1. Introduction

Individual orders for ships or possibly orders in (very) small series is a characteristic of market niches toward which the European shipbuilding industry is oriented. In the implementation of the prototype project, the shipyard is exposed to a high probability of frequent changes and modifications through the design, as well as construction and outfitting phases, which results in not only an increase in labor, material, and energy costs but also an extension of the contractual terms of construction or delivery. Due to the frequent absence of orders for a second ship in the series, European shipyards are constantly faced with high profitability and competitiveness risk for this reason.

Improving efficiency through the application of digital technologies in products and business processes is also one of the responses of the European maritime industry to the increasing challenges imposed by the long-term strategies of Far Eastern industrial giants to dominate the global maritime market in all its niches.

For example, designing a ship using 3D modeling in the context of the Digital Twin allows shipyard’s, clients’, and key suppliers’ teams to optimize technical–technological solutions in the direction of achieving the highest level of outfitting precisely at the stage that results in the lowest costs of the shipbuilding process (

Kunkera et al., 2022). The observed shipyard recognizes, as such, the block erection phase before they are lifted onto the slipway or joined into the hull, in which, using the example of the construction of a cruise ship using its Digital Twin, it achieved almost 70% of the ship’s outfitting, with an increase in productivity of approximately 20% and the same savings in the electricity consumption (

Kunkera et al., 2022). However, project development using the Digital Twin—taking into account the high complexity of the vessels from the market niches that European shipyards are oriented to—prolongs the design process as expected and ultimately shortens the time of building and outfitting the ship and thus the overall process of project realization. In addition to this, the shipyard, in addition to a competitive delivery deadline, also achieves savings in financing and insurance costs and frees up production capacities and infrastructure earlier to carry out activities on other or new projects.

Considering the capital intensity of the shipping industry (according to

C. Y. Kim (

2017), the average value of a newbuilding is approximately USD 60 million—of course, depending on the type, size, and purpose), a large number of stakeholders are involved in the process of financing the procurement of a ship; in addition, especially for highly complex and technologically demanding ships, the process of project realization, from contracting to handover, is extremely time-consuming, lasting up to a year in the design process and approximately 20 to 24 months in the construction and outfitting process. Usually, in the case of a new building, payment to the shipyard is agreed upon in five equal instalments. Given the complexity of the financing process, i.e., the legal relationship of its stakeholders (even in the simple structures of the shipping company’s investment capital) and the exposure to the consequences of seasonal and short-term conjuncture cycles, great interpersonal team skills are necessary for risk management in the process of realizing shipbuilding projects. Namely, the project’s cash flow is planned according to the agreed schedule of payments to the shipyard, i.e., according to the deadlines for the realization of (usually five) key events. Hence, even the slightest disturbance in the dynamics of payments, i.e., the procurement of (key) equipment and materials due to the untimely fulfilment of financial obligations to the shipyard, implies not only jeopardizing the contractual delivery date of the ship but also—both for the shipping company and for the shipyard—all the other competitive advantages of early outfitting.

By analyzing the available literature, particularly research papers on the topic of the implementation of digital trends and technologies, the authors of this study observe the high potential of the applicability of blockchain technology in the maritime sector, with an emphasis on supply chain processes. However, the authors note a gap in the research review, given the pronounced lack of not only quantitative but also qualitative studies related to the possibilities of applying the concept of smart contracts in shipbuilding processes. In order to contribute to maintaining or improving the competitiveness of the European shipbuilding industry, the authors explore the possibilities of upgrading the process of realizing shipbuilding projects by introducing the blockchain application of smart contracts in the financing of the construction and purchase of the ship. At the same time, this study presents shipowners with a financing model for purchasing a ship that minimizes their investment risk, especially emphasized by the increasingly pronounced cyclicality of the shipping market. Thus, this study’s scientific contribution is recognized in pointing out to shipbuilding industry business entities the possibility of achieving savings in project implementation by managing the ship construction and purchase financing process using blockchain technology. The authors present the correlation between the software application of smart contracts and early outfitting, in terms of improving its level, as a novelty of this research.

Following the literature review, the authors explain the choice of the research methodology. The second part of the third chapter presents the basics of blockchain technology and the respective software application of smart contracts, including the approach from a legal view. In the fourth chapter, the most frequently applied model of financing the construction and purchase of ships is described, whose legal structure of relations between stakeholders in the process is recognized by the authors of this article as the most risk-balanced. The fifth chapter presents the results of theoretical improvements in the process of project realization achievable by managing the financing process using the software application of smart contracts and in relation to the empirically determined average activity duration of the (sub) steps of the financing process controlled using the traditional approach. In conclusion, the sixth chapter summarizes the achievements of the study, with a recommendation to expand the research in the direction of determining the total possible realization of savings in the process of project realization; in this chapter, ultimately, the authors point out the obstacles, keeping in mind the complexity of the model in general in the maritime industry, to the introduction of blockchain technology, i.e., cryptocurrencies, in the financing processes of ship procurement.

2. Literature Review

The contribution of blockchain technology to the digital transformation of the industry is generally recognized, among other things, in the possibilities of faster (literally automatic), cheaper, and safer (B2B, B2C, C2C) transactions (by using cryptocurrencies) than the realization of complete transparency in the flows of goods and information within supply chains; secure and transparent processing; and storage of large amounts of data generated in the processes of legal entities; as well as the development of the full potential of the smart contract application (

Kundih, 2020).

Given the fulfilment of security criteria and the possibility of real-time asset disposal (

Kundih, 2020), and with lower costs given the absence of supervision by a central authority, we still find the most extensive application of blockchain technology in transfers of (digital) money, i.e., payments (

Digital Assets d.o.o., 2022)—today in the world, thousands of blockchain networks are used for this purpose (

Kundih, 2020). Thus, blockchain technology increasingly directly threatens the operations of financial institutions—namely, in addition to losing significant transaction fees by being excluded from the payment process, they are also left without information about their legal and physical clients as a key basis for selling their services and financial models (

Žnidar, 2020). Recognizing the threat to their business, but also the possibility of savings in their own business processes, financial institutions, together with the main auditing firms as well as consultants from the sector at the world level, are increasingly actively involved in the research of blockchain applications, in addition to the development and testing of their own prototype software platforms (

Žnidar, 2020). Thus, for example, Mastercard, in the development of its own payment system, being a competitor to the prevailing cryptocurrencies, registered over 30 patents related to blockchain technology (

Kundih, 2020).

In addition to the field of finance, the advantages of blockchain technology are also recognized in other economic sectors, i.e., branches of industry. In healthcare, for example, blockchain has started to be used for the purpose of monitoring the implementation of research projects and controlling the results thereof, as well as for the purpose of recording or storing the medical documentation of patients (

Digital Assets d.o.o., 2022). As stated by

Rana et al. (

2022), the implementation of blockchain technology in the tourism sector, which unites transport companies, hotels, catering, insurance companies, tour operators, and travel agents, as well as various payment service providers, started in 2014 and significantly contributed to the reduction in the risk of fraud and corruption, simplification of the billing service mechanism, increased data security, better management of contractual arrangements, and generally increased productivity of tourism companies through the automation of routine business operations, all of which are recognized as important growth drivers of small or poor economies according to the level of development of tourism superpowers.

The security protocols of blockchain technology minimize the risks of fraud attempts in the insurance industry; namely, by applying its smart contracts application, it is possible to obtain and verify a far greater amount of information from a large number of different sources regarding the subject of insurance, thereby detecting false identities of potential fraudsters and preventing multiple compensations of damages on the same basis to the same insured and/or payment of the insured amount on the same subject by several different insurance companies (

Žnidar, 2020). For this purpose, for example, Toyota is considering connecting the sensors in the car to the blockchain system—the sensors would record or collect data while driving, store them in a block, and thus be immediately available to insurance companies in the event of damage for a faster and accurate assessment of the cause of its occurrence (

Nožinić, 2022).

For example, South Korea, Estonia, and the United Arab Emirates are using blockchain technology to keep records of government registers (e.g., birth certificates of individuals and registrations of business entities, etc.) (

Nožinić, 2022), and the possibility of improving electoral processes is generally recognized since its implementation enables the transparency of vote counting while minimizing the possibility of voter fraud (

Digital Assets d.o.o., 2022).

The transparency and immutability of transaction records, as well as the implementation of the software application of smart contracts, significantly improve the management of supply chains, along with a resulting increase in their efficiency, that is, the speed of the flow of goods and services. According to research conducted on the basis of the experience of 306 experts from various industries,

J.-S. Kim and Shin (

2019) conclude that the implementation of blockchain technology has positive effects on the relations between stakeholders in the chain and also observed the lack of contribution of the property of information immutability to its effectiveness. By speeding up the verification of data on the origin of the material, or, for example, the authorization of intellectual property rights (

Nožinić, 2022), the possibility of delays in the design of (semi)products, their production, and supply to the next user in the chain is significantly reduced, which, for example, contributes greatly to the improvement in business processes in the aviation industry (

Kundih, 2020). The properties of blockchain technology make it easier to prove the origin and quality of the material, as well as the monitor its traceability and manipulation integrity through production processes—for example, in agriculture for the purpose of the reliable and timely measurement or preservation of grain quality, thus minimizing the risk of delays and fraud in the supply chain (

Kundih, 2020;

Žnidar, 2020). Improving the quality assurance and traceability of products, from the farmer/producer to the end consumer, is extremely important in food supply chains—Walmart has thus, based on the IBM platform, developed its own blockchain system for monitoring the food safety in its offer, minimizing the possibility of the infectious diseases transfer (

C. Y. Kim, 2017).

In their work,

Peronja et al. (

2020) analyze the implementation of blockchain technology in the maritime industry transport processes, presenting the possibilities of reducing container freight rates (depending on the freight market) by digitizing the bill of lading (BOL) with smart contract applications; further, the paper presents the savings achieved by the digital BOL compared to its manipulation in the traditional, “paper” way, as well as the reduction in its issuance cost with regard to the cargo type. The authors base their research, among other things, on the experimental or prototype implementation by ports and carriers of the, for example, “CargoX” smart contract BOL application, as well as TradeLens, a blockchain-based trade platform developed by IBM in cooperation with one of the world’s shipping giants, the company Maersk (

Peronja et al., 2020). And despite the fact that from the start of its application, in 2018, more than 70 million containers were logistically processed, over 36 million documents were issued, i.e., over 3.7 billion events were monitored. Even though some of the largest carriers used it, such as Hapag Lloyd or MSC, as well as some of the largest ports, e.g., Port of Rotterdam or PSA Singapore, the level of global cooperation between stakeholders of the maritime industry has not been realized in the dynamics or scope that is in accordance with the expectations of its founders (

Dupraz, 2022). The reasons for the failure, among other things, are recognized in the impossibility of achieving a satisfactory level of interoperability, as well as in the possibility of insight of the Maersk company, one of the co-founders of the platform, into the databases of its market competitors; at the end of 2022, the founders decided to close it down (

Dupraz, 2022;

Kjaergaard-Winther, 2022).

Further,

Czachorowski et al. (

2019) state that the application of innovative technologies should generally be recognized as a response to the ever-stricter requirements of regulatory bodies (e.g., IMO, the European Union) toward the maritime industry—marked as one of the biggest polluters in the world—to achieve its environmental acceptability, and in their work, they specifically focus on the possibilities of using blockchain technology, especially in the supply chain. Thus, the authors highlight the example of the company “Marine Transport International”—a freight forwarder that launched the public blockchain system “TrustMe” in 2016 with the aim of meeting the requirements of the IMO Convention “Safety of Life at Sea” (SOLAS) of that same year, and all in regard to the declaration of the verified gross mass (VGM) of packed containers before they are loaded onto the ship (

Czachorowski et al., 2019). With the aforementioned regulation, all responsibility for the accuracy of the declaration of VGM toward the carrier or port terminal has been transferred to the shipper (

Buxbaum, 2016)—TrustMe solution has, in this sense, facilitated its work by providing accurate, immutable, and transparent records of VGM to all stakeholders in the chain without the need to involve any intermediaries for the storage or transfer of data (

Czachorowski et al., 2019).

Reducing access costs to maritime supply chains as well as their transaction costs is a prerequisite, according to

Philipp et al. (

2019), to small- and medium-sized legal entities reaching a more equal position in relation to large business entities, especially when it comes to international and multimodal supply chains. The authors of this paper point out that the implementation of the smart contract blockchain application, in addition to resulting in the automation of transactions and thus the exclusion or minimization of the need for expensive legal or other intermediary services, also facilitates inter-organizational cooperation and the connection of fundamental stakeholder processes, which together contributes to the easier integration of smaller- and medium-sized companies in the maritime value and supply chains (

Philipp et al., 2019). However, as a limiting factor of this research, based on interviews with experts and case studies, the authors cite insufficient knowledge of the legal regulations applicable to the maritime logistics sector and thus also of legal obstacles to blockchain technology implementation in supply chain processes, while as a research gap, they point out the current lack of analysis of challenges in the possibilities of digitizing the operations of small- and medium-sized seaports, which, as the authors explain, provides this study with, in particular, the originality and high novelty value (

Philipp et al., 2019).

In addition to the supply chain,

Zhu et al. (

2020) propose, in their study, other possibilities of applying blockchain technology in the shipbuilding system for the purpose of synchronizing and tracking the data of various stakeholders in shipbuilding processes with the aim of achieving complete collaboration with fast intercommunication and safe work. Thus, according to the authors, the application of blockchain technology makes it impossible for unauthorized parties to use the assets of shipyard facilities; further, the distributed manufacturing process is improved by realizing real-time transparency and efficiency in value transactions between different shipbuilding processes and geographically dislocated facilities (

Zhu et al., 2020). Today, trust in communication exists between people involved in the process, while the exchange of information between IoT-based machines is deficient or often even blocked; however,

Zhu et al. (

2020) also discuss the possible contribution of blockchain technology to the realization of complete trust in communication between machines, by raising their level of intelligence through the incorporation of unified brain-thinking and decision-making mechanisms. Ultimately, as the authors state, thanks to blockchain technology, not only have intelligent distributed production networks become a reality, but the possibility of their further transformation into faster, safer, and more energy-efficient cloud chain hybrid distributed production opens up (

Zhu et al., 2020).

However, since it is still in its infancy stage, so far, only a few research studies have been conducted on the topic of the applicability of the smart contracts concept. Current studies mostly identify and discuss the challenges of this blockchain application, primarily those related to coding procedures and transaction security, to a lesser extent those related to the privacy of contracting parties, and certainly to an insufficient extent those related to the program execution and its network adaptability (

Alharby & Moorsel, 2017). Thus,

Zou et al. (

2019) explore the potential challenges developers face in developing smart contracts (primarily on the Ethereum blockchain platform), i.e., to what extent their development may differ compared to the creation of traditional software applications. Their exploratory study, based on interviews with 20 developers and the validation of the conclusions from those interviews in cooperation with 232 practitioners, confirmed the “immaturity” of the smart contracts development phase, i.e., revealed its current shortcomings—the insufficiency of development software tools of a higher level, numerous limitations in applicable programming languages and virtual machines/operating systems, a lack of online support, and undefined ways of guaranteeing the security of smart contract code (

Zou et al., 2019). The difficulty of writing secure smart contracts is also discussed by

Bhargavan et al. (

2016)—namely, the openness of the Ethereum platform also allows access to programmers under a pseudonym, thereby opening the possibility of programming smart contracts with a dangerous combination of trusted and untrusted code.

Luu et al. (

2016), in their work, also investigate the issue of the secure execution of smart contracts by highlighting, as an example, The DAO venture capital fund (

Wikipedia, 2023), whose security bug in the code of the Ethereum-based program in 2016 resulted in the malicious transfer of Ether worth USD 50 million. Hence, the authors discuss several new security bugs in smart contracts, and for each one, they elaborate on the resulting scenarios of attacks on the network by malicious users, and as a solution for fixing them, i.e., reducing the vulnerability of the program, they propose ways of improving the Ethereum operational semantics (

Luu et al., 2016). In conclusion, the paper presents the OYENTE programming tool for analyzing smart contracts with the aim of finding potential security bugs; the tool was developed at the beginning of 2016 by the authors themselves in order to help developers write safer programs and help users avoid problematic contracts (

Luu et al., 2016). Nevertheless, in their work,

Alharby and Moorsel (

2017) emphasize the fact that the research is too scarce on the possible threats of a criminal nature to the implementation of smart contracts, especially those that additionally propose solutions to overcome criminal threats; also,

Fauziah et al. (

2020) highlight countering cybercrime threats as one of the main challenges in the application of smart contracts in industry, with an emphasis on the execution of financial transactions.

3. Research Methodology and Technology Overview

The competitiveness of the shipyard is, among others, determined by the deadlines for the construction and delivery of the ship, while the costs of labor, energy, insurance, financing, and others increase with the length of the project realization process. With regard to the impact of the financing process on the duration of the ship’s construction, the author’s intention is to answer through this research, and in relation to the production program of the observed shipyard, whether blockchain technology, through the application of smart contracts, is applicable for improving the process of financing the construction and purchase of a ship according to the offered financing model.

According to

Yaga et al. (

2018), the application of blockchain technology can certainly be desirable if a large number of geographically dispersed but networked entities participate in the process implementation, for those who want to avoid or reduce the costs of third-party process regulation but, at the same time, the possibility of mutual (legal) disputes, and for those who want to have insight into the origin of (digital) assets as well as the overall history of transactions in the process. Blockchain technology is applicable if the process flow is basically transactional, with assets that can be digitally identified, and for which there is a need for a high level of data protection of the ownership rights (

Yaga et al., 2018). The need to use blockchain technology must be recognized by business entities whose competitive position on the market can primarily be threatened by input data corruption, operational data theft, or obstruction of the information credibility that the business entity distributes further into the value chain (

Tucker & Pang, 2019).

Therefore, the goal of this research is to study an existing problem in the field of shipbuilding—that is, the complexity of the process of financing the construction and purchase of commercial ships, and to research the applicability of novel technology, which is blockchain technology and smart contracts. For this purpose, a case study methodology was chosen.

The case study approach is applicable in the case of an in-depth exploration of complex issues in their real-life settings (

Crowe et al., 2011). Case studies can be exploratory, descriptive, and explanatory. The exploratory case study mainly answers the question “what”—for example, “what can be learned from a study of different approaches in start-ups” (

Yin, 2009).

Leonardo et al. (

2017) suggest that exploratory research is applicable to develop and provide new ideas and discoveries. Thus, the exploratory type of case study is suitable for this research. Also, a case study can be a single-case case study or a multiple-case case study. In a single case study, only one case is being analyzed, and in multiple case studies, several cases are analyzed for comparison purposes (

Yin, 2009). This research aims to explore and investigate ways of improving the financial aspect of shipbuilding project realization, particularly by studying the advancements achievable by applying blockchain technology. Since the study was performed on the financing process case (based on data derived from three projects of the same kind—cruise vessels sequentially built or delivered in the observed shipyard), the exploratory single case study was chosen.

According to

Crowe et al. (

2011), the case study approach explores the way an intervention can be implemented and the way it works in real-world settings. The authors hereby define the main phases of conducting the case study research: context definition, case selection, data collection, analysis, interpretation, and reporting research findings (

Crowe et al., 2011), as shown in

Figure 1.

3.1. Blockchain

A blockchain (chain of blocks) is a technology that can be described as digital bookkeeping (

Digital Assets d.o.o., 2022); it represents a decentralized data structure (

Kundih, 2020) unidirectionally chained into blocks. The essence of blockchain technology is a digital ledger/database (stored in blocks in chronological order) that contains key information about transactions (who participates in the transaction, what is its value, whether the transaction was executed successfully, etc.) (

Digital Assets d.o.o., 2022;

Hayes, 2024). The digital ledger is public (distributed ledger), namely, it is distributed among all independent users (nodes) in the network, which makes blockchain technology transparent. Blockchain technology is a form of a distributed computer system, which means that the networking of the distributed ledger with each unit (node—e.g., computer) in the system is based on the P2P concept (

Travaš, 2018)—all nodes can exchange (send and receive) messages with each other because each node has its own memory and processor.

All information (about transactions) contained in the distributed ledger is cryptographically protected, i.e., an identical blockchain record is stored on every computer connected to a certain blockchain network, and according to (

Kundih, 2020), change is only possible in the case of acceptance of the same by at least 50% +1 user (node) in that system.

The most important element of blockchain security is reaching an agreement between its users about a certain state in the system (such as the validity of transactions—the credibility of data); the problem of achieving such an agreement or consensus in a decentralized system, such as the blockchain, with the assumed complete mutual distrust of partners in the network, is solved by applying appropriate algorithms (

Hozjan, 2017;

Oremuš, 2022). Algorithms for achieving consensus are based on mathematical problems, and by solving them, the transactions are confirmed in the system (

Arunović, 2018), so they provide partners in the network with confidence in the accuracy of data added to new blocks as well as the truth and immutability of data in previous blocks. The most commonly used consensus algorithms are the following:

Proof-of-Work (PoW)—the process of confirming transactions, i.e., adding newly created blocks to the network chain, typical for the Bitcoin blockchain system;

Proof-of-Stake (PoS)—an algorithm developed from the Bitcoin cryptocurrency competitors’ blockchain systems (for example, Peercoin, Ethereum, or Nxt) (

Hozjan, 2017;

Činčurak, 2020), with the primary goal of saving energy (

Kundih, 2020), since this method of confirming transactions does not require high hardware requirements for computing power, and a functional computer system with a stable Internet connection is sufficient (

Oremuš, 2022).

Thus, most of today’s top contending smart contract networks use the PoS consensus mechanism to reduce energy consumption significantly. Ethereum’s switch from the PoW consensus algorithm to the PoS in 2022 reduced its energy consumption by 99.84% from around 80 TWh per year to 0.01 TWh per year (on the contrary, the estimated energy consumption of Bitcoin for 2025 reaches even 175 TWh) (

Digiconomist, 2025). While energy consumption and the ecological impact of blockchain technology remain concerns in the context of blockchains using the PoW consensus mechanism, this impact can be considered minor for blockchains using the PoS consensus protocol.

The Byzantine Fault Tolerance (BFT) algorithm is also of great importance, created for the purpose of achieving an agreement between partners in the network, even if some of them are faulty or even malicious (so-called Byzantine nodes) (

Hozjan, 2017;

ITU Online, 2024). Given the resistance to spreading false information, i.e., cyber attacks, BFT, also called the “Byzantine Agreement”, is primarily used in security-demanding and scalable network environments, such as quantum communication networks (

ITU Online, 2024;

Jing et al., 2024).

Blockchain networks can generally be public or private, i.e., free, open access to everyone, or accessible only to those with the network administrator’s approval. For example, cryptocurrency blockchain systems are, as a rule, public—everyone has the option of joining the network and has a copy of the digital ledger, that is, a transparent insight into the data of each individual transaction. In the public blockchain, the consensus mechanism is distributed (

Travaš, 2018;

Gupta & Chahal, 2020), and it is realized by applying mostly PoW and PoS algorithms (

Czachorowski et al., 2019;

Oremuš, 2022). The public blockchain operates on an open-source basis, that is, there is no requirement for users to install expensive software (

Kundih, 2020;

Czachorowski et al., 2019).

As stated by (

Kundih, 2020), the so-called “bankers” cryptocurrency, Ripple, developed as a direct competitor to Bitcoin, operates in a controlled blockchain, a system with a central server that controls and monitors the execution of activities in the network; also, a controlled blockchain differs from a public one in that the software may or may not be of open or freely available code.

A private blockchain is a type of managed or permissioned system, since participation in the network requires the approval of a central authority (

Oremuš, 2022); it is largely centralized with regard to the administrator’s authority to limit the rights of partners in the network—they may or may not be able to take over any of the functions in the system, i.e., access data in the chain (

Peronja et al., 2020;

Czachorowski et al., 2019). Although the system is distributed, access to the network is usually granted to users known in advance, and less complex mathematical equation algorithms are used to achieve consensus, which results in a higher process speed, lower costs of the necessary computer equipment, and lower energy consumption (

Czachorowski et al., 2019). The aforementioned properties of the private type of blockchain make it the preferred choice by organizations or companies, enabling their complete control over their internal transactions as well as transactions with their approved external partners (

Žnidar, 2020;

Peronja et al., 2020).

If the properties of the private blockchain want to be used by several organizations or companies gathered around a common interest, the private blockchain grows into a federated or consortium; its formation is more complex with regard to more involved legal entities; however, since it is managed by a team of group representatives and not by an individual, internal authority, the degree of decentralization and thus network security is higher compared to the private type (

Oremuš, 2022;

Gupta & Chahal, 2020).

The implementation of blockchain technology in the supply chain presumes the creation of a private network, that is, the availability of the system only to participants in the process; after establishing expectations about the desired contribution of blockchain technology (the growth of profits of stakeholders in the chain, the improvement in client satisfaction, and/or other), an applicable consensus algorithm is defined, depending on the criteria of business systems involved in the chain. Then, a platform is selected for the implementation of smart contracts (e.g., open source, like Hyperledger), the smart contracts are then programmed with operations depending on the complexity of the purpose (e.g., executing only financial operations or, e.g., determining the interdependence of parameters that affect the price of a product), and ultimately, a user interface is created (

Travaš, 2018;

Kundih, 2020).

While blockchain-based financing offers numerous benefits, its computational efficiency is low compared to financing through traditional financial systems that can process thousands of transactions per second. During periods of high demand, the Ethereum network can become congested with longer transaction processing times, leading to high transaction costs as users compete to get their possibly time-sensitive transactions processed in as little time as possible. To counter this issue, various Layer 2 solutions are being implemented with a development emphasis on interoperability to ensure the facilitation of transactions between different blockchains.

3.2. Smart Contracts

Unlike the original definition from the end of the 20th century, modern explanations of smart contracts are based on the logic of computer programming, which is how they are created. The content of smart contracts consists of contract objects—actions on which two or more contracting parties have agreed; objects of the contract, which are actually the cause of the creation of the contract, are contained in the code, and the lines of code written inside the computer program are actually smart contracts (

Perić, 2022). Program code is immutable; it executes the defined terms of the contract automatically, irreversibly, and altogether independently, i.e., without the need or possibility of human involvement in the sense of stopping or changing it (

Bartolović, 2018;

Perić, 2022). It is precisely the elimination of relying on the trust of the contracting parties, in other words, on their promises to perform contractual obligations, which is what traditional contract law actually rests on, that was actually one of the most important reasons for designing smart contracts (

Perić, 2022).

Smart contracts are primarily programmed with the Solidity programming language, which is object-oriented and primarily intended for the creation of smart contracts (

Zou et al., 2019)—namely, unlike other programming languages that are based on writing program commands in code and then executing them in such a written way, in the Solidity programming language, the values or objects (of the contract) are written in code, which is hence manipulated or exchanged among the code users (thereby executing the smart contract) (

Perić, 2022). Smart contracts are written or run in the Solidity programming language on the Ethereum blockchain platform (

Zou et al., 2019), a programmable upgrade of the Bitcoin blockchain system, because unlike the latter, which was designed primarily for digital currency transactions, the Ethereum system was developed for the purpose of creating and performing more complex operations, such as the execution of a computer program (

Perić, 2022). Like other blockchain networks, Ethereum is maintained or powered by users’ computers; each node, to perform computing functions, uses the Ethereum Virtual Machine (EVM) program platform, i.e., an operating system that understands and executes smart contracts, whereby users, for each execution of a smart contract, must previously pay a certain amount to the network of the reference cryptocurrency, i.e., Ether (

Bhargavan et al., 2016;

Bartolović, 2018). The price of the smart contract execution service depends on the required length of operation of the EVM operating system, i.e., its intensity of use of computer units (

Kuiper et al., 2024;

Ved & Andrade, 2024).

As of 2025, the Ethereum network is considered the most viable option for launching serious financial products, mainly because of the network’s security and stability. Its main competitor, Solana, prioritizes transaction speed (around 65,000 transactions per second) and low transaction costs; the main trade-off for this performance is the high hardware requirements necessary to run a validation node (for example, Solana currently has some 5000 nodes) (

Kuiper et al., 2024;

Ved & Andrade, 2024). On the other hand, Ethereum processes around 15 transactions per second, but due to the low hardware requirements, it has more than 1 million active validation nodes (

Kuiper et al., 2024;

Wackerow, 2025). Also, the fact that Ethereum has six different and independently developed execution clients and five consensus clients (clients: software that validator nodes run to connect to a blockchain network), with none of them used by more than 60% of the validators, ensures that a bug or an error in a single client does not stop the network from running (

Wackerow, 2025;

Dalton, 2023).

In addition to Ethereum, great application potential is also recognized in the EOS or NEO blockchain platforms; for programming smart contracts, EOS uses the C++ programming language, i.e., Web Assembly (Wasm) code format for the purpose of their more efficient execution, whereby the functions of smart contracts are implemented similarly to the Ethereum network (

Bartolović, 2018). The NEO blockchain environment is created by the NeoVirtual Machine (NeoVM) programming platform, and although smart contracts are written in code similar to those written on the Ethereum platform, NEO enables their creation not by one (Solidity) but by a large number of programming languages—VB.Net, C#, F#, Java, Python (e.g., version 3.7 or above), Kotlin, JavaScript, and Go (

Neo, 2024), thereby enabling the participation of a wide range of developers in the creation of smart contracts, even the direct transfer of already existing program code of the contract to the blockchain system (

Bartolović, 2018).

The smart contract is executed independently and instantly according to the principle of “given/when-then” statement written in code, i.e., at the moment when all the assumptions and circumstances contained in the code are satisfied, while autonomously verifying the authenticity of its content, i.e., the fulfilment of the assumption for its self-execution (

Perić, 2022). Upon the execution of the contract, i.e., the completion of the transaction, the blockchain is irreversibly updated, and only the contracting parties, i.e., those who are allowed to see its results, have insight into the transaction (

Perić, 2022). Drafting a contract according to the logic of a computer program has far less of a requirement for the involvement of a lawyer compared to drawing up a contract in a traditional form, and the need for notary certification is completely eliminated, which ultimately results in large financial savings for the contracting parties (

Perić, 2022). Since they are based on blockchain technology, the security of smart contracts guarantees the encryption of messages, which can only be read by contractual parties, i.e., users in the network who have been assigned a decryption key (

Bartolović, 2018;

Perić, 2022). With computer programming, it is possible to accurately specify the parameters of the value or objects of the contract (e.g., monetary amount or real estate data), thereby reliably protecting the interests of the contracting parties, except in rare but possible cases caused by errors in the program—in that case, immutability as a property of smart contracts becomes an (difficult to overcome) obstacle to their corrections (

Bartolović, 2018;

Perić, 2022). An example of smart contract enforcement is shown in

Figure 2.

Since smart contracts are executed exclusively within the digital world, the problem of achieving their necessary connection with contract objects from the real world is overcome by “oracle” computer programs, which “feed” digital network protocols with the necessary “physical” information (

Bartolović, 2018;

Peronja et al., 2020;

Blockchain Hub, 2023). In addition to providing them with data from external systems, oracle programs also determine what smart contracts execute using the given data (

Travaš, 2018). However, this raises the issue of the credibility of this information since the process of obtaining it is not decentralized but depends on the central server of some external system, e.g., company or financial institution, etc. (

Travaš, 2018).

Smart Contracts from a Legal Aspect

According to

Werbach and Cornell (

2017), US legal doctrine treats smart contracts as gentlemen’s agreements, which do not negate the legal nature of the contractual relationship and which seek to avoid litigation between the contracting parties in the case of different interpretations of contract execution. In 2018, a U.S. Senate report stated that while smart contracts might sound new, the concept is rooted in basic contract law (

Joint Economic Committee, 2018). Usually, the judicial system adjudicates contractual disputes and enforces them, but it is also common to have another arbitration method. With smart contracts, a program enforces the contract built into code. A number of US states have passed legislation on the use of smart contracts, such as Arizona, Nevada, Tennessee, Wyoming, and Iowa.

As Perić states in his thesis (

Perić, 2022), current legal theory interprets the operation of smart contracts “in addition to the law” (

extra legem), and not “against the law” (

contra legem), that is, it treats their nature on the border of what is legally permissible, until legal science and the profession fully investigate, analyze, and ultimately legally regulate them. Although the latter is in conflict with the architecture of blockchain technology as a decentralized system of equal partners protected by anonymity and mutual direct exchange of information through the network without the mediation of any regulator, it is nevertheless unavoidable if one wants to achieve their full legal acceptability by state (and/or supranational) bodies (

Allam, 2018;

Perić, 2022). Namely, since the smart contract becomes irreversible by its execution, i.e., difficult to change, with the absence of its legal norm, the user’s (most often property-)legal protection is also absent if, for example, a certain problem with the execution of the terms of the contract is established (

Allam, 2018;

Perić, 2022).

Within its program policies for the creation of a sustainable economy or a carbon-neutral Europe by 2050, the European Commission recognizes the adoption of digital trends and technologies as a leading strategy for its realization. The digital strategy of the European Union (EU), among other things, includes guidelines for ensuring protection from cyber threats, defining unambiguous regulations for online services, and adapting legal rules and regulations to the processes of the digital economy; apart from the fact that one of its focuses is directed toward the development of AI applications on the trust and security of its users, the EU wants to position itself in the world as a leader in the implementation of blockchain technology (

European Commission, 2020,

2023). The future of the application popularity of smart contracts in the EU countries depends primarily on the success of the Blockchain strategy implementation, as one of the fundamental steps in the economy transition to a digital one; namely, by recognizing the importance of ensuring the blockchain application users’ legal protection, the strategy’s ultimate goal is to create a unique, pan-European regulatory environment for the implementation of applications, the operation of the platforms that run them, and the activities of the companies that develop them (

European Commission, 2023).

Within legal theory, there is no consensus on the legal status of smart contracts. For example,

Perić (

2022) finds that the Croatian legal system, based on the Anglo-Saxon or EU legal acquis, according to current legal theory and regulations, does not recognize smart contracts as legally binding; namely, although by comparing their content with the content or elements—essential, natural, and accidental—of the contract in the traditional form, similarities can be observed, smart contracts clearly do not meet any of the legally regulated assumptions of the occurrence of legal effects of a contractual relationship—its creation, changes, and termination.

Mik (

2019), on the other hand, considers that smart contracts do not create new legal problems and that questions regarding their enforceability or validity are inherently misplaced. According to the author, smart contracts are not legal agreements but rather technologies automating the performance of obligations deriving from traditional contracts that exist or do not exist regardless of being encoded into smart contracts. Hence, a contract written in code is legally binding, assuming there is consideration and intention, the subject matter is not illegal, the parties have contractual capacity, and no vitiating factors are present since the source of the parties’ obligations is the agreement and not words or documents.

It is, therefore, the author’s conclusion that even though there are differences in opinion regarding the legal status of smart contracts, there are no legal obstacles to agreements between persons with legal capacity being written into code or expressed as smart contracts.

4. Application of Smart Contracts in the Bareboat Charter Financing Model

Trying to adapt to an acceptable level of market risk for owners or operators of commercial vessels, particularly cruise ships, and applying the possibility of the client/shipowner applying to state authorities for the issuance of a guarantee for the return of advance payments, and in accordance with the EU directives as a measure by the governments of European countries to improve the competitiveness of the shipbuilding industry (

EUR-Lex, 2023a), the observed shipyard system has been on the market for the last several years with the offer of construction and purchase of ships under the newbuilding lease model according to the provisions of the BIMCO contract form BARECON 2001 and 2017, respectively (

BIMCO, 2023). In addition to the shipyard and the owner, the model includes the charterer, the competent authority for issuing state guarantees—the Ministry of Finance (MF), and the State Supervision Organization (SSO) for the purpose of controlling that the payment conditions are met according to the agreed schedule of key events. Since the owner usually pays 80% of the project value with a loan from a commercial bank (lender), with a loan repayment term equal to the lease period of the newbuilding (most often 10 years), the possibility of contracting the financing model in question is conditioned by the issuance of a guarantee to the lender to secure the loan through its specified repayment period; the guarantee in question to secure the return of the loan is issued by the Export Credit Agency (ECA) from the country of incorporation of the shipyard/exporter, i.e., the country where the shipbuilding contract (SBC) is concluded. ECA is generally an institution founded either by the state, with private capital, or is in mixed, state-private ownership, but in any case, the state strategically monitors and/or shapes the programs of ECA, considering its extremely important role in supporting domestic companies in export placements of their products and services (

CFI Team, 2023;

Boyle, 2023). Namely, ECA offers export credit (EC), which, according to The Organisation for Economic Cooperation and Development (OECD) (

National Action Plans on Business and Human Rights, 2023), is classified as a classic loan arrangement, insurance of claims (of domestic companies, i.e., exporters), or a guarantee for credit insurance (for the “foreign” buyer, i.e., the importer), all for the purpose of enabling payment deferrals for delivered/exported products and services (

Boyle, 2023;

National Action Plans on Business and Human Rights, 2023). Payment deferral is approved for a certain period of time, so we distinguish between short-term, medium-term (repayment over a period of 2 to 5 years) and long-term EC (payment over a period longer than 5 years) (

CFI Team, 2023;

National Action Plans on Business and Human Rights, 2023). For its service, ECA calculates a value premium for the client in accordance with OECD guidelines; in addition to or instead of the premium, it can also calculate interest on the EC amount (

Boyle, 2023). Before the global economic crisis, i.e., in 2008, the role of ECAs in supporting the export of countries was minor, and their service was requested only in cases of high-risk export arrangements that private lenders were not willing to follow; however, after the crisis and the drastic drop in the offer of loans by commercial banks that are present in international trade, ECAs have become key partners to domestic companies in the export placement of goods and services (

CFI Team, 2023). Although ECAs work in accordance with the economic policies and prescribed regulations of their operating countries, in case there are significant differences, and for the purpose of ensuring fair trade, the procedures of ECAs must be harmonized with the guidelines of the World Trade Organization (WTO), to whose directives they are ultimately subjected (

CFI Team, 2023). In addition, OECD member states follow the recommendations of that body’s Council (The “Common Approaches”) in the approach of assessing the impact of export goods on the environment and the location of exports in general, before the decision on the approval of each individual EC (

OECD, 2025), and all with the aim of contributing to the socially responsible business on a global level (

National Action Plans on Business and Human Rights, 2023). Furthermore, EU member states are obliged, in accordance with EU Regulation 1233/2011, to submit an annual report on the work of their ECAs, based on which the European Parliament assesses their compliance with EU policies and objectives, with an emphasis on human rights and environmental protection (

National Action Plans on Business and Human Rights, 2023).

The model is based on financing the construction of the ship with the dynamics commonly applied in the referent industry in five equal payment instalments, conditioned by the fulfilment of key events: the effectiveness of SBC, beginning of processing (cutting) of ferrous metallurgy, laying of the ship’s keel, launching, and handover.

Figure 3 shows the dynamics of project realization with regard to five key events realized on average in the observed shipyard based on the example of three newbuildings of similar parameters from the cruise ship niche.

According to the directive of the EU authority (

European Commission, 2013), the MF issues a guarantee for advance payments in the amount of up to 80% of the value of the advance payments or up to 64% of the project value. The approved amount of state guarantee also depends on the possible participation of the shipyard in the ownership structure of the owner. For the remaining at least 20% of the advance payments’ value, the shipyard must provide a guarantee on a commercial basis through a private financial institution—bank or insurance company. Since the owner assigns the guarantees to the lender, the contractual text of the guarantees, otherwise attached to the shipbuilding contract, is previously (indirectly) agreed upon by the lender and the guarantee issuer.

Concerning the current practice of the observed shipyard system, the model assumes the issuance of a state guarantee at the highest possible value, provided that the precondition of settling the first advance payment from the owner’s funds is met. Since the MF issues the guarantee upon the occurrence of the second key event, the shipbuilder temporarily guarantees the owner the first advance payment with the guarantee of a commercial bank or insurance company. Although the main insurance instrument of state guarantee is mortgage (of the first order) on a newbuilding, its registration by MF is possible only after the keel has been laid since the occurrence of this (third) key event fulfills the prerequisite for the registration of the construction object in the ship register of the competent state authority. Therefore, the issuance of the state guarantee, i.e., the realization of the first advance payment from the loan (and upon the second key event), is previously conditioned by the issuance of a debenture by the shipyard in an amount equal to the value of the state guarantee for the period until the completion of the construction of the ship, particularly, its handover. Newbuilding is entered in the register as a ship under construction and owned by the shipyard. During the construction of the ship, the lender secures the loan, in addition to a state guarantee and lien on the shares of the owner’s company, by registering a second-order lien on the ship under construction; after the ship handover to the owner, i.e., the activation of the lease contract, the lender returns the state guarantee to the MF, which subsequently cancels its lien on the newbuilding. The loan is repaid during the lease period of the ship—ten years, in the case of the newbuildings analyzed in this paper. Besides the lien on the boat, but now of the first order, in addition to the transferred pledge on the shares of the owner’s company, the lender conditions additional credit protection instruments during the loan repayment period—the allocation of monthly bareboat rate/charter hire in their favor, as well as a corporative guarantee issued by the lessee, or, in case of insufficient value of the lessee’s assests, by an affiliated company. Moreover, and as stated earlier, the ECA issues a guarantee to the lender, in the value of up to 95% of the loan amount, to ensure repayment of the loan; however, it does not register a lien (second order) on the ship (now in the exploitation phase), but, in case of the necessity of activating the insurance instrument in question, contracts with the lender the collection from the sale of the ship in the value of 95% of the realized sales price; in this case, the jurisdiction over the possible sale of the ship is contracted in favor of the lender.

Figure 4 shows the (legal) structure of the relationship between the parties involved in the analyzed model of financing the construction and purchase of a ship, and the order of basic activities, i.e., transactions in the process, is clarified.

During the ship construction, the owner pays the lender the amount of the agreed interest on the loan in the dynamics of withdrawing credit funds, i.e., according to the schedule of four key events, starting with the event of processing/cutting of ferrous metallurgy; however, in the case of untimely use of the loan, and in accordance with the agreed schedule for the placement of credit trances, the owner also pays interest on the unused part of the loan for the period of delay in withdrawing the funds. The owner is obliged to pay the agreed amount of the EC premium to the issuer of the relevant guarantee 60 days before handing over the ship; normally, the lender approves the incorporation of the EC issuance cost into the total loan amount.

Along with paying the principal and interest on the loan, through a monthly lease, the lessee also pays the cost of the agreed interest on the owner’s 20% participation in the price of the newbuilding, which is used to pay the shipyard the first advance instalment. If the lease agreement (BBCA) of the ship also defines the option to purchase the ship at any time during the ten-year lease period, and/or the obligation to purchase the ship at the end of that period, the parties to the contract can also agree to settle the cost of interest on the owner’s participation in the entire amount at the time of the ship’s purchase.

Although recognized as attractive for clients, especially those engaged in the cruise market, whether they are only in the role of lessee or finally the ultimate owner of the ship, the presented model of financing the construction and purchase of the ship, due to the large number of its participants and consequently the legal complexity of the very process, represents a high risk to the shipyard in the sense of jeopardizing the newbuilding realization plan, i.e., disruption or delay in the dynamics of cash flow compared to the planned. Untimely settlement of obligations to suppliers and subcontractors, and thus untimely supply and installation of equipment, primarily endangers the calculated and planned advantages of ship outfitting in the earlier stages of construction from the cost and time aspect, but also from the aspect of worker health and safety. Regardless of whether the shipyard is allowed a delay in the project realization in regard to the terms of the SBC, and also whether the settlement of the shipyard’s costs caused by the delay—such as the cost of additional engaged working hours and energy due to ship outfitting in the later stages of construction, as well as costs of insurance, financing, protection of the facility under construction, and comprehensively general/overhead costs—is agreed upon, it ultimately results in a delay in comparative and further production activities for the realization of other projects, or in other words, disruption in the fulfilment of the shipyard’s business plan. Besides the shipbuilder, the delay in the dynamics of shipbuilding also causes the owner additional financing costs, both the ones for the period of the non-use of credit funds, and possibly those due to the later delivery of the ship and consequently the later start of the lease collection. Also, in the case of delayed delivery of the ship to the lessee, and depending on the provisions of the BBCA, the owner also bears the lessee’s damage caused by the delay in the ship’s exploitation, whereby the lessee, due to the cancelation or postponement of the start of the business arrangement (e.g., cruise or only the transport of passengers and/or cargo), additionally also suffers reputational damage, and if the conditions arise for the termination of the BBCA, the mutual damage is immeasurable.

With the aim of reducing or eliminating the risk of delay in the realization of the project due to a possible disruption in the process dynamics of the applied financing model, the authors of this paper theoretically investigate the applicability of blockchain technology—preferably, and given its properties, Hyperledger technology—for the purpose of managing the financing process or the control thereof. Namely, the Hyperledger blockchain is an upgrade of blockchain technology designed with the aim of cross-sector economic connection in a simple, transparent, and secure data exchange between distributed ledgers of various legal entities—industrial, service, government, and similar (

Travaš, 2018;

Educative, Inc., 2023). Since the network environment is created by interconnected distributed ledgers, Hyperledger enables the decentralization of oracle programs, that is, it eliminates the possibility of data manipulation obtained with smart contracts from other, external systems (

Travaš, 2018).

Since all stakeholders in the financing process are known, but have no mutual trust or trust in independent intermediaries, and considering the high frequency of transactions in the process and thus possible savings by shortening their implementation (seconds or minutes instead of days or weeks), as well as the requirement to maintain copies of data in multiple distributed computers, i.e., ledgers, there is undoubtedly a need to create a permissioned blockchain system (

Czachorowski et al., 2019;

Peck, 2017). Furthermore, and in accordance with the necessities of the process, the permissioned system enables the privacy of transaction data, provides protection against external attacks, and allows multiple users of the system to update data (

Peck, 2017). Ultimately, it is the permissioned blockchain that applies the concept of smart contracts and, at the same time, enables monitoring of their programming or changes (

Czachorowski et al., 2019;

Peck, 2017).

5. Results and Discussion

In this chapter, the steps or activities of the financing process according to (key) events are described in the supply chain range from the lessee to key suppliers and subcontractors. On the basis of data collected through interviews and discussions with representatives of the relevant functional units of the shipyard and law offices, the average duration of preparation, implementation, and adoption of each individual activity is presented up until the payment realization (materials, equipment, and work), i.e., ultimately the sale/handover of the ship (“transactions”), depending on the step of the process, i.e., the (key) event.

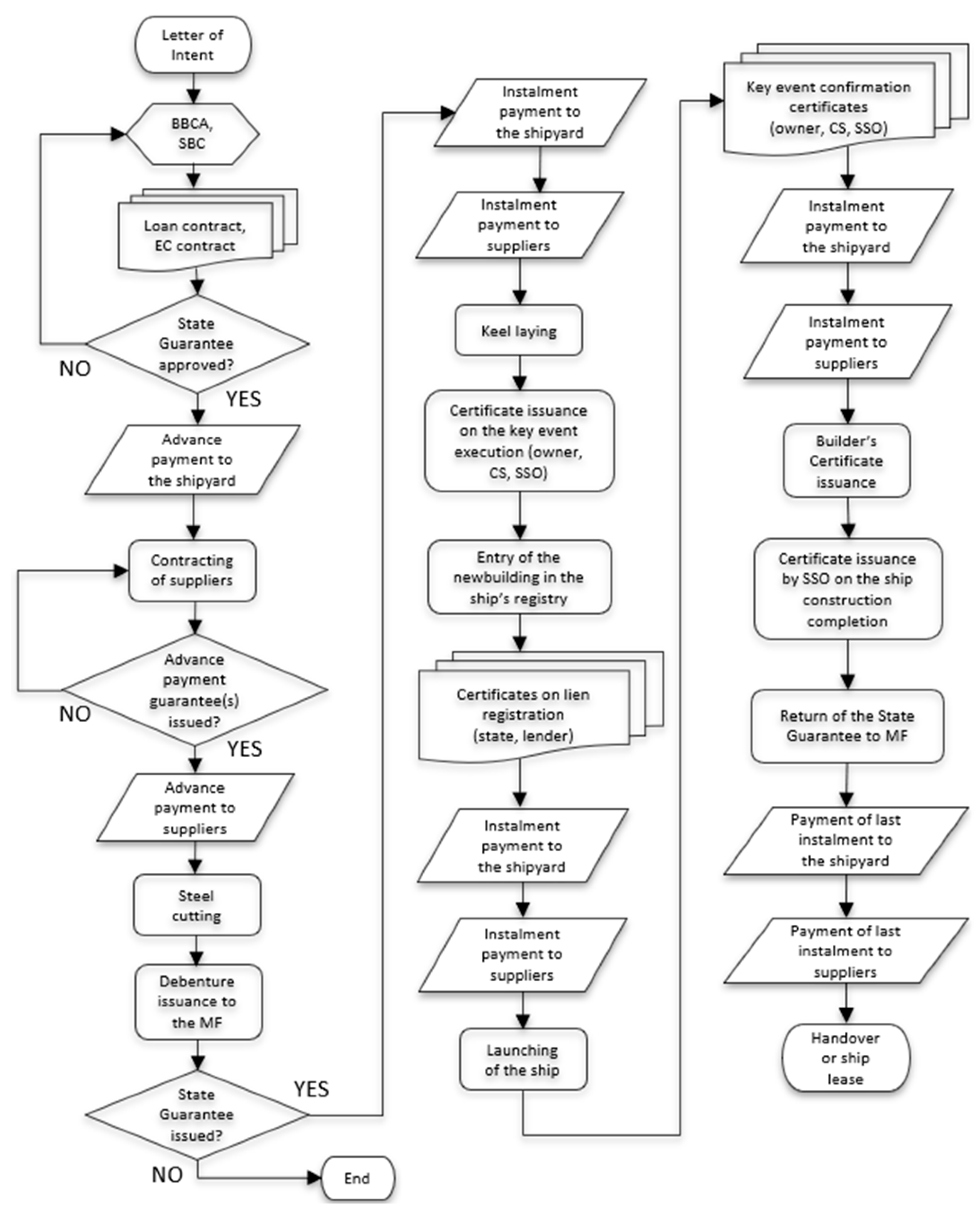

Considering the (key) events in the realization of the shipbuilding project, the authors of the research describe the activities of the financing process through eight steps (from A to H), as shown in

Figure 5.

Figure 6 shows the simplified flow chart of the process of financing the construction and purchase of a vessel according to a long-term bareboat charter model.

In accordance with the activities of the financing process and based on the authors’ theoretical and empirical (new) findings on blockchain technology, the structure of transaction verification using the software application of smart contracts was applied in the research. Also, the theoretical improvements that can be achieved in the financing process and the realization of the construction and purchase of the ship through the observed model were analyzed.

The applicability of the blockchain application of smart contracts is firstly recognized by the authors in regard to its property of extremely precise, i.e., unequivocal, indication of contractual terms and conditions, and based on “if-then” statements—with regard to the automatic execution of smart contracts, this property has the effect of significantly reducing or even eliminating the possibility of breach of contract, delays in fulfilling the provisions of the contract, different interpretations of contractual conditions, and the like (

Allam, 2018). In addition, the relevant contractual terms and conditions for a particular transaction are fully visible to other nodes in the network, which ensures (independent) monitoring of transactions, i.e., the impossibility of subsequent changes to the terms of the contract—the transparency of transactions thus achieved eliminates the possibility of manipulation or, in the worst case, fraud of the contracting parties (

Allam, 2018). From the mentioned features comes the speed or efficiency of the contract execution—namely, since they are computer programs, smart contracts make decisions independently, that is, they are self-executing depending on the fulfilment of prerequisites, thus avoiding the need for external institutional/human “interference” in transactions; rather, they are monitored by users in the network (

Allam, 2018;

Kõlvart et al., 2016). Given that non-trusting parties participate in the process of financing the construction and purchase of a ship, the security of transactions achieved by cryptographic information protection is another feature of smart contracts recognized as being of great importance for their applicability (

Allam, 2018). In conclusion, the possibility of achieving significant savings in the realization of shipbuilding projects by minimizing the volume of intermediary services and even by completely excluding them from the process is of crucial importance for the implementation of smart contracts (

Allam, 2018).

However, the authors recognize a significant ethical issue in implementing blockchain technology in supply chain processes, considering the question of transparency versus privacy. While the transparency of blockchain transactions could greatly reduce fraud and corruption by making transactions publicly verifiable, this may conflict with the need for confidentiality in financial transactions and the necessity of preventing access to sensitive data of unauthorized parties and possible privacy violations. This emphasizes the need for data security. The launch of reference programs, i.e., smart contracts within a private or consortium network, is assumed. Furthermore, if the necessary level of IT, corporate, or regulatory environment is ensured, the highest level of confidentiality, security, flexibility, and scalability of the process would be enabled by programming or executing smart contracts with the Hyperledger Fabric software platform (

Travaš, 2018;

LF Decentralized Trust, 2023). Its main features make it applicable in various industries and activities (

Travaš, 2018;

IBM, 2023). Namely, in addition to its modular architecture, the Hyperledger Fabric platform forms a managed or permissioned blockchain system, thus enabling separate, “private” transactions between users through separate “channels” without disrupting the functioning of the umbrella infrastructure (

LF Decentralized Trust, 2023). Furthermore, while supporting various consensus algorithms, Hyperledger Fabric does not preclude the use of any of the cryptocurrencies; in addition, it also enables writing smart contracts in different, already-established programming languages such as Javascript, Python, Java or Go (

Travaš, 2018;

LF Decentralized Trust, 2023). Given the multi-party supply chain environment, the BFT consensus algorithm is assumed, which, however, also raises an ethical issue, considering the ecological footprint of the subject algorithm—namely, BFT is based on PoW, the most energy-consuming consensus protocol (

Sapkota & Grobys, 2021;

Hyperledger, 2024).

5.1. Effectiveness of the Shipbuilding Contract; Steel Purchase Order

After receiving an inquiry from the client (investor, owner) and signing a non-disclosure agreement (NDA), which mainly relates to the client’s concept design (preliminary General Arrangement and the technical outline of the ship), the shipyard prepares a preliminary offer for the construction of the ship, and, in the case of its acceptance, signs a Letter of Intent (LOI) with the client and lessee. When the letter is signed, over the next approximately four months, the shipyard, together with the technical and commercial teams of the client or lessee, works on the activities of establishing the ship and working out its technical description with the aim of defining the contractual technical documentation (initial design), which also includes an optional list of suppliers of key outfit and materials. Defining the key outfit (engines, generators, air conditioning devices, and others, demanding in terms of volume and weight—approximately 20 outfit units) is not only necessary for the purpose of preparing the final calculation or contract price of the ship but also for the purpose of developing the Digital Twin; namely, the positioning of virtual 3D models of the key outfit and systems in the digital prototype of the ship enables the definition of optimal technical–technological solutions for its installation in the later stages of modeling. By means of virtual 3D modeling of the ship through the initial design phase, an “Early phase Digital twin ship” is created (

Kunkera et al., 2022;

European Commission, 2023). The stages of project development up to the signing of the shipbuilding contract are shown in

Figure 7.

For the further development of the 3D model of the ship and its evolution into a “Prototype of a Digital twin ship” (

Gierin & Dyck, 2021;

Kunkera et al., 2022), as well as the creation of the basic design, the shipyard needs detailed documentation of the key outfit, which suppliers usually charge. Furthermore, for the timely supply of ferrous metallurgy (with an emphasis on steel plates), making an (advance) payment at the earliest stage of project implementation is also necessary. Therefore, in the period between the signing of the SBC and its effectiveness, the appropriate functioning units of the shipyard analyze in detail the technical and commercial conditions of the supplier, including delivery deadlines, with the aim of choosing the preferred one among the optionally defined ones (in accordance with the approved list of suppliers, as part of the contractual technical documentation). Work on 3D modeling depends, to a large extent, on the data from the technical documentation for the outfit supplied by the owner (“owner’s supply”); therefore, the owner is obliged to submit the relevant documentation no later than the effectiveness of the SBC. The effectiveness of the SBC is usually reached within a period of 90 days from its signing. Upon its effectiveness, the shipyard pays the amount to the previously selected key suppliers for the supply of the technical and technological documentation for the outfit.

According to the shipyard’s standard construction plan, applied to the observed three cruise ships of similar parameters, orders of ferrous metallurgy are placed (for steel plates mostly in their entirety) after approximately five months from the effectiveness of the contract, but with advance payment of almost the full amount of the purchase value, except for the part retained until the receipt of the material. During the same period, the relevant functional units of the shipyard complete technical and commercial negotiations with the main outfit suppliers with the aim of realizing the procurement contract, i.e., payment of advance no later than approximately six months after the effectiveness of the contract, with the aim of achieving timely outfitting of sections, i.e., hull blocks.

Table 1 describes the activities of the (legal) steps of the financing process, from the signing of the letter of intent to contract the construction and purchase or lease of the ship to the first order of outfit and materials, with the participants in each listed activity. Furthermore, the empirically established average times for the execution of activities within each individual step of the process managed by the traditional approach are listed.

Documents are typically prepared concurrently within each individual step. After the preparation of (legal) activities, their implementation follows, and then the adoption of reference documents. The implementation or adoption of activities is carried out sequentially in sub-steps (e.g., there are five sub-steps within step C, with tabular markings from C.1 to C.5). Within the same sub-step, multiple activities can be implemented or adopted concurrently.

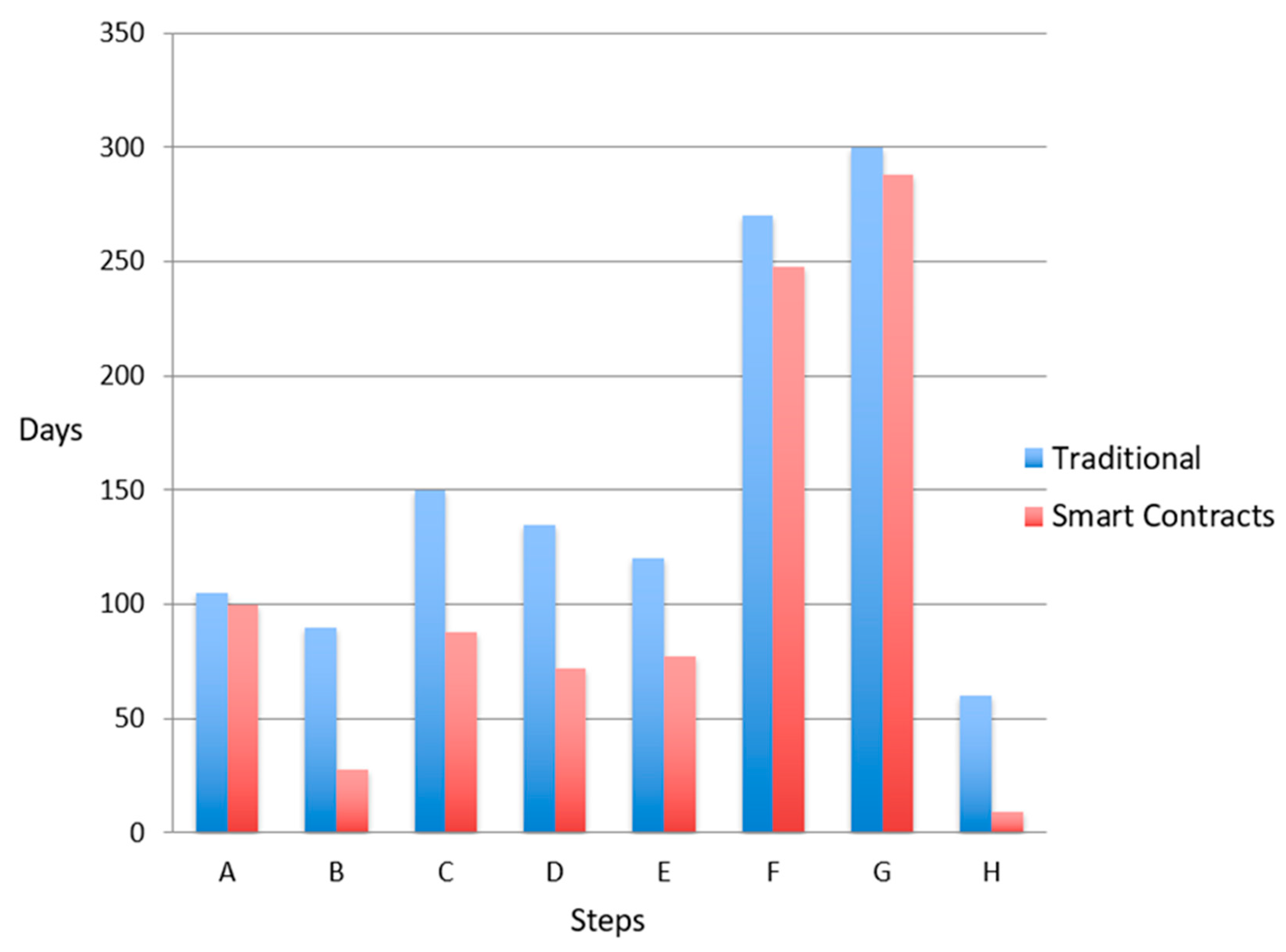

By conducting the financing process with smart contracts, the time frames of implementing activities and adopting documents are annulled due to the automaticity of their execution, while the duration of document preparation is kept within the time frames of the traditional process, given the implied necessity of conducting legal and commercial negotiations between stakeholders in the process. The authors start from the assumption that the programming of smart contracts takes place precisely during the negotiations regarding the content and structure of the prerequisites for transactions.

Taking into account the longest duration of sub-steps (

max(

tSUB)) within each individual step, the research results in the possibility of shortening the duration (Δt

S) of that step according to the following expression:

where

n is the total number of sub-steps.

Thus, step B of the financing process, normally lasting approximately 3 months in the traditional way of management, can be shortened (Δt

B) by up to 62 days, calculated as follows:

whereby such a significant reduction in the step period primarily refers to the elimination of the typically slow implementation of activities or the adoption of documents by government institutions.

Moreover, in the analysis of the longest average times of step C’s sub-steps, the average duration of which is 5 months, it is possible to shorten the process with smart contracts by approximately 62 days. Finally, the duration of step A is reduced by an average of 5 days.

5.2. Construction of the Ship to the Launch

Table 2,

Table 3 and

Table 4 present the empirically determined average times for the execution of legal activities in the steps of the traditionally controlled financing process, from the order of ferrous metallurgy to steel cutting (step D), through the next key event, i.e., the laying of the keel (step E), and up to the penultimate in the process of the project realization—launching the ship (step F).

Table 1.

Activities of the financing process from the LOI to the order of ferrous metallurgy (steps A, B, and C).

Table 1.

Activities of the financing process from the LOI to the order of ferrous metallurgy (steps A, B, and C).

| Activity | Transaction | CH 1 | OW 2 | SH 3 | ECA | MF | SSO | LE 4 | OWB 5 | SHB 6 | SU 7 | SUB 8 | Preparation of Documents | Implementation of Activities (Handover of Documents) | Adoption of Document (i.e., Delivery to Where It Is Needed) | AE 9 | AR 10 |

|---|

| | | | | | | | | | | | | | Step | Time (d) | Step | Time (d) | Sub step | Step | Time (d) | Sub step | | |

| Conclusion of the BBCA | | ● 11 | ● | ○ 12 | | | | | | | | | A | 80 | A | 4 | A.1 | B | 7 | B.1 | x | |

| Conclusion of the SBC | | ○ | ● | ● | | | | | | | | | A | 90 | A | 5 | A.1 | B | 7 | B.1 | x | |

| Contract conclusion on the lender’s right of lien over the owner’s shares | | | ● | | | | | ● | | | | | A | 40 | B | 5 | B.2 | D | 3 | D.1 | x | |

| Corporate guarantee issuance of the lessee to the lender | | ● | ○ | | | | | ● | | | | | A | 30 | B | 8 | B.2 | D | 7 | D.2 | x | |

| Contract conclusion on the assignment of the lease to the lender | | ● | ○ | | | | | ● | | | | | A | 15 | B | 7 | B.2 | D | 6 | D.2 | x | |

| Loan Contract conclusion to the owner | | ○ | ● | ○ | | | | ● | | | | | A | 70 | B | 10 | B.2 | D | 10 | D.2 | x | x |

| EC Contract conclusion to the lender | | | ○ | | ● | | | ● | | | | | A | 60 | D | 15 | D.2 | G | 12 | G.1 | x | |

| Guarantee issuance to the owner to secure the first advance payment | | | ● | ○ | | | | | | ● | | | A | 30 | B | 10 | B.1 | B | 5 | B.2 | x | x |

| Certificate issuance to the MF on the contractual documentation acceptability | | ○ | ○ | ○ | | ● | ● | | | | | | A | 30 | B | 15 | B.2 | B | 15 | B.3 | | |

| Approval of the State Guarantee by the MF or the Government of the issuing country | | | ● | ○ | | ● | ○ | ● | | | | | B | 35 | B | 25 | B.3 | B | 15 | B.4 | x | |

| | Shipbuilding Contract effective—advance payment to the shipyard | | ○ | ○ | | | | | ● | ● | | | | | | | | | | | | |

| Contract conclusion on the procurement of the ferrous metallurgy | | | | ● | | | | | | | ● | | B | 25 | B | 15 | B.3 | C | 7 | C.1 | x | |

| Guarantee issuance to the shipyard for advance payment of ferrous metallurgy | | | | ● | | | | | | | ○ | ● | B | 20 | B | 12 | B.4 | C | 10 | C.1 | x | |

| Guarantee issuance to the ferrous metallurgy supplier for the withheld amount payment | | | | ○ | | | | | | ● | ● | | B | 20 | C | 15 | C.1 | C | 8 | C.2 | x | |

| | Advance payment to the ferrous metallurgy supplier | | | ○ | | | | | | ● | ○ | ● | | | | | | | | | | |

| Preliminary Contract conclusion for key equipment | | | | ● | | | | | | | ● | | B | 40 | B | 10 | B.4 | C | 7 | C.1 | x | |

| | Payment for technical documentation of key equipment | | | ○ | | | | | | ● | ○ | ● | | | | | | | | | | |

| Contract conclusion on the purchase of key equipment | | | | ● | | | | | | | ● | | C | 22 | C | 15 | C.3 | C | 7 | C.4 | x | |

| Guarantee issuance to the shipyard for advance payment | | | | ● | | | | | | | ○ | ● | C | 18 | C | 10 | C.4 | C | 10 | C.5 | x | |

| Payment guarantee issuance to the supplier | | | | ○ | | | | | | ● | ● | | C | 20 | C | 14 | C.4 | C | 8 | C.5 | x | |

| | Order/payment of ferrous metallurgy; Advance payment for key equipment | | | ○ | | | | | | ● | ○ | ● | | | | | | | | | | |