y. (2010). The global credit crisis and China’s exchange rate. Singapore Economic Review, 55(2), 253–272. [Google Scholar] [CrossRef]

- Melvin, M., & Shand, D. (2017). When carry goes bad: The magnitude, causes, and duration of currency carry unwinds. Financial Analysts Journal, 73(1), 121–144. [Google Scholar] [CrossRef]

- Melvin, M., & Taylor, M. P. (2009). The crisis in the foreign exchange market. Journal of International Money and Finance, 28(8), 1317–1330. [Google Scholar] [CrossRef]

- Menkhoff, L., Lucio, S., Maik, S., & Andreas, S. (2012). Carry trades and global foreign exchange volatility. Journal of Finance, 67, 681–718. [Google Scholar] [CrossRef]

- Pilling, D. (2008, October 3). Beware the unwinding of the yen carry trade. Financial Times. [Google Scholar]

- Snaith, S., Coakley, J., & Kellard, N. (2013). Does the forward premium puzzle disappear over the horizon? Journal of Banking & Finance, 37(10), 3681–3693. [Google Scholar]

- The Economist. (2007). What keeps bankers awake at night? Financial stability. Economist, 382, 73–74. [Google Scholar]

- Xanthopoulos, A. (2011). An interpretation of carry trade profitability. Working Paper. SSRN. [Google Scholar]

- Yamani, E. (2019). Diversification role of currency momentum for carry trade: Evidence from financial crises. Journal of Multinational Financial Management, 49, 1–19. [Google Scholar] [CrossRef]

- Zhuang, A. (2015). The forward premium puzzle revisited [Ph.D. thesis, The University of North Carolina at Charlotte]. [Google Scholar]

| Sample (N = 216) | Non-Crisis (N = 188) | Crisis (N = 28) | ||||

|---|---|---|---|---|---|---|

| Panel A: Spot Rates | ||||||

| Country | Mean | STD | Mean | STD | Mean | STD |

| UK | 0.6261 | 0.0744 | 0.6288 | 0.0739 | 0.6083 | 0.0769 |

| Canada | 1.2210 | 0.1892 | 1.2160 | 0.1820 | 1.2546 | 0.2330 |

| Norway | 6.9206 | 1.1972 | 6.9748 | 1.2026 | 6.5566 | 1.1125 |

| Australia | 1.3264 | 0.2858 | 1.3098 | 0.2795 | 1.4376 | 0.3080 |

| Japan | 106.2776 | 13.9935 | 105.9819 | 14.2763 | 108.2631 | 11.9578 |

| Sweden | 7.7653 | 1.1977 | 7.7472 | 1.1599 | 7.8872 | 1.4447 |

| Euro | 0.8404 | 0.1338 | 0.8443 | 0.1275 | 0.8142 | 0.1706 |

| New Zealand | 1.5506 | 0.3570 | 1.5248 | 0.3514 | 1.7233 | 0.3523 |

| Switzerland | 1.1661 | 0.2568 | 1.1557 | 0.2612 | 1.2356 | 0.2160 |

| Panel B: Forward Rates | ||||||

| Country | Mean | STD | Mean | STD | Mean | STD |

| UK | 0.6268 | 0.0737 | 0.6293 | 0.0733 | 0.6099 | 0.0758 |

| Canada | 1.2220 | 0.1901 | 1.2172 | 0.1827 | 1.2546 | 0.2350 |

| Norway | 6.9433 | 1.2069 | 6.9921 | 1.2128 | 6.6155 | 1.1332 |

| Australia | 1.3336 | 0.2858 | 1.3161 | 0.2786 | 1.4513 | 0.3098 |

| Japan | 104.9494 | 13.8464 | 104.6265 | 14.0663 | 107.1175 | 12.2771 |

| Sweden | 7.7701 | 1.2023 | 7.7465 | 1.1613 | 7.9283 | 1.4629 |

| Euro | 0.8397 | 0.1337 | 0.8432 | 0.1273 | 0.8164 | 0.1717 |

| New Zealand | 1.5611 | 0.3597 | 1.5346 | 0.3540 | 1.7390 | 0.3533 |

| Switzerland | 1.1625 | 0.2551 | 1.1518 | 0.2593 | 1.2344 | 0.2160 |

| Panel C: Interest Rates | ||||||

| Country | Mean | STD | Mean | STD | Mean | STD |

| UK | 0.0282 | 0.0225 | 0.0262 | 0.0226 | 0.0419 | 0.0166 |

| US | 0.0410 | 0.0140 | 0.0415 | 0.0138 | 0.0375 | 0.0150 |

| Norway | 0.0342 | 0.0224 | 0.0304 | 0.0206 | 0.0592 | 0.0182 |

| Australia | 0.0455 | 0.0172 | 0.0438 | 0.0164 | 0.0569 | 0.0187 |

| Canada | 0.0237 | 0.0156 | 0.0234 | 0.0161 | 0.0262 | 0.0122 |

| Japan | 0.0028 | 0.0024 | 0.0024 | 0.0019 | 0.0056 | 0.0034 |

| Sweden | 0.0205 | 0.0168 | 0.0179 | 0.0155 | 0.0379 | 0.0145 |

| Euro | 0.0238 | 0.0173 | 0.0217 | 0.0173 | 0.0381 | 0.0094 |

| New Zealand | 0.0481 | 0.0206 | 0.0458 | 0.0194 | 0.0641 | 0.0215 |

| Switzerland | 0.0077 | 0.0126 | 0.0065 | 0.0124 | 0.0158 | 0.0103 |

| Currencies | Number of Months Shorted | % of the Currency Being Shorted | Number of Months Being Longed | % of the Months Being Longed | Total |

|---|---|---|---|---|---|

| Great Britain Pound (GBP) | 114 | 52.78% | 102 | 47.22% | 216 |

| Canadian dollar (CAD) | 106 | 49.07% | 110 | 50.93% | 216 |

| Norwegian krone (NOK) | 42 | 19.44% | 174 | 80.56% | 216 |

| Australian dollar (AUD) | 0 | 0.00% | 216 | 100.00% | 216 |

| Japanese yen (JPY) | 216 | 100.00% | 0 | 0.00% | 216 |

| Swedish krona (SEK) | 171 | 79.17% | 45 | 20.83% | 216 |

| Euro (EUR) | 151 | 69.91% | 65 | 30.09% | 216 |

| New Zealand dollar (NZD) | 0 | 0.00% | 216 | 100.00% | 216 |

| Swiss franc (CHF) | 216 | 100.00% | 0 | 0.00% | 216 |

| US dollar (USD) | 64 | 29.63% | 152 | 70.37% | 216 |

| Variable | Mean | Median | STD | t-Stat | Min | Max |

|---|---|---|---|---|---|---|

| Ending CT long position | 859.36 | 800.08 | 91.57 | 137.93 | 800.03 | 1000.20 |

| Ending CT short position | 940.77 | 1000.01 | 91.53 | 151.06 | 800.02 | 1000.11 |

| Net CT USD profit | −81.42 | −199.95 | 183.10 | −6.54 | −199.97 | 200.14 |

| Net CT profit % | −8.14% | −19.99% | 18.31% | −6.54 | −20.00% | 20.01% |

| Ending CIAT long position | 855.58 | 799.09 | 89.89 | 139.89 | 790.66 | 1002.49 |

| Ending CIAT short position | 944.22 | 1002.28 | 92.66 | 149.76 | 796.87 | 1012.30 |

| Net CIAT USD profit | −88.64 | −205.23 | 182.48 | −7.14 | −215.12 | 197.02 |

| Net CIAT profit % | −8.86% | −20.52% | 18.25% | −7.14 | −21.51% | 19.70% |

| USD Profit difference between CT and CIAT | 7.23 | 7.19 | 2.95 | 36.01 | −2.30 | 20.61 |

| % Profit difference between CT and CIAT | 0.72% | 0.72% | 0.29% | 36.01 | −0.23% | 2.06% |

| Year | N | USD Net CT Profit | % Net CT Profit | USD Net CIAT Profit | % CIAT Profit | USD Profit Difference | % Profit Difference |

|---|---|---|---|---|---|---|---|

| 2000 | 12 | −133.2781 | −13.33% | −140.9334 | −14.09% | 7.6553 | 0.7655% |

| 2001 | 12 | 200.0921 | 20.01% | 192.9214 | 19.29% | 7.1707 | 0.7171% |

| 2002 | 12 | 200.1020 | 20.01% | 191.7862 | 19.18% | 8.3158 | 0.8316% |

| 2003 | 12 | 200.0848 | 20.01% | 192.0000 | 19.20% | 8.0848 | 0.8085% |

| 2004 | 12 | 200.0947 | 20.01% | 192.9736 | 19.30% | 7.1211 | 0.7121% |

| 2005 | 12 | −166.5925 | −16.66% | −177.0444 | −17.70% | 10.4519 | 1.0452% |

| 2006 | 12 | −199.9358 | −19.99% | −209.7607 | −20.98% | 9.8249 | 0.9825% |

| 2007 | 12 | 33.4217 | 3.34% | 25.3055 | 2.53% | 8.1162 | 0.8116% |

| 2008 | 12 | 0.0953 | 0.01% | −10.9028 | −1.09% | 10.9981 | 1.0998% |

| 2009 | 12 | −199.9570 | −20.00% | −206.1892 | −20.62% | 6.2322 | 0.6232% |

| 2010 | 12 | −199.9486 | −19.99% | −206.0389 | −20.60% | 6.0902 | 0.6090% |

| 2011 | 12 | −199.9519 | −20.00% | −205.5651 | −20.56% | 5.6133 | 0.5613% |

| 2012 | 12 | −199.9570 | −20.00% | −207.0323 | −20.70% | 7.0753 | 0.7075% |

| 2013 | 12 | −199.9661 | −20.00% | −206.1804 | −20.62% | 6.2143 | 0.6214% |

| 2014 | 12 | −199.9585 | −20.00% | −206.6506 | −20.67% | 6.6921 | 0.6692% |

| 2015 | 12 | −199.9549 | −20.00% | −205.9647 | −20.60% | 6.0098 | 0.6010% |

| 2016 | 12 | −199.9584 | −20.00% | −203.7319 | −20.37% | 3.7735 | 0.3774% |

| 2017 | 12 | −199.9617 | −20.00% | −204.5883 | −20.46% | 4.6266 | 0.4627% |

| Variable | Non-Crisis Period (N = 188) | Crisis Period (N = 28) | Tests of Differences in Means | |||

|---|---|---|---|---|---|---|

| Mean | Median | Mean | Median | Diff. Mean | t-Stat | |

| USD Net CT profit | −97.81 | −199.95 | 28.65 | 200.09 | −126.47 | (−3.50) *** |

| %Net CT profit | −9.78% | −20.00% | 2.87% | 20.01% | −12.65% | (−3.50) *** |

| USD Net CIAT profit | −104.86 | −205.41 | 20.25 | 187.81 | −125.12 | (−3.47) *** |

| %Net CIAT profit | −10.49% | −20.54% | 2.03% | 18.78% | −12.51% | (−3.45) *** |

| USD profit difference | 7.05 | 7.05 | 8.40 | 8.34 | −1.35 | (−3.40) *** |

| %Profit difference | 0.71% | 0.70% | 0.84% | 0.83% | −0.13% | (−2.28) ** |

| FULL | Before Crisis | During Crisis | After Crisis | |||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| CT | CIAT | CT | CIAT | CT | CIAT | CT | CIAT | |

| crisis | 128.54 *** | 127.55 *** | ||||||

| (3.93) | (3.92) | |||||||

| sp500ret | −176.73 | −158.38 | −296.15 | −286.72 | 276.35 | 308.55 | −0.02 | 6.57 |

| (−0.67) | (−0.61) | (−0.75) | (−0.72) | (0.49) | (0.56) | (−1.47) | (0.99) | |

| cpichg | 11,723.82 *** | 11,679.12 *** | −508.53 | −500.88 | 13,088.60 * | 13,127.07 * | −0.09 | 72.75 |

| (3.27) | (3.27) | (−0.10) | (−0.09) | (1.97) | (2.00) | (−0.34) | (0.63) | |

| riskprem | 6818.98 *** | 6872.71 *** | 18,265.17 *** | 18,269.35 *** | −12,789.96 | −12,772.33 | 0.39 *** | −47.75 |

| (4.41) | (4.47) | (9.08) | (9.04) | (−1.44) | (−1.45) | (3.37) | (−0.97) | |

| twexb | 6.62 *** | 6.65 *** | −3.18 | −3.10 | 7.24 ** | 7.34 ** | −0.00 | 0.07 *** |

| (6.16) | (6.22) | (−1.32) | (−1.28) | (2.43) | (2.48) | (−1.26) | (2.75) | |

| intercept | −920.96 *** | −932.50 *** | 252.72 | 234.17 | −637.28 * | −655.75 * | −199.95 *** | −212.67 *** |

| (−7.59) | (−7.73) | (0.93) | (0.86) | (−1.95) | (−2.02) | (−28,883.34) | (−72.66) | |

| adj. R-sq | 0.27 | 0.27 | 0.55 | 0.55 | 0.17 | 0.18 | 0.14 | 0.08 |

| N | 216 | 216 | 86 | 86 | 28 | 28 | 102 | 102 |

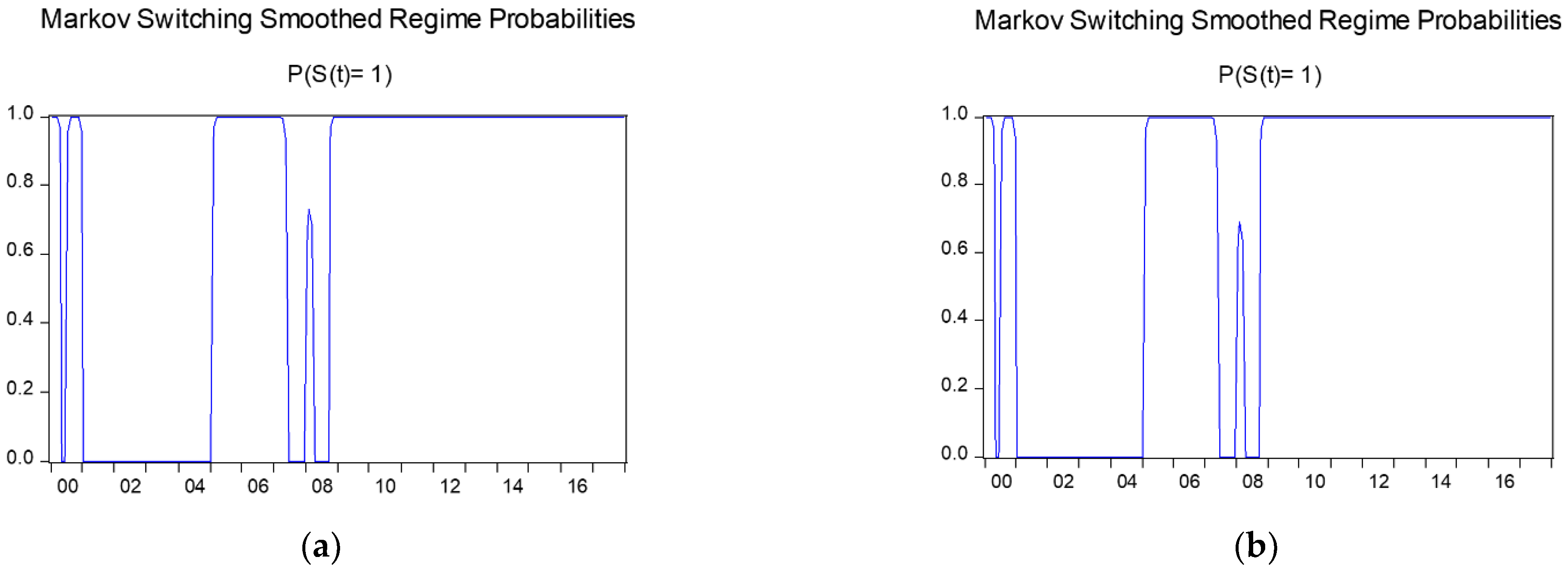

| Panel A: Regime Modeling with Switching Regressors | |||||

| Carry Trade (CT) | Covered Trade (CIAT) | ||||

| State 1 | State 2 | State 1 | State 2 | ||

| Markov Prob | 1 | 0.9753 | 0.0247 | 0.9790 | 0.0210 |

| 2 | 0.0066 | 0.9335 | 0.0551 | 0.9449 | |

| Regime 1 | Regime 2 | Regime 1 | Regime 2 | ||

| Common (Switching Regressors) | |||||

| Regime 1 | Regime 2 | Regime 1 | Regime 2 | ||

| SP500ret | −25.37 | 46.10 | −9.84 | 60.95 | |

| z-statistic | (−0.82) | (1.01) | (−0.29) | (1.46) | |

| CPIchg | −632.23 | 2404.87 | −650.71 | 2172.76 | |

| z-statistic | (−1.61) | (3.04) | (−1.50) | (3.00) *** | |

| RiskPremium | −990.20 | −855.47 | −935.11 | −818.57 | |

| z-statistic | (−5.61) *** | (−2.61) *** | (−4.80) *** | (−2.73) *** | |

| TWEXB | −1.74 | 1.75 | −1.81 | 1.68 | |

| z-statistic | (−92.43) *** | (39.13) *** | (−86.92) *** | (41.14) *** | |

| Log (Sigma) | 2.68 | 2.74 | 2.78 | 2.65 | |

| z-statistic | (45.46) *** | (30.16) *** | (47.14) *** | (29.17) *** | |

| Log-Likelihood | −923.6155 | −932.94 | |||

| Panel B: Regime Modeling with Non-Switching Regressors | |||||

| Carry Trade (CT) | Covered Trade (CIAT) | ||||

| State 1 | State 2 | State 1 | State 2 | ||

| 0.9790 | 0.0210 | 0.9793 | 0.0207 | ||

| 0.0551 | 0.9449 | 0.0542 | 0.9458 | ||

| Regime 1 | Regime 2 | Regime 1 | Regime 2 | ||

| Common (Non-Switching Regressors) | |||||

| Carry Trade (CT) | Covered Trade (CIAT) | ||||

| SP500ret | −36.38 | −222.50 | |||

| z-statistic | (−1.15) | (−0.65) | |||

| CPIchg | −535.14 | −537.50 | |||

| z-statistic | (−1.37) | (−1.25) | |||

| RiskPremium | −973.96 | −912.83 | |||

| z-statistic | (−5.61) *** | (−4.76) *** | |||

| TWEXB | −1.74 | −1.80 | |||

| z-statistic | (−93.17) *** | (−87.59) *** | |||

| Regime 1 | Regime 2 | Regime 1 | Regime 2 | ||

| Log (Sigma) | 2.67 | 6.02 | 2.77 | 6.01 | |

| z-statistic | (44.60) *** | (67.12) *** | (46.48) *** | (67.20) *** | |

| Log-Likelihood | −1132.94 | −1147.69 | |||

| (1) | (2) | |||

|---|---|---|---|---|

| CT % | z-Statistic | CIAT % | z-Statistic | |

| GARCH^2 | 0.518 | (6.068) *** | 0.518 | 6.05 |

| crisis | 0.033 | (0.32) | ||

| sp500ret | −23.473 | −11.150 | −23.425 | −1.15 |

| cpichg | −1228.656 | (−3.006) *** | −1228.313 | (−2.99) *** |

| riskprem | −3019.786 | (−19.220) *** | −3020.538 | −18.59 |

| TWEXB | −1.564 | (−68.87) *** | −1.564 | (−68.47) *** |

| Variance Equation | ||||

| constant | 4.784 | 1.081 | 4.801 | 1.075 |

| Residual2(−1) | 0.747 | 3.943 | 0.750 | (3.89) *** |

| GARCH(−1) | 0.370 | 5.449 | 0.369 | (5.217) *** |

| N | 216.000 | 216.000 | ||

| Adj. R2 | 0.249 | 0.246 | ||

| Log-Likelihood | −118.135 | −1181.142 | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Danso, C.A.; Refalo, J. An Examination of G10 Carry Trade and Covered Interest Arbitrage Before, During, and After Financial Crises. J. Risk Financial Manag. 2025, 18, 190. https://doi.org/10.3390/jrfm18040190

Danso CA, Refalo J. An Examination of G10 Carry Trade and Covered Interest Arbitrage Before, During, and After Financial Crises. Journal of Risk and Financial Management. 2025; 18(4):190. https://doi.org/10.3390/jrfm18040190

Chicago/Turabian StyleDanso, Charles Armah, and James Refalo. 2025. "An Examination of G10 Carry Trade and Covered Interest Arbitrage Before, During, and After Financial Crises" Journal of Risk and Financial Management 18, no. 4: 190. https://doi.org/10.3390/jrfm18040190

APA StyleDanso, C. A., & Refalo, J. (2025). An Examination of G10 Carry Trade and Covered Interest Arbitrage Before, During, and After Financial Crises. Journal of Risk and Financial Management, 18(4), 190. https://doi.org/10.3390/jrfm18040190