Implementation of Sustainability Strategies in Operations and Abnormal Stock Returns Under Uncertainty: Evidence from Companies Listed on the Vietnamese Stock Market During the COVID-19 Outbreak

Abstract

1. Introduction

2. Materials and Methods

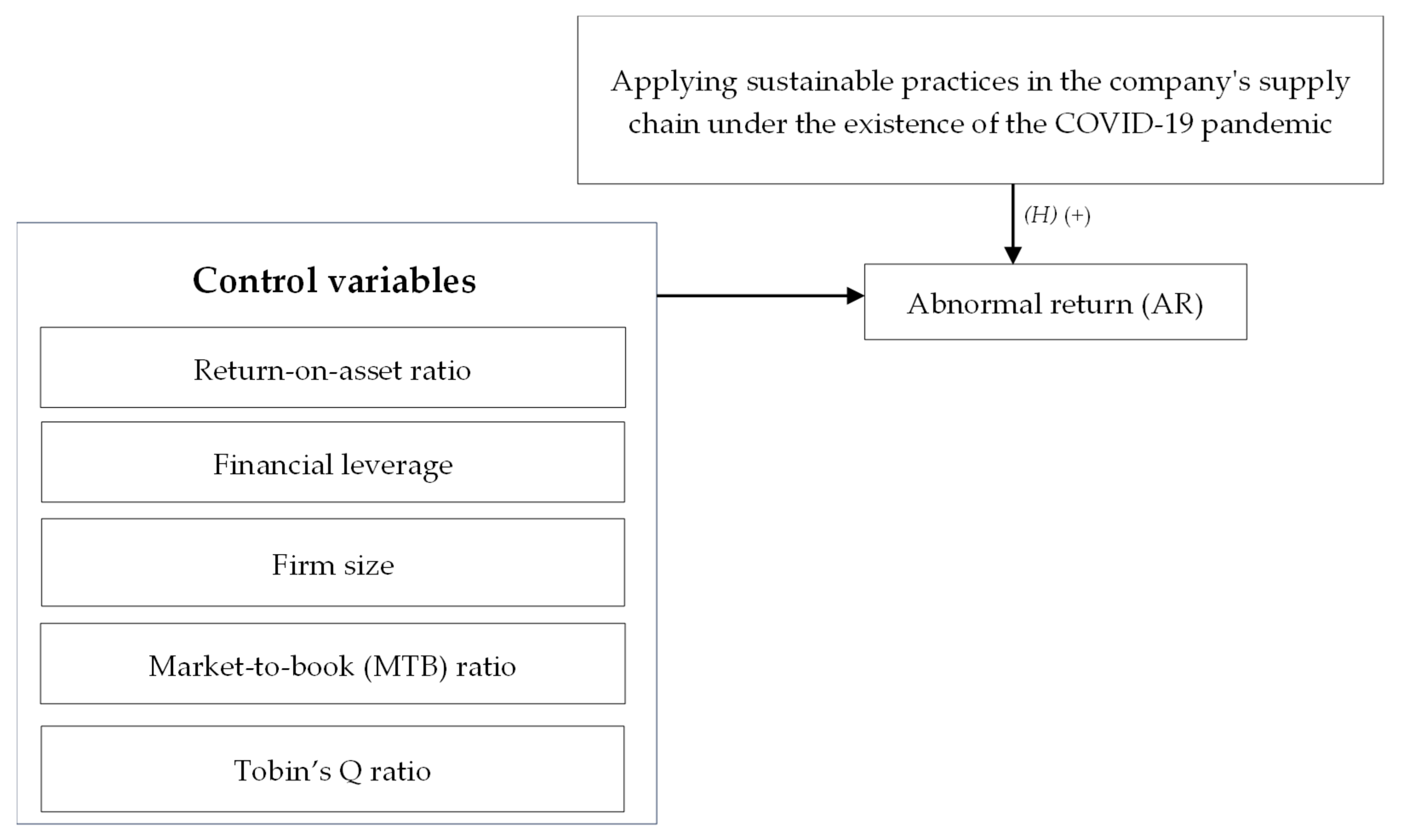

2.1. Research Framework and Hypotheses

2.2. Data Collection

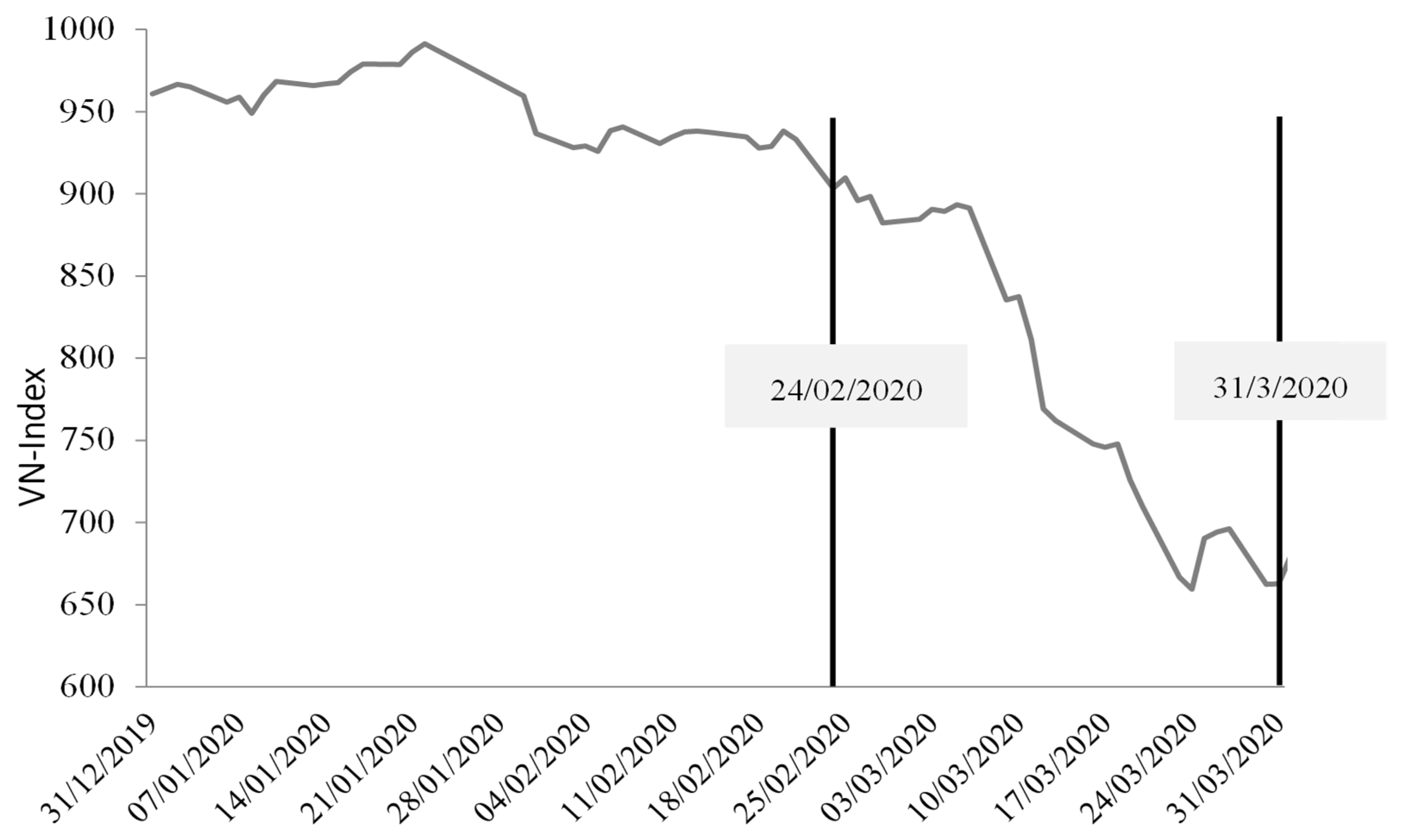

- The period from 2 January 2020 to 31 March 2020 captured the overall effects of the COVID-19 pandemic on the Vietnamese stock market during the first quarter of 2020 and was utilized to assess the general effects of the pandemic on abnormal stock returns.

- The period between 2 January 2020 and 23 February 2020 served as a baseline, representing the stock market conditions before the widespread recognition of the negative impacts of the COVID-19 pandemic to establish a benchmark for comparison against the period affected by the pandemic.

- The period from 24 February 2020 to 31 March 2020 was considered the starting date for when the negative impacts of the COVID-19 pandemic on the economy, society, and global stock markets were first reported (Albuquerque et al., 2020; Fasan et al., 2021; Ramelli & Wagner, 2020). This period was used as an event window to assess the impact of the COVID-19 outbreak and compare the changes in abnormal returns between companies that did and did not implement sustainability strategies during the outbreak. During this period, the VN-Index also experienced a significant decline owing to negative news related to the COVID-19 pandemic, both globally and in Vietnam.

- The period from 11 March 2020 to 31 March 2020 was used as the second event window, aiming to emphasize the impact of global news of the COVID-19 outbreak on the differences in abnormal stock returns of companies that did and did not implement sustainability strategies in their operations.

2.3. Data Analysis

- Step 1: Estimate the ratio of the return rate of the market on day tth to the return rate of stock ith on day tth based on the regression shown in Equation (1). The dataset used for estimation was obtained from the daily data of the return rate of the market and return rate of stock data during the period from 2 January to 31 December 2019 of 107 companies (equivalent 26,750 observations).

- Step 2: investigate the abnormal return of ith based on the transformed function, as presented in Equation (4):

3. Results and Discussion

3.1. The Impact of Implementing Sustainability Strategies in Operations on Abnormal Stock Returns of Companies Listed on the Vietnam Stock Market Between 2 January 2020 and 31 March 2020

3.2. Difference-in-Differences (DID) Analysis for the Impact of Implementing Sustainability Strategies in Operations on the Abnormal Stock Returns of Companies Listed on the Vietnamese Stock Market During the COVID-19 Pandemic

4. Discussion

5. Conclusions and Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Abbas, H., & Tong, S. (2023). Green supply chain management practices of firms with competitive strategic alliances—A study of the automobile industry. Sustainability, 15(3), 2156. [Google Scholar] [CrossRef]

- Acheampong, P., Agalega, E., & Shibu, A. K. (2014). The effect of financial leverage and market size on stock returns on the Ghana stock exchange: Evidence from selected stocks in the manufacturing sector. International Journal of Financial Research, 5(1), 125–134. [Google Scholar] [CrossRef]

- Adelman, M. A. (1951). The measurement of industrial concentration. The Review of Economics and Statistics, 33, 269–296. [Google Scholar] [CrossRef]

- Agustina, M. P., & Pawestri, H. P. (2023, January 30–31). Effect of return on equity, debt to asset ratio, and inflation rate on the value of the company [Conference session]. Conference on Economic and Business Innovation (CEBI) (pp. 22–32), Sydney, Australia. [Google Scholar]

- Ahmar, A. S., & Del Val, E. B. (2020). SutteARIMA: Short-term forecasting method, a case: COVID-19 and stock market in Spain. Science of the Total Environment, 729, 138883. [Google Scholar] [CrossRef] [PubMed]

- Ahmed, H., Al Bashar, M., Taher, M. A., & Rahman, M. A. (2024). Innovative approaches to sustainable supply chain management in the manufacturing industry: A systematic literature review. Global Mainstream Journal of Innovation, Engineering & Emerging Technology, 3(02), 1–13. [Google Scholar] [CrossRef]

- Ahmed, W., Ahmed, W., & Najmi, A. (2018). Developing and analyzing framework for understanding the effects of GSCM on green and economic performance: Perspective of a developing country. Management of Environmental Quality: An International Journal, 29(4), 740–758. [Google Scholar] [CrossRef]

- Al-Awadhi, A. M., Alsaifi, K., Al-Awadhi, A., & Alhammadi, S. (2020). Death and contagious infectious diseases: Impact of the COVID-19 virus on stock market returns. Journal of Behavioral and Experimental Finance, 27, 100326. [Google Scholar] [CrossRef]

- Albuquerque, R., Koskinen, Y., Yang, S., & Zhang, C. (2020). Resiliency of environmental and social stocks: An analysis of the exogenous COVID-19 market crash. The Review of Corporate Finance Studies, 9(3), 593–621. [Google Scholar] [CrossRef]

- Amankwah-Amoah, J. (2020). Stepping up and stepping out of COVID-19: New challenges for environmental sustainability policies in the global airline industry. Journal of Cleaner Production, 271, 123000. [Google Scholar] [CrossRef]

- Anh, D. L. T., & Gan, C. (2020). The impact of the COVID-19 lockdown on stock market performance: Evidence from Vietnam. Journal of Economic Studies, 48(4), 836–851. [Google Scholar] [CrossRef]

- Arslan, M., Zaman, R., & Phil, M. (2014). Impact of dividend yield and price earnings ratio on stock returns: A study non-financial listed firms of Pakistan. Research Journal of Finance and Accounting, 5(19), 68–74. Available online: https://dl1.vatanfile.ir/03/3f31a4d6ed473a7e454a.pdf (accessed on 15 June 2021).

- Ashraf, B. N. (2020). Stock markets’ reaction to COVID-19: Cases or fatalities? Research in International Business and Finance, 54, 101249. [Google Scholar] [CrossRef] [PubMed]

- Baker, S. R., Bloom, N., Davis, S. J., Kost, K., Sammon, M., & Viratyosin, T. (2020). The unprecedented stock market reaction to COVID-19. The Review of Asset Pricing Studies, 10(4), 742–758. [Google Scholar] [CrossRef]

- Barbosa, M. W., & Cansino, J. M. (2024). The impacts of environmental collaboration on the environmental performance of agri-food supply chains: A mediation-moderation analysis of external pressures. International Journal of Logistics Research and Applications, 27, 2712–2736. [Google Scholar] [CrossRef]

- Barney, J. B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120. [Google Scholar] [CrossRef]

- Barney, J. B. (2018). Why resource-based theory’s model of profit appropriation must incorporate a stakeholder perspective. Strategic Management Journal, 39(13), 3305–3325. [Google Scholar] [CrossRef]

- Baskin, J. (1989). Dividend policy and the volatility of common stocks. Journal of Portfolio Management, 15(3), 19. [Google Scholar] [CrossRef]

- Bhat, D. A., Chanda, U., & Bhat, A. K. (2020). Does firm size influence leverage? Evidence from India. Global Business Review, 24(1), 21–30. [Google Scholar] [CrossRef]

- Borusyak, K., Jaravel, X., & Spiess, J. (2024). Revisiting event study designs: Robust and efficient estimation. Review of Economic Studies, 91(6), 3253–3285. [Google Scholar] [CrossRef]

- Brigham, E. F., & Houston, J. F. (2019). Fundamentals of financial management. Cengage Learning. [Google Scholar]

- Burritt, R. L., Schaltegger, S., Bennett, M., Pohjola, T., & Csutora, M. (2011). Environmental management accounting and supply chain management (Vol. 27). Springer Science & Business Media. [Google Scholar] [CrossRef]

- Carter, C. R., & Rogers, D. S. (2008). A framework of sustainable supply chain management: Moving toward new theory. International Journal of Physical Distribution & Logistics Management, 38(5), 360–387. [Google Scholar] [CrossRef]

- Castro-Iragorri, C. (2019). Does the market model provide a good counterfactual for event studies in finance? Financial Markets and Portfolio Management, 33, 71–91. [Google Scholar] [CrossRef]

- Chavez, R., Yu, W., Feng, M., & Wiengarten, F. (2016). The effect of customer-centric green supply chain management on operational performance and customer satisfaction. Business Strategy and the Environment, 25(3), 205–220. [Google Scholar] [CrossRef]

- Chiang, C., & Chuang, M.-C. (2024). Effect of Sustainable Supply Chain Management on Procurement Environmental Performance: A Perspective on Resource Dependence Theory. Sustainability, 16(2), 586. [Google Scholar] [CrossRef]

- Chiou, T.-Y., Chan, H. K., Lettice, F., & Chung, S. H. (2011). The influence of greening the suppliers and green innovation on environmental performance and competitive advantage in Taiwan. Transportation Research Part E: Logistics and Transportation Review, 47(6), 822–836. [Google Scholar] [CrossRef]

- Damert, M., Koep, L., Guenther, E., & Morris, J. (2021). Stakeholders and socially responsible supply chain management: The moderating role of internationalization. Sustainability Accounting, Management and Policy Journal, 12(4), 667–694. [Google Scholar] [CrossRef]

- Dang Ngoc, H., Vu Thi Thuy, V., & Le Van, C. (2021). COVID 19 pandemic and Abnormal Stock Returns of listed companies in Vietnam. Cogent Business & Management, 8(1), 1941587. [Google Scholar] [CrossRef]

- Danso, A., Adomako, S., Amankwah-Amoah, J., Owusu-Agyei, S., & Konadu, R. (2019). Environmental sustainability orientation, competitive strategy and financial performance. Business Strategy and the Environment, 28(5), 885–895. [Google Scholar] [CrossRef]

- Darnall, N., Welch, E. W., & Cho, S. K. (2019). Sustainable supply chains and regulatory policy. In Handbook on the sustainable supply chain (pp. 513–525). Edward Elgar Publishing. [Google Scholar] [CrossRef]

- de Oliveira, U. R., Espindola, L. S., da Silva, I. R., da Silva, I. N., & Rocha, H. M. (2018). A systematic literature review on green supply chain management: Research implications and future perspectives. Journal of Cleaner Production, 187, 537–561. [Google Scholar] [CrossRef]

- Dhasmana, S., Ghosh, S., & Kanjilal, K. (2023). Does investor sentiment influence ESG stock performance? Evidence from India. Journal of Behavioral and Experimental Finance, 37, 100789. [Google Scholar] [CrossRef]

- Do, A., Nguyen, Q., Nguyen, D., Le, Q., & Trinh, D. (2020a). Green supply chain management practices and destination image: Evidence from Vietnam tourism industry. Uncertain Supply Chain Management, 8(2), 371–378. [Google Scholar] [CrossRef]

- Do, A. D., Nguyen, Q. V., Le, Q. H., & Van Loi, T. A. (2020b). Green supply chain management in Vietnam industrial zone: Province-level evidence. The Journal of Asian Finance, Economics and Business, 7(7), 403–412. Available online: https://pdfs.semanticscholar.org/1b6e/846c3f44d466e9cc9dcc2980a3289fbeb68f.pdf (accessed on 15 June 2021). [CrossRef]

- Dong, K. T. P., Hoa, N. T. N., Hiep, T. C., & Truc, T. V. T. (2023). The impact of banking relationship on firm performance: Evidence from Ho Chi Minh Stock Exchange, Vietnam. International Journal of Business and Society, 24(2), 711–726. [Google Scholar] [CrossRef]

- Durugbo, C., & Amankwah-Amoah, J. (2019). Global sustainability under uncertainty: How do multinationals craft regulatory policies? Corporate Social Responsibility and Environmental Management, 26(6), 1500–1516. [Google Scholar] [CrossRef]

- Emerson, R. M. (1962). Power-dependence relations. American Sociological Review, 27(1), 31–41. [Google Scholar] [CrossRef]

- Fama, E. F., & French, K. R. (1992). The cross-section of expected stock returns. The Journal of Finance, 47(2), 427–465. [Google Scholar] [CrossRef]

- Fasan, M., Soerger Zaro, E., Soerger Zaro, C., Porco, B., & Tiscini, R. (2021). An empirical analysis: Did green supply chain management alleviate the effects of COVID-19? Business Strategy and the Environment, 30(5), 2702–2712. [Google Scholar] [CrossRef]

- Feng, M., Yu, W., Wang, X., Wong, C. Y., Xu, M., & Xiao, Z. (2018). Green supply chain management and financial performance: The mediating roles of operational and environmental performance. Business Strategy and the Environment, 27(7), 811–824. [Google Scholar] [CrossRef]

- Freeman, R., & Phillips, R. A. (2002). Stakeholder Theory: A Libertarian Defense. Business Ethics Quarterly, 12(3), 331–349. [Google Scholar] [CrossRef]

- Freeman, R. E. (1984). Strategic management: A stakeholder approach. Pitman Publishing Inc. [Google Scholar]

- Freeman, R. E. (2010). Strategic management: A stakeholder approach. Cambridge university press. [Google Scholar]

- Fu, M., & Shen, H. (2021). COVID-19 and corporate performance in the energy industry. Energy Research Letters, 1(1), 1–4. [Google Scholar] [CrossRef]

- Givens, l. (2024). resilience to supply chain disruptions: An investigation of the roles of innovativeness and green supply chain management practices during the COVID-19 pandemic [University of South Alabama Institutional Repository]. Available online: https://jagworks.southalabama.edu/theses_diss/182 (accessed on 10 August 2024).

- Godfrey, P. C., Merrill, C. B., & Hansen, J. M. (2009). The relationship between corporate social responsibility and shareholder value: An empirical test of the risk management hypothesis. Strategic Management Journal, 30(4), 425–445. [Google Scholar] [CrossRef]

- Gong, Y., Jiang, Y., & Jia, F. (2023). Multiple multi-tier sustainable supply chain management: A social system theory perspective. International Journal of Production Research, 61(14). [Google Scholar] [CrossRef]

- Green, K. W., Jr., Zelbst, P. J., Meacham, J., & Bhadauria, V. S. (2012). Green supply chain management practices: Impact on performance. Supply Chain Management: An International Journal, 17(3), 290–305. [Google Scholar] [CrossRef]

- Hamdy, O. M. M., Elsayed, K. K., & Elahmady, B. (2018). Impact of sustainable supply chain management practices on Egyptian companies’ performance. European Journal of Sustainable Development, 7(4), 119–130. [Google Scholar] [CrossRef]

- Hardiningsih, P., Januarti, I., Yuyetta, E. N. A., Srimindarti, C., & Udin, U. (2020). The effect of sustainability information disclosure on financial and market performance: Empirical evidence from Indonesia and Malaysia. International Journal of Energy Economics and Policy, 10(2), 18–25. [Google Scholar] [CrossRef]

- He, H., & Harris, L. (2020). The impact of COVID-19 pandemic on corporate social responsibility and marketing philosophy. Journal of Business Research, 116, 176–182. [Google Scholar] [CrossRef]

- He, Q., Liu, J., Wang, S., & Yu, J. (2020). The impact of COVID-19 on stock markets. Economic and Political Studies, 8(3), 275–288. [Google Scholar] [CrossRef]

- Herwany, A., Febrian, E., Anwar, M., & Gunardi, A. (2021). The influence of the COVID-19 pandemic on stock market returns in Indonesia stock exchange. The Journal of Asian Finance, Economics and Business, 8(3), 39–47. [Google Scholar] [CrossRef]

- Hiển, L. M., Vĩnh, N. Q., Hưng, P. T., & Vân, P. T. T. (2021). Nhân tố ảnh hưởng đến quản trị chuỗi cung ứng xanh tại các khách sạn trên địa bàn Hà Nội. Tạp Chí Tài Chính, 1. Available online: https://tapchitaichinh.vn/tai-chinh-kinh-doanh/nhan-to-anh-huong-den-quan-tri-chuoi-cung-ung-xanh-tai-cac-khach-san-tren-dia-ban-ha-noi-336802.html (accessed on 10 July 2022).

- Hmouda, A. M. O., Orzes, G., & Sauer, P. C. (2024). Sustainable supply chain management in energy production: A literature review. Renewable and Sustainable Energy Reviews, 191, 114085. [Google Scholar] [CrossRef]

- Hoang, T., Przychodzen, W., Przychodzen, J., & Segbotangni, E. A. (2020). Does it pay to be green? A disaggregated analysis of US firms with green patents. Business Strategy and the Environment, 29(3), 1331–1361. [Google Scholar] [CrossRef]

- Hoejmose, S. U., Roehrich, J. K., & Grosvold, J. (2014). Is doing more doing better? The relationship between responsible supply chain management and corporate reputation. Industrial Marketing Management, 43(1), 77–90. [Google Scholar] [CrossRef]

- Hörisch, J., Freeman, R. E., & Schaltegger, S. (2014). Applying stakeholder theory in sustainability management: Links, similarities, dissimilarities, and a conceptual framework. Organization & Environment, 27(4), 328–346. [Google Scholar] [CrossRef]

- Hung, D. V., Hue, N. T. M., & Duong, V. T. (2021). The impact of COVID-19 on stock market returns in Vietnam. Journal of Risk and Financial Management, 14(9), 441. [Google Scholar] [CrossRef]

- Išoraitė, M. (2024). Sustainable supply chain management Tools. In Lecture notes in intelligent transportation and infrastructure: Vol. Part F2296. Springer. [Google Scholar] [CrossRef]

- Judge, G. G., Hill, R. C., Griffiths, W. E., Ltitkepohl, H., & Lee, T. (1988). Introduction to the theory and practice of econometrics. John Wiley & Sons. [Google Scholar]

- Kim, E. (2018, July 29–August 1). Green supply chain management in organic agriculture sector: A case study in Vietnam food safety management [Conference session]. 13th International Congress on Logistics and SCM Systems (ICLS 2018) (pp. 506–513), Ho Chi Minh City, Vietnam. [Google Scholar]

- Kok, S. K., & Yap, S. (2024). Điểm cân bằng ESG và lợi nhuận. Available online: https://nhipcaudautu.vn/phat-trien-ben-vung/diem-can-bang-esg-va-loi-nhuan-3357191/ (accessed on 10 August 2024).

- Kumala, L., Suherman, S., & Dong, K. T. P. (2024). The impact of CEO gender and educational background on capital structure. Global Advances in Business Studies, 3(1), 13–25. [Google Scholar] [CrossRef]

- Kushwaha, G. S., & Sharma, N. K. (2016). Green initiatives: A step towards sustainable development and firm’s performance in the automobile industry. Journal of Cleaner Production, 121, 116–129. [Google Scholar] [CrossRef]

- Laari, S., Töyli, J., & Ojala, L. (2018). The effect of a competitive strategy and green supply chain management on the financial and environmental performance of logistics service providers. Business Strategy and the Environment, 27(7), 872–883. [Google Scholar] [CrossRef]

- Laari, S., Töyli, J., Solakivi, T., & Ojala, L. (2016). Firm performance and customer-driven green supply chain management. Journal of Cleaner Production, 112, 1960–1970. [Google Scholar] [CrossRef]

- Le, H. T. T., Hoang, H. V., & Phan, N. T. H. (2024). The COVID-19 pandemic and financial stability in Vietnam: Evidence from the interbank market. International Journal of Social Economics, 51(2), 156–177. [Google Scholar] [CrossRef]

- Le, T. (2020). The effect of green supply chain management practices on sustainability performance in Vietnamese construction materials manufacturing enterprises. Uncertain Supply Chain Management, 8(1), 43–54. [Google Scholar] [CrossRef]

- Lin, C.-Y., Alam, S. S., Ho, Y.-H., Al-Shaikh, M. E., & Sultan, P. (2020). Adoption of green supply chain management among SMEs in Malaysia. Sustainability, 12(16), 6454. [Google Scholar] [CrossRef]

- Liu, S., Eweje, G., He, Q., & Lin, Z. (2020). Turning motivation into action: A strategic orientation model for green supply chain management. Business Strategy and the Environment, 29(7), 2908–2918. [Google Scholar] [CrossRef]

- Liu, W., Bai, E., Liu, L., & Wei, W. (2017). A framework of sustainable service supply chain management: A literature review and research agenda. Sustainability, 9(3), 421. [Google Scholar] [CrossRef]

- Luthra, S., Garg, D., & Haleem, A. (2014). Green supply chain management: Implementation and performance—A literature review and some issues. Journal of Advances in Management Research, 11(1), 20–46. [Google Scholar] [CrossRef]

- MacKinlay, A. C. (1997). Event studies in economics and finance. Journal of Economic Literature, 35(1), 13–39. Available online: https://www.jstor.org/stable/2729691 (accessed on 10 July 2021).

- Majumdar, A., Sanjib, M., & Sinha, K. (2020). COVID-19 debunks the myth of socially sustainable supply chain: A case of the clothing industry in South Asian countries. Sustainable Production and Consumption, 24, 150–155. [Google Scholar] [CrossRef]

- Mayuni, I. A. I., & Suarjaya, G. (2018). Pengaruh ROA, FIRM SIZE, EPS, dan PER terhadap return saham pada sektor Manufaktur di BEI. E-Jurnal Manajemen Unud, 7(8), 4063–4093. Available online: https://download.garuda.kemdikbud.go.id/article.php?article=1370117&val=989&title=PENGARUH%20ROA%20FIRM%20SIZE%20EPS%20DAN%20PER%20TERHADAP%20RETURN%20SAHAM%20PADA%20SEKTOR%20MANUFAKTUR%20DI%20BEI (accessed on 10 July 2021).

- Mazur, M., Dang, M., & Vega, M. (2021). COVID-19 and the march 2020 stock market crash. Evidence from S&P1500. Finance Research Letters, 38, 101690. [Google Scholar] [CrossRef]

- Mio, C., & Fasan, M. (2012). Does corporate social performance yield any tangible financial benefit during a crisis? An event study of Lehman brothers’ bankruptcy. Corporate Reputation Review, 15, 263–284. [Google Scholar] [CrossRef]

- Nazir, S., Zhaolei, L., Mehmood, S., & Nazir, Z. (2024). Impact of green supply chain management practices on the environmental performance of manufacturing firms considering institutional pressure as a moderator. Sustainability, 16(6), 2278. [Google Scholar] [CrossRef]

- Negri, M., Cagno, E., Colicchia, C., & Sarkis, J. (2021). Integrating sustainability and resilience in the supply chain: A systematic literature review and a research agenda. Business Strategy and the Environment, 30(7), 2858–2886. [Google Scholar] [CrossRef]

- Nguyen, C. T., Hai, P. T., & Nguyen, H. K. (2021). Stock market returns and liquidity during the COVID-19 outbreak: Evidence from the financial services sector in Vietnam. Asian Journal of Economics and Banking, 5(3), 324–342. [Google Scholar] [CrossRef]

- Nguyen, T. N. H., Khuu, T. P. D., Nguyen, Q. H., & Nguyen, M. C. (2024). Can sustainable supply chain strategies of company enhance for mitigation of risk damages and long-term resilience? An empirical analysis for the context of COVID-19 pandemic. WPOM-Working Papers on Operations Management, 15, 112–131. [Google Scholar] [CrossRef]

- Nguyen, X., & Le, T. (2020). The impact of global green supply chain management practices on performance: The case of Vietnam. Uncertain Supply Chain Management, 8(3), 523–536. [Google Scholar] [CrossRef]

- Pagell, M., & Wu, Z. (2009). Building a more complete theory of sustainable supply chain management using case studies of 10 exemplars. Journal of Supply Chain Management, 45(2), 37–56. [Google Scholar] [CrossRef]

- Park, A., & Li, H. (2021). The effect of blockchain technology on supply chain sustainability performances. Sustainability, 13(4), 1726. [Google Scholar] [CrossRef]

- Perrow, C. (1986). Complex organizations: A critical essay (3rd ed.). Random House. Available online: https://archive.org/details/complexorganizat00perr/page/n1/mode/2up (accessed on 2 March 2025).

- Pfeffer, J., & Salancik, G. (2015). External control of organizations—Resource dependence perspective. In Organizational behavior 2 (pp. 355–370). Routledge. [Google Scholar]

- Pfeffer, J., & Salancik, G. R. (1978). The external control. Harper & Row. [Google Scholar]

- Phuong, L. (2021). Investor sentiment by relative strength index and stock return: Empirical evidence on Vietnam’s stock market. Accounting, 7(2), 451–456. [Google Scholar] [CrossRef]

- PRI. (2021). Principles for responsible investment—Annual report 2021. Available online: https://dwtyzx6upklss.cloudfront.net/Uploads/s/u/b/pri_annualreport_2021_15698.pdf (accessed on 15 September 2021).

- Qiu, S. C., Jiang, J., Liu, X., Chen, M.-H., & Yuan, X. (2021). Can corporate social responsibility protect firm value during the COVID-19 pandemic? International Journal of Hospitality Management, 93, 102759. [Google Scholar] [CrossRef]

- Quintana-García, C., Benavides-Chicón, C. G., & Marchante-Lara, M. (2021). Does a green supply chain improve corporate reputation? Empirical evidence from European manufacturing sectors. Industrial Marketing Management, 92, 344–353. [Google Scholar] [CrossRef]

- Rajesh, R. (2020). Exploring the sustainability performances of firms using environmental, social, and governance scores. Journal of Cleaner Production, 247, 119600. [Google Scholar] [CrossRef]

- Ramadhani, B. A., & Nur, D. I. (2024). Analysis of company value and financial performance as intervening variables in property, real estate and building construction companies on the Indonesia stock exchange. International Journal of Economics (IJEC), 3(1), 581–589. [Google Scholar] [CrossRef]

- Ramelli, S., & Wagner, A. F. (2020). Feverish stock price reactions to COVID-19. The Review of Corporate Finance Studies, 9(3), 622–655. [Google Scholar] [CrossRef]

- Saini, N., Malik, K., & Sharma, S. (2023). Transformation of supply chain management to green supply chain management: Certain investigations for research and applications. Cleaner Materials, 7. [Google Scholar] [CrossRef]

- Savita, K. S., Dominic, P. D. D., & Ramayah, T. (2016). The drivers, practices and outcomes of green supply chain management: Insights from ISO14001 manufacturing firms in Malaysia. International Journal of Information Systems and Supply Chain Management, 9(2). [Google Scholar] [CrossRef]

- Seuring, S., & Müller, M. (2008). From a literature review to a conceptual framework for sustainable supply chain management. Journal of Cleaner Production, 16(15), 1699–1710. [Google Scholar] [CrossRef]

- Seuring, S., Aman, S., Hettiarachchi, B. D., de Lima, F. A., Schilling, L., & Sudusinghe, J. I. (2022). Reflecting on theory development in sustainable supply chain management. Cleaner Logistics and Supply Chain, 3, 100016. [Google Scholar] [CrossRef]

- Shekarian, E., Ijadi, B., Zare, A., & Majava, J. (2022). Sustainable supply chain management: A comprehensive systematic review of industrial practices. Sustainability, 14(13), 7892. [Google Scholar] [CrossRef]

- Sun, J., Sarfraz, M., Khawaja, K. F., & Abdullah, M. I. (2022). Sustainable supply chain strategy and sustainable competitive advantage: A mediated and moderated model. Frontiers in Public Health, 10, 895482. [Google Scholar] [CrossRef]

- Svensson, G., Ferro, C., Hogevold, N., Padin, C., & Sosa Varela, J. C. (2018). Developing a theory of focal company business sustainability efforts in connection with supply chain stakeholders. Supply Chain Management: An International Journal, 23(1), 16–32. [Google Scholar] [CrossRef]

- Truong, Q.-T., Nguyen, D. N., Tran, Q.-N., Al-Mohamad, S., & Bakry, W. (2020). COVID-19 in Vietnam: What happened in the stock market? Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3654017 (accessed on 10 July 2021).

- Utomo, C. D., & Hanggraeni, D. (2021). The impact of COVID-19 pandemic on stock market performance in Indonesia. The Journal of Asian Finance, Economics and Business, 8(5), 777–784. [Google Scholar] [CrossRef]

- Vo, D. H., Ho, C. M., & Dang, T. H.-N. (2022). Stock market volatility from the COVID-19 pandemic: New evidence from the Asia-Pacific region. Heliyon, 8(9), e10763. [Google Scholar] [CrossRef]

- Wang, X., Cai, H., & Florig, H. K. (2016). Energy-saving implications from supply chain improvement: An exploratory study on China’s consumer goods retail system. Energy Policy, 95, 411–420. [Google Scholar] [CrossRef]

- WHO. (2020). Coronavirus disease (COVID-19) pandemic. Available online: https://iris.who.int/bitstream/handle/10665/348296/WHO-EURO-2021-1772-41523-60739-eng.pdf?sequence=1 (accessed on 15 June 2021).

- Wilkerson, T. (2005, April 5). Best practices in implementing green supply chains [Paper presentation]. North American supply chain world conference and exposition, Anaheim, CA, USA. Available online: www.supply-chain.org/galleries/default-file/Best%20Practices%20in%20Green%20Supply%20Chain%20Management%20FINAL.pdf (accessed on 10 August 2024).

- Xu, N., Huo, B., & Ye, Y. (2024). The impact of supply chain pressure on cross-functional green integration and environmental performance: An empirical study from Chinese firms. Operations Management Research, 17, 612–634. [Google Scholar] [CrossRef]

- Xu, S., Zhang, X., Feng, L., & Yang, W. (2020). Disruption risks in supply chain management: A literature review based on bibliometric analysis. International Journal of Production Research, 58(11), 3508–3526. [Google Scholar] [CrossRef]

- Yamini, Y. (2020). The impact of COVID-19 on the stock returns of companies of oil & gas industry of G7 nations. International Journal of Management, 11(11), 477–488. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3747524 (accessed on 10 August 2024).

- Yang, Y., Jia, F., & Xu, Z. (2019). Towards an integrated conceptual model of supply chain learning: An extended resource-based view. Supply Chain Management: An International Journal, 24(2), 189–214. [Google Scholar] [CrossRef]

- Yến, N. T. (2016). Chuỗi cung ứng xanh thủy sản Việt Nam: Thực trạng và giải pháp. Tạp Chí Quản Lý và Kinh Tế Quốc Tế, 85(85), 35–44. Available online: https://www.thuvientailieu.vn/tai-lieu/chuoi-cung-ung-xanh-thuy-san-viet-nam-thuc-trang-va-giai-phap-65203/ (accessed on 10 July 2021).

- Zhang, D., Hu, M., & Ji, Q. (2020). Financial markets under the global pandemic of COVID-19. Finance Research Letters, 36, 101528. [Google Scholar] [CrossRef]

- Zhu, Q., Krikke, H., & Caniëls, M. C. J. (2017). Integrated supply chain risk management: A systematic review. The International Journal of Logistics Management, 28(4), 1123–1141. [Google Scholar] [CrossRef]

| Variables | Description | Mean (N = 6313) | SD |

|---|---|---|---|

| Dependent variable | |||

| during the period from 2 January 2020 to 31 March 2020. | 0.001 | 0.023 | |

| Independent variables | |||

| obtains the value of 1 and 0 to describe the group of companies that did and did not implement sustainability strategies, respectively. | Dummy variable | ||

| Obtains the value of 1 for the trading days during the period from 24 February 2020 to 31 March 2020 and obtains the value of 0 for trading days during the period from 2 January 2020 to 23 February 2020 (for the first event window). Obtains the value of 1 for the trading days during the period from 11 March 2020 to 31 March 2020 and obtains the value of 0 for trading days during the period from 2 January 2020 to 10 March 2020 (for the second event window) | Dummy variable | ||

| Interaction variable | |||

| during the period from 2 January 2020 to 31 March 2020. | 1.252 | 0.771 | |

| during the period from 2 January 2020 to 31 March 2020. | 1.424 | 1.191 | |

| during the period from 2 January 2020 to 31 March 2020. | 1.457 | 1.150 | |

| during the period from 2 January 2020 to 31 March 2020. | 16.426 | 1.661 | |

| during the period from 2 January 2020 to 31 March 2020. | 0.529 | 0.217 | |

| Variables | Description | Period from 2 January 2020 to 31 March 2020 | Period from 2 January 2020 to 23 February 2020 | |

|---|---|---|---|---|

| FEM | FGLS Model | FGLS Model | ||

| Implementation of sustainability strategies in operation of companies | - | 0.00077 ** | 0.00056 ** | |

| Tobin’s Q ratio | −0.00459 | −0.00123 ** | −0.00143 ** | |

| Return-on-assets ratio | −0.00020 | −0.00017 * | 0.00010 ** | |

| Market-to-book value | −0.00614 *** | −0.00054 * | 0.00043 * | |

| Size of companies | 0.00391 | 0.00006 | 0.00005 | |

| Financial leverage | −0.02540 * | 0.00211 * | 0.00222 * | |

| Constant | −0.05250 | −0.00020 | −0.00029 | |

| Number of observations | 6313 | 6313 | 3424 | |

| F-test | 4.07 *** | |||

| Chi2 test | 14.66 ** | 13.42 ** | ||

| SP | AR | TobinQ | MTB | Lev | Size | ROA | |

|---|---|---|---|---|---|---|---|

| SP | 1 | ||||||

| AR | 0.011 | 1 | |||||

| TobinQ | 0.073 | −0.020 | 1 | ||||

| MTB | 0.180 | −0.012 | 0.916 | 1 | |||

| Lev | 0.139 | 0.024 | −0.323 | −0.151 | 1 | ||

| Size | 0.364 | 0.013 | −0.123 | 0.058 | 0.655 | 1 | |

| ROA | 0.091 | −0.004 | 0.523 | 0.425 | −0.444 | −0.307 | 1 |

| The First Event Window | The Second Event Window | ||||

|---|---|---|---|---|---|

| Variables | Description | Coefficient | Coefficient | Coefficient | Coefficient |

| COVID-19 outbreak | −0.00228 *** | −0.00268 *** | −0.00392 *** | −0.00369 *** | |

| Implementation of sustainability strategies in operation of companies | −0.00013 ** | −0.00056 ** | −0.00026 ** | −0.00055 ** | |

| 0.00220 ** | 0.00183 ** | 0.00179 ** | 0.00115 ** | ||

| Tobin’s Q ratio | −0.00124 * | −0.00127 * | |||

| Return-on-assets ratio | −0.00053 ** | −0.00062 ** | |||

| Market-to-book value | 0.00182 ** | 0.00229 ** | |||

| Size of companies | 0.00002 | 0.00004 | |||

| Financial leverage | 0.00016 * | 0.00017 * | |||

| Constant | 0.00054 *** | −0.00043 *** | 0.00113 *** | −0.00088 *** | |

| Number of observations | 6313 | 6313 | 6313 | 6313 | |

| R2 | 0.004 | 0.004 | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hoa, N.T.N.; Dong, K.T.P.; Khanh, N.K.; Canh, N.M. Implementation of Sustainability Strategies in Operations and Abnormal Stock Returns Under Uncertainty: Evidence from Companies Listed on the Vietnamese Stock Market During the COVID-19 Outbreak. J. Risk Financial Manag. 2025, 18, 146. https://doi.org/10.3390/jrfm18030146

Hoa NTN, Dong KTP, Khanh NK, Canh NM. Implementation of Sustainability Strategies in Operations and Abnormal Stock Returns Under Uncertainty: Evidence from Companies Listed on the Vietnamese Stock Market During the COVID-19 Outbreak. Journal of Risk and Financial Management. 2025; 18(3):146. https://doi.org/10.3390/jrfm18030146

Chicago/Turabian StyleHoa, Nguyen Thi Ngoc, Khuu Thi Phuong Dong, Nguyen Kim Khanh, and Nguyen Minh Canh. 2025. "Implementation of Sustainability Strategies in Operations and Abnormal Stock Returns Under Uncertainty: Evidence from Companies Listed on the Vietnamese Stock Market During the COVID-19 Outbreak" Journal of Risk and Financial Management 18, no. 3: 146. https://doi.org/10.3390/jrfm18030146

APA StyleHoa, N. T. N., Dong, K. T. P., Khanh, N. K., & Canh, N. M. (2025). Implementation of Sustainability Strategies in Operations and Abnormal Stock Returns Under Uncertainty: Evidence from Companies Listed on the Vietnamese Stock Market During the COVID-19 Outbreak. Journal of Risk and Financial Management, 18(3), 146. https://doi.org/10.3390/jrfm18030146